Submitted:

05 February 2024

Posted:

05 February 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature review

2.1. The Current State of Research on the Impact of CBAM on China

2.2. The Current State of Research on Carbon Tax Policies

2.3. The Application of Evolutionary Game Theory in the Steel Industry

2.4. Summary

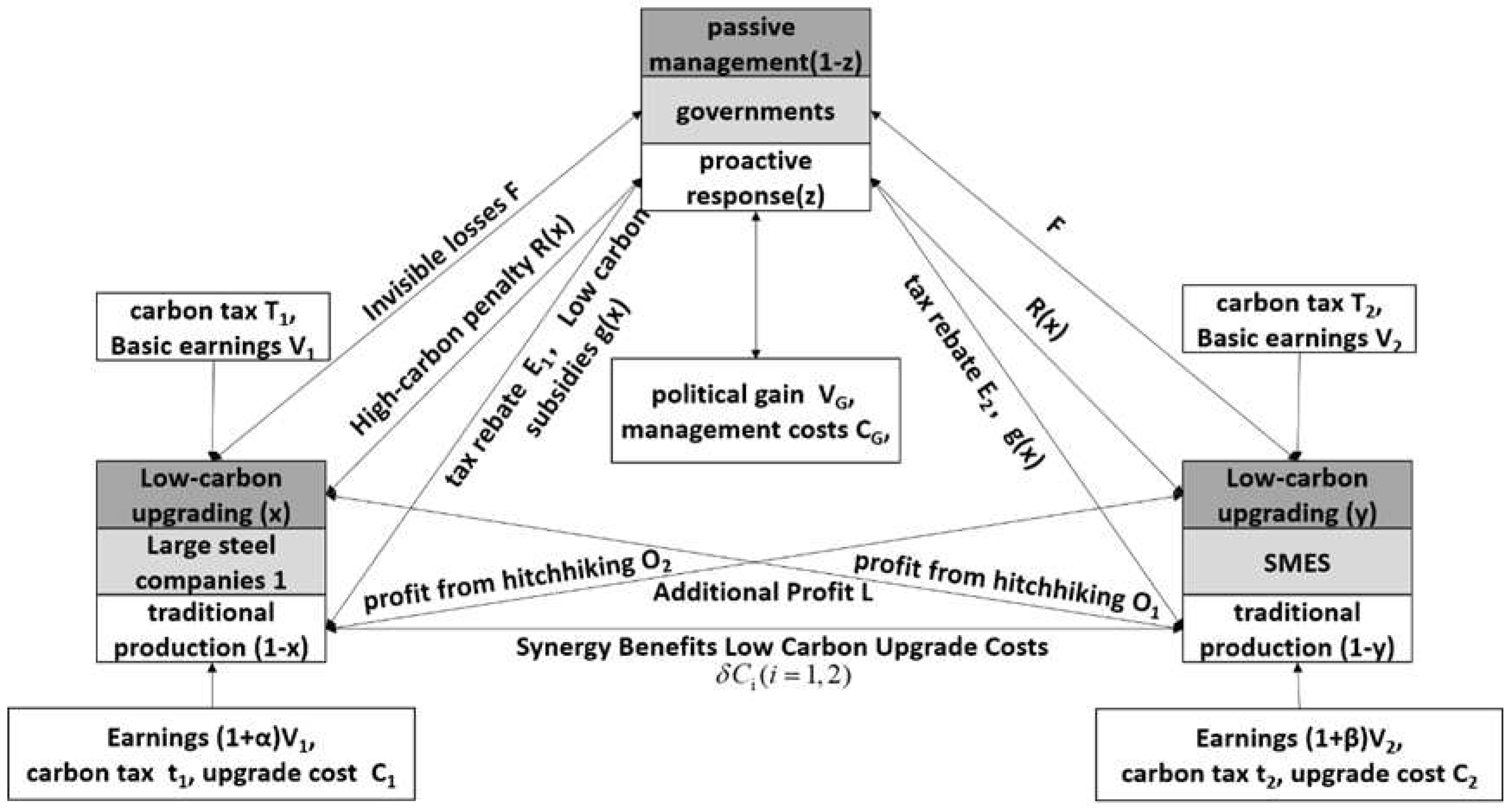

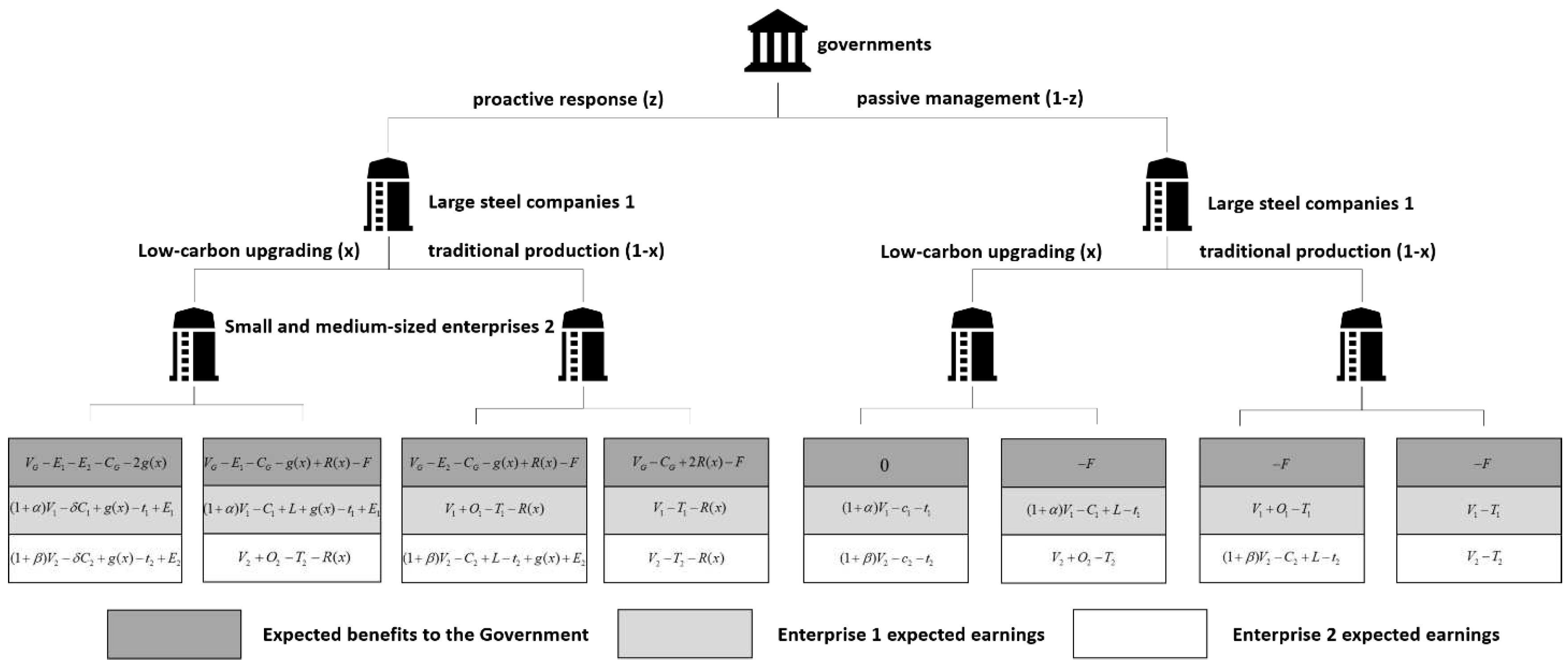

3. Construction of a tripartite evolutionary model

3.1. Description of the problem

3.2. Model assumptions

4. Model analysis

4.1. Analysis of replication dynamics

- Large Steel Enterprise 1

- 2.

- Small and medium-sized steel companies 2

- 3.

- government

4.2. Stable equilibrium analysis

5. Evolutionary numerical modeling simulation

5.1. Parameter Sources and Settings

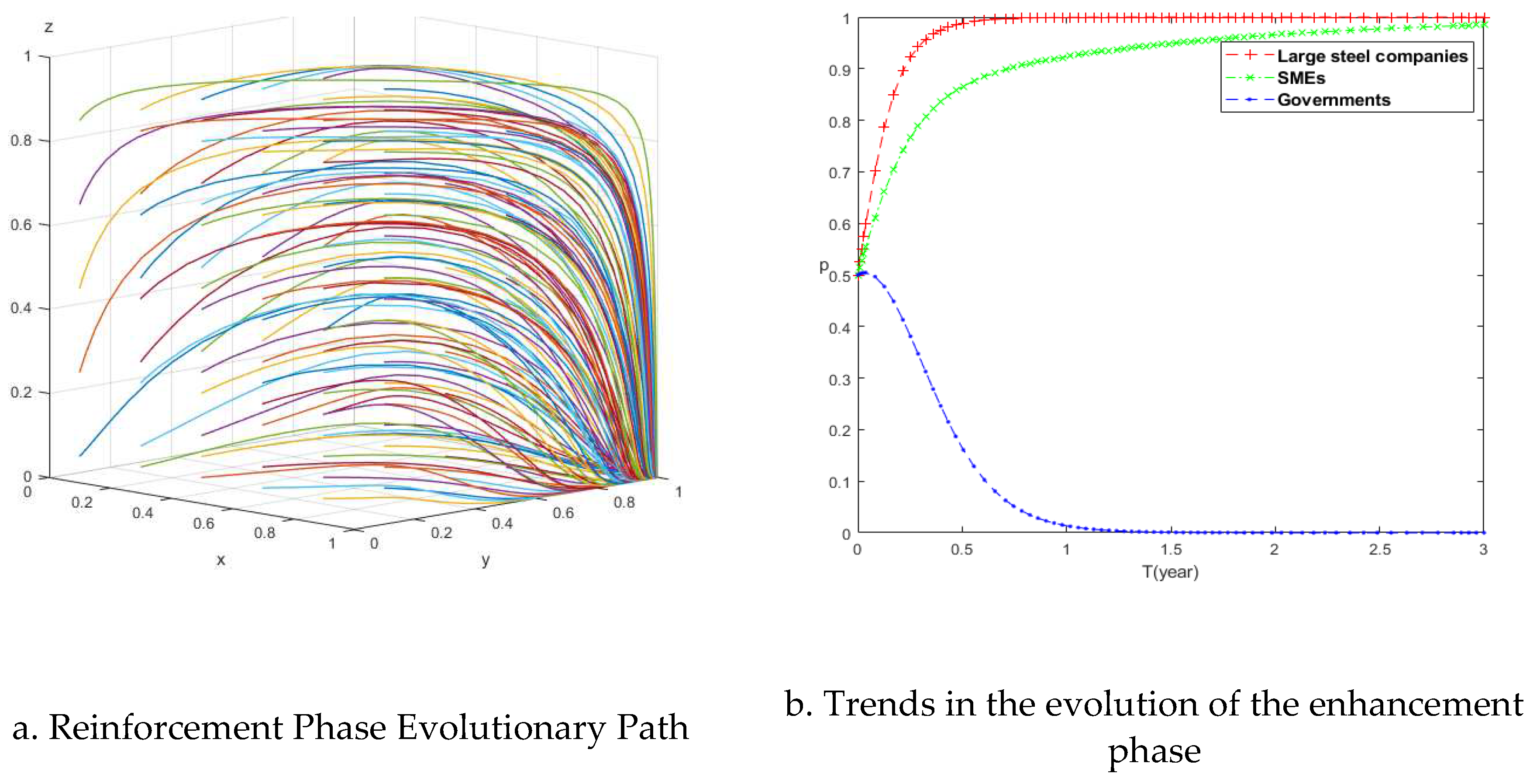

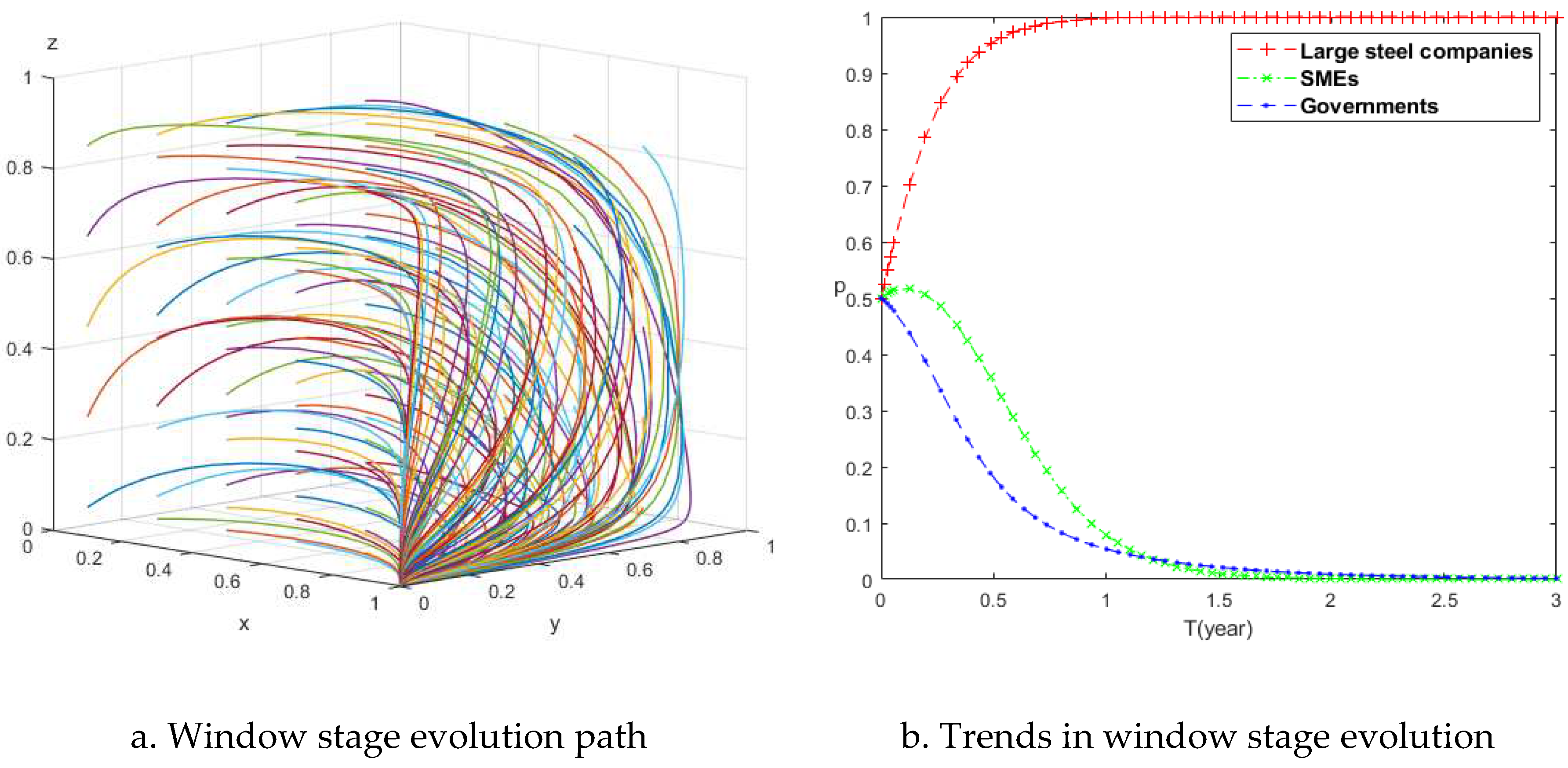

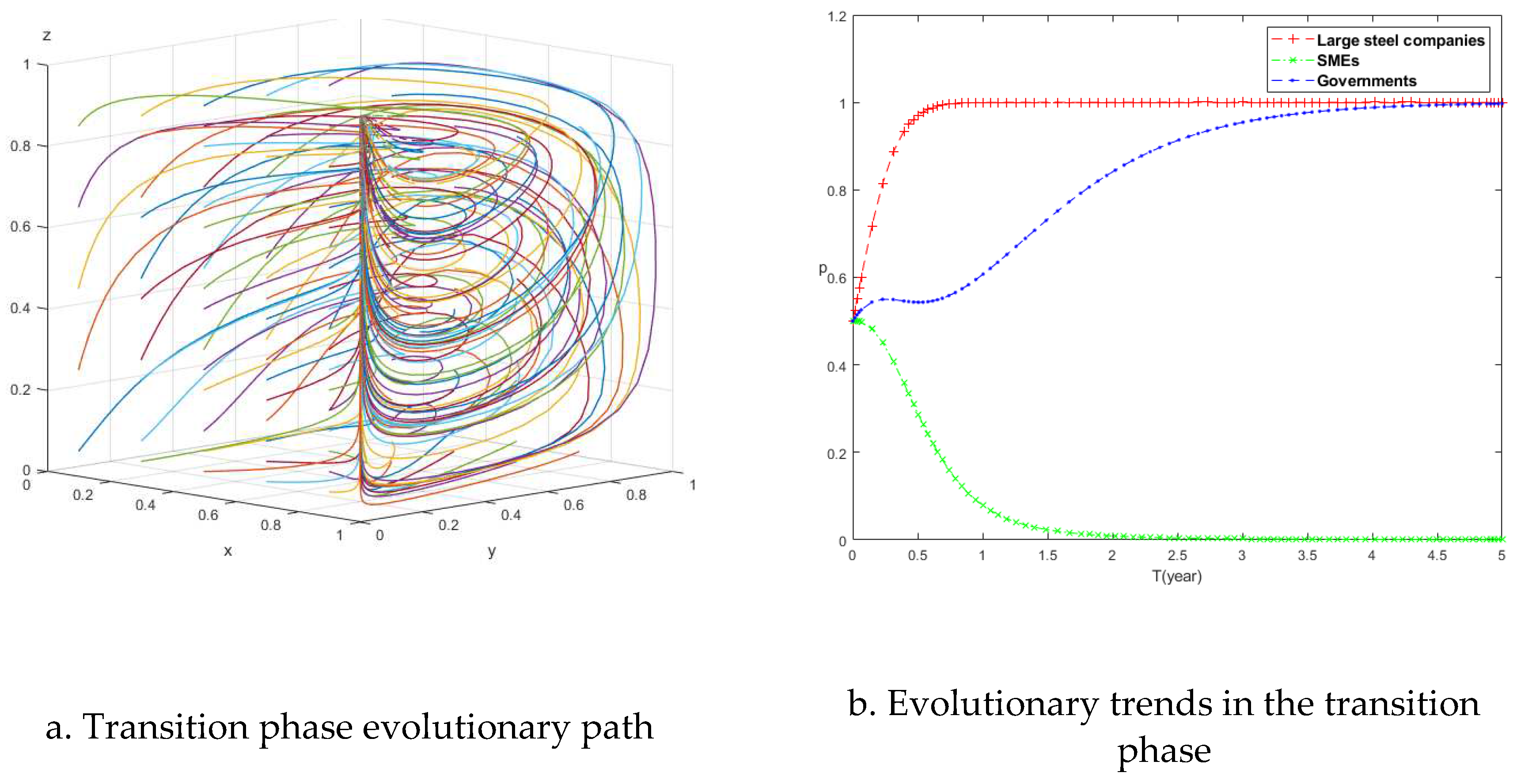

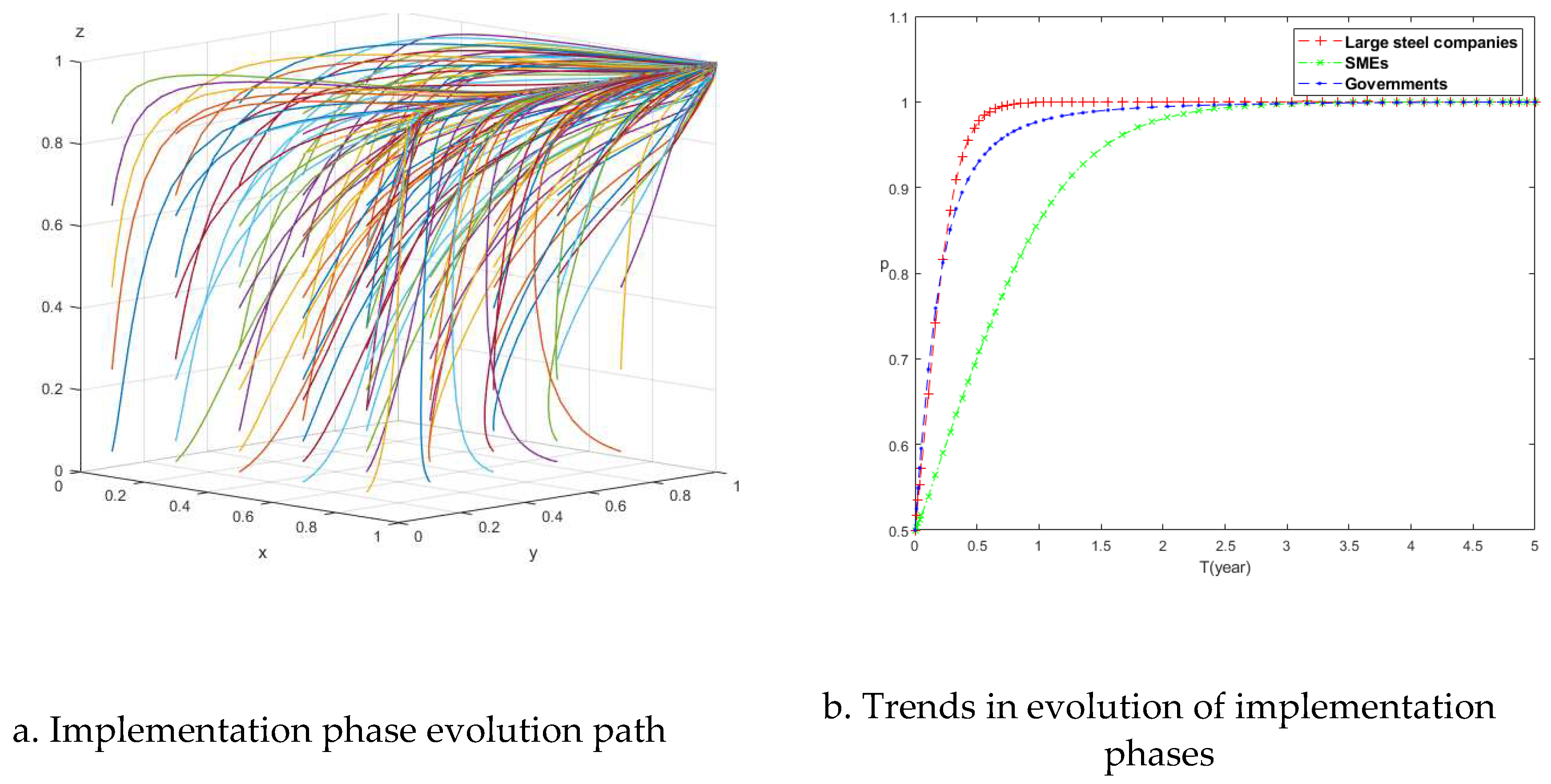

5.2. Results of evolutionary paths at different stages

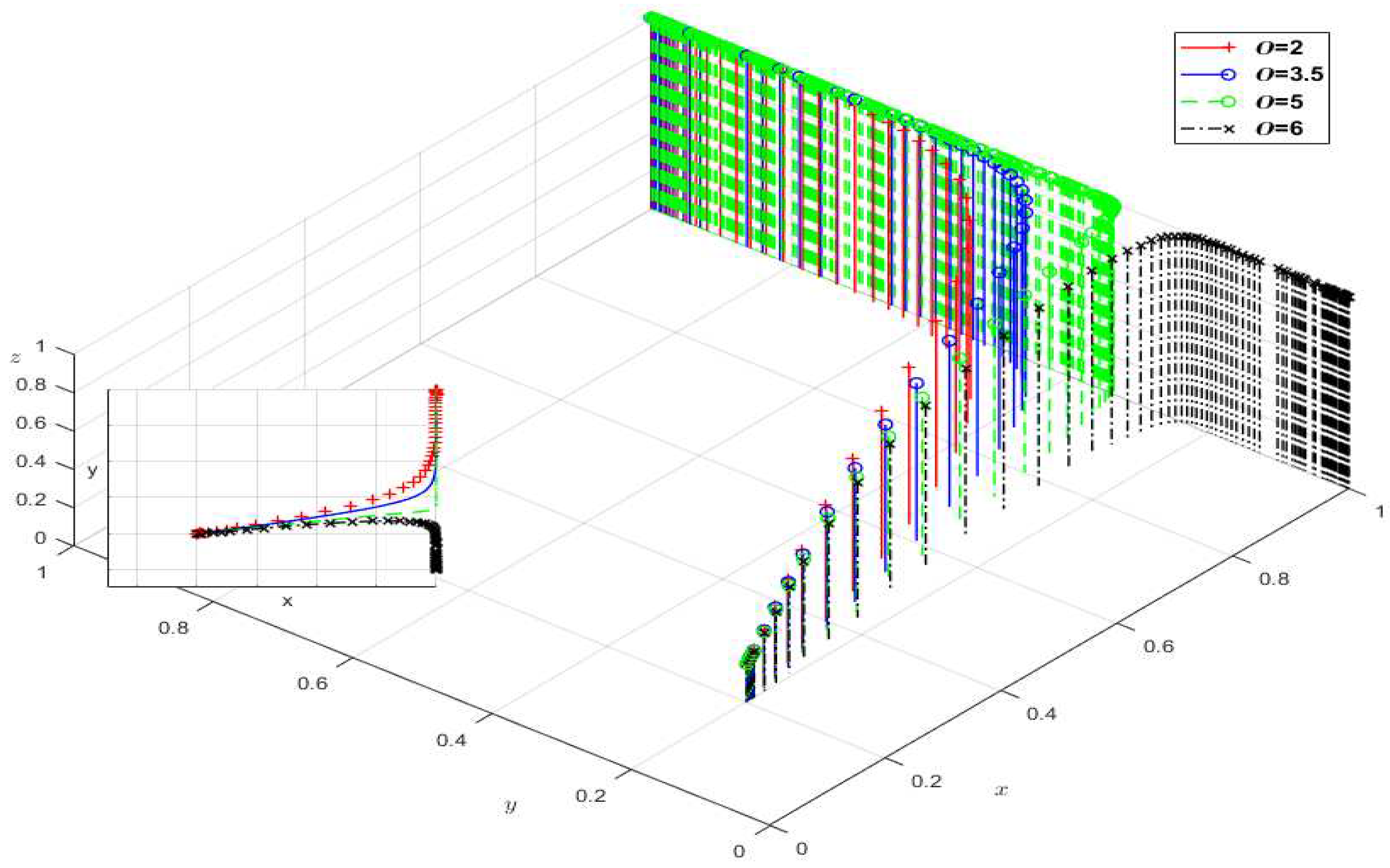

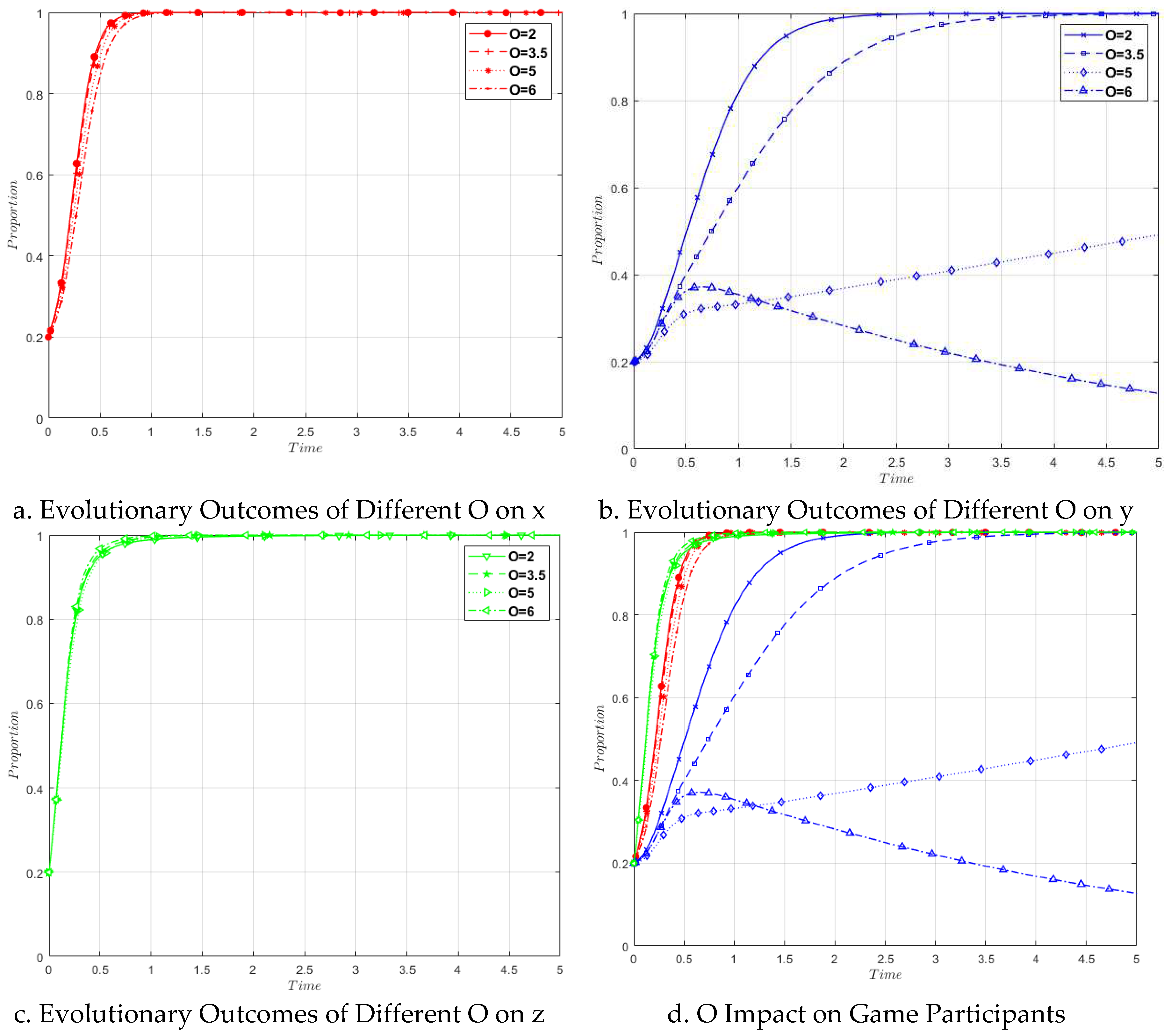

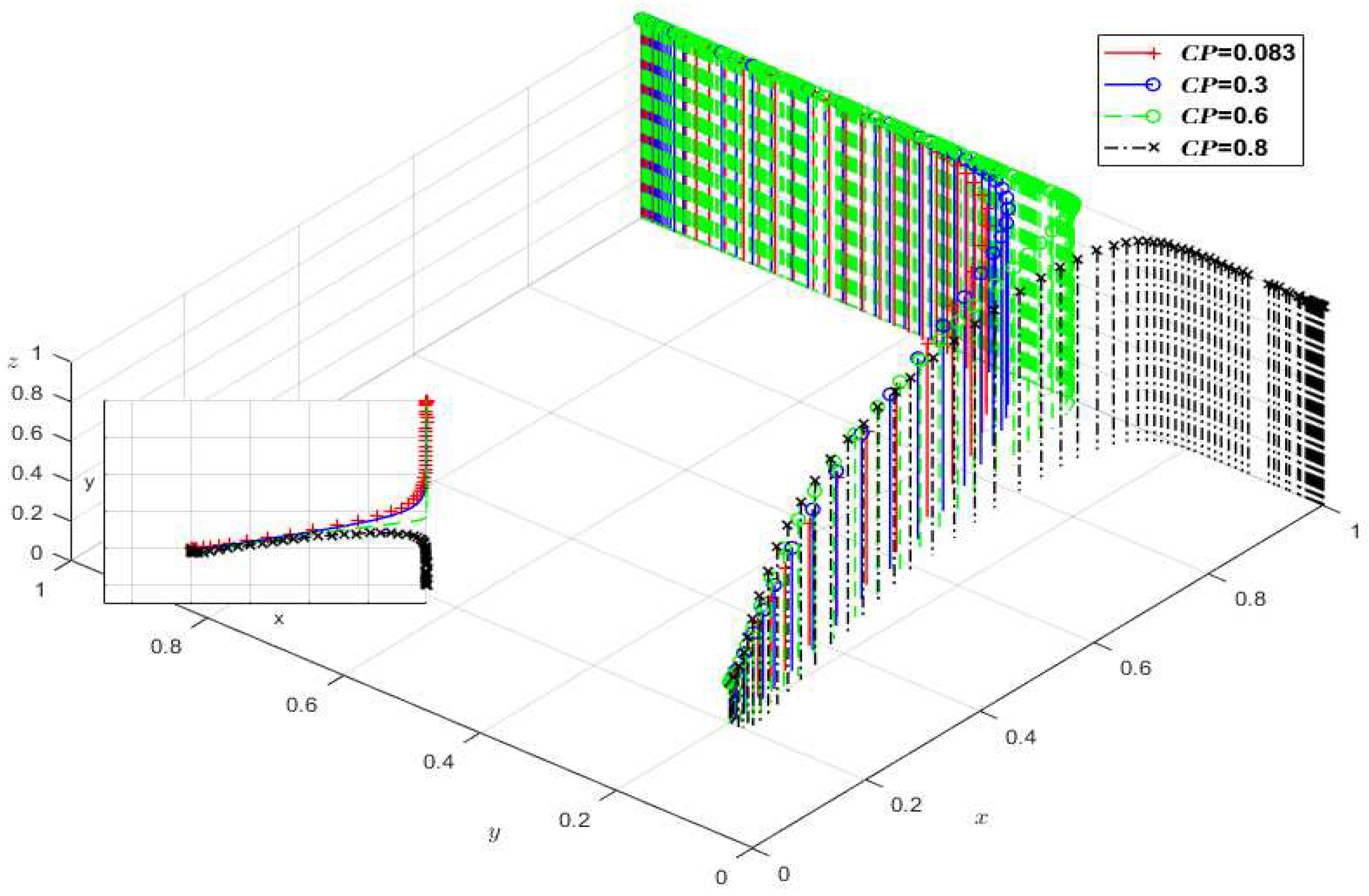

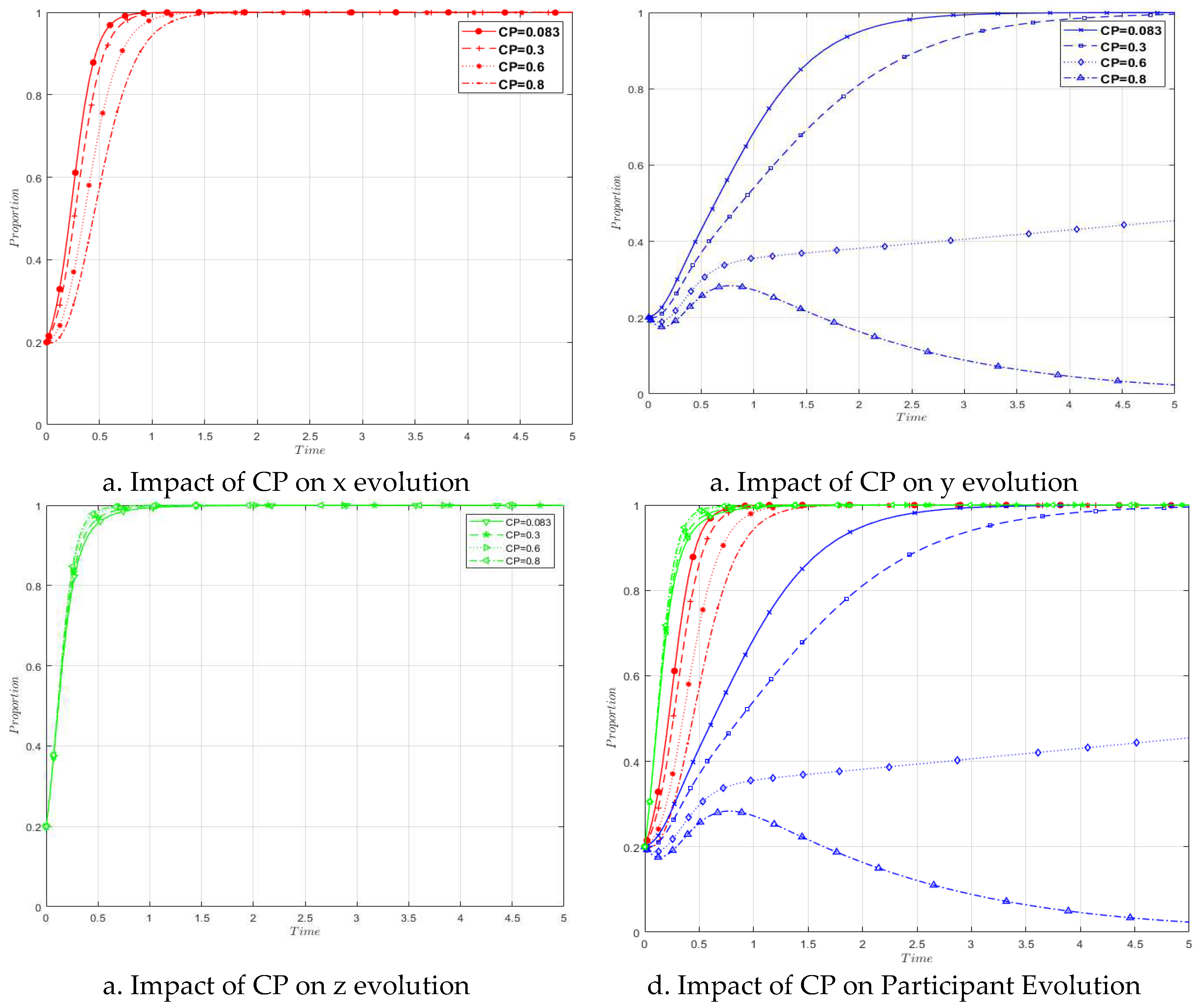

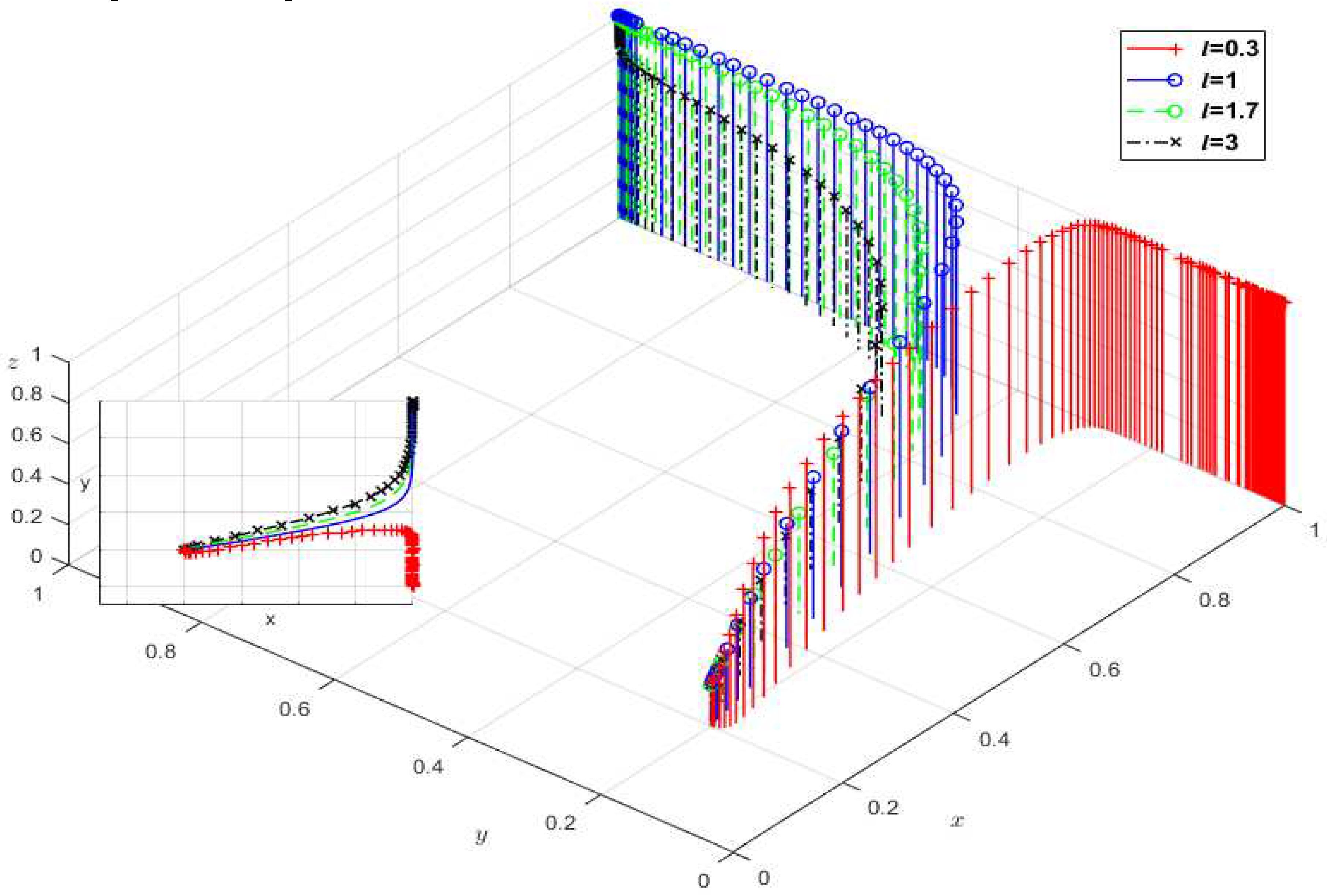

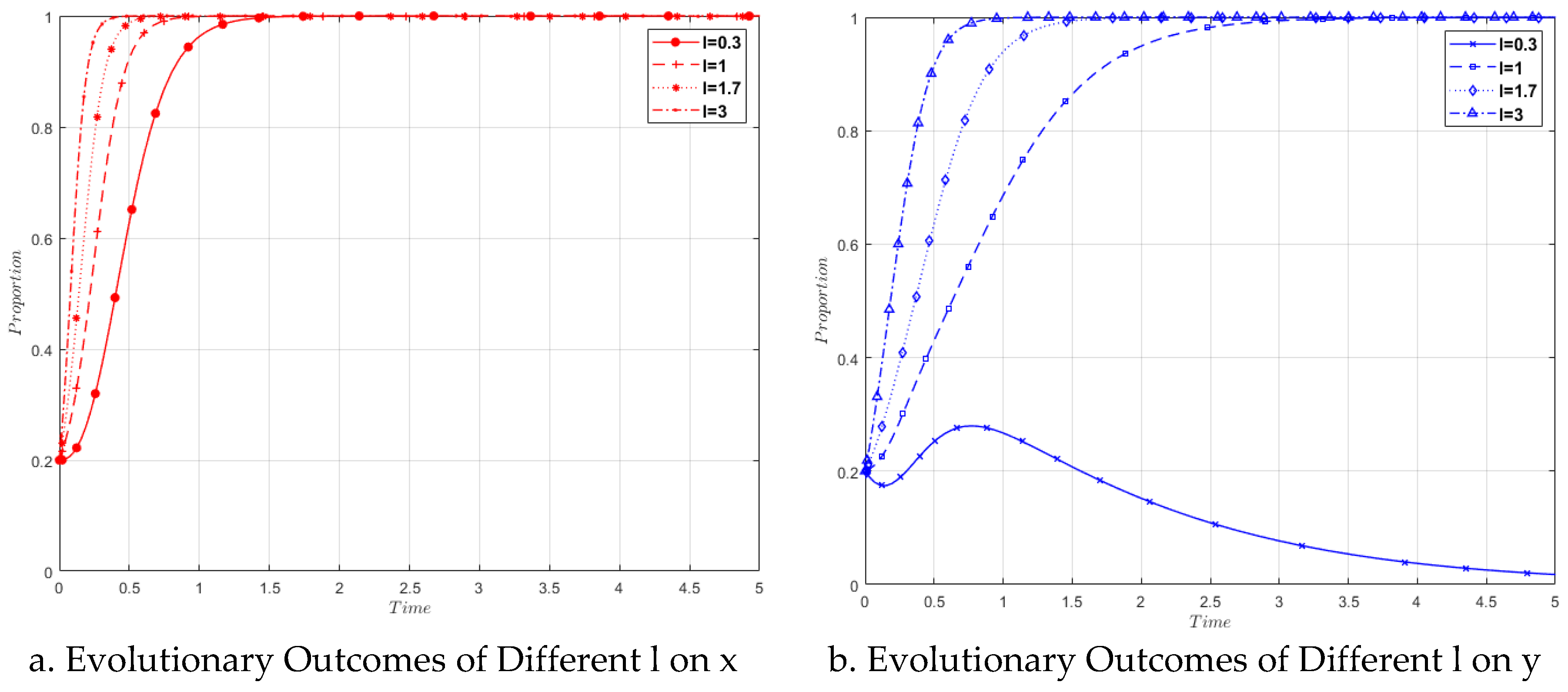

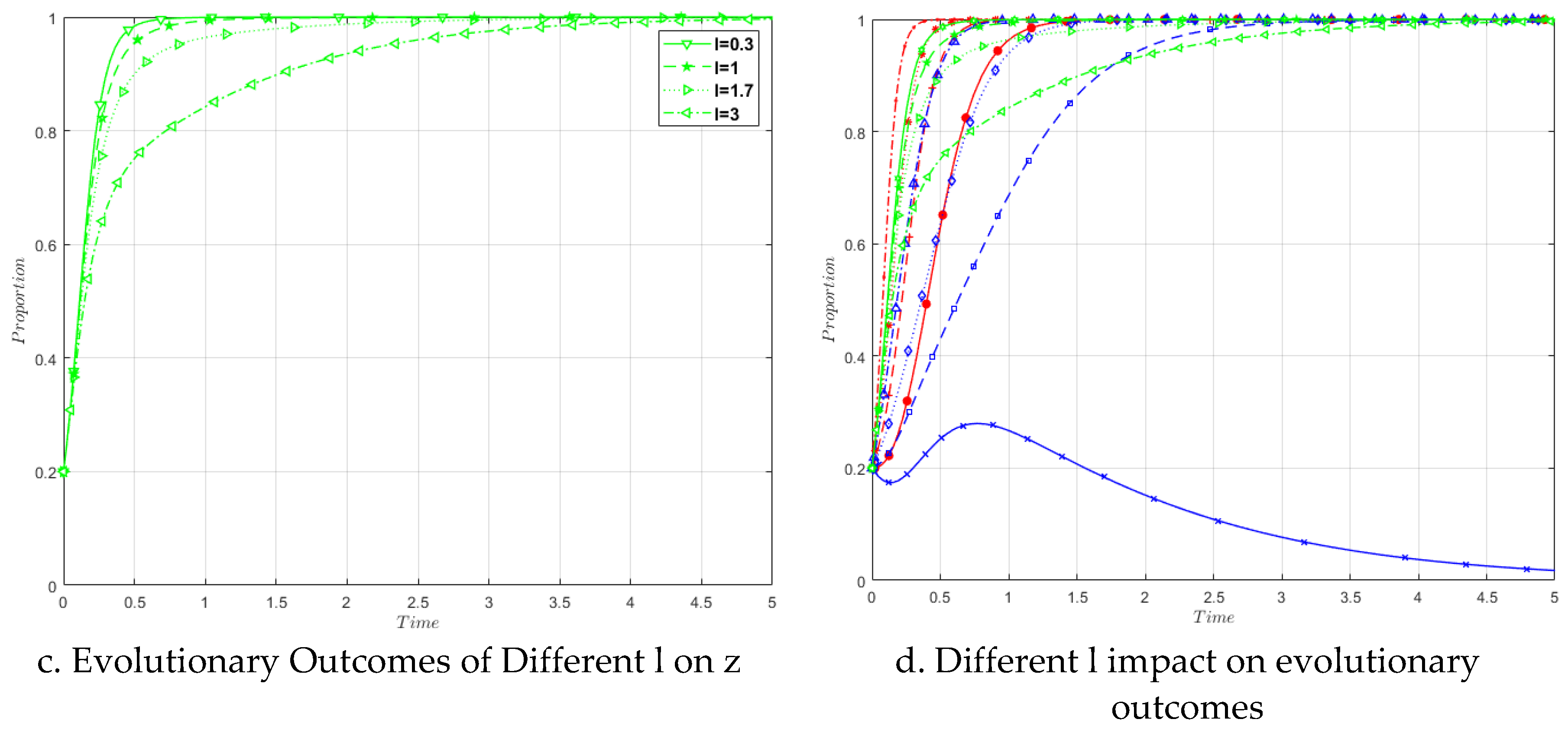

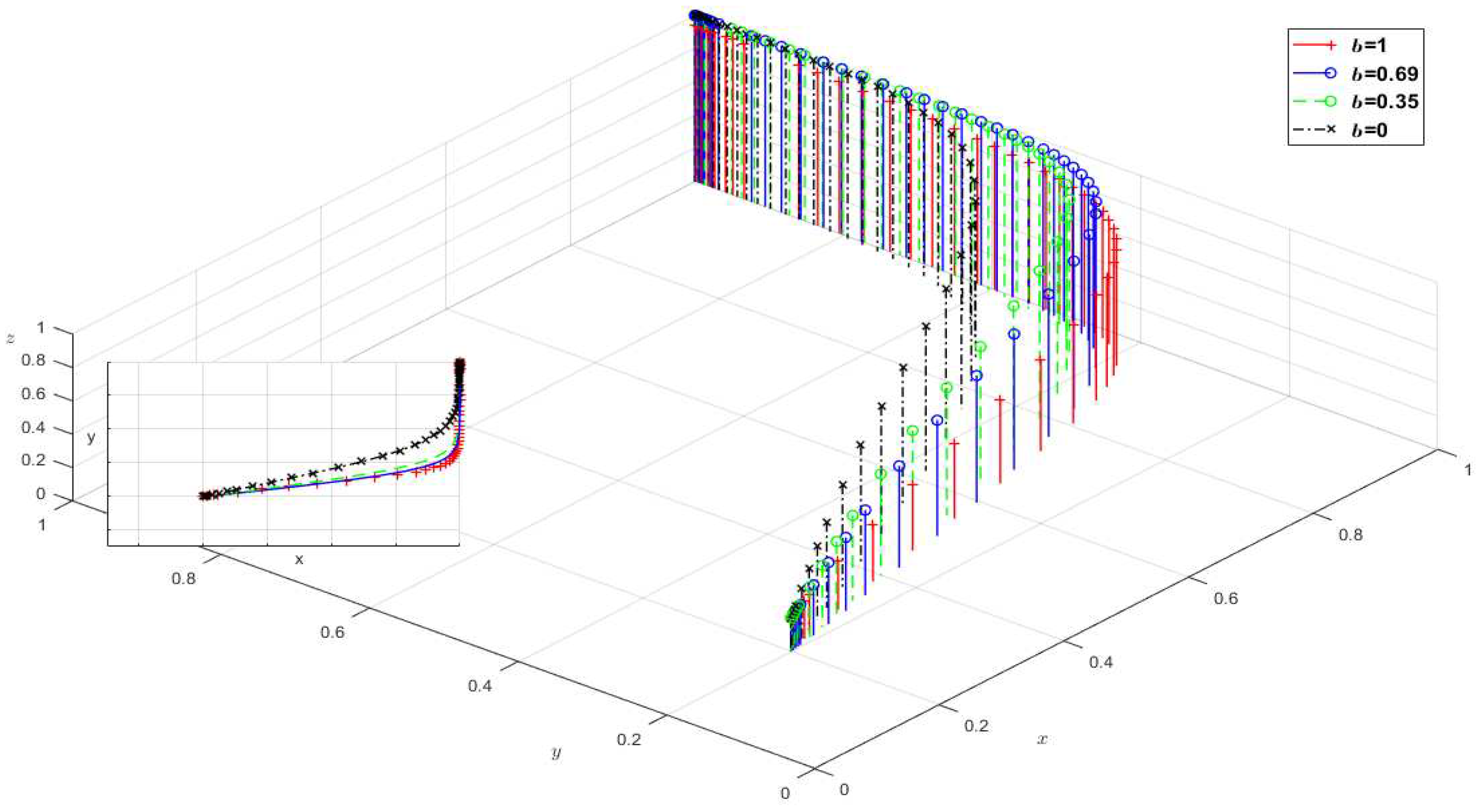

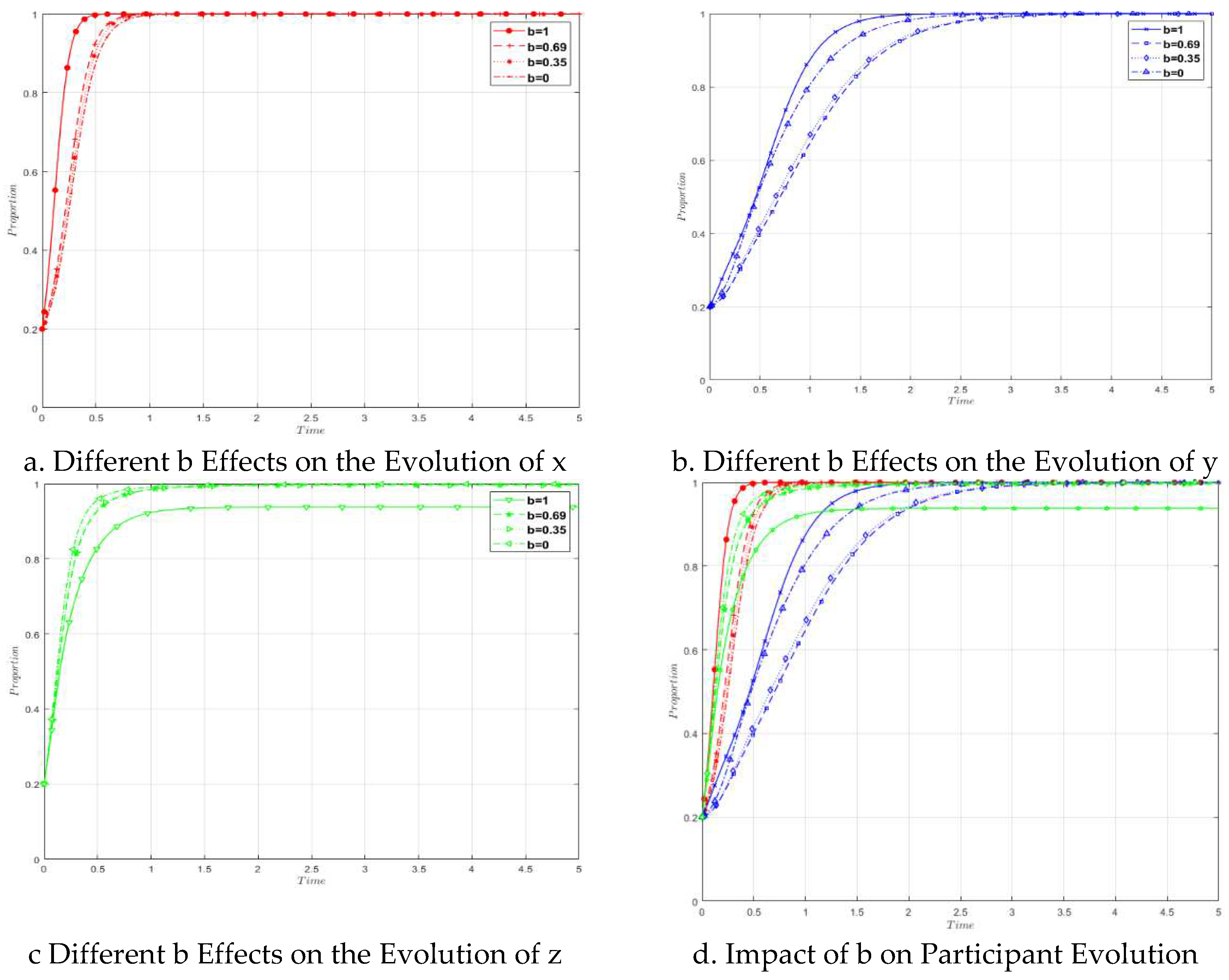

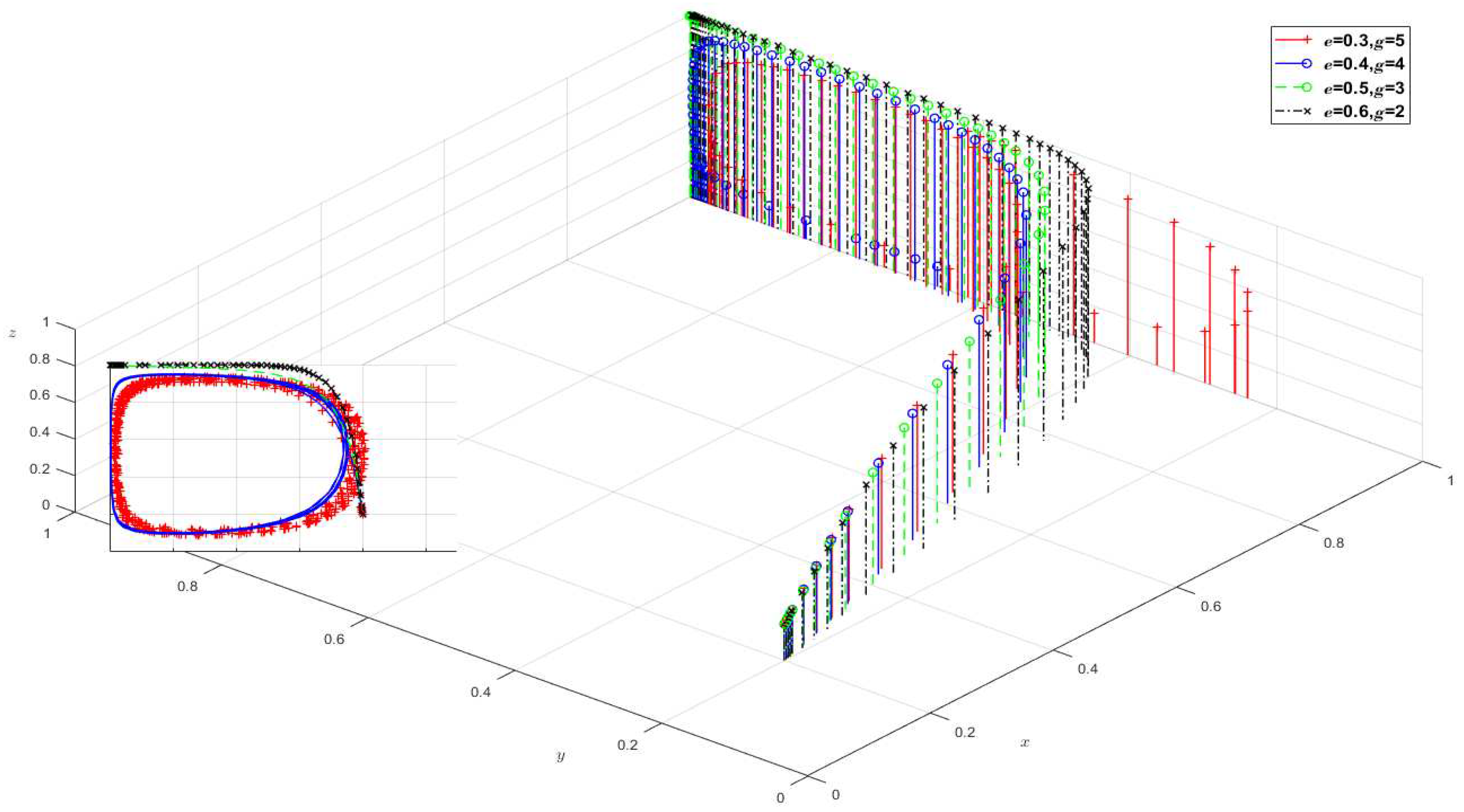

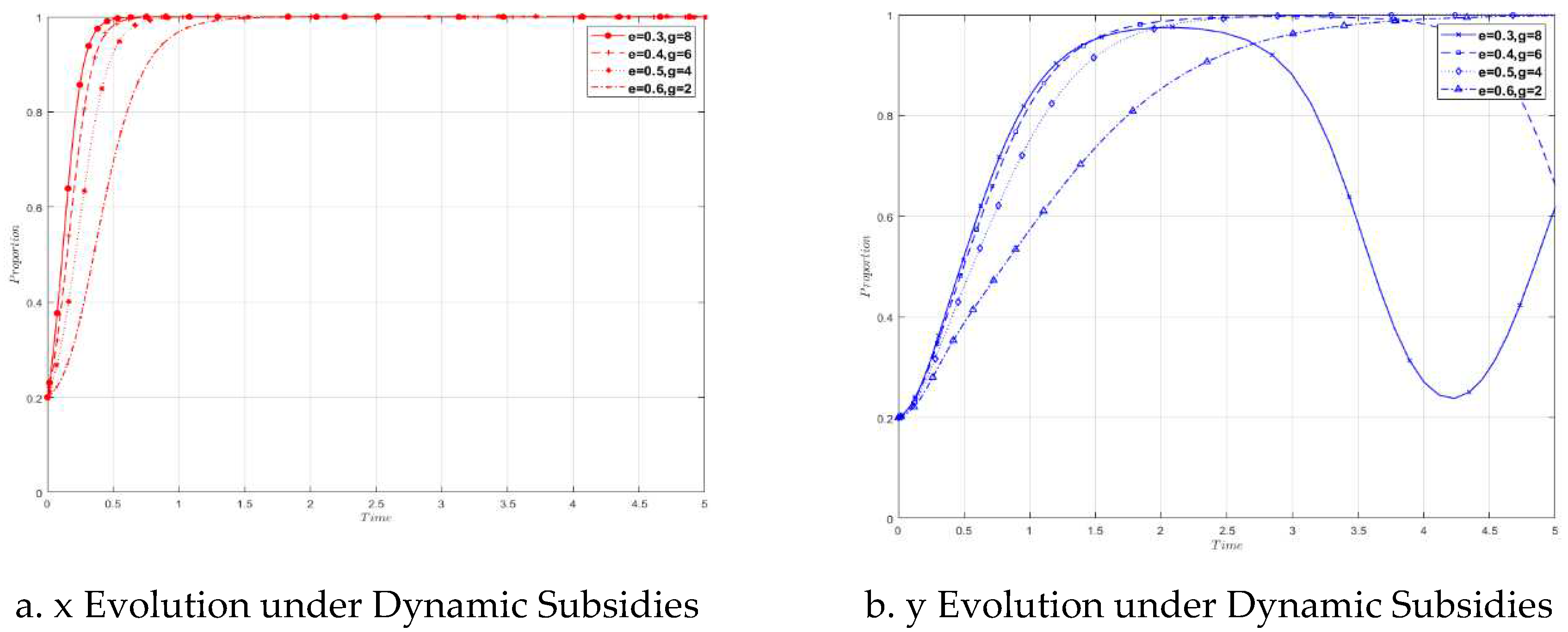

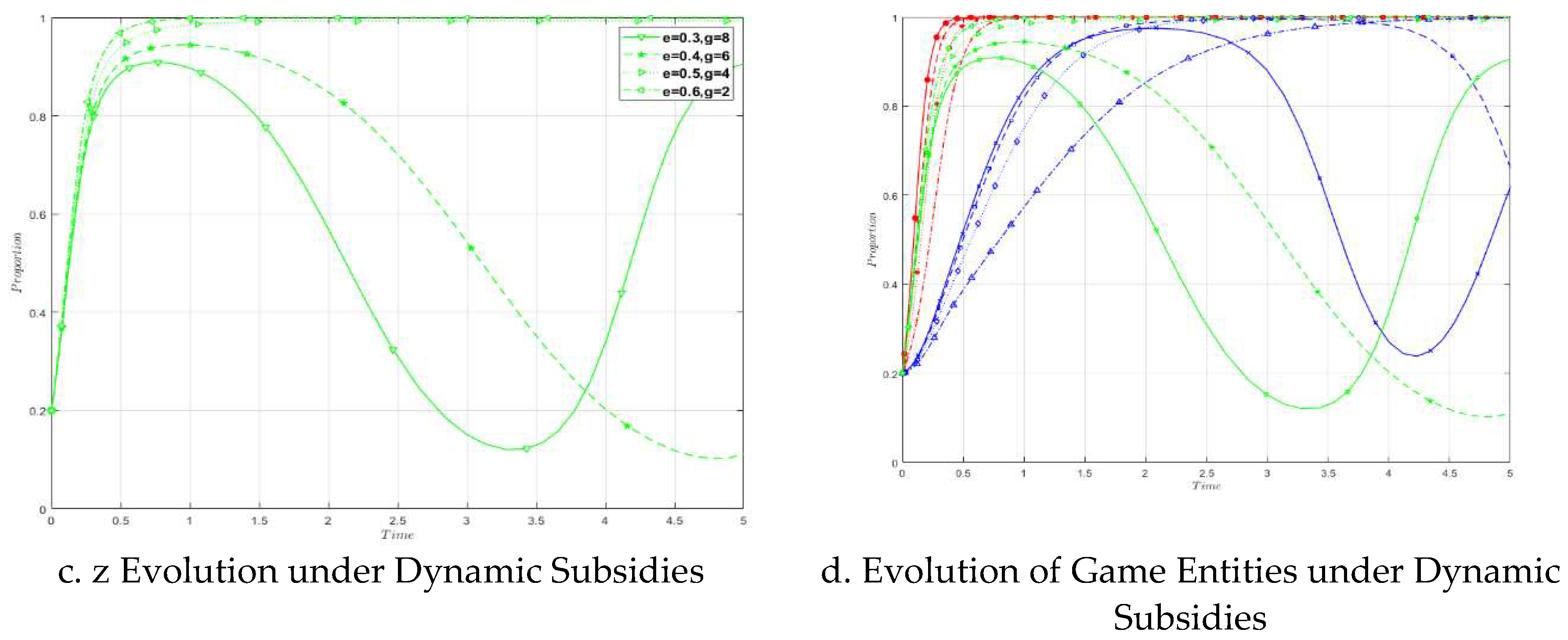

5.3. Sensitivity analysis of key variables to tripartite evolutionary systems

6. Conclusions and policy recommendations

- (1)

- Large-scale steel enterprises exhibit greater sensitivity to CBAM, leading them to prioritize low-carbon upgrade strategies. The government's attitude towards CBAM management will shift gradually from passive to proactive as CBAM is implemented, and with the improvement of regulations and changes in corporate behavior, it will ultimately return to a passive state. Small and medium-sized enterprises are less affected by CBAM, and the probability of choosing low-carbon upgrade strategies depends on proactive government management.

- (2)

- Free-rider benefits are a major hindrance to enterprises' low-carbon upgrades, with substantial free-rider benefits significantly suppressing the enthusiasm of small and medium-sized enterprises for low-carbon upgrades.

- (3)

- The export volume of steel products plays a decisive role in enterprises' decisions to choose low-carbon upgrades. With an increase in export volume, steel enterprises of different scales evolve towards the decision of "implementing low-carbon upgrades" in a shorter time and at a faster rate. Government constraints, such as limitations on fiscal expenditures like tax refunds, will slow down the speed of evolution towards a stable state.

- (4)

- With the implementation of CBAM, the reduction of free carbon quotas in the EU will not have a decisive impact on the decisions of the three parties involved but will only affect the rate at which the entities evolve towards stable points.

- (5)

- The improvement of the Chinese carbon market serves as an effective means to address CBAM. When the gap between domestic carbon prices in China and EU carbon prices narrows, it will alter the evolutionary trend of enterprises, shifting from upgrades to maintaining their existing structures. This highlights that a robust carbon pricing mechanism can effectively alleviate the trade impact brought about by CBAM.

- (6)

- Government dynamic subsidies and penalties for enterprises should be within an optimal range to generate the most effective incentives and punitive effects with minimal fiscal expenditure. Excessive penalties or subsidies are not conducive to enterprises choosing low-carbon production models and can increase the financial burden on companies. Small and medium-sized steel enterprises exhibit greater sensitivity to government policies, leading to evolutionary changes in response to fluctuations in government strategies.

- (1)

- To prevent free-rider phenomena and expedite the low-carbon upgrading transformation of steel enterprises, the government should formulate effective environmental policies and regulations. Establishing a low-carbon standard system, increasing the free-riding costs for small and medium-sized enterprises as well as large enterprises, and minimizing the benefits derived by enterprises from free-riding behaviors are essential measures. This approach aims to reduce free-rider occurrences, thereby promoting the low-carbon upgrading of enterprises.

- (2)

- Enhance the mechanism of the Chinese carbon trading market and reduce the gap between Chinese carbon prices and international carbon prices. Establish a robust carbon pricing mechanism and progressively facilitate the entry of the steel industry into the Chinese carbon market. This will alleviate the carbon tax pressure resulting from the implementation of CBAM, ensuring the high competitiveness of steel products in the international market.

- (3)

- The government should implement appropriate penalties and fiscal support to facilitate the evolution of enterprises towards the "implementing low-carbon upgrades" strategy. When providing subsidies and penalties, a graded approach based on different enterprise scales should be adopted to determine the penalty and low-carbon subsidy amounts. This approach prevents individual enterprises from exploiting low-carbon subsidies, while also avoiding additional fiscal pressure on the government due to excessive financial expenditures. Through judicious penalties and incentives, the entire steel industry can be encouraged to undergo low-carbon upgrades, harnessing the regulatory guidance role of the government.

Author Contributions

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Beck, U.R.; Kruse-Andersen, P.K.; Stewart, L.B. Carbon leakage in a small open economy: The importance of international climate policies. Energy Economics 2023, 117, 106447. [Google Scholar] [CrossRef]

- European Union. 2023. Commission Implementing Regulation (EU) 2023/1773 of 17 August 2023 laying down the rules for the application of Regulation (EU) 2023/956 of the European Parliament and of the Council as regards reporting obligations for the purposes of the carbon border adjustment mechanism during the transitional period. Official Journal of the European Union, L 228, 94–195. ELI Link:. http://data.europa.eu/eli/reg_impl/2023/1773/oj.

- Carbon Border Adjustment Mechanism. Available online: https://ec.europa.eu/taxation_customs/green-taxation-0/carbon-border-adjustment-mechanism_en (accessed on 25 December 2021).

- Xu, J.; Lu, C.; Ruan, S.; et al. Estimating the efficiency and potential of China's steel products export to countries along the “Belt and Road” under interconnection: An application of extended stochastic frontier gravity model. Resources Policy 2022, 75, 102513. [Google Scholar] [CrossRef]

- Cali, M.; Ghose, D.; Montfaucon, A.F.; et al. Trade Policy and Exporters’ Resilience[J]. 2022.

- Ren, Y.; Liu, G.; Shi, L. The EU Carbon Border Adjustment Mechanism will exacerbate the economic-carbon inequality in the plastic trade[J]. Journal of Environmental Management, 2023, 332, 117302. [Google Scholar] [CrossRef] [PubMed]

- Zhu, N.; Qian, L.; Jiang, D.; Mbroh, N. A simulation study of China's imposing carbon tax against American carbon tariffs. Journal of Cleaner Production 2020, 243, 118467. [Google Scholar] [CrossRef]

- Gu, R.; Guo, J.; Huang, Y.; Wu, X. Impact of the EU carbon border adjustment mechanism on economic growth and resources supply in the BASIC countries. Resources Policy 2023, 85, 104034. [Google Scholar] [CrossRef]

- Lin, B.; Zhao, H. Evaluating current effects of upcoming EU Carbon Border Adjustment Mechanism: Evidence from China's futures market. Energy Policy 2023, 177, 113573. [Google Scholar] [CrossRef]

- Qi, S.; Xu, Z.; Yang, Z. China's carbon allowance allocation strategy under the EU carbon border adjustment mechanism: An integrated non-parametric cost frontier approach. Science of the Total Environment 2022, 831, 154908. [Google Scholar] [CrossRef]

- Yang, C.; Yan, X. Impact of carbon tariffs on price competitiveness in the era of global value chain. Applied Energy 2023, 336, 120805. [Google Scholar] [CrossRef]

- Yu, Y.Y.; Liu, L.J.; Wang, H.J. Who is most affected by carbon tax? Evidence from Chinese residents in the context of aging. Energy Policy 2024, 185, 113956. [Google Scholar] [CrossRef]

- Naef, A. The impossible love of fossil fuel companies for carbon taxes. Ecological Economics 2024, 217, 108045. [Google Scholar] [CrossRef]

- Wang, Z.J.; Zhou, R.F.; Ma, Y.F.; Yong-Jian, W. Carbon tax and low-carbon credit: Which policy is more beneficial to the capital-constrained manufacturer's remanufacturing activities? Environmental Research 2023, 118079. [Google Scholar] [CrossRef] [PubMed]

- Lamb, W.F.; Antal, M.; Bohnenberger, K.; et al. What are the social outcomes of climate policies? A systematic map and review of the ex-post literature[J]. Environmental Research Letters 2020, 15, 113006. [Google Scholar] [CrossRef]

- Von Neumann, J.; Morgenstern, O. (1947). Theory of games and economic behavior, 2nd rev.

- Zhou, W.; Zhao, T.; Cao, X.; Li, J. Government regulation, horizontal coopetition, and low-carbon technology innovation: A tripartite evolutionary game analysis of government and homogeneous energy enterprises. Energy Policy 2024, 184, 113844. [Google Scholar] [CrossRef]

- Meng, L.; Liu, K.; He, J.; Han, C.; Liu, P. Carbon emission reduction behavior strategies in the shipping industry under government regulation: A tripartite evolutionary game analysis. Journal of Cleaner Production 2022, 378, 134556. [Google Scholar] [CrossRef]

- Yuan, M.; Li, Z.; Li, X.; Li, L.; Zhang, S.; Luo, X. How to promote the sustainable development of prefabricated residential buildings in China: A tripartite evolutionary game analysis. Journal of Cleaner Production 2022, 349, 131423. [Google Scholar] [CrossRef]

- Zhang, C.; Zhang, X. Evolutionary game analysis of air pollution co-investment in emission reductions by steel enterprises under carbon quota trading mechanism. Journal of Environmental Management 2022, 317, 115376. [Google Scholar] [CrossRef]

- Liu, Y.; Cui, M.; Gao, X. Building up scrap steel bases for perfecting scrap steel industry chain in China: An evolutionary game perspective. Energy 2023, 278, 127742. [Google Scholar] [CrossRef]

- Zhang, Y.; He, Q. (2013, November). Evolutionary game analysis and computer simulation of iron ore price negotiation. In 2013 6th International Conference on Information Management, Innovation Management and Industrial Engineering (Vol. 1, pp. 409–412). IEEE.

- Lin, M.; Liu, S.Q.; Luo, K.; Burdett, R. Dynamic incentives to promote green production of the iron and steel industry in the post-pandemic period. Annals of Operations Research 2023, 1–37. [Google Scholar] [CrossRef]

- Han, S. Strongly robust equilibrium and competing-mechanism games. Journal of Economic Theory 2007, 137, 610–626. [Google Scholar] [CrossRef]

- Hu, J. Synergistic effect of pollution reduction and carbon emission mitigation in the digital economy[J]. Journal of Environmental Management 2023, 337, 117755. [Google Scholar] [CrossRef]

- Muslemani, H.; Liang, X.; Kaesehage, K.; et al. Opportunities and challenges for decarbonizing steel production by creating markets for ‘green steel’products[J]. Journal of Cleaner Production 2021, 315, 128127. [Google Scholar] [CrossRef]

- Uyarra, E.; Shapira, P.; Harding, A. Low carbon innovation and enterprise growth in the UK: Challenges of a place-blind policy mix. Technological Forecasting and Social Change 2016, 103, 264–272. [Google Scholar] [CrossRef]

- Zhang, Z.; Shang, Y.; Zhang, G.; Shao, S.; Fang, J.; Li, P.; Song, S. The pollution control effect of the atmospheric environmental policy in autumn and winter: Evidence from the daily data of Chinese cities. Journal of Environmental Management 2023, 343, 118164. [Google Scholar] [CrossRef] [PubMed]

- Xu, S.; Tang, H.; Lin, Z.; et al. Pricing and sales-effort analysis of dual-channel supply chain with channel preference, cross-channel return and free riding behavior based on revenue-sharing contract[J]. International Journal of Production Economics 2022, 249, 108506. [Google Scholar] [CrossRef]

- Schreurs, M.A.; Economy, E. (Eds.). (1997). The internationalization of environmental protection (No. 54). Cambridge University Press.

- Gaines, S.E. (1997). Rethinking Environmental Protection, Competitiveness, and International Trade. U. Chi. Legal F., 231.

- Weiss, E.B.; Jacobson, H.K. (Eds.). (2000). Engaging countries: strengthening compliance with international environmental accords. MIT press.

- Ekins, P.; Speck, S. Competitiveness and exemptions from environmental taxes in Europe. Environmental and resource economics 1999, 13, 369–396. [Google Scholar] [CrossRef]

- Liang, Q.M.; Wang, T.; Xue, M.M. Addressing the competitiveness effects of taxing carbon in China: domestic tax cuts versus border tax adjustments. Journal of Cleaner Production 2016, 112, 1568–1581. [Google Scholar] [CrossRef]

- Landrigan, P.J.; Fuller, R.I.C.H.A.R.D. Environmental pollution: an enormous and invisible burden on health systems in low-and middle-income counties. World Hosp Health Serv 2012, 50, 35. [Google Scholar]

- National Research Council. (2010). Hidden costs of energy: unpriced consequences of energy production and use. National Academies Press.

- Nilsson, U.S.; Uggla, C.; Wainwright, J. A Dynamical Systems Approach to Geodesics in Bianchi Cosmologies. General Relativity and Gravitation 2000, 32, 1981–2005. [Google Scholar] [CrossRef]

- Lyapunov, A.M.; Walker, J.A. (March 1, 1994). "The General Problem of the Stability of Motion." ASME. J. Appl. Mech. March 1994, 61, 226–227. [Google Scholar] [CrossRef]

- Ritzberger, K.; Weibull, J.W. .Evolutionary Selection in Normal-Form Games[J]. Econometrica 1995, 63, 1371–1399. [Google Scholar] [CrossRef]

- Chen, G. Impact of carbon border adjustment mechanism on China's manufacturing sector: A dynamic recursive CGE model based on an evolutionary game. Journal of Environmental Management 2023, 347, 119029. [Google Scholar] [CrossRef] [PubMed]

- Jiang, S.; Wei, X.; Jia, J.; Ma, G. Toward sustaining the development of green residential buildings in China: A tripartite evolutionary game analysis. Building and Environment 2022, 223, 109466. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, A. Government subsidies, market competition and the TFP of new energy enterprises. Renewable Energy 2023, 216, 119090. [Google Scholar] [CrossRef]

- Chu, Z.; Bian, C.; Yang, J. Air pollution regulations in China: A policy simulation approach with evolutionary game. Problemy Ekorozwoju 2022, 17. [Google Scholar] [CrossRef]

- Mörsdorf, G. A simple fix for carbon leakage? Assessing the environmental effectiveness of the EU carbon border adjustment. Energy Policy 2022, 161, 112596. [Google Scholar] [CrossRef]

- Tsai, I.C. Impact of proximity to thermal power plants on housing prices: Capitalizing the hidden costs of air pollution. Journal of Cleaner Production 2022, 367, 132982. [Google Scholar] [CrossRef]

- Wang, X.; Zhu, L. How does export VAT rebates policy affect corporate investment efficiency? Evidence from corporate tax stickiness. Pacific-Basin Finance Journal 2023, 82, 102130. [Google Scholar] [CrossRef]

- Chang, K.; Long, Y.; Yang, J.; Zhang, H.; Xue, C.; Liu, J. Effects of subsidy and tax rebate policies on green firm research and development efficiency in China. Energy 2022, 258, 124793. [Google Scholar] [CrossRef]

| Game Participants | Governments | ||||

|---|---|---|---|---|---|

| Proactive response (z) | Passive management (1-z) | ||||

| Small and medium-sized enterprises 2 | |||||

| Low-carbon upgrading (y) | traditional production (1-y) | Low-carbon upgrading (y) | traditional production (1-y) | ||

| Large steel companies 1 | Low-carbon upgrading (x) | ||||

|

traditional production (1-x) |

|||||

| Equilibrium point | |||

|---|---|---|---|

| Equilibrium point | stability | Stability conditions |

|---|---|---|

| saddle point | - | |

| ESS | ||

| ESS | ||

| ESS | ||

| ESS | ||

| ESS | ||

| ESS | ||

| ESS |

| parameter value | window stage | Transition phase | Implementation phase | intensive phase |

|---|---|---|---|---|

| V1 | 15 | 15 | 15 | 15 |

| V2 | 10 | 10 | 10 | 12 |

| α | 0.35 | 0.35 | 0.35 | 0.35 |

| β | 0.25 | 0.25 | 0.25 | 0.25 |

| C1 | 12 | 12 | 12 | 12 |

| C2 | 10 | 10 | 10 | 10 |

| δ | 0.75 | 0.75 | 0.75 | 0.75 |

| e | 0.4 | 0.4 | 0.5 | 0.5 |

| g | 2 | 2 | 3 | 3 |

| r | 3 | 3 | 4 | 4 |

| Oi | 3 | 5 | 3 | 2 |

| L | 5 | 5 | 4 | 4 |

| N1 | 15 | 15 | 14 | 14 |

| N2 | 12 | 10 | 10 | 10 |

| M1 | 8 | 8 | 8 | 8 |

| M2 | 6 | 6 | 6 | 6 |

| ES | 6 | 6 | 6 | 6 |

| b | 1 | 0.9 | 0.5 | 0 |

| EP | 1 | 1 | 1 | 1 |

| CP | 0.083 | 0.083 | 0.083 | 0.083 |

| l | 1 | 1 | 1 | 2 |

| Vg | 10 | 10 | 10 | 10 |

| Cg | 6 | 6 | 6 | 6 |

| F | 5 | 8 | 15 | 8 |

| E1 | 4 | 4 | 4 | 4 |

| E2 | 3 | 3 | 3 | 3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).