Purpose: This article evaluated the decline of registered auditors (RAs) and its impact on the future of the assurance industry in South Africa. Auditors play a critical role in ensuring the transparency, trust, and credibility of financial statements. The decrease in the number of registered auditors has become a pressing issue, raising concerns about the assurance industry’s ability to maintain a sufficient number of registered auditors and continue providing assurance services to public and private entities. Methodology: A qualitative Delphi methodology was employed, involving interviews with RAs who are registered with the Independent Regulatory Board for Auditors (IRBA). Eight RAs participated in structured interviews. This approach enabled the researcher to gather expert opinions, identify emerging trends, and explore challenges and opportunities within the audit profession related to the decline of RAs. Main findings: The decline of RAs is straining client demands, increasing workloads, and leading to a shortage of audit firms, which in turn affects audit quality and methodologies. Audit firms struggle to attract and retain talent due to regulatory burdens, economic pressures, and concerns about work-life balance. These pressures have resulted in higher audit fees, increased compliance costs, and more extensive training requirements. Smaller audit firms are especially impacted, with some downscaling their assurance services or exiting the market entirely. Practical implications: This study underscores the pressing need for regulatory bodies, such as the IRBA, to address the challenges faced by audit firms, particularly in terms of compliance and workforce retention. Proactive strategies are required to preserve the quality and accessibility of assurance services. Contribution: This study contributes to the ongoing discourse on the future of the audit profession by offering grounded insights into how the industry might sustain itself amid a declining number of RAs and changing professional dynamics.

1. Introduction

The audit profession plays a critical role in ensuring financial transparency and public trust (Abrahams and Phesa, 2025). In recent years, however, a worrying global trend has emerged, the supply of qualified auditors is declining (Abrahams and Phesa, 2025). Multiple countries have reported auditor shortages and a decline in entry into the profession (Ellis, 2022, Khumalo, 2023, Tyson, 2023, Yiu and Zhong, 2023). For example, the United States saw over 300,000 accountants leave their jobs in a two-year span, with an estimated 17% workforce contraction (Ellis, 2022). Similarly, Australia’s pool of registered company auditors has shrunk by more than 30% over the past decade, a decline attributed to demographic shifts, firm consolidations, and an ageing workforce (Hecimovic et al., 2009). Across jurisdictions, younger professionals are increasingly reluctant to pursue careers in auditing due to demanding workloads, stringent regulations, and concerns about work-life balance (Harber, 2018). These global pressures, including regulatory burden, talent shortages, firm closures, and audit market consolidation, have created a challenging environment for the sustainability of the audit profession (Ramalepe, 2023, Ahn et al., 2024, Tyson, 2023, Vien, 2024, Eldaly, 2012, Fülöp and Pintea, 2014).

South Africa mirrors these international trends, with evidence pointing to a notable decline in its registered auditor (RA) population (Irba, 2024a). Recent data from the Independent Regulatory Board for Auditors (IRBA) indicate that the number of RAs in South Africa fell by approximately 11.7% between 2019 and 2023 (Irba, 2023). This contraction stems from multiple factors, such as auditors retiring faster than they can be replaced, and fewer young accountants entering the auditing field (Irba, 2024a). The profession has struggled to attract new talent, in part due to negative public perceptions resulting from high-profile corporate scandals and the intense demands of audit work (Abrahams and Phesa, 2025). Additionally, South African auditors face increased regulatory pressure (Abrahams and Phesa, 2025). Amid audit failures, regulators have tightened oversight and IRBA inspections in recent years (Irba, 2024b). At the same time, such measures aim to restore confidence, but they have increased compliance costs and liability risks for auditors (Celestin, 2020b). Smaller audit practices, in particular, are strained by the cost of complying with stricter standards and oversight (Celestin, 2020a). Many small and mid-tier firms find it difficult to absorb these burdens, which has led some to merge with larger firms or exit the assurance market entirely (Celestin, 2020a). This audit market consolidation further concentrates the industry among the Big Four firms, raising concerns about reduced competition and the capacity to serve the public interest (Celestin, 2020a). In summary, by 2025, the South African auditing landscape will be characterised by a shrinking auditor workforce and mounting challenges related to audit quality, talent retention, and firm viability (Abrahams and Phesa, 2025, Harber, 2018).

The purpose of this study was to evaluate the impact that the decline of RAs will have on the future of the assurance industry in South Africa. The study employed a qualitative research approach by conducting structured interviews with eight RAs currently registered with the Independent Regulatory Board for Auditors (IRBA), the South African audit regulatory body. Notably, IRBA was once ranked number one for seven consecutive years from 2010 to 2016 in the World Economic Forum’s Global Competitiveness Report for the strength of its auditing and reporting standards (Irba, 2016). Even though the IRBA has declined since 2017 due to recent scandals (Steinhoff scandal, VBS Mutual Bank Collapse, Tongaat Hulett and others) (Irba, 2017), which have led to a significant loss of trust (Ramsarghey and Hardman, 2020), IRBA still plays a significant role in the world and is one of the most respected regulatory bodies, evidenced by the recent re-election of Mr. Imre Nagy, CEO of the IRBA as the board member and the chairperson of IFIAR Audit and Finance Committee in the International Forum of Independent Audit Regulators, “with Ireland (IAASA), Poland (PANA), Singapore (ACRA), and South Africa (IRBA) being appointed to the IFIAR Board for a four-year term, joining currently appointed board members from 12 jurisdictions to form a full board of 16 members” (Irba, 2025). This shows how IRBA is still relevant and amongst the world leaders in the auditing space. For this reason, we find this study relevant not only in South Africa, but globally, as it may show the same sentiment in other jurisdictions.

The central research question guiding this inquiry is: How will the decline in Registered Auditors affect the assurance industry in the future within the South African economy? This study aims to:

Describe professional concerns about the decline in RAs in South Africa.

Explain the drivers of RA decline between 2019 and 2023.

Document firm-level strategies adopted to adapt to changes in RA numbers.

Examine regulatory challenges shaping audit practice and their perceived proportionality.

Assess near-term risks (5–10 years) for capacity, quality, and market structure.

Identify opportunities for growth and improvement in the profession.

Examine strategies to sustain the RAs in a midst of a decline.

This study addresses a growing and pressing concern, that is, the shortage of assurance auditors, which is placing an increasing strain on the capacity, quality, and sustainability of assurance services within the country. By directly engaging with experienced professionals through in-depth interviews, the research captures practitioner-based insights into how this trend is shaping audit practice, firm resilience, and public trust in financial reporting. The findings offer a grounded and forward-looking evaluation of the risks, challenges, and potential responses to the auditor shortage.

Importantly, this study contributes to the academic literature as one of the first qualitative investigations into the future impact of declining RAs in the South African context and, as noted before, may contribute significantly to the debate in other jurisdictions. It adds to the broader discourse on the future of the assurance profession, offering evidence-based perspectives that may inform policy, regulatory reform, and professional development strategies aimed at sustaining the audit industry in an increasingly constrained environment.

The following sections of the article outline the literature review, methodology, analysis and discussion of results, and conclusions. The conclusion includes the study's contribution, limitations, recommendations for practice and policy, and directions for future research.

2. Literature Review

This section offers an overview of previous researchers’ findings and identifies gaps in the existing research. Furthermore, it establishes a foundation for the theoretical studies upon which this thesis is based.

2.1. Theoretical Review: Behavioural and Institutional Theory

The Behavioural Theory, and more specifically the Theory of Planned Behaviour (TPB) developed by Ajzen (1991), underpins this study. According to TPB, human behaviour is driven by three core components: behavioural beliefs, normative beliefs, and control beliefs. Behavioural beliefs relate to anticipated outcomes (positive or negative) of a particular behaviour, which shape an individual’s attitude. Normative beliefs involve perceived social pressures or expectations from others. Control beliefs reflect how easy or difficult the individual perceives the behaviour to be, influenced by past experiences and anticipated obstacles (Ajzen, 1991).

This theory applies to the auditing profession in the South African context. It offers a lens to understand the declining interest in registering as an RA, particularly among young professionals. For example, behavioural beliefs may be shaped by the perceived risk, intensity of regulatory scrutiny, or unattractive working conditions in the profession. Normative pressures could relate to the societal and professional expectations placed on auditors. At the same time, control beliefs may stem from the perceived difficulty of qualifying, sustaining performance, or maintaining independence in the face of growing compliance demands.

As this study seeks to evaluate how the decline in RAs may affect the future of the assurance industry, behavioural theory allows for a deeper analysis of why auditors are leaving or avoiding the profession altogether. It provides a psychological framework for interpreting the motivations, deterrents, and professional decisions that contribute to the diminishing supply of RAs, which in turn has tangible implications for audit firm capacity, assurance quality, and industry sustainability.

Institutional theory offers a lens through which to interpret how audit firms respond to external systemic influences, including regulatory demands, professional expectations, and pressures arising from global market dynamics (Abrahams and Phesa, 2025). Scott (2013) identifies three forms of institutional pressure, coercive, normative, and mimetic, that guide and constrain organisational behaviour. These mechanisms are particularly pertinent when examining the global shortage of auditors, as firms navigate technological integration, regulatory complexity, and workplace restructuring to manage uncertainty and maintain legitimacy (Malsch and Gendron, 2011, Fülöp and Pintea, 2014). The theory thus provides a valuable framework for analysing how evolving institutional contexts shape the long-term viability of the audit profession (Abrahams and Phesa, 2025).

2.2. Empirical Literature

The decline of Registered Auditors (RAs) in South Africa has become a critical concern within the auditing profession, raising questions about the future capacity and credibility of the assurance industry (Abrahams and Phesa, 2025). This section reviews empirical studies between 2019 and 2025 that explore the causes of this decline, its implications for audit quality, firm sustainability, regulatory pressure, and technological transformation. The literature further identifies key gaps in the South African context that this study seeks to address.

An empirical study by Harber (2018) remains one of the earliest South African investigations into the decline in RAs. Harber (2018) identified growing public misunderstandings of the audit profession, increasing regulatory scrutiny, and heightened litigation risk as key deterrents. His findings showed that audit professionals were concerned about the increasing workload, complexity of the job, and regulatory overreach, issues which have persisted and worsened in subsequent years (Harber, 2018). While insightful, Harber’s study predates several major developments, such as the removal of Mandatory Audit Firm Rotation (MAFR) (Mantshantsha, 2023), the surge in post-COVID global mobility, and IRBA’s stricter enforcement of penalties. As a result, there is a clear need to re-examine the topic in the current context.

Ahn et al. (2024) examined how the global shortage of accounting graduates has affected the talent pipeline within audit firms. Their research found that many firms have been forced to broaden recruitment beyond traditional target universities, which has, in turn, been associated with lower audit quality (Ahn et al., 2024). This trend is mirrored in South Africa, where limited interest in pursuing careers in audit has further reduced the attractiveness of the RA designation (Abrahams and Phesa, 2025). This study confirms that declining enrolments and a shifting labour market are now international challenges threatening the profession’s future (Abrahams and Phesa, 2025).

The issue of auditor retention is further explored by Knechel et al. (2021), who studied the consequences of high turnover in public accounting. Their results showed that firms suffering from brain drain, particularly the loss of high-performing auditors, experienced client losses and compromised audit quality, especially in complex audit engagements (Knechel et al., 2021).

Further compounding the problem is the growing pressure of regulatory compliance and workload (Caseware, 2024). According to Persellin et al. (2019), auditors reported that excessive workloads, driven by tight deadlines and staff shortages, led to reduced audit quality, compromised professional judgement, and ultimately lower job satisfaction. The stress and time constraints auditors face, particularly in peak season, continue to drive early exits from the profession (Persellin et al., 2019).

Cpa Ireland (2023) offers additional insight into how the global regulatory environment affects the viability of small audit firms. The report warns that by 2030, many sole practitioners may withdraw from the audit market due to rising compliance costs and the complexity of current auditing standards (Cpa Ireland, 2023). The report calls for proportional audit standards for Less Complex Entities (LCEs), a view echoed by many South African auditors struggling to balance regulatory obligations with operational sustainability (Cpa Ireland, 2023).

Similarly, the Financial Reporting Council (2024) report highlights a consistent decline in the number of registered audit firms in the UK, attributing this trend to consolidation and the exit of smaller practices. Abrahams and Phesa (2025) confirms that many small and mid-tier firms are abandoning audit work due to the increasing difficulty of navigating complex standards not designed for SME audits. These developments parallel the South African situation, where audit market concentration is growing, and smaller firms are struggling to survive in an environment favouring larger players (Abrahams and Phesa, 2025).

The technological transformation of audit work adds another layer of complexity (Caseware, 2024). Han et al. (2023) reviewed how AI, blockchain, and data analytics are reshaping audit procedures. Their study concluded that while automation improves efficiency, it also demands a new skillset from auditors, creating a mismatch between traditional training and emerging audit needs (Han et al., 2023). This is especially challenging for smaller South African firms that lack the capacity or capital to invest in advanced technologies and staff upskilling.

Caseware (2024) reinforces these challenges, stating that nearly 90% of audit teams globally struggle to attract and retain qualified auditors. The report also notes that data analytics is now used in 78% of audits, while skills in data science are at 18%, IT auditing (15%), and cybersecurity (12%) are increasingly in demand. Notably, the report highlights that internal audit teams are being asked to do more with fewer resources, placing additional strain on existing professionals and accelerating burnout, a pattern also observable among South African RAs (Caseware, 2024).

In summary, the empirical literature confirms that the auditing profession is under significant strain due to talent shortages, excessive workloads, regulatory burdens, and the pressures of digital transformation. While the causes and effects of the RA decline are well-documented in global contexts, limited empirical work has explored these dynamics from South African RAs' perspective. This study addresses this gap by directly engaging with eight practising RAs to gather qualitative insights into how these challenges are being experienced locally and how they are likely to impact the future of the assurance industry.

3. Methodology

This study employed a qualitative method approach, structured using the Delphi methodology to ensure coherence across the research philosophy, strategy, design, data collection, and analysis techniques. Data were gathered through interviews and analysed using descriptive and thematic methods to address the study’s objectives.

3.1. Research Philosophy

This study adopts a pragmatic research philosophy, which supports the use of flexible, real-world approaches to investigating complex issues. Pragmatism aligns with the study’s goal of evaluating the practical implications of a declining number of Registered Auditors (RAs) on the future of the assurance industry. Given the exploratory nature of this inquiry, a qualitative approach was deemed most suitable for gathering in-depth insights from experienced auditors. The study uses inductive reasoning, enabling the researcher to draw conclusions based on themes that emerged from participants’ responses.

3.2. Research Design

A Delphi-based qualitative design was used to obtain expert consensus on the implications of the auditor shortage. The Delphi method is ideal for underexplored or emergent issues where expert judgment is essential. It involves multiple rounds of structured input from a panel of subject-matter experts to arrive at shared understandings or highlight areas of divergence. For this study, the Delphi approach was conducted in two rounds to allow for iterative reflection and refinement of participant views.

3.3. Research Sample

he research population and sample for the interviews consisted exclusively of existing Registered Auditors (RAs), selected to provide in-depth professional insights into the future implications of the decline in the auditing profession. Participants were identified through direct outreach to audit firms listed on the Independent Regulatory Board for Auditors (IRBA) website, where contact information was obtained and used to invite eligible RAs to participate. The interviews were conducted from 1 March to 27 May 2025. All interviews were conducted using structured, open-ended questions via a Zoom recorded call, allowing participants to respond. The responses were subsequently prepared for analysis using qualitative coding to identify common patterns, concepts, and themes across participants’ insights.

3.4. Sample Size for the Interviews

The data was collected through open-ended structured interviews with Registered Auditors currently practicing in South Africa. The interview guide included questions focused on the perceived impact of the declining RA population on audit quality, firm operations, regulatory pressures, talent retention, and the sustainability of the profession. Participants responded to the interview questions using Microsoft Forms. The responses were compiled and prepared for thematic analysis. Ethical clearance was obtained, and all participants provided informed consent before taking part in the study.

Although the original sample size target was 14 participants, consistent with guidance from Harber (2018), who found saturation at this level, the final sample comprised eight RAs. These participants were selected using snowball sampling, a non-probability technique appropriate for reaching professionals within a specialised and relatively small population. The sample was diverse in terms of firm size, audit experience, and geographic location within South Africa. Participation continued until thematic saturation was deemed to have been reached.

3.5. Analysis of Findings for the Interviews

Interview responses were analysed using a thematic coding approach. The qualitative data was organised in Microsoft Excel and then imported into QSR NVivo 12 software, a computer-assisted qualitative data analysis software. The software was used to identify recurring keywords, concepts, and themes in the open-ended responses. Codes were developed inductively based on common patterns in the data. Themes were refined through comparison across participants and rounds. The iterative nature of the Delphi method allowed participants to review and comment on preliminary findings, thereby enhancing the validity and depth of the final themes.

4. Ethical Approval and Informed Consent

The study was conducted in accordance with the ethical guidelines of the University of KwaZulu-Natal, dated 26 February 2025, and expires on 26 February 2026, with the reference number HSSREC/00008274/2025. Permission to access potential participants was obtained through formal gatekeeper letters from the Independent Regulatory Board for Auditors (IRBA) and the South African Institute of Chartered Accountants (SAICA). Participation in the interview was voluntary, and all participants provided informed consented at the beginning of the interview that was recorded. No personally identifiable information was collected, and responses were treated with strict confidentiality.

5. Analysis and Discussion of Results

The South African auditing profession faces a decline in RAs, risking the quality and sustainability of assurance services. This chapter analyses data from RAs using semi-structured interviews and thematic analysis with NVivo. Zoom interviews, recorded and transcribed, enabled systematic coding to develop themes aligned with research goals.

Following Spencer and Ritchie (2012) and Saldaña (2021), a mix of pre-existing and inductive codes guided analysis. The approach balanced organic insights with theoretical frameworks, providing a nuanced understanding of the decline, its drivers, consequences, and strategic responses from key industry stakeholders.

Table 5.1 presents the codebook for the thematic analysis. The table shows that eight themes were uncovered from the transcribed data collected from the RAs and discussed under several subthemes.

| Theme |

Subthemes |

| Sustaining the Auditing Profession Amidst Decline |

Concern about the Decline of RAs in South Africa

Perceived Causes of the Decline

Future Challenges Facing the Auditing Profession

Opportunities for Growth and Improvement |

| Reasons for the Decline in Registered Auditors |

Regulatory Burden and Compliance Pressure

Economic and Commercial Pressures

Migration and Talent Drain

Career Risk, Burnout, and Work-life Balance

Structural and Generational Shifts in the Profession

Perceived Erosion of Audit Purpose |

| Strategies to Adapt to Changes in the Number of Registered Auditors |

Technological Integration and Innovation

Technology-Enabled Talent Upskilling

Talent Management and Capacity Planning

Risk Management and Business Model Repositioning |

Regulatory Challenges in the Audit Profession

|

One-size-fits-all regulation and the disproportionate burden on auditors

The weight of compliance

Disconnect between regulators and practitioners |

| Challenges Facing the Auditing Profession in the Next 5 to 10 Years |

A Shrinking, Pressured Profession

The Risk-Reward Imbalance and Economic Pressures

Technological Disruption and Readiness

Systemic Weakness in Oversight and Policy |

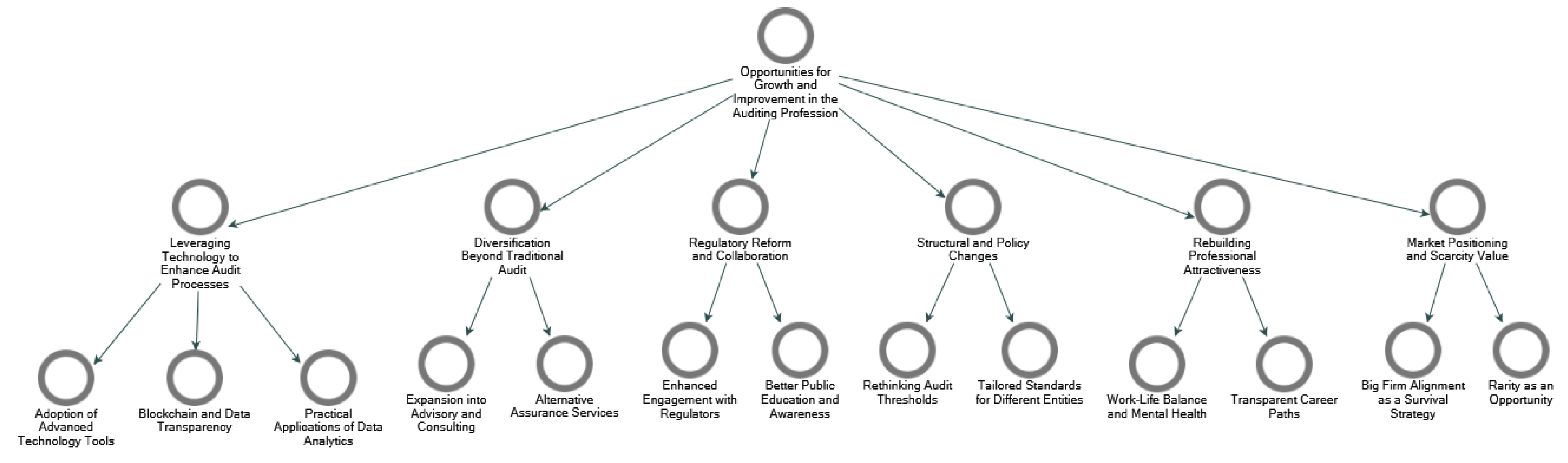

Opportunities for Growth and Improvement in the Auditing Profession

|

Leveraging Technology to Enhance Audit Processes

Diversification Beyond Traditional Audit

Regulatory Reform and Collaboration

Structural and Policy Changes

Rebuilding Professional Attractiveness

Market Positioning and Scarcity Value |

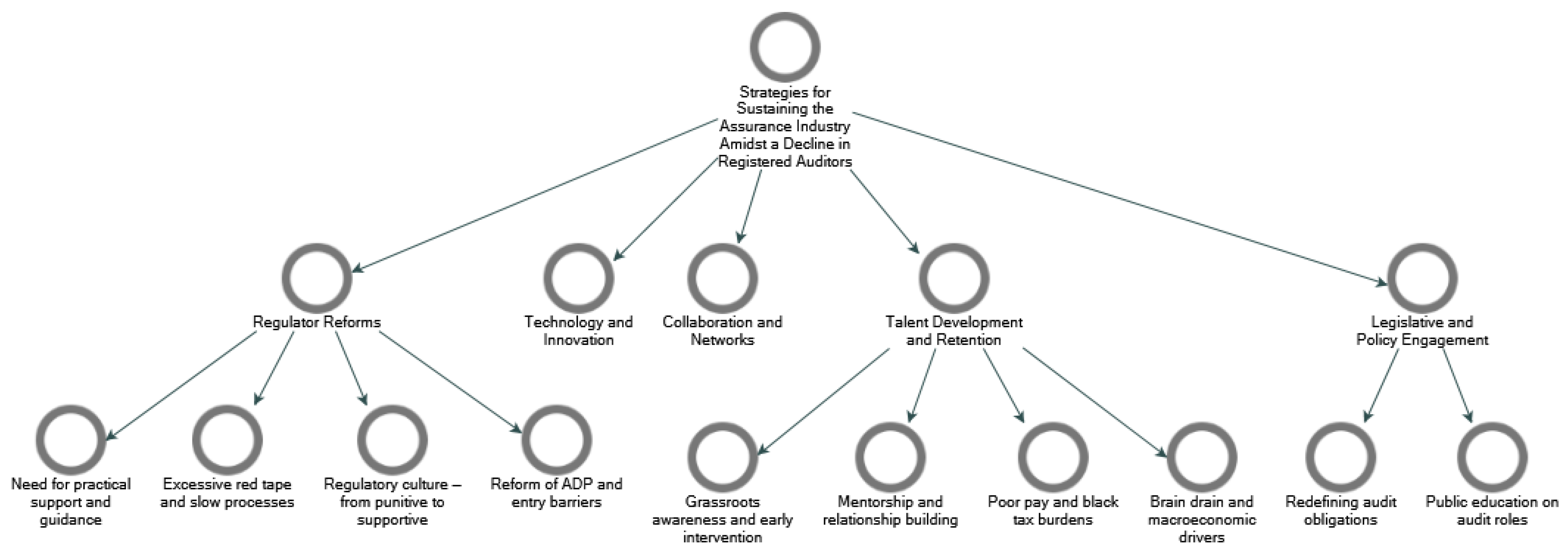

| Strategies for Sustaining the Assurance Industry Amidst a Decline in Registered Auditors |

Regulator Reforms

Technology and Innovation

Collaboration and Networks

Talent Development and Retention

Legislative and Policy Engagement |

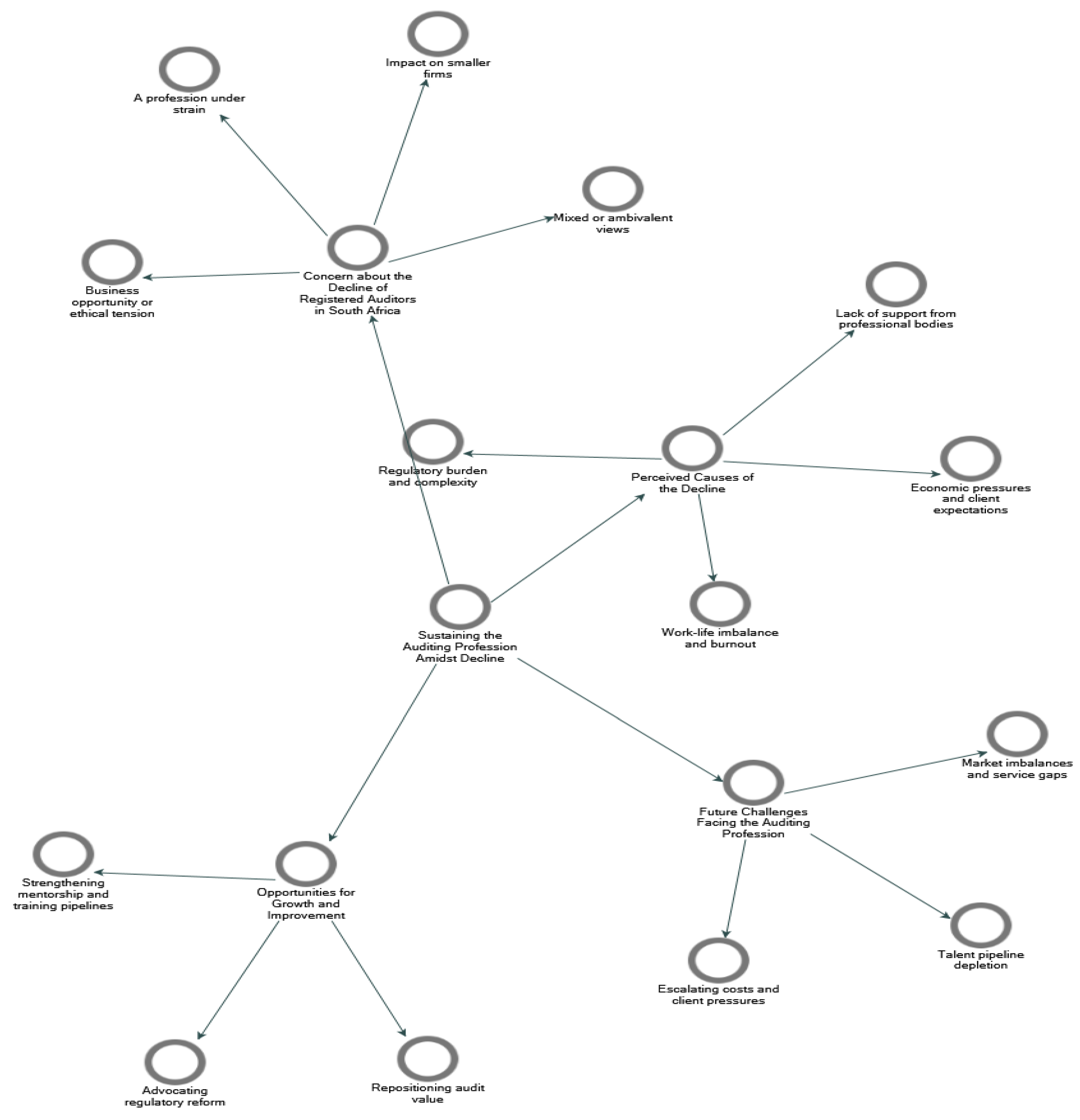

5.1. Theme 1: Sustaining the Auditing Profession Amidst Decline

This theme addresses the research aim number 1, which sought to know the concerns about the decline in RAs in South Africa. The theme is discussed under the subthemes depicted in

Figure 5.1.

5.2. Subtheme 1.1: Concern about the Decline of RAs in South Africa

The decline in the number of Registered Auditors (RAs) in South Africa has elicited a mixture of concern, reflection, and pragmatic acceptance from those within the profession. The voices of the interviewees paint a nuanced picture, highlighting not only the perceived risks but also the complexities surrounding the issue.

5.2.1. A Profession Under Strain

Many participants expressed deep concern about what the shrinking pool of auditors’ signals for the profession’s standing and future viability. Interviewee 1 captured this anxiety when they remarked:

"It doesn’t create a good public sort of image or reputation for auditors. Why are auditors leaving? Clearly, something is broken or something isn’t right... My concern is: what are we as auditors, or what is IRBA, not doing correctly?" (Participant 1).

For this auditor, the decline is not just a matter of numbers but a symptom of broader systemic challenges. They criticised the professional bodies, IRBA and SAICA, for being insufficiently hands-on, describing them as distant entities that issue guidance but fail to provide meaningful, practical support:

"They have all these circulars and things on their website, and they make it your responsibility as an auditor... but I don’t think they’re dynamic in terms of taking members by the hand."

Interviewee 3 echoed this concern, linking the decline in RAs to the weakening of the audit training pipeline and the potential erosion of professional quality:

"If auditing continues in its direction and we give up auditing as something we do, how can we train our future chartered accountants? How would a CA of today be compared with a CA in 20 years if we've come through two completely different training mechanisms?" (Participant 3).

For them, the decline threatens not just the audit function but the broader ecosystem of accounting expertise in South Africa.

Similarly, Interviewee 8 worried about the downstream consequences of having fewer auditors safeguarding stakeholder interests. They warned:

"It points to the sustainability of the profession going forward. With a dwindling pool of registered auditors, there's less protection for stakeholders, which increases risk for businesses and the economy at large."(Participant 8).

5.2.2. Business Opportunity or Ethical Tension

A few participants noted that the decline also creates practical shifts in the market. Interviewee 1, reflecting candidly, observed:

"If RAs decline, that means more business for other RAs. So, yes, I am concerned. But it’s more business for someone else. But some RAs will say: we don’t want the business." (Participant 1).

This duality — the prospect of greater demand alongside reputational harm — points to the complex dynamics at play. For some, the shrinking RA pool could be a commercial advantage; yet this comes with ethical and quality concerns, as Interviewee 4 cautioned:

"If RAs are fewer, then it means even the audit fee is going to increase for client organisations... It could be costly both for clients and audit firms themselves." (Participant 4).

5.2.3. Impact on Smaller Firms

Several participants emphasised how smaller firms bear the brunt of the challenges brought on by RA decline. Interviewee 1 described how small and medium-sized practices struggle to absorb clients dropped by larger firms:

"It’s much tougher for the smaller firms. All these changes of legislation... it’s making it really difficult for the smaller firms to keep up." (Participant 1)

Interviewee 5 highlighted the looming risk of a service gap:

"Somewhere there’s going to come a point where we don’t have auditors. The people that will remain won’t be the small or medium practitioners — only the large ones, and they’re not interested in a lot of the smaller clients." (Participant 5).

This sentiment was shared by Interviewee 6, who pointed out the broader economic consequences:

"If you've got a decline of registered auditors, you're likely to have more clients but fewer auditors. That could drive up costs and create competition among clients just to secure audit services." (Participant 6).

5.2.4. Mixed or Ambivalent Views

Not all participants saw the issue in starkly negative terms. Interviewee 2, for example, expressed a more measured concern:

"I’m more concerned about the reasons for the decline than the decline itself." (Participant 2).

For Interviewee 7, the issue was approached with a degree of ambivalence, shaped in part by the lack of visible value in the profession:

"On the one hand, I think I’m concerned about the effect on the profession... On the other hand, I’m double-minded about what is really the value of being an auditor, especially as a black auditor. There’s no value at all." (Participant 7).

Similarly, Interviewee 8 admitted that while the decline might enhance their personal marketability as an RA, they nonetheless saw it as detrimental for the profession’s long-term sustainability:

"If I were to be selfish, I’d say no [I’m not concerned] because it means I’m more in demand. But holistically, I am concerned. It points to the sustainability of the profession going forward." (Participant 8).

Concerns over the decline of RAs in South Africa highlight fears about the profession’s image, trust, and operational issues. Participants worry about weakened public confidence, lack of institutional support, and the growing gap between large and small practices. They recognise that while this decline changes market dynamics and offers opportunities, it also presents risks. The core worry is that without reforms, this decline could increase inequalities, reduce audit quality, and harm the industry’s ability to serve the public interest.

5.3. Subtheme 1.2: Perceived Causes of the Decline

5.3.1. Regulatory Burden and Complexity

Many auditors pointed to an increasingly onerous regulatory environment as a primary driver of RA attrition. Interviewee 1 lamented:

“All these changes of legislation... it’s making it really difficult for smaller firms to keep up. It pushes up training, it pushes up costs.”(Participant 1).

Interviewee 5 elaborated on how the regulatory scope has expanded beyond reasonable limits:

“The pool of things auditors believe they must do is becoming wider and wider. The real focus of audit — saying the financials are free of material misstatement — is a small part of what auditors do at the end of the day.”(Participant 5).

5.3.2. Lack of Support from Professional Bodies

There was widespread frustration with professional bodies like IRBA and SAICA, which were perceived as distant and insufficiently supportive. As Interviewee 1 put it:

“I don’t think IRBA and SAICA are as hands-on... they have all these circulars, but they make it your responsibility.”(Participant 1).

5.3.3. Economic Pressures and Client Expectations

Several participants described the misalignment between client expectations and audit realities. Interviewee 1 reflected:

“Clients don’t care about the quality of the audit file. They just want the financial statements signed off, and they don’t want to pay for the work that goes into that.”(Participant 1).

Similarly, Interviewee 3 highlighted how funding constraints push clients to seek cheaper audit services, further undermining the profession:

“Those non-commercial audits came to us because they couldn’t afford the fees of the bigger firms... now even we can’t service them, and they may be left without audit options.”(Participant 3).

5.3.4. Work-life imbalance and burnout

Several RAs cited unsustainable workloads as a contributing factor to attrition. As Interviewee 1 succinctly put it:

“The hours that you work is crazy. There’s a lack of work-life balance.”(Participant 1)

5.4. Subtheme 1.3: Future Challenges Facing the Auditing Profession

The future of the auditing profession, as envisioned by participants, appears fraught with structural, economic, and ethical challenges.

5.4.1. Talent Pipeline Depletion

Participants were particularly concerned about the erosion of the talent pipeline. Interviewee 3 warned:

“How can we train future CAs if auditing is no longer part of their foundation? What will the CA of tomorrow look like compared to today’s?” (Participant 3).

Interviewee 4 echoed this, stressing the difficulty of mentoring when there are fewer RAs:

“There won’t be enough people to mentor trainees... it impacts the up-and-coming professionals.”(Participant 4)

5.4.2. Market Imbalances and Service Gaps

Interviewee 5 foresaw a growing gap in service provision:

“The people that will remain will be large practitioners... and they’re not interested in smaller clients. There’s going to be a huge gap in service delivery.”(Participant 5).

5.4.3. Escalating Costs and Client Pressures

The imbalance between shrinking RA numbers and persistent client needs is expected to escalate audit fees and client competition for services, as Interviewee 6 pointed out:

“There’ll be more clients but fewer auditors. That could drive up costs and create competition among clients just to get audits done.”(Participant 6).

5.5. Subtheme 1.4: Opportunities for Growth and Improvement

Despite their concerns, some participants identified opportunities for renewal and growth within the profession.

5.5.1. Repositioning Audit Value

Participants suggested that the profession needs to better articulate and demonstrate its value to clients and society. Interviewee 8 reflected:

“With fewer auditors, there’s less protection for stakeholders. We need to remind people of the critical role we play in safeguarding public interest.” (Participant 8)

5.5.2. Advocating Regulatory Reform

Participants highlighted the need to simplify or tailor regulations to firm size and capacity. Interviewee 1 argued:

“Smaller firms can’t be held to the same regulatory standard as the big firms without support... It’s just not sustainable.”(Participant 1).

5.5.3. Strengthening Mentorship and Training Pipelines

The importance of nurturing the next generation of auditors came through strongly. Interviewee 4 suggested:

“We need to ensure there are enough RAs to mentor trainees and guide them properly.”(Participant 4)

Overall, the narratives reveal a profession at a crossroads, with participants worried about the decline of the profession due to regulatory overload, economic pressures, lack of support, and client apathy. The consequences could be talent shortages, weaker assurance, higher costs, and service gaps harming both the profession and public interest. However, there are pathways forward, such as regulatory reform, strengthening the audit pipeline, technological innovation, and positioning auditing as a public good. Without action, RAs decline could reshape assurance, reducing its ability to serve South Africa’s needs.

Theme 1 is supported by several sources that directly document shrinking pipelines and attrition. The foundational Abrahams and Phesa (2025) frames the decline as a global, multifactorial trend, with talent shortages, recruitment difficulties, and burnout repeatedly cited. Caseware (2023) noted a sharp rise in hiring difficulty, firms turning work away, and a contracting graduate pool. Empirical and interview-based studies such as Murray (2024), Boyle et al. (2024), Jahn and Loy (2023) focus on falling enrolments and talent scarcity. Research on exits and retention Abramova et al. (2025), Knechel et al. (2021), Harber (2018)links declining appeal, turnover, and “brain drain” to the decline of auditors. Many studies interrogate competencies, quality, market behaviour, or role transformation without asserting a numerical decline. Reviews of competency supply–demand gaps (Kroon and Do Céu Alves, 2023), academic career choices (Plumlee and Reckers, 2014), and entry-level knowledge, skills, and abilities (Pasewark, 2021) address fit and skills rather than headcount. Quality-focused oversight Irba (2024b), tracks remediation and deficiencies, not workforce size. Technology-oriented work Isotalo (2024) highlights the transformation from AI and automation.

The most convincing argument for Theme 1 is the convergence of pipeline contraction (fewer accounting students and graduates choosing audit), negative work perceptions (stress, burnout, alternative career appeal), and retention challenges (measurable turnover). The neutral or differently focused sources help limit the scope: concerns about competencies, quality inspections, or technological change may influence how audit is practised and what skills are valued, but they do not directly indicate a decline in registered auditor numbers. For South Africa, the alignment of local evidence on declining audit appeal with international pipeline and retention data strengthens the case that maintaining the profession requires targeted interventions in attraction, development, and retention, rather than just curriculum or quality control reforms.

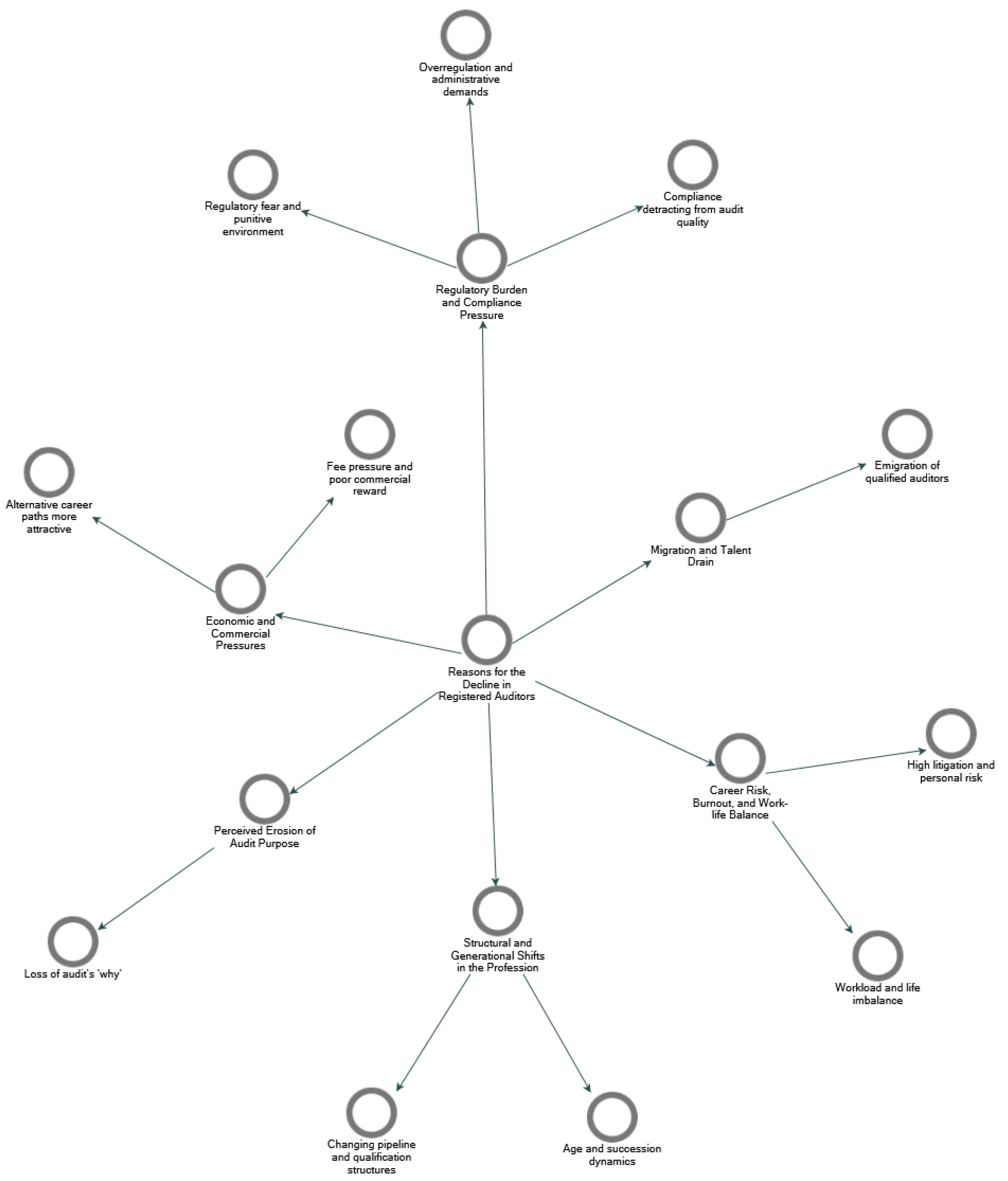

5.6. Theme 2: Reasons for the Decline in Registered Auditors

This theme addresses the research aim number 2. The number of RAs declined by 11.72% from 2019 to 2023, and the decline of assurance RAs was 3.46% within the same period. Comment on possible reasons for these trends. This section presents an in-depth analysis of interviewees’ perspectives regarding the reasons behind the decline in RAs between 2019 and 2023.

Figure 5.

2: Visualising experts reasons for the decline in registered auditors.

Figure 5.

2: Visualising experts reasons for the decline in registered auditors.

5.7. Subtheme 2.1: Regulatory Burden and Compliance Pressure

5.7.1. Overregulation and Administrative Demands

Participants consistently highlighted that excessive regulation has overwhelmed audit practitioners, particularly smaller firms that lack the resources of larger counterparts.

“Overregulation is definitely a massive part... just the amount of time that we’re spending on stuff that’s not reviewing the files. That’s just out of balance at the moment.” (Interviewee 2)

“The auditing profession does not necessarily compensate you as much as you would be compensated out in commerce… the regulation is layered more and more. It’s just becoming more tedious.” (Interviewee 8)

5.7.2. Regulatory Fear and Punitive Environment

Auditors feel targeted by regulators, creating anxiety and discouraging continued practice in assurance. These are reflected in the quotes attributable to participants 5 and 7.

“The very first thing that comes to my mind... you are reminded daily that you will be penalised up to 25 million rand by IRBA… They even use the words ‘we will catch you’.” (Interviewee 5)

“I think what you’re seeing should have been more [attrition]. I’m expecting that, especially in the light of these penalties that they keep on publishing in the Government Gazette.” (Interviewee 7)

5.7.3. Compliance Detracting from Audit Quality

Several auditors noted that the focus on regulatory compliance shifts attention away from professional judgment and substantive audit work.

“We focus so much on ticking the box that you miss the fact that this company has going concern issues... that is what extreme regulation is doing.” (Interviewee 8)

“We spend so much time trying to understand this control environment and document it just to pretty much put IRBA at ease... but it doesn’t really add that much value to my audit.” (Interviewee 2)

5.8. Subtheme 2.2: Economic and Commercial Pressures

5.8.1. Fee Pressure and Poor Commercial Reward

Interviewees described how rising costs, client fee resistance, and declining profitability make auditing unsustainable.

“The fees that you recover are almost not worth doing the audit work.” (Interviewee 1)

“Our clients are very fee-oriented… they don’t have the loyalty they had in the past.” (Interviewee 2)

“Auditing has always been a grudge buy... it’s an expense on the income statement that stands out like a sore thumb.” (Interviewee 8)

5.8.2. Alternative Career Paths More Attractive

Audit is increasingly seen as unattractive compared to alternative career opportunities in commerce or technology.

“Now you can go and study a computer programming course... you’re going to earn double before you’re thirty, and you don’t have a regulator watching over your shoulder daily.” (Interviewee 5)

“Auditing is not sexy anymore… there are so many new paths in the CA/RA pipeline, and that also blurred the lines.” (Interviewee 5)

5.9. Subtheme 2.3: Migration and Talent Drain

Emigration of Qualified Auditors

Many noted that South African audit qualifications are highly portable, leading to an outflow of talent.

“A lot of auditors prefer to go work in the UK, in Europe or Australia... people migrate and that’s why the SAICA and IRBA qualifications are very handy.” (Interviewee 1)

“Quite a number of people in our industry have migrated to other countries... there won’t be a need to continue registering as an RA with IRBA.” (Interviewee 4)

5.10. Subtheme 2.4: Career Risk, Burnout, and Work-life Balance

5.10.1. High Litigation and Personal Risk

Participants expressed fear over the personal liability associated with assurance work.

“You’re in a profession where people will tell you, listen, we’re going to subpoena you in court.” (Interviewee 1)

“Auditors are soft targets for regulation... those who could run away have, and those that can’t are stuck.” (Interviewee 3)

5.10.2. Workload and Life Imbalance

COVID-19 and evolving work expectations have made the long hours of audit work unappealing.

“COVID definitely changed people’s mindsets... the perception is that auditing takes a lot of your personal time. People aren’t as keen for that these days.” (Interviewee 2)

“There’s better work-life balance in commerce than in the audit space.” (Interviewee 4)

5.11. Subtheme 2.5: Structural and Generational Shifts in the Profession

5.11.1. Age and Succession Dynamics

Older auditors are stepping away from auditing, leaving younger partners to bear the load.

“Those numbers tell me those that can run away will and have... the younger ones can’t give it up because it’s their livelihood.” (Interviewee 3).

5.11.2. Changing Pipeline and Qualification Structures

Interviewees criticised additional qualification hurdles, like the ADP, as discouraging.

“It’s four and a half years’ worth of training to register as an RA... it’s unappealing. People aren’t keen to wait that long.” (Interviewee 8).

“Since IRBA took away the public exams and introduced the ADP program… as a trainee it is like a prison sentence.” (Interviewee 4)

5.12. Subtheme 2.6: Perceived Erosion of Audit Purpose

Loss of Audit’s ‘Why’

Several participants spoke of a declining sense of professional purpose.

“There’s not a big talk around the purpose of the profession any longer... we need to understand the why of what we are doing.” (Interviewee 8)

“It was sexy 20 years ago to become an auditor… now it’s just not anymore.” (Interviewee 5)

The findings show a complex mix of regulatory, economic, generational, and personal factors causing the decline in RAs in South Africa. Once prestigious, the profession is now seen as less attractive. Some challenges are systemic, while others stem from changing priorities among young professionals and weaknesses in training future auditors. Interviewees share concern that if unaddressed, these issues could threaten the profession's long-term sustainability.

Abrahams and Phesa (2025) stated an 11.72% drop in Registered Auditors (2019–2023), by mapping six mutually reinforcing causes. On the talent pipeline and perception, evidence points to both quantity and fit problems: skills–demand gaps are flagged in Kroon and Do Céu Alves (2023); firms report recruitment strain and a shrinking graduate pool in Caseware (2024); South African appeal is declining for young CAs(SA) in Harber (2018); and large-firm perspectives diagnose fewer accounting graduates and readiness concerns in Murray (2024).

Regulation and compliance costs alter the profession’s risk–reward profile, perceptions of over-regulation and the chilling effect of rotation are prominent in Harber (2018); inspection demands and remediation work are documented in Irba (2024b); quantified cost pressures appear in Celestin (2020a); cross-regional failure patterns tied to regulatory stringency are noted in Celestin (2020b); and fee-raising structures such as joint audits are discussed in Coffee (2019). Talent shortages, recruitment challenges, and burnout are evidenced by firm surveys in Caseware (2024), reinforced by outflows from assurance roles in Harber (2018), systematic departure drivers in Knechel et al. (2021), junior exit rates in Abramova et al. (2025), and by the practitioner perceptions captured in Murray (2024).

Technological change compounds skills mismatches and transition costs: firms grapple with virtual work, BI tools, and adoption hurdles in Caseware (2023); AI’s specific impacts on audit roles are analysed in Isotalo (2024); and competency misalignment linked to evolving skill needs appears in Kroon and Do Céu Alves (2023). Financial pressure and profitability shape incentives and strategy, consulting–audit income dynamics and fee economics are treated in Coffee (2019), fee payments and bargaining power in Kharuddin and Basioudis (2022), wage-related attractiveness in Albu et al. (2011), and profitability concerns are explicitly noted in Murray (2024). Finally, audit resignations and risk factors are substantiated through departure hazards in Knechel et al. (2021), South African turnover dynamics in Harber (2018), junior turnover pressures in Abramova et al. (2025), quality-related deficiencies in Irba (2024b), systemic failure risks in Coffee (2019), and direct acknowledgment in Murray (2024). Together, these sources corroborate a decline driven by intertwined pipeline, regulatory, technological, economic, and risk mechanisms that will require coordinated responses across attraction, formation, and retention.

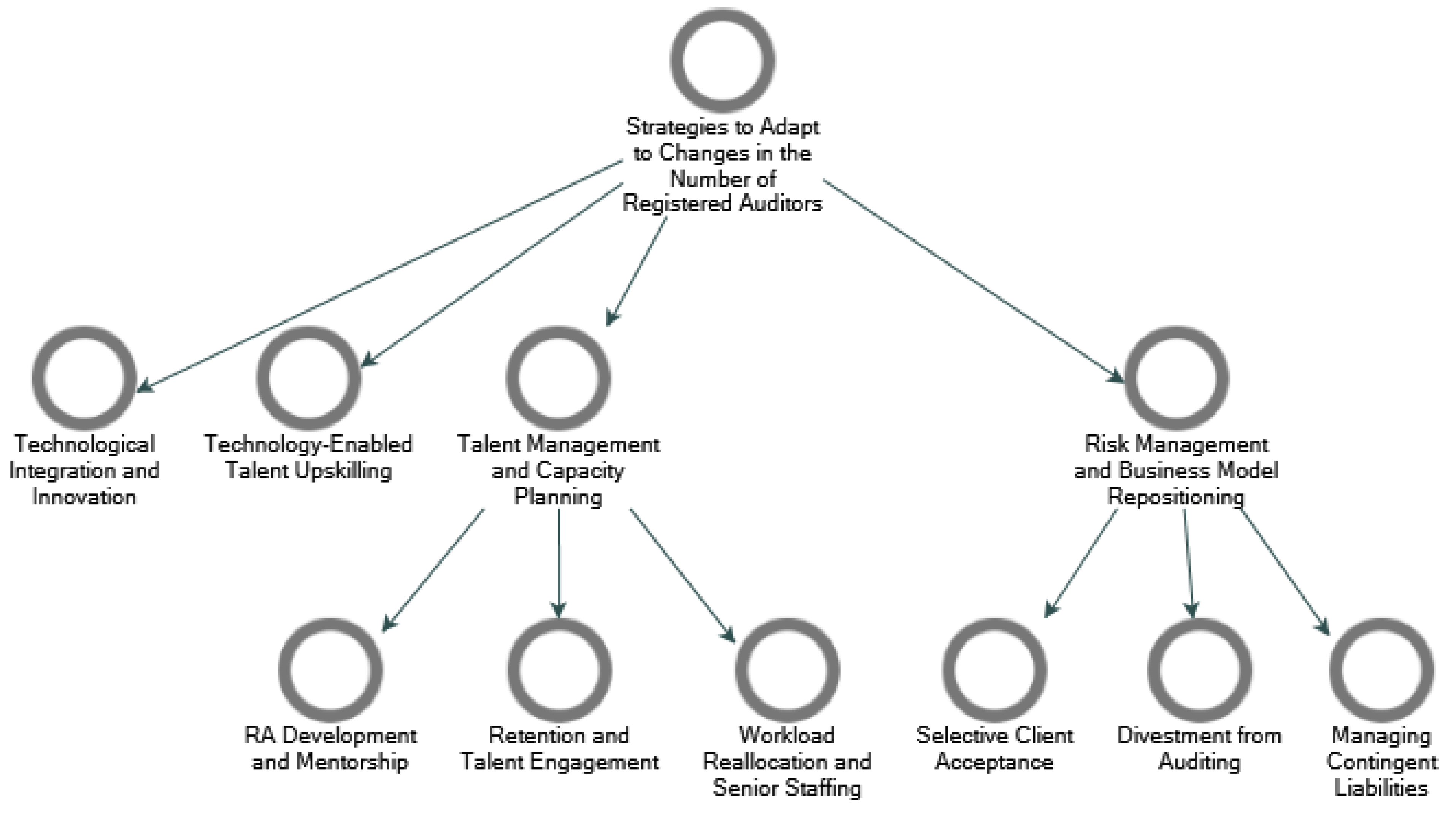

5.13. Theme 3 Strategies to Adapt to Changes in the Number of Registered Auditors

This theme addresses the research aim number 3, which sought to know the strategies the firm implemented to adapt to changes in the number of Registered Auditors.The interviews revealed diverse, multi-faceted strategies employed by audit firms to navigate the evolving environment of Registered Auditors (RAs). These strategies were clustered into three major subthemes: (1) Technological Integration and Innovation, (2) Talent Management and Capacity Planning, and (3) Risk Management and Business Model Repositioning (Figure 4.3).

Figure 5.

3: Visualising Strategies to Adapt to Changes in the Number of Registered Auditors.

Figure 5.

3: Visualising Strategies to Adapt to Changes in the Number of Registered Auditors.

5.14. Subtheme 3.1: Technological Integration and Innovation

In response to the complex challenges facing the auditing profession, particularly the shrinking pool of Registered Auditors (RAs) and the intensifying pressure to maintain profitability and audit quality, firms are increasingly turning to technological integration as a strategic imperative. Participants in the study revealed how Artificial Intelligence (AI) tools and digital platforms are not only supporting audit execution but are fundamentally reshaping traditional audit processes.

“We try to use that stuff, electronic more electronic AI sort of stuff, data analytics and stuff incorporated into the audit. We try to think out of the box in terms of what can be done to satisfy certain assertions… We use AI tools like I use ChatGPT, I use Copilot… I’ve got five open as I’m speaking to you.” (Participant 1).

Similarly, Interviewee 8 articulated the efficiency gains associated with automation of routine processes, recounting,

“The tools are so important… the way we use IT now… historically, the audit team would go out to the client and they would sit there and vouch tedious amounts of information. These days... they run a script and basically test 100% of the population… That process probably takes them about a day or two, where ordinarily it would have taken a trainee probably two weeks.” (Participant 8)

The adoption of platforms like ChatGPT, Copilot, Pocket CA, CA Assistant, and Data Snipper was key in transforming audit file prep, risk assessments, and streamlining assertions. These tools help auditors validate data, automate documentation, and perform logical tests efficiently. Moving from manual to AI-augmented audits shows that technology is essential for the future of audit practices in resource-limited settings. This shift supports industry goals to stay competitive amid regulatory pressure and talent shortages. AI is viewed not as a job threat but as a tool that helps audit teams work better despite staffing challenges.

5.15. Subtheme 3.2: Technology-Enabled Talent Upskilling

In response to the evolving technological landscape and the resultant transformation of audit practices, firms have recognised the critical need to enhance the digital literacy and technical competencies of their workforce. This subtheme captures a proactive response by firms to the dual challenge of Registered Auditor (RA) shortages and rapidly advancing audit technologies by investing in structured, internal upskilling initiatives. One noteworthy approach described by Interviewee 8 involved the establishment of an internal:

“We’ve got this data school now… we basically train them on all of these things… coding aspects, the tools which they use… and we try to then, if they haven’t found a job, deploy them onto the audit and incorporate them as part of the audit team.” (Participant 8)

The above quote underscores a deliberate shift from traditional audit training towards a technology-enabled model, where proficiency in coding, automation tools, and data analysis is positioned as equally vital as financial reporting knowledge.

5.16. Subtheme 3.3: Talent Management and Capacity Planning

Amid the declining number of Registered Auditors (RAs) in South Africa, talent management and strategic capacity planning have emerged as central priorities within audit firms. This theme explores how firms are responding to the resource crisis through proactive strategies in RA development, retention, and adaptive resourcing models, demonstrating a shift towards a more sustainable and diversified workforce model. The responses from interview participants reflect a nuanced understanding that building and maintaining audit capacity now requires a multi-pronged approach, involving both structural and cultural transformation.

5.16.1. RA Development and Mentorship

To counteract the diminishing pipeline of RAs, firms have adopted a dual-pronged strategy of structured mentorship and qualification diversification. As articulated by Interviewee 2,

“We provide them with the opportunity to do the IRBA mentorship, that is the 18-month ADP program... and we’ve recently registered with ACCA… we’ve got two ACCA trainees currently at our firm.”(Participant 2).

This reflects a clear institutional commitment to cultivating home-grown audit talent through the IRBA's Audit Development Programme (ADP), a supervised practical training framework designed to prepare candidates for registration as RAs. Simultaneously, the adoption of alternative professional pathways, such as ACCA accreditation, signals an evolution in how firms conceptualise audit competency. These alternative routes serve to expand the talent pool, making room for internationally trained accountants and providing flexibility in addressing capacity gaps. Ultimately, these efforts represent a broader shift towards talent diversification and long-term workforce sustainability, ensuring the continued relevance and resilience of the audit function.

5.16.2. Retention and Talent Engagement

Beyond talent development, firms are increasingly recognising the need to retain experienced professionals through innovative and empowering talent engagement strategies. According to Interviewee 4,

“You have to come up with retention strategies… giving people partnership into the firm… make them realise that this firm is not, I’m not working for a particular person. This is mine… if you give someone ownership, then they better take care of something.”(Participant 4).

This highlights a fundamental shift from hierarchical employment structures to co-ownership models, where equity participation and a sense of belonging are used to foster loyalty. The emphasis on internal promotion and shared ownership is seen not only as a motivational tool but also as a way to preserve institutional memory and ensure leadership continuity. This approach aligns with modern organisational behaviour theories which suggest that autonomy and recognition significantly enhance employee engagement and performance.

5.16.3. Workload Reallocation and Senior Staffing

Faced with a constrained RA supply, firms are also reconfiguring their internal structures by redistributing audit responsibilities and hiring experienced non-RA professionals. Interviewee 6 noted,

“We may need to employ more senior staff, who are not necessarily RAs, but that will actually make sure that they do the work, then the RA will just have to review and ensure everything is done accordingly.”(Participant 6).

This operational model allows firms to preserve the quality and integrity of audits while optimising the scarce capacity of RAs for review and sign-off duties. The reallocation strategy illustrates a form of hierarchical task restructuring, where workload is divided based on competency and regulatory necessity. This adaptive staffing model not only ensures continuity in service delivery but also mirrors global trends in professional services, where multidisciplinary teams are leveraged to balance regulatory requirements, cost efficiency, and client satisfaction.

The above findings under this theme underscore a critical evolution in how audit firms approach human capital management. By broadening qualification pathways, offering participatory career trajectories, and reconfiguring task assignments, firms are moving towards a more agile and inclusive resourcing strategy. These interventions address not just the symptoms of the RA shortage but also its structural causes, such as rigid qualification routes, talent drain, and limited career progression. Furthermore, these talent strategies reveal a sector grappling with the competing demands of regulatory compliance, economic sustainability, and human-centred leadership. The shift towards empowerment, mentorship, and collaborative staffing models suggests that the auditing profession in South Africa is not simply reacting to crisis, but is reimagining its workforce architecture to thrive in a complex and evolving professional environment

5.17. Subtheme 3.4: Risk Management and Business Model Repositioning

The structural decline in the number of Registered Auditors (RAs) in South Africa has prompted audit firms to critically re-evaluate their business models and risk exposure. As financial, regulatory, and operational pressures intensify, firms are undertaking strategic repositioning—prioritising profitability, selectivity, and liability mitigation. The findings reveal that risk-conscious decision-making has become central to the sustainability of audit practices, as firms grapple with the high compliance burdens, marginal audit returns, and growing liability exposure.

5.17.1. Selective Client Acceptance

One of the most prominent strategies employed by firms is increased selectivity in client engagement, driven by the need to protect margins and manage regulatory exposure. Firms have instituted minimum audit fee thresholds and are rejecting audit engagements deemed financially unviable. As Interviewee 2 explained,

“We’ve pretty much put a minimum audit fee that we are able to service that client… we just realised that for certain… you’re not able to perform an audit at a profitable margin.” (Participant 2).

The above approach reflects a pragmatic shift towards quality over quantity, with firms prioritising resource allocation to engagements that align with their financial and operational capacities.

Similarly, Interviewee 6 highlighted the cost-to-effort misalignment in small audit files. ““How do you expect me really for a 2.5 audit to have to open a file… planning until conclusion for 2.5? Really, it’s not worth it.”(Participant 6).

These sentiments underscore a growing intolerance for underpriced and overburdened audit engagements, which contribute to professional fatigue and financial strain. Selective client onboarding thus serves as both a risk mitigation mechanism and a sustainability strategy.

5.17.2. Divestment from Auditing

Beyond client selectivity, some firms have opted for more radical measures by divesting from assurance services altogether. This trend reflects a fundamental reassessment of auditing’s long-term profitability and risk profile. For instance, Interviewee 3 stated,

“We no longer believe in… audit on its own would never be profitable… we will lose a significant chunk of revenue, but we’re hoping that the cost of reducing the staff… will restore a higher level of overall profitability.” (Participant 3).

The above strategic retreat from auditing illustrates how the burden of compliance, coupled with tight margins, has rendered audit services economically untenable for certain practices. Likewise, Interviewee 5 expressed intent to exit auditing to pursue more profitable service lines:

“I am 80% sure that I’m going to de-register as a registered auditor by the end of next year… I will make up 50% more of that fees by having more time to attend to my non-audit clients.” (Participant 5).

These accounts point to an ongoing structural recalibration, in which firms redirect their efforts towards tax advisory, accounting, and consulting services. This strategic pivot not only optimises profitability but also reduces exposure to professional indemnity risks and regulatory interventions.

5.17.3. Managing Contingent Liabilities

A critical concern influencing strategic decisions is the potential for significant contingent liabilities arising from audit engagements. Interviewees highlighted the disproportionate risk-reward dynamics, where small profits are outweighed by the threat of regulatory fines. Interviewee 3 noted,

“Out of a 6 million Rand audit turnover, we’ve made 190,000 Rand of profit… that profit alone will not cover one fine from IRBA.” (Participant 3).

This reflects a broader apprehension that even a single sanction could erase years of profitability, especially for small to mid-sized firms.

Additionally, the lack of appeals mechanisms and the perception of unchecked regulatory power exacerbate these concerns.

As Interviewee 5 pointed out,

“There’s no appeals process… the perception out there is that if someone complain at the IRBA, then you in trouble.” (Participant 5).

These fears reflect a growing distrust in regulatory processes and protections, and suggest that risk aversion is not only economic but also institutional. The absence of effective insurance coverage for regulatory fines further discourages participation in audit markets, incentivising firms to either reduce audit exposure or exit the space entirely.

Subtheme 3 reflects a paradigm shift in how audit firms in South Africa are navigating a high-risk, low-reward environment. Faced with diminishing RA numbers, tightening regulations, and economic constraints, firms are implementing strategic triage: narrowing client bases, abandoning audit services, and proactively mitigating liability exposure. These repositioning strategies are not reactive but deliberately transformational, indicating a profession in search of new operating models that prioritise resilience, efficiency, and ethical sustainability. Moreover, these changes have far-reaching implications for audit quality and public assurance. As firms become more selective or exit the audit field, audit capacity may become increasingly concentrated, potentially threatening competition, independence, and access, especially for small and medium-sized enterprises. The sector may therefore require regulatory recalibration and systemic support mechanisms to preserve the integrity and inclusiveness of the auditing ecosystem in the long term.

Theme 3 depicts firms adapting to a high-risk, low-reward environment through three complementary levers. On technological integration and innovation, adoption is advancing but uneven, per Caseware (2023) “cloud adoption keeps rising” and “business intelligence catches on,” while also noting operational frictions in “using new technologies” and “communicating with clients virtually.” Caseware (2024), extends this to “virtual-world realities,” talent responses, and new services. The profession-level shift is amplified by emerging tools as per Isotalo (2024) details how AI, automation, and blockchain are reshaping evidence gathering and judgement, and calls for clarity on which audit tasks are being displaced.

For talent management and capacity planning, the evidence base is consistent with Caseware (2023) that flags “talent management a top challenge,” with difficulty “finding the right talent” surging and skills readiness lagging. The upstream pipeline is strained according to Boyle et al. (2024) that highlights declining enrolments, negative perceptions, and faculty hiring challenges; Murray (2024) similarly cites a “lack of accounting professionals” and falling enrolments. Competency misalignments persist according to Kroon and Do Céu Alves (2023), implying curriculum recalibration for future RA capacity, while Jahn and Loy (2023) notes that stringent access requirements (e.g., partial exams) raise workload and stress for entrants. Retention sits alongside acquisition, which can be seen by Abramova et al. (2025) that references “Retention Effectiveness Strategies for CPA Firms,” underscoring the need to stabilise headcount, not just feed the pipeline.

Strategic triage pruning client portfolios, exiting certain audits, and mitigating liability, follow from the pressures documented across sources. Abrahams and Phesa (2025) links firm behaviour to financial pressure and profitability, audit resignations and risk factors, and regulation and compliance costs, situating choices within institutional constraints. Liability exposure is evident in Sanni (2024), that discusses negligent cases affecting big firms (e.g., Deloitte), reinforcing proactive risk management. Regulatory intensity and recurring deficiencies according to Irba (2024b), raise the cost of engagement (e.g., revenue recognition, journal entries, significant judgements/estimates), encouraging portfolio focus. Market structure and specialisation choices according to Kharuddin and Basioudis (2022) provide the economic logic, fee payments, economies of scale, and selective industry focus, behind narrowing to defensible niches. Together, these sources depict firms investing in technology, rebuilding capacity, and tightening risk perimeters as pragmatic responses to the sustained decline in RAs and the broader constraints acting on South African audit practices.

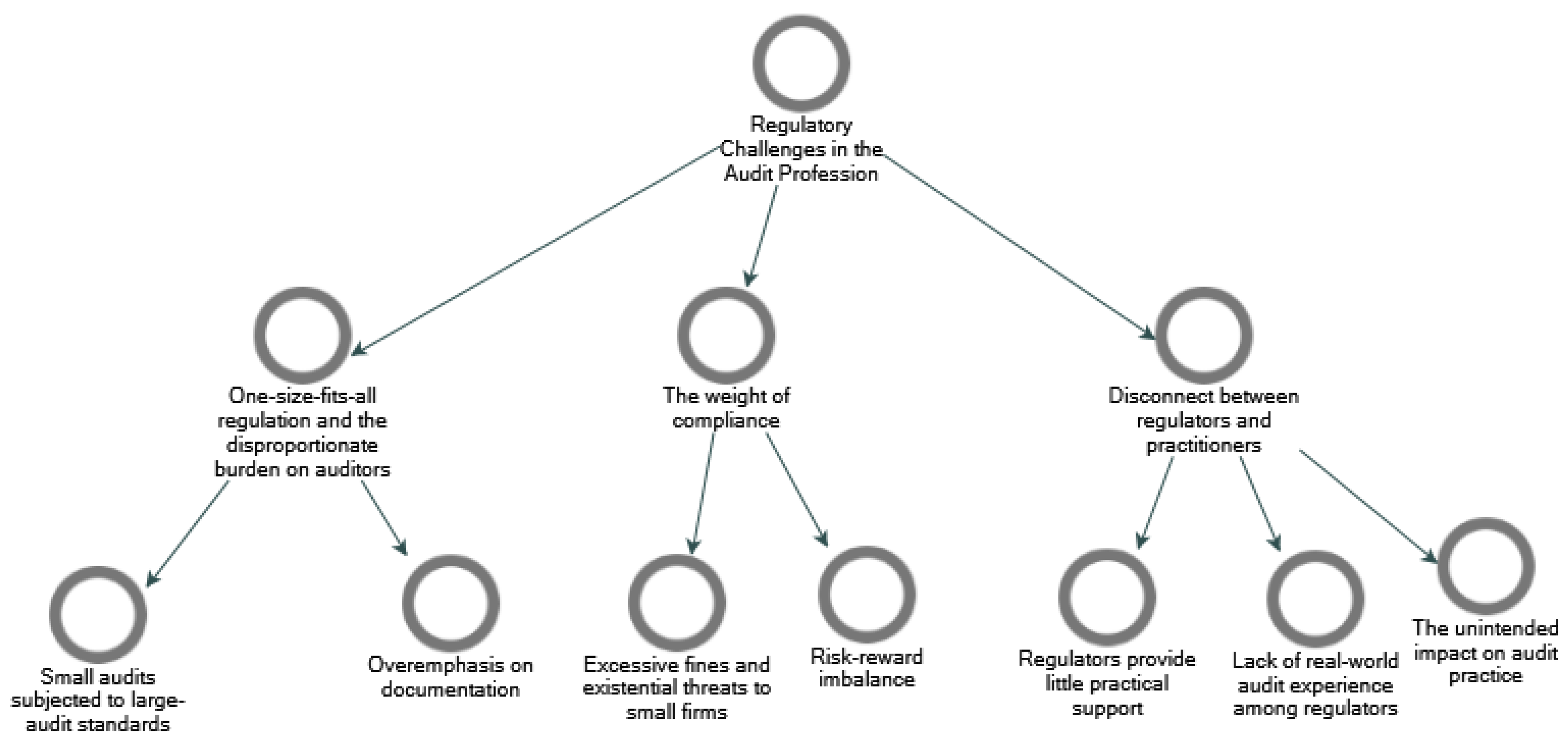

5.18. Theme 4: Regulatory Challenges in the Audit Profession

This theme addresses the research aim number 4, that highlights the challenges posed by current audit regulations in South Africa. The narratives reveal that auditors face significant difficulties arising from regulatory frameworks that many view as disproportionate, punitive, and out of touch with the realities of practice. Three overarching subthemes emerged from the data, as illustrated in the figure below:

Figure 5.

4: Visualising Regulatory Challenges in the Audit Profession.

Figure 5.

4: Visualising Regulatory Challenges in the Audit Profession.

5.19. Subtheme 4.1 One-Size-Fits-All Regulation and the Disproportionate Burden on Auditors

5.19.1. Small Audits Subjected to Large-Audit Standards

Participants voiced deep frustration at how current audit regulations impose a one-size-fits-all approach that fails to account for differences in client size, complexity, and risk profile. This rigid regulatory model was widely seen as inefficient, costly, and damaging to smaller firms.

Interviewee 1 highlighted this issue vividly, describing the disconnect between the standards and the realities of auditing small entities:

"Now you have to audit a sole proprietor or director... and you have to do the audit procedures as if you’re doing it for a company that’s doing 100 million revenue... I know I can’t rely on these internal controls... but unfortunately, I can’t write that in my file. I have to go through system notes, do a walkthrough... two days have passed, and I’ve never even done the actual control testing." (Participant 1).

For this auditor, the problem is not a reluctance to comply, but a sense that the standards are out of step with the realities of small businesses, placing disproportionate burdens on both auditors and clients.

Interviewee 2 echoed this concern, noting the absence of regulatory differentiation:

"There’s still not a clear distinction between a larger firm and a small to medium firm. I was quite optimistic with the proposal for that audit of less complex entities... but they declined."(Participant 2).

Similarly, Interviewee 6 argued that regulations need to better accommodate professional judgement:

"Unfortunately, as per standards, it’s one size fits all. But when it comes to clients, that’s not one size fits all. Auditing could be structured in a way to say you are allowed perhaps to have professional judgment per your client."(Participant 6).

Drawing from the above narratives, participants felt that regulatory frameworks impose unnecessary steps on smaller audits, increasing costs and effort without improving audit quality. They argued for reforms that allow proportionality and professional judgment.

5.19.2. Overemphasis on Documentation

The demands for exhaustive documentation were seen as stifling critical thinking and genuine audit quality Interviewee 8 shared:

"The team is so pressed to get through the fieldwork... they miss the bigger picture because they’re under so much pressure. They're so tick-box driven, tick, tick, tick... they aren't really taking time to think." (Participant 8).

From the above statement, one could assume that the documentation demands and fear of inspection have driven a box-ticking culture, where auditors focus on file completeness rather than meaningful assurance.

5.20. Subtheme 4.2: The Weight of Compliance

Another subtheme uncovered from the transcribed data was anxiety over the harsh penalties imposed by regulators.

5.20.1. Excessive Fines and Existential Threats to Small Firms

Participants described how disproportionate fines and disciplinary processes threatened the very existence of smaller practices. Interviewee 4 voiced concern about the existential threat posed by such penalties:

"Fines and penalties are actually a big concern because they are prohibitive. Once you are fined, then you are out of business because it’s beyond hefty."(Participant 4).

Interviewee 5 provided a striking example of how even administrative errors can lead to ruinous consequences:

"This practitioner said no, I’m not doing audits [on one form], but then on the fees form, there was audit income declared. Improper conduct — 100,000 rand fine for that. Where’s the balance?"(Participant 5).

For Interviewee 6, these risks have led to a reconsideration of their professional future:

"There is no way I’m going to be rich being an RA... IRBA comes back to you, then they charge you... they will sell your assets. When they are done with you, you will be nobody."(Participant 6).

The above narrative reveals that participants believe the regulatory system imposes disproportionate punishments, particularly on smaller practices, fostering fear and discouraging auditors from continuing in the profession.

5.20.2. Risk-Reward Imbalance

The economic model of auditing was viewed as increasingly unsustainable: high personal and professional risk, but without corresponding financial reward. Interviewee 7 reflected on the mismatch between audit risk and its financial returns:

"Auditors take risk by taking on this work... but then you must look at the reward. The rewards are not there. It just doesn’t make sense."(Participant 7).

5.21. Subtheme 4.3: Disconnect Between Regulators and Practitioners

5.21.1. Regulators Provide Little Practical Support

Beyond the standards themselves, participants felt let down by the lack of practical, supportive engagement from the regulator. They described a relationship defined more by fear and compliance than collaboration or guidance.

Interviewee 2 reflected on their recent experience of inspection:

"They don’t want to advise... they were very focused on the theory and the legislation... but not willing to give recommendations for our firm."(Participant 2).

5.21.2. Lack of Real-World Audit Experience Among Regulators

Interviewee 3 offered a scathing critique of the mentality behind inspections:

"The principle of not documented, not done is effectively the same as asking somebody to prove a negative... these fools are being allowed to take that view." (Participant 3)

For them, this dogmatic stance has widened the gap between the regulator and practitioners:

"There’s a disconnect. If they don’t sit in our firm, they don’t understand where we come from. That gap is something that needs significant attention."

Participants feel that regulators operate in isolation from the practical realities of auditing, enforcing rules without offering workable solutions or guidance. Interviewee 3 critiqued the regulatory personnel:

"If you go and make an IRBA inspector have to spend a month in an audit firm... I wouldn’t be surprised if he gets marched to the door and chucked out because he can’t function in a practical commercial world."

Overall, there is a perception that regulators and inspectors lack sufficient on-the-ground audit experience, leading to unrealistic expectations and ineffective oversight.

5.21.3. The Unintended Impact on Audit Practice

Ironically, participants feared that regulatory overreach — intended to improve audit quality — may in fact undermine it. Time and resources are diverted from substantive audit work to compliance with form, checklists, and documentation.

Interviewee 8 summarised this dilemma:

"All this regulation... the practical implementation is not being considered correctly. The team is so pressed to get through the fieldwork... they miss the bigger picture because they’re under so much pressure."(Participant 8).

The auditors interviewed painted a picture of a profession struggling under the weight of disproportionate and rigid regulation. While participants accepted the need for high standards and accountability, they called for a more nuanced, risk-based, and supportive regulatory approach — one that acknowledges the realities of small firms and low-complexity audits. The current system, they argued, threatens not just the viability of smaller firms but the overall quality and integrity of audit practice. Without reforms that balance rigour with proportionality and support, they warned, the regulatory framework risks weakening the very assurance it seeks to protect.

Theme 4, that auditors perceive regulation as disproportionate, punitive, and out of touch, is directly substantiated by several sources. Harber (2018), offers explicit confirmation, describing the profession in South Africa as over-regulated, with burdens translating into more work and higher costs, and warning that measures such as MAFR will further depress the profession’s appeal. The scoping review Abrahams and Phesa (2025) reinforces this with “regulatory fatigue” and rising regulatory demands, framed as coercive and normative pressures within institutional theory. Practice-side sentiment aligns with (Caseware, 2023) that lists “new laws and regulations” among top challenges, indicating day-to-day operational strain. The legal edge of the regime appears in Sanni (2024) (e.g., a negligent case against Deloitte in China; ASIC proceedings), Ghosh and Tang (2015) discusses the litigation risk scores linked to enforcement actions, and Albu et al. (2011) links the rule-based shifts harming comparability. Structural frictions are also evident in Jahn and Loy (2023), which associates higher access requirements with fewer professionals and notes that small practices face oversight and sanctions more often. Market-economics and professional expectations intersect in Coffee (2019) that states auditing as a low-margin “commodity” pushes talent towards consulting and questions whether legislative fixes are adequate, and in Kharuddin and Basioudis (2022), where regulators’ expectations around deep industry understanding raise the bar for engagement complexity. Overall, the weight of evidence supports theme 4’s claim that regulations and related legal exposures are widely experienced as costly, exacting, and misaligned with professional realities, even as some documents merely chart their effects rather than judging their proportionality.

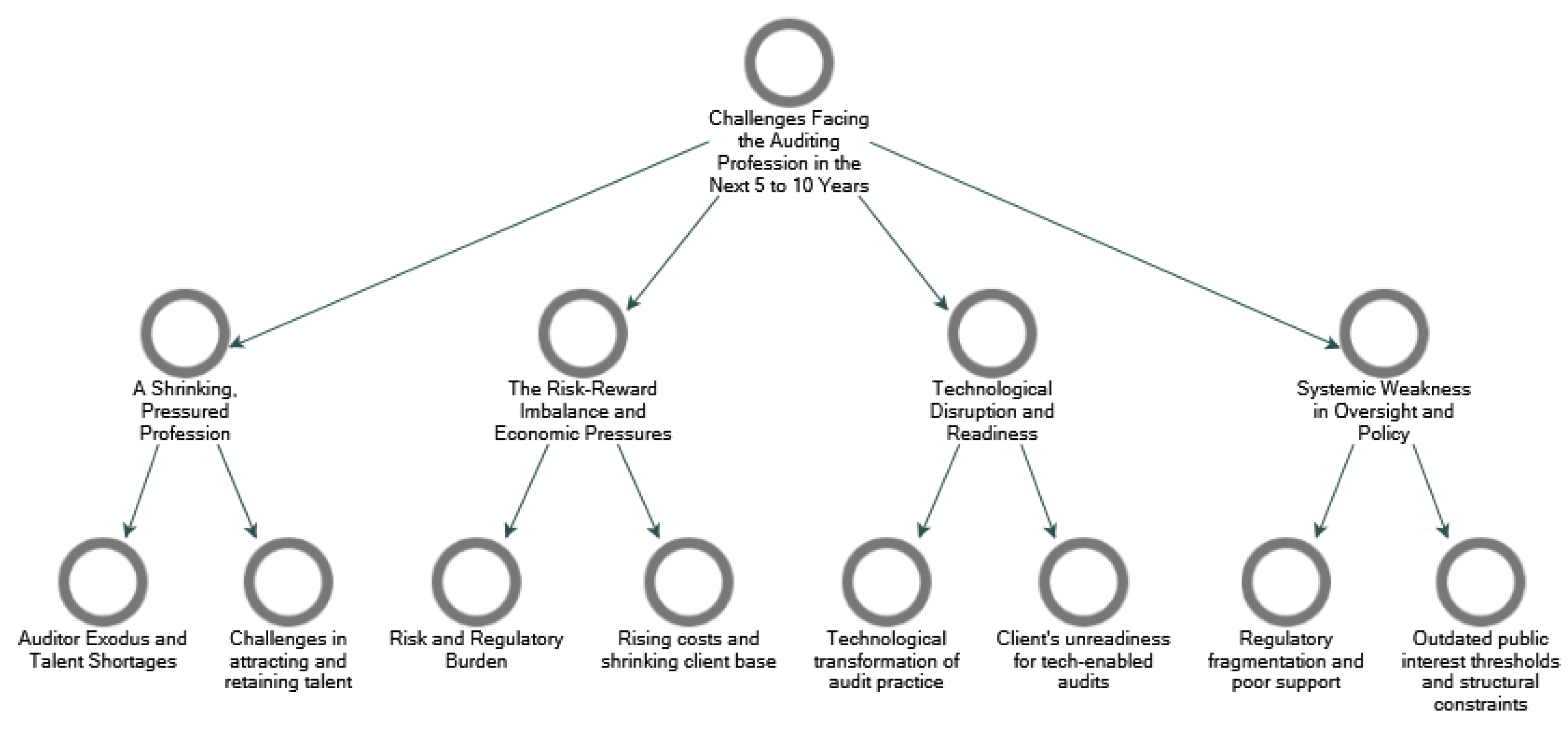

5.22. Theme 5: Challenges Facing the Auditing Profession in the Next 5 to 10 Years

This theme addresses the research aim number 5. The interviews revealed a complex landscape of challenges facing the South African auditing profession. The findings are organised into four overarching subthemes, illustrated in the figure below

Figure 5.

5: Visualising the challenges facing the auditing profession in the next 5 to 10 Years.

Figure 5.

5: Visualising the challenges facing the auditing profession in the next 5 to 10 Years.

5.23. Subtheme 5.1: A Shrinking, Pressured Profession

5.23.1. Auditor Exodus and Talent Shortages

Participants expressed profound concern over the shrinking pool of Registered Auditors (RAs). Interviewee 6 predicted:

"I see a huge decrease in this part as well... The assurance category within the RAs will carry on decreasing even higher."(Participant 6).

Similarly, Interviewee 3 framed this as a systemic risk:

"You're going to have a significant gap between the demand and the supply... There will not be enough auditors to conduct the audit requirements of the commercial sector."(Participant 3)

5.23.2. Challenges in Attracting and Retaining Talent

Interviewees noted that the profession struggles to remain attractive, particularly in light of alternative employment options abroad or with international firms. As Interviewee 2 explained:

"It’s just going to become really expensive to hire personnel... people are working for overseas companies locally, earning substantially more than what they would earn at a company like ours."(Participant 2)

Interviewee 8 added that this exodus places strain on those who remain:

"The existing resources become fatigued, drained... risk of losing quality staff essentially."(Participant 8).

5.24. Subtheme 5.2: The Risk-Reward Imbalance and Economic Pressures

5.24.1. Risk and Regulatory Burden

Interviewees described the profession as increasingly punitive, with fines and sanctions eroding its appeal. Interviewee 7 highlighted:

"The risk is a big issue... The risk versus the rewards — that is the big issue to say if those dynamics don't change, then I think the profession... is doomed."(Participant 7)

Interviewee 6 echoed this, noting the chilling effect of IRBA’s approach:

"They don’t give you recommendations... they name and shame you. So by one error, you become... so bad."(Participant 6).

5.24.2. Rising Costs and Shrinking Client Base

Several participants described how rising fees — driven by regulatory and operational pressures — risk pricing clients out of the market. Interviewee 2 cautioned:

"We might lose clients, or they might prefer a cheaper service... They might just move over to an independent review, which is substantially cheaper." (Participant 2)

Interviewee 8 similarly observed:

"There’s that growing tension between clients and audit firms because of the rising fee... clients are basically shopping around all the time."(Participant 8).

5.25. Subtheme 5.3: Technological Disruption and Readiness

5.25.1. Technological Transformation of Audit Practice