The human resources function has undergone substantial evolution in recent decades, transforming from an administrative necessity to a strategic business partner essential for organizational success (Ulrich & Dulebohn, 2015). This evolution has been particularly pronounced at the senior leadership level, where Chief Human Resources Officers and other senior HR executives increasingly participate in strategic decision-making and organizational transformation efforts (Boudreau & Ramstad, 2007; Lawler & Boudreau, 2015).

As organizations navigate complex challenges including post-pandemic adaptation, digital transformation, and changing workforce expectations, senior HR leadership has become increasingly vital to organizational effectiveness (Cappelli et al., 2019). However, our data reveals significant differences in how industries are approaching their HR leadership investments, with some sectors substantially expanding HR leadership capabilities while others systematically reduce these roles.

These contrasting approaches raise important questions about the strategic positioning of HR leadership in contemporary organizations. Do these patterns reflect fundamentally different strategic orientations toward HR, or do they represent industry-specific responses to particular challenges? What factors drive organizations to invest in or reduce HR leadership capabilities? How do these decisions reflect broader strategic priorities and organizational contexts?

This study addresses these questions through a systematic analysis of HR leadership migration patterns across major industry sectors. By examining the distinctive patterns of HR leadership expansion and contraction, we contribute to the strategic human resource management literature by demonstrating how organizations calibrate HR leadership capabilities based on their specific business context and strategic priorities.

Literature Review

The Evolution of Strategic HR Leadership

The evolution of human resources from an administrative function to a strategic business partner has been extensively documented in the literature. Ulrich and Dulebohn (2015) trace this transformation, noting the increasing importance of HR professionals in contributing to organizational strategy and competitive advantage. This evolution has fundamentally changed expectations for HR leadership, with senior HR executives increasingly engaged in strategic decision-making and organizational transformation efforts (Lawler & Boudreau, 2015).

Boudreau and Ramstad (2007) further develop this perspective through their “decision science” framework, arguing that HR must evolve beyond service delivery to develop sophisticated decision frameworks that connect human capital investments to strategic outcomes. This perspective positions HR leadership as central to organizational effectiveness through its role in optimizing human capital investments.

The strategic positioning of HR leadership has particular significance during periods of organizational transformation. Schweiger and Lippert (2005) examine the critical role of HR leadership in merger integration, demonstrating how sophisticated HR capabilities contribute to post-merger success through effective cultural integration and talent management. This research suggests that organizations may strategically increase HR leadership capabilities during significant transformational initiatives to manage complex people-related challenges.

Industry Context and HR Leadership Configurations

Research examining industry-specific approaches to HR leadership has identified distinctive patterns across sectors. Datta et al. (2005) demonstrate significant cross-industry variation in HR practices and their performance effects, suggesting that industry characteristics significantly influence the value and configuration of HR capabilities.

Specific industry contexts have received focused scholarly attention. In healthcare, Shanafelt et al. (2020) document the unprecedented workforce challenges following the COVID-19 pandemic, highlighting the critical role of strategic HR leadership in addressing workforce sustainability issues. In financial services, Deloitte (2022) examines how regulatory complexity and digital transformation shape HR leadership requirements, necessitating sophisticated capabilities in compliance management and organizational redesign.

The contingent relationship between industry transformation and HR leadership capabilities is examined by Christensen and Lægreid (2011) in the public sector context, documenting how government-wide reform initiatives reshape administrative functions including HR. Similar industry-specific dynamics are identified by PwC (2022) in the entertainment sector, where business model transformation fundamentally reshapes talent management requirements and HR leadership configurations.

Research Gap and Contribution

While existing research has extensively examined the strategic evolution of HR functions and the relationship between HR capabilities and organizational performance, less attention has been given to how organizations calibrate their HR leadership investments in response to specific strategic challenges and industry contexts. This study addresses this gap by systematically analyzing patterns of HR leadership expansion and contraction across major industry sectors, providing insights into how organizations strategically position HR leadership capabilities based on their particular business context and transformation needs.

By examining these patterns through both quantitative analysis of leadership migration data and qualitative assessment of strategic context, this study contributes to the strategic human resource management literature by demonstrating how organizations view HR leadership as a dynamic capability to be calibrated based on business needs rather than as a fixed administrative function.

Methodology

This study analyzes HR leadership migration patterns using data extracted from GrauntX talent analytics platform in September 2025. Our dataset comprises 200 U.S.-based companies with at least 50 employees, divided equally between those with the highest growth rates (n=100) and those with the most negative growth rates (n=100) in senior HR leadership headcount. We focused exclusively on director-level and above HR positions (including “Director,” “Vice President,” “Chief,” “Head of” titles) over the 12-month period from October 2024 to September 2025.

Organizations were systematically ranked by net change in senior HR positions, with freelancers, Greek life/student associations, and other non-corporate entities excluded. GrauntX algorithms identified senior roles using job title keywords, years of professional experience, and organizational context. The final sample included HR leadership teams ranging from 37-371 professionals across multiple sectors including Healthcare, Technology, Financial Services, Manufacturing, and Professional Services. Key variables collected included company name, industry classification, HR leadership count, and year-over-year percentage change.

Notable limitations include potential underrepresentation of organizations with lower professional networking engagement, variations in job title conventions, self-reporting bias in profile information, temporal factors affecting growth rates during the specific period, and the exclusion of smaller organizations that might include high-growth startups or specialized HR consultancies. Our comparative extreme groups design enabled identification of distinctive patterns between organizations successfully expanding HR leadership capabilities and those experiencing significant contraction.

Results

HR Leadership Migration Patterns

Our analysis reveals distinctive patterns of HR leadership migration across industry sectors, with clear clustering of growth and contraction trends.

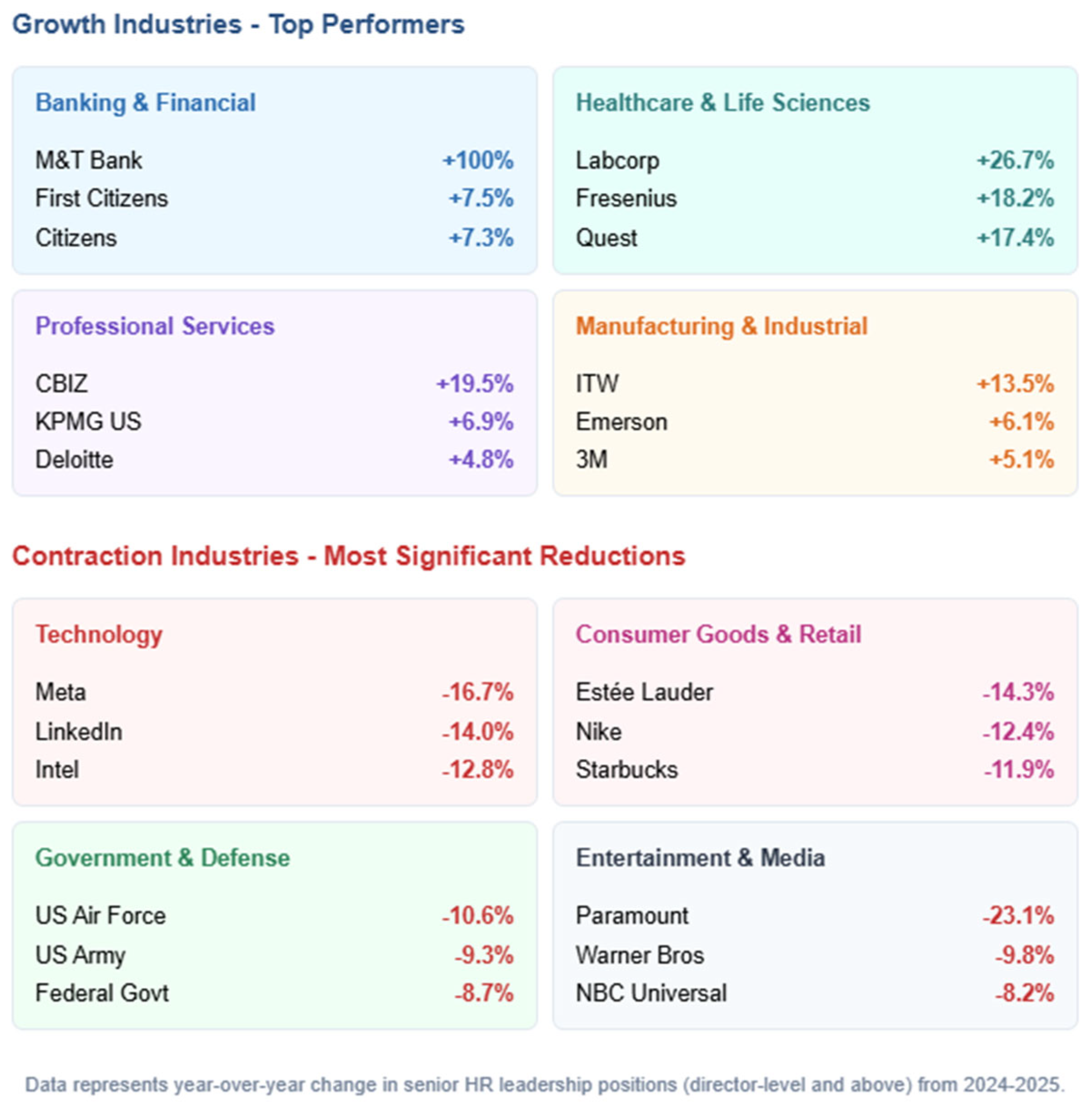

Figure 1 presents these patterns visually, highlighting the stark contrasts between industries experiencing substantial growth in senior HR leadership positions and those undergoing systematic reductions.

The data reveals a compelling narrative: traditional sectors undergoing complex transformations (banking, healthcare, manufacturing, and professional services) are substantially expanding their HR leadership capabilities, while technology, consumer goods, government, and entertainment sectors are systematically reducing these positions. These patterns reflect fundamental strategic decisions rather than simple headcount adjustments.

Growth Industries

Several sectors show remarkable expansion in senior HR leadership ranks:

Banking and Financial Services: M&T Bank demonstrates a 100% increase in HR leadership positions, with other institutions like First Citizens Bank (+7.5%), Citizens (+7.3%), and PNC (+5.5%) also showing substantial growth. This expansion reflects multiple converging factors reshaping the financial services landscape. First, banking institutions are navigating complex regulatory environments that demand sophisticated compliance and risk management capabilities extending to human capital practices. Second, the sector is undergoing significant digital transformation requiring new talent strategies, skill development, and organizational models. Third, changing customer expectations are driving banks to rethink their service delivery models, with corresponding implications for workforce design and employee experience (Deloitte, 2022). Unlike technology companies that might reduce HR leadership through automation, financial institutions appear to be expanding HR capabilities specifically to manage increasingly complex people dimensions of business transformation. M&T Bank’s dramatic growth coincided with its acquisition of People’s United Financial, suggesting that merger integration has driven significant investment in HR leadership capabilities to navigate cultural and operational alignment challenges (Schweiger & Lippert, 2005). The sector’s approach to HR expansion represents a strategic investment in transformation capacity rather than merely administrative growth.

Healthcare and Life Sciences: Organizations like Labcorp (+26.7%), Fresenius Medical Care (+18.2%), and Quest Diagnostics (+17.4%) have significantly expanded HR leadership teams. This growth reflects the healthcare sector’s response to unprecedented workforce challenges that have fundamentally reshaped talent dynamics. The prolonged COVID-19 pandemic created extraordinary strain on healthcare systems, resulting in widespread burnout, accelerated retirement, and unprecedented staff shortages (Shanafelt et al., 2020). Unlike manufacturing or financial services, healthcare’s HR expansion appears driven primarily by existential workforce sustainability challenges rather than digital transformation or business model evolution. Healthcare organizations face unique challenges in reconciling workforce shortages with growing demand, requiring sophisticated workforce planning, novel retention strategies, and innovative approaches to work design. New market entrants like CHRISTUS Health and traditional organizations like the American Heart Association (both showing 100% growth from different baseline positions) further illustrate the sector’s varied approaches to HR capability building.

Manufacturing and Industrial: Contrary to narratives of sector decline, manufacturing companies like ITW (+13.5%), Emerson (+6.1%), and 3M (+5.1%) are expanding HR leadership capabilities. This growth reflects manufacturing’s complex reinvention journey as the sector navigates several simultaneous transformations. First, advanced manufacturing technologies including automation, robotics, and IoT are fundamentally changing production processes and workforce requirements. Second, supply chain disruptions have prompted many manufacturers to reconsider their global footprint and workforce distribution. Third, changing skill requirements are creating significant talent challenges as organizations struggle to attract and develop workers with the technical capabilities needed for increasingly sophisticated operations (Cascio & Boudreau, 2014).

Professional Services: Firms like CBIZ (+19.5%), KPMG US (+6.9%), and Deloitte (+4.8%) show substantial HR leadership growth. This expansion reflects professional services’ distinctive talent-centric business model, where human capital directly drives revenue generation and competitive advantage. Unlike manufacturing or healthcare where HR expansion might support broader business transformation, professional services firms are expanding HR leadership capabilities because talent strategy is fundamentally inseparable from business strategy in knowledge-based organizations (Lawler & Boudreau, 2015).

Contraction Industries

In contrast, several sectors are systematically reducing senior HR leadership:

Technology: Nearly all major tech companies in our dataset show declining HR leadership numbers, with Meta (-16.7%), LinkedIn (-14%), and Intel (-12.8%) leading this contraction. This pattern reflects the tech sector’s distinctive approach to workforce management, characterized by several factors. First, tech companies have pioneered advanced people analytics and HR automation tools that potentially reduce the need for traditional HR leadership roles (Cappelli et al., 2019). Second, the sector has undergone significant workforce recalibrations following the pandemic-driven hiring surge, with many companies now focusing on operational efficiency. Third, tech organizations typically operate with flatter hierarchies and distributed decision-making models that may require fewer formal HR leadership positions.

Consumer Goods and Retail: Companies like Estée Lauder (-14.3%), Nike (-12.4%), and Starbucks (-11.9%) show substantial reductions in HR leadership positions. This contraction coincides with significant structural changes in the consumer sector driven by shifting consumer behaviors, digital transformation, and economic pressures. The retail landscape in particular has experienced dramatic channel shifts, with traditional retail formats giving way to omnichannel and direct-to-consumer models. This transformation has often prompted organizational restructuring focused on agility and cost efficiency.

Government and Defense: All government entities in the dataset show negative growth, with the US Air Force (-10.6%) and US Army (-9.3%) experiencing significant reductions in HR leadership positions. This pattern reflects broader public sector trends toward centralization and streamlining of administrative functions (Christensen & Lægreid, 2011).

Entertainment and Media: The entertainment sector shows some of the most dramatic reductions in HR leadership, with Paramount’s 23.1% decline exemplifying this trend. This contraction reflects the industry’s fundamental restructuring amid streaming competition, content consumption changes, and media consolidation.

Discussion

Understanding the Patterns: Strategic Implications

-

1.

Transformation vs. Efficiency

Industries expanding HR leadership are typically undergoing significant business transformation requiring sophisticated people strategies. Banking institutions navigating complex regulatory environments and digital transformation are investing in HR capabilities to manage organizational change (Deloitte, 2022).

Conversely, industries reducing HR leadership often prioritize operational efficiency or consolidate HR functions. The technology sector’s contraction likely reflects both post-pandemic workforce recalibration and greater HR process automation (Cappelli et al., 2019).

-

2.

Countercyclical HR Investment

Interestingly, sectors facing significant challenges—such as healthcare with its workforce shortages—are often increasing HR leadership capabilities. This suggests organizations invest more heavily in HR during periods of organizational stress or transformation.

Meanwhile, relatively stable sectors focus on cost control by reducing HR leadership positions, reflecting the tension between viewing HR as strategic investment versus administrative cost center (Ulrich et al., 2017).

Understanding Growth Patterns: Beyond the Numbers

When examining organizations showing 100% growth in HR leadership positions, it’s important to recognize that this metric can represent significantly different scenarios. For established organizations with substantial existing HR functions, like M&T Bank, a 100% increase represents a strategic doubling-down on HR capabilities, often in response to major organizational changes such as mergers or transformational initiatives.

In contrast, for newer market entrants or organizations previously operating with minimal HR leadership, a 100% increase might represent the addition of just one or two leadership positions—yet still signify a meaningful strategic shift toward prioritizing formal HR capabilities. Organizations like the American Heart Association fall into this category, where the percentage growth may be the same, but the absolute change and organizational context differ substantially.

These distinctions matter when interpreting the data, as they reflect different strategic positions: expansion of mature HR functions versus establishment of new HR leadership capabilities. Both represent investments in HR leadership, but with potentially different implications for organizational strategy and execution capacity (Cascio & Boudreau, 2014).

Strategic HR Leadership Calibration: Illustrative Cases

The migration patterns of HR leadership across industries can be better understood through examining organizational approaches that demonstrate different strategies for HR capability investment. Based on publicly available information and scholarly research, we can identify several distinctive approaches to HR leadership calibration:

Banking Sector: Strategic HR Expansion During Integration

Recent merger activity in the banking sector illustrates how some financial institutions approach HR leadership as a strategic enabler during significant business transformation. M&T Bank’s acquisition of People’s United Financial represents a case where HR leadership capabilities were prioritized during integration rather than treated as targets for cost reduction (Schweiger & Lippert, 2005). While specific staffing numbers are not publicly disclosed, industry analysts have noted the bank’s substantial investment in HR capabilities to navigate complex integration challenges.

This approach aligns with Schweiger and Lippert’s (2005) research on merger integration, which emphasizes that successful post-merger integration requires robust HR capabilities in several key domains:

Cultural assessment and alignment

Talent retention in critical roles

Harmonization of compensation and benefits

Communication and change management

Unlike organizations that view HR primarily as an administrative function to be streamlined during mergers, some financial institutions appear to recognize that integration success depends significantly on human capital factors that require specialized HR leadership capabilities.

Healthcare Sector: Crisis-Driven HR Capability Enhancement

The healthcare sector’s response to workforce challenges provides another distinctive approach to HR leadership investment. Major diagnostic providers like Labcorp experienced unprecedented demand during the pandemic while simultaneously confronting healthcare workforce shortages and burnout issues documented by Shanafelt et al. (2020).

Industry reports and healthcare leadership forums have highlighted how several major healthcare organizations responded by enhancing their HR leadership capabilities in critical areas:

Workforce sustainability and wellbeing

Talent acquisition in high-shortage specialties

Compensation strategy in volatile labor markets

Operating model redesign for resilience

This approach to HR capability enhancement differs from merger-driven expansion, as it represents a response to external workforce challenges rather than internal organizational transformation. As Shanafelt et al. (2020) document, the pandemic created extraordinary strain on healthcare systems, resulting in widespread burnout, accelerated retirement, and unprecedented staff shortages that demanded sophisticated HR responses.

Technology Sector: Data-Driven HR Recalibration

The technology sector presents a contrasting approach characterized by strategic recalibration of HR leadership structures. Companies like Meta have publicly discussed their efforts to reassess organizational structures following periods of rapid expansion. Tech industry analysts have observed how several major technology companies have consolidated HR functions while leveraging advanced people analytics capabilities (Cappelli et al., 2019).

This approach to HR leadership calibration is characterized by:

Consolidation of operational HR functions through technology

Greater reliance on embedded HR business partners within business units

Leveraging advanced analytics to inform people decisions

Maintaining strategic HR capabilities while reducing administrative leadership

As Cappelli et al. (2019) describe, technology companies have been at the forefront of applying artificial intelligence and advanced analytics to HR functions, potentially enabling more efficient HR operating models. Unlike simple cost-cutting, this approach represents a sophisticated evolution that aims to maintain strategic HR capabilities through different organizational structures and technology enablement.

Comparative Analysis

These contrasting approaches illustrate that HR leadership investment decisions reflect fundamental strategic positioning rather than simple administrative headcount management. Organizations calibrating their own HR leadership capabilities should consider their strategic context, transformation needs, and organizational maturity rather than simply following industry trends.

The banking sector’s integration-focused expansion, healthcare’s crisis-driven enhancement, technology’s data-enabled recalibration, and media’s transformation-driven realignment represent qualitatively different strategic approaches to HR leadership calibration, each aligned with specific organizational challenges and business contexts.

This analysis supports Cascio and Boudreau’s (2014) contingency perspective on strategic human resource management, which emphasizes that effective HR leadership configuration depends significantly on specific organizational challenges and strategic priorities rather than universal best practices.

Theoretical Implications

These findings have several important implications for strategic human resource management theory. First, they demonstrate the contingent relationship between organizational context and HR leadership configurations, supporting and extending the contingency perspective advanced by Cascio and Boudreau (2014). The distinctive patterns of HR leadership investment across industries reflect fundamentally different strategic positions rather than universal best practices, suggesting that effective HR leadership configuration depends significantly on specific organizational challenges and transformation needs.

Second, the findings extend Ulrich et al.’s (2017) conceptualization of HR as a strategic capability by demonstrating how organizations calibrate this capability based on their particular business context. The contrasting approaches to HR leadership investment across growth and contraction industries suggest that organizations view HR leadership as a dynamic capability to be adjusted based on strategic priorities rather than as a fixed administrative function.

Third, the findings contribute to the literature on technology and HR transformation by providing insights into how digital capabilities influence HR leadership structures. The technology sector’s distinctive approach to HR leadership reduction, characterized by advanced analytics and automation capabilities, suggests that technology may enable organizations to maintain or enhance strategic HR capabilities with leaner leadership structures under certain conditions.

Practical Implications

These findings have several practical implications for organizational leaders as they evaluate their own HR leadership investments:

For Organizations in Growth Industries

If your organization is expanding HR leadership, consider these priorities:

Align with strategic objectives: Ensure expanded HR capabilities directly support your organization’s strategic priorities to maximize return on investment (Lawler & Boudreau, 2015).

Develop specialized expertise: Focus on building capabilities specific to your industry’s challenges—workforce planning for healthcare, change management for manufacturing, etc. (Cascio & Boudreau, 2014).

Establish clear governance: Create structures to coordinate expanded HR leadership and prevent duplication of efforts, especially in decentralized organizations (Ulrich et al., 2017).

For Organizations in Contraction Industries

If your organization is reducing HR leadership, focus on:

Preserving strategic capabilities: Maintain critical capabilities in organizational design, talent strategy, and change management despite overall reductions (Cappelli & Keller, 2014).

Strategic technology adoption: Ensure HR technology investments truly enhance capabilities rather than simply automating existing processes (Marler & Parry, 2016).

Sustaining employee experience: Maintain focus on employee experience despite reduced HR leadership capacity (Stone et al., 2015).

Future Trends

Looking ahead, several trends may shape the continued evolution of HR leadership across industries, based both on patterns observed in our data and supporting research:

Specialized Expertise Growth: The data shows growth concentrated in sectors facing complex transformational challenges (banking, healthcare), suggesting organizations will increasingly value specialized HR expertise over generalist leadership roles. Industries with the highest growth rates appear to be investing in specialized capabilities in organizational design, talent strategy, and employee experience rather than general HR management (Ulrich et al., 2017).

Deeper Business Integration: Organizations showing the most strategic HR leadership growth (like M&T Bank and Labcorp) demonstrate that the most valuable HR leadership roles will be those most deeply integrated with business strategy rather than those operating as separate administrative functions. The pattern of selective growth even within contracting industries suggests companies are prioritizing HR roles with direct business impact (Lawler & Boudreau, 2015).

Technology as Enabler: The technology sector’s contraction in HR leadership, despite its overall business growth, suggests increasing reliance on HR technology to handle traditional functions. However, the continued investment in HR leadership by sectors undergoing complex transformations indicates that while HR technology continues advancing, it most effectively enhances rather than replaces strategic HR leadership. Organizations viewing technology as a complement to HR leadership will likely gain competitive advantage (Marler & Parry, 2016).

Conclusion

The migration patterns of senior HR talent reveal fundamental strategic positioning as organizations recalibrate their approach to talent management. These patterns provide valuable insights for strategic planning:

Industries expanding HR leadership signal focus on transformation and talent as competitive differentiators

Industries contracting HR leadership often prioritize operational efficiency or leverage technology to automate traditional functions

Successful organizations view HR leadership as a dynamic strategic capability to be calibrated based on business needs

By understanding these migration patterns, organizations can better position themselves to attract, retain, and leverage the HR leadership capabilities necessary for success in today’s complex business environment.

This study contributes to the strategic human resource management literature by demonstrating how organizations calibrate HR leadership capabilities based on their specific business context and transformation needs. Future research should examine the performance implications of different HR leadership investment strategies and explore how organizations can most effectively balance efficiency and strategic capability in HR leadership configurations.

References

- Boudreau, J.W.; Ramstad, P.M. (2007). Beyond HR: The new science of human capital. Harvard Business Press.

- Cappelli, P.; Keller, J.R. Talent management: Conceptual approaches and practical challenges. Annual Review of Organizational Psychology and Organizational Behavior 2014, 1, 305–331. [Google Scholar] [CrossRef]

- Cappelli, P.; Tambe, P.; Yakubovich, V. Artificial intelligence in human resources management: Challenges and a path forward. California Management Review 2019, 61, 15–42. [Google Scholar] [CrossRef]

- Cascio, W.F.; Boudreau, J.W. (2014). Short introduction to strategic human resource management. Cambridge University Press.

- Christensen, T.; Lægreid, P. (2011). The Ashgate research companion to new public management. Ashgate Publishing.

- Datta, D.K.; Guthrie, J.P.; Wright, P.M. Human resource management and labor productivity: Does industry matter? Academy of Management Journal 2005, 48, 135–145. [Google Scholar] [CrossRef]

- Deloitte. (2022). 2022 banking and capital markets outlook: Embracing a new trajectory. Deloitte Center for Financial Services.

- Küng, L. (2017). Strategic management in the media: Theory to practice (2nd ed.). Sage Publications.

- Lawler, E.E.; Boudreau, J.W. (2015). Global trends in human resource management: A twenty-year analysis. Stanford University Press.

- Marler, J.H.; Parry, E. Human resource management, strategic involvement and e-HRM technology. The International Journal of Human Resource Management 2016, 27, 2233–2253. [Google Scholar] [CrossRef]

- PwC. (2022). Global entertainment & media outlook 2022-2026. PwC Research.

- Schweiger, D.M.; Lippert, R.L. (2005). Integration: The critical link in M&A value creation. In G. K. Stahl, M. E. Mendenhall (Eds.), Mergers and acquisitions: Managing culture and human resources (pp. 17-45). Stanford University Press.

- Shanafelt, T.; Ripp, J.; Trockel, M. Understanding and addressing sources of anxiety among health care professionals during the COVID-19 pandemic. JAMA 2020, 323, 2133–2134. [Google Scholar] [CrossRef] [PubMed]

- Stone, D.L.; Deadrick, D.L.; Lukaszewski, K.M.; Johnson, R. The influence of technology on the future of human resource management. Human Resource Management Review 2015, 25, 216–231. [Google Scholar] [CrossRef]

- Ulrich, D.; Dulebohn, J.H. Are we there yet? What’s next for HR? Human Resource Management Review, 2015, 25, 188–204. [Google Scholar] [CrossRef]

- Ulrich, D.; Kryscynski, D.; Ulrich, M.; Brockbank, W. (2017). Victory through organization: Why the war for talent is failing your company and what you can do about it. McGraw-Hill Education.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).