1. Introduction

It is worth mentioning that the attainment of financial autonomy is mainly attributed as a pivotal milestone in their life by the youth who belong to the contemporary generations, which can be attributed primarily for economic volatility witnessed globally in the latter part of the last decade (Arnett, 2000; Hellevik & Settersten, 2012). The quest for financial Independence is considered superior to a mere economic goal; it has transitioned as an element of one's personal development that ominously contributes to an individual's sense of autonomy, competence, and self-reliance. A nation like India, marked by rapid economic development in recent decades, is known for its complex sociocultural milieu that heavily influences young adults, financial self-efficacy, and resilience (Lee & Mortimer, 2009; Cunnien et al., 2009). In other words, in the diverse socio-economic environment of India, Financial autonomy is prominent as it acts as an indicator of personal success, reflects on societal and familial standing, and impacts individuals' holistic well-being. Financial well-being (FWB) has emerged as an essential aspect of an individual's holistic well-being, encompassing various financial crescendos: income, savings, investments, debts, and life-enduring goals. The core idea behind FWB is to handle one's finances effectively and to indicate a sense of security and satisfaction about an individual's financial status, present and future. The core idea behind FWB is to handle one's finances effectively and to indicate a sense of security and satisfaction about an individual's financial status, present and future. The importance of financial well-being cannot be overstated. An individual's financial well-being can reduce stress and give better control over one's financial future, leading to greater happiness and satisfaction (Porter & Garman, 1993).

It is interesting to mention that rapid growth and wealth inequalities characterize India's vibrant economic environment. This makes financial well-being (FWB) and financial resilience decisive not only for individual stability but also for societal prosperity, particularly considering the high-income inequality that exists in the country. Attaining financial Independence gives more meaning to younger generations and is more valuable than an economic quest. It is a crucial rite of passage into adulthood, autonomy, and self-reliance, deeply interwoven with India's socio-economic fabric (Arnett, 2000; Hellevik & Settersten, 2012).

Financial well-being (FWB) encompasses more than conventional monetary indices like income levels, savings, or investments in India. It involves people feeling safe about their money matters and capable of dealing with future financial demands and life goals (Porter & Garman, 1993).

Genuinely comprehending the connection between "core self-evaluation," “well-being," and "resilience" when it comes to finances is crucial. Indian society is very diverse, making it harder for people to understand things like money broadly due to socio-economic conditions and cultural norms that affect how people acknowledge cash. It has already been proven in previous studies that improved knowledge of personal finance management and the ability to save up income will have positive effects on both someone's well-being level as well as their adaptability to adverse situations (Van Rooij et al., 2012; Lusardi & Mitchell, 2007).

Though gaining traction in personal finance research, FWB and FR are still relatively nascent, particularly in emerging economies like India. Prevailing literature mainly focuses on inclusion, literacy, and capability. (Brüggen et al., 2017; Collins and Urban, 2020), With less emphasis on the all-inclusive concept of FWB.Though FWB studies on other part of the globe have indicated that financial knowledge on wealth accretion (Van Rooij et al., 2012), investing behavior (Van Rooij et al., 2011a; Hsiao & Tsai, 2018), superannuation provision (Lusardi & Mitchell, 2007; Van Rooij et al., 2011b), and debt organization (Limbu & Sato, 2019; Norvilitis et al., 2003, 2006 )the distinctive socio-economic and cultural setting of India presents a persuasive case for a more beleaguered investigation of FWB. With its diverse socio-economic conditions and cultural setting, India's emerging economy promises a rich contextual ground for further probing FWB and FR. A massive disparity in income levels, educational backgrounds, and cultural values can significantly affect individual perceptions and experiences of financial well-being (Shedge et al.; S., 2023). India, though it witnessed rapid economic advancement in the last few decades, is still struggling with problems of income inequality ((World Economic Forum, 2020).

The disparity in income results in lower savings rates among numerous households in India (Buch et al., 2020) and is expected to hurt FWB and FR in a nation like India. The gap in financial literacy across demography further exacerbates the problem of uneven income and necessitates an investigation into FWB and FR from the Indian perspective.

Various Government Schemes, such as Pradhan Mantri Jan Dhan Yojana (Prime Minister's People’s Wealth Scheme), were conceived to ensure financial inclusion and showcase inequities in financial well-being throughout different social hierarchies (UNDP, 2020). Research conducted by Sethy et al. (2023) also indicates that substantial differences in financial status exist based on age, gender, marital status, education level, religion, etcetera. The above findings underscore the need for a multi-dimensional approach towards understanding and improving FWB among Indians.`

This study examines how personality traits interact with financial status and various demographic variables to form FWB within the Indian social setting. The implications of these research findings are woven around psychological and socio-economic aspects of individuals' professed autonomy in their finances and related matters. Besides, It helps design development-oriented interventions, fostering economic stability among Indians and their satisfaction with life.

This research aims to investigate various dimensions related to resilience vis-à-vis well-being with a particular focus on India, where socioeconomic and cultural factors are key determinants and any knowledge on this topic will not improve the quality of life of Indian Gen Y and Gen Z . This will further help in designing workable strategies or even policies that can improve the FWB and FR of people living in India but also of people who live in other areas of the globe in similar socio-economic settings. Prior studies have proved that Financial Well depends on financial metrics and encompasses subjective measures such as contentment about one's financial situation and perceived control over it (Agarwalla et al., 2015). As an indicator of personal satisfaction with one's financial situation, subjective financial well-being holds great significance in the Indian context. It indicates a certain level of income or ability to meet financial obligations and experience a sense of security, control over their finances, and happiness about their financial circumstances(Mahendru et al., 2020). Prior work has shown that many factors, such as income, savings, debt levels, financial knowledge, and behavior, influence an individual's Well-being.(Ramana & Muduli, 2019)(Bhatia & Singh, 2023)

Core self-evaluation denotes an individual's overall appraisal and perception regarding their worth, expertise, and abilities. In contrast, Well-being, on the other side, reflects upon various aspects of one's financial situation and satisfaction, including income savings in investment portfolios and, in general, it represents overall financial security (Lusardi & Mitchell, 2007); further prior work by highlights of a positive relationship that exists between core self-evaluation and financial Well-being FR, a review of research showcases that their studies on this direction are in nascent stages, especially in the Indian context.

Notably, the association between financial autonomy and Well-being is mediated by life management skills essential for traversing through the intricacies of contemporary society (Shim et al., 2009, 2010). These skills, such as financial literacy, planning, and decision-making, are all-inclusive so individuals can develop a steady and prosperous future. It will be daunting for an individual to achieve financial autonomy because of the unique blend of modern economic practices and traditional values. However, the financial self-efficacy that results from successfully meeting one's monetary needs can reinforce core self-evaluations, i.e., an individual's assessment of their value and capabilities, thus influencing holistic life satisfaction and well-being (Lee & Mortimer, 2009; Cunnien et al., 2009).

In this research, we investigate the intricacies of Core self Evaluations(CSE), a construct proposed by (Judge et al., 2003) that comprises four elements, namely self-esteem, general self-efficacy, locus of control, and emotional stability and their relationship with Financial well being among Indian generational cohorts (GenY and Gen Z). CSE significantly predicts life outcomes, such as occupational success and financial status (Judge et al., 2009). This predictive capability of CSE is highly significant in the Indian context, where economic conditions are diverse and the societal framework is distinct (Poncho et al., 2019)

The study is conducted by adapting a 15item scale developed by Judge et al. (2003) to measure CSE and by adopting items from the Consumer Financial Protection Bureau(CFPB)Financial Well-being Scale to ensure that responses are measured using a validated instrument that is precisely indicative of financial outcomes and reflects upon self-evaluation score of individuals, By adopting this approach for the study the researchers aim to shed light on the nuanced dynamics of financial Well-being that goes beyond the conventional focus on financial metrics to encompass the phycological aspects that play a significant role in shaping perception with respect towards financial Well-being in Indian socio-economic context.

To summarise, this work explores the relationship between personality traits, economic status, financial Well-being, and their interplay with various demographic elements within a vibrant and diverse context of Indian society. The research helps to gain insights into the psychological and socio-economic demographic factors that influence the perception of financial autonomy and realities. Further, the study aids in developing targeted interventions aimed at enhancing economic stability and life satisfaction among Indian youth.

2. Theoretical Background

Financial Well-being (FWB) is a topic widely discussed among researchers and policymakers in almost all forums in emerging countries like India. As stated in one of the introductory sections, the conservative measurement of FWB is limited to Financial metrics and requires a major research-based revision(Kanchan et al. (2021); this is very much needed as FWB influences an individual's perception and comportment toward financial status (Brüggen et al., 2017; Netemeyer et al., 2018). This section of the paper attempts to explore the multi-dimensional aspects of FWB. It emphasizes the interaction between psychological qualities, Core self-evaluations (CSE), and distinctive roles performed by income and gender in defining an Individual’s financial autonomy and satisfaction. By integrating findings from multiple studies, the researchers attempt to give a fresh perspective on these factors that influence FWB in the Indian socio-economic setting.

A quick review of existing literature that discusses financial well-being is not unidimensional, and it comprises numerous variables such as one's satisfaction with their finances, the ability to meet financial needs, and related stress (Xiao et al., 2006; Sehrawat K, Vij M and Talan G, 2021). The above-mentioned variables profoundly impact their well-being and performance (Ng & Diener, 2014; Prawitz et al., 2006; Sorgente & Lanz, 2019).

The above research indicates that economic factors alone establish a causal relationship between affluence and contentment Ngamaba et al. (2020) Shim et al. (2009, 2010). A summary of the table that discusses the antecedents of FWB in South Asian countries is appended below for clarity(Table 1)

2.1. Table 1 Summary Table of Recent Literature

| Author and Year |

Country/context |

Design |

Antecedents of FWB |

Major observations |

| M. Zyphur, WenDong Li, Zhen Zhang, R. Arvey, Adam P. Barsky(2015) |

USA |

A twin sample was drawn from MIDUS, an American representative population. From 25 to 74 years old, 998 sets of identical twins make up the countrywide twins sample from MIDUS. Seven hundred twelve sets of identical twins were used to collect control factors, CSE, income, and SFWB data. This group includes 170 male twins, 194 monozygotic twins, and 135 male and 213 female dizygotic twins. With ages ranging from 25 to 74, the average was 44.66. From 1996 to 1997, the researchers collected the data needed for the investigation. |

Income, personality, the role of gender |

Income and Well-being are becoming more contentious due to the wealth divide. After accounting for personality variables called core self-evaluations (CSE), the researcher found that US twins express higher subjective financial Well-being (SFWB) for men with higher wages than women. Money affects men's subjective Well-being (SFWB) due to "unshared environmental" factors, emphasizing individual experiences. Childhood socio-economic environment (CSE) and environmental and inherited factors affected men's and women's income and subjective Well-being.

|

| Kanchan Sehrawat, Madhu Vij, Gaurav Talan(2021) |

India |

The study employs partial least squares structural equation modeling (PLSSEM) to validate the hypothesized correlations in survey data collected from 349 respondents. The extensive validation capabilities and intricate interaction management of PLSSEM allow for precise analysis and the derivation of accurate conclusions from the gathered data.

|

financial literacy, financial behavior (FinB), and personality |

This study investigates the comprehensive financial well-being (FWB) framework in the context of an emerging economy. The results suggest a good relationship, although not perfect, between an individual's subjective perception of their financial Well-being (FWB) and their actual financial circumstances. The subjective Well-being of friends with benefits (FWB) is significantly influenced by important objective factors such as the ability to meet financial responsibilities, savings, credit score, financial emergencies, investment diversification, and retirement planning. Furthermore, prudent financial behaviors (FinBs), such as avoiding credit and making informed decisions, directly improve financial Well-being (FWB) and indirectly enhance it by improving the objective financial situation. This emphasizes the crucial importance of conscious financial behaviors in achieving an enhanced financial condition and, consequently, a higher felt financial well-being. |

| M. Ponchio, Rafaela Almeida Cordeiro, Virginia Nicolau Gonçalves(2019) |

Brazil |

The study utilizes a theoretical framework to formulate its hypotheses and empirically assesses them using regression-based models. This assessment is based on a survey of 1,027 individuals. This approach enables a thorough investigation of the acquired data by examining the hypothesized relationships and resulting outcomes. |

1. Consumer Spending SelfControl (CSSC)

2. Personal Saving Orientation (PSO)

3. Materialism

4. Financial Knowledge (FK)

5. Time Perspective (TP)

|

The study found that materialism, temporal perspective, and consumer spending self-control substantially impacted Financial well-being. Financial well-being refers to the anxiety one experiences in managing money and confidence in one's financial future. Individual savings can ensure long-term financial stability. The impact of materialism on financial stress varies depending on one's perspective of time. The relationship is mediated by Consumer Spending SelfControl, which demonstrates the interaction between financial habits, values, and Well-being. |

| Mohamad Fazli Sabria, Rusitha Wijekoonb and Husniyah Abd Rahimc(2020) |

Malaysia |

The study focused on Malaysia's government sector, which has the highest public employment-population ratio. Four Peninsular Malaysian regions were sampled using a multistage random sampling. Penang (North), Johor (South), Terengganu (East), and Perak (West) each elected a state by ballot. The purpose was to select 30 responders from five state government agencies randomly. Given the likelihood of data loss, 600 individuals were chosen. The poll had 590 participants and a 98.3% response rate. This method ensured that the study was representative of all regions, boosting its credibility and significance for the Malaysian government. |

money attitude, financial practices, self-efficacy, and emotional coping |

The study's findings can help the government and nongovernmental organizations (NGOs) develop a comprehensive approach to improve the living standards and FWB of employees with lower household incomes. More understanding of the factors of FWB is critical for assisting workers in developing financial prudence, which will, in the long run, reduce the number of Malaysian workers experiencing financial troubles. |

| Leila Falahati, M. Sabri(2015) |

Malaysia |

A sample of 2,500 students from eleven public and private colleges in Malaysia participated in the poll. A self-administered questionnaire was given to 350 randomly selected students from each university. As a consequence, 2,519 valid responses in all were obtained for the study. Using the participant's parameter ratios provided for the analysis, 700 respondents were randomly selected for structural equation modeling (SEM) to improve the results' accuracy. The young people's sample, which included an equal number of men and women, was a representative subset of university students in Malaysia that was used to study financial attitudes and habits. |

The antecedents of financial Well-being identified in the study are:

1. Marital Status

2. Employment Status

3. Education

4. Income

5. Health

Additionally, the study investigates the moderating effect of gender on these determinants of financial Well-being, specifically within the context of Malaysian college students.

|

The study revealed that gender exerts diverse effects on the financial stability of Malaysian college students. Financial management is the primary determinant of financial success for males, whereas financial literacy and awareness are essential for women. Peers, the media, and marketing serve as secondary agents of socialization, highlighting the adverse effects of financial behavior in both genders, which can result in financial distress. Gender-specific financial education that enhances managerial skills and financial literacy is crucial because socialization impacts an individual's financial Well-being. |

W. Younas, Tariq Javed, K. Kalimuthu, M. Farooq, Faisal KhalilurRehman, Valliappan Raju (2019)

|

Pakistan |

The research utilized the Stratified Random Sampling Technique to gather data from educational institutes, corporate sectors, and food courts in Pakistan. The authors disseminated a questionnaire online via Google Docs and offline. To determine the sample size, G.power software indicated a need for 164 participants, while Krejcie and Morgan's method required 384. Despite this, 600 questionnaires were distributed, yielding 463 responses, of which 416 were deemed suitable for the study's analysis. |

-

1.

SelfControl -

2.

Financial Literacy |

The study suggests that an individual's financial activity substantially impacts their Well-being. The results suggested that while an individual's financial behavior significantly impacts their Well-being, self-control has a limited direct impact. Financial knowledge has a direct and positive impact on one's financial Well-being. The findings of this study highlight the importance of having knowledge and understanding about finances, as well as behaving responsibly in managing one's finances to promote financial Well-being. Therefore, interventions that focus on enhancing these areas could significantly improve the financial health of individuals. |

The articles presented in the above table summarize research on financial Well-being from various global authors that cover factors like personality traits, income, financial literacy, and spending patterns. The various works include by Zyphur et al. (2015) in the USA that focuses on the influence of income and personality on FWB; another one by Sehrawat et al. (2021) in the Indian context that focuses on financial literacy, A work by Ponchio et al. (2019) in Brazil that looks into the relationship between self-control and financial well being; Sabri et al. ( 2020) on their work discuss about money attitudes; and the work by the same author along with Falahati (2015) carried out in Malaysia that identify the influence of demographic elements of FWB. Younas et al ( 2019) .In their study on financial Well-being, Younas et al. (2019) emphasize two antecedents, financial literacy and self-control, based on research conducted among people in Pakistan. However, these studies reflect a need for a deeper exploration of how various cultural, economic, and personality shifts determine FWB in a post-COVID era in a non-Western society.

2.2. Core Self-Evaluation and Well-Being

The “ Core Selfevaluation Theory” proposed by Judge et al. (1997) is an exceptional psychological construct that can assess personality trait variables in Organizational Psychology. Core Self Evaluation (CSE) epitomizes the fundamental appraisal carried out by an individual about their self-worth and capabilities(Judge et al.,1997; Judge et al., 2009). It is indicative of one's self-concept, comprising of individual subconsciousness and evaluation of one's capabilities and self-control, Chang CH et al. (2012). CSE includes four personality dimensions: self-esteem, self-efficacy, locus of control, and emotional stability (Judge,2009). Timothy and Judge (1997) developed the concept of CSE as an assessment of an individual, their outlook toward their environment, the situations in which they realize themselves, and how they see their proficiencies and self-esteem. It is interesting to note that these four attributes that form CSE are not identical, and each has its role in making a fundamental appraisal of an individual.CSE is consistently highlighted as a robust and reliable psychological construct to portray the linkage between personality and hedonism, stress, and individual motivation(Ferris DL et al., 2011). The basic assumption is that individuals with higher degrees of CSE values are perceived or observed to be are as ones with a high degree of proficiency in completing activities in their work and life and also are disposed to risk in decision-making scenarios as they depend on their positive resource available in their surroundings Crocker J,&Park LE(2004). In short, people with high self-esteem, self-efficacy, locus of control, and emotional stability are confident in their capabilities and experience control over the events happening in their environment. It has been reported in studies that people with a high degree of CSE accomplish entrusted tasks without great stress and offers to take leadership roles Judge TA et al. ( 2004)

The prevailing literature showcases that Core self-evaluations (CSE), including self-esteem, general self-efficacy, locus of control, and emotional stability, have been identified as significant predictors of FWB(Dienerand, Lucas,1999). It is worth mentioning that financial Well-being is influenced by personality and trait level effects as these impact how people interpret an environmental stimulus, information processing, and decision-making (KimPrieto et al., 2005). Differences exist in individuals while perceiving ideas in objectively equivalent circumstances. An individual with an elevated level of self-esteem and self-efficacy may effectively respond to challenging scenarios and manage well compared to others with lower self-esteem and efficacy (KammeyerMueller et al., by keeping themselves self-motivated and positive (KammeyerMueller et al., 2009). Likewise, an individual with an internal locus of control will have the agency required to contour their environment and future (Furnham, 1986) and will not be affected by environmental factors that cannot be controlled (Judge et al., 2004). Studies by multiple researchers (Larsen & Ketelaar, 1991; Zelenski & Larsen, 2002) reveal that individuals with higher levels of emotional stability can avoid responses in stressful circumstances and life events. It further reinforces a positive outlook on the future, as observed by Larsen and Ketelaar (1991) and Zelenski and Larsen (2002). This unique characteristic is linked to the ambition to follow positive outcomes rather than simply trying to evade failure(Johnson et al., 2008)

Traits including neuroticism(emotional stability), self-esteem, generalized self-efficacy, and locus of control have a validated link with overall Well-being (Diener & Diener, 1995; Carver & Scheier, 1999; Peterson, 1999; Tsaousis et al., 2007). These traits are also connected with certain aspects of individuals, such as work-family satisfaction(Boyer & Mosley, 2007), Occupation (Judge & Larsen, 2001), and Financial well-being (SFWB) afar the influence of income (Judge et al., 2009; Ng & Diener, 2014). These variables are observed to be markedly heritable and constant over time (Trzesniewski et al., 2003; Neisse et al., 2006).In addition, their interconnections are part of higher-order factors, as Judge et al. (2002) explained. In Short, CSE is the primary personality construct reflecting an individual's self-worth, abilities, and competence, influencing well-being (Judge, 2009; Judge et al., 2005).

Discrete from straightforward measures of Well-being, contentment, or efficacy that are dependent on life satisfaction or affective experience (Easterlin, 2003), CSE acts as a predecessor to Well-being instead of being part of the concept itself (Judge et al., 1998; Diener & Diener, 1995; Ryan & Deci, 2001).In light of established links between components of CSE and well-being, it is expected that a positive correlation will be observed between personality and Financial well-being (SFWB), as observed in the prior studies conducted by Zyphur et al. (2015).

Given the diverse context of a country like India, the extrapolative capability of CSE is highly significant as it impacts individuals' financial decisions and long-term goals. A study to gain insight on these lines is necessary for understanding how one's inherent personality traits and unique experiences form financial behavior and financial Well-being (SFWB) in distinct cultural settings Judge et al., 2003; Zyphur et al., 2015; Judge et al., 2009

2.3. Role of Income and Gender in Financial Well-being

Income plays a significant role in considering the interplay between personality and financial Well-being (FWB). Income is a critical element of an individual financial status Buchler et al. (2009). Prior studies indicate that income plays a significant role in determining one's economic well-being despite the fact of familiarizing oneself with a new environment and acclimatizing to an unknown social circle Diener and Biswas-Diener (2002) and Clark et al. (2008)

The relationship between income and financial Well-being is always a focal point of research literature((Zyphur et al., 2015), denotes that higher income leads to a higher degree of FWB in men; however, in the case of women, the relationship between income and FWB seems less pronounced. This difference could be due to varying psychological factors, probably reflecting gendered social roles and expectations in a conventional society(Zyphur et al., 2015; Diener & Biswas-Diener, 2002). The link between income, core self-evaluation, and financial Well-being is a complex and multifaceted relationship that has garnered attention in recent research (Cheung & Lucas, 2015). A study by Judge and Hurst found that higher-income individuals tend to have more positive core self-evaluations associated with higher levels of financial Well-being (Judge, 2009). Additionally, higher-income individuals may have more access to financial resources and opportunities, positively impacting their well-being. Furthermore, higher-income individuals may also have greater control over their financial circumstances and feel more empowered to make financial decisions, leading to increased financial well-being.(Diener & BiswasDiener, 2002)

Though broader well-being (WB) appraisal includes various well-being aspects like family, social ties, health, and job satisfaction, as indicated by Diener and Seligman (2004), which downplayed the role of income, A more in-depth review of the literature highlights observations contrary to these views and states that income plays a detrimental role in one's holistic Well-being VeraToscano et al. (2006). This could be because FWB assessments emphasize one's subjective view of one's financial situation; therefore, income is expected to positively influence subjective Well-being, underlining its prominence in evaluating the financial dimensions of Well-being.

Prevailing scholarly works indicate that gender ominously intersects with FWB and CSE; interestingly, traditional Indian society has prescribed gender roles that limit the economic opportunities presented to individuals, thereby affecting their financial autonomy and self-perception. As indicated earlier in this work, research points to a gendered difference in the relationship between income and Well-being. The psychological factors such as needs, desires, and societal roles potentially play a significant role in the interplay between income, gender, and FWB.

Empirical studies on the relationship between gender, core self-evaluation, and financial Well-being have been sparse in recent years; however, based on the existing literature, there could be conceivable differences in how CSE shapes financial Well-being in India (Vera-Toscano et al., 2005). A probable explanation for these gender differences can be attributed to the prevailing societal norms and gender roles that can affect a person's attitude, money, and financial decision-making, such as financial self-efficacy. A critical determinant that can contribute to the gender difference in the relationship that exists between core self-evaluation and financial Well-being is the disparity in access to educational and employment opportunities for women in India( Rink et al., 2021); the author opines that these barriers deny women an opportunity to develop and apply their CSE traits, namely self-confidence, and belief in their abilities, which can adversely affect their financial Well-being. In addition, the prevailing societal expectations and cultural norms play a considerable role in shaping gender differences in an individual's core self-evaluation score and, thereby, their financial Well-being.

This warrants an investigation that probes into gender-specific dynamics in the quest for measures that enhance FWB(Crowley, 1998; Diener & Biswas-Diener, 2002; Bem, 1974; Eagly et al., 2000). In the postglobalization era of the Indian economy, women are more actively engaged in job roles. A revised inquiry helps to gain novel insights that can add value to existing knowledge.

2.4. Financial Well-Being and Psychological Factors

FWB is one's subjective appraisal of financial position ( Ng & Diener,2014; Xiao et al., 2014). It is one discernment of the financial adequacy of an individual (Hira & Mugenda, 1998) and the feeling of contentment concerning several aspects of an individual's financial position. In a broader sense, FWB refers to the degree of financial adequacy, financial security, and a belief that one can meet one's monetary needs and achieve financial goals (Xiao et al., 2006).

In early studies, researchers used objective indicators to assess an individual's financial Well-being ( Joo & Grable, 2004; Kahneman & Deaton, 2010). Various reckonable measures of wealth, such as income, debt, and savings, were projected as objective evidence of an individual's financial standing, thereby providing a fair judgment of one's financial ability. However, many of the later studies (Diener, 1984; Diener & Biswas-Diener, 2002; Kahneman & Deaton, 2010; Ng & Diener, 2014) have highlighted that the prior listed indicators can explain only a part of variations in FWB experienced by an individual. Therefore, in order to accommodate subjective attributes that can affect one’s FWB, were also incorporated in many of the studies carried out later (Prawitz et al., 2006; Sorgente & Lanz, 2019), and they address both financial and nonfinancial attributes of FWB and are often considered over quantitative or objective measures and the current study focus only on demographic and subjective aspects of FWB. Numerous works have probed upon the determinants of FWB (Joo & Grable, 2004; Kaur et al., 2021; Salignac et al., 2019). Many of the studies have focused on factors such as age, gender, education, marital status, employment, and fiscal aspects such as income and wealth (Hira & Mugenda, 1998; Plagnol, 2011; Porter & Garman, 1993; Sahi, 2013)and other factors that are considered as an essential factor that can affect one's FWB. However, the literature explicitly indicates that there exist discrepancies in the manner in which these socio-economic and demographic factors have an impact on FWB as a consequence of various psychological traits (Gerrans et al., 2013; Gonçalves et al., 2021; Nanda & Banerjee, 2021). Some studies have provided evidence that objective and subjective financial awareness can positively impact an individual's satisfaction and behavior while managing their finances (Shim et al., 2012; Xiao et al., 2014). Empirical research (Abreu & Mendes, 2010; Lusardi & Mitchell, 2007; van Rooij et al., 2012; Wagner & Walstad, 2018) shows cases that though overt expertise in the domain is essential, it is not sufficient enough to induce behavioral change in individuals (Fernandes et al., 2014; Mandell, 2008; Willis, 2011). It is an individual's personality traits that decide how one puts their knowledge into practice(De Meza et al., 2008; Ponchio et al., 2019), approach towards money CastroGonzález et al., 2020; Pandey et al., 2020)and perception of being in control of one’s finances (Farrell et al., 2016; Vosloo et al., 2014) and other salient attributes that affect ones’ FWB. The personality attributes influencing one's FWB encompass self-esteem, locus of control, future orientation, self-efficacy, the propensity to plan, risk-aversive behavior, etcetera.(Chatterjee et al., 2019; Garðarsdóttir & Dittmar, 2012; Norvilitis et al., 2003; Shobha & Chakraborty, 2017; Strömbäck et al., 2017).A study on these lines can provide vital information about the behavioral heterogeneities among individuals and their perception in a non-western cultural setting. The following variables are considered for our study.

2.5. Self Efficacy

self-efficacy (SE) denotes an individual’s trust in their ability to manage their finances. The social cognitive theory on self-regulation accentuates a person's ability to regulate and manage behavior, and self-efficacy is a significant predictor of overall performance (Bandura, 1977, 1991).)The construct of self-efficacy, a significant constituent of CSE score (Judge et al., 2009), plays a prominent role in a context where Well-being is focused; FSE involves an individual's judgment about their ability to manage personal finance and influence or change financial outcomes. Research studies indicate that an individual who possesses high trust in their ability to successfully manage their funds and allow them to engage in desired financial behavior and attain positive financial outcomes as well as financial Well-being (Asandimitra & Kautsar, 2019; Farrell et al., 2016; GamstKlaussen et al., 2019; Vosloo et al., 2014). In addition, individuals with a higher degree of FSE have showcased a willingness to invest in risky financial assets despite uncertain and volatile market conditions and thereby act as a predictor of wealth creation and financial satisfaction (Asebedo & Payne, 2018; Chatterjee et al., 2011).).

FSE helps to build self-confidence and self-esteem in individuals so that they can make the right financial decisions, leading to financial Well-being (Chandra et al., 2017; Limbu & Sato, 2019; Sachitra et al., 2019; Warmath & Zimmerman, 2019).

At its most basic level, FSE is a method of enhancing one's sense of self. Different studies have linked people's self-esteem to better financial choices (Chandra et al., 2017; Limbu & Sato, 2019; Sachitra et al., 2019; Warmath & Zimmerman, 2019). According to this study, financial wellness refers to the satisfaction and security levels that individuals experience regarding their monetary conditions.

2.6. Locus of Control

Regarding FWB, Locus of Control is valuable because it has something to do with what people think about how much control they have over what occurs in their lives. For instance, Cobb-Clark et al. (2016) revealed that based on their research findings, those with a high internal locus of control were generally more financially comfortable than others. This group believes a lot about changing one's economic condition.

They usually acquire economic stability by actively managing funds and saving or investing(Strömbäck et al., 2017; Sabri,2022). More work must be done regarding interventions to improve internal locus of control. Similarly, there is a necessity for further inquiry into the factors impacting the association between these two concepts(Kesavayuth et al., 2018).

2.7. Emotional Stability( Neuroticism)

We benefit from emotional stability about money. This extent of budgeting is often sensible when making budgets during insecure times. (Park & Sela, 2018; Burr et al., 2009). People with emotional stability can stay calm and think clearly when faced with complex financial problems (Aren & Köten, 2019). It is well recognized that maintaining good mental health is crucial for leading a fulfilling life since it enhances cognitive abilities and facilitates long-term planning.

Individuals with emotional stability have proficient coping mechanisms, enhancing their emotional Well-being. Consequently, this affects their financial conduct, resulting in robust financial Well-being. In 2020, Chipeşiu Ng and Kang (2022) conducted a study during the COVID-19 pandemic that showed how important it is to have emotional stability when handling money problems. More so, Khan et al. (2023) carried out research among Romanian medical practitioners, which underscores the relevance of emotional stability in conquering financial hurdles. The study reveals a strong correlation between emotional stability and overall Well-being. Neuroscientific investigations have shown that several brain systems responsible for processing emotions play a role in determining financial risk-taking and risk-avoiding behaviors (Peterson, 2007). Further investigation is required to address the lack of understanding of the precise effects of emotions on financial decisions. In order to

However, there are times when circumstances do not align as expected. According to Blanchard and Pearson (2020), making financial mistakes and impulsive choices are the consequences of a deteriorating mental state.

Research by Kuhnen and Knutson 2011 suggests that an individual's emotional state can impact their decision-making and viewpoint on taking financial risks. To enhance decision-making in high-pressure situations, it is vital to comprehend the impact of our emotions on market activities and the reasons behind the failure or success associated with different emotional states (Duxbury et al., 2020).

2.8. Self-Esteem and Financial Well-Being

There is little doubt that an individual's financial situation is closely connected to their self-esteem. Assume an individual's income is ample to meet essential expenses, and that person belongs to the fortunate minority who never experienced financial concerns. In that case, an individual probably has a higher self-esteem than others who consistently appear to lack money.

People who are content with their current state are more inclined to preserve money for the future, which helps create a more secure economic climate. People with a sense of empowerment are more inclined to have a positive outlook on their financial situation and make rational decisions (Kannadhasan et al., 2016).In addition, individuals with high self-esteem are significantly more inclined to engage in financial risk-taking than those with low self-esteem. If an individual's financial status is consistently unstable and can barely sustain themselves, they likely have a low opinion of themselves.

Individuals with low self-esteem are prone to unfavorable financial choices and less inclined to make advantageous ones. Individuals with difficulty establishing or attaining savings goals may exhibit compulsive spending tendencies.

Opportunities for success elude an individual, and they should be able to grasp them. In addition, those with low self-esteem are more prone to experiencing distress when confronted with challenges, as indicated by Mahendru et al. (2020). Researching the correlation between income and financial self-esteem

2.9. Core Self-Evaluation and Financial Resilience

Core self-evaluation denotes an individual's discernment of their skill worth and overall competence and has affected various facets of their life, including financial resilience. Johnston et al. (2021) highlight that individuals with a greater degree of core self-evaluation exhibit higher financial resilience than they have. These individuals may have Faith in their competency to manage financial challenges and find solutions to their pecuniary problems. Further, these individuals are more likely to take proactive steps like seeking additional income sources or implementing effective budgeting strategies(Johnston et al., 2021). For example, using the given sources on core self-evaluation and financial resilience, it can be assumed that core self-evaluation influences how strong one is financially. The sources mention self-confidence and efficiency in oneself, which are factors of core self-evaluations. The thing is that a high level of self-esteem may make people think highly of themselves and their abilities to handle financial matters with ease(Smith et al., 2019). Moreover, regarding economic resilience, self-efficacy is very important to someone's life. (Farrell et al., 2016). Individuals with high self-efficiency generally believe they can perform particular tasks, including making sound monetary judgments and coping with complex financial situations more than others. In other words, those individuals whose central self-appraisal maintains confidence when dealing with typical money problems will most probably demonstrate resiliency in this area(Hamid et al., 2023). Let it be understood, however, that financial resilience does not entirely depend on core self-evaluation alone(Farrell et al., 2016).

As a result, core self-evaluation has been influenced a lot. Indeed, it is not the sole determinant of an individual's financial resilience. In addition, resilient youth can draw on available resources in their families, schools, and communities, thus fostering their development of the necessary skills for financial resilience.

Similarly, core self-evaluation may play a role in one's financial resilience. The sources suggest that individuals with high self-efficacy and positive core self-evaluation are likelier to take precautions and engage in proactive financial resilience (Farrell et al., 2016).

2.10. Summary of Literature and Hypothesis Set for the Study

Our erudite exploration to understand the interplay between individual psychological attributes, an outcome, and financial outcomes has gained substantial attention among various stakeholders. This interplay takes on inimitable characteristics as it is shaped by India's diverse socio-economic and cultural landscapes. Core Self-evaluation (CSE), encompassing self-esteem, locus of control, self-efficacy, and emotional stability, acts as a diagnostic instrument through financial Well-being (FWB) and resilience (FR) examined. The present study intends to dissect the intricate relationship prevailing between CSE, FWB, and FR in the Indian milieu. Based on the review in these lines, the researchers propose individual psychological factors. Significantly influence financial experiences and, thereby, the outcomes. The paper seeks to facilitate financial behavior and its determinants by locating the inquiry within India's intricate and volatile economy to contribute to a more nuanced understanding of such behavior, paving the way for policies and educational frameworks well-suited to the Indian socio-economic context.

Development and Elaboration on Hypotheses:

H1: Core Self-Evaluations and Financial Well-Being. This study assumes that core self-evaluations are fundamental in shaping an individual's financial position in India. This relationship may be broken down into specific dimensions as follows:

• H1a: Self-Esteem & FWB "Greater self-esteem relates positively to financial well-being in India." In this hypothesis, individuals with high self-esteem view themselves favorably when it comes to money matters, thus enhancing their financial Well-being amidst the evolving Indian economy.

• H1b: Locus of Control & FWB "Internal locus of control is associated with higher levels of financial well-being in India." This claim is made from the point of view that people who believe they can influence their finances will have an easier time navigating through Indian economic conditions and, hence, acquire better financial Well-being than others.

• H1c: Self-Efficacy & FWB "Self-efficacy relates positively with financial well-being in India." This assertion emphasizes how confidence in managing one's finances determines individual economic welfare, particularly in dynamic Indian markets.

• H1d: Emotional Stability & FWB "Emotional stability predicts good financial well-being in India." Therefore, this presupposes that emotional stability helps individuals manage their finances even during times of stress, making them financially stable amidst diverse sociopolitical backgrounds characteristic of India.

H2: Core Self-Evaluations and Financial Resilience Regarding resilience, this research suggests that CSE shapes how people withstand and recover from finances. Hardships.

H2a: Self-esteem and Financial resilience

"Greater self-esteem supports increased financial resilience in India." The assumption is that high self-esteem gives people the strength to confront financial problems and bounce back after experiencing failure.

H2b: Locus of Control and FR

"Greater internal locus of control increases an individual's financial capability in India." Individuals with control over their finances are better positioned to manage and defeat all financial setbacks.

H2c: Self-Efficacy and FR

"Improved fiscal resilience in India is associated with heightened self-efficacy. " Here, a strong belief in oneself is highlighted as essential for one to become stronger after such a time.

H2d: Emotional Stability and FR

“

•Hypothesis 2d: Relationship between Mental Health and Financial Resilience "Emotional stability is a significant factor in Indians' ability to withstand financial challenges." According to this hypothesis, a person's emotional stability level is critical in their ability to manage their finances effectively.

Hypothesis three is centered around the observation that gender-wise distribution and income levels can significantly affect people's Financial well-being (FWB) and their capacity for Financial Resilience (FR) in India. This hypothesis critically examines how various gender dynamics as well as income disparities shape money stories within the Indian context and can be set as follows :

Hypothesis 3 a: In India, higher income levels positively correlate with an individual's ability to weather financial storms, indicating improved financial outcomes.

Hypothesis 3b: In India, gender influences an individual's financial resilience and Well-being, likely through disparities in financial access, decision-making power, and socio-economic opportunities

4. Data Analysis and Results

Two prominent techniques assisted as the base for data analysis:

1. Partial Least Squares (PLS) Modeling: This statistical method established the primary hypotheses on the structural relationships between core self-evaluations and financial resilience or Well-being. PLS modeling, famous for its ability to define multifaceted variable interfaces, is predominantly appropriate for exploratory research settings where predicting and explaining Variance in target constructs is essential.

2. Correlation Analysis: The researcher has employed a correlation analysis in order to investigate the interrelationships among core self-evaluations (CSE), financial Well-being (FWB), financial resilience (FR), annual income, and gender. This approach is adopted to quantify the degree of linear relationship between pairs of variables. The statistical significance for the study is determined by way of two-tailed tests with a conventional alpha level of 0.05, where p-values less than0.05 were considered indicative of significant relationships, ensuring the reliability and generalizability of our research

The integration of a structured questionnaire with progressive statistical techniques and the methodology of this study facilitated researchers to accomplish a more nuanced understanding of the correlation between psychological factors and financial well-being. The inclusion of CSES alongside financial well-being measures offered a momentous background, simplifying a deeper examination of the impact of personal assessments on financial behaviors. This broad methodology allowed for identifying significant elements of financial Well-being and resilience amongst individuals born after 1982, a task that would have been exceptionally stimulating without such meticulous understanding.

Interpretation

Overall Model Fit and Quality: The model's indicators of APC, ARS, AARS, and GoF display a consistent and robust model. With an APC value of 0.234, the paths within the model signify an average level of strength. Furthermore, it has been observed that this model elucidates more Variance independent variables; the values of ARS and AARS are 0.634 0.628, respectively, highlighting an excellent predictive power.(Ref-

Table 2)

• Multicollinearity Assessment: AFVIF and AVIF values are below 5, revealing the absence of multicollinearity as a risk to the reliability of the model's assessments. Also, the absence of multicollinearity mitigates against overestimation effects on individual variables' predictive capability by shared variances with other predictors. .(Ref-

Table 2)

• Goodness of Fit: The goodness-of-fit index (GoF) value is 0.604, indicating a solid fit for the model. Furthermore, it suggests that the consistency between the model's structure and hypothesized relationships with observable data supports the theoretical circumstances for the study.( .(Ref-

Table 2)

Interpretation

Average Variance Extracted (AVE): Values beyond 0.5 for AVE would indicate that more than half of the Variance observed in the variables is accounted for by the latent construct, signifying convergent validity is satisfactory. The latent variables meet all these benchmarks. (Schuberth et.al.,2018)(Ref-

Table 3)

Composite Reliability: This indicates that a value greater than 0.7 is satisfactory and depicts that the measures of a construct are consistent. Additionally, this threshold is passed by all latent variables, which entails high internal reliability (Raykov, 2004)(Ref-

Table 3)

Cronbach's Alpha: In most cases, Cronbach's alpha is used to measure internal consistency. Usually, a value of 0.6 or higher is considered acceptable. Therefore, all latent variables in this study have Cronbach's Alpha above 0.6, which shows adequate internal consistency (Streiner, 2003).(Ref-

Table 3)

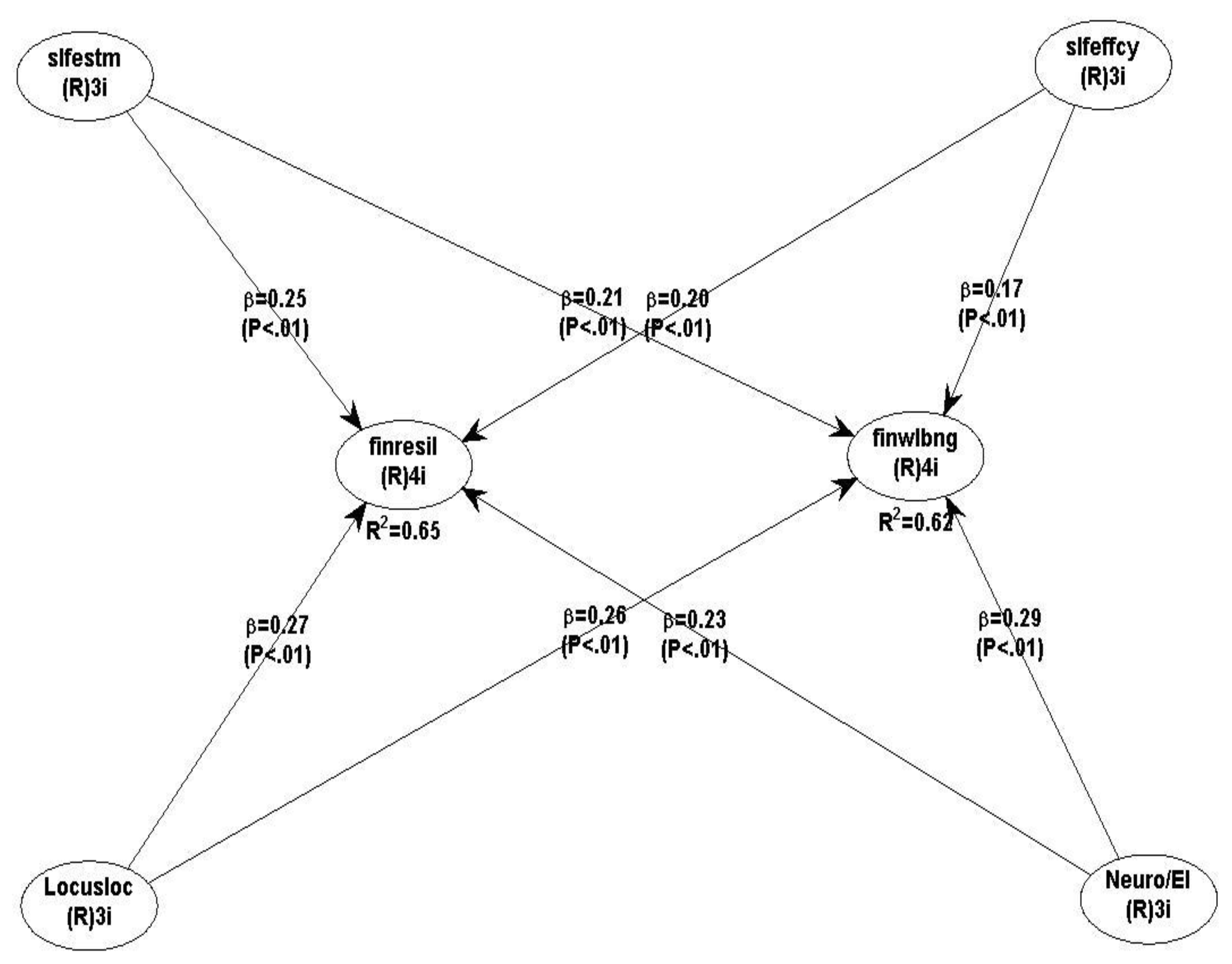

A comprehensive examination of Core Self Evaluation(CSE) and its influence on perceived financial outcomes in the Indian context is examined using the Partial least square model. The study reveals statistically significant positive relationships across all dimensions of CSE, namely Self-Esteem, Self-Efficacy, Self-Esteem, Locus of Control, Neuroticism/Emotional Intelligence with outcome variables such as Financial Well-being (FWB) and Financial Resilience (FR). The hypotheses 1a to 1c and 2a to 2c are validated. The path coefficients indicate that higher levels of Self-Esteem, Locus of Control, Self-Efficacy, and Emotional Stability are positively related to both Financial Well-being and Financial Resilience, with all p-values being significant at less than 0.001, thereby indicating a solid positive relationship between the CSE dimensions and FWB/FR.(

Figure 1)

The current research indicates Self-Esteem, Locus of Control, Self-Efficacy, and Emotional Stability—with Financial Well-being (FWB) and Financial Resilience (FR). In particular, Self-Esteem (β = 0.210, SE = 0.055 for FWB; β = 0.254, SE = 0.059 for FR) and Emotional Stability (β = 0.290, SE = 0.057 for FWB; β = 0.227, SE = 0.055 for FR) appear to be the effective predictors of financial outcomes. This finding denotes that individuals with higher self-esteem and emotional stability tend to experience more excellent financial stability and a greater resilience to recover from economic downturns. Likewise, Locus of Control and Self-Efficacy also demonstrate robust positive connections to financial Well-being and resilience (with coefficients ranging from β = 0.171 to β = 0.267), demonstrating that trust in one's financial agency and confidence in one's ability to manage finance is positively related to an individual's financial well being and are crucial for survival in India's dynamic economic landscape. Further, the low level of standard errors associated with path coefficients bolsters the high reliability of estimates, reinforcing the argument that CSE is a pivotal element in shaping an individual’s financial well-being in the Indian subcontinent. (Ref-

Table 4)

Hypothesis H3 was tested using Correlation, and the following results were obtained

The correlation analysis demonstrates the relationship stated in hypotheses 3a and 3b. Hypothesis 3a, which posits a positive relation between FWB and annual income, is supported by a moderate positive correlation (r = 0.533, p < .001). The above results denote that higher income levels correlate with improved financial Well-being, likely due to greater access to financial resources, reduced stress, and enhanced life satisfaction from financial security. The correlation (r = 0.480, p < .001) between income and financial resilience reinforces the notion that higher income enhances Well-being and contributes to greater financial resilience, thereby acting as a buffer against financial unpredictability.

The current study also reveals moderate positive correlations between FWB and FR with gender (r = 0.527 and r = 0.534, respectively, p < .001). These results indicate that gender factors affect financial outcomes, potentially reflecting societal and economic roles that control access to resources and opportunities. Further weak correlation witnessed between annual income and gender (r = 0.328, p < .001) shows cases of the prevailing systematic gender inequalities in income, which can affect an individual's resilience and well-being. A robust positive correlation witnessed between financial well-being (FWB) and financial resilience (FR) (r = 0.744, p < .001) underlines that individuals with a greater degree of financial resilience tend to experience better financial well-being. This indicates that resilience acts as a protective buffer, augmenting stability and satisfaction by enabling individuals to steer through financial challenges hassle-free.(

Table 5)

The results presented in the last couple of paragraphs stress the importance of considering economic factors and gender while designing financial policies to improve resilience and Well-being across diverse populations, which can result in more equitable economic participation.

5. Discussion

Our work helps uncover the robust connection between Core self-esteem (CSE) and financial well-being, reverberating global research that elucidates the effect of individual financial behavior and psychological resilience on overall life satisfaction. Our study's findings align with prior work carried out by Zyphur et al. (2015) and Kanchan et al. (2021), who examined the gendered nuances and an all-inclusive role of financial literacy in shaping financial Well-being, respectively. The present research bolsters the notion that financial well-being in India surpasses tangible aspects of wealth, in line with broader perspectives put forth by Porter and Garman (1993) and which was later accentuated by Serido, Shim, and Tang (2013). This further emphasizes the view that financial Well-being involves a sense of security and satisfaction that can assuage stress and increase control over an individual's financial future, resulting in an enhanced level of happiness and life satisfaction.

Core Self Evaluation theory, propounded by Judge et al. (2003), posits that self-esteem, self-efficacy, locus of control, and emotional stability can influence one’s life satisfaction and financial outcomes. This view is further substantiated in work carried out by Poncho et al. (2019), who has investigated the influence of consumer spending self-control on financial Well-being, thereby demonstrating the interplay between financial behaviors, personal values, and overall well-being and our research reinforces the findings from these works.

Our study offers a persuasive narrative that surpasses established boundaries, thereby positioning financial outcomes within a psychosocial framework that demands re-examining socio-economic and welfare policies. Further, it indicates a shift toward more tailored and gender-sensitive approaches while designing financial literacy and inclusion programs, specifically in nations grappling with economic volatility and shifting cultural paradigms.

5.1. Theoretical Implications

The research presented here contributes to the existing body of knowledge about financial well-being (FWB) and resilience, focusing on the Indian social and economic context. The study's unique strength is its holistic approach to dealing with FWB. Our study has moved beyond considering conventional economic metrics, mainly income and assets. It has included psychological aspects that are pivotal in shaping perceptions concerning financial well-being and resilience. This approach stems from prior work by Porter & Garman (1993), Serido, Shim, & Tang (2013), and other researchers who have underlined the need for an individual's sense of security and satisfaction with one's financial status to enhance overall life satisfaction. To add on another major highlight of this work is that it focuses on Core self-evaluations (CSE) proposed by Judge et al. (2003), which have four components, namely self-esteem, self-efficacy, locus of control, and emotional stability .in this study they are not only considered as variables that predict life satisfaction but also of financial Well-being and resilience thereby providing evidence to support the CSE theory in the Indian economic landscape.

The findings from the study reaffirm that the above psychological constructs are convolutedly connected with financial outcomes, thereby providing a robust example of how the CSE theory can be contextualized to explore the dynamics of financial Well-being in a non-Western society, thereby drawing attention to the interplay of core self-evaluations with social, economic conditions as well as cultural norms.

One of the study's main strengths lies in its ability to highlight the gendered nuances in financial Well-being and resilience, echoing global research findings like those of Zyphur et al. (2015). Besides, it recognizes that environmental factors, rather than genetic predispositions, affect the correlation between income and FWB, showcasing the impact of societal roles and expectations on financial Well-being. In addition, integrating validated instruments such as the Consumer Financial Protection Bureau's (CFPB) scale for financial Well-being and resilience indicators, as well as the Core Self-Evaluations Scale (CSE), augments the reliability of the study's findings as well as enhances the discourse on financial behaviors in the Indian context.

5.2. Managerial Implications

The study presented here constitutes the foundation for targeted interventions to enhance economic stability and satisfaction related to life, specifically among Indian Gen 'Y' and Gen ‘Z.'It aids in formulating an inclusive, sophisticated, and culturally sensitive financial education and policy that can address the needs of a country facing economic volatility and cultural shifts. Our research further accentuates that the newly developed intervention should target financial inclusion and literacy by considering psychological traits that influence that can influence FWB and FR, as highlighted by Collins and Urban (2020). Apart from these, the standardized instruments used for our study bolster the validity of the findings, thereby providing a comprehensive tool for assessing how FWB and FR are shaped by psychological, economic, and demographic factors in a vibrant, culturally rich economic setting of a nation like India.