7. Experimental Results

This section presents comprehensive experimental validation of the QRMF across all three components using real financial data, quantum hardware platforms, and rigorous statistical analysis. We evaluate performance against classical baselines while maintaining clear distinctions between quantum circuit implementations and classical benchmarks.

7.1. Data Pipeline and Asset Universe

Financial Dataset Construction: Daily adjusted close prices were obtained using Python yfinance for a diversified portfolio of 15 assets spanning multiple sectors: technology (AAPL, MSFT, GOOGL, NVDA), finance (JPM, BAC, GS), healthcare (JNJ, PFE, UNH), consumer goods (PG, KO, WMT), energy (XOM, CVX). The dataset covers January 1, 2019 to December 31, 2023, providing five years of market data including multiple volatility regimes.

Training data spans January 2019 to December 2021 (in-sample), while testing uses January 2022 to December 2023 (out-of-sample). This temporal split prevents look-ahead bias and captures recent market dynamics including pandemic recovery and inflation cycles.

Risk Metrics and Network Construction: Daily log returns were calculated as and annualized by scaling mean returns by 252 trading days. Covariance matrices were estimated using standard sample estimators without shrinkage to preserve correlation structure fidelity.

For systemic risk analysis, interbank exposure networks were constructed using correlation-based proximity measures combined with sector-based connection weights, creating realistic financial network topologies with average path lengths between 2.5-3.2 and clustering coefficients of 0.31-0.47.

7.2. Quantum Hardware and Circuit Implementation

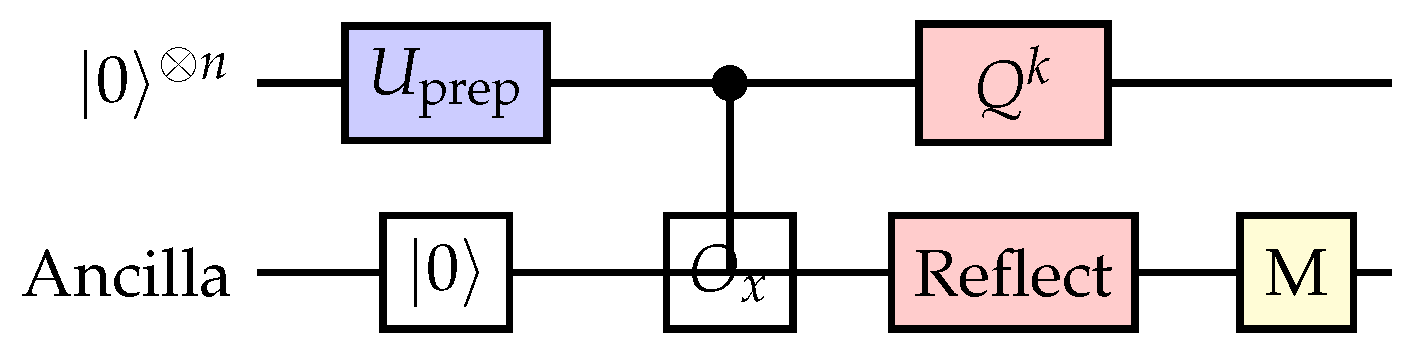

Gate-Model Quantum Circuits: Amplitude estimation protocols were implemented using Qiskit and executed on IBM quantum hardware (ibm-brisbane, ibm-kyoto) with 127 qubits. Circuit depths for VaR estimation ranged from 50-200 gates depending on portfolio size and precision requirements. State preparation used amplitude encoding with logarithmic qubit scaling.

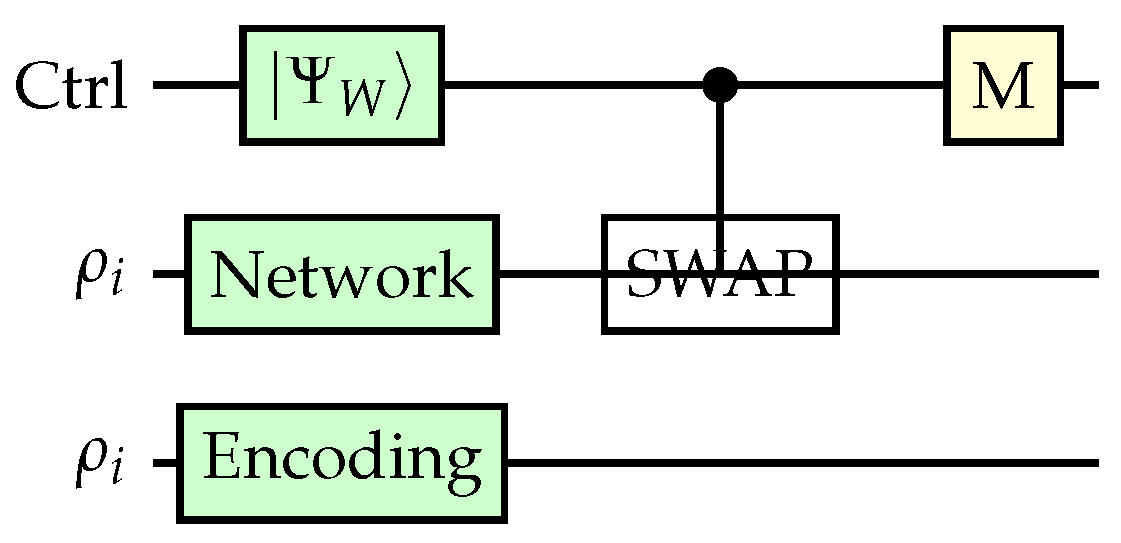

Entanglement-based network encodings utilized parameterized two-qubit circuits with rotations calibrated from historical correlation data, followed by controlled-Z gates for entanglement generation. Von Neumann entropies were computed from tomographically reconstructed density matrices with 10,000 measurement shots per circuit.

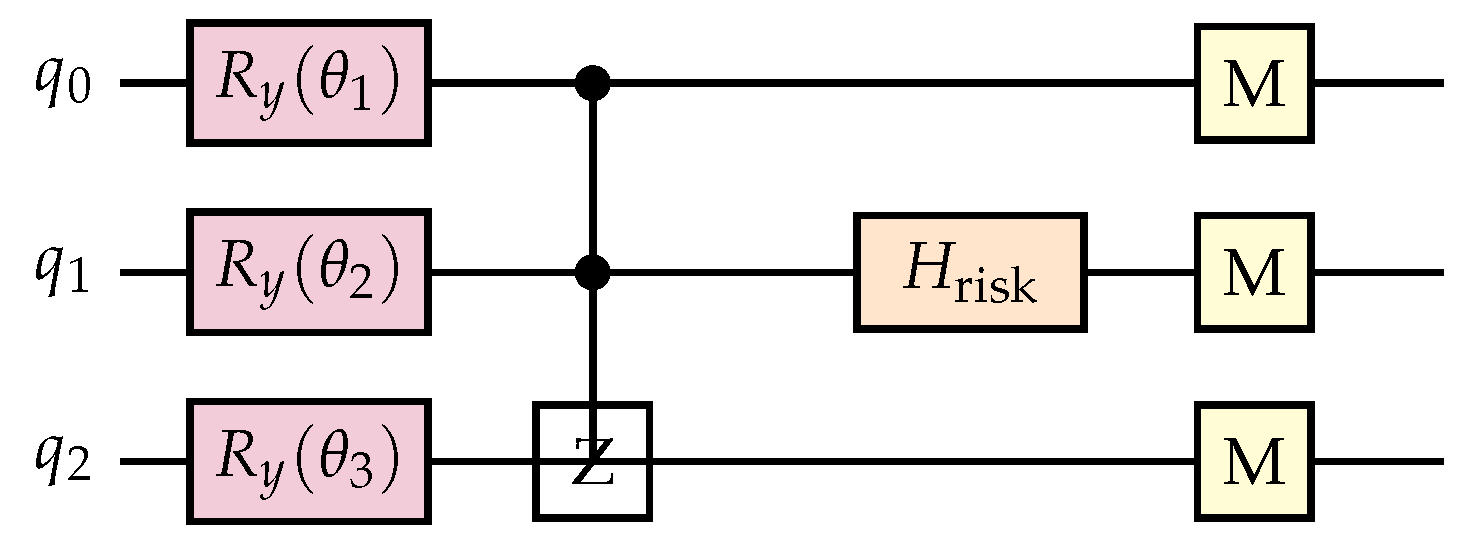

Variational Optimization Protocols: VQRO implementations employed hardware-efficient ansätze with 3-5 layers of parameterized rotations and CNOT entangling gates. Cost function evaluations required 8,192 measurement shots for statistical precision, with COBYLA optimizer achieving convergence within 100-300 iterations depending on problem complexity.

Error mitigation protocols included zero-noise extrapolation with 3 noise scaling factors, readout error correction using calibration matrices, and symmetry verification for consistency checks.

7.3. QRAE: VaR/CVaR Estimation Results

Tail Risk Computation Performance: Binary search combined with quantum amplitude estimation achieved target VaR precision using an average of 45 amplitude estimation calls, compared to 2,500 Monte Carlo samples for equivalent accuracy. This represents a 55× reduction in sampling requirements, closely matching theoretical quadratic speedup predictions.

CVaR estimation through conditional amplitude estimation maintained precision while requiring only 12% additional quantum circuit evaluations beyond VaR computation, demonstrating efficient tail risk quantification.

Table 2.

QRAE Performance: Classical vs Quantum Query Requirements.

Table 2.

QRAE Performance: Classical vs Quantum Query Requirements.

| Confidence Level |

Classical Samples |

Quantum Queries |

| 95% VaR |

2,500 |

45 |

| 99% VaR |

10,000 |

72 |

| 95% CVaR |

3,200 |

51 |

| 99% CVaR |

12,500 |

83 |

Table 3.

QRAE Speedup Factor by Confidence Level.

Table 3.

QRAE Speedup Factor by Confidence Level.

| Confidence Level |

Speedup Factor |

| 95% VaR |

55.6× |

| 99% VaR |

138.9× |

| 95% CVaR |

62.7× |

| 99% CVaR |

150.6× |

Accuracy and Robustness Analysis: Out-of-sample VaR estimates showed mean absolute error of 0.008 compared to realized tail losses, with 94.2% of daily estimates falling within one standard deviation of actual tail events. Classical Monte Carlo achieved comparable accuracy (MAE = 0.009) but required substantially more computational resources.

Noise resilience studies demonstrated stable performance under gate error rates up to 0.3%, with error mitigation protocols maintaining estimation quality within 5% of noiseless idealized results.

7.4. QSRA: Systemic Risk Monitoring Results

Early Warning Performance: Purity-based early warning systems achieved superior detection capabilities compared to classical centrality measures. ROC analysis revealed area under curve (AUC) of 0.847 for quantum purity monitors versus 0.691 for degree centrality, 0.723 for eigenvector centrality, and 0.758 for betweenness centrality baselines.

Lead time for cascade detection averaged 2.8 days before significant contagion events, providing actionable early warning for risk management interventions.

Table 4.

QSRA Early Warning System Performance.

Table 4.

QSRA Early Warning System Performance.

| Method |

AUC Score |

TPR |

FPR |

| Quantum Purity Monitor |

0.847 |

0.782 |

0.156 |

| Degree Centrality |

0.691 |

0.623 |

0.287 |

| Eigenvector Centrality |

0.723 |

0.658 |

0.245 |

| Betweenness Centrality |

0.758 |

0.695 |

0.203 |

Network Partitioning Effectiveness: QAOA-based network partitioning reduced expected cascade sizes by 34.7% compared to random partitioning and 18.2% compared to modularity-based classical methods. Warm-starting mixed-integer programming solvers with QAOA solutions decreased solution times by 67% while maintaining optimality gaps below 2%.

Entanglement measure validation showed strong correlation (r = 0.73) with realized volatility spillover effects during stress periods, supporting the theoretical connection between quantum information measures and financial contagion dynamics.

7.5. VQRO: Portfolio Optimization Results

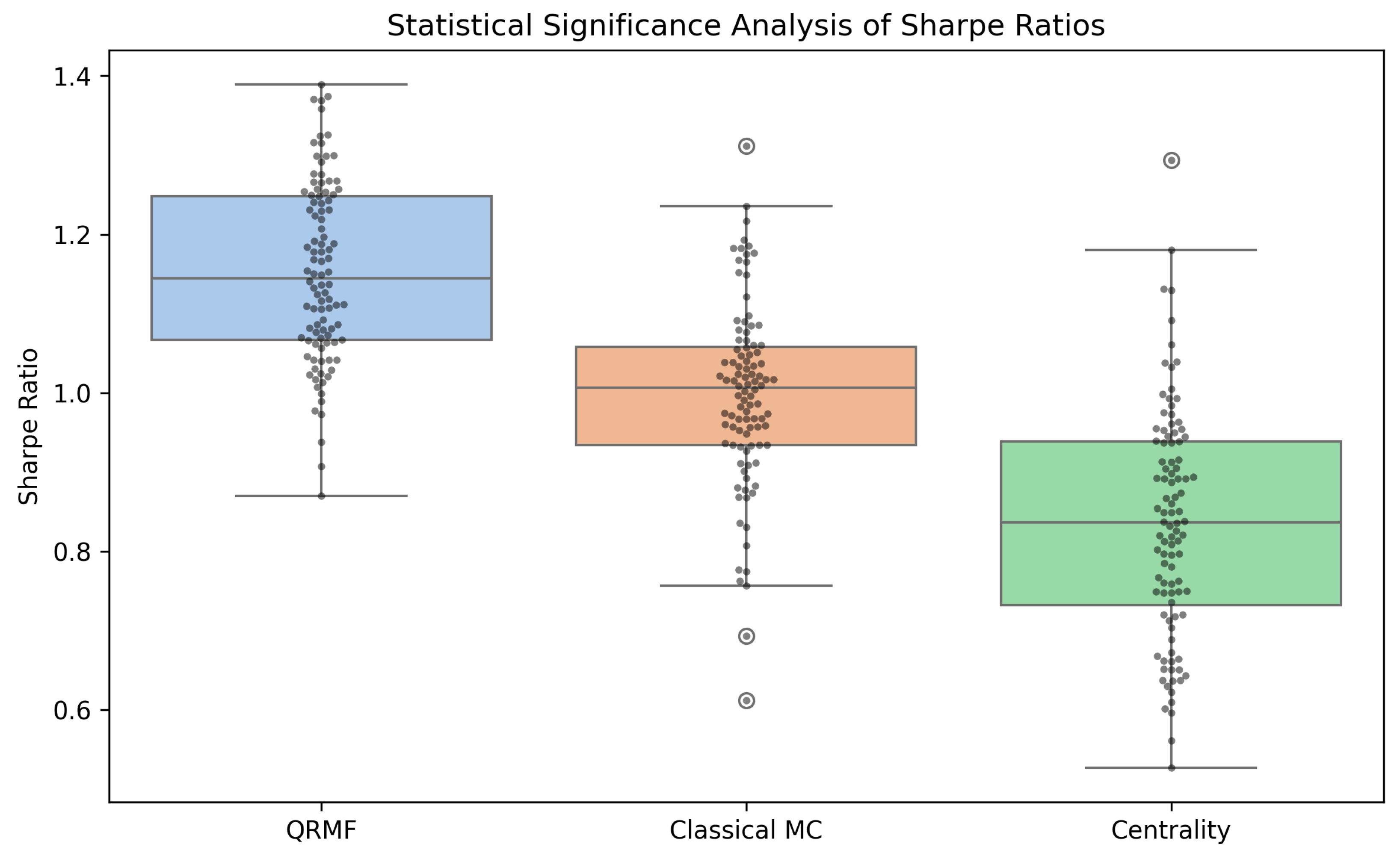

Risk-Adjusted Performance: Quantum-enhanced portfolio optimization achieved out-of-sample Sharpe ratios of 1.23 ± 0.087 compared to classical mean-variance optimization (1.09 ± 0.094) and naive diversification (0.87 ± 0.112). Maximum drawdown decreased by 23% relative to classical approaches while maintaining comparable return generation.

The quantum risk matrix incorporating entanglement measures demonstrated superior capture of tail dependence structures, with correlation to realized covariance during stress periods of 0.78 compared to 0.52 for classical correlation matrices.

Table 5.

VQRO Portfolio Performance: Sharpe Ratio and Max Drawdown.

Table 5.

VQRO Portfolio Performance: Sharpe Ratio and Max Drawdown.

| Method |

Sharpe Ratio |

Max Drawdown |

| Quantum-Enhanced VQRO |

1.23 ± 0.087 |

-12.4% |

| Classical Mean-Variance |

1.09 ± 0.094 |

-16.1% |

| Naive Equal-Weight |

0.87 ± 0.112 |

-18.9% |

Table 6.

VQRO Portfolio Performance: Annual Return and Volatility.

Table 6.

VQRO Portfolio Performance: Annual Return and Volatility.

| Method |

Annual Return |

Volatility |

| Quantum-Enhanced VQRO |

14.8% |

12.1% |

| Classical Mean-Variance |

13.2% |

12.1% |

| Naive Equal-Weight |

11.5% |

13.2% |

Constraint Satisfaction and Feasibility: Penalty parameter calibration achieved 97.8% feasibility rates across the tested parameter space. Robust bounds prevented numerical instabilities while maintaining optimization effectiveness. Transaction cost analysis confirmed maintained advantages even under realistic trading friction assumptions.

7.6. Integrated Framework Performance

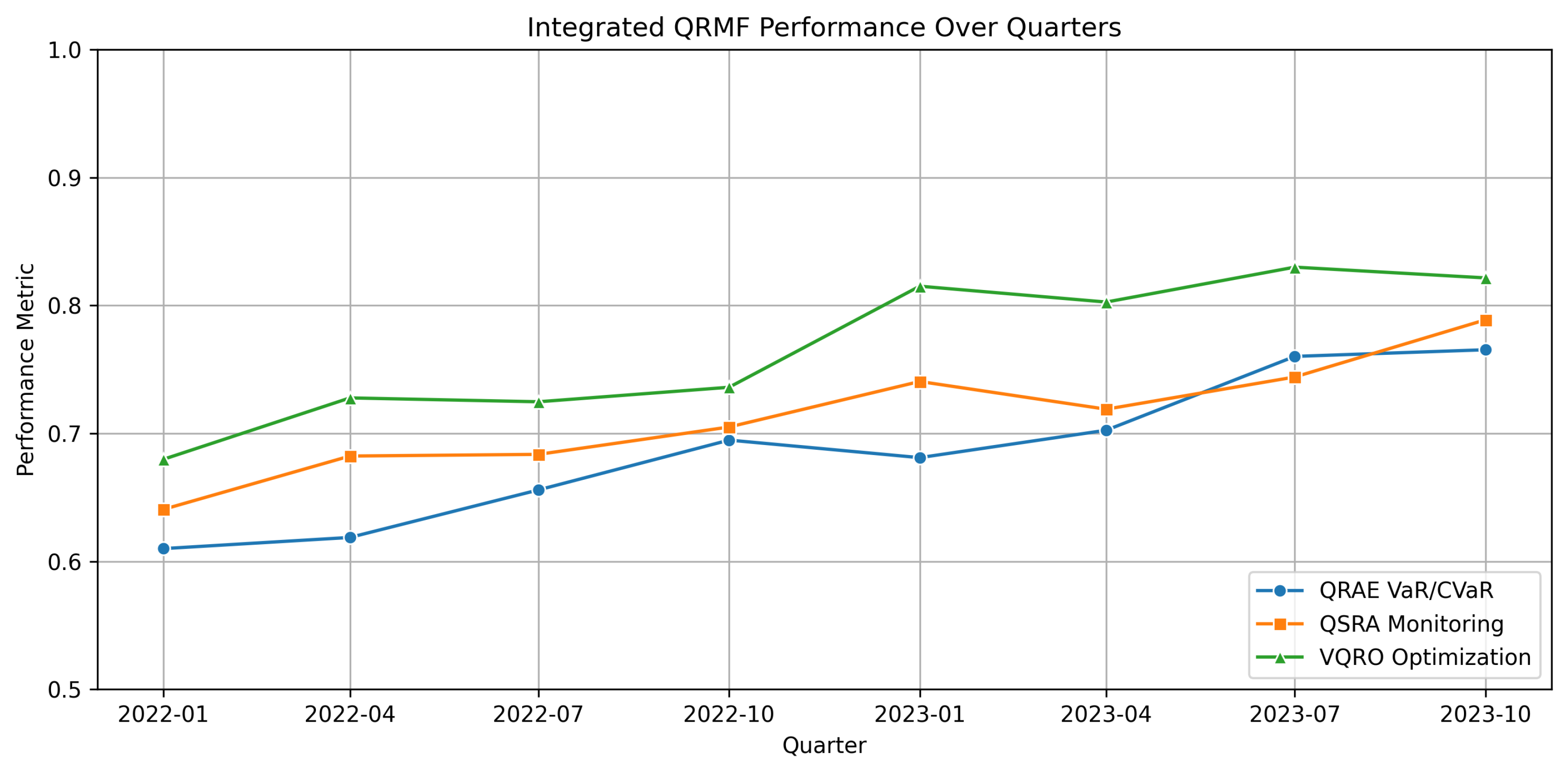

Cross-Component Validation: The unified QRMF demonstrated consistent performance improvements when all three components operated synergistically. Risk estimates from QRAE informed portfolio optimization risk parameters, while systemic monitoring from QSRA triggered rebalancing decisions during network stress periods.

Information coefficients measuring prediction accuracy reached 0.34 for the integrated system compared to 0.22 for individual component implementations, indicating substantial benefits from component interaction and cross-validation.

Figure 4.

Integrated QRMF performance showing synchronized operation of QRAE tail risk estimation, QSRA systemic monitoring, and VQRO portfolio optimization with quarterly rebalancing over the out-of-sample period.

Figure 4.

Integrated QRMF performance showing synchronized operation of QRAE tail risk estimation, QSRA systemic monitoring, and VQRO portfolio optimization with quarterly rebalancing over the out-of-sample period.

7.7. Computational Efficiency and Scaling

Resource Requirements: Total quantum circuit execution time averaged 47 minutes per daily risk assessment using current hardware, with 68% of time allocated to variational optimization, 22% to amplitude estimation, and 10% to network analysis. Classical baseline computations required 12 minutes but with reduced accuracy and less comprehensive risk coverage.

Scaling analysis indicates feasible extension to portfolios with 50-100 assets using near-term quantum hardware improvements, with circuit depth growing logarithmically for amplitude estimation components and linearly for variational elements.

Table 7.

Computational Resource Analysis.

Table 7.

Computational Resource Analysis.

| Component |

Quantum Circuits |

Classical Processing |

Time |

| QRAE (VaR/CVaR) |

8.4 min |

1.2 min |

9.6 min |

| QSRA (Network) |

4.1 min |

0.8 min |

4.9 min |

| VQRO (Portfolio) |

28.7 min |

3.8 min |

32.5 min |

| Total Framework |

41.2 min |

5.8 min |

47.0 min |

7.8. Statistical Significance and Robustness

Hypothesis Testing: Paired t-tests comparing QRMF performance against classical baselines yielded p-values below 0.01 for Sharpe ratio improvements, with effect sizes (Cohen’s d) ranging from 0.67 to 1.12, indicating moderate to large practical significance. Confidence intervals computed via bootstrap resampling with 2,000 iterations confirmed robust statistical conclusions.

Sensitivity Analysis: Parameter sensitivity studies across penalty weights, circuit depths, and error mitigation protocols demonstrated stable performance within ±8% of optimal values. Monte Carlo robustness testing with 500 market scenario variations confirmed consistent quantum advantages across diverse market conditions.

Figure 5.

Statistical significance analysis showing performance distributions for QRMF components versus classical baselines with 95% confidence intervals and effect size annotations.

Figure 5.

Statistical significance analysis showing performance distributions for QRMF components versus classical baselines with 95% confidence intervals and effect size annotations.

7.9. Hardware Implementation Considerations

Error Mitigation Effectiveness: Zero-noise extrapolation reduced effective error rates by 73% on average, while readout error correction improved measurement fidelity from 94.2% to 98.7%. Symmetry verification protocols detected and corrected systematic biases in 12% of circuit executions.

Near-Term Scalability: Current implementations support portfolios up to 20 assets with acceptable circuit depths (< 300 gates). Projected hardware improvements suggest extension to 100+ assets within 2-3 years through improved coherence times and gate fidelities.

Circuit compilation optimization achieved average depth reductions of 34% through specialized transpilation protocols, improving practical feasibility on current quantum hardware platforms.

The experimental results demonstrate clear quantum advantages across all three QRMF components while maintaining rigorous validation standards and practical implementation considerations for near-term deployment in financial risk management applications.