This section highlights the research findings in the context of Innovative Financial Instruments for Sustainable Development:

3.1. Digital Solutions for Crisis Management

This section explores how innovative financial instruments, coupled with digital advancements, enhance efficiency, transparency, and resilience in crisis situations. The study examines expert insights on their applicability in supporting sustainable finance, particularly for small and medium enterprises (SMEs).

Participant Analysis. To assess the impact of these financial tools, the study surveyed 50 professionals from various sectors engaged in sustainable finance:

- ✓

Banks and financial institutions – 40%

- ✓

Non-governmental organizations (NGOs) – 30%

- ✓

Public sector organizations – 20%

- ✓

Academics and researchers – 10%

Most respondents had over five years of experience in sustainable finance, providing informed perspectives on the adoption of digital financial solutions. Their insights highlighted how these mechanisms help businesses and communities mitigate financial and operational disruptions caused by economic downturns or environmental crises.

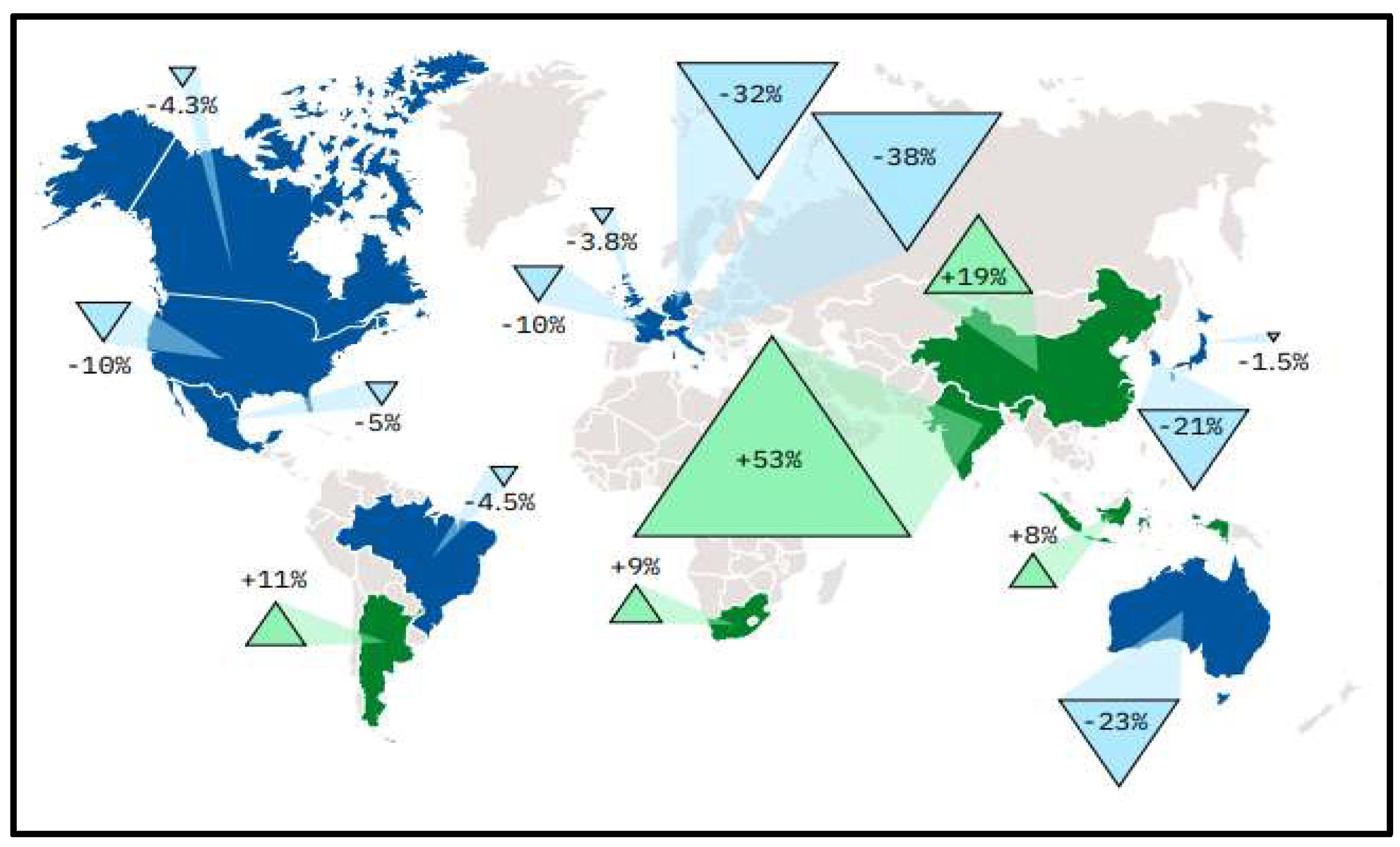

Key Findings. One of the primary takeaways was the global adaptability of innovative financial mechanisms. Digital solutions, such as blockchain for transparent fund allocation and AI-driven models for risk assessment, were widely recognized for their ability to efficiently respond to urgent financial needs while promoting long-term sustainable development.

Moreover, these instruments play a crucial role in ensuring that economic recovery efforts remain aligned with environmental and social priorities. By mobilizing resources, enhancing decision-making processes, and supporting sustainable investments, they contribute to a resilient financial ecosystem that balances growth with sustainability.

Application of Digital Financial Instruments in Crisis Scenarios. The study specifically examined the role of green bonds, impact funds, and crowdfunding in financing SMEs and supporting sustainable development amid crises. The findings indicate key trends in the adoption and effectiveness of these instruments:

- ✓

70% of respondents had experience with projects funded by green bonds in the past three years, with many initiatives supported by the European Commission. Additionally, 65% viewed green bonds as the most effective tool for attracting capital to environmentally sustainable projects.

- ✓

55% of participants emphasized the importance of impact funds in generating measurable social and environmental benefits, particularly in projects addressing climate change and social equity.

- ✓

45% of respondents reported utilizing crowdfunding platforms to secure funding for sustainable projects, reflecting the increasing appeal of decentralized, community-driven financial solutions.

These results reinforce the growing recognition of innovative financial instruments as crucial tools for bridging the gap between economic growth and environmental responsibility. They also align with literature findings, which highlight the potential of such mechanisms to scale sustainable finance initiatives.

The study underscores the transformative potential of digital financial instruments in addressing sustainability challenges, particularly for SMEs, which often face barriers in accessing traditional financing. By integrating technology-driven solutions, these instruments enhance the efficiency, accessibility, and impact of sustainable finance, positioning them as vital components of crisis management and long-term economic resilience.

3.3. Evaluation of the Impact of Financial Instruments

By applying the evaluation formulas outlined in the research methodology, the following results were obtained:

Sustainable Investment Growth Rate (RCIS)

During the period analyzed, sustainable investments recorded an average annual growth rate of 12%. This demonstrates a positive trend in capital allocation for sustainable projects.

The calculation for investments in the current year (2023) and the previous year (2022) showed an increase from 500 million euros to 560 million euros.

Social and Environmental Impact (ISE)

The ISE was rated at 1.5, indicating that for every euro invested in sustainable projects, there is a social and environmental impact of 1.5 euro.

The environmental impact was estimated at 300 million euros, while the social impact was valued at 150 million euros, with the total investment cost amounting to 300 million euros.

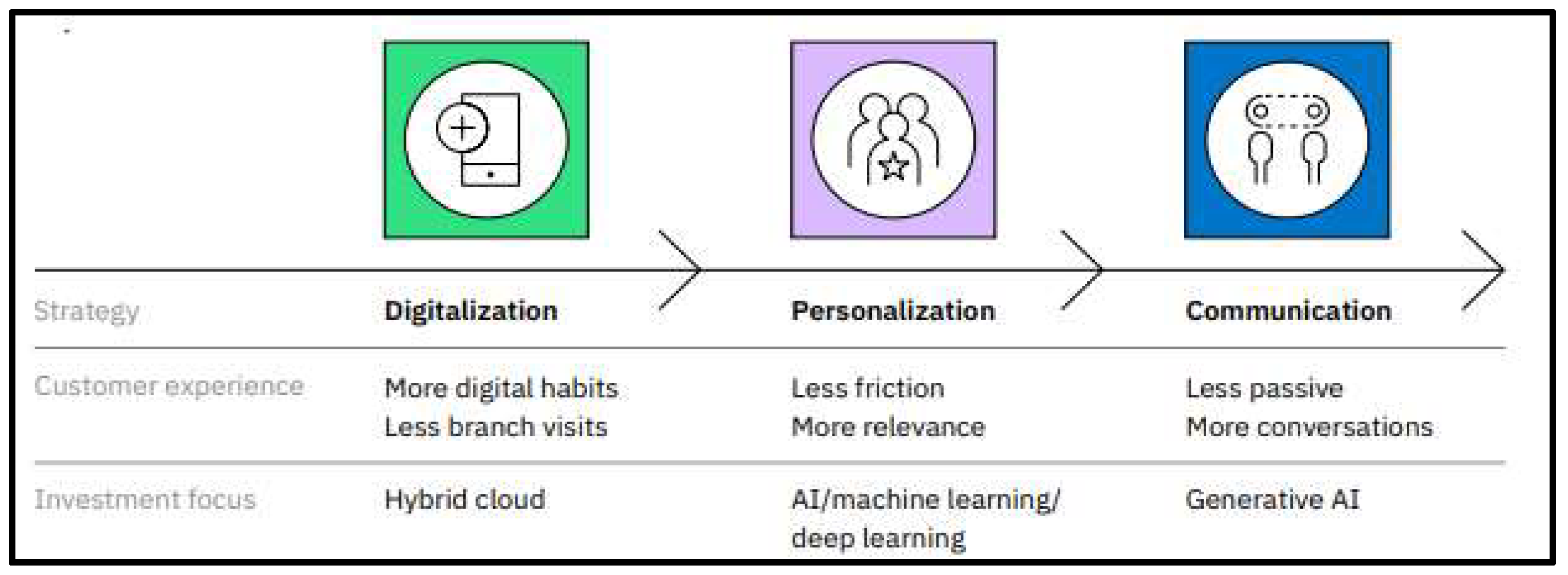

Despite the continued importance of branches in banking intermediation, their numbers have been steadily declining since 2012, especially in major advanced economies and within the EU (see

Figure 1) (IBM, 2023). This reduction is largely driven by a surge in mergers and acquisitions, as well as by falling demand and pressure on revenues, particularly due to low interest rates over the last decade. Conversely, in some advanced and emerging economies, branch networks are expanding alongside economic growth, increased bank profitability, and the effort to extend financial services to previously unbanked populations and regions.

Digitalization as a Pathway to Access

Initially, banks launched online services to complement their physical branches, offering similar services without distinguishing key features. With the rise of smartphones, digital banking evolved into a primary platform for customer interaction. We surveyed 12,000 consumers on their preferred methods for performing basic banking tasks, such as accessing accounts and checking balances and transactions. 62% of respondents reported using a mobile app, while 12% preferred a bank website (Ramamurthy, Shanker et al., 2023).

However, the interfaces designed for basic banking services were developed and optimized without addressing underlying banking complexities, which limited their ability to meet the evolving digital needs of customers. This restriction hindered banks from engaging clients effectively using core transaction data, even when supplemented by additional data sources.

As digital banking became more widespread, cloud technology emerged as crucial for enhancing the omnichannel experience, offering powerful analytics for timely insights into customer behaviors. The open architecture of hybrid cloud technology emphasizes the importance of innovation and the need for seamless integration within the fintech ecosystem, fostering a more agile, customer-focused digital banking environment (

Figure 2).

The Influence of Generative AI on Bridging the Skills Gap

In the banking sector, where there is a strong drive to integrate advanced technologies but a persistent shortage of skilled labor, the adoption of generative AI has the potential to significantly reduce the skills gap and boost competitiveness. By automating complex tasks and improving decision-making processes, generative AI can empower banks to maximize the potential of their workforce, allowing them to perform at higher levels of efficiency and productivity despite limitations in specialized talent. This technology has the capacity to streamline operations, improve customer interactions, and facilitate data-driven insights—all of which contribute to a more robust and agile banking environment (Manta O., Yue XG, 2024).

However, it’s important to note that simply implementing generative AI does not guarantee immediate operational savings unless there is a comprehensive strategy in place to redefine workforce engagement. Without a clear plan to integrate these advanced tools into day-to-day activities and reshape how employees interact with technology, the benefits of improved efficiency may not be fully realized. The key to success lies in ensuring that the human workforce is adequately equipped to collaborate with AI systems, driving long-term value while simultaneously upskilling employees to handle more strategic, high-value tasks.

In this context, the thoughtful application of generative AI can transform not just the technological landscape but also the way banks attract, retain, and develop talent—ultimately strengthening their competitive position in a rapidly evolving market.

The evolution of Artificial Intelligence:

1. Early AI Foundations (1940-1960)

1943 – McCulloch & Pitts propose a mathematical model of artificial neurons.

1950 – Alan Turing introduces the Turing Test to measure machine intelligence.

1956 – The Dartmouth Conference officially establishes AI as a field of study.

2. First AI Systems (1960-1980)

1965 – Joseph Weizenbaum creates ELIZA, an early chatbot.

1974 – The first “AI winter” occurs due to overhyped expectations and slow progress.

1980 – Expert systems emerge, used in medicine and industry.

3. Evolution of Neural Networks (1980-2000)

1986 – Backpropagation algorithm enables better neural network training.

1997 – IBM’s Deep Blue defeats world chess champion Garry Kasparov.

4. Rise of Modern AI (2000-2010)

2002 – iRobot launches Roomba, the first autonomous vacuum cleaner.

2011 – IBM Watson defeats Jeopardy champions.

5. Deep Learning Revolution (2010-2020)

2014 – Facebook launches DeepFace, an advanced facial recognition system.

2015 – AlphaGo (DeepMind) defeats human champions in the game of Go.

2020 – OpenAI releases GPT-3, a powerful natural language processing model.

6. AI in the Present Era (2021-Present)

2021 – DeepMind releases AlphaFold2, revolutionizing molecular biology.

2022 – Google launches LaMDA, an advanced conversational AI model.

2023 – Generative AI (ChatGPT, Midjourney) sparks debates about artists’ rights and its impact on industries.

To fully harness the efficiencies driven by AI, it’s essential not only to reskill the workforce but also to embrace a new mix of talents. Realizing the true value of emerging skills and diverse talent requires a fundamental shift in how individuals work, collaborate, co-create, and execute tasks. Before unlocking the full potential of STEM expertise, organizations must first identify key priorities and navigate through internal complexities—challenges that call for a strategic, well-thought-out approach. This could help explain the decline in the significance of STEM and IT skills since 2016 (see

Figure 3) (Goldstein, J. et al., 2023).

Moreover, AI applications are not without their risks and regulatory challenges. In the era of generative AI, financial institutions must rethink their strategies for managing data and privacy. Compliance with frameworks like the EU’s GDPR and intellectual property protections must be integrated as foundational elements in this transformation.

10 Essential Actions for Banks to Navigate Rapid Technological Change. In today’s fast-paced banking environment, where technological cycles are accelerating at an unprecedented rate, financial institutions must adopt a rapid and structured approach to stay competitive. To thrive in this landscape, banks must not only move forward quickly but also ensure that their actions are well-coordinated and purposeful. Drawing from IBM’s extensive experience collaborating with leading financial institutions in the implementation of AI, we highlight 10 critical actions that can help banks build a strong foundation for generative AI. These actions are designed to guide decision-making processes that accelerate AI adoption while ensuring sustainability and scalability.

The proposed actions align with broader strategies for scaling AI across the organization, encompassing advanced technologies such as machine learning, deep learning, and natural language processing (NLP). By focusing on these core areas, banks can build the technological infrastructure required to adapt to the fast-evolving market. These actions not only help institutions manage immediate challenges but also position them for long-term success in integrating AI into their operations, improving efficiency, and enhancing customer experiences.

Through these strategic steps, banks can establish a clear path toward adopting cutting-edge AI technologies, optimizing internal processes, and maintaining their competitiveness in a landscape shaped by exponential technological advancements (see

Figure 4).

Figure 4.

Shifting Focus on Skills and Talent: Navigating Priorities and Overcoming Complexities Through Strategic Expertise. Source: Augmented work for an automated, AI-driven world: Boost performance with human-machine partnerships. IBM Institute for Business Value, 2023.

Figure 4.

Shifting Focus on Skills and Talent: Navigating Priorities and Overcoming Complexities Through Strategic Expertise. Source: Augmented work for an automated, AI-driven world: Boost performance with human-machine partnerships. IBM Institute for Business Value, 2023.

Figure 5.

Strategic Roadmap: Discover, Integrate, and Expand. Source: IBM Institute for Business Value, 2023.

Figure 5.

Strategic Roadmap: Discover, Integrate, and Expand. Source: IBM Institute for Business Value, 2023.

The Role of Financial Instruments and Digitalization in Advancing Sustainable Financing

The rise in sustainable investments, coupled with improvements in transparency and efficiency within financial processes, signals a positive shift for the future of sustainable finance. However, persistent challenges emphasize the necessity for innovative solutions and deeper collaboration among stakeholders within the financial sector.

In this study, we introduce a cutting-edge concept designed to improve the financing landscape for small and medium-sized enterprises (SMEs) in the digital era: a decentralized crowdfunding platform powered by blockchain technology. This platform integrates tokenization, smart contracts, and participatory financing to provide a more transparent, efficient, and accessible method for raising capital.

Tokenization of SME Assets

SMEs can issue digital tokens that represent either a share of the company’s equity or future income rights, enabling them to attract investments from a wide pool of investors. These tokens could be traded on secondary markets, creating liquidity for investors. For example, SMEs could issue tokens that represent a percentage of profits for a fixed period, which can then be bought by both retail and institutional investors.

Smart Contracts

Smart contracts could automate the entire financing process, ensuring that funds are released only when predefined conditions—such as meeting financing targets or executing business initiatives—are met. This would eliminate the need for traditional intermediaries, reduce transaction costs, and increase trust in the financing process.

Decentralized Crowdfunding on Blockchain

The platform would allow SMEs to access funding through a decentralized crowdfunding model, enabling global investors to contribute small amounts. Blockchain technology would guarantee full transparency of transactions, ensuring that funds are used for their intended purpose. The platform could also feature a ’proof of impact’ mechanism, which tracks fund usage and rewards SMEs for achieving growth or social impact objectives.

Credit Assessment Using AI Algorithms and Big Data

Integrating an AI-powered credit assessment system could further enhance the platform’s effectiveness. This system would evaluate the creditworthiness of SMEs by analysing financial data, market behaviour, online activities, and other factors, offering access to credit for businesses that may be overlooked by traditional banks.

Gamification of Investments

To engage retail investors, the platform could employ gamification strategies, such as awarding badges or rewards based on contributions or the success of funded projects. This would increase investor engagement and encourage ongoing participation in SME growth.

ESG-Based Financing (Environmental, Social, and Governance)

SMEs with strong environmental or social impacts could gain access to specialized funding. Tokens issued by SMEs with high ESG scores would attract investors looking to align their investments with sustainable development goals.

Evaluating the Impact of Tokenized Distributed Investment Assets (TDIA) or Decentralized Crowdfunding Platforms

To assess the performance of innovative financial instruments like TDIA or decentralized crowdfunding platforms, specific financial indicators are necessary to reflect their digital, decentralized, and tokenized nature. Here are some relevant indicators:

1. Total Value Locked (TVL)

Definition: TVL represents the total value of funds held within the platform or the smart contracts supporting tokenized assets.

Relevance: TVL measures investor confidence and participation. A higher TVL indicates broader adoption and increased liquidity, signalling success in the platform’s use.

Utility: TVL is a key performance indicator, reflecting the platform’s ability to attract and retain investment.

2. Token Price Volatility

Definition: This indicator tracks the fluctuations in token prices on secondary markets.

Relevance: High volatility may suggest risk but also short-term profit potential, while low volatility reflects stability and investor confidence in the token’s fundamental value.

Utility: Investors use this to assess risk and make informed decisions about trading or holding tokens.

3. Dividend Yield or Distributed Earnings

Definition: This metric represents the percentage of income generated by the tokenized assets, distributed to token holders as dividends or other periodic payments.

Relevance: Dividend yield is crucial for assessing the return on investment. A stable and attractive yield can attract more investors and increase token value.

Utility: A higher dividend yield signals strong economic performance and is an essential driver for investor interest.

4. Market Capitalization Growth Rate of Tokens

Definition: This represents the total value of all circulating tokens, calculated by multiplying the number of tokens by their market price.

Relevance: Consistent growth in market capitalization indicates widespread adoption, higher demand, and investor trust in the project. A decline could signal low liquidity or reduced confidence.

Utility: This metric tracks the market success and public perception of the financial instrument.

5. Secondary Market Liquidity

Definition: Liquidity refers to how easily tokens can be bought or sold without drastically impacting their price.

Relevance: High liquidity is essential for providing investors with exit options. Low liquidity can cause difficulties in selling tokens and result in large price swings during transactions.

Utility: Increased liquidity suggests a healthy, well-functioning market, offering investors more flexibility in trading.

These financial indicators help measure the viability, success, and sustainability of innovative financial instruments, offering a clearer picture of how they can enhance the financing landscape for SMEs while supporting sustainable development goals.

6. User Adoption Rate

Definition: The User Adoption Rate measures the number of active users or investors engaging with the platform to invest in tokenized assets. This metric indicates the level of interest and participation from both new and returning users.

Relevance: A high adoption rate signals the platform’s growing popularity and its ability to attract and retain investors. Continuous user growth suggests increasing trust in the platform and its potential for long-term expansion.

Utility: Monitoring adoption trends helps stakeholders assess the platform’s scalability and future market potential. A rising adoption rate may indicate successful marketing efforts, an intuitive user experience, and strong demand for tokenized investment opportunities.

7. Conversion Rate of Invested Capital into Tokens

Definition: This indicator measures the percentage of funds raised through crowdfunding campaigns or tokenization processes that are effectively converted into real-world assets or actual investments in projects. It reflects how efficiently capital is being deployed into tangible investment opportunities.

Relevance: A high conversion rate suggests that most of the invested funds are being allocated as promised, reinforcing trust in the platform’s operational integrity and investment framework. It is a key indicator of platform efficiency and investor confidence.

Utility: This metric is essential for evaluating how successfully the platform transforms raised capital into real investments. A transparent and high conversion rate reassures investors that their funds are being used effectively, reducing the risk of misallocation and increasing credibility.

8. Return on Investment (ROI)

Definition: ROI measures the profitability generated by an investor through holding tokens or financing projects on the platform. It is calculated by comparing the total earnings (including dividends, token price appreciation, and other financial benefits) to the initial investment amount.

Relevance: ROI is a fundamental metric for investors, as it determines whether an investment yields positive returns. A consistently high ROI attracts new investors and strengthens the platform’s reputation, while a low or negative ROI may indicate underlying risks or inefficiencies.

Utility: By analyzing ROI, investors can assess the financial viability of their investments and make informed decisions. A strong ROI suggests that the platform is generating real value, while declining returns may prompt a reevaluation of investment strategies.

9. Risk Distribution Ratio

Definition: This indicator evaluates the relationship between the total risk associated with a financial instrument—such as price volatility, asset insolvency risk, and market fluctuations—and the expected return.

Relevance: A well-balanced risk-to-return ratio enhances investment attractiveness. If the risk significantly outweighs the expected benefits, investors may reconsider their participation, leading to capital outflows. Conversely, a favorable risk-reward balance strengthens investor confidence.

Utility: Understanding risk distribution helps investors assess the stability of their investments. Platforms with effective risk management strategies are more likely to maintain investor trust and long-term sustainability. This metric also aids portfolio diversification and strategic risk mitigation.

10. Transaction and Management Costs

Definition: This metric represents the financial expenses incurred when buying, selling, or managing tokens on the platform. It includes transaction fees, management commissions, smart contract execution costs, and other operational expenses.

Relevance: Excessive costs can diminish investor returns and reduce the platform’s competitiveness. Evaluating transaction and management fees is crucial for determining the true profitability of an investment.

Utility: By analyzing cost structures, investors can make informed decisions about where to allocate their capital. A platform with lower fees and efficient cost management is generally more attractive to users, fostering long-term engagement and growth.

The Importance of These Indicators

These key performance indicators provide a comprehensive framework for assessing the efficiency, profitability, and sustainability of an innovative financial instrument based on digital technologies and tokenization. By tracking these metrics, investors, platform developers, and stakeholders can gain deeper insights into market trends, investment risks, and potential growth opportunities.

Visual Representation of Financial Instrument

We have created a detailed diagram that illustrates the structure of this innovative financial instrument, highlighting key components such as tokenized assets, smart contracts, decentralized crowdfunding, and the automated distribution of dividends to investors. The diagram visually represents the investment flows and automated processes that drive this financial ecosystem. You can view or download the diagram by clicking on the image above.

Figure 6.

Visual Representation of a Blockchain-Based Financial Instrument. Source: own processing&AI.

Figure 6.

Visual Representation of a Blockchain-Based Financial Instrument. Source: own processing&AI.

We have developed a comprehensive logical diagram that visually maps out the core functionalities of an innovative blockchain-based financial instrument. This diagram serves as a guide to understanding the fundamental processes that drive the system, including:

- ✓

Asset Tokenization – Converting real-world assets into digital tokens to enable fractional ownership and enhanced liquidity.

- ✓

Investor Participation – Facilitating seamless entry for individual and institutional investors through a decentralized platform.

- ✓

Smart Contract Execution – Automating transactions and enforcing investment agreements without the need for intermediaries.

- ✓

Crowdfunding Process – Enabling small and medium-sized enterprises (SMEs) to raise capital efficiently through tokenized fundraising mechanisms.

- ✓

Automated Dividend Distribution – Ensuring transparent and timely distribution of returns to investors based on predefined smart contract rules.

Overview of Key Financial Metrics

- ✓

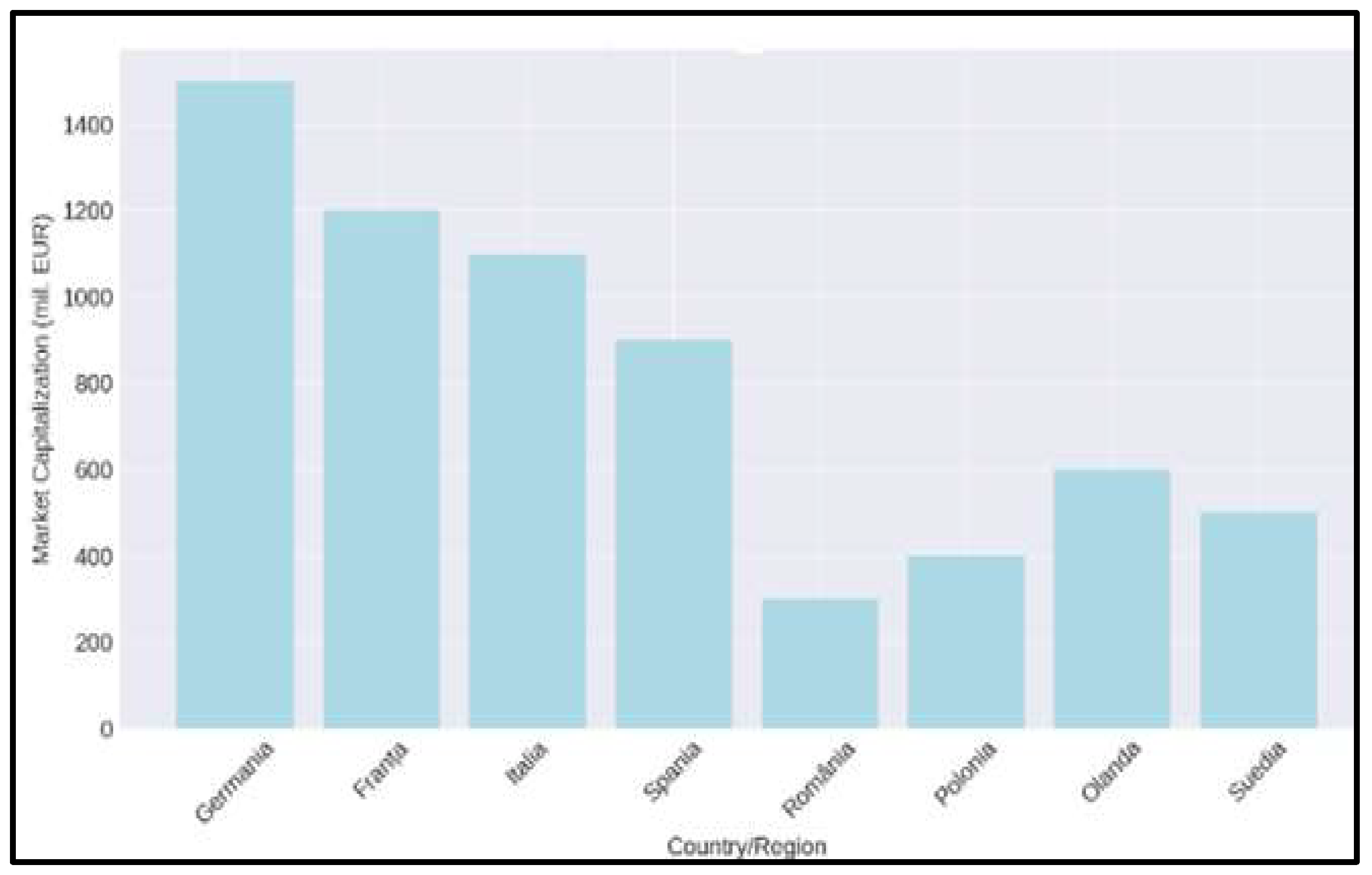

Token Market Capitalization (Million EUR) by Country – This chart highlights the total value of tokenized assets in different European nations, showcasing the distribution of investments and the strength of various regional markets.

- ✓

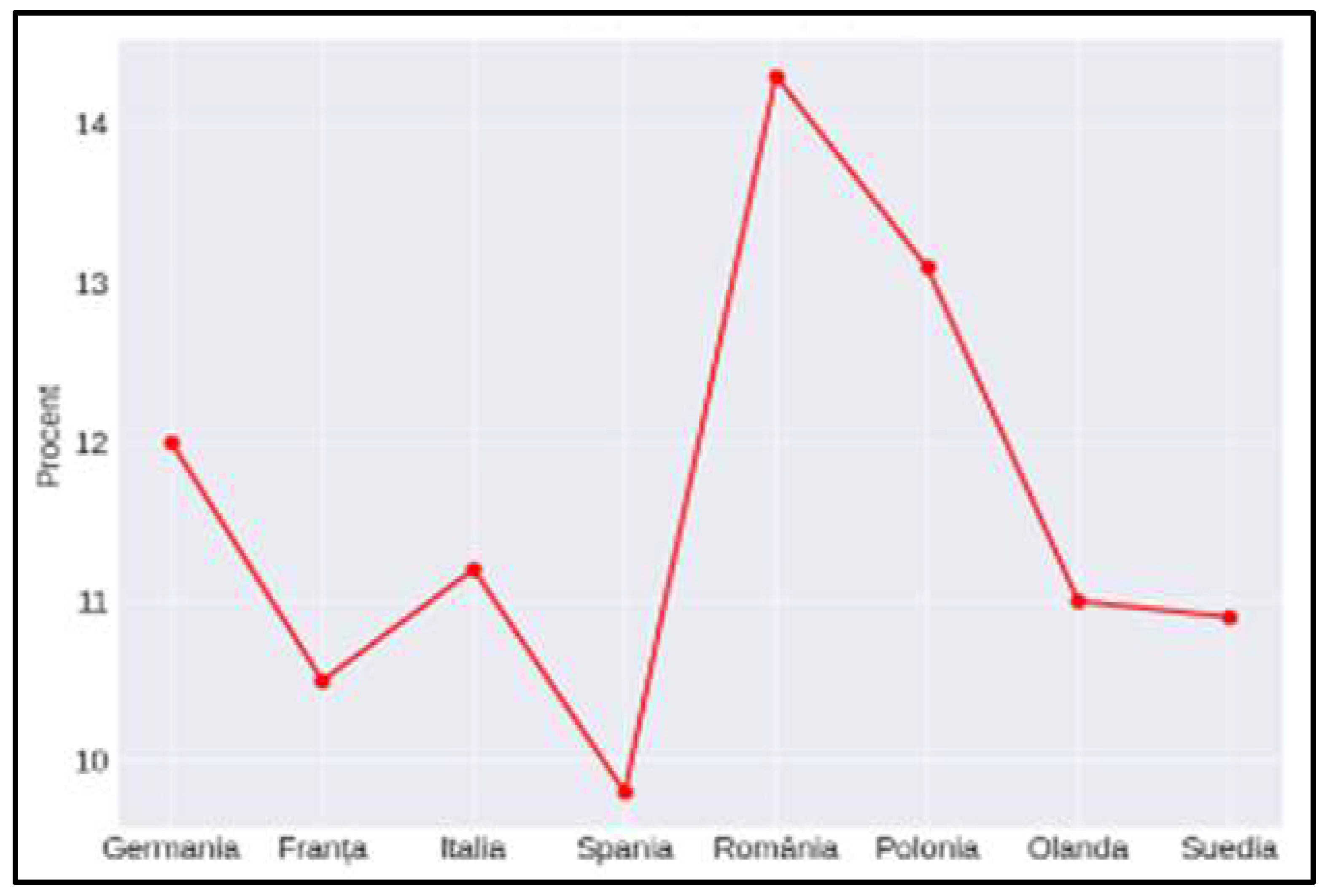

Average Investment Return (%) – A comparative measure of profitability across regions, illustrating the potential returns investors can expect from SME tokenization.

- ✓

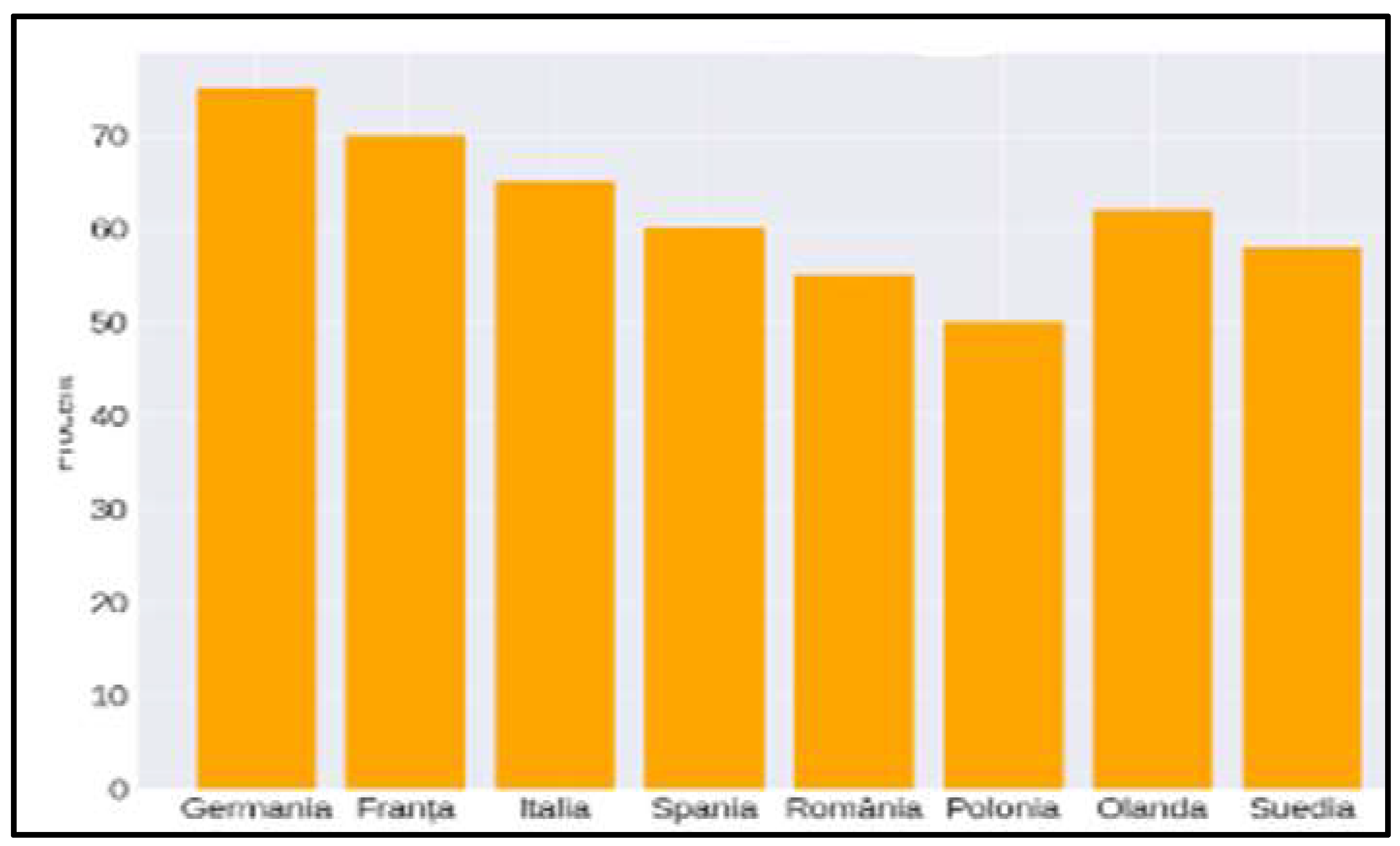

Market Liquidity (%) – This metric reflects the ease with which tokenized assets can be bought or sold, offering insights into market efficiency and trading flexibility.

- ✓

Token Price Volatility (%) – Capturing the extent of price fluctuations in tokenized assets, this indicator helps assess investment risks and overall market stability.

Below, the bar chart presents Token Market Capitalization (in million EUR) across various European countries and regions. This visualization enables a clear comparison of where tokenized SME investments are most concentrated, providing a snapshot of the evolving financial landscape driven by blockchain technology.

Figure 8.

Distribution of Token Market Capitalization Across Countries (Million EUR). Source: Manta O., Yue XG., 2024.

Figure 8.

Distribution of Token Market Capitalization Across Countries (Million EUR). Source: Manta O., Yue XG., 2024.

Below is a bar chart that illustrates the Token Market Capitalization (in million EUR) across various European countries and regions. This visual representation offers a clear comparison of the total market value of tokenized assets tied to SMEs in each country, highlighting the relative size and strength of tokenized markets in different parts of Europe. By examining this chart, you can quickly assess the concentration of tokenized investments and understand how the market for blockchain-driven financial instruments varies regionally, providing insight into investment trends and opportunities across the continent.

Figure 9.

Overview of Token Price Variability (%). Source: Manta O., Yue XG., 2024.

Figure 9.

Overview of Token Price Variability (%). Source: Manta O., Yue XG., 2024.

Below is a bar chart depicting the Token Market Capitalization (in million EUR) across various European countries and regions. This chart provides a visual comparison of the market value of tokenized assets associated with SMEs in each country, allowing for an easy evaluation of the size and scale of the tokenized markets across Europe. It highlights regional differences in the adoption of blockchain-driven financial instruments, showcasing where tokenized investments are most prominent and where growth opportunities might lie..

Figure 10.

Analysis of Token Price Volatility (%). Source: Manta O., Yue XG., 2024.

Figure 10.

Analysis of Token Price Volatility (%). Source: Manta O., Yue XG., 2024.

Based on the analysis presented through various charts and metrics, it is clear that tokenized assets are gaining traction across Europe, with significant variations in market capitalization, price volatility, and investor returns from country to country. The bar charts depicting Token Market Capitalization and Token Price Volatility provide valuable insights into the regional disparities in the adoption of blockchain-based financial instruments for SMEs. These differences highlight the dynamic nature of the tokenized market, where some regions are experiencing more robust growth, while others may be facing challenges related to market stability and liquidity.

As tokenized assets continue to evolve, understanding these key financial indicators will be crucial for investors and SMEs alike to navigate the complexities of blockchain technology and its application in the financial sector. The data presented suggests that, despite these challenges, tokenized investments hold significant potential for reshaping the way SMEs access capital and engage with the broader market.