1). Introduction

Innovation and the financial system are inextricably linked foundation factors of modern economic growth and development. In fact, the more important role that financial institutions have played in being drivers of technological advances and supporters of structural transformation within the emerging knowledge-based paradigms of economic growth has been manifestly their prime driving force. Against this backdrop, this paper therefore probes the relationship between banking credit and innovation around the world, placing special emphasis on how access to finance leads to technological advance and higher economic growth at both sectoral and regional levels. The insight from the international datasets and empirical studies underpins opportunities and challenges in reaping financial resources for technological development. Banking systems are important channels for technological change. Domestic credit to the private sector, often presented as a percentage of GDP, has been regarded as another key indicator of financial development, since it is perceived as a proxy for the ability of banks to channel resources to their business sectors. These resources are crucial to make investments in innovation, research, and development feasible. Both theoretical and empirical studies suggest that a firm’s ability to innovate strongly correlates with its access to credit. Those firms with greater access to financial means can invest in high-risk projects that yield great rewards, enhance productivity, and meet the challenges of an increasingly globalized market. Yet, the intensity of influence actually varies from sector to sector, across regions, and even across institutional landscapes; it therefore requires nuanced financial policies that also consider specific contexts. Innovation, in other words, is particularly bound to substantial pre-investments, especially in progressive and creative industries; hence, innovation is risky. For example, research by Qi and Ongena (2020) highlights the critical role that availability of credit plays in affecting the financing constraint of firms. Their findings indeed indicate that access to credit boosts firm productivity in research and development, therefore acting as a catalyst for innovation. This is particularly important in industries such as software, design, and film production, where ideas require a great deal of financial investment to reach the stage of commercializable innovation. More broadly, the banking ecosystems contribute to technological advance through the promotion of innovations beyond that of the single firm. Matkovskaya at al. (2022) stress that it is at this point-that is, once financial institutions start to take an ecosystem-based approach, considering themselves enablers of long-term innovation rather than mere suppliers of credit-that their role can be truly transformational. These opportunities could actually help attain much greater competitiveness at the industrial level, which can result from better integration of technological advances into bank operations and latent opportunities for innovation. In this regard, financial practices in alignment with innovation ecosystems underpin a core role for policy frameworks capable of spurring adaptive and forward-thinking approaches in the banking sector.

Another complication in this relationship may turn out to be that banking competition itself can affect innovation. Liu and Zhao attempt to throw some light on how the competitive banking environment affects credit financing and corporate innovation. In one direction, bank competition may lead to improved credit terms and improve innovative activities, but in the other direction, excessive competition can undermine credit quality and undermine its long-term sustainability. What that all basically means is that there should be a proper weighing of the promotion of competition and preservation of financial stability, where the banking systems support innovation without destabilizing the markets. Regional dynamics also play a role in differing impacts of access to credit on innovation. For instance, Yuan and Zhou (2021) present evidence that, in the Beijing-Tianjin-Hebei region, targeting of credit allocation was done in the interests of industrial upgrade and economic transformation. This regional focus underlines coherence of the financial strategy with local development goals and allows financial institutions to generate innovation in a way that contributes to inclusive and sustainable growth. Coupled with these dynamics, surplus liquidity within banking systems presents unparalleled opportunities for innovation and its challenges. The authors of Salim et al. (2024) conducted an analysis of excess liquidity in regard to its possible diversion toward productive investments stimulating technological progress. Their findings put forward the necessity of strong regulatory and institutional frameworks that can guarantee the efficient transformation of superfluous financial means into tangible innovation remnants. This befits the critical need to unlock the innovation potential of financial systems through policy intervention. That would mean the impact of banking credit goes beyond the level of individual firms and industries and toward more general economic priorities, reaching to the development of the creative economy, development of green technologies, and cultivation of human capital. Examples of the use of specialized financial instruments to accelerate progress in environmentally sustainable technologies and high-value industries are shown by Lin et al. (2023) and Li et al. (2023) by using green credit policies. Therefore, from the results, increased demand can be observed for the use of specialized finance serving designated goals, whether this is accelerating innovation in green technology or furthering initiatives toward STEM education. While positive links between credit and innovation were pointed out in various contexts, the same contexts also displayed adverse relationships; for instance, negative correlations of domestic credit and R&D expenditure. This result is highlighted by a number of international studies that caution financial systems’ tendency to focus on short-term earnings rather than long-term objectives of innovation. How such gaps occur is what needs further explanation, with respect to the structural and institutional variables that shape the financial decision-making processes. The paper brings together international research findings and original empirical material, detailing the various ways in which bank credit can provide the decisive stimulus to technological progress and industrial development. In this context, strategic complementarity between financial systems, innovation policies, and developmental goals is paramount. The aim of this report is to contribute to the ongoing debate concerning access to credit and innovation interactions, based on in-depth case studies, regional trends, and policy frameworks that provide useful insights to policymakers, financial institutions, and researchers in general.

2). Literature Review

Qi and Ongena (2020) analyze firm innovation that is driven by access to bank credit, underlining the fact that financial resources further inventive activities. Their results stress that increased credit availability plays as the most crucial enabler for companies to engage in high-potential but equally risky projects. Using empirical evidence from various industries, they are able to prove that credit is the fodder for innovation, as firms receiving greater access to financing are able to show higher productivity in R&D. This article underlines the importance of well-structured credit policies in unlocking firms’ potential for innovation and growth. Matkovskaya et al., (2022) discuss more of the macro perspective by evaluating the role of the banking ecosystems in the identification and development of latent opportunities for innovation. They reveal a technological incremental model that describes an opportunity for banks to lead beyond conventional business logics and position themselves in the role of the principal facilitator of innovation processes. The ecosystem approach underlines how banks can act as agents of improvement for long-term competitiveness through active support of innovations. The study also underlines the strategic relevance of embedding technological change into banking practices for financial services to be in synergy with industrial innovation. Liu and Zhao (2024) further extend the discussion to the impact of banking competition on credit financing and its implications for efficiency in corporate innovation. The findings suggest that, with increased bank competition, the credit terms are more favorable, hence encouraging firms in the pursuit of technological innovations. However, this study warns that very high levels of competition may be deterring to credit quality and sustainability of innovation. This balanced analysis emphasizes the fact that caretakers should ensure, through regulatory policies, that banking competition has a positive impact on the innovation ecosystem without destabilizing the financial markets. How does regional focus imply the interaction of bank credit and industrial upgrading? This is best brought into perspective in the work of Yuan and Zhou (2021) for the Beijing-Tianjin-Hebei region. The authors analyze the technological innovation modes employed within this area and illustrate how rightly directed credit allocation can accelerate the pace of structural transformation and industrial upgrading. Their research underlines the importance of contextualizing credit policies in regional economic contexts in a way that could enable financial institutions to support innovation in a manner consistent with wider developmental goals. Salim et al. (2024) investigate the relationship between bank lending and technological innovation in countries under excess liquidity conditions. Their work addresses that critical issue: how to channel surplus liquidity into those productive investments that bring innovation. They note that excess liquidity provides an opportunity for prioritization toward lending that drives innovation, provided the regulatory and institutional environment is hospitable to the long-term investment in R&D. This view, therefore, emphasizes the role of policy intervention in making sure that financial surpluses actually translate into tangible innovation outcomes. Put together, these papers go to provide the complex interrelationship that exists between bank credit and technological innovation. Each of them reiterates that it would hugely depend on appropriate financial policies, ecosystem-based approach, competitive banking environments, and regionally adaptive frameworks if bank credit is to realize its full potentiality in stimulating innovation. The findings also bring out the role of banks in determining technological and industrial advancement and the centrality of the banks in ensuring a sustainable economic development process.

Lin et al., (2023) present an excellent and instructive review of the dynamic interaction between banking and innovation, with a particular demonstration of how financial intermediaries can serve as transmission mechanisms of technological development. By synthesizing evidence across these studies, the authors have done well in highlighting how appropriately framed banking systems can be catalysts for innovation. In particular, by providing tailored credit instruments and financial products, such intermediaries tend to lower risk barriers for those firms undertaking R&D. However, their analysis also makes full allowance for the complexities arising from differences in the quality of institutions, the risk appetite, and their regulatory environment, which strongly affects the ability of banks to foster innovation. The review serves as a critical reminder that long-term economic growth can only be achieved by bringing national agendas for innovation and banking practices into harmony. Li et al. (2023) set their focus on the critical nexus between technology credit, innovation, and upgrading of industrial structure, hence giving some useful insights into how access to credit in technology-driven initiatives propels industrial transformation. Their findings indeed prove that access does encourage firms to adopt state-of-the-art technologies that enhance productivity and restructure the industry toward high-value sectors. The most striking feature of their findings is the call for policy alignment, due to the fact that the success of this transformation depends upon caught-up countries synchronizing their credit policies with national innovation objectives. Their recommendation on the development of financial instruments that would specially support technological innovation finds relevance in ensuring credit allocation taps identified industries of transformative potential. Lin et al. (2023) address the increasingly relevant issue of assessing the effect of green credit on green technology innovation. The empirical evidence has revealed that the green credit policy, diverting financial resources into environmentally viable technologies, can substantially incentivize the development of green innovations. Yet, it had one important caveat: such policies would be successful only with concomitant strong mechanisms for implementation and the capability of financial institutions to manage the funds for risks from the so-called green investments. The research underlines the twin role of the financial sector in stimulating innovation on one side, with the pressing global sustainability concerns on the other. Li (2024) discusses the linkage between FinTech and efficient banking; her arguments come out strongly in her thesis. Focusing on supply chain finance and credit risk assessment, she shows exactly how innovations in FinTech can transform banking and fit into enhancing the evaluation of risks, optimization of credit allocation, and reduction of operational costs. She has developed machine learning models that could take a person’s creditworthiness assessment a notch higher, and this can go a long way in implementing best practice financially, with immediate applicability to the cause of furthering technological innovation at the supply chain level. This embodies how powerful FinTech can be in transforming conventional banking structures and its greater implications for technological advancement in general. Popova et al. (2020) present a critical review of the status quo of digital innovation in the realm of traditional credit cooperative services and discuss, in this context, the role of digital transformation in fostering financial inclusions and innovations. According to their findings, cooperatives are able to extend their service delivery level with the adoption of digital platforms, to make more innovative credit products available, and to remain competitive even within a less technologically preeminent environment. With such emphasis on digitalization as a strategic tool, the authors portray it as a pathway to achieving sustainability and competitiveness of traditional financial systems in a more digitally oriented market.

The issue Liu et al. (2022) investigated is commercial credit in promoting firm innovations within the context of Chinese A-Share listed companies. The study focused on access to commercial credit, which plays an important role in facilitating the firm’s ability to engage in innovative activity. Results suggest that credit allocation suited to innovation-specific needs can be an important enhancer of a firm’s ability to pursue research and development for competitive advantage. The authors empirically evidence, at the firm level, that commercial credit is not just a financial resource but a strategic driver of innovation. Mwai (2021) explores the relationship between financial innovations and financial deepening among commercial banks in Kenya. This PhD work showcases how such innovations in mobile banking and digital credit platforms are transformational, increasing financial inclusion by facilitating broader access to credit. Mwai’s results show how innovation is revolutionizing Kenya’s banking industry, a country known to have initiated mobile financial services. By integrating financial deepening and technological change, the study shows how innovation in monetary products and services can support economic growth and social equity. Campanella et al. (2020) add in with the analysis of the influence of FinTech on the European banking system. Their approach is to explain how FinTech solutions have torn asunder the traditional functions of banking, especially with regard to credit evaluation, risk management, and customer engagement. The dual role of FinTech—both as disruptor and enabler—forces banks to innovate and make the switch to digital strategies to remain relevant. This research includes case studies and empirical findings on how FinTech influences the efficiency of banking and customer satisfaction across the European continent. De Nicola et al. (2023) explore the conditions under which firm innovation performance may depend on bank ownership. The authors contribute to a study conducted for the World Bank by assessing how far state-owned banks and private banks differ in their effectiveness at supporting innovative activities. The study has also proved that, because of their profit motive and operational flexibility, private banks are more capable of devoting resources to innovative firms. However, state-owned banks fix market failures and play an important role in granting credit to sectors or firms with long-term innovation goals. This nuanced perspective underlines the importance of ownership in structuring the innovation landscape. Biyase et al. (2023) examine the link between technological innovation, financial development, and inequality in BRICS countries. The results show the complex interaction in which, under different conditions, financial development and technological innovation could decrease and increase inequality. On the one hand, innovation promotes economic growth and brings opportunities, but these benefits are poorly distributed in most countries with marked and growing inequalities. The authors now call for a balancing act by policymakers to ensure that innovation-oriented growth is tempered with equity-centered frameworks in order to attain inclusiveness in development.

Yasar (2020) situates bank liquidity creation within the framework of technological innovation, arguing that a robust banking system capable of generating liquidity is indispensable for fostering innovation. He identifies a dual role for banks: financing innovation by providing credit and serving as innovators themselves by adopting advanced technologies. However, Yasar cautions that an overemphasis on liquidity creation could result in inefficiencies, advocating for a balanced approach where financial stability supports innovative investments. Mang’ana (2022) focuses on the Kenyan banking sector, examining the strategic adoption of technological innovations by commercial banks to achieve a competitive edge. His findings reveal that banks implementing technologies such as mobile banking, digital payment systems, and artificial intelligence outperform their competitors. According to Mang’ana, this competitive advantage stems not only from improved operational efficiency but also from enhanced customer experiences and expanded market reach. This study emphasizes that technological innovation in banking transcends operational enhancements, becoming a strategic necessity in a highly competitive market. Hakizimana, Wairimu, and Stephen (2023) explore digital transformation in banking and its effect on overall bank performance. Their research shows that the integration of digital technologies and automation enhances service delivery, reduces costs, and improves performance. However, the authors identify significant challenges, such as cybersecurity threats, regulatory compliance issues, and gaps in digital literacy, which need to be addressed to fully realize the benefits of digital banking. They stress the importance of a holistic transformation strategy that integrates technological advancements with organizational readiness. Zheng et al. (2023) investigate the impact of financial globalization on technological innovation, providing evidence on how cross-border financial flows influence technological progress. They find that financial globalization facilitates innovation by improving access to capital and enabling knowledge transfer. However, they caution that disparities in institutional quality and regulatory frameworks across countries can lead to unequal benefits. Zheng et al. advocate for globally harmonized policies to ensure that financial globalization promotes inclusive and sustainable innovation. Gupta, Jindal, and Malhotra (2022) study the increasing adoption of digital technologies in India’s banking sector, highlighting innovations such as blockchain, biometric authentication, and artificial intelligence. Their research indicates that digital technologies enhance efficiency and customer engagement but note that successful implementation depends on factors such as organizational culture, regulatory support, and technological infrastructure. The study underscores the importance of creating supportive environments for the effective adoption and integration of digital innovations. Juhro (2022) addresses the challenges faced by central banks in the digital era, including managing digital currencies, regulating fintech, and ensuring data security. He emphasizes that central banks must strike a balance between fostering innovation and maintaining financial stability. Juhro highlights the need for adaptive policy frameworks to navigate the complexities of digital transformation effectively, ensuring that innovation and stability align in central banking. Set at the intersection of service innovation, digital transformation, and banking stability, the selected studies highlight critical insights into how banking services and technological advancements influence customer behavior, financial stability, and economic growth. These findings provide valuable guidance for financial institutions and policymakers. Nguyen, Ho, and Ngo (2024) examine the influence of service innovation on customer satisfaction and loyalty in Vietnamese retail banks. Their findings demonstrate that innovations such as advanced digital banking platforms, personalized financial solutions, and streamlined customer support significantly enhance customer experiences. This improved satisfaction fosters loyalty, resulting in higher customer retention and long-term profitability for banks. The study emphasizes the need for continuous service innovation to keep pace with evolving customer expectations in competitive markets. However, challenges such as high implementation costs and ensuring technological accessibility across diverse customer segments are also highlighted. Marfo-Yiadom (2022) explores the interaction between innovation, national culture, and banking stability. The research underscores that cultural factors like risk tolerance and trust profoundly impact the adoption of innovations in banking systems. The findings reveal that banking stability is closely tied to how well banks integrate new technologies while maintaining customer trust and adhering to regulatory compliance. The study concludes that although innovation enhances efficiency and competitiveness, it must be carefully managed to prevent destabilization, especially in culturally diverse environments. Degryse, Roukny, and Tielens (2022) investigate the concept of asset overhang and its effect on technological adoption within banks. Their research finds that banks burdened by high asset overhang often resist adopting new technologies due to fears of devaluating existing assets. This resistance can stifle technological progress and reduce competitiveness. The study highlights the need to address structural inefficiencies within banks to enable a smoother transition to innovative technologies, aligning asset management practices with modernization demands.

Sihite (2024) provides a comprehensive review of digital transformation in banking, emphasizing its critical role in enhancing competitiveness. The study identifies technologies such as artificial intelligence, blockchain, and open banking as vital tools for streamlining operations, reducing costs, and improving customer engagement. It establishes digitalization as a strategic necessity for banks aiming to remain competitive. However, the research also notes significant obstacles, including regulatory compliance challenges, cybersecurity risks, and the digital divide, which need to be addressed to unlock the full benefits of digital transformation. Dezem et al. (2024) focus on optimizing innovation strategies through open banking APIs. Their findings advocate a data-driven approach to balancing in-house and outsourced innovation efforts. Open banking ecosystems, enabled by APIs, promote collaboration with third-party developers while allowing banks to maintain control over core services. This flexible and scalable approach ensures that banks remain agile and competitive in a rapidly evolving technological landscape. Becerril-Velasco (2022) examines how taxation and banking systems impact the adoption of ICTs. The study provides a theoretical framework showing that favorable fiscal policies and supportive banking regulations accelerate technological adoption, driving economic modernization and financial inclusion. Tax incentives and a conducive banking environment are identified as essential factors for integrating ICTs effectively. Xu et al. (2024) explore the relationship between bank risk culture and corporate innovation in China. Their findings suggest that banks with a proactive risk culture are more likely to support innovative corporate projects through tailored financial solutions. This alignment of risk management with growth opportunities not only fosters corporate innovation but also strengthens the financial sector.

3). Data

We have used the following data from the Global Inovation Index as showed in

Table 1.

4). Econometric Model

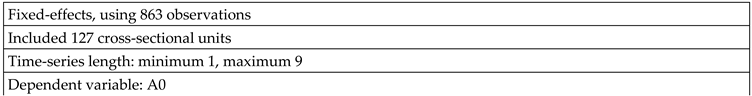

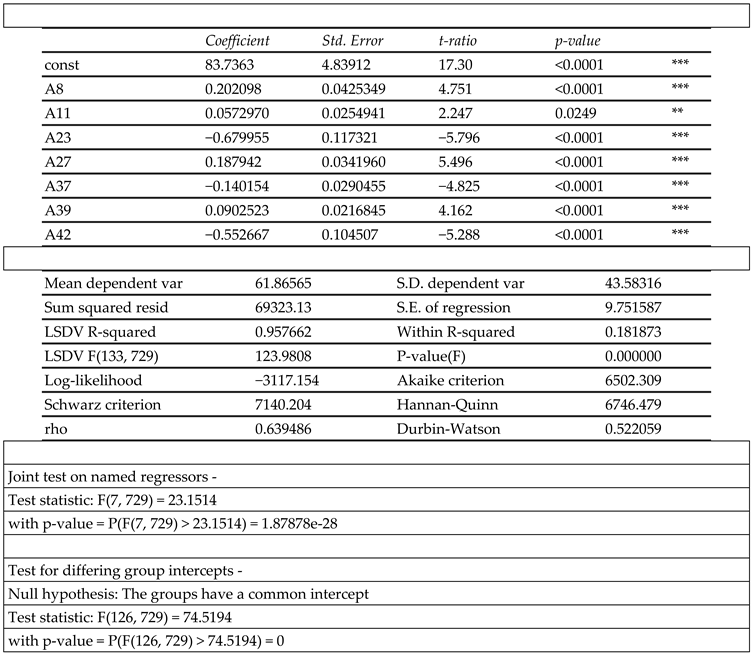

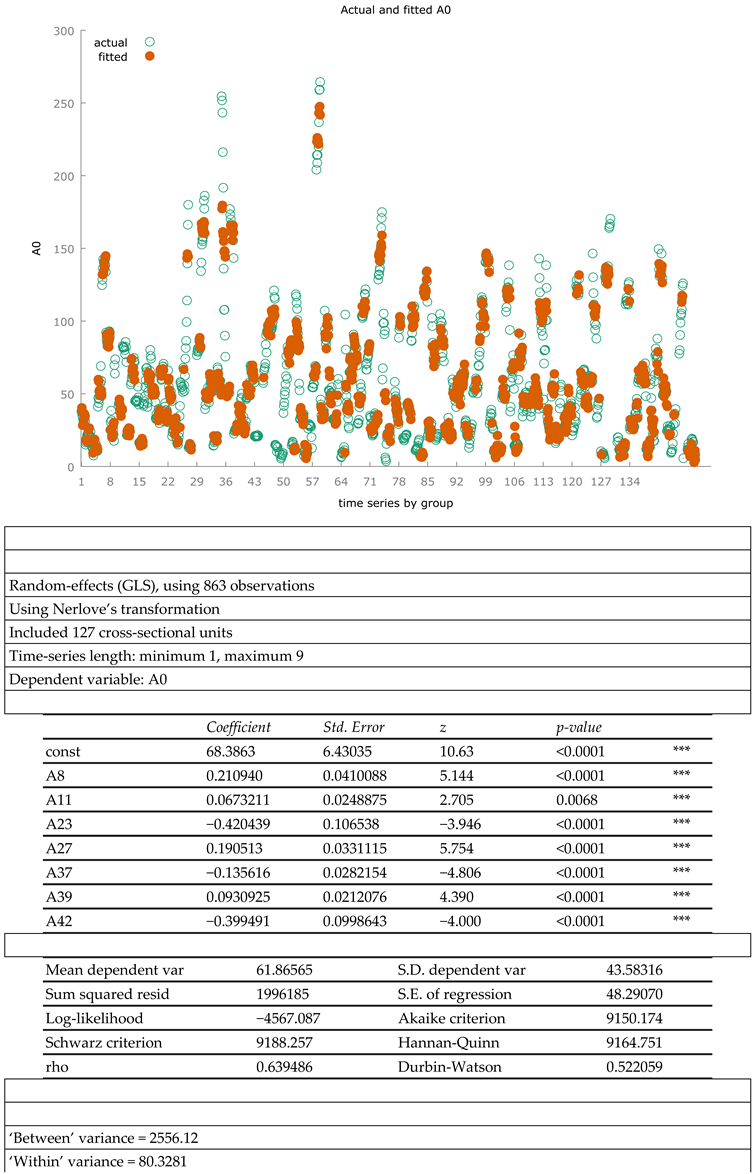

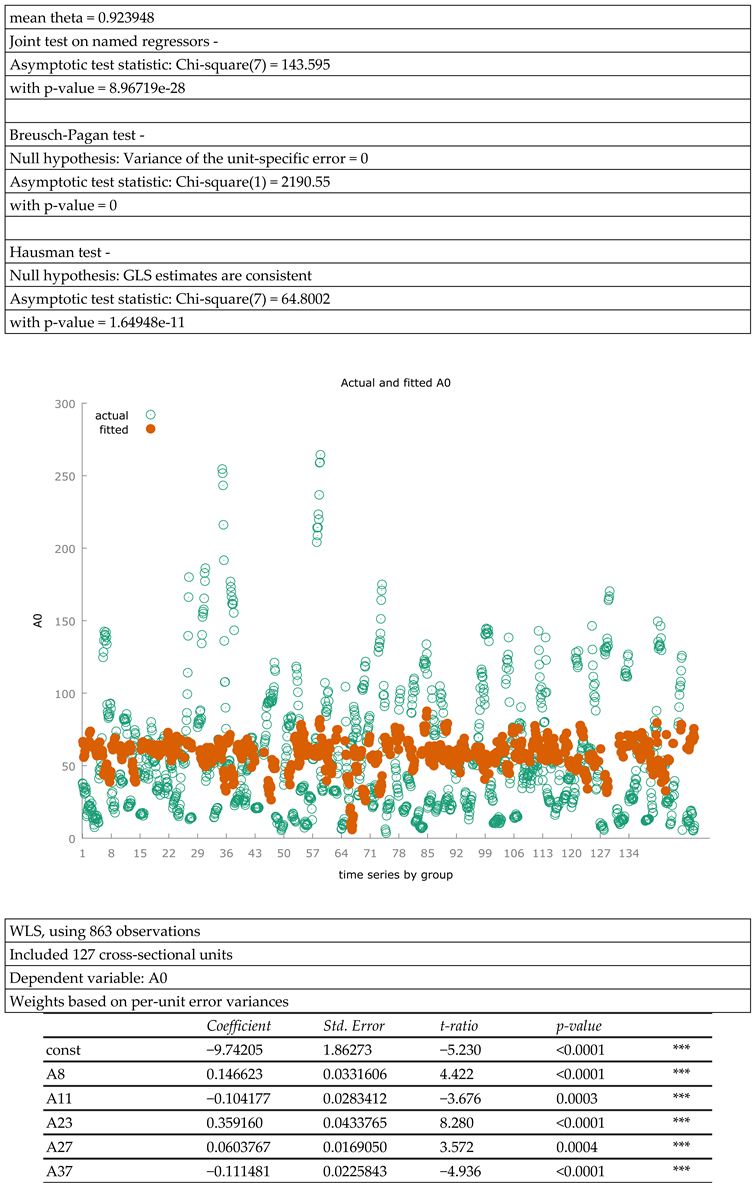

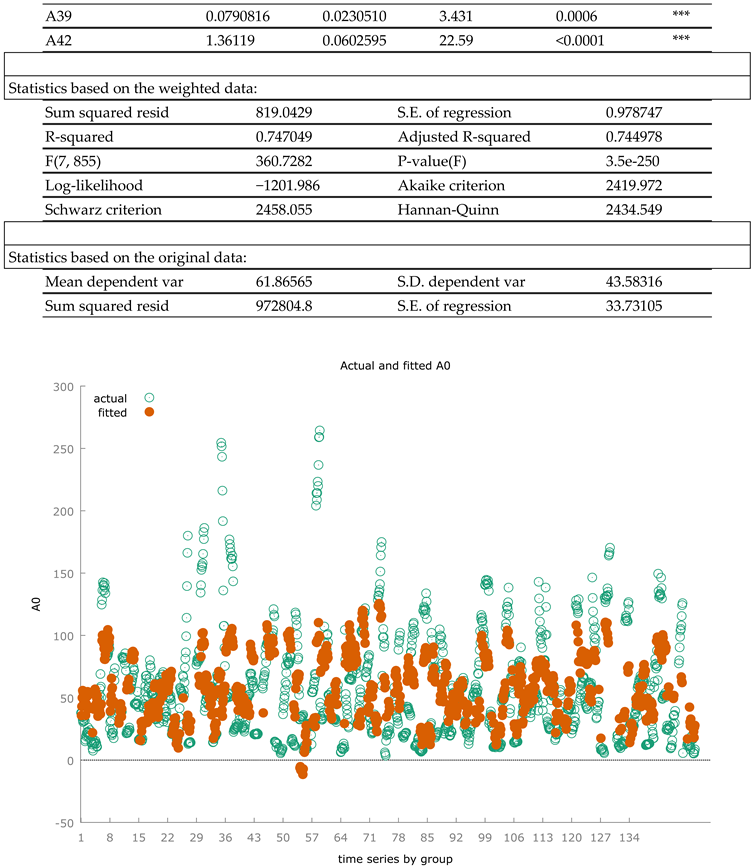

We have estimated the following data using panel data with fixed effects, panel data with random effects and WLS:

where t=[2013;2022] and i=127.

The positive relationship between Domestic credit to private sector by banks (% of GDP) and Creative goods exports, % total trade. One interesting dynamic in the interaction of financial development and creative industry growth is the relationship between the share of domestic credit to the private sector by banks and creative goods exports as a percentage of the total trade. This positive relationship suggests that inasmuch as domestic credit to the private sector rises, the capacity for a nation to foster, produce, and export creative goods also increases significantly. The connection between finance and the creative economy is theoretically unpacked through economic theory and empirical observation concerning innovation, entrepreneurship, and global competitiveness. Domestic credit to the private sector is one of the critical indicators for the inclusion of finances and the soundness of a nation’s banking system. It is the percentage at which financial institutions extend credits and loans and any other financial services to businesses and private individuals. The more banks provide credit to the private sector, the more, in effect, they are empowering business firms to invest in productivity, research, and innovation. The creative industries are an interesting crossroads where culture, technology, and commerce or business blend together, and access to capital is very important. Except for design, film production, fashion, and software development, being capital-intensive requires long-term investment in developing intellectual property, market products, and competing in international trade. This means that a greater access to domestic credit has provided an enabling environment in which creative businesses can thrive. The creative goods export, as a percentage of the total trade, shows a country’s capability concerning the creation and marketing of products with a high value and cultural or technological content, such as works of art, music, video games, digital content, and craftsmanship. Specifically, financing opportunities tend to greatly benefit those industries that typically involve high upfront costs, uncertainty in demand patterns, and a generally long gestation period before profits are realized. Increased domestic credit to the private sector, therefore, blunts these barriers by putting at the disposal of the imaginative entrepreneur the means to innovate and reach wider markets. This translation into monetary backing increased typically shows increased productivity, better marketing strategies, and the ability to meet international standards, all of which in turn enhance creative exports. At the same time, this vztah between domestic credit and creative exports could be situated within the global value chains. Many of the creative industries rely on collaboration and supply chain networks across many countries. Access to credit, for instance, enables the creation of these networks, investment in advanced production technologies, and the adoption of digital platforms for global marketing. In turn, this increases their competitiveness in the export of creative goods. This implies that countries with stronger financial systems have been better positioned to integrate into the global creative economy and thus capture higher shares of creative trade. This relationship is empirically supported. For example, highly domestic credit-intensive countries such as those from Europe and East Asia are usually the leaders in global creative exports. On the other hand, where economic access to finance is restricted in an economy, the growth of the creative sector usually lags behind, though this observation underlines the nurturing role of financial systems for fostering innovation-led industries. In short, this statement emphasizes the fact that the positive relationship between domestic credit to the private sector and creative goods exports showcases access to finance playing a vital role in driving innovation and entrepreneurship in a country’s global competitiveness within the creative economy. Strong financial systems spur investment in creative industries and help harness the cultural and technological resources of nations in effectively exporting their goods.

The positive relationship between Domestic credit to private sector by banks (% of GDP) and Cultural and creative services exports, % total trade. This positive relation may indicate an interplay between financial and cultural-economic dynamics-the share of cultural and creative services in the total trade, and domestic credit provided to the private sector by banks in percent of GDP. Entailing such a positive relation, this very industry of the production and export of cultural and creative services, which is increasingly valued for their economic and social worth, is highly dependent on access to credit. Domestic credit to the private sector is the percentage of GDP that businesses can obtain credit for investment, operations, and innovation. The higher the percentage of credit to the private sector, the more developed the financial facilities are for business enterprise, in particular for SMEs. Access to credit in cultural and creative industries such as filmmaking, music, design, software, and performing arts is a critical means for surmounting high costs of production, research and development needs, and marketing expenses of many industries that require substantial upfront investments in content or service development that can effectively compete at the international level. Therefore, a proper banking system-one that gives enough credit to the private sector-means that cultural and creative companies can get well positioned and insert themselves into the international trade circuits. The export of cultural and creative services as a share of total trade is a broader reflection of how far a country can capitalize on its culture and its IP to generate economic benefit. This metric often correlates with those countries that have devised policies to support creative industries, and also those promoting innovation, entrepreneurship, and global connectivity. The positive correlation with domestic credit indicates that where businesses in the creative sector can access finance, they are best placed to scale up their operations and enhance the quality of products to meet international demand. Filmmakers, for instance, may utilize bank loans to finance film productions that meet higher standards for international distribution, while software developers may use credit to finance projects that, in and of themselves, are destined for export. This also brings into view the interlinkages between financial access and the creation of cultural value. In countries which emphasize financial inclusion and the growth of the private sector, the effects can be felt even in more unconventional sectors, such as creative services. The creative economy is driven by innovation and adaptability, both of which are facilitated by adequate funding. This dynamic fosters not only economic benefits but a variety of cultural diplomacy, whereby the exportation of the cultural product assists in sharing heritage and creativity with the rest of the world. Another very important area highlighted by the linkage of domestic credit with creative exports is policy coherence. For example, while creating the banking system and promoting the creative sector side by side, the government will be creating an enabling environment for economic diversification and competitiveness. This will be particularly important for developing economies that aim to diversify away from primary commodities into the high-value international market for cultural services. Improved access to credit makes for the real inclusion of emerging creative entrepreneurs in the economy and international trade. Conclusion: In fact, this positive relationship indicates the role of financial infrastructure in allowing creativity to blossom and enabling participation in world trade. By investing in credit availability, countries can unlock the potential of creative sectors to strongly contribute to economic growth, as well as cultural exchange.

The negative relationship between Domestic credit to private sector by banks (% of GDP) and GERD performed by business, % GDP. In some contexts, this bears an interesting negative correlation with the GERD performed by business as a percentage of GDP versus domestic credit to the private sector by banks. This relationship points out the interaction between financial systems and innovation-driven expenditure that is so crucial for economic growth and competitiveness. Domestic credit to the private sector from banks indicates financial development and reveals the availability of loans, credit lines, and other financial instruments to private enterprises. It shows the availability of capital to businesses for funding operational activities or expanding and investing in new ventures. The GERD performed by business enterprises is, therefore, the direct indicator of the extent to which the private sector contributes to innovation and technological progress by investment in research and development activities. It would appear that a negative relationship between the two variables suggests that an increase in the availability of domestic credit is not being translated into higher investments in R&D by businesses. One explanation for this inverse relationship could be the allocation of financial resources. When credit has become abundant, firms may prefer projects that offer short-run financial payoffs over longer-run projects of innovation, which are necessarily riskier and require sustained investment. For example, borrowed money is used to enhance production capacity, marketing effort, or mergers and acquisitions at the expense of R&D, since the latter has delayed or unsure payoffs. This is more likely to occur in economies where stakeholders strongly emphasize short-term financial performance. Besides, the quality of financial institutions and assurance provided by appropriate incentives towards innovation are also not less important in voicing this relationship. The credit policies, in turn, may not favor the R&D-intensive sectors in economies with poorly developed or excessively risk-averse banking systems. Banks would preferably extend credit to industries with more predictable cash flows or tangible collateral, relative to high-tech or innovation-driven businesses. This risk aversion dims the potential of private enterprises to invest in life-changing technologies and attendant processes. The relationship possibly reflects structural problems in an economy, too. Generally speaking, economies whose contribution of GERD by business is low have too little government support for innovation-e.g., tax incentives or subsidies-for supporting R&D activities. This lack of popular support reduces the ability of private firms to undertake R&D even when financial capital is available. Similarly, cultural and institutional factors-that is, a weak regime of intellectual property-further discourage private investment in innovation, which in turn negatively reinforcements the relationship. This negative correlation could also be indicative of a wider pattern of macroeconomic behavior. For example, in economies troubled by financial fragility or high levels of indebtedness, it is likely that the private sector focuses on deleveraging rather than aggressive innovation strategies. High credit availability could indicate overheating in the same way that businesses are overleveraged and their investments restrained from long-term projects. The inverse relationship performed by business GERD as a percentage of GDP and domestic credit to the private sector in the end points out the complex interplays between the financial systems, institutional environments, and the landscape of innovation. Actions constituting policy intervention, such as the creation of an appropriate atmosphere for R&D with fiscal incentives, alignment of the financial markets with the goals of innovation, and the culture of long-term investment in transformative sectors, need to be addressed in bridging this gap.

The positive relationship between Domestic credit to private sector by banks (% of GDP) and Graduates in science and engineering, %. It represents an important juncture in the development of finance and investment in human capital, as represented by the relationship between the proportion of domestic credit to the private sector by banks in percent of GDP and the percentage of graduates in science and engineering. These two indicators signify not just the maturity of a country’s financial system and educational landscape but depict the potential for sustainable economic growth driven by innovation and technological advancement. Domestic credit to the private sector by banks, as a percent of GDP, is a key indicator of a country’s financial development and its ability to supply resources in the most effective ways to entrepreneurs. The higher such credit shares indicate the soundness of the financial infrastructure that would spur entrepreneurship, business growth, and investment in innovative projects. In fact, when businesses have adequate available credit, they are more likely to invest in research and development, adopt new technologies, and enhance their operational efficiencies-all things that are essential for skill-intensive sectors. By contrast, the percentage of graduates in science and engineering would show educational focus in fields that are crucial for technological innovation and industrial progress. This would form the backbone for such industries as information technology, manufacturing, biotechnology, and energy, which are indispensable to the modern economy. A high proportion of graduates in these disciplines would therefore show that the workforces were well-equipped to meet the demands knowledge-intensive industries place on them. This positive relationship may indicate that any increase in domestic credit to the private sector will surely impact and bring further emphasis on science and engineering education. This could be partly explained along with a few reasons of its own: First, easy availability of credit encourages different investments in various higher education infrastructure, including universities, research facilities, and training centers, which then produce skilled graduates in science and engineering disciplines. It is also common for financial institutions to offer loans and grants to support education projects-a self-reinforcing relationship where increased education can be positively correlated with financial development. Second, those firms that benefit from improved availability of credit are more likely to partner with educational institutions in creating a supply of talent that better meets their needs. Many such partnerships therefore establish grants for scholarships, internships, and research jobs, which attract students to enroll in science and engineering programs. As industries expand and diversify because of greater allocative efficiency, demand from employers for students in the technical fields increases and further encourages student enrollment in these degree fields. Besides, interaction between these two will give birth to innovation ecosystems. Often, the places that have well-developed financial systems combined with consistent production of science and engineering graduates become the technological hubs that received numerous investments in startups, research parks, and incubators. This creates a virtuous circle wherein the financial feed education, and in turn, education provides the human resource the economy needs to grow technologically. The positive correlation between domestic credit to the private sector and the percentage of science and engineering graduates underlines how financial development is interwoven with human capital formation. This correlation plays a very basic role in shaping the economic resilience and competitive ability of a nation in an exacting global environment, whereby access to education and innovation is created.

The negative relationship between Domestic credit to private sector by banks (% of GDP) and ICT services exports, % total trade. Indeed, it is rather fascinating to note the negative response between domestic credit to the private sector by banks as a percentage of GDP and ICT services exports as a percentage of total trade. This shows that with an increase in the credit allocation in the private sector by the financial sector, the share of the ICT service tends to shrink in the total portfolio of the trade. Many factors could thus lie at the root of this trend, reflecting the interaction of structural economic factors, sectoral considerations, and priorities in investment. One probable reason may emanate from how money is apportioned within economies. For one, the increased domestic credit to the private sector often feeds into the capital-intensive industries-like manufacturing, construction, and traditional services-maybe eclipsing those on ICT. These could be promising or attractive such that they siphon much of the funding into themselves, hence leaving little credit availability or investor attention for ventures oriented to ICT. Therefore, while credit expansion increases aggregate economic activities in an economy, it probably detracts from the relative competitiveness of ICT-exports in a country’s trade profile. Besides, countries that have high domestic credit to GDP usually have a relatively developed banking system and diversified economies. The latter is often less dependent on the ICT exports main driver of trade, using instead manufacturing or resource-based exports. ICT services could also make up a smaller share of trade simply because other sectors would dominate the volumes of export. In the case of economies with strong industrial bases, this is more obvious: the manufacturing and export of heavy goods become far more dominant over services, let alone ICT. The economies with a low level of domestic credit accessibility may have less capital intensive industry and depend on the ICT service as one of the major contributors to the trade. Many developing economies followed this trend, because resource constraints operating through traditional sectors compel them to evoke human capital and low-cost technological innovation for ICT services exports. For such countries, ICT services are often an easy and scalable entry point into global trade networks, thereby bypassing traditional resource-intensive pathways to global integration. Besides, the negative relationship may also reflect the role of government policy and institutional frameworks. Economies pursuing the development of ICT often channel investments through selective programs, tax incentives, and public-private partnerships, rather than through traditional bank credit. Such selective means of developing ICT sectors may reduce the direct dependence of ICT firms on national bank credit. While countries with high levels of domestic credit penetration may simultaneously show slower policy adaptation to support the growth in ICT, especially if the financial ecosystem focuses on traditional sectors or considers ICT ventures riskier. Finally, structural maturity of the ICT industries may also be at play. In countries where ICT was already a well-established sector of the economy, the share of ICT services in trade would tend to decline as other emerging sectors grow independently of domestic credit dynamics. On the other hand, in countries where the ICT sector was still expanding, it may account for a higher share in trade in reflecting its role as an engine of growth. These factors, in short, refer to the reasons situation wherein domestic credit to the private sector and ICT services exports are negatively correlated, namely, structural economic variables, sectoral competitiveness, and investment patterns. Whereas domestic credit feeds economic growth, the allocation of such credit is often biased toward traditional sectors, thereby reducing the ICT exports’ relative prominence in trade portfolios. This would hint at some complex trade-offs that economies need to consider while chasing financial sector expansion along with the development of the ICT sector.

The positive relationship between Domestic credit to private sector by banks (% of GDP) and ICT use. The correlation between domestic credit to the private sector by banks and ICT use is multi-faceted and an increasingly important relation in modern-day economies. While it is expected that a positive relationship is found between them, this, in fact suggests that increased access to financial capital for private businesses is coupled with more adoption and use of Information and Communication Technologies. This relationship can be analyzed along several interlinked mechanisms that highlight just how finance and technology reinforce economic and social development together. First, domestic credit to the private sector is the amount of financial capital available to businesses and households to form investment in main assets and operational tools. Now, ICT use-that is, access to digital infrastructure, mobile technology, and internet connectivity, and access to related services-frequently involves considerable upfront investments and continuing costs. The bank’s provision of credit to the private sector would, therefore, enable enterprises-SMEs in particular-to invest in acquiring advanced technologies, upgrading digital systems, and integrating these into operational frameworks. Enhanced productivity, coupled with better customer engagement, thus leads to improved efficiency that contributes to a self-reinforcing circle of growth and innovation. Besides, the very use of ICT can spur the development of financial systems and hence provide a two-way causality between the two. With heightened ICT adoption, access to digital banking platforms, online payment systems, and mobile wallets will be easier for both businesses and people, thus creating less friction in credit access. For instance, emerging economy mobile banking technologies have enabled hitherto underserved sections of the population to become clients of formal financial systems. This therefore adds to the increase in financial inclusion and also increases the private sector’s ability to use more domestic credit, creating sort of a feedback, whereby at higher levels of use of ICT, there is encouragement towards more credit provision and vice versa. The positive relationship also captures the spillover gains of ICT-enabled development in the general economy. Businesses that integrate ICT into their processes often have better market reach, enhanced data analytics capabilities, and smoother supply chain operations. Accordingly, these improvements not only drive profitability but also the chances of favorable terms from financial institutions given that banks view such firms as less risky borrowers. As a result, banks are more willing to grant credit. In addition, ICT use supports financial institutions in better credit assessment and management processes. Due to big data analytics performed by ICT, banks can assess credit risks more precisely and hence are providing specialized financial products to the needs of individual businesses. This ensures better efficiency in credit allocation because financial resources are channeled to enterprises which can best utilize it to their advantage for growth. Such synergies reinforce the positive association between credit availability and ICT adoption. In particular, the latter relationship is very pronounced for the economies in digital transformation. Many governments and policy makers tend to emphasize the development of ICT infrastructure by realizing its role in entrepreneurship and innovation. In such an environment, access to domestic credit provides private agents with the opportunity to gain from governmental efforts by using ICT as a competitive edge. This aspect constitutes just those reasons that make coordinated efforts to expand financial and technological access so strategically important. This positive association between domestic credit to the private sector by banks (% of GDP) and ICT use underlines the interaction between finance availability and technological development. Essentially, credit availability either initiates or boosts business enterprise’s capacity to adopt ICT, and in turn, ICT use initiates increases in financial inclusion and efficiency, thus creating a virtuous circle. This is one of the hallmarks of present policies and strategies of development and exemplifies how finance and technology combined enable sustainable development.

The positive relationship between Domestic credit to private sector by banks (% of GDP) and Infrastructure Index. Basically, there is a positive and reinforcing relationship between the infrastructure index and domestic credit provided by banks to the private sector as a percentage of Gross Domestic Product. Bank credit to the private sector is one of the most important channels through which financing is transmitted to various economic activities, including those of infrastructure. The infrastructure index is an important ingredient comprising the quality and availability of basic structures in transportation, energy, water, and telecommunications that facilitates economic growth and increased performance by the private sector. Together, these become interlocking elements within a self-reinforcing development cycle leading to economic stability. When banks contribute more credits to the private sector, firms and entrepreneurs have more access to funds. The funds are usually invested in infrastructure-related projects that include the development of roads, bridges, ports, power plants, and telecommunications networks. Investment in large projects on infrastructure developed by private construction firms and public-private partnerships, for example, find their funding from bank loans. Such investment bolsters the infrastructure index because it improves the availability and quality of physical capital underlying the economic activity. Improved infrastructure indeed cuts down transaction costs and improves productivity, thus providing an enabling environment where business expansion can more aggressively demand further credit. In other words, the higher the ranking of the infrastructure index, the better the creditworthiness of the private sector is assessed. Well-developed infrastructure presupposes lower business risks because of reliable supplies of energy, efficient transportation networks, and modern structures of communication. Such conditions, therefore, while offering predictability, are attractive to banks in terms of perfection in reduction of costs for business operations. Since they view firms in better infrastructural regions as being less risky with higher potential returns on investment, they would be more willing to give credit access to such firms. Of course, this is self-reinforcing-a better infrastructure expands access to credit, which in turn promotes further infrastructure development. The interaction between domestic credit to the private sector and the infrastructure index is so crucial in shaping the macroeconomic outcomes. Moreover, adequate infrastructure not only connects rural and urban areas but also integrates markets and improves access to education and health-all elements that act to trigger inclusive growth. The infrastructure development, in turn, further triggers entrepreneurship and credit demand, translating into economic diversification and resilience. Reciprocally, it will enable the banks to lend such funds to productive sectors, which would then be better allocated for long-term infrastructure planning and innovation. Therefore, infrastructure development will not only be sustainable but also flexible enough to respond to changing economic needs. It is in this positive relationship that government policies and regulatory frameworks play a vital role in strengthening. Supportive financial regulations, such as incentives for infrastructure financing and risk-sharing mechanisms, encourage banks to increase their lending to infrastructure-related sectors. The public investment in infrastructure may act as a catalyst to attract the contribution of the private sector and, thereby, bank credit. Due to the interaction of both public and private stakeholders, increased domestic credit to the private sector will finally be transformed into actual improved quality and availability of infrastructure. In sum, domestic credit to the private sector by banks and an infrastructure index are positively correlated, complementing each other toward economic growth. The more credit available, the more business can invest in crucial infrastructure projects; the better the infrastructure will be for economic efficiency; and the stronger the credit environment. These factors together create a synergistic relationship that underpins sustainable development.

5). Policy Implications

The interrelationship of banking credit and technological innovation therefore underlines some important policy directions that would ensure growth with inclusiveness and sustainability. This demands that policymakers, financial institutions, and other relevant stakeholders take targeted measures to maximize the interaction between credit access and innovation. Most fundamentally, this involves the use of adaptive financial policies that align credit allocation with long-term goals related to innovation. This is where policymakers come in-to foster the availability of credit to those industries that have the highest demand for technological development, such as green technologies, creative industries, and all other related to science, technology, engineering, and mathematics. Examples include tax incentives, subsidies, and specialized financial instruments that can be used to channel private sector credit into R&D and infrastructure projects. The bottom line is to limit risks while assuring that scarce financial resources are used efficiently in those transformative industries. Another important strategic policy direction is the one dealing with strengthening the regulatory framework in a manner that balances financial stability with the facilitation of innovation. Alternatively, while the competitive environment tends to overall reduce some barriers to access, excessive competition may lead to a deterioration in the quality of credit given and unsustainable levels of innovation. Regulators have to ensure the right balance by encouraging competitive markets, though with all the adequate measures in place to ensure that they do not become destabilizing. Part of this approach means monitoring credit flows to ensure that high-risk sectors receive adequate funding without financial stability being threatened. Ecosystem-based approaches give the necessary fillip to innovations in banking systems. There is a need to incentivize financial institutions through the adoption of strategies that place them in a vantage position to be an enabling force for technological progress and not just pure credit providers. All this could further be encouraged by stimulating banks to collaborate with innovative hubs, technology incubators, and research institutions in order to enhance their role in identifying and financing high-potential projects. This provides an enabling culture of innovation within the financial system to drive competitiveness at the industrial level along with technological growth. These findings also highlight the need for regional and sectoral focus in credit allocation. Policies designed considering the local economic context can maximize the impact of banking credit on innovation. In this respect, credit allocation with a targeted approach in the Beijing-Tianjin-Hebei region has fostered industrial upgrading and economic transformation with great effect. Policymakers need to pursue such region-specific strategies in guiding financial resources through the developmental goals of less privileged or new markets. Green credit policies become critically relevant given the graving relevance of sustainable development. Every encouragement through appropriate incentives should be given to banks to provide funds for viable technologies and projects that are environmentally friendly. For this, strong mechanisms for risk-return appraisals of green investments have to be in place to ensure that financial flows are efficiently linked to sustainable innovation. The resultant effect of such policies will not only contribute to solving global ecological challenges but also put emerging economies in a competitively advantageous position in green technology markets. Furthermore, the need for accelerating digital transformation of banking systems serves the dual purpose of innovation and financial inclusion. Digital platforms and FinTech afford greater efficiencies in credit allocation, especially for SMEs. Policymakers should create an enabling environment for digital banking by addressing challenges in cybersecurity, digital literacy, and clarity of regulations. Finally, the need to fully dispel the negative correlation of domestic credit and R&D investment in some contexts indicates the relevance of cultural and institutional reforms. For this, policies should be able to encourage long-term investment in firms and financial institutions. Ensuring intellectual property protection, providing tax credits for R&D, and innovation ecosystem strengthenings are all Basic structural barriers that must be overcome to ensure that credit-for-innovation-driven growth is promoted. Implementing these policy measures would be able to empower various countries to tap into this synergy between banking credit and innovation, directed toward inclusive and sustainable economies that are technologically advanced.

6). Conclusions

The article has discussed the cause-and-effect relationship among banking credit, technological innovation, and economic development, and how they influence global competitiveness. Banking credits through domestic credit to the private sector have contributed much in the advancement of technologies in various sectors such as infrastructure, creative industries, and green technology. Additionally, financial systems enhance this good relationship by efficiently allocating resources relevant to innovation-driven growth in each industry and regional peculiarity. One of the more important findings in this study is that domestic credit is positively associated with several indicators of innovation, such as infrastructure development and creative goods exports. Credit availability supports a firm in overcoming financial constraints and in investing in projects that involve high risks but bring high rewards, one of the important drivers of economic diversification and resilience. That is, for instance, heavy development projects in infrastructure-intensive industries, which in turn raise productivity in a self-reinforcing cycle of creditworthiness and further development. Where financial resources are available to them, creative industry entrepreneurs will go ahead and innovate, bringing with them capacity to compete on a world platform-a potent possibility for change presented by financial systems. On the other hand, the study found negative correlations in specific contexts: between domestic credit and R&D expenditure, for example, or ICT service exports. These suggest that financial resources are not necessarily optimally channeled to underpin goals on long-term innovation. In addition, many of the short-term financial priorities and structural inefficiencies of financial institutions themselves may be diverting credit away from innovation-intensive sectors. This then leads to the need for selective policy interventions aimed at aligning the financial system with national strategies of innovation so that any credit allocation would give priority to the transformative industries and long-term economic objectives. Green credit and ecosystem-based banking strategies were identified and underlined to play a very important role in the pursuance of sustainable development. Green credit policies channel financial resources to viable environmentally friendly technologies and projects, reducing key global ecological challenges while competitively positioning the economies in emergent green technology markets. Ecosystem approaches go one step further in enhancing the capacity of financial systems to enable innovation through the various forms of collaboration between banks, research institutions, and technology hubs. It also configures the regional dynamics of the credit-innovation relationship. Context-specific strategies in an area such as Beijing-Tianjin-Hebei explained how the targeted allocation of credit could act as financial policy tools in leading regional economic transformation. The approach emphasized coherence between the credit system and the goals of local development, especially in lagging or developing markets. Banking credit and technological innovation are switched on with each other in a very complex way: there are opportunities, on one hand, and challenges on the other one. Realization of this relationship will come when policymakers and financial institutions adopt adaptive strategies in the pursuit of efficiency in the realization of financial stability with the promotion of innovation. These include the establishment of competitive banking environments, green and digital transformations, and overcoming structural impediments to innovation. By positioning the financial system to serve innovation ecosystems and larger development goals, countries can fully mobilize banking credit toward inclusive, green, and technology-advanced economic development pathways.

References

- Qi, S.; Ongena, S. Fuel the Engine: Bank Credit and Firm Innovation. J. Financial Serv. Res. 2019, 57, 115–147. [Google Scholar] [CrossRef]

- Matkovskaya, Y.S.; Vechkinzova, E.; Biryukov, V. Banking Ecosystems: Identification Latent Innovation Opportunities Increasing Their Long-Term Competitiveness Based on a Model the Technological Increment. J. Open Innov. Technol. Mark. Complex. 2022, 8, 143. [Google Scholar] [CrossRef]

- Liu, X.; Zhao, Q. Banking competition, credit financing and the efficiency of corporate technology innovation. Int. Rev. Financial Anal. 2024, 94. [Google Scholar] [CrossRef]

- Yuan, Q.; Zhou, H. An Analysis on Bank Credit and Industrial Structure Upgrading of Beijing-Tianjin-Hebei Region-Based on Technological Innovation Mode. 2020; 17. [Google Scholar] [CrossRef]

- Salim, A.; Suripto; Yuniarti, D. ; Abasimi, I.; Zakiyyah, N.A.A.; A'Yun, I.Q. Research elevation of bank lending and technological innovation in the excess liquidity countries. Heliyon 2024, 10, e33462. [Google Scholar] [CrossRef] [PubMed]

- Lin, C. , Liu, S., & Wei, L. (2023). Banking and innovation: a review. Journal of Chinese Economic and Business Studies, 21(1), 143-176.

- Li, J. , Ye, S. , Peng, Y., & Cheng, February). Technology Credit, Technology Innovation and Industrial Structure Upgrading. In Proceedings of the 4th International Conference on Economic Management and Model Engineering, ICEMME 2022, November 18-20, 2022, Nanjing, China., M. (2023. [Google Scholar]

- Lin, T.; Wu, W.; Du, M.; Ren, S.; Huang, Y.; Cifuentes-Faura, J. Does green credit really increase green technology innovation? Sci. Prog. 2023, 106. [Google Scholar] [CrossRef] [PubMed]

- Li, Y. (2024). Essays in financial technology: banking efficiency and application of machine learning models in Supply Chain Finance and credit risk assessment (Doctoral dissertation, University of Glasgow).

- Popova, L. V. , Daeva, T. V., Dugina, T. A., Melikhov, V. A., & Chekrygina, T. A. (2020). Digital innovation in traditional services of credit cooperative. In Frontier Information Technology and Systems Research in Cooperative Economics (pp. 477-485). Cham: Springer International Publishing.

- Liu, T.; Wang, J.; Rathnayake, D.N.; Louembé, P.A. The Impact of Commercial Credit on Firm Innovation: Evidence from Chinese A-Share Listed Companies. Sustainability 2022, 14, 1481. [Google Scholar] [CrossRef]

- Mwai, A. M. (2021). Financial Innovations and Financial Deepening of Commercial Banks in Kenya (Doctoral dissertation, JKUAT-COHRED).

- Campanella, F. , Serino, L., Battisti, E., Christofi, M., & Giakoumelou, A. (2020, November). Financial technology: evidence in the European banking system. In 2020 IEEE International Conference on Technology Management, Operations and Decisions (ICTMOD) (pp. 1-6). IEEE.

- De Nicola, F.; Melecky, M.; Iootty, M. Bank Ownership and Firm Innovation; World Bank: Washington, DC, United States, 2023. [Google Scholar]

- Biyase, M.; Zwane, T.; Mncayi, P.; Maleka, M. Do Technological Innovation and Financial Development Affect Inequality? Evidence from BRICS Countries. Int. J. Financial Stud. 2023, 11, 43. [Google Scholar] [CrossRef]

- Yasar, S. (2020). Bank Liquidity Creation and Technological Innovation. Available at SSRN 375 4386.

- Odhiambo, O.E.; Mang’ana, R. Strategic Adoption of Technological Innovations on Competitive Advantage of Commercial Banks in Kenya. J. Bus. Strat. Manag. 2022, 7, 16–36. [Google Scholar] [CrossRef]

- Hakizimana, S. , Wairimu, M. M. C., & Stephen, M. (2023). Digital Banking Transformation and Performance-Where Do We Stand?. International Journal of Management Research and Emerging Sciences, 13(1).

- Zheng, M.; Feng, G.-F.; Wang, Q.-J.; Chang, C.-P. Financial globalization and technological innovation: International evidence. Econ. Syst. 2022, 47. [Google Scholar] [CrossRef]

- Gupta, C.; Jindal, P.; Malhotra, R.K. A study of increasing adoption trends of digital technologies-An evidence from Indian banking. INTERNATIONAL SCIENTIFIC AND PRACTICAL CONFERENCE “TECHNOLOGY IN AGRICULTURE, ENERGY AND ECOLOGY” (TAEE2022). LOCATION OF CONFERENCE, TajikistanDATE OF CONFERENCE; p. 050004.

- Juhro, S. M. (2022). Central banking practices in the digital era: Salient challenges, lessons, and implications. Central Bank Policy Mix: Issues, Challenges, and Policy Responses, 261.

- Sunel, E. (2020). OECD Economics Department Working Papers: Boosting access to credit and ensuring financial inclusion for all in Costa Rica.

- Kowalewski, O.; Pisany, P. Banks' consumer lending reaction to fintech and bigtech credit emergence in the context of soft versus hard credit information processing. Int. Rev. Financial Anal. 2022, 81. [Google Scholar] [CrossRef]

- Nguyen, H.M.; Ho, T.K.T.; Ngo, T.T. The impact of service innovation on customer satisfaction and customer loyalty: a case in Vietnamese retail banks. Futur. Bus. J. 2024, 10, 1–15. [Google Scholar] [CrossRef]

- Marfo-Yiadom, E. (2022). Essays on innovations, national culture, and banking system stability (Doctoral dissertation, University of the Witwatersrand, Johannesburg).

- Degryse, H. , Roukny, T., & Tielens, J. (2022). Asset overhang and technological change. Centre for Economic Policy Research.

- Sihite, M. (2024, October). The Role of Banking Digitalization in Enhancing Competitiveness: A Conceptual Review. In Proceeding of International Conference on Business, Economics, No. 1, Finance and Technology (Vol. 1; pp. 197–206.

- Dezem, V.; Sachan, S.; Macedo, M.; Longaray, A.A. Optimal data-driven strategy for in-house and outsourced technological innovations by open banking APIs. Futur. Bus. J. 2024, 10, 1–30. [Google Scholar] [CrossRef]

- Becerril-Velasco, C. I. (2022). The role of taxation and banking systems in the adoption of ICTs: a theoretical approach. Inter disciplina, 10(26), 291-314.

- Xu, K.; Liu, J.; Teng, Z.-L.; Wang, W. Risk culture of banks and corporate innovation: Evidence from Chinese listed companies. Int. Rev. Econ. Finance 2024, 94. [Google Scholar] [CrossRef]

Table 1.

Variables.

| Variable |

Acronym |

Definition |

| Domestic credit to private sector by banks (% of GDP) |

DCPS |

Domestic credit to the private sector by banks (% of GDP) refers to the financial resources banks provide to the private sector, measured as a percentage of a nation’s GDP. This credit includes loans, purchases of non-equity securities, and trade credit offered to private entities, excluding those extended to the public sector or facilitated by other financial institutions. This measure serves as an indicator of the depth and efficiency of a country’s financial system, reflecting how effectively the banking sector supports private sector activities, entrepreneurship, and economic growth. Higher percentages generally suggest greater financial access, enabling businesses and individuals to secure funding for investments, expansion, or consumption. However, very high levels may indicate the risks associated with over-leveraging. As a vital element in economic development, this variable is widely used to analyze financial inclusion, economic stability, and the capacity of banks to promote productive private sector activities within an economy. |

| Creative goods exports, % total trade |

CGE |

Creative goods exports as a percentage of total trade represent the share of a country’s exports coming from creative industries like arts, design, media, fashion, and cultural sectors. This measure highlights how important creativity-driven industries are in shaping a nation’s trade profile, showing its ability to generate value through innovation, cultural expression, and intellectual property. A higher percentage indicates a stronger focus on creative industries, reflecting diversification and competitiveness in global markets. This metric is often used to assess a country’s cultural economy and its connection to the global creative economy. |

| Cultural and creative services exports, % total trade |

CCS |

Cultural and creative services exports, % of total trade The share of cultural and creative services in a country’s total exports. They include audiovisual productions, design, advertising, architecture, publishing, and software services among others that carry cultural expressions and creative content. This is an indicator underline the role of creative economy in international trade and reflects the ability of the country to carry out production and exportation of value-added, culturally attached goods and services. The higher the percentage, the more integrated into world markets would be a strong creative sector, contributing to its economic diversification by showcasing its cultural invention to the entire world. |

| GERD performed by business, % GDP |

GERD |

GERD performed by business, % of GDP refers to the percentage a country allocates from its Gross Domestic Product towards Gross Domestic Expenditure on Research and Development performed by the business enterprise sector. This variable captures the degree of investment by private enterprises in the development of innovation and R&D activities involving the invention of new technologies, processes, and products. It is an important indicator of the technological advance and competitiveness of countries; higher values indicate enterprises’ strong commitment to innovation-driven growth. This measure also reflects the contribution of the private sector towards encouraging economic productivity, knowledge creation, and long-term sustainable development. |

| Graduates in science and engineering, % |

STEM |

Graduates in science and engineering, % The variable refers to the percentage of university students in a given year who graduated in the fields of science, technology, engineering, and mathematics out of all fields. This indicator reflects the emphasis given a country to technical education, its capacity to provide a relevant supply of skilled labor in areas crucial for innovation and technological progress, and economic growth. A higher percentage would mean a greater emphasis on training professionals for industries like manufacturing, research, and information technology that are believed to be vital in the current competitive, global knowledge-based economy and, therefore, for sustainable development. |

| ICT services exports, % total trade |

ICTEXPORT |

The value of ICT services exports means the portion of the total trade that comes from exports of information and communication technology services. These would include telecommunications, computer software, data processing, and other digital services provided to foreign markets. It reflects the extent to which ICT activities contribute to a nation’s trade dynamics and hence to economic growth. A higher percentage would reveal that ICT is a greater part of the country’s export profile, emphasizing its technological capacity and competitiveness within the global digital market. This indicator is often used when referring to areas such as innovation, digital infrastructure, and integration into international markets. |

| ICT use |

ICTUSE |

ICT use basically refers to the adoption and usage of ICT devices, such as computers, mobile gadgets, the Internet, and software applications, by households, business enterprises, and governments. The uses would categorically run from access to digital information, communication online, e-commerce, e-learning, and to digital services. In this respect, the use of ICT enhances efficiency, knowledge access, and innovation in various sectors. The high level of use of ICT shows technological advancement, economic modernization, and increased connectivity. It also measures the rate of digital inclusion, technological literacy, and readiness in society to engage in the digital economy. |

| Infrastructure index |

INFINDEX |

Infrastructure Index refers to the quality, availability, and recent development of essential infrastructure systems such as transport, energy, telecommunications, and water supply. It exhibits how well such systems support economic activities, societal needs, and overall development. A high infrastructure index relates to reliable, well-developed infrastructure that supports trade, connectivity, and productivity while reducing operational costs and inefficiencies. On the other hand, a low index indicates poor or insufficient infrastructure that is normally associated with slower economic rates of growth and a general lack of access to basic services. Because it is widely applied in economic and development studies, the index can be used as an excellent indicator of a country’s capacity in sustaining and promoting long-run economic progress. |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).