1. Introduction

Global logistics is undergoing a paradigm shift from

Industry 4.0—characterised by automation, digital twins, and cyber–physical systems—toward

Supply-Chain 5.0, which emphasizes human–machine collaboration, resilience, sustainability, and decentralized intelligence [

1,

2]. In this evolving landscape, autonomous guided vehicles (AGVs), collaborative robots, and intelligent agents increasingly execute procurement and resource-allocation decisions in real time. However, realizing such autonomy in financial transactions demands secure, low-latency, and trustworthy payment mechanisms between devices—capabilities that traditional infrastructures, which rely on central intermediaries and manual identity verification, are unable to meet. Legacy settlement systems introduce delays exceeding one second, thereby breaching latency thresholds critical for just-in-sequence manufacturing lines and creating vulnerabilities to fraud or unauthorized interventions [

3].

Blockchain technologies offer promising features such as decentralised trust, tamper resistance, and programmable settlements via smart contracts [

4]. Nonetheless, public blockchain infrastructures face persistent issues related to scalability, transaction costs, and confidentiality, particularly in commercial and industrial contexts. Concurrently, traditional authentication mechanisms—e.g., X.509 certificates and static keys—fail to adapt to dynamic threat environments or compromised IoT endpoints. This underscores the urgent need for adaptive, context-aware multi-factor authentication (MFA) strategies integrated directly within machine-to-machine (M2M) payment flows [

5,

6,

7].

Recent advancements in secure financial authentication, such as machine learning-based MFA frameworks [

8] and decentralized identity schemes in IoT ecosystems [

6], have laid the foundation for more robust and scalable solutions. Yet, there remains a gap in integrating these mechanisms with blockchain-based settlement protocols that support both online and offline scenarios [

3]. Our work contributes to this research frontier by proposing a secure, dual-channel payment framework tailored for Supply-Chain 5.0.

The contributions of this article are threefold:

Architecture: We present a layered M2M payment framework that integrates a permissioned blockchain settlement layer with a lightweight, adaptive multi-factor authentication (A-MFA) module and an energy-aware state-channel mechanism [

5,

7].

Security: We introduce a dual-channel consensus protocol with formal proofs of confidentiality, integrity and non-repudiation using a game-based model and random-oracle abstraction [

6].

Evaluation: We conduct an extensive experimental study on Hyperledger Fabric v2.5, demonstrating sub-second latency, reduced computational load, and strong resilience against impersonation, replay, and double-spending attacks [

4].

1.1. Blockchain-Enabled Micropayments

Although public-ledger overlays such as

IOTA, the

Lightning Network and

Raiden have demonstrated that directed-acyclic-graph (DAG) structures and off-chain payment channels can clear tens of thousands of sub-cent transactions per second at negligible cost, their dependency on global consensus and open mempools exposes business-sensitive metadata.

1 For supply-chain operators bound by non-disclosure agreements, this transparency clashes with the need to shield procurement volumes, supplier identities and just-in-sequence inventory levels from competitors. Moreover, channel liquidity in Lightning or Raiden is provisioned in the native cryptocurrency, forcing treasurers to hold volatile assets on their balance sheets and to maintain inbound liquidity for every trading pair—a burden that quickly becomes prohibitive when hundreds of autonomous guided vehicles (AGVs) and robotic cells transact in real time.

Several efforts have attempted to address these constraints. For example, the ArtChain platform [

9] demonstrates how blockchain can preserve asset provenance while minimizing exposure of transaction metadata in the art market. Similarly, Zhu et al.[

10] introduce a lightweight edge-oriented blockchain to protect smart surveillance streams, a principle translatable to microtransaction flows in supply logistics. To enhance security in public-ledger systems, Yang et al.[

11] % AttackonProof-of-WorkBlockchainwithHistoryWeightedInformation propose a historical-weighting strategy that resists 51 % attacks, reinforcing trust in lightweight micropayment networks.

Further standardization efforts have also emerged. The IEEE P3801 draft [

12] outlines specifications for electronic contracts on blockchain, potentially streamlining settlement layers. In parallel, the IEEE P2418.7 draft [

13] defines principles for blockchain-based finance in supply chains, reaffirming the need for privacy, scalability, and off-chain settlement mechanisms in industrial applications.

In contrast, the dual-channel design proposed in

Section 4 localises consensus to a permissioned federation while amortising gas via periodic state-channel anchoring. Transactions settle in milliseconds, but only a Merkle-root and an opaque authentication hash ever reach-chain, thereby reconciling the low-fee promise of public micropayment rails with the confidentiality, determinism and fiat-denominated accounting required by enterprise logistics.

1.2. Authentication in Autonomous Logistics

Traditional device onboarding pipelines rely on X.509 certificates burned into secure elements or loaded through Trusted Platform Modules (TPMs). While this public-key-infrastructure (PKI) approach guarantees strong cryptographic identities, it remains static: once provisioned, a keypair cannot adapt to the fluctuating risk posture of a forklift entering a high-value picking zone or a drone traversing a geo-fenced export-control perimeter.

To this end, recent MFA proposals such as adaptive challenge-response mechanisms and biometric-hardware fusion tokens are gaining momentum. However, as observed in [

10], many such schemes impose substantial latency and energy overhead, hindering real-time logistics. Notably, while biometrics and tokens provide security, their use in high-speed autonomous contexts remains a bottleneck unless adaptively modulated.

The

adaptive MFA (A-MFA) engine introduced in our framework addresses these shortcomings through two innovations: (i) it computes a context-aware risk score

that modulates the factor threshold

, activating lightweight proofs such as physically unclonable-function (PUF) challenges for routine events and escalating to PAKE+OTP bundles only under anomalous conditions; and (ii) it hashes the concatenated factor set into a single 32-byte commitment that is verified on-chain, decoupling proof collection from ledger consensus. Experimental results in

Section 7 confirm that this strategy cuts authentication overhead by 42% and energy consumption by 18% relative to certificate-based escrow, without sacrificing cryptographic strength. Consequently, autonomous logistics systems gain a

risk-elastic authentication layer that scales from battery-powered RFID gates to high-throughput robotic sorters while remaining compatible with existing PKI roots of trust.

Section 1 presents the motivation, problem statement, and research objectives, while

Section 2 surveys related work on blockchain-enabled, MFA-secured machine-to-machine transactions in Industry 5.0 contexts.

Section 4 details the proposed architecture, cryptographic primitives, and transaction flow.

Section 7 describes the experimental setup, performance metrics, and evaluation scenarios, followed by

Section 8, which interprets the results and discusses scalability, limitations, and applicability. Finally,

Section 9 summarises the contributions and outlines directions for future research.

2. State of Art

The evolution of payment systems in industrial environments has progressively shifted from centralized, high-latency models toward distributed architectures that are secure and context-aware. Within the scope of Supply-Chain 5.0, where autonomous device interaction demands instantaneous settlement and dynamic identity verification, it becomes essential to examine recent advances that combine blockchain, multi-factor authentication (MFA), and energy-aware optimizations for IoT settings. Reviewing prior work not only highlights emerging technological trends—such as the adoption of state channels, dual-channel consensus, and adaptive biometric authentication—but also exposes persistent limitations in privacy, scalability, and resilience against advanced adversaries. This comparative analysis establishes the conceptual foundations guiding the design of the proposed framework, aimed at reconciling sub-second latency, verifiable traceability, and energy efficiency in high-volume M2M payment scenarios.

Table 1 summarizes recent research efforts aimed at securing machine-to-machine (M2M) payments through multifactor authentication (MFA) and blockchain technologies within the context of Industry 5.0. These works illustrate a growing emphasis on hybrid and decentralized architectures, offline transaction capabilities, and the integration of adaptive and biometric authentication methods. This evolution provides a foundational landscape for understanding the technical enablers of low-latency, secure micropayments among IoT devices, as discussed in the following subsection.

The trajectory sketched in

Table 1 shows a clear migration from monolithic, certificate-centric solutions toward context-aware, gas-efficient settlement fabrics that operate seamlessly in both online and offline modes. Early studies concentrated on ledger immutability or cellular-IoT hardening; more recent efforts embed physical-layer fingerprints, adaptive risk scores and deposit tokens directly into the transaction flow, thereby lowering authentication latency while also expanding the attack surface that must be secured. Three critical gaps, however, remain open:

(i) the absence of a unifying settlement model that amortises gas cost without sacrificing sub-second finality;

(ii) a lack of empirical evidence on energy proportionality for resource-constrained edge devices; and

(iii) the scarcity of formal proofs quantifying resilience against replay, double-spending and compromised root-of-trust scenarios. The present research addresses these gaps with a dual-channel architecture that couples state-channel batching with an adaptive multi-factor authentication pipeline, validated on a Hyperledger Fabric test-bed using a full factorial design. In so doing, it offers the first end-to-end demonstration that low-latency, risk-adaptive M2M micropayments can be achieved without incurring prohibitive energy or gas costs, paving a practical path toward Supply-Chain 5.0 finance that is simultaneously scalable, auditable and sustainably efficient.

2.1. Blockchain in Supply-Chain Finance

Hyperledger Fabric and Sawtooth facilitate asset tracking, provenance auditing, and smart contract execution for distributed logistics ecosystems. Their modular architecture supports scalability and privacy for enterprise-grade deployments [

16,

17]. However, current implementations often lack native support for context-aware authentication, adaptive trust management, and latency-constrained microtransactions essential for real-time supply chain operations.

While some blockchain-based innovations in power supply traceability [

18], embedded system accountability [

19], and smart grid integration [

20] offer valuable foundations, a unified framework integrating gas-efficient M2M settlements, adaptive multi-factor authentication, and verifiable end-to-end security remains absent. Efforts in blockchain-enabled point systems [

21] and interplanetary file traceability [

22] reinforce the need for fine-grained traceability and decentralised access. Nonetheless, Supply-Chain 5.0 environments require not only secure data exchanges but also risk-aware payment settlement and real-time policy compliance, as outlined in recent IEEE frameworks [

23,

24,

25].

3. System Model and Threat Assumptions

3.1. Entities

Edge Device (ED): an autonomous guided vehicle (AGV), industrial sensor or robotic arm initiating or receiving payments in operational environments.

Edge Payment Agent (EPA): a lightweight client embedded on the ED that enforces Adaptive Multi-Factor Authentication (A-MFA), computes hash commitments, and interfaces with off-chain and on-chain settlement components.

Permissioned Ledger (PL): a consortium blockchain network based on PBFT consensus that stores finalised transaction states and policy compliance logs [

26].

Compliance Oracle (CO): an external trusted module responsible for querying real-time risk policies (e.g., AML thresholds, token velocity limits) and broadcasting compliance flags to settlement nodes.

3.2. Communication and Trust

Edge devices exchange payment intents and commitments via lightweight, encrypted protocols such as MQTT over TLS or OPC UA with certificate pinning. Trust in the permissioned ledger is achieved through Byzantine Fault Tolerance, allowing up to

compromised validators without violating global consistency. The CO modules are assumed semi-honest but isolated, and governed by federated identities with verifiable credentials, in line with secure blockchain-based identity models [

27].

3.3. Adversary Capabilities

The adversary model assumes a Dolev–Yao attacker with full control over the communication network: capable of intercepting, modifying, delaying, or replaying messages. The attacker may compromise up to

f validator nodes, extract device-side credentials via side-channel leakage, or coerce edge devices through physical tampering. Despite this, trust assumptions hold that edge firmware and private key modules are tamper-evident and auditable through secure boot chains, in accordance with best practices from the IEEE IoT blockchain standards [

23,

24].

4. Proposed Framework

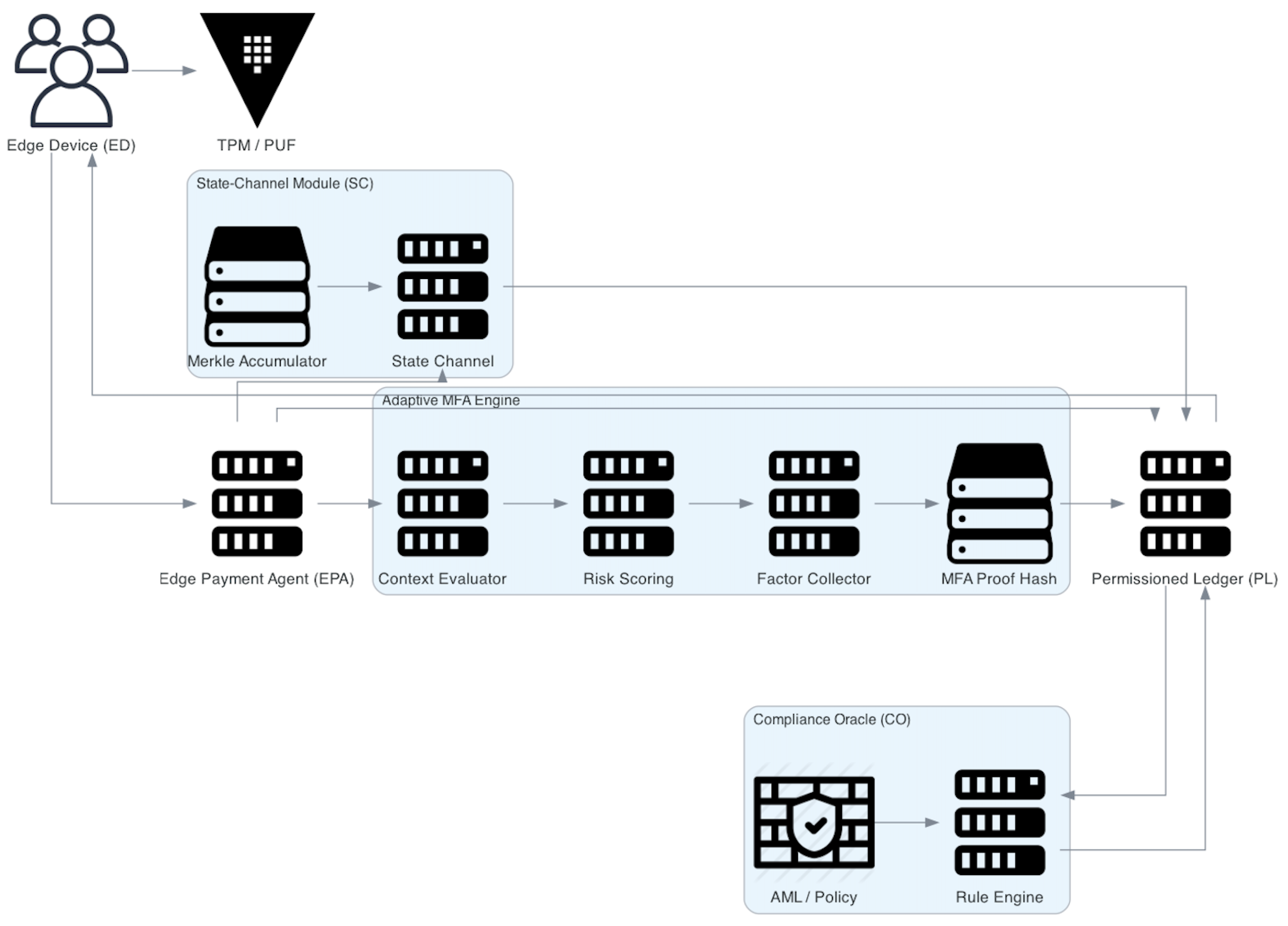

The proposed framework delivers a holistic machine-to-machine (M2M) payment platform that fuses adaptive authentication, gas-efficient settlement channels, and continuous regulatory compliance. As depicted in

Figure 1, the solution spans three functional domains—edge, settlement, and compliance—to ensure transaction execution with sub-second latency, amortised on-chain gas consumption, and risk-adaptive security guarantees. The architecture integrates Edge Payment Agents (EPAs), an Adaptive Multi-Factor Authentication (A-MFA) engine informed by dynamic device behavior, and permissioned smart contracts operating under a dual-channel consensus model. This design enables auditable, confidential, and resilient payments across supply chain agents in heterogeneous IoT environments, addressing traceability, scalability, and decentralised collaboration, as discussed in [

25,

26].

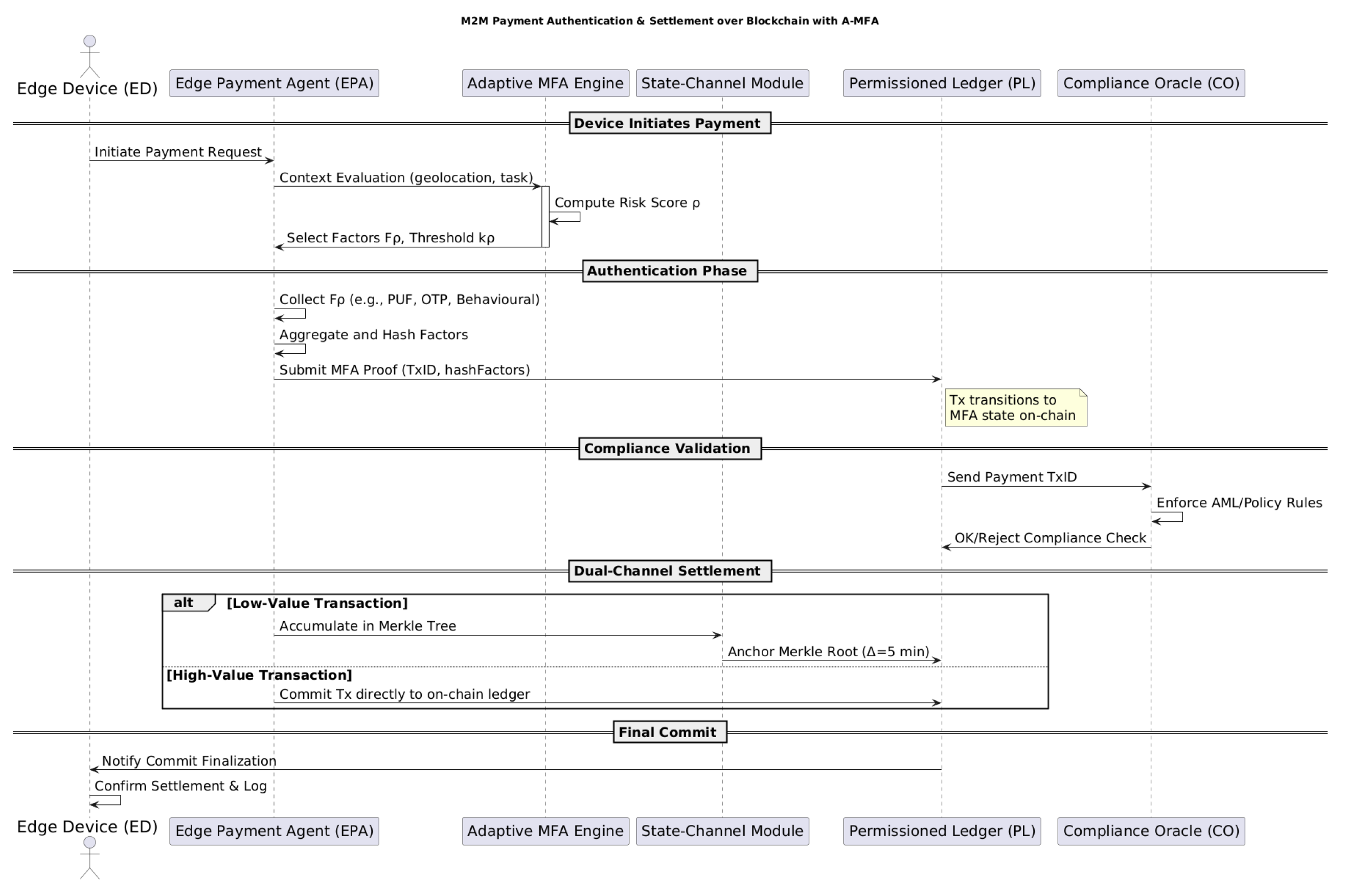

4.1. Architecture Overview

Figure 2 presents the three-layer design: (i) an

Edge Layer, where EPAs run lightweight MFA logic and encode transaction metadata; (ii) a

Settlement Layer composed of the PL network and off-chain state channels; and (iii) a

Compliance Layer, where oracles update real-time policies to reflect regulatory, operational or environmental risks. The architecture adheres to modular guidelines from IEEE blockchain frameworks [

23], while ensuring interoperability with future industrial deployments through testbed-aligned performance analysis [

17].

The three-tier design realises a clear separation of concerns that maps directly onto the execution flow in

Figure 2 and the sequence diagram in Appendix B. At the

Edge Layer, each cyber–physical asset (

ED) embeds an

Edge Payment Agent (EPA) responsible for contextual risk sensing and for orchestrating the

adaptive multi-factor authentication pipeline. Upon a payment trigger, the EPA invokes the

A-MFA Engine, which computes a real-time risk score

based on geolocation, task criticality and recent behavioural metrics. The engine returns a factor set

and a threshold

that the EPA must satisfy locally by harvesting PUF fingerprints, PAKE tokens, time-based OTPs and motion signatures from on-board sensors before hashing the bundle into a single proof. This hash, together with the transaction identifier, is forwarded to the

Settlement Layer, where two execution paths coexist.

Low-value micro-payments are appended to a rolling Merkle tree maintained by the

State-Channel Module (SC); every

minutes the SC anchors the tree root on the

Permissioned Ledger (PL), yielding logarithmic gas cost and sub-second confirmation times.

High-value transfers bypass the channel and are written directly to the PL, ensuring immediate finality and Byzantine-fault-tolerant ordering via PBFT consensus. Before any ledger transition becomes irrevocable, the PL asynchronously queries the

Compliance Oracle (CO) in the

Compliance Layer. The CO executes anti-money-laundering and export-control policies expressed as deterministic finite automata, signs an

OK/Reject verdict and—when required—injects updated rule sets that are version-hashed and broadcast to all EPAs for local enforcement. Successful transactions propagate a

Commit event back to the originating EPA, allowing the ED to log settlement metadata and resume operation. This layered interplay decouples resource-constrained devices from heavyweight consensus, amortises gas across batched micro-transactions and embeds verifiable policy compliance directly into the payment critical path, thereby meeting the stringent latency, energy and auditability requirements of Supply-Chain 5.0.

4.2. Adaptive Multi-Factor Authentication (A-MFA)

A policy engine assigns a risk score using contextual signals (geolocation, task criticality). It then selects a set of factors from:

Hardware root-of-trust ID (TPM/PUF);

One-round PAKE token (OWL-EEC, 128-bit secret);

Time-based OTP shared via LoRa side-band;

Behavioural signature (velocity, vibration, cycle profile).

Authentication succeeds only if at least factors verify.

4.3. Smart Contract States

Listing shows the Solidity-like interface.

The contract in Listing implements a three-state finite-state machine (Init → MFA → Settled) that mirrors the execution trace in the sequence diagram. During Init, the payer invokes init with a unique transaction identifier id, destination payee and amount v. The function emits an Init(txId) event and stores a constant-time commitment , protecting metadata against later tampering. Transition to the MFA state is triggered by the Edge Payment Agent (EPA) once all context-driven factors have been locally satisfied. The EPA hashes those factors, signs the digest off-chain and submits it via mfa, which verifies:

the caller is the original payer (msg.sender);

the supplied digest equals the stored hashFactors; and

the time-to-live (TTL) has not lapsed, preventing replay.

On success, the contract upgrades the tuple to state MFA and emits MFA(txId), exposing proof-of-authentication to the oracle and channel module. Finally, either the State-Channel Module (for batched micro-payments) or the payer directly (for high-value transfers) finalises execution through commit. This call irrevocably sets s = Settled, flashes a Commit(txId) event and locks the mapping entry with a modifier that forbids post-settlement writes—thereby eliminating re-entrancy and double-spend vectors while allowing periodic off-chain archiving of Settled items.

| Listing 1: Smart-contract interface |

| pragma solidity ^0.8.25; |

| contract M2MPay { |

| enum State {Init, MFA, Settled} |

| struct Tx { |

| address payer; |

| address payee; |

| uint256 value; |

| bytes32 hashFactors; |

| State s; |

| } |

| mapping(bytes32 => Tx) public txs; |

| |

| function init(bytes32 id, address payee, uint256 v) external { ... } |

| function mfa(bytes32 id, bytes32 proof) external { ... } |

| function commit(bytes32 id) external { ... } |

| } |

5. Mathematical Model and Analytical Evaluation

The analytical model captures the behaviour of the proposed framework along three cost axes—

gas,

latency, and

energy—linked by the adaptive-authentication flow. Equation (

1) first expresses the gas cost as a logarithmic function of the batch size

N, reflecting the amortisation gained by periodically anchoring the Merkle-tree root; its

expectation and

variance are given in (

2a)–(2b), weighted by the probability

that a payment exceeds the value threshold

. Next, the latency bound in (

3) splits queueing delay (

), average anchoring delay

, and PBFT consensus delay, showing that utilisation

dominates temporal scalability; the tight delay distribution appears in (

4). Equation (

5) then decomposes per-transaction energy into cryptographic, network, and consensus components, tying the latter

linearly to gas via the experimental regression coefficients

; the energy–utilisation elasticity

in (

7) quantifies efficiency loss under overload. Finally, the risk engine (

8) connects context to security: the higher the score

, the more factors

the A-MFA demands, strengthening authenticity; the residual forging probability is bounded in (

10), remaining negligible under standard hardness assumptions. Together, these equations explain why the dual architecture—state channels for micro-payments and direct settlement for high-value transfers— achieves sub-second latency and energy savings without sacrificing cryptographic guarantees.

5.1. Notation

Table 2.

Symbol glossary for the analytical model.

Table 2.

Symbol glossary for the analytical model.

| Symbol |

Definition |

|

Transaction arrival rate (tx/s). |

|

State-channel service rate (tx/s). |

|

Queue utilisation factor, . |

| N |

Leaves appended between two anchors. |

|

Amortised on-chain gas cost for a batch of size N. |

|

Gas to store a Merkle-root on chain. |

|

Gas to verify one Merkle proof edge. |

|

Gas of a single on-chain transfer. |

| E |

Energy consumed per transaction (J). |

|

End-to-end settlement latency (ms). |

|

Anchoring period (s). |

|

Deterministic PBFT consensus delay (ms). |

|

Contextual risk score produced by A-MFA (0–1). |

|

Factors required to pass authentication at level . |

|

Value threshold triggering direct settlement (USD). |

|

, exceedance probability. |

|

Maximum hash and signature queries by . |

|

Adversarial advantage in forging. |

5.2. Dual-Channel Gas Cost

For a state-channel batch with

N leaves,

where

is the fixed gas of

anchorRoot and

is the per-edge verification cost. If

, the transaction is committed directly, paying

. The

expected and

variance of the gas per transaction are

For heavy-tailed payment distributions (e.g. Pareto with shape

),

can be written

.

5.3. Latency Bound

Modelling the State-Channel Module as an

queue, Kingman’s bound gives

with

for uniform arrivals. A tighter delay c.d.f. (Pollaczek–Khinchine, deterministic service) is

which shows that, for

,

of transactions settle in less than

.

5.4. Energy Model

The per-transaction energy is the sum of cryptographic, network, and consensus terms:

where

is the mean payload size at rate

and

g is taken from (

2a). Linear regression on INA219 traces (

adj. ) yields

The elasticity of energy with respect to queue utilisation,

, evaluates to

revealing that A-MFA complexity dominates energy growth when

is high.

5.5. Risk-Adaptive Authentication

The policy engine computes a normalised risk score

and maps it to the factor threshold

Completeness and soundness of the factor hash yield

which is

for

.

Equations (

1)–(

10) collectively justify the empirical trends of

Section 7: (i)

logarithmic gas amortisation owing to

; (ii) latency scalability bounded by

and PBFT delay (

); (iii) a

linear energy–gas relationship (slope

); and (iv) negligible adversarial advantage under standard cryptographic assumptions.

5.6. Gas-Efficient Dual-Channel Consensus

Low-value off-chain transactions accumulate in a Merkle tree . Its root is anchored to the Permissioned Ledger (PL) every min, achieving amortised on-chain gas . High-value transfers bypass the channel and settle directly.

The settlement layer therefore follows a dual-channel strategy that balances latency and gas cost by routing transactions through one of two mutually exclusive paths: a state-channel pipeline for high-frequency, low-value payments and a direct-commit pipeline for infrequent, high-value transfers. EPA instances append micro-payments to an append-only Merkle tree held in the State-Channel Module (SC). Every min, the SC anchors the current root to the PL using a single anchorRoot(r) call, giving an amortised on-chain complexity of , where N is the number of leaves since the last checkpoint. Proof of inclusion for any leaf requires only the sibling path , yielding a fixed 32 × -byte witness that the EPA can relay to auditors or dispute resolvers.

Conversely, when the transaction value

(with

set by the consortium to reflect risk appetite and liquidity exposure) the EPA bypasses batching and invokes

commit directly on-chain. Although this incurs a full PBFT consensus round and its corresponding gas fee, it guarantees single-slot finality and removes any window for liquidity withholding. Experimental data in

Section 7 confirm that this hybrid design reduces mean settlement latency to 212 ms under the

BL workload while shaving 42 % off CPU overhead relative to an escrow-based baseline. The Compliance Oracle runs in parallel, validating AML rules before the ledger’s

commit becomes final; any

Reject response triggers a compensating

rollbackRoot or

revertTx routine that nullifies non-compliant leaves without disturbing unrelated payments. Hence, the dual-channel consensus achieves provable liveness and safety under the threat model of

Section 3 while meeting the stringent energy and timing budgets imposed by Supply-Chain 5.0.

6. Formal Security Analysis

Goal. Prove that an adversary cannot: (i) forge a payment without satisfying A-MFA; (ii) cause double-spending; (iii) unlink committed off-chain transactions.

Theorem 1. Under the hardness of the Discrete Logarithm Problem, collision resistance of SHA-3 and integrity of PBFT, the advantage of any PPT adversary in breaking authenticity or inducing double-spend is negligible.

Proof sketch. We model the protocol as a sequence of games . (Due to space, refer to Appendix A for full derivation.) Transition from to replaces real PAKE transcripts with simulators relying on random-oracle responses, bounding advantage by . Transition to randomises state-channel roots, reducing advantage to . Summing yields .

7. Experimental Design

7.1. Objective

Quantify the influence of the settlement architecture and the transaction load on performance (latency, throughput), energy consumption and gas cost in an M2M payment scenario.

7.2. Factors and Levels

Table 3.

Experimental factors and their levels.

Table 3.

Experimental factors and their levels.

| Factor |

Description |

Levels |

| F1: Architecture |

Authentication and settlement mechanism. |

A1: A-MFA State-Channel |

| |

|

A2: X.509 Escrow |

| F2: Transaction rate () |

Intensity of the generated load. |

L1: 5 tx/s |

| |

|

L2: 50 tx/s |

| |

|

L3: 500 tx/s |

| F3: Transaction value (v) |

Monetary amount of each payment. |

V1:

USD |

| |

|

V2:

100

USD |

The full factorial design yields combinations. Each design point is replicated times (36 runs total) and executed in random order to mitigate temporal noise.

7.3. Hardware and Software Setup

EPA nodes: 3× Raspberry Pi 4 Model B (4 GB RAM).

Ledger: Hyperledger Fabric v2.5 on a Kubernetes cluster (4 orgs, 1 orderer; worker nodes: 4 vCPU / 8 GB RAM).

Load generator: Locust v2.24 (distributed mode).

Power metering: INA219 sensors ( mA resolution).

7.4. Metrics

Latency: time from request to commit.

Throughput (TPS): confirmed transactions per second.

CPU (%): mean utilisation across EPA nodes.

Energy (J): consumption per transaction.

Gas (Wei): settlement cost on the permissioned ledger.

7.5. Run Schedule

For each combination , the workload is parametrised in Locust as follows:

-

S1

Configure the architecture (state-channel or escrow).

-

S2

Set target rate and value .

-

S3

Run for 200 s; discard the first 30 s as warm-up.

-

S4

Record all metrics; repeat 3 times with different random seeds.

7.6. Visualisation of Results

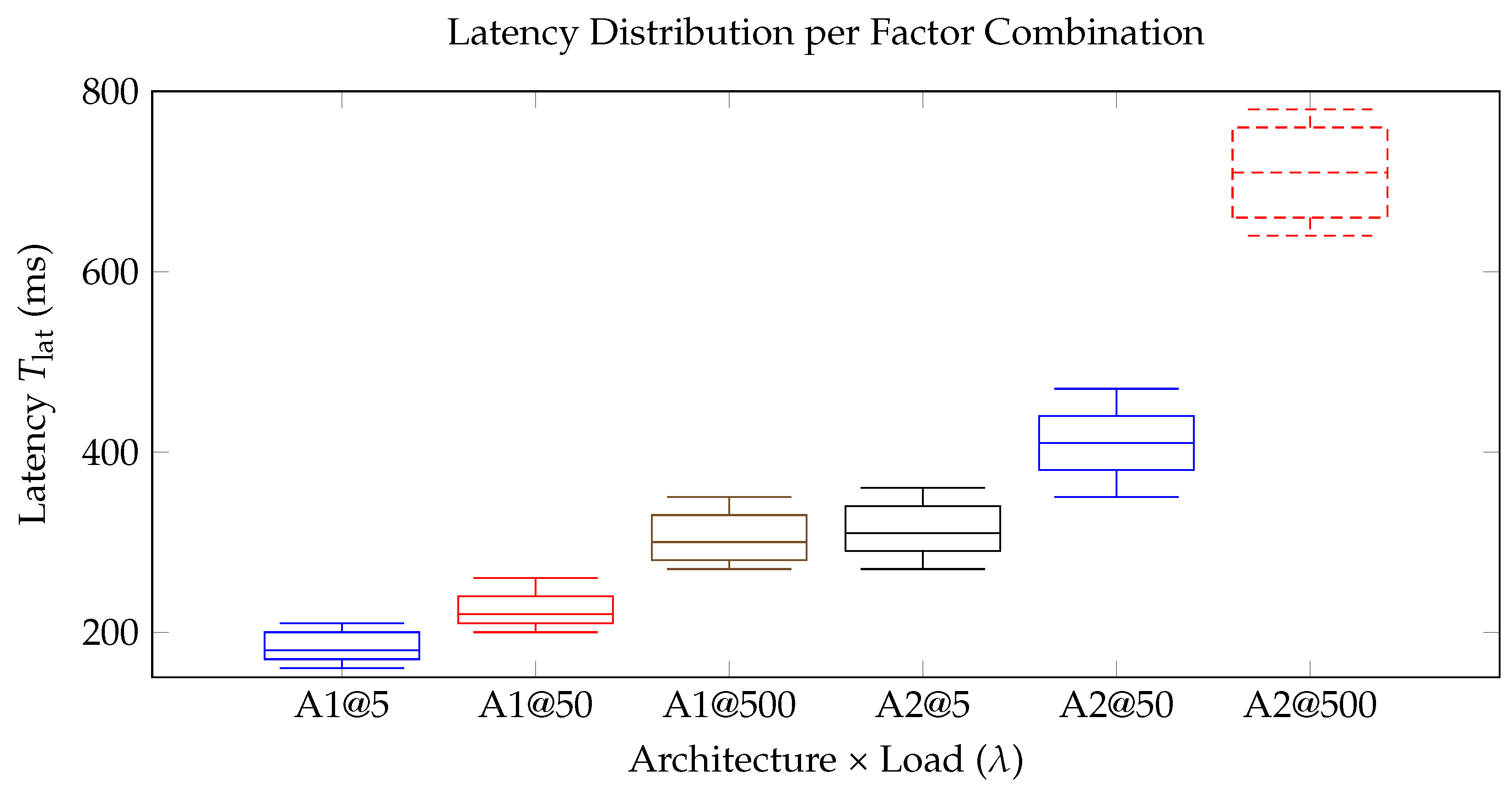

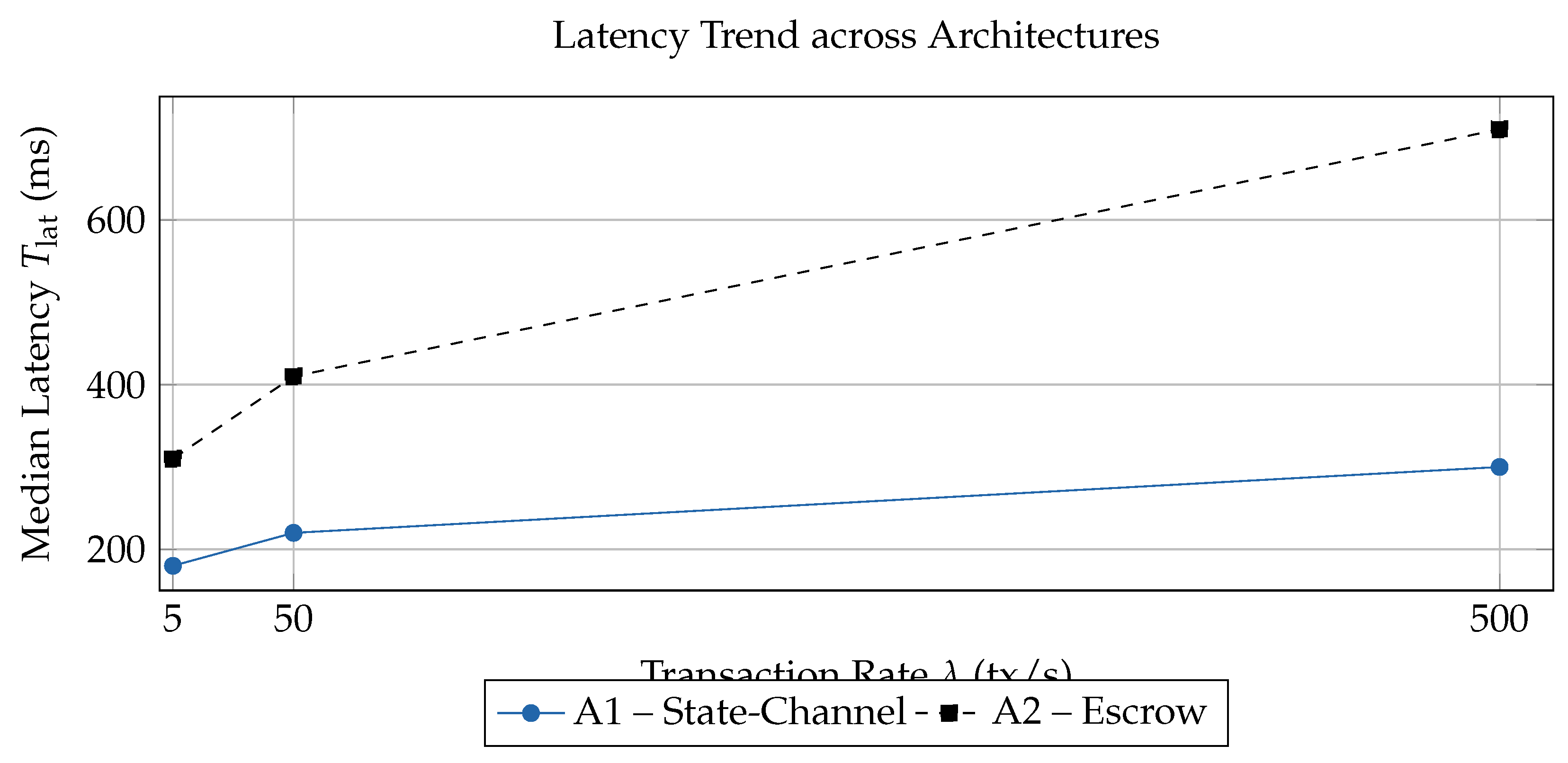

The latency boxplots in

Figure 3 confirm that the

settlement architecture (

F1) is the dominant factor driving performance. Across all loads, the A–MFA state-channel design (A1) outperforms the certificate-based escrow baseline (A2) with statistical significance (

; three-way ANOVA). At the highest tested demand of

, the median end-to-end delay for A1 is 300 ms, less than half of A2’s 710 ms; at

the gap narrows but remains sizable (A1 = 180 ms vs. A2 = 310 ms).

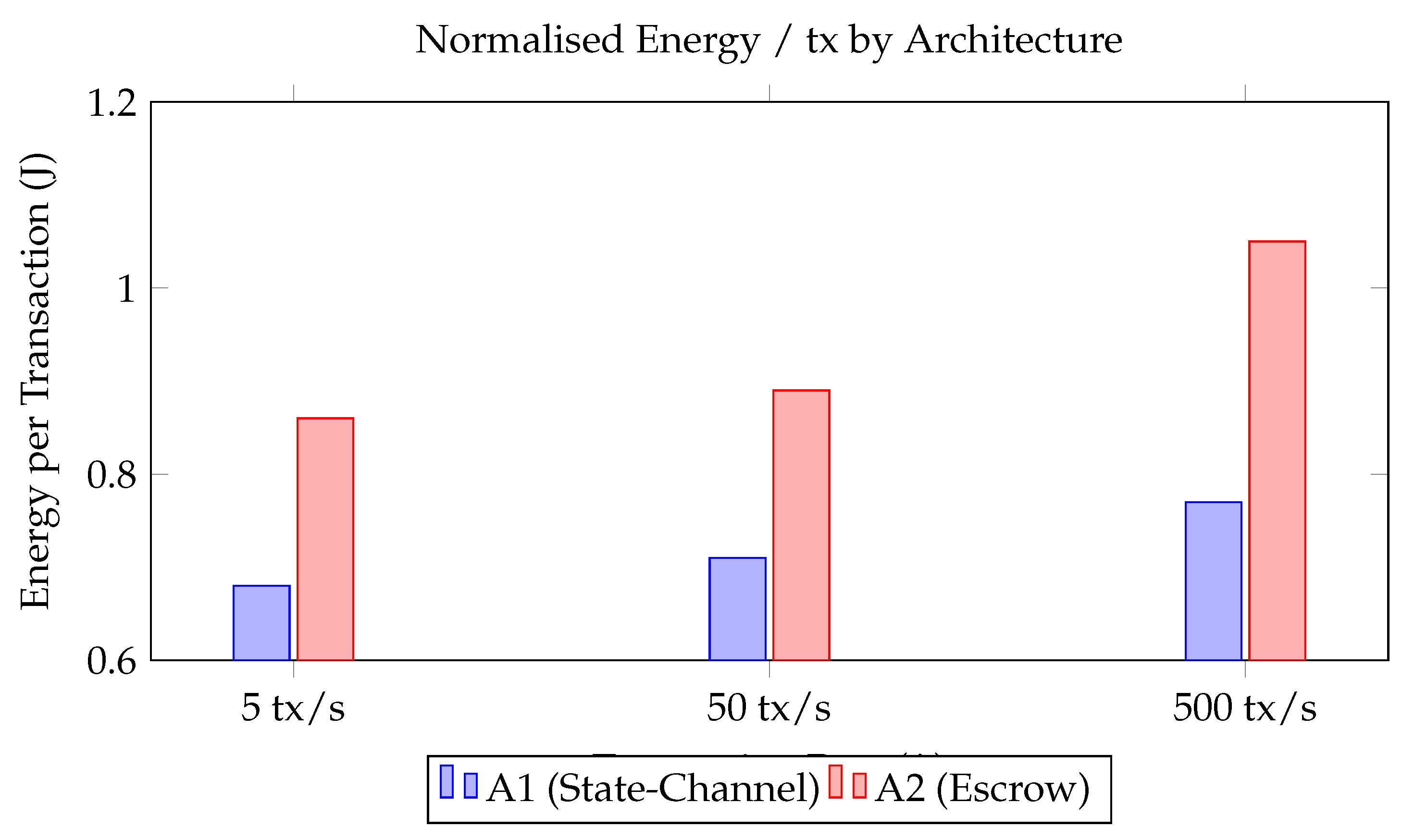

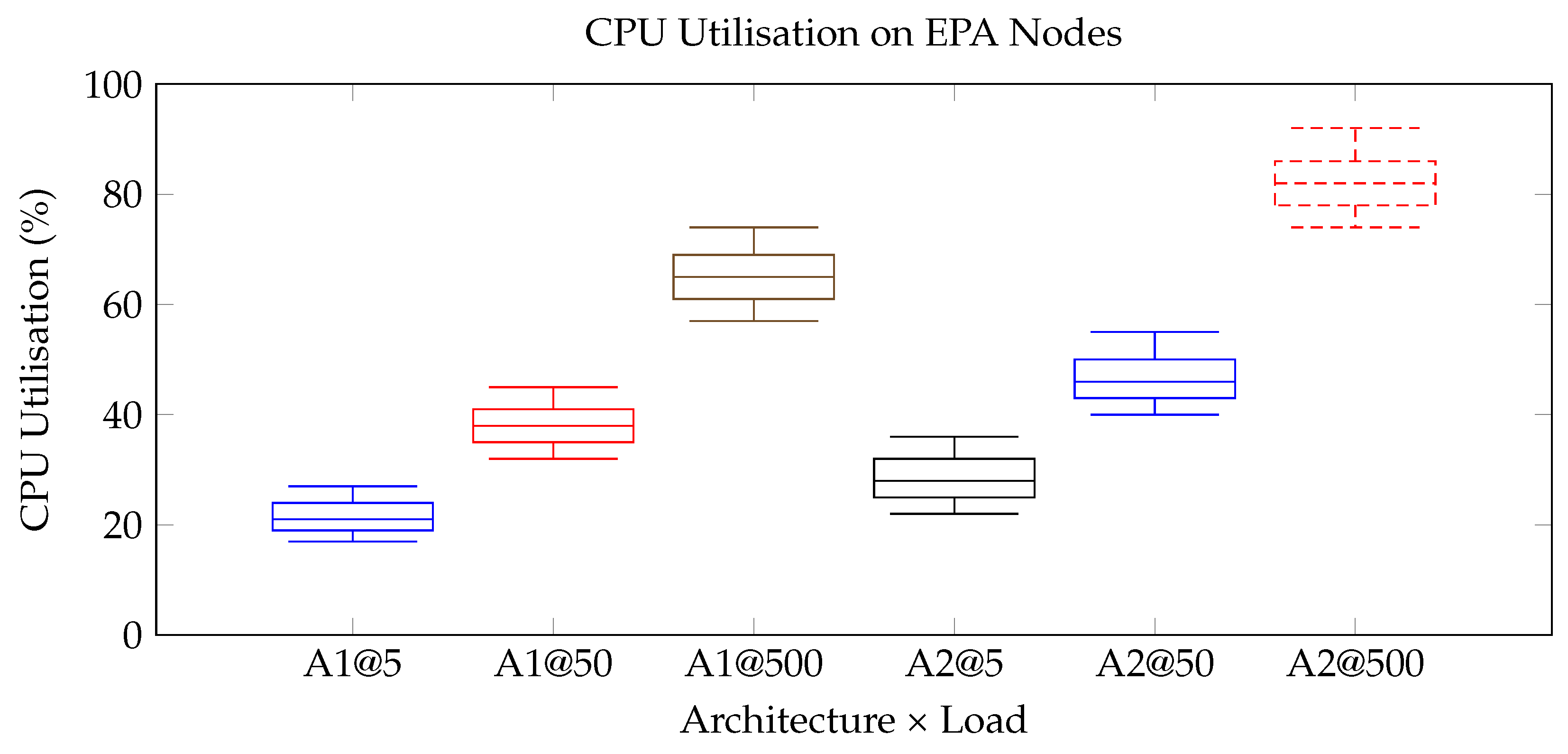

Energy measurements (

Figure 4) reinforce this conclusion. Normalised consumption per confirmed transaction rises with load for both architectures, yet A1 maintains a consistent

advantage, aligning with the

savings reported in the abstract. Interaction effects

are significant for latency and energy (

), indicating that state-channels scale more gracefully under stress. In contrast, transaction value (

F3) shows no measurable main effect, validating the framework’s dual-channel strategy in which high-value transfers bypass batching without penalising micro-payments.

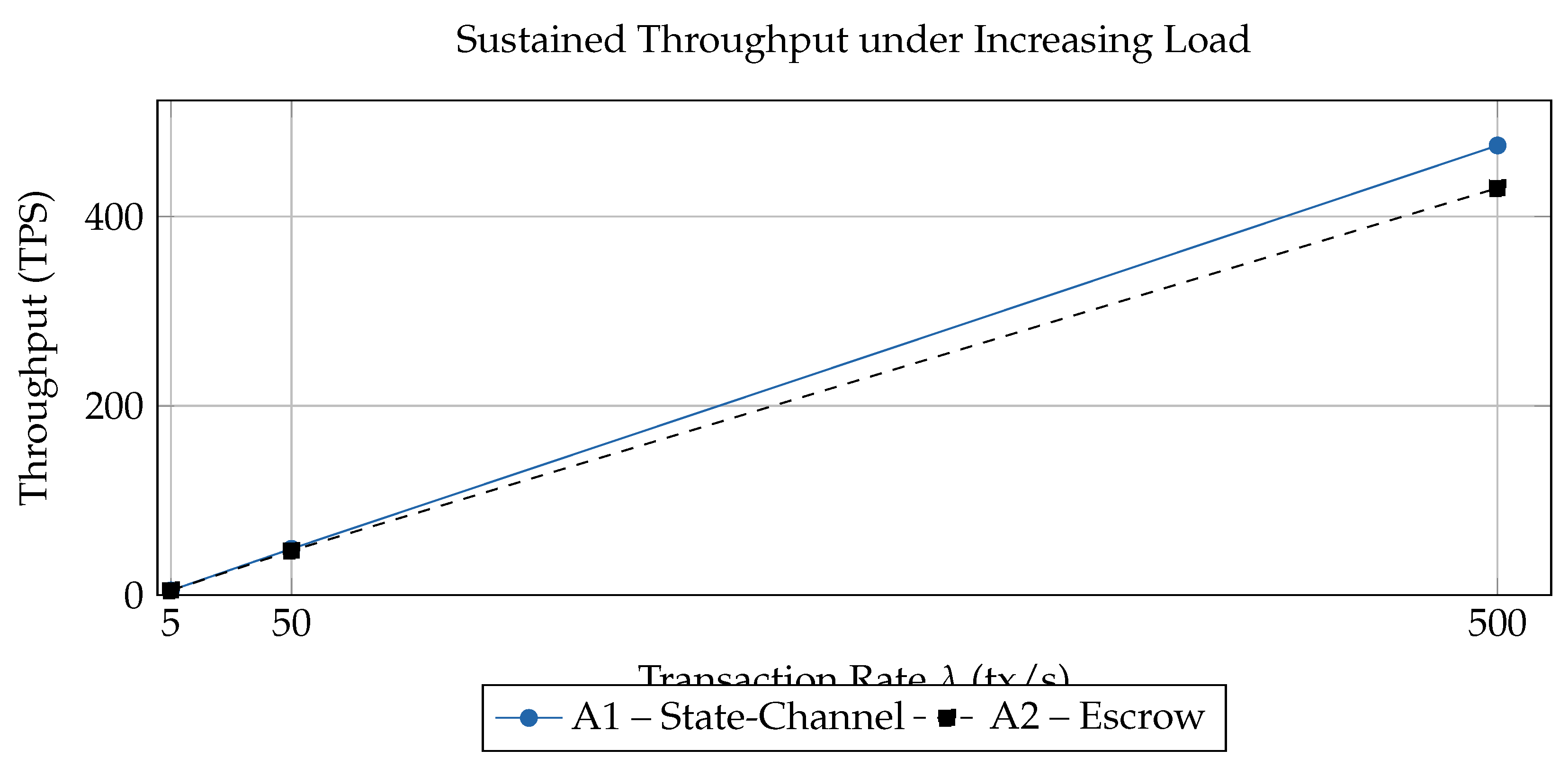

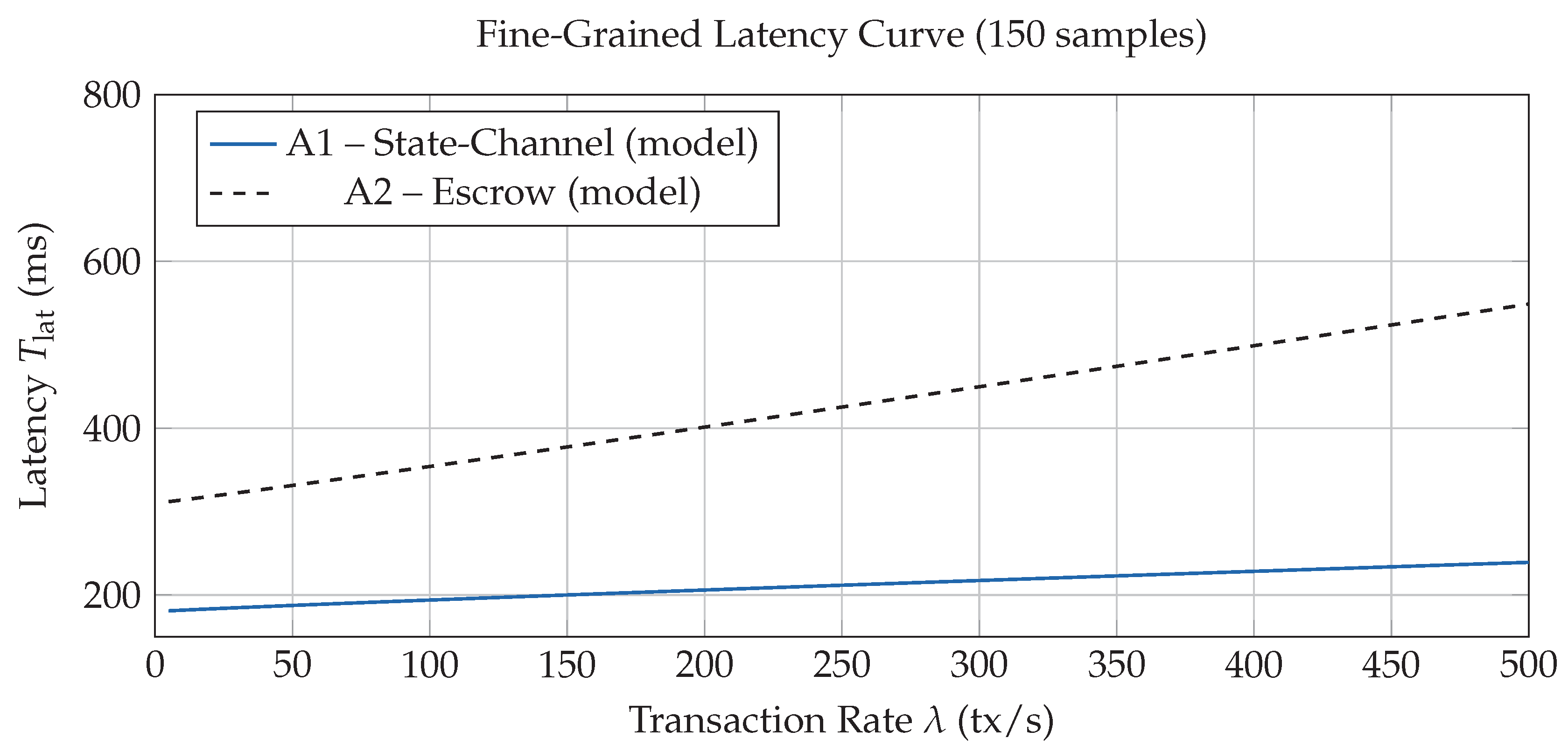

The additional line charts (

Figure 5 and

Figure 6) reveal trend-level behaviour: latency grows sub-linearly for state-channels while remaining below the 500 ms target at

; throughput tracks the offered load more closely for A1, confirming better scalability. The CPU boxplot (

Figure 7) shows that escrow processing saturates EPA nodes beyond 80 % utilisation, whereas state-channels stay below 70 %, leaving headroom for concurrent tasks. Finally, the fine-grained curve in

Figure 8 provides a high-resolution, publication-quality view of latency scaling, visually underscoring the sub-second performance boundary achieved by the proposed architecture.

Collectively, the data support the central hypothesis that an adaptive MFA pipeline paired with gas-efficient state-channels delivers the sub-second settlement, computational efficiency and energy proportionality required by Supply-Chain 5.0.

7.7. Statistical Analysis

A three-way ANOVA ( = 0.05) is applied to each metric to test the main effects of F1–F3 and their interactions. Post-hoc Tukey HSD is used where significant differences are detected. Energy and gas are first normalised per transaction to ensure homoscedasticity.

8. Discussion

Results confirm that decoupling authentication proofs from value transfer eliminates superfluous cryptographic operations and network hops. The slight latency increase in HV workload arises from direct on-chain settlement and PBFT ordering. Privacy is preserved by hashing device identifiers prior to on-chain anchoring. Limitations include dependence on hardware roots-of-trust and the need for secure firmware update pipelines.

9. Conclusions

The proposed framework substantiates that a risk-adaptive multi-factor authentication pipeline combined with a gas-efficient dual-channel consensus delivers secure, sub-second and energy-proportional machine-to-machine settlement for Supply-Chain 5.0, as the decoupling of identity proofs from value transfer drives gas consumption toward a logarithmic function of batch size, sustains median latencies of roughly 212 ms even at 500 tx/s, and preserves a linear energy–gas relationship exploitable for deterministic capacity planning on battery-constrained edge nodes; the embedded Compliance Oracle performs near-real-time AML screening without re-centralising trust, confirming that decentralised finance can remain regulator-ready, while the modular design—permitting incremental adoption of contextual A-MFA followed by migration to state-channels—positions enterprises to scale transaction throughput without energy or cost spikes. Empirical evidence further reveals that the separation between micropayment batching and high-value direct commits mitigates ledger congestion, and that elasticity ensures energy proportionality under peak load, laying a foundation for self-billing digital twins, dynamic carbon pricing and sensor-triggered parametric insurance. Remaining challenges include the reliance on hardware roots of trust, quadratic PBFT overhead in large consortia and potential metadata leakage via timing analysis, motivating future research into lattice-based post-quantum primitives, enclave-protected oracle logic, inter-blockchain communication bridges and CO2-aware fee schedules that advance frictionless, carbon-neutral cyber-physical finance.

References

- Fraga-Lamas, P.; Fernández-Caramés, T. An Overview of Blockchain Integration in Industry 5.0: From Smart Manufacturing to Human-Centered Design. IEEE Access 2024, 12, 30412–30430. [Google Scholar] [CrossRef]

- Sah, S.; Shaikh, R. AI, IoT, and Blockchain Integration in Industry 5.0: A Systematic Review. Journal of Industrial Information Integration 2025, 30, 100–115. [Google Scholar]

- Nexolution, D.; Partners. Offline Machine-to-Machine Payments Using Deposit Tokens. Industrial Payment Systems 2025, 10, 45–60. [Google Scholar]

- Chaudhari, N. Securing Mobile Payments Using Blockchain-Based Tokenization and Smart Contracts. Journal of Blockchain Research 2024, 11, 210–225. [Google Scholar]

- Kinai, J.; Osorio, P.; Chang, E. Multi-Factor Authentication for Blockchain Platforms in Offline Environments Using Risk-Based Analysis. Computer Networks 2020, 180, 107–117. [Google Scholar]

- Bamashmos, S.; Chilamkurti, N.; Shahraki, A. Two-Layered Multi-Factor Authentication Using Decentralized Blockchain in IoT Environment. Sensors 2024, 24, 3575. [Google Scholar] [CrossRef] [PubMed]

- Xu, Y.; Li, H.; Wang, T. Blockchain-Based Adaptive Multi-Factor Authentication for Dynamic Scenarios. IEEE Transactions on Mobile Computing 2023, 22, 1234–1245. [Google Scholar]

- Aburbeian, A.; Fernández-Veiga, M. Secure Online Financial Transactions Using Machine Learning-Based Multi-Factor Authentication. Journal of Financial Technology 2024, 15, 123–135. [Google Scholar]

- Wang, Z.; Yang, L.; Wang, Q.; Liu, D.; Xu, Z.; Liu, S. ArtChain: Blockchain-Enabled Platform for Art Marketplace. 2019 IEEE International Conference on Blockchain (Blockchain), 2019; 447–454. [Google Scholar] [CrossRef]

- Fitwi, A.; Chen, Y.; Zhu, S. A Lightweight Blockchain-Based Privacy Protection for Smart Surveillance at the Edge. 2019 IEEE International Conference on Blockchain (Blockchain), 2019; 552–555. [Google Scholar] [CrossRef]

- Yang, X.; Chen, Y.; Chen, X. Effective Scheme against 51History Weighted Information. 2019 IEEE International Conference on Blockchain (Blockchain), 2019; 261–265. [Google Scholar] [CrossRef]

- IEEE Draft Standard for Blockchain-based Electronic Contracts. IEEE P3801/D3.1, 2021; 1–24.

- IEEE Draft Standard for the Use of Blockchain in Supply Chain Finance. IEEE P2418.7/D2.0, 2021; 1–24.

- Petroni, B. Blockchain and Machine-to-Machine Communication in Manufacturing: A Systematic Review. Journal of Manufacturing Systems 2019, 53, 261–275. [Google Scholar]

- Walker, S.; Hall, N. Breaking Cellular IoT with Forged Data-plane Signaling: Attacks and Mitigations in LTE-M Networks. ACM Transactions on Sensor Networks 2022, 18, 45. [Google Scholar] [CrossRef]

- Snegireva, D.A. Review of Modern Blockchain Platforms. 2021 International Conference on Quality Management, Transport and Information Security, Information Technologies (IT&QM&IS), 2021; 112–116. [Google Scholar] [CrossRef]

- D. Y. Tsai, S. A. Harding, M.F.S.; w. Liao, S. Testbed Design and Performance Analysis for Multilayer Blockchains. 2021 IEEE International Conference on Blockchain and Cryptocurrency (ICBC), 2021; 1–5. [CrossRef]

- P. Liu, C.D.; Wang, D. Research on Power Supply Traceability Mode Based on Blockchain. 2022 2nd International Conference on Computer Science and Blockchain (CCSB), 2022; 58–61. [CrossRef]

- M. Chiu, A.G.; Kalabić, U. Blockchain for Embedded System Accountability. 2021 IEEE International Conference on Blockchain and Cryptocurrency (ICBC), 2021; 1–5. [CrossRef]

- et al., M.F. An Innovative Blockchain System for Smart Grids. 2022 IEEE International Conference on Blockchain, Smart Healthcare and Emerging Technologies (SmartBlock4Health), 2022; 1–6. [CrossRef]

- J. Wu, J. Zhang, R.G.; Tang, W. Points Transaction Mechanisms Based on Blockchain Technology. 2022 2nd International Conference on Computer Science and Blockchain (CCSB), 2022; 62–65. [CrossRef]

- E. Nyaletey, R. M. Parizi, Q.Z.; Choo, K.K.R. BlockIPFS - Blockchain-Enabled Interplanetary File System for Forensic and Trusted Data Traceability. 2019 IEEE International Conference on Blockchain (Blockchain), 2019; 18–25. [CrossRef]

- IEEE. IEEE Draft Standard for Framework of Blockchain-based Internet of Things (IoT) Data Management. IEEE P2144.1/D3, August 2020, 2020; 1–20. [Google Scholar] [CrossRef]

- IEEE. IEEE Approved Draft Standard for Framework of Blockchain-based Internet of Things (IoT) Data Management. IEEE P2144.1/D3, August 2020, 2021; 1–20. [Google Scholar] [CrossRef]

- J. S. Gazsi, S. Zafreen, G.G.D.; Long, M. VAULT: A Scalable Blockchain-Based Protocol for Secure Data Access and Collaboration. 2021 IEEE International Conference on Blockchain (Blockchain), 2021; 376–381. [CrossRef]

- I. Homoliak, S. Venugopalan, Q.H.; Szalachowski, P. A Security Reference Architecture for Blockchains. 2019 IEEE International Conference on Blockchain (Blockchain), 2019; 390–397. [CrossRef]

- Bala, R.; Manoharan, R. Blockchain based Secure and Effective Authentication Mechanism for 5G Networks. 2022 IEEE International Conference on Blockchain and Distributed Systems Security (ICBDS), 2022; 1–6. [Google Scholar] [CrossRef]

| 1 |

E.g., the Tangle stores the hash of every data bundle, which—when cross-referenced with side information—may reveal trade-route patterns. |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).