Submitted:

26 June 2024

Posted:

26 June 2024

You are already at the latest version

Abstract

Keywords:

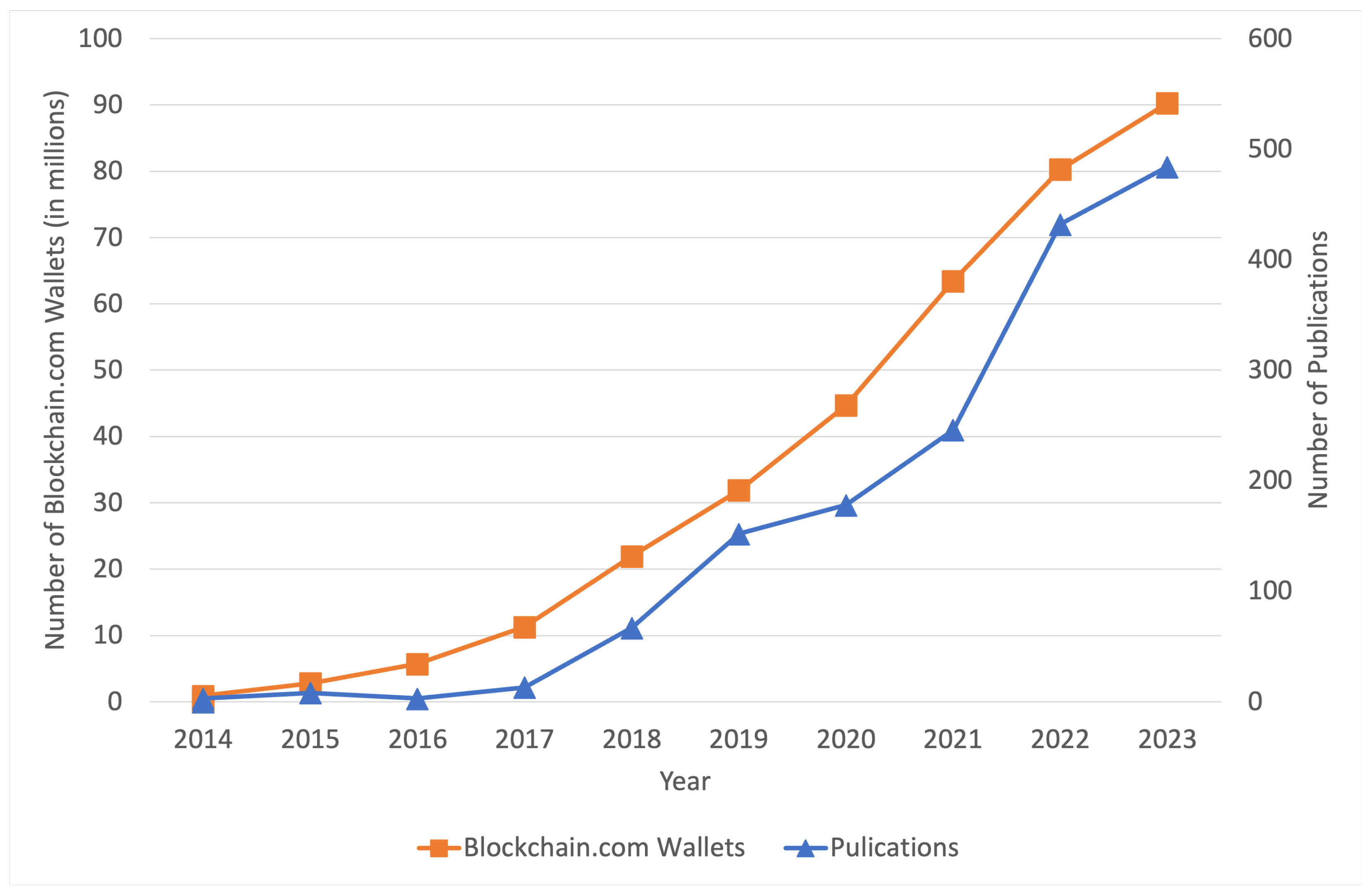

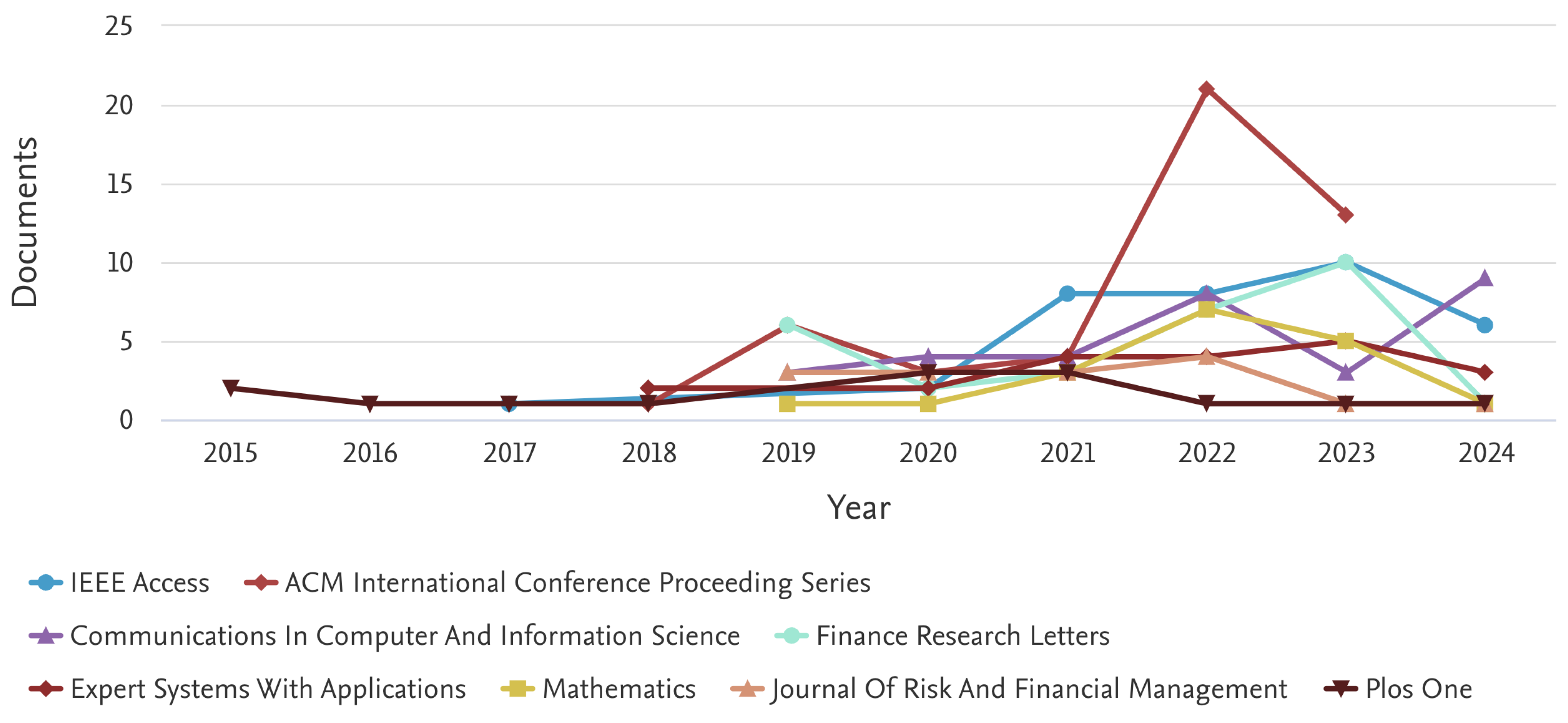

1. Introduction

1.1. Scope and Objectives

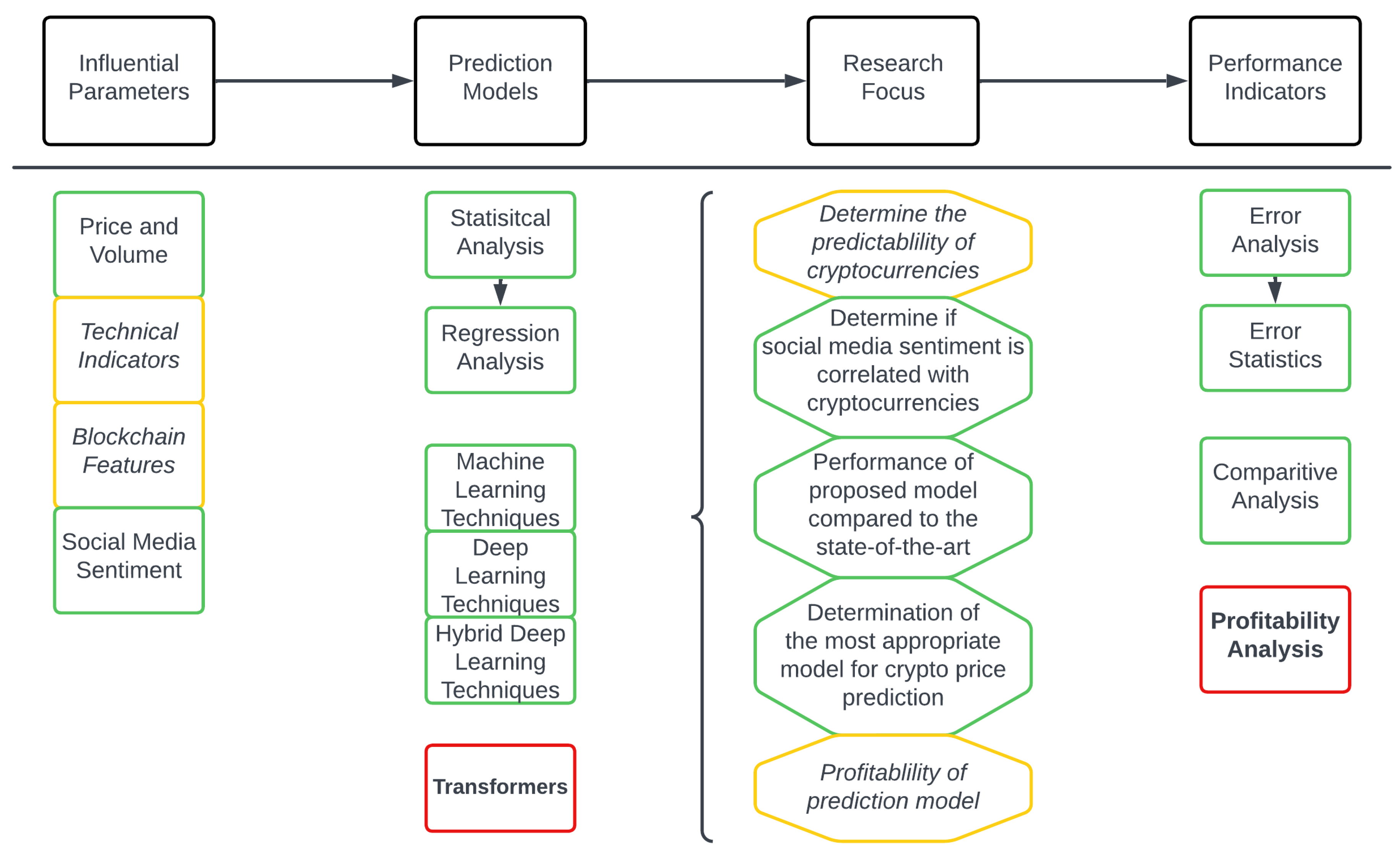

- Comprehensive Parameter Analysis: Beyond simply identifying common parameters key influential parameters that have been considered for algorithmic methods used in cryptocurrency price prediction, this review includes an exploration of less-studied parameters, offering insights into their underutilised potential.

- Methodological Innovation: By examining state-of-the-art methodologies, this review highlights the evolution of predictive models from basic statistical approaches to sophisticated machine learning and deep learning techniques. It critically assesses the applicability of these models in real-world market scenarios, and a novel evaluation on how they utilise the various data sources available; and

- Future Research Directions: Based on the identified shortcomings, research challenges and gaps in the literature, this review proposes research avenues to help guide future research directions.

2. Methodology

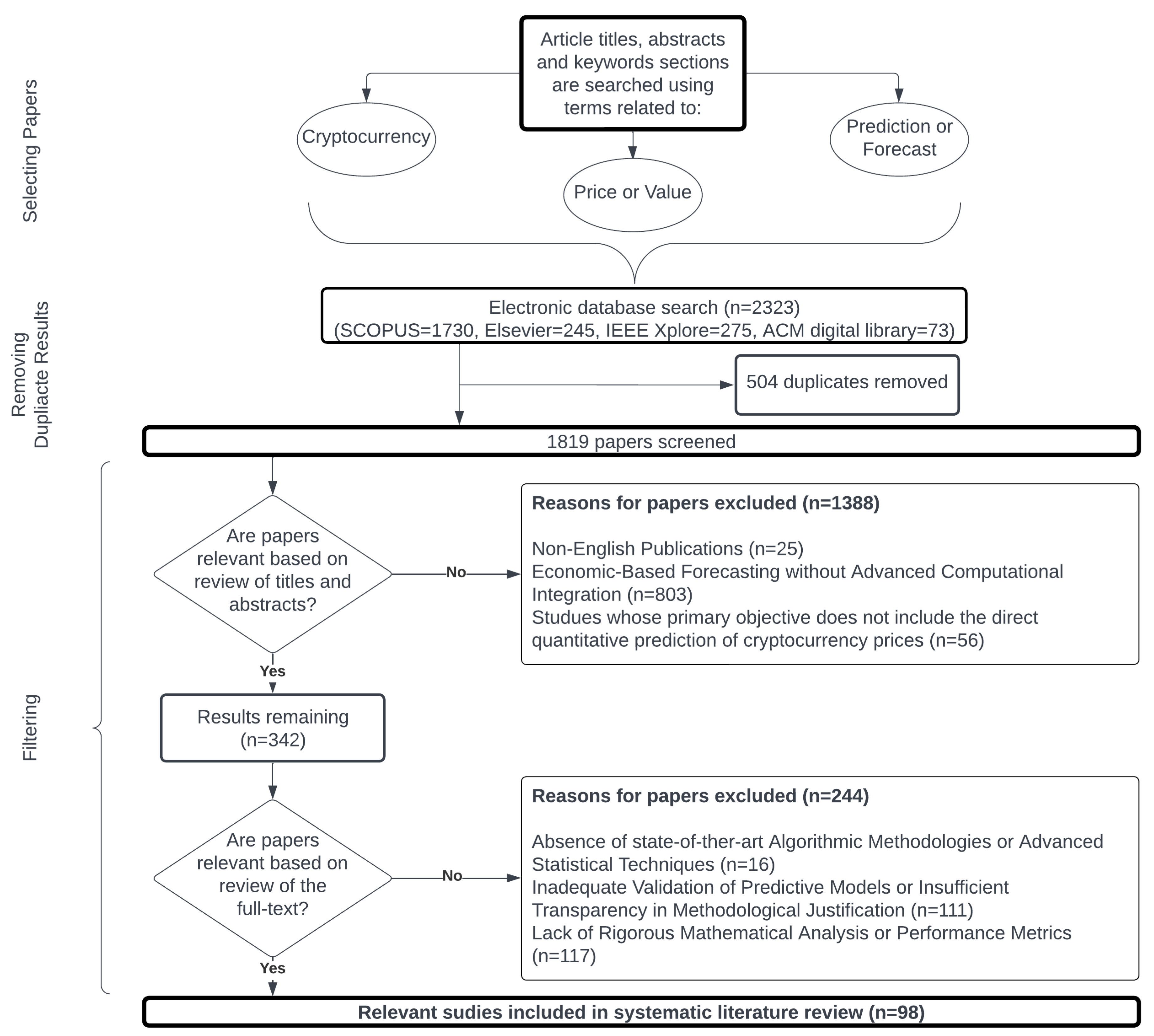

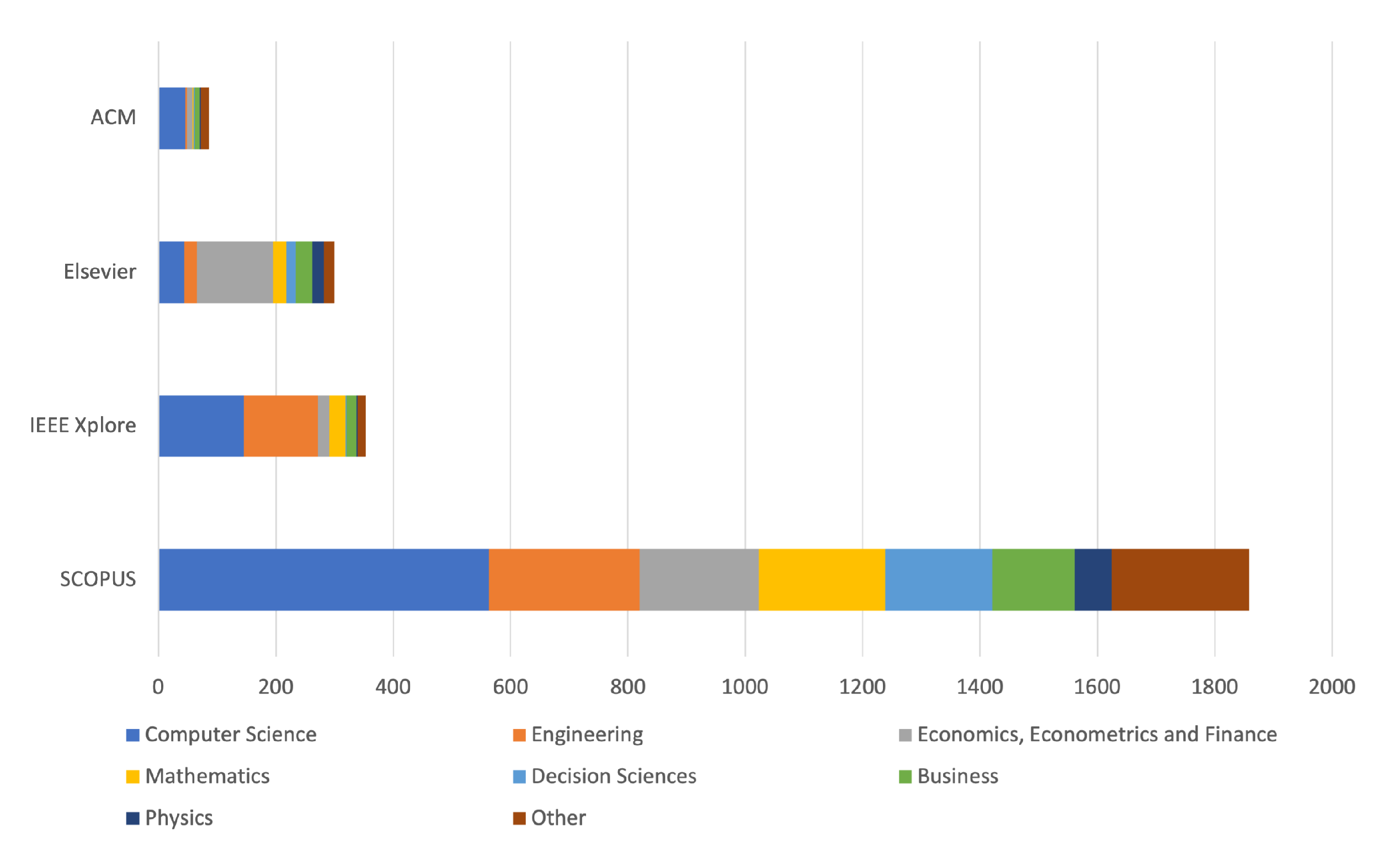

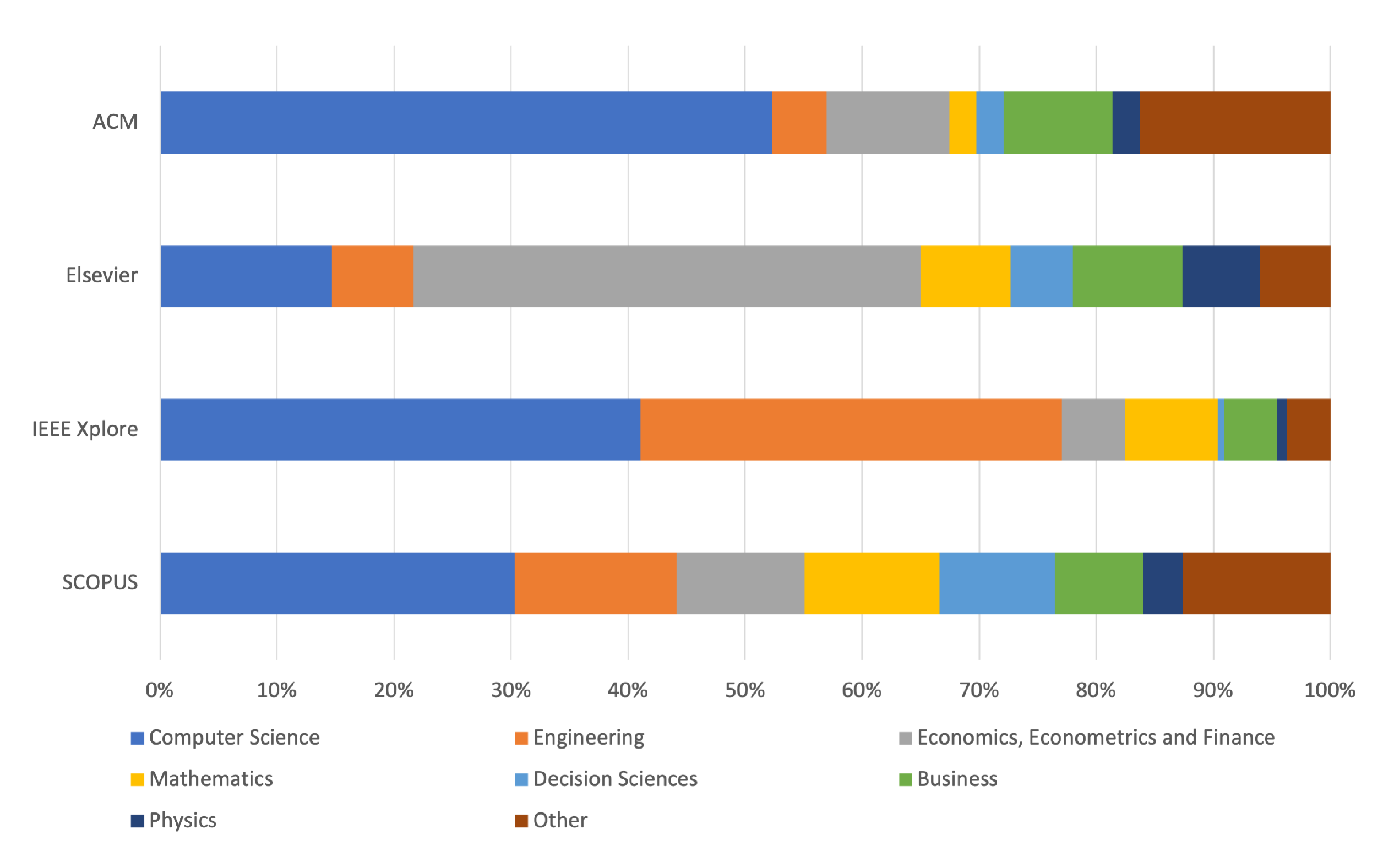

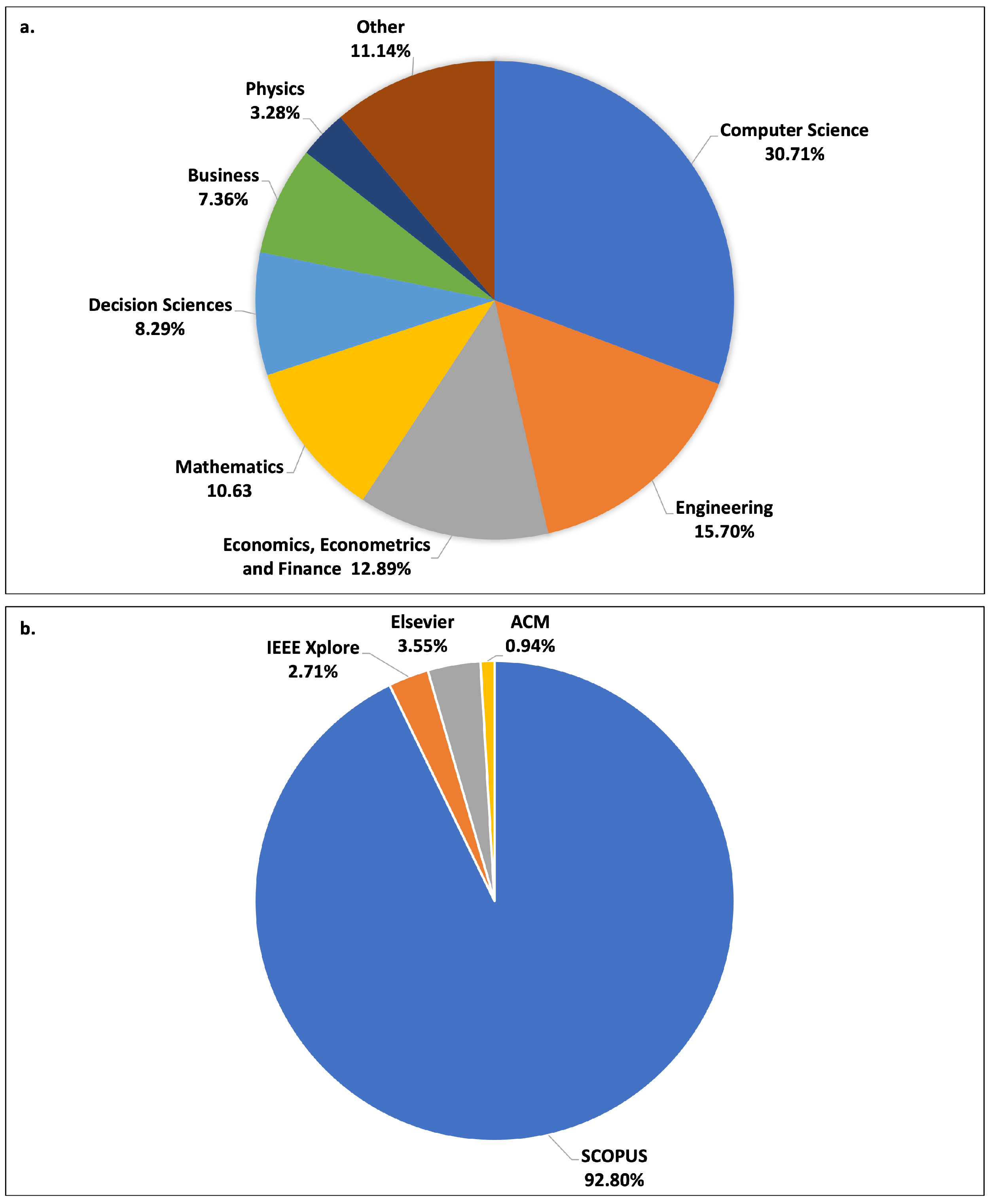

2.1. Paper Selection

2.2. Duplicate Removal

2.3. Results Filtering

- Language and Scope: This review specifically targets studies that utilise algorithmic methodologies such as state-of-the-art computational techniques (including machine learning, deep learning, etc.), and other advanced statistical techniques capable of handling large dataset and extracting predictive insights from complex market dynamics. Studies not written in English, or primarily employing traditional economic or financial models without integration of these advanced state-of-the-art techniques were excluded.

- Relevance to Cryptocurrency Price Prediction: Studies were also excluded that did not directly aim to predict cryptocurrency prices through quantitative models. For instance, papers primarily using traditional or theoretical economic analysis or financial forecasting models, without empirical testing or incorporating advanced computational techniques, were not considered.

- Methodological Rigor: Studies lacking in rigorous mathematical analysis evident from either the absence of rigorous statistical analysis or failure to report essential performance metrics like accuracy, precision, recall, or mean squared error were excluded. Additionally, studies that do not provide proper validation methods for their predictive models or fail to describe their methodologies transparently were also excluded. It was crucial that included studies demonstrated substantial mathematical outcomes with sufficient validation or justifications of there methods used, that contribute directly to the field of cryptocurrency price prediction.

2.4. Initial Review

3. Influential Parameters for Cryptocurrency Price Prediction

3.1. Price and Volume

3.2. Technical Indicators

3.3. Blockchain Features

3.4. Social Media Sentiment

Examples of Data Extraction Include:

- Twitter: Tweets containing specific keywords or hashtags, tweets posted by certain influential users or institutions, and tweets posted by users with a specific minimum or maximum number of followers. Some previous works have also extracted data by using keywords and hashtags relating to specific equities or equity markets, for example, Kilimci [22] used “BitcoinDollar”, “BitcoinUSD”, “BTCDollar”, “BTCUSD” for the extraction of Bitcoin related tweets. Others have used posts that contain explicit statements of the user’s mood states, for example, Bollen et al. [27] used posts with the expressions “I feel", “I am feeling", “I don’t feel", “I’m". These data points can be leveraged to gauge market sentiment and predict potential price movements based on the emotional tone and public reactions to market events or news [21,22,23,24,26,27,28,29,36,45,57,95,98,99,101,102,103,104,105,106,107].

- Reddit: Analysis of comments and posts in both general and specific cryptocurrency-related subreddits. This involves tracking the frequency and sentiment of posts about specific cryptocurrencies or the overall cryptocurrency market as a whole, and examining the community engagement that follows specific and general market-related events. For instance, the subreddit r/Bitcoin frequently features discussions that reflect user sentiments ranging from bullish to bearish, which correlate with market movements [108]. During specific events like regulatory announcements or technological advancements (e.g., Bitcoin halving), the increase in posting frequency and shift in sentiment can be significant indicators of market. Addtionally subreddits such as r/CryptoCurrency and r/EthTrader are pivotal in gathering collective investor sentiment, such as threads discussing new ICOs or tokens may serve as early indicators of market interest or skepticism [108,109,110,111].

Methodological Considerations for Social Media Sentiment Data:

3.5. Summary of Influential Parameters Used

4. Recent Methodologies Employed

4.1. Machine Learning Based Prediction

4.2. Deep Learning Based Prediction

4.3. Hybrid Deep Learning Based Prediction

4.4. Open-Source Contributions in Cryptocurrency Price Prediction Research

4.5. Comparative Summary of Methodological Aspects

5. Discussion

5.1. Influential Parameters

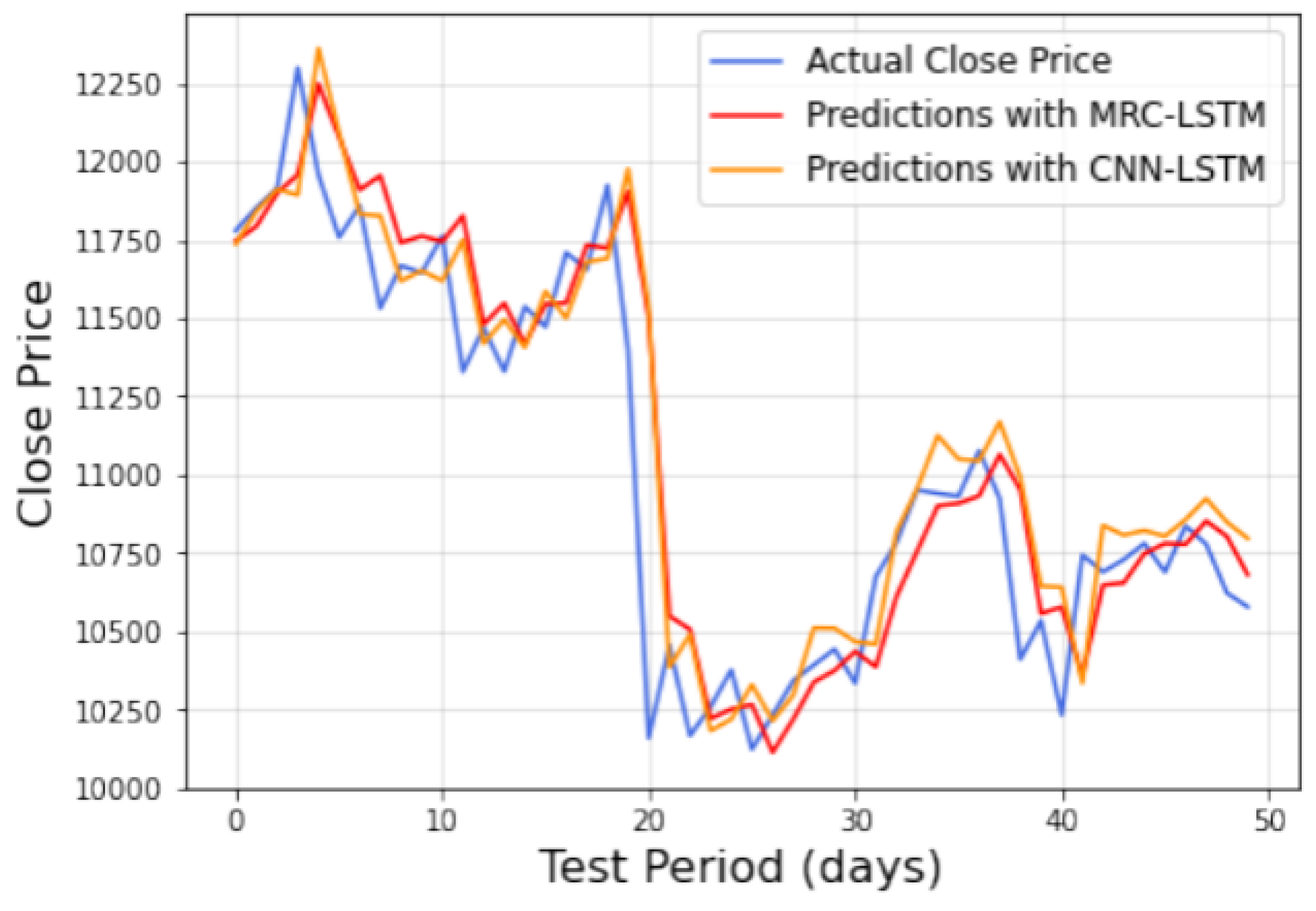

5.2. Prediction Models

5.2.1. Evaluation of Model Accuracy and Reliability

5.3. Research Focus

5.4. Performance Indicators

6. Future Directions in Cryptocurrency Price Prediction

6.1. Enhancing Predictive Models with Advanced Technologies

6.1.1. Exploring Transformer Capabilities

6.1.2. Hybrid Model Innovations

6.2. Strengthening Feature Analysis

6.2.1. Deepening Technical Indicator and Blockchain Feature Analysis

6.2.2. Enhancing the Incorporation of Market Sentiment and Social Media Data

6.3. Enhancing Real-World Application and Profitability of Prediction Models

6.3.1. Integrating Practical Profitability Metrics and Usability

6.3.2. Regulatory Compliance and Ethical Considerations

7. Conclusions

References

- Evans, C.W. Bitcoin in Islamic banking and finance. Journal of Islamic Banking and Finance 2015, 3, 1–11. [Google Scholar] [CrossRef]

- Bulíř, A. Income inequality: does inflation matter? IMF Staff papers 2001, 48, 139–159. [Google Scholar] [CrossRef]

- Patel, M.M.; Tanwar, S.; Gupta, R.; Kumar, N. A deep learning-based cryptocurrency price prediction scheme for financial institutions. Journal of information security and applications 2020, 55, 102583. [Google Scholar] [CrossRef]

- Tanwar, S.; Patel, N.P.; Patel, S.N.; Patel, J.R.; Sharma, G.; Davidson, I.E. Deep learning-based cryptocurrency price prediction scheme with inter-dependent relations. IEEE Access 2021, 9, 138633–138646. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A peer-to-peer electronic cash system. Decentralized Business Review, 2008; 21260. [Google Scholar]

- Crazymumzysa. The Importance of Cryptocurrency! Is Cryptocurrency the future?, 2016.

- Ahamad, S.; Nair, M.; Varghese, B. A survey on crypto currencies. 4th International Conference on Advances in Computer Science, AETACS. Citeseer, 2013, pp. 42–48.

- Xie, Z.; Dang, S.; Zhang, Z. On Convergence Probability of Direct Acyclic Graph-Based Ledgers in Forking Blockchain Systems. IEEE Systems Journal 2023, 17, 1121–1124. [Google Scholar] [CrossRef]

- Lin, C.; He, D.; Huang, X.; Xie, X.; Choo, K.K.R. PPChain: A Privacy-Preserving Permissioned Blockchain Architecture for Cryptocurrency and Other Regulated Applications. IEEE Systems Journal 2021, 15, 4367–4378. [Google Scholar] [CrossRef]

- Narayanan, A.; Bonneau, J.; Felten, E.; Miller, A.; Goldfeder, S. Bitcoin and cryptocurrency technologies: a comprehensive introduction; Princeton University Press, 2016.

- Bouri, E.; Gupta, R. Predicting Bitcoin returns: Comparing the roles of newspaper-and internet search-based measures of uncertainty. Finance Research Letters 2021, 38, 101398. [Google Scholar] [CrossRef]

- AliciaAdamczyk. What’s behind dogecoin’s price surge-and why seemingly unrelated brands are capitalizing on its popularity, 2021.

- Bouri, E.; Saeed, T.; Vo, X.V.; Roubaud, D. Quantile connectedness in the cryptocurrency market. Journal of International Financial Markets, Institutions and Money 2021, 71, 101302. [Google Scholar] [CrossRef]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where Is Current Research on Blockchain Technology?—A Systematic Review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef] [PubMed]

- Giudici, G.; Milne, A.; Vinogradov, D. Cryptocurrencies: market analysis and perspectives. Journal of Industrial and Business Economics 2020, 47, 1–18. [Google Scholar] [CrossRef]

- Fang, F.; Ventre, C.; Basios, M.; Kanthan, L.; Martinez-Rego, D.; Wu, F.; Li, L. Cryptocurrency trading: a comprehensive survey. Financial Innovation 2022, 8, 1–59. [Google Scholar] [CrossRef]

- Kyriazis, N.A. A survey on efficiency and profitable trading opportunities in cryptocurrency markets. Journal of Risk and Financial Management 2019, 12, 67. [Google Scholar] [CrossRef]

- Price manipulation in the Bitcoin ecosystem. Journal of Monetary Economics 2018, 95, 86–96. [CrossRef]

- Thakkar, A.; Chaudhari, K. Fusion in stock market prediction: a decade survey on the necessity, recent developments, and potential future directions. Information Fusion 2021, 65, 95–107. [Google Scholar] [CrossRef] [PubMed]

- Patel, N.P.; Parekh, R.; Thakkar, N.; Gupta, R.; Tanwar, S.; Sharma, G.; Davidson, I.E.; Sharma, R. Fusion in Cryptocurrency Price Prediction: A Decade Survey on Recent Advancements, Architecture, and Potential Future Directions. IEEE Access 2022, 10, 34511–34538. [Google Scholar] [CrossRef]

- Colianni, S.; Rosales, S.; Signorotti, M. Algorithmic trading of cryptocurrency based on Twitter sentiment analysis. CS229 Project 2015, 1, 1–4. [Google Scholar]

- Kilimci, Z.H. Sentiment analysis based direction prediction in bitcoin using deep learning algorithms and word embedding models. International Journal of Intelligent Systems and Applications in Engineering 2020, 8, 60–65. [Google Scholar] [CrossRef]

- Stenqvist, E.; Lönnö, J. Predicting Bitcoin price fluctuation with Twitter sentiment analysis 2017. p. 31.

- Rahman, S.; Hemel, J.N.; Anta, S.J.A.; Al Muhee, H.; Uddin, J. Sentiment analysis using R: An approach to correlate cryptocurrency price fluctuations with change in user sentiment using machine learning. 2018 Joint 7th International Conference on Informatics, Electronics & Vision (ICIEV) and 2018 2nd International Conference on Imaging, Vision & Pattern Recognition (icIVPR). IEEE, 2018, pp. 492–497.

- Shah, D.; Zhang, K. Bayesian regression and Bitcoin. 2014 52nd annual Allerton conference on communication, control, and computing (Allerton). IEEE, 2014, pp. 409–414.

- Serafini, G.; Yi, P.; Zhang, Q.; Brambilla, M.; Wang, J.; Hu, Y.; Li, B. Sentiment-driven price prediction of the bitcoin based on statistical and deep learning approaches. 2020 International Joint Conference on Neural Networks (IJCNN). IEEE, 2020, pp. 1–8.

- Bollen, J.; Mao, H.; Zeng, X. Twitter mood predicts the stock market. Journal of Computational Science 2011, 2, 1–8. [Google Scholar] [CrossRef]

- John, D.L.; Stantic, B. Forecasting Cryptocurrency Price Fluctuations with Granger Causality Analysis. Asian Conference on Intelligent Information and Database Systems. Springer, 2022, pp. 201–213.

- John, D.L.; Stantic, B. Machine Learning or Lexicon Based Sentiment Analysis Techniques on Social Media Posts. Asian Conference on Intelligent Information and Database Systems. Springer, 2022, pp. 3–12.

- Pirgaip, B.; Dinçergök, B.; Haşlak, Ş. Bitcoin market price analysis and an empirical comparison with main currencies, commodities, securities and altcoins. In Blockchain Economics and Financial Market Innovation; Springer, 2019; pp. 141–166.

- Kilimci, H.; Yıldırım, M.; Kilimci, Z.H. The Prediction of Short-Term Bitcoin Dollar Rate (BTC/USDT) using Deep and Hybrid Deep Learning Techniques. 2021 5th International Symposium on Multidisciplinary Studies and Innovative Technologies (ISMSIT), 2021, pp. 633–637. [CrossRef]

- Guo, Q.; Lei, S.; Ye, Q.; Fang, Z. MRC-LSTM: A Hybrid Approach of Multi-scale Residual CNN and LSTM to Predict Bitcoin Price, 2021.

- Ji, S.; Kim, J.; Im, H. A comparative study of bitcoin price prediction using deep learning. Mathematics 2019, 7, 898. [Google Scholar] [CrossRef]

- Madan, I.; Saluja, S.; Zhao, A. Automated bitcoin trading via machine learning algorithms. URL: http://cs229. stanford. edu/proj2014/Isaac% 20Madan 2015, 20. [Google Scholar]

- Tan, X.; Kashef, R. Predicting the closing price of cryptocurrencies: a comparative study. Proceedings of the Second International Conference on Data Science, E-Learning and Information Systems, 2019, pp. 1–5.

- Lamon, C.; Nielsen, E.; Redondo, E. Cryptocurrency price prediction using news and social media sentiment. SMU Data Sci. Rev 2017, 1, 1–22. [Google Scholar]

- Chen, M.; Narwal, N.; Schultz, M. Predicting price changes in Ethereum. International Journal on Computer Science and Engineering (IJCSE) ISSN 2019, pp.0975–3397.

- Velankar, S.; Valecha, S.; Maji, S. Bitcoin price prediction using machine learning. 2018 20th International Conference on Advanced Communication Technology (ICACT). IEEE, 2018, pp. 144–147.

- Wu, C.H.; Lu, C.C.; Ma, Y.F.; Lu, R.S. A new forecasting framework for bitcoin price with LSTM. 2018 IEEE International Conference on Data Mining Workshops (ICDMW). IEEE, 2018, pp. 168–175.

- Tandon, S.; Tripathi, S.; Saraswat, P.; Dabas, C. Bitcoin price forecasting using LSTM and 10-fold cross validation. 2019 International Conference on Signal Processing and Communication (ICSC). IEEE, 2019, pp. 323–328.

- Politis, A.; Doka, K.; Koziris, N. Ether price prediction using advanced deep learning models. 2021 IEEE International Conference on Blockchain and Cryptocurrency (ICBC). IEEE, 2021, pp. 1–3.

- Kim, J.; Kim, S.; Wimmer, H.; Liu, H. A cryptocurrency prediction model using LSTM and GRU algorithms. 2021 IEEE/ACIS 6th International Conference on Big Data, Cloud Computing, and Data Science (BCD). IEEE, 2021, pp. 37–44.

- Nakano, M.; Takahashi, A.; Takahashi, S. Bitcoin technical trading with artificial neural network. Physica A: Statistical Mechanics and its Applications 2018, 510, 587–609. [Google Scholar] [CrossRef]

- Alonso-Monsalve, S.; Suárez-Cetrulo, A.L.; Cervantes, A.; Quintana, D. Convolution on neural networks for high-frequency trend prediction of cryptocurrency exchange rates using technical indicators. Expert Systems with Applications 2020, 149, 113250. [Google Scholar] [CrossRef]

- Eom, C.; Kaizoji, T.; Kang, S.H.; Pichl, L. Bitcoin and investor sentiment: statistical characteristics and predictability. Physica A: Statistical Mechanics and its Applications 2019, 514, 511–521. [Google Scholar] [CrossRef]

- Doumenis, Y.; Izadi, J.; Dhamdhere, P.; Katsikas, E.; Koufopoulos, D. A critical analysis of volatility surprise in bitcoin cryptocurrency and other financial assets. Risks 2021, 9, 207. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, L.; Zhou, Q.; Jin, X. A Novel Bitcoin and Gold Prices Prediction Method Using an LSTM-P Neural Network Model. Computational Intelligence and Neuroscience 2022, 2022. [Google Scholar] [CrossRef]

- Li, Y.; Dai, W. Bitcoin price forecasting method based on cnn-lstm hybrid neural network model. The journal of engineering 2020, 2020, 344–347. [Google Scholar] [CrossRef]

- Peng, Y.; Albuquerque, P.H.M.; de Sá, J.M.C.; Padula, A.J.A.; Montenegro, M.R. The best of two worlds: Forecasting high frequency volatility for cryptocurrencies and traditional currencies with Support Vector Regression. Expert Systems with Applications 2018, 97, 177–192. [Google Scholar] [CrossRef]

- Yiying, W.; Yeze, Z. Cryptocurrency price analysis with artificial intelligence. 2019 5th International Conference on Information Management (ICIM). IEEE, 2019, pp. 97–101.

- McNally, S.; Roche, J.; Caton, S. Predicting the Price of Bitcoin Using Machine Learning. 2018 26th Euromicro International Conference on Parallel, Distributed and Network-based Processing (PDP), 2018, pp. 339–343. [CrossRef]

- Jay, P.; Kalariya, V.; Parmar, P.; Tanwar, S.; Kumar, N.; Alazab, M. Stochastic Neural Networks for Cryptocurrency Price Prediction. IEEE Access 2020, 8, 82804–82818. [Google Scholar] [CrossRef]

- Wu, C.H.; Lu, C.C.; Ma, Y.F.; Lu, R.S. A New Forecasting Framework for Bitcoin Price with LSTM. 2018 IEEE International Conference on Data Mining Workshops (ICDMW), 2018, pp. 168–175. [CrossRef]

- Phaladisailoed, T.; Numnonda, T. Machine Learning Models Comparison for Bitcoin Price Prediction. 2018 10th International Conference on Information Technology and Electrical Engineering (ICITEE), 2018, pp. 506–511. [CrossRef]

- Saad, M.; Choi, J.; Nyang, D.; Kim, J.; Mohaisen, A. Toward Characterizing Blockchain-Based Cryptocurrencies for Highly Accurate Predictions. IEEE Systems Journal 2020, 14, 321–332. [Google Scholar] [CrossRef]

- Akbiyik, M.E.; Erkul, M.; Kämpf, K.; Vasiliauskaite, V.; Antulov-Fantulin, N. Ask “Who”, Not “What”: Bitcoin Volatility Forecasting with Twitter Data. Proceedings of the Sixteenth ACM International Conference on Web Search and Data Mining; Association for Computing Machinery: New York, NY, USA, 2023; WSDM ’23, p.9. [Google Scholar] [CrossRef]

- Herremans, D.; Low, K.W. Forecasting Bitcoin Volatility Spikes from Whale Transactions and Cryptoquant Data Using Synthesizer Transformer Models. Available at SSRN 4247684 2022. [Google Scholar]

- Shou, M.H.; Wang, Z.X.; Li, D.D.; Zhou, Y.T. Forecasting the price trends of digital currency: a hybrid model integrating the stochastic index and grey Markov chain methods. Grey Systems 2021, 11, 22–45. [Google Scholar] [CrossRef]

- Ren, X.; Jiang, Z.; Su, J. The Use of Features to Enhance the Capability of Deep Reinforcement Learning for Investment Portfolio Management. 2021 IEEE 6th International Conference on Big Data Analytics, ICBDA 2021, 2021, pp. 44–50. [Google Scholar] [CrossRef]

- Huang, H.; Ye, T. Asset Trading Strategies Based on LSTM - Bitcoin and Gold as an Example. CAIBDA 2022 - 2nd International Conference on Artificial Intelligence, Big Data and Algorithms, 2022, pp. 650–655.

- Zhang, Z.; Dai, H.N.; Zhou, J.; Mondal, S.K.; García, M.M.; Wang, H. Forecasting cryptocurrency price using convolutional neural networks with weighted and attentive memory channels. Expert Systems with Applications 2021, 183. [Google Scholar] [CrossRef]

- Liu, F.; Li, Y.; Li, B.; Li, J.; Xie, H. Bitcoin transaction strategy construction based on deep reinforcement learning. Applied Soft Computing 2021, 113. [Google Scholar] [CrossRef]

- García-Medina, A.; Huynh, T.L.D. What drives bitcoin? An approach from continuous local transfer entropy and deep learning classification models. Entropy 2021, 23. [Google Scholar] [CrossRef]

- Bangroo, R.; Gupta, U.; Sah, R.; Kumar, A. Cryptocurrency Price Prediction using Machine Learning Algorithm. 2022 10th International Conference on Reliability, Infocom Technologies and Optimization (Trends and Future Directions), ICRITO 2022, 2022. [CrossRef]

- Han, N.; Zhang, S.; Wang, H.; Chen, Z.; Hou, X.; Sun, Z. Quantitative investment decision model based on ARIMA and iterative neural network. 2022 IEEE Conference on Telecommunications, Optics and Computer Science, TOCS 2022, 2022, pp. 1076–1081. [Google Scholar] [CrossRef]

- Guo, Y.; Zhao, R.; Ma, X.; Zhu, C.; Xie, X. A Reasonable Investment Method based on Multiple Factors Time Series. Proceedings - 2022 International Conference on Machine Learning, Cloud Computing and Intelligent Mining, MLCCIM 2022, 2022, pp. 179–187. [Google Scholar] [CrossRef]

- Zhou, W.; Guo, Y.; Li, S. Study on the Risk-Return Mathematical Model Based on LSTM Time-Series Model and Monte Carlo Simulations. Proceedings - 2022 International Conference on Data Analytics, Computing and Artificial Intelligence, ICDACAI 2022, 2022, pp. 354–367. [Google Scholar] [CrossRef]

- Wenhao, Q. Smart Portfolio Trading Strategy Based on Random Forest Model with Limited Information. 2022 IEEE 2nd International Conference on Data Science and Computer Application, ICDSCA 2022, 2022, pp. 1437–1441. [Google Scholar] [CrossRef]

- De Rosa, P.; Schiavoni, V. Understanding Cryptocoins Trends Correlations. Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics), 2022, Vol. 13272 LNCS, pp. 29–36. [CrossRef]

- Birim, Ş.Ö.; Sönmez, F.E.; Liman, Y.S. Estimating Return Rate of Blockchain Financial Product by ANFIS-PSO Method. Lecture Notes in Networks and Systems, 2022, Vol. 504 LNNS, pp. 802–809. [CrossRef]

- Ye, X.; Li, Y.; Feng, X.; Heng, C. A Crypto Market Forecasting Method Based on Catboost Model and Bigdata. 2022 7th International Conference on Intelligent Computing and Signal Processing, ICSP 2022, 2022, pp. 686–689. [Google Scholar] [CrossRef]

- Montenegro, C.; Armas, R. Can the Price of BTC Bitcoin Be Forecast Successfully with NARX Neural Networks? Lecture Notes in Networks and Systems, 2022, Vol. 468 LNNS, pp. 521–530. [CrossRef]

- Parvini, N.; Abdollahi, M.; Seifollahi, S.; Ahmadian, D. Forecasting Bitcoin returns with long short-term memory networks and wavelet decomposition: A comparison of several market determinants. Applied Soft Computing 2022, 121. [Google Scholar] [CrossRef]

- Shahbazi, Z.; Byun, Y.C. Knowledge Discovery on Cryptocurrency Exchange Rate Prediction Using Machine Learning Pipelines. Sensors 2022, 22. [Google Scholar] [CrossRef] [PubMed]

- Serrano, W. The random neural network in price predictions. Neural Computing and Applications 2022, 34, 855–873. [Google Scholar] [CrossRef]

- Xie, C.; Wu, X.; Bai, X. Optimal Strategy: A Comprehensive Model for Predicting Price Trend and Algorithm Optimization. ACM International Conference Proceeding Series, 2022, pp. 457–460. [CrossRef]

- Saleh, G.; Arabiat, L.; Al-Badarneh, A. Testing Lasso Regression and XGBOOST on Crypto-Currency Volatility and Price Prediction. 2023 14th International Conference on Information and Communication Systems, ICICS 2023, 2023. [CrossRef]

- Shamshad, H.; Ullah, F.; Ullah, A.; Kebande, V.R.; Ullah, S.; Al-Dhaqm, A. Forecasting and Trading of the Stable Cryptocurrencies With Machine Learning and Deep Learning Algorithms for Market Conditions. IEEE Access 2023, 11, 122205–122220. [Google Scholar] [CrossRef]

- Ali, F.; Suryakant, R.; Nimbore, S. Ensemble Model Based on Deep Learning for Forecasting Crypto Asset Futures in Markets. 2023 3rd International Conference on Smart Generation Computing, Communication and Networking, SMART GENCON 2023, 2023. [CrossRef]

- Narang, H.K.; Shrirame, V.K.; Kurrey, B. Price Prediction of Ethereum Using Blockchain Historical and Exchange Data by Supervised Machine Learning Algorithms. Proceedings - 2023 4th International Conference on Industrial Engineering and Artificial Intelligence, IEAI 2023, 2023, pp. 8–15. [Google Scholar] [CrossRef]

- Kumar, M.R.; Umar, S.; Venkatram, V. Short Term Memory Recurrent Neural Network-based Machine Learning Model for Predicting Bit-coin Market Prices. 14th International Conference on Advances in Computing, Control, and Telecommunication Technologies, ACT 2023 Vol. 2023, June. 1683–1689.

- Hawi, L.A.; Sharqawi, S.; Al-Haija, Q.A.; Qusef, A. Empirical Evaluation of Machine Learning Performance in Forecasting Cryptocurrencies. Journal of Advances in Information Technology 2023, 14, 639–647. [Google Scholar] [CrossRef]

- Kanzari, D. Context-adaptive intelligent agents behaviors: multivariate LSTM-based decision making on the cryptocurrency market. International Journal of Data Science and Analytics, 2023. [CrossRef]

- Xie, S.; Zhao, Z.; Li, L.; Wu, H. Gold and Bitcoin Trading Strategies: a Comprehensive Model for Optimal Investment Returns. Proceedings of SPIE - The International Society for Optical Engineering, 2023, Vol. 12783. [CrossRef]

- Milicevic, M.; Jovanovic, L.; Bacanin, N.; Zivkovic, M.; Jovanovic, D.; Antonijevic, M.; Savanovic, N.; Strumberger, I. Optimizing Long Short-Term Memory by Improved Teacher Learning-Based Optimization for Ethereum Price Forecasting. Lecture Notes on Data Engineering and Communications Technologies, 2023, Vol. 166, pp. 125–139. [CrossRef]

- Srivastava, V.; Kumar Dwivedi, V.; Kumar Singh, A. Prediction of Bitcoin Price using Optimized Genetic ARIMA Model and Analysis in Post and Pre Covid Eras*. Proceedings - 2023 3rd International Conference on Smart Data Intelligence, ICSMDI 2023, 2023, pp. 143–148. [Google Scholar] [CrossRef]

- Aghashahi, M.; Bamdad, S. Analysis of different artificial neural networks for Bitcoin price prediction. International Journal of Management Science and Engineering Management 2023, 18, 126–133. [Google Scholar] [CrossRef]

- Kalyani, K.; Parvathy, V.S.; Abdeljaber, H.A.; Satyanarayana Murthy, T.; Acharya, S.; Joshi, G.P.; Kim, S.W. Effective Return Rate Prediction of Blockchain Financial Products Using Machine Learning. Computers, Materials and Continua 2023, 74, 2303–2316. [Google Scholar] [CrossRef]

- Mahfooz, A.; Phillips, J.L. Conditional Forecasting of Bitcoin Prices Using Exogenous Variables. IEEE Access 2024, 12, 44510–44526. [Google Scholar] [CrossRef]

- Ramesh, R.; Karthic, M.J. Optimizing Cryptocurrency Price Prediction: A Hybrid Approach with Resilient Stochastic Clustering and Gravitational Search Algorithm. International Journal of Intelligent Systems and Applications in Engineering 2024, 12, 239–248. [Google Scholar]

- Giudici, P.; Raffinetti, E.; Riani, M. Robust machine learning models: linear and nonlinear. International Journal of Data Science and Analytics 2024. [Google Scholar] [CrossRef]

- Amiri, A.; Tavana, M.; Arman, H. An Integrated Fuzzy Analytic Network Process and Fuzzy Regression Method for Bitcoin Price Prediction. Internet of Things (Netherlands) 2024, 25. [Google Scholar] [CrossRef]

- Ladhari, A.; Boubaker, H. Deep Learning Models for Bitcoin Prediction Using Hybrid Approaches with Gradient-Specific Optimization. Forecasting 2024, 6. [Google Scholar] [CrossRef]

- Kelotra, A.; Pandey, P. Stock market prediction using optimized deep-convlstm model. Big Data 2020, 8, 5–24. [Google Scholar] [CrossRef] [PubMed]

- Buzcu, B.; Ozgun, M.; Yılmaz, D. Cryptocurrency Price Prediction Using News and Social Network Data 2021.

- Liu, L. Are Bitcon returns predictable?: Evidence from technical indicators. Physica A: Statistical Mechanics and its Applications 2019, 533, 121950. [Google Scholar] [CrossRef]

- Uras, N.; Ortu, M. Investigation of Blockchain Cryptocurrencies’ Price Movements through Deep Learning: A Comparative Analysis. Proceedings - 2021 IEEE International Conference on Software Analysis, Evolution and Reengineering, SANER 2021, 2021, pp. 715–722. [Google Scholar] [CrossRef]

- Cavalli, S.; Amoretti, M. CNN-based multivariate data analysis for bitcoin trend prediction. Applied Soft Computing 2021, 101. [Google Scholar] [CrossRef]

- Pellon Consunji, M. EvoTrader: Automated bitcoin trading using neuroevolutionary algorithms on technical analysis and social sentiment data. ACM International Conference Proceeding Series, 2021. [CrossRef]

- El Badaoui, M.; Raouyane, B.; El Moumen, S.; Bellafkih, M. Impact Machine Learning Classification And Technical Indicators Forecast The Direction Of Bitcoin. Proceedings - SITA 2023: 2023 14th International Conference on Intelligent Systems: Theories and Applications, 2023. [CrossRef]

- Abraham, J.; Higdon, D.; Nelson, J.; Ibarra, J. Cryptocurrency price prediction using tweet volumes and sentiment analysis. SMU Data Science Review 2018, 1, 1. [Google Scholar]

- Ghahramani, M.; Najafabadi, H.E. Compatible deep neural network framework with financial time series data, including data preprocessor, neural network model and trading strategy. arXiv, 2022; arXiv:2205.08382. [Google Scholar]

- Fleischer, J.; Von Laszewski, G.; Theran, C.; Bautista, Y.J.P. Time series analysis of blockchain-based cryptocurrency price changes. arXiv, 2022; arXiv:2202.13874. [Google Scholar]

- Hasan, S.H.; Hasan, S.H.; Ahmed, M.S.; Hasan, S.H. A novel cryptocurrency prediction method using optimum cnn. Computers, Materials and Continua 2022, 71, 1051–1063. [Google Scholar] [CrossRef]

- Sabeena, J.; Sagar, P. Enhancing Predictive Accuracy for Real Time Cryptocurrency Market Prices with Machine Learning Techniques. International Conference on Sustainable Communication Networks and Application, ICSCNA 2023 - Proceedings, 2023, pp. 1288–1292. [CrossRef]

- Bute, H.; Singh, A.; Nandurbarkar, S.; Wagle, S.A.; Pareek, P. Bitcoin Price Prediction using Twitter Sentiment Analysis. International Journal of Intelligent Systems and Applications in Engineering 2024, 12, 469–477. [Google Scholar]

- Gupta, A.; Pandey, G.; Gupta, R.; Das, S.; Prakash, A.; Garg, K.; Sarkar, S. Machine Learning-Based Approach for Predicting the Altcoins Price Direction Change from a High-Frequency Data of Seven Years Based on Socio-Economic Factors, Bitcoin Prices, Twitter and News Sentiments. Computational Economics 2024. [Google Scholar] [CrossRef]

- Phillips, R.C.; Gorse, D. Predicting cryptocurrency price bubbles using social media data and epidemic modelling. 2017 IEEE Symposium Series on Computational Intelligence (SSCI). IEEE, 2017, pp. 394–400. [CrossRef]

- Kim, Y.B.; Kim, J.G.; Kim, W.; Im, J.H.; Kim, T.H.; Kang, S.J.; Kim, C.H. Predicting Fluctuations in Cryptocurrency Transactions Based on User Comments and Replies. PLoS ONE 2016, 11, e0161197. [Google Scholar] [CrossRef] [PubMed]

- Sagi, O.; Rokach, L. Ensemble learning of online discussion data for cryptocurrency trend prediction. Data Mining and Knowledge Discovery 2018, 32, 1542–1575. [Google Scholar]

- Ante, L. The social influence of blockchain communities from Reddit data. Journal of Information Technology & Politics 2021, 18, 373–387. [Google Scholar]

- Albariqi, R.; Winarko, E. Prediction of bitcoin price change using neural networks. 2020 international conference on smart technology and applications (ICoSTA). IEEE, 2020, pp. 1–4.

- Jang, H.; Lee, J. An Empirical Study on Modeling and Prediction of Bitcoin Prices With Bayesian Neural Networks Based on Blockchain Information. IEEE Access 2018, 6, 5427–5437. [Google Scholar] [CrossRef]

- Aggarwal, A.; Gupta, I.; Garg, N.; Goel, A. Deep learning approach to determine the impact of socio economic factors on bitcoin price prediction. 2019 twelfth international conference on contemporary computing (IC3). IEEE, 2019, pp. 1–5.

- Zhang, C.; Li, Y.; Chen, X.; Jin, Y.; Tang, P.; Li, J. DoubleEnsemble: A new ensemble method based on sample reweighting and feature selection for financial data analysis. 2020 IEEE International Conference on Data Mining (ICDM). IEEE, 2020, pp. 781–790.

- Chu, J.; Nadarajah, S.; Chan, S. Statistical analysis of the exchange rate of bitcoin. PloS one 2015, 10, e0133678. [Google Scholar] [CrossRef]

- Mizuno, H.; Kosaka, M.; Yajima, H.; Komoda, N. Application of neural network to technical analysis of stock market prediction. Studies in Informatic and control 1998, 7, 111–120. [Google Scholar]

- Lo, A.W.; Mamaysky, H.; Wang, J. Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation. The journal of finance 2000, 55, 1705–1765. [Google Scholar] [CrossRef]

- Chen, J.; Hui, P.M.; Gerlach, R.; Algesheimer, R.; Garcia, D. The sentiment expressed on social media predicts the Bitcoin exchange rate. PLOS ONE 2018, 13, e0205823. [Google Scholar] [CrossRef]

- Lachanski, M.; Pav, S. Do Tweets precede trades? The relationships between Twitter sentiment, stock returns, and volatility. Marketing Letters 2017, 28, 69–84. [Google Scholar]

- Feng, W.; Wang, Y.; Zhang, Z. Informed trading in the Bitcoin market. Finance Research Letters 2018, 26, 63–70. [Google Scholar] [CrossRef]

- Lachanski, M.S.; Pav, S. Shy of the Character Limit: "Twitter Mood Predicts the Stock Market" Revisited. Econ Journal Watch 2017, 14, 302–345. [Google Scholar]

- TechCrunch. Twitter to end free access to its API 2023.

- Company, F. Elon Musk’s Twitter API Changes: Monetization and the Impact on Users 2023.

- AOL. Elon Musk backtracks on Twitter API decision after developer backlash, 2023.

- Press, T. Comparing Platform Research API Requirements, 2023.

- Blog, R. 13 Top Social Media APIs & Free Alternatives List - April, 2024, 2024.

- Roach, J. Why everyone is freaking out about the Reddit API right now. Digital Trends 2023. [Google Scholar]

- Help, R. Reddit Data API Wiki, 2024. Accessed: 2024-05-01.

- Reddit. Creating a Healthy Ecosystem for Reddit Data and Reddit Data API Access, 2023. Accessed: 2024-05-01.

- Reddit Data API Wiki. https://support.reddithelp.com/hc/en-us/articles/360043034832-Reddit-Data-API-Wiki, 2024.

- Vaswani, A.; Shazeer, N.; Parmar, N.; Uszkoreit, J.; Jones, L.; Gomez, A.N.; Kaiser. ; Polosukhin, I. Attention is all you need. Advances in neural information processing systems 2017, 30. [Google Scholar]

- Hutto, C.; Gilbert, E. Vader: A parsimonious rule-based model for sentiment analysis of social media text. Proceedings of the International AAAI Conference on Web and Social Media, 2014, Vol. 8.

- Sheth, K.; Patel, K.; Shah, H.; Tanwar, S.; Gupta, R.; Kumar, N. A taxonomy of AI techniques for 6G communication networks. Computer communications 2020, 161, 279–303. [Google Scholar] [CrossRef]

- Singh, S.; Bhat, M. 2024; arXiv:cs.LG/2401.08077].

- Penmetsa, S.; Vemula, M. Cryptocurrency Price Prediction with LSTM and Transformer Models Leveraging Momentum and Volatility Technical Indicators. 2023 IEEE 3rd International Conference on Data Science and Computer Application (ICDSCA), 2023, pp. 411–416. [CrossRef]

- Sridhar, S.; Sanagavarapu, S. Multi-Head Self-Attention Transformer for Dogecoin Price Prediction. 2021 14th International Conference on Human System Interaction (HSI), 2021, pp. 1–6. [CrossRef]

| 1 | |

| 2 | which can be found at https://www.blockchain.com/explorer/charts#block

|

| Ref. | Year | Data Source | Methodology | Data Collection Period | Performance Indicators | Task Type |

|---|---|---|---|---|---|---|

| [25] | 2014 | Social Media Posts | Bayesian Regression | Every 2 seconds - over 200 million data points | Double the investment in less than 60 day period | Regression |

| [21] | 2015 | Social Media Posts | Naive Bayes, logistic regression, and SVM | 21 Days | Accuracy= 95% | Classification |

| [34] | 2015 | Price and 16 Blockchain Features | Random forests, SVM, GLM | 5 Days | Sign Prediction Accuracy= 98.5% | Classification |

| [23] | 2017 | Social Media Posts | Sentiment Analysis - VADER | 31 Days | Accuracy= 83% | Classification |

| [24] | 2018 | 500 tweets extracted every day | 5 regression algorithms and 11 classification algorithms | 3 Months | Regression accuracy= 70%, Naive Bayes accuracy= 89.65% Random Forest Classification accuracy= 85.78% | Classification & Regression |

| [33] | 2019 | 29 Blockchain features | DNN, LSTM, CNN, DNR | 2590 Days | Profitability Analysis | Classification |

| [35] | 2019 | Price and Volume | LSTM, ARIMA, Bayesian regression, SVM | 1,839 days | LSTM RMSE= 33.7091 | Classification |

| [22] | 2020 | 17629 tweets | Sentiment analysis, various Deep learning algorithms, Word embeddings | 92 Days | Word Embedding accuracy= 89.13% | Classification |

| [94] | 2020 | 12 technical indicators and price | Deep-ConvLSTM | 729 days | MSE= 7.2487, RMSE= 2.6923 | Classification |

| [26] | 2020 | Price and Volume, Social Media Sentiment | VADER, ARIMAX, LSTM | 944 days | LSTM MSE= 0.000304 | Classification |

| [3] | 2020 | Price and Volume | LSTM-GRU | 1851 Days | 1, 3, 7 day MAPE of 4.0727, 6.2754, 19.3493 | Classification |

| [31] | 2021 | Price and Volume, 7 Technical indicators | Deep and hybrid Deep Learning | 74 days | MAPE= 2.4076 | Classification |

| [4] | 2021 | Price | LSTM-GRU | 1,736 days | Litecoin MSE= 0.02038, Zcash MSE= 0.00461 | Classification |

| Influential Parameter | Benefits | Challenges |

|---|---|---|

| Price and Volume |

|

|

| Technical Indicators |

|

|

| Blockchain Features |

|

|

| Social Media Sentiment (Twitter & Reddit) |

|

|

| Ref. | Year | Data Sources | Methodology | Language | Code URL |

|---|---|---|---|---|---|

| [115] | 2020 | Financial Data | DoubleEnsemble, DNN, Gradient Boosting Decision Tree | Python | https://github.com/microsoft/qlib/tree/main/examples/benchmarks/DoubleEnsemble |

| [103] | 2021 | Blockchain-Based Cryptocurrency Price Changes | LSTM | Python | https://github.com/ cybertraining-dsc/su21-reu-361 |

| [56] | 2022 | Public Twitter Data | Several Deep Learning Architectures | Python | https://github.com/meakbiyik/ask-who-not-what |

| [102] | 2022 | Public Twitter Data | Different Convolutional Layers, LSTM | Python | https://github.com/mmghahramanibozandan/MyPaper_DL_ML_Fin |

| [57] | 2022 | Historical Price, Public Twitter Data | Synthesiser Transformer models | Python | https://github.com/dorienh/bitcoin_ synthesiser |

| Data Source | Benefits | Challenges |

|---|---|---|

| Machine Learning |

|

|

| Deep Learning |

|

|

| Hybrid Deep Learning |

|

|

| Ref. | Year | ML Approach | Features | Performance Metrics |

|---|---|---|---|---|

| [25] | 2014 | Bayesian Regression | Historical Price and Volume | Investment Doubling in < 60 days |

| [116] | 2015 | Statistical Analysis | Historical Price | Volatility Analysis, Risk Measures (VaR, ES) |

| [113] | 2017 | Bayesian Neural Networks (BNNs) | Historical price, Blockchain Features, macroeconomic indexes | RMSE: 0.0031, MAPE: 0.0325 |

| [51] | 2018 | Bayesian Optimised RNN and LSTM Networks | Historical price | Highest classification accuracy: 52%, RMSE: 8%; Outperformed ARIMA model; GPU implementation was 67.7% faster than CPU. |

| [49] | 2018 | GARCH Model, SVR | Historical Price, Volatility measures | RMSE: 0.0313, MAE: 0.01315 |

| [33] | 2019 | DNN, LSTM, CNN, ResNet, Ensemble, SVM | Bitcoin blockchain features | MAPE: DNN=3.61, LSTM=3.79, CNN=4.27, ResNet=4.95, Ensemble=4.02, SVM=4.75 |

| [39] | 2020 | LSTM with AR(2) Model | Historical Price | MSE: 4574.12, RMSE: 9.08, MAE: 9.75, MAPE: 0.15 |

| [44] | 2020 | CNN-LSTM, CNN, MLP, RFBNN | Historical Price | Accuracy CNN-LSTM: BTC=0.6106, Dash=0.7412, ETH=0.5899, LTC=0.6763, XMR=0.7994, XRP=0.6704 |

| [3] | 2020 | GRU and LSTM Hybrid Model | Historical Price | RMSE: 1-day: LTC=2.2986, XMR=3.2715, 3-days: LTC=2.0327, XMR=5.5005, 7days: LTC=4.5521, XMR=20.2437 |

| [4] | 2021 | GRU and LSTM Hybrid Model | Historical Price, Inter-dependency of the parent coin | MSE: 1-day: LTC=0.0203, Zcash=0.0046, 3-days: LTC=0.0266, Zcash=0.0048, 7days: LTC=0.2337, Zcash=0.0052 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).