1. Introduction

A large part of the literature studied in this paper considers the impact of digital technologies on business as a positive phenomenon, despite other elements that may potentially not always be positive. While the integration of Artificial Intelligence (AI) as the most emphasized technology positively affects operational efficiency, other less positive, or even negative, effects may not have been sufficiently taken into account in the literature. Here, more precisely, the triangle of chain effects but also opposite ones such as the high costs associated with digital infrastructure, operational efficiency and cyber risk is considered [1,2]. Nevertheless, trends show that businesses in all industries have integrated or are integrating digital technologies into their models as part of digital transformation [3]. There is academic and practical evidence that even in the financial sector, namely in the financial management of businesses, digital technologies, specifically artificial intelligence, are finding extraordinary applicability and integration [4,5,6]. These technologies not only improve the speed of financial data processing, but also significantly help in detecting fraud and increasing the accuracy of financial reporting [7].

The main challenge identified by the literature review is related to the lack of theoretical and practical explanations that should consistently address concerns about security and high costs associated with the adoption and integration of digital technologies in the financial sector, as well as provide potential and functional solutions [8,9]. Despite the great potential that AI offers, many organizations hesitate to invest due to the lack of technical capacities and high initial infrastructure costs [10]. In this context, this research focuses on the integration of digital technologies, especially Artificial Intelligence (AI), and, in a lighter tone, proposes to further intensify research on the integration of Data Analytics and Blockchain in financial management. According to a recent analysis, the main barriers to the implementation of AI in business financial management are the lack of trust, complex regulations and the lack of integrated digital strategies [11]. These gaps, although not very pronounced, together with the gap identified by this paper, fully emphasize the need for new research that will address not only the benefits of integrating AI in financial management, but also the real costs and risks of its application in this sector. On the other hand, developing countries, in addition to the need to accelerate knowledge on this topic, need to increase the dynamics of adoption and integration of digital technologies, respectively AI. The case study presents a representation of developing countries.

In principle and in content, many hypothetical research questions have been raised around this issue and are aimed at discussing how the integration of AI affects the financial management of businesses in an ethical and practical way [12,13]. Several studies emphasize that the use of AI algorithms in financial decision-making requires transparency and ethics in the coding and training of models [14]. As a result, research studies have raised different problems and formulated different theories, contributing to the continuation of the discussion and development of this topic. Also, research conducted in different industries, especially those focusing on the impact of digital technologies on financial management, concludes that there is a need for further clarification on the effect of this application on operational efficiency and risk management within the financial management of businesses and organizations [15,16].

Considering the information collected and analyzed from the literature, the purpose of this study is to further analyze the impact of digital technologies with a focus on the impact of AI on the financial management of businesses, including three basic criteria: the cost of technological infrastructure, operational efficiency and data security. Four hypotheses have been formulated with the aim of addressing the research problem. This research has refined important indicators of the operational efficiency of businesses based on both the literature and data collected from surveys with businesses in Kosovo. The process is described in the research methodology section. Considering these indicators and the regional context, the study identifies the need for more intensive research in this area and on this topic. We also recommend that further research be conducted to explore the ethical implications, real security risks and long-term effects of digital technologies on organizational performance in business and financial management.

2. Theoretical Background and Hypothesis Development

Digital technologies are now the most popular component systems applied to process, store, and transmit information in digital form. The fact is that these technologies have intervened in changing the way of doing business in all industries as well as the way people live to a considerable extent [17]. The most important digital systems include software and hardware components compatible with those of the entire digital system, including the internet, AI, computers, various mobile devices, software, cloud computing, machine learning, the Internet of Things (IoT), and blockchain. In the operational aspect, the implementation of digital technologies in business financial management has shown significant positive effects, influencing the transformation of the process and organizational structure [18,19]. Key technologies such as AI, blockchain, and data analytics have increased the efficiency and effectiveness, as well as the transparency, of financial processes. These technologies have reduced operational and resource costs, improved the reliability of reporting, and contributed to better decision-making by providing important information from real-time data analysis. A notable impact is the automation of repetitive operations in the financial management process [20]. The adoption of digital solutions has also allowed organizations to optimize resource allocation and improve transaction processing [21]. However, initial investment costs and data security remain challenges, requiring organizations to adopt strong security measures and policies to mitigate risks. Digital transformation, in addition to other improvements, enables consistent maintenance and continuous updating of security protocols to address emerging threats. In continuation of this, also concluded that digital transformation, in addition to improving efficiency and effectiveness, also makes it possible to continuously update its security protocol to address developing threats [22]. Generally, digital technologies enable businesses and organizations with the capacity to forecast financial trends more accurately and make data-driven decisions, offering a competitive advantage in the market. Despite some serious challenges, the effective integration of digital technologies is assumed to be essential for organizations to achieve their strategic goals, mainly to remain competitive in an increasingly dynamic business environment [23]. In the case of digital technologies in accounting, in recent decades, the application has profoundly changed or transformed the role of accountants, by enabling almost fully computerized accounting processes and systems. They confirmed that digital technologies have simplified the accounting process, enabling companies to utilize contemporary practices and automated cost accounting tools [24]. Advances such as cloud computing, data analytics, artificial intelligence, and blockchain have influenced the role and the importance of accountants by reducing the need for manual operations and improving the accuracy of information [25]. Specifically, AI has automated repetitive tasks and enhanced data analysis, allowing accountants to focus on strategic analyses [26]. They reconfirm that the implementation of digital technologies in financial management, in addition to measurable success, also faces several interesting challenges [27]. Here is to think on data security and privacy primarily, leadership and organizational culture revision, and significant investments in digital infrastructure. Risk management and compliance regulations for business financial management are also critical factors necessitating attention [28]. Specifically, blockchain presents challenges related to the high level of energy consumption and the large-scale application of the system, and the instability of cryptocurrencies.

A more specific case is the use of artificial AI in financial management, which undoubtedly increases operational efficiency and effectiveness and, respectively, operational and financial performance by enabling more effective analysis and decision-making. AI, among other things, enables predictive investment analysis, personalized customer service through fraud and cyberattack detection, automated accounting planning, and market situation analysis [29]. Despite AI’s ability to analyze customer data and help in tailoring personalized services to customers, there are ongoing concerns regarding the ethical implications of AI applications and data security risks. Data security issues increase the need for further specific research to respond to these challenges effectively [30,31]. The most prominent challenges that businesses face in keeping up with the requirements of successful digital integration are related to the big and rapid need for staff retraining and the development of data security systems. Such challenges are particularly evident in SMEs, which often find integration difficult for many reasons. The introduction and implementation of technologies such as blockchain and big data are considered revolutionary in increasing the efficiency and productivity of accounting practices by increasing quality and reducing operational costs in these areas [32,33]. Based on many assumptions in the literature that suggest AI implementation is hindered in one way or another by the high cost of digital infrastructure, the capabilities of AI implementation, and the first hypothesis, respectively, have been formulated [34].

2.1. Digital Infrastructure Cost and Implementation of AI in Business Finance Management

Digital infrastructure represents the backbone of digital transformation in business and financial management, involving hardware, software, cloud platforms, and networking systems. Investments in digital technologies enable organizations to systematize and make more efficient processes, effectively integrate data, and support distant business operations [35]. Several other studies confirm that while initial costs are high, long-term benefits in efficiency, effectiveness, quality, and speed of decision-making are significant [36]. There is sufficient evidence showing that the cost implications are related to the limited budgets and firms’ complexity, and they vary across firm sizes and regions. SMEs, predominantly in developing countries, often lack sufficient capital to adopt comprehensive digital infrastructures, relying instead on incremental adoption [32]. Corporations and bigger companies probably have stronger budgets, but they have to deal with the greater complexity in integration and maintenance of digital technologies [37]. In terms of the successful application of AI in business financial management, there are several contextual issues in the literature. Various authors provide evidence about the capacity of businesses to successfully adopt AI, noting that large corporations or companies are more successful in effectively implementing AI in business financial management compared to SMEs. This is because the necessary digital infrastructure has high costs that appear as a significant obstacle to the effective implementation of artificial intelligence (AI) in business and financial management. SMEs mainly have limited budgets and other limited capabilities compared to large companies. The high costs associated with AI infrastructure technologies limit small and medium-sized businesses, and, as a result, they may lack the ability for successful strategic planning based on forecasting. Similarly, one study identifies financial and infrastructural constraints as key barriers to AI adoption, highlighting that digital maturity and leadership commitment are necessary to overcome these barriers [38,39]. A systematic review from which they found that while large companies can effectively absorb the relatively high costs of digital infrastructure, SMEs, in most cases, do not have the financial capacity to invest in and then maintain the technological systems enabling the implementation of AI [40]. As a consequence, this results in a slower and less effective rate of AI adoption in general, specifically in business and financial management. Comparative studies on the timescales for return on investment remain limited when it comes to investments in digital infrastructure. Mature organizations in the application of AI mainly manage to return the investment within about one year, while digital-new companies have average return on investment periods of about two years [41]. These findings are mainly based on different industries and show the average for the industry. This indicates that specific comparisons are lacking, e.g., in financial management or in operations management [42]. Firms that deploy a hybrid infrastructure and apply structured financial management strategies by effectively planning and monitoring operations and resources manage to reduce total digital infrastructure costs by approximately 35% and achieve AI scalability three to five times faster than firms that operate differently [43]. This is not enough to fill the gap in the literature; there is a lack of academic literature dedicated to the relationship between investments in digital infrastructure and increasing or improving sustainable competitive advantage with the application of AI. The aspect of increasing the capacity for innovation after the investment is also not sufficiently addressed. It has been understood that digital infrastructure includes the integration of digital systems with legacy systems, cybersecurity, data structure, cloud capacity, compliance, and change management [44]. This makes the system have costs that are not seen in the first place, and as such, can be underestimated in cases of various financial analyses. The points out that firms often overlook operational expenses that are often repeated within the process of controlling and maintaining AI systems [45]. These costs surprisingly reach up to about 50% of the total costs of the AI infrastructure project. Therefore, in business financial management, there are critical and often dangerous gaps in strategic cost planning, causing delays in AI implementation and inadequate financial results [46].

Several studies present a realistic picture of how AI enables businesses to automate financial operations such as customer service, forecasting, risk analysis, and fraud detection. AI also supports decision-making through real-time data analysis, providing greater reliability than human processing [46,47]. However, despite its positive contribution to operational efficiency, factors such as the availability and cost of digital infrastructure, cultural acceptance, and varying regulatory frameworks affect the implementation of AI in business financial management. Other issues, such as algorithmic transparency, accountability, control, and bias in decision-making, remain arguments of discussions [48]. Despite the extensive work conducted on this topic, throughout the literature review, we found insufficient empirical evidence on the ethical and socio-economic consequences of AI in business financial management, especially regarding the performance of AI in different data environments and the dynamic adaptability of AI models. Based on these gaps, we hypothesize that the cost of digital infrastructure may hinder the effective implementation of AI. This is primarily a causal hypothesis: we did not observe evidence suggesting that higher investment directly reduces the adoption of AI. Instead, we argue that higher investment facilitates greater implementation, while limited or low investment makes the effective integration of AI in business financial management challenging or even, in some cases, impossible. Consistent with these findings and the recommendations in the literature, we formulated the first hypothesis supposing that digital technological investment costs hinder the integration of AI in business financial management.

2.2. Operational Efficiency in Business Financial Management and AI Integration

Numerous studies confirm that integrating digital technologies into business processes improves operational efficiency by automating process flows, increasing operational speed, optimizing resources, and providing real-time analytical feedback. This integration greatly frees managers and finance teams from repetitive and monotonous tasks and allows them to focus more on strategic planning. Financial reporting has also become faster and more accurate than hybrid or fully human-generated reports. [49,50].

However, the benefits of integrating digital technologies into financial management operations depend on the degree of digital integration and the skill levels of the staff. Specifically, operational efficiency and effectiveness are unlikely to improve significantly when AI technology integration is limited or staff have low engagement skills [51]. A growing body of evidence suggests that digital tools can improve functions such as communication and organization, but they can also lead to overload and stress due to frequent demands on skills and knowledge [52]. Remote work may increase short-term effectiveness; however, its long-term effects on innovation and team cohesion may be negative. For SMEs in particular, hybrid models offer increased flexibility; however, they often undermine a healthy work-life balance, contributing to digital exhaustion [53]. Without a thoughtful reshape of work and decision-making practices, the integration of digital technologies, specifically the integration of IA into hybrid work, risks delivering meagre returns on investment over time [54,55]. In this respect, we found that the literature offers few academic studies that assess the sustainability of operational efficiency in business financial management or explore the accidental consequences of integrating AI. One area that remains unknown and probably disputed is the long-term impact of AI on efficiency in hybrid work settings.

There is no doubt that when successfully applied and integrated, artificial intelligence, blockchain, cloud computing, and data analytics improve transparency, increase resource optimization, and improve transaction processing [56]. However, we found that most studies present these benefits without quantifying them. The success of integration varies across sectors, industries, and countries. Regulatory barriers and insufficient staff skills remain key obstacles, and small and medium-sized enterprises in particular face resistance due to legacy systems and budget constraints [57,58]. Furthermore, there is a lack of longitudinal studies examining the integration of digital technology into financial management, especially in the context of unstable or absent regulations and rapidly changing markets. Most of the existing research remains at the conceptual stage or provides only short-term insights with limited scope. As research points out, regulatory stability is critical for creating a sustainable operating environment and a viable strategic scope. Several studies conclude that large-scale integration efforts often fail due to a lack of long-term adaptive decision-making and planning [48]. This gap led us to formulate our second hypothesis, assuming that the successful integration of digital technologies into business financial management positively affects operational efficiency. We determined this relationship by analyzing theoretical assessments from the literature and quantitatively analyzed a large sample of financial management professionals from various business industries.

2.3. Cybersecurity Risk in Business Financial Management

Another important variable addressed in this paper is data security risk, referred to in the literature as cybersecurity risk. There are findings that the increasing digitalization of financial management operations has also increased cybersecurity risks, given that finance always involves the handling of sensitive data. Consistent with this finding, it recommends that financial institutions adopt encryption, multifactor authentication, and secure cloud platforms to protect data and prevent potential cyberattacks. These measures require investments in cybersecurity platforms, which in turn increase the cost of digital integration. For SMEs, such investments are often difficult, or even impossible, due to budget and expertise constraints [59,60]. Large companies face fewer of these challenges, although they are not entirely without problems. From another perspective, it can be assumed that the integration of digital technologies, especially AI, can contribute to long-term strategic development in cybersecurity. However, this assumption remains largely unchallenged in the literature [39,60]. Since the beginning of the digitalization of business, much academic focus has shifted towards cost-benefit analysis, leading to a relative neglect of the risks posed by the technologies themselves, especially AI [61]. Even in recent years, most academic work has been structured by assumptions and reports based on empirical financial perspectives that remain underdeveloped. Cyberattacks can severely damage financial operations, erode trust, and threaten the financial stability of organizations if research is not conducted to help prevent them [60,61,62]. Another consequence is the loss of company value, as cyber incidents can cause stock price declines, reduced financial performance, impaired operational efficiency, and damage to business reputation [63].

This context supports our hypothesis in the continuity of the theoretical circle, which aligns the work with achieving the goal by providing quantitative results on the relationship between the integration of AI in particularly in financial management, and the cybersecurity risks that such integration may produce or affect growth. Regardless of the interpretation, especially when expressed through numerical findings, this reasoning supports the formulation of our third assumption: integration of AI into business financial management increases the vulnerability to security risk threats.

In conclusion, the literature provides ample evidence to show that the effectiveness of cybersecurity in managing business finances varies depending on the size of the firm, its investment capacity, and its human resources. SMEs appear to underperform in the field of cybersecurity due to budget constraints and staff expertise. Some regulatory changes and additions, e.g., such as GDPR, have managed to make improvements in terms of compliance, but have not eliminated vulnerabilities and risks [29,84]. This dispute further strengthens our assumption about the risk expressed through the final hypothesis. We assumed that vulnerability to security risk threats affects the digital technological investment costs.

2.4. Research Problem

Integrating AI into business financial management can significantly increase the effectiveness of the strategy and improve operational efficiency [65]. However, these benefits are only realized when businesses invest effectively in digital infrastructure. This financial barrier limits the effective implementation of digital technologies, especially the full integration of AI when considering that many businesses and organizations have limited capacity for investment. Another challenge identified as urgent includes the increased risk to data security during and after the integration of digital technologies. The exposure of digital financial systems to cyber threats has increased [66], causing the need for significant investments in order to protect data. This poses a challenge for many SMEs considering their limited financial capacity. In conclusion, we consider that the full integration of digital technologies into business financial management operations presents both opportunities and challenges. The opportunities are clear as technologies such as AI, blockchain, and advanced big data analytics have the potential to improve operational efficiency by increasing quality, automating processes, and enabling innovative financial management models [67]. We have found that in practice, however, this creates a vicious circle: digital technologies are expensive; they increase efficiency and performance, but they also increase data security risks. Increased cyber risk, in turn, requires even greater investments. Ultimately, business sustainability and data security should not be compromised. Therefore, further research is needed to explore strategies for integrating digital technologies into business financial management more efficiently and effectively.

2.5. Research Methods

This research paper applies a quantitative research model based on a cross-sectional survey, preceded and complemented by a qualitative thematic analysis, to assess the use of digital technologies and their impact on the financial management of businesses from seven different industries. A random sampling method was applied to a list of different companies that are registered and operational in the Kosovo region. The target respondents are professionals with managerial or operational responsibilities at different management and education levels. A fully structured questionnaire in software and designed using a standard format with multiple Likert-type questions was distributed by email to 400 participants. The 247 respondents from businesses in different industries who responded created a satisfactory and appropriate sample size for statistical analysis in social sciences and business research [67,68,69]. The instrument consisted of eight constructs related to each of the hypothesis variables operationalized using a minimum of four and a maximum of eight related items, as recommended by the scale design literature [70,71], and grouped in a Likert grid or matrix format to improve efficiency, minimize respondent burden, and maintain reliability [72,73]. Reliability test, correlation analysis, linear regression, and validity tests were conducted in the sense of a quantitative approach, while thematic analysis was applied to the qualitative responses to capture contextual insights and formulate hypotheses. The sample was validated as representative due to its diversity in roles, industries, and regions, even if it did not fully meet all the requirements of the quantitative sampling formula. This combined approach ensured both statistical rigor and contextual depth, fully supporting the exploratory and confirmatory objectives of the research.

Table 1.

Demographic-statistics.

Table 1.

Demographic-statistics.

| Category |

Count |

Percentage |

| Gender |

|

|

| Male |

154 |

62.4% |

| Female |

93 |

37.6% |

| Education |

| Master |

133 |

53.8% |

| Bachelor |

61 |

24.7% |

| PhD |

30 |

12.1% |

| High School |

23 |

9.3% |

| Organization Size |

| SME |

124 |

50.2% |

| Big Organization |

56 |

22.7% |

| Microbusiness |

47 |

19.0% |

| Other (Individual) |

20 |

8.1% |

| Industry |

| Finance & Banking |

104 |

42.1% |

| Retail and Consumer Goods |

45 |

18.2% |

| Technology & IT |

36 |

14.6% |

| Education, Research and Training |

27 |

10.9% |

| Government and Public Administration |

14 |

5.7% |

| Energy & Utilities |

11 |

4.5% |

| Healthcare & Pharmaceuticals |

10 |

4.0% |

| Position |

| Mid-management |

153 |

61.9% |

| Higher management |

72 |

29.1% |

| Low-management |

22 |

8.9% |

| Function |

| CFO |

26 |

10.5% |

| Finance director |

62 |

25.1% |

| Financial manager |

64 |

25.9% |

| Controller (financial operations manager) |

46 |

18.6% |

| Accountant |

30 |

12.1% |

| Business analyst |

19 |

7.7% |

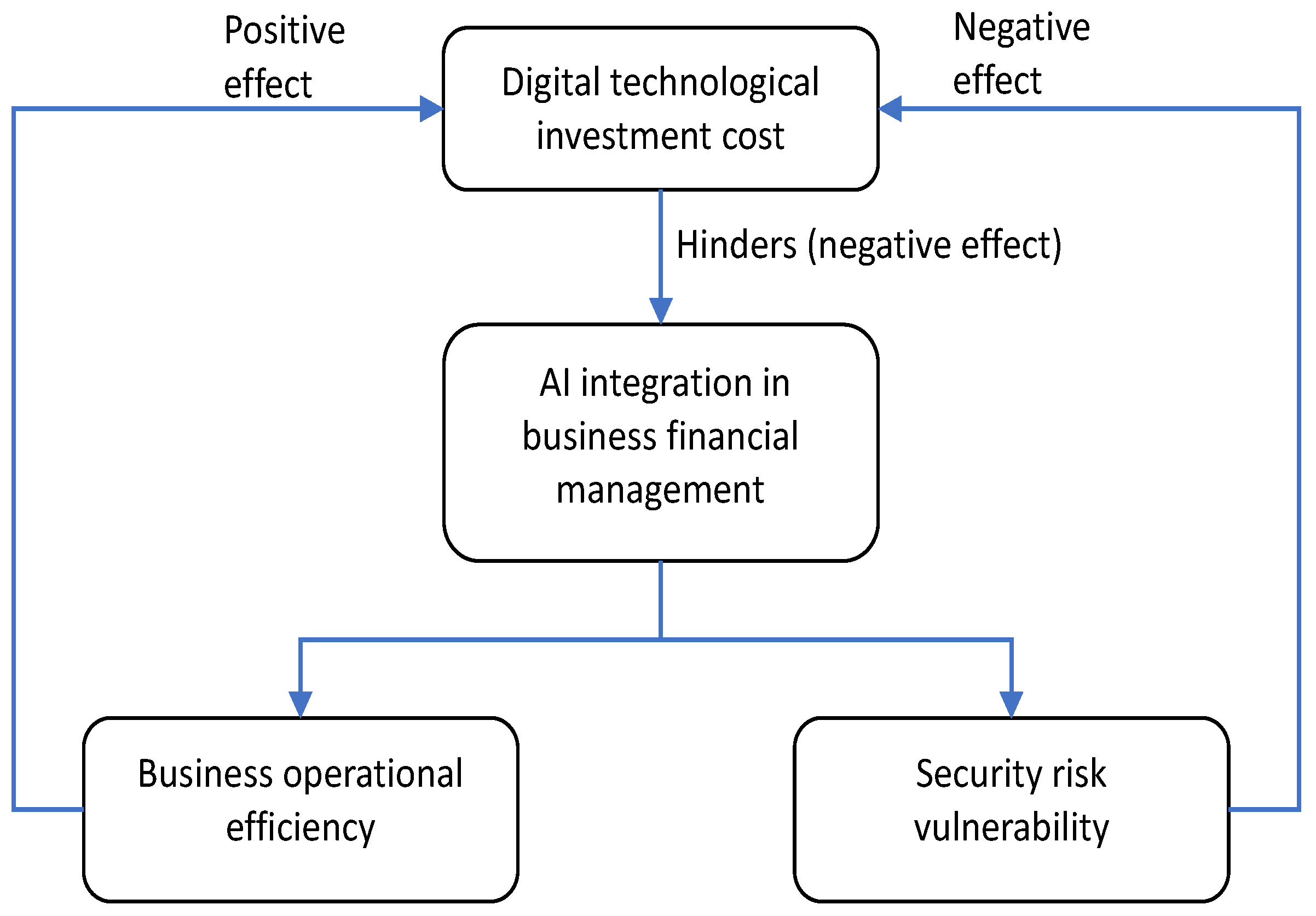

2.6. The Conceptual Model

Based on the literature research and the purpose of this ongoing research, we have built the theoretical conceptual model.

Figure 1 and

Table 2 present the hypothesis variables, the main definitions from the literature, existing theories, and adequate references.

Figure 1 shows the conceptual framework developed in this paper. The negative and positive effects do not mean that we would expect to have a negatively numerical expression of corresponding correlation between the variables, but that we would have a conceptual correlation that indicates cause and effect. Therefore, the increase in cyber vulnerability is generally considered a negative effect not necessarily represented numerically with a minus sign, despite the high significance. This study adopts the conceptual framework that addresses the relationship between the cost of digital technology investment, AI integration, business operational efficiency, and vulnerability to security risk in business financial management. Total financial resources required to acquire, implement, integrate, and maintain digital and AI technologies define the cost intended for digital technologies [17,24,26,74,81], and are based on the Technology-Organization-Environment (TOE) framework [26], the Resource-Based View (RBV) [85], and the Dynamic Capability Theory [22]. The extent to which AI technologies are integrated into financial activities such as analysis, forecasting, reporting, auditing and risk management represents the integration of AI in business financial management [19,20,75,76,85], drawing on socio-technical systems theory [4], the IS Success Model [5], and the Dynamic Capability Theory [22]. The ability to deliver financial and operational results with minimal loss, cost, and time is understood as Business operational efficiency [1,2,23,79], supported by the IS Success Model [5] and the Learning Curve Theory [2]. The susceptibility of financial systems and data to breaches, fraud, manipulation, or unauthorized access arising from AI applications represents the security risk vulnerability [4,18,21,25,80,82], and is anchored in Risk Management Theory and the socio-technical systems perspective [4]. The conceptual framework diagram highlights that the costs of digital investments affect AI integration, which in turn affects operational efficiency and security risk vulnerability, implicating all variables in a cyclical approach.

3. Data Analysis and Results

This section presents the results of the survey conducted to analyze the integration of AI in financial management. The survey aimed to identify the challenges and new opportunities these technologies bring for financial professionals. Data analysis is conducted using statistical methods and platforms through a simple linear regression, which allows us to understand and explain the dependency between the variables of the hypotheses raised and to determine, to a certain extent, the impact or to predict the impact of the independent variable on the dependent variable over time in the future. The formulation of hypotheses is conducted based on the defined problem and the main research question. Consequently, the hypothesis variables are constructed using literature research findings. According to [30], every research process begins with the identification of a problem, and through literature review and analysis of variables, it enables the formulation of hypotheses. This process ensures the constructed hypotheses can be tested since their variables are measurable. Other authors emphasize that the hypothesis is an attempt to provide a possible solution to the study problem and should be built based on existing knowledge, namely, previous research [31]. Based on the above findings, we hypothesized that the attitude around the high costs associated with technological infrastructure is broadly recognized as a hindrance to the effective implementation of digital technologies, specifically artificial intelligence in business and financial management. Even though it has been reported that implementing intelligent technologies in business financial management has brought multiple profits and return on investment in a short period, initial financing or investment still seems to be difficult for businesses in many countries.

First, we performed multiple regression by setting control variables such as education, company size, managerial level, industry, and manager function. However, the model clearly shows that the Perceived Cost of Investment is the main factor hindering the integration of artificial intelligence into business financial management. The level of education of managers has a small but significant moderating effect, while all other predictors contribute minimally or not at all to the model. Given these results, we considered that a simple regression model focusing on the perceived cost of investment could provide a more efficient and sufficient explanation without losing explanatory power.

Table 3.

Reliability analyses and correlation for H1.

Table 3.

Reliability analyses and correlation for H1.

| Analysis |

Measurement |

Value |

Explanation |

| Reliability analysis |

Cronbach’s Alpha (Independent variable measured by four items) |

0.87 |

High reliability allows further analysis of independent variables. |

| |

Cronbach’s Alpha (Dependent variable measured by four items) |

0.859 |

Very high reliability and reliability, supporting dependent variables’ stability. |

| Correlation analysis |

Pearson correlation (r) |

0.824 |

Moderate to strong positive relationship (r>0.5) |

| |

Significance level (p) |

0.001 |

Significant (p < 0.05), supporting Hypothesis H1. |

| Hypothesis H1 conclusion |

The high cost of investments is related to the application of AI in business financial management. |

- |

The significance of the correlation supports Hypothesis H1. |

The results from linear regression show the following parameters: The constant B has a numerical value of 0.824 and a statistical significance level of 0.00. These parameters are eminent indicators that allow us to understand that the hindrance of application of AI in business financial management is affected by the high cost of investments in technological infrastructure. Such a result has also been discussed in the literature section by various authors, as elaborated in the literature review section. In this case, the regional study in Kosovo is not much of an exception.

The regression analysis generates a statistically significant model, suggesting that with the improvement of the digital infrastructure, a more effective implementation of AI is achieved. In the case of this research, this can be understood as the fact that while the technological infrastructure is expensive and cannot be improved, there will be obstacles and problems in the hindrance in integration of AI in the financial management of businesses. The model is statistically significant, strong, and assumption-compliant. From the analysis, it can be seen that Digital Infrastructure Cost has a dominant influence on the model. This is confirmed by the standardized Beta, explaining that for every 1 unit increase in Digital Infrastructure Cost, the hindrance in AI Implementation increases by 0.875 units. The model is statistically significant, strong, and assumption-compliant. From the analysis, it is seen that Digital Infrastructure Cost has a dominant influence on the model. This is confirmed by the standardized Beta. Since the optimal model has no autocorrelation, it has been found that simple linear regression is sufficient to test this hypothesis. When it comes to the opportunities, it is confirmed that the integration of digital technologies in business financial management, among other things, increases performance by increasing operational efficiency.

The statistics displayed in

Table 4 powerfully support H2. The results show that the integration of AI in business financial management is a meaningful, positive, and very significant predictor of business operational efficiency. In the analysis, linear regression produced a model that explains about 35.8% of the variability in Operational Efficiency (dependent variable) through the Integration level of AI in Financial Management (independent variable). The p-value = 0.001 indicates that the relationship is statistically significant (p < 0.001).

Table 5.

Coefficients for H1.

Table 5.

Coefficients for H1.

| Coefficient |

B |

Std. Error |

Beta |

t |

Sig. |

95% Confidence

Interval for B |

| Constant (Intercept) |

.451 |

.144 |

|

3.133 |

.002 |

.168 |

.735 |

| Digital Infrastructure Cost |

.875 |

.038 |

.824 |

22.788 |

.000 |

.799 |

.950 |

As an additional analysis, the Durbin-Watson statistic was also used to show that there is no significant autocorrelation that could affect the validity of the model. We consider that the Durbin-Watson statistic is an essential component in linear regression analysis since it shows how the relationship between the residuals stands, an element that affects the quality of the prediction because there may be incorrect values of the model coefficients.

The results related to the second hypothesis (H2) testing suggest that the level of integration of AI in business financial management positively impacts the operational efficiency of the business. Since the model from the regression analysis explains most of the variance well, clearly indicating that the independent variable is statistically significant, the diagnostic model is a substantial fit without any serious violation of assumptions, we consider, as the authors do, that there is no need for further testing [32]. The regression model produced the following results: correlation coefficient R = 0.598; the R Square value specifying 35.8% of the variance in dependent variable (operations efficiency) can be explained by the independent variable (level of AI integration in business); adjusted R Square of 0.355 confirms the model simplification as discussed within the methodology section: the standard error of the estimate is 0.49551, suggesting a relatively moderate spread of the residuals around the regression line. The F statistic of 136.560 with a p value < .001 is another indication indicating the model is statistically significant. The Durbin-Watson statistic of 1.749 is acceptable and indicates no serious autocorrelation in the residuals.

Table 6.

Coefficients for H2.

Table 6.

Coefficients for H2.

| Statistics |

Value |

Interpretation (How it Supports H2) |

| Unstandardized Coefficient (B) |

0.629 |

This positive value shows that increased digital technology integration is associated with improved operational efficiency. |

| Standard Error (B) |

0.054 |

This is a small standard error, indicating a precise estimate of the effect. |

| Standardized Coefficient- β |

0.598 |

A strong standardized effect size. |

| t-value |

11.686 |

This high t-statistic suggests the effect is highly statistically significant. |

| p-value (Sig.) |

0.000 |

p < 0.001 confirms that the effect is significant and not due to random chance. |

| 95% Confidence Interval for B |

[0.523, 0.735] |

Interval does not include zero, indicating a consistently positive effect. |

Running multiple linear regression shows that Business size has a small but statistically significant negative relationship suggesting larger businesses may report slightly lower operational efficiency after controlling for other factors as displayed in the

Table 2. In this case, we have found that simple regression analysis is sufficient for this hypothesis.

Table 7.

Model summary for H2.

Table 7.

Model summary for H2.

| Statistics |

Model Values H2 |

Supporting the Hypothesis H2 |

| R |

0.598 |

Specifies a moderately to strongly positive relationship between digital tech and efficiency |

| R Square |

0.358 |

The suggestion is that 35.8% of the variance in operational efficiency is explained by digital technology integration in business finance management. |

| Adjusted R Square |

0.355 |

Explanatory power remains strong after adjustments. |

| Std. Error of the Estimate |

0.49551 |

Low error suggests predicted dependent variable values are close enough to actual observations, relatively close to the line. |

| R Square Change |

0.358 |

Shows significant improvement in model fit due to the inclusion of digital technology |

| F Change |

136.560 |

High F-statistic confirms the predictor (digital technology integration) contributes significantly to the model |

| Durbin-Watson |

1.749 |

Indicates no autocorrelation. Model assumptions are likely valid. |

| Predictor (Model H2) |

Integration of AI |

Represents the explicit independent variable under examination. |

| Dependent Variable |

Operational

Efficiency |

Proves what is being enhanced or clarified in business financial management |

It is confirmed that the integration of AI into business financial management operations increases the vulnerability to security risk threats, as supposed in H3. Cronbach’s Alpha was 0.864, and four specific items measuring the dependent variable of H3, vulnerability to security risk, are reliable and allowed us to continue with the statistical analyses.

Table 8.

Model summary for H3.

Table 8.

Model summary for H3.

| Metrics |

Values for H3 |

Values for H4 |

| R |

.790 |

High correlation between the predictor and outcome. |

| R² |

.625 |

62.5% of the variance in security risk threats is explained by the integration of digital technology. |

| Adjusted R² |

.623 |

Confirms the R² remains strong even after adjusting for potential bias. |

| Std. Error of Estimate |

.44346 |

Relatively low, suggesting decent model accuracy. |

| F-Statistic |

407.932 |

High value showing the model is statistically significant. |

| Sig. F Change |

.000 |

Strong evidence (p < 0.001) that the predictor significantly contributes to the model. |

| Durbin-Watson |

1.874 |

Indicates no serious autocorrelation in residuals (ideal range: 1.5–2.5). |

Table 9.

Coefficients for H3.

Table 9.

Coefficients for H3.

| Metric |

Value |

Interpretation |

| Unstandardized Coefficient (B) |

0.973 |

For each 1-unit increase in digital technology integration, security risk threats increase by 0.973 units. This is a strong, positive effect. |

| Standard Error |

0.048 |

Indicates a precise estimate (low standard error). |

| t-value |

20.197 |

The predictor is statistically significant, since t is very high. |

| Sig. (p-value) |

.000 |

The outcome is highly significant (p < 0.001), and the relationship is not due to chance. |

| Confidence Interval (95%) |

[0.878, 1.068] |

The true effect is likely in this range – still positive and strong. |

| Beta (Standardized Coefficient) |

0.790 |

Confirms a strong outcome size in standardized terms. |

Table 10.

Model summary for and coefficients for H4.

Table 10.

Model summary for and coefficients for H4.

| Model summary |

Coefficients |

| Statistic |

Value |

Statistic |

Value |

| R |

0.515 |

B (Unstandardized Coefficient) |

0.516 |

| R Square (R²) |

0.265 |

Std. Error |

0.055 |

| Adjusted R² |

0.262 |

t-value |

9.410 |

| Std. Error of the Estimate |

0.62194 |

Sig. (p-value) |

0.000 |

| F Change |

88.555 |

Standardized Beta (β) |

0.515 |

| Sig. F Change |

0.000 |

95% Confidence Interval |

[0.408, 0.625] |

| Durbin-Watson |

1.762 |

Tolerance / VIF |

1.000 / 1.000 |

This analysis provides the model that makes available robust empirical support for the assumption that increased security risk threats cause increased digital infrastructure costs. Specifically, it produces the results showing that approximately 26.5% of the variance in costs is explained by risk threats. The outcome is statistically significant, moderately robust, and economically eloquent. This analysis provides the model that makes available robust empirical support for the assumption that increased security risk threats cause increased digital infrastructure costs. The outcome is statistically significant, moderately robust, and economically eloquent. This research work provides empirical results and new quantitative evidence supporting the assumption that data security risks drive financial investment in digital technologies, specifically within the setting of financial management operations. From the literature review, we have found reviews that show that many papers talk about cyber risk in financial management. However, we have not encountered a quantitative approximation as we have analyzed through our survey. We assume that studies in different regions can be done with the same model, and we expect approximate results. The remaining control variables (Industry, Education, Management level, and Function) are not statistically significant (p > .05), meaning their effects are not important for this model.

3.1. Main Findings

The main finding, respectively, the main contribution of this paper is the identification of a complex and self-reinforcing dynamic by creating a negative feedback loop, or a vicious cycle between the cost of digital infrastructure, the integration of AI in business financial management, operational efficiency, and data security risk. The findings show that the high costs of digital infrastructure are an obstacle to the full and effective integration of AI as a technology of choice in business financial management. However, the implementation of AI in financial management significantly contributes to operational efficiency by improving process quality and increasing business process speed. Contrary to the benefits, the active employment of AI increases the risk of data security in financial management. This causes an increase in the exposure of businesses to increasing vulnerability due to the handling of sensitive financial information through intelligent systems. Consequently, businesses need to invest more in cybersecurity infrastructure. This situation creates a vicious cycle: the integration extent of AI is limited due to high costs of digital infrastructure. However, in the case this investment in digital infrastructure is complete, it affects positively business processes by increasing the operational efficiency. In many cases, the increased integration of AI into business processes in financial management has negative effects in terms of cybersecurity risk. Therefore, the implementation of AI in business financial management should be considered as a strategic aspect that requires a detailed and effective decision-making approach and strategic planning.

4. Discussions

Theoretical Implications

This study contributes to the research by providing a theoretical perspective on the dynamics of digital transformation and its impact on business financial management, focusing on the integration of intelligence (AI) in this context. The theoretical analysis produces four central theoretical implications.

Advancing digital transformation theory in financial contexts. The findings from this research reinforce and extend digital transformation theory by defining the integration of AI not only as a technological change but also as an organizational, strategic, and regulatory transformation. This is supported by [84], who argue that digital transformation offers a multidisciplinary and cross-functional reconfiguration of business processes. The Kosovo case study shows that digital transformation in a developing country must take into account the unique challenges of functions and capacity equipment, thus refining the theory to adapt to different socio-economic realities. In conclusion, it is emphasized that digital transformation in the context of business financial management is a comprehensive organizational, strategic and regulatory process that must be adapted to specific socio-economic realities, especially in developing countries like Kosovo.

Resource-based review. The integration of AI in business financial management in decision-making, performance discovery, and financial reporting highlights the value of organizational capabilities as sources of competitive advantage. This point is consistent with the Resource-Based View [85,86], and Dynamic Context Framework, which find application when applied to digital capabilities in an adaptive manner [87,88]. These findings also correspond to the report by [48], emphasizing the role of information systems mediations in relation to technology integration for financial performance. In conclusion of this section, it is emphasized that the integration of artificial intelligence into the financial management of businesses strengthens operational efficiency and competitive position through the development of organizational capacities, confirming the need for dynamic adaptability in digital contexts and the validity of the resource-based approach.

Institutional implications and regulatory delays. A key theoretical contribution lies in identifying regulatory implementation delays, cybersecurity assurance, and data governance. [29] and [19] note that the speed of digital technology integration is outpacing the implementation of regulations, a problem that is magnified in developing economies. This gap reinforces the need for an institutional perspective on digital technology integration by recognizing the impact of policies, norms, and structures in place in shaping the success or failure in theory advancement. Consequently, the lack of cybersecurity and data governance shows that existing structures and policies directly influence the success or failure of the integration of digital technologies, especially in developing economies.

Technological integration theory and hybrid infrastructure. This study supports the theoretical model that views transformation as a hybrid integration of legacy and new technologies. While AI holds the greatest transformative potential, the study confirms that technologies such as blockchain, cloud computing, and data analytics work synergistically. The findings align with [25,60,77,78], who argue for a layered and construct-dependent approach to digital innovation in finance, where legacy systems are still prevalent.

Practical Implications

The research presents some important practical implications for businesses, policymakers, and stakeholders to transform digital things within a developing country like Kosovo.

Strategic allocation of resources for human and technological capacity. Effective integration of AI in managing investment requirements in both people and financial capital for digital technology. As highlighted by [35], organizations need to develop internal capabilities to manage technology while ensuring that staff remain flexible and digitally competent. This is an important feature in Kosovo, where digital capabilities and IT infrastructure remain underdeveloped compared to advanced economies.

Urgent need for adaptive cyber-friend policies. As artificial intelligence and digital finance systems become more complex, data security becomes mission-critical. The study calls for comprehensive and proactive cyber-friend policies, including encryption, role-based access control, and auditing of actors [42,59]. In developing countries cyber resilience is typically weaker; regional integration and institutional support are needed to bridge the policy gap. With the increasing complexity of digital systems and the integration of artificial intelligence, data security becomes more controversial. This requires more proactive cyber policies, especially in developing countries where regional support and cooperation are needed.

The study confirms that AI has a positive impact on business processes, namely financial management, as it is an integrated system in risk management and decision-making systems. It can generate a competitive advantage through its responses and accuracy (24, 55). Nevertheless, [51] highlighted that this advantage is only sustainable if artificial intelligence systems are designed ethically and implemented in a transparent manner. The ultimate practical impact of this study is in identifying the need for businesses to invest in the integration of artificial intelligence and ensure that these systems are designed ethically and implemented with transparency, in order to positively impact the financial management of businesses.

5. Conclusions

This work aims to analyze the partial impact of the implementation of digital technology on the financial management of businesses. We discussed some of the main challenges and prospects that digital technologies pose to businesses today. The results show that digital technologies, specifically artificial intelligence (AI), blockchain, and data analysis, have a significant impact on the operational dynamics of financial functions. These technologies affect the improvement of operational efficiency by reducing operating costs and optimizing resources, improving transparency and reliability in financial reporting in the operational aspect. An important finding is the positive impact of these digital technologies on the automation of monotonous operations and improving data analysis, empowering optimal use of resources, and reducing the processing time of financial transactions. The high cost of initial investments in digital technology, as well as the challenges related to data security, have been identified. These challenges have been considered important, recommending that organizations address them in a timely and effective manner to optimally benefit from the employment of digital technologies. At the same time, the progressive use of digital technologies has enhanced the business capability to forecast financial trends and make data-based decisions, providing a competitive advantage in the market. Finally, the effective implementation of digital technologies is also indispensable for business in the developing regions for business operations to ensure competitiveness and continuity in a dynamic and highly unpredictable business environment.

Author Contributions

Y.L.: Conceptualization; methodology; validation; visualization; supervision; project administration. F.S. GJ: Selection of literature; questionnaire design; distribution and collection of data; data analysis; comprehensive editing of the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- ernevičienė, J.; Kabašinskas, A. Explainable artificial intelligence (XAI) in finance: a systematic literature review. Artificial Intelligence Review 2024, 57, 216. [Google Scholar] [CrossRef]

- Li, B. The Role of Artificial Intelligence in Financial Risk Management. Adv. Econ. Manag. Politi- Sci. 2025, 158, 110–117. [Google Scholar] [CrossRef]

- Yi, Y. The Impact of AI on the Accounting Industry. Adv. Econ. Manag. Politi- Sci. 2025, 184, 90–95. [Google Scholar] [CrossRef]

- Al-Qudah, A.A.; Al-Okaily, M.; Yadav, M.P.P. The growth of FinTech and blockchain technology in developing countries: UAE’s evidence. Int. J. Account. Inf. Manag. 2024, 33, 383–406. [Google Scholar] [CrossRef]

- Sharma, Q. S. AI-driven financial risk management systems: Enhancing predictive capabilities and operational efficiency. Applied and Computational Engineering 2024, 69, 134–139. [Google Scholar] [CrossRef]

- Reslan, F.B.; Al Maalouf, N.J. Assessing the Transformative Impact of AI Adoption on Efficiency, Fraud Detection, and Skill Dynamics in Accounting Practices. J. Risk Financial Manag. 2024, 17, 577. [Google Scholar] [CrossRef]

- Obiya, S.O. Leveraging Blockchain and Data Analytics to Enhance Financial Inclusion in Nigeria: A Study of Blockchain-Based Information System. Int. J. Res. Sci. Innov. 2024, XI, 547–557. [Google Scholar] [CrossRef]

- Basdekidou, V.; Papapanagos, H. Blockchain Technology Adoption for Disrupting FinTech Functionalities: A Systematic Literature Review for Corporate Management, Supply Chain, Banking Industry, and Stock Markets. Digital 2024, 4, 762–803. [Google Scholar] [CrossRef]

- Makarenko, I.; Danylenko, O.; Malakhov, V.; et al. Development of Blockchain Technology in Financial Accounting. Computation 2024, 12, 250. [Google Scholar] [CrossRef]

- Zhang, C.; Zhu, W.; Dai, J.; Wu, Y.; Chen, X. Ethical impact of artificial intelligence in managerial accounting. Int. J. Account. Inf. Syst. 2023, 49. [Google Scholar] [CrossRef]

- Bahoo, S.; Cucculelli, M.; Goga, X.; Mondolo, J. Artificial intelligence in Finance: a comprehensive review through bibliometric and content analysis. SN Bus. Econ. 2024, 4, 1–46. [Google Scholar] [CrossRef]

- Alvarez, M. Blockchain Technology in Enhancing Financial Inclusion: A Study of Developing Economies. Well Testing Journal 2024, 33, 455–489. [Google Scholar]

- Mbaidin, H.O.; Alsmairat, M.A.; Al-Adaileh, R. Blockchain adoption for sustainable development in developing countries: Challenges and opportunities in the banking sector. Int. J. Inf. Manag. Data Insights 2023, 3. [Google Scholar] [CrossRef]

- Zhao, Y.; Wang, L.; Zhang, H.; et al. Integrating Advanced Technologies in Financial Risk Management: A Comprehensive Analysis. Advances in Economics, Management and Political Sciences 2024, 108. [Google Scholar] [CrossRef]

- European Central Bank. Explainability, accountability, transparency in the rise of AI: benefits and risks for financial stability. 2024. Available online: https://www.ecb.europa.eu/press/financial-stability-publications/fsr/special/html/ecb.fsrart202405_02~58c3ce5246.bg.

- Kapçiu, R.; Bushati, S.; Çerma, U.; Duçi, E.; Tabaku, E. Implementing AI in FinTech: Evidence from Albanian Financial Institutions and Establishing an Interdisciplinary AI Laboratory. Interdiscip. J. Res. Dev. 2025, 12, 47–47. [Google Scholar] [CrossRef]

- Hidayat, M.; Defitri, S.Y.; Hilman, H. The Impact of Artificial Intelligence (AI) on Financial Management. Manag. Stud. Bus. J. (PRODUCTIVITY) 2024, 1, 123–129. [Google Scholar] [CrossRef]

- Kroon, B.; Alves, J.; Martins, F. Blockchain Implementation Challenges in Finance. Journal of Distributed Ledger Technology 2021, 8, 44–59. [Google Scholar]

- Smith, J.; Zhang, L. Cybersecurity in the age of digital finance. International Journal of Digital Accounting Research 2023, 23, 45–62. [Google Scholar]

- Creswell, J. W.; Creswell, J. D. Research Design: Qualitative, Quantitative, and Mixed Methods Approaches; SAGE Publications: Thousand Oaks, CA, 2018. [Google Scholar]

- Leedy, P. D.; Ormrod, J. E. Practical Research: Planning and Design; Pearson, 12th ed., 2020.

- Hair, J. F.; Black, W. C.; Babin, B. J.; Anderson, R. E. Multivariate Data Analysis, 8th ed.; Cengage: Boston, 2018. [Google Scholar]

- Adeyelu, O.O.; Ugochukwu, C.E.; Shonibare, M.A. THE IMPACT OF ARTIFICIAL INTELLIGENCE ON ACCOUNTING PRACTICES: ADVANCEMENTS, CHALLENGES, AND OPPORTUNITIES. Int. J. Manag. Entrep. Res. 2024, 6, 1200–1210. [Google Scholar] [CrossRef]

- Nielsen, S. Management accounting and the concepts of exploratory data analysis and unsupervised machine learning: a literature study and future directions. J. Account. Organ. Chang. 2022, 18, 811–853. [Google Scholar] [CrossRef]

- Qasim, A.; Kharbat, F.F. Blockchain Technology, Business Data Analytics, and Artificial Intelligence: Use in the Accounting Profession and Ideas for Inclusion into the Accounting Curriculum. J. Emerg. Technol. Account. 2019, 17, 107–117. [Google Scholar] [CrossRef]

- Kulik, C. T.; Rozwell, C. J.; MacDonald, E.; Ghauri, P. N.; da Silva, L. Enablers, barriers and strategies for adopting new technology in accounting. International Journal of Accounting Information Systems 2024, 52, 100666. [Google Scholar]

- Lehner, O.M.; Ittonen, K.; Silvola, H.; Ström, E.; Wührleitner, A. Artificial intelligence based decision-making in accounting and auditing: ethical challenges and normative thinking. Accounting, Audit. Account. J. 2022, 35, 109–135. [Google Scholar] [CrossRef]

- Liu, M.; Wu, K.; Xu, J.J. How Will Blockchain Technology Impact Auditing and Accounting: Permissionless versus Permissioned Blockchain. Curr. Issues Audit. 2019, 13, A19–A29. [Google Scholar] [CrossRef]

- Budiasih, Y. The Influence of Digital Technology on Financial Management. Account. Stud. Tax J. (COUNT) 2024, 1, 92–100. [Google Scholar] [CrossRef]

- Kroon, N.; Alves, M.D.C.; Martins, I. The Impacts of Emerging Technologies on Accountants’ Role and Skills: Connecting to Open Innovation—A Systematic Literature Review. J. Open Innov. Technol. Mark. Complex. 2021, 7, 163. [Google Scholar] [CrossRef]

- Kureljusic, M.; Karger, E. Forecasting in financial accounting with artificial intelligence – A systematic literature review and future research agenda. J. Appl. Account. Res. 2023, 25, 81–104. [Google Scholar] [CrossRef]

- Clohessy, T.; Acton, T.; Morgan, L. The impact of cloud-based digital transformation on IT service providers: evidence from focus groups. International Journal of Cloud Applications and Computing (IJCAC) 2017, 1–19. [Google Scholar] [CrossRef]

- Gulin, D.; Hladika, M.; Valenta, I. D. Digitalization and the Challenges for the Accounting Profession. ENTRENOVA – Enterprise Research Innovation 2019, 428–437. [Google Scholar] [CrossRef]

- Han, H.; Shiwakoti, R.K.; Jarvis, R.; Mordi, C.; Botchie, D. Accounting and auditing with blockchain technology and artificial Intelligence: A literature review. Int. J. Account. Inf. Syst. 2022, 48. [Google Scholar] [CrossRef]

- Yarmoliuk, O.; Abramov, A.; Mulyk, T.; Smirnova, N.; Ponomarova, N. Digital technologies in accounting and reporting: benefits, limitations, and possible risks. Rev. Amaz. Investig. 2024, 13, 323–333. [Google Scholar] [CrossRef]

- Bahrammirzaee, A. Artificial intelligence and machine learning in finance: A bibliometric review. Research in International Business and Finance 2022, 61, 101646. [Google Scholar] [CrossRef]

- Alcázar-Blanco, A.C.; Rangel-Preciado, J.F.; Portillo-Santos, F. Incorporating Artificial Intelligence into Finance: A Bibliometric Analysis. J. Risk Financial Manag. 2024, 17, 556. [Google Scholar] [CrossRef]

- DeVellis, R. F. Scale Development: Theory and Applications; Sage: Thousand Oaks, CA, 2017. [Google Scholar]

- Dillman, D. A.; Smyth, J. D.; Christian, L. M. Internet, Phone, Mail, and Mixed-Mode Surveys: The Tailored Design Method, 4th ed.; Wiley: Hoboken, NJ, 2014. [Google Scholar]

- Norman, G. Likert scales, levels of measurement and the ‘laws’ of statistics. Advances in Health Sciences Education 2010, 15, 625–632. [Google Scholar] [CrossRef]

- Field, A. Discovering Statistics Using IBM SPSS Statistics, 4th ed.; Sage: London, 2013. [Google Scholar]

- Gordon, L.; Loeb, M. Cybersecurity: Risk management framework and investment cost analysis. Business Horizons 2021, 64, 659–671. [Google Scholar] [CrossRef]

- Ma, L.; Wang, J.; Zhou, Y. Artificial intelligence, dynamic capabilities, and corporate financial asset allocation. International Review of Financial Analysis 2024, 96(B), 103773. [Google Scholar]

- Babbie, E. R. The Practice of Social Research, 12th ed.; Wadsworth Cengage Learning: Belmont, CA, 2010. [Google Scholar]

- Fincham, J.E. Response Rates and Responsiveness for Surveys, Standards, and the Journal. Am. J. Pharm. Educ. 2008, 72, 43. [Google Scholar] [CrossRef] [PubMed]

- Baruch, Y.; Holtom, B.C. Survey response rate levels and trends in organizational research. Hum. Relat. 2008, 61, 1139–1160. [Google Scholar] [CrossRef]

- Adeyelu, A.; Ugochukwu, S.; Shonibare, B. Challenges of Digitalization for SMEs in Developing Economies. International Journal of Business Technology 2024, 18, 45–47. [Google Scholar]

- Al-Okaily, M.; Alqudah, H.; Taamneh, A.; Alqudah, G. Digital transformation and financial performance: The mediating role of accounting information systems. Technology in Society 2022, 70, 102006. [Google Scholar]

- Astuti, R.; Augustine, Y. Enhancing Financial Management through Technology Integration. Journal of Accounting and Finance Innovation 2022, 5, 78–91. [Google Scholar]

- Budiasih, Y. Digital Financial Management: Challenges in Data Security and Investment. Journal of Financial Tech Research 2024, 7, 21–38. [Google Scholar]

- Chen, M.; Huang, C.; Zhang, Y. Ethical concerns in financial AI applications. AI and Ethics 2021, 2, 215–229. [Google Scholar]

- Clark-Wilson, A.; Preston, C.; Griffiths, D.; Cornu, B. Understanding Digital Technologies and Their Impact on Society. Technology and Society Journal 2022, 10, 88–104. [Google Scholar]

- Clohessy, T.; Acton, T.; Morgan, L. The adoption of cloud computing in SMEs: an empirical study in Ireland. Journal of Small Business and Enterprise Development 2017, 24, 933–960. [Google Scholar]

- Crookes, D.; Conway, D. Digital Change and Financial Competitiveness. Management Finance Review 2018, 9, 110–126. [Google Scholar]

- Duong, L. AI in Financial Decision-Making: Opportunities and Challenges. Journal of Emerging Financial Technologies 2024, 12, 1–14. [Google Scholar]

- Han, H.; Shiwakoti, B.; Jarvis, M.; Mordi, C.; Botchie, D. Digitalization and Modern Accountancy. Journal of Finance and Tech 2023, 15, 65–78. [Google Scholar]

- Hidayat, T.; Defitri, M. Barriers to Financial Digitalization in Southeast Asia. Asian Journal of Business and Technology 2024, 13, 47–63. [Google Scholar]

- Jasim, Y.; Raewf, M. Accounting in the Digital Era. Journal of Economic and Financial Studies 2020, 11, 50–67. [Google Scholar]

- Liu, J.; Wu, Y.; Xu, Z. Big Data in Accounting and Auditing. International Journal of Accounting Information Systems 2019, 34, 100428. [Google Scholar]

- Motahhir, S.; Bossoufi, B. Key Digital Technologies in Modern Business. Journal of Information Systems and Digital Innovation 2013, 14, 89–103. [Google Scholar]

- Nguyen, P.; Tran, H. AI and Sustainable Competitive Advantage in Finance. Journal of Strategic Financial Management 2022, 19, 143–160. [Google Scholar]

- Nikou, E.; Brännback, M. Digitalization and SME Performance: A Resource-Based View. Journal of Small Business and Enterprise Development 2019, 26, 1063–1082. [Google Scholar]

- Osei-Assibey, K.; Agyemang, A. A. Cybersecurity Threats and Financial Performance: Evidence from Emerging Markets. Journal of Financial Crime 2021, 28, 1230–1246. [Google Scholar]

- Pappas, S. Artificial Intelligence Adoption in Banking and Finance. International Journal of Financial Studies 2021, 9, 67. [Google Scholar]

- Qasim, A.; Kharbat, F. F. AI and Blockchain in the Accounting Profession: Future Perspectives. Journal of Accounting Innovation 2021, 6, 45–59. [Google Scholar]

- Rahman, R.; Hossain, M. Financial Technology and Cybersecurity Risks. Journal of Risk and Financial Management 2021, 14, 217. [Google Scholar]

- Reddy, L.; Kumar, S. AI Integration in Enterprise Financial Systems. Enterprise Information Systems Journal 2024, 18, 12–28. [Google Scholar]

- Rossi, P.; Galli, A. Accounting Information Systems in the Age of Digital Transformation. Management Research Review 2022, 45, 389–405. [Google Scholar]

- Safa, M. S.; Von Solms, E. The Influence of Human Factors on Information Security. Information Management and Computer Security 2016, 24, 99–118. [Google Scholar]

- Salinas, R.; Ortega, V. Strategic Implementation of AI in SMEs. Journal of Applied Management Research 2024, 10, 55–71. [Google Scholar]

- Saunders, D.; Lewis, P.; Thornhill, A. Research Methods for Business Students; Pearson: Harlow, 2019. [Google Scholar]

- Schmidthuber, J.; Hilgers, S.; Kortsch, A.; Weking, S. Artificial intelligence in the public sector: A research agenda. Government Information Quarterly 2022, 39, 101713. [Google Scholar]

- Schneider, S.; Kokshagina, T.; Teece, T.; Appio, M. Business model innovation in transforming economies: A dynamic capabilities perspective. Industrial Marketing Management 2022, 106, 241–254. [Google Scholar]

- Shapiro, C.; Varian, H. R. Information Rules: A Strategic Guide to the Network Economy; Harvard Business School Press: Boston, MA, 1999. [Google Scholar]

- Smith, T.; Roberts, L. Operational Efficiency Gains from AI in Accounting. International Journal of Accounting Research 2023, 18, 87–102. [Google Scholar]

- Tan, P.; Low, A. The Impact of Data Analytics on Auditing Quality. Auditing: A Journal of Practice & Theory 2022, 41, 155–178. [Google Scholar]

- Tapscott, D.; Tapscott, A. Blockchain Revolution: How the Technology Behind Bitcoin and Other Cryptocurrencies is Changing the World; Penguin: New York, 2016. [Google Scholar]

- Truby, K. Artificial intelligence and finance: An overview. Oxford Journal of Legal Studies 2021, 41, 1–25. [Google Scholar]

- Uyar, S.; Kuzey, P. Accounting Research in the Digital Age: A Bibliometric Review. Meditari Accountancy Research 2022, 30, 1021–1047. [Google Scholar]

- Velte, F. The bidirectional relationship between ESG performance and earnings management – Empirical evidence from Germany. Journal of Global Responsibility 2020, 11, 407–435. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Warren, W. Jr.; Mavengere, S. W.; Brown, L. Risk Management in Digital Finance: Frameworks and Practices. International Journal of Financial Risk Management 2022, 12, 230–249. [Google Scholar]

- Xu, S.; Chen, J.; Li, M. AI-Driven Financial Forecasting Models: Accuracy and Ethical Concerns. Journal of Financial Data Science 2024, 6, 45–59. [Google Scholar]

- Zhao, Y.; Wang, F. Artificial Intelligence in Financial Services: Adoption and Challenges. Journal of Financial Services Research 2022, 61, 23–44. [Google Scholar]

- Rusu, V.; Popescu, A.; Ionescu, L.; Dumitrescu, C.; Teodorescu, D. Optimizing Romanian Managerial Accounting Practices through Digital Technologies: A Resource-Based and Technology-Deterministic Approach to Sustainable Accounting. Electronics 2024, 13, 3206. [Google Scholar]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Liu, L.; Cui, L.; Han, Q.; Zhang, C. The impact of digital capabilities and dynamic capabilities on business model innovation: the moderating effect of organizational inertia. Humanit. Soc. Sci. Commun. 2024, 11, 1–10. [Google Scholar] [CrossRef]

- Coreynen, W.; Matthyssens, P.; Vanderstraeten, J.; van Witteloostuijn, A. Unravelling the internal and external drivers of digital servitization: A dynamic capabilities and contingency perspective on firm strategy. Ind. Mark. Manag. 2020, 89, 265–277. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).