Submitted:

04 November 2025

Posted:

04 November 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

Highlights

- To assess the impact of ESG adoption on air pollution reduction in the West Kazakhstan region, a key oil and gas producing area in Kazakhstan.

- To perform a spatial analysis of atmospheric emissions in the region to evaluate the environmental impact of the KPO company, which develops the Karachaganak oil and gas condensate field.

- To analyze the effectiveness of ESG strategy implementation at KPO, benchmarking its performance against leading national and international oil and gas companies within a sustainable development framework.

- To develop an ESG algorithm for evaluating recurring functions and identifying operations with concentrated ESG risks. This algorithm will integrate the environmental, social, and governance components of ESG into a unified strategic planning system for sustainable development.

- To perform a correlation-regression analysis examining the relationship between atmospheric emission levels and the E, S, and G factors of the ESG model for the selected oil and gas companies, and to provide a predictive assessment of ESG’s influence on emission reduction.

2. Materials and Methods

2.1. Object of the Study

2.2. Research Methodology

2.3. Data sources

- 1.

- Environmental indicators.

- 2.

- Economic and energy indicators.

- 3.

- Social (S) and governance (G) performance indicators for the companies under study.

- Varying reporting timelines: The sustainability reports of the analyzed companies covered different periods. To ensure comparability, the earliest common year for all five companies—2019—was selected as the baseline.

- Evolving reporting standards: Although the Sustainable Development Goals (SDGs) were adopted in 2015, the companies implemented GRI standards in different years. Furthermore, standardized requirements for the circular economy within ESG frameworks remain under development.

- Lack of standardized disclosure: Sustainability reports lack strict formatting requirements, allowing companies significant discretion in data presentation. Established practice shows that environmental (E) criteria are relatively standardized for indicators such as greenhouse gas emissions, net carbon intensity, energy consumption, and waste management. In contrast, no consensus exists regarding social (S) and governance (G) indicators, which complicates their analysis, comparative assessment, and interpretation.

Literature Review

| Direction | Works (authors) | Conclusions | Field of knowledge / application |

|---|---|---|---|

| The relevance of ESG application | [3,4,27,28,29,30,31,32,33,34,35,36,37] | ESG is seen as a tool for implementing the concept of sustainable development, a driving force for technological development that can help reduce environmental pollution and eliminate factors influencing climate change. | Economic research |

| Justification of the relevance of the research topic | |||

| Assessment of global, regional, and national greenhouse gas emissions | [2,38,39,40,41,42,43,44,45,46,47] | Growing global carbon emissions from fossil fuels are becoming one of the fundamental problems of the modern economy and require a comprehensive ESG approach that includes political regulators, technological, organizational, economic and social aspects. | Environmental research |

| Identification of factors, independent variables | |||

| Studying the best global practices of ESG transformation | [48,49,50,51,52,53,54,55] | The study of the best global practices in ESG transformation and sustainable development around the world has shown that ESG strategies are supported at the legislative level | Interdisciplinary research |

| Rationale for recommendations | |||

| Implementing ESG principles into the strategy of oil and gas companies | [56,57,58,59,60] | By integrating ESG principles, oil and gas companies can significantly improve their energy efficiency, which in turn helps reduce air pollution. | Economic research |

| Identification of factors, independent variables | |||

| Development of green technologies, sustainable and responsible investment | [61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81] | The applicability of ESG strategies is discussed from a macroeconomic perspective of regulatory policy. Due to the dominance of the climate and environmental components of ESG, insufficient attention is paid to the disclosure of environmental S.G. components. | Economic research |

| Justification of the relevance of the research topic Identification of factors, independent variables |

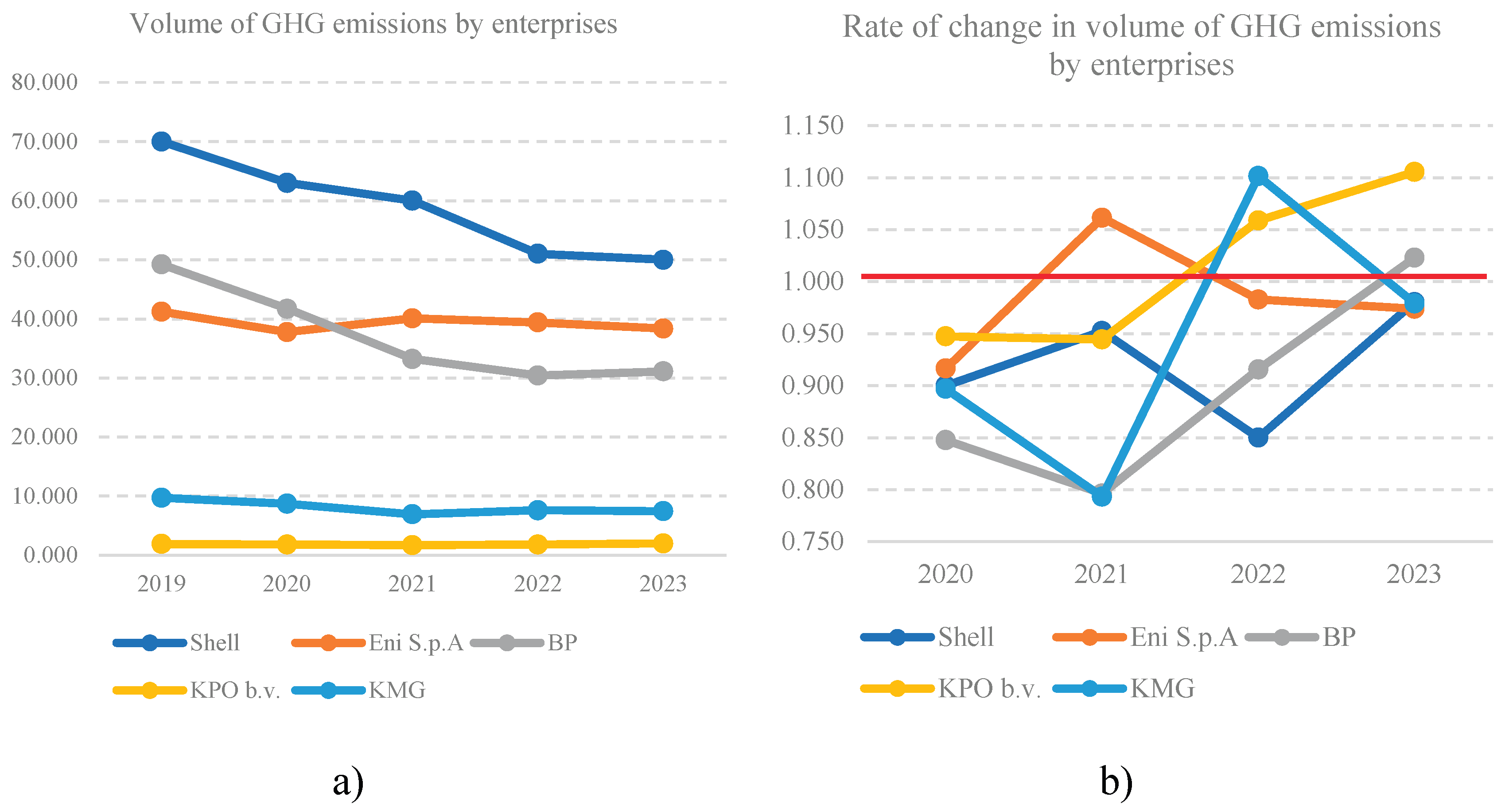

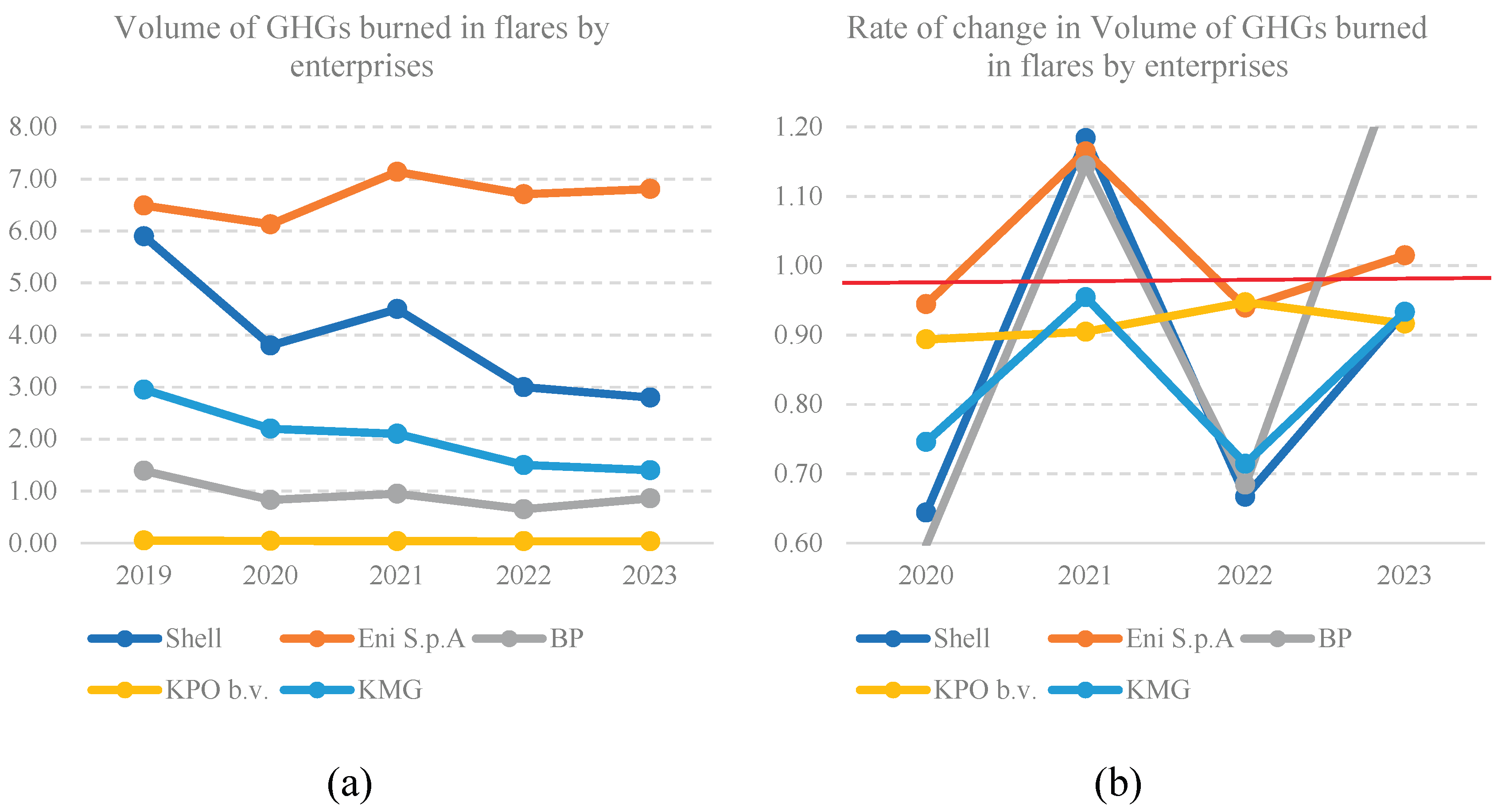

3. Results

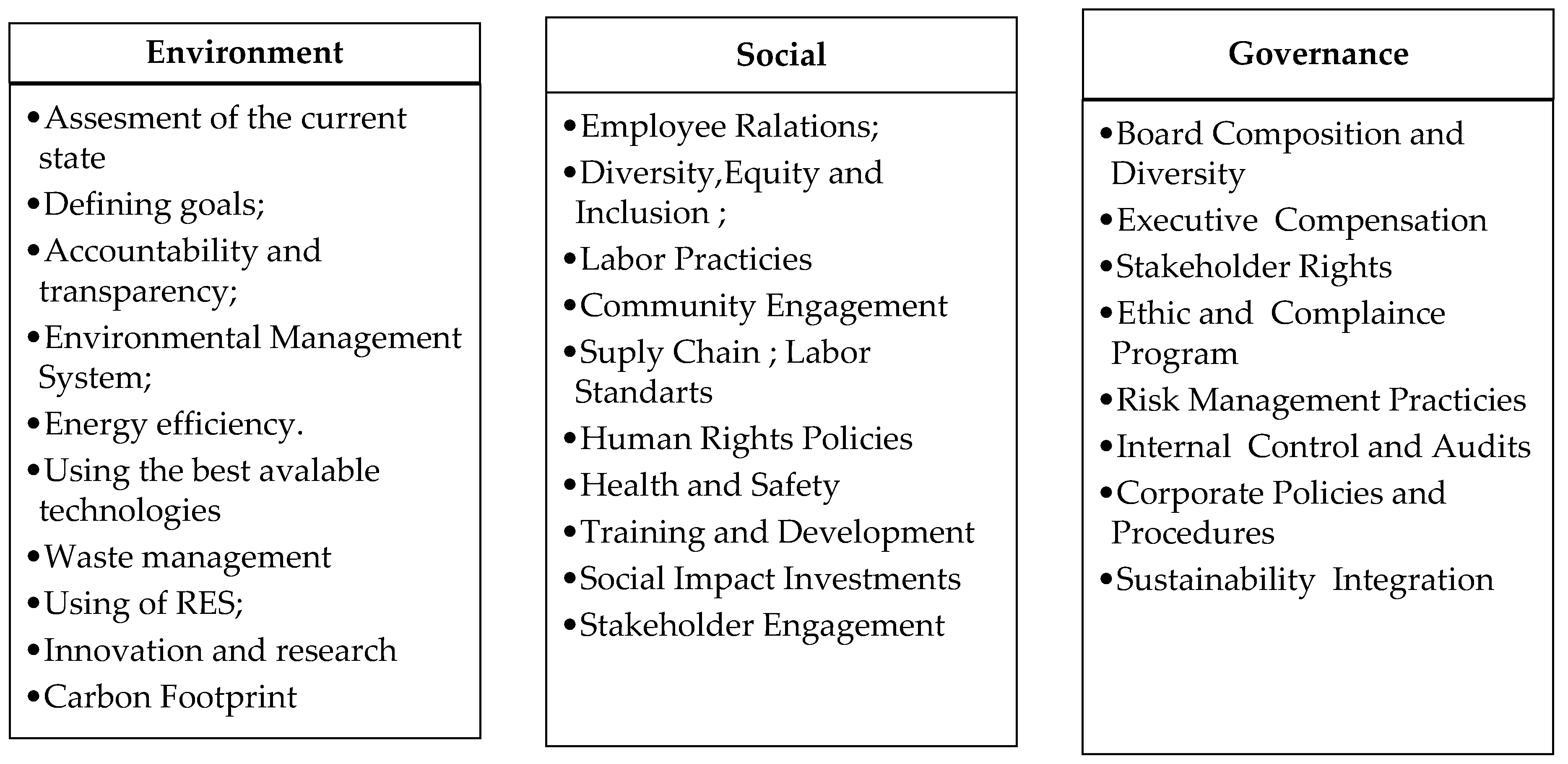

3.1. Implementation of the Environmental (E) Component of the ESG Strategy

- Flares for gas and condensate combustion during well development and testing.

- Open tanks and storage facilities.

- Warehouses and storage areas for reagents.

- Boiler house operations.

- Drilling and cement solutions.

- Solid drilling waste and drilling wastewater.

- Heavy-duty vehicle fleet.

3.2. Implementation of the Social (S) and Governance (G) Components of the ESG Strategy.

4. Modeling

4.1. Modeling of GHG Emissions Based on Environmental Factors in the Oil and Gas Industry

- X13 and X14 in KMG: close values - minimal difference → high multicollinearity → alias).

- X1 and X2: In some companies, they move in parallel (correlation ≈ 1).

- X6 and X7: At Shell, BP, and EniS.p.A, the indicators often move in sync (the same trend).

- X9 and X10: The variables are “scaled,” but proportional to each other.

- X11 and X12: Often nearly proportional (all years rise/fall together).

- X2 is a strong duplicate of X1 → makes the X matrix undefined.

- X6 and X7 — in small samples, it’s better to leave only one (X7 is more informative).

- X10 is almost always linearly dependent on X9 (all observations are nearly proportional).

- X12 is very close to X11 (a scale factor, duplicates).

- X14 ≈ X13 (in some rows, the difference is 0 → complete collinearity).

- Coefficients: Estimate Std. Error z-value Pr(>|z|)

- (Intercept) 10.94087567 5.83964695 1.8736 0.0609924 .

- X1 0.85999310 0.47076372 1.8268 0.0677292 .

- X3 -2.11488142 4.04309198 -0.5231 0.6009150

- X4 0.05534474 0.02754940 2.0089 0.0445448 *

- X5 -9.11477183 4.74350876 -1.9215 0.0546655 .

- X7 0.03013069 0.04034971 0.7467 0.4552214

- X8 0.03668248 0.01007773 3.6400 0.0002727 ***

- X9 -2.17414745 1.96847151 -1.1045 0.2693828

- X11 -0.00389659 0.00178096 -2.1879 0.0286754 *

- X13 0.00253414 0.00098908 2.5621 0.0104039 *

- X15 -0.18348608 1.15986542 -0.1582 0.8743023

- X16 0.06956297 0.01750540 3.9738 7.074e-05 ***

- Estimate Std. Error z-value Pr(>|z|)

- (Intercept) 5.38069167 3.55208454 1.5148 0.12982

- X8 0.05288441 0.00222165 23.8041 < 2.2e-16 ***

- X11 -0.00636748 0.00152916 -4.1640 3.127e-05 ***

- X13 0.00261056 0.00083545 3.1247 0.00178 **

- X16 0.10166146 0.01319440 7.7049 1.310e-14 ***

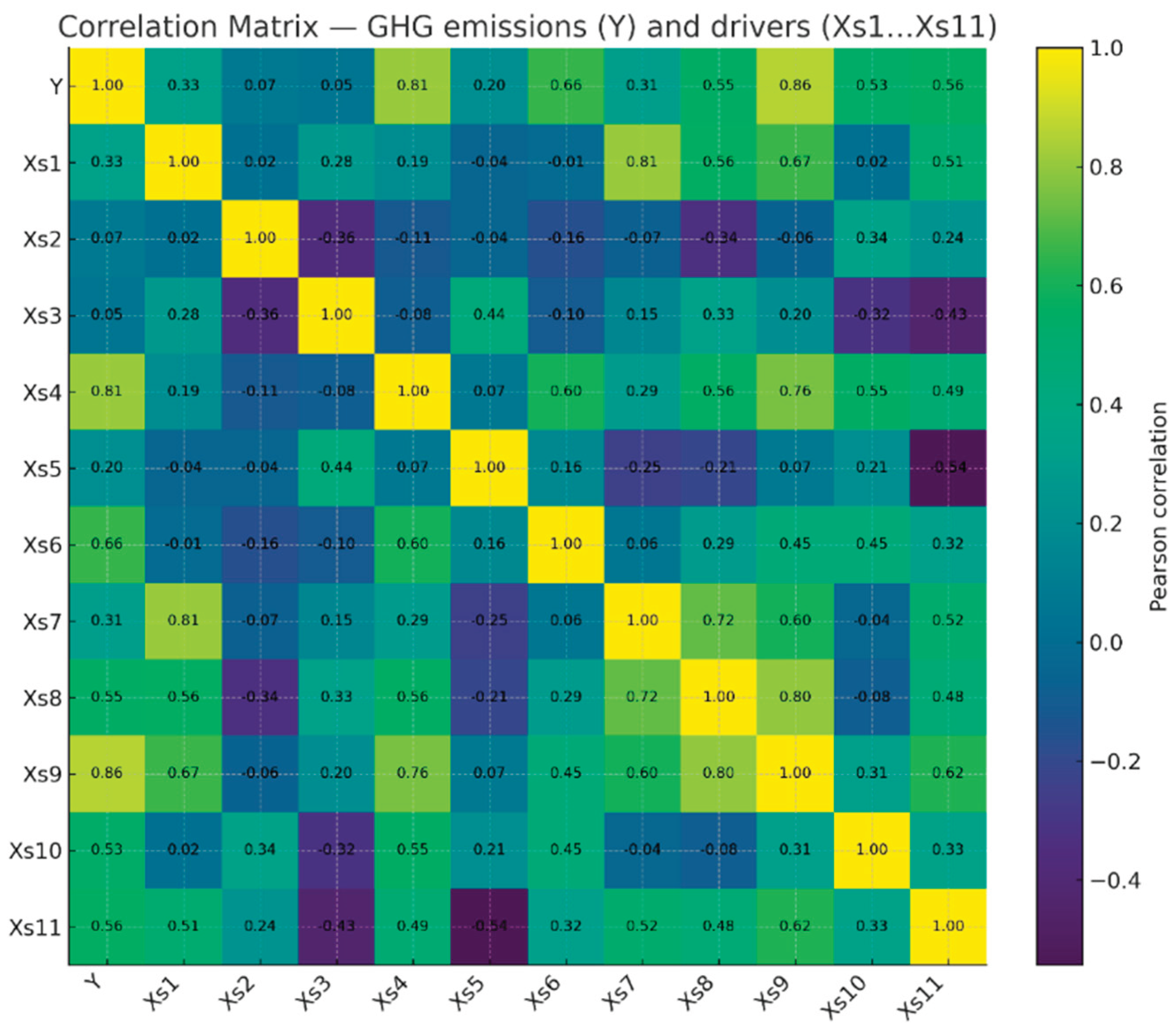

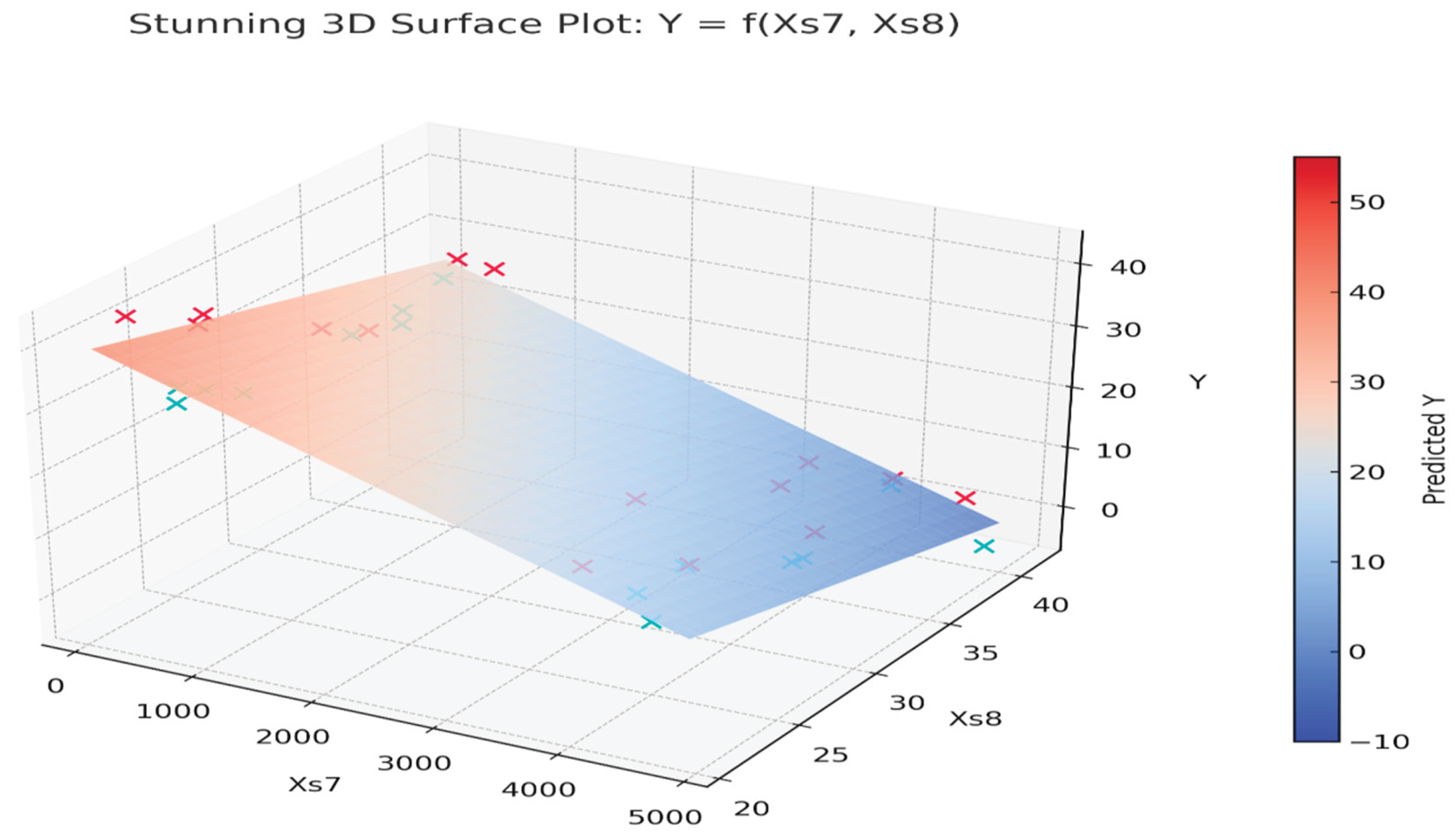

4.2. Modeling of GHG Emissions Based on Factors Demonstrating the Social Responsibility of Companies in the Oil and Gas Industry

- Estimate Std. Error z-value Pr(>|z|)

- (Intercept) 1.0275e+02 3.1881e+01 3.2228 0.001270 **

- Xs1 1.0166e+01 9.9885e+00 1.0178 0.308781

- Xs2 -3.6245e-01 1.3573e+00 -0.2670 0.789440

- Xs3 3.2524e-02 2.0996e-02 1.5491 0.121368

- Xs4 -3.7928e-02 3.2649e-02 -1.1617 0.245362

- Xs5 9.4815e-03 9.5502e-03 0.9928 0.320804

- Xs6 4.8436e-01 4.1010e-01 1.1811 0.237568

- Xs7 -3.2479e-03 1.6184e-03 -2.0069 0.044760 *

- Xs8 -2.3854e+00 7.4694e-01 -3.1936 0.001405 **

- Xs9 -1.6766e-03 5.3711e-03 -0.3122 0.754925

- Xs10 -9.6529e-02 1.4743e-01 -0.6547 0.512644

- Xs11 -1.8208e-05 1.3603e-04 -0.1338 0.893521

4.3. Modeling GHG Emissions Based on Factors Demonstrating the Management Responsibility of Companies in the Oil and Gas Industry

4.4. Modeling GHG Emissions Based on Factors Demonstrating the Integrated Impact of ESG Responsibility of Oil and Gas Companies

5. Suggestions for Improving the ESG Strategy for Reducing Atmospheric Emissions

6. Discussion

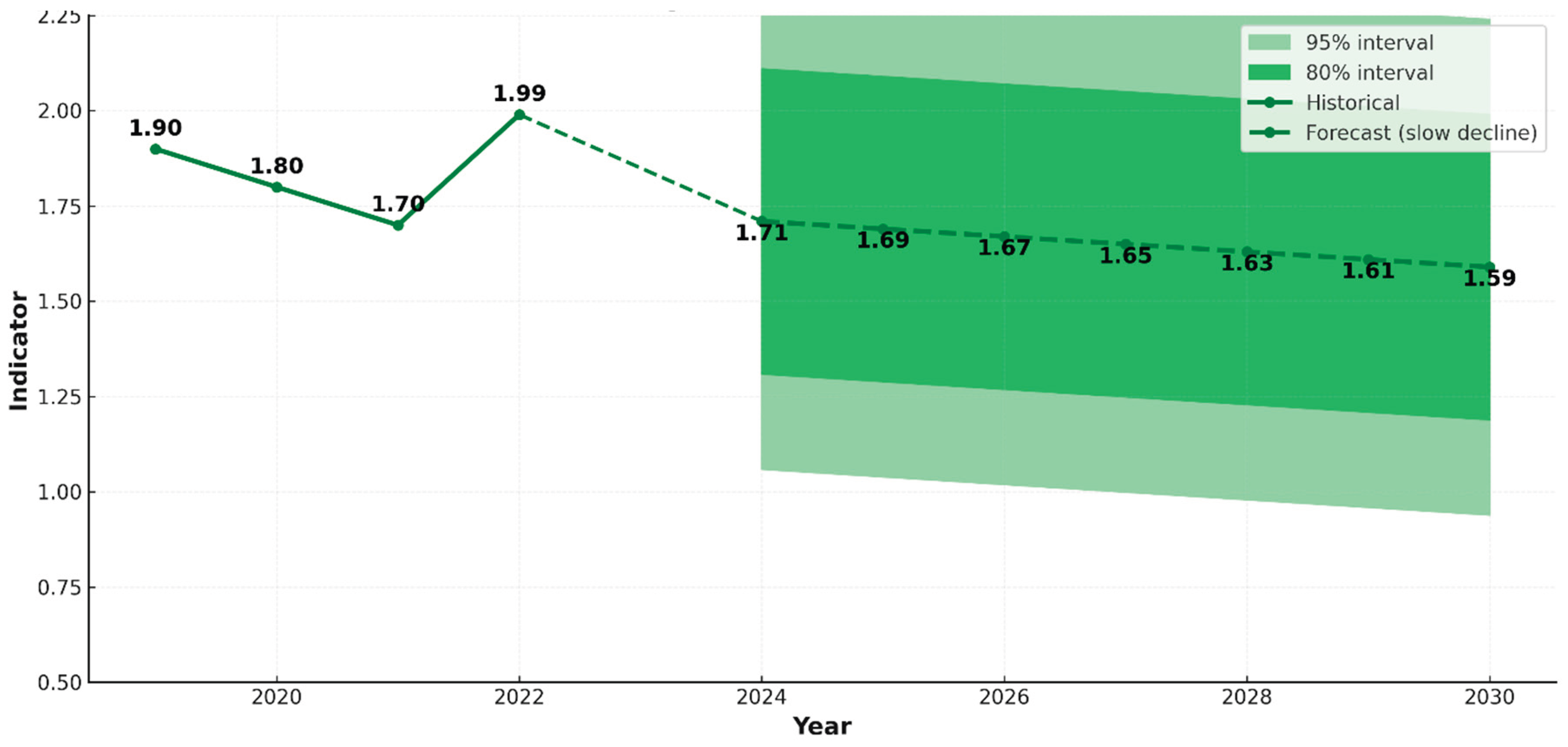

7. Conclusions

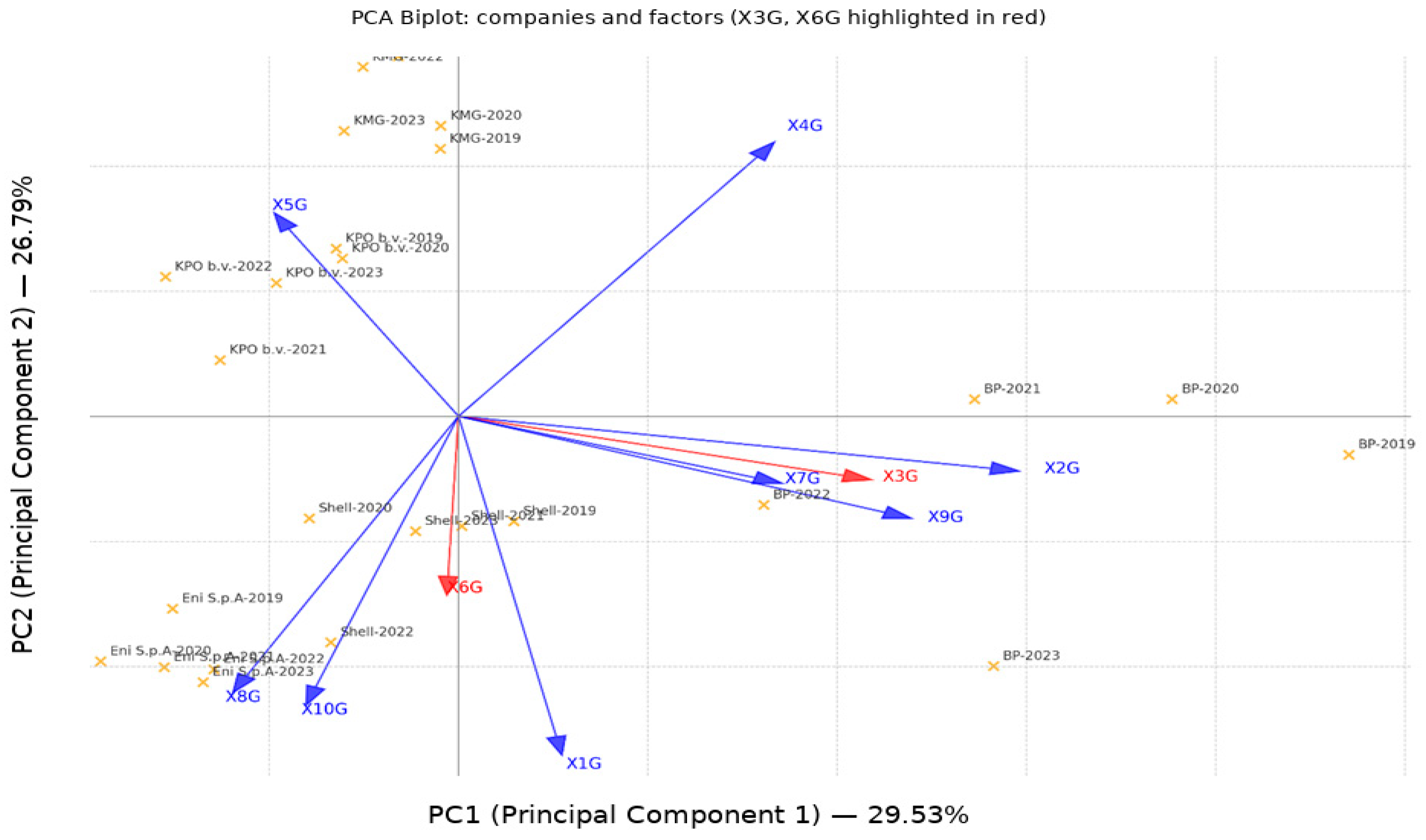

- This article presents a relevant study on implementing ESG strategies to reduce emissions in an industrial region of Kazakhstan. The study focuses on the Karachaganak oil and gas condensate field, selected because spatial analysis identified it as a primary source of atmospheric pollution in the region. To ensure systematic and objective analysis, KPO’s indicators, along with its plans for achieving sustainable development goals, key trends, and ESG implementation challenges, were benchmarked against leading global oil and gas companies—Shell, Eni S.p.A., BP—and the Kazakh company KMG. This comparative approach aligns with current trends in international research.

- This paper proposes a novel methodology for assessing ESG initiatives in Kazakhstan’s oil and gas industry. Its contribution lies in developing a comprehensive approach to ESG emission analysis that incorporates the spatial distribution of emission sources. The study holds practical significance by examining the oil and gas sector—a cornerstone of the national economy—and evaluating the impact of ESG initiatives on air pollution reduction. Implementing a tailored ESG strategy in the region represents a promising pathway for effective emission reduction, decarbonization, sustainable natural resource management, and the transition to a green economy. The paper provides specific recommendations for oil and gas companies to reduce atmospheric emissions.

- Econometric modeling was employed to identify relationships between ESG indicators and air pollution reduction. A piecewise approach was used to isolate key factors influencing emission reductions. Integrating all factors into a single model revealed the dominant influence of environmental factors. Consequently, following methodologies in similar studies, social and governance factors were integrated into a combined model, while environmental factors were assessed independently. Correlation and regression analysis demonstrated a strong relationship between emission volumes and specific E-factors (Total Energy Consumption, Water Usage, Hazardous Waste Disposal, Compliance with Environmental Regulations), S-factors (Investments in Renewable Energy, Gender Representation), and G-factors (Corporate Ethics as measured by Code of Conduct violations, Tax Compliance).

- Compared to KPO, the other companies studied have a longer history of ESG implementation, which is reflected in the modeling results. In the integrated S+G model for these companies, these factors contribute significantly more to emission reductions than at KPO b.v. This indicates that ESG principles hold substantial potential to help countries meet their commitments under the Paris Agreement. Furthermore, in contexts where environmental factors—despite their dominant role—face limitations (technological, financial, or geographical), robust social and governance criteria can significantly contribute to achieving decarbonization targets.

- A significant finding of our study is the constraint posed by the limited ESG information base. Although oil and gas companies generally demonstrate high transparency and can be considered highly accountable, their sustainability reports vary considerably in content and reported indicators. Established practice in Sustainability Development Reporting (SDR) for oil and gas and other High-Polluting Enterprises (HPE) shows that Environmental (E) criteria are standardized, with data comparable across reporting periods, units of measurement, and calculation methodologies (e.g., greenhouse gas emissions, net carbon intensity, energy intensity, waste disposal). In contrast, no unified framework exists for Social (S) and Governance (G) indicators, creating substantial difficulties in their analysis, comparative assessment, and interpretation.

- The experience of KPO can be extrapolated to other countries, as oil and gas companies globally face similar challenges related to air pollution. The study’s findings provide compelling evidence to support further research into implementing ESG strategies for air pollution reduction, not only in Kazakhstan but also in other oil and gas producing regions worldwide.

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A. Environmental, Social and Corporate Responsibility Indicators Derived from Sustainability Reports and Annual Reports of Oil and Gas Companies

| № | Environmental | Social | Governance |

| 1 | Volume of GHGs burned in flares, mil.t CO2 equivalent | Occupational Safety count of accidents (LRIT)per 1 million hours | Board Structure (Proportion of women),% |

| 2 | Carbon Footprint Reduction = net carbon intensity,gCO2e/MJ | Fatal accident rate (FAR), Number per 100 million hours | Transparency and Anti-Corruption Policy (Code of Conduct violations), count |

| 3 | GHG intensities, Tonne CO2e/tonne production | Training and Development, H | Corporate Ethics (Code of Conduct violations), count |

| 4 | Methane emissions, thousands t | Total Social Investments, mil. USD | Share of Economic diversification in Local development investments ,% |

| 5 | Methane intensity,% | Environmental investment, mil USD | Total amount of goods, works and services of local content, mil. USD |

| 6 | Sulphur oxides (SOx), thousand t | Investments in Biodiversity Conservation,mil.USD | Taxes,bil.USD |

| 7 | Nitrogen oxides (NOx), thousand t. | Renewable Energy Investments (Low carbon development), mil.USD | Human Resource Management (employees level of staff turnover),% |

| 8 | Total energy consumption, (millions of GJ) | Diversity and Inclusion (women in the company), % | Supplier engagement (suppliers with criticalities/areas for improvement),count |

| 9 | Energy efficiency, GJ/t | Human Rights -reports to the Global Helpline, count | Stakeholder Management System, grievances, count |

| 10 | Volume of production, thousand t | Employee Satisfaction,% | Sustainability Strategy SDGs (the overall weight of the sustainability goals),% |

| 11 | Water Usage, Million m3 | Number of employees,count | |

| 12 | Total Waste Disposal, thousand t. | ||

| 13 | Hazardous Waste disposal,thousand t. | ||

| 14 | Non-hazardous waste disposal, thousand t | ||

| 15 | Oil Spills and Environmental Incidents, volume,thousand t./count | ||

| 16 | Compliance with Environmental Regulations, count |

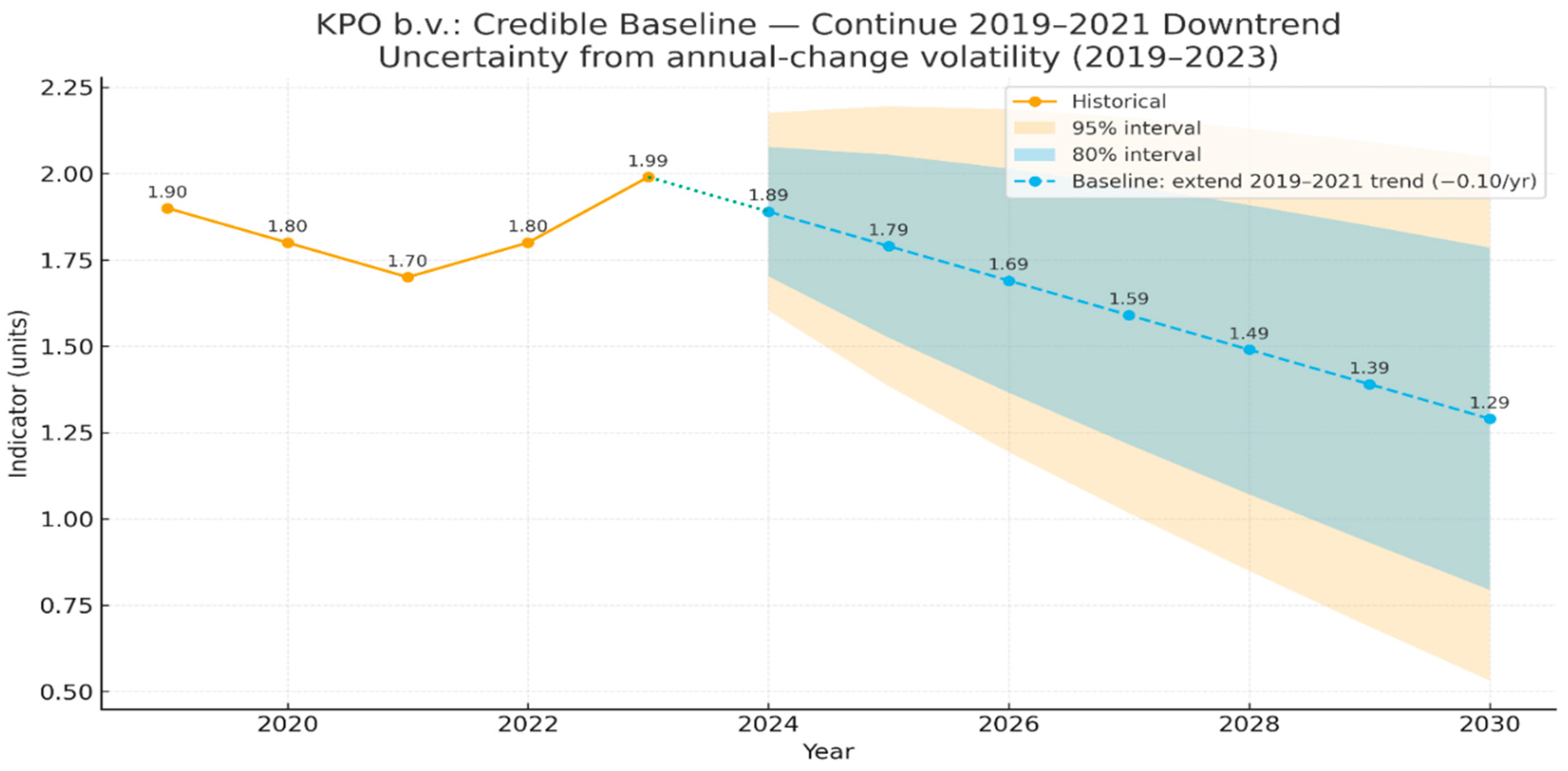

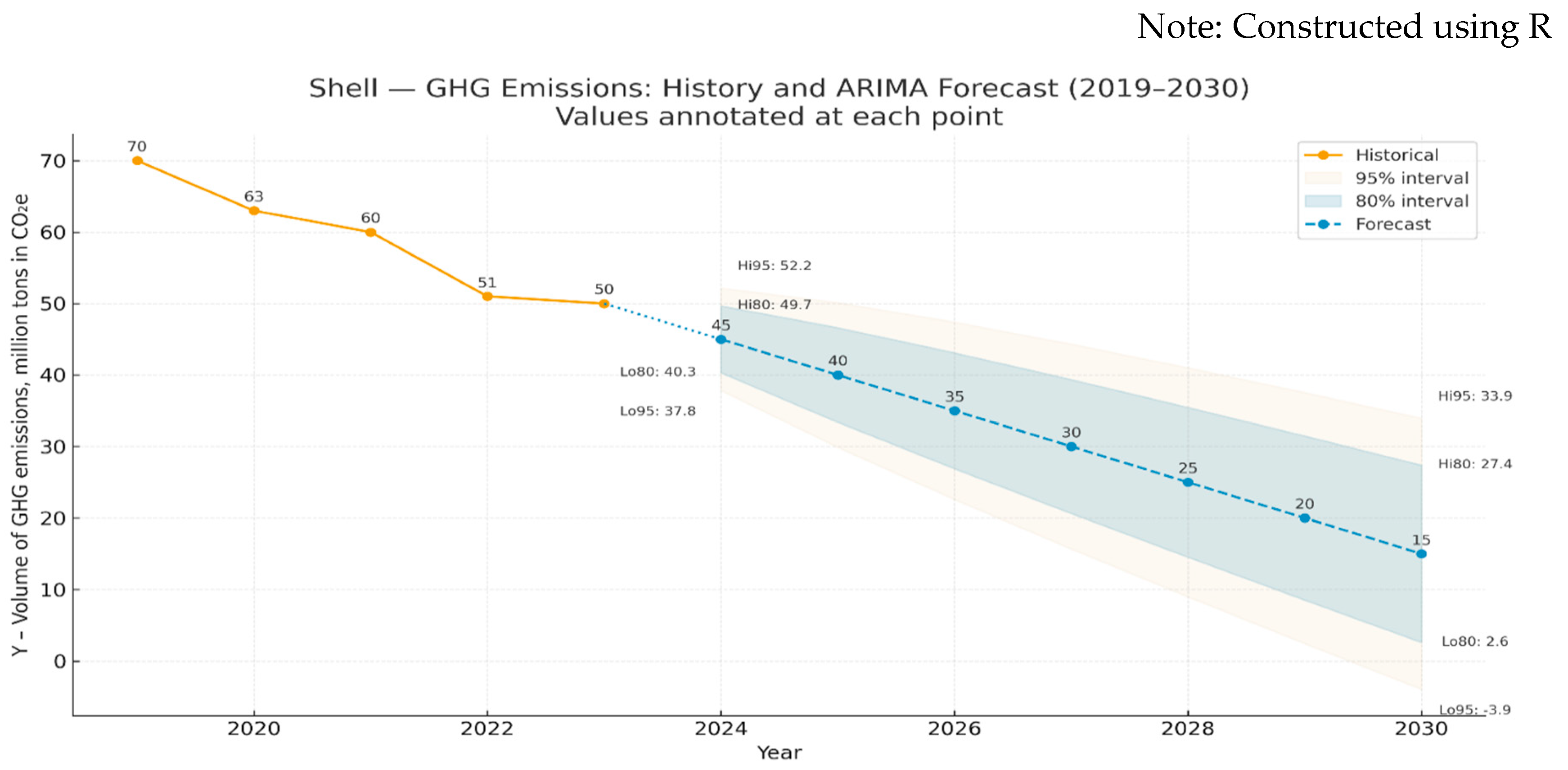

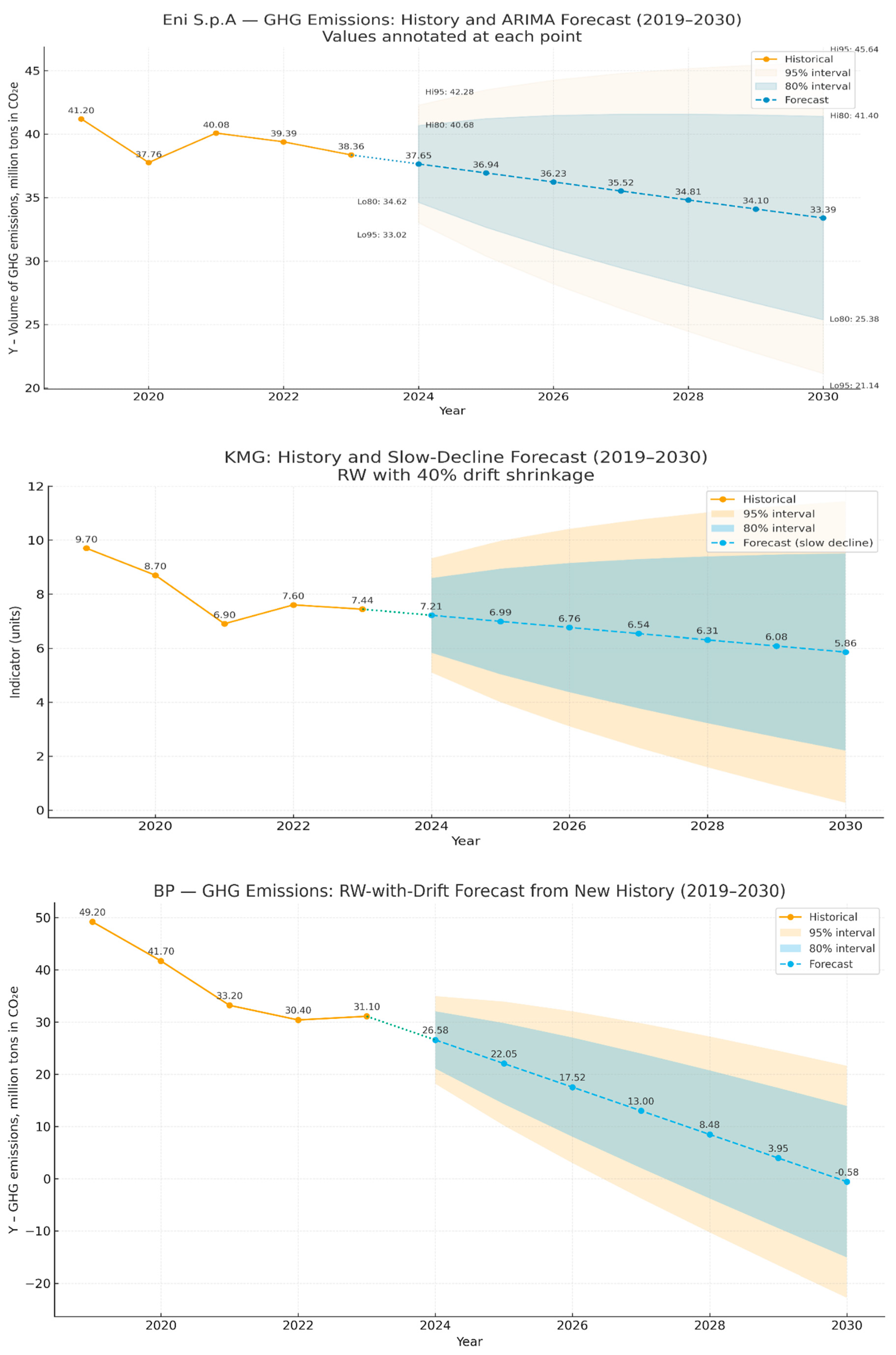

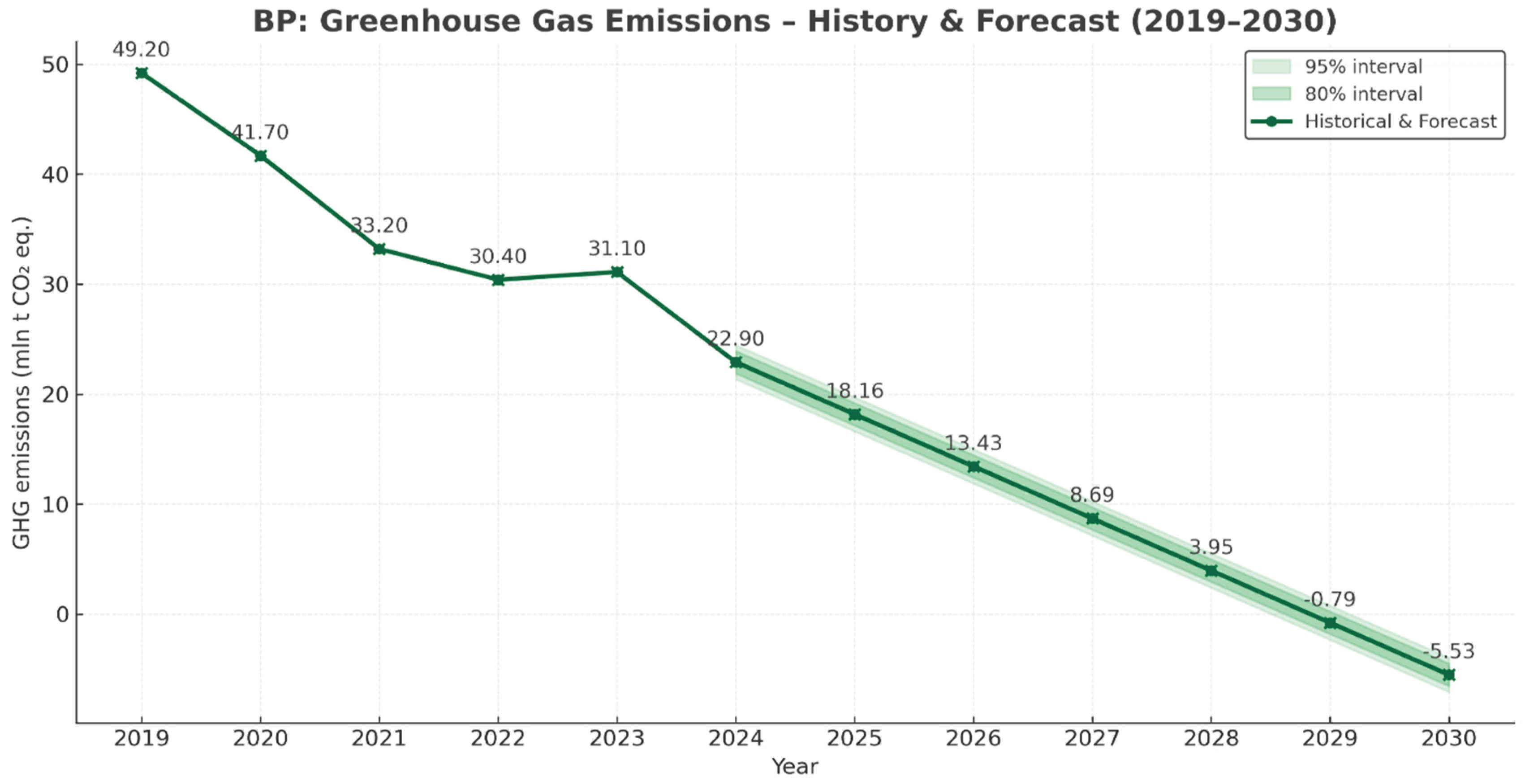

Appendix B. RW+Drift Forecasting of GHG Emissions (mil.t CO2 Equivalent) Taking Into Account the Impact of Factors Demonstrating the Environmental Responsibility of Oil and Gas Companies

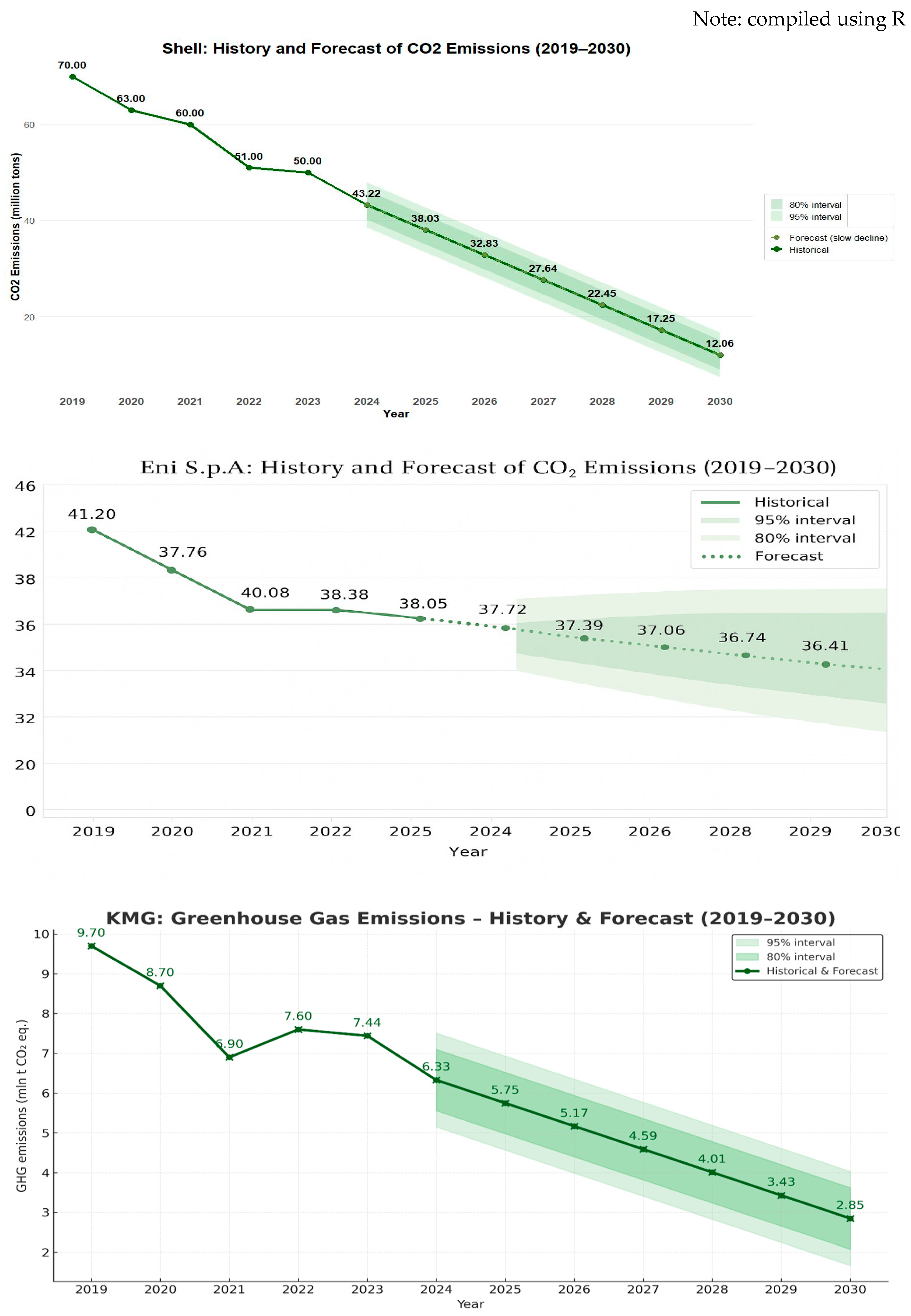

Appendix C. Results of Forecasting GHG Emissions (mil.t CO2 Equivalent) Into the Atmosphere Based on the Integrated S+G Model for: Shell, EniS.p.A, KMG, BP

References

- Coccia, M. New directions of technologies pointing the way to a sustainable global society. Sustainable. Futures 2023, 5, 100114. [Google Scholar] [CrossRef]

- Baur, D.G., & Todorova, N. Big oil in the transition or Green Paradox? A capital market approach. Energy Econonomics, 2023, 125, 106837. [CrossRef]

- Jackson, R. (2023). Global carbon emissions from fossil fuels reached record high in 2023. Univ. Exet. Stanford Doerr Sch. Sustain. Available online:https://sustainability.stanford.edu/news/global-carbon-emissions-fossil-fuels-reached-record-high-2023.

- Sala, S., Ciuffo, B., Nijkamp, P.A systemic framework for sustainability assessment. Ecological economics, 2015, 119 (Suppl. C), 314–325. [CrossRef]

- Semenova, T.; Martínez Santoyo, J.Y. Economic Strategy for Developing the Oil Industry in Mexico by Incorporating Environmental Factors. Sustainability, 2024, 16, 36. [Google Scholar] [CrossRef]

- Adilet.zan.kz, 2023. The Strategy on Achieving Carbon Neutrality by 2060. URL: https://adilet.zan.kz/rus/docs/U2300000121 (accessed 13 September 2025).

- About, K.P.O. (n.d.). KPO. Available online: https://www.kpo.kz/en/about-kpo (accessed on 20 October 2025).

- Miles, L.D. (1972). Techniques of value analysis and engineering (2nd ed.). McGraw-Hill. ISBN 9780318165547, 0318165546.

- Adambekova, A.; Kozhagulov, S.; Quadrado JC, Salnikov V, Polyakova S, Tazhibayeva T, Ulman, A. Reduction of Atmosphere Pollution as the Basis of a Regional Circular Economy: Evidence from Kazakhstan. Sustainability 2025, 17, 2249. [CrossRef]

- Global Reporting Initiative Standards. Official Website. 2023. Available online: https://www.globalreporting.org/ (accessed on 20 October 2025).

- ISO 14001:2018; Environmental Management System. International Organization for Standardization: Geneva, Switzerland, 2018. Available online: https://www.greenwgroup.com/iso-140012018-environmental-management-system/ (accessed on 20 October 2025).

- ISO 50001:2018; Energy Management Systems. International Organization for Standardization: Geneva, Switzerland, 2018. Available online: https://www.bsigroup.com/ (accessed on 13.September.2025).

- ISO 26000: 7 Core subjects of Corporate Social Responsibility. Borealis. (2024,July2). Available online: https://www.boreal-is.com/blog/iso-26000-social- responsibility/ (accessed on 13 September2025).

- ISO 45001-2018; Occupational Health and Safety Management Systems—Requirements with Guidance for Use. International Organization for Standardization: Geneva, Switzerland, 2018. Available online: https://www.iso.org/ru/standard/63787.html/ (accessed on 13 September2025).

- IOGP (2024) International Association of Oil &Gas Producers Efficient use of energy in oil and gas upstream facilities. Available online: https://www.iogp.org/bookstore/product/efficient-use-of-energy-in-oil-and-gas-upstream-facilities/ (accessed on 13 September2025).

- Turbina, K.E.; Yurgens, I.Y. (Eds.) (2022). ESG-Transformatsiya kak Vektor Ustoychivogo Razvitiya; V treh tomah. [ESG transformation as a vector of sustainable development: in three volumes]Tom 2/Podobsh. Red; Izdatel’stvo Aspect Press: Moscow, Russia, 650p, ISBN 978-5-7567-1219-3. https://mgimo.ru/up load/2022/10/ (accessed on 23 October 2025). (In Russian).

- Bureau of National Statistics of the Republic of Kazakhstan. Available online: https://stat.gov.kz/ (accessed on 13 September 2025).

- Information bulletins on the state of the environment of the Republic of Kazakhstan. Available online: https://www.kazhydromet.kz/ru/ecology/ezhemesyachnyy-informacionnyy-byulleten-o-sostoyanii-okruzhayuschey-sredy (accessed on 13 September 2025).

- Air emissions - sustainability report, –.; KPO. Available online: https://www.kpo.kz/docs/sustainability_report_2023/024-vybrosy_v_atmosferu.php (accessed on 20 October 2025).

- Karachaganak Petroleum Operating, B.V. (2023). KPO ESG Report 2023. Available online: https://www.kpo.kz/en/sustainability (accessed on 20 October 2025).

- Shell. (2023). Sustainability report 2023. Available online: https://www.shell.com/sustainability/reporting-centre/reporting-centre-archive/ (accessed on day month year).

- Eni (n.d.). Eni for 2023 Sustainability Performance. Available online: https://www.eni.com/static/en-IT/infographics/eni-for-2023/home/ (accessed on 20 October 2025).

- KazMunayGas (2023). Оtchet po ustojchivomu razvitiyu 2023.(Sustainability Report 2023) Available online:. Available online: https://www.kmg.kz/ (accessed on 20 October 2025).

- BP (2023). Sustainability report 2023. Available online: https://www.bp.com/en/global/corporate/sustainability/sustainability-reporting.html (accessed on 20 October 2025).

- SoPact (n.d.). Sustainability Reporting Guidelines. Available online: https://www.sopact.com/guides/sdg-reporting (accessed on 20 October 2025).

- Emissions Database for Global Atmospheric Research, (.n.d.).; EDGAR Available online:. Available online: https://edgar.jrc.ec.europa.eu/ (accessed on 20 October 2025).

- UN News (2021). Air pollution is one of the main threats to humans and the planet. Available online: https://news.un.org/en/story/2021/09/1102467 (accessed on 23 October 2025).

- Howes, S.; Wyrwoll, P. (2012). Asia’s environmental problems: Common features, and possible solutions.

- In Zheng, L.; Chen, Z. (2023). Economic policy uncertainty and corporate ESG performance. Available at SSRN: https://doi.org/10.2139/ssrn.4552630.

- Allen, M.; Dube OP, Solecki W, Aragón-Durand F, Cramer W, Humphreys S,Kainuma, M. Special report: Global warming of 1.5 C. Intergovernmental Panel on Climate Change (IPCC), 2018, 677, 393. Cambridge University Press, Cambridge, UK and New York, NY, USA, pp. 49–92, Available online: https://www.ipcc.ch/site/assets/uploads/sites/2/2019/06/SR15_Full_Report_Low_Res.pdf.

- Pörtner, H.-O.; Roberts, D.C.; Tignor, M.; et al. (2022). Summary for policymakers. In Pörtner, H.-O., Roberts, D.C., Poloczanska, E.S., Mintenbeck, K., Alegría, A., Craig, M., Langsdorf, S., Löschke, S., Möller, V. & Okem A. (Eds.), Climate Change 2022: Impacts, Adaptation, and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change (pp. 3–33). Cambridge University Press. Available online: https://doi.org/10.1017/9781009325844.001.

- Zickfeld, K.; MacIsaac, A.J.; Canadell, J.G.; et al. Net-zero approaches must consider Earth system impacts to achieve climate goals. Nat. Clim. Chang. 2023, 13, 1298–1305. [Google Scholar] [CrossRef]

- Tignor, M.; et al. (Eds.), Climate Change 2022: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change (pp. 3–3310). Cambridge University Press. https://doi.org/10.10179781009325844.001.

- United Nations Development Programme. (2022).The 8th National Communication and the 5th Biennial Report of the Republic of Kazakhstan to the UN Framework Convention on Climate Change. Available online: https://www.undp.org/kazakhstan/publications/8th-national-communication-and-5th-biennial-report-republic-kazakhstan-un-framework-convention-climate-change (accessed on 23 October 2025).

- Unated Nations. (2020). Antonio Guterres. Carbon neutrality by 2050: the world’s most urgent mission. Available online: https://www.un.org/sg/ru/content/sg/articles/2020-12-11/carbon-neutrality-2050-the-world’s-most-urgent-mission (accessed on 23 October 2025).

- World Bank. (2024). Achieving carbon neutrality by 2060: A sustainable energy future for countries in Europe and Central Asia. Available online: https://www.worldbank.org/en/region/eca/publication/net-zero-energy-by-2060-charting-europe-and-central-asia-s-journey-toward-sustainable-energy-futures (accessed on 23 October 2025).

- Qian, Y.; Liu, Y. Improve carbon emission efficiency: What role does the ESG initiatives play? Journal of Environmental Management 2024, 367, 122016. [Google Scholar] [CrossRef]

- Emission Index. (2024) Greenhouse Gas Emissions in Kazakhstan. Available online: https://www.emissionindex.com/countries/kazakhstan (accessed on 20 October 2025).

- European Commission. (2021).European Climate Law URL: https://climate.ec.europa.eu/eu-action/european-climate-law_en(accessed 20 October 2025).

- European Commission. (2022). European Union: About the European Union and its activities. URL: https://op.europa.eu/webpub/com/eu-what-it-is/en(accessed 23 October 2025).

- Vinokurov,E,Ahunbaev,A,Usmanov,N,Sarsembekov,T.(2022). Regulirovanie vodno-energeticheskogo kompleksa Tsentral’noj Azii [Regulation of the water energy complex of Central Asia]. Doklady i rabochie dokumenty.22/4.Almaty, Moscow: Eurasian Development Bank.2022,117s. Available online: https://eabr.org/analytics/special-reports/regulirovanie-vodno-energeticheskogo-kompleksa-tsentralnoy-azii (in Russian).

- Awe, Y.A.; Larsen, B.K.; Sanchez-Triana, E. (2022). The Global Health Cost of PM2. 5 Air Pollution: A Case for Action Beyond 2021(English), World Bank Group. United States of America. Available online: https://coilink.org/20.500.12592/vbj8qx on 02Mar2025, COI: 20.500.12592/vbj8qx, ISBN 978-1-4648-1816-5.

- Alamar, N.; Murali; van Scheers, J. (Eds.). (2008). Globalization and sustainable growth. In Environmental Management, Sustainable Development and Human Health (pp.13-19). [CrossRef]

- Lee, L.J.-W.; Tai, S.W. (2009). Environmental management and sustainable development in the oil and gas industry: A case study from Kazakhstan. In Environmental Management, Sustainable Development and Human Health (pp. 201–214). CRC Press. eBook, ISBN9780429206979.

- Ness, J.E.; Garvin, H.; Ravi, V. (2022). An Overview of Policies Influencing Air Pollution from the Electricity Sector in Central Asia. Golden, CO: National Renewable Energy Laboratory. NREL/TP-7A40-81861. Available online: https://www.nrel.gov/docs/fy23osti/81861.pdf.

- Nguyen ATThe relationship between economic growth energy consumption carbon dioxide emissions: evidence from Central Asia Eur, J. Bus. Econ. 2019, 12, 1–15. [CrossRef]

- Esekina А,, S.; Tokpaev; ZR; Cherednichenko, A.V., Kasenov, A.A., Ermahanova, E.M., Kasenova, D.A., ... & Shorman, A.T.(2023). Analiz dinamiki natsional’nyh vybrosov i pogloshenij parnikovyh gazov v Kazakhstane za 2012-2021gg. [Analysis of the dynamics of national emissions and absorption of greenhouse gases in Kazakhstan for 2012-2021] Hydrometeorologiya i ecologiya.3, 6–23. https://doi.org/10.54668/2789-6323-2023-110-3-6-23 (in Russian).

- Adambekova,A., Adambekov,N., Amankeldy,N., Salimbayeva,R.Scientific justification for the specific application of ESG principles. Journal of Economic Research & Business Administration 2023, 4. [CrossRef]

- Baratta, A.; Cimino, A.; Longo, F.; Solina, V.; Verteramo, S. The impact of ESG practices in industry with a focus on carbon emissions: Insights and future perspectives. Sustainability 2023, 15, 6685. [Google Scholar] [CrossRef]

- Rojo-Suárez, J.; Alonso-Conde AB,Gonzalez-Ruiz, J.D. Does sustainability improve financial performance? An analysis of Latin American oil and gas firms. Resources Policy 2024, 88, 104484. [CrossRef]

- Martto, J.; Diaz, S.; Hassan, B.; Mannan, S.; Singh, P.; Villasuso, F.; Baobaid, O. (2023, October). ESG strategies in the oil and gas industry from the maritime & logistics perspective-opportunities & risks. In Abu Dhabi International Petroleum Exhibition and Conference (p. D041S129R004). SPE. [CrossRef]

- Quayson, M.; Bai, C.; Mahmoudi, A.; Hu, W.; Chen, W.; Omoruyi, O. Designing a decision support tool for integrating ESG into the natural resource extraction industry for sustainable development using the ordinal priority approach. Resources Policy 2023, 85, 103988. [Google Scholar] [CrossRef]

- Ye, J.; Xu, W. Carbon reduction effect of ESG: empirical evidence from listed manufacturing companies in China. Frontiers in Ecology and Evolution 2023, 11, 1311777. [Google Scholar] [CrossRef]

- Cong, Y.; Zhu, C.; Hou, Y.; Tian, S.; Cai, X. Does ESG investment reduce carbon emissions in China? Front. Environ. Sci 2022, 10. [Google Scholar] [CrossRef]

- Li, C.; Ba, S.; Ma, K.; Xu, Y.; Huang, W.; Huang, N. ESG rating events, financial investment behavior and corporate innovation. Econ. Anal. Policy 2023, 77, 372–387. [Google Scholar] [CrossRef]

- Bandeira, G.L.; Trindade, D.N.P.; Gardi, L.H.; Sodario, M.; Simioni, C.G. (2023, April). Developing an ESG strategy and roadmap: An integrated perspective in an O&G company. In Offshore technology conference (p. D021S027R002). OTC. [CrossRef]

- WBCSD; Brekelmans, H. (2020, September 4). Shell: Aiming to become a net-zero energy business by 2050. Available online: https://www.wbcsd.org/news/shell-net-zero-energy-business-2050/.

- Mooneeapen, O.; Abhayawansa, S.; Mamode Khan, N. The influence of the country governance environment on corporate environmental, social and governance (ESG) performance. Sustainability Accounting, Management and Policy Journal 2022, 13, 953–985. [Google Scholar] [CrossRef]

- Babaeva Zh, R.; Semenov KK,Semenova, A.S. (2024). Traktovka ESG: sistemanicheskij obzor literatury. Rossijskij zhurnal menedzhmenta, [Interpretation of the Unified State Register: A Systematic Literature Review. Russian Journal of Management] (2), 253-288. https://doi.org/10.21638/spbu18.2024.205 (in Russian).

- EniSpA (n.d.). Reducing emissions linked to Oil&Gas production, contributing to the Net Zero target. Available online: https://www.eni.com/en-IT/sustainability/decarbonization/oil-gas.html (accessed on 23 October 2025).

- Chia, S.Y., Hong, S., Howes, S., Wyrwoll, P., Minh, V.H., Xuegong, S., ... & Clough, P. (2012). Moving Toward A New Development Model For East Asia-The Role of Domestic Policy and Regional Cooperation. Books. Economic Research Institute for ASEAN and East Asia (ERIA). (Zhang Yunling, Fukunari Kimura, & Sothea Oum, Eds.). Available online: http://www.eria.org/RPR-FY2011-10.pdf.

- Wang, Y. , Sun, X., & Guo, X. Environmental regulation and green productivity growth: Empirical evidence on the Porter Hypothesis from OECD industrial sectors. Energy Policy, 2019, 132, 611–619. [Google Scholar] [CrossRef]

- Szczepańczyk, M.; Nowodziński, P.; Sikorski, A. ESG Strategy and Financial Aspects Using the Example of an Oil and Gas Midstream Company: The UNIMOT Group. Sustainability 2023, 15, 13396. [Google Scholar] [CrossRef]

- Cheng, X.; Chen, K.; Su, Y. Green innovation in oil and gas exploration and production for meeting the sustainability goals. Resources Policy 2023, 87, 104315. [Google Scholar] [CrossRef]

- Wang, J.; Ma, M.; Dong, T.; Zhang, Z. Do ESG ratings promote corporative green innovation? A quasi-natural experiment based on Syn Tao Green Finance’s ESG Ratings. Int. Rev. Financ. Anal. 2023, 87, 102623. [Google Scholar] [CrossRef]

- Chipalkatti, N.; Le, Q.V. , & Rishi, M. Sustainability and society: do environmental, social, and governance factors matter for foreign direct investment? Energies 2021, 14, 6039. [Google Scholar] [CrossRef]

- Wang, W. (2024). The study of ESG strategies on the development and financial performance of traditional energy enterprises using System Dynamics-A case study on one oil and gas company. Doctoral dissertation, Massachusetts Institute of Technology. Available online: https://hdl.handle.net/1721.1/155984.

- Dsouza, S.; Krishnamoorthy, K. Boosting Corporate Value through ESG Excellence in Oil and Gas Sector. International Journal of Energy Economics and Policy, 2024, 14, 335–346. [Google Scholar] [CrossRef]

- Adilet.zan.kz, 2013 Concept on Transition towards Green Economy by 2050. Available online: https://adilet.zan.kz/rus/docs/T1300000577 (accessed on day month year).

- Hupart, J.H.; Adams, D.G.; McKitterick, W.G.; Kelsch, T. (2024, May 20). Understanding ESG ratings: Legal insights & perspectives. Mintz. Available online: https://www.mintz.com/insights-center/viewpoints/2151/2024-05-20-understanding-esg-ratings-legal-insights-perspectives.

- Berg, F.; Koelbel, J.F.; Rigobon, R. Aggregate confusion: The divergence of ESG ratings. Review of Finance, 2019, 26, 1315–1344. [Google Scholar] [CrossRef]

- Kong, X.; Li, Z.; Lei, X. Research on the impact of ESG performance on carbon emissions from the perspective of green credit. Sci Rep 2024, 14, 10478. [Google Scholar] [CrossRef]

- Meynier, T.; Mishkin, S.H., & Triggs, M. (2023, January 30). EU finalizes ESG reporting rules with international impacts. Harvard Law School Forum on Corporate Governance. Available online: https://corpgov.law.harvard.edu/2023/01/30/eu-finalizes-esg-reporting-rules-with-international-impacts/.

- National Law Review. (2021, March 10). EU Adopts ESG Ratings Regulation: Strengthening Transparency and Reliability. Available online: https://natlawreview.com/article/eu-seeks-improve-esg-ratings (accessed on 23 October 2025).

- Iris Carbon. (n.d.). A Beginner’s Guide to ESG Rating Agencies and Methodologies. Available online: https://www.iriscarbon.com/a-beginners-guide-to-esg-rating-agencies-and-methodologies/ (accessed on 23 October 2025).

- European Cluster Collaboration Platform.(2025).Green transition support. Retrieved Febrary 2, 2025 from Available online: https://www.clustercollaboration.eu/.(accessed on 23 October 2025).

- Kitaj stal mirovym liderom po «zelenomu» kreditovaniyu.(2023, 18 noyabrya). Bol’shaya Aziya. [China Becomes World Leader in Green Lending (2023, November 18)]. Greater Asia. (in Russian). Available online: https://bigasia.ru/kitaj-stal-mirovym-liderom-po-zelyonomu-kreditovaniyu/.

- UK Government. (2021, June 30). UK half way to net zero. Available online: https://www.gov.uk/government/news/uk-half-way-to-net-zero (accessed on 23 October 2025).

- Smart Energy Decisions. (2020, May 8). FedEx cuts emissions intensity 40% with fuel saving strategies. Available online: https://www.smartenergydecisions.com/energy-management/2020/05/08/fedex-cuts-emissions-intensity-40-with-fuel-saving-strategies (accessed on 23 October 2025).

- Synesgy. (2024, 4 June). ESG Indicators: how to evaluate sustainability performance. Synesgy. Available online: https://www.synesgy.com/en/esg-guide/esg-indicators-how-to-evaluate-sustainability-performance/ (accessed on 10 October 2025).

- Grinets, I.A.; Kaznacheev, P.F. (2015). Ekonomicheskiy rost i institutsionalnoe razvitie v neftegazovyh stranah. [Economic growth and institutional development in oil and gas countries] Vserossiyskiy ekonomicheskiy zhurnal ECO, (4 (490)), 105-115. (in Russian). Available online: https://cyberleninka.ru/article/n/ekonomicheskiy-rost-i-institutsionalnoe-razvitie-v-neftegazovyh-stranah.

- Adilet.zan.kz, 2021. Environmental Code of the Republic of Kazakhstan. Available online: https://adilet.zan.kz/rus/docs/K2100000400 (accessed on 10 October, 2025).

- Complaince &Business Ethics Association. (2023). Lim, Yu. PWC Kazakhstan opublikoval 4 izdanie Rejtinga 50-ti luchshyh kompanij, operiruyushih v Kazakhstane, po urovnyu raskrytiya ESG informatsii. [PWC Kazakhstan has published the 4th edition of the Rating of the 50 best companies operating in Kazakhstan, according to the level of ESG information disclosure. (in Russian). Available online: https://compliance.org.kz/.

- Tengrinews. (2025, 6 March). KASE nagradila KPO za luchshiy ESG-otchet. (KASE awarded KPO for the best ESG report).Tengrinews. (in Russian). Available online: https://tengrinews.kz/kazakhstan_news/kpo-nagradili-za-luchshiy-otchet-ob-ustoychivom-razvitii-564145/amp.

- Simply Sustainable (nd) The importance of governance within, E.S.G. Simply Sustainable. Available online: https://simplysustainable.com/insights/the-importance-of-governance-of-g-in-esg (accessed on 20 October 2025).

- The Report. (n.d.). What is the social S in ESG? ESG | The Report. Available online: https://esgthereport.com/what-is-esg/the-s-in-esg/ (accessed on 20 October 2025).

- Imashev EZhProstranstvennyj analiz izmeneniya ecologicheskogo sostoyaniya okruzhayushej sredjy Zapadno-Kazahstanskoy oblasti [Spatial analysis of changes in the ecological state of the environment in the West Kazakhstan region] Vestnik, K.a.z.N.U. Seriya geograficheskaya, 2011, 1, 13–20. Available online: https://bulletin-geography.kaznu.kz/index.php/1-geo/article/download/617/503 (in Russian).

- Kalieva, H.; Fadeeva; L; Erubaeva; G(2014)Ecologicheskij analiz sostoyaniya atmosphernogo vozduha Burlinskogo rajona Zapadno-Kazahstanskoy oblasti [Ecological analysis of the state of atmospheric air in the Burlinsky district of the West Kazakhstan region] Vestnik, K.a.z.N.U. Seriya ecologicheskaya,41,97-102. (in Russian). Available online: https://bulletin-ecology.kaznu.kz/.

- Sukhanberdina, L.H., Khon, V.N., & Khon, L.V. (2017). Air pollution control on Karachaganak field. Available online: http://hdl.handle.net/123456789/793.

- KenesaryD.,(2015). Nauchno-metodologicheskie osnovy upravleniya riskami zdorovyu naseleniya na primere regiona Karachaganaksrogo neftegazokondensatnogo mestorozhdeniya. Dissertacia na soiskanie uchenoj stepeni doctora philosophii (PhD) [Scientific and methodological foundations for managing public health risks using the example of the Karachaganak oil and gas condensate field. Doctoral Dissertation. Kazakh National Medical University]. (in Russian). Available online: https://kaznmu.kz/rus/ wpcontent/uploads/2015/.

- KenesaryA.,(2017). Nauchno-metodicheskie podhody razrabotki sanytarno-zashitnyh zon s primeneniem novyh tehnologij, snizhayushih zagryaznenie okruzhayushej sredy. Dissertacia na soiskanie uchenoj stepeni doctora philosophii (PhD) [Scientific and methodological approaches to the development of sanitary protection zones using new technologies that reduce environmental pollution. Doctoral Dissertation. Kazakh National Medical University]. (in Russian). Available online: https://kaznmu.edu.kz/rus/wpcontent/uploads/2017/.

- Kenessary, D.; Kenessary, A.; Kenessariyev, U.; Juszkiewicz, K.; Amrin, M.; Erzhanova, A. Human health cost of hydrogen sulfide air pollution from an oil and gas Field. Annals of Agricultural and Environmental Medicine 2017, 24. [Google Scholar] [CrossRef] [PubMed]

- Kemme, David M., Sovereign Wealth Fund Issues and the National Fund(s) of Kazakhstan (December 15, 2011). Available at SSRN: https://ssrn.com/abstract=3622312 or. https://doi.org/10.2139/ssrn.3622312.

- Bell, A.; Jones, K. Explaining Fixed Effects: Random Effects Modeling of Time-Series Cross-Sectional and Panel Data. Political Sci. Res. Methods, 2015, 3, 133–153. [CrossRef]

- Box, G.E.P.; Jenkins, G.M.; Reinsel, G.C. (1994) The Boxing and Jenkins Method—ARIMAX. In Time Series Analysis, Forecasting and Control, 3rd ed.; Prentice Hall: Englewood Cliff, NJ, USA.

- Kong, X.; Li, Z.; Lei, X. Research on the impact of ESG performance on carbon emissions from the perspective of green credit. Scientific reports, 2024, 14, 10478. [Google Scholar] [CrossRef]

- Khan, S.A. R. , Tabish, M., & Zhang, Y. Embracement of industry 4.0 and sustainable supply chain practices under the shadow of practice-based view theory: Ensuring environmental sustainability in corporate sector. Journal of Cleaner Production, 2023, 398, 136609. [Google Scholar] [CrossRef]

- Li, J.; Zhang, Z. The impact of ESG performance and enterprise value under the dual-carbon goals–based on A-share listed manufacturing enterprises. Applied Economics 2025, 1–19. [Google Scholar] [CrossRef]

- Tibshirani, R. Regression shrinkage and selection via the lasso. Journal of the Royal Statistical Society Series B: Statistical Methodology, 1996, 58, 267–288. [Google Scholar] [CrossRef]

- Grewal, J.; Hauptmann, C.; Serafeim, G. Material sustainability information and stock price informativeness. Journal of Business Ethics 2021, 513–544. [Google Scholar] [CrossRef]

- Korolev, N.; Kozyaruk, A.; Morenov, V. Efficiency increase of energy systems in oil and gas industry by evaluation of electric drive lifecycle. Energies, 2021, 14, 6074. [Google Scholar] [CrossRef]

- Muhammetoglu, A.; Al-Omari, A.; Al-Houri, Z.; Topkaya, B.; Tumbul, T.; Muhammetoglu, H. Assessment of energy performance and GHG emissions for the urban water cycle toward sustainability. Journal of Water and Climate Change, 2023, 14, 223–238. [Google Scholar] [CrossRef]

- Li, L.; Lee, G.; Kang, D. Energy Consumption and Greenhouse Gas (GHG) Emissions in Urban Wastewater Treatment Facilities: A Case Study of Seoul Metropolitan City (SMC). Water 2025, 17, 464. [Google Scholar] [CrossRef]

- Safitri, N.K. , Ridwan, A.Y., Hediyanto, U.Y.K.S., & Ma’ali el Hadi, R. Developing Waste Management System based on Open-Source ERP. JATISI (Jurnal Teknik Informatika dan Sistem Informasi) 2021, 8, 848–858. [Google Scholar] [CrossRef]

- Kazhydromet. (n.d.). https://www.iqair.com/ru/kazakhstan/batys-qazaqstan (accessed on 10 October 2025). (accessed on null).

- Ulman, A., Salnikov, V., Musralinova, G., Tuimebayev, Z., Polyakova, S., Tazhibayeva, T., ... & Raimbekova, Z. Air pollution in the West Kazakhstan region: A multi-source analysis. Atmospheric Research, 2025, 108560. [CrossRef]

- Masenov, K.B. , Ashibekov, S., & Bakytbek, A. The influence of gas processing facility on plants. The Way of Science, 2016, 12, 14–17. [Google Scholar]

- PwC.(2023, 25 января) Global M&A Trends in Energy, Utilities and Resources: 2023 Outlook. https://www.pwc.com/gx/en/services/deals/trends/2023/energy-utilities-resources.html (accessed 23 October 2025).

- PwC.(2025), Oil and gas. PwC. https://www.pwc.com/gx/en/industries/energy-utilities-resources/oil-gas-energy.html(accessed 23 October 2025).

- Vakulchuk, R.; Overland, I.; Suryadi, B. ASEAN’s energy transition: How to attract more investment in renewable energy. Energy, Ecology and Environment 2023, 8, 1–16. [Google Scholar] [CrossRef]

- World Bank. (2022). Impactful women: Examining opportunities and constraints for women in mining organizations worldwide. World Bank. https://www.worldbank.org/en/events/2022/03/09/impactful-women-examining-opportunities-and-constraints-for-women-in-mining-organizations-worldwide(accessed on 23 October 2025).

- Catalyst. (2023). Women’s workplace representation trends & solutions. Catalyst. https://www.catalyst.org/research/womens-workplace-representation-trends-solutions/.

- Shakil, M.H. Environmental, social and governance performance and financial risk: Moderating role of ESG controversies and board gender diversity. Resources Policy 2021, 72, 102144. [Google Scholar] [CrossRef]

- Caby, J. , Coron, C., & Ziane, Y. How does gender diversity in top management teams affect carbon disclosure and its quality: Evidence from the technological industry. Technological Forecasting and Social Change 2024, 199, 123077. [Google Scholar] [CrossRef]

- Peng, X.; Li, J.; Liu, Y.; Tang, Q.; Lan, Y.C. Corporate gender diversity and carbon reduction: the moderating effect of national culture. Applied Economics 2025, 1–24. [Google Scholar] [CrossRef]

- OECD. (2022). Climate change and corporate governance. OECD Publishing. [CrossRef]

- OECD. (2023).Pioneering global progress in tax transparency: A journey of transformation and development – 2023 Global Forum annual report. Global Forum on Transparency and Exchange of Information for Tax Purposes. https://www.oecd.org/content/dam/oecd/en/networks/global-forum-tax-transparency/global-forum-annual-report-2023.pdf.

- World Bank Group. (2024). Annual report 2024: A better bank for a better world. https://documents1.worldbank.org/curated/en/099101824180532047/pdf/BOSIB-3bdde89d-72a5-4a7f-b371-dd8e86adb477.pdf (accessed 23 October 2025).

- Coutts & Company. (2023). Public transparency report 2023. https://www.coutts.com/content/dam/rbs-coutts/coutts-com/Files/responsible-investing/pri-report/pri-transparency-report-2023.pdf (accessed on 23 October 2025).

- PwC. (2023). Tax transparency and sustainability reporting in 2023. https://www.pwc.com/gx/en/services/governance-risk-compliance/tax-transparency-and-sustainability-reporting-in-2023.html (accessed 23 October 2025).

- Iram, R. , Zhang, J., Erdogan, S., Abbas, Q., & Mohsin, M. Economics of energy and environmental efficiency: evidence from OECD countries. Environmental Science and Pollution Research, 2020, 27, 3858–3870. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Y. , Dong, L., Sun, Y., Ma, Y., & Zhang, N. Is air pollution the original sin of firms? The impact of air pollution on firms’ ESG scores. Energy Economics, 2024, 136, 107704. [Google Scholar] [CrossRef]

- Shell (2023) Shell publishes reports on Sustainability, Climate & Energy Transition Lobbying and Payments to Governments https://royaldutchshellplc.com/2023/03/29/shell-publishes-reports-on-sustainability-climate-energy-transition-lobbying-and-payments-to-governments/(accessed on 23 October 2025).

- Mazzantini, N., & Risucci, V. (2024). Sustainability in the Energy Sector: A Study of Proactive and Reactive Approaches. The Case of Enel and Eni. BA in International Business Capstone, John Cabot University, Rome, Italy. https://hdl.handle.net/20.500.14490/832.

- Aghion, P., Boneva, L., Breckenfelder, J., Laeven, L., Olovsson, C., Popov, A., & Rancoita, E. (2022). Financial markets and green innovation (No. 2686). ECB working paper, ISBN: 978-92-899-5270-5. [CrossRef]

- European Bank for Reconstruction and Development. (n.d.). Home. https://www.ebrd.com/home.html (accessed on 10 October 2025).

- Amović, G. , Maksimović, R., & Bunčić, S. Critical success factors for sustainable public-private partnership (PPP) in transition conditions: An empirical study in Bosnia and Herzegovina. Sustainability 2020, 12, 7121. [Google Scholar] [CrossRef]

- Karthikeyan, C. (2025). Transforming the Modern Workplace With AI (Artificial Intelligence) With Special References From India: Transformational Dynamics for Better Organizational Behavior. In Navigating Organizational Behavior in the Digital Age With AI (pp. 337–360). IGI Global Scientific Publishing. [CrossRef]

- Mukhiyayeva, D., Sembiyeva, L., & Zhagyparova, А. (2024). Evaluating ESG frameworks: A comparative analysis of global standards and their application in Kazakhstan. ECONOMIC Series of the Bulletin of the LN Gumilyov ENU, 245-261. [CrossRef]

- Kuura, O.V. , Varavina, Y.V., & Kozlovaa, M.V. ESG Transformation Factors of Kazakhstan’s Economy in the Context of Sustainable Development. Economy: strategy and practice, 2024, 19, 20–40. [Google Scholar] [CrossRef]

- Wielechowski, M., & Krasuski, P. ESG concepts in business practice. Characteristics and assessment of common ESG frameworks. MAZOWSZE Studia Regionalne, 2024, (Special Edition 2024), 9-26. [CrossRef]

- Arvidsson, S. , & Dumay, J. Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Business strategy and the environment, 2022, 31, 1091–1110. [Google Scholar] [CrossRef]

| Essence/meaning | Interaction | Frequency of implementation | Management level, responsible person | Management risks | |

|---|---|---|---|---|---|

| Assesment of the current state |

Assessing achievements and gaps in reducing air pollution and implementing sustainable practices | Annually, according to the terms of preparation of the SDR | KPO Environmental Department; Responsible person - Senior Management - Managing Director for Strategy/Deputy General Director |

Failure to comply with international and national standards and regulations can lead to fines, legal consequences, and damage to a company’s reputation. Failure to take current trends into account will lead to additional costs. | |

| Defining goals | Defining the SDGs of both the company itself and its role in the sustainable development of the region and ways to achieve them | according to GRI - annual review and updating of objectives (KPO, Eni) | Middle and senior management (heads of departments responsible for implementing the relevant ESG principle). For KPO, the team responsible for developing the “Green Strategy” and ESG goals is approved by the KPO Board of Directors. | The unattainability of the set goals from the standpoint of resource inadequacy (time, financial, technological, human) can reduce the effectiveness of the measures being implemented | |

| Accountability and transparency | Creation of mechanisms and tools to ensure transparency of ESG implementation processes | Annually, according to the ERM compilation deadlines. Ongoing coverage of ESG events/incidents | KPO Environmental Department, which is responsible for the implementation of sustainable development principles, the responsible person is senior management - Managing Director for Strategy / Deputy General Director | Risks of insufficient resources and investment, insufficient transparency and reporting, and risks of greenwashing | |

| Environmental Management System | Planning environmental activities and monitoring their implementation | Implementation and review of environmental management systems on an annual basis (KPO, Eni) | Special committees and working groups implement an integrated management system that covers occupational health, safety, and environmental protection. The responsible person is the Director of Health, Safety, Environment, and Integrity. | Risks associated with non-compliance with national and international environmental standards, insufficient transparency and reporting | |

| Energy efficiency | Rational use of energy resources, reduction of energy costs | In accordance with GRI 302, the frequency of implementation of energy efficiency measures within the framework of the ESG strategy of KPO includes both annual and long-term plans, for example from 2022-2026. | KPO implements an energy management system in accordance with ISO 50001:2018. Special committees and working groups are in place. The responsible person is senior management – Managing Director for Strategy/Deputy General Director. | Environmental, technological and reputational risks | |

| Using the best avalable technologies (BAT) |

Implementation of projects to introduce the best technologies for both reducing environmental pollution and business management | BAT implementation should be ongoing, with an annual review | The Committee is responsible for the implementation of sustainable development principles and environmental management, including the introduction of BAT. The responsible person is senior management - Managing Director for Strategy / Deputy General Director | Technological risks, lack of resources and investment, non-compliance with regulatory requirements | |

| Waste management |

Implementation of measures for the collection, accumulation, transportation, processing, disposal or rendering harmless of waste, supervision of these processes | constantly | KPO Environmental Department, which is responsible for the implementation of programs to reduce waste generation and minimize their negative impact on the environment. Responsible person - senior management - Managing Director for Strategy / Deputy General Director | Non-compliance with regulations, lack of transparency and reporting; changing public opinion and pressure from environmental organizations | |

| Using of RES | Reduction of pollutant emissions; Compliance with environmental standards, Economic efficiency | Every year, according to GRI | The committee is responsible for sustainable development and environmental management. The person responsible is senior management - Managing Director for Strategy/Deputy CEO. | Non-compliance with regulatory requirements, technological risks, lack of resources and investment | |

| Innovation and research |

EIA; Development of new technologies; economic efficiency |

Annual reports on achieved results and future plans, which comply with GRI requirements for transparency and reporting | Project team responsible for innovation and research aimed at reducing air pollution; Person in charge - Senior Management - Managing Director for Strategy / Deputy CEO | Lack of resources and investment; insufficient personnel qualifications; non-compliance with regulatory requirements | |

| Carbon Footprint |

Reducing the negative impact on the environment, assessing the level of pollution | constantly | KPO Environmental Department, which is responsible for the implementation of programs to reduce waste generation and minimize their negative impact on the environment. Responsible person - senior management - Managing Director for Strategy / Deputy General Director | Non-compliance with regulations, lack of transparency and reporting; changing public opinion and pressure from environmental organizations | |

| Essence/meaning | Interaction | Frequency of implementation | Management level, responsible person | Management risks | |

|---|---|---|---|---|---|

| Employee Ralations | creating a sustainable and responsible company | Constantly, annually within the framework of the SDR | The contractor’s committee, which develops the company’s sustainable development strategy, is responsible for senior management - the Managing Director of Human Resources. | Violation of workers’ rights, lack of transparency leading to social conflicts | |

| Diversity, Equity and Inclusion |

Creating equal opportunities, social responsibility | Constantly, annually within the framework of the SDR | A contractor committee that develops measures for the company’s development, including aspects of diversity and inclusion; the person in charge is senior management - the Managing Director of Human Resources. | Lack of employee engagement, reputational, financial, and legal risks | |

| Labor Practicies | Working conditions and workers’ rights, Social responsibility | Constantly, annually within the framework of the SDR | Occupational Health and Safety and Environment Working Groups, responsible person - HR Director, senior management - HR Managing Director | Violation of labor rights, unsafe working conditions leading to social conflicts | |

| Community Engagement | Community engagement strengthens social ties and contributes to a better quality of life in the region | Constantly, annually within the framework of the SDR | Stakeholder Engagement Committee, responsible person - senior management - Managing Director for Strategy | Ineffective communication and violation of regulatory requirements can lead to social conflicts and reputational risks | |

| Suply Chain ; Labor Standarts | Sustainable supply chain practices help minimize negative environmental impacts | Constantly, annually within the framework of the SDR | A special subcommittee responsible for the implementation of ESG strategies, including supply chain management and compliance with labor standards; the person in charge is senior management - the Director of Sustainability | Lack of personnel qualifications, economic, reputational, social risks | |

| Human Rights Policies | compliance with legal regulations, creating a sustainable and responsible business model | Constantly, annually within the framework of the SDR | Sustainable Development Subcommittee (Senior Management: Director of Sustainable Development) | Violations of workers’ rights and a lack of transparency can lead to reputational damage. | |

| Health and Safety | preventing accidents and ensuring safe working conditions | Constantly, annually within the framework of the SDR | Occupational Health and Safety and Environment Working Groups, responsible person - HR Director, senior management - HR Managing Director | Risks of industrial injuries, insufficient personnel training, non-compliance with standards, emergency situations, reputational | |

| Training and Development | improving the skills of employees and implementing broad sustainable development goals | Constantly, annually within the framework of the SDR | The Sustainable Development Committee is responsible for the development and implementation of strategies, including employee training, and the person in charge is senior management - the HR Director. | insufficient staff qualifications, low employee engagement, and lack of clear goals and metrics can lead to reputational risks. | |

| Social Impact Investments | creating a sustainable and socially responsible business | Constantly, annually within the framework of the SDR | The Social Affairs Committee is responsible for the development and implementation of social programs aimed at improving the living conditions of local communities and employees. The person responsible is senior management - Managing Director for Strategy / Deputy CEO. | Risks of failure to meet stakeholder expectations, lack of transparency, changes in legislation, financial and reputational risks | |

| Stakeholder Engagement | contributes to improving relations with key groups, helps the company effectively achieve its goals | Constantly, annually within the framework of the SDR | committee responsible for interaction with interested organizations; responsible person - senior management - Managing Director for Strategy | Incomplete understanding of stakeholder needs, insufficient transparency, and lack of resources can lead to conflicts of interest and reputational risks. | |

| Essence/meaning | Interaction | Frequency of implementation | Management level, responsible person | Management risks | |

|---|---|---|---|---|---|

| Board Composition and Diversity | contributes to the improvement of corporate governance, increasing the sustainability and reputation of the company, compliance with modern requirements and expectations of stakeholders. | annually or as part of strategic planning | The Board of Directors of the company, responsible person - senior management - Director of Sustainable Development | Lack of diversity in the boardroom, conflicts of interest, lack of transparency, and poor risk management can lead to ignoring different perspectives, which will negatively impact the company’s strategy. | |

| Executive Compensation | contributes to the improvement of corporate governance and the overall development of the company | annually or as part of strategic planning | The Remuneration Committee is responsible for developing and implementing policies that link executive compensation to the achievement of ESG objectives; responsible person - senior management - Chief Sustainability Officer | Insufficient effectiveness of strategic and operational management may lead to non-compliance with established ESG goals and objectives, conflicts of interest, and reputational risks | |

| Stakeholder Rights | Involvement of all stakeholders, including investors, employees, customers and local communities, in the process of developing and implementing an ESG strategy | constantly | The Board of Directors ensures interaction with stakeholders, including investors, employees and local communities; the person responsible is the senior management of the company. | Lack of transparency can lead to mistrust from stakeholders, conflicts of interest, reputational and regulatory risks. | |

| Ethic and Complaince Program | developing a corporate culture based on honesty and responsibility, ensuring the integration of ethical standards into business processes and contributing to the achievement of the company’s environmental goals. | annually or as part of strategic planning | The Board of Directors is responsible for the strategic direction and oversight of the Ethics and Compliance Program; the responsible person is the Chief Ethics and Compliance Officer. | Lack of clear and transparent reporting on compliance with regulations and standards can lead to a lack of trust from stakeholders, including investors and the public. | |

| Risk Management Practicies | Systematic identification and analysis of risks associated with environmental, social, and governance aspects. | annually or as part of strategic planning | The Board of Directors and specialized committees responsible for strategic direction and oversight of ESG initiatives | Environmental, social, corporate, regulatory risks | |

| Entegral control and audit | the company’s compliance with environmental regulations and standards, which is important for reducing air pollution and minimizing the negative impact on the environment | annually within the framework of the SDR | The Sustainable Development Committee includes representatives from various departments to ensure a cross-functional approach to management; the responsible person is middle management (ESG managers), senior management (the Director of Internal Audit). | A lack of open data on a company’s activities can make it difficult to prove its sustainability to investors and regulators, which can lead to greenwashing, loss of trust, and reputational risks | |

| Corporate Policies and Procedures | form the basis for managing a company’s ESG aspects, creating clear goals and standards that guide the company’s actions in the area of sustainable development and air pollution reduction | Constantly | The Company’s Board of Directors is responsible for strategic direction and oversight of ESG initiatives, including the development and implementation of corporate policies and procedures. Responsible person: Senior Management - Chief Sustainability Officer | Insufficient integration of ESG into business processes can lead to a discrepancy between the stated goals and the actual actions of the company, reputational and regulatory risks | |

| Sustainability Integration | Integrating sustainability into a company’s business strategy allows for environmental, social, and governance considerations to be taken into account when making decisions. | annually within the framework of the SDR | The Board of Directors of the company, responsible person - senior management - Director of Sustainable Development | Reputational, financial, regulatory, operational risks | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).