1. Introduction

Global climate change presents urgent challenges that affect various aspects of life, including the business sector, which is increasingly pushed to adopt sustainability principles. This growing awareness also influences corporate and accounting practices, as sustainable accounting offers a framework for reporting that supports climate change mitigation. Delays in implementing such practices may harm businesses, the public, and the environment (Dasinapa, 2024; Wahyuni et al., 2024).

In Indonesia, the risks of climate change are amplified by its complex geography and demographics. The government and the Financial Services Authority (OJK) have actively promoted the adoption of ESG (Environmental, Social, and Governance) principles to strengthen industrial resilience and economic sustainability (Bosi et al., 2022).

Corporate Social Responsibility (CSR) and ESG-related disclosures are increasingly demanded by stakeholders who expect not only financial transparency but also environmental and social accountability. Sustainable accounting is seen not only as compliance but also as a way to enhance corporate reputation and attract investors (Wahyuni et al., 2024). High-quality ESG reporting, aligned with standards such as GRI and SASB, has been associated with improved firm reputation and stakeholder trust (Dasinapa, 2024).

In Indonesia, CSR has become a legal obligation under the Company Law and OJK regulation. While studies confirm its positive effect on market value and reputation, findings on its direct impact on financial performance remain mixed (Cahyaningati et al., 2022). Similarly, environmental performance such as energy efficiency and waste management can boost investor confidence, though effects vary across sectors (Gidage et al., 2025).

Good governance, encompassing transparency and accountability, strengthens stakeholder trust and long-term firm stability (Bosi et al., 2022; Bridoux & Stoelhorst, 2022). ROA and PBV are widely used to measure financial performance, capturing operational efficiency and market perception, respectively. However, past findings on ESG’s influence on ROA and PBV are inconsistent (Dasinapa, 2024; Triyani & Siswanti, 2024; Zou, 2024).

Despite extensive literature, few studies in Indonesia simultaneously assess CSR, environmental performance, and governance in relation to both ROA and PBV. Even fewer incorporate managerial strategy such as employee training as a moderating factor (Bosi et al., 2022). Managerial strategy reflects internal efforts to support ESG adoption. Training programs can enhance employee capacity to execute CSR, improve environmental practices, and ensure good governance (Piao et al., 2022). As part of the ESG social pillar, employee training also signals the firm’s commitment to human capital development (Chew & Chan, 2008; Koster et al., 2011; Voegtlin & Greenwood, 2016).

This study aims to examine the direct impact of CSR, environmental performance, and governance on ROA and PBV, while also analyzing the moderating role of managerial strategy. The findings are expected to offer practical insights for companies and investors evaluating ESG implementation and inform human capital oriented strategies (Mulchandani et al., 2022).

Theoretically, the research is grounded in Stakeholder Theory and the Resource-Based View (RBV), which highlight firms’ broader responsibilities and the strategic value of human capital, respectively (Nwafor et al., 2020). By integrating ESG and managerial strategy in an emerging market context, this study enriches the ESG literature and provides actionable guidance for sustainable corporate performance and policy formulation (Annesi et al., 2025).

2. Literature Review

Sustainable accounting has evolved into a strategic approach that integrates sustainability principles into corporate accounting practices. It extends beyond traditional financial reporting by incorporating environmental, social, and governance (ESG) factors into decision-making and disclosure processes. The ESG framework provides a multidimensional basis for evaluating a firm’s long-term sustainability. Its environmental pillar reflects the company’s responsibility for managing its impact on nature, including efforts to reduce carbon emissions, enhance energy efficiency, and conserve resources. The social pillar emphasizes worker protection, community engagement, and employee well-being, while the governance pillar focuses on internal structure, transparency, and accountability mechanisms. In Indonesia, the importance of ESG has been reinforced through regulatory initiatives, such as POJK No. 51/2017 and the IDX’s reporting guidelines, which encourage sustainability reporting (Ahmad et al., 2024; Shaikh, 2021).

Financial performance remains a key metric for assessing the outcomes of ESG initiatives. Price to Book Value (PBV) represents the market's valuation relative to a firm’s book value and captures external perceptions of future growth. Return on Assets (ROA) reflects internal operational efficiency. Used together, these indicators offer a comprehensive view of financial performance from both market and managerial perspectives (Ikhsan et al., 2022; Tripopsakul & Puriwat, 2022). In this context, ESG activities are increasingly viewed not only as ethical imperatives but also as strategic levers for enhancing firm value and profitability.

In terms of Corporate Social Responsibility (CSR), studies have consistently shown that transparent and consistent CSR implementation can enhance public perception, employee morale, and consumer trust. These outcomes often lead to improved financial performance and long-term competitive advantage (Amaliyah et al., 2023; Pulino et al., 2022). In Indonesia, CSR is not only voluntary but legally mandated, further embedding social contribution as part of business responsibility. Empirical studies in the region suggest that companies committed to CSR tend to outperform those that treat it as mere compliance, positioning CSR as a strategic investment rather than a cost centre.

Environmental performance also plays a critical role in financial outcomes. Firms that implement environmentally friendly practices such as waste minimization, energy conservation, and adoption of clean technologies enjoy reputational benefits and cost efficiencies, which can lead to improved access to capital and investor trust (Sharma et al., 2022). However, the degree of impact may vary across industries and regions due to differences in regulatory enforcement and environmental awareness(Holderegger & Duarte, 2024).

Governance has become a foundational pillar of business sustainability. It is associated with ethical decision-making, transparent operations, and reduced agency costs. Effective governance frameworks enhance long-term stakeholder trust and reduce risk exposure. Research confirms that firms with strong governance structures are more likely to achieve consistent financial performance and attract investment (Zhang, 2024). In emerging markets like Indonesia, where institutional maturity varies, the governance pillar is particularly critical.

Despite growing interest, literature assessing all three ESG pillars in an integrated framework remains limited. Most studies examine ESG dimensions in isolation, often overlooking the dynamic interplay among them. Furthermore, few studies have explored how internal factors, particularly managerial strategies such as employee training and strategic alignment, may moderate the ESG–performance relationship (Amaral et al., 2023; Júnior et al., 2024). These internal capabilities may influence the success of ESG adoption by embedding sustainability into daily operations.

Given these gaps, future research must adopt a more holistic perspective that incorporates contextual and organizational dimensions. In the case of Indonesia, where institutional structures and ESG maturity differ from developed economies, integrating ESG with strategic human capital development offers a promising avenue for improving both sustainability and performance outcomes.

3. Hypotheses Development

The increasing adoption of sustainable accounting principles under the ESG (Environmental, Social, and Governance) framework reflects the shifting paradigms in corporate accountability and strategic performance. ESG pillars offer an integrated lens through which firms manage environmental responsibilities, engage ethically with stakeholders, and implement transparent governance practices (Ahmad et al., 2023; Shaikh, 2021). Regulatory initiatives in Indonesia, such as POJK No. 51/2017, further emphasize this shift by mandating ESG disclosures, reinforcing the relevance of ESG as both a regulatory and strategic imperative. In line with this direction, this study posits that the integration of ESG practices with effective managerial strategy can yield improvements in market valuation (PBV) and profitability (ROA).

Corporate Social Responsibility (CSR) plays a pivotal role in enhancing firm legitimacy and stakeholder trust. Grounded in Stakeholder Theory and Legitimacy Theory, CSR is seen not only as ethical compliance but as a mechanism to build long-term reputational capital (Velte, 2023; Zou, 2024). Prior studies have shown mixed results—some affirm CSR’s positive influence on firm value (Valentine, 2024), while others indicate inconsistencies across sectors and regulatory contexts (Oktaviani & Dwi, 2023; Yusra, 2022). In Indonesia, mandatory CSR regulations have elevated disclosure standards, with evidence suggesting financial improvements for compliant firms. Based on this, the study proposes:

H1:

CSR positively influences PBV.

H4:

CSR positively influences ROA.

Environmental Performance, representing a firm's ecological efficiency, has emerged as a key predictor of financial sustainability. Anchored in the Natural Resource-Based View, firms that manage environmental risks through emission control, energy efficiency, and sustainable waste management tend to develop competitive advantages (Raja Ahmad et al., 2023). Empirical research across manufacturing and industrial sectors in Indonesia confirms that firms with strong environmental practices experience improved financial outcomes (Marginingsih & Suparno, 2024). Accordingly, the following hypotheses are advanced:

H2:

Environmental performance positively influences PBV.

H5:

Environmental performance positively influences ROA.

Good Governance is essential in reducing agency costs and ensuring operational transparency. Agency Theory posits that effective governance mitigates information asymmetry and enhances shareholder trust (Gunawan et al., 2024; Juliana et al., 2024). Studies have consistently linked sound governance practices to stronger financial metrics in both PBV and ROA (Darsono et al., 2022; Nazam & Rojuaniah, 2024). In Indonesia’s context, governance reforms have proven instrumental in attracting investor confidence and improving financial integrity (Li, 2024). Consequently, we hypothesize:

H3:

Good governance positively influences PBV.

H6:

Good governance positively influences ROA.

In addition to the direct effects of ESG, this study also explores the moderating role of managerial strategy, specifically through employee training and internal sustainability integration. Drawing on the Resource-Based View (RBV) and Contingency Theory, managerial strategy is seen as a dynamic capability that enhances the effectiveness of ESG implementation (Secioputri & Putro, 2025; Wang et al., 2025). Training employees to understand and operationalize ESG principles transforms these practices from symbolic gestures into measurable value drivers. Studies suggest that such internal alignment can amplify the positive effects of CSR, environmental practices, and governance on financial performance (Annisa Trimur Fadila & Ida Bagus Ketut Bayangkara, 2025; Meena, 2023). Accordingly, the following interaction hypotheses are developed:

H7:

Managerial strategy moderates the relationship between CSR and PBV.

H8:

Managerial strategy moderates the relationship between Environmental Performance and PBV.

H9:

Managerial strategy moderates the relationship between Good Governance and PBV.

H10:

Managerial strategy moderates the relationship between CSR and ROA.

H11:

Managerial strategy moderates the relationship between Environmental Performance and ROA.

H12:

Managerial strategy moderates the relationship between Good Governance and ROA.

In conclusion, this study integrates ESG constructs with firm performance through the lens of strategic human capital development. The hypothesized model not only addresses gaps in the existing literature—especially in emerging markets—but also seeks to offer a nuanced understanding of how internal strategies such as employee training serve as critical enablers for ESG effectiveness. This comprehensive model bridges theoretical insights with practical implications, contributing to a more grounded and actionable roadmap for sustainable corporate performance in Indonesia (Natalia & Tetiana, 2025; Zhao, 2024; Zhu & Newman, 2023).

3. Method

3.1. Research Design

This study adopts a quantitative explanatory approach using Structural Equation Modelling Partial Least Squares (SEM-PLS) to examine the effect of corporate sustainability practices particularly Environmental, Social, and Governance (ESG), Corporate Social Responsibility (CSR), and corporate governance quality—on firm financial performance. SEM-PLS is appropriate for analysing complex causal relationships, especially when the model contains both reflective and formative constructs, and when predictive accuracy and exploratory model validation are emphasized. Furthermore, this approach accommodates data that may not fully meet multivariate normality assumptions, which is common in sustainability-related datasets.

3.2. Data Sources and Sampling

The population in this study includes publicly listed companies on the Indonesia Stock Exchange (IDX) between 2018 and 2022. A purposive sampling technique was applied based on the following inclusion criteria:

The company published annual financial statements and sustainability reports for at least 3 consecutive years.

ESG score data were available from external databases (e.g., Refinitiv, Bloomberg ESG, MSCI Ratings).

Governance indicators were disclosed (e.g., board structure, committee activities).

Data were collected from:

ESG performance: Refinitiv ESG, Bloomberg ESG Disclosure Score, MSCI ESG Ratings.

Financial indicators (PBV and ROA): Audited financial statements and IDX reports.

CSR and governance data: Extracted manually through content analysis of sustainability reports aligned with GRI standards and POJK No. 51/POJK.03/2017.

3.3. Variable Measurement and Operationalization

All constructs are grounded in the literature and measured using standardized or theory-informed indicators, as follows table 1:

Table 3.

1 Summary of variables and measurement.

Table 3.

1 Summary of variables and measurement.

| Variable category |

Variable Name |

Measurement |

| Dependent variable |

Price to Book Value (PBV) |

Stock Price / Book Value per Share |

| |

Return on Assets (ROA) |

Net income/Total sales |

| Independent variable |

CSR |

GRI-based index |

| |

Environmental Performance |

Thomson Reuters score for environmental disclosure |

| |

Governance |

Thomson Reuters score for governance disclosure |

| Moderating role |

Managerial strategy |

Training employee disclosure |

3.4. Model Specification

The theoretical model assumes that ESG, CSR, Environmental Performance, and governance quality each influence financial performance, either directly or indirectly. Based on this framework, the model includes:

Main Structural Equation:

PBV = β1 .CSR + β2.EP + β3.GOV + ϵ

ROA = β1 .CSR + β2.EP + β3.GOV + ϵ

Optional Mediation/Moderation Paths:

3.5. SEM-PLS Estimation Procedure

Analysis was performed using SmartPLS 4, following a two-step evaluation:

a) Measurement Model Evaluation

Reflective constructs: Assessed for reliability using Cronbach’s Alpha, Composite Reliability, and Average Variance Extracted (AVE). Discriminant validity was evaluated via HTMT ratio.

Formative constructs (CSR): Assessed for multicollinearity (VIF) and the significance of indicator weights.

b) Structural Model Evaluation

Estimation of path coefficients using bootstrapping (5000 subsamples).

Evaluation of R², Q² (predictive relevance), and f² (effect size).

Testing of indirect (mediated) and moderated effects if modeled.

Assessment of model fit through SRMR and NFI indices (as additional reference).

To prevent common method bias (CMB), the study employed Harman’s single-factor test and full collinearity VIF checks (threshold < 3.3).

3.6. Ethical Considerations and Data Transparency

Although this study utilizes secondary data, ethical standards were strictly observed. All data sources are publicly accessible or obtained via licensed academic subscriptions. There was no collection of personally identifiable information. The full dataset, SmartPLS project file, and coding book are available on the project’s GitHub repository (to be linked post-review) for the sake of reproducibility and transparency.

4. Result and Discussion

4.1. Result

Descriptive Statistics and Univariate Analysis

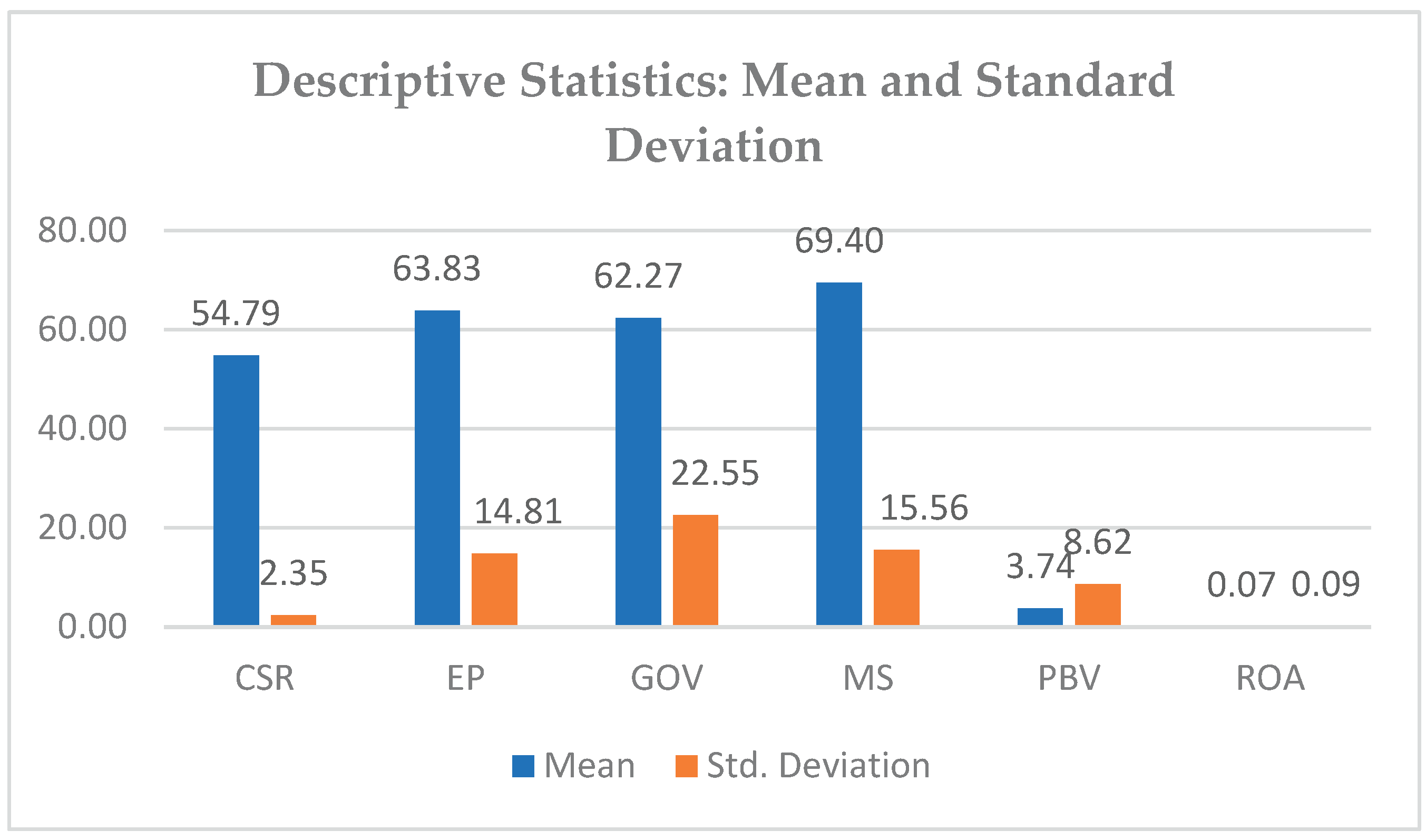

Descriptive statistical analysis was conducted to provide a general overview of the distribution and central tendency of the variables used in the study, namely: Corporate Social Responsibility (CSR), Environmental Performance, Good Governance, Managerial Strategy, Price to Book Value (PBV), and Return on Assets (ROA).

Table 4.1 presents the descriptive statistics for each variable, including minimum, maximum, mean, and standard deviation.

Figure 4.

1. Descriptive Statistics: Mean and Standard Deviation.

Figure 4.

1. Descriptive Statistics: Mean and Standard Deviation.

The following figure presents a visual comparison of the mean and standard deviation of each variable to highlight the dispersion and centrality. From the graph, Managerial Strategy appears to have the highest average, while ROA exhibits the lowest, indicating limited profitability in the sample during the observed period.

4.2. Measurement Model Evaluation (Outer Model)

In Structural Equation Modeling–Partial Least Squares (SEM-PLS), assessing the measurement model is a critical step to ensure that the latent constructs are measured accurately through their observed indicators. This study utilizes reflective indicators for constructs such as CSR, Environmental Performance, Good Governance, Managerial Strategy, PBV, and ROA, where the primary criteria for validity include outer loading values and significance levels.

As shown in Table 4.2 and the accompanying loading diagram (Gambar 4.1), all indicator loadings exceed the minimum threshold of 0.70, indicating strong indicator reliability. This suggests that each observed variable has a strong correlation with its respective latent construct, and hence, meets the requirements for convergent validity.

Moreover, no indicators exhibited loading values below 0.40, thus no item deletion was necessary. In alignment with Hair et al., (2020), loadings between 0.40–0.70 are retained if AVE and Composite Reliability remain acceptable. In this model, all criteria are satisfactorily met

4.3. Multicollinearity Assessment (VIF Test)

To ensure there is no multicollinearity among predictor constructs in the structural model, a Variance Inflation Factor (VIF) analysis was conducted. According to Kock (2015), a VIF value below 3.3 is considered acceptable, and below 5.0 is still tolerable.

As summarized in

Table 4.3, all VIF values are comfortably below the critical threshold, confirming that multicollinearity is not a concern in this model. This strengthens the robustness of the model and the trustworthiness of the path coefficient estimations.

4.4. Structural Model Evaluation (Inner Model)

After ensuring the quality of measurement through the measurement model (outer model), the next stage is to test the structural model (inner model). The purpose of this test is to find out the strength of relationships between latent constructs and test hypotheses in the research model. The test was carried out using the bootstrapping technique of 5000 subsamples in SmartPLS.

Table 4.4 presents the results of path estimation (path coefficients), t-statistical values, and p-values used to test hypothesis significance.

Results of Significance Test and Hypothesis Interpretation

Based on the test results, several key findings were obtained as follows:

CSR (X1) had a significant positive influence on PBV (Y1), with a coefficient of 0.115, t-statistic of 2.154 (>1.96), and p-value of 0.016 (<0.05). This suggests that a company's involvement in social responsibility has an impact on market perception, and the value of a company's books.

Environmental Performance (X2) also had a significant effect on PBV, with a coefficient of 0.229, t-statistic of 3.462, and p-value of 0.000. This reinforces the argument that the market rewards companies that demonstrate a commitment to energy efficiency, waste management, and emissions reduction.

Good Governance (X3) was significant for PBV, with a coefficient of 0.101, t-statistics of 1.813, and p-value of 0.035. Good governance creates trust and increases the company's credibility in the eyes of investors.

In terms of operational performance, CSR (X1), Environmental Performance (X2), and Good Governance (X3) also had a significant effect on ROA (Y2), which showed a p-value below 0.05 and a t-statistic, respectively above 1.96. It confirms that sustainability is not just an image but is closely linked to the efficiency of asset use.

Moderation Test by Managerial Strategy

To test whether the Managerial Strategy (M) plays a moderator role, a test was carried out on the interaction between M and each variable independent of PBV and ROA.

The results show:

Managerial strategies are not significant in moderating the CSR relationship → PBV and ROA.

It is also not significant in moderating the Environmental Performance → PBV and ROA.

However, managerial strategies significantly moderate the relationship between Good Governance → PBV (p = 0.021) and Good Governance → ROA (p = 0.007).

This means that the quality of a company's internal strategy strengthens the relationship between good governance practices and improved financial performance. This shows the importance of alignment between governance structures and effective managerial strategies.

4.5. Coefficient of Determination (R²) and Predictive Relevance (Q²)

Table 4.

5. Coefficient of Determination (R²).

Table 4.

5. Coefficient of Determination (R²).

| Dependent Variable |

R-square |

| PBV (Y1) |

0,076 |

| ROA (Y2) |

0,085 |

The R² value for PBV is 0.109, meaning that the model explains 10.9% of PBV variations, the remaining 89.1% is influenced by other variables outside of this model.

The R² value for ROA is 0.123, meaning that 12.3% of ROA variations are explained by CSR, environment, and governance.

Although this R² is relatively low, it is common in models involving complex managerial and social variables and reinforces the argument for the need for additional variables in future models.

Since the value of Q² > 0, all independent constructs have predictive relevance to the dependent variables, even if the levels are still low to moderate.

4.6. Model Fit (SRMR)

| Dependent Variable |

Q2 |

| PBV (Y1) |

0,061 |

| ROA (Y2) |

0,078 |

Table 4.

7. Goodness of Fit (SRMR).

Table 4.

7. Goodness of Fit (SRMR).

| Fit Index |

Value |

| SRMR |

0,061 |

The Standardized Root Mean Square Residual (SRMR) value of 0.069 < 0.08, indicates that this model as a whole has a good fit, as per the standards of Hair et al. (2019). This means that the difference between observed and predicted covariance is low, and the model can be said to be able to adequately represent the data.

4.1. Discussion

The results of the study show that Corporate Social Responsibility (CSR) has a significant positive effect on company value as measured through Price to Book Value (PBV). These findings confirm that companies that are active and transparent in disclosing CSR activities are more valued by the market because they are considered to have a long-term commitment to their stakeholders and the social environment. This is in line with Stakeholder Theory, which states that companies are not only accountable to shareholders, but also to wider stakeholders (Freeman, 1984). In addition, Legitimacy Theory explains that CSR functions as a company's mechanism to gain social legitimacy (Hamidu et al., 2015), which is then reflected in market valuation. Studies by (Hadiwibowo & Purwanti, 2024) also confirm that structured CSR practices can increase investor confidence and positive market perception of companies.

Nevertheless, the influence of CSR on PBV can vary depending on the geographical and industry context. In Indonesia and Malaysia, CSR implementation is influenced by regulatory strength, social awareness, and different stakeholder pressures. In sectors with low ESG awareness, the influence of CSR on PBV may not be very significant. This is in line with the findings of Thanetsunthorn & Wuthisatian, (2025), who show that the effectiveness of CSR as a positive signal depends on the level of market expectations and institutional structure. Therefore, CSR should not be seen solely as a regulatory burden, but rather as a strategic investment in building a reputation and increasing the company's long-term value in the eyes of investors.

This study shows that Environmental Performance (EF) has a significant positive effect on Price to Book Value (PBV). These findings reinforce the argument that a company's good environmental performance, such as emissions management, waste, and energy efficiency, can boost market confidence. Investors are increasingly paying attention to the aspect of environmental sustainability as an indicator of the company's long-term responsibility. This is in line with Stakeholder Theory and Legitimacy Theory, which explain that companies that show commitment to environmental issues gain stronger social support and market legitimacy (Sharma et al., 2022; Yunarsih et al., 2023). Previous research by (Helmina et al., 2024) also confirmed that companies with high EF tend to be more appreciated by investors through an increase in market value.

However, EF's influence on PBV is highly dependent on the industry context and the presence of supportive regulations. In developing countries such as Indonesia and Malaysia, although regulations related to sustainability reporting are starting to develop, their implementation is not evenly distributed across sectors. Companies that are proactive towards environmental issues have the opportunity to create value differentiation in the market. Therefore, EF implementation is not only a form of compliance, but can be used as a strategic tool to create sustainable added value (Mausuly & Prasetyowati, 2022; Onyeka & Orajekwe, 2024). Thus, companies that want to increase PBV in the long term should make environmental issues an integral part of their business strategy.

The results of the study show that Good Governance (GG) has a significant positive influence on PBV. Good corporate governance, including transparency, accountability, and effective oversight can increase investor confidence and create a strong perception of stability. This is in line with Agency Theory, which states that governance practices reduce conflicts between management and owners, as well as reduce agency costs (Jensen et al., 1976). In addition, Stakeholder Theory also underlines that fair governance creates strong relationships with all stakeholders, which ultimately increases the company's value. Research by Harmaen et al., (2022) and Trisnaningsih & Rahmasari, (2022) reinforces these findings, by showing that GG is an important factor in investment decisions.

However, the influence of GG on a company's value can also be limited by the company's regulatory structure and culture. In Indonesia and Malaysia, the implementation of good governance still faces challenges in terms of internal oversight and compliance with the code of conduct. In some more tightly regulated sectors such as banking, the positive impact of GG on PBV is seen to be stronger than other sectors that are less regulated. This emphasizes the need for public policies that encourage improvement of governance practices, as well as strengthening the company's internal capacity in implementing the principles of good governance (Beta & Kalalo, 2023; Yuli Soesetio, 2023). In this context, GG is not only a formal compliance framework but is a strategic instrument for creating long-term value and competitiveness.

The results show that CSR has a significant positive influence on Return on Assets (ROA), indicating that corporate social responsibility practices not only impact reputation, but also increase operational efficiency and profitability. These findings are consistent with Stakeholder Theory, which states that meeting stakeholder expectations can strengthen social relationships and consumer loyalty, thereby driving increased revenue. Previous research by Lestari et al., (2024); Wijaya & Iryanto, (2024) also found that companies that consistently implement CSR tend to have better financial performance.

Nonetheless, the effectiveness of CSR on ROA can vary depending on the sector and regulatory context. In more heavily regulated sectors, CSR tends to be integrated into business strategies and has a real impact on financial performance. In contrast, in the informal sector or those that do not yet have high ESG awareness, CSR is often treated as an additional burden. Therefore, the integration of CSR in operational strategies and the quality of their implementation are determining factors to the extent to which CSR can convert social value into economic benefits (Ayamga et al., 2024; Hermawan et al., 2023).

Environmental performance was also found to have a significant positive influence on ROA. Companies that maintain energy efficiency, waste management, and carbon emissions, are generally able to reduce operational costs and reduce legal and reputational risks. This reinforces the Agency Theory, which states that good environmental performance creates an incentive for management to act efficiently and responsibly. Research by Pramudiati et al., (2022) shows that sustainability initiatives in environmental management are proven to increase competitiveness and long-term profitability.

However, as with CSR, the impact of environmental performance on ROA is greatly influenced by the level of regulatory maturity and industry concern for sustainability. In traditional sectors that are less exposed to regulatory pressures, environmental initiatives may not yet be fully monetized in the form of direct benefits. In contrast, sectors such as energy or manufacturing that face high regulatory pressures tend to be more motivated to tailor business strategies to environmental goals. Therefore, the integration of environmental performance into the company's managerial system must be adjusted to sector dynamics and market demands (Fauzi, 2022; Khanh et al., 2024).

The results of this study show that Environmental Performance (EP) has a positive and significant effect on Return on Assets (ROA). These findings reinforce the argument that companies that successfully manage environmental issues—such as energy efficiency, emissions control, and waste management—not only achieve social legitimacy, but also increase long-term profitability. In other words, good environmental sustainability practices are not solely philanthropic, but rather operational efficiency strategies that contribute directly to increasing ROA. Previous studies have also confirmed the same thing, where investment in environmentally friendly technology is able to reduce operational costs while increasing competitiveness (Helmina et al., 2024; Pramudiati et al., 2022).

Theoretically, these findings are in line with the Natural Resource-Based View (NRBV) which states that natural resources and sustainable environmental management can be the basis for competitive advantage. In addition, from the perspective of Stakeholder Theory, companies that pay attention to environmental issues will gain higher trust from investors, customers, and the wider community, which in turn improves reputation and revenue stability (Setiawati & Hidayat, 2023). However, sectoral and regulatory variability can affect the magnitude of this impact. For example, in the renewable energy sector, the effect tends to be stronger than traditional industries that still face limitations in sustainability infrastructure (Fauzi, 2022). Therefore, the results of this study not only confirm the importance of environmental performance in increasing ROA but also signal to management that environmental investment is an essential part of business strategy to ensure profitability and long-term sustainability.

The findings of the study show that Good Governance (GG) has a positive effect on Return on Assets (ROA), which shows that good corporate governance contributes to the efficiency of asset management and the achievement of profitability. Based on Agency Theory, the application of governance principles such as transparency, accountability, and independence of the board of directors can reduce agency costs and encourage more rational and efficient decision-making. The study of Christy & Sufiyati, (2023) and Nurkhin et al., (2023) corroborates that good governance mechanisms minimize conflicts of interest and improve internal control structures, which have a direct impact on financial performance.

However, the success of the implementation of GG in increasing ROA is also greatly influenced by institutional and organizational culture factors. In countries such as Indonesia and Malaysia, the implementation of the GG principle often faces challenges such as weak external oversight, limited human resource capacity, and inconsistencies in regulatory implementation. In this context, the role of regulators is important to strengthen supervisory policies and encourage companies to make good governance part of their long-term strategy. These findings confirm that good governance is not just compliance with formalities but is an important foundation in improving the competitiveness and sustainability of companies (Oshim & Igwe, 2024; Rizal & Amran, 2022).

The research findings show that managerial strategies do not significantly moderate the relationship between CSR and a company's market value (PBV). This means that the interaction between social responsibility practices and managerial approaches does not provide a meaningful reinforcement of investor perception. These results are consistent with a study by Park & Byun, (2022) which states that in the context of immature regulations such as in Indonesia, managerial strategies have not played a sufficient role in encouraging the effectiveness of CSR to increase company value. This is also in line with the Contingency Theory, that the effectiveness of a strategy depends on the compatibility between external context and organizational characteristics, which does not seem to be optimally implemented in CSR management.

Meanwhile, managerial strategies also did not show a significant moderation role in the relationship between environmental performance and PBV. This indicates that the strategy implemented by management has not been able to raise environmental performance to a strong signal for the market. Research by Daromes & Ng, (2023) and Lee & Hooy, (2024) also supports that in the context of developing countries, external factors such as regulation and public awareness determine market perception of environmental issues more than the company's internal strategy. It is different from Good Governance, where it is found that managerial strategy functions as a significant moderator. The interaction between good governance and managerial strategy has been proven to strengthen its impact on PBV. This supports the Agency Theory that responsible management and a good governance structure will build investor trust and increase the market valuation of the company.

5. Conclusions

This study aims to systematically investigate the relationship between corporate sustainability practices—represented by Corporate Social Responsibility (CSR), Environmental Performance (EF), and Good Governance (GG) and corporate financial performance, through two main indicators, namely Price to Book Value (PBV) as a representation of market value and Return on Assets (ROA) as an indicator of internal profitability. Using the Structural Equation Modeling–Partial Least Squares (SEM-PLS) approach, this study found that the three dimensions of ESG have a significant and positive influence on financial performance, both in terms of market perception and in terms of operational efficiency. These findings reinforce the position of sustainability as a strategic foundation in modern business, which not only serves to fulfill ethical and social obligations, but also serves as a key driver of long-term economic value creation.

From a theoretical point of view, these results are strongly intertwined with Stakeholder Theory, which emphasizes the importance of symbiotic relationships between companies and all stakeholders in building reputation and legitimacy. In addition, Legitimacy Theory has also received support, especially in the context of how companies gain social acceptance through CSR practices and sustainability reporting. Meanwhile, Agency Theory becomes relevant when good corporate governance is able to reduce information asymmetry and increase managerial accountability. This study also evaluated the role of managerial strategy as a moderation variable and found that its effect was only significant in strengthening the relationship between good governance (GG) on market value and company profitability. However, the influence of MS moderation on CSR and EF is not significant, indicating that there are still challenges in translating managerial strategies into effective strengthening of the social and environmental dimensions.

Thus, overall, this study confirms that the integration of ESG into a company's strategic framework is not an optional option, but rather a prerequisite for maintaining the company's competitiveness and value. However, the effectiveness of strengthening ESG through managerial strategies is not uniform; Its success is largely determined by the institutional context, organizational readiness, and human resource capabilities in internalizing sustainability values into daily business decision-making. The study enriches the literature by providing empirical evidence from the context of developing countries, as well as opening up space for further exploration of the conditions that enable ESG to be a catalyst for overall business performance.

From a practical point of view, these results provide strategic guidance for managers, policymakers, and company stakeholders. Companies need to be more active in integrating CSR, environmental efficiency, and good governance practices into their core business strategies, not just as complementary elements or symbolic efforts. These implications include the importance of ongoing training for employees in understanding ESG values, increased transparency of sustainability reporting, and the adoption of internal audit systems that support sustainability accountability. On the other hand, the finding that managerial strategies do not consistently moderate the relationship between ESG and financial performance indicates the need for increased strategic capacity within organizations, so that sustainability values do not just stop at the policy level but are truly internalized in the decision-making process.

Policy implications are also important to emphasize. Regulators such as the Financial Services Authority (OJK) and the Indonesia Stock Exchange (IDX) are expected to not only require sustainability reporting but also encourage incentive systems for companies that apply ESG principles substantially. The government needs to provide a policy framework that encourages data disclosure, research repeatability, and ESG innovation at the corporate level. On the other hand, institutional investors are expected to use ESG as a parameter in the risk assessment and investment decision-making process. This will create a healthy ecosystem between market players, regulators, and the public in realizing sustainable and inclusive economic development.

Author Contributions

Conceptualization, RB dan DWH; methodology AS.; Validation, RB.; Formal analysis, BA dan OL; Research, DWP.; Resources, AS dan RB; Data curation, AS.; Writing—Preparation for the original draft, RB, AS and SAA; Writing—reviewing and editing, RB and DP; Visualization, AS.; supervision, DP and AF; Project Administration, SAA dan AS; Acquisition of funding, R.B. All authors have read and approved the published version of the manuscript.

Funding

This research was funded by a grant from Directorate of Research, Technology, and Community Service, Ministry of Higher Education, Science, and Technology of the Republic of Indonesia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data supporting this study’s findings are available from the corresponding author when it is a reasonable request.

Acknowledgments

This research was supported by the Research and Community Service Directorate, Telkom University and Directorate of Research, Technology, and Community Service, Ministry of Higher Education, Science, and Technology of the Republic of Indonesia according to the contract number: No. 125/C3/DT.05.00/PL/2025; 7925/LL4/PG/2025; 106/LIT07/PPM-LIT/2025.

Conflicts of Interest

The authors declare no conflicts of interest

References

- Ahmad, H., Yaqub, M., & Lee, S. H. (2024). Environmental-, social-, and governance-related factors for business investment and sustainability: a scientometric review of global trends. Environment, Development and Sustainability, 26(2), 2965–2987. [CrossRef]

- Amaliyah, E. D. E., Rohmawati, L., & Dwiantari, S. (2023). Improving market value of textile and garment company through company growth, company financial performance, and macroeconomics. Jurnal Akuntansi Aktual, 10(1), 69. [CrossRef]

- Amaral, M., Willerding, I., & Lápolli, É. (2023). ESG and sustainability: The impact of the pillar social. Concilium, 23(13), 186–199.

- Annesi, N., Battaglia, M., Ceglia, I., & Mercuri, F. (2025). Navigating paradoxes: building a sustainable strategy for an integrated ESG corporate governance. Management Decision, 63(2), 531–559. [CrossRef]

- Annisa Trimur Fadila, & Ida Bagus Ketut Bayangkara. (2025). Strategi dan Implementasi Keberlanjutan PT Garuda Indonesia dalam Mewujudkan ESG. Jurnal Publikasi Ekonomi Dan Akuntansi, 5(2), 195–204. [CrossRef]

- Ayamga, T. A., Avortri, C., Nasere, D., Donnir, S., & Tornyeva, K. (2024). The Influence of Corporate Social Responsibility on the Financial Performance of Firms in Ghana: The Moderating Role of Board Independence and Diversity. American Journal of Industrial and Business Management, 14(04), 510–536. [CrossRef]

- Beta, H., & Kalalo, M. (2023). Analysis of the influence of good corporate governance and intellectual capital on financial performance (Studies of entertainment and media industry companies listed on the IDX in 2014–2021. Jurnal Ekonomi Dan Bisnis Digital, 2(4), 1115–1136. [CrossRef]

- Bosi, M. K., Lajuni, N., Wellfren, A. C., & Lim, T. S. (2022). Sustainability Reporting through Environmental, Social, and Governance: A Bibliometric Review. Sustainability (Switzerland), 14(19). [CrossRef]

- Bridoux, F., & Stoelhorst, J. W. (2022). Stakeholder Governance: Solving the Collective Action Problems in Joint Value Creation. Academy of Management Review, 47(2), 214–236. [CrossRef]

- Cahyaningati, R., Miqdad, M., & Kustono, A. S. (2022). Analysis of the Relationship Between Corporate Social Responsibility and Good Corporate Governance on Fee Audit and Firm Value. IJEBD (International Journal Of Entrepreneurship And Business Development), 5(2), 273–284. [CrossRef]

- Chew, J., & Chan, C. C. A. (2008). Human resource practices, organizational commitment and intention to stay. International Journal of Manpower, 29(6), 503–522. [CrossRef]

- Christy, S., & Sufiyati, S. (2023). Factors affecting profitability of banking companies listed on the Indonesia Stock Exchange. International Journal of Applied Economics, Business and Management (IJAEB), 1(4), 1855–1866. [CrossRef]

- Daromes, F. E., & Ng, S. (2023). Environmental Management Control Systems and Environmental Performance: Direct and Indirect Effect. International Journal of Professional Business Review, 8(6), e01753. [CrossRef]

- Darsono, S., Wong, W., Nguyen, T., Jati, H., & Dewanti, D. (2022). Good governance and sustainable investment: The effects of governance indicators on stock market returns. Advances in Decision Sciences, 26(1), 69–101. [CrossRef]

- Dasinapa, M. B. (2024). The Integration of Sustainability and ESG Accounting into Corporate Reporting Practices. Advances in Applied Accounting Research, 2(1), 13–25. [CrossRef]

- Fauzi, T. (2022). The effect of environmental performance on firm value with mediating role of financial performance in manufacturing companies in Indonesia. Academic Journal of Interdisciplinary Studies, 11(3), 256. [CrossRef]

- Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach. Pitman.

- Gidage, M., Gyamfi, B. A., & Asongu, S. A. (2025). Environmental Reporting and Financial Performance: Evidence From the Banking Sector in BRICS Countries. Business Strategy and the Environment, 7412–7437. [CrossRef]

- Hadiwibowo, I., & Purwanti, L. (2024). Corporate Social Responsibility and Firm Performance: A Literature Review. Accounting and Finance Studies, 4(3), 135–157. [CrossRef]

- Hair, J. F., Howard, M. C., & Nitzl, C. (2020). Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. Journal of Business Research, 109, 101–110. [CrossRef]

- Hamidu, A. A., Haron, H. M., & Amran, A. (2015). Corporate social responsibility: A review on definitions, core characteristics and theoretical perspectives. Mediterranean Journal of Social Sciences, 6(4), 83–95. [CrossRef]

- Harmaen, T., Mangantar, M., & Tulung, J. E. (2022). Pengaruh Good Corporate Governance terhadap Kinerja Keuangan perbankan syariah di Indonesia periode 2014-2018. Jurnal EMBA : Jurnal Riset Ekonomi, Manajemen, Bisnis Dan Akuntansi, 10(2), 799. [CrossRef]

- Helmina, M., Yusniar, M., & Respati, N. (2024). Green development and its impact on financial performance and corporate value in the coal industry. Multidisciplinary Science Journal, 7(5). [CrossRef]

- Hermawan, S., Nadiroh, P., Rahmawati, I. D., Qonitah, I., Lating, A. I. S., & Alieva, S. S. (2023). Professional Ethics and Ethical Orientation: Key to Preventing Creative Accounting Practices Among Accounting Students (Vol. 1). Atlantis Press SARL. [CrossRef]

- Holderegger, R., & Duarte, L. F. de A. (2024). The use of environmental, social and governance indicators as business strategies. In Scientific Journal of Applied Social and Clinical Science (Vol. 4, Issue 6, pp. 2–5). [CrossRef]

- Ikhsan, M., Jumono, S., Munandar, A., & Abdurrahman, A. (2022). The Effect of Non Performing Loan (NPL), Independent Commissioner (KMI), and Capital Adequacy Ratio (CAR) on Firm Value (PBV) Mediated by Return on Asset (ROA). Quantitative Economics and Management Studies, 3(5), 810–824. [CrossRef]

- Jensen, M. C., Meckling, W. H., Benston, G., Canes, M., Henderson, D., Leffler, K., Long, J., Smith, C., Thompson, R., Watts, R., & Zimmerman, J. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. In Journal of Financial Economics (Issue 4). Harvard University Press. http://hupress.harvard.edu/catalog/JENTHF.html.

- Júnior, J., Povedano, R., Santos, L., Belli, M., & Gaio, L. (2024). ESG index impact on the performance of education sector companies. Revista de Administração Da UFSM, 17(2).

- Khanh, T., Rajagopal, P., Tram, N., & Bardai, B. (2024). Environmental strategy and environmental management accounting as contributors to environmental and financial performance: The case of manufacturing firms in Vietnam for the Sustainable Development Goals (SDGs). Journal of Ecohumanism, 3(8). [CrossRef]

- Koster, F., de Grip, A., & Fouarge, D. (2011). Does perceived support in employee development affect personnel turnover? International Journal of Human Resource Management, 22(11), 2403–2418. [CrossRef]

- Lee, A. X., & Hooy, C. W. (2024). CEO Power and ESG Performance: The Mediating Role of Managerial Risk-Taking. Institutions and Economies, 16(2), 57–82. [CrossRef]

- Lestari, V., Soraya, A., & Hwihanus, H. (2024). Corporate social responsibility, corporate financial performance and the confounding effects of economic fluctuations. Journal of Management and Sustainable Development (JMSD), 1(4), 1–11. [CrossRef]

- Li, Y. (2024). The Impact of Corporate ESG Performance on Green Innovation Efficiency —— Evidence from China. Highlights in Business, Economics and Management, 36. [CrossRef]

- Marginingsih, R., & Suparno, S. (2024). The effects of environmental, social and governance (ESG) disclosures on financial performance: A theoretical approach. Asian Leadership Studies (ALS.

- Mausuly, F. R., & Prasetyowati, R. A. (2022). Pengaruh Profitabilitas dan Market Value Ratio terhadap Harga Saham Bank Umum Syariah. Bukhori: Kajian Ekonomi Dan Keuangan Islam, 2(1), 49–64. [CrossRef]

- Meena, G. (2023). Advancing digital innovation to strengthen brand value: Supporting wooden craft entrepreneurs’ creative development for wider market appeal. Shodhkosh: Journal of Visual and Performing Arts, 4(2). [CrossRef]

- Mulchandani, K., Mulchandani, K., Iyer, G., & Lonare, A. (2022). Do Equity Investors Care about Environment, Social and Governance (ESG) Disclosure Performance? Evidence from India. Global Business Review, 23(6), 1336–1352. [CrossRef]

- Natalia, P., & Tetiana, S. (2025). Мoтивація персoналу в esg кoнцепції. 249–254.

- Nazam, R., & Rojuaniah, R. (2024). The effect of the application of good corporate governance (GCG) principles on job satisfaction and employee performance. Jurnal Indonesia Sosial Teknologi, 5(4), 1904–1914. [CrossRef]

- Nurkhin, A., Widiyanto, W., Widiatami, A., & Aeni, I. (2023). Do corporate governance implementation and bank characteristics improve the performance of Indonesian Islamic banking? Before-COVID-19 pandemic analysis. Banks and Bank Systems, 18(3), 126–135. [CrossRef]

- Nwafor, B. C., Piranfar, H., & Aston, J. (2020). The Functionality and Comparisons of BSC and Alternative Theories in Organisations: Business Perspective. Academicus International Scientific Journal, 21, 59–72. [CrossRef]

- Oktaviani*, Y., & Dwi, M. L. (2023). Causality Analysis of Profitability and CSR on PBV in Commercial Banks Listed on The IDX 2016-2020. In Jurnal Ilmu Keuangan dan Perbankan (JIKA) (Vol. 12, Issue 2, pp. 203–214). [CrossRef]

- Onyeka, A., & Orajekwe, J. (2024). Web-based environmental disclosure and firm value: Empirical evidence on listed manufacturing firms in Nigeria. IIARD International Journal of Economics and Business Management, 9(2), 12–25. [CrossRef]

- Oshim, J. C., & Igwe, A. O. (2024). Corporate Governance and Financial Performance of Listed Consumer Goods Firms in Nigeria. International Journal of Business and Management Review, 12(1), 96–115. [CrossRef]

- Park, W., & Byun, C. G. (2022). Effect of Managerial Compensation and Ability on the Relationship between Business Strategy and Firm Value: For Small and Medium-Sized Enterprises (SMEs). In Sustainability (Switzerland) (Vol. 14, Issue 8). [CrossRef]

- Piao, X., Xie, J., & Managi, S. (2022). Environmental, social, and corporate governance activities with employee psychological well-being improvement. BMC Public Health, 22(1), 1–12. [CrossRef]

- Pramudiati, N., Adyaksana, R. I., & Susilowati, A. (2022). Do Environmental Performance and Corporate Social Responsibility Disclosure Affect Financial Performance? Jurnal Akuntansi, 12(2), 1–11. [CrossRef]

- Pulino, S. C., Ciaburri, M., Magnanelli, B. S., & Nasta, L. (2022). Does ESG Disclosure Influence Firm Performance? Sustainability (Switzerland), 14(13), 1–18. [CrossRef]

- Raja Ahmad, R. A., Samsuddin, M. E., Azmi, N. A., & Abdullah, N. (2023). Is Environmental, Social and Governance (ESG) Disclosure Value Enhancing? Evidence from Top 100 Companies. Asia-Pacific Management Accounting Journal, 18(2), 143–164. [CrossRef]

- Rizal, R., & Amran, E. (2022). Determinants of Islamic bank profitability: Empirical evidence from NTB Islamic Bank. At-Tijaroh: Jurnal Ilmu Manajemen Dan Bisnis Islam, 8(1), 58–70. [CrossRef]

- Secioputri, G. L., & Putro, U. S. (2025). Aligning Corporate Strategy with Environmental, Social, and Governance (ESG): A Case Study of InfraTrans. Journal Integration of Management Studies, 3(1), 147–166. [CrossRef]

- Setiawati, A., & Hidayat, T. (2023). The influence of environmental, social, governance (ESG) disclosures on financial performance. Journal of Economics Management and Banking, 9(3), 225–240. [CrossRef]

- Shaikh, I. (2021). Environmental, Social, and Governance (Esg) Practice and Firm Performance: an International Evidence. Journal of Business Economics and Management, 23(1), 218–237. [CrossRef]

- Sharma, R. B., Lodha, S., Sharma, A., Ali, S., & Elmezughi, A. M. (2022). Environment, Social and Governance Reporting and Firm Performance: Evidence from GCC Countries. International Journal of Innovative Research and Scientific Studies, 5(4), 419–427. [CrossRef]

- Thanetsunthorn, N., & Wuthisatian, R. (2025). Corporate social responsibility in emerging markets: the role of reciprocity in business-government relations. Social Responsibility Journal, 21(3), 520–548. [CrossRef]

- Tripopsakul, S., & Puriwat, W. (2022). Understanding the Impact of ESG on Brand Trust and Customer Engagement. Journal of Human, Earth, and Future, 3(4), 430–440. [CrossRef]

- TRISNANINGSIH, S., & RAHMASARI, B. P. (2022). The Effect of GCG on Company Value With Financial Performance As An Intervening Variable. Journal of Tourism Economics and Policy, 2(3), 203–212. [CrossRef]

- Triyani, D. A., & Siswanti, I. (2024). The effect of sustainability reporting disclosure, environment, social and governance rating, and digital banking transactions on firm value with financial performance as an intervening variable (Case study on commercial bank in Indonesia). Türk Turizm Araştırmaları Dergisi. [CrossRef]

- Velte, P. (2023). The link between corporate governance and corporate financial misconduct. A review of archival studies and implications for future research. In Management Review Quarterly (Vol. 73, Issue 1). Springer International Publishing. [CrossRef]

- Voegtlin, C., & Greenwood, M. (2016). Corporate social responsibility and human resource management: A systematic review and conceptual analysis. Human Resource Management Review, 26(3), 181–197. [CrossRef]

- Wahyuni, P. D., Marsyaf, M., & Fisher, B. (2024). The Role of Leverage in Moderating ESG Disclosure and Financial Slack on the Company’s Financial Performance. International Journal of Business and Applied Social Science, October, 12–19. [CrossRef]

- Wang, Y. Y., Huang, S. C., & Chen, K. S. (2025). The impact of ESG practices and change support on firm performance: The mediating role of innovation culture. International Journal of Innovative Research and Scientific Studies, 8(1), 2599–2609. [CrossRef]

- Wijaya, H. D., & Iryanto, B. W. (2024). The Influence of Corporate Social Responsibility (CSR) and Environmental Social Governance (ESG) Disclosure on Profitability in Companies in the IDX ESG & IDX HIDIV20 Sector from 2020 to 2023. Jurnal Indonesia Sosial Sains, 5(11), 2828–2844. [CrossRef]

- Yuli Soesetio. (2023). Good Corporate Governance Mechanisms and Financial Performance in Controlling Financial Distress. ADPEBI International Journal of Business and Social Science, 3(1), 14–26. [CrossRef]

- Yunarsih, N. K., Wirama, D. G., Putra, I. N. W. A., & Sisdyani, E. A. (2023). Effect of Environmental Performance, Managerial Ownership, and Dividend Policy on the Relative Value of a Company. International Research Journal of Management, IT and Social Sciences, 10(3), 141–153. [CrossRef]

- Yusra, I. (2022). Does Corporate Social Responsibility Disclosure Have a Role Improve Financial Performance? a Panel Data Approach. Economica, 11(1), 1–11. [CrossRef]

- Zhang, J. (2024). An Empirical Analysis of ESG Scores and Firm Performance Based on the CSI 300 Index. Highlights in Business, Economics and Management, 36, 448–457. [CrossRef]

- Zhao, S. (2024). Integrating Artificial Intelligence into ESG Practices: Opportunities, Challenges, and Strategic Solutions for Corporate Sustainability. Finance & Economics, 1(9). [CrossRef]

- Zhu, F., & Newman, A. (2023). One Size Does Not Fit All: Organizational Rewards, Managerial Experience, and Employee Retention in Entrepreneurial New Ventures. Entrepreneurship: Theory and Practice, 47(5), 1788–1815. [CrossRef]

- Zou, Z. (2024). The Correlation Between Corporate Profitability and ESG Ratings: Samples from Forestry and Paper Industry (Issue 2023). Atlantis Press International BV. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).