1. Introduction

The digital uprising has changed the notion of finance by driving extensive transformation in banking, risk management, and regulatory areas. (Arner, Barberis, & Buckley, 2016; Philippon, 2019). In Indonesia, this phenomenon for example the rapid expansion of digital financial services driven by fintech advances, and the widespread adoption of mobile technology has significantly increased financial inclusion, providing banking access to millions of people previously untouched by the formal economy (Boot & Thakor, 2025; World Bank, 2020). In addition to this advancement, a new spectrum of systemic risks and regulatory challenges have emerged. As the digital changes in Indonesia's financial ecosystem are becoming more pronounced (Birindelli & Iannuzzi, 2024; Yang & Ali, 2024). The institutions that have the responsibility to ensure the stability of the Indonesian Deposit Insurance Corporation are now tasked with maintaining depositors' confidence and financial integrity under conditions that were never thought of before (Demirgüç-Kunt & Kane, 2002). The institutions that have the responsibility to ensure the stability of the Indonesian Deposit Insurance Corporation are now tasked with maintaining depositors' confidence and financial integrity under conditions that were never thought of before (Zetzsche, Buckley, Arner, & Barberis, 2017; IMF, 2021). Recent global and regional disruptions, ranging from the 1998 Asian Financial Crisis to the volatility triggered by the COVID-19 pandemic, underscore the need for a strong and adaptable financial safety net (Barua & Barua, 2021; OECD, 2022). Besides, Indonesia's response has often been hampered by regulatory fragmentation, slow policy adaptation, and persistent gaps in deposit guarantee coverage and bank resolution readiness (World Bank, 2022; Claessens, 2014).

The literature largely agrees that if digital transformation goes beyond regulatory modernization, the resulting gaps can foster moral hazards, undermine depositors' trust, and make existing safeguards dangerously obsolete (Demirgüç-& Detragiache, 2002; Garcia, 2000; Claessens, 2014). These issues are particularly acute in emerging markets, where rapid digitalization coexists with legacy vulnerabilities and governance challenges (Yang & Ali, 2024; Arner et al., 2017). Despite extensive research on financial innovation and regulatory changes, Indonesia is still under-examined in terms of how deposit guarantees, bank resolution mechanisms, and governance quality interact in a rapidly evolving digital environment (Boot & Thakor, 2025; Zetzsche et al., 2017). In this context, there is an urgent need for a new and integrative perspective that goes beyond digitalization analysis or isolated regulatory reform. The risk involves regarding showing inefficiency in the financial sector but also its resilience against shocks and uncertainties in modern digital era. This research will address these complex challenges in a scientific imperative and a national priority, with thoughtful implications which will enhance financial stability, depositors' well-being, and the credibility of Indonesian financial institutions.

1.1. Study Aims and Key Inquiries

What is the impact of financial sector digitalization on financial stability in Indonesia?

How do the of deposit insurance and bank resolution mechanisms (BRM) mediates the relationship between digitalization, regulatory frameworks, financial inclusion, macroeconomic stability, and financial stability (FS)?

To what extent does governance quality moderate the relationship between financial sector digitalization and financial stability?

What regulatory weaknesses exist in the Indonesian financial system that affect financial stability?

What strategic policy recommendations can increase the effectiveness of LPS in ensuring financial stability in the digital era?

2. Literature Review

The digitalization of the financial system is significantly changing the risk landscape and regulatory priorities in developing countries. In Indonesia, the rapid adoption of fintech and platform-based services has increased the complexity of maintaining financial stability, especially as cyber risks and regulatory gaps become more prominent (Arner, Barberis, & Buckley, 2017; Birindelli & Iannuzzi, 2024). The implementation of effective deposit guarantees, and bank resolution mechanisms is essential to maintain depositor confidence and mitigate systemic shocks in this evolving environment (Boot & Thakor, 2025; Claessens, 2015). However, as digital transformation evolves, traditional security is increasingly challenged by emerging threats and new market structures (Zetzsche, Buckley, Arner, & Barberis, 2017). This literature review investigates the interaction between digitalization, regulatory adaptation, and governance dynamics in shaping financial stability in Indonesia's growing financial sector.

2.1. Digitalization of the Financial Sector

The emergent adoption of digital financial services (DFS) in Indonesia, such as mobile banking, e-wallets, and fintech, has transformed financial openness and operational efficiency in the banking sector (Boot and Finance, 2021; Boot Thakor, 2025). This digitalization has significantly expanded financial inclusion, that lowered barriers to entry for underserved populations and facilitated new forms of economic input (World Bank, 2022). But this shift in technology has also introduced new vulnerabilities, especially cybersecurity threats, data privacy risks, and the increasing complexity of digital platforms (Birindelli & Iannuzzi, 2024; Claessens, 2015). Various recent studies highpoint that deposit insurance, which were originally created for traditional banking environments, its faeces substantial challenges in adapting to digital risks now. Birindelli and Iannuzzi (2024) argues that cyber occurrence may undermine public trust in the financial institutions, put into the hazard the credibility of deposit protection procedures, and increase the risk of sudden withdrawals. As a result, of this the regulatory authorities are forced to adjust their frameworks to stabilise the drive for innovation with the need for robust systemic safeguards (Boot & Thakor, 2025; Claessens, 2015). In addition, as digital transactions become more intertwined with real-time systems and cross-platform ecosystems, traditional deposit insurance coverage may fail to address operational disruptions or losses caused by cyberspace (World Bank 2022). This systemic challenge is not exclusive to Indonesia; Cross-national analysis underscores the urgency of reforming regulatory and insurance structures to maintain financial stability in the digital age (Arner, Barberis, & Buckley, 2017). we hypothesize: H1: Digitalization of the financial sector has a negative effect or negative relation with adequacy of deposit insurance due to increasing cybersecurity risks and regulatory challenges.

2.2. Regulatory Framework and Policy Reforms

There is comprehensive need of strong regulatory framework to ensure stability and consistency in the banking areas, especially in the growing fast financial view. The institutional collaborative efforts have supported the implementation of practical norms and capital requirements, that has created a layered defense against any sort of shocks and uncertainties in indonesia (OECD, 2022; World Bank, 2022). Most recent work of Boot and Thakor (2025) underscores that dynamic regulatory adaptation, which integrates traditional and digital financial innovations, significantly enhances the credibility of deposit guarantee schemes by reducing bank and consumer uncertainty. Laeven and Valencia (2020) provide global empirical evidence that ongoing regulatory reforms, including improved supervision and crisis management protocols, improve the effectiveness of deposit insurance by reducing the risk of contagion and facilitate prompt and orderly bank resolution. The research warns that excessive complexity or inconsistent application of regulations can lead to regulatory arbitrage, where financial institutions shift activities to less regulated areas, undermining the protection intentions of reform (Claessens, 2015; Arner, Barberis, & Buckley, 2017). The policy harmonization in regulatory bodies has significantly narrowed uncertainties and shocks, thus strengthening depositor protection and overall financial stability Collectively by institutions (OECD, 2022). These insights climax that a well-designed regulatory framework, characterized by consistency of prudence, adaptability, and effective coordination, is positively associated with the adequacy of deposit insurance and the resilience of the financial sector. H2: Regulatory framework has positive impact on adequacy of deposit insurance through enforcement of wise standards and systemic risk mitigation.

2.3. Macroeconomic Stability

The sustainable economic growth, moderate inflation rates, and stable exchange rates, as microeconomic indicators are essential for a strong financial system that supports the efficiency of deposit guarantee mechanisms. Numerous research concentrating on Indonesia has reliably revealed that the great periods of macroeconomic stability are linked to increased confidence in the banking sector and reduced risk of crises. Corelli, (2019) is of the view that a robust macroeconomic basis creates circumstance where financial institutions can manage risk more effectually, thereby reducing the probability of bank failures and increasing the credibility of deposit insurance. In emerging economies various empirical studies show that stable macroeconomic conditions correlate with increased public confidence in the financial system and the execution of more efficient crisis management strategies (Barua & Barua, 2021). It will not only help regulators in coping with shocks and uncertainties but also helps for maintain depositors' confidence during in stressful periods. Claessens (2015) advised that lengthy periods of alleged stability can lead to irony of risk by banks and regulators, highlighting the need for hand on policy measures, even in a seemingly stable macroeconomic environment. Many scholarly works suggest that macroeconomic stability is an important driver of effective deposit insurance, providing the necessary operational capacity and institutional credibility for crisis prevention and financial system protection. As a result, we propose the following hypothesis. H3: Macroeconomic stability is positively associated with the adequacy of deposit guarantees, fostering an environment conducive to effective risk management and crisis prevention.

2.4. Financial Inclusion and Literacy

As more people in developing economies gain access to formal financial services, the traditional risk landscape faced by deposit guarantee schemes has evolved in complex ways.. Grohmann, Klühs, and Menkhoff (2018) offer strong cross-border evidence suggesting that increased financial literacy not only increases individuals' engagement with the formal financial sector but also deepens their understanding of financial protection, such as deposit insurance. Ahamed and Mallick (2019) further affirm that financial inclusion contributes positively to bank stability by enlarging depositor bases and encouraging sustainable inter-mediation, with the most substantial effects observed in financially literate populations. Nevertheless, the corporate literature has emphasized prospective confronts. Dupas, Karlan, Robinson, and Ubfal (2018) specified in their investigation that rapid financial inclusion among populations with low financial literacy can refute stability because of uninformed depositor behavior, vulnerability to rumours or misconceptions about coverage limits during stressful times. In Indonesian corporate settings, empirical findings expose that financial literacy and positive interface with formal banking services extensively increase depositor confidence in the formal banking sector, highlighting the importance of targeted educational initiatives along with increased access (Alamsyah et al., 2020). notwithstanding these diverse viewpoints, the literature reliably advocates that financial inclusion can improve the adequacy and effectiveness of deposit insurance, provided it is supported by adequate literacy programs to ensure that depositors are well-informed about the benefits and limitations of coverage. Considering above synthesis we propose H4: Financial inclusion is positively associated with the adequacy of deposit insurance depending on the provision of adequate financial literacy programs that promote informed decision-making among depositors.

2.5. Cybersecurity Risk

In the brisky digitized financial sector, cybersecurity jeopardises have become a major threat to the banking stability systems around the world. The increasing confidence on digital platforms for financial transactions exposes both banks and deposit insurance authorities to a cyber threat, that includes phishing attacks and data breaches to large-scale ransomware incidents (Birindelli and Iannuzzi, 2024). Empirical research has consistently shown that cyber incidents not only cause direct financial losses, but also undermine depositors' trust, which is critical to the effectiveness of deposit insurance schemes (Bouveret, 2018). For deposit guarantee agencies, such as LPS Indonesia, operational risks posed by cyberattacks can jeopardize their ability to guarantee deposits and manage bank settlements in a timely manner during crises (BIS, 2021). Studies show that major cybersecurity breaches can trigger panic withdrawals, especially if the public considers personal or financial information to be risky (Birindelli & Iannuzzi, 2024; Bouveret, 2018). The Bank for International Settlements (2021) further emphasizes that integrating strong cyber risk management and crisis response protocols is essential to maintain the operational integrity of the deposit guarantee framework. These findings highlight that cybersecurity risks are not just technical issues, but important determinants of financial stability and trust of deposit insurance mechanisms. It’s evident without adequate cybersecurity readiness, even a well-capitalized insurance scheme can be compromised by a single disruptive incident. Hence, we hypothesize that H5: Cybersecurity risks are negatively associated with the adequacy of deposit insurance.

2.6. Mediating Effect: Deposit Insurance Adequacy

The adequacy of deposit insurance plays a central role in turning external regulatory, economic, and cybersecurity pressures into outcomes that improve financial stability. Adequate insurance coverage not only instils trust among depositors but also empowers regulators to manage banking crises more effectively, thereby reducing the likelihood of unstable bank runs (Anginer, Demirgüç-, & Zhu, 2014). Their study reveals a clear inverse correlation between insurance adequacy and systemic risk, especially in emerging markets, where such coverage can increase depositor confidence. Demirgüç-and Kane (2002), provide cross-national evidence that well-capitalized deposit insurance schemes significantly reduce trust-driven bank operations and the costs associated with the completion of failed institutions. According to their findings, a credible deposit insurance system, one with sufficient funding and transparent management, fosters greater public trust. This, in turn, makes managing a financial crisis a more orderly process. Nonetheless, the literature highlights an important caveat: Deposit insurance must be accompanied by strict supervision. if substantial deposit insurance is not paired with strong regulatory measures, it can actually promote financial instability by incentivizing banks to take on excessive risk (Demirgüç-and Detragiache, 2002). This core problem—the moral hazard created when banks feel shielded from the consequences of their actions. (2000) and Demirgüç-and Kane (2002), who emphasize the necessity of vigilant regulatory scrutiny to counter it. These findings congregate on the central insight that the credibility of deposit insurance depends on governance that supports prudent oversight and transparent administration. As a result, it serves as an important link linking macro-level factors, such as regulation and digital threats, to depositor behavior and financial sector resilience. we propose hypothesis to confirm H6: The adequacy of deposit insurance is positively associated with insurance policy guarantees.

2.7. Bank Resolution Mechanisms and Insurance Policy Guarantees

The bank's resolution mechanism and insurance policy guarantee are essential to maintain financial stability. Deposit insurance institutions, such as LPS, offer policy guarantees that formally guarantee the protection of depositors' funds within certain limits. These guarantees play an important role in reducing uncertainty and increasing confidence in the financial system (Garcia, 2000). The literature shows that transparent policy guarantees significantly reduce depositors' anxiety, reduce the risk of bank runs, and increase the effectiveness of deposit insurance, especially during financial crises (Demirgüç-& Kane, 2002). Eisenbeiss (2012) highlights that institutional credibility rooted in genuine and consistently communicated collateral is essential to influence depositor behavior and improve overall market confidence. However, an effective bank resolution mechanism is essential for managing failing institutions without triggering broader financial instability. Calomiris and Herring (2013) argue that a well-structured resolution regime facilitates the exit or restructuring of distressed banks, thereby minimizing contagion and maintaining systemic resilience. Empirical studies emphasize that the synergy between strong deposit insurance and credible resolution mechanisms increases crisis management capacity, allowing authorities to respond quickly and reduce disruptions to the financial system (Laeven & Valencia, 2020). Collectively, the evidence suggests that adequate deposit insurance, supported by credible policy guarantees, strengthens the link between insurance frameworks and resolution mechanisms, ultimately aiding in smooth crisis management and minimizing systemic risks. Therefore, we hypothesize that H7: Adequacy of deposit insurance is positively associated with the bank's resolution mechanism, facilitating smooth crisis management and minimizing systemic disruption.

2.8. Insurance Policy Guarantees

Insurance policy guarantees are formal assurances provided by deposit insurance agencies such as LPS to protect depositors' funds up to a specified limit. The literature consistently indicates that clear and credible guarantees play a crucial role in reducing depositor uncertainty and are fundamental to fostering trust in the financial system (Garcia, 1999; Eisenbeiss, 2012). Garcia (1999) highlights the historical significance of explicit deposit insurance policies in reassuring the public and preventing destabilizing bank runs. Eisenbeiss (2012) further emphasizes that the authenticity and transparency of these guarantees shape depositor perceptions and influence banking behaviors. Transparent communication and reliable policy guarantees have also been linked to effective crisis management. When deposit insurance terms are clearly communicated and understood by the public, empirical evidence suggests that depositors are less likely to panic during periods of instability, thereby enhancing the effectiveness of deposit insurance frameworks (Demirgüç-Kunt and Kane 2002). This contributes to a stable financial environment and supports systemic resilience. Therefore, we propose the following hypothesis: H8: Clear and credible insurance policy guarantees are positively associated with financial stability by bolstering depositor confidence and promoting a more resilient financial system. Furthermore, well-designed and credible insurance policy guarantees are essential for facilitating orderly bank resolution processes. When banks and regulators depend on insurance guarantees, the resolution of failing banks becomes more predictable and less disruptive (Calomiris & Herring, 2013). Such guarantees enable authorities to manage crises more systematically and maintain market discipline, ultimately minimizing contagion and systemic risks (Laeven & Valencia, 2020). Thus, we propose the following hypothesis: H9: Insurance policy guarantees are positively associated with bank resolution mechanisms because credible guarantees promote orderly resolution processes.

2.9. Bank Resolution Mechanisms

The establishment of an efficient bank resolution mechanism is essential to maintain financial stability, especially after a banking crisis or institutional failure. Contemporary frameworks employ strategies such as bail-in provisions, bridge banks, and asset management companies to manage failing banks without inciting widespread contagion (Calomiris & Herring, 2013; Laeven & Valencia, 2013). Calomiris and Herring (2013) argue that the efficacy of a resolution regime depends on its capacity to promptly address troubled banks, ensuring that shareholders and creditors bear the financial burden rather than taxpayers or depositors. Empirical evidence suggests that a well-executed resolution process plays an important role in containing systemic risks, minimizing market disruptions, and maintaining depositor confidence (Laeven & Valencia, 2020). In contrast, Beck, Demirgüç-, and Levine (2006) underscore that delays, lack of coordination, or mismanagement during bank resolutions can exacerbate uncertainty, reduce public trust, and increase the risk of contagion throughout the financial system. Therefore, timely and transparent interventions are essential to strengthen the stability of the banking sector and maintain the integrity of the deposit guarantor framework. Collectively, the literature underscores that strong bank resolution mechanisms are essential for crisis management, directly supporting financial stability by effectively managing failing institutions and reducing secondary effects. Thus, we hypothesize that an effective H10: Bank resolution mechanism is positively associated with financial stability by reducing the risk of transmission, managing failing institutions, and maintaining depositor confidence.

2.10. Bank Resolution Mechanisms- Mediating Effects:

Efficient bank resolution mechanisms, including bail-in provisions, bank bridges, and asset management strategies, are essential to contain the risk of contagion and manage failing institutions (Calomiris & Herring, 2013; Laeven & Valencia, 2013). The implementation of timely resolution measures is directly related to the stability of the banking sector. Research shows that delays or mismanagement in this process can exacerbate systemic risks and undermine depositors' confidence (Beck et al., 2006). Bank resolution tools will also help provide the proper deposit insurance, if anything shall happen and protect banks during times of volatility. Thus, we hypothesize: H11: Effective bank resolution mechanisms mediate the positive relationship between deposit insurance adequacy and financial stability by providing efficient intervention and resolution tools.

2.11. Insurance Policy Guarantees

Insurance policy guarantees refer to the formal assurances provided by LPS regarding the protection of depositors’ funds. Clear and credible guarantees are vital for reducing uncertainty and reinforcing trust in the financial system (Garcia, 1999; Eisenbeiss, 2012). Empirical evidence suggests that transparent communication about policy guarantees mitigates depositor panic and strengthens the efficacy of deposit insurance in crisis scenarios. Policy guarantees may promote trust with the clients by providing them assurance. Therefore, we hypothesize: H12: Insurance policy guarantee mediate the positive relationship between Deposit insurance adequacy and financial stability by proving safety to depositors.

2.12. Financial Stability

Financial stability stands as a major dependent variable within this framework of analysis, reflecting circumstances in which systemic volatility is under control, depositor confidence is strong, and the financial sector can absorb and adapt to economic shocks (Richard, Devinney, Yip, & Johnson, 2009;). Richard et al. (2009) emphasize that strong financial stability allows for the effective functioning of financial intermediaries, promotes investor confidence, and supports long-term economic growth. Empirical evidence suggests that a well-designed deposit insurance system, when equipped with effective bank resolution mechanisms, strengthens the banking sector's ability to withstand periods of stress and prevent the escalation of local problems into broader systemic crises (Demirgüç-& Detragiache, 2002). This stability is not only important to maintain depositors' confidence but also to encourage productive lending and sustainable economic expansion. In contrast, related instability is often characterized by rapid withdrawals, failures of key institutions, or inadequate crisis management that can erode public trust, limit investment, and trigger prolonged recessions. (Yukl, 2012). Therefore, financial stability is widely recognized as a policy goal and a marker of economic resilience, which supports sustainable growth and overall confidence in the financial system.

Thus, we hypothesize, H13: Financial stability is positively associated with a resilient banking system, fostering economic growth and investor confidence.

2.13. Moderating Role of Governance Quality

The quality of governance, which includes transparency, regulatory effectiveness, and anti-corruption measures, is an important factor in the success of financial stability mechanisms. Kaufmann, Kraay, and Mastruzzi (2009) provide global evidence that countries with strong governance frameworks are more successful in implementing regulatory policies, such as deposit insurance and bank resolution mechanisms. Their findings suggest that the high quality of governance enhances the positive effects of these mechanisms on financial system stability by strengthening policy enforcement and fostering public trust. Similarly, La Porta et al. (1998) underscores the importance of legal origins and institutional quality in financial sector outcomes. They argue that even the most well-designed deposit insurance or resolution policies can fail in environments with weak governance, where enforcement is inconsistent, and corruption erodes trust in regulatory bodies. Strong governance not only builds the trust of depositors and investors, but also ensures that digitalization and financial inclusion initiatives do not pose any unwanted risks. Further empirical studies show that the quality of governance moderates the risks associated with rapid digitalization, making deposit insurance systems more adaptable and less vulnerable to new forms of systemic risk (Kaufmann et al., 2009). In countries with high governance standards, digital innovations can be integrated more securely and the positive effect of deposit guarantees and resolution mechanisms on stability are strengthened. In addition, financial inclusion has been found to increase the likelihood of financial stability provided institutions maintain a high level of transparency and accountability (Ahamed & Mallick, 2019). A well-structured and clearly articulated insurance policy not only protects depositors but also enhances the resilience of the broader financial sector, especially in the rapidly evolving banking market (Jungo et al., 2022; Fernández-Villaverde et al., 2020). The H14 hypothesis suggests that the quality of governance positively moderates the relationship between digitalization and the adequacy of deposit guarantees, so that the negative impact of digitalization on the adequacy of deposit guarantees can be mitigated when the quality of governance is high. Hypothesis H15 suggests that governance quality positively moderates the relationship between deposit insurance adequacy and bank resolution effectiveness on financial stability, thereby enhancing the positive effects of deposit insurance adequacy and bank resolution effectiveness on financial stability when governance quality is high. Hypothesis H16 asserts that financial inclusion is positively associated with financial stability, ensures the safety of banking firms, and contributes to a more resilient financial sector. This leads to Hypothesis H17, which proposes that insurance policy guarantees mediate the relationship between financial inclusion and stability (Jungo et al., 2022).

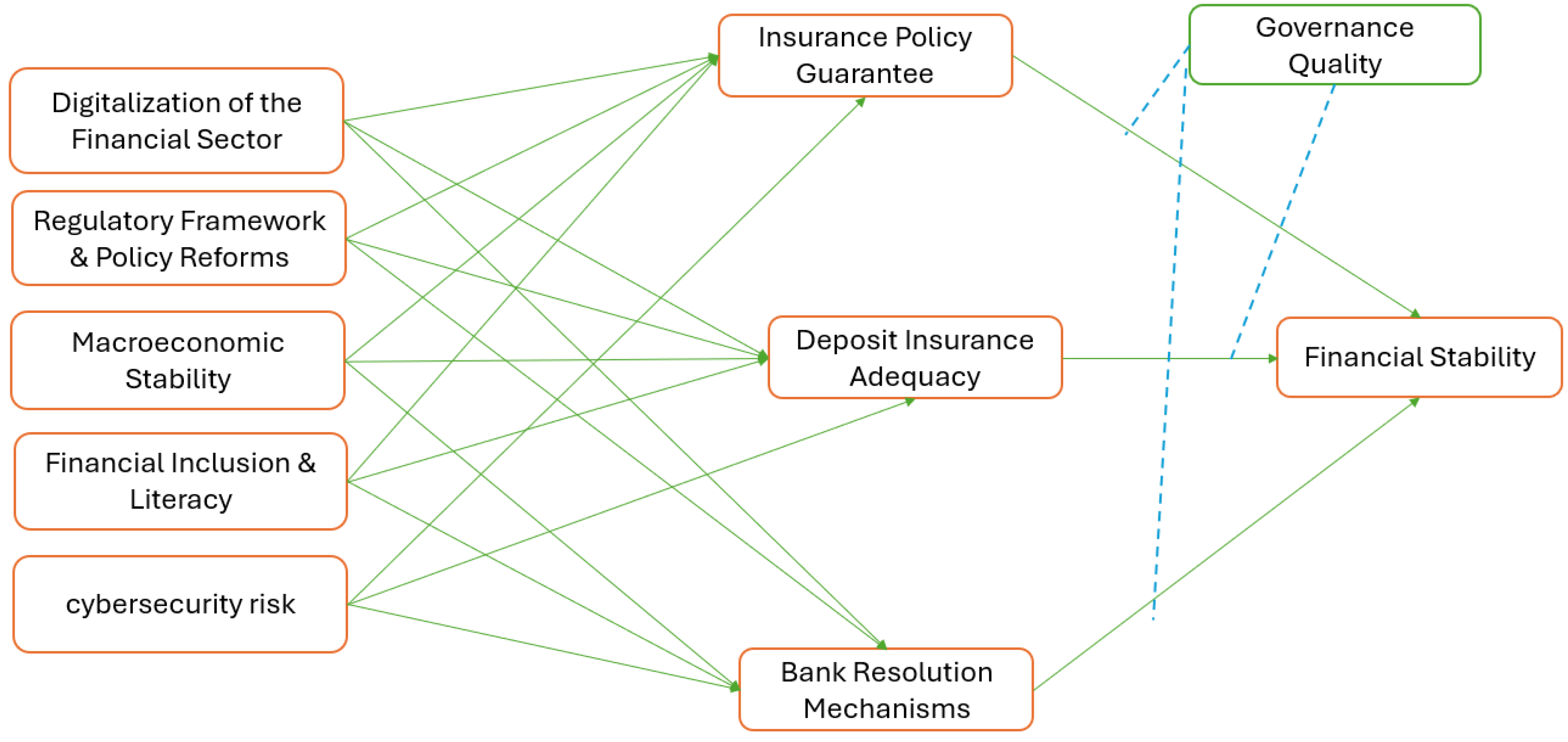

Building on a thorough synthesis of recent literature and the robust theoretical and empirical arguments previously discussed, this study introduces an integrative conceptual framework designed to clarify the intricate interconnections that shape financial stability in Indonesia's swiftly transforming financial sector. The model is based on evidence that deposit insurance adequacy, insurance policy guarantees, bank resolution mechanisms, and governance quality collectively mediate and moderate the effects of external factors such as digitalization, financial inclusion, macroeconomic stability, regulatory reforms, and cybersecurity risk. The framework identifies financial stability as the ultimate dependent variable, influenced not only by the direct effects of deposit insurance and bank resolution effectiveness but also by the moderating role of governance quality and the mediating roles of insurance policy guarantees and financial inclusion. The conceptual model also highlights the dual role of digitalization—as both a driver of innovation and efficiency and a potential source of systemic risk—whose impact on deposit insurance adequacy is dependent on the strength of governance. Additionally, the model considers the positive influence of financial inclusion on stability, particularly when supported by credible insurance guarantees and robust literacy initiatives. By systematically integrating these critical constructs and relationships, the proposed conceptual diagram offers a comprehensive foundation for empirically examining how Indonesia’s financial safety nets, institutional frameworks, and policy interventions interact to foster resilience, safeguard depositor confidence, and promote sustained economic growth. This framework not only enhances academic understanding but also provides actionable insights for policymakers aiming to strengthen the architecture of financial stability in emerging markets.

3. Materials and Methods

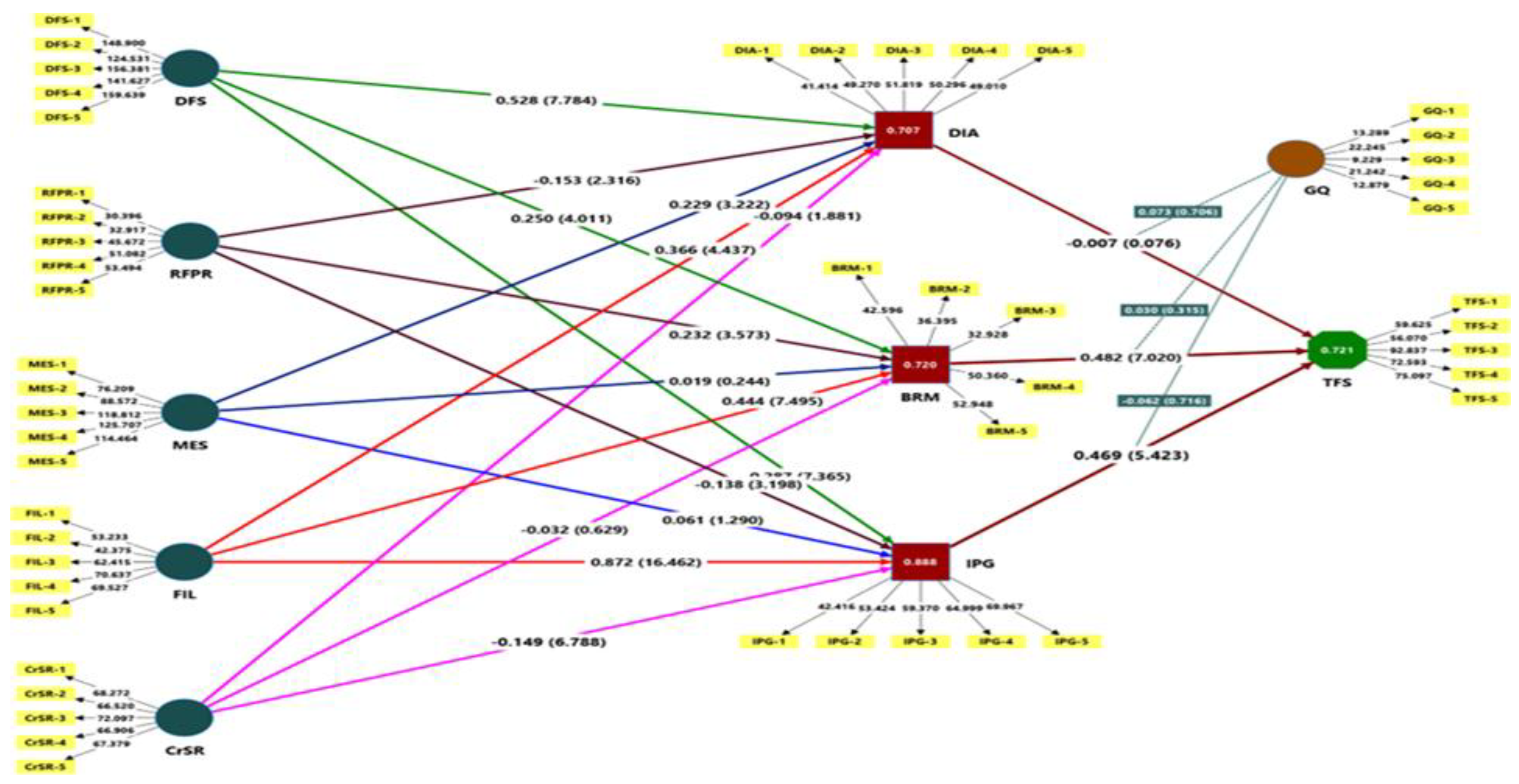

This study adopted a quantitative research methodology employing Partial Least Squares Structural Equation Modeling (PLS-SEM) to meticulously examine the intricate relationships between financial and institutional determinants as mentioned in

Figure 1, that affect Target Financial Stability (TFS) within Indonesia's dynamic financial environment. PLS-SEM was selected for its capability to model complex interactions involving latent constructs, its suitability for smaller sample sizes, and its dual support for predictive and exploratory research objectives, making it particularly suitable for developing emerging theories in complex fields such as financial stability (Hair et al., 2019; Sarstedt et al., 2022). The model was constructed to evaluate the direct effects, significant indirect pathways, and crucial mediating roles of the key variables: Bank Resolution Mechanisms (BRM), Digitalization of Financial Services (DFS), Cybersecurity Risk (CrSR), Financial Inclusion and Literacy (FIL), and Insurance Policy Guarantees (IPG). Data were gathered through a carefully designed, structured questionnaire, which was informed by foundational literature on financial stability frameworks (e.g., Basel Committee principles), bank resolution standards (e.g., Financial Stability Board Key Attributes), and the evolution of digital finance (Ozili, 2023). Responses were collected using multi-item, reflective scales (5-point Likert, 1=Strongly Disagree to 5=Strongly Agree) for each construct, ensuring content validity through thorough evaluation by a panel of academic and industry experts, adhering to established psychometric protocols (MacKenzie et al., 2011).

A stratified random sampling method was employed to ensure that Indonesia's key financial sectors were represented proportionally, resulting in a final analytical sample of 265 highly qualified professionals from an initial pool of 400 surveys. This carefully selected group included senior decision-makers such as C-suite executives, directors, and regulatory leaders from commercial banks with active digital operations, fintech innovators, key government regulatory bodies such as the OJK and Ministry of Finance, and monetary authorities such as Bank Indonesia. By focusing on individuals with strategic oversight of financial operations and risk frameworks, this study gathered the expert-level insights necessary for a comprehensive evaluation of TFS determinants (Hiebl & Richter, 2018).

3.1. Ethical Considerations and Informed Consent

Our study did not require formal ethical approval, as it entailed minimal risk and involved the collection of anonymous data from financial professionals via an online survey. Participation was entirely voluntary, and no personal or identifiable information was collected from the participants. The survey form included a statement detailing the study objectives, assurances of confidentiality, and the voluntary nature of participation. Respondents provided informed consent by completing the questionnaire after reviewing this statement.

3.2. Measurement of Inner Model and Outer Model

Data analysis was performed using SmartPLS 4.0, following the established two-step analytical protocol (Anderson & Gerbing, 1988). Initially, the measurement model was subjected to rigorous validation: internal consistency reliability was confirmed through Cronbach's alpha (α > 0.7) and Composite Reliability (CR > 0.7) (Nunnally & Bernstein, 1994); convergent validity was established with Average Variance Extracted (AVE > 0.5) (Fornell & Larcker, 1981); and discriminant validity was rigorously verified using the Fornell-Larcker criterion and heterotrait-monotrait (HTMT) ratio (< 0.85) (Henseler et al., 2015). Subsequently, the structural model was evaluated: path coefficient significance was tested via non-parametric bootstrapping with 5,000 subsamples (Hair et al., 2022); model fit was assessed using the Standardized Root Mean Square Residual (SRMR < 0.08) (Hu & Bentler, 1999); explanatory power was determined by R² values; effect sizes (f²) were calculated to assess substantive impact (Cohen, 1988); and specific indirect effects for mediation, such as IPG and BRM, were decomposed using the product-of-paths approach with bias-corrected bootstrap confidence intervals (Preacher & Hayes, 2008). Robustness was ensured by meticulous data screening.

Minimal missing data (<5%), confirmed as completely missing at random via Little's MCAR test, were addressed using mean substitution. Potential outliers were identified using the Mahalanobis distance (p < 0.001) and winsorized to mitigate undue influence. The study strictly adhered to ethical principles. All participants provided informed consent with strict confidentiality and complete anonymity guaranteed throughout data collection and analysis, in alignment with the GDPR and COPE guidelines. No personally identifiable or sensitive organizational information was solicited or retained..

6. Conclusions

This study highlights the increasing recognition that financial stability in the digital era is influenced by factors beyond traditional risk management, with a growing emphasis on the integration of innovation, regulatory adaptability, and inclusive financial systems. The study's findings emphasize the critical role of digital financial services and the expansion of inclusive products in strengthening systemic resilience. However, it is crucial that innovation is underpinned by strong regulatory frameworks to ensure that technological progress is enhanced rather than undermined by stability. These insights have significant implications for Indonesia. As the financial sector undergoes rapid digital transformation, entities such as the Indonesia Deposit Insurance Corporation (Lembaga Penjamin Simpanan or LPS) must adapt strategically. Financial stability can no longer be sustained by static tools alone; it necessitates a comprehensive approach anchored in digitalization, supported by effective deposit insurance, directed by robust bank resolution mechanisms, and reinforced through clear policy guarantee frameworks. LPS is at a critical juncture, with its future role extending beyond depositor protection to shape the broader financial stability agenda. By leveraging digital innovation, enhancing regulatory coordination, and strengthening its resolution and policy frameworks, LPS can transition from a reactive safety net to a proactive stabilizer within Indonesia’s financial ecosystem. The path to sustainable financial stability lies in adopting a forward-looking strategy in which innovation, regulation, and strategic institutional reform operate in concert. For Indonesia, equipping LPS with these tools and mandates will be essential for building a resilient, inclusive, and future-ready financial system. For policymakers and financial leaders, the message is clear: fostering innovation and enhancing regulatory capacity are complementary goals. By simultaneously advancing both, countries can develop financial systems that are more resilient, more inclusive, and better prepared for future disruptions. Ultimately, this study underscores that financial stability is no longer solely related to risk management. It involves embracing change with a thoughtful, coordinated approach that leverages technology, safeguards users, and maintains system strength both now and in the future..

This study, while offering valuable insights into financial stability, digitalization, and regulatory frameworks, has several significant limitations. First, the analysis relies on survey data from the Indonesian financial sector, which may limit findings' applicability to countries with different economic structures and digital advancement stages. Future research should conduct multi-country analyses to expand these results. Second, although the sampling strategy included financial professionals, it may not fully represent the entire financial industry's perspectives, potentially underrepresenting smaller entities, fintech start-ups, or consumer stakeholders. Third, while the research identifies critical relationships among variables, the cross-sectional survey design limits causal inference and mediation analysis, as temporal sequencing cannot be definitively established (Maxwell & Cole, 2007; Rungtusanatham et al., 2014). Findings related to indirect effects should be interpreted cautiously, and future longitudinal research would provide stronger causal analysis. Finally, the rapidly evolving landscape of financial technologies and regulations suggests these findings may become less relevant as the sector transforms. Continuous research will be essential to maintain practical insights as the industry evolves.