1. Introduction

Multi-attribute decision-making (MADM) serves as a crucial decision-support tool that faces dual challenges of information incompleteness and decision-makers' behavioral preferences in complex environments [

1,

2,

3,

4,

5,

6,

7,

8] Conventional research often treats information uncertainty processing and behavioral decision analysis as separate domains, failing to adequately address the complexity inherent in real-world decision scenarios. This study develops an innovative decision-making framework by integrating grey system theory, prospect theory, and the entropy weight method to holistically consider both information incompleteness and behavioral characteristics [

9,

10,

11,

12,

13,

14,

15].

Grey system theory [

3] is particularly suitable for handling incomplete information scenarios. Its fundamental component, interval grey numbers [

12,

13,

14,

15], captures both quantitative and qualitative uncertainty through bounded intervals, providing a mathematical foundation for addressing decision information deficiencies. Complementing this, prospect theory [

16,

17] from behavioral economics reveals three characteristic decision-making patterns under risk: reference dependence, loss aversion, and diminishing sensitivity - features that are particularly prominent in complex decisions. It is noteworthy that while existing literature [

18,

19,

20] has begun exploring prospect theory applications in MADM, most studies remain confined to precise information environments and fail to effectively incorporate uncertainty processing methods.

Regarding weight determination, information entropy [

21,

22] serves as an effective tool for measuring information uncertainty, yet its integration with interval grey numbers remains an understudied area. Particularly when evaluating significantly different alternatives, traditional fixed-weight approaches [

13] cannot adequately reflect decision-makers' differentiated considerations across alternatives.

To address these theoretical gaps, this study constructs a three-phase integrated framework of "grey number representation - behavioral modification - entropy optimization." The framework first preserves original information integrity through the algebraic operation system of interval grey numbers [

15], overcoming information distortion in data-deficient situations. Second, it incorporates prospect theory's dynamic reference point mechanism to quantify psychological expectations as value functions within grey intervals, breaking through the limitation of existing research [

18,

19,

20] that only applies to precise numerical values. Specifically, we develop a grey-entropy distance-based algorithm for alternative-specific weighting by establishing a bi-objective optimization model that considers both information entropy and solution deviations, thereby achieving dynamic weight adjustment.

The theoretical innovations of this research manifest in three aspects: (1) establishing mapping relationships between interval grey numbers and prospect value functions to enable behavioral parameter calibration under uncertainty for the first time; (2) proposing an improved grey-entropy coupling weight model that enhances weight interpretability through solution discrimination factors; and (3) developing a cumulative prospect-based grey number ranking method that demonstrates higher cognitive consistency in decision outcomes compared to conventional models [

13]. This integrated approach not only remedies the artificial separation of uncertainty processing and behavioral analysis in existing research but also provides novel insights for behavioral decision-making in complex environments.

2. Basic Concepts and Definitions

Definition 1. Suppose the decision scheme set is and the attribute indicator set is . Because the decision information is not represented by precise values, but rather by interval grey numbers, the attribute value of alternative under attribute is denoted as a non-negative interval grey number: and .

Then, the attribute vector of is denoted as

.

The decision matrix is expressed as:

Definition 2. Let the weight assigned by the decision-maker to attribute under alternative be an interval grey number ,.

Then, the interval grey weight matrix composed of

is expressed as:

Definition 3. Given the differing dimensions across attributes, it is necessary to normalize the elements in the interval-valued decision matrix. For benefit-type attributes, normalization was performed as follows:

For cost-type attributes, the normalization is performed as follows:

Let the normalized decision matrix after dimensionless processing be denoted as:

where all elements are non-negative interval grey numbers defined in [0, 1].

The

n-dimensional non-negative interval grey number vector:

is called the grey positive ideal point and is the

n-dimensional non-negative interval grey number vector.

is called the grey negative ideal point, where:

Definition 4. As a valid metric in metric spaces, Euclidean distance satisfies the following three fundamental properties: non-negativity, homogeneity, and triangle inequality. In grey space, when grey numbers degenerate to whitened values, the grey distance reduces to Euclidean distance. Thus, Euclidean distance serves as a special case of grey distance.

Consider two n-dimensional interval grey number vectors:

,

,

where ,, .

The distance between the two

n-dimensional interval grey number vectors

and

is defined as follows:

Then, the distances from each alternative to the positive and negative ideal points are calculated as:

3. Decision-Making Model Based on Prospect Theory

Prospect Theory

The prospect value is jointly determined by a value function and decision weights, expressed as:

Here,

is the prospect value,

is the value function that represents the subjectively perceived value formed by the decision maker, and

is the decision weight, an evaluative function assigned by the decision maker. If the attribute value provided by the decision maker is greater than the positive ideal point, the decision maker may perceive a gain, where the magnitude of the gain is determined by the distance between the attribute value and the positive ideal point. Similarly, the magnitude of the loss can be determined by the distance between the attribute value and the negative ideal point. Based on the function proposed by Tversky and Kahneman [

17] to measure the decision-maker's attitude toward gains and losses, the prospect value function formula for each attribute of the alternative

is as follows:

Let

denote the gain prospect function, representing a positive prospect value, and

(

) denote the loss prospect function, representing a negative prospect value. Where

and

are the gain- and loss-correlation coefficients, respectively.

is a risk-aversion parameter;

> 0. Ensuring that losses are steeper than gains.

0.89,

0.92, and

2.25 [

16].

3.2. Determining Optimal Attribute Weights

For a MADM problem with partially unknown weight information and interval grey numbers as attribute values, let the decision attribute weight vector for each alternative be or .

For each alternative , the comprehensive prospect value of each alternative should be maximized. Therefore, the optimal weights can be computed using information entropy.

Based on Definition 2, let:

Let , be the optimal solution to be determined, where , .

Then, the optimal comprehensive prospect value for alternative is given by :

By ranking the optimal comprehensive prospect values of all alternatives in descending order, we obtain the complete ranking of alternatives and identify the optimal solution.

4. Procedure

Step 1: Construct the interval grey number decision matrix based on the MADM problem, and then normalize it to obtain the standardized decision matrix .

Step 2: Determine ideal positive and negative points. Calculate the distance between each alternative’s attributes and and using Equations (10) and (11). The positive and negative prospect matrices for each alternative are then computed using (Equation (14)).

Step 3: With the goal of maximizing the comprehensive prospect value, calculate the optimal weights for gains and losses using the information entropy method (Equations (17)–(20)).

Step 4: Substitute , into to compute the optimal comprehensive prospect value , for each alternative. All alternatives were ranked in descending order of to obtain the final optimal ranking.

5. Example

Here, we refer to data from Reference [

1], considering a venture capital firm evaluating five potential investment projects:

,

,

,

, and

. Six risk-based criteria were assessed: market risk (

); technological risk (

), management risk (

), environmental risk (

), production risk (

), financial risk (

).

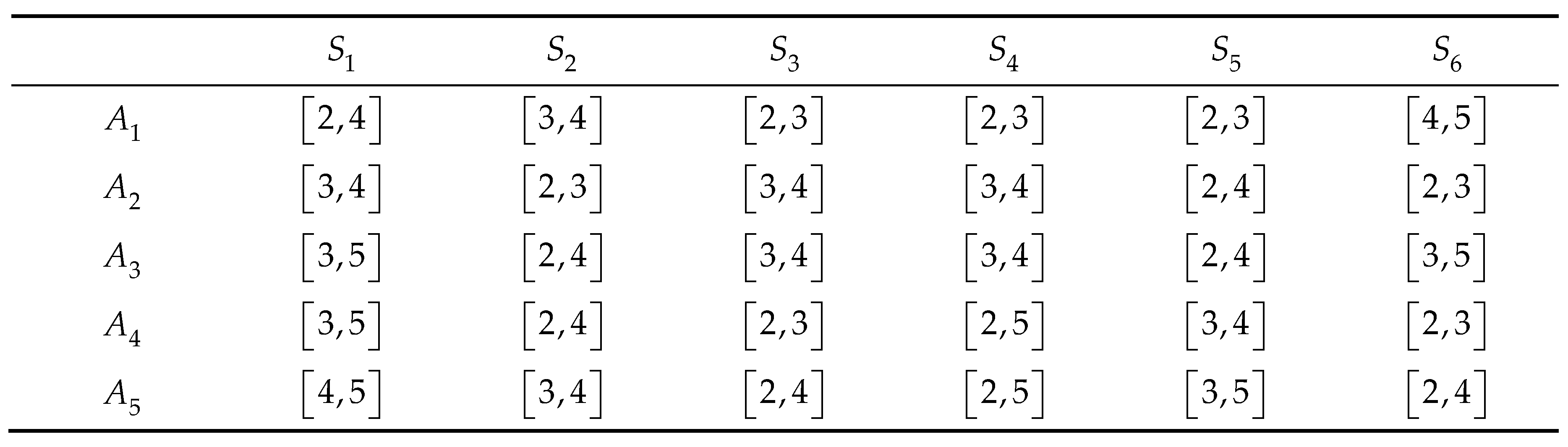

All six attributes are cost-type criteria, with evaluation scores ranging from one (low risk) to five (high risk). Decision-makers assessed each project against these criteria, providing interval-valued scores for each attribute. The resulting decision matrix is expressed as follows:

Table 1.

Information for the decision-making.

Table 1.

Information for the decision-making.

The known attribute weight information is given as:

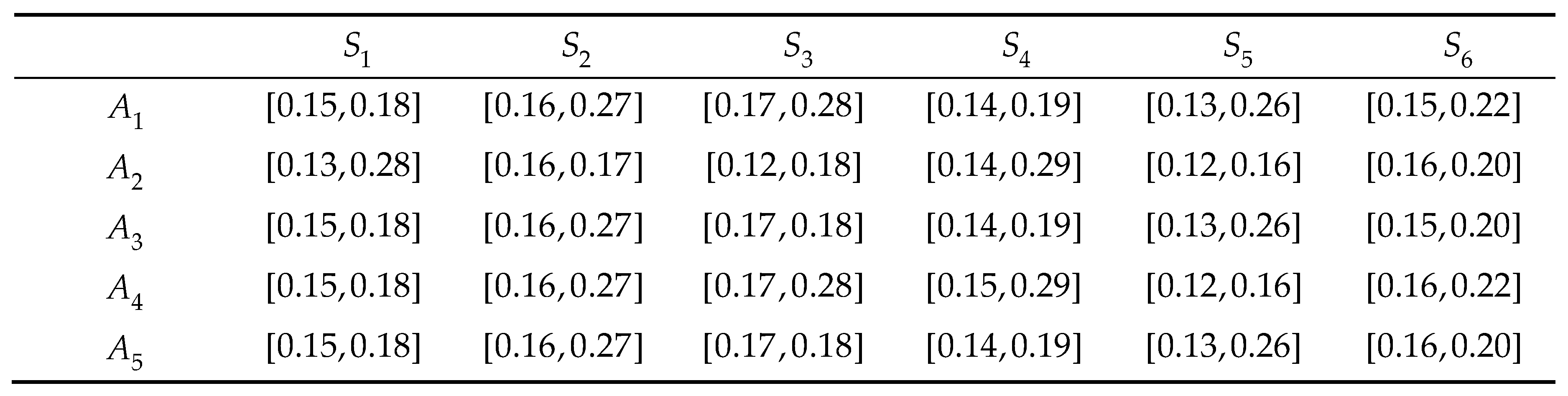

Table 2.

The initial attribute values of decision scheme.

Table 2.

The initial attribute values of decision scheme.

The normalized decision matrix is obtained according to Equation (4) as follows:

Table 3.

Normalized decision-making information after transformation.

Table 3.

Normalized decision-making information after transformation.

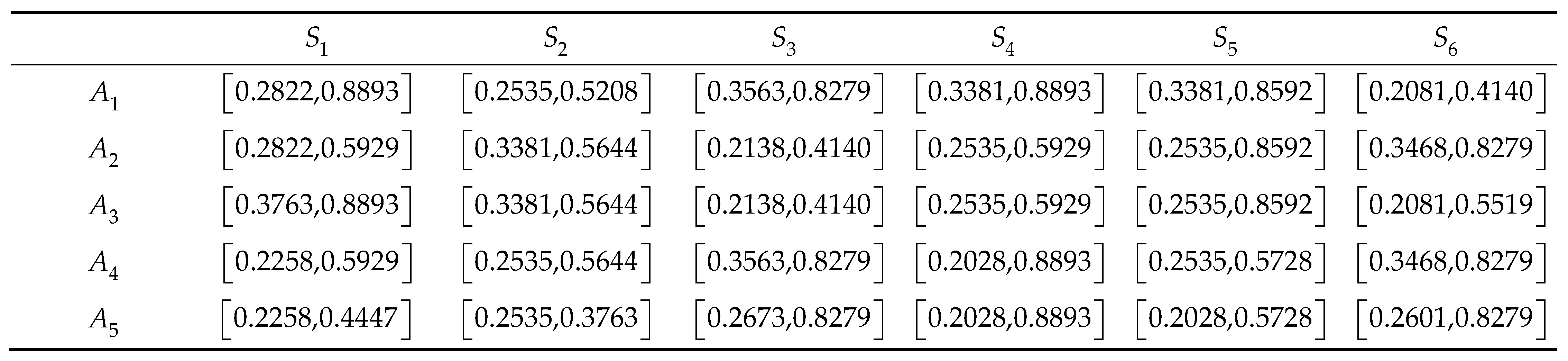

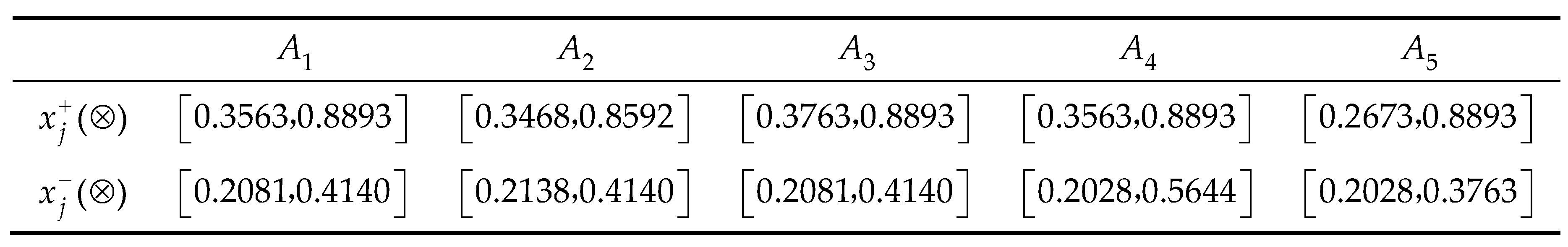

- 2.

From the decision matrix, the positive and negative ideal points are determined as:

Table 4.

The grey positive and negative ideal point.

Table 4.

The grey positive and negative ideal point.

The distances from each alternative to the positive and negative ideal points were calculated using Equations (11) and (12) respectively.

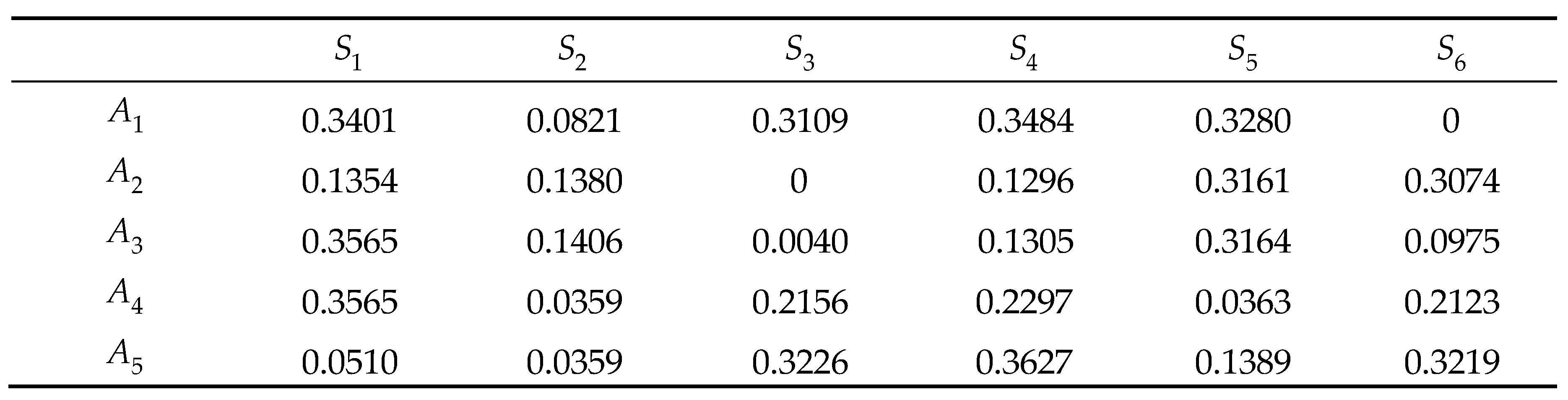

Table 5.

The gain matrix.

Table 5.

The gain matrix.

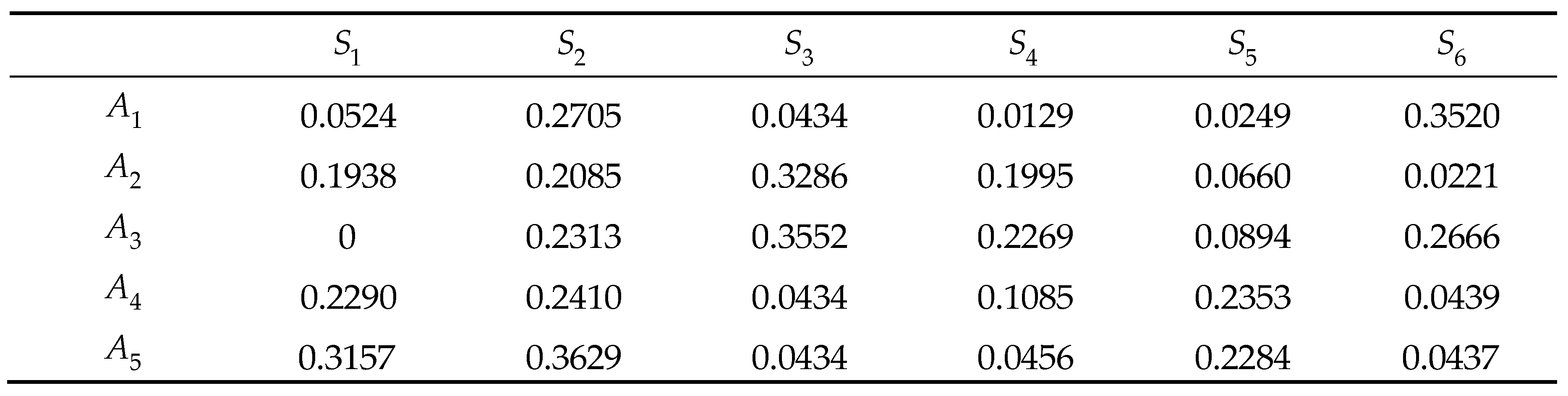

Table 6.

The loss matrix.

Table 6.

The loss matrix.

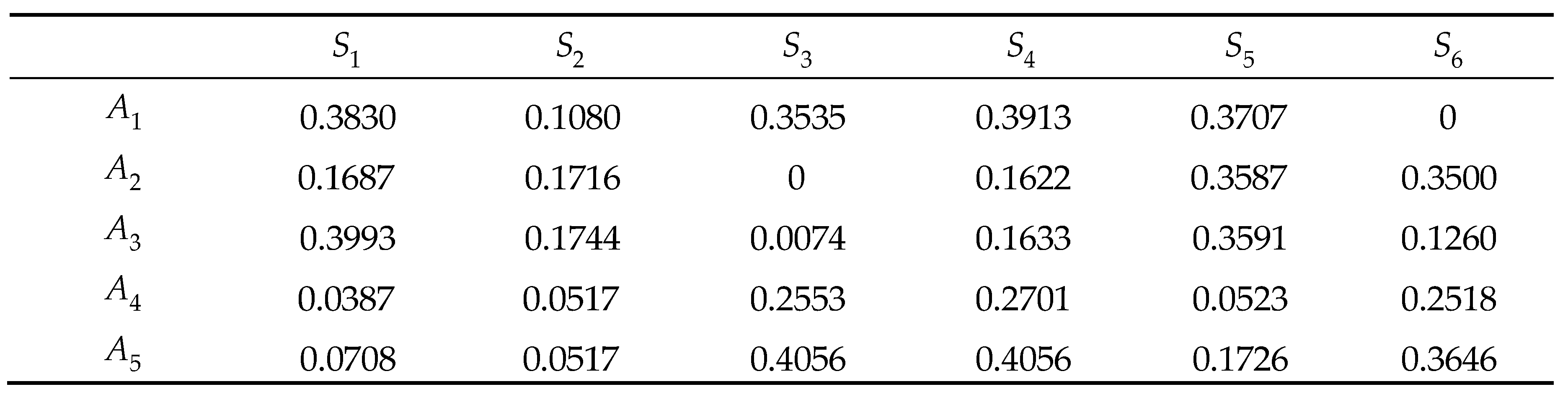

The positive and negative prospect matrices for each alternative are calculated using Equation (14).

Table 7.

The positive prospect value matrix.

Table 7.

The positive prospect value matrix.

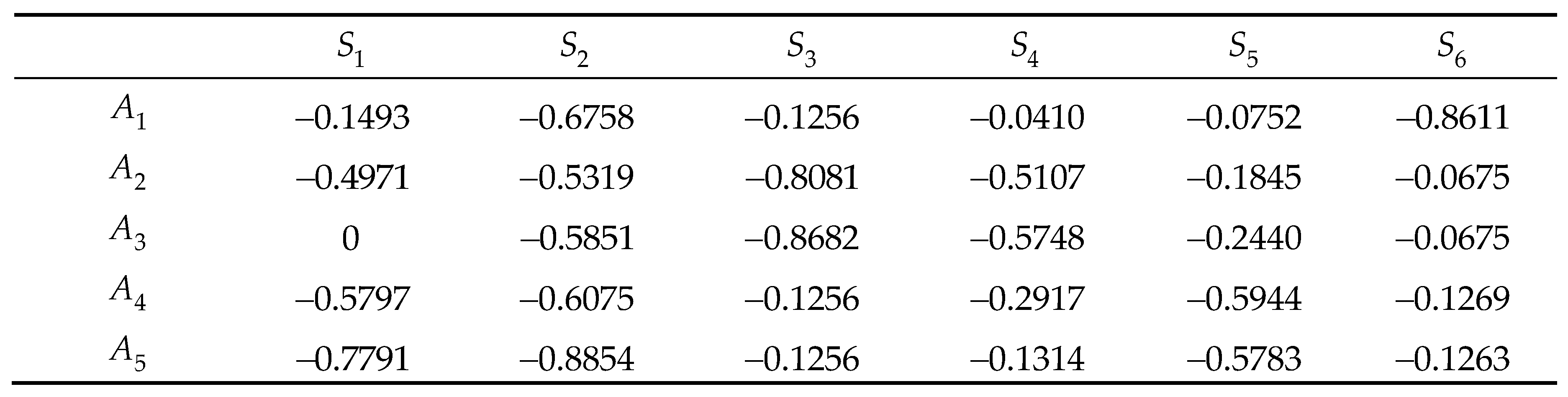

Table 8.

The negative prospect value matrix.

Table 8.

The negative prospect value matrix.

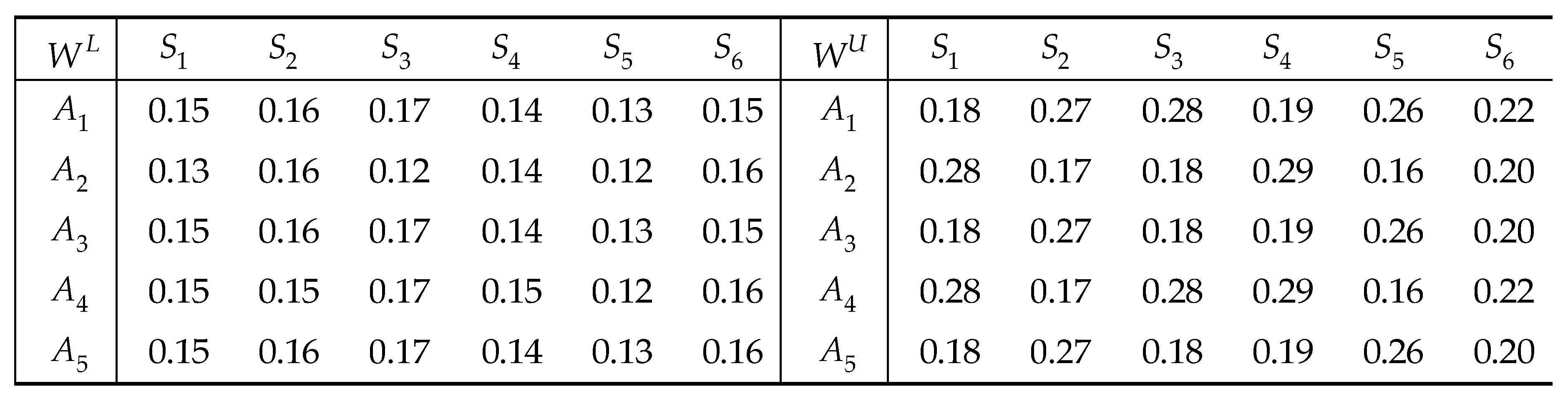

- 3.

With the objective of maximizing the comprehensive prospect value, an optimization model is established:

Table 9.

The weights for the five attributes.

Table 9.

The weights for the five attributes.

The optimal weights for the gains and losses are calculated using the information entropy method (Equations (17)–(20)) as follows:

,

,

where .

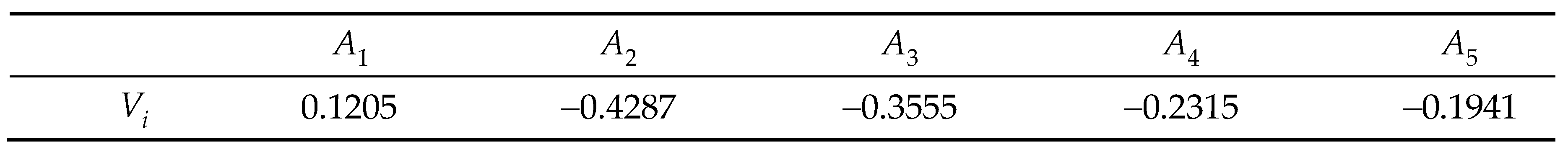

- 4.

By substituting the optimal weight vectors , into the comprehensive prospect value function, we obtain the optimal integrated prospect values for each alternative:

Table 10.

The optimal comprehensive prospect value.

Table 10.

The optimal comprehensive prospect value.

The comprehensive prospect values reveal that only yields a positive value, whereas all the others are negative. Consequently, for complex venture capital investments, is the optimal choice for project investment.

6. Conclusion

This study addresses MADM problems in which attribute weights are inconsistent and entirely unknown and attribute values are expressed as interval grey numbers. The proposed framework integrates three key components.

The interval Grey Number Distance Model: Measures the disparity between alternatives and ideal benchmarks.

Prospect Value Theory: Quantifies gains/losses based on decision-makers’ psychological preferences.

Information entropy-based weight optimization: Bijective weights are derived to balance the subjective biases.

Advantages Over Existing Models,

Behavioral Realism: Explicitly accounts for decision-makers’ varying perceptions of attribute values.

Adaptability: Suitable for high-uncertainty scenarios with incomplete weight information.

Practical Utility: The entropy-driven weighting method enhances the reliability of outcomes in complex real-world decisions.

This framework provides a robust tool for venture capital firms and other high-stakes decision environments in which risk perception and data uncertainty play critical roles.

Author Contributions

Conceptualization, F.L.; methodology, F.L.; software, F.L. and J.G.; validation, F.L.; formal analysis, F.L. and J.G.; investigation, F.L.; resources, F.L.; data curation, F.L.; writing—original draft preparation, F.L.; writing—review and editing, F.L. and J.G.; visualization, F.L. and J.G.; supervision, F.L. and J.G.; project administration, F.L. and J.G.; funding acquisition, F.L. and J.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding authors.

Acknowledgments

The authors thank the journal editor and anonymous reviewers for their guidance and constructive suggestions.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Abbreviations

The following abbreviation is used in this manuscript:

| MADM |

multi-attribute decision-making |

References

- Xu, Z. Study on methods for multiple attribute decision making under some situations. Southwest Jiao University 2003, 6–31. [Google Scholar]

- Wei G., A. Study on methods for fuzzy multiple Attribute decision making under some situations. Southwest Jiao University 2009, 13–45. [Google Scholar]

- Liu, S.; Dang, Y.; Fang, Z. Grey Systems Theory and Its Applications (10th Edition). Beijing: Science Press 2010; pp. 18-31.

- Wan, X.; Dang, Y. Multi-index grey target decision method based on adjustment coefficient. Journal of Intelligent & Fuzzy Systems 2015, 29, 769–775. [Google Scholar] [CrossRef]

- Zhu, X.; Wen, H. Application of multi-index grey target decision method in prediction of coal temperature in goaf. Combustion Science and Technology 2024, 196, 3527–3541. [Google Scholar] [CrossRef]

- Qiao, M. TODIM–VIKOR framework for development potential evaluation of forest health tourism based on the single-valued neutrosophic number multiple attribute group decision making. Soft Computing 2024, 28, 8065–8076. [Google Scholar] [CrossRef]

- Tong, C.; Pei, S.; Xiao, L. Research on effectiveness evaluation of corporate culture construction based on the neutrosophic cubic number multiple attribute decision making. Journal of Intelligent & Fuzzy Systems 2024, 46, 2219–2231. [Google Scholar] [CrossRef]

- Jundan, H.; Qian, L.; Qi, D. A novel framework for comprehensive value evaluation of cultural tourism resources with 2-tuple linguistic neutrosophic numbers multiple attribute decision making. Journal of Intelligent & Fuzzy Systems 2023, 45, 7841–7858. [Google Scholar] [CrossRef]

- Ma, K.; Weng, H.; Chen, Y. A Dynamic Landslide Warning Model based on Grey System Theory. IEEE Access 2025, 13, 22407–22419. [Google Scholar] [CrossRef]

- Luo, D.; Hao, H. Emergency management of agricultural drought disaster based on grey dynamic multi-attribute group decision method. Water Saving Irrigation 2022, 6, 24–30. [Google Scholar]

- Yang, L.; Xu, W.; Xiao, C.; Li, J. Multi-parameter Evaluation Method of Smart Community Grade Based on Multi-attribute Decision Making. Computing Technology and Automation 2022, 41, 164–168. [Google Scholar]

- Ci, T.; Liu, X. An Attribute Value Normalisation Method for Interval Number Multi-Attribute Decision Making Based on Decision Maker Preferences. Statistics Decision 2015, 3, 36–38. [Google Scholar]

- Ebrahimi, E.; Fathi, M.; Sobhani, S. A modification of technique for order preference by similarity to ideal solution (TOPSIS) through fuzzy similarity method (a numerical example of the personnel selection). Journal of applied research on industrial engineering 2023, 10, 203–217. [Google Scholar] [CrossRef]

- Chen, X.; Liu, S. Grey multiple attribute group decision-making method with partial weight information. Systems Engineering and Electronice 2009, 31, 843–846. [Google Scholar]

- Pan, X.; He, S.; Wang, Y. A new decision analysis framework for multi-attribute decision-making under interval uncertainty. Fuzzy Sets and Systems 2024, 480, 108867. [Google Scholar] [CrossRef]

- Kahneman, D.; Amos, T. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Tversky, A.; Daniel, K. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and uncertainty 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Liu, Y.; Forrest, J.; Liu, S.; Liu, J. Multi-objective grey target decision-making based on prospect theory. Control and Decision 2013, 28, 345–350. [Google Scholar]

- Zhang, L.; Li, X. Entropy-weighted TOPSIS Multi-attribute Decision-making Model and Its Applications Based on Generalized Greyness. Journal of Grey System 2024, 36, 15–26. [Google Scholar]

- Li, P.; Wang, K.; Xu, Z. A two-sided matching decision-making method based on preference-approval structure and prospect theory. Chinese Journal of Management Science 2017, 21, 592–606. [Google Scholar]

- Chen, P. Effects of the entropy weight on TOPSIS. Expert Systems with Applications 2021, 168, 114186. [Google Scholar] [CrossRef]

- Li, F.; Su, M.; Li, D. Combination evaluation model based on entropy weight method. International Conference on Machine Learning and Computer Application 2021, 1–5. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).