1. Introduction

Examining the dynamic interplay between the Offshore Oil and Gas Industry and the transformative potential of Additive Manufacturing (AM) is crucial when it comes to establishing entrepreneurial strategies which might result in a positive financial impact.

Historically, the Offshore Oil and Gas Industry has been characterized by capital-intensive operations influenced by market forces, regulatory requirements, and technological advancements (Yan et al., 2023). Recent events, such as the COVID-19 pandemic and the Russia-Ukraine conflict, have further disrupted the industry, prompting a reevaluation of operational strategies (Guo et al., 2024). Companies are increasingly integrating AM technologies to enhance production processes, reduce waste, and improve supply chain dynamics, this aligning with sustainability goals (Egon et al., 2024).

Additionally, it’s important to state that the adoption of AM allows for on-demand production and customization, significantly impacting competitiveness and operational efficiency in this high-stakes environment (Naghshineh, 2024). Entrepreneurs in the industry face high barriers to entry, necessitating tailored strategies that encompass financial resources, compliance with environmental regulations, and the integration of innovative technologies (Jafar et al., 2024). Building strategic partnerships and fostering a culture of continuous improvement are essential for navigating these complexities and seizing emerging opportunities in a rapidly evolving market landscape.

Moreover, the industry's shift towards cleaner energy sources has prompted companies to leverage their expertise in large-scale offshore projects, positioning themselves as leaders in the transition to sustainable energy solutions (Bhattacharya & Kammen, 2024). Despite the potential benefits of Additive Manufacturing, challenges remain, including the need for standardized practices and regulatory compliance to ensure the safe use of 3D-printed components (Jin et al., 2022).

As companies prioritize innovation and technological integration, the interplay between traditional operational practices and advanced manufacturing techniques will play a crucial role in enhancing competitiveness in the Offshore Oil and Gas Industry. By effectively addressing these challenges and capitalizing on available opportunities, entrepreneurs can navigate the complexities of the industry and achieve sustainable growth.

1.1. Objective

The primary objective of this study is to evaluate the competitive dynamics of companies integrating AM technologies into their production processes, with a focus on high-stakes industries such as Offshore Oil and Gas.

By applying strategic analytical frameworks such as Porter’s Five Forces, the study aims to identify how AM adoption influences factors like operational efficiency, market positioning, and industry competitiveness.

This research seeks to provide actionable insights into how AM-enabled companies can leverage technological advancements to overcome market challenges, optimize supply chains, and align with sustainability goals.

1.2. Research Questions

This section outlines the critical inquiries that guide the study, focusing on the integration of AM within high-stakes industries.

By addressing these questions, the research seeks to uncover insights into the transformative potential of AM in complex industrial environments.

How does the adoption of AM influence the competitive positioning of companies in high-stakes industries such as the Offshore Oil and Gas industry?

How does AM impact operational efficiency and supply chain dynamics in industries with complex logistics, such as offshore operations?

1.3. Research Gap

Despite the growing adoption of AM in various industries, there remains a limited understanding of its specific impact on competitiveness and operational efficiency in high-stakes sectors such as offshore oil and gas. While AM's potential benefits - such as reduced production costs, enhanced customization, and sustainability improvements - are widely acknowledged, there is a gap in research that directly explores how these advantages affect market positioning and industry dynamics.

Furthermore, the challenges associated with AM adoption, including regulatory hurdles, standardization issues, and the integration of AM into existing manufacturing ecosystems, are not fully addressed within the context of offshore industries.

This research aims to bridge this gap by providing a comprehensive analysis of AM’s role in shaping competitive strategies and operational practices within the offshore oil and gas sector.

1.4. Hypothesis

The hypothesis guiding this study is that the adoption of AM in Offshore Oil and Gas companies significantly enhances their competitiveness by improving operational efficiency, reducing costs, and enabling faster, on-demand production.

Additionally, it is hypothesized that AM adoption helps companies navigate industry challenges, such as inventory management and supply chain disruptions, while contributing to sustainability goals.

2. Literature Review

2.1. Conventional Strategies in the Offshore Oil and Gas Industry

A firm's strategy is generally shaped by its standing within its industry or market environment and by the competitive edge it holds in that context. (Dirani & Ponomarenko, 2021; Garcia et al., 2014)

Thus, it’s imperative to affirm that the Offshore Oil and Gas Industry requires distinct strategies to stay competitive, especially given its reliance on high-risk environments, extensive supply chains, and specialized technological needs. (Amaechi et al., 2022; Olugu et al., 2022)

Figure 1.

Structure of Offshore Oil and Gas Licensing (Concessionary Systems).

Figure 1.

Structure of Offshore Oil and Gas Licensing (Concessionary Systems).

One of these strategies stems from the procuration of concessionary licensing systems, primary Offshore fiscal frameworks employed globally, where governments permit private companies to explore, develop, and produce resources, retaining ownership of natural resources but transferring the right to produce them to a private company, which then pays royalties and taxes based on production. (Dirani & Ponomarenko, 2021)

This system contrasts with contractual approaches like production sharing agreements, where the state shares directly in production or revenue rather than transferring title to resources at the production site. Concessionary systems are commonly used in countries such as Norway, the UK, and Australia, and often emphasize maximizing state revenue through royalties and taxation while encouraging investment by allowing companies to own produced oil and gas at the export point rather than the wellhead. (Olleik et al., 2021; Singh et al., 2023)

Strategic Partnerships and Value Creation

Building strategic partnerships is another essential strategy for entrepreneurs in the Offshore Oil and Gas Industry. Collaborations can provide access to unique capabilities and resources, allowing companies to undertake large-scale projects.

By leveraging their existing experience and relationships with energy stakeholders, oil and gas companies can position themselves as leaders in the energy transition, offering distinctive value propositions to their customers. (Kienzler et al., 2023)

2.2. Metal Additive Manufacturing and On-Demand Production

The process of Additive Manufacturing (AM) is based on the direct conversion of 3D data from a CAD file into a physical object by sequentially building layers of material (Frazier, 2014).

It’s noteworthy that AM enables the production of complex or customized parts without additional tools, reducing conventional processing steps and spare part inventories through on-demand manufacturing, while also allowing changes in production without extra costs or the need to alter tools or molds (DebRoy et al., 2018; Vafadar et al., 2021).

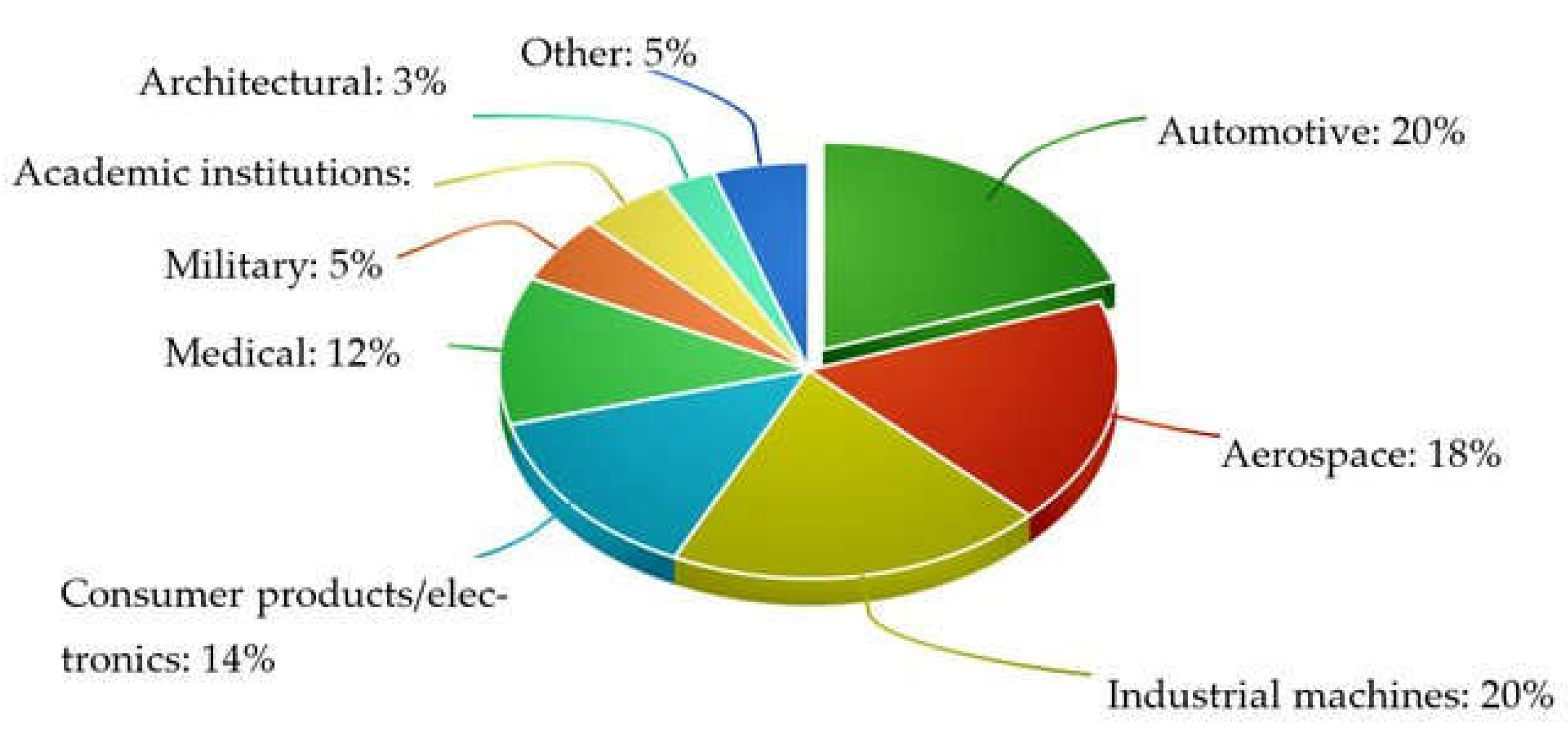

According to Vafadar et al. (2021), AM has been implemented and used in a wide range of industries as presented in

Figure 2.

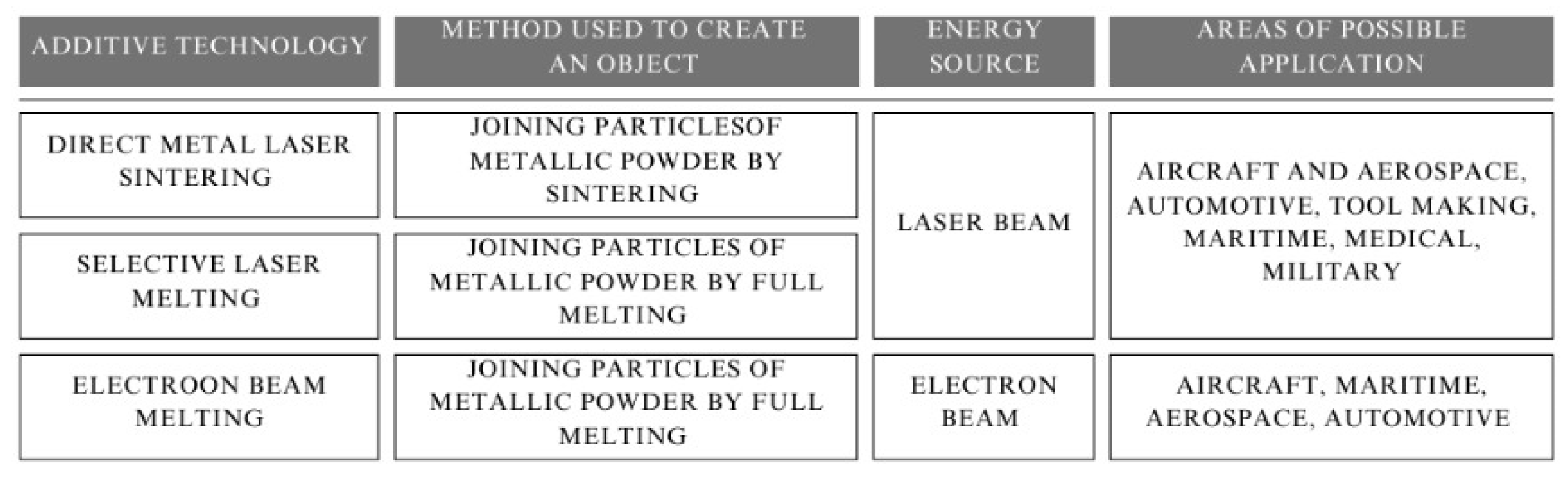

Regarding metal AM, three primary systems are employed to produce metal parts: powder bed systems, powder feed systems, and wire feed systems (Frazier, 2014).

In the context of the Offshore sector, the most commonly utilized technologies are Direct Metal Laser Sintering (DMLS), Selective Laser Melting (SLM), and Electron Beam Melting (EBM) (Deja et al., 2020).

3. Unplanned Downtime

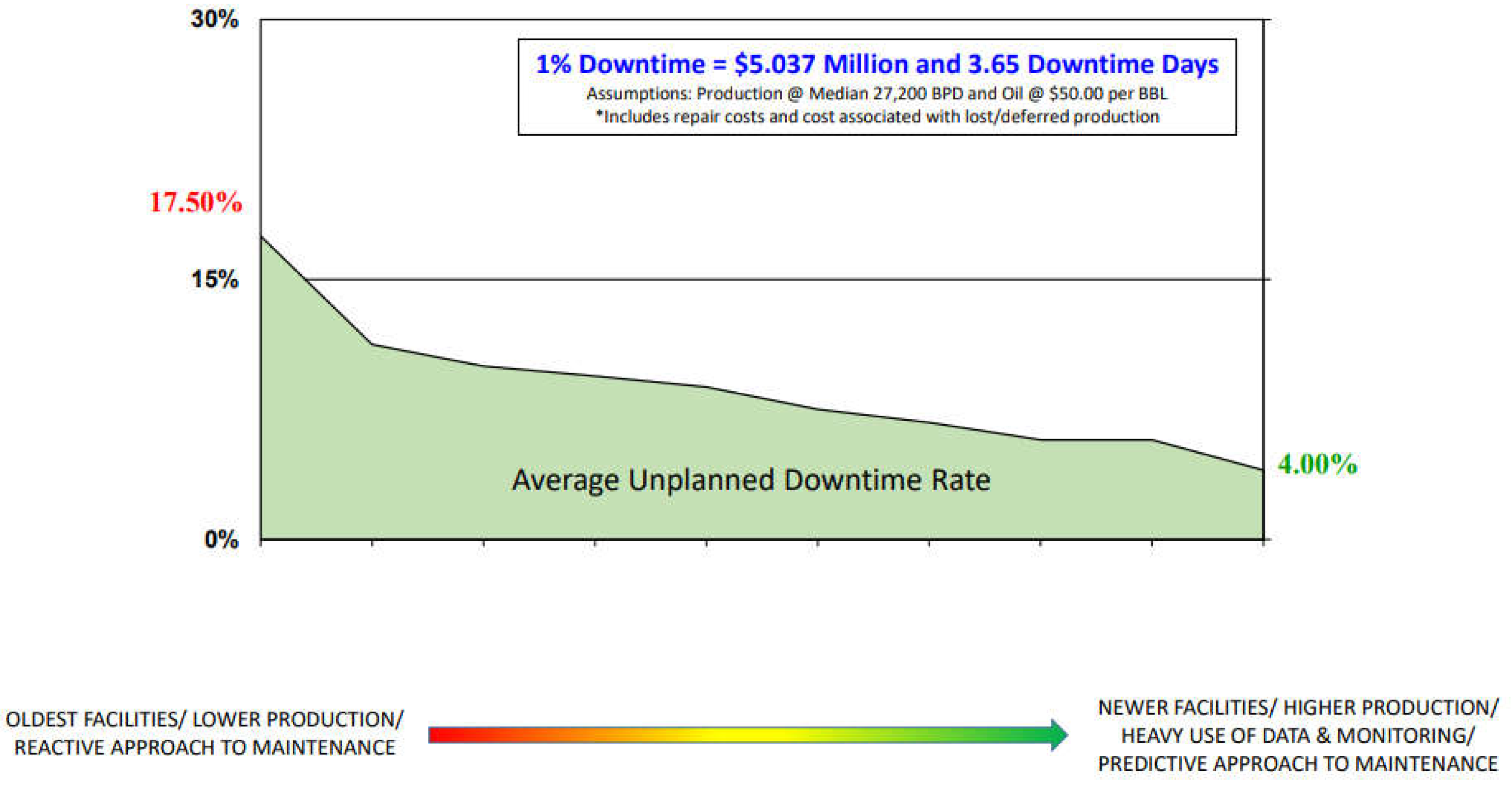

In the Offshore Oil and Gas Industry, where Lead Time requirements are stringent, the financial consequences of Unplanned Downtime can be severe. When equipment failures or breakdowns occur, necessitating part replacements, the annual cost impact could reach as high as $88 million. This figure encompasses both the expenses associated with repairs and the financial losses resulting from production delays or interruptions. (Kimberlite International Oilfield Research et al., 2016)

Figure 4.

Cost of Downtime regarding Offshore platform conditions (Kimberlite International Oilfield Research et al., 2016).

Figure 4.

Cost of Downtime regarding Offshore platform conditions (Kimberlite International Oilfield Research et al., 2016).

According to GE Oil & Gas (2016), offshore unplanned Downtime contributes with 37% of the major expenses, a notable factor regarding the economic burden associated with Offshore Downtime pertains to the substantial logistics expenses incurred in transportation to the remote Offshore sites of Original Equipment Manufacturer (OEM) components (Md Sapry, 2020). It is significant to observe that in most cases, Subtractive Manufacturing techniques are employed to produce OEM parts, which play a crucial role in maintaining the efficient functioning of Offshore installations (Deja et al., 2020).

These components are typically procured from diverse suppliers, occasionally spanning multiple continents. Subsequently, they are transported to offshore locations, requiring intricate coordination to ensure the timely and precise delivery of the requisite components, encompassing customs clearance, compliance with import regulations, mitigation of weather-related delays, and synchronized scheduling with maintenance interventions. (Alan E. Branch, 2008)

Bearing this in mind, the implementation of AM as an on-demand manufacturing process can help optimize the supply chains and, in turn, reduce logistical costs.

4. Competitiveness Analysis

When assessing the competitive dynamics and strategic positioning of the Offshore Oil and Gas Industry, particularly regarding the integration of Additive Manufacturing (AM), using frameworks such as PESTEL, Porter’s Five Forces, and SWOT provides a holistic understanding.

These frameworks help evaluate external environmental factors, competitive pressures, and internal capabilities. Below are introductions and analyses for each framework.

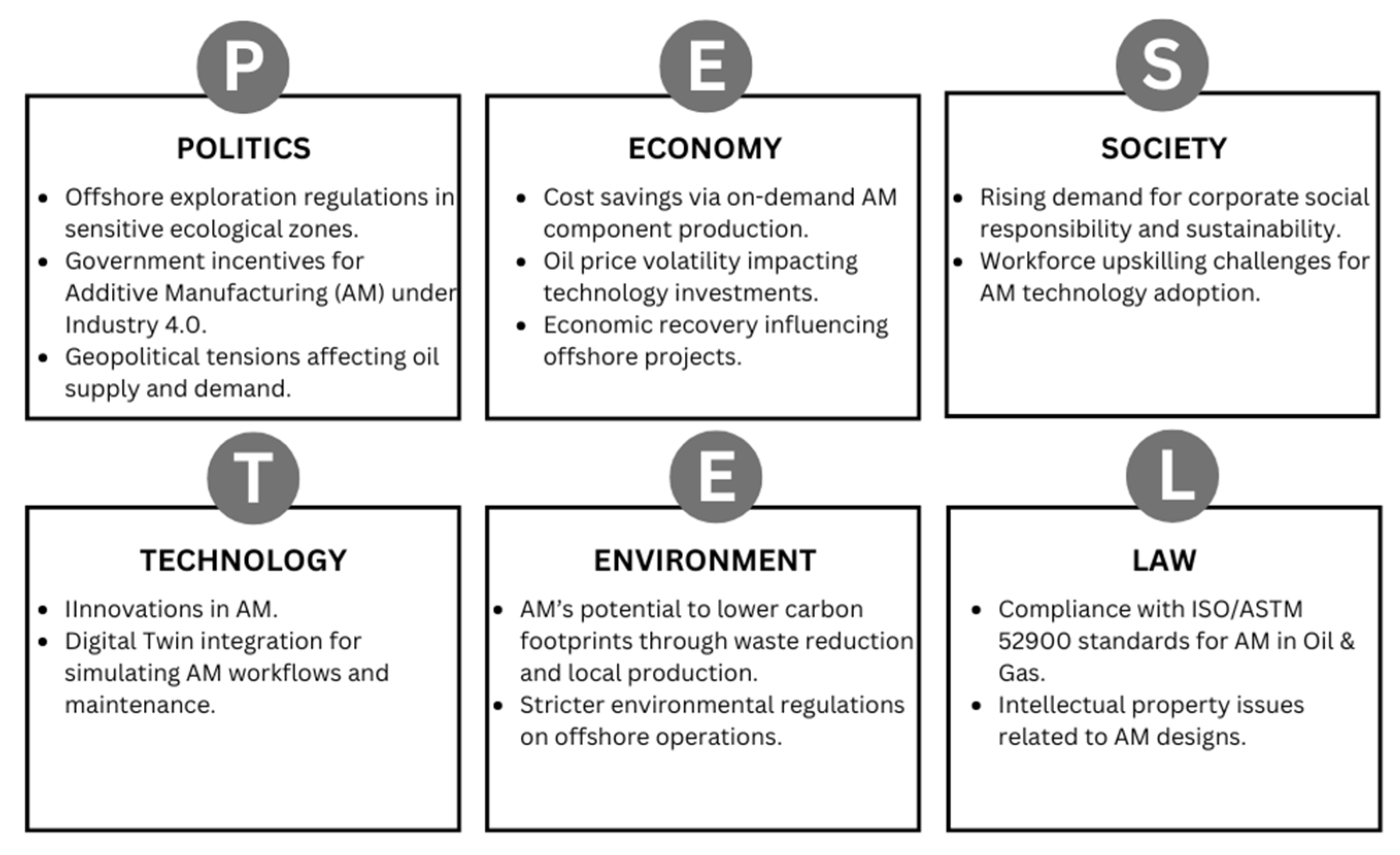

4.1. PESTEL Analysis

The PESTEL framework examines the external macro-environmental factors influencing an industry. For the Offshore Oil and Gas Industry, factors such as technological advancements like AM, geopolitical dynamics, and environmental regulations play a significant role.

The integration of AM can disrupt traditional supply chains and production methods, necessitating a closer examination of the Political, Economic, Social, Technological, Environmental and Legal factors shaping the industry.

Analysis:

Figure 5.

PESTEL Analysis.

Figure 5.

PESTEL Analysis.

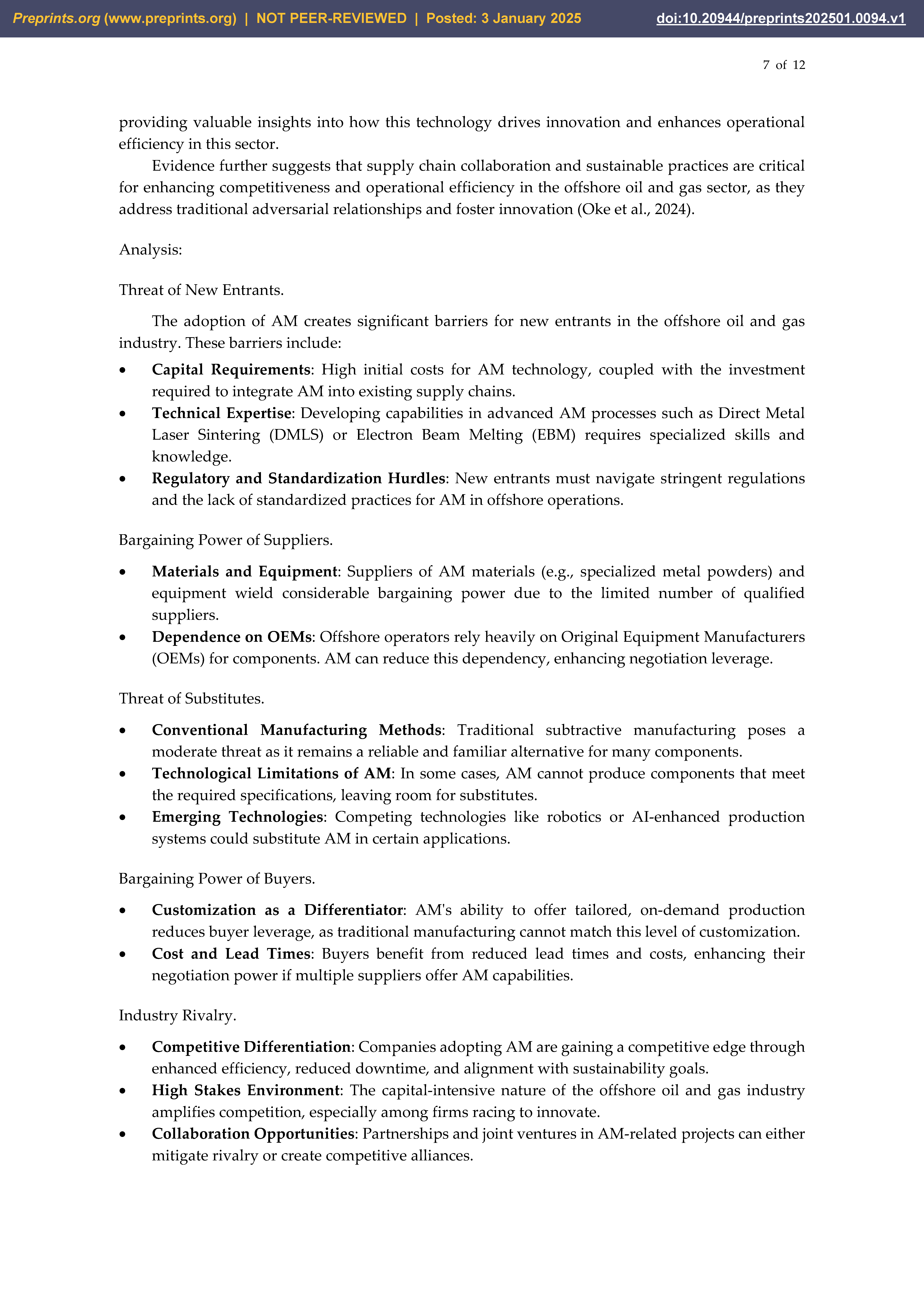

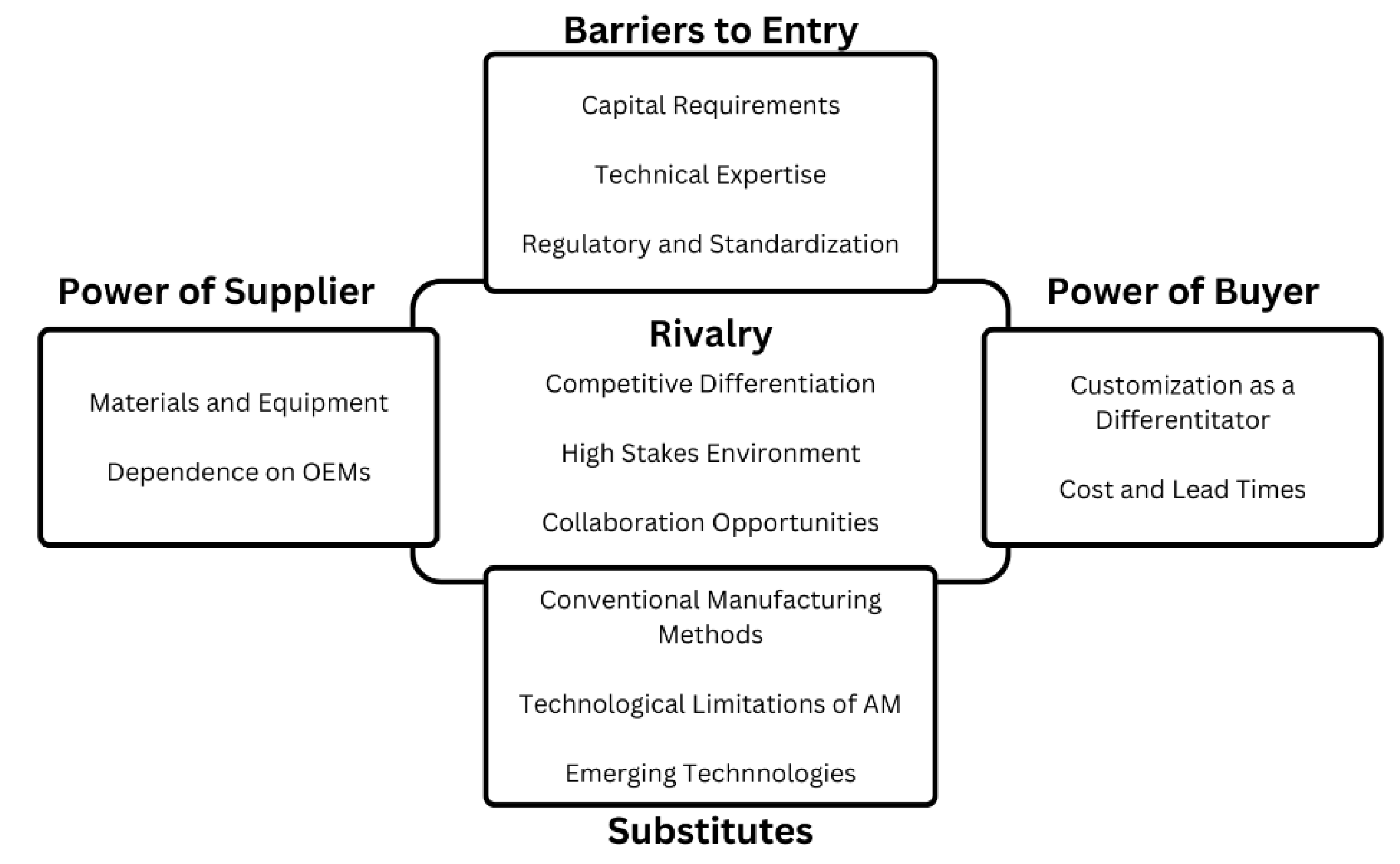

4.2. Porter’s Five Forces Framework

Porter's Five Forces Framework is a strategic analysis tool that evaluates industry competitiveness through five forces: the threat of new entrants, bargaining power of suppliers, threat of substitute, power of buyers, and industry rivalry (Pangarkar & Prabhudesai, 2024).

Figure 6.

The Five Competitive Forces That Shape Strategy according to Porter (1980).

Figure 6.

The Five Competitive Forces That Shape Strategy according to Porter (1980).

The structure of an industry, as reflected in the five competitive forces, shapes competition and profitability. To understand the fundamental reasons behind an industry's current profitability and predict future trends, a business must comprehend the underlying factors driving these five competitive forces (Porter, 1980).

It's imperative to note that this framework is a highly effective tool for analyzing the competitiveness of Offshore Oil and Gas companies, offering a structured approach to evaluating industry dynamics and identifying how AM influences the above-mentioned factors, ultimately providing valuable insights into how this technology drives innovation and enhances operational efficiency in this sector.

Evidence further suggests that supply chain collaboration and sustainable practices are critical for enhancing competitiveness and operational efficiency in the offshore oil and gas sector, as they address traditional adversarial relationships and foster innovation (Oke et al., 2024).

Analysis:

Threat of New Entrants.

The adoption of AM creates significant barriers for new entrants in the offshore oil and gas industry. These barriers include:

Capital Requirements: High initial costs for AM technology, coupled with the investment required to integrate AM into existing supply chains.

Technical Expertise: Developing capabilities in advanced AM processes such as Direct Metal Laser Sintering (DMLS) or Electron Beam Melting (EBM) requires specialized skills and knowledge.

Regulatory and Standardization Hurdles: New entrants must navigate stringent regulations and the lack of standardized practices for AM in offshore operations.

Bargaining Power of Suppliers.

Materials and Equipment: Suppliers of AM materials (e.g., specialized metal powders) and equipment wield considerable bargaining power due to the limited number of qualified suppliers.

Dependence on OEMs: Offshore operators rely heavily on Original Equipment Manufacturers (OEMs) for components. AM can reduce this dependency, enhancing negotiation leverage.

Threat of Substitutes.

Conventional Manufacturing Methods: Traditional subtractive manufacturing poses a moderate threat as it remains a reliable and familiar alternative for many components.

Technological Limitations of AM: In some cases, AM cannot produce components that meet the required specifications, leaving room for substitutes.

Emerging Technologies: Competing technologies like robotics or AI-enhanced production systems could substitute AM in certain applications.

Bargaining Power of Buyers.

Customization as a Differentiator: AM's ability to offer tailored, on-demand production reduces buyer leverage, as traditional manufacturing cannot match this level of customization.

Cost and Lead Times: Buyers benefit from reduced lead times and costs, enhancing their negotiation power if multiple suppliers offer AM capabilities.

Industry Rivalry.

Competitive Differentiation: Companies adopting AM are gaining a competitive edge through enhanced efficiency, reduced downtime, and alignment with sustainability goals.

High Stakes Environment: The capital-intensive nature of the offshore oil and gas industry amplifies competition, especially among firms racing to innovate.

Collaboration Opportunities: Partnerships and joint ventures in AM-related projects can either mitigate rivalry or create competitive alliances.

Figure 7.

Five Force’s Analysis.

Figure 7.

Five Force’s Analysis.

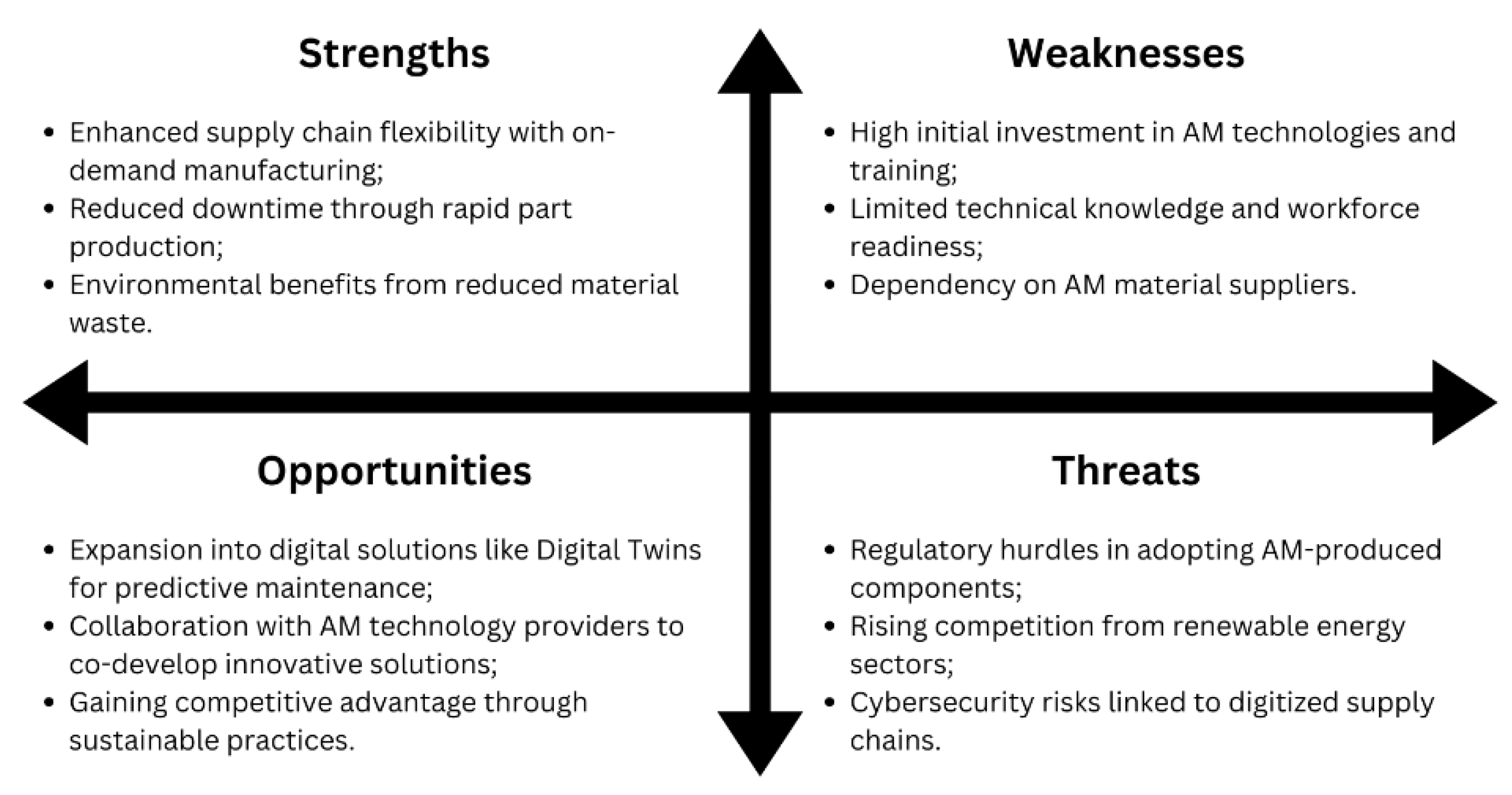

4.3. SWOT

The SWOT analysis identifies internal strengths and weaknesses alongside external opportunities and threats. For the Offshore Oil and Gas sector, AM presents both significant opportunities (e.g., operational efficiency) and challenges (e.g., technological readiness). This framework helps strategize effective AM integration.

Analysis:

5. Method

5.1. Data Collection

This study will employ Porter’s Five Forces framework to assess the competitiveness of companies integrating additive manufacturing (AM) into their production processes.

Data will be systematically gathered from multiple credible sources, including corporate reports, peer-reviewed scientific publications, and official company websites. Additionally, existing statistical data - such as industry graphs and datasets - will be utilized to strengthen the analysis and provide quantitative support for the findings.

5.2. Procedure

The analysis will follow a structured approach aligned with the methodology of Porter’s Five Forces, focusing on critical factors such as the bargaining power of suppliers, the bargaining power of buyers, the threat of substitutes, the threat of entrants, and industry rivalry within the industry.

To enhance the depth of the study, complementary strategic tools, including SWOT and PESTEL analyses, may be incorporated. These frameworks will provide additional insights into the internal and external factors influencing the competitive landscape, ensuring a holistic understanding of the industry dynamics.

6. Discussion

The discussion highlights the transformative role of Additive Manufacturing (AM) in enhancing competitiveness within the Offshore Oil and Gas Industry. By leveraging AM, companies can achieve significant improvements in operational efficiency, supply chain optimization, and environmental sustainability.

6.1. PESTEL Analysis

From the PESTEL analysis, it is evident that AM aligns with technological advancements, enabling on-demand production that minimizes lead times and material waste. Environmental advantages, such as a reduced carbon footprint and compliance with stricter regulations, underscore its relevance in an industry increasingly focused on sustainability. However, challenges remain, including geopolitical tensions and economic volatility, which must be carefully navigated. Social factors, particularly the need for workforce upskilling, represent another critical barrier that could delay the widespread adoption of AM technologies. Moreover, adherence to legal frameworks such as ISO/ASTM 52900 compliance is essential to ensure the safe and reliable integration of AM.

6.2. Five Forces’ Analysis

The Five Forces analysis reveals that AM adoption creates substantial barriers to entry for new competitors due to high capital requirements, complex regulatory landscapes, and the need for advanced technical expertise. While AM reduces dependency on traditional suppliers, it introduces new reliance on specialized material providers, whose bargaining power could influence market dynamics. Additionally, the customization capabilities of AM and its ability to reduce downtime enhance its value proposition, thereby shifting buyer power dynamics. While conventional manufacturing remains relevant for specific applications, and emerging technologies may compete with AM in the future, the immediate benefits of AM position as a significant competitive advantage. Furthermore, industry rivalry is intensified as companies adopting AM gain differentiation through innovation, improved operational efficiency, and alignment with sustainability goals.

6.3. SWOT Analysis

The SWOT analysis complements this understanding by identifying AM's strengths in enhancing supply chain flexibility, reducing downtime, and providing environmental benefits. However, its weaknesses include high initial investment costs, gaps in technical knowledge, and workforce readiness challenges. AM also presents significant opportunities for the development of digital solutions, such as digital twins, and fosters collaborations with technology providers to co-develop innovative solutions. At the same time, threats such as regulatory hurdles, rising competition from renewable energy sectors, and cybersecurity risks in digitized environments require careful management.

7. Conclusion

In conclusion, the adoption of Additive Manufacturing (AM) represents a paradigm shift for the Offshore Oil and Gas Industry, offering unprecedented opportunities to enhance operational efficiency, reduce downtime, and align with sustainability goals. AM’s ability to produce components on-demand, optimize supply chains, and minimize material waste positions it as a critical enabler of innovation in an industry that is traditionally capital-intensive and logistically complex. Furthermore, by addressing environmental concerns and adhering to evolving regulatory standards, AM fosters a path toward greater compliance and corporate responsibility, essential in today’s market landscape.

However, the successful integration of AM demands a multifaceted approach that acknowledges and mitigates its inherent challenges. High initial investment costs, a limited pool of skilled labor, and regulatory complexities must be addressed through strategic investments, workforce development, and cross-sector collaborations. Companies that adopt AM early stand to gain a competitive edge, particularly as technology continues to evolve and its applications expand across the industry.

The strategic insights derived from frameworks such as PESTEL, Porter’s Five Forces, and SWOT highlight the transformative potential of AM, while also emphasizing the need for systemic change to unlock its full value. AM is not merely a technological upgrade; it is a tool for redefining operational paradigms, fostering resilience against market volatility, and catalyzing industry-wide sustainability initiatives. As the Offshore Oil and Gas sector navigates the transition to cleaner energy and more efficient practices, AM will play an increasingly pivotal role in shaping its future, offering a clear pathway toward innovation and long-term competitiveness.

8. Limitations

The limitations of this study reflect the complexity and evolving nature of integrating Additive Manufacturing (AM) into the Offshore Oil and Gas Industry. A significant limitation is the sensitivity of AM adoption to economic volatility, particularly fluctuations in oil prices, which directly impact the financial resources available for investment in advanced technologies. This financial dependency can create uncertainty regarding the scalability and long-term viability of AM in offshore operations.

Technical constraints also present a challenge, as AM cannot yet replace conventional manufacturing for all components, especially those requiring specific material properties or performance characteristics that are difficult to achieve with current AM technologies. Furthermore, the lack of comprehensive empirical data directly quantifying AM’s impact on cost reduction, operational efficiency, and downtime in offshore environments limits the ability to draw definitive conclusions about its effectiveness.

Regulatory and standardization issues further hinder AM’s widespread adoption. The inconsistent implementation of international standards, coupled with stringent regional regulations, creates barriers for companies seeking to integrate AM into their operations. This fragmentation complicates compliance and raises costs, particularly for multinational companies operating in diverse regulatory environments.

Finally, workforce readiness remains a critical limitation. The adoption of AM requires a skilled workforce capable of operating, maintaining, and optimizing these advanced systems. However, the current gap in technical expertise and the need for extensive upskilling efforts delay the realization of AM’s full potential. Addressing these limitations will require coordinated efforts across industry, academia, and regulatory bodies to create a conducive environment for the successful integration of AM into offshore operations.

9. Future Research

Future research should focus on addressing the critical gaps identified in this study to facilitate the effective integration of Additive Manufacturing (AM) into the Offshore Oil and Gas Industry. A priority area for investigation is a comprehensive lifecycle cost analysis that compares the long-term economic benefits of AM-enabled processes with traditional manufacturing methods, particularly in offshore operations. This analysis should encompass direct and indirect costs, including logistics, maintenance, and downtime reduction.

Research should also explore the harmonization of international standards and regulations for AM adoption. Developing a unified regulatory framework would reduce compliance complexity and support the scalability of AM technologies across regions. Studies focusing on how regional policies and industry standards, such as ISO/ASTM 52900, can be aligned to promote safe and reliable AM integration will be instrumental.

The skills gap in AM adoption represents another pressing area for investigation. Future research should evaluate the effectiveness of workforce training programs and propose strategies for developing technical expertise within the industry. This includes assessing the role of partnerships between academia, industry, and government in fostering a skilled labor pool capable of supporting advanced manufacturing technologies.

Further studies are needed to quantify the environmental benefits of AM, particularly its potential to reduce carbon footprints and material waste. By conducting detailed analyses of AM’s impact on resource efficiency and sustainability, researchers can provide actionable insights for companies aiming to align with global sustainability goals.

Finally, future research should examine the potential synergies between AM and emerging technologies, such as artificial intelligence (AI), robotics, and digital twins. Investigating how these technologies can enhance AM’s capabilities, streamline operations, and provide predictive insights will be crucial for maximizing its impact on the offshore sector. Collectively, these research efforts will not only address existing limitations but also position AM as a transformative solution for achieving operational excellence and sustainability in high-stakes industries.

References

- Bhattacharya, S., & Kammen, D. (2024). GREENER IS CHEAPER: AN EXAMPLE FROM OFFSHORE WIND FARMS. National Institute Economic Review, 1–17. [CrossRef]

- DebRoy, T., Wei, H. L., Zuback, J. S., Mukherjee, T., Elmer, J. W., Milewski, J. O., Beese, A. M., Wilson-Heid, A., De, A., & Zhang, W. (2018). Additive manufacturing of metallic components – Process, structure and properties. Progress in Materials Science, 92, 112–224. [CrossRef]

- Deja, M., Stanisław Siemiątkowski, M., & Zieliński, D. (2020). Multi-Criteria Comparative Analysis of the use of Subtractive and Additive Technologies in the Manufacturing of Offshore Machinery Components. Polish Maritime Research, 27, 71–81.

- Dirani, F., & Ponomarenko, T. (2021). Contractual Systems in the Oil and Gas Sector: Current Status and Development. Energies, 14(17), 5497. [CrossRef]

- Egon, A., Bell, C., & Shad, R. (2024). Sustainability in Additive Manufacturing: Analyzing the Environmental Impact of Additive Manufacturing Processes. [CrossRef]

- Frazier, W. E. (2014). Metal additive manufacturing: A review. In Journal of Materials Engineering and Performance (Vol. 23, Issue 6, pp. 1917–1928). Springer New York LLC. [CrossRef]

- Garcia, R., Lessard, D., & Singh, A. (2014). Strategic partnering in oil and gas: A capabilities perspective. Energy Strategy Reviews, 3(C), 21–29. [CrossRef]

- Guo, X., Lu, X., Mu, S., & Zhang, M. (2024). New roles for energy and financial markets in spillover connections: context under COVID-19 and the Russia–Ukraine conflict. Research in International Business and Finance, 71, 102403. [CrossRef]

- Jafar, M. R., Tripathi, N. M., Yadav, M., & Nasato, D. S. (2024). Additive Manufacturing in the Age of Industry 4.0 and Beyond. In Advances in Pre- and Post-Additive Manufacturing Processes (pp. 213–230). CRC Press. [CrossRef]

- Jin, Z., He, C., Fu, J., Han, Q., & He, Y. (2022). Balancing the customization and standardization: exploration and layout surrounding the regulation of the growing field of 3D-printed medical devices in China. Bio-Design and Manufacturing, 5(3), 580–606. [CrossRef]

- Kienzler, C., Lichy, A., Tai, H., & Marel, F. (2023). How oil and gas companies can be successful in renewable power.

- Kimberlite International Oilfield Research, David Bat, & Mike Stovall. (2016). 2016 Summary Report. https://www.kimberliteresearch.com/.

- Md Sapry, H. R. (2020). Exploring Logistic Setup Challenges during a Scheduled Offshore Platform Shutdown. International Journal of Advanced Trends in Computer Science and Engineering, 9(1.1 S I), 149–154. [CrossRef]

- Naghshineh, B. (2024). Mapping the enhancing effects of additive manufacturing technology adoption on supply chain agility. Management Review Quarterly. [CrossRef]

- Oil & Gas, G. (2016). The Impact of Digital on Unplanned Downtime: an Offshore Oil and Gas Perspective.

- Oke, A., Osobajo, O. A., & Taylor, S. (2024). Addressing the Trilemma of Challenges: The Need for More SC Strategic Collaborations in the UK Oil and Gas Sector. Sustainability, 16(2), 570. [CrossRef]

- Pangarkar, N., & Prabhudesai, R. (2024). Using Porter’s Five Forces analysis to drive strategy. Global Business and Organizational Excellence, 43(5), 24–34. [CrossRef]

- Porter, M. E. (1980). Industry Structure and Competitive Strategy: Keys to Profitability. Financial Analysts Journal, 36(4), 30–41. [CrossRef]

- Vafadar, A., Guzzomi, F., Rassau, A., & Hayward, K. (2021). Advances in metal additive manufacturing: A review of common processes, industrial applications, and current challenges. In Applied Sciences (Switzerland) (Vol. 11, Issue 3, pp. 1–33). MDPI AG. [CrossRef]

- Yan, L. W., Gupta, M., Tajuddin, N. M., M Diah, M. A. B., Shah, J. M., Masoudi, R., & Mokhtar, S. B. (2023, April 24). Integration of Petroleum Technologies for the Economic Monetization of Small Offshore Fields. Day 1 Mon, May 01, 2023. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).