3. Results

The selection of media sources included in this analysis was based on their significant influence, audience reach, and active digital presence within the Bulgarian media landscape. Specifically, the selected platforms are prominent media outlets with television and/or radio coverage, representing a mixture of public and private media, as well as local and international news providers. This approach ensures a diverse and comprehensive overview of online media content in Bulgaria. The analyzed dataset covers a period of one year, specifically from April 2024 to March 2025. This timeframe was chosen to provide an up-to-date and representative snapshot of contemporary media coverage, capturing seasonal trends, significant national and international events, and editorial dynamics across the examined platforms. The data collected from these sources are presented in the following tables and graphically illustrated in corresponding figures to facilitate clear and insightful analysis.

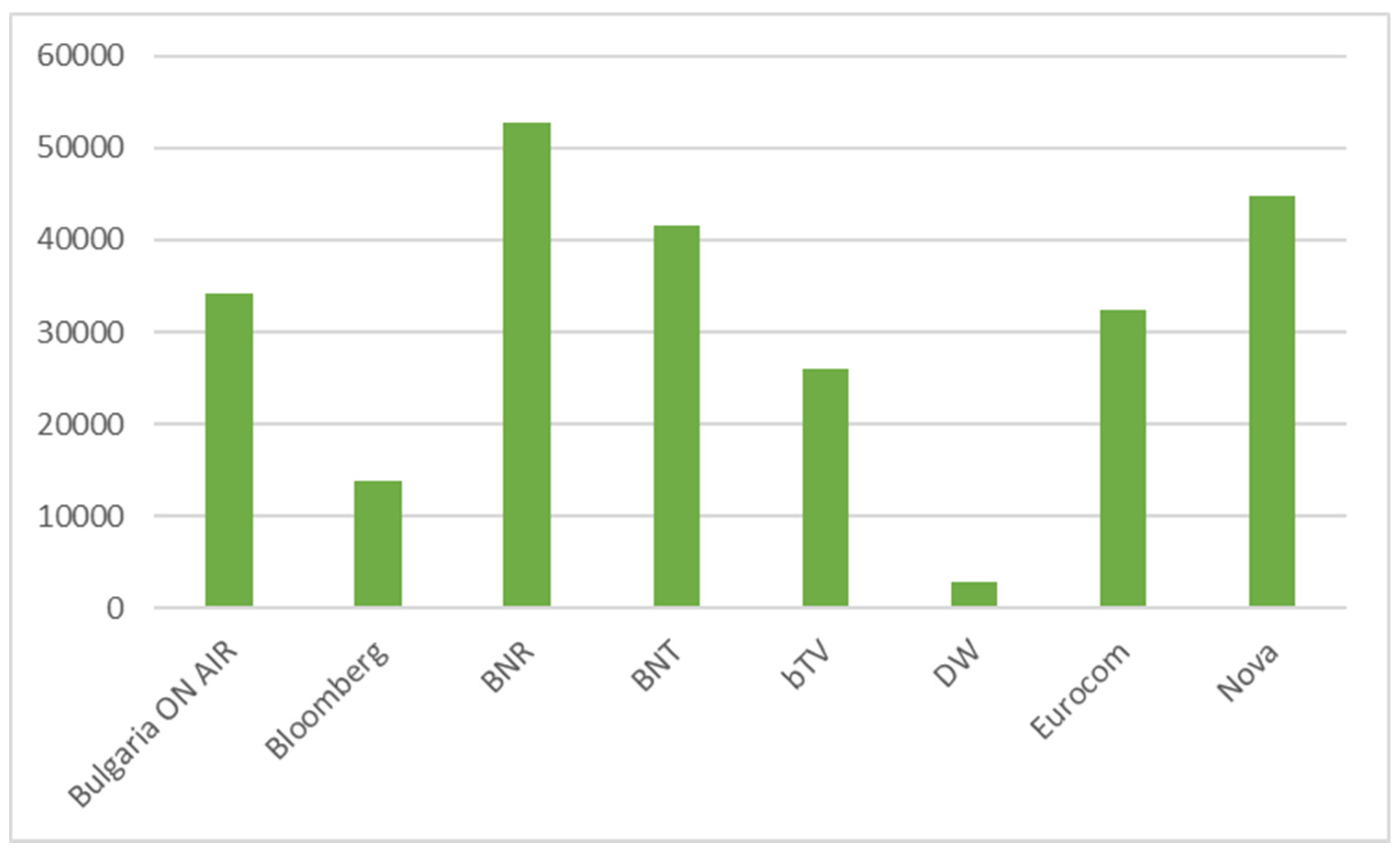

Table 1 presents the total number of publications for each of the analyzed media platforms within the period from April 2024 to March 2025.

The data clearly illustrates considerable variations in the quantity of published content across the examined media platforms. The Bulgarian National Radio (BNR) recorded the highest total number of publications, amounting to 52,692, followed by Nova (44,867 publications) and the Bulgarian National Television (BNT) with 41,520 publications. These three media outlets evidently play leading roles in terms of news coverage and information dissemination within the country. Platforms such as Bulgaria ON AIR (34,213 publications) and Eurocom (32,358 publications) also demonstrate considerable activity, highlighting their significance within the Bulgarian digital media landscape. Other platforms like bTV (25,911 publications) and Bloomberg (13,842 publications) show moderate content activity. In stark contrast, Deutsche Welle (DW) published significantly fewer articles – only 2,719. This disparity is likely due to DW’s specific editorial strategy focusing on selected international and socially significant topics, as opposed to local Bulgarian platforms, which tend to provide more frequent daily news coverage. These initial findings offer an essential starting point for subsequent analyses, helping to identify the dominant information sources in Bulgaria’s digital media ecosystem and enabling the formulation of hypotheses regarding editorial policies and target audiences of the various media platforms.

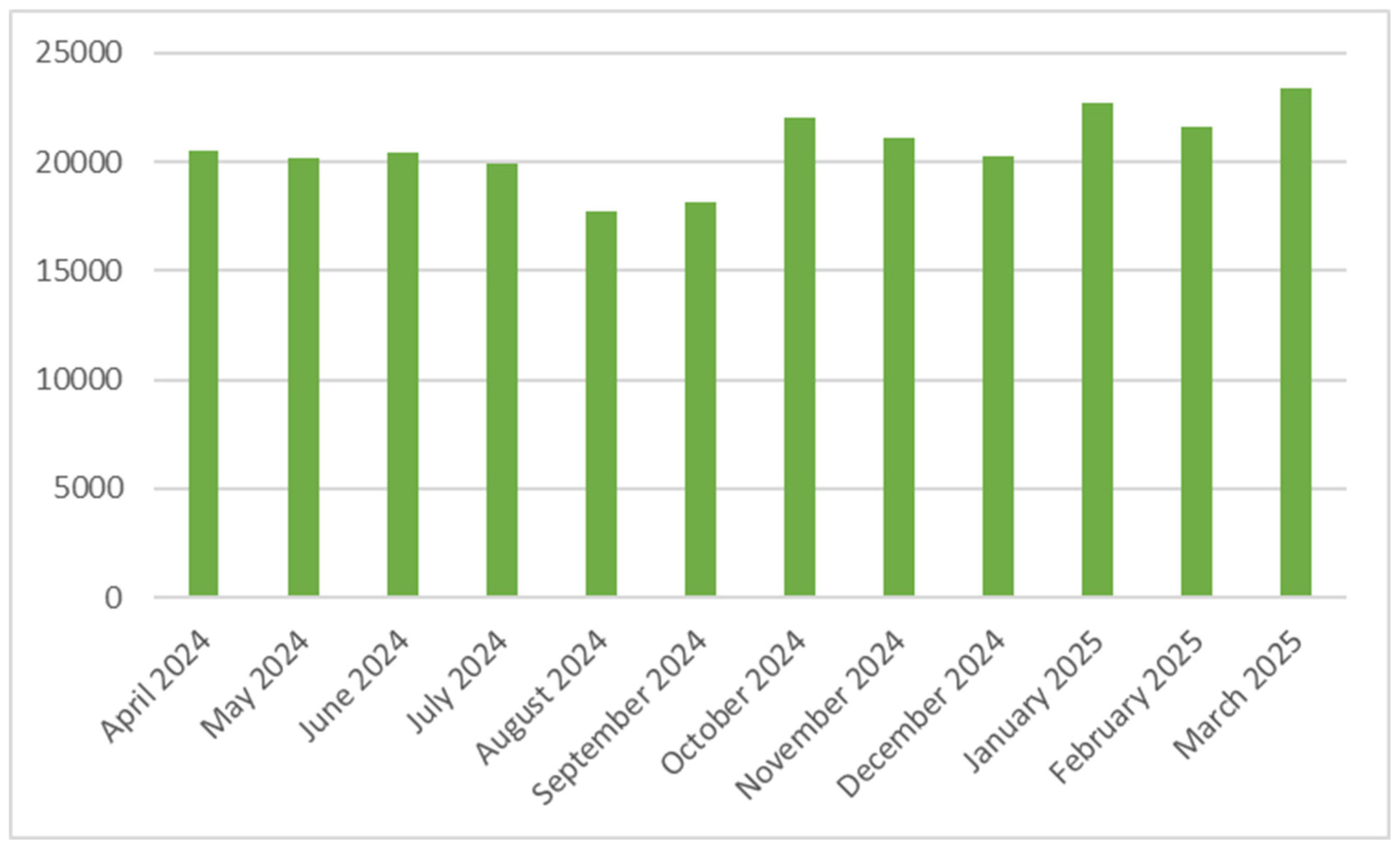

Table 2 presents the number of publications aggregated monthly across all analyzed media platforms, covering the period from April 2024 to March 2025.

The monthly distribution of publications reveals a relatively consistent content generation throughout the year, with clear seasonal fluctuations. Noticeable peaks occur in March 2025 (23,368 publications) and January 2025 (22,740 publications), likely due to increased coverage related to significant political, economic, or social events common at the beginning of the year. October 2024 also shows heightened media activity with 22,037 publications, potentially reflecting increased editorial attention around national and international developments during this period. Conversely, August 2024 registers the lowest activity (17,736 publications), reflecting typical seasonal patterns associated with vacation periods and reduced overall media output. September 2024 similarly shows relatively lower numbers, suggesting a gradual return to standard publication volumes following the summer season. Overall, these monthly variations underline the responsiveness of media platforms to seasonal influences, holidays, and significant events, reflecting adaptive editorial strategies that align with audience interests and newsworthiness.

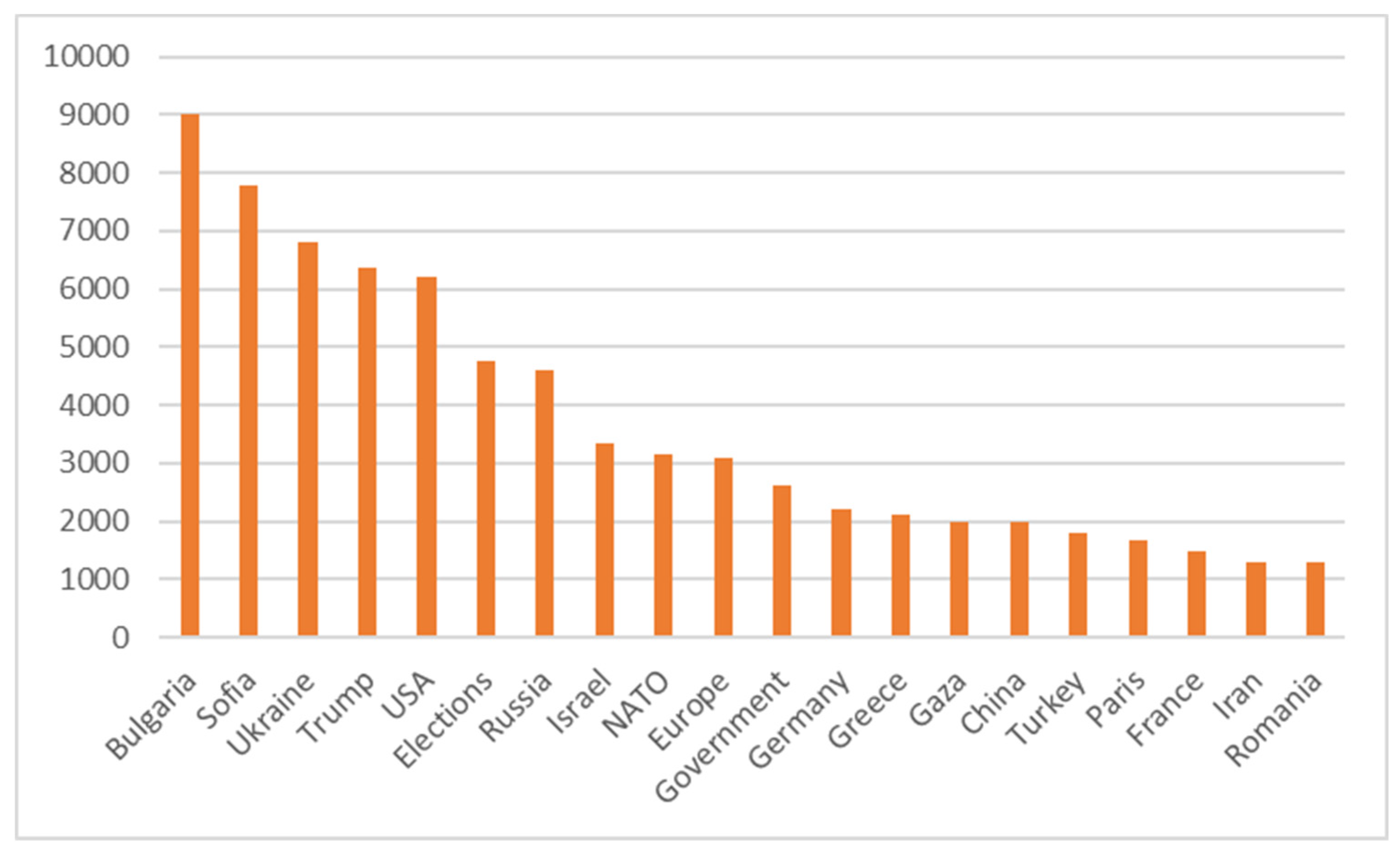

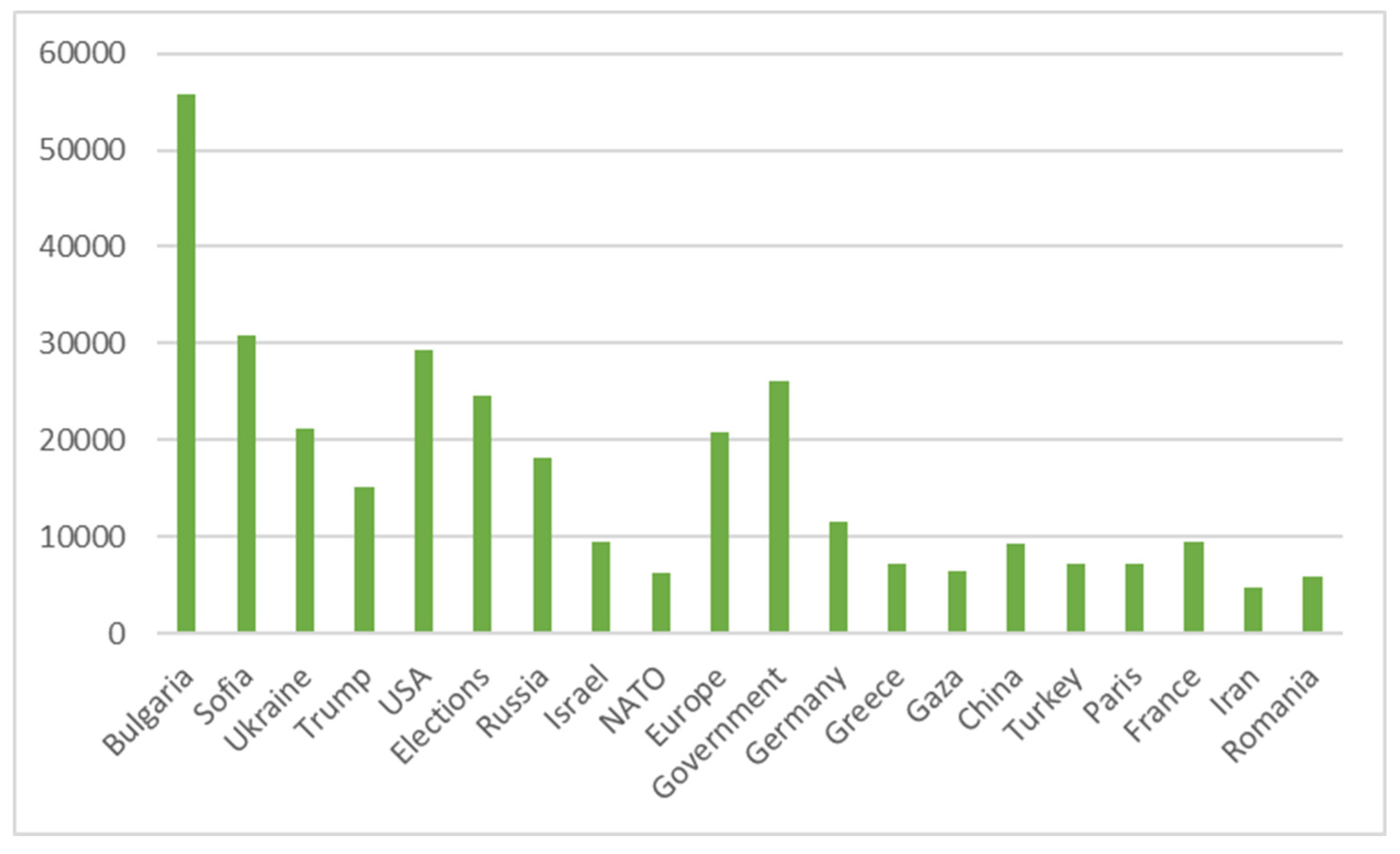

Table 3 presents the 20 most frequently occurring words in publication titles, along with their occurrences in the main body of the publication texts, during the analyzed period (April 2024–March 2025).

Figure 4 provides a graphical representation of the data shown in

Table 3 in the context of the top 20 most frequent words in publication titles.

The analysis of the most frequently used words in publication titles highlights key thematic focuses of the studied media platforms. The prominence of geographic references such as “Bulgaria” (9,008 occurrences) and “Sofia” (7,776 occurrences) underlines a strong emphasis on domestic news and local events. Frequent mentions of countries and geopolitical terms including “Ukraine,” “USA,” “Russia,” “Israel,” “Germany,” “Greece,” “China,” “Turkey,” “France,” “Iran,” and “Romania” reflect significant editorial attention to international affairs, geopolitical tensions, and diplomatic relations. The presence of “Trump” (6,374 occurrences) and thematic words such as “Elections” and “Government” indicate an ongoing focus on politics and governance issues. The occurrence of “Paris” (1,662 occurrences) is likely driven by heightened media attention around the upcoming 2024 Summer Olympic Games hosted in the French capital.

Figure 5 provides a graphical representation of the data shown in

Table 3 in the context of the occurrences of the top 20 title words in publication texts.

The frequency of these title words in publication texts further validates their thematic significance within media content. Words such as “Bulgaria” (55,816 occurrences) and “Sofia” (30,777 occurrences) maintain their prominence, underscoring continuous coverage of domestic topics throughout the articles. Terms like “Government” (26,030), “Elections” (24,628), and “USA” (29,274) highlight in-depth discussions related to political and governance issues, both domestically and internationally. The extensive mentions of geopolitical entities such as “Ukraine,” “Russia,” and “Europe” demonstrate consistent editorial interest in global affairs. Lower but significant frequencies of terms such as “Paris” (7,104 occurrences) further reflect sustained interest related to internationally relevant events, notably the Paris 2024 Olympics, generating deeper textual coverage beyond headlines. It is noteworthy that the ranking of words based on their frequency in publication titles does not completely align with their frequency within the publication texts. Such discrepancies suggest differences in editorial strategies between selecting attention-grabbing headlines and delivering detailed content within the articles. For instance, certain terms like “Trump,” “NATO,” and “Israel” have relatively high prominence in titles compared to their frequency in article texts, likely due to their newsworthiness and capacity to attract readers’ attention. Conversely, words such as “Government,” “Europe,” and “Bulgaria,” which have higher occurrences within texts, indicate deeper thematic coverage beyond mere headlines. This observation underscores the distinct roles played by titles (aiming to capture reader interest quickly) and article bodies (intended to provide comprehensive and detailed information).

To better understand the consistency and variations in editorial attention toward prominent topics over the studied period, we conducted a monthly analysis of the top 10 most frequent words identified previously. This approach allows us to highlight any substantial fluctuations or seasonal patterns in media focus on specific issues, entities, or geographical references.

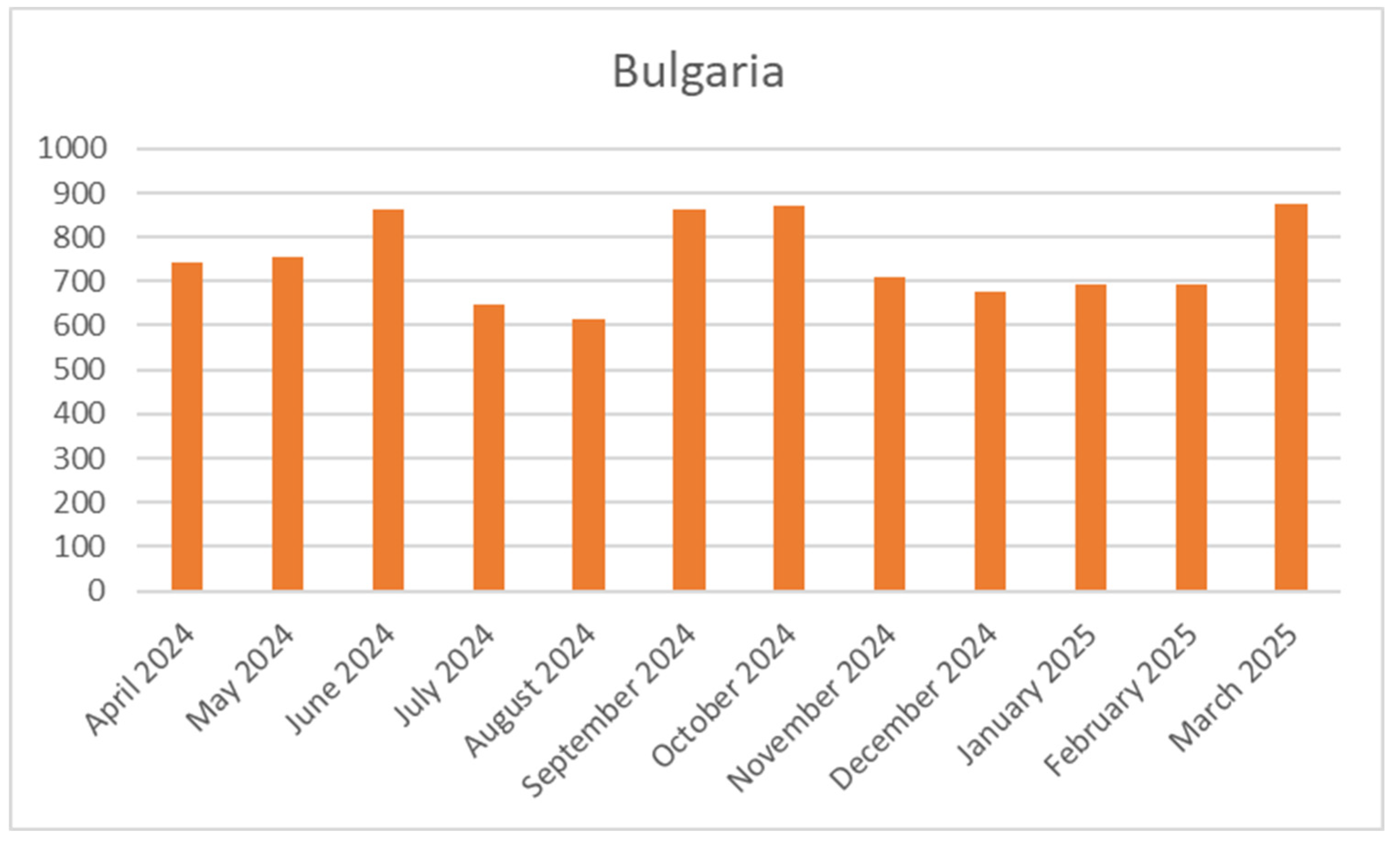

Table 4 presents the monthly frequency of occurrences of the word “Bulgaria” in publication titles from April 2024 to March 2025.

The monthly distribution of the occurrences of “Bulgaria” in publication titles reveals a moderate but notable fluctuation throughout the analyzed period. Peaks in the usage of “Bulgaria” appear during the months of March 2025 (877 titles), October 2024 (871 titles), September 2024 (863 titles), and June 2024 (862 titles), potentially corresponding with significant domestic political, economic, or social events prompting increased national coverage. Conversely, lower frequencies of the word were registered in the summer months – July (649 titles) and August (614 titles) – reflecting a typical seasonal reduction in media coverage, possibly due to decreased political and economic activity during the vacation period. Overall, despite observable fluctuations, the word “Bulgaria” consistently remains a central and frequently used keyword, underscoring its stable and persistent importance within the editorial content of analyzed media platforms.

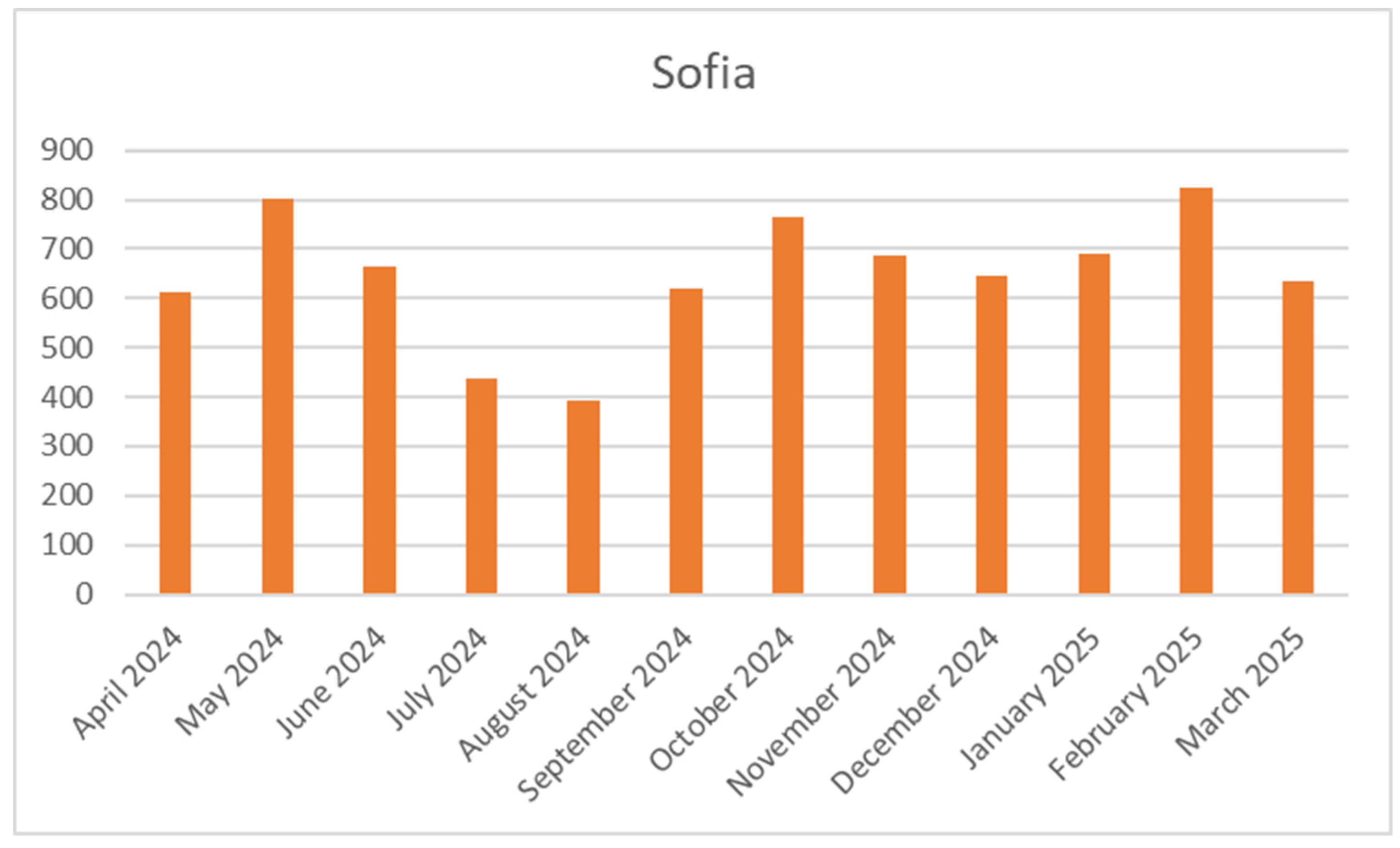

Table 5 presents the monthly frequency of occurrences of the word “Sofia” in publication titles from April 2024 to March 2025.

The monthly analysis of the term “Sofia” in publication titles highlights clear variations in editorial attention throughout the studied period. Significant peaks are observable in February 2025 (824 titles) and May 2024 (802 titles), suggesting increased media coverage possibly linked to important political, economic, or social events centered in the capital city during these periods. Noticeably lower coverage occurred during the summer months, particularly in July 2024 (438 titles) and August 2024 (391 titles), following a similar seasonal pattern to that observed for “Bulgaria,” reflecting decreased urban and institutional activity during these months. The distribution indicates that while the focus on Sofia as a central geographical and political reference is consistently high, specific events likely dictate fluctuations in the city’s prominence in headlines over the year.

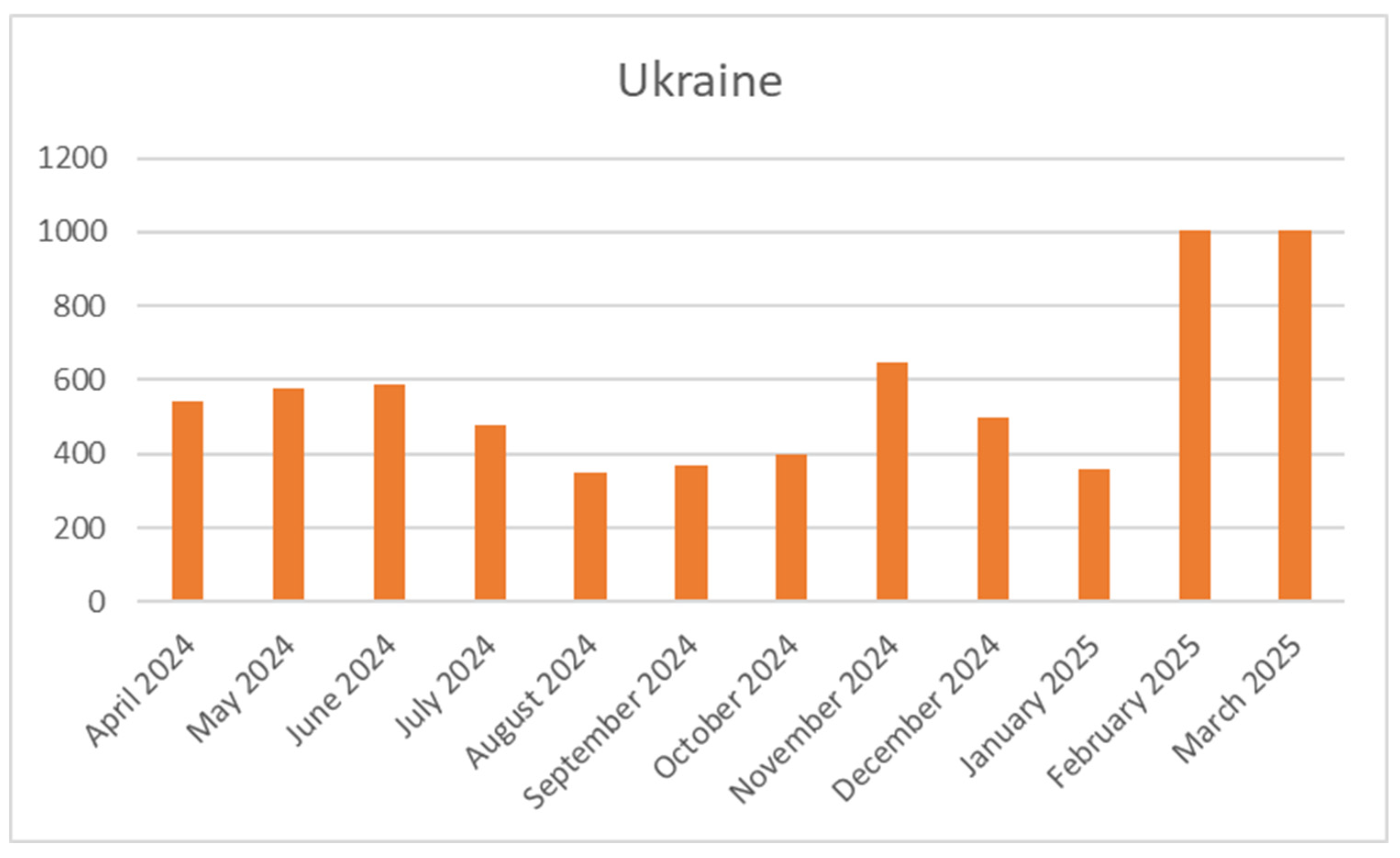

Table 6 presents the monthly frequency of occurrences of the word “Ukraine” in publication titles from April 2024 to March 2025.

The monthly frequency of the word “Ukraine” in publication titles displays considerable variability, reflecting shifting editorial priorities tied closely to geopolitical developments. A significant peak in coverage is evident in February 2025 (1,006 titles) and March 2025 (1003 titles). These substantial increases could be linked to critical geopolitical or military developments involving Ukraine, possibly including intensified conflicts, diplomatic negotiations, or other major international events attracting heightened media attention. Conversely, a noticeable drop in occurrences appears during the late summer months, particularly in August 2024 (351 titles) and September 2024 (370 titles), suggesting decreased media emphasis, potentially due to a temporary reduction in newsworthy events related to Ukraine during this period. Overall, these data indicate that the coverage related to Ukraine is significantly event-driven, aligning closely with developments in the geopolitical landscape and influencing the editorial agenda across the studied Bulgarian media outlets.

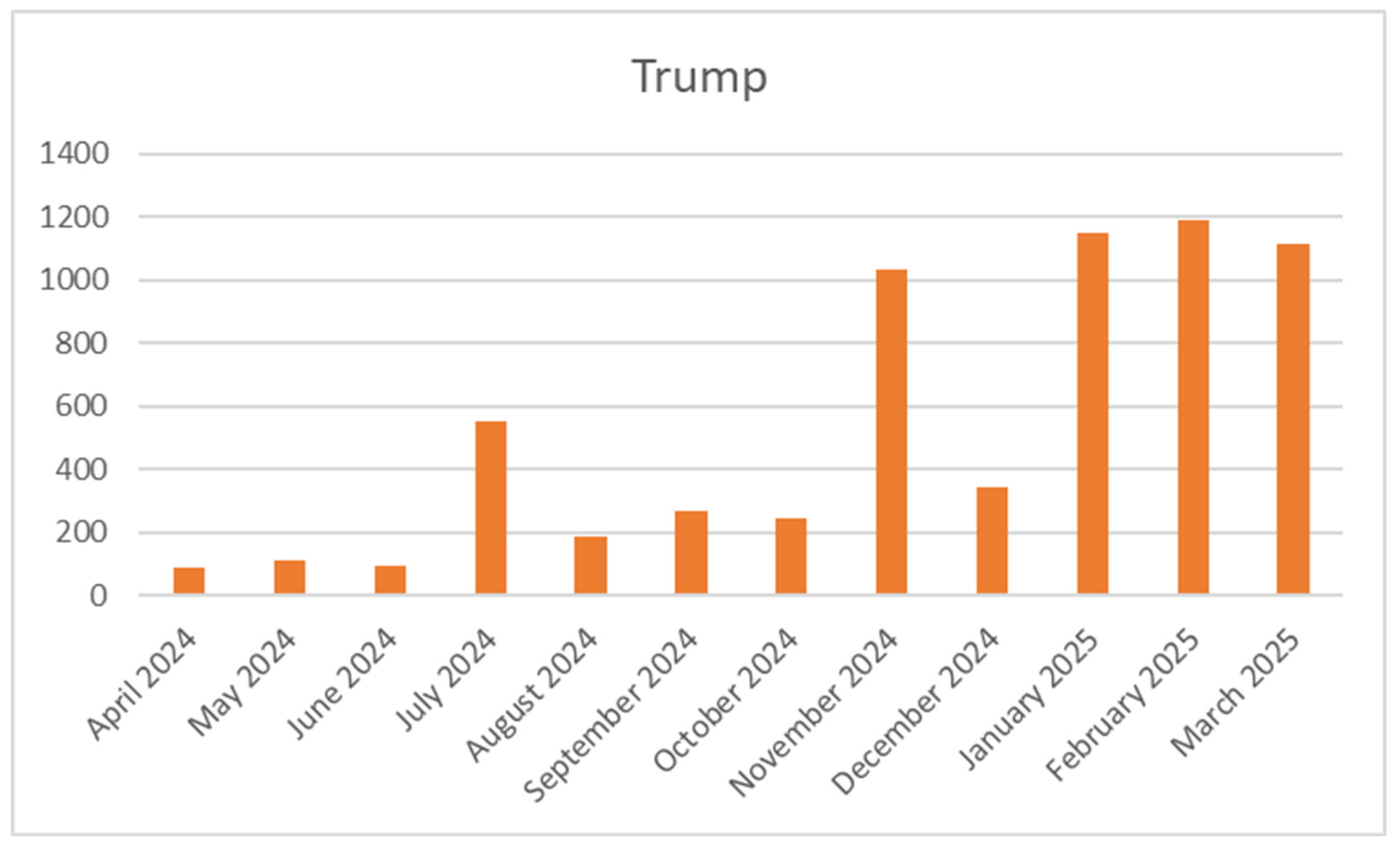

Table 7 presents the monthly frequency of occurrences of the word “Trump” in publication titles from April 2024 to March 2025.

The frequency of the word “Trump” in publication titles reveals significant fluctuations, strongly correlating with notable political events and developments associated with former US President Donald Trump. A remarkable increase occurs from November 2024 (1,034 titles) through February 2025 (1,191 titles), with a peak in media coverage. This period coincides with critical political events, most likely connected to the US presidential elections, electoral campaigns, or significant political controversies involving Donald Trump. In contrast, markedly lower occurrences were recorded from April to June 2024, suggesting relatively lower media interest or fewer newsworthy events concerning Trump during this timeframe. The sharp spikes from late 2024 into early 2025 emphasize the extent to which media coverage of international figures like Trump is heavily event-driven and influenced by political cycles, elections, and significant controversies or developments.

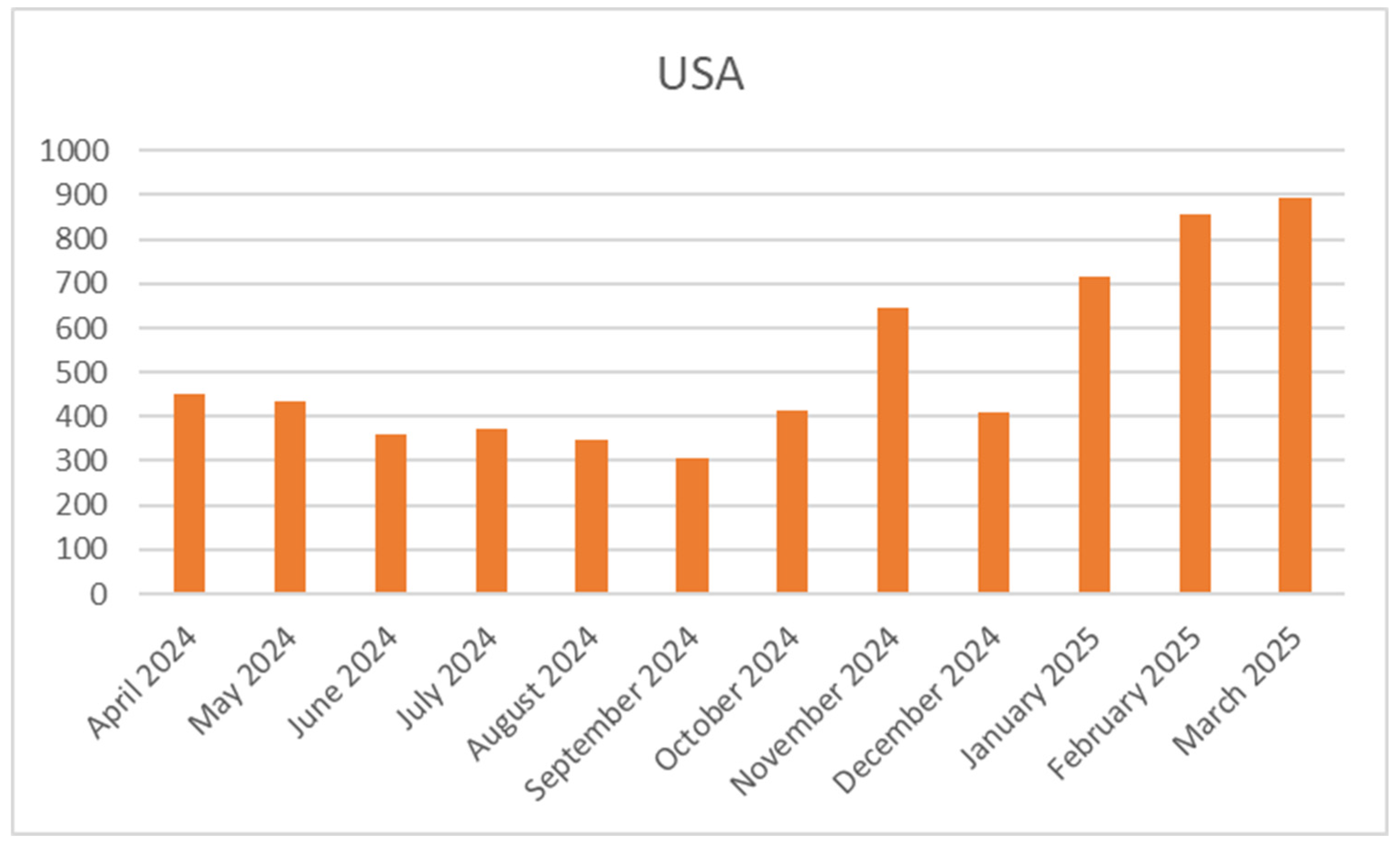

Table 8 presents the monthly frequency of occurrences of the word “USA” in publication titles from April 2024 to March 2025.

The monthly distribution of the word “USA” in publication titles exhibits noticeable variability, with distinct peaks toward the end of 2024 and the beginning of 2025. Significantly increased coverage is observed from November 2024 (645 titles) to March 2025 (895 titles), reflecting heightened media attention possibly driven by major political events, including the U.S. presidential elections, shifts in foreign policy, or prominent international developments involving the United States. The highest peak in March 2025 (895 titles) and similarly high frequencies in February (855 titles) and January 2025 (717 titles) further align with post-election coverage, transition periods, and related political dynamics. Lower occurrences from June to September 2024 suggest a period of relatively subdued media interest, likely reflecting fewer significant newsworthy events involving the USA during these months. Overall, the observed monthly variations highlight how Bulgarian media coverage related to the USA closely mirrors the dynamics of political cycles and international events involving American political and economic influence.

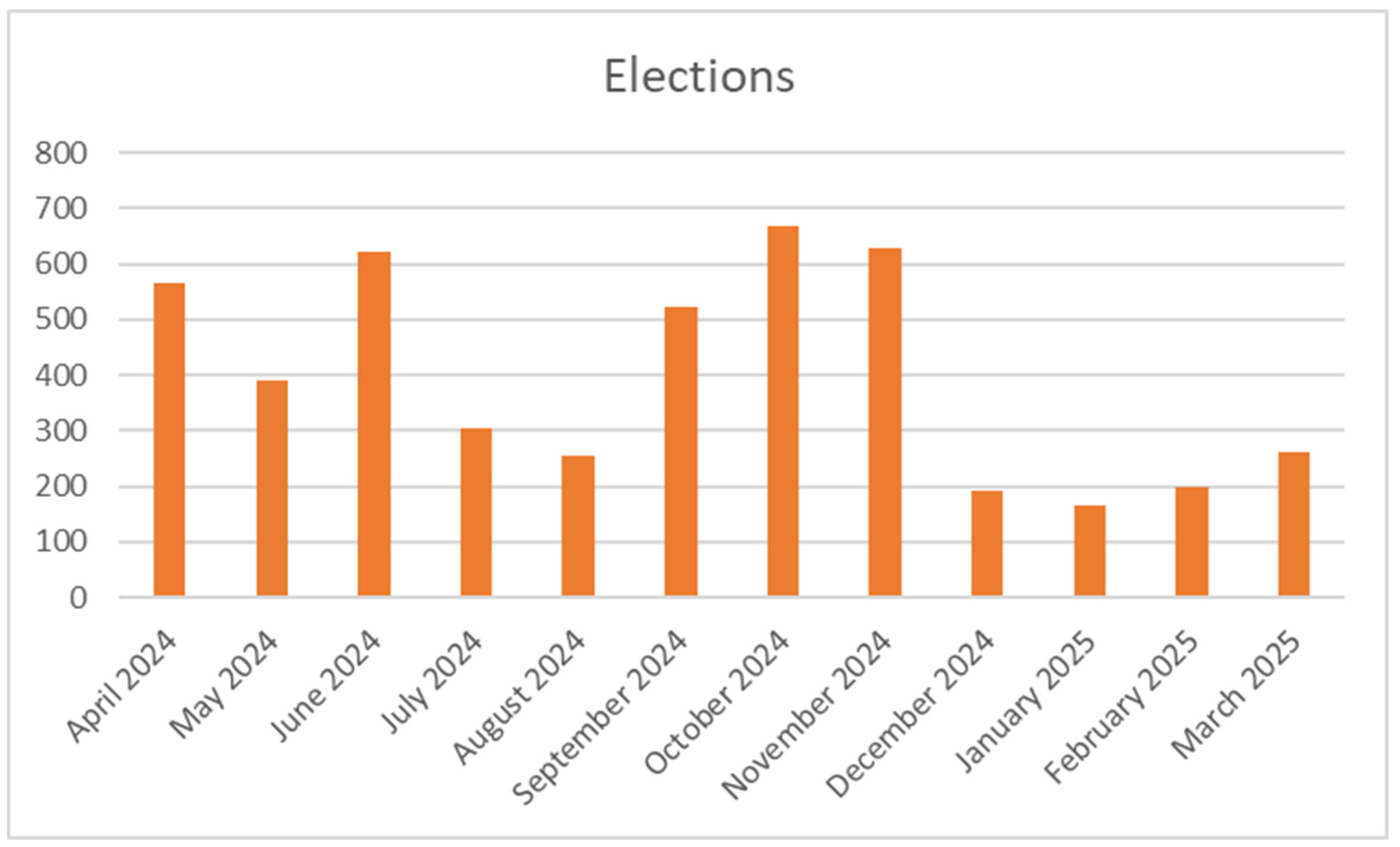

Table 9 presents the monthly frequency of occurrences of the word “Elections” in publication titles from April 2024 to March 2025.

The monthly distribution of the word “Elections” in publication titles shows distinct patterns related to political events occurring during the analyzed period. Notable peaks in media coverage are evident in October 2024 (669 titles) and November 2024 (629 titles), likely coinciding with significant national or international election events, including coverage of the U.S. presidential elections and potential local or European political elections. Another prominent increase is observed earlier in June 2024 (622 titles), possibly reflecting regional or European political events or campaigns drawing considerable media attention. Markedly lower media coverage from December 2024 to March 2025 (ranging between 165 and 263 titles) suggests a period of decreased electoral activities and fewer election-related developments, typical for post-election periods and early calendar months. Overall, the fluctuations clearly illustrate how media attention toward elections is inherently tied to specific electoral cycles and political timelines, demonstrating peaks around major voting events and significant decreases during less politically active months.

Table 10 presents the monthly frequency of occurrences of the word “Russia” in publication titles from April 2024 to March 2025.

The monthly occurrences of the word “Russia” in publication titles exhibit moderate fluctuations throughout the analyzed period. Notable peaks in coverage are evident in March 2025 (580 titles) and November 2024 (448 titles), likely correlating with significant geopolitical developments, diplomatic interactions, or international events involving Russia, potentially connected to regional conflicts, energy policy issues, or diplomatic relations. Conversely, lower frequencies appear during the summer months, particularly July 2024 (296 titles) and August 2024 (293 titles), reflecting reduced editorial emphasis possibly due to fewer notable events or reduced political activities involving Russia during these periods. Overall, media coverage related to Russia remains consistent but is evidently responsive to significant international and regional events, highlighting its ongoing relevance within Bulgarian media coverage and global geopolitics.

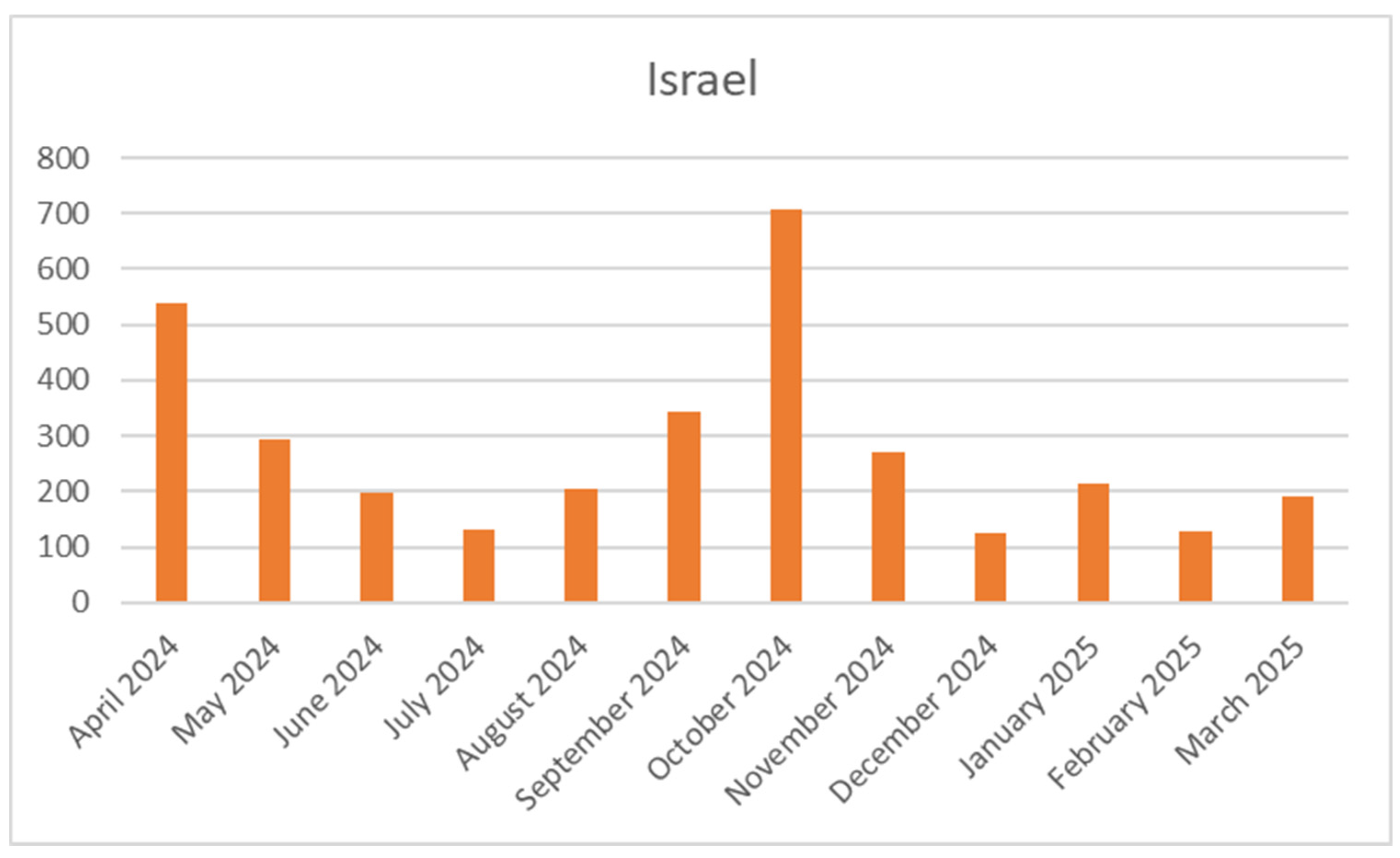

Table 11 presents the monthly frequency of occurrences of the word “Israel” in publication titles from April 2024 to March 2025.

The monthly occurrences of the word “Israel” show substantial fluctuations, reflecting the event-driven nature of media coverage surrounding the country. The most prominent peaks appear in October 2024 (707 titles) and April 2024 (537 titles), likely indicating major political, military, or diplomatic events involving Israel, such as significant geopolitical tensions, conflicts, or high-profile diplomatic activities. Coverage declines sharply during other months, reaching its lowest points in December 2024 (124 titles) and July 2024 (133 titles), suggesting a period of relatively reduced newsworthy activity involving Israel during these months. Overall, the coverage of Israel appears strongly influenced by specific events, crises, or diplomatic interactions, resulting in notable peaks interspersed with periods of lower media visibility.

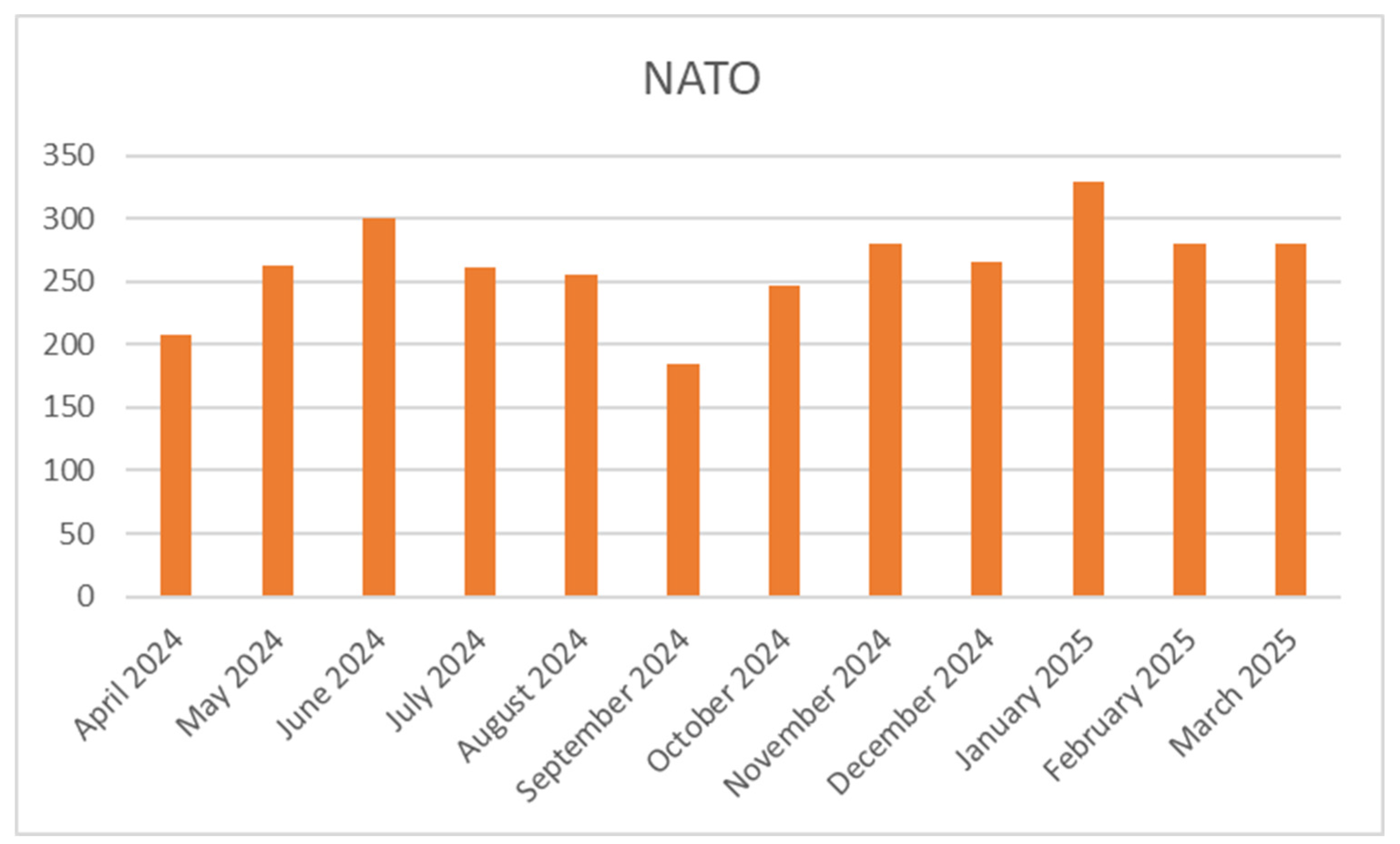

Table 12 presents the monthly frequency of occurrences of the word “NATO” in publication titles from April 2024 to March 2025.

The frequency of the word “NATO” in publication titles remains relatively stable across the studied period, with moderate fluctuations indicating a steady media focus on NATO-related topics. Slight peaks are evident in January 2025 (329 titles) and June 2024 (300 titles), possibly connected to NATO summits, significant policy announcements, or strategic developments involving the alliance. The lowest frequency occurs in September 2024 (184 titles), reflecting a temporary decline in relevant NATO news or activity during this month. Nonetheless, coverage remains generally consistent, reflecting NATO’s ongoing relevance in international security, geopolitical discussions, and Bulgaria’s own strategic positioning within the alliance. Overall, these data illustrate that NATO-related coverage is driven primarily by scheduled or emergent geopolitical and security events rather than exhibiting extreme fluctuations.

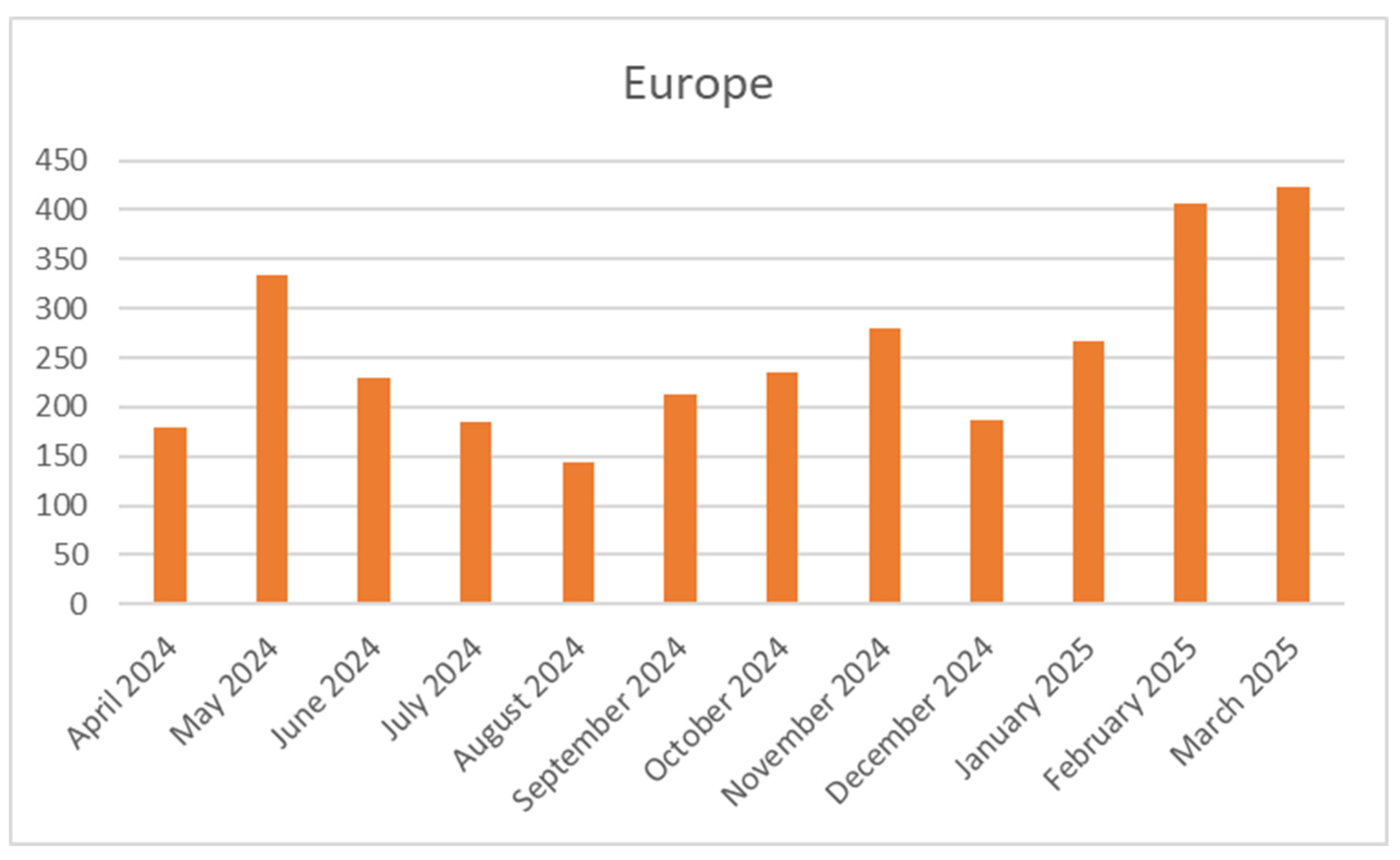

Table 13 presents the monthly frequency of occurrences of the word “Europe” in publication titles from April 2024 to March 2025.

The monthly occurrences of the word “Europe” in publication titles demonstrate moderate fluctuations throughout the analyzed period. A significant increase occurs in February 2025 (407 titles) and remains relatively high in March 2025 (424 titles), indicating potentially increased media interest in European Union activities, economic policies, diplomatic interactions, or regional developments during this timeframe. Another noticeable peak in May 2024 (333 titles) may correspond to important EU-related events or discussions, such as European parliamentary activities, economic updates, or geopolitical decisions affecting the continent. The lowest number of occurrences is seen in August 2024 (144 titles), reflecting a typically lower media activity during summer months when fewer significant political or institutional activities occur in Europe. Overall, media coverage of “Europe” appears consistently present but clearly responsive to key European political, economic, and diplomatic events or developments, thus reflecting periodic increases in editorial attention toward the continent.

To achieve a deeper understanding of editorial priorities and thematic preferences among individual media platforms, we conducted a detailed analysis of how frequently the top 20 identified keywords appear in each platform’s publications. This analysis reveals distinct editorial strategies, varying focuses on domestic and international topics, and potential audience targeting differences across media outlets.

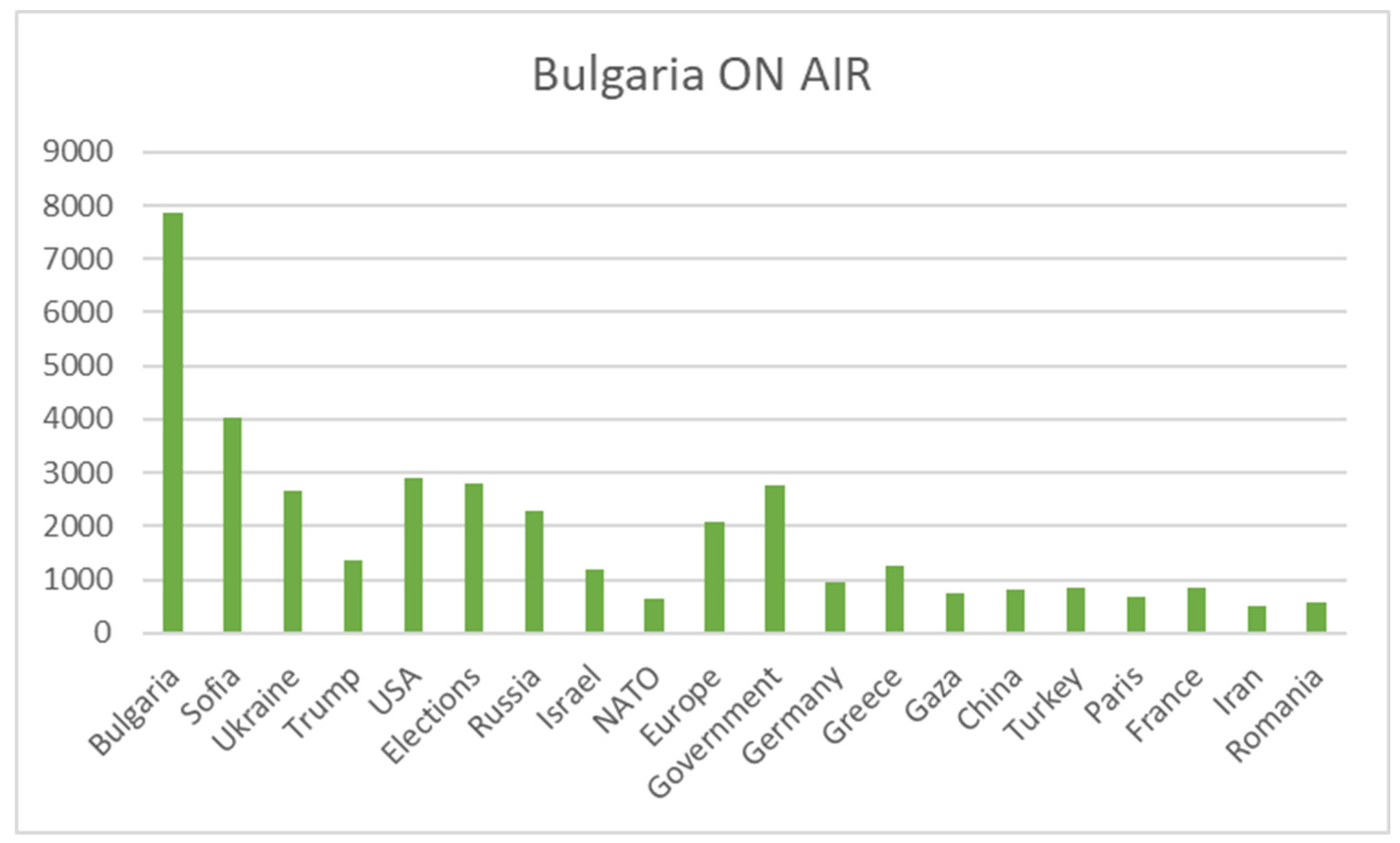

Table 14 presents the distribution of top 20 words in publications of Bulgaria ON AIR from April 2024 to March 2025.

The keyword distribution in the content of Bulgaria ON AIR indicates a strong editorial interest in both domestic and international themes, with a clear balance between local relevance and global reporting. The dominant presence of “Bulgaria” (7,866) and “Sofia” (4,026) confirms consistent attention to national and urban issues, likely reflecting daily political, social, and infrastructural developments. Additionally, “Government” (2,760) and “Elections” (2,790) highlight the channel’s sustained focus on political processes and institutional coverage. Among international topics, terms like “USA” (2,896), “Ukraine” (2,666), “Russia” (2,290), and “Europe” (2,089) appear frequently, reflecting global political tensions and regional diplomacy – likely driven by ongoing conflicts and EU affairs. This suggests a relatively even distribution of coverage between Western and Eastern geopolitical interests. Notably, words associated with Middle Eastern conflicts – such as “Israel”, “Gaza”, “Iran”, and “Turkey” – also maintain a significant presence, pointing to a comprehensive international news agenda. Coverage of “Paris” (670) and “France” (851) may be related to high-profile global events like the 2024 Olympics or EU developments. In summary, Bulgaria ON AIR demonstrates a content strategy that intertwines domestic political reporting with timely international developments, positioning itself as a news source with both local grounding and global awareness.

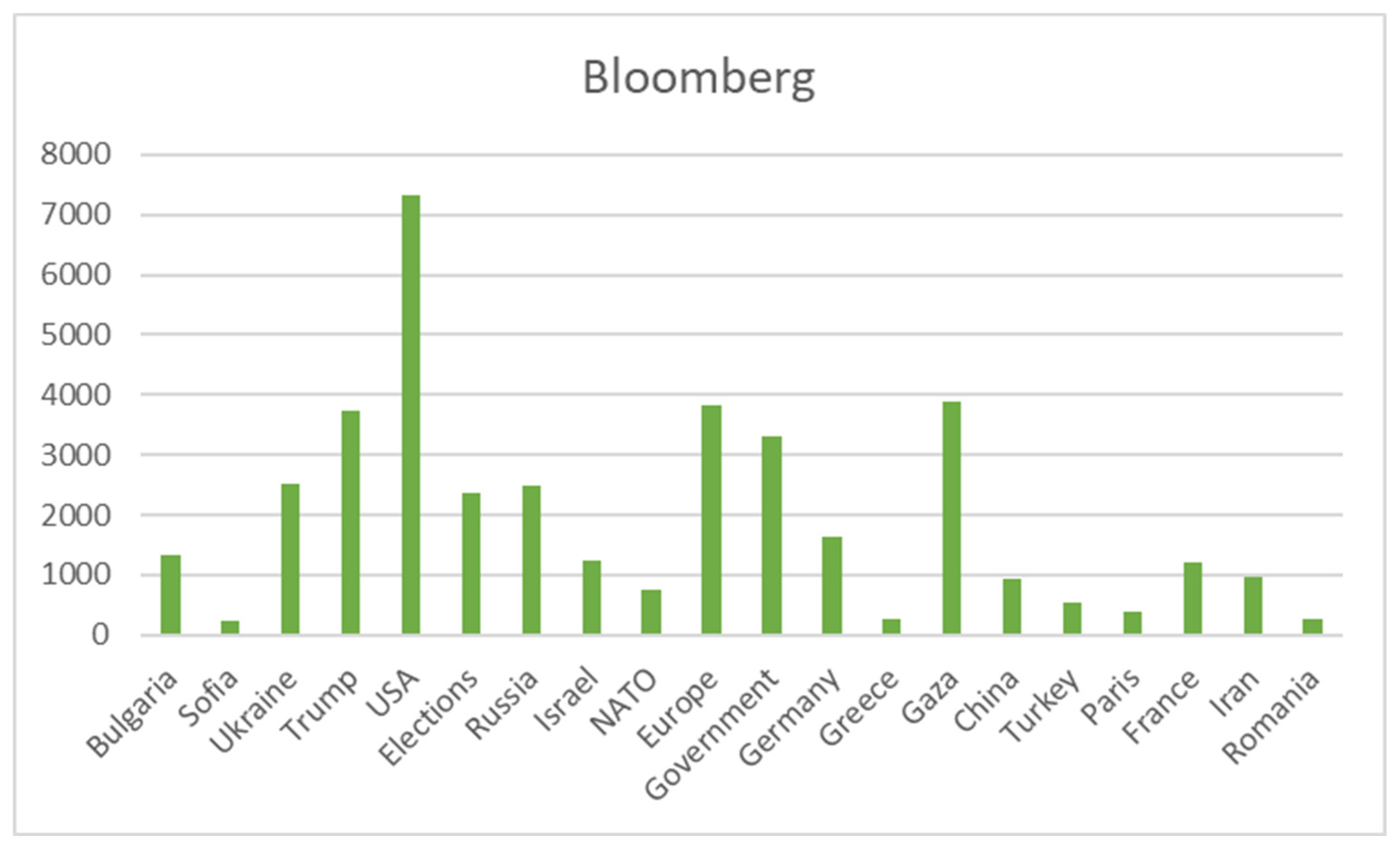

Table 15 presents the distribution of top 20 words in publications of Bloomberg from April 2024 to March 2025.

The data for Bloomberg TV Bulgaria reaffirm the outlet’s international and policy-oriented focus, with minimal emphasis on local content. Terms like “USA” (7,320), “Gaza” (3,891), “Trump” (3,742), “Europe” (3,813), and “Government” (3,313) are among the most prominent, reflecting deep editorial engagement with global political developments, international conflict, and leadership dynamics. Although “Bulgaria” (1,341) and “Sofia” (247) are present, their relatively low frequencies suggest limited coverage of national or local topics, aligning with Bloomberg’s global positioning and target audience. This contrast is especially noticeable when compared to public broadcasters such as BNR or BNT. The strong presence of “Russia”, “Ukraine”, “China”, “Germany”, and “France” reflects focused attention on major global actors and regions relevant to economic and geopolitical analysis. The especially high number of mentions of “Gaza” (even surpassing “Trump”) indicates extensive coverage of Middle Eastern conflicts – likely viewed through the lenses of global stability, humanitarian impact, and international policy response. Topics related to elections (2,368) and governance (3,313) further emphasize the outlet’s interest in institutional processes, democratic systems, and global leadership transitions – core themes for Bloomberg’s economic-political reporting model. In summary, Bloomberg TV Bulgaria stands out for its strongly international, policy-centric editorial strategy, with limited domestic coverage but deep engagement with global developments that affect markets, security, and international governance.

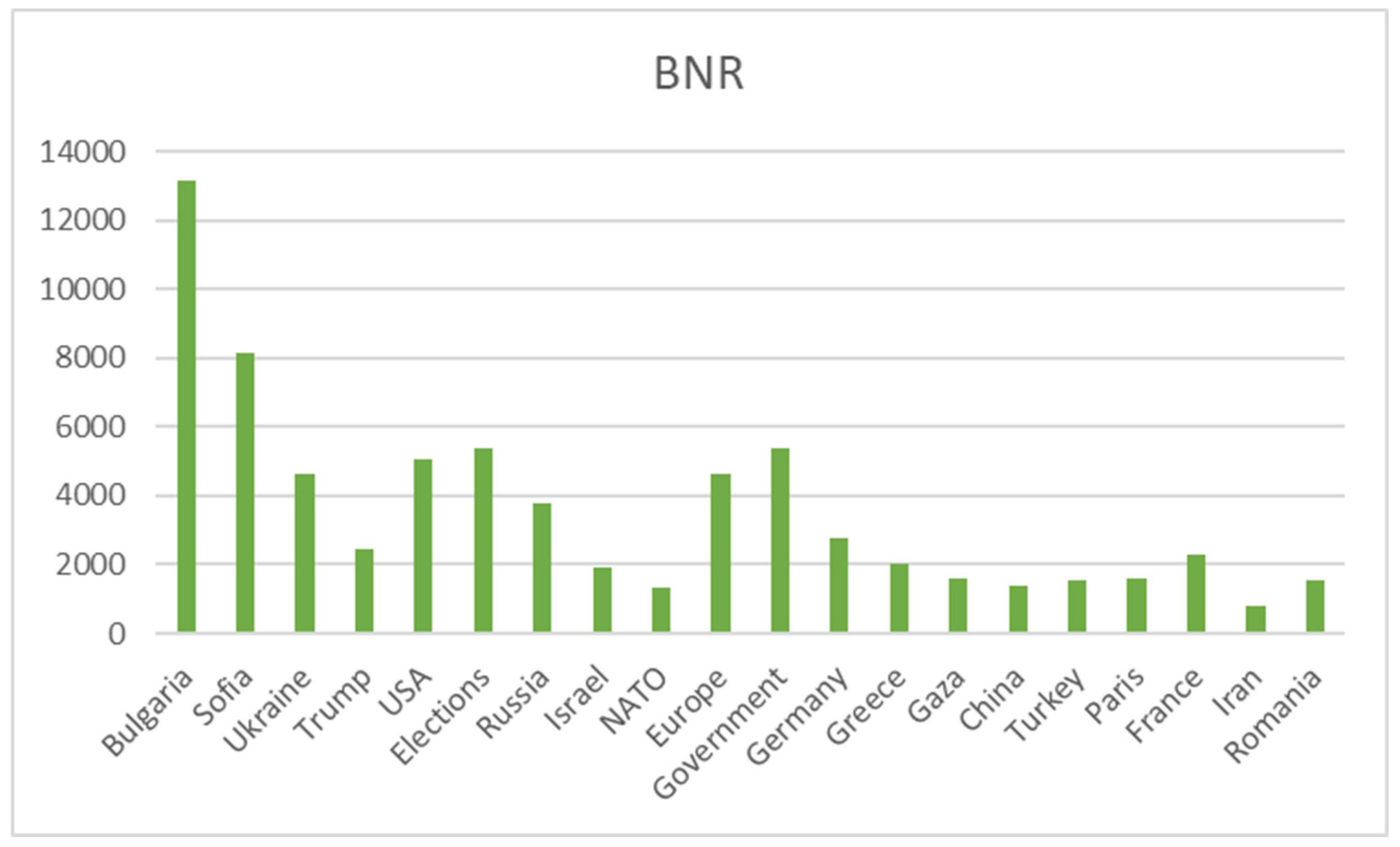

Table 16 presents the distribution of top 20 words in publications of BNR from April 2024 to March 2025.

The data for BNR confirms its profile as a public service broadcaster with a strong focus on national and institutional topics. The most frequently occurring words – “Bulgaria” (13,176), “Sofia” (8,149), “Elections” (5,400), and “Government” (5,389) – reflect the outlet’s consistent commitment to informing the public about domestic affairs, governance, and political processes. The frequency of “Ukraine” (4,625), “Russia” (3,798), “USA” (5,071), and “Europe” (4,632) indicates substantial attention to global developments, especially those with geopolitical significance for Bulgaria and the European Union. This supports BNR’s role not only as a national broadcaster, but also as a gateway to international information for the Bulgarian audience. Mentions of “NATO” (1,356), “Israel” (1,941), and “Gaza” (1,573) reflect coverage of international security, military alliances, and conflicts – themes that are both timely and relevant in the current global context. At the same time, regional countries such as Greece, Romania, and Turkey appear with relatively high frequency, confirming a regional orientation in addition to global and national reporting. The coverage of “Trump” (2,467), “France” (2,315), and “Germany” (2,751) points to consistent attention to the political dynamics in key Western countries, likely in relation to diplomacy, European affairs, or global leadership shifts. In conclusion, BNR maintains a well-balanced editorial strategy, with a strong core of national reporting complemented by robust international coverage. The data highlight BNR’s role as a comprehensive and reliable source of both domestic and global news for Bulgarian audiences.

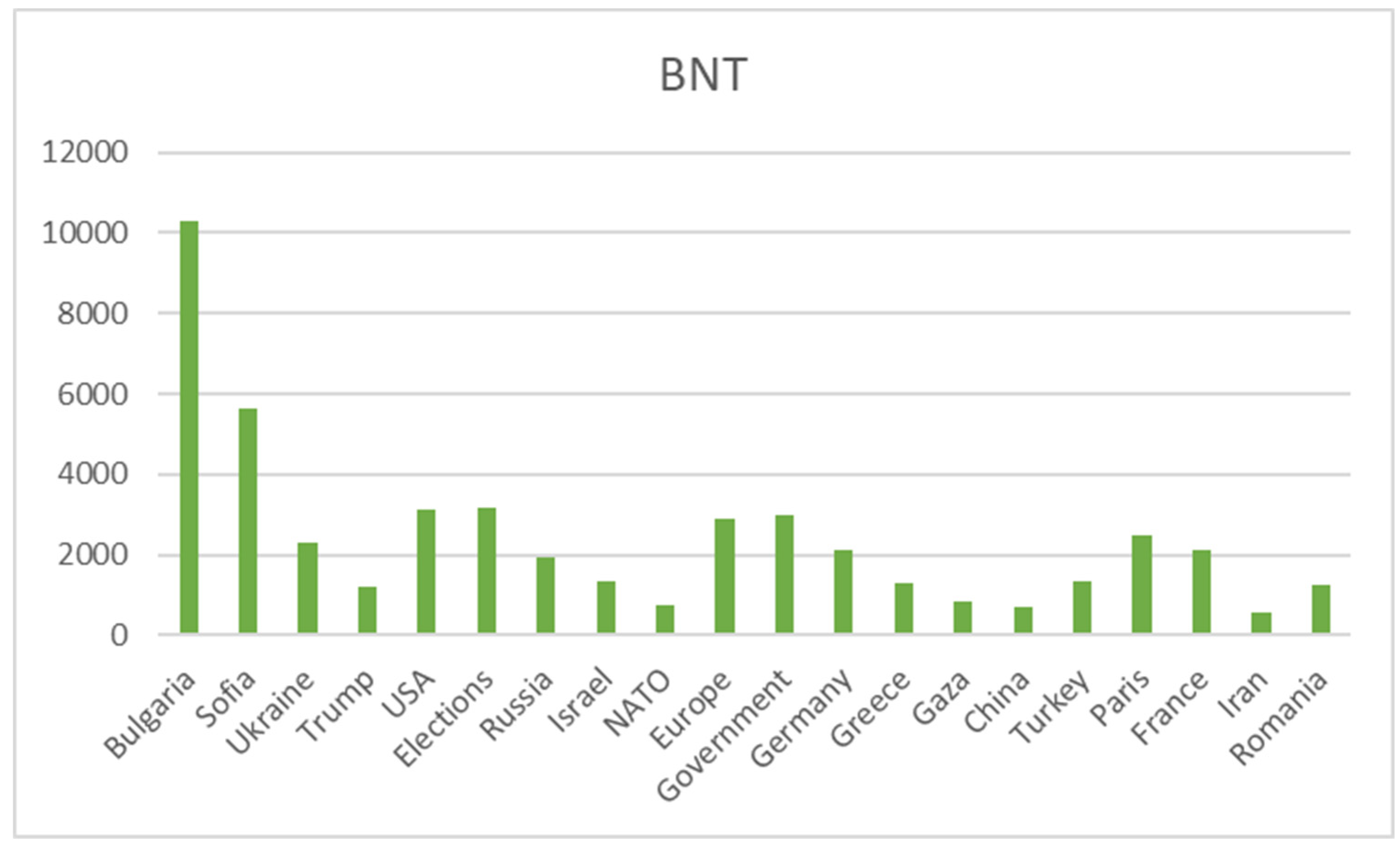

Table 17 presents the distribution of top 20 words in publications of BNT from April 2024 to March 2025.

The lexical distribution for BNT, Bulgaria’s national public television broadcaster, demonstrates a balanced editorial approach, combining extensive national coverage with regular attention to international developments. The high frequency of domestic terms such as “Bulgaria” (10,294) and “Sofia” (5,628) reflects the outlet’s public service mission to inform citizens about national and municipal issues. Similarly, the substantial use of “Elections” (3,174) and “Government” (2,992) confirms BNT’s role in reporting on institutional processes, democratic governance, and policy matters. While the international terms appear in lower absolute numbers compared to some other platforms, they still indicate solid global engagement. The presence of “USA” (3,109), “Europe” (2,884), “Ukraine” (2,325), and “Russia” (1,927) shows that BNT maintains consistent coverage of global geopolitical developments, particularly those affecting the region and Bulgaria’s international position. Mentions of “Germany” (2,111), “France” (2,128), and especially “Paris” (2,500) suggest coverage of European Union affairs and major global events – likely including the 2024 Summer Olympics in Paris, which could explain the notable prominence of the city name. Terms such as “Israel”, “Gaza”, and “Iran” reflect coverage of Middle Eastern conflicts, albeit at a more moderate level than in international or business-focused outlets. The regional perspective is reinforced through frequent references to Greece, Turkey, and Romania. Overall, BNT’s content profile aligns with its role as a national broadcaster – informing the public on local governance and national politics, while maintaining a clear, though proportionally smaller, window to the international stage.

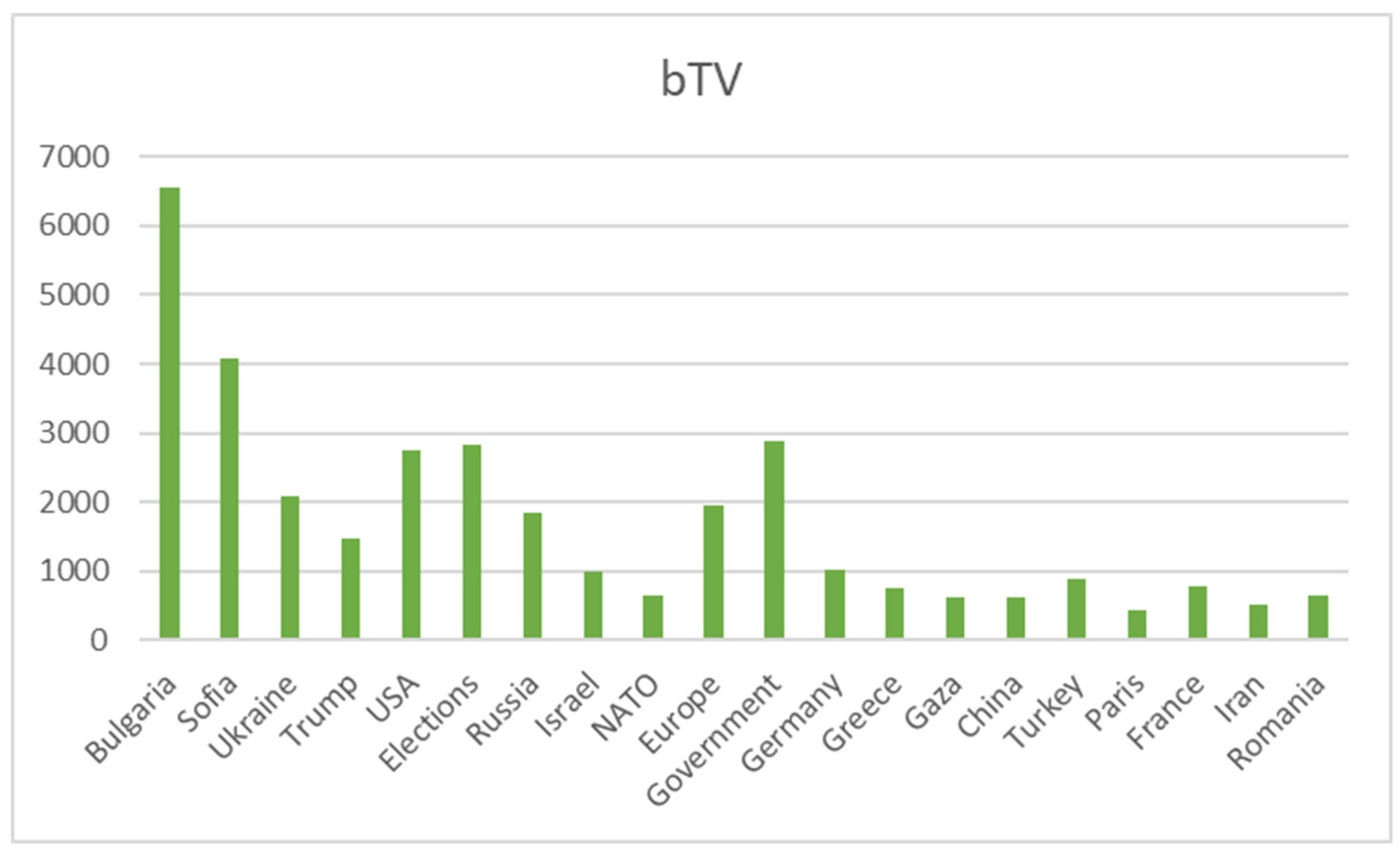

Table 18 presents the distribution of top 20 words in publications of bTV from April 2024 to March 2025.

The content distribution for bTV, one of Bulgaria’s largest private national broadcasters, reveals a balanced editorial profile with a slightly stronger domestic orientation complemented by solid international reporting. High frequencies of “Bulgaria” (6,542) and “Sofia” (4,069) confirm consistent coverage of national and local events. The prominence of “Government” (2,869) and “Elections” (2,839) indicates a strong focus on political processes, public institutions, and electoral dynamics – key themes in national reporting. Although the frequencies for international terms are not as high as in internationally oriented platforms like Bloomberg or DW, bTV maintains a well-rounded foreign affairs section. Terms such as “USA” (2,761), “Ukraine” (2,093), “Russia” (1,836), and “Europe” (1,947) demonstrate attention to major global developments, particularly those affecting Bulgaria’s geopolitical context. Coverage of Middle Eastern issues is present but relatively modest, with “Israel”, “Gaza”, “Iran”, and “NATO” each appearing in under 1,000 publications. This suggests that international conflict is covered selectively, likely based on event salience or relevance to domestic discourse. Regional focus is visible through mentions of Greece (764), Turkey (878), and Romania (654), suggesting attention to Bulgaria’s neighboring countries and EU partners. In conclusion, bTV exhibits a dual editorial focus, combining consistent reporting on national politics and institutions with contextual international coverage, without showing the extreme thematic skew typical of either public broadcasters or international news agencies.

Table 19 presents the distribution of top 20 words in publications of DW from April 2024 to March 2025.

The data for DW – Bulgarian service, as an international broadcaster, reflect a clearly global editorial focus, consistent with Deutsche Welle’s mission to present international perspectives to regional audiences. Domestic keywords such as “Bulgaria” (600) and “Sofia” (187) appear with relatively low frequency, confirming that DW does not prioritize local news reporting. Instead, the editorial emphasis is on broader political, global, and democratic developments. Terms such as “Government” (978), “USA” (946), “Ukraine” (827), “Russia” (835), and “Germany” (815) are among the most frequent, suggesting sustained coverage of international political relations, war and conflict, governance, and EU affairs. Germany’s presence, not surprisingly, is notable and likely influenced by DW’s country of origin and its lens on EU leadership and diplomacy. “Europe” (722) and “Elections” (674) reinforce DW’s attention to institutional and political processes across the continent. NATO, Israel, Gaza, and China also appear regularly, indicating coverage of geopolitical flashpoints and international security. Compared to other platforms, DW places less emphasis on regional neighbors like Greece, Romania, and Turkey, likely due to its global orientation rather than Balkan-centric focus. In conclusion, DW’s Bulgarian service demonstrates a predominantly international content strategy, reporting on major geopolitical and governance topics while providing minimal coverage of Bulgarian domestic affairs – aligning fully with its role as a global public broadcaster.

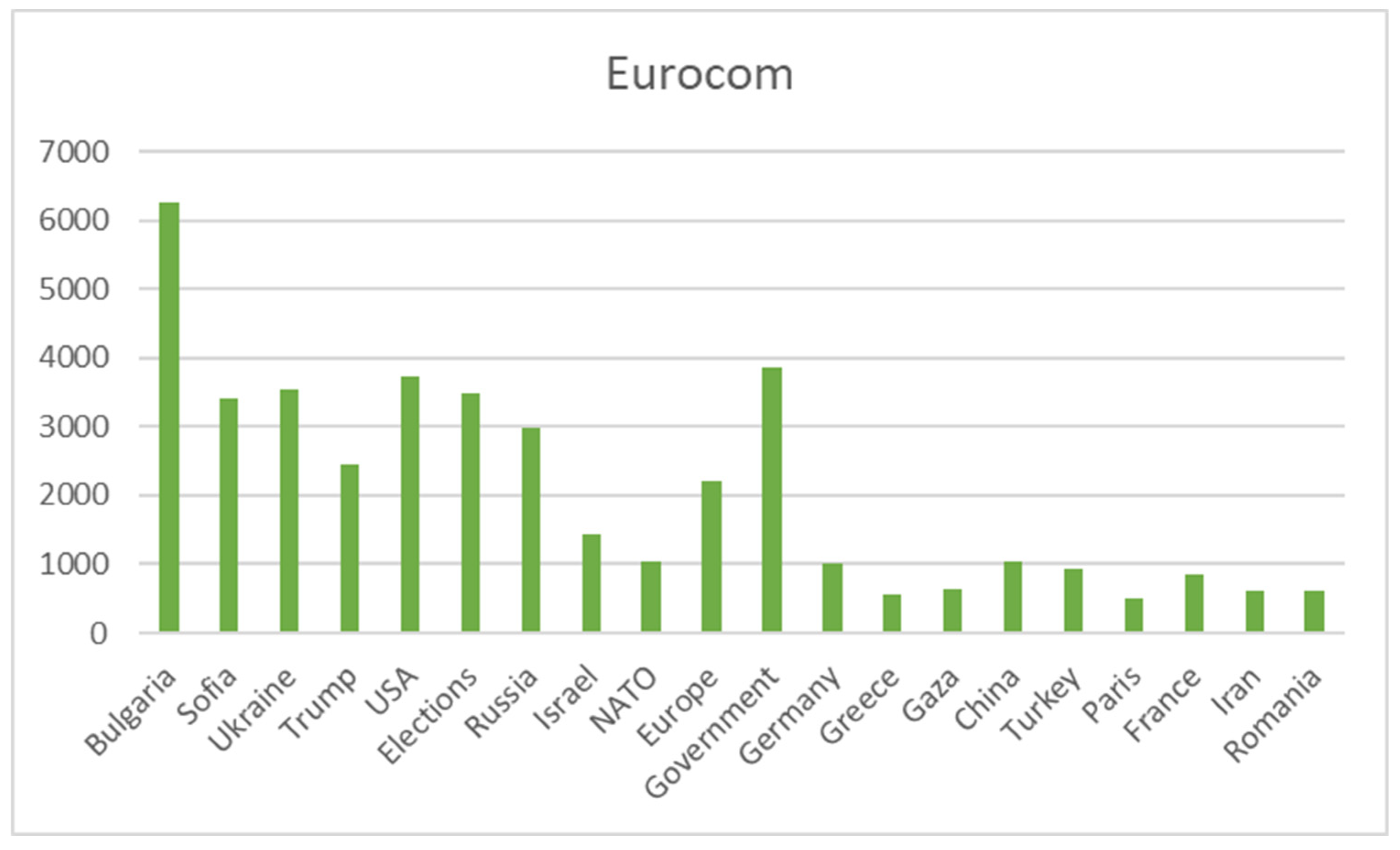

Table 20 presents the distribution of top 20 words in publications of Eurocom from April 2024 to March 2025.

The lexical profile of Eurocom, a private Bulgarian media outlet with a distinct editorial voice, shows a strong engagement with national political content, paired with considerable attention to international developments. The high number of references to “Bulgaria” (6,251), “Sofia” (3,417), “Government” (3,865), and “Elections” (3,482) clearly reflects a dominant focus on domestic politics, governance, and civic affairs. This positions Eurocom as an outlet heavily invested in political commentary and national discourse. However, Eurocom also dedicates substantial coverage to international affairs, with terms like “USA” (3,736), “Ukraine” (3,528), “Russia” (2,990), and “Trump” (2,446) appearing at high frequencies. This mix suggests an editorial strategy that combines internal political analysis with global context – particularly the international dimensions of security, diplomacy, and foreign influence. The presence of “NATO” (1,027) and “Europe” (2,206) reinforces Eurocom’s attention to Bulgaria’s place within regional and alliance structures, while Middle Eastern topics like “Israel”, “Gaza”, and “Iran” are present but not dominant. Mentions of “China” (1,041) and “Germany” (1,013) reflect interest in key global powers, while references to neighboring countries like “Turkey”, “Greece”, and “Romania” support a well-rounded editorial scope that includes regional relevance. In summary, Eurocom demonstrates a dual editorial profile: deeply focused on domestic political life, while simultaneously maintaining a meaningful presence in international and geopolitical reporting. This combination positions the outlet as both nationally engaged and globally aware.

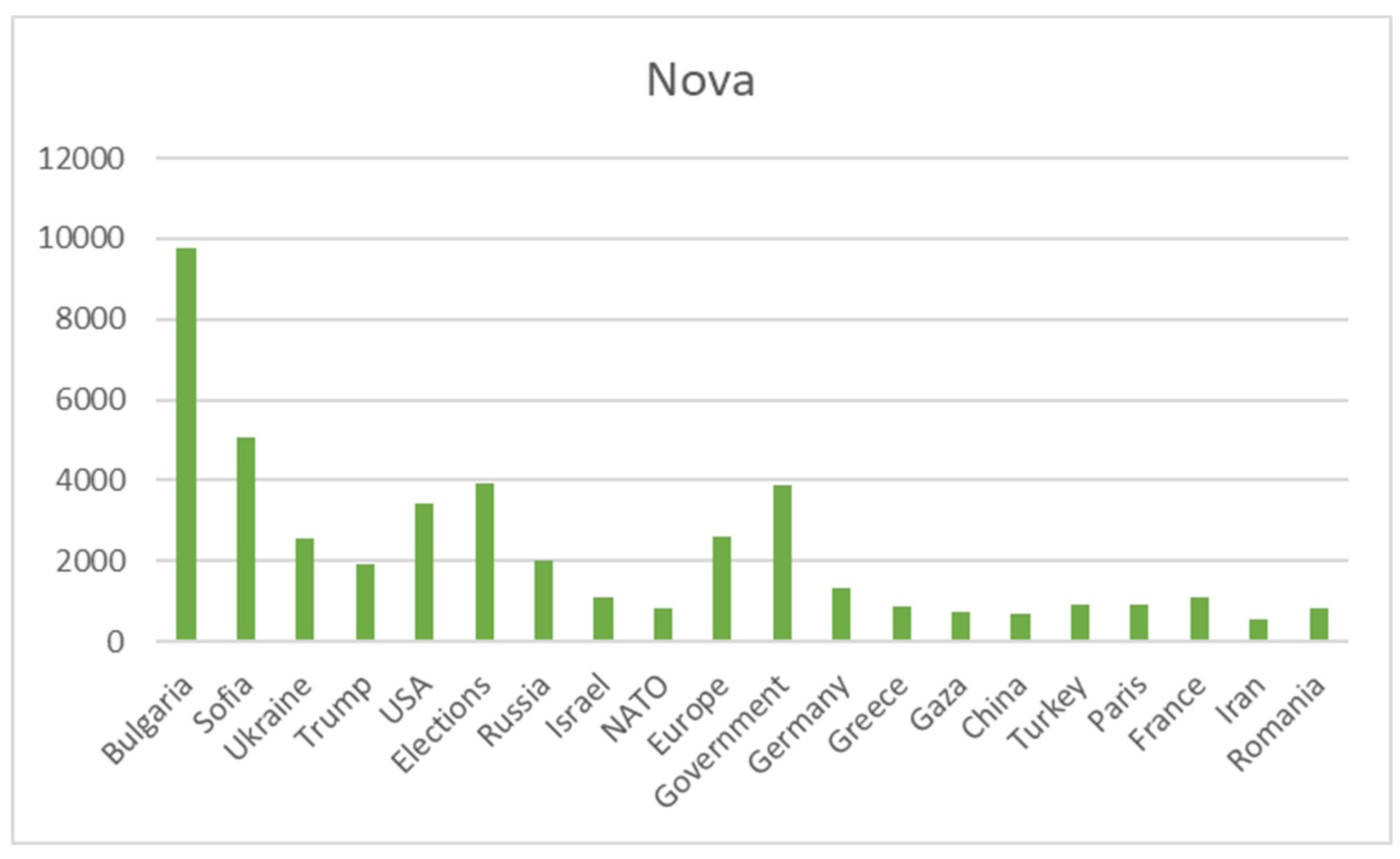

Table 21 presents the distribution of top 20 words in publications of Nova from April 2024 to March 2025.

The lexical profile of Nova TV, one of Bulgaria’s major commercial broadcasters, reflects a content strategy that strongly integrates national political focus with timely international coverage. Terms like “Bulgaria” (9,746), “Sofia” (5,054), “Government” (3,864), and “Elections” (3,901) show that Nova maintains high engagement with domestic politics and governance, reflecting the editorial weight placed on informing viewers about internal developments and institutional processes. Internationally, Nova provides moderate but consistent coverage of global topics. Frequent mentions of “USA” (3,435), “Ukraine” (2,544), “Russia” (2,015), and “Europe” (2,587) suggest a broad awareness of key geopolitical developments, especially those with regional and security implications. Nova also demonstrates engagement with event-driven topics, such as “Trump” (1,925) and “Paris” (906) – the latter likely driven by the 2024 Summer Olympics. Similarly, “France” (1,113) and “Germany” (1,319) show up with relatively high frequency, reflecting the importance of EU-centric coverage. Mentions of “Israel”, “Gaza”, “Iran”, and “NATO” confirm that Nova addresses international conflicts and alliances, though not with the intensity seen in more globally focused outlets like Bloomberg or DW. The presence of regional neighbors – “Greece”, “Turkey”, and “Romania” – further supports Nova’s commitment to reporting with both national and regional relevance. In conclusion, Nova TV offers a broad editorial mix, balancing domestic political reporting with responsive coverage of global and regional developments. Its content reflects a mainstream media profile, tailored to a general audience with interest in both local and international affairs.

The results obtained through quantitative and lexical analysis of web publications from eight major Bulgarian media platforms over the period April 2024 – March 2025 allow for several key experimental conclusions that highlight both overarching patterns and distinctive editorial strategies. The analysis of publication volume showed significant variation among platforms, with BNR, Nova, and BNT emerging as the most prolific sources of digital content. Seasonal patterns were evident, particularly with reduced output during the summer months and increased activity in the autumn and early winter, coinciding with periods of heightened political and social developments. The examination of the most frequently used words in titles and full texts revealed a consistent editorial focus on both domestic and international topics. High-frequency terms such as “Bulgaria”, “Sofia”, and “Government” underscore the media’s engagement with national affairs, while terms like “USA”, “Ukraine”, “Russia”, and “Europe” reflect the salience of global geopolitical developments in Bulgarian media discourse. Comparative analysis between word usage in titles and in article bodies revealed editorial strategies designed to capture audience attention. Certain words, including “Trump” and “NATO”, appeared more frequently in titles than in article content, likely chosen for their attention-grabbing quality. In contrast, words such as “Government” and “Bulgaria” were more dominant in the texts themselves, suggesting that these topics receive more substantive treatment within the body of the articles. The monthly dynamics of the top ten keywords illustrated clear, event-driven fluctuations. For instance, coverage of “Trump” and “USA” peaked during the U.S. election period, while the terms “Elections” and “Government” became more prominent during domestic political events. Other terms, such as “Paris”, spiked in connection with specific international occasions like the 2024 Summer Olympics. Finally, the distribution of keywords across individual media platforms demonstrated clear editorial distinctions. Public service broadcasters such as BNR and BNT exhibited a strong focus on domestic issues and political coverage. In contrast, internationally oriented media such as Bloomberg, DW, and Bulgaria ON AIR emphasized global political and economic developments. Private national outlets including bTV, Nova, and Eurocom adopted a more balanced approach, combining consistent local reporting with selective but substantial international coverage.