Introduction

1.1. Background and Context

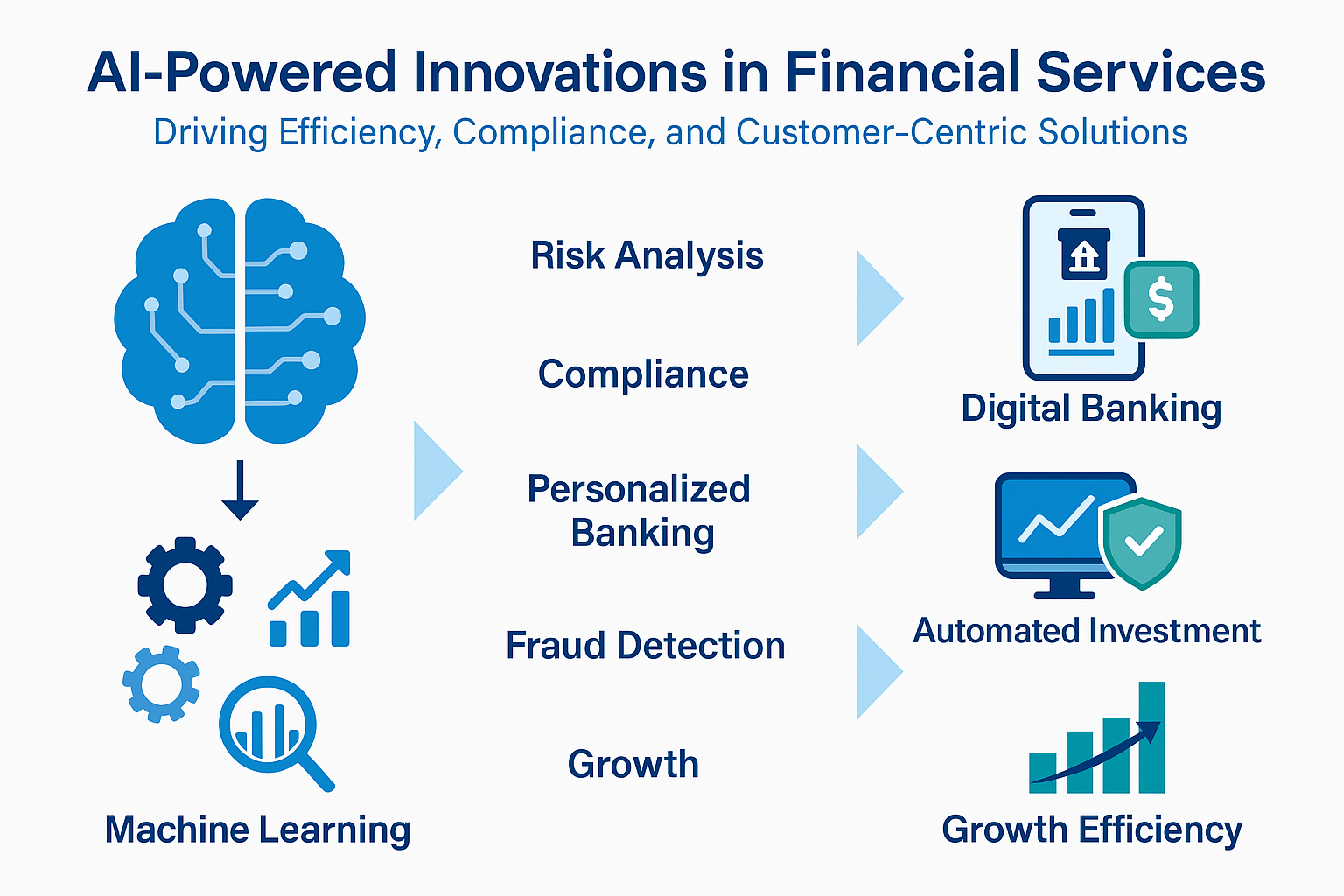

Over the past decade, artificial intelligence (AI) has evolved from a speculative concept into a transformative force reshaping global industries. Nowhere is this impact more evident than in financial services, a sector characterized by complex data flows, high-value transactions, and rigorous regulatory oversight. As customer expectations rise and competition intensifies, financial institutions are increasingly turning to AI-powered technologies to enhance efficiency, mitigate risk, and create personalized experiences. From algorithmic trading to biometric authentication and intelligent customer service, AI is no longer a futuristic tool; it is the foundation of modern financial infrastructure. Historically, finance has been driven by human expertise and traditional models of decision-making. However, the explosion of big data and advances in computing power have catalyzed a shift towards automated and intelligent systems capable of learning from patterns, adapting to market dynamics, and making data-driven decisions at scale. In this context, AI is not merely an auxiliary tool but a strategic enabler of innovation and competitive advantage.

1.2. Objectives of the Study

This article aims to explore the multifaceted role of AI in transforming financial services. The primary objectives are threefold:

To provide a comprehensive overview of how AI technologies are applied across key sectors of the financial ecosystem, including banking, insurance, investment, and compliance.

To examine the underlying technological foundations that enable these applications, including machine learning, natural language processing, and automation tools.

To analyze both the value AI creates and the challenges it presents, particularly in terms of ethics, data privacy, regulatory compliance, and workforce implications.

By addressing these objectives, the article seeks to bridge the gap between technological potential and practical implementation in finance.

1.3. Scope and Significance

The scope of this study spans the integration of AI across diverse financial domains, including but not limited to fraud detection, robo-advisory services, claims automation, and regulatory monitoring. Special emphasis is placed on emerging trends such as generative AI, sustainable finance, and quantum computing, which promise to redefine the future landscape of financial innovation. The significance of this inquiry lies in its timeliness and relevance. As the financial services industry faces unprecedented disruption from digital challengers and evolving consumer behavior, understanding the strategic application of AI is not optional; it is imperative. Moreover, the findings of this article have implications not only for financial professionals but also for policymakers, technologists, and academic researchers concerned with the ethical and economic impacts of intelligent systems.

1.4. Structure of the Paper

The article is structured into nine sections. Following this introduction,

Section 2 presents a conceptual overview of AI in finance, tracing its evolution and identifying key drivers of adoption.

Section 3 explores the practical deployment of AI across core financial sectors, including detailed discussions of specific applications.

Section 4 examines the technological foundations enabling AI, while

Section 5 outlines the operational and strategic benefits AI delivers.

Section 6 addresses the risks and limitations of AI integration, and

Section 7 provides case studies to contextualize theoretical insights.

Section 8 considers future directions and emerging opportunities. Finally,

Section 9 concludes with a synthesis of insights and offers policy and strategic recommendations for stakeholders navigating this rapidly evolving landscape.

2. Overview of AI in Financial Services

2.1. Definition and Core Concepts

Artificial Intelligence (AI), in the context of financial services, refers to the use of computer systems that can simulate human intelligence processes such as learning, reasoning, perception, and decision-making to improve financial operations. Unlike traditional software, which relies on fixed rules, AI adapts over time by processing large volumes of data, recognizing patterns, and refining its outputs without explicit reprogramming.

Within the broader umbrella of AI, several subfields are especially relevant to finance. These include:

Machine Learning (ML): Algorithms that learn from historical data to make predictions or classifications.

Natural Language Processing (NLP): Techniques that allow machines to interpret, generate, and interact using human language.

Robotic Process Automation (RPA): Software “robots” that automate repetitive and rules-based financial tasks.

Cognitive Computing: Systems that mimic human thought processes to solve complex problems, particularly in customer interaction and decision support.

Together, these technologies enable systems that can analyze unstructured data, personalize customer experiences, flag fraudulent transactions in real time, and much more.

2.2. Evolution of AI in Finance

AI’s entry into finance was gradual but strategic. Early uses in the 1980s and 1990s were largely experimental, limited to expert systems for credit scoring or statistical models for market prediction. With the rise of high-frequency trading in the early 2000s, financial institutions began deploying rudimentary machine learning models to gain a competitive edge. However, the real turning point came in the 2010s, with the convergence of three forces: the explosion of data (from digital payments, mobile banking, and social media), advances in algorithmic development, and the exponential increase in computing power via cloud infrastructure. These developments transformed AI from a research concept into a commercial necessity. Today, AI is embedded in nearly every layer of financial operations—from the back-office processing of transactions to front-end customer engagement platforms. As digital ecosystems expand, AI continues to evolve from reactive analytics to proactive and predictive intelligence.

2.3. Key Drivers of AI Adoption

Several factors are accelerating the adoption of AI across the financial industry:

Data Proliferation: The digitalization of financial services has resulted in massive amounts of structured and unstructured data. AI tools are uniquely equipped to make sense of this data and extract actionable insights at scale.

Customer Expectations: Modern consumers demand personalized, seamless, and always-available financial services. AI enables institutions to meet these expectations through real-time personalization, 24/7 virtual assistants, and predictive financial advice.

Cost Pressures: Faced with shrinking margins and rising operational costs, financial institutions are under pressure to automate routine tasks, reduce human error, and optimize resource functions where AI excels.

Regulatory Demands: Compliance with complex regulations like GDPR, Basel III, or anti-money laundering directives requires continuous monitoring and reporting. AI-powered RegTech solutions can improve accuracy and reduce the compliance burden.

Competitive Advantage: Both incumbent institutions and fintech startups are racing to leverage AI for market differentiation. In this landscape, failing to adopt AI is increasingly viewed as a strategic liability.

These drivers underscore a pivotal shift: AI is no longer an optional innovation for forward-thinking firms; it has become a foundational technology for survival and success in modern finance.

3. AI Applications in Core Financial Sectors

Artificial Intelligence is reshaping how financial institutions operate, compete, and deliver value. This section explores AI’s practical implementation across key areas of financial services, focusing on its role in banking, insurance, investment management, and regulatory compliance.

3.1. AI in Banking and Payments

3.1.1. Fraud Detection and Prevention

In a digital-first banking environment, fraud tactics have become more sophisticated and harder to detect through conventional methods. AI-powered systems offer a dynamic and proactive defense. By analyzing historical transaction data and real-time behavioral patterns, machine learning algorithms can detect anomalies that suggest fraudulent activity, often before damage is done. For instance, when a customer’s card is suddenly used in a foreign location with an unusual spending pattern, AI systems instantly flag the transaction, prompting authentication measures or temporarily freezing the account. Unlike static rules-based systems, AI evolves with changing fraud patterns, reducing false positives and improving detection accuracy over time.

3.1.2. Chatbots and Virtual Assistants

Customer service has undergone a dramatic shift with the introduction of AI-driven chatbots and virtual assistants. Banks now deploy these tools on websites, mobile apps, and messaging platforms to answer queries, process transactions, and guide customers through complex services. Powered by natural language processing (NLP), these systems can understand customer intent, respond conversationally, and even escalate complex issues to human agents when necessary. Virtual assistants like Erica (Bank of America) or Eno (Capital One) not only streamline customer interactions but also generate data-driven insights into customer needs and preferences.

3.2. AI in Insurance

3.2.1. Claims Processing and Underwriting

Insurance companies are increasingly automating claims processing using AI algorithms that assess damage from photos, estimate repair costs, and verify policyholder details in minutes. In auto insurance, for example, computer vision models can analyze crash photos, while NLP tools parse accident reports for relevant details. In underwriting, AI assists by integrating non-traditional data, like social media behavior, geolocation, and IoT data from smart devices to refine risk profiling. This enables insurers to offer more personalized and fair premiums while reducing the time needed for manual assessments.

3.2.2. Risk Assessment and Customer Engagement

Risk modeling is a core function in insurance, and AI enhances it by incorporating a wider array of predictive signals. For instance, AI can assess property risk by analyzing satellite imagery or climate models. In health insurance, wearable devices offer real-time data for lifestyle-based underwriting. On the customer engagement front, insurers are deploying chatbots for policy explanations, reminders, and renewal nudges. These tools enhance satisfaction while reducing dependency on call centers.

3.3. AI in Investment and Wealth Management

3.3.1. Robo-Advisors

Robo-advisors are one of the most visible examples of AI in consumer finance. These digital platforms use algorithms to construct and manage investment portfolios based on an individual’s risk tolerance, goals, and time horizon. Firms like Betterment, Wealthfront, and Schwab Intelligent Portfolios offer fully automated services that rival traditional advisory models in both cost and accessibility. By eliminating human bias, offering 24/7 access, and automating rebalancing, robo-advisors democratize investment management and appeal especially to younger, tech-savvy clients.

3.3.2. Portfolio Optimization

Institutional investors use AI to model asset allocation strategies, forecast market behavior, and optimize portfolio returns under different macroeconomic scenarios. These systems analyze large datasets—including news sentiment, economic indicators, and social media trends—to uncover investment signals that human analysts might overlook. Moreover, AI supports high-frequency trading by executing orders in milliseconds based on real-time market changes. This level of speed and precision is unattainable through manual trading methods.

3.4. AI in Regulatory Compliance and Risk Management

3.4.1. Anti-Money Laundering (AML)

Money laundering schemes are increasingly sophisticated, making traditional detection methods inadequate. AI enhances AML efforts by identifying suspicious transaction patterns and detecting networks of illicit activity across multiple accounts and entities. Deep learning models can sift through massive transaction volumes, flagging unusual behaviors such as rapid fund movement between shell companies or round-tripping transactions. AI systems are also used to optimize Know Your Customer (KYC) checks by validating identities against global databases.

3.4.2. Regulatory Technology (RegTech)

RegTech is a rapidly growing subdomain where AI assists firms in navigating complex, evolving regulatory landscapes. AI tools automate tasks such as report generation, risk scoring, and real-time compliance monitoring.

For example, NLP-powered engines can analyze lengthy legal documents or regulatory updates, extract key obligations, and recommend action points to compliance teams. This not only reduces human error but ensures institutions remain agile in responding to changes in regulation.

4. Technological Foundations of AI in Finance

Behind the visible benefits of AI applications in finance lies a robust stack of enabling technologies. These foundational elements, machine learning, natural language processing, robotic process automation, and analytics, power the intelligence, adaptability, and automation that define modern financial innovation.

4.1. Machine Learning and Deep Learning

At the heart of AI is machine learning (ML), a branch of artificial intelligence where algorithms learn from historical data to identify patterns and make decisions without being explicitly programmed. In finance, ML is used to detect fraud, predict stock movements, personalize services, and assess creditworthiness. A more advanced subset, deep learning, involves neural networks with many layers that simulate the way the human brain processes information. Deep learning models are particularly useful for processing unstructured data such as images, audio, or text, making them ideal for applications like automated loan approvals (based on scanned documents) or sentiment analysis in market trading.

Key characteristics of ML and deep learning in finance include:

High adaptability to changing data trends

Ability to process and learn from massive datasets

Support for real-time analytics and predictions

These models continue to improve with exposure to more data, which is why data quality and quantity are critical to their success.

4.2. Natural Language Processing (NLP)

Natural language processing is the technology that enables machines to understand, interpret, and respond to human language. In finance, NLP powers a range of use cases, including:

Customer interaction via chatbots and voice assistants

Document analysis for legal contracts, regulatory texts, or financial reports

Sentiment analysis from news, earnings calls, or social media to inform investment strategies

NLP models today can summarize documents, extract key financial information, and even generate reports. For example, AI tools can review thousands of pages of regulatory filings and highlight areas of concern or obligation in seconds—a task that would take human teams days or weeks. The evolution of transformer-based models (such as BERT and GPT) has significantly improved NLP’s accuracy and contextual understanding, enabling more nuanced insights in financial communications.

4.3. Robotic Process Automation (RPA)

Robotic Process Automation refers to software bots that mimic human actions to carry out repetitive, rule-based tasks. Unlike AI systems that "learn," RPA operates within set parameters but is highly efficient for high-volume operational tasks.

In finance, RPA is commonly used for:

Data entry and reconciliation

Generating routine compliance reports

Customer onboarding workflows

Processing loan applications or insurance claims

What makes RPA transformative is its ability to work 24/7 without fatigue, ensuring speed and accuracy. When paired with AI (a combination known as intelligent automation), RPA can also make decisions, such as routing a suspicious transaction for further review or flagging inconsistencies in KYC data.

4.4. Predictive and Prescriptive Analytics

Predictive analytics uses statistical algorithms and machine learning techniques to forecast future events based on historical data. In financial services, predictive models are used to:

Anticipate customer churn

Forecast credit risk

Predict stock market trends

Estimate insurance claims

Going one step further, prescriptive analytics provides actionable recommendations by evaluating different scenarios and outcomes. For example, a prescriptive model might suggest the optimal asset allocation to maximize returns under various market conditions. These tools help financial institutions move beyond reactive strategies, empowering them to take preemptive action and make data-informed decisions.

5. Benefits and Value Creation Through AI

The adoption of artificial intelligence in financial services is not simply about modernization; it is fundamentally about value creation. By embedding intelligence into their processes, institutions gain measurable advantages in performance, agility, and customer satisfaction. This section outlines the core benefits AI delivers across financial ecosystems.

5.1. Operational Efficiency

One of the most immediate and visible benefits of AI is the significant improvement in operational efficiency. Financial institutions manage vast amounts of data and execute millions of transactions daily, many of which involve repetitive and rules-based tasks. AI automates these processes with greater speed and accuracy than human counterparts, reducing costs and freeing up staff for more strategic activities. For instance, banks leveraging robotic process automation (RPA) have reported processing times reduced from hours to minutes in back-office operations such as account reconciliation, document verification, and loan processing. Moreover, predictive algorithms streamline tasks like demand forecasting and liquidity management, leading to leaner, more agile operations.

5.2. Enhanced Customer Experience

Customer expectations in the digital age revolve around immediacy, personalization, and seamless interaction. AI plays a central role in delivering on these expectations. Chatbots and virtual assistants respond to routine queries 24/7, often resolving issues without human intervention. More importantly, AI tailors financial services to individual behaviors and preferences. For example, AI-driven recommendation engines suggest savings plans, investment products, or credit options tailored to a user’s profile. Sentiment analysis tools help institutions better understand client concerns, while real-time behavioral analytics adjust offers and messaging to suit each user. This personalization fosters loyalty and trust, enhancing customer lifetime value and reducing attrition.

5.3. Cost Reduction and Revenue Growth

AI enables firms to cut operational costs by automating manual processes, reducing errors, and optimizing resource allocation. In areas like fraud detection or underwriting, where human oversight is costly and time-intensive, AI provides rapid, scalable, and accurate solutions. At the same time, AI opens new revenue channels by enabling hyper-targeted marketing, cross-selling, and improved product offerings. Digital wealth platforms using AI attract a new segment of investors by offering low-cost, algorithm-based advisory services that scale rapidly without proportional increases in staff or infrastructure. McKinsey & Company estimates that AI could deliver up to $1 trillion in additional value annually across the global banking sector alone, through both cost savings and increased top-line growth.

5.4. Real-Time Decision Making

In financial markets, the speed of decision-making often determines success. AI facilitates real-time analysis of market data, credit risks, customer interactions, and regulatory changes, enabling institutions to act quickly and confidently. Credit scoring models using AI assess loan applicants in seconds, even using alternative data (like payment histories or mobile phone usage) for thin-credit-file customers. In investment banking, AI algorithms make split-second trading decisions based on real-time price movements, news sentiment, and social media trends. Moreover, AI-driven risk engines can monitor portfolios continuously, flagging potential losses or compliance breaches as they emerge, allowing firms to take corrective action before problems escalate.

6. Challenges and Risks of AI Integration

While artificial intelligence offers remarkable benefits, its adoption is not without complications. The integration of AI into financial systems introduces a set of complex challenges—technical, ethical, regulatory, and social. Addressing these risks is essential to ensure AI technologies are deployed responsibly, sustainably, and equitably.

6.1. Data Privacy and Security Concerns

AI thrives on data, customer behavior, financial transactions, biometric information, and social patterns, all of which are sensitive by nature. The collection, storage, and processing of this data raises serious privacy concerns, especially under stringent regulations like the General Data Protection Regulation (GDPR) in Europe or the California Consumer Privacy Act (CCPA) in the United States. Moreover, financial institutions are prime targets for cyberattacks. Integrating AI systems introduces new vulnerabilities, including adversarial attacks where malicious actors manipulate input data to mislead AI models. As AI becomes more central to decision-making, ensuring the confidentiality, integrity, and availability of data becomes a critical concern. Institutions must implement robust cybersecurity protocols, enforce data minimization principles, and design AI systems that are both privacy-preserving and auditable.

6.2. Algorithmic Bias and Fairness

AI models are only as fair as the data on which they are trained. If historical data reflect human biases such as racial, gender, or socioeconomic disparities, AI systems may perpetuate or even amplify these injustices. In financial services, this could manifest in discriminatory credit scoring, biased loan approvals, or uneven fraud detection outcomes. Algorithmic bias is particularly problematic in opaque “black-box” models where decisions are difficult to interpret or challenge. Without transparency, customers have limited recourse to understand or dispute automated decisions.

Addressing bias requires deliberate strategies, including:

Regular auditing of AI systems for fairness

Diversification of training datasets

Use of explainable AI (XAI) tools to clarify model logic

Involvement of ethicists and social scientists in model development

6.3. Ethical and Legal Implications

AI’s growing autonomy raises fundamental ethical questions about accountability, consent, and decision-making authority. For example, if a robo-advisor makes a poor investment decision, who is responsible: the client, the firm, the algorithm, or the developer? In legal terms, existing frameworks often lag behind AI’s capabilities. Regulators are still grappling with how to define liability, enforce accountability, and create transparent standards for algorithmic governance. Additionally, ethical dilemmas arise when AI is used to influence customer behavior through micro-targeted marketing or behavioral nudging. These practices can easily cross into manipulation if not carefully monitored. To address these issues, financial institutions must adopt ethical AI principles of transparency, accountability, and inclusivity and embed them throughout the AI lifecycle, from design to deployment.

6.4. Workforce Displacement and Skill Gaps

As AI automates repetitive and analytical tasks, concerns about workforce displacement are increasingly prominent. Back-office roles in processing, underwriting, and compliance are especially vulnerable, with AI systems performing these functions faster and often more accurately. However, rather than simply replacing jobs, AI is transforming them. The demand is shifting toward roles that require digital fluency, data literacy, and human-AI collaboration skills. This presents both a challenge and an opportunity for workforce reskilling. Financial institutions must invest in upskilling and re-skilling programs to prepare their employees for an AI-augmented future. Partnerships with academic institutions, vocational training providers, and internal learning platforms will be crucial in narrowing the skills gap and mitigating social disruption.

7. Case Studies and Industry Examples

To understand the transformative impact of artificial intelligence in financial services, it is instructive to examine how industry leaders and innovators are deploying AI in practice. This section highlights select case studies from global banks, insurance companies, and fintech startups, offering concrete examples of how AI technologies are delivering tangible outcomes.

7.1. AI-Driven Innovations in Global Banks

JP Morgan Chase is a leading example of AI integration at scale. Its proprietary platform, COiN (Contract Intelligence), uses natural language processing to review and extract data from complex legal documents, such as commercial loan agreements. Previously, a task that took legal teams over 360,000 hours annually, COiN now completes it in seconds, reducing human error and operational costs significantly. HSBC, another global banking giant, uses AI in its fight against money laundering. Its AI-powered systems analyze patterns across millions of transactions and flag suspicious behavior more accurately than traditional rule-based models. This has enhanced its anti-money laundering (AML) efforts while easing the compliance burden on human analysts. Bank of America’s virtual assistant, Erica, serves over 25 million users with real-time support on mobile banking tasks. Powered by machine learning and NLP, Erica offers spending insights, credit report updates, and bill reminders, blending convenience with financial literacy.

7.2. InsurTech and AI-Enhanced Insurance Services

AI is rapidly transforming the insurance sector, especially through the rise of InsurTech startups that embed intelligence across the customer journey. Lemonade, a digital-first insurance provider, uses AI to process claims in under three minutes through its chatbot “AI Jim.” The system can detect fraud by analyzing user behavior during claims submission, while also utilizing machine learning to improve its risk models continually. This results in lower operational costs and faster claims resolution, key pain points in traditional insurance. Allianz, a global insurer, has deployed AI tools for predictive modeling in health and property insurance. By integrating satellite imagery, weather forecasts, and environmental data, Allianz’s AI systems assess property risk and climate exposure more accurately, enabling proactive underwriting and loss mitigation strategies. Ping An Insurance in China takes it a step further, using AI for facial recognition during customer onboarding, speech recognition in call centers, and AI-driven diagnostics in its health insurance vertical, making it a pioneer in full-spectrum AI adoption.

7.3. AI in FinTech Startups

FinTech startups are among the most agile adopters of AI, using it to deliver hyper-personalized, low-cost, and accessible financial services. Zest AI applies machine learning to credit underwriting, especially for underserved populations. By analyzing thousands of variables, including non-traditional credit data, Zest AI builds fairer, more inclusive lending models that reduce bias and increase loan approval rates without compromising risk management. Kensho, an analytics company acquired by S&P Global, uses NLP to generate insights from financial news, earnings calls, and macroeconomic events. Its platform enables institutional investors to make data-informed decisions based on structured analysis of unstructured information. Upstart, an AI-powered lending platform, offers personal loans using alternative data like education level, employment history, and online behavior. The platform claims its AI models reduce default rates while expanding access to credit for individuals often overlooked by conventional scoring systems. These examples illustrate that AI is not only enhancing traditional financial institutions but also powering the next wave of innovation in digital finance.

8. Future Trends and Opportunities

As artificial intelligence continues to mature, its role in financial services is expanding into new and uncharted territories. While current applications have already delivered significant operational and strategic benefits, the next wave of AI innovation promises even greater disruption. This section explores three critical frontiers that are expected to shape the future of AI in finance: generative AI, sustainable finance, and quantum AI.

8.1. Generative AI in Financial Services

Generative AI, capable of creating original content such as text, images, and even code, is gaining traction across the financial industry. Unlike traditional AI, which focuses on classification or prediction, generative models like GPT-4 and DALL·E generate human-like outputs based on complex prompts.

In finance, generative AI is being explored for:

Automated report generation: Banks and investment firms are beginning to use large language models (LLMs) to draft earnings summaries, investment commentary, and client updates.

Code generation and optimization: Generative models can assist in writing or debugging trading algorithms, financial models, and compliance scripts, reducing development time and human error.

Conversational banking: The next generation of virtual assistants is expected to offer deeply personalized interactions, able to hold contextual financial conversations, schedule appointments, and deliver complex insights in natural language.

However, generative AI also introduces new risks, including hallucination (fabrication of facts), data privacy issues, and misinformation. Robust validation mechanisms and human oversight will be critical to ensuring safe deployment in high-stakes financial contexts.

8.2. AI for Sustainable Finance

As environmental, social, and governance (ESG) criteria become central to investment decisions, AI is increasingly used to support sustainable finance initiatives. The complexity of ESG data, much of which is unstructured or inconsistent, makes it a natural candidate for AI-driven analysis.

AI contributes to sustainable finance through:

ESG data aggregation and scoring: Machine learning models can process news articles, social media, satellite imagery, and regulatory filings to evaluate a company’s environmental impact or social responsibility.

Climate risk modeling: AI helps banks and insurers assess exposure to physical and transitional climate risks, such as rising sea levels or carbon regulation.

Green portfolio optimization: Algorithms can construct investment portfolios that align with sustainability goals while balancing financial returns.

The fusion of AI and ESG represents a critical opportunity to align financial performance with broader societal outcomes, making AI a catalyst not just for profit, but for planetary well-being.

8.3. Quantum AI and Financial Modeling

While still in its early stages, the convergence of quantum computing and AI, often referred to as Quantum AI, is poised to revolutionize financial modeling. Traditional computing struggles with certain complex optimization problems, especially those involving vast datasets or many interdependent variables.

Quantum AI could drastically improve:

Portfolio optimization: Solving for the best mix of assets given thousands of risk-return constraints in near real-time.

Option pricing and risk analysis: Enhancing Monte Carlo simulations and stochastic modeling with greater precision.

Fraud detection: Processing massive transaction networks faster than classical algorithms could manage.

Although large-scale commercial applications remain years away, financial institutions like Goldman Sachs and JPMorgan Chase are already investing in quantum research partnerships to prepare for this paradigm shift.

9. Conclusion

9.1. Summary of Key Insights

Artificial intelligence is no longer a peripheral innovation in financial services; it is a central driver of transformation across banking, insurance, investment management, and regulatory compliance. From enhancing operational efficiency and automating risk detection to personalizing client engagement and opening access to underserved populations, AI has proven its value as both a strategic tool and a competitive necessity. This article has explored the foundational technologies powering AI, machine learning, NLP, RPA, and predictive analytics alongside their practical applications. It has also examined the tangible benefits these technologies deliver, as well as the ethical, regulatory, and social challenges they introduce. Through real-world case studies, we’ve seen how both established institutions and agile startups are leveraging AI to innovate, differentiate, and scale. As financial markets evolve, so too will the sophistication of AI tools, pushing the boundaries of what’s possible—from generative AI assistants and ESG-focused analytics to quantum-powered financial modeling.

9.2. Policy and Strategic Recommendations

To ensure AI adoption leads to sustainable, inclusive, and secure innovation, several key strategic and policy considerations should be prioritized:

Strengthen regulatory clarity: Governments and international bodies must develop transparent, adaptive regulatory frameworks that support innovation while enforcing accountability, fairness, and data protection.

Invest in explainability and auditability: Financial institutions should commit to building AI systems that are interpretable and traceable. This is particularly vital in high-stakes contexts such as lending decisions and compliance.

Address algorithmic bias through proactive auditing: Regularly auditing AI systems for fairness and representativeness can prevent discriminatory outcomes and build public trust.

Advance workforce transformation: To mitigate job displacement, institutions should actively invest in employee retraining and reskilling programs that align with the new demands of AI-augmented roles.

Promote ethical AI governance: Firms should establish internal AI ethics boards and adopt best practices for responsible AI development, ensuring alignment with human values and long-term societal goals.

9.3. Outlook for the Future

Looking ahead, the trajectory of AI in financial services points toward deeper integration, greater personalization, and increased autonomy. Generative AI will reshape communication and compliance. Quantum computing could unlock new levels of modeling accuracy. AI-driven ESG platforms may redefine how financial success is measured, not just by profits, but by sustainable impact. However, realizing this future will require a careful balance between innovation and integrity. Financial institutions, regulators, technologists, and researchers must collaborate to ensure AI remains a force for positive transformation, democratizing access, enhancing resilience, and reimagining finance in the digital era.

References

- Davitaia, A. (2024). From Risk Management to Robo-Advisors: The Impact of AI on the Future of FinTech. Available at SSRN 5281119.

- Davitaia, A. (2025). Machine Learning in Voice Recognition: Enhancing Human-Computer Interaction. Available at SSRN 5329570. [CrossRef]

- Davitaia, A. (2025). Advancements in Fingerprint Recognition: Applications and the Role of Machine Learning. Available at SSRN 5268481. [CrossRef]

- Davitaia, A. (2025). Optimizing Real-Time Traffic Management Using Java-Based Computational Strategies and Evaluation Models. Available at SSRN 5228096. [CrossRef]

- Davitaia, A. (2025). Recursive Techniques for Hierarchical Management in Digital Library Systems. Available at SSRN 5228100. [CrossRef]

- Davitaia, A. (2025). Choosing Agile SDLC for a Software Development Project Using React,. NET, and MySQL. Available at SSRN 5215308. [CrossRef]

- Davitaia, A. (2025). Fingerprint-Based ATM Access Using Software Delivery Life Cycle. Available at SSRN 5215323. [CrossRef]

- Davitaia, A. (2022). The Future of Translation: How AI is Changing the Game. Available at SSRN 5278221. [CrossRef]

- Onabowale, O. (2024). Fintech Innovations: The Role of Artificial Intelligence and Robo-Advisors in Modern Finance.

- Lundstén, F. (2024). Artificial intelligence in the Financial Services industry: A study of future opportunities and risks.

- Davitaia, A. (2025). Intelligent Finance: The Evolution and Impact of AI-Driven Advisory Services in FinTech. Available at SSRN 5285808.

- Azzutti, A. (2024). Artificial Intelligence and Machine Learning in Finance: Key Concepts, Applications, and Regulatory Considerations. In The Emerald Handbook of Fintech: Reshaping Finance (pp. 315-339). Emerald Publishing Limited.

- Runzhe, L. (2024). Quantitative finance and fintech research under artificial intelligence: Artificial Intelligence, Quantitative Finance, Fintech. Journal of Global Finance and Investment, 1.

- Kholia, T. (2025). Artificial Intelligence in Capital Markets: Use Cases, Risks, and Regulatory Challenges. Risks and Regulatory Challenges (March 13, 2025), 13 March. [CrossRef]

- Apostolov, A. (2023). AI-BASED TOOLS IN EUROPEAN SECURITIES MARKETS: AN OVERVIEW OF ADOPTION, USE CASES, FINDINGS, AND IMPLICATIONS. Endless light in science, (апрель). 201–210.

- Linciano, N. , Caivano, V., Costa, D., Soccorso, P., Poli, T. N., & Trovatore, G. (2022). L’Intelligenza Artificiale Nell’Asset E Nel Wealth Management (Artificial Intelligence in the Asset and Wealth Management). CONSOB Fintech Series.

- Naveen Karthick, R. , Nizarahamed, N., & Parthasarathi, G. AI In Finance: Risk Management, Fraud Detection, and Algorithmic Trading.

- Arnone, G. (2024). Introduction to AI in FinTech. In AI and Chatbots in Fintech: Revolutionizing Digital Experiences and Predictive Analytics (pp. 1-19). Cham: Springer Nature Switzerland.

- Brynjolfsson, E. , & McAfee, A. (2017). Machine, platform, crowd: Harnessing our digital future. W. W. Norton 43 & Company.

- Arner, D. W. , Barberis, J. N., & Buckley, R. P. (2017). Fintech, regtech, and the reconceptualization of financial regulation. Northwestern Journal of International Law & Business, 37, 371–413.

- McKinsey & Company. (2020). The future of AI in financial services, https://www.mckinsey.com.

- Organisation for Economic Co-operation and Development. (2021). Artificial intelligence in society. OECD 51 Publishing. [CrossRef]

- Accenture. (2021). AI in financial services: Reinventing the human experience, https://www.accenture.com.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).