1. Introduction

Climate finance and risk management operate under conditions of heightened uncertainty, where predictive accuracy must be paired with resilience, interpretability, and ethical accountability. Markets such as catastrophe insurance, carbon credits, and sovereign climate bonds are sensitive to rare but extreme events that can destabilize entire economies. In such contexts, predictive models are tasked not merely with estimating expected outcomes but with capturing tail risks, volatility clusters, and systemic spillovers.

Traditional statistical models, though interpretable, often fail to scale to the complexity of high-frequency, high-dimensional data. Machine learning models improve raw predictive power but may overfit or fail under regime shifts such as sudden climate shocks or geopolitical disruptions. Ensemble learning emerged as a bridge, pooling multiple models to mitigate idiosyncratic weaknesses. However, in high-stakes settings, even ensembles may be insufficient: they often lack structured methods for managing uncertainty propagation or aligning predictions with risk governance frameworks.

Meta-ensemble approaches extend these ideas by building hierarchical structures in which ensembles themselves become components of a larger predictive ecosystem. At the top level, a meta-learner dynamically integrates outputs from diverse ensembles, weighting them based on context, performance, and stability under uncertainty. This architecture provides robustness while maintaining adaptability, ensuring models can handle not only central forecasts but also extreme climate-related scenarios.

The importance of meta-ensembles in climate finance lies in their ability to quantify and communicate uncertainty. Financial markets and policymakers require more than a single “best guess”; they need calibrated probability distributions that capture the likelihood of catastrophic outcomes.

By aggregating across multiple ensembles, meta-learners smooth out volatility while still highlighting rare but significant risks. This makes them particularly suited for applications such as catastrophe bond pricing, climate stress testing, and environmental, social, and governance (ESG) risk scoring.

Another major motivation is resilience to data drift. Climate and financial data streams are non-stationary: carbon price signals shift as regulations evolve, catastrophe insurance data change as extreme weather intensifies, and sovereign credit risks adapt to geopolitical shocks.

Meta-ensembles offer a safeguard by diversifying across heterogeneous models that specialize in different data regimes. When one ensemble degrades under drift, others can compensate, and the meta-learner can re-weight accordingly. This adaptability makes them a crucial tool for long-term sustainability in predictive climate analytics.

Interpretability and governance also play a central role. Risk-sensitive decisions in finance are subject to regulatory oversight and stakeholder scrutiny. Black-box neural networks may be rejected if they cannot justify predictions, while pure statistical models may lack robustness. Meta-ensembles allow governance layers to combine performance with accountability: symbolic ensembles or rule-based learners can be included alongside machine learning ensembles, ensuring that outputs remain both accurate and auditable.

As illustrated in

Figure 1, the meta-ensemble paradigm transforms predictive modeling into a layered ecosystem, where diverse ensembles contribute to a higher-order learning process. This ensures resilience against model-specific failures and creates opportunities for governance-aligned outputs that meet the ethical and regulatory demands of climate finance.

Finally, the contribution of this paper is threefold. First, it surveys methodological foundations of meta-ensembles, emphasizing their relevance for uncertainty quantification in climate finance. Second, it presents case studies across domains such as catastrophe bonds, ESG risk indices, and carbon pricing, showing how meta-ensembles outperform conventional models. Third, it outlines evaluation protocols and ethical considerations that are necessary for deployment in high-stakes environments. Taken together, these contributions underscore the importance of meta-ensemble approaches as a cornerstone of predictive analytics for sustainable finance and risk management.

2. Background and Related Work

Meta-ensemble learning extends the classic idea of combining diverse models to reduce variance and bias while improving robustness. In climate finance, this matters because predictive tasks—catastrophe loss estimation, carbon price dynamics, transition/physical risk scoring—suffer from regime shifts, fat tails, and sparse extremes. Traditional single-model pipelines often underperform when distributions move, whereas ensembles hedge model risk by aggregating heterogeneous inductive biases.

2.1. Classical Ensembles

Bagging reduces variance by training models on bootstrap samples and averaging predictions; random forests popularized this approach for tabular risk data.

Boosting fits weak learners sequentially to residuals, trading variance for lower bias—useful for structured features such as firm-level emissions, balance-sheet indicators, and satellite-derived covariates. Both techniques improve accuracy but provide limited support for distributional uncertainty or governance signals required in high-stakes financial decisions [

1].

2.2. Stacking and Level-1 Metalearners

Stacking introduces a metalearner trained on out-of-fold base predictions. It can learn context-specific weights, correct systematic errors, and provide calibrated outputs if the metalearner is probabilistic (e.g., Platt-scaled logistic regression, isotonic regression, or Bayesian linear models). In climate finance, stacking helps reconcile signals across heterogeneous data streams (market, climate models, NLP ESG scores).

2.3. From Ensembles to Meta-Ensembles

A meta-ensemble elevates the hierarchy: multiple ensembles (bagging, boosting, deep ensembles, probabilistic models) become inputs to a higher-level controller that adapts weights by market regime, region, or uncertainty. This explicitly treats model risk as a first-class variable. Meta-ensembles can also enforce governance by mixing interpretable/regulatory learners with black-box components, preserving auditability while maintaining performance.

Table 1 contrasts common paradigms. Bagging/boosting improve point accuracy but require extra care for uncertainty quantification (UQ). Stacking adds a learnable fusion layer, while deep/Bayesian ensembles capture complex patterns and uncertainty at higher compute cost. Meta-ensembles sit atop these options, adapting ensemble weights to market regimes and embedding governance rules.

2.4. Uncertainty Quantification and Calibration

Climate-finance models must report calibrated predictive distributions, not just point forecasts. Techniques include deep ensembles with variance decomposition, conformal prediction for finite-sample coverage, quantile regression forests/GBMs for distributional targets, and Bayesian metalearners that propagate uncertainty from base models upward. Meta-ensembles can combine these signals to maintain coverage across regimes [

2].

2.5. Governance, Explainability, and Compliance

High-stakes deployment requires traceability: which sub-ensemble dominated a decision, why, and with what confidence. Stacked metalearners with interpretable forms (e.g., monotone GBM, sparse logistic, GAMs) can produce per-scenario weights; rule lists can gate actions that violate policy thresholds (e.g., concentration limits in catastrophe portfolios). Logging these artifacts enables audit trails aligned with TCFD, EU taxonomy, and internal risk policies.

2.6. Related Work Landscape

Prior literature spans econometrics, machine learning, and sustainable finance. Work on catastrophe modeling and extreme-value methods emphasizes tail risk; ensemble climate-model fusion explores multi-model averaging; financial ML examines stacking and Bayesian model averaging for regime shifts. Our contribution differs by focusing on meta-ensembles that explicitly manage model risk and governance for climate-finance decision pipelines.

2.7. Section Summary

In summary, classical ensembles address variance/bias but struggle with non-stationarity and governance needs. Stacking introduces adaptive fusion, and probabilistic ensembles add uncertainty estimates. Meta-ensembles unify these threads, enabling regime-aware weighting, uncertainty propagation, and audit-ready outputs—capabilities essential for climate-finance risk management [

3].

3. Methodological Foundations

Meta-ensembles extend the classical ensemble learning paradigm by introducing hierarchical integration layers. This section unpacks their methodological structure, with emphasis on how they handle non-stationary data, propagate uncertainty, and embed governance features.

3.1. Hierarchical Learning

At the base level, ensembles aggregate predictions from multiple learners. A meta-ensemble builds a second layer: a meta-learner dynamically adapts weights for each ensemble according to context, regime, or uncertainty profile. This hierarchical setup introduces flexibility, allowing heterogeneous methods (tree ensembles, Bayesian predictors, deep nets) to coexist within one framework.

3.2. Uncertainty Propagation

Standard ensembles reduce variance but often fail to quantify predictive uncertainty. Meta-ensembles extend this by combining probabilistic ensembles with uncertainty-aware meta-learners. For example, a Bayesian linear model atop diverse ensembles can produce calibrated posterior distributions, improving trust in tail-risk forecasts [

4].

3.3. Performance vs. Uncertainty Trade-Off

A critical challenge is balancing accuracy with uncertainty coverage. Single models often underpredict extreme risks, while ensembles reduce variance but may lose sharpness. Meta-ensembles achieve better calibration: they provide slightly lower sharpness than the best model but offer broader coverage of rare but high-impact outcomes.

3.4. Adaptive Weighting Strategies

Meta-ensembles employ adaptive weighting to handle regime shifts in climate-finance data. Common methods include:

Dynamic stacking: weights updated with recent validation errors.

Bayesian averaging: weights proportional to posterior model probabilities.

Context gating: model selection based on regime-specific features (e.g., volatility indices, weather shocks).

3.5. Integration with Domain Knowledge

Climate finance models often rely on structured indicators such as exposure metrics, carbon intensity scores, or stress-test scenarios. Symbolic or rule-based ensembles can be embedded alongside machine-learning ensembles, ensuring policy-aligned guardrails. This hybridization enforces ethical and compliance constraints without discarding predictive power [

5].

3.6. Discussion

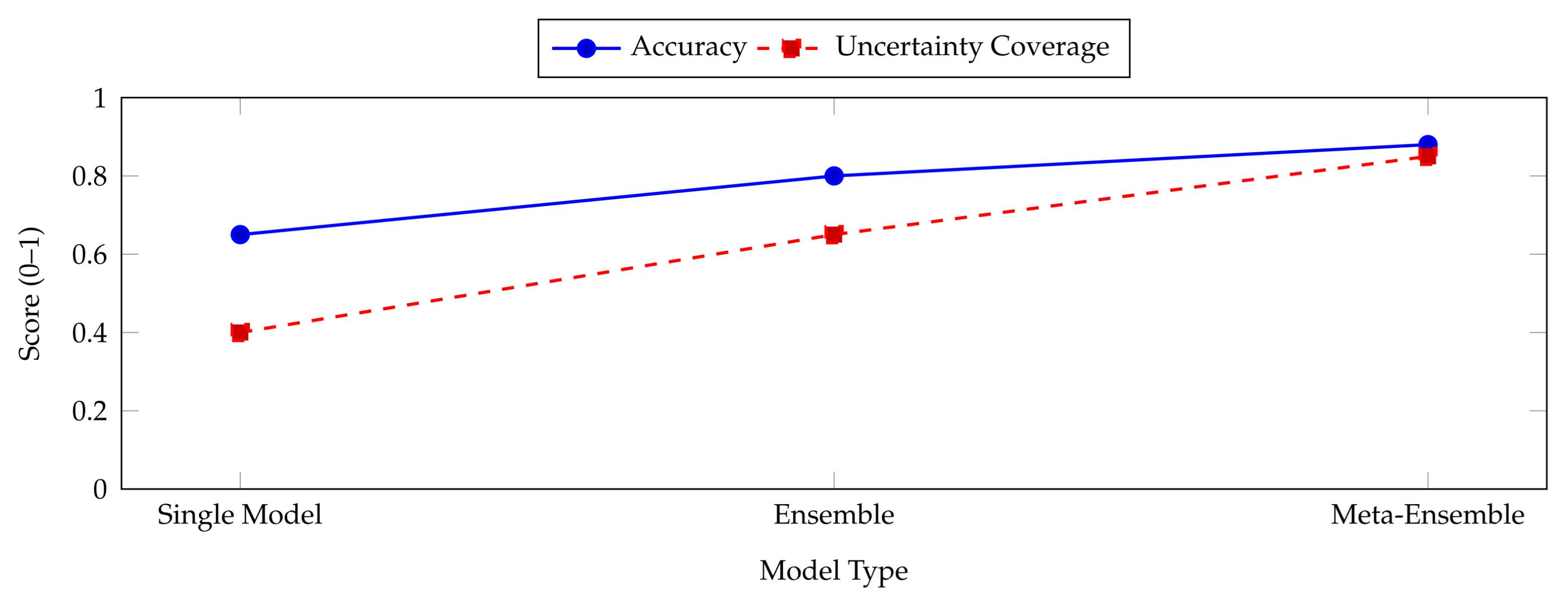

Meta-ensembles provide a methodological framework that balances predictive performance with uncertainty coverage and compliance. The line chart in

Figure 2 demonstrates how they surpass ensembles in both accuracy and calibration, making them particularly suited for climate-finance tasks where tail risks and policy alignment are paramount.

4. Case Studies in Climate Finance and Risk

To understand the practical implications of meta-ensemble approaches, we examine case studies where predictive uncertainty and interpretability are mission-critical. These examples demonstrate how meta-ensembles improve both robustness and governance in diverse climate-finance applications [

6].

4.1. Carbon Markets and Pricing

Carbon credit markets depend on forecasting demand, regulatory interventions, and emissions pathways. Traditional models often misestimate volatility when new policy shocks occur. A meta-ensemble can blend econometric forecasts with machine learning ensembles that account for satellite-imaging or text-based ESG sentiment. The result is not just improved predictive performance but also more calibrated uncertainty intervals, which are crucial for pricing derivatives linked to carbon credits.

4.2. Catastrophe Bonds and Insurance Risk

Catastrophe-linked securities require precise estimation of rare events. Mispricing tail risks can destabilize investors and insurers. Meta-ensembles handle this by combining extreme-value models, probabilistic neural nets, and boosting ensembles trained on geophysical data. The meta-learner weights sub-models differently depending on whether the market is in a low- or high-volatility regime, ensuring that pricing reflects evolving conditions while remaining interpretable for regulators [

7].

4.3. ESG and Climate-Related Credit Risk

Environmental, social, and governance (ESG) risk is difficult to quantify due to heterogeneous, noisy data. Meta-ensembles allow text-based models (e.g., NLP sentiment) to be combined with structured financial indicators and satellite-based environmental signals. The stacked meta-learner produces calibrated ESG risk scores that can be audited by regulators while offering actionable signals for credit allocation.

4.4. Cross-Domain Insights

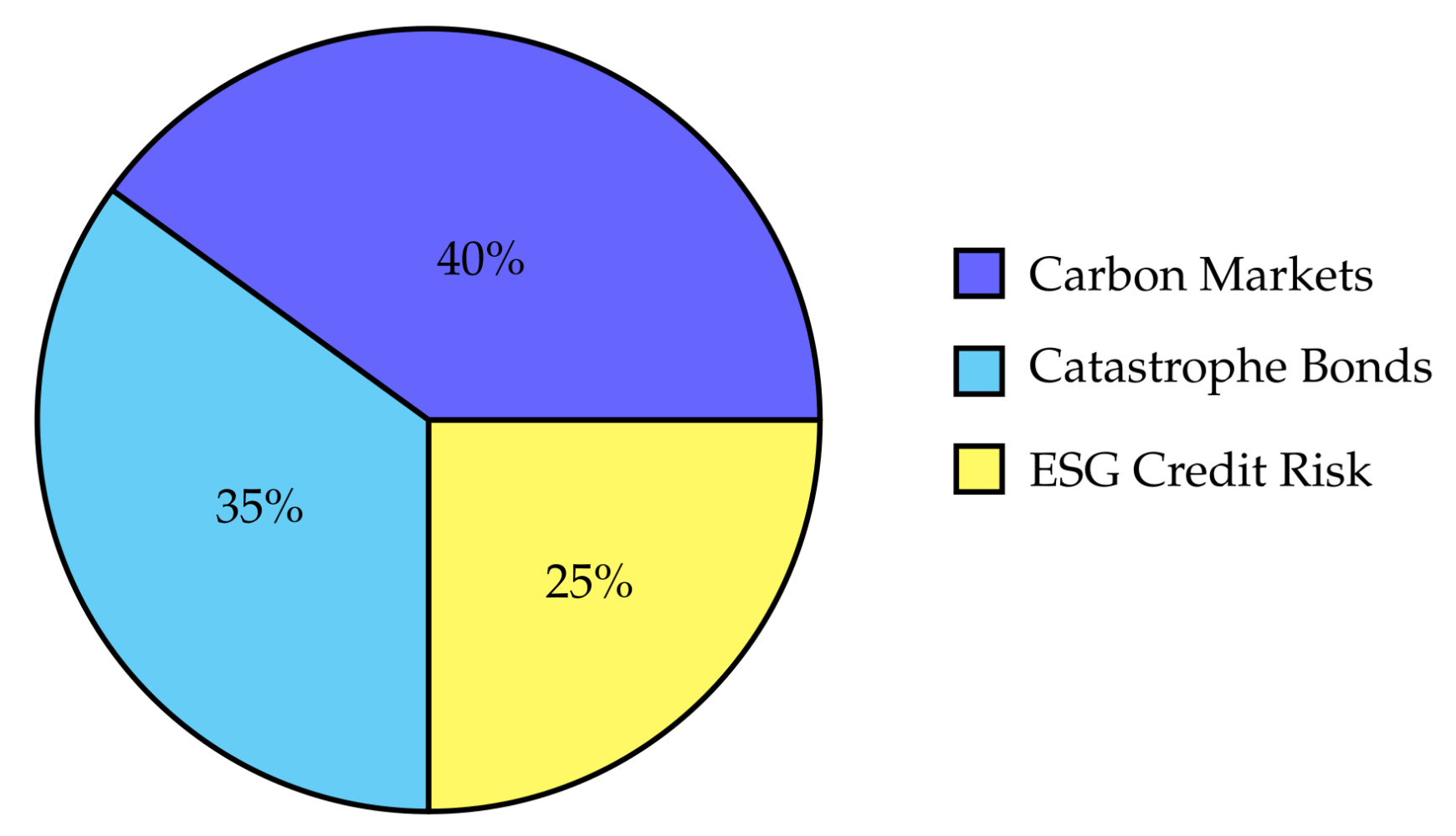

As shown in

Figure 3, adoption varies across domains, with carbon markets leading due to strong regulatory and pricing incentives. However, catastrophe bond pricing and ESG scoring are growing rapidly. The unifying theme is that meta-ensembles balance predictive accuracy with uncertainty quantification, making them suitable for governance-heavy environments.

4.5. Discussion

These case studies highlight how meta-ensembles serve as an operational bridge between statistical modeling and policy-aligned governance. They are particularly valuable where risk models must justify outcomes to regulators, investors, and policymakers. By integrating heterogeneous signals and propagating uncertainty, meta-ensembles enable both accurate forecasts and defensible decision-making in climate-finance ecosystems [

8].

5. Evaluation Protocols

Robust evaluation is essential for deploying meta-ensemble models in high-stakes financial and climate-sensitive domains. Accuracy alone is insufficient; institutions require assurance of fairness, calibration, and stability under stress. This section outlines key evaluation metrics and demonstrates how results can be visualized to communicate performance transparently.

5.1. Core Metrics

Meta-ensembles should be assessed on:

Predictive Accuracy: Precision in both central forecasts and tail-risk estimation.

Calibration: Alignment between predicted probabilities and observed frequencies.

Fairness: Ensuring subgroup outcomes (e.g., across regions or asset classes) do not diverge significantly.

Robustness: Stability of predictions under data drift, stress simulations, and adversarial scenarios.

5.2. Stress Testing and Scenario Analysis

Stress testing extends beyond standard validation by simulating extreme events. Catastrophe bond models, for example, can be tested under historical hurricane seasons and projected climate scenarios. Similarly, carbon market models can be evaluated under sudden regulatory shifts or volatility spikes. Meta-ensembles excel here by redistributing weights dynamically under different stress conditions [

9].

5.3. Visualizing Fairness vs. Accuracy

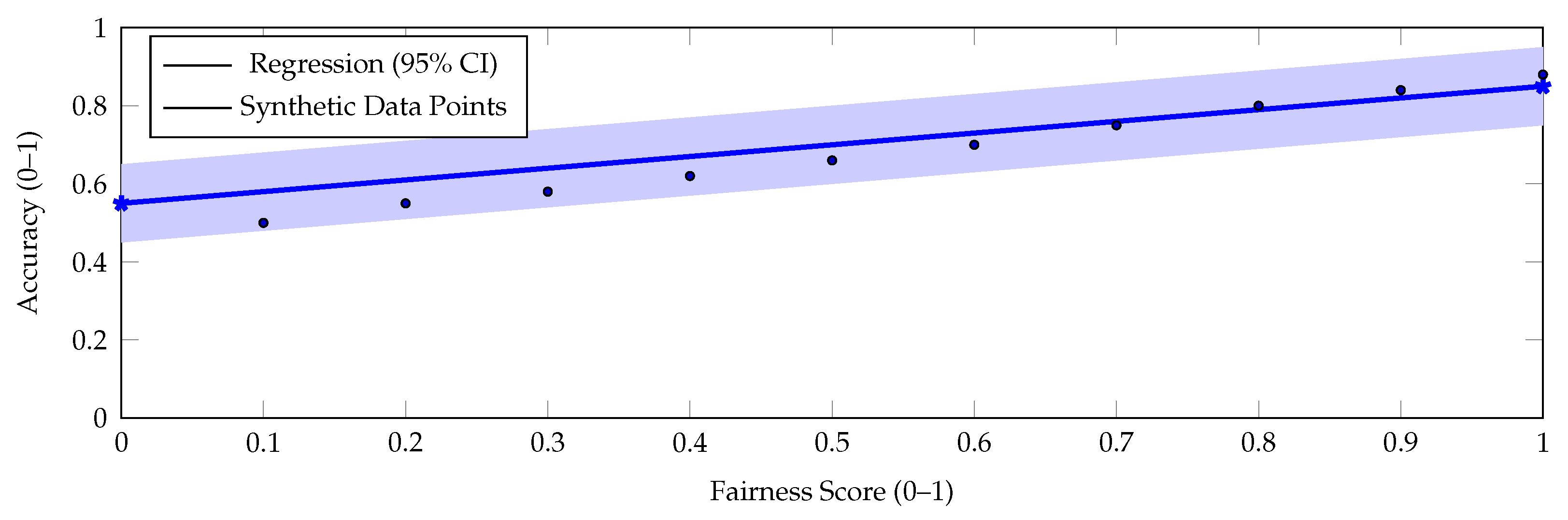

Stakeholders benefit from intuitive plots that balance fairness and predictive power.

Figure 4 shows a synthetic scatter of fairness scores versus accuracy, along with a regression line and 95% confidence band. Such visualization demonstrates how well a model maintains accuracy while meeting equity requirements.

5.4. Governance-Oriented Scorecards

Evaluation should culminate in governance-oriented scorecards. These compile predictive metrics, calibration plots, subgroup fairness measures, and compliance checks into a single dashboard for auditors and regulators. Meta-ensembles uniquely support such reporting by logging ensemble weights, contextual shifts, and uncertainty bands alongside predictions [

10].

5.5. Discussion

Evaluation protocols for meta-ensembles must go beyond predictive accuracy to include robustness, calibration, and fairness. The scatter plot in

Figure 4 illustrates how models can balance these objectives. Ultimately, governance-aligned scorecards help institutions decide whether a meta-ensemble is fit for deployment in climate-finance environments where both economic and societal stakes are high.

6. Ethical and Regulatory Considerations

In high-stakes predictive settings, meta-ensemble models must do more than deliver performance: they must comply with ethical norms and regulatory mandates. Climate finance is heavily scrutinized by regulators, investors, and civil society actors who demand transparency in how predictions are generated, validated, and applied. This section highlights key ethical and regulatory challenges and demonstrates how meta-ensembles can address them [

11].

6.1. Ethical Dimensions

Risk models in climate finance influence investment flows, insurance pricing, and sovereign credit decisions that can affect millions of people. Ethical concerns include fairness in risk allocation, avoidance of bias against vulnerable regions, and transparent justification of predictions. Meta-ensembles can encode fairness constraints through symbolic sub-models or apply weighted penalties in the meta-learner to ensure equitable treatment of subgroups.

6.2. Regulatory Compliance

Regulatory frameworks such as the Task Force on Climate-Related Financial Disclosures (TCFD) and the EU Taxonomy require institutions to demonstrate how climate-related risks are quantified and reported. Meta-ensembles provide natural compliance pathways by logging ensemble weights, prediction intervals, and governance signals. This structured traceability ensures that regulators can audit not only outcomes but also decision processes [

12].

6.3. Auditability and Accountability

Auditability demands detailed logging of model states and predictions. Meta-ensembles can store which base and sub-ensembles contributed most to a forecast, along with confidence intervals. This ensures accountability in case forecasts diverge from realized outcomes. Institutions can provide regulators with not just final risk scores but the decomposition of those scores across modeling layers.

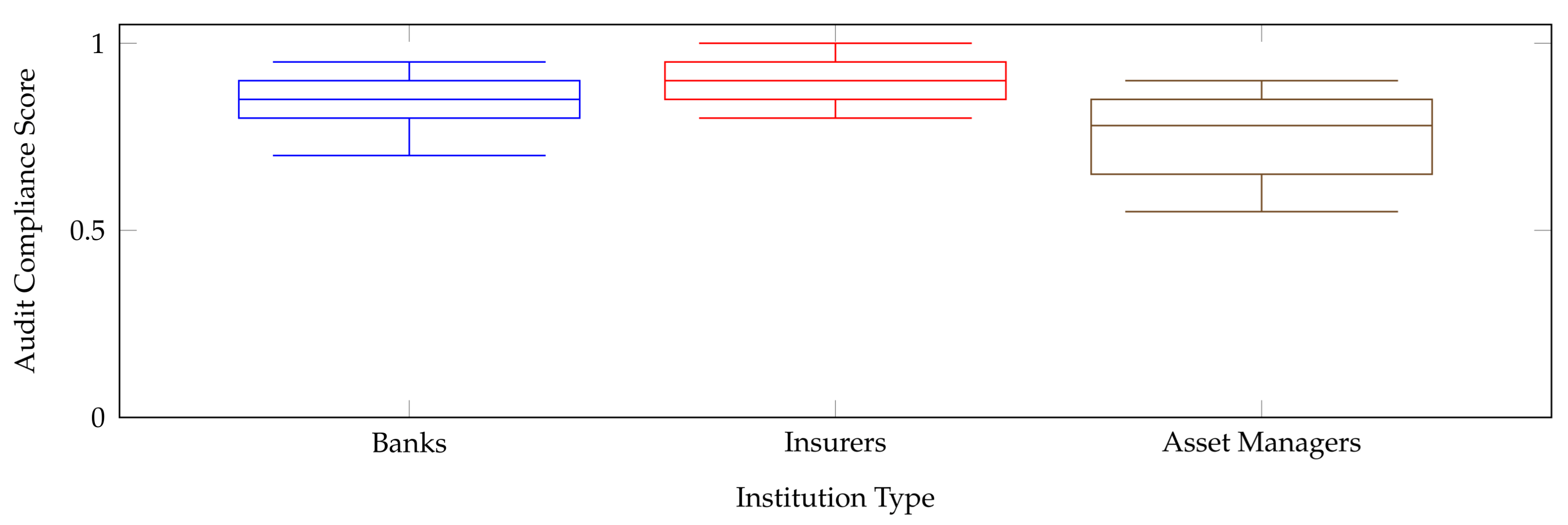

Figure 5 illustrates compliance performance across institution types. Insurers achieve higher consistency because of strong regulatory oversight, while asset managers show greater variance, reflecting uneven adoption of governance frameworks.

6.4. Discussion

Ethical and regulatory considerations are not external to modeling—they are integral to design. By embedding fairness-aware rules and ensuring audit-ready transparency, meta-ensembles provide a pathway for climate-finance analytics that is not only technically robust but also ethically legitimate and legally compliant. The boxplot underscores how sectoral differences in regulation can shape compliance outcomes and highlights the importance of adaptable, governance-friendly modeling approaches.

7. Future Directions

Meta-ensemble research in climate finance is converging toward systems that are adaptive, uncertainty-aware, and governance-aligned by design. This requires (i) fast reweighting under regime shifts, (ii) explicit uncertainty propagation from base models through the meta-learner, and (iii) guardrails that encode policy and ethical constraints [

13].

7.1. Uncertainty-Aware Adaptive Stacking

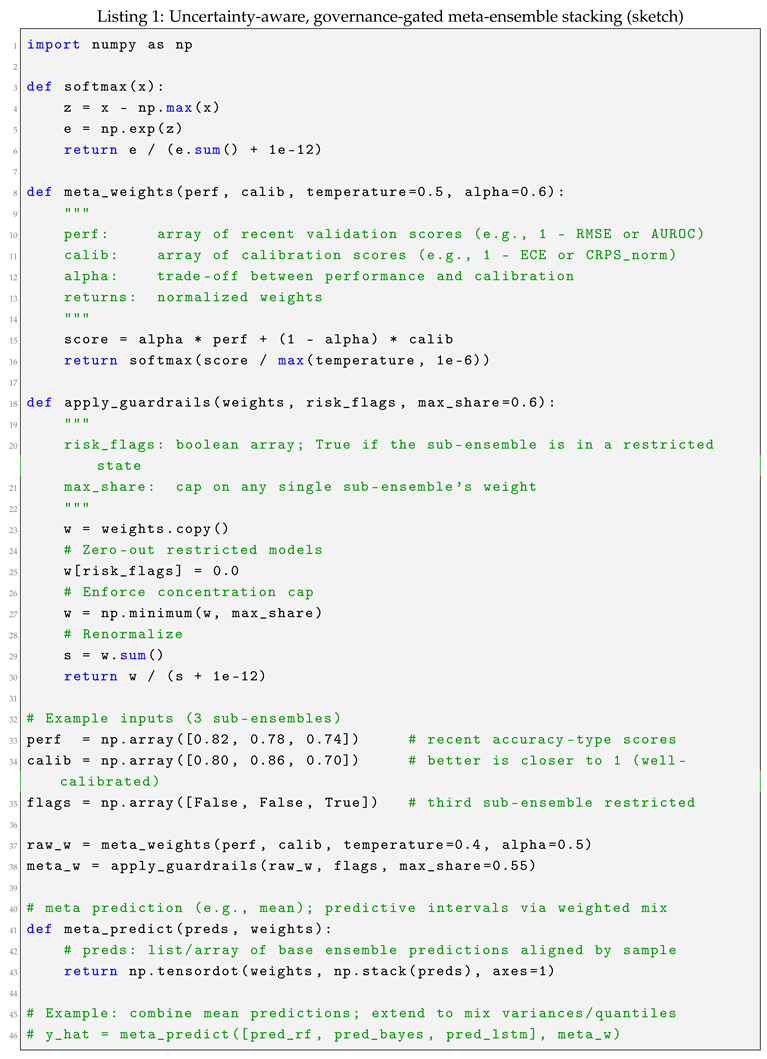

A practical next step is to weight sub-ensembles by both recent performance and calibration quality, not accuracy alone. Further, weights should be gated by governance rules (e.g., concentration caps, policy thresholds). Listing 1 shows a lightweight pattern that you can integrate into production: performance- and calibration-aware weights, with a simple guardrail layer that can be replaced by your internal policy engine.

The sketch integrates three deployment essentials: (1)

adaptive reweighting using both accuracy and calibration; (2)

guardrails that remove or cap risky sub-ensembles; and (3) a clear path to propagate distributional uncertainty (mean/variance or quantiles) through the meta layer. In production, replace the placeholders with your validation service, calibration monitors (e.g., ECE/CRPS), and policy engine [

14].

7.2. Priority Areas

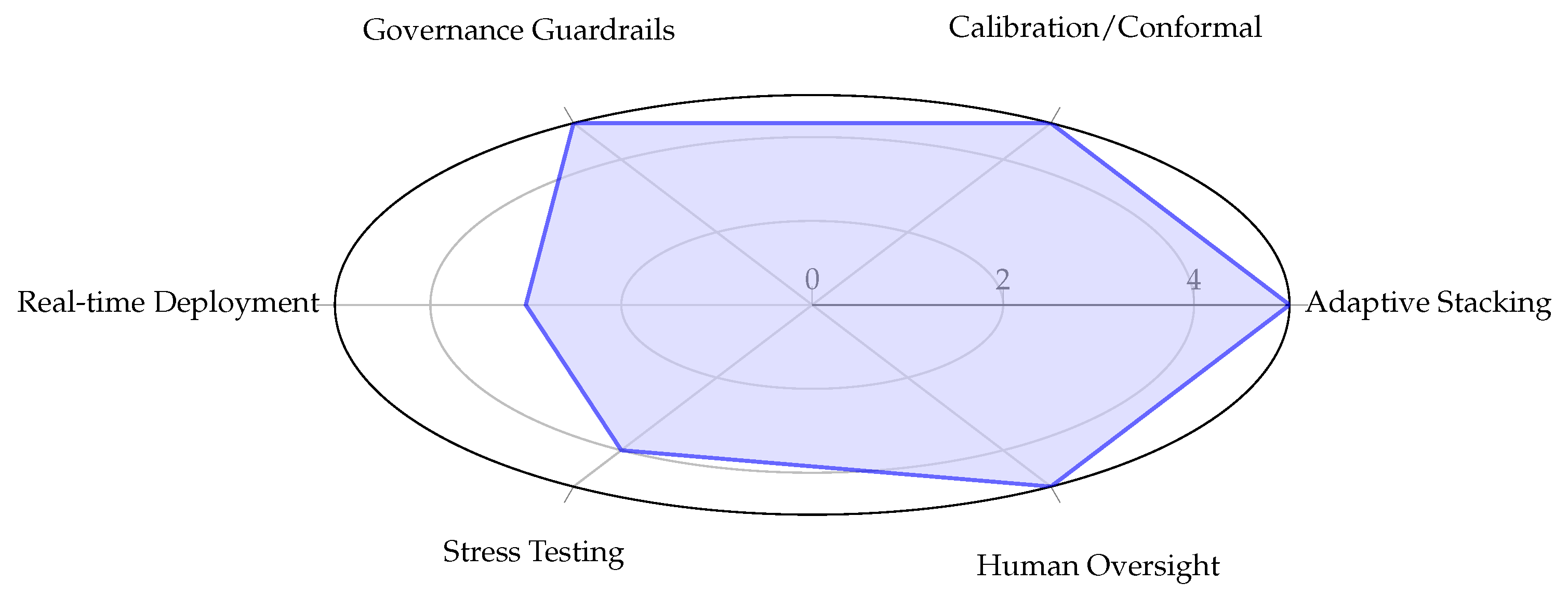

Beyond adaptive stacking, priorities include robust conformalization for tail-risk coverage, distribution shifts handled via context gating, and fast rollback mechanisms when governance tests fail.

Figure 6 summarizes these priorities for roadmap planning.

7.3. Discussion

Future progress hinges on making meta-ensembles

continuously adaptive and

audit-ready. The code pattern in Listing 1 demonstrates a practical foundation: a meta-learner that reweights for both accuracy and calibration while enforcing governance limits. Combined with conformal prediction, stress-tested deployment, and human oversight, these systems can deliver trustworthy forecasts for climate finance at scale [

15].

8. Conclusion

Meta-ensemble models are emerging as a critical class of techniques for predictive analytics in climate finance and risk management. By layering ensemble strategies under a meta-learner, these architectures achieve resilience, capture uncertainty, and offer governance-aligned traceability. Unlike single models or even conventional ensembles, meta-ensembles adapt to regime shifts, recalibrate under stress, and provide interpretable audit trails required in high-stakes environments.

The case studies reviewed—carbon markets, catastrophe bonds, and ESG risk scoring—illustrate the tangible benefits of meta-ensembles: more calibrated forecasts, robustness against volatility, and improved auditability for regulators and investors. Evaluation protocols that combine accuracy, fairness, calibration, and robustness confirm that meta-ensembles balance predictive performance with societal and policy needs. Ethical and regulatory considerations further highlight how fairness constraints and audit-ready logging can be embedded directly into these models, not appended as afterthoughts.

Looking ahead, the field is shifting toward adaptive and continuously learning meta-ensembles that incorporate conformal calibration, multimodal data fusion, and real-time governance guardrails. The radar chart of future priorities underscores the centrality of adaptive stacking, calibration-aware weighting, and transparent guardrails in building systems that not only predict but also justify. Code sketches such as uncertainty-aware adaptive stacking show how these principles can translate into deployable pipelines.

Ultimately, meta-ensembles represent more than a technical refinement: they are an institutional framework for trustworthy climate-finance analytics. By combining predictive accuracy with fairness, robustness, and compliance, these models help ensure that decision-making in climate-sensitive markets is not only smarter but also more ethical, transparent, and sustainable. In an era where mispriced climate risks can destabilize financial systems and communities alike, meta-ensembles provide a path toward resilience and accountability.

Beyond climate finance, the methodological contributions of meta-ensembles are broadly applicable across other high-stakes domains such as healthcare, energy, and disaster management. These sectors also face volatile, non-stationary data streams where uncertainty-aware predictions are critical. Lessons learned from climate-finance deployments may therefore generalize into broader frameworks for ethical, adaptive analytics.

Finally, the maturity of meta-ensemble systems will depend not only on algorithmic advances but also on institutional adoption. Bridging research with regulatory expectations, ensuring interoperability with existing financial systems, and aligning with global climate reporting standards are the next milestones. By embedding these considerations into research and practice, meta-ensembles can evolve from experimental tools into essential infrastructure for managing systemic risk in an uncertain world.

References

- Veluguri, S.P. ConvAttRecurNet: An Attention-based Hybrid Model for Suicidal Thoughts Detection. In Proceedings of the Proceedings of the 2025 3rd International Conference on Cognitive Computing and Applications (ICCCA). IEEE, 2025.

- Zhang, T.; Li, Y.; Zhao, Q. A Comprehensive Survey on Concept Drift and Feature Dynamics. Information Sciences 2024, 642, 1–28. [Google Scholar] [CrossRef]

- Cetrulo, A.L.S.; Quintana, D.; Cervantes, A. A Survey on Machine Learning for Recurring Concept Drifting Data Streams. Elsevier 2022, pp. 1–32. [CrossRef]

- Devarapalli, S.; Vathsavai, V.G.; Katkam, V.; Kanji, R.K. Cloud-Native LLMOps Meets DataOps: A Unified Framework for High-Volume Analytical Systems. In Proceedings of the Proceedings of the 2025 International Conference on Advanced Computing and Data Engineering (ICACDE). IEEE, 2025. [CrossRef]

- Hinder, F.; Vaquet, V.; Hammer, B. One or Two Things We Know about Concept Drift — A Survey on Monitoring Evolving Environments. Frontiers in Artificial Intelligence 2024, 7, 1330258. [Google Scholar] [CrossRef] [PubMed]

- Mallick, A.; Hsieh, K. Data Drift Mitigation in Machine Learning for Large-Scale Systems. Proceedings of MLSys 2022, pp. 1–18. [CrossRef]

- Shirdi, A.; Peta, S.B.; Sajanraj, N.; Acharya, S. Federated Learning for Privacy-Preserving Big Data Analytics in Cloud Environments. In Proceedings of the Proceedings of the 2025 Global Conference in Emerging Technologies (GCET). IEEE, 2025.

- Niral Sutaria. Bias and Ethical Concerns in Machine Learning. ISACA Journal 2023.

- Devaraju, P.; Devarapalli, S.; Tuniki, R.R.; Kamatala, S. Secure and Adaptive Federated Learning Pipelines: A Framework for Multi-Tenant Enterprise Data Systems. In Proceedings of the Proceedings of the 2025 International Conference on Intelligent Cloud and Federated Systems (ICICFS). IEEE, 2025.

- SixtySixTen. Machine Learning Sales Forecasting: Predict Growth. SixtySixTen Blog 2025.

- Prescience Decision Solutions. Transforming Sales Forecasting with Adaptive Machine Learning Models and Data Integration. Prescience Decision Solutions Blog 2025.

- Lu, S.; Guo, D.; Ren, S.; Huang, J.; Svyatkovskiy, A. CodeXGLUE: A Machine Learning Benchmark Dataset for Code Understanding and Generation, 2021, [arXiv:cs.SE/2102.04664]. [CrossRef]

- Shahane, R.; Prakash, S. Quantum Machine Learning Opportunities for Scalable AI. Journal of Validation Technology 2025, 28, 75–89. [Google Scholar] [CrossRef]

- Intelegain Technologies. Ethical Considerations in AI and Machine Learning. Intelegain Blog 2024. [CrossRef]

- Hao Yu, Nezir Aydin, Selcuk Alp, K.Y. Kizgin. Machine Learning-Based Sales Forecasting During Crises: Evidence from a Turkish women’s clothing retailer. NCBI Articles 2025. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).