1. Introduction

A careful examination of value cocreation (VCC) studies, which has become highly salient to marketers in recent years, highlights two key activities that initiate and advance the process: collaboration and dialogical interactions (Lusch and Vargo, 2007; Prahalad and Ramaswami, 2004) between stakeholders providing mobile financial services (MFS) in Emerging Markets (Ems). Such digital finance could benefit billions of people by spurring inclusive growth that adds $3.7 trillion to the GDP of emerging economies within a decade (Kim et al., 2018). EMs are markets characterize by weak capital market and regulatory infrastructures and fast-paced disruptive change. (Marquis, & Raynard, 2015).

Financial technology (Fintech) innovations are fast transforming the global financial industry and speeding up the financial inclusion initiatives of microfinance institutions (MFIs). Collaborating to engage in value cocreation means the integration of the firm-provider and customer’s resources (Vargo and Lusch, 2004). Dialogical interactions are processes of consistent exchange aimed at listening to the customer to share knowledge and to understand and identify known or latent needs (Ballantyne and Varey, 2008). Yet, collaboration and dialogical interactions with the customer are two key ingredients that have been missing from the innovation drive of firms engaged in mobile financial services in EMs and responsible for the failures and successes in this area. Researchers and marketers interested in mobile financial services success in emerging marketers have not yet identified that dialogical interactions are the underlying elements of value cocreation that provides the foundation for mobile financial services success when it facilitates financial inclusion. These markets as a new source of radical innovation. By directing attention on creating awareness, access, affordability, and availability (4As) (Dadzie, Amponsah, Dadzie & Winston, 2017), managers can create an exciting environment for innovation. Firms such as Safaricom in Kenya have innovated mobile banking services such as M-Pesa and other products to enable customers use their mobile phones to access financial services and execute financial transactions. There have been, however, some innovation failures for other products after trying to engage in value cocreation with customers for mobile financial innovation. This study, after a careful analysis, pinpoints to the absence of effective collaboration when engaging in value cocreation with the customer for mobile financial services in EMs. As such, two key players of a multinational financial firm and a mobile network operator were interviewed on their value cocreation with customers in EMs that ensured mobile financial inclusion.

In this study, we seek to combine and build on extant work on VCC to advance the research questions of how does value cocreation ensure the success of mobile financial inclusion in EMs? This development highlights the VCC components of collaborations and dialogical interactions in prior work according to each study’s theoretical formulation of VCC. Integrating these diverse perspectives, we expose financial services inclusion as a key outcome of VCC in EMs with the view that dialogical interactions are the most effective way to achieve financial inclusion.

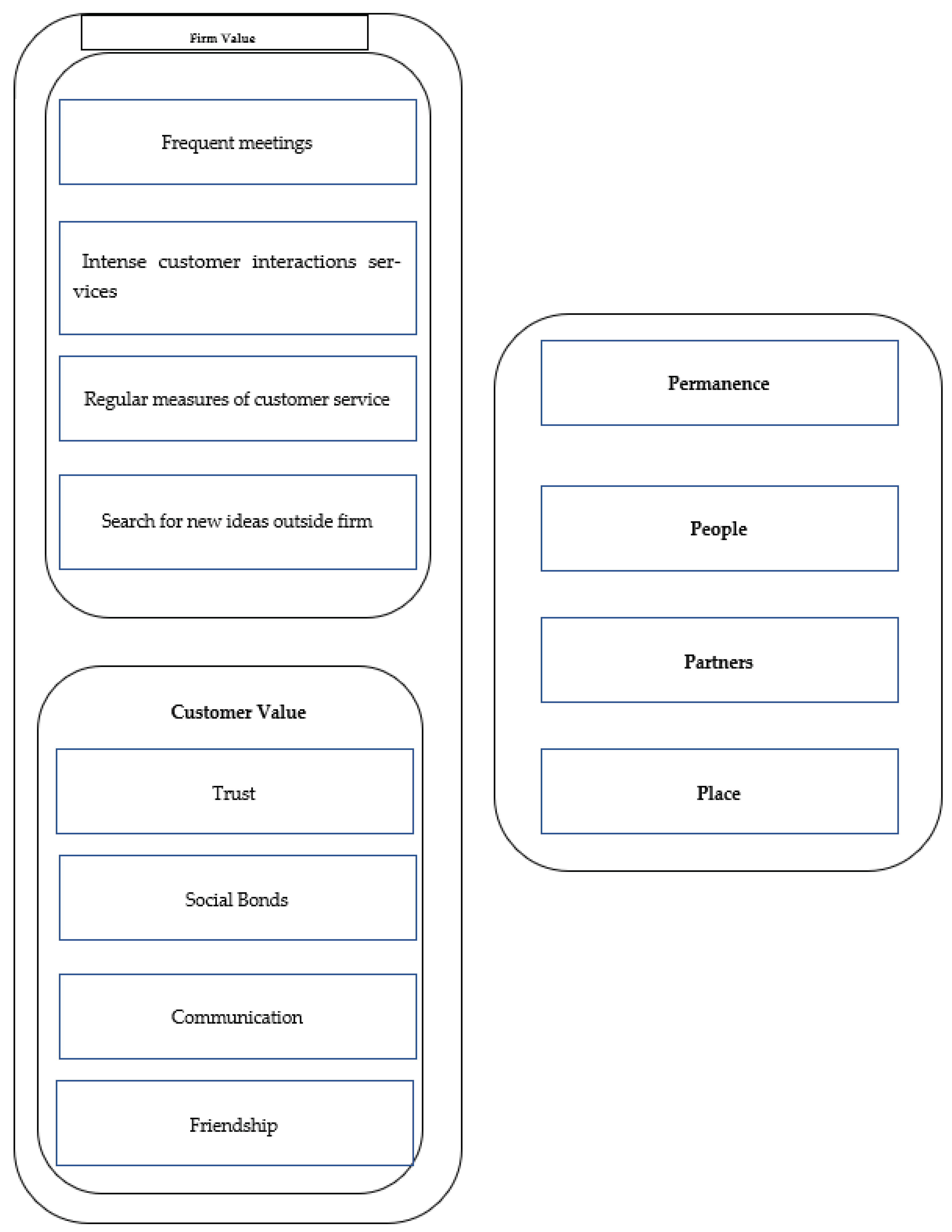

Motivated by and using insights from our conceptual development, we apply a qualitative study in the context of Ghana and Kenya. We derive four key themes of 1) frequency of meetings with customers; 2) intensity of customer interaction; 3) regular measures of customer service 4) search for new ideas outside organization. These themes together inform financial inclusion in EMs. We begin the next session with a summary of research on the value cocreation activities of collaboration and dialogical interactions. We follow up with the details of the qualitative descriptive methodology utilizing exemplars from extant research. Findings from the qualitative descriptive study and analyzing the data from the contexts of Ghana and Kenya is provided. We end with discussions and conclusions and point the direction to future research in this area.

Conceptual Development

We reviewed extant literature related to collaborations and dialogical interactions during VCC and determined key differences relating to these activities in EMs. The conceptual development embodies these perspectives in EMs. Operating in markets with weak business infrastructures as exist in EMs significantly impacts not only how value is co-created, but also the type(s) of value that is co-created. For example, while value for a business customer in a Western market might be convenience, value for the micro-entrepreneur in African markets might be an enhanced ability to leverage social networks. Incorporating non-Western markets is vital to gaining a global perspective and a more comprehensive understanding of the value cocreation process for digital financial inclusion.

Collaboration and Dialogical Interactions

In VCC, consumers engage in value cocreation with the firm involving elements of trust, commitment, social bonds, communication and even friendship (Forsström, 2005). This is therefore an equitable relationship that manifest the firm’s customer centrism (Prahalad and Ramaswamy, 2002), willingness to share control (Fisher and Smith, 2011), and provision of a facilitative environment (Storbacka and Nenonen, 2011). Both the firm and the customer do the asking, listening, observing, and experimenting during dialogical interactions (Sapir et al., 2016). Lundkvist et al., (2004) suggest that the purpose of dialogical interaction is not merely to exchange information, but rather, to explore and jointly create new knowledge. The first rule of engagement is that dialogical interactions should be motivating for both the firm and customer, centering on issues of interest to both (Campbell, 2003). The customer must be kept actively interested in the process and aware of the benefits to be motivated to share knowledge and skills (Prahalad and Ramaswamy, 2004). For example, a firm-provider may need to provide education seminars for both parties to be on the same page. To further motivate the customer, the firm should also provide facilitating innovation environments (Prahalad and Ramaswami, 2004). Secondly, the firm should provide supportive encounters - emotionally, cognitively, and physically (Payne et al., 2007). Thirdly, the customer needs to trust the firms not to misuse the information they provide or unfairly exploit the relationship, which furthermore means that there should be necessary transparency for effective collaboration and to build trust (Prahalad and Ramaswamy, 2004). Without trust and motivation, the customer may not share vital information (Sawhney and Prandelli, 2000). Rules of engagement also require that the process should be compatible with existing customer skills and should make adaptation to the customer’s activities easy (Schoenbachler and Gordon, 2002). Through the different levels of interaction, a service provider aligns “its resources, competencies and processes with the customers’ value-generating processes” (Grönroos, 2004, p. 152). Interaction is the primary interface between actors and an opportunity for firms operating in EMs to understand, share, and serve needs, and to simultaneously assess and adapt resource commitments (Prahalad and Ramaswamy, 2004).

Although existing studies demonstrate that collaboration and dialogical interactions build a close working relationship between the firm-provider and customer, the assumption is that the process of collaboration and dialogical interactions for value cocreation is efficiently supported by the required business infrastructures and results in financial inclusion. The findings of this study provide insights on financial inclusion strategies involving collaboration and dialogical interactions with the customer in EMs with weak business infrastructures and unique socio-cultural influences as a precursor to sustainable value cocreation outcomes.

Financial Inclusion

The World Bank defines financial inclusion as consumers and businesses having “access to useful and affordable financial products and services that meet their needs”, with access to transactional accounts being the initial step toward financial inclusion (Demirguc-Kunt and Klapper, 2013). Digital Financial Services for financial inclusion has become an important avenue for the development of the micro, meso and macro-EMs. This situation occurs because digital financial services reduce costs, expenses and increases incomes of individual consumers, communities, agents, government, and other members of the associated value chain. Digital Financial Services through the mobile phone promotes sustainable inclusive economic growth and development (World Bank, 2013; Ouma et al., 2017) and reduces socio-economic vulnerabilities. Other studies discussing the business environment in subsistence markets address themes of sustainability, scalability, and embeddedness in these markets. Sustainability refers to the ability of projects to deliver and survive and involves issues such as value chain reconfigurations and consumer education (Anderson and Kupp, 2007; Prahalad and Hart, 2002). Scalability refers to the ability of projects to attain a wide reach and involves creating the potential for scale and replication. While some authors indicate that scalability can be reached through provision of transportable solutions (Prahalad and Fruehauf, 2005), other authors argue for scalability through using local entrepreneurs (Goyal et al., 2020). Some studies also argue that scalability can be achieved through the adaptation of value propositions to suit local market conditions such as exploring shared use, flexible payment, and tiered pricing (Prahalad and Hart, 2002; Boyer et al., 2003, Mendoza and Thelen, 2008). Embeddedness refers to the extent to which the business is an integral part of the lives of the local people. This involves the harnessing of native capability, local intelligence, and local market information (London and Hart, 2010). Embeddedness in these relational marketplaces also embraces the idea of making the local people co-owners or distributors of the business (Klein, 2008). These expositions demonstrate that sustainability, scalability, and embeddedness all inform financial inclusion, and this financial inclusion needs to be taken into consideration when firms engage in value cocreation with their customer in EMs. Our study therefore investigates this value cocreation and mobile financial inclusion in EMs.

3. Results

We found high significant correlation between offering new service channels to order new services and adjust customer complaints (.774) and to deliver new services (.823); offering new service channels to adjust customer complaints and to deliver new services (.789); offering new services to provide after-sales service and conformance with existing service channels (.803); offering new service channels to order new service channels along with other new service channels (.728). We ran paired-sample t-test on the highly correlated items and found only significant mean differences between offering new service channels to adjust customer complaints (mean=3.697) and to deliver new services (mean=3.795) (t-test=4.204; p=.000). The findings from this descriptive study propose a sustainable business model that can help MNCs and other FSPs effectively deliver mobile money services to the bottom of the pyramid market segments. Our analyses show that there is the need for frequent and intense interactions with customers, frequent monitoring, and the need to obtain external ideas on the part of the MNC.

This value cocreation is dependent on the communication from customers, trust, social bonds, and friendship which would rely on the value cocreation processes of collaboration and dialogical interactions to produce social and environmentally sustainable outcomes. Prahalad and Ramaswamy (2004) indicate that at the bottom of the pyramid, more than 60% of the population is untapped and they are easy to reach with little competition. Despite their deplorably small per capita income, the volume of customers yields a market potential in the trillions of dollars of disposable income (London and Hart, 2010). EMs need but lack basic financial services, a situation that makes poverty persist. EMs mostly have no access to savings accounts, credit lines, and other necessary services. However, technology has the potential to compensate for cost, infrastructure, and other barriers to service delivery, and mobile financial services provide financial services to emerging customers.

Stuy 2: Value Cocreation between MNOs and Customers

This second study, which is an ethnographic study, was focused on value cocreation between MNOs and their customers in EMs for mobile services innovation. Safaricom, the leading MNO in Kenya was representative on MNOs in EMs. MNOs offer mobile financial services through mobile money. Unlike mobile banking, there is no need for bank account with mobile money services which requires only a basic mobile phone (Amankwah-Amoah et al., 2018). Traditional mobile network operation strategy is characterized by value cocreation with customers that is now growing but supported with a wide coverage. MNOs such as Safaricom with wide coverage and capacity and involved in the provision of innovative mobile financial services to consumers. Ultimately, value cocreation with customers can play an important role in innovations for mobile financial services that will improve social and environmental sustainability and consumer wellbeing in EMs.

The value Cocreation outcome with Safaricom in EMs are Permanence, People, Partner, and Place. These outcomes are the themes that emerge from our qualitative study with Safaricom customers (S-customers) in Kenya. These value cocreation outcomes in EMs ensure social and environmental sustainability and therefore mobile financial inclusion for EMERGING consumers as well as the firms engaged in value cocreation. We discuss these value cocreation outcomes in the four themes below. These themes emerge from the failures of Safaricom in EMs and therefore how to have mobile financial inclusion as a value cocreation outcome when cocreating with customers. To discuss these themes, we draw from the sustainability framework discussed by Seghezzo (2009) which are

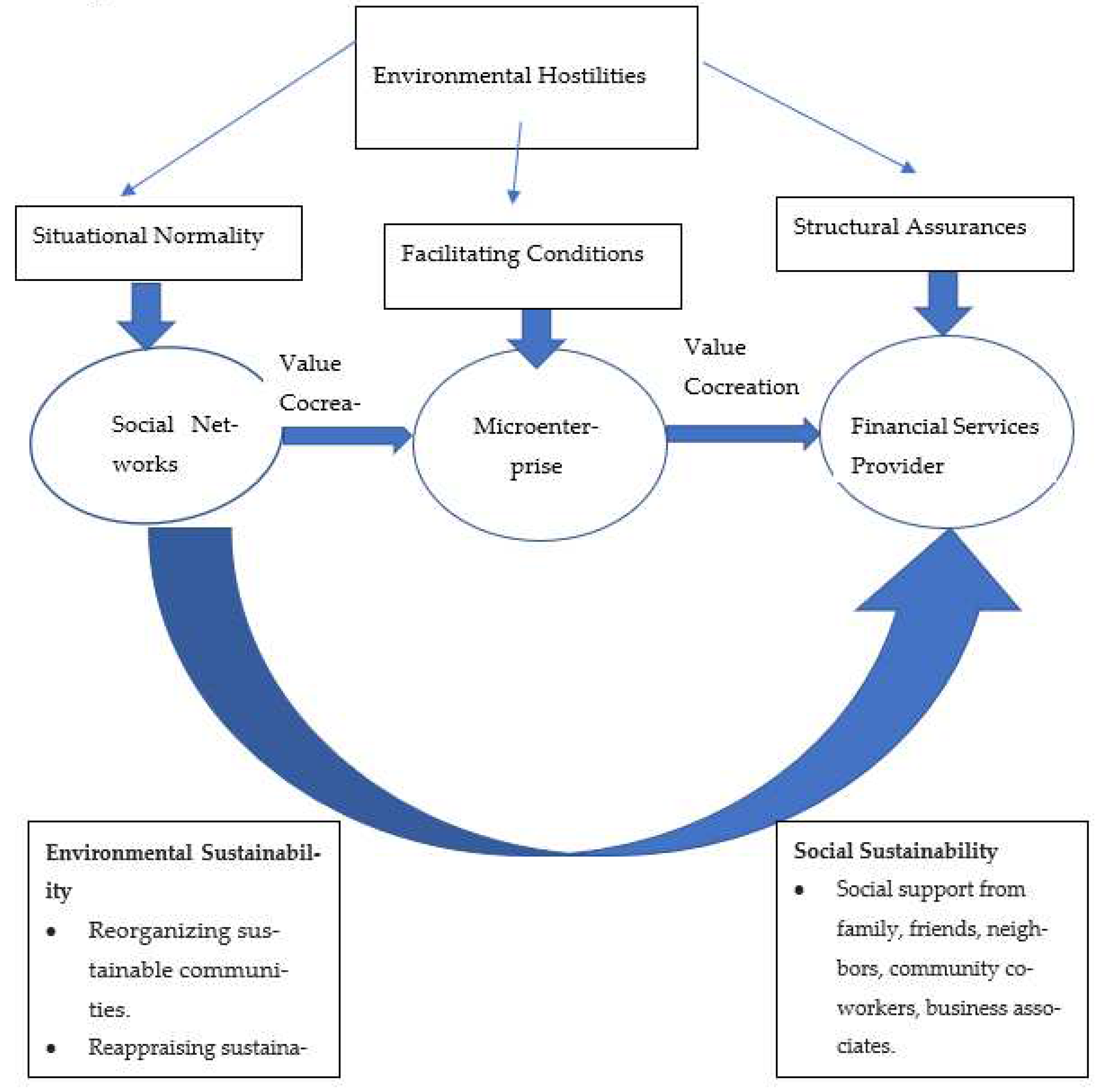

Permanence, People, Partners, and Place. These themes relate to social and financial sustainability in EMs and ensure mobile financial inclusion. We focused mainly on the mobile services innovation failures of Safaricom to elucidate these themes. Figure 2 details how value cocreation between the MNO and consumers results in mobile financial inclusion and environmental and social sustainability.

Figure 2.

Value Cocreation Process and Mobile Financial Inclusion Outcomes.

Figure 2.

Value Cocreation Process and Mobile Financial Inclusion Outcomes.

3.1. Permanence

The theme of permanence refers to the maintenance of present conditions and is a dimension of time. Permanence contributes to social and environmental sustainability but is different from sustainability which is meeting our own needs without compromising the needs of future generations. Social sustainability results when social creativity is leveraged. Social creativity grows out of the relationship between an individual and his or her professional work and relationship with other actors and the artifacts that embody group knowledge and generate new ideas (Steiner et al., 2000). As S-customer 1 stressed, the rapid change in technology benefits from social creativity for permanence and as a result mobile financial inclusion:

I think the rapid change in technology led to this because people became more advanced and had access to mobile phones. It was a short-term plan not projected for long term success. Due to the rapid change of consumer taste and preferences in mobiles. Main reason for failure they didn’t not champion for the product to create awareness. Simu ya jamii was a product launched at a time where its usefulness was pretty much outdated. Simu ya solar was soon phased out by introduction of power back up options such as the power bank with which in the current market of smartphones is more favored. Simu Ya Solar: The phones, compared to today’s invention of power banks, can be said to have lacked a pleasing outlook and is totally outdated (S-Customer 1)

Customer 1’s narrative adds to prior research on value cocreation that the individual’s motivation, engagement, and creativity is what spurs value cocreation. For customer 1, there is the need to champion the product. The championing of this product derives from the social creativity and eventually results in social sustainability. Figure 1 shows how in EMs, social and environmental sustainability are additionally important because of existing environmental hostilities. In contrast to Grönroos and Voima, (2013) who proposes the value-in-experience concept based on a form of social creativity for value cocreation, social creativity here is not only focused on idea-generation and the experience but also on social sustainability. Thus, social sustainability can result in mobile financial inclusion, more comparable to what Babu et al., (2020) discuss on value cocreation for social innovation in Bangladesh.

Figure 1.

Value Cocreation for Mobile Financial Inclusion with Social and Environmental Sustainability.

Figure 1.

Value Cocreation for Mobile Financial Inclusion with Social and Environmental Sustainability.

As shown in the first theme, our informants engage in value cocreation as a customer with Safaricom and as customer 1 notes that some products of Safaricom such as Simu ya jamii was launched at a time where its usefulness was pretty much outdated and another product Simu ya solar was soon phased out by introduction of power back up options and finally there was the need to champion these products before or as they were introduced. All these suggestions relate directly to the social environment of customers in EMs which rely on social sustainability for value cocreation and therefore financially include their networks by considering their needs and wants. Authors like Sorensen et al., (2017) noted that there is the need for consideration of “parties, activities and resources involved in value cocreation whereas the value outcome determination refers to the type of value outcomes customers perceive (p.20). In this situation, there is the need for the consideration of permanence in EMs which are low income and cannot afford a deterioration in this low-income environment.

Our data suggest that the consideration of environmental sustainability was also essential to the success of Safaricom, and the lack of this consideration resulted in mobile non-financial inclusion and therefore some failures. This has led to the conclusion of the need for environmental sustainability for mobile financial inclusion in EMs. For example, S-customer 2 details:

System Failures, which despite being rare and short-lived really impact a lot of the service users. For example, when there’s a system failure, calls would not go through. Neither would text messages be sent or such technologies as M-Pesa work. When the service goes off, massive losses are experienced especially by businesses that are heavily reliant on the services. There needs to be more reliable backup systems to ensure that downtimes are really minimized. Many people, including myself were complaining of airtime running out especially after the bundles were exhausted. There’s currently a new App SwiftSquad that offers guidelines on how to minimize data usage on various social media platforms. Safaricom App store: Safaricom users simply don't use it. There have been a lot of bug complaints, some as petty as log in failures which frustrate the end user. Another example is Daktari 1525 which may not be of great use during an emergency considering that many people seek medical consultation (S-Customer 2).

Sustainability in EMs also involves consideration of environmental sustainability which refers to the flow of useful goods and services from natural capital can be renewable or non-renewable. Customer 2 refers to this clean and affordable use of the energy that powers mobile services as essential to value cocreation outcomes of these services. Current global consumptive behavior has been proven unsustainable, signifying a need to adopted alternative lifestyles for environmental sustainability. As discussed earlier, the EMs are mostly low income and focused on the economic implications which are interconnected socially, ecologically, and economically with sustainability implications (Heuer and Lundrum, 2016).

Value cocreation through dialogical interactions with a customer is a phenomenon exemplified by strong personal, situational, and cultural forces, often acting in unison so social and environmental sustainability involves all individuals within a social network. Therefore, mobile financial inclusion is ensured this way. To be even more strategic consideration of large populations with a target market and ensuring there is social and environmental sustainability in this target market result in mobile financial inclusion. S-Customer 3 details:

Linda jamii- failed to penetrate the market as it had been anticipated and the product was not clear on its target market. High schools where there were no mobile phones would have been a success in such a market. Simu Ya Jamii was invented when its relevance wasn’t acknowledgeable. The targeted market made it a failure because phones have always been so common. Imagine if it had targeted boarding schools. I never heard about products such as Daktari 1525, Linda Jamii, Big, Hakikisha, Shupavu 291 might not be doing very well: I think there was no more market for simu ya jamii since everyone was using a mobile phone. It was quite ironic. I personally think big box, 1963-cashless card and daktari 1525 registered poorly in the market because there was poor marketing and introduction of the products in the market. Also, in addition there was poor training offered to the intermediaries of the products (S-Customer 3).

We can get a sense of some of the reasons why there are failures in some of the value cocreation outcomes initiated by MNOs in EMs. The first reason for this lack of permanence was the wrong selection of the target market. The second reason for the value cocreation outcome failure was poor promotions and the third was a lack of training of intermediaries. Our data suggest that the lack of a sense of understanding of the target market associated with the lack of proper efforts by the MNO in connecting with this market resulted in a lack of permanence of this mobile financial services value cocreation outcomes.

According to Viswanathan et al (2010), the high interactivity and intricate and expansive set of relationships as well as the severe resource constraints result in fluid transactions. Fluid transactions are the one-to-one interactional transactions, which involve buyers and sellers interacting face-to-face. Such fluidity is reflected in the intricate relationships amongst vendors, customers, and their business and social networks. Fluid transactions increase the investment in idiosyncratic resources such as social networks and connections that provide social skills, techniques of negotiation, confidence building, and access to advice (Viswanathan et al., 2010). Social networks in subsistence markets usually relate to reciprocity, which also provide a range of support, including information, emotional guidance, and material resources (De Souza Briggs 1998). In these ways, fluid transactions play a key role in the value cocreation process in subsistence markets.

The target market in EMs should be where the most need for the mobile financial services to ensure social and environmental sustainability and thus mobile financial inclusion. The MNO’s choice of target market is under question here because if market share expansion and eventually, profitability is the goal then where the need is most acute in the opportunity for the target market choice. Profitability stands a better chance in scale and impact in EMERGING market. In EMs, financial literacy is also a huge need. High schools in EMs need mobile financial services and can apply the mobile phone to their learning. Access rather than ownership is seen as a temporary and not a permanent state (Bruno and Faggini, 2017). Mobile financial services usage when it is not affordable by the right target market in EMs do not lend themselves to consumers wanting to permanent value cocreation outcomes for the MNOs. This leads us to the consideration of who these target markets are.

3.2. People

Low-income consumers in EMs have different needs from those in Western markets. This is because they lack financial education, have fewer resources, and operate in challenging socio-economic conditions. Consumers in educational institutions in these environments have the need for financial literacy education them escape poverty by building savings, growing assets, and creating wealth. There are also untapped opportunities in EMs for financial service providers to leverage mobile financial services to re-design services for consumers in EMs. Financial service providers serving EMs are rewarded with profitable sources of income by offering mobile financial services for learning to students in EMs to learn financial literacy and other skills to escape the poverty trap.

Symbiotic relationships, fluid transactions and feedback loops. Symbiotic relationships between MEs and their customers or suppliers occur because of the dual roles played by them as both consumer and producer (Viswanathan et al., 2009). According to Viswanathan et al. (2009) symbiotic relationships result in similar socioeconomic backgrounds for the MEs and their customers and this creates insights into the needs of customers. These insights are a form of learning that provides a better appreciation of market requirements and preferences. Additionally, because of their symbiotic roles, MEs learn and develop skills in both roles (Viswanathan et al., 2010). These learning opportunities also enable the adaptation of the MEs processes, systems, structures, and market offerings to be customized to needs of the customers Viswanathan and Ritchie (2010).

Maende and Alwanga (2020) chronicles how a toolkit of strategy choices can successfully deploy social innovation in EMs. While firms would have profitability upmost on their agenda, there is the need to consider the low incomes of their target market to ensure this profitability. Frugal innovation along with encouraging savings and investments for the customer is the ultimate. Saving even a dollar or two per week can cultivate much needed savings habits. Core concepts such as saving money are the foundation for proactive financial planning. These practices will not only help consumers build savings, but also will further develop good money management habits enabling consumers the rare opportunity to plan for their future. The activities within the networks ensure a dynamic process of collective learning and contribute creative ideas during value cocreation. Social interaction ties, norms of reciprocity and trust enhance knowledge sharing (Yang and Li, 2016) and this in turn enhances the amount of knowledge that can be made available during value cocreation. Another target market in EMs that is potentially attractive for value cocreation for mobile financial services are corporate employees. Online financial planning is a new and innovative avenue of financial planning to consumers without access to professional financial advice (Servon and Kaestner, 2008). Such social savings and investment strategies that leverage the social networks of consumers in EMs would provide consumers the opportunity to grow wealth through mobile financial services and ensure social sustainability that would in turn result in mobile financial inclusion S-Customer 4 details this opportunity in his narration:

On M-shwari, many Kenyans are afraid of taking Mshwari loans which has a very small pay period. It would have been better if the loan had several packages i.e., monthly, quarterly etc. There should be the introduction of mobile phones which are more efficient - portable, affordable, and available. M-tiba is a new service in the market but the company hasn’t created enough awareness of its availability and how it works e.g., in the rural areas very few people know of its existence. Majority of Kenyans didn’t understand how these services worked. These services are not well known in Kenya. Lots of cash has been used to advertise them but still people have not embraced them more work and promotions need to be done on them to synthesize them and make known to the public. (S-Customer 4)

As S-customer 4 indicates, M-shwari loans with several payment options could be ideal as loans to workers in EMs through mobile financial services. Additionally, S-customer indicates that the opportunity exists to introduce this service to rural areas in EMs. In these rural areas, the competition from banks is much less since they do not find it profitable to operate there and mobile financial services would reduce travel expenses and transfer charges (Donovan, 2012). Consumers in rural areas of EMs also have comparatively lower skills in addition to being low-income. This need however represents an opportunity for new and innovative mobile financial services for these people through value cocreation that is socially and environmentally sustainable to ensure mobile financial inclusion. S-customer 5

Also, for the 1963 card- the Kenyan market is not yet ready for automated cash systems in the matatu industry due to the pricing factor and semi-skilled workers. I think one major challenge they face in competition especially from their rivals Airtel which offers almost the same services but a cheaper cost. Safaricom has dealt with this by reducing its transaction cost. The three non-profitable products are Big Box, 1963 card and little cabs. Big Box: This one’s rather too expensive and not affordable to a majority of the population. The key factors are slow uptake by the Kenyan market, competition from global rivals in the case of Little cabs-Uber. Peoples attitude is a great hindrance to many innovations especially attitude towards the new technology. People feel like it’s too complicated to use. But safaricom have addressed this by making their services as simple as possible and fully accessible. I think one of Safaricom’s innovation challenge was that of differentiating its services (S-Customer 5)

As indicated by S-customer 5, it would be expedient to consider the prices of competitors as well when pricing immobile financial services innovations co-created in EMs. This consideration leads to profitability along with market share expansion and sustainable innovative value cocreation outcomes. An example is that of the Smart MNO which achieved one of the highest profit margins (63.7%) of any network operator in the Asia-Pacific region through value cocreation with used handsets, despite having amongst the lowest average monthly revenues per user. The EMERGING consumers in the Philippines use mobile phones for ‘entertainment and enjoyment’ purposes and enabled them to save money by avoiding long distance travel and providing pricing for their agricultural produce, seek professional medical advice or find a job. The example of the Smart MNO shows that mobile financial services with added value can be very successful in EMs because the value cocreation outcomes address the range of needs of the people and are therefore sustainable. This attracts suspicion from MNC partners and keen competition from MNC banks. S-customer 6 also reveals that sustainability issues also relate to the value chain and collaborators of the MNOs.

Big Box failed because the banks were for some time suspicious of it eating into their traditional financial territory. Like M-shwari, it was a product which enables customers to enjoy loan services which were only limited to the bank. I would consider M-shwari as one of their biggest failures. This is because the service did not pick up as quickly as M-pesa did. Some of the key factors that I think might have influenced this failure include (a) poor strategic planning during the conception of the concept, (b) poor marketing strategies for hooking in new customers, and (c) lack of patience with the service’s growth S-Customer 6).

S-customer 6 sees that the collaborators of the MNO are persons who will ensure the sustainability of mobile financial services and therefore mobile financial inclusion. The relationship with these persons must therefore be included in the strategic planning of the MNOs as well as their marketing strategies. Most ideally, sharing marketing expenses with MNCs reduces costs and enhances profitability. S-customer 6 indicates that there is the need to be patient with the growth as well and this consideration is important as new persons are targeted or collaborated with.

3.3. Partners

Partnering is one avenue of sustainability to obtain mobile financial inclusion through value cocreation with the customer. EMs experience scarcity of resources such as limited access to capital, technology, technical, and managerial skills (DeBerry-Spence and Elliot 2012). Therefore, value cocreation. Through the various levels of interaction, a service provider tailors “its resources, competencies and processes with the customers’ value-generating processes” (Grönroos 2004, p. 152). (“Marketing as Value Co-creation Through Network Interaction ... - Springer”) These partnering efforts improve on inefficiencies, enhance innovation, and migrate best practices, leveraging the social networks of the customer for social sustainability. However, partnering can only provide social sustainability when there is trust.

S-customer 7 explains this aspect of partnering that has the potential to create mistrust when partners became competitors. Partnering however becomes essential when there is the need to improve customer care and reduce fraud and with social sustainability there is mobile financial inclusion:

A mobile banking product (saving and borrowing) between Safaricom and Equity bank failed because of mistrust between the two companies. Equity has since acquired a mobile license and launched their own product known as Equitel. - multiplying the number of base transmission station's known as boosters. Customer care service is poor. Calling their customer care service lines is quite frustrating. In most cases, unless you are a premium customer (postpaid), it is almost impossible to access the service. Both using their services and consuming services like API integration has been poorly addressed. In looking at this issue I guess more people would be satisfied and confident in their services. Safaricom networks would be congested making it impossible to make calls and sending money. The myriad cases of fraud have also discouraged some subscribers. Some of the products that they come up with can only be used in major towns and not everywhere in the country e.g., 1963- cashless card which can only be used in Nairobi (S-Customer 7).

Just as customer care is poor without partnering, so are the occurrence of rampant issues of fraud because an innovation co-created can only be used in the larger city and no other towns. S-Customer-7 speaks of innovative mobile financial services that are more adaptive to local needs. This adaptation ensures social and environmental sustainability. The local needs in this EMs are mainly financial empowerment, access to knowledge, skills, and frugal products to emerge from the poverty trap:

Learning is possible via the phone. Also, through the Blaze be your own boss, Safaricom has encouraged and mentored many young entrepreneurs which has helped to address the issue of non-employment in the Country. They are open to new integrated products especially with banks leading to products like M-Shwari and M-kesho: Together with Commercial bank of Africa and Equity Bank, the services allow for saving and borrowing Within Safaricom, they have set aside a portion within their database where their engineers can come up with innovations or even test innovations. Also, they train upcoming innovators e.g., Safaricom Certified hackers in Strathmore University. Safaricom Academy has sponsored smart students to mobile computing certifications in Strathmore university in the future and offer internship opportunities to college students especially those undertaking science-based courses. innovative products by businesspeople are riding on this platform. services from those offered by the banks and coming up with concepts that would best suit any individual despite their level of education or their knowledge of the ever-changing technology. There however the need to prevent delays in their system that becomes impossible and unreliable (S-Customer 8).

Reliability, availability, and maintainability issues do not lead to sustainability that ensures mobile financial inclusion. S-customer 8 explains that despite all the value cocreation with partnering stakeholders and customers, mobile financial inclusion is not assured because of the limited social and environmental sustainability that results from the lack of reliability of the systems.

3.4. Place

Place-based sustainability approaches require a recognition of the uniqueness of EMs in terms of its local resources, people's capacities, culture, knowledge, and preferences (e.g., Barca 2009). For example, in the presence of strong consumer demand and low-cost handsets, Smart recognized that one of the major hindrances to their mobile innovative services was the reluctance of Sari-Sari stores to stock pre-paid cards due to the relatively high inventory costs and security concerns. Smart’s introduction of over the air recharge technology and sachet-based pricing solved these problems. In their partnering, Smart worked to ensure that the start-up costs associated with becoming a retailer were minimal with low capital requirements for merchants. Such actions led to social and environmental sustainability and hence mobile financial inclusion. S-customer 9 further details:

Mesa Foundation Academy serves talented but poor students with demonstrable leadership potential. A brilliant idea must be backed up the requisite systems and processes for it to work. For success more, research must be done. Talents need to be monitored and nurtured. Like mpesa this was an idea of a student and now it's a major achievement and unique in kind over the globe. The lesson is to always keep trying and listen to customer feedback. If one product doesn't pick never give up the one that pick, put more on it. Also, before coming up with an idea and implementing on it, first consider if it serves the need of the market. From Safaricom innovation journey, we can learn that innovations, with the right guidance, tools, and a positive mindset of the developer, it could be a solution that a whole nation has been waiting for to develop. (S-Customer 9)

Value cocreation with customers can be sustainable with strategic planning as indicated earlier. However, S-customer 7 exposes the fact that planning for mobile financial inclusion in communities is based on addressing the needs of the people in the community and ensuring a better quality of life and hence ensuring social and environmental sustainability. Good climate conditions, health, transportation patterns and household affordability are all indicators of this sustainability. By making communities more livable, sustainability goals are promoted with consumer wellbeing and there is mobile financial inclusion. Customer 10 narrates:

Safaricom has been on the front line encouraging and supporting young and creative youth who have portrayed to provide solutions to daily challenges. This has been done through hubs enabling children to access questions and revision material by just subscribing with a mobile to access the workshops. By sponsoring talents e.g., sports and inter school’s education competitions e.g., debates and offering both skilled and non-skilled employment. Safaricom has offered IT scholarship, Mentorship, and employment opportunities for IT graduates to gain more experience by working in the real world after school completion. Safaricom has supported various innovations and one thing I am aware of is how it has transformed the education sector by partnering with innovations such us Shupavu 291. They give back to the community through charitable activities. Starting of the Mpesa innovative school helps cultivate the innovative culture amongst people (S-Customer10).

In the above narration we can perceive the M-pesa mobile financial services thriving in conditions of community sustainability with good health and learning. Environmental hostilities in EMs occur as the absence of Situational normality, facilitating conditions and structural assurances (Pavlou, 2003). Situational normality refers to beliefs that success is anticipated because the situation is normal. Facilitating conditions are conditions that involve shared standards, relationship values, and common beliefs about behaviors and goals. The mitigation of environmental hostilities can occur through social and environmental sustainability, which in turn ensures financial inclusion.

Achieving social and environmental sustainability can occur through a social network build up that reorganizes living conditions in the form of sustainable communities, reappraises economic sectors in the form of sustainable work practices and agriculture. develop new technology in the form of renewable energy and agriculture and adjustments in individual lifestyles. Value cocreation between microenterprises and their networks and microenterprises and financial services firms simultaneously, results in a social network build up making available abundant social network resources and can achieve these objectives.

Mobile financial services are one of the emerging activities for financial inclusion by combining philanthropic and business approaches for financial inclusion. In this chapter, the value cocreation for Mobile Financial Inclusion in EMs converts mitigates the environmental hostilities in the EMs through a social network support build up that also ensures social environmental sustainability.

4. Discussion

In the business model (

Figure 1), we consider the impact of the external barriers to social environmental hostilities, which when eliminated would facilitate mobile financial inclusion. We consider the extent to which the relationship provides structural assurances, situational normality, and facilitating conditions from the perspective of African firms. Structural assurances are the beliefs that favorable outcomes would occur because of contextual structures which involve contracts, regulations, and guarantees (Pavlou, 2002).

Value cocreation in EMs is a topical research consideration (Rahman et al., 2019). Our study shows how mobile financial inclusion can be achieved through value cocreation between the microenterprise customer and financial services provider. One way that value cocreation between microenterprises and financial services providers can enhance financial inclusion is through managing environmental hostilities through a build of social network support, which also ensures social and environmental sustainability. The customer’s value creation process refers to a series of activities performed by the customer to achieve a particular goal. One key aspect of the customer’s ability to create value is the amount of information, knowledge, skills, and other resources that they can access and use. (“Managing the co-creation of value | SpringerLink”) Collaboration between microenterprises and financial services firms, who follow different institutional logics. In our paper we discover how social and environmental sustainability can mitigate environmental hostilities simultaneously through a social network build up. This social network build-up occurs when cocreation occurs simultaneously with the social networks of the microenterprises which in turn cocreates with the financial services provider.

Theoretical Implications

There are several theoretical implications resulting from this framework. To create dynamism in the ecosystem, the value co-creation of stakeholders leverages the 4 Ps of people, partnership, place, and permanence. Thus, not only are networks leveraged, but these networks also become partners with immense collaboration potential to share networks, ideas, and knowledge. Such dynamic value co-created platforms would provide competitive advantage. Additionally, the concept of permanence would provide sustainable competitive advantage. The involvement of consumers in the production relationship (Vargo and Lusch 2004) is especially beneficial for this digital value co-creation. The model presents a conceptual framework based on value co-creation with customers and other stakeholders for digital benefits. Although we consider several stakeholders, making the value co-creation more complex, the goal of the framework is to find demonstrate the dynamics that can emerge from simple elements introduced for digital value co-creation with multiple stakeholders.

The model itself provides value as it presents a pathway to develop further product ideas. Components of the model can also be studied in isolation raising valuable research questions, as follows: 1) How does emerging economy digital value co-creation impact the dynamism of co-creation within the eco-system; 2) How significant is the impact of digital value co-creation in emerging markets? With the digital value co-creation framework, the model exhibits the nature of the dynamic relationships when partnerships, place, people, and permanence are considered.

This framework demonstrates how digital value co-creation in emerging markets creates unrecognized dynamism in digitized industries. The value co-creation in digitized industries demonstrates that when digitized multi-stakeholder value co-creation occurs in a controlled environment, multiple stakeholders can be targeted simultaneously and in a sustainable manner. \ In essence, this is seen as being more efficient in the management of resources (Hunt and Morgan, 2005). This digital value co-creation creates dynamism in global ecosystems.

Managerial Implications

Within the education sector, digital value co-creation becomes important as students are moving toward customizing what they want to learn (Adams & Downey, 2016) and this makes value co-creation and digital financial inclusion essential in emerging markets. According to Adams and Downey (2016), the financial industry offers many applications, such as the user selection of risk tolerance and/or long-term goals and the tourism industry similarly has its customers relying on digital platforms to provide a variety of travel options. Digital value co-creation in emerging markets has also got dynamic capabilities to develop an ecosystem of healthcare development and management. In emerging markets, where there is a global macro-level. As emerging economies enlarges and become more dynamic, their populations require better and affordable healthcare. Many governments have responded and rolling out affordable public healthcare systems that are more efficient and cheaper leveraging the mobile phone. With value co-creation, more apps on the iPhone can be developed. An example is salesforce for healthcare cloud system in the United States that leverages artificial intelligence.