1. Introduction

With carbon neutrality gradually becoming a global consensus, governments and all sectors of society are actively taking actions to mitigate the impacts of climate change and promote the green transformation of the economy and society. Industrial park is an important carrier of regional economic development, and its energy consumption pattern and carbon emission level play a key role in realizing the goal of regional carbon neutrality [

1]. There are many enterprises in industrial parks with large energy demand, and the traditional centralized energy supply method is often difficult to meet the diversified and low-carbon energy demand of enterprises [

2]. In recent years, significant technological breakthroughs have been achieved in new energy equipment such as photovoltaic and wind power generation. Enterprises are gradually adopting distributed energy instead of traditional energy to reduce carbon emissions. However, distributed energy equipment is subject to the enterprise’s own energy consumption requirements and natural conditions, there is still a certain amount of time idling in the energy supply as well as energy redundancy, and there is still room to improve the utilization efficiency of the energy system [

3]. Distributed energy sharing, as an innovative energy utilization mode, can integrate and optimize the local distributed energy resources of industrial parks through technical means such as microgrids, achieve efficient energy utilization and reduce corporate carbon emissions [

4].

At the same time, carbon neutrality is gradually becoming a shared global goal, with governments around the world formulating corresponding low-carbon policies, including carbon subsidies, carbon trading, and carbon taxes [

5]. Among these, market-based carbon trading systems are widely regarded as an effective method for controlling carbon emissions [

6]. The core of this mechanism lies in treating carbon emission rights as a scarce resource, allowing enterprises to buy, sell and trade in the carbon market, and through economic incentives, encouraging enterprises to reduce carbon emissions and promote green and low-carbon development [

7]. Under the joint action of carbon emissions trading mechanism and distributed energy sharing model, the industrial park network composed of core enterprises and supporting enterprises expands from a single production network to a super network structure containing production network, energy network and carbon trading network. The interdependence and interaction between multiple networks have transformed the production decision of enterprises from single-objective decision to complex decision with multi-objective attributes. In this case, how to realize the equilibrium of production flow, energy flow and carbon trading flow is a realistic problem that enterprises need to solve. Based on this, this paper establishes a distributed energy sharing supernetwork model for industrial parks under the carbon emissions trading mechanism, solves the network equilibrium decision of enterprises, and systematically analyzes the influence of carbon limit and carbon trading price on the equilibrium strategy of distributed energy sharing network of industrial parks. Specifically, this article aims to answer the following questions:

(1) What are the conditions for reaching network equilibrium for distributed energy sharing in industrial parks under carbon emissions trading mechanism?

(2) Under network equilibrium conditions, what is the most ideal level of low-carbon energy, product trading volume, and trading prices for park enterprises?

(3) What is the impact of carbon emission cap allocated to enterprises by the government on the networks equilibrium decision of distributed energy sharing in industrial parks?

(4) How does the carbon trading price in the carbon trading market affect the network equilibrium decision of distributed energy sharing in industrial parks?

The main contributions of this paper are reflected in the following aspects. First, we expand the network equilibrium structure of industrial parks in existing studies into a super network structure including energy network, production network and carbon trading network, and construct a network equilibrium model of distributed energy sharing in industrial parks under the carbon emissions trading mechanism. Secondly, we use variational inequality to characterize the dynamic process of simultaneous participation, mutual influence and game between multiple parties in distributed energy sharing in industrial parks. From the perspective of industrial park multi-body network, we explore the interaction relationship between enterprises under the multi-layer network within the park. Then, with the goal of realizing the equilibrium of enterprises’ production flow, energy flow and carbon trading flow, we adopt the projection correction algorithm to solve the equilibrium state of the supernetwork. Finally, we analyze the influence of carbon emission limit and carbon trading price on the network equilibrium decision through numerical examples, which provides a reference for the decision-making of the government and enterprises.

The organizational structure of the rest of this article is as follows. In

Section 2, we review and synthesize the related literature. In

Section 3, we presented the problem description and model assumptions.

Section 4 analyzes the equilibrium conditions of distributed energy sharing network for industrial parks.

Section 5 constructs an industry park distributed energy sharing network equilibrium model and solves the model.

Section 6 provides a numerical example and analyzes the solution results of the example.

Section 7 draws conclusions.

2. Literature Review

The carbon emissions trading mechanism is a key measure for promoting low-carbon, green, and sustainable economic development. In recent years, scholars have conducted a large number of studies on the impact of carbon emissions trading mechanism on carbon emission reduction [

8]. Zhang analyzed Chinese city data from 2004-2015 through robust econometric methods and found that the carbon trading policy in pilot areas reduced carbon emissions by about 16.2% [

9]. Wang et al. utilized panel data from 30 Chinese provinces and municipalities spanning 2008-2018 to assess the impact of carbon trading policies on achieving carbon neutrality through a combination of control group methods and difference-in-differences analysis [

10]. Wu et al. employed the data envelopment analysis method to examine the impact of carbon emissions trading schemes on carbon emission efficiency in the steel industry. Results indicate that carbon emission efficiency in pilot provinces implementing emissions trading has significantly improved by 5% [

11]. Wang found that industrial clustering and total volume control combined with trading mechanisms have amplified the carbon reduction effects of digital trade [

12]. In addition, some scholars have researched the production decision-making problem of enterprises under the carbon emissions trading mechanism. Yu et al. examined the effects of carbon pricing and overconfidence on the decision-making and profits of supply chain members, and carbon trading price is found to be effective in guiding emission reductions under the rational state of low-cost manufacturers, but fails after the abatement cost increases [

13]. Fan et al. reveal the association between carbon trading price uncertainty and enterprises’ incentives to invest in clean technology, emphasizing the importance of uncertainty in carbon policy design [

14]. Li et al. analyzed two competing low-carbon supply chains under a carbon trading mechanism, finding that carbon quota systems struggle to effectively drive emissions reductions—raising carbon trading prices is the key [

15]. Wang et al. constructed a two-channel low-carbon supply chain network equilibrium model incorporating risk-averse retailers. Findings indicate that raising carbon trading prices effectively incentivizes firms to increase carbon reduction rates and profit from selling carbon allowances [

16]. Xu et al. developed a Stackelberg game model to analyze market dynamics under three scenarios, exploring the impact of carbon trading mechanisms on green innovation production in manufacturing enterprises [

17].

On this basis, some other scholars have paid attention to the important role of carbon emissions trading mechanism in the energy field. In the study of renewable energy investment decision-making, Chen et al. established a renewable energy investment decision model for utility companies under three carbon cap-and-trade mechanisms and analyzed its impact on investment decision-making [

18]. Wei et al. constructed a two-level electricity supply chain game model and compared the optimal solutions under the grandfather carbon cap mechanism and the benchmark carbon cap mechanism [

19]. Yan et al. took the renewable energy industry in China as an example to explore the impacts of carbon trading mechanism on the investment decision, carbon emission, consumer surplus and social welfare of power companies, and found that the hybrid carbon trading scheme is optimal [

20]. In terms of energy optimization decision-making research, Meng et al. studied the two-level supply chain operation decision-making problem under different carbon trading policies based on energy performance contracts [

21]. Fu et al. established a dynamic differential game model for distributed energy sharing within industrial clusters under a quota trading mechanism, analyzing the impact of the quota trading mechanism on distributed energy sharing decisions in industrial parks [

22]. Wu et al. based on the perspective of energy producer and seller, used a mixed-integer programming method with game equilibrium to solve the low-carbon energy trading process in the community under the cap-and-trade mechanism [

23]. He et al. proposed a multi-objective optimization model for long-term planning of regional power systems based on renewable energy generation portfolio standards and carbon cap-and-trade mechanisms [

24]. In the study of optimal energy scheduling, Zhang et al. incorporated the carbon trading mechanism into the optimal scheduling model of virtual power plants and proposed a self-concluding variational particle swarm optimization algorithm, which effectively improved the utilization rate of renewable energy sources [

25]. Gao et al. incorporated demand response into a tiered carbon trading mechanism, providing economically optimal low-carbon dispatch solutions for integrated energy systems [

26]. Huo et al. examined the impact of seasonal variations on carbon trading mechanisms, establishing a stepwise carbon pricing model and proposing a novel quota allocation method to achieve low-carbon economic dispatch [

27].

Nowadays, under the dual role of carbon trading mechanism and distributed energy sharing, the relationships within industrial parks are becoming more and more complex, and enterprises need to make optimal decisions on production, energy and low carbon to reduce risks [

28]. The network equilibrium model, as a tool to describe the interaction and equilibrium state of each node in the network, has been widely used in supply chain research. Liu et al. constructed a closed-loop supply chain network equilibrium model based on the dual objectives of profit maximization and carbon emission minimization, solving it using an improved projection contraction algorithm [

29]. Wan et al. considered consumer low-carbon preferences and altruistic behavior among agents across tiers in dual-channel hotel supply chains, establishing a network equilibrium model grounded in variational inequalities. They employed an improved projection gradient algorithm to determine system equilibrium conditions and optimal decisions [

30]. Jiang et al. established a supply chain multi supply chain under the condition of network equilibrium. The effects of network structure on enterprises’ earnings, total trade flows and overall social welfare were investigated [

31]. Fargetta et al. examined the impact of temporal variations on supply chain network equilibrium and proposed a sustainable closed-loop supply chain network equilibrium model based on a time-dependent framework, and analyzed the optimal behaviors of each decision maker and the conditions for the equilibrium of the closed-loop supply chain network [

32]. On this basis, some scholars have extended the single network equilibrium to form a multi-network equilibrium model. In the study of equilibrium problems in energy and transportation networks, Ni used finite-dimensional variational inequalities to establish a network equilibrium model for car rental market competition based on non-cooperative game theory, which is able to analyze the network equilibrium of diverse driver types, multi-demand zones, and differentiated online car rental platforms [

33]. Xie et al. constructed a network equilibrium model based on the distribution network and the transportation network in order to capture traffic flow, queue, and tariffs’ time-varying characteristics [

34]. Chen et al. constructed a network equilibrium model to examine the interactions between electric vehicle drivers’ travel plans, analyzing how charging and rest behaviors influence fatigue costs [

35]. Li et al. proposed a stochastic rescue network with finite path capacity and established an equilibrium model for the network based on cumulative prospect theory, which reduces the disaster response cost [

36]. In the study of the equilibrium problem of energy network and carbon trading network, Zhang constructed a network equilibrium model based on product trading sub-network and carbon trading sub-network, and researched the impact of carbon cap and price on closed-loop supply chain network [

37].

In summary, the existing literature has conducted extensive research on the equilibrium problem in supply chain networks, laying a solid foundation. However, previous studies have mostly focused on a single production network and a multi-network structure with two layers of network superimposed, without considering the factors of product, energy and carbon trading at the same time, and few literatures have analyzed the impact of carbon emissions trading mechanism on the equilibrium decision of distributed energy sharing network in industrial parks. And in the actual production and operation process of distributed energy sharing in industrial parks, there are often interactions between the energy network and the production network as well as the carbon trading network, which need to be explored as a decision-making method for complex network equilibrium. Therefore, this paper introduces the network equilibrium theory into the study of industrial park distributed energy sharing research, and describes the industrial park network as a supernetwork structure composed of production network, energy network, and carbon trading network from the perspective of heterogeneous members within the industrial park. The network equilibrium model is constructed based on the theory of variational inequality, and the conditions for the decision makers of each party and the network system to reach the equilibrium state are obtained. Finally, the model is solved by the projection correction algorithm to explore the influence of the carbon emissions trading mechanism on energy sharing and optimal profit decision-making, so as to provide support for the decision-making of industrial park producers.

3. Problem Description and Model Assumptions

3.1. Description of the Problem

The distributed energy sharing network of industrial park constructed in this paper is a three-level supernetwork structure consisting of I supporting enterprises, J core enterprises and K demand markets in the industrial park, including product network, energy network and carbon trading network, as shown in

Figure 1 In the product network, the supporting enterprises provide production materials and semi-finished products for the core enterprises, which sell the products to the end market through production and processing. Under the carbon emissions trading mechanism, the government allocates a free initial carbon quota to each enterprise. When the actual carbon emissions of the enterprise are greater than the carbon quota, the enterprise can buy carbon quota in the carbon trading market, and vice versa, the enterprise can sell the carbon quota. In order to reduce carbon trading costs, enterprises adopt distributed low-carbon energy sources and cooperate with upstream and downstream enterprises in distributed energy sharing through the energy sharing service platform to reduce carbon emissions. Enterprises also consider the decisions of competitors and upstream and downstream enterprises when making decisions, and the decision makers at each level compete with each other to achieve Nash equilibrium.

3.2. Model Assumptions

Assumption 1: Referring to Xiao et al. on the setting of supply chain network equilibrium problem [

38], it is assumed that the types of products traded between core and supporting enterprises in the industrial park are the same and interchangeable. The products are produced on demand and supply and demand equilibrium is considered. Assume that the supply of products from supporting enterprises to core enterprises is

, the price of products is

the production cost is

and the transaction cost is

; the supply of products from core enterprises to the demand market is

, the price of products is

the production cost is

and the transaction cost is

;

Assumption 2: Enterprises invest in distributed low-carbon energy individually and share energy only with upstream and downstream cooperative enterprises to reduce carbon emissions and improve product competitiveness. Assuming that the distributed low-carbon energy level of the supporting enterprises is, the cost is, and the impact coefficient of the low-carbon energy level on the emission reduction per unit of product is; the distributed low-carbon energy level of the core enterprises is, the cost is, and the impact coefficient of the low-carbon energy level on the emission reduction per unit of product is.

Assumption 3: Referring to the assumption of Chen et al. on carbon emissions trading mechanism [

18], the government allocates carbon cap to enterprises based on their initial carbon emissions. If initial emissions exceed the cap, enterprises must purchase additional carbon allowances from the carbon trading market. Carbon trading prices are influenced by factors such as supply and demand dynamics, macroeconomic conditions, and climate change, making them exogenous variables. Assuming that the initial carbon emission of supporting enterprises is

, the carbon limit is

; the initial carbon emission of core enterprises is

, the carbon limit is

, and the carbon trading price is

. Core enterprises serve as the leaders within the industrial park, possessing sufficient capital to invest in distributed energy systems and enhance energy decarbonization. They can trade unused emission allowances to supporting enterprises. The carbon trading center can regulate carbon trading volumes to ensure balanced carbon transaction flows.

Assumption 4: Each cost and production function in the model is a continuously differentiable convex function [

39].

The parameters used in the model and their specific meanings are shown in

Table 1.

4. Analysis of Equilibrium Conditions of Distributed Energy Sharing Network in Industrial Park

4.1. Optimal Decision Behavior and Equilibrium Conditions for Supporting Enterprises

In a competitive environment, the production cost of supporting enterprises in an industrial park is not only related to their own output, but also related to the output of their peer supporting enterprises. The production cost function of the supporting enterprises is

, where

is a vector with dimensional of

, the transaction cost between the supporting enterprise

and the core enterprise

is

.We assume that both the production cost and transaction cost functions about

exhibit the properties of convexity and continuous differentiability, and that the revenue

can be obtained by supplying products to the core enterprise. The low-carbon energy level of the supporting enterprise is

, and the initial carbon emission per unit of product is

. By sharing distributed energy with the core enterprise, the carbon emission per unit of product can be reduced by

, and the difference between the actual carbon emission and the carbon cap needs to be purchased at the price of

in the carbon market. The supporting enterprise

makes decisions on

and

, and the objective function of profit maximization for the supporting enterprise is:

The constraints indicate that the actual carbon emissions of the supporting enterprises are higher than the government carbon limit. The non-cooperative Nash game is played between the supporting enterprises, and since the production cost function and the transaction cost function are convex functions with respect to the trading volume of the products, the objective of profit maximization with respect to all the supporting enterprises can be described in the form of the following variational inequality:

i.e., for solving the problem of

, so that it is satisfied:

where

is the equilibrium price reached between the supporting enterprises and the core enterprises, and

is the Lagrange multiplier corresponding to constraint (2).

4.2. Optimal Decision Behavior and Equilibrium Conditions for Core enterprises

The core enterprise

purchases raw materials or semi-finished products

from the supporting enterprise

to produce the product

and sells it to the demand market

. The transaction cost between the core enterprise and the supporting enterprises is

, and the production cost function of the core enterprise is

, where

is a vector with dimensional of

. The transaction cost when the core enterprise sells its products to the demand market is

, assuming that the production cost and transaction cost functions are continuously differentiable convex functions about

, and that the revenue

can be obtained by selling products to the demand market. The low carbon energy level of the core enterprises is

, the initial carbon emissions per unit of product produced are

, the government allocates carbon cap

to each core enterprise, and the core enterprises can reduce carbon emissions per unit of product by

through distributed energy sharing with supporting enterprises. Due to the dominant position of core enterprises in the process of distributed energy sharing in industrial parks, they can obtain a higher level of low carbon energy and carbon emission cap. Assuming that the actual carbon emissions of core enterprises under distributed energy sharing are always lower than the carbon cap allocated by the government, the difference between the actual carbon emissions and the carbon cap can be sold at the price of

in the carbon market to benefit from the carbon trading. The core enterprise

makes decisions on

and

, and the objective function of profit maximization for the core enterprise is:

The first constraint indicates that the actual carbon emission of the core enterprises is smaller than government-allocated carbon cap; the second constraint indicates the logistic equilibrium condition of the core enterprises and the supporting enterprises, wheredenotes the conversion rate of raw materials of the core enterprises. Since the production cost function, transaction cost function are all convex functions about the volume of product transactions, the objective of profit maximization about all core enterprises can be described as the following form of variational inequality:

i.e., for solving

, so that it is satisfied:

where

is the equilibrium price reached between the core enterprise and the demand market, and

and

are the Lagrange multipliers corresponding to constraints (5).

4.3. Optimal Decision Behavior and Equilibrium Conditions in Demand Markets

Demand in the market

is a function of the price of the product

. Since consumer markets are competitive, market demand

is related not only to the price of the product in the demand market, but also to the price of the product in other demand markets. Consumers incur transaction costs when purchasing the core enterprise’s product

, assuming that the demand function and the transaction cost function are continuously differentiable convex functions. Under the assumption of perfect competition and the spatial price equilibrium condition, a transaction occurs only when the price accepted in the demand market

is equal to the sum of the core enterprise’s pricing for the market and the transaction costs, and the equilibrium condition for the demand market is:

Then the objective function of the demand market in equilibrium can be described in the form of the following variational inequality:

i.e., for solving

, so that it is satisfied:

4.4. Optimal Decision Behavior and Equilibrium Conditions for Carbon Trading Centers

According to the assumption, in the carbon trading network of industrial parks, core enterprises are the supply side of carbon trading and supporting enterprises are the demand side. Core enterprises and supporting enterprises carry out carbon emissions trading in the carbon trading center. The carbon trading center collects transaction fees from both parties in accordance with a certain transaction rate

and generates a certain transaction cost

, assuming that the benefit function and cost function of the carbon trading center are continuously differentiable convex functions, the optimal objective function of the carbon trading center is:

The constraints indicate the equilibrium between the supply and demand of carbon trading flows of core and supporting enterprises, at which time the optimal equilibrium decisions of both parties can be described in the form of the following variational inequality:

i.e., for solving

, so that it is satisfied:

where

is the optimal equilibrium distributed energy low-carbon level of core and supporting enterprises, and

is the Lagrange multiplier corresponding to constraint (11).

5. Construction and Solution of the Network Equilibrium Model

The whole industry park distributed energy sharing super network can be in equilibrium only when the product output, the transaction price and the distributed energy low carbon level among the participants of each layer in the industry park distributed energy sharing network satisfy the sum of the above four variational inequalities. Then the decision of the equilibrium of the distributed energy sharing network of industrial parks can be equated to the solution of the following variational inequality:

i.e., to solve

, so that it is satisfied:

Referring to the study of Liu et al. [

29], we use the projection correction algorithm to solve the equilibrium model of the distributed energy sharing network of industrial parks under the carbon emissions trading mechanism. The solution process can be described using the following form of standard variational inequality:

i.e., solving

, such that:

Each component in represents the function derived from the part following the multiplication sign in equation (13), and the symbolrepresents the inner product of the N-dimensional Euclidean space.

The specific algorithm for the projection correction solution is as follows:

Step 1: Initialization. Assume that the iteration stepsatisfies, and the number of iterations: . L is the Lipschitz constant. Set the initial value and the tolerance.

Step 2: Iterative calculation. Solve the following variational inequality problem for

:

Step 3: Correct the calculation. Solve the following variational inequality problem for

:

Step4: Convergence check. If, terminate the loop, otherwise, make and return to step 2 to continue the iteration.

6. Numerical Example Analysis

6.1. Numerical Examples

In order to analyze in detail the influence of carbon emission limit and carbon trading price on the equilibrium strategy of distributed energy sharing network of industrial parks under the carbon emissions trading mechanism, this paper obtains some cost parameters of distributed energy sharing of industrial parks as well as the national carbon emission right trading data by investigating the distributed energy sharing platform of Suzhou industrial park and the Shanghai Environmental and Energy Exchange. Combined with the relevant provisions of China’s carbon trading policy, and with reference to Yang et al.’s numerical simulation study on supply chain network equilibrium under the carbon emissions trading mechanism [

40], we reasonably set up the relevant cost functions and parameters, and carry out numerical example analysis. It explores the equilibrium decision-making of distributed energy sharing network members of industrial parks under different circumstances, and provides reference for the distributed energy sharing decision-making of industrial parks under the carbon emissions trading mechanism.

In this paper, a distributed energy sharing supernetwork model of an industrial park consisting of two supporting enterprises, two core enterprises, two demand markets and one carbon trading center is constructed with the following parameter settings as well as cost function and demand function:

Parameter settings:

,,,,,,,,.

The production cost function for core and supporting enterprises is:

,;

,;

The transaction cost function is:

,;,;

The distributed energy cost function is:

,;

The market demand function is:

.;

The carbon trading center cost function is:

,;

6.2. Analysis of Numerical Results

The model is solved using the projection correction algorithm, which is programmed using matlab with an iterative step size of 0.01. The program converges the equilibrium results after 255 iterations to a point through which the vector information of the optimal solution can be derived.

Table 2 shows the equilibrium results.

From the equilibrium results, the low-carbon level of distributed energy of core enterprises is slightly higher than that of supporting enterprises, and the profits of core enterprises are higher than that of supporting enterprises, which indicates that under the carbon emissions trading mechanism, core enterprises are able to sell their carbon emission rights through the distributed energy sharing of industrial parks, and thus obtain higher profits.

6.3. Impact of Carbon Emission Cap on Network Equilibrium

The following analysis examines how changes in carbon cap for core enterprises and supporting enterprises affect various variables and the profits of all parties involved. In the case of fixing other parameters unchanged, changing the carbon cap of supporting enterprises (200,250,300,350), the equilibrium results of each variable are obtained, as shown in

Table 3.

As can be seen from Table 4, when the carbon emission cap allocated by the government to the core enterprises rises, the volume of products traded and the market price rise, but the low-carbon level of distributed energy of the core enterprises decreases, the profits of the core enterprises increase, the profits of the supporting enterprises decrease, and the total profits of the system also decrease. This suggests that the government’s raising of the carbon cap for core enterprises will similarly reduce the profits of supporting enterprises. This is due to the fact that as the government relaxes the carbon emission limits on core enterprises, the carbon cap available for sale in carbon trading by core enterprises also increase, thus reducing the incentive for distributed energy sharing by core enterprises. Through the equilibrium constraints of carbon trading, core enterprises will gain higher profits through carbon trading, while supporting enterprises will have lower profits due to increased carbon trading costs. It can be seen that if the government relaxes the carbon emission constraints on core enterprises too much, it will exacerbate the polarization of the profits of core and supporting enterprises and negatively affect the total profits of the system.

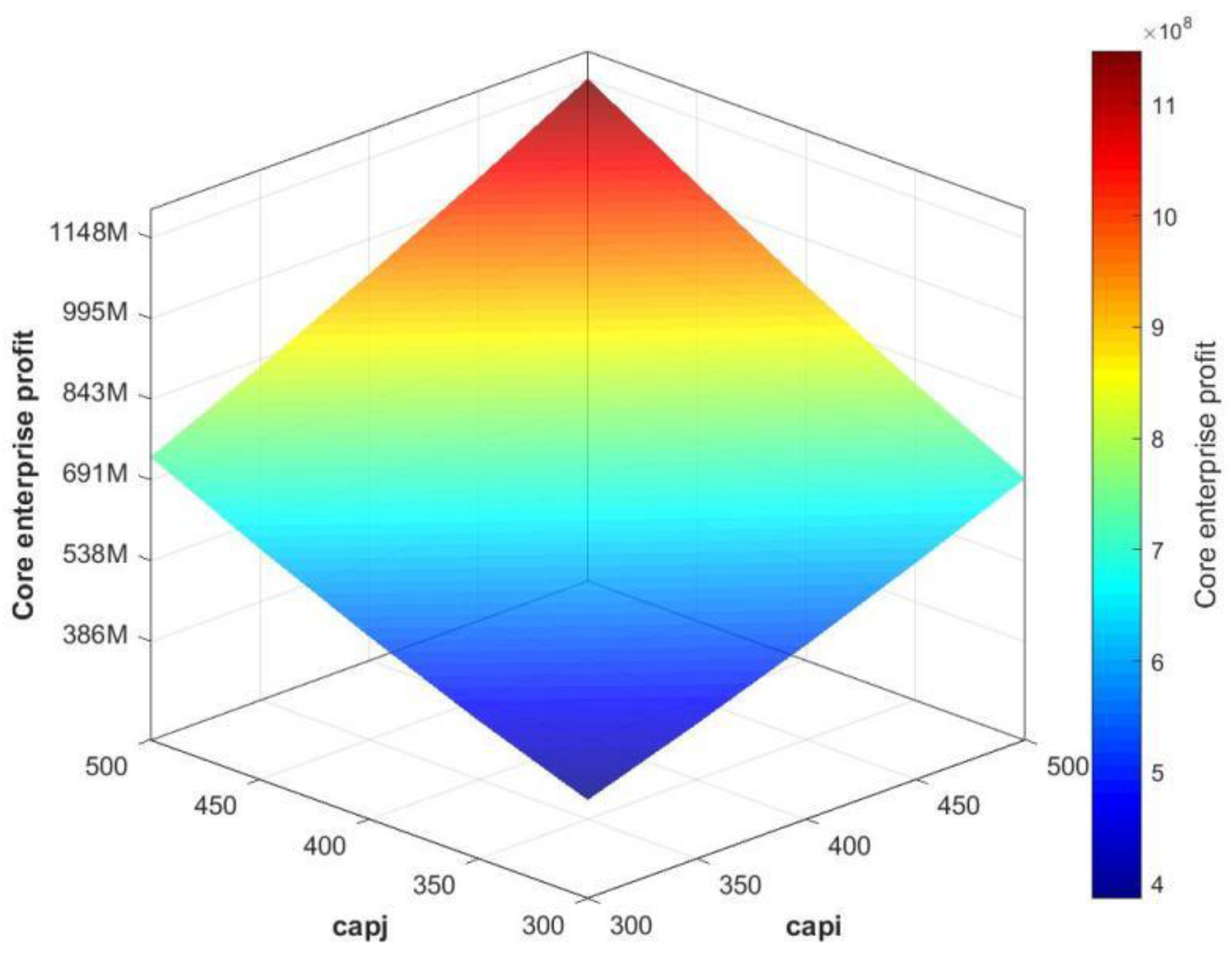

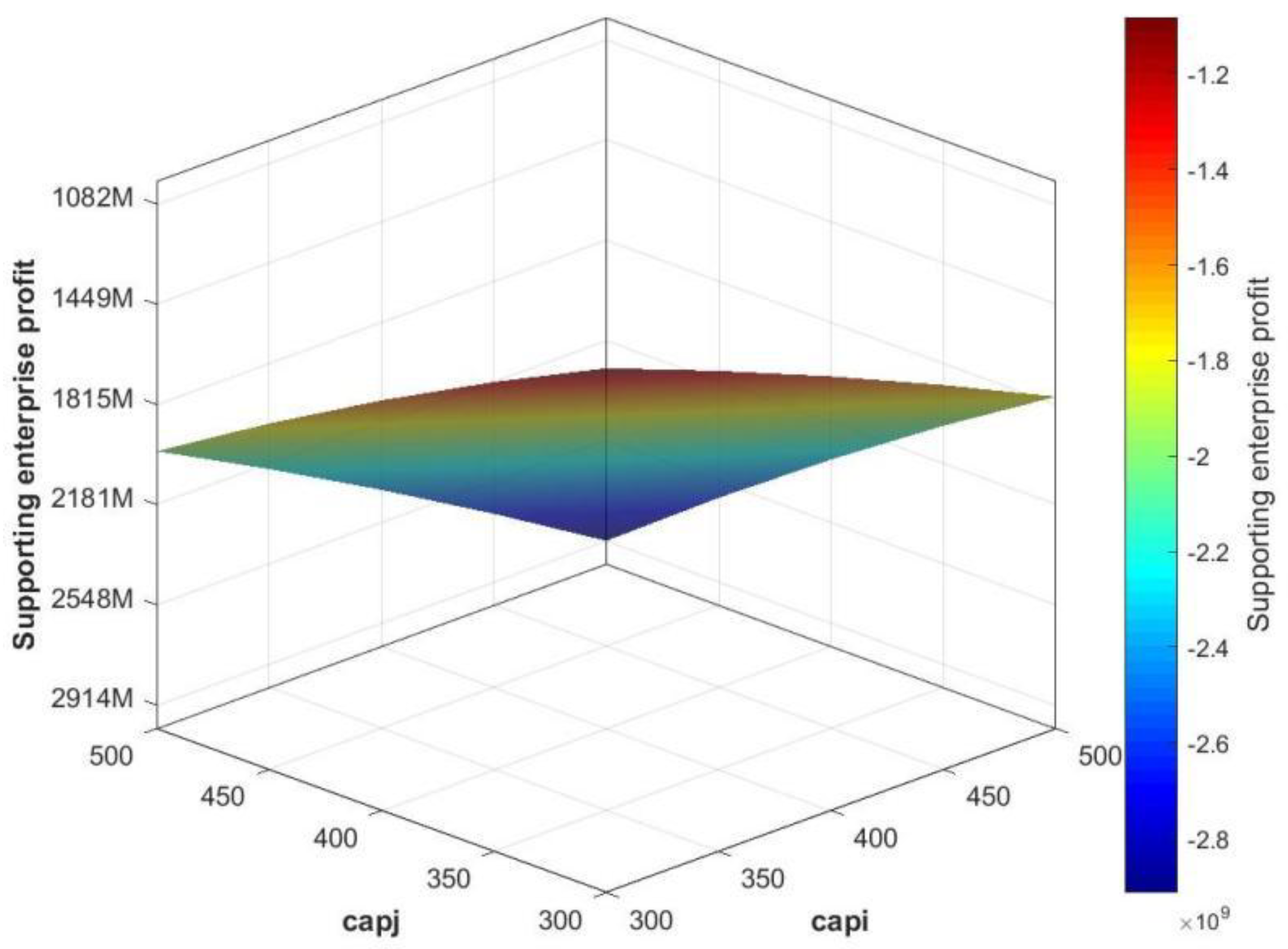

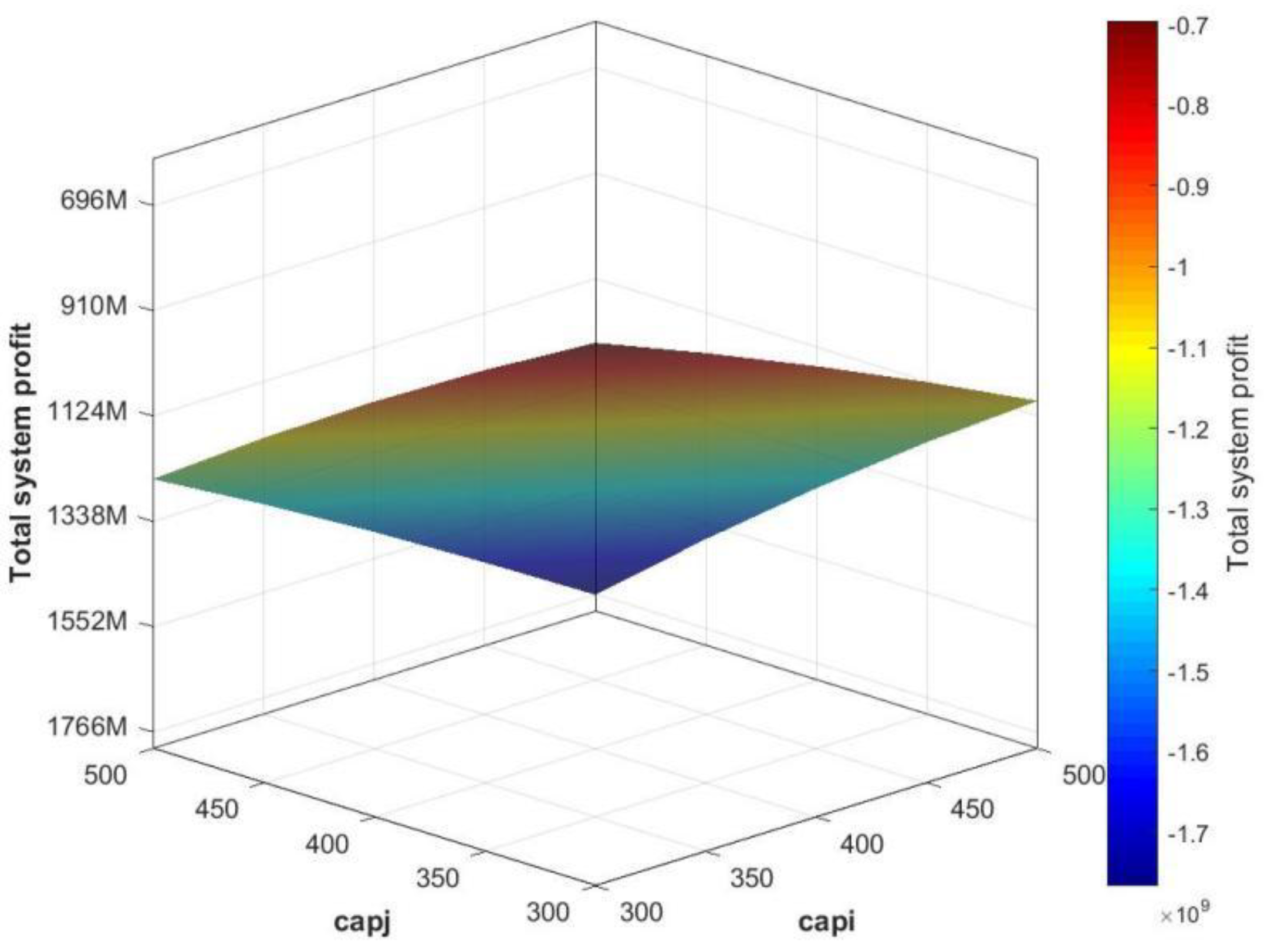

Figures 2,

3, and

4 respectively examine the impact of corporate carbon cap on the profits of core enterprises, supporting enterprises, and the overall system.

Figure 2 shows that as both core and supporting enterprises’ carbon cap increase, the core enterprise’s profits also rise. This indicates that raising either the core enterprise’s or supporting enterprises’ carbon cap positively impacts the core enterprise’s profits. This occurs because the core enterprise holds a more advantageous position in carbon trading, enabling it to generate greater returns by adjusting its carbon cap sales strategy.

Figure 3 reveals that supporting enterprises’ profits exhibit a continuous downward trend as their own carbon cap increases. Furthermore, when the core enterprise’s carbon cap rises, supporting enterprises’ profits decrease further. This signifies that supporting enterprises face dual profit pressures within the carbon emissions trading mechanism.

The results in

Figure 4 indicate that the system’s total profit declines as both core and supporting enterprises’ carbon cap increase. This further validates the conclusions from

Table 2 and

Table 3, confirming that excessively lenient carbon emission cap policies hinder the overall economic efficiency of distributed energy sharing networks within industrial parks. In summary, when formulating carbon emission cap policies, governments must strike a balance between promoting industrial development and safeguarding the overall system efficiency. This approach prevents excessive adjustments to individual enterprises’ carbon cap from negatively impacting the balanced development of the entire network.

6.4. Impact of Carbon Trading Prices on Network Equilibrium

Carbon trading price is an exogenous variable formed under the market-based trading of carbon trading centers. In the following, we analyze the impact of the price change of carbon trading on the trading volume of products, energy low-carbon level, and profit of each core and supporting enterprise in the industrial park. In the case of fixing other parameters unchanged, changing the carbon trading price (2.5,5,7.5,10), the equilibrium results of each variable are obtained, as shown in

Table 5.

As can be seen from

Table 5, as the carbon trading price rises, the product trading volume and product price, the distributed energy low-carbon level of core and supporting enterprises, the profits of both parties, and the total profit of the system all show different degrees of decline. This shows that a higher carbon trading price will increase the carbon trading cost of enterprises, reduce the enthusiasm of enterprise production, and have a negative impact on the distributed energy sharing of industrial parks, which in turn affects the profits of enterprises and the total profits of the system. It can be seen that too high a carbon trading price is not conducive to the development of distributed energy sharing in industrial parks, and is also not conducive to the normal operation of the production network of industrial parks. The government should regulate the carbon trading market according to the actual situation, and guide the carbon trading price in a reasonable range through the formulation of policies and measures, so as to activate the carbon trading market and at the same time ensure the normal operation and profit level of enterprises.

7. Conclusions

This paper constructs an equilibrium model for distributed energy sharing networks in industrial parks by employing the variational inequality method. The model is based on the hypernetwork structure formed by production networks, energy networks, and carbon trading networks comprising core enterprises and supporting enterprises within the industrial park. The product trading volume and distributed energy low-carbon level decision-making when the core enterprises and supporting enterprises of the park act as the supplier and buyer of carbon trading respectively are explored, and the conditions for the decision-makers of each party and the network system to reach an equilibrium state are further obtained. The model is solved by using variational inequality and projection correction algorithm, and the effects of the changes of the main parameters in the model on the network equilibrium are analyzed through numerical examples. The main conclusions are as follows:

- (1)

Although the government’s raising of carbon emission cap for supporting enterprises will raise the trading volume and market price of products, as well as the profits of core enterprises, it will reduce the low-carbon level of distributed energy among supporting enterprises, decrease the profits of supporting enterprises, and lower the overall system profit. This suggests that the government’s elevation of carbon emission cap for supporting enterprises will reduce the enthusiasm of supporting enterprises for distributed energy sharing, affect the low-carbon level of distributed energy of supporting enterprises, increase the actual carbon emissions per unit of product, force supporting enterprises to buy more carbon emission cap from the core enterprises, widen the polarization of enterprises’ profits, and negatively affect the supporting enterprises’ profits and the system’s total profits.

- (2)

The government’s raising of the carbon emission cap for core enterprises will raise the trading volume and market price of products, as well as the profits of core enterprises, but it will likewise lower the low-carbon level of distributed energy of core enterprises, the supporting enterprises’ profits, and the system’s total profits. This suggests that the government’s elevation of carbon emission cap for core enterprises will lead to an increasing number of carbon cap available for sale in carbon trading by core enterprises, thereby reducing the incentive for core enterprises’ distributed energy sharing. Through the equilibrium constraint of carbon trading, core enterprises will gain higher profits through carbon trading, while supporting enterprises will have lower profits due to increased carbon trading costs, which in turn widens the polarization of enterprises’ profits and negatively affects total system profits.

- (3)

The increase of carbon trading price will lead to different degrees of decline in product trading volume and product price, distributed energy low-carbon level of core enterprises and supporting enterprises, profits of both parties and total system profits. This indicates that a higher carbon trading price will increase the carbon trading cost of enterprises, reduce the enthusiasm of enterprise production, and have a negative impact on the distributed energy sharing of industrial parks, which in turn affects the profits of enterprises as well as the total profits of the system.

Based on the above findings, the following management implications can be summarized: firstly, the government should strengthen the carbon emission control on high-emission supporting enterprises, which not only improves the low-carbon level of their distributed energy, but also helps to improve the profitability of the whole system; secondly, the government should strengthen the carbon emission constraints on the core enterprises, so as to prevent the polarization of profit distribution between the core and supporting enterprises from negatively affecting the system’s total profit; Finally, too high a carbon trading price is not conducive to distributed energy sharing in industrial parks, and the government should guide the carbon trading price to be in a reasonable range. Finally, too high carbon trading price is not conducive to distributed energy sharing in industrial parks, and the government should guide the carbon trading price in a reasonable range.

Author Contributions

For Conceptualization, H.F. and X.W.; methodology, Y.Z.; software, W.Y.; validation, H.F. and X.W.; formal analysis, H.F.; writing—original draft preparation, Y.Z.; writing— review and editing, H.F. and X.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Liaoning Provincial Science and Technology Program Joint Program (Grant 2024-BSLH-236)

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- SOVACOOL, B.K.; GEELS, F.W.; ISKANDAROVA, M. Industrial Clusters for Deep Decarbonization. Science 2022, 378, 601–604. [Google Scholar] [CrossRef]

- ZHU, D.; YANG, B.; WU, Y.; DENG, H.; DONG, Z.; MA, K.; GUAN, X. Joint Trading and Scheduling Among Coupled Carbon-Electricity-Heat-Gas Industrial Clusters. IEEE Trans. Smart Grid 2024, 15, 3152–3164. [Google Scholar] [CrossRef]

- GILANI, M. A.; KAZEMI, A.; GHASEMI, M. Distribution System Resilience Enhancement by Microgrid Formation Considering Distributed Energy Resources. Energy 2020, 191, 116442. [Google Scholar] [CrossRef]

- HAN, X.; SUN, L.; TAO, Y. Distributed Energy-Sharing Strategy for Peer-to-Peer Microgrid System. Journal of Energy Engineering 2022, 146, 04020033. [Google Scholar] [CrossRef]

- GUO, X. Effects of China’s Low-Carbon Policy under Stochastic Shocks-a Multi-Agent DSGE Model Analysis. Environmental Science and Pollution Research 2023, 30, 65177–65191. [Google Scholar] [CrossRef]

- LIU, B. Carbon Trading and Regional Carbon Productivity. Journal of Cleaner Production 2023, 420, 138395. [Google Scholar] [CrossRef]

- WANG, Z.; WU, Q. Carbon Emission Reduction and Product Collection Decisions in the Closed-Loop Supply Chain with Cap-and-Trade Regulation. International Journal of Production Research 2021, 59, 4359–4383. [Google Scholar] [CrossRef]

- ZHANG, W.; LI, G.; GUO, F. Does Carbon Emissions Trading Promote Green Technology Innovation in China? Applied Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- ZHANG, Y.; LI, S.; LUO, T.; GAO, J; The Effect of Emission Trading Policy on Carbon Emission Reduction: Evidence from an Integrated Study of Pilot Regions in China. China. Journal of Cleaner Production 2020, 265, 121843. [Google Scholar] [CrossRef]

- WANG, X.; HUANG, J.; LIU, H. Can China’s Carbon Trading Policy Help Achieve Carbon Neutrality? the Five-Sphere Integrated Plan Perspective. Journal of Environmental Management 2022, 305, 114357. [Google Scholar] [CrossRef]

- WU, R.; TAN, Z.; LIN, B. Does Carbon Emission Trading Scheme Really Improve the CO2 Emission Efficiency? Steel Industry. Energy 2023, 277, 127743. [Google Scholar] [CrossRef]

- WANG, Y.; LIU, J.; ZHAO, Z.; REN, J.; CHEN, X. Research on Carbon Emission Reduction Effect of China’s Regional Digital Trade under the “Double Carbon” Target -- Combination of the Regulatory Role of Industrial Agglomeration and Carbon Emissions Trading “Double Carbon” Target-- Combination of the Regulatory Role of Industrial Agglomeration and Carbon Emissions Trading Mechanism. Journal of Cleaner Production 2023, 405, 137049. [Google Scholar]

- YU, J.; SUN, L. Supply Chain Emission Reduction Decisions, Considering Overconfidence under Conditions of Carbon Trading Price Volatility. Sustainability 2022, 14, 15432. [Google Scholar] [CrossRef]

- FAN, X.; CHEN, K.; CHEN, Y.J. Is Price Commitment a Better Solution to Control Carbon Emissions and Promote Technology Investment? Management Science 2023, 69, 325–341. [Google Scholar] [CrossRef]

- LI, F.; YANG, Y.; ZHANG, W.; LI, J. A Study on the Co-Opetition Game Between Low-Carbon Supply Chains Under Carbon Cap-and-Trade Policy. Managerial and Decision Economics 2025, 46, 2986–2999. [Google Scholar] [CrossRef]

- Wang, H.; Lin, C. The Dual-Channel Low-Carbon Supply Chain Network Equilibrium with Retailers’ Risk Aversion Under Carbon Trading. Sustainability 2025, 17, 2557. [Google Scholar] [CrossRef]

- Xu, Y.; Dong, C.; Zhang, B.; Gong, M.; Wang, X. The synergistic effect of carbon trading and green credit on manufacturing enterprises’ production decisions and sustainability performance. International Review of Economics & Finance 2025, 103, 104519. [Google Scholar] [CrossRef]

- CHEN, W.; CHEN, J.; MA, Y. Renewable Energy Investment and Carbon Emissions under Cap-and-Trade Mechanisms. Journal of Cleaner Production 2021, 278, 123341. [Google Scholar] [CrossRef]

- WEI, C.; ZHANG, L.; DU, H. Impact of Cap-and-Trade Mechanisms on Investments in Renewable Energy and Marketing Effort. Sustainable Production and Consumption 2021, 28, 1333–1342. [Google Scholar] [CrossRef]

- YAN, Y.; SUN, M.; GUO, Z. How Do Carbon Cap-and-Trade Mechanisms and Renewable Portfolio Standards Affect Renewable Energy Investment? Energy Policy 2022, 165, 112938. [Google Scholar] [CrossRef]

- MENG, C.; ZHANG, R.; LIU, B. Energy Performance Contracting in a Supply Chain under Cap-and-Trade Regulation and Carbon Tax Policy. International Transactions on Electrical Energy Systems 2022, (1), 1716380. [Google Scholar] [CrossRef]

- FU, H.; SONG, L. Differential Game Model of Distributed Energy Sharing in Industrial Clusters Based on the Cap-and-Trade Mechanism. IEEE Access 2023, 11, 67707–67721. [Google Scholar] [CrossRef]

- WU, C.; CHEN, X.; HUA, H.; YU, K.; GAN, L.; SHEN, J.; DING, Y. Peer-to-Peer Energy Trading Optimization for Community Prosumers Considering Carbon Cap-and- Trade. Trade. Applied Energy 2024, 358, 122611. [Google Scholar] [CrossRef]

- HE, Y. Multi-Objective Optimization of Regional Power Generation Mix Considering Both Carbon Cap-and-Trade Mechanisms and Renewable Portfolio Standards. Renewable Energy 2024, 231, 120939. [Google Scholar] [CrossRef]

- ZHANG, L.; LIU, D.; CAI, G.; LYU, L.; KOH, L.H.; WANG, T. An Optimal Dispatch Model for Virtual Power Plant That Incorporates Carbon Trading and Green Certificate Trading. International Journal of Electrical Power & Energy Systems 2023, 144, 108558. [Google Scholar]

- GAO, L.; YANG, S.; CHEN, N.; GAO, J. Integrated Energy System Dispatch Considering Carbon Trading Mechanisms and Refined Demand Response for Electricity, Heat, and Gas. Energies 2024, 17, 4705. [Google Scholar] [CrossRef]

- HUO, S.; LI, Q.; PU, Y.; XIE, S.; CHEN, W. Low Carbon Dispatch Method for Hydrogen-Containing Integrated Energy System Considering Seasonal Carbon Trading and Energy Sharing Mechanism. and Energy Sharing Mechanism. Energy 2024, 308, 132794. [Google Scholar] [CrossRef]

- WANG, Z. Evaluation and Application of Port Industrial Upgrading Based on Global Value Chain of Complex Network. Journal of Coastal Research 2020, 110 (SP 1), 231–234. [Google Scholar] [CrossRef]

- LIU, Y.; ZHANG, G. Closed-Loop Supply Chain Network Equilibrium Strategy Model with Environmental Protection Objectives. Population, Resources and Environment 2020, 18, 251–261. [Google Scholar] [CrossRef]

- WAN, X.; JIANG, B.; LI, Q.; HOU, X. Dual-Channel Environmental Hotel Supply Chain Network Equilibrium Decision under Altruism Preference and Demand Uncertainty. Uncertainty. Journal of Cleaner Production 2020, 271, 122595. [Google Scholar] [CrossRef]

- JIANG, T.; LIN, Y.; NGUYEN, T. Market Equilibrium in Multi-tier Supply Chain Networks. Naval Research Logistics 2022, 69, 355–370. [Google Scholar] [CrossRef]

- FARGETTA, G.; SCRIMALI, L.R.M. A Sustainable Dynamic Closed-Loop Supply Chain Network Equilibrium for Collectibles Markets. Computer Management Science 2023, 20, 19. [Google Scholar] [CrossRef]

- NI, L.; CHEN, C.; WANG, X.; CHEN, X. Modeling Network Equilibrium of Competitive Ride-Sourcing Market with Heterogeneous Transportation Network Companies. Companies. Transportation Research Part C: Emerging Technologies 2021, 130, 103277. [Google Scholar] [CrossRef]

- XIE, S.; XU, Y.; ZHENG, X. On Dynamic Network Equilibrium of a Coupled Power and Transportation Network. IEEE Trans. Smart Grid 2022, 13, 1398–1411. [Google Scholar] [CrossRef]

- CHEN, Z.; DENG, Y.; XIE, C.; GUAN, C.; PAN, T. Network Equilibrium of Battery Electric Vehicles Considering Drivers’ Resting Behavior. Transportation Research Part C: Emerging Technologies 2023, 155, 104305. [Google Scholar] [CrossRef]

- LI, C.; ZHANG, W.; YEE, H.M.; YANG, B. Optimal Decision of a Disaster Relief Network Equilibrium Model. Mathematics 2023, 9, 2657–2671. [Google Scholar] [CrossRef]

- ZHANG, G.; ZHANG, X.; SUN, H.; ZHAO, X. Three-Echelon Closed-Loop Supply Chain Network Equilibrium under Cap-and-Trade Regulation. Sustainability 2021, 13, 6472. [Google Scholar] [CrossRef]

- XIAO, Y.X.; ZHANG, R.Q. Supply Chain Network Equilibrium Considering Coordination between After-Sale Service and Product Quality. Computers & Industrial Engineering 2023, 175, 108848. [Google Scholar]

- PENG, Y.; CHEN, B.; VEGLIANTI, E. Platform Service Supply Chain Network Equilibrium Model with Data Empowerment. Sustainability 2022, 14, 5419. [Google Scholar] [CrossRef]

- YANG, Y.; XU, X. Production and Carbon Emission Abatement Decisions under Different Carbon Policies: Supply Chain Network Equilibrium Models with Consumers’ Low-Carbon Awareness. Consumers’ Low-Carbon Awareness. International Transactions in Operational Research 2023, 31, 2734–2764. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).