Submitted:

08 January 2026

Posted:

09 January 2026

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Problem Statement

- Main contributions of the paper

- i.

- Development of Hybrid Models: Integrating Machine Learning, Deep Learning, and Statistical Models.One model class—ANN, LSTM, or ARIMA—was typically utilised alone in previous analyses. This work introduces a hybrid, multi-family modelling framework that combines statistical (ARIMA/ETS), machine learning (SVM, Decision Tree), and deep learning (ANN, LSTM, BiLSTM) methods. Because of this integration, the model may collectively represent trend, seasonality, nonlinear patterns, and residual changes, increasing prediction accuracy.

- ii.

- A long-term, multi-state forecasting framework: In previous research that determined mango pricing (e.g., [11,20]) was limited to a single state and small market, or short forecasting period. For long-term economic analysis and national agriculture planning, these constrained scopes were inadequate. But the new study provides a comprehensive forecasting technique that encompasses 23 Indian states and anticipates until 2035.Thus, it one of the first nationally conducted long-term forecasting studies for a horticulture product in India. The model supports state-level policy design, procurement plan formulation, and supply chain oversight by offering extended predictions for all main mango-growing regions, hazardous decision-making, stabilised markets strategies, and optimisation. This broad geographical and temporal coverage significantly surpasses the capabilities of earlier research and establishes a new national benchmark for agricultural price forecasting.

- iii.

- Attention approach based mechanism: The LSTM and traditional RNN models were unclear. The analysis incorporates an Attention-LSTM, which allows the model to wisely focus on the most instructional historical time points. This is a significant methodological advancement in explainability and forecast accuracy.

- iv.

- Integrating Seasonal and Exogenous Factors: Unlike other studies that mostly relied on past pricing, this study includes seasonality indicators and environmental variables as exogenous elements. By allowing the models to learn seasonal shocks, climate effects, and cyclical oscillations, this improves long-term forecast dependability.

- v.

- Evaluation of Multi-Model Precision: The majority of previous analyses simply evaluated one or two models. This analysis offers a comprehensive quantitative evaluation of seven distinct models (ARIMA+DT, ANN, LSTM, GARCH, ETS+SVM, ETS+BiLSTM, Attention-LSTM) using industry-standard measures including MAE, MSE, RMSE, and R(square).

- vi.

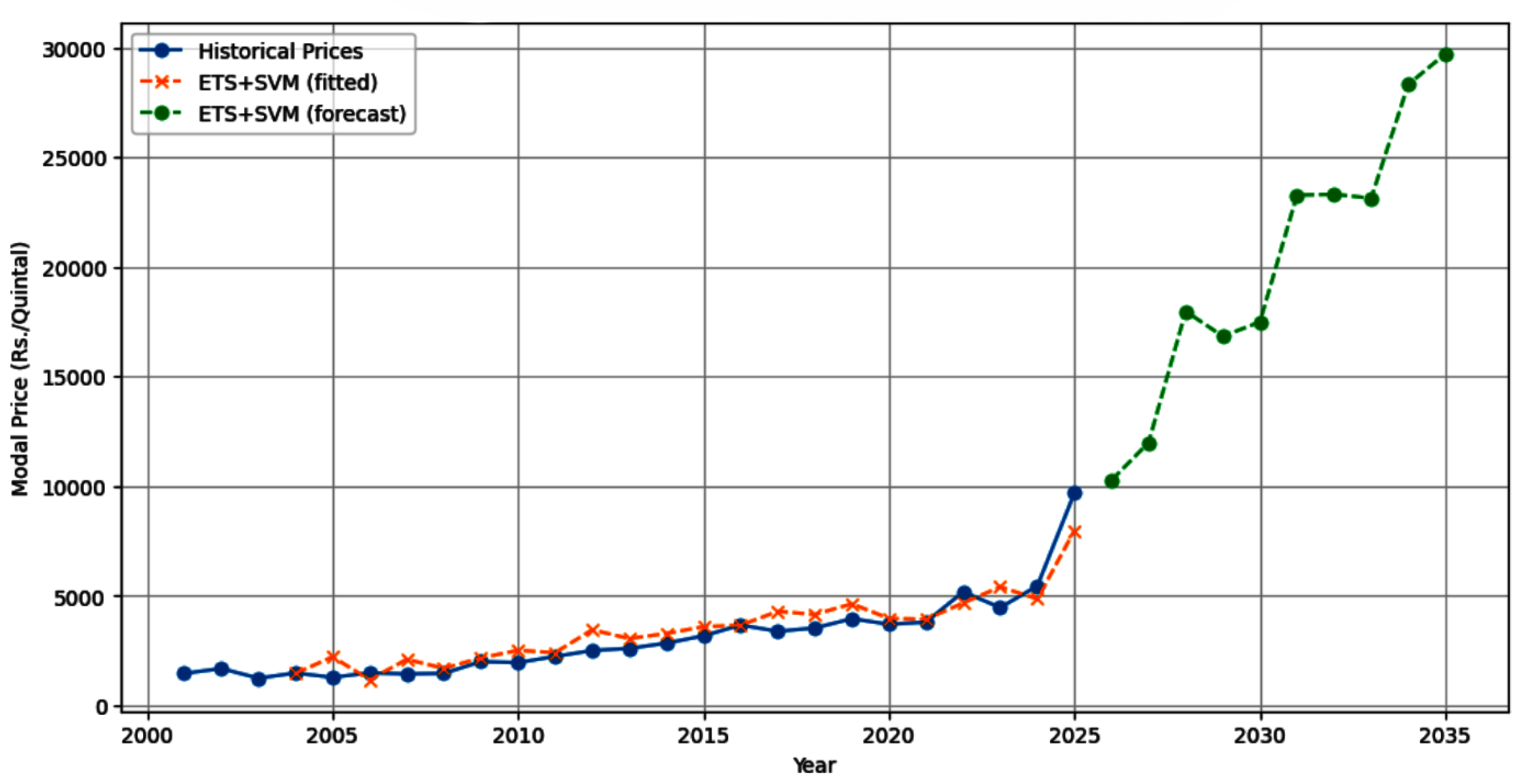

- Novel ETS + BiLSTM and ETS + SVM Hybrid Architectures: In a mango price forecasting investigation, ETS decomposition has never been combined with cultivated nonlinear models such as SVM or BiLSTM. By decomposing the data into linear components (ETS) and using SVM or BiLSTM to model nonlinear residuals, the technique produces more precise and reliable predictions.

- vii.

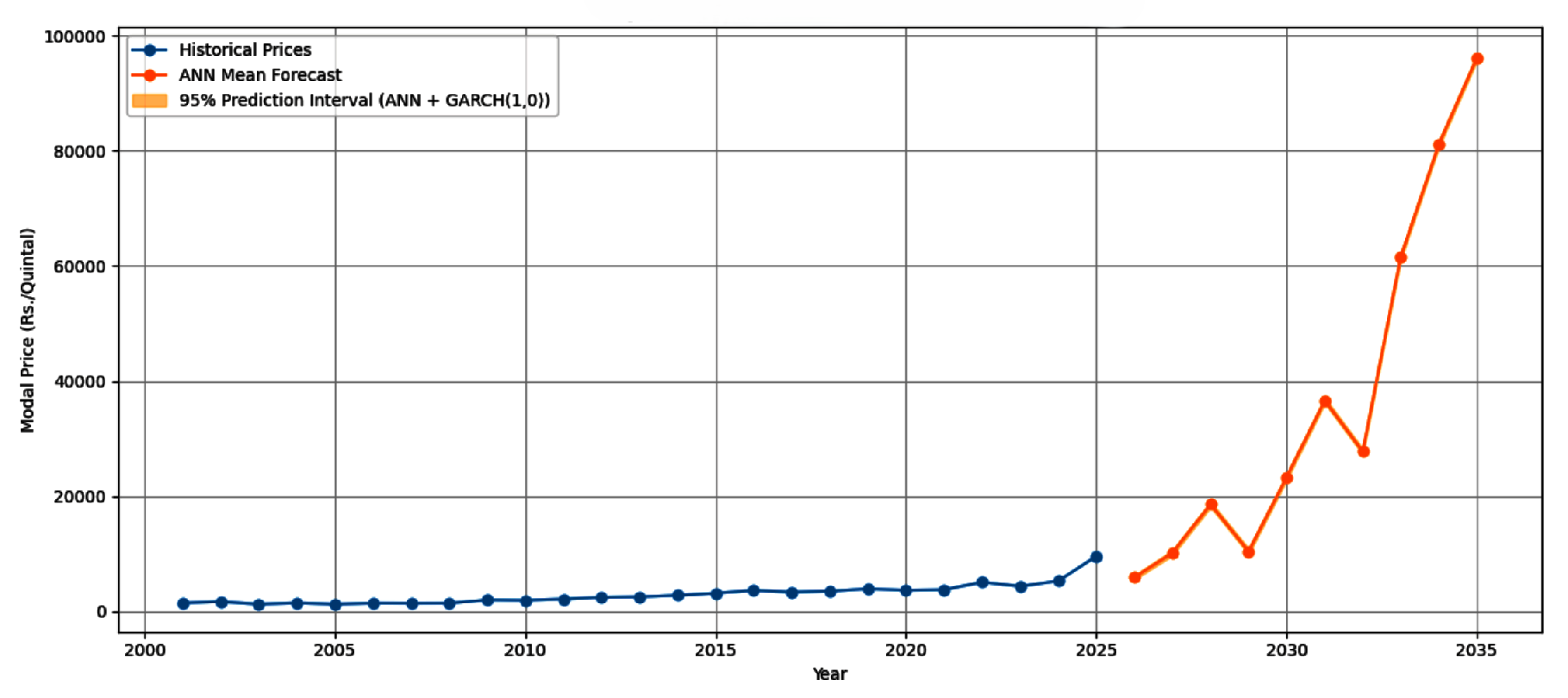

- ETS + ANN + GARCH Forecasting with Volatility Awareness: Volatility clustering, a common feature of agricultural prices, was frequently disregarded in previous studies. By incorporating both stable trends and erratic market phases, the hybrid ETS + ANN + GARCH model produces uncertainty-aware forecasts that are crucial for risk-sensitive decisions.

- viii.

- Integrated Framework for Tracking Linear, Nonlinear, and Volatility Patterns: Previous study models were able to capture independent characteristics like trend, volatility, or nonlinearity. This approach is the first to combine trend using ARIMA/ETS, nonlinear patterns using ANN/LSTM/BiLSTM, and volatility using GARCH into a single, coherent forecasting method.

- ix.

- Efficient Interpretation for Farmers, Traders, and Policymaker: Modelling was the main issue with earlier analysis. This analysis demonstrates how stakeholders can use forecast prediction for proceeds planning, storage decisions, expenditure scheduling, and market stability strategies.

3. Previous Work

| SNo. | Citation (Author, Year) | Research Objective | Methodology | Data Used (Time Series Period) | Key Findings and Accuracy Level | Evaluation Metric |

|---|---|---|---|---|---|---|

| 1 | [3] | Using recurrent neural network (RNNs)to predict the minimum and maximum price | LSTM, GRU, Simple RNN | Vegetables and Fruits | LSTM, MAE (3.43), MSE (65.659), (0.993), MEDAE (1.99), EV (0.99). GRU, MAE (4.24), MSE (88.23), (0.991), MEDAE (5.69), EV (0.98). Simple RNN, MAE (4.815), MSE (105.251), ( 0.989), EV (0.99). | MAE, MSE, RMSE, , MEDAE, EV |

| 2 | [6] | Image recognition to detect fruit weights and deep learning based YOLOv9 to classify the level of ripeness | Cost estimation YOLOv9 | Fruit data | ||

| 3 | [4] | The mislabeling of mangoes in local Pakistani markets | CNN,Gaussian Mixture Model | Image mango data | Anwar Ratol, Precision(0.98), Recall(0.98),F1-score(0.98), Support(22), Chaunsa, Recall(0.97), Recall(0.97), F1_score(0.97), Support(16), Dosehri, Precision(0.97), Recall(0.97), F1_score(0.97), Support(23), Accuracy 0.97 | Precision,Recall,F1-Score,Support |

| 4 | [5] | Handling large volumeb of data ,emerges as an innovation solution to enhance the precision of mangon production estimation | YOLOv4-tiny,YOLOv5-CS,ANN, RetinaNet, YOLOv5, R-CNN | Image mango data | YOLO-Trained accuracy(96.725%) recall(77.4%),F1 Score (86%), R-CNN Accuracy(98.57%) recall(63.80%), F1 score(77.46%) | |

| 5 | [34] | Review agricultural product price forecasting methods and challengs. | Literature review (Traditional, Intelligent, and Combined models). | N/A (Review of various historical studies and methods). | Combined models and integration of unstructured data (news) are future trends. | Accuracy of values and precision of trends |

| 6 | [7] | Considering the profit component agriculture,particularly in India | (Vegetables and Pulses According to Weather) data | Decision tree accuracy(90.20%),K-NN accuracy(89.78%), Random Forest(90.43%), Neural Network(91.00%) | RMSE | |

| 7 | [10] | Optimizing productivity and reducing food waste | Gaussian Process Regression,FCN,Linear Regression,ANN, KNN,SVR And RF | Mango (remote sensing and weather variables) | Gaussian process regression accuracy(85.95%),FCN accuracy(73.6%),Linear Regression accuracy(90%),ANN, KNN,SVR And RF accuracy(86.5%),R-CNN accuracy(96%),Faster R-CNN accuracy(90%) | MAE,NMAE,RMSE, FLEM |

| 9 | [13] | Boost farmers livelihoods and increase yield as well | CNN,RNN, ARIMA, ARIMAX, LASSO, SVM, XGBOOST, CNN-RNN, CNN-LSTM, MLR-ANN, GRNN,MARS | Crop data | Precision rate for the computed model (86%),recall(87%),F1-Score(86.5%) | RMSE,F1-SCORE,RECALL |

| 10 | [20] | Forecast the price of mango using ARIMA model | ARIMA ,FORECASTING PRICE | Mango | MAPE | |

| 11 | [33] | Assess short-term impact of Russia-Ukraine conflict on food supply and prices. | Counterfactual analysis using SARIMA and VAR forecasting models. | Monthly food price indexes from Jan 2000 to Dec 2022. | Significant export decline; short-lived commodity surge but persistent retail price increases. | Forecast errors (Actual vs. Counterfactual) |

| 12 | [8] | The forecasting of horticulture commodity price has wide-ranging impacts on farmers, traders, and end-users | ARIMA, ANN, GARCH, SARIMA, RNN,ARCH | Banana data | ARIMA Model MSE(44007.7), RMSE(209.78), MAPE(65.79), SMAPE(30.14) MASE(2.44), MDA(0.55), SARIMA Model MSE(43614.2) RMSE(208.84), MAPE(74.13), SMAPE(37.80), MASE(12.37), MDA(0.56), GARCH Model MSE(29549.6), RMSE(171.9), MAPE(60.91), SMAPE(32.49), MASE(7.78), MDA(0.46), ANN Model MSE(13686.7), RMSE(116.99), MAPE(16.56), SMAPE(11.12), MASE(0.58), MDA(1.00), RNN Model MSE(7157.16), RMSE(84.6), MAPE(9.58), SMAPE(7.43), MASE(0.12), MDA(1.74) | MSE,RMSE, MAPE, SMAPE, MASE,MDA |

| 13 | [9] | Forecasting prices for dripping crops | ANN, ARIMA,LSTM, Ridge regression,Linear regression | Crop data | Linear regression Model On Training data MSE(1.22) RMSE(1.32), MAPE(1.23), on Validation data MSE(1.28), RMSE(1.52), MAPE(1.56) on Testing data MSE(0.98), RMSE(0.95), MAPE(0.85), Ridge regression Model Training data MSE(1.19) RMSE(1.28), MAPE(1.19),Validation data MSE(1.26) RMSE(1.51), MAPE(1.56), Testing data MSE(0.97) RMSE(0.92), MAPE(0.84), ARIMA Model Training Data MSE(1.15)RMSE (1.26), MAPE(1.17),on Validation data MSE(1.25) RMSE(1.49), MAPE(1.55), Testing data MSE(0.88) RMSE(0.84), MAPE(0.82), LSTM model Training data MSE(1.10) RMSE(1.14), MAPE(1.01),Validation data MSE(1.74)RMSE(1.74), MAPE(1.45), Testing data MSE(0.74)RMSE(0.77), MAPE(0.81) | MSE,RMSE,MAPE |

| 14 | [35] | Investigate if live hog futures prices help forecast forthcoming spot prices. | 6 Futures-based models (e.g., futures spread, linear regression). | Daily hog spot and futures prices from Jan 2021 to March 2023. | Futures-based models outperformed no-change models; spread models best for 1–4 months ahead. | RMSE, MAE, MAPE, MSPE, and DM tests |

| 15 | [2] | Computer Vision for mango price estimation based on breed classification in Thailand | YOLO, YOLOv2, YOLOv3, YOLOv4 and YOLOv5, R-CNN | Image mango data | Kiewsavoy ,ResNetModel accuracy(87.0968%) ,MoblieNetV2 modelaccuracy(83.8710%), GoogleNetmodel accuracy(83.87%), Turmeric, ResNetModel (100%), MoblieNetV2 model (100%), GoogleNet model (100%) | |

| 16 | [16] | Focuses on the decisions of picking, inventory, ripening, delivering and selling mangos in harvesting season | Stochastic programming model,Bass model,EV,SP, EEV,VSS | Mango data | Bass model MAPE Mangifera indica Linn(18%),Irwin(27%)Jin-Hwang(14%),Yu-Wen(13%),Sensation(40%), Keitt(30%) MSE Mangifera indica Linn(22554941),Irwin (7971410592) Jin-Hwang(471484026),Yu-Wen(47548986)Sensation (5648911), Keitt(446139313) | MAPE,MSE |

| 17 | [27] | Evaluate deep learning models for China’s soybean futures. | Comparative study of 9 models (iTransformer, TFT, PatchTST, etc.). | Soybean futures and exogenous variables (ER, SF) from Jan 1, 2007 to Dec 31, 2024. | iTransformer best for MAPE (short/long term); | TFT best for multivariate settings. MAE, RMSE, MAPE |

| 18 | [30] | Predict daily prices for major vegetables for market monitoring. | VMD-FOA-GRU: Variational Mode Decomposition + Fruit Fly Optimization + GRU. | Daily price data of 6 vegetables (cabbage, cucumber, etc.) from 2014 to 2024. | values consistently exceeded 99.4%, outperforming single deep learning models. | MAE, RMSE, |

| 19 | [36] | Predict China’s aquatic product consumer price index. | VMD-IBES-LSTM: Variational Modal Decomposition + Improved Bald Eagle Search + LSTM. | 5 fishery products (e.g., carp) from Week 52, 2012 to Week 44, 2021. | High accuracy; RMSE for five test sets: 0.480, 0.214, 0.288, 0.58, and 0.68. | MSE, RMSE, MAE, MAPE |

| 20 | [13] | Boost farmers livelihoods and increase yield as well | CNN,RNN, ARIMA,ARIMAX, LASSO,SVM, XGBOOST,CNN-RNN, CNN-LSTM,MLR-ANN,GRNN,MARS | Crop data | Precision rate for the computed model (86%),recall(87%),F1-Score(86.5%) | RMSE,F1-SCORE,RECALL |

| 21 | [16] | Focuses on the decisions of picking, inventory, ripening, delivering and selling mangos in harvesting season | Stochastic programming model,Bass model,EV,SP,EEV, VSS | Mango data | Bass model MAPE Mangifera indica Linn(18%),Irwin(27%)Jin-Hwang(14%),Yu-Wen(13%),Sensation(40%), Keitt(30%)MSE Mangifera indica Linn(22554941),Irwin(7971410592) Jin-Hwang(471484026),Yu-Wen(47548986)Sensation(5648911), Keitt(446139313) | MAPE,MSE |

| 22 | [28] | Detect anomalies and cluster regional wholesale fruit/vegetable prices. | Hybrid ML: Noise reduction (IQR/Hampel) + PCA + Gaussian Mixture Models. | Chilean produce prices across 16 regions from 2015 to 2023. | Model is robust for detecting regional price anomalies and supply chain planning. | Sensitivity analysis and robustness validation. |

| 23 | [29] | Enhance futures return prediction while preventing data leakage. | Rolling VMD-LASSO-Mixed Ensemble: Rolling window + LASSO + 6 algorithms. | Daily returns of 5 commodities (coffee, cotton, corn, etc.) from 2010 to 2024. | Framework improved accuracy; Rolling VMD successfully prevented data leakage. | MSE, MAE, Theil U, ARV, DA |

| 24 | [14] | Forecasting of area, production and the idea about price trend and used to provide support in decision making and proper planning for sustainable growth of the developing country | ARIMA(5,1,2), ARIMA(3,1,1) | Food | Validation of the ARIMA(5,1,2) model RMSE(705.239),MAE(539.033), MAPE(13.701%),Theil inequality(0.0796). Validation of the ARIMA(3,1,1) model RMSE(441.593),MAE(325.648) MAPE(7.077%)Theil inequality coefficient(0.0526) | RMSE,MAE,MAPE |

| 25 | [15] | Thus aim of the study was to develop precise and easy early population prediction model of mango hopper for tropical monsoon climate conditions | SARIMA AND HYBRID SARIAM ANN | Mango | Fitting error statistics for SARIMA model R2(0.90),MSE(1.33),RMSE(1.15), MAE(0.93),MAPE(.0.51), SARIMA -ANN model R2(0.91),MSE(1.23),RMSE(1.11), MAE(0.91),MAPE(0.51),Validation error statistics SARIMA model R2(0.92),MSE(1.74),RMSE(1.31), MAE(0.96),MAPE(0.33),SARIMA-ANN Model R2(0.94),MSE(1.30),RMSE(1.14) MAE(0.73),MAPE(0.28) | RMSE,MAE,MSPE,R2 |

| 26 | [17] | The present study was conducted in Tamil Nadu .since, area and production of mango and banana are higher in Tamil Nadu. | ARIMA model ,Regression model ,TDNN,SVM,NLSVR | mango and banana dataset | ARIMA model MAPE(29.39),MAX APE(346.07),MAE(1.11),DF(18), SIG.(88),OUTLIERS(0) | MAPE,MAX APE,MAE, SIG,OUTLIERS |

| 27 | [26] | the present investigation was carried out for weekly data interval of 20 consecutive years(1998-2017)to understand the population dynamics of mango hoppers and developed good fit time series prediction model for better management of hoppers in humid agro-climatic conditions | Multiple linear regression,SARIMA, ARIMA | Mango hoppers dataset | SARIMA(1,0,2)(1,1,1),R2(.89), Schwarz criterion(SIC)(0.62), SARIMA(1,0,1) (0,1,1),R2(.88), Schwarz criterion(SIC)(0.68), SARIMA(1,0,0)(0,1,1),R2(.88), Schwarz criterion(SIC)(0.70),SARIMA(1,0,0) (1,1,0),R2(.86), Schwarz criterion(SIC)(0.89) fitting and validation(2018) R2(0.963),MSE(0.622),RMSE (0.789),MAE(0.566),MAPE(2.111) | R2,RMSE,MAPE,MAE, MSE |

| 28 | [18] | Region VII reports that many mango orchards in Cebu province are dying because of the absence of required post-harvest attention | NDVI,TIME SERIES USING HIERARCHICAL CIUSTERING | Mango | Cluster1 containing 29 division cluster2 containing 24 division, cluster3 containing 2.17 division | |

| 29 | [31] | Develop an efficient method for predicting corn market prices. | SGKGBA: STL + GARCH-M + KPCA + GWO-optimized BiGRU-Attention. | Weekly Chinese corn prices and 21 factors from Jan 2014 to June 2024. | High accuracy: MAE 0.0159, RMSE 0.0215, MAPE 0.5544%, 0.9815. | MAE, RMSE, MAPE, . |

| 30 | [19] | Inflation has up as a leading concern of India’s economic policymakers and citizens over the last decade | Forecasting ,inflation,Seasonal ARIMA,ARIMA | Mango | SARIMAX(1,0,0)x(1,1,1)12,ARIMA | |

| 31 | [12] | Product price forecasting system that pulls data from the indian Ministry of Agriculture and Farmers can more easily identify which markets to sell at and when | Data imputation, time quantisation,classification, Machine learning | Product | RMSE | |

| 32 | [23] | Forecast model has been developed for the mango production in Pakistan(AREA,RAIN -FALL, TEMPERATURE) | ARIMA-X(1,1,1), ARMA[12,13] | Mango | R2,Standard Error | |

| 33 | [32] | Propose a novel vegetable-price forecasting method using Mixture of Experts. | VPF-MoE: Combines LLMs (TimeMoE/Time-LLM) with deep learning (N-BEATS/TIDE). | Daily prices for 5 vegetables (e.g., eggplant) from Jan 1, 2014 to March 31, 2024. LLMs generally outperform other methods; VPF-MoE adapts to different vegetable types. | MAE, MSE, , PCC. | |

| 34 | [21] | Horticulture sector plays a prominent role in economic growth for most of the developing countries . | ARIMA,HYBRID MODELS,NLSVR, REGRESSION MODEL TIME SERIES,TDNN, MEAN MEDIAN MODE SKEWNESS,KURTOSIS | MANGO AND BANANA | ARIMA MANGO YIELD MAPE(3.83),TDNN(2.81), NLSVR(2.81),ARIMA-TDNN(1.98),ARIMA-NLSVR(1.73) ARIMA BANANA YIELD MAPE(12.10),TDNN(7.58), NLSVR(6.93),ARIMA-TDNN(5.12),ARIMA-NLSVR(4.73) | MAPE |

| 35 | [22] | the growth rate and instability of mango production is studied for the period 1992-93 to 2013-14. | Adjusted R2,Growth rate ,instability, root mean square error, spline model ,trend | Mango | ||

| 36 | [24] | From this viewpoint ,we investigate domestic integration among ten major mango market,LAHORE, FAISALABAD,MULTAN, GUJRANWALA, SARGODHA, KARACHI, HYDERBAD, SIKKUR, PRESHAWA AND QUETTA | Mangoes ,cointegration,causlity | Mango |

4. Research Method

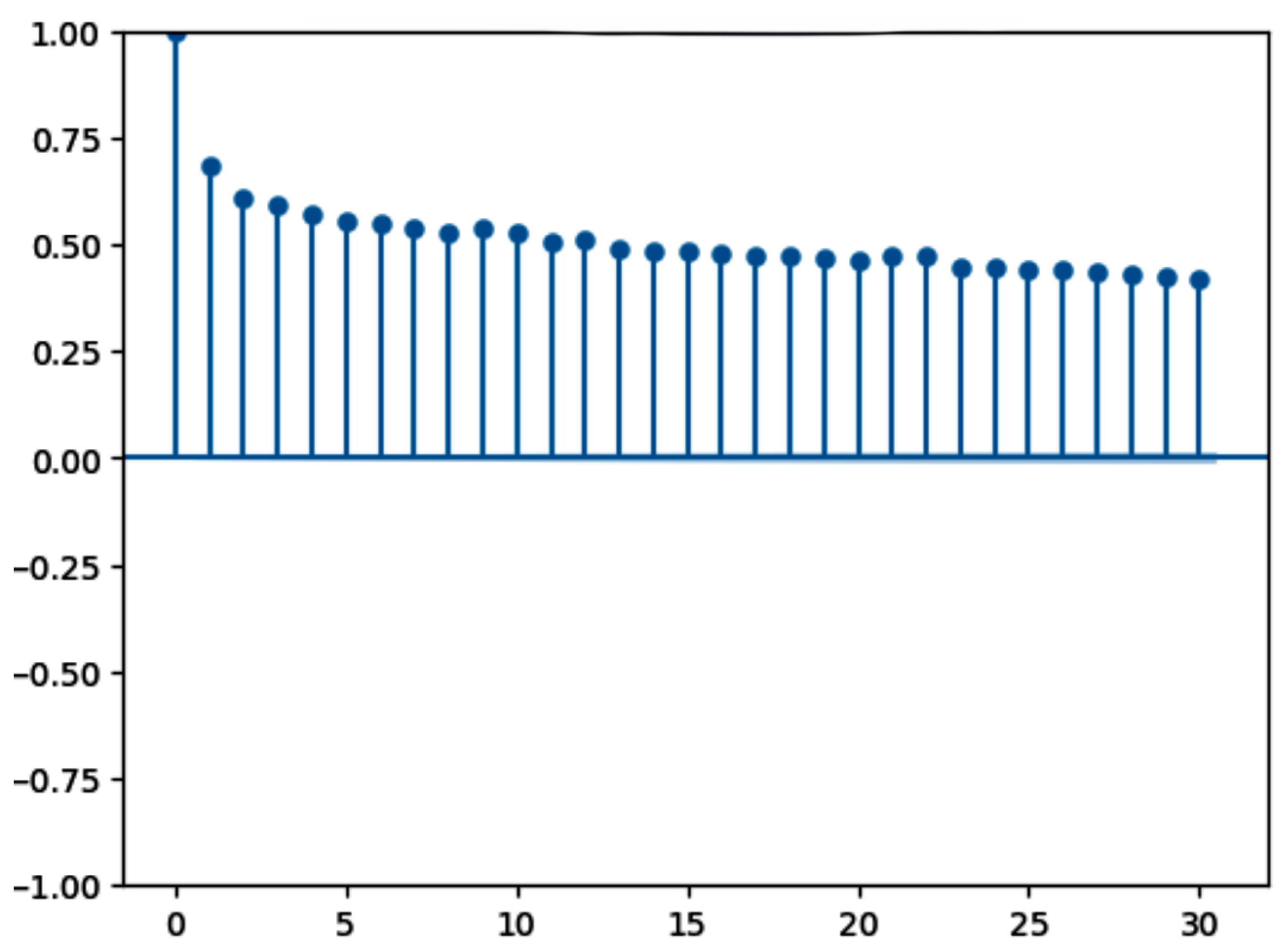

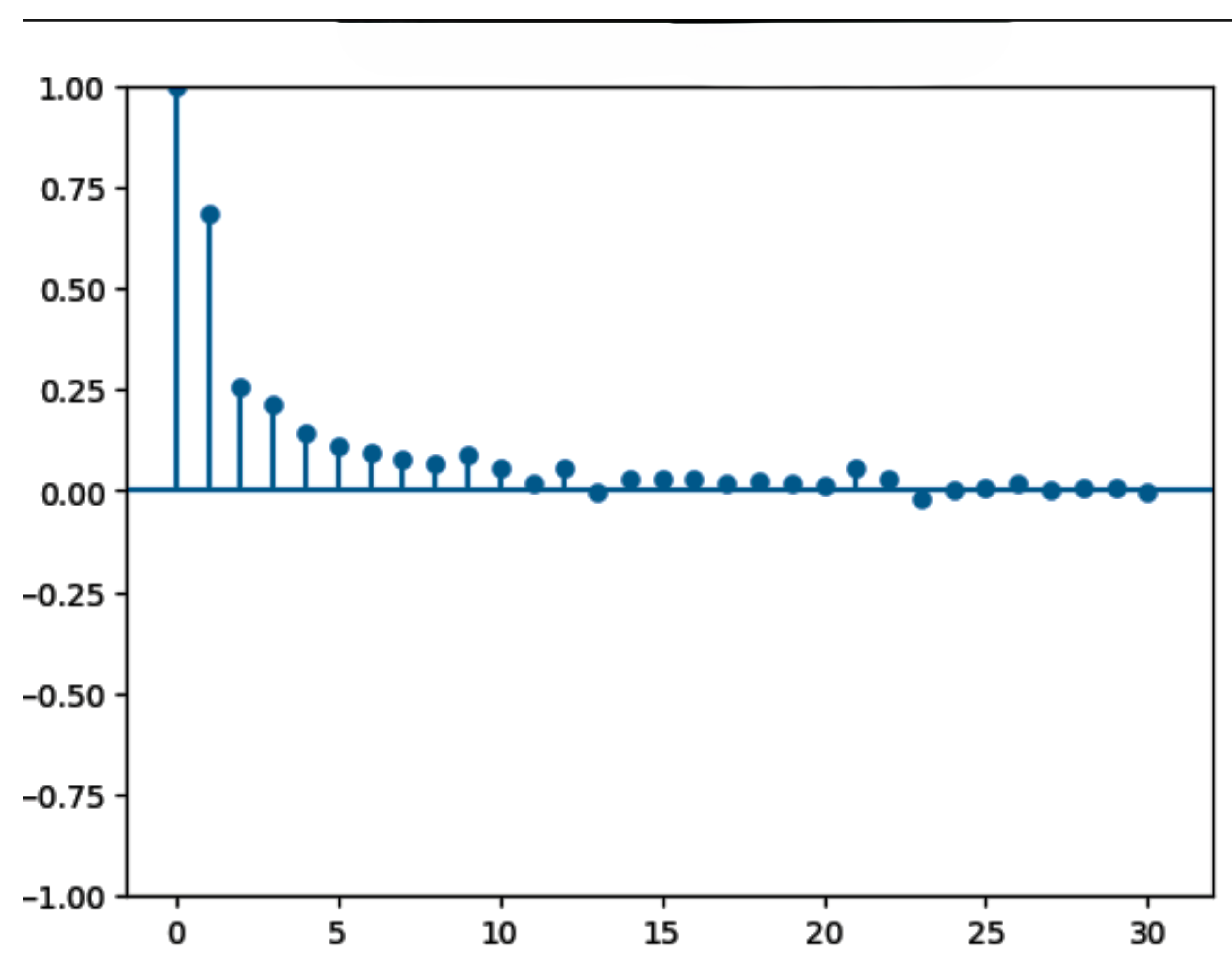

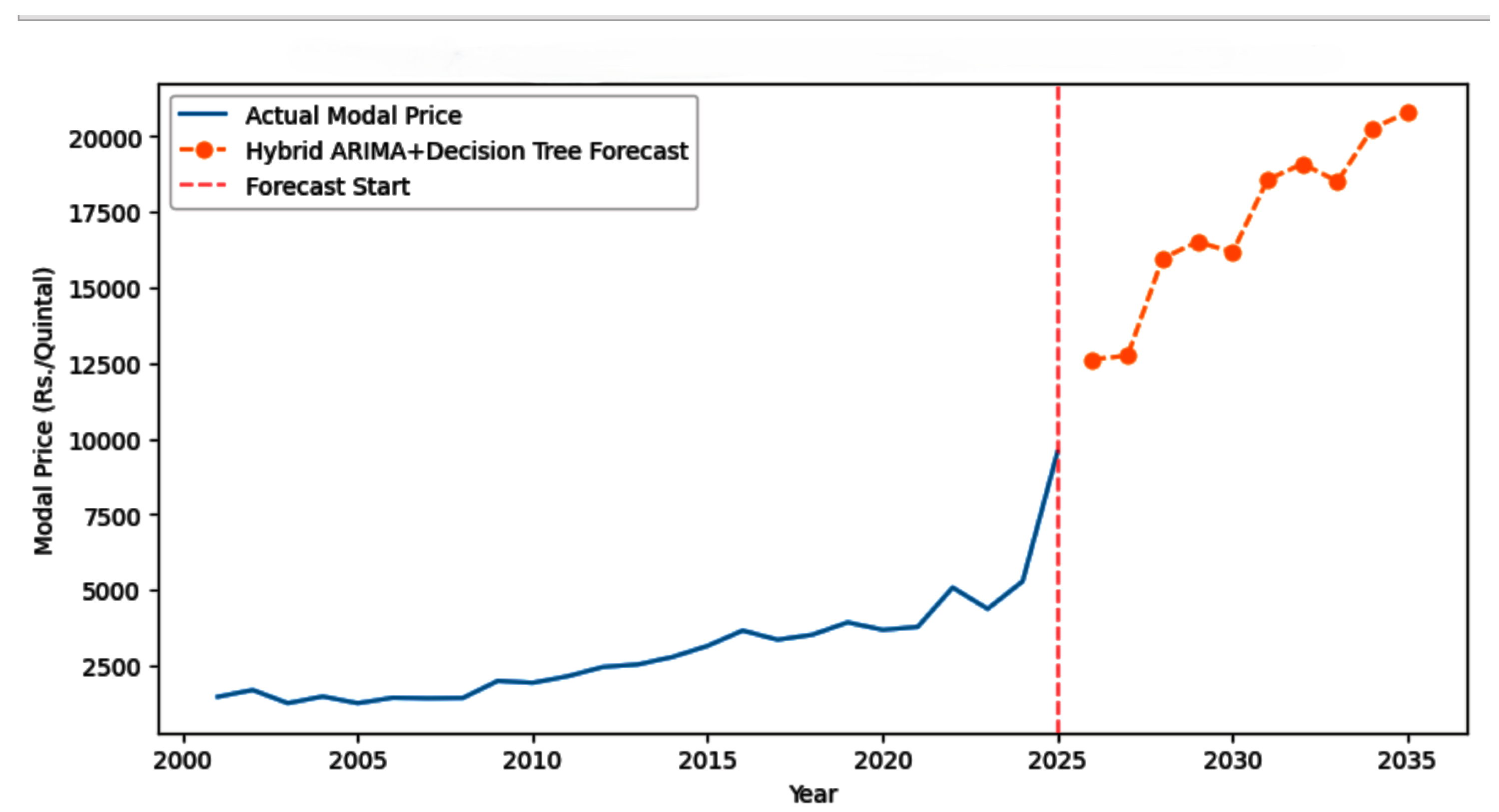

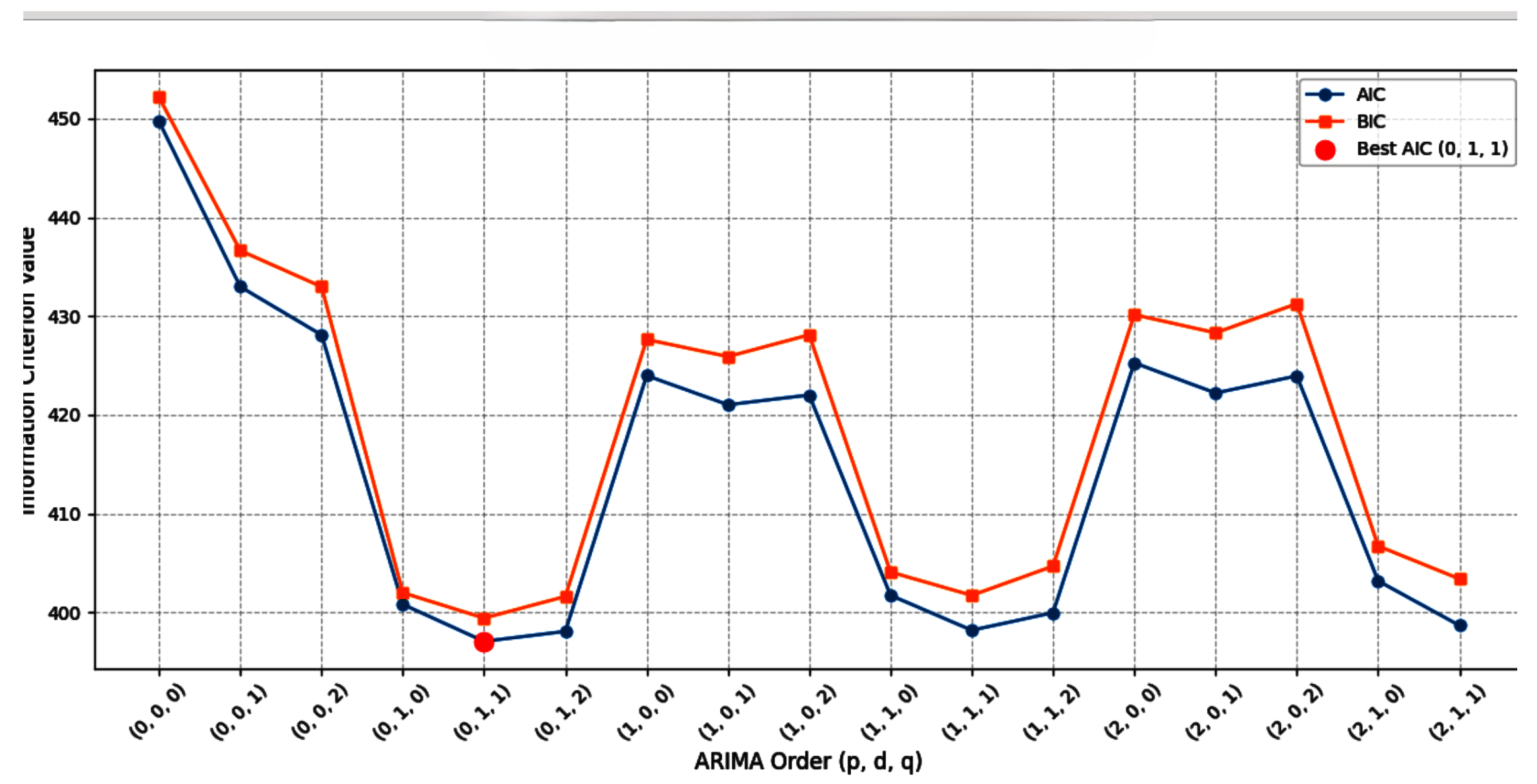

4.1. BOX -Jenkins Hybrid Autoregressive Integrated Moving Average(ARIMA) and( Decision Tree)Models

| Transform | ADF Statistic | p-value | Used_Lag | N_ObsWM | Crit_1% | Crit_5% | Crit_10% |

|---|---|---|---|---|---|---|---|

| Original | -46.520997 | 0.0 | 91 | 375001 | -3.430367 | -2.861548 | -2.566774 |

| diff_1 | 109.598447 | 0.0 | 94 | 374997 | -3.430367 | -3.861548 | -2.566774 |

| ARIMA Model order | order(011) | order(012) | order(111) | order(211) | order(212) | order(112) |

|---|---|---|---|---|---|---|

| AIC | 397.064107 | 398.082520 | 398.192113 | 398.678592 | 399.714501 | 399.968077 |

| BIC | 399.420215 | 401.616681 | 401.726275 | 403.390807 | 405.604770 | 404.680293 |

| Time | 0.006 | 0.009 | 0.013 | 0.012 | 0.034 | 0.014 |

| S.no | Year | Hybrid ARIMA DT Forecasting |

|---|---|---|

| 1 | 2026 | 12630.112316 |

| 2 | 2027 | 12754.083696 |

| 3 | 2028 | 15976.008736 |

| 4 | 2029 | 16516.039232 |

| 5 | 2030 | 16180.946513 |

| 6 | 2031 | 18576.680938 |

| 7 | 2032 | 19094.206088 |

| 8 | 2033 | 18519.158104 |

| 9 | 2034 | 20276.976371 |

| 9 | 2035 | 20795.247673 |

| MAE | MSE | RMSE | RMAPE | R2_Score |

|---|---|---|---|---|

| 0.000 | 0.000 | 0.0000 | 1 |

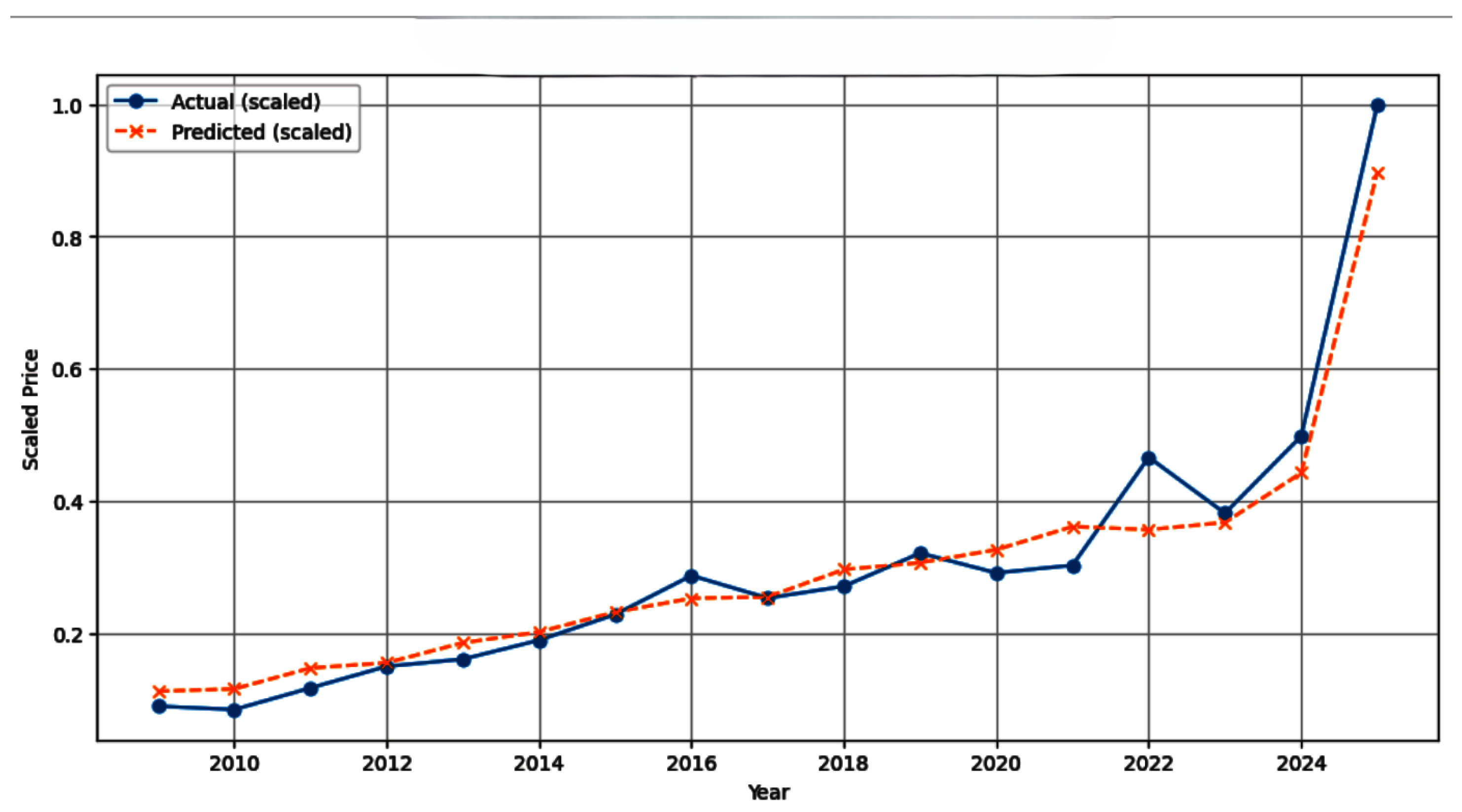

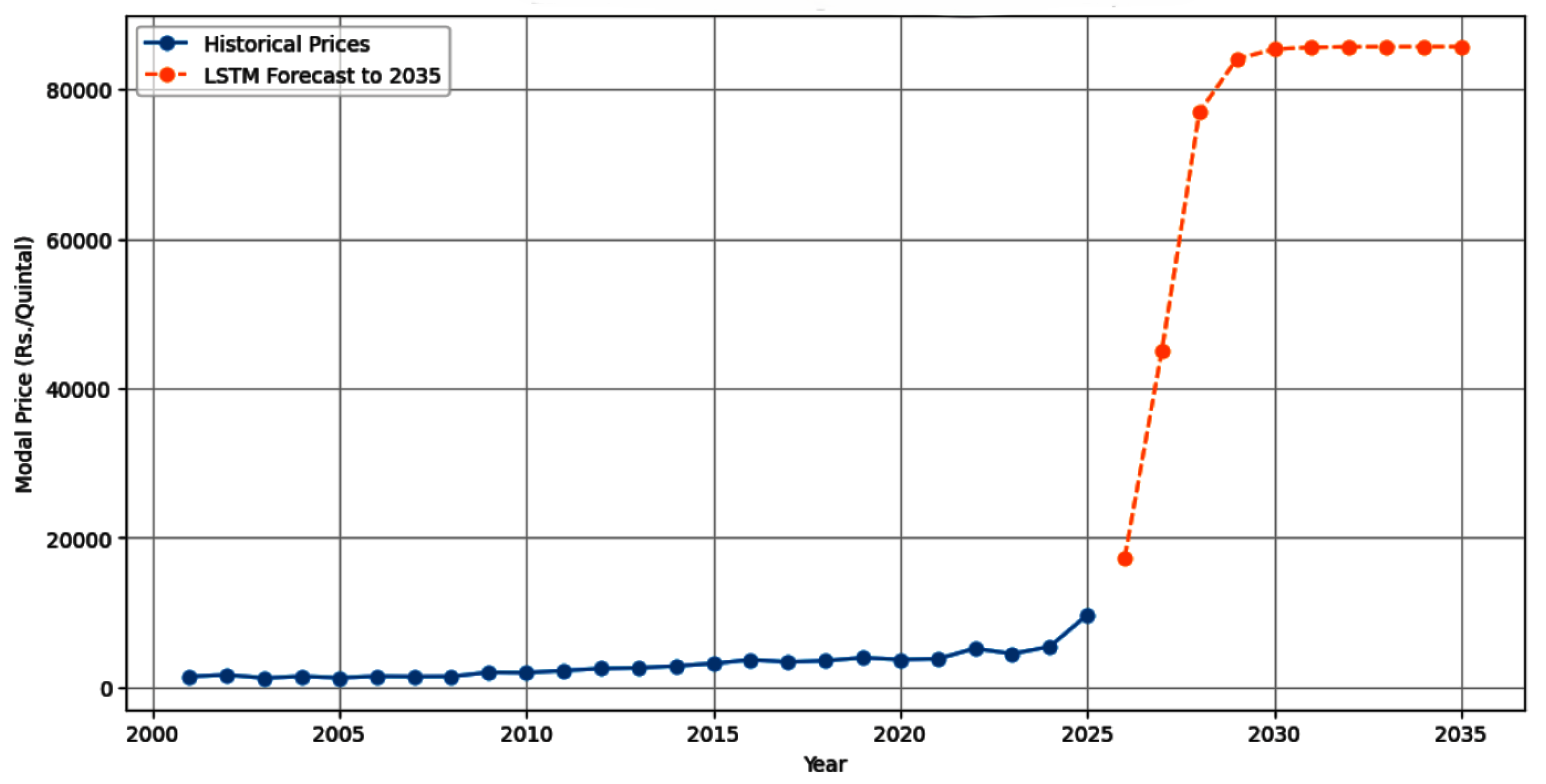

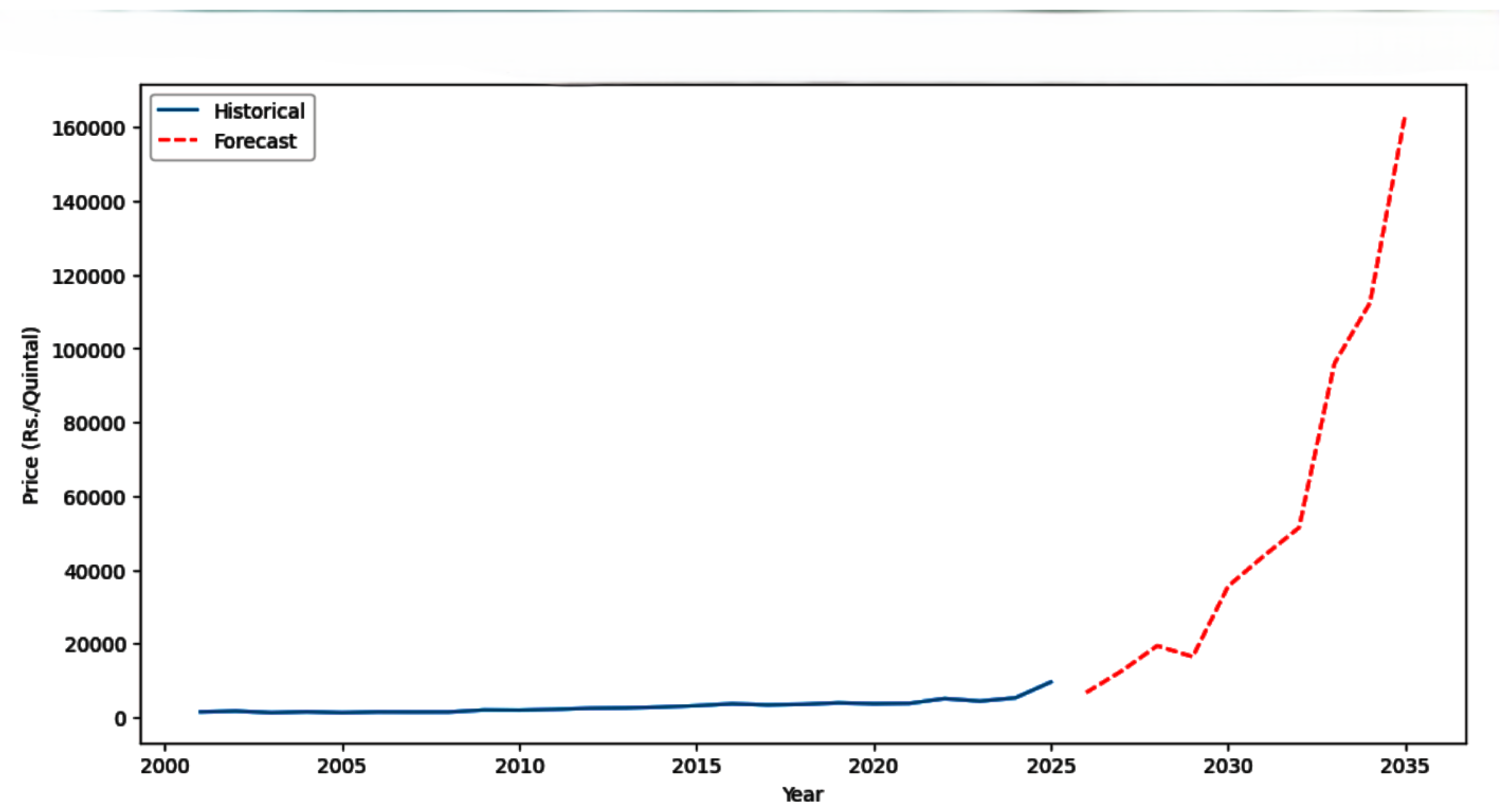

4.2. Long-Shrot-Trem Memory(LSTM) Model:

| MSE | RMSE | MAE | R2_Score |

|---|---|---|---|

| 0.0021 | 0.0458 | 0.0342 | 0.9529 |

| S.no | Year | Forecasted_price |

|---|---|---|

| 1 | 2026 | 17361.833984 |

| 2 | 2027 | 45129.320312 |

| 3 | 2028 | 76947.750000 |

| 4 | 2029 | 84088.367188 |

| 5 | 2030 | 85366.273438 |

| 6 | 2031 | 85612.523438 |

| 7 | 2032 | 85682.585938 |

| 8 | 2033 | 85701.640625 |

| 9 | 2034 | 85706.640625 |

| 10 | 2035 | 85707.757812 |

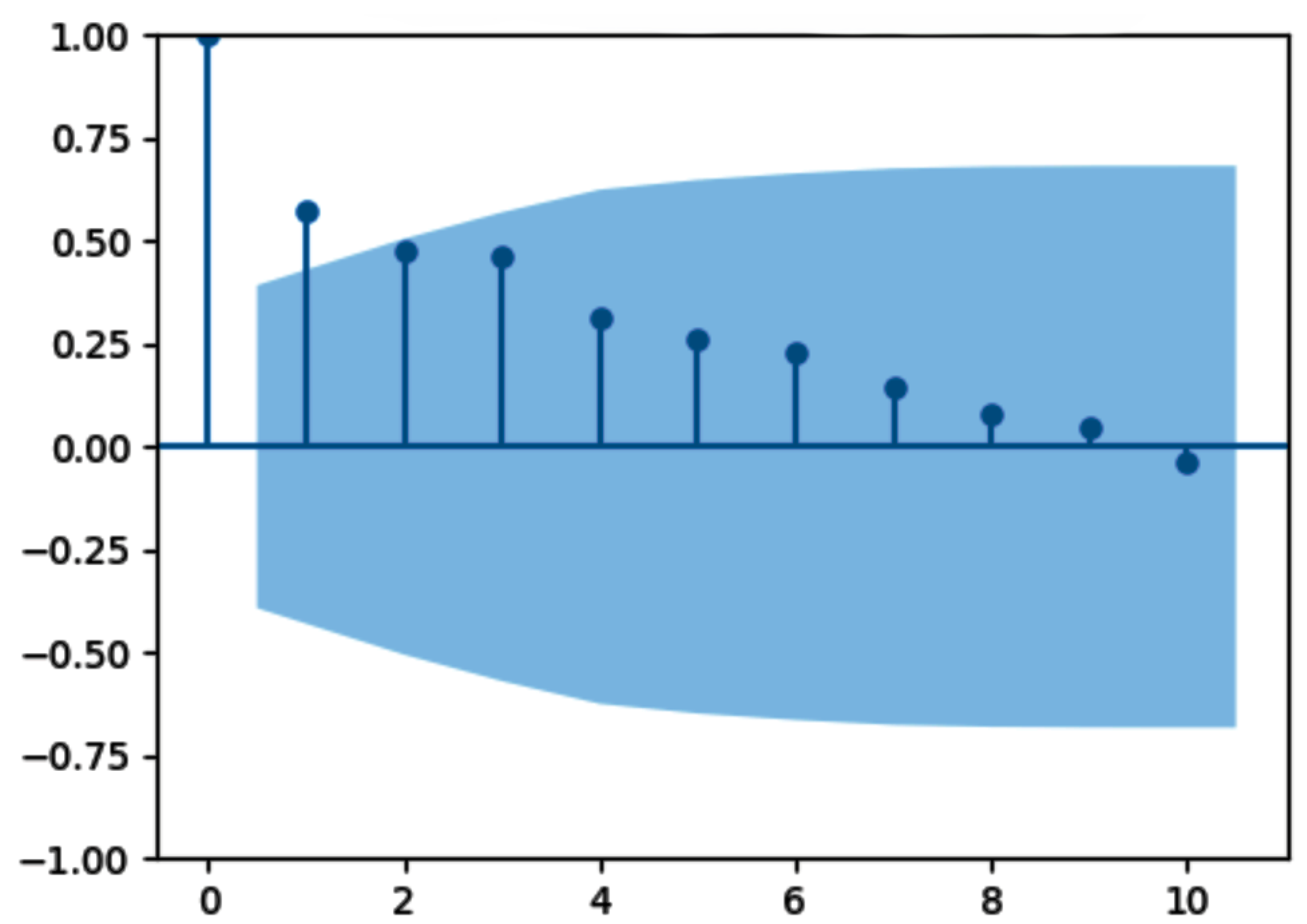

4.3. Hybrid Error Trend Seasonality(ETS)

| MSE | RMSE | MAE | R2_Score | NRAMSE mean | NRMSE range | SMAPE |

|---|---|---|---|---|---|---|

| 0.006 | 0.078 | 0.063 | 0.873 | 0.335 | 0.078 | 0.465 |

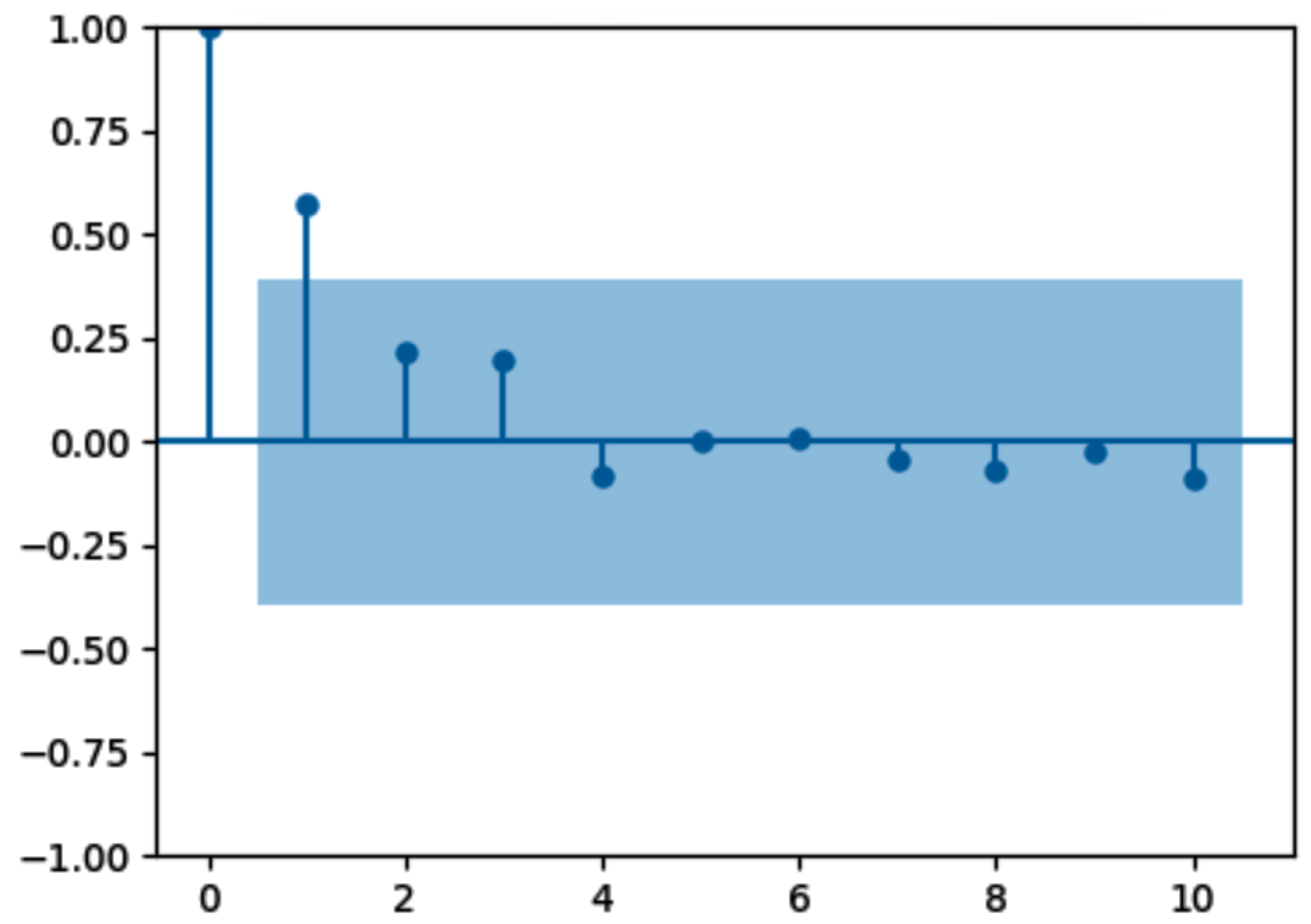

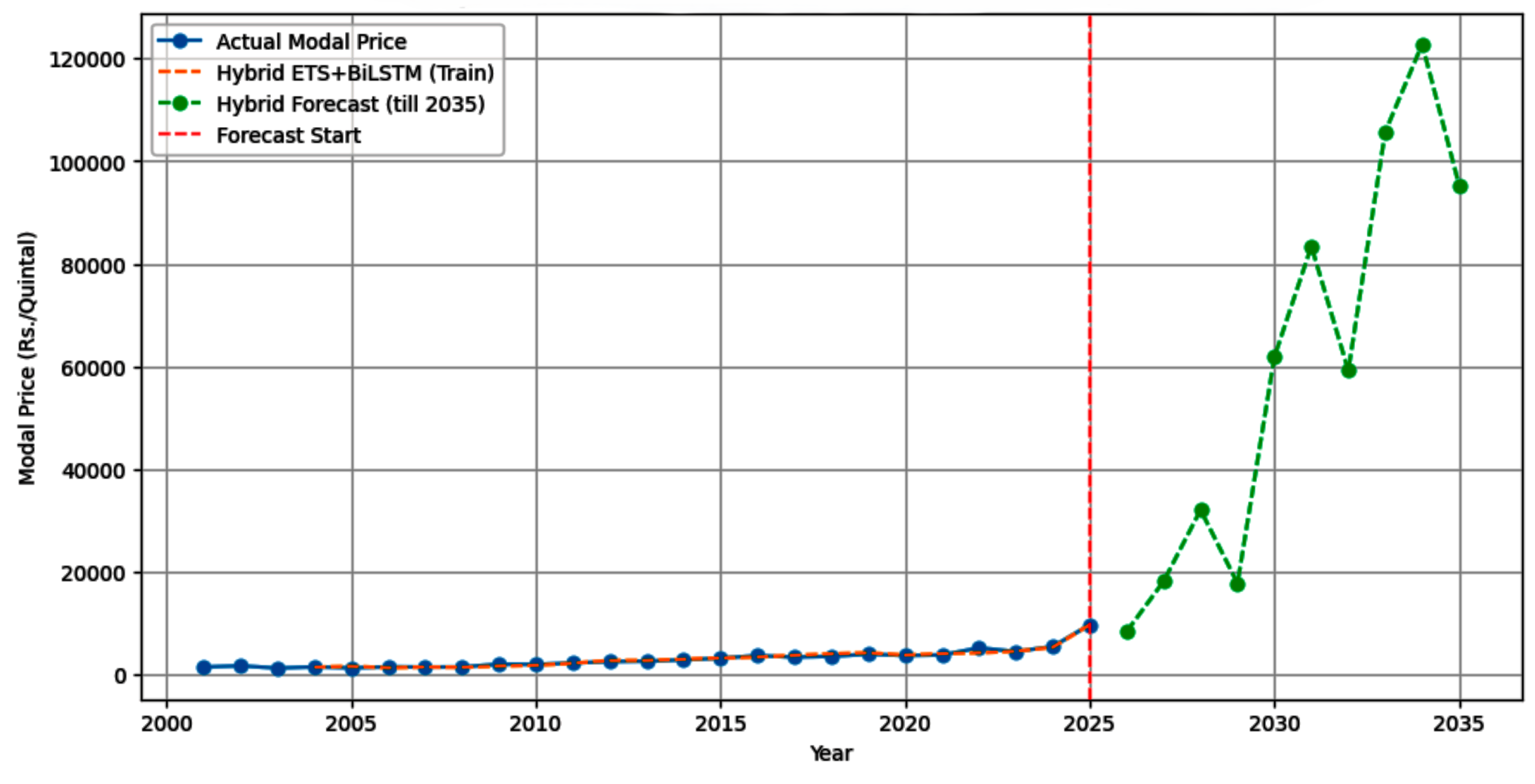

4.4. Hybrid ETS -BiLSTM Model:s

| MAE | MSE | RMSE | R2_Score |

|---|---|---|---|

| 0.024381 | 0.001188 | 0.034466 | 0.975072 |

| S.no | Year | Forecasted_price |

|---|---|---|

| 1 | 2026 | 8389.606955 |

| 2 | 2027 | 18164.456223 |

| 3 | 2028 | 32060.076838 |

| 4 | 2029 | 17785.109728 |

| 5 | 2030 | 61908.443448 |

| 6 | 2031 | 83423.989295 |

| 7 | 2032 | 59219.310578 |

| 8 | 2033 | 105724.14221 |

| 9 | 2034 | 122770.617312 |

| 10 | 2035 | 95345.215007 |

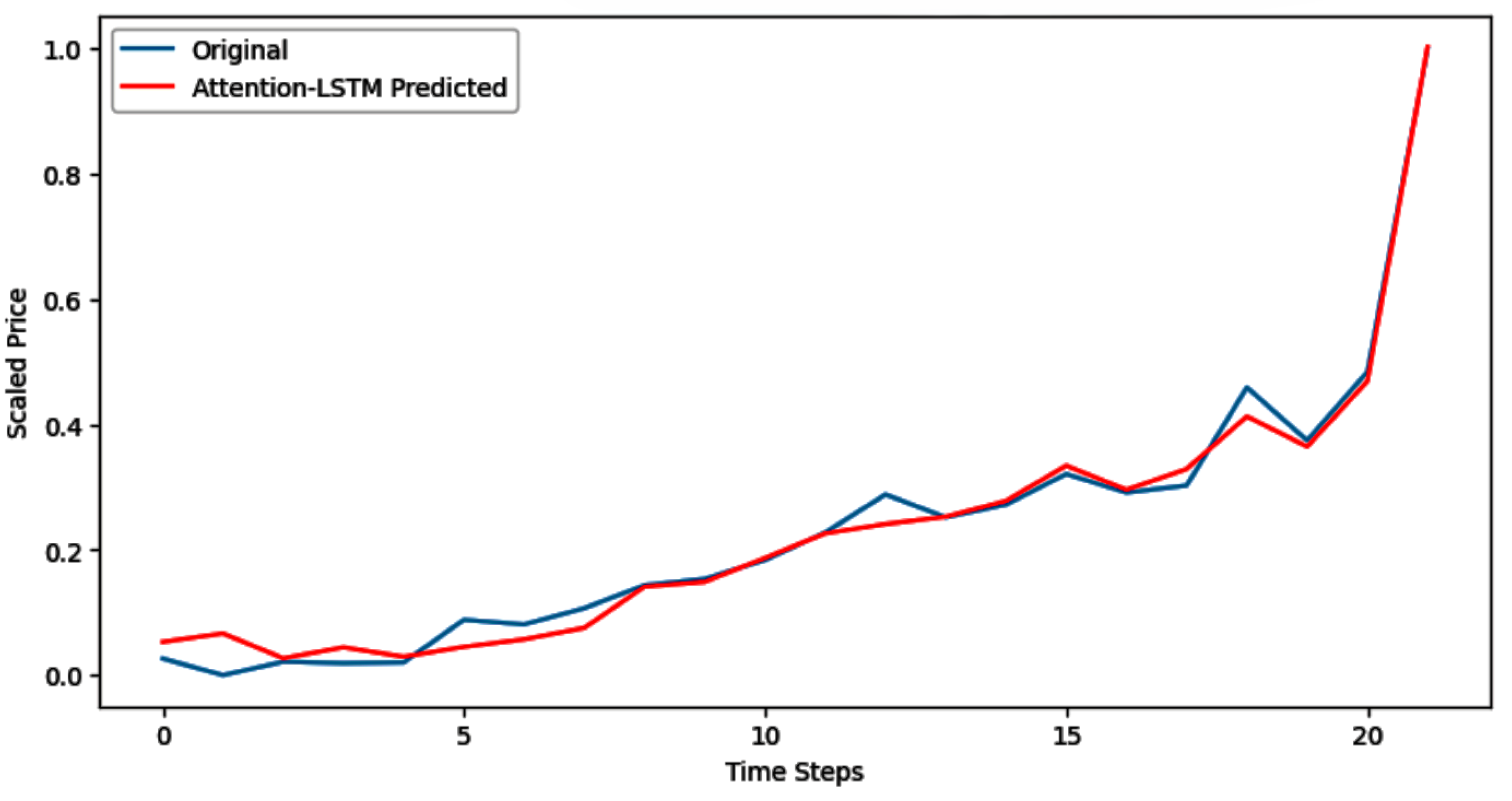

4.5. Attention-LSTM Model:

| Layer (type) | Output Shape | Param # |

|---|---|---|

| input_layer (InputLayer) | (None, 3, 1) | 0 |

| lstm (LSTM) | (None, 3, 50) | 10,400 |

| attention (Attention) | (None, 50) | 2,550 |

| dense (Dense) | (None, 1) | 51 |

| MAE | RMSE | MSE | R2_Score |

|---|---|---|---|

| 0.019 | 0.026 | 0.001 | 0.986 |

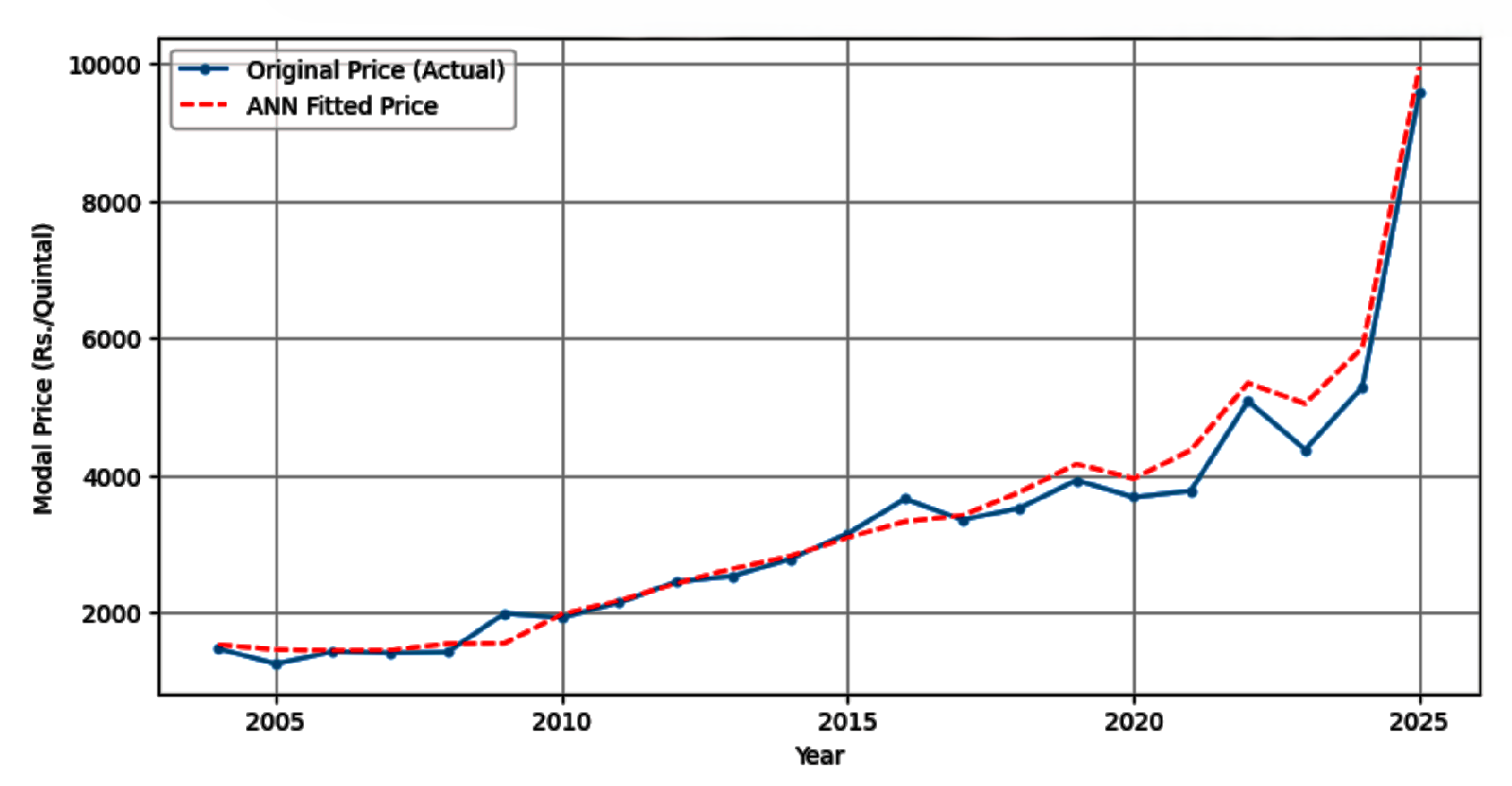

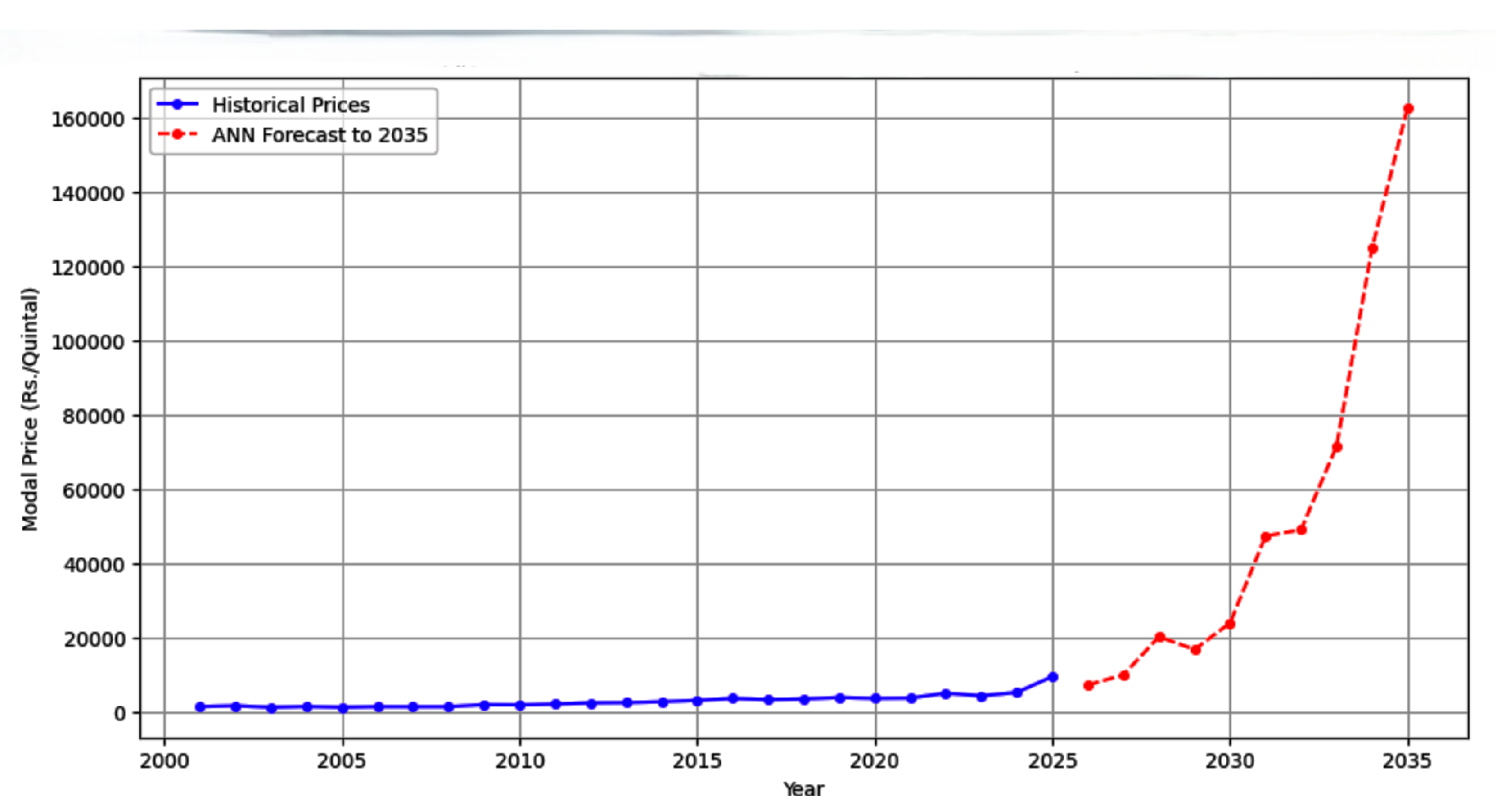

4.6. Artificial Neural Network(ANN) Model:

| Layer (type) | Output Shape | Param # |

|---|---|---|

| dense (Dense) | (None, 50) | 200 |

| dense_1 (Dense) | (None, 25) | 1, 275 |

| dense_2 (Dense) | (None, 1) | 26 |

| MAE | MSE | RMSE | R2_Score |

|---|---|---|---|

| 0.0260 | 0.0012 | 0.0352 | 0.9741 |

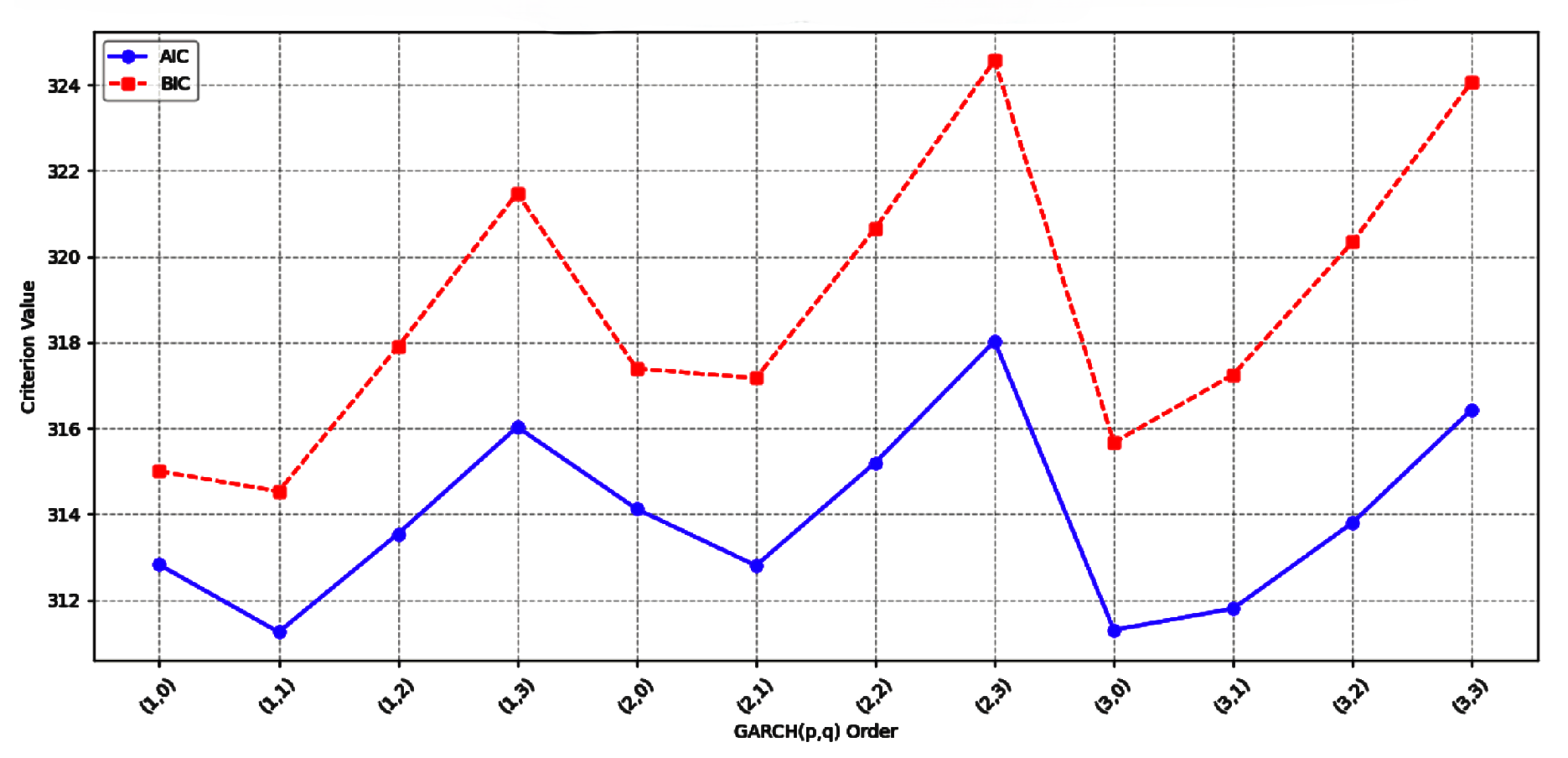

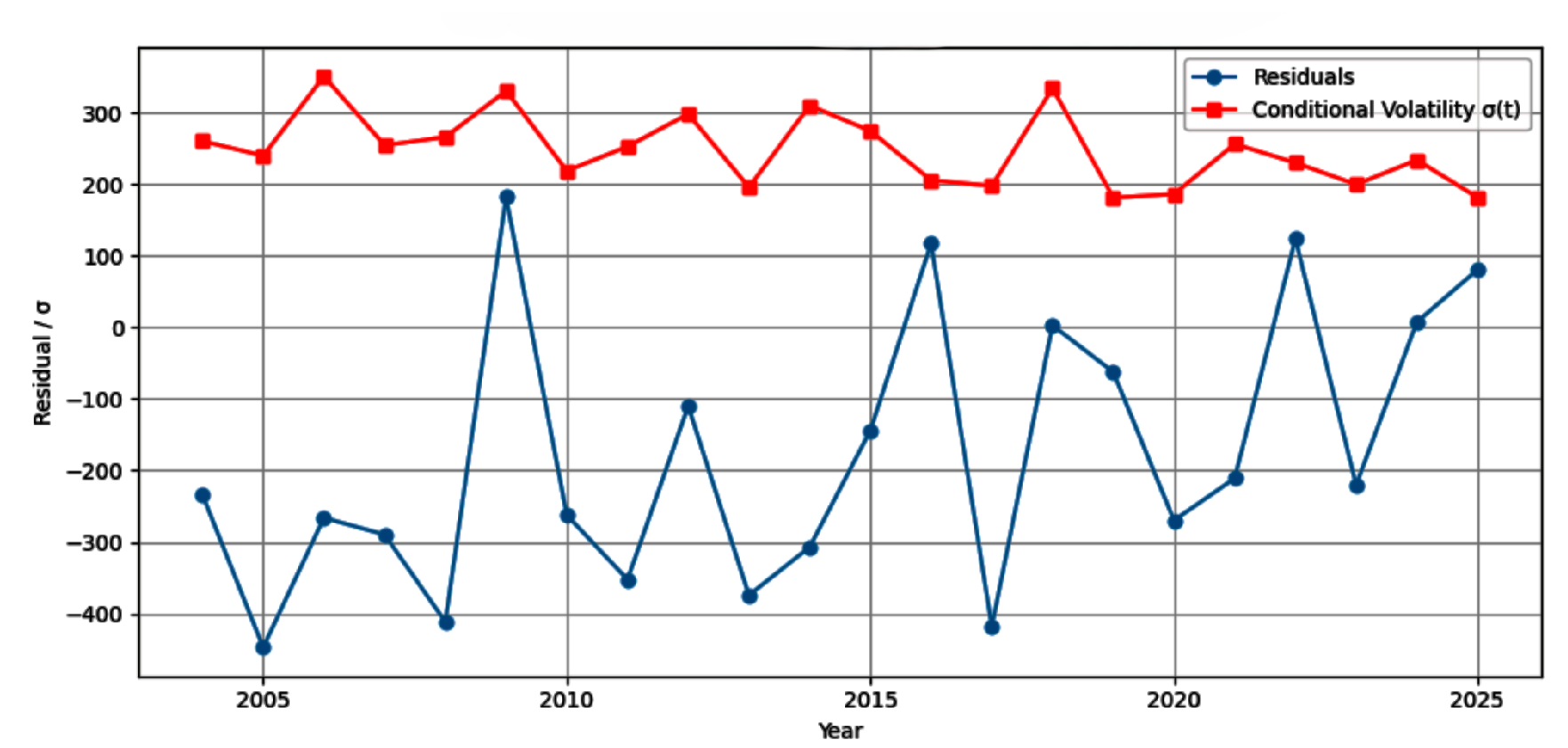

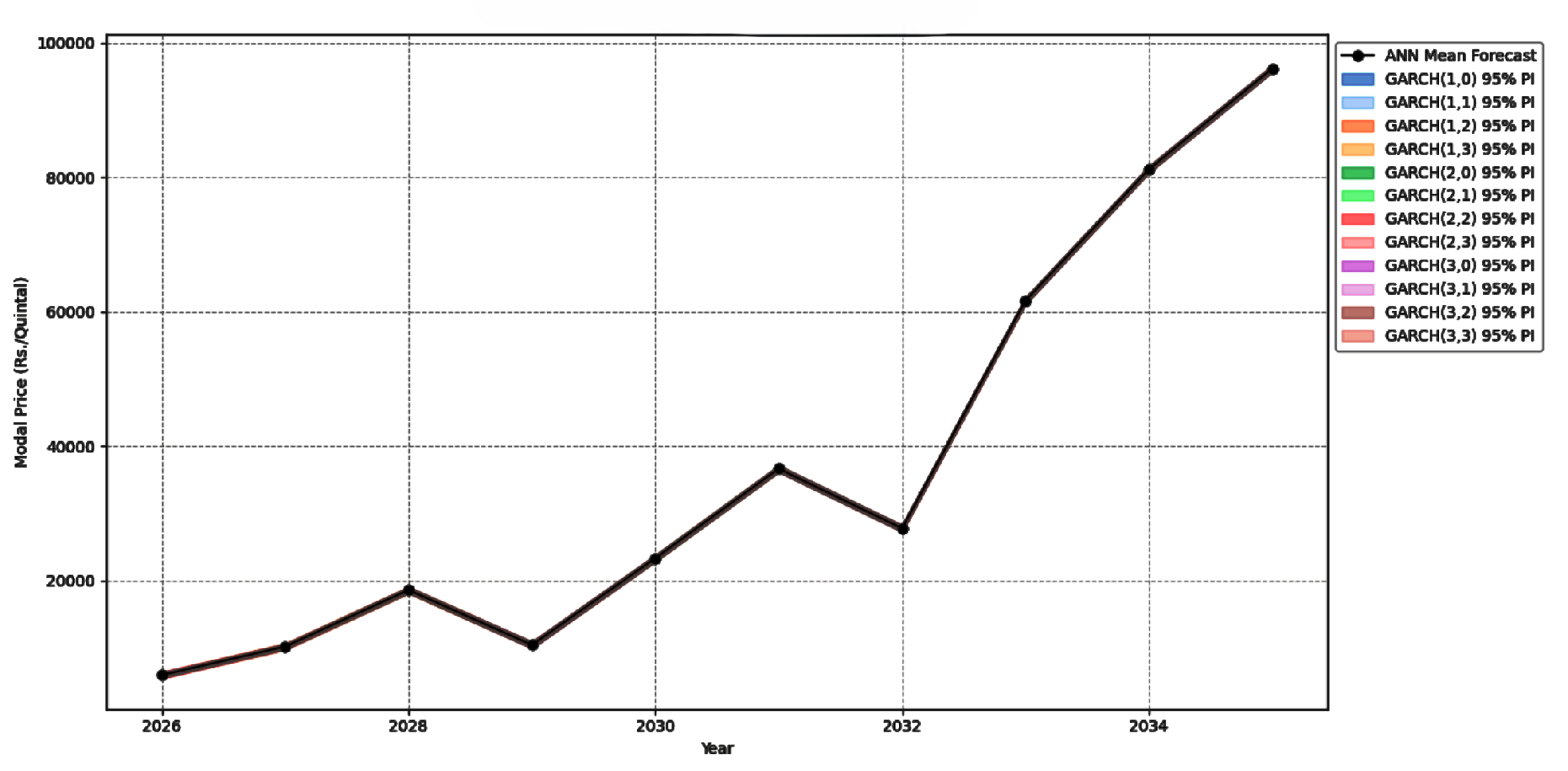

4.7. Hybrid Grach Model:

| s.no | P | Q | AIC | BIC | RMSE | R2_Score |

|---|---|---|---|---|---|---|

| 1 | 1 | 0 | 282.696366 | 284.878451 | 0.0 | 1.0 |

| 2 | 1 | 1 | 283.859778 | 287.132905 | 0.0 | 1.0 |

| 3 | 2 | 0 | 284.696366 | 287.969493 | 0.0 | 1.0 |

| 4 | 1 | 2 | 285.243879 | 289.608049 | 0.0 | 1.0 |

| 5 | 1 | 3 | 285.813598 | 291.268810 | 0.0 | 1.0 |

| 6 | 2 | 1 | 285.859778 | 290.223947 | 0.0 | 1.0 |

| 7 | 3 | 0 | 286.696366 | 291.060535 | 0.0 | 1.0 |

| 8 | 2 | 2 | 287.243879 | 292.699092 | 0.0 | 1.0 |

| 9 | 2 | 3 | 287.813592 | 294.359846 | 0.0 | 1.0 |

| 10 | 3 | 1 | 287.859778 | 293.314990 | 0.0 | 1.0 |

| 11 | 3 | 2 | 289.243702 | 295.789957 | 0.0 | 1.0 |

| 12 | 3 | 3 | 289.813579 | 297.450876 | 0.0 | 1.0 |

5. Discussion

- This analysis is play significant role in area of horticultural market in India (national) and international market.It goes beyond the typical emphasis on single models and image-based classification to provide a comprehensive solution for managing market risk.

- Previous research relied on a large number of combined forecasting models based on traditional methods, whereas a single deep learning forecasting model has emerged.

- Specifically, this frame may simultaneously detect trend-seasonality disintegration (ETS), non-linear mapping (ANN), and volatility modelling (GARCH).

- This analysis tell us we can use deep learning models like Attention -LSTM the use of deep learning in this sector by abstracting deeper insights from temporal data.

- This analysis effectively built an integrated hybrid ETS+ANN+GRACH model.

- Mango model price forecasting is highly relevant and can help us make better decisions.

6. Conclusion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| LSTM | Long Short-Term Memory |

| SARIMA | Seasonal AutoRegressive Integrated Moving Average |

| ETS | Error, Trend, Seasonal |

| MAE | Mean Absolute Error |

| RMSE | Root Mean Squared Error |

| MAPE | Mean Absolute Percentage Error |

References

- Pardhi, R.; Singh, R.; Rathod, S.; Singh, P. K. Effect of price of other seasonal fruits on mango price in Uttar Pradesh. Economic Affairs 2016, 61(4), 627. [Google Scholar] [CrossRef]

- Yosbuth, C.; Pattarajariya, K.; Sitthikarn, P.; Ditjarern, S.; Siriborvornratanakul, T. Using Computer Vision for Mango Price Estimation Based on Breed Classification and Quality Grading. Journal of The Institution of Engineers (India): Series B 2024, 105(2), 443–454. [Google Scholar] [CrossRef]

- Gothai, E.; Rajalaxmi, R. R.; Thamilselvan, R.; Harshath, S. M. Forecasting Price Prediction for Vegetables and Fruits Using Recurrent Neural Network. 2024 5th International Conference on Electronics and Sustainable Communication Systems (ICESC), 2024; IEEE; pp. 1889–1896. [Google Scholar]

- Peerzada, S.; Saud, M. R.; Javed, D. NeuralMango: Advanced Mango Classification and Price Prediction. 2024 International Conference on Engineering & Computing Technologies (ICECT), 2024; IEEE; pp. 1–6. [Google Scholar]

- Arcila-Diaz, L.; Mejia-Cabrera, H. I.; Arcila-Diaz, J. Estimation of Mango Fruit Production Using Image Analysis and Machine Learning Algorithms. In Informatics 2024, 11(4), 87. [Google Scholar] [CrossRef]

- Kumar, S. Y.; Mishra, A.; Nambiar, R.; Nekar, A.; Benedict, S. Fruit Weight Prediction and Cost Estimation Using YOLOv9-based Deep Learning. 2024 International Conference on IoT Based Control Networks and Intelligent Systems (ICICNIS), 2024; IEEE; pp. 1304–1309. [Google Scholar]

- Sharma, C.; Misra, R.; Bhatia, M.; Manani, P. Price prediction model of fruits, vegetables and pulses according to weather. 2023 13th international conference on cloud computing, data science & engineering (confluence), 2023; IEEE; pp. 347–351. [Google Scholar]

- Kumari, P.; Goswami, V.; Harshith, N.; Pundir, R. S. Recurrent neural network architecture for forecasting banana prices in Gujarat, India. Plos one 2023, 18(6), e0275702. [Google Scholar] [CrossRef]

- Banerjee, S.; Mondal, A. C. An ingenious method for estimating future crop prices that emphasises machine learning and deep learning models. International journal of information technology 2023, 15(8), 4291–4313. [Google Scholar] [CrossRef]

- Torgbor, B. A.; Rahman, M. M.; Brinkhoff, J.; Sinha, P.; Robson, A. Integrating remote sensing and weather variables for mango yield prediction using a machine learning approach. Remote Sensing 2023, 15(12), 3075. [Google Scholar] [CrossRef]

- Garde, Y.; Chavda, R. R.; Thorat, V. S.; Pisal, R. R.; Shrivastava, A.; Varshney, N. Forecasting area, productivity and prices of mango in Valsad District of Gujarat: Time series analysis. Environment Conservation Journal 2023, 24(2), 218–227. [Google Scholar] [CrossRef]

- Ma, W.; Nowocin, K.; Marathe, N.; Chen, G. H. An interpretable produce price forecasting system for small and marginal farmers in india using collaborative filtering and adaptive nearest neighbors. In Proceedings of the Tenth International Conference on Information and Communication Technologies and Development, 2019; pp. 1–11. [Google Scholar]

- Thapaswini, G.; Gunasekaran, M. A methodology for crop price prediction using machine learning. 2022 ieee 2nd international conference on mobile networks and wireless communications (icmnwc), 2022; IEEE; pp. 1–7. [Google Scholar]

- Garde, Y. A.; Chavda, R. R.; Thorat, V. S.; Pisal, R. R. Forecasting of area, productivity and prices of mango in Navsari district, Gujarat. 2021. [Google Scholar] [CrossRef]

- Munj, A. Y.; Jalgaonkar, V. N.; Salvi, B. R.; Narangalkar, A. L.; Choudhary, J. S.; Kumari, M.; Mali, S. S.; Das, B. Prediction of mango hopper, Idioscopus nitidulus (Walker) using hybrid modelling in Konkan region. Journal of Agrometeorology 2021, 23(1), 60–65. [Google Scholar] [CrossRef]

- Chen, S. I.; Chen, W. F. The Optimal Harvest Decisions for Natural and Artificial Maturation Mangoes under Uncertain Demand, Yields and Prices. Sustainability 2021, 13(17), 9660. [Google Scholar] [CrossRef]

- Sujatha, P. Hybrid Statistical Models for Forecasting Yield of Mango and Banana in Tamil Nadu, India. Asian Journal of Agricultural Extension, Economics & Sociology 2021, 39(11), 168–174. [Google Scholar] [CrossRef]

- Navaja, R. B.; Campomanes, F. P.; Patiño, C. L.; Flores, M. J. L. Analyzing the Status of Mango Trees in Brgy. Cantipay, Carmen, Cebu Using Ndvi and Time Series Clustering. The International Archives of the Photogrammetry, Remote Sensing and Spatial Information Sciences 2019, 42, 313–317. [Google Scholar] [CrossRef]

- Dharavath, R.; Khosla, E. Seasonal ARIMA to forecast fruits and vegetable agricultural prices. 2019 IEEE International Symposium on Smart Electronic Systems (iSES)(Formerly iNiS), 2019; IEEE; pp. 47–52. [Google Scholar]

- Pardhi, R.; Singh, R.; Paul, R. K. Price forecasting of mango in Varanasi market of Uttar Pradesh. Current Agriculture Research Journal 2018, 6(2), 218. [Google Scholar] [CrossRef]

- Rathod, S.; Mishra, G. C. Statistical models for forecasting mango and banana yield of Karnataka, India. Journal of Agricultural Science and Technology 2018, 20(4), 803–816. [Google Scholar]

- Abhiram Dash, A. D.; Dhakre, D. S.; Debasis Bhattacharya, D. B. Fitting of appropriate model to study growth rate and instability of mango production in India. 2017. [Google Scholar]

- Qureshi, M. N.; Bilal, M.; Ayyub, R. M.; Ayyub, S. Modelling on Mango Production in Pakistan. Sci. Int.,(Lahore) 2014, 26(3), 1227–1231. [Google Scholar]

- Ghafoor, A.; Mustafa, K.; Mushtaq, K.; others. Cointegration and causality: An application to major mango markets in Pakistan. Lahore Journal of Economics 2009, 14(1), 85–113. [Google Scholar] [CrossRef]

- Khan, M.; Mustafa, K.; Shah, M.; Khan, N.; Khan, J. Z. Forecasting mango production in Pakistan an econometric model approach. Sarhad J. Agri 2008, 24(2), 363–370. [Google Scholar]

- Bana, J. K.; Choudhary, J. S.; Kumar, S.; Ghoghari, P. D.; Kalaria, G. B.; Desai, H. R.; Patil, S. J.; Patil, P. Seasonal time series forewarning model for population dynamics of mango hopper (Hemiptera: Cicadellidae) in humid agro-climatic conditions. International Journal of Pest Management 2024, 70(4), 626–636. [Google Scholar] [CrossRef]

- Dai, X.; Chen, L.; Hou, Y.; Ning, X.; Zhao, W.; Cui, Y.; Liu, J.; Wang, M. A Comparative Study of Neural Network Models for China’s Soybean Futures Price Forecasting. Agriculture 2025, 15(24), 2586. [Google Scholar] [CrossRef]

- Aguilera, S. G.; Karbassi Yazdi, A. Anomaly Detection and Regional Clustering in Chilean Wholesale Fruit and Vegetable Prices with Machine Learning. Agriculture 2025, 15(22), 2362. [Google Scholar] [CrossRef]

- Ye, Y.; Zhuang, X.; Yi, C.; Liu, D.; Tang, Z. Enhancing Agricultural Futures Return Prediction: Insights from Rolling VMD, Economic Factors, and Mixed Ensembles. Agriculture 2025, 15(11), 1127. [Google Scholar] [CrossRef]

- Wang, G.; Xu, S.; Chen, Z.; Li, Y. A Hybrid Model Integrating Variational Mode Decomposition and Intelligent Optimization for Vegetable Price Prediction. Agriculture 2025, 15(9), 919. [Google Scholar] [CrossRef]

- Feng, Y.; Hu, X.; Hou, S.; Guo, Y. A Novel BiGRU-Attention Model for Predicting Corn Market Prices Based on Multi-Feature Fusion and Grey Wolf Optimization. Agriculture 2025, 15(5), 469. [Google Scholar] [CrossRef]

- Zhao, C.; Wang, X.; Zhao, A.; Cui, Y.; Wang, T.; Liu, J.; Hou, Y.; Wang, M.; Chen, L.; Li, H. A vegetable-price forecasting method based on mixture of experts. Agriculture 2025, 15(2), 162. [Google Scholar] [CrossRef]

- Hamulczuk, M.; Pawlak, K.; Stefańczyk, J.; Gołębiewski, J. Agri-food supply and retail food prices during the Russia–Ukraine conflict’s early stage: implications for food security. Agriculture 2023, 13(11), 2154. [Google Scholar] [CrossRef]

- Sun, F.; Meng, X.; Zhang, Y.; Wang, Y.; Jiang, H.; Liu, P. Agricultural product price forecasting methods: A review. Agriculture 2023, 13(9), 1671. [Google Scholar] [CrossRef]

- Xiong, T.; Li, M.; Cao, J. Do futures prices help forecast spot prices? Evidence from China’s new live hog futures. Agriculture 2023, 13(9), 1663. [Google Scholar] [CrossRef]

- Wu, J.; Hu, Y.; Wu, D.; Yang, Z. An aquatic product price forecast model using VMD-IBES-LSTM hybrid approach. Agriculture 2022, 12(8), 1185. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.