1.1. Introduction

Shareholders primarily expect favourable returns on their investments, encompassing both the preservation of their principal and potential capital appreciation (Shin, 2013). Shareholder value (SV) is defined as the economic benefits generated by a company and distributed to equity owners, including profit generation, wealth creation, and value enhancement; it materialises when returns exceed the minimum required return on equity and is commonly measured through dividends and share price appreciation (O’Connell & Ward, 2020). Effective corporate governance (CG) provides the structural framework that guides business operations, establishing regulations, defining roles, allocating resources efficiently, managing relationships, and mitigating risks, which in turn is essential for ensuring SV (Almashhadani et al., 2022).

Despite widespread recognition of the importance of Corporate Governance, mixed empirical evidence raises questions about how governance influences corporate performance and shareholder value. Rezaee (2020) documents a significant impact of Corporate Governance on shareholders' Value in U.S. firms; however, Boutrik et al. (2021) find a negligible impact in Nigerian contexts, suggesting that unobserved mediators may shape the relationship between Corporate Governance and shareholders' Value. The question of which tools ensure that a robust corporate governance system enhances Shareholders’ Value remains unresolved. High-profile corporate failures increase this tension. The collapse of Enron revealed serious violations of governance controls and exposed critical risks in financial reporting and managerial oversight (Nguyen, 2011). Similarly, the 2018 banking crisis in Ghana was attributed to weak CG frameworks and non-compliance with governance standards (Torku & Laryea, 2021; Osei et al., 2019). These crises challenge existing Corporate Governance policies (OECD, 2015; Roffia, 2025) and highlight the need for a robust internal audit to support governance processes (Eulerich & Eulerich, 2020).

While CG mechanisms such as board independence, audit committee expertise, and board composition are presumed to underpin Shareholders’ Value, their direct effects are inconsistent across empirical studies. Although board independence is widely regarded as a cornerstone of good governance, empirical studies paint a far more nuanced picture. In a survey of 78 manufacturing firms in West Java, Indonesia, greater board independence is associated with higher firm Value (Mbate, 2023). In contrast, a study of 152 non-financial firms listed on the Pakistan Stock Exchange reveals that board independence is negatively associated with financial performance (Khan et al., 2024). Again, Audit committee expertise yields contrasting outcomes with Kieback et al. (2022) arguing that appointing members with both financial and industry expertise triggers positive abnormal returns.

In contrast, audit committee independence in Pakistan and the UK is associated with a decline in financial reporting quality (Hasan et al., 2025). Ganguli and Guha Deb (2021) agreed that board composition has a positive impact on firm Value. From these findings, it appears that there is a corporate tool through which corporate governance has a positive impact on firm performance and shareholder value. It is also intriguing to note that the theories underpinning this study provide practical but limited perspectives on the contribution of corporate governance to shareholder value. The theoretical tensions between control and collaboration (Agency Theory vs. Stewardship Theory), economic performance and social responsibility (Shareholder Value Theory vs. Triple Bottom Line Theory), and structural stability and strategic adaptability (Resource Dependence Theory vs. Dynamic Capabilities Theory) reflect the shifting and often competing expectations placed on governance systems in contemporary organisations.

The question that arises is why some firms operationalised their governance system to improve shareholders' Value while others see no tangible benefit. This reveals both a theoretical and practical gap. We argue that the underlying corporate tool that may hold the key is the internal audit performance. The mediating role of Internal Audit Performance between Corporate Governance and Shareholders' Value is unexplored in the existing literature. We contend that internal audit performance (IAP) is the critical conduit for translating governance directives into risk-based controls and strategic recommendations for shareholders’ value creation. Therefore, this study seeks to fill this gap. By resolving conflicting findings through the mediation role of the internal audit performance, we advance both theory and practice.

1.2. Research Objectives

Guided by the unresolved inconsistencies in the literature on Corporate Governance and Shareholders’ Value relationship and the theoretical overlap among Agency, RBV, and Stewardship perspectives, this study aims to

1.3. The Significance of the Study

Theoretically, this study offers the first multi-theory mediation framework that bridges Shareholders/Value, Agency, RBV, Stewardship Dynamic Capabilities and Triple Bottom Line (TBL) Theories. Empirically, it provides evidence from an emerging-economy context on how internal audits translate governance into measurable shareholder returns. Practically, our findings will equip regulators, boards, and audit committees with a clear roadmap: strengthening internal audit function capabilities is essential if Corporate Governance Systems are to yield real Value for shareholders.

2.0. Literature Review

This section explores theories that advocate for delivering Value to shareholders and other stakeholders. It also examines empirical studies on the relationship between corporate governance and firm performance.

2.1. Theories Underpinning the Study

This section outlines the theoretical foundation of the study. While Hanefah and Endaya (2018) proposed the Agency, Institutional, and Communication Theories as potential frameworks for understanding the relationships among management, shareholders, and an independent party (the Auditor), this study is primarily based on the Shareholders' Value Theory, Agency Theory, Stewardship Management Theory, Resource Dependency Theory, Dynamic Capabilities Theory. and Triple Bottom Line (TBL) Theory.

2.1.1. Shareholders’ Value Theory

It contends that a firm’s ultimate objective is to maximise shareholder returns. It assumes that investors commit resources with the expectation of favourable returns through dividends and stock price appreciation (Friedman, 1970; Jensen, 2001). This theory asserts that a firm’s primary goal is to maximise returns for its shareholders (Friedman, 1970; Jensen, 2001). While it provides a clear economic rationale for governance and internal control, its narrow focus on financial performance neglects broader corporate responsibilities, such as sustainability and ethical governance. Moreover, it offers limited guidance on how shareholder value should be operationalised and sustained. This study advances this theoretical stance by positioning internal audit as a strategic partner that not only enforces fiscal discipline and asset protection but also enhances resource optimisation in support of long-term shareholder value (Lenz & Enslin, 2025). This addresses the implementation gap in the theory by integrating internal audit activities with measurable shareholder value.

2.1.2. Agency Theory

Agency Theory (Jensen & Meckling, 1976) is widely used to explain governance mechanisms that reduce conflicts between managers and shareholders. It views internal audit as a tool for reducing agency costs by increasing transparency and managerial accountability (Maurović & Hasić, 2014). However, its assumption of inherent mistrust between agents and principals often promotes adversarial relationships, overlooking the possibility of trust-based collaboration. This study balances this tension by incorporating stewardship principles and encouraging internal audit practices that not only monitor but also support managerial integrity and shared objectives. Internal audit is thereby repositioned as a governance enhancer rather than merely a watchdog.

2.1.3. Stewardship Management Theory

Contrary to Agency Theory, Stewardship Theory (Davis et al., 1997) posits that managers are intrinsically motivated to act in the best interests of the firm. It shifts the emphasis from control to trust and collaboration. While this theory captures the ethical dimension of governance, it often underestimates the potential for conflict or incompetence. Within the framework of this study, internal audit plays a dual role, supporting executive stewardship through advisory and consultative functions while also maintaining an independent stance to safeguard accountability (Oseni, 2021). This dual function reconciles the trust-control dichotomy that typically divides Agency and Stewardship theories.

2.1.4. Resource Dependence Theory

Pfeffer and Salancik (1978) introduce the idea that organisational survival hinges on the ability to manage dependencies and uncertainties in the external environment. This theory emphasises the importance of external relationships, yet offers limited insight into the internal mechanisms necessary to achieve resource alignment. The framework of this bridges this theoretical gap by tasking the internal audit function with assessing internal capabilities, ensuring that resource allocations are strategically aligned with both internal goals and external demands (Gyamera et al., 2023). It emphasises the audit's role in fostering adaptability and resilience.

2.1.5. Dynamic Capabilities Theory

Teece et al. (1997) highlight the importance of an organisation’s ability to reconfigure resources and competencies in response to change. This theory is particularly relevant in the current landscape of technological disruption and ESG demands. However, it often lacks clarity on the functional roles that enable the development of dynamic capability. The study fills this void by identifying internal audit as a critical agent in cultivating dynamic capabilities through foresight, risk anticipation, digital audit integration, and sustainability governance (Helfat & Peteraf, 2009). The model redefines audit effectiveness in terms of innovation, learning, and continuous transformation.

2.1.6. Triple Bottom Line (TBL) Theory

Elkington's (1994) TBL theory calls for evaluating corporate success beyond profit to include social and environmental impact—"people, planet, and profit." Although increasingly influential, the theory offers little operational guidance on the mechanisms required to integrate sustainability into governance. The conceptual framework of this study operationalises TBL by integrating sustainability assurance into internal audit functions, thereby enabling governance systems to measure and manage non-financial risks. Audit is no longer confined to compliance, but has become a vehicle for ESG monitoring and impact reporting.

In conclusion, these theories form the bedrock of this study, offering a multi-theory explanation of how internal audit can enhance value creation, governance functionality, and organisational sustainability. Our review highlights strong empirical support for the internal audit's role in enhancing risk management (Sarens & De Beelde, 2006), improving compliance (Egbunike & Egbunike, 2017), supporting board effectiveness (Pickett, 2012), and enabling strategic decision-making (Zaidan & Neamah, 2022).

2.2. Empirical Literature Review

A business is viewed as a nexus of relationships between management and shareholders. Shareholders expect management to improve their share values. Therefore, management must institute strategic policies and frameworks to guide the business's operations. The most important framework is the corporate governance system. The internal audit function is the department that directly facilitates the operationalisation of corporate governance decisions to meet stakeholders’ expectations. Thus, this section examines the relationship between corporate governance and shareholders, emphasising the crucial role of the internal audit function in this context.

2.2.1. Shareholders' Value

Shareholders' Value represents the net worth of equity and is generated through business activities, encompassing total returns from dividends and share price increases. The creation of this Value hinges on management's strategic allocation of resources within a sustainable investment portfolio. Evaluating business performance often centres on the creation, improvement, and sustainability of shareholder value, which is crucial for retaining existing shareholders and attracting new ones. Shareholders expect businesses to maximise their investments, and prioritising shareholder wealth can motivate management to develop strategic policies that also consider the interests of other stakeholders (How et al., 2019). Effective management practices are essential to ensure that activities do not jeopardise the business's viability, as a focus on shareholder value is fundamental to achieving broader corporate objectives. Neglecting this aspect can lead to a decline in a company's viability.

2.2.2. Corporate Governance

The internal audit function operationalises corporate governance principles and practices, aligning them with organisational goals to achieve corporate objectives (IIA, 2019; Alzeban, 2020). According to Pickett (2012), a robust corporate governance framework ensures that the tasks and responsibilities of the internal audit function are clearly defined and effectively communicated (Chen et al., 2020). This would help improve business performance (Skare & Hasić, 2016). This clarity enables internal auditors to perform their duties with confidence, providing valuable insights into the organisation's risk management and control systems (Pickett, 2012). Corporate governance should establish a clear reporting line that enhances the objectivity and independence of internal auditors within an organisation (Abudu et al., 2015; Zain et al., 2021). Corporate governance fosters an ethical culture within an organisation, providing an enabling environment for internal audit functions (Azar, 2020; Brazel et al., 2021). The other critical role of corporate governance is to provide a risk management framework that allows internal auditors to concentrate on high-risk areas (Al-Twaijry, 2020). However, the extent to which corporate governance can contribute to internal audit and business performance depends on the board's expertise and diversity (Danso et al, 2024). The internal audit function can not play any value-adding role without adequate resourcing. Corporate governance should provide resources, including skilled personnel, budgetary support, and advanced technological tools (Nagy & Cenker, 2021).

2.2.3. Internal Audit Performance

Internal audit performance is crucial for enhancing corporate governance and creating shareholder value. Corporate governance frameworks are implemented through internal audits to ensure profitability, minimise agency costs, and enhance organisational reputation (Jensen & Meckling, 1976). Postula et al. (2020) and Lin et al. (2021) emphasise that effective internal audit performance strengthens governance outcomes, thereby contributing to long-term shareholder value. Organisations must comply with various legal and regulatory frameworks to ensure operational continuity. Non-compliance can lead to significant costs, including legal fees and reputational damage (Nwadike & Wilkinson, 2022). Internal auditors play a key role in maintaining compliance and monitoring activities to prevent breaches (Pickett, 2012; Egbunike & Egbunike, 2017). Inyang et al. (2021) recommend expanding internal audits to include compliance audits, which will better enable the identification and mitigation of risks. Risk management is another essential function of internal audits. As organisations face inherent risks that can impact their objectives, internal auditors are shifting towards a proactive approach that emphasises sustainability and strategic insights regarding environmental, social, and governance (ESG) risks (Ramadhan et al., 2023). Effective risk management is crucial for achieving organisational goals, and internal auditors play a central role in developing robust risk management systems (Sarens & De Beelde, 2006). While all employees share responsibility for risk management, the internal audit function plays a pivotal role in fostering a risk-aware culture (Pickett, 2012; Weekes-Marshall, 2020). Recent studies indicate a shift towards enhancing operational efficiency through improved risk management within internal audit functions (Zaidan & Neamah, 2022; Hilmi & Fatinen, 2022).

The complexities of modern business and the digital environment have transformed internal control systems, exposing organisations to cyber risks. To address these challenges, businesses must implement digital auditing practices to protect data (Lois et al., 2020). Internal auditing is essential in establishing adequate internal controls and risk management frameworks to mitigate vulnerabilities (Bozkus & Caliyurt, 2018). As organisations increasingly rely on technology, internal auditors must assist in designing and implementing robust controls to manage cyber risks effectively.

2.2.4. Corporate Governance Practice

Corporate governance encompasses the frameworks, policies, and practices that organisations implement to ensure accountability, transparency, fairness, and alignment of management activities with the interests of both shareholders and stakeholders (OECD, 2015). Research by Olawale and Obinna (2023) indicates that organisations with strong corporate governance frameworks tend to outperform those with weaker systems. Effective governance facilitates sound decision-making, enhances transparency, and optimises resource allocation, ultimately driving superior organisational performance. Moreover, corporate governance is vital for fostering best business practices by establishing robust processes that provide strategic direction, effective policies, and efficient procedures, all of which are essential for helping organisations achieve their objectives. These governance practices are also crucial for protecting the interests of shareholders and other stakeholders (Jacoby et al., 2019).

Ghana has effectively aligned its corporate governance framework with internationally recognised standards, notably the Principles of Corporate Governance established by the Organisation for Economic Co-operation and Development (OECD). In addition to embracing these global principles, several local regulatory bodies significantly influence corporate governance practices within the country. Key institutions include the Securities and Exchange Commission (SEC), the Bank of Ghana (BoG), the Companies Act of 2019 (Act 992), the National Insurance Commission (NIC), and the National Pensions Regulatory Authority (NPRA). These organisations provide comprehensive guidelines that address essential governance components, including board composition, audit and risk committee structures, shareholder rights, internal audit and control systems, as well as transparency and disclosure requirements.

2.3. Hypothesis Development

Corporate governance (CG) mechanisms are designed to align managerial decisions with shareholder interests (Agency Theory) while cultivating supportive, value-oriented stewardship (Stewardship Theory). Empirical evidence, however, is inconsistent. For instance, board independence, gender/skills diversity, and specialised committees have been shown in some studies to enhance market valuation and operational performance through stronger monitoring and strategic advice (Puni & Anlesinya, 2020; Danoshana & Ravivathani, 2019). Conversely, other recent evidence reports null or even adverse effects where independent or diverse boards slow decision processes, increase coordination costs, or lack firm-specific knowledge, thereby diluting Value (Fariha et al., 2022; Konak, 2023). This divergence creates a tension: if CG mechanisms are inherently value-enhancing, why do they sometimes fail? Consistent with the shareholder-value perspective, we test the following hypothesis.

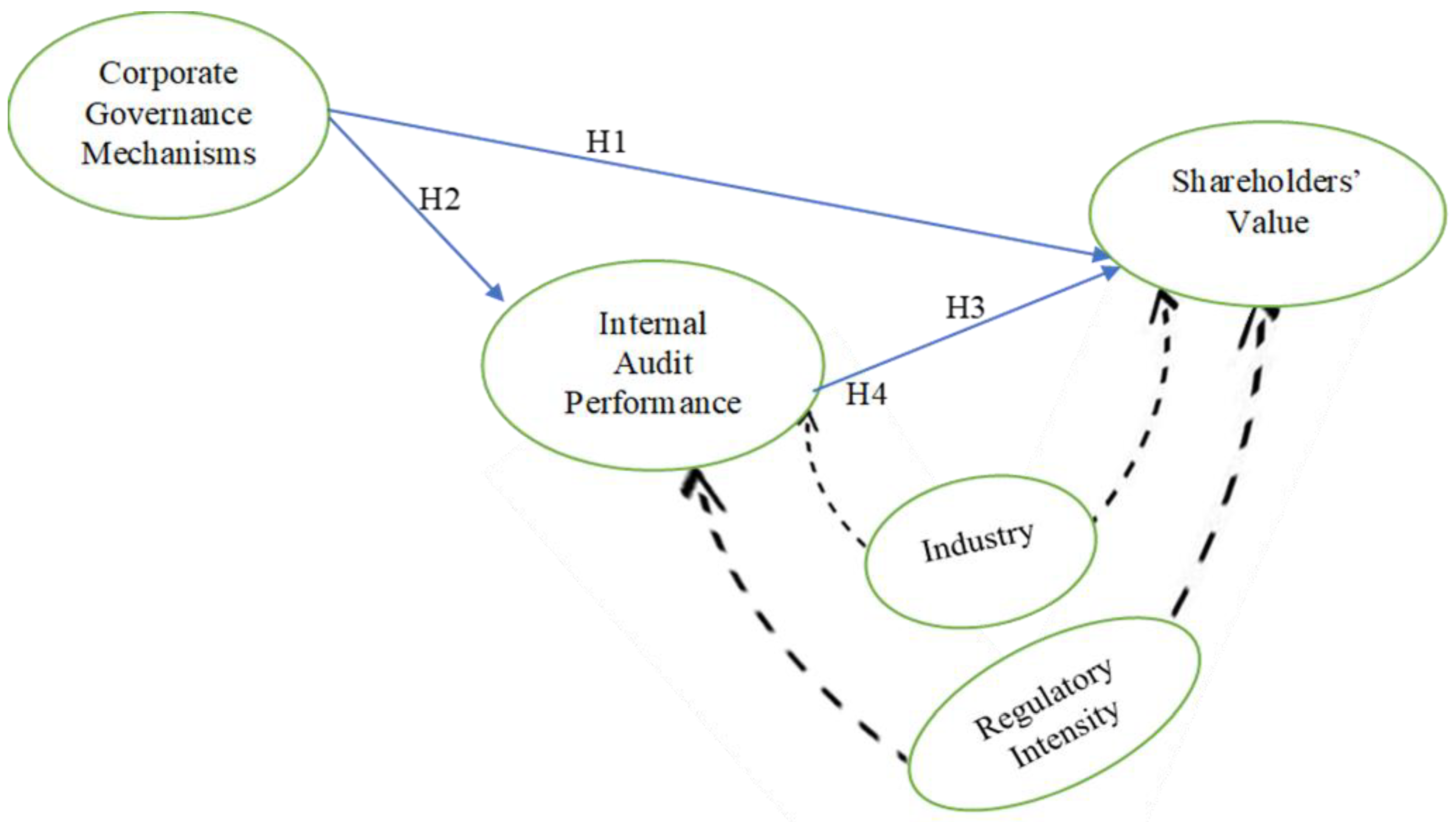

H1: Corporate governance (CG) mechanisms positively influence Shareholders’ Value

From a theoretical perspective, both Agency and Stewardship theories suggest that effective boards provide internal auditors with the necessary authority, resources, and informational access to enable their effective performance. However, empirical evidence does not support this theoretical position. Boards with diverse expertise and active audit/risk committees have been linked to stronger internal audit quality, reporting reliability, and control effectiveness (Boutrik et al., 2021; Mwape, 2022). Nevertheless, other studies observe that formal Corporate Governance structures do not automatically translate into higher internal audit performance (Fariha et al., 2022; Konak, 2023). These conflicting views imply that the strength of Corporate Governance may or may not enhance internal auditing capability. Therefore, we hypothesised that:

H2: Corporate governance (CG) mechanisms positively improve the Internal audit performance (IAP)

Internal audit performance (IAP) reflects a range of organisational abilities, including risk management, compliance assurance, internal control improvement, and internal resource coordination, that can generate Value for shareholders. Empirical evidence suggests that high-performing internal audit units are associated with lower compliance costs, greater process efficiency, and increased profitability (Turetken et al., 2020; Oppong et al., 2021). However, some companies report minimal value effects when the internal audit remains limited to routine financial checks rather than strategic collaboration (dos Reis Cardillo & Basso, 2025). This variability raises the question of whether Internal Audit reliably translates its activities into shareholder value. Based on this, we formulated the following hypothesis.

H3: Internal audit performance (IAP) has a significant positive effect on shareholders' Value (SV).

It can be deduced from the above empirical analysis that researchers disagree on whether corporate governance (CG) mechanisms directly enhance shareholders' Value (SV) or yield a negligible/negative effect. The theories also offer no clear path for when monitoring structures translate into Value. To address this tension, we advance a conceptual framework that positions internal audit performance (IAP) as the missing mechanism. Based on this, we formulate the following hypotheses:

H4: Internal Audit Performance mediates the relationship between Corporate Governance mechanisms and Shareholders’ Value.

We argue that Corporate Governance mechanisms generate potential that must be activated through internal audit capabilities. When IAP is strong, governance directives are converted into risk-based controls and strategic insights that enhance Value; when IAP is weak, governance remains ceremonial, explaining previous null or negative findings.

2.4. Conceptual Framework

Extant studies provide conflicting evidence on whether corporate governance (CG) mechanisms directly enhance shareholders' Value (SV). This inconsistency suggests that CG's impact is contingent on an internal mechanism that translates formal oversight into tangible performance gains. We posit Internal Audit Performance (IAP) as that mechanism. Agency theory clarifies why firms establish boards, committees, and risk-oriented policies to curb opportunism and align managers with owners. However, it remains largely silent on how the information generated by these mechanisms is integrated into everyday processes. The Resource-Based View (RBV) treats internal audit performance (IAP) as a value-creating capability encompassing risk management, compliance assurance, internal controls, and resource orchestration; however, it provides little insight into the governance inputs required to build and sustain this capability. Stewardship theory, meanwhile, celebrates trust and collaborative problem-solving but underestimates the need for formal structures and specialised skills to translate good intentions into measurable Value. Our framework bridges these blind spots by specifying the internal audit function as an enabler of the impact of corporate governance on shareholders’ Value, thereby offering an integrated, testable mechanism that integrates structure, capability, and outcome.

Figure 1 presents the conceptual framework.

Building on IIA (2020) and Pickett (2012), we conceptualise Internal Audit Performance (IAP) as the degree to which the internal audit function delivers both assurance and advisory services that strengthen risk governance, ensure regulatory compliance, fortify internal controls, and optimise the use of organisational resources. In practice, high-performing audit teams maintain dynamic compliance registers, educate management on evolving regulatory requirements, embed enterprise risk management frameworks across business units, and streamline information and resource flows to eliminate waste and bottlenecks. In doing so, they convert governance intentions into day-to-day operational discipline and, ultimately, sustained value creation for shareholders.

Corporate governance encompasses the structures and processes that uphold accountability, transparency, and alignment with shareholder interests (OECD, 2015; Hui, 2018). We focus on mechanisms where prior evidence is mixed. Board independence and diverse board composition can enhance oversight, enrich debate, and mitigate managerial opportunism; however, in highly concentrated ownership settings, they may also slow decision-making and dilute firm-specific agility. Similarly, audit and risk committees typically strengthen reporting quality and control rigour, but when under-resourced or created merely for compliance optics, they become symbolic, adding bureaucracy without substance. Finally, the board’s risk attitude and technical expertise, too often ignored in governance studies, are pivotal for empowering internal auditors, prioritising material risks, and ensuring that governance prescriptions are translated into proactive, value-protecting actions. By specifying these levers and linking them to IAP, our framework moves beyond generic “good governance” claims and offers a testable mechanism that clarifies when and how Corporate Governance creates shareholder value.

To isolate the unique mediating effect of Internal Audit Performance (IAP) on the Corporate Governance–Shareholder Value relationship, we include industry sector and regulatory intensity as control variables. The industry sector controls (manufacturing, services, trading) account for sector-specific governance norms, competitive dynamics, capital intensity, and risk profiles that can shape both governance practices and value outcomes. While regulatory intensity captures variation in external oversight inspection frequency and sanction severity, which directly influence the scope and rigour of internal audit activities and can independently affect firm performance and valuation. By holding these contextual factors constant, we ensure our estimates of the CGM → IAP → SV pathway reflect the true operational role of internal audit, rather than confounding differences in industry or regulatory regimes.

2.5. Research Gap

Despite extensive literature linking corporate governance to firm performance (Puni & Anlesinya, 2020), internal audit to performance outcomes (Turetken et al., 2020) and corporate governance to IA effectiveness (Boutrik et al., 2021), scholars have rarely modelled the full causal chain from Corporate Governance to Shareholders’ Value through Internal Audit Performance in a single empirical test. Empirical evidence regarding the direct relationship between Corporate Governance and Shareholders’ Value is contradictory; some studies report positive effects (Puni & Anlesinya, 2020; Rezaee, 2020), while others find insignificant or negative links (Konak, 2023), implying a missing mechanism. However, prior studies either treat IA as a control (Agyei-Mensah, 2018) or narrowly proxy "audit quality," overlooking Internal Audit Performance as a multidimensional capability (risk management, compliance, controls, and resource orchestration) that operationalises governance into Value. Theoretically, Agency Theory explains why boards and committees exist to curb opportunism but does not detail how their monitoring outputs permeate daily operations; the Resource-Based View (RBV) recognises IAP as a strategic asset but remains silent on the Corporate Governance inputs that enable it; Stewardship Theory emphasises collaboration but downplays the importance of formal systems and specialised skills required to convert intent into measurable returns. This misalignment creates a clear gap: we lack an integrated framework that positions Internal Audit Performance as the mediating capability reconciling Corporate Governance structures with realised shareholder value. Contextually, most evidence is derived from developed markets or specific industries, leaving emerging economy settings underexplored and risking omitted variable bias when industry and regulatory intensity are overlooked.

This study addresses these gaps by integrating Agency, RBV, and Stewardship perspectives into a unified framework and testing the mediating role of the Internal Audit Function on the relationship between Corporate Governance and Shareholders' Value using bootstrapped PLS-SEM; it also controls for industry and regulatory intensity to isolate the true mechanism. In doing so, it provides a theory-driven explanation for the relationship between corporate governance and shareholder value. It offers a practical blueprint for boards and regulators aiming to translate governance mechanisms into tangible benefits for shareholders' Value.

3.0. Research Methodology

A research design is a strategic blueprint that guides data collection, measurement, and analysis, minimising bias and enhancing inferential validity (Pandey & Pandey, 2021). Given our interest in testing a mediation mechanism (CG → IAP → SV) and isolating it from contextual influences, we adopt an explanatory, mixed-method design (Babbie, 2020). The population comprises all 37 firms listed on the Ghana Stock Exchange as of December 31 2023. We employed multistage sampling: first categorising firms into services, trading, and manufacturing; then conducting proportionate simple random sampling, which resulted in 30 firms (81.1%). Within each firm, purposive sampling targeted 10 key role-holders involved in Corporate Governance and Internal Audit, including the Internal Audit Directorate, Finance Directorate, CEOs and Audit Committee chairs, yielding 300 respondents. We employed PLS-SEM (XSTAT Premium) because the model is prediction-oriented and includes a higher-order construct (IAP), the data are non-normal, and mediation paths require bootstrapped indirect-effect testing (Hair et al., 2017). Primary data were gathered via structured questionnaires (core constructs) and semi-structured interviews (contextual clarification). Items were adapted from validated scales: Corporate Governance (Agyei-Mensah, 2018), Internal Audit Performance (Berhe et al., 2016), and Shareholders ' Value (perception-based measures, following Omran et al., 2008; Klapper & Love, 2004). Semi-structured interviews were conducted with the 20 internal auditors and 20 audit committee chairpersons who had also completed the questionnaire, in order to elicit deeper, qualitative insights.. Expert review and a pre-test with 10 firms refined wording; Cronbach’s α = 0.76 confirmed acceptable reliability

3.1. Variable Definition and Measurement

Table 1.

Variable Definition and Measurement.

Table 1.

Variable Definition and Measurement.

| Construct |

Conceptual Definition |

Key Indicators |

Measurement Approach |

Empirical support (illustrative studies) |

| Corporate Governance (CG) |

Formal structures, policies, and board attributes that ensure accountability, transparency, and alignment of managerial actions with shareholder interests. |

Board Independence (BI); Board Composition & Diversity (BCD); Corporate Governance Committees (CGC) and Board Risk Attitude (BRA). |

Reflective Likert-type items, 1–5 |

Aadapte from Agyei-Mensah (2018); Puni & Anlesinya (2020); Danoshana & Ravivathani (2019); Fariha et al. (2022); Konak (2023) |

| Internal Audit Performance (IAP) (Second-order) |

The extent to which the internal audit function delivers assurance and advisory services that strengthen risk governance, compliance, internal controls, and resource optimisation. |

First-order dimensions: Compliance Management Performance (CMP), Risk Management Performance (RMP), Internal Control Systems (ICS), and Internal Resource Management Performance (IRMP). |

Reflective Likert-type items, 1–5 |

Adapted from Berhe et al. (2016); Turetken et al. (2020); Oppong et al. (2021); dos Reis Cardillo & Basso (2025) |

| Shareholders’ Value (SV) |

Perceived economic benefits delivered to equity owners |

Perceptions of long-term value creation for shareholders |

Reflective Likert-type perception items |

Omran et al. (2008); Klapper & Love (2004); O’Connell & Ward (2020) |

| Industry (Control) |

Sectoral context shaping governance demands and audit scope. |

Dummy variables: Manufacturing (IND_M), Services (IND_S), Trading (IND_T); baseline = Other. |

Dummy coding |

Dalton et al. (1998); Rezaee (2020) |

| Regulatory Intensity (Control) |

Degree of external oversight and compliance burden imposed on the firm’s sector. |

Frequency of inspections and sanction severity |

Likert items 5-point |

Carcello et al. (2002); Hu, Lin & Tosun (2022) |

3.2. Structural Equations with Controls

3.2.1. Measurement Models

CG = λ₁ BI + λ₂ BCD + λ₃ COM + λ₄ BRA + ε_CG

IAP = λ₅ CMP + λ₆ RMP + λ₇ ICP + λ₈ IRMP + ε_IAP

3.2.3. Structural (Mediation) Model with Controls

IAP = β₁ CG + γ₁ IND_M + γ₂ IND_S + γ₃ IND_T + γ₄ REG_INT + ζ₁

SV = β₂ CG + β₃ IAP + γ₅ IND_M + γ₆ IND_S + γ₇ IND_T + γ₈ REG_INT + ζ₂

Where:

β = structural path coefficients of interest (direct and mediated effects).

γ = coefficients for control variables.

λ = factor loadings in the measurement model.

ε, ζ = measurement and structural error terms, respectively.

Significance is assessed through bootstrapped t-statistics (two-tailed, α = .05). mediation is confirmed if the indirect CG → IAP → SV path is significant and the direct CG → SV path diminishes (partial) or becomes non-significant (full) when IAP is included.

4.0. Results and Discussion4.1. Descriptive Statistics

Table 2 below presents the descriptive statistics.

From

Table 2, the Shareholders’ Value (SV) was rated at a moderate level (M = 3.09, SD = 1.07), signalling neither clear satisfaction nor outright dissatisfaction with value creation. This middling score is consistent with concerns about high operating costs and potential managerial self-interest in the Ghanaian context, an agency misalignment that reinforces the need for effective monitoring and incentive structures. Corporate governance (CG) mechanisms clustered around the mid-point but with meaningful dispersion (SD ≈ 0.93–1.07). Board Risk Attitude (BRA) recorded the highest mean (M = 3.65, SD = 0.93), indicating that boards are reasonably engaged in risk oversight. Board Composition/Diversity (BCD: M = 3.40, SD = 1.01), Board Independence (BOI: M = 3.30, SD = 1.05), and Committee Structures (CGC: M = 3.25, SD = 1.07) indicate a moderate presence of formal governance levers, but also variability across firms precisely the heterogeneity that may explain mixed CG value findings in prior studies. Internal Audit Performance (IAP) dimensions were similarly moderate. Internal Control Processes (ICP) was the highest (M = 3.29, SD = 1.10), followed by Internal Resource Management Practices (IRMP: M = 3.13, SD = 1.16), Compliance Management (CMP: M = 3.05, SD = 1.17), and Risk Management Practices (RMP: M = 3.00, SD = 1.09). The pattern suggests that firms prioritise control design but lag in proactive risk and compliance management, which is precisely the capability gap our mediation model expects IAP to address.

Contextual controls revealed that approximately 8.5% of firms were involved in trading (M = 0.085, SD = 0.28) and 46.2% in services (M = 0.462, SD = 0.50), with the remainder in manufacturing/other sectors. Regulatory intensity was moderate to high in terms of inspection frequency (M = 3.48, SD = 0.95), but only mid-level in terms of sanction severity (M = 2.92, SD = 1.15), implying that external pressure is present but not uniformly stringent. Taken together, these descriptive portray governance and audit infrastructures that exist but are uneven, providing a strong empirical rationale to test whether IAP mediates the CG–SV relations, and to examine how regulatory pressure and industry setting condition that mechanism.

4.2. Data Quality and Measurement Model Assessment

Before conducting hypothesis testing, we thoroughly evaluated our measurement model. The ANOVA confirmed adequate item variability (F = 14.10, p < .0001), and all multi-item constructs surpassed established reliability standards: Corporate Governance Mechanisms (CGM) had Cronbach’s α = .777 and composite reliability (ρc) = .858, while Internal Audit Performance (IAP) achieved α = .870 and ρc = .911. Convergent validity was also satisfactory, with AVE values above .50 (CGM = .603; IAP = .719). Regulatory Intensity (REG) was modelled as a single composite (α = .113) because of its two weakly correlated indicators, and industry dummies were included as single-indicator controls. Discriminant validity was confirmed—each construct's AVE was higher than its greatest squared inter-construct correlation—and cross-loadings indicated that every indicator loaded at least .10 higher on its construct than on any other. The indicator-level collinearity was minimal (VIFs 1.32–2.27). See Appendix A for detailed results.

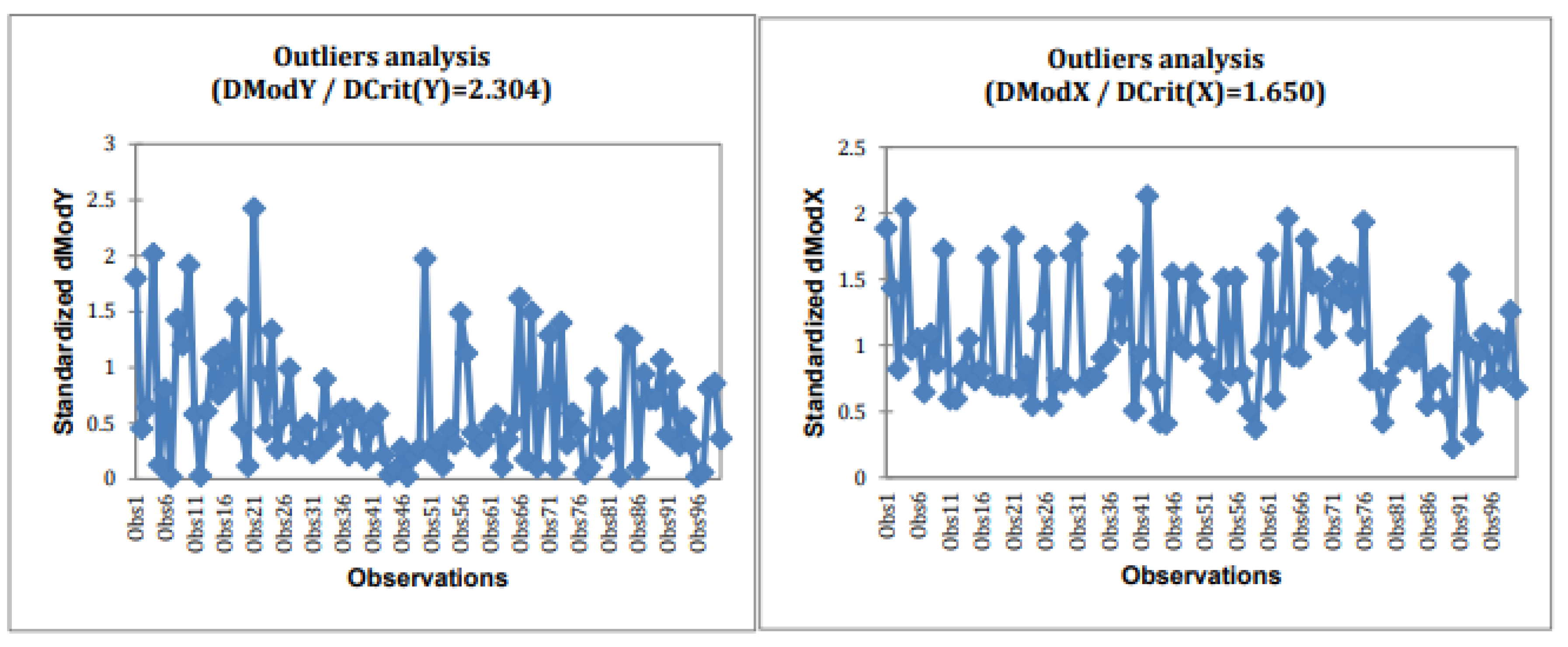

Finally, to ensure that no single case unduly influenced our PLS-SEM results, we conducted outlier diagnostics by examining standardised DModX and DModY values for each observation.

Figure 2 below presents the details.

The outlier diagnostics based on standardised DModX and DModY in

Figure 2 indicated that only six observations exceeded the ±2.0 threshold on at least one dimension. A sensitivity analysis excluding these points produced negligible changes in the structural estimates (Δβ < .02), so all cases were retained for the final model. Collectively, these results offer a solid foundation for testing our structural hypotheses.

4.2. Structural Model and Hypotheses Testing

Having established the soundness of our measurement model, we now turn to evaluating the structural relationships postulated by our Internal Audit and Corporate Governance Model. In this section, we first examine the explanatory power of the model by reporting variance explained (R²) for both Internal Audit Performance (IAP) and Shareholders’ Value (SV), as well as predictive relevance (Q²) for SV.

Table 2 displays the explanatory and predictive relevance of the model.

Table 3.

Explanatory and Predictive Relevance.

Table 3.

Explanatory and Predictive Relevance.

| Construct |

R² |

R² (Bootstrap) |

Standard error |

Critical ratio (CR) |

Lower bound (95%) |

Upper bound (95%) |

Q² cum |

| IAP |

0.256 |

0.273 |

0.048 |

5.306 |

0.177 |

0.377 |

0.203 |

| SV |

0.552 |

0.571 |

0.060 |

9.217 |

0.447 |

0.679 |

0.487 |

The measurement model for Internal Audit Performance (IAP) explained 25.6% of its variance (R² = .256; bootstrapped R² = .273; SE = .048; CR = 5.306; 95% CI [.177, .377]), with a Stone–Geisser Q²cum of .203, indicating acceptable predictive relevance. Shareholders’ Value (SV) was even better accounted for, with R² = .552 (bootstrapped R² = .571; SE = .060; CR = 9.217; 95% CI [.447, .679]) and Q²cum = .487, reflecting strong out-of-sample predictive power of our model.

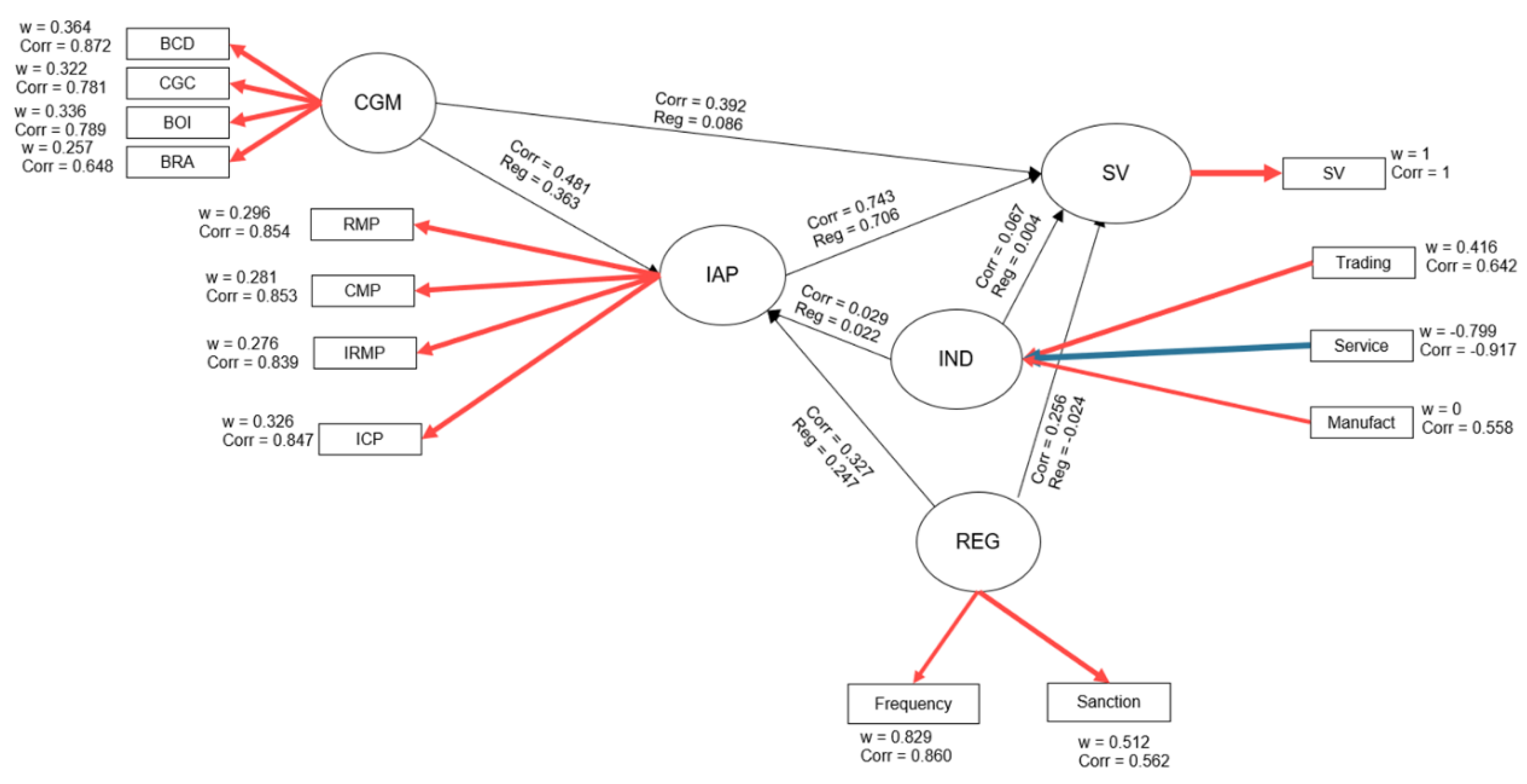

The estimated path coefficients for the hypothesised direct effects Corporate Governance Mechanisms (CGM) and Regulatory Intensity (REG) on IAP; and IAP, CGM, REG, and Industry controls on SV, along with their bootstrapped standard errors, critical ratios, confidence intervals and indirect effects (bootstrapped) are presented in

Table 4 and

Figure 3 below.

Our first hypothesis predicted a direct positive effect of corporate governance mechanisms (CGM) on shareholder value (SV). Contrary to expectations and much of the traditional governance literature (Puni & Anlesinya, 2020; Danoshana & Ravivathani, 2019), the estimated path coefficient was small and non-significant (β = 0.086; SE = 0.048; t = 1.787; p > .05) and demonstrated in

Table 4 and

Figure 3. This finding aligns with recent evidence from Konak (2023) and Fariha et al. (2022), who report that independent boards and specialised committees may sometimes slow decision-making, dilute accountability, or lack firm-specific insight, thereby failing to create immediate market or accounting gains. The null result suggests that formal governance structures alone are insufficient to move the value needle. Instead, CG mechanisms appear to set the stage without guaranteeing returns until they are operationalised through internal control and audit processes. This helps explain why empirical studies in emerging-market contexts often find mixed or absent CG→SV links (Boutrik et al., 2021; Rezaee, 2020). Our results thus reinforce the argument that value creation requires more than board composition or committee charters. It requires effective follow-through, which we show is fulfilled by robust internal audit performance (IAP). Consequently, we reject H1 and refocus on the mediating role of IAP in translating governance into shareholder gains.

Hypothesis 2 posited that stronger corporate governance mechanisms (CGM) would translate into higher internal audit performance (IAP), in line with Agency Theory’s emphasis on robust monitoring and Stewardship Theory’s focus on collaborative oversight. Empirically, the CGM→IAP path was highly significant (β = 0.365, SE = 0.040, t = 9.189, p < .001), indicating that firms with more independent boards, diverse skill sets, and active audit and risk committees tend to develop more capable and value-adding internal audit functions. This result is consistent with Boutrik et al. (2021), who found that firms with specialist audit committee expertise exhibit higher audit quality and reporting reliability. Similarly, Mwape (2022) documents that independent directors significantly enhance audit objectivity by shielding internal auditors from managerial pressure. Our findings extend these studies by quantifying the direct impact of the broader CGM bundle, including board independence, committee structures, and board risk attitude, on the composite IAP construct, which encompasses risk management, compliance, controls, and internal resource management. Board composition and diversity emerged as the strongest driver of internal audit performance (weight = 0.364), underscoring how a mix of skills, backgrounds, and perspectives equips audit teams with richer insights and broader stakeholder alignment. Close behind, board independence carried a substantive weight of 0.336, reflecting the critical role that non-executive directors play in safeguarding auditor objectivity and ensuring unfettered access to information. The audit and risk committees also made a meaningful contribution (weight = 0.322), highlighting that formally empowered committees, especially those with financial and industry expertise, provide essential oversight, guidance, and resources to the internal audit function. Together, these weights reveal that while all three governance levers are important, diversity in board composition has a marginally larger impact on audit effectiveness, likely because it brings complementary knowledge and challenge processes that drive robust risk assessment and control innovation.

Our third hypothesis asserted that superior Internal Audit Performance (IAP) would translate into greater Shareholders' Value (SV). The empirical evidence strongly supports this linkage: the IAP→SV coefficient was large and highly significant (β = 0.706, SE = 0.057, t = 12.392, p < .001). This finding aligns with Turetken et al. (2020), who document that firms with proactive audit functions incur lower compliance costs. and improved profit margins. Theoretically, this result aligns with the Resource-Based View, which posits that an effective internal audit is a firm-specific capability that safeguards assets, uncovers inefficiencies, and guides management toward value-enhancing opportunities. It also vindicates the proposition of Stewardship Theory that auditors and managers can collaborate to pursue long-term goals. By empirically demonstrating that IAP accounts for over 70% of a one-unit change in SV, we confirm that audit functions do not merely check the books; they actively drive value creation.

Finally, we tested whether IAP serves as the conduit through which Corporate Governance Mechanisms (CGM) impact SV. The bootstrapped indirect effect of CGM on SV via IAP was substantial (β indirect = 0.257; SE = 0.032; 95% CI [.190, .319]), and the Variance Accounted For (VAF) was approximately 75%, signifying practically full mediation. In other words, CGM’s influence on shareholder outcomes operates primarily by empowering the internal audit function. This mediation finding bridges the explanatory gap identified by Konak (2023) and Boutrik et al. (2021), who observed inconsistent direct CGM→SV effects but noted stronger governance and audit relations. It also extends the Internal Audit Value-Adding (IAVA) framework by empirically validating IAP as the missing mechanism in the governance-value chain. Practically, our results suggest that boards and regulators should focus not only on board composition and committee charters but also on strengthening audit capabilities through training, resourcing, and clear mandates to ensure that governance structures yield tangible shareholder benefits.

4.3. Discussion of Results

Our findings deliver a cohesive explanation for the long-standing “governance–value” puzzle and advance theory by specifying the mechanism through which board structures translate into firm performance. Contrary to traditional expectations (Agency Theory; Stewardship Theory) and empirical positives in contexts such as Ghanaian banks (Puni & Anlesinya, 2020) and Sri Lankan firms (Danoshana & Ravivathani, 2019), we observed no direct significant impact of Corporate Governance on shareholders' Value. This null result mirrors recent studies in Pakistan and other emerging markets (Fariha et al., 2022; Konak, 2023) and suggests that formal governance architecture alone is insufficient for value creation. Instead, boards and committees merely establish monitoring intent, and where this intent is not operationalised, shareholder returns remain muted.

In line with our second hypothesis, however, Corporate Governance mechanisms strongly predicted Internal Audit Performance, confirming that diverse, independent boards and empowered audit committees actively build the firm-specific internal audit capabilities (Boutrik et al., 2021; Mwape, 2022) needed to translate governance intent into action. Board composition and diversity were especially significant (weight = 0.364), reflecting the Value of varied perspectives in driving robust risk assessment and control innovation. Crucially, superior audit performance then delivered shareholder value. The impact of IAP on SV was positive and significant, echoing Resource-Based View arguments that internal audit is a strategic capability (Turetken et al., 2020).

Our mediation analysis ties these strands together, CGM influences SV only through IAP, demonstrating practically full mediation. This resolves conflicting CG→SV findings by demonstrating that effective internal audit functions must support governance structures to yield shareholder benefits. Theoretically, we integrate Agency, Stewardship, and RBV into an Internal Audit Value-Adding (IAVA) framework, shifting the focus from governance form to governance function. Practically, our work directs boards, managers, and regulators to invest not just in board composition or regulatory codes, but also in building internal audit charters, budgets, and competencies, ensuring that governance intentions are operationalised into controls, compliance, and strategic insights that drive real Value for shareholders.

The interview data reveal several recurring themes that deepen our quantitative findings. Many board members appear to serve as “tick-the-box” appointees rather than value-adding advisors, with one respondent noting that “the cost of running the corporate board outweighs the benefits, especially when large boards include members who merely fulfill governance code requirements”. Others highlighted that board selection often reflects external influence rather than industry-relevant expertise, undermining the board’s ability to guide strategy or oversee risk. As a result, boards seldom engage in continuous oversight “only wait at the end of the year to receive management and auditors’ reports, which further diminishes their effectiveness. Paradoxically, this dynamic place greater informational and decision-making burden on the internal audit function. However, the respondents also cautioned that auditors sometimes lack the technical skills to go beyond financial and compliance checks, and must compensate for infrequent board engagement by stepping in to bridge the gap between governance and operations. Together, these qualitative insights underscore why formal governance structures alone fail to move the value needle and why our finding of full mediation by Internal Audit Performance makes sense, only when audit teams possess both mandate and expertise can governance intent be translated into the continuous, strategic oversight that creates real shareholder value.

5.0. Conclusion

We contend that the conflicting empirical findings on the impact of corporate governance on shareholder value stem from differences in internal audit effectiveness across firms. A strong governance framework alone is insufficient; it must be aligned with a high-performing internal audit function to unlock real Value. In this synergy, governance establishes the structures, processes, and policies, while internal audit brings them to life, continuously monitoring operations, offering strategic insights, and driving risk-based decision-making to ensure organisational objectives are met and shareholder value is maximised. By demonstrating that Corporate Governance Systems have no direct effect on Shareholders' Value until they strengthen the Internal Audit function, we resolve the long-standing empirical puzzle of mixed Corporate Governance and shareholders' value findings in emerging-market settings. Our comprehensive mediation result integrates multiple theoretical perspectives, reflecting the emphasis on vigilant monitoring of Agency Theory, the collaborative governance ethos of Stewardship Theory, and the focus on internal capabilities of the Resource-Based View. It also aligns with Dynamic Capability Theory, highlighting how adaptive audit functions enable firms to reconfigure processes in rapidly changing environments. Additionally, it aligns with the Triple Bottom Line framework, demonstrating that robust internal audit not only drives economic returns but also underpins social responsibility and environmental stewardship.

6.0. Recommendations

Based on the above conclusions, we offer the following recommendations:

6.1. For Boards and Executives

The board should prioritise investment in your internal audit function. This means not only appointing skilled internal auditors but also granting them clear charters, sufficient budgets, and direct access to the board and management.

6.2. For Regulators and Standard-Setters

Regulatory bodies and Standard Setters should embed minimum standards for internal audit capability into corporate governance codes. This will require firms to report on internal audit performance, professional development, the scope of audit activities, and staffing in their annual reports.

6.3. For Chief Internal Auditors

The Chief Internal Auditors should position their function as a strategic partner by expanding beyond compliance management to risk-based reviews and forward-looking advisory services that inform board strategy.

6.4. For Shareholders at the Annual General Meeting

At annual general meetings, shareholders should empower and protect the independence of the internal audit function. This involves voting for audit committee members with strong audit backgrounds and technical expertise, and insisting on transparent reporting of internal audit activities and findings to ensure the function can operate free from undue managerial influence.

7.0. Contribution

Our findings shift the theoretical debate from structural proxies to governance functionality, marking a novel contribution to both governance and audit literatures. Practically, we move beyond "does governance work?" to "how and when does governance create value?", empirically validating Internal Audit Performance as a critical engine that translates corporate governance systems into shareholders' Value. Because both corporate governance frameworks and internal audit functions are ubiquitous across legal systems and market contexts, our study provides a universally applicable roadmap, enabling both emerging-market and developed-economy firms to diagnose governance gaps, strengthen audit capabilities, and thereby drive sustainable shareholder value.

8.0. Originality

To the best of our knowledge, this is the first study in an emerging market context to demonstrate practically full mediation of the internal audit performance on the relationship between Corporate Governance Mechanisms and Shareholders' Value. Unlike prior work that treats governance structures and audit quality in isolation, we show their synergistic interaction, establishing internal audit as the operational engine of corporate governance.

9.0. Limitations of the Study

While our study sheds new light on how internal audit performance (IAP) mediates the impact of corporate governance on shareholders' Value in Ghanaian listed firms, we wish to acknowledge some limitations and identify opportunities for future research. We rely on survey data from respondents, which individual biases or organisational politics may influence. Future studies should triangulate perceptual data with objective indicators, such as audit reports, regulatory filings, or market-based performance metrics. Since we only sampled publicly listed firms in Ghana, the generalisability of our results to private firms and other emerging and developed markets is limited. Comparative, multi-country studies, ideally with matched governance codes or regulatory regimes, are recommended. Additionally, the use of a single-period survey precludes strong causal inferences and overlooks the dynamic development of capability over time.

10.0. Author’s Contribution Statement

Abudu Dawuda was responsible for conceptualisation, data curation, formal analysis, investigation, development of methodology, project administration, software management, and resource provision. He also prepared the original manuscript draft. Prof. Syed Ahmed Salman supervised the research, validated the findings, contributed to the visualisation of the proposed model, and led the review and editing of the final manuscript. Both authors have read and approved the final version of the manuscript.

11.0. Declaration of Funding

There is no funding for this study

12.0. Informed Consent Statement

Prior to data collection, we obtained each participant’s informed consent, assured them that their responses would be treated with strict confidentiality, and secured their voluntary agreement to take part in the study.

13.0. Data Availability Statement

The authors confirm that the data supporting the findings of this study are available within the article as supplementary materials. The data can be shared upon reasonable request.

14.0. Disclosure of Generative Artificial Intelligence (AI)

We wish to acknowledge that the Grammarly Premium Version and Subscription-based ChatGPT were used to improve language quality, not for idea generation or writing.

15.0. Disclosure of Interest

The authors declare that there are no competing interests or potential conflicts of interest regarding the research, authorship, and publication of this study.

References

- Abudu, D., Gariba, O. A., & Alnaa,S.E. (2015). The Organisational Independence of Internal Auditors in Ghana: Empirical Evidence from Local Government. Asian Journal of Economic Modelling,3(2),33-45.

- Agyei-Mensah, B. K. (2018). The Impact of Corporate Governance Attributes and Financial Reporting Lag on Corporate Financial Performance. African Journal of Economic and Management Studies, 9(3), 349-366.

- Alabdullah, T. T. Y., & Churiyah, M. (2023). The Impact of Top Management Features on South Alabama Construction Companies’ Firm Performance: The Role of Board Size as a Moderator. Current Advanced Research on Sharia Finance and Economic Worldwide, 3(1), 100-126.

- Almashhadani, M., Almashhadani, H. A., & Almashhadani, H. A. (2022). Corporate Governance as an Internal Control Mechanism and Its Impact on Corporate Performance International Journal of Business and Management Invention, 11(8), 53-59.

- Al-Twaijry, A. A. (2020). Evaluating the internal audit function's performance through a risk-based audit approach. Journal of Accounting in Emerging Economies, 10(3), 437-452.

- Alzeban, A. (2020). "The relationship between the audit committee, internal audit and firm performance". Journal of Applied Accounting Research, 21(3), 437–454. [CrossRef]

- Azar, N. (2020). The Effect of Corporate Governance Mechanisms and their Interactions on Earnings Quality (Doctoral dissertation, University of Malaya (Malaysia)).

- Babbie, E. (2020). The practice of social research (15th ed.). USA, Cengage Learning.

- Berhe, A. G., Mihret, A. G., & Ali, M. S. (2016). The Effects of Internal Audit on the Performance of Ethiopian Financial Institutions. Journal of Finance, Accounting & Management, 7(2).

- Boutrik, S., Meghari, R., & Brahiti, I. (2021). The contribution of the audit committee to the improvement of the quality of the internal audit. La Revue des Sciences Commerciales, 20(1), 184-204.

- Bozkus K. S., & Caliyurt K. (2018). "Cyber security assurance process from the internal audit perspective", Managerial Auditing Journal, 33(4), 360–376.

- Brazel, J. F., Jones, K. L., & Prawitt, D. F. (2021). The moderating effect of corporate governance on the relation between a CEO’s ethical orientation and fraudulent financial reporting. Journal of Business Ethics, 169(1), 111-132.

- Carcello, J. V., Hermanson, D. R., Neal, T. L., & Riley Jr, R. A. (2002). Board characteristics and audit fees. Contemporary accounting research, 19(3), 365–384.

- Chen, Y., Len, B., Lu, L., & Zhou, G. (2020). Can internal audit functions enhance a firm's operational efficiency? Evidence from China. Managerial Auditing Journal, Emerald Publishing Limited, 0268-6902. [CrossRef]

- Dalton, D. R., Daily, C. M., Ellstrand, A. E., & Johnson, J. L. (1998). Meta-analytic reviews of board composition, leadership structure, and financial performance. Strategic management journal, 19(3), 269-290.

- Danoshana, S., & Ravivathani, T. (2019). The impact of corporate governance on firm performance: A study on financial institutions in Sri Lanka. SAARJ. Journal on Banking and Insurance Research, 8(1), 62-67.

- Danso, F. K., Adusei, M., Sarpong-Danquah, B., & Prempeh, K. B. (2024). Board expertise diversity and firm performance in sub-Saharan Africa: do firm age and size matter?. Future Business Journal, 10(1), 98.

- Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Toward a stewardship theory of management. Academy of Management Review, 22(1), 20–47.

- dos Reis Cardillo, M. A., & Basso, L. F. C. (2025). Revisiting knowledge on ESG/CSR and financial performance: A bibliometric and systematic review of moderating variables. Journal of Innovation & Knowledge, 10(1), 100648.

- Egbunike, P. A., & Egbunike, F. C. (2017). An Empirical Examination of Challenges Faced by Internal Auditors in Public Sector Audit in South-Eastern Nigeria. Asian Journal of Economics, Business and Accounting 3(2), 1-13.

- Elkington, J. (1994). Towards the sustainable corporation: Win-win-win business strategies for sustainable development. California management review, 36(2), 90–100.

- Eulerich, A. K., & Eulerich, M. (2020). What is the Value of internal auditing?–A literature review on qualitative and quantitative perspectives—A Literature Review on Qualitative and Quantitative Perspectives (April 22, 2020). Maandblad Voor Accountancy en Bedrijfseconomie, 94, 83-92.

- Fariha, R., Hossain, M. M., & Ghosh, R. (2022). Board characteristics, audit committee attributes and firm performance: empirical evidence from an emerging economy. Asian Journal of Accounting Research, 7(1), 84–96.

- Freeman, R. E., & Phillips, R. A. (2002). Stakeholder theory: A libertarian defence. Business ethics quarterly, 12(3), 331–349.

- Friedman, M. (1970). The social responsibility of business is to increase its profits. In L. B. Pincus (Ed.), Perspectives in business ethics (pp. 246–251). Singapore: McGraw-Hill.

- Governance as an Internal Control Mechanism and Its Impact on Corporate Performance.

- Ganguli, S.K., & Guha Deb, S. (2021). Board composition, ownership structure and firm performance: New Indian evidence. International Journal of Disclosure and Governance, 18(3), 256-268.

- Gyamera, E., Abayaawien Atuilik, W., Eklemet, I., Adu-Twumwaah, D., Baba Issah, A., Alexander Tetteh, L., & Gagakuma, L. (2023). Examining the effect of financial accounting services on the financial performance of SME: The function of information technology as a moderator. Cogent Business & Management, 10(2), 2207880.

- https://www.theiia.org/globalassets/site/resources/guiding-principles-of-corporate- governance.pdf.

- Hair Jr, J. F., Matthews, L. M., Matthews, R. L., & Sarstedt, M. (2017). PLS-SEM or CB-SEM: updated guidelines on which method to use. International Journal of Multivariate Data Analysis, 1(2), 107–123.

- Hanefah, M. M., & Endaya, K. A. (2018). Internal Audit Effectiveness: An Approach Proposition to Develop the Theoretical Framework. Research Journal of Finance and Accounting ,4(10), 92-102.

- Helfat, C. E., & Peteraf, M. A. (2009). Understanding Dynamic Capabilities: Progress Along a Developmental Path Strategic organisation, 7(1), 91–102.

- Hilmi, Y., & Fatine, F. E. (2022). The contribution of internal audit to corporate performance: a proposal of measurement indicators. International Journal of Performance & Organizations (IJPO), 1(10, 45-50.

- Hassan, L., Rasheed, B., Malik, Z. F., Fraz, S. T., & Aslam, N. (2025). The Effect of Audit Committee Characteristics on Financial Reporting Quality with the Moderating Role of Audit Quality. Centre for Management Science Research, 3(3), 695–710.

- How, SM., Lee, C.G. & Brown, D.M. (2019). Shareholder Theory Versus Stakeholder Theory in Explaining Financial Soundness. Int Adv Econ Res 25, 133–135. [CrossRef]

- Hui, K. J. (2018). Cash Holdings, Corporate Governance and Firm Performance in the Hospitality Industry (Doctoral dissertation, University of Malaya (Malaysia)).

- IIA (2020). International Professional Practices Framework (IPPF). The Institute of Internal Auditors, Altamonte Springs. https://na.theiia.org/standards- guidance/Pages/Standards-and-Guidance-IPPF.aspx.

- Institute of Internal Auditors (2019). Code of Ethics Implementation Guides (IPPF). Accessed on December 9, 2022, from https://www.theiia.org.

- Inyang, O. E. , Enya E. F., & Otuagoma O. F.(2021). Internal Audit Effectiveness in the Public Health Sector in South-South Nigeria. United International Journal for Research & Technology, 2(8),127-132.

- Jacoby, G., Liu, M., Wang, Y., Wu, Z., & Zhang, Y. (2019). Corporate governance, external control, and environmental information transparency: Evidence from emerging markets. Journal of International Financial Markets, Institutions and Money, 58, 269-283.

- Jensen, M. C. (2001). Value Maximisation, Stakeholder Theory, and the Corporate Objective Function. Journal of Applied Corporate Finance, 14(3), 8–21.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure. Journal of Financial Economics 3 (1), 305-360.

- Kieback, S., Thomsen, M., & Watrin, C. (2022). Market reactions to the appointment of audit committee directors with financial and industry expertise in Germany. International Journal of Auditing, 26(4), 446-466.

- Khan, Y., Arshad, M. W., ul Hassan, J., Batool, S., & Usman, M. (2024). The Influence of Various Corporate Governance Dimensions on Financial Performance Indicators: An Empirical Study of Cement Companies Listed on the Pakistan Stock Exchange. Dialogue Social Science Review (DSSR), 2(5), 233–254.

- Klapper, L. F., & Love, I. (2004). Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance, 10(5), 703-728.

- Konak, O. (2023). Internal Audit of Governance in Turkey: An Analysis in BIST-100 Companies (Doctoral dissertation, Marmara Universitesi (Turkey)).

- Lenz, R., & Enslin, B. (2025). The Gardener of Governance: A Call to Action for Effective Internal Auditing. CRC Press.

- Liu, W., Wang, J., Jia, F., & Choi, T. M. (2022). Blockchain announcements and stock value: a technology management perspective. International Journal of Operations & Production Management, 42(5), 713–742.

- Lois, P., Drogalas, G., Karagiorgos, A., & Tsikalakis, K. (2020). "Internal audits in the digital era: opportunities, risks and challenges". EuroMed Journal of Business,15(2), 205–217. [CrossRef]

- Maurović, L., & Hasić, T. (2014). Reducing agency costs by selecting an appropriate system of corporate governance, Ekonomska Istraživanja – Economic Research (special issue, 1): 225–242.

- Mbate, M. M. (2023). Effects of CEO duality, board independence, ownership concentration, company age on profit persistence and firm Value: an empirical study of manufacturing companies in West Java, Indonesia. The ES Accounting and Finance, 1(02), 54–60.

- Mwape, A. (2022). The Impact of Poor Corporate Governance on the Effectiveness of Internal Audit at the Road Development Agency (RDA) in Zambia. Open Journal of Business and Management, 10(5), 2325-2365.

- Nagy, J., & Cenker, W. J. (2021). Evaluating the impact of the internal audit function on the audit committee's oversight of financial reporting. Journal of Accounting and Public Policy, 40(4), 106883.

- Nguyen, H. C. (2011). Factors causing Enron’s collapse: An investigation into corporate governance and corporate culture. Corporate Ownership and Control Journal, 8(3), 565-644.

- Nwadike, A., & Wilkinson, S. (2022). Challenges to Building Code Compliance in New Zealand. International Journal of Construction Management, 22(13), 2493–2503.

- O’Connell, M., & Ward, A. M. (2020). Shareholder Theory/ Shareholder Value. Encyclopedia of Sustainable Management, 1–7. [CrossRef]

- OECD (2015). G20/OECD Principles of Corporate Governance. OECD Publishing, Accessed on 2-11-2022 From.

- Olawale, A., & Obinna, E. (2023). An Empirical Analysis of Capital Structure, Liquidity and Banking Sector Performance in Nigeria (2011-2021). Journal of Finance and Economics, 11(3), 149-159.

- Omran, M. M., Bolbol, A., & Fatheldin, A. (2008). Corporate governance and firm performance in Arab equity markets: Does ownership concentration matter?. International review of law and economics, 28(1), 32–45.

- Oppong, C., Atchulo, A. S., Dargaud Fofack, A., & Afonope, D. E. (2024). Internal Control Mechanisms and Financial Performance of Ghanaian Banks: The Moderating Role of Corporate Governance. African Journal of Economic and Management Studies, 15(1), 88–103.

- Osei, A. A., Yusheng, K., Caesar, A. E., Tawiah, V. K., & Angelina, T. K. (2019). Collapse of big banks in Ghana: Lessons on its corporate governance. International Institute for Science, Technology, and Education, 10(10), 27–36.

- Oseni, N. A. (2021). Determinants of Internal Audit Effectiveness in Public Universities in South-West Nigeria (Master's thesis, Kwara State University (Nigeria)).

- Pandey, P., & Pandey, M. M. (2021). Research methodology tools and techniques. Bridge Centre.

- Pfeffer, J., & Salancik, G.R. (1978). The external control of organisations: A resource dependence perspective. New York: Harper & Row.

- Pickett, K. H. S. (Ed.). (2012). The internal auditing handbook. John Wiley & Sons. [CrossRef]

- Puni, A., & Anlesinya, A. (2020). Corporate governance mechanisms and firm performance in a developing country. International Journal of Law and Management, 62(2), 147-169.

- Postula , M., Irodenko , O., & Dubel,P. (2020). Internal Audit as a Tool to Improve the Efficiency of Public Service. European Research Studies Journal, XXIII, (3), 700-715.

- Ramadhan, Y., Ramzy, W., Munawaroh, F., & Sunardi, D. (2023). The Role of Internal Auditors in the Implementation of Social Environmental Governance. JASa (urnal Akuntansi, Audit dan Sistem Informasi Akuntansi), 7(3), 544-554.

- Sarens, G., & De Beelde, I. (2006). Building a research model for internal auditing: insights from literature and theory specification cases. International Journal of Accounting, Auditing and Performance Evaluation, 3(4), 452-470.

- Roffia, P. (2025). The Evolution of the OECD Corporate Governance Principles-A Comparative Analysis (1999–2023). In Proceedings of IAC 2025 in Prague (Vol. 1, pp. 48-54). Czech Institute of Academic Education, zs.

- Rezaee, Z. (2025). Business Sustainability Framework: Theory and Practice. Taylor & Francis.

- Skare, M., & Hasić, T. (2016). Corporate Governance, Firm Performance, and Economic Growth – Theoretical Analysis. Journal of Business Economics and Management, 17(1), 35–51. [CrossRef]

- Shin, T. (2013). The shareholder value principle: The governance and control of corporations in the United States. Sociology Compass, 7(10), 829–840.

- Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic management journal, 18(7), 509-533.

- Torku, K., & Laryea, E. (2021). Corporate governance and bank failure: Ghana’s 2018 banking sector crisis. Journal of Sustainable Finance & Investment, 1-21.

- Turetken, O., Jethefer, S., & Ozkan, B. (2020). Internal Audit Effectiveness: Operationalisation and Influencing Factors. Managerial Auditing Journal 35 (2), 238–271. [CrossRef]

- Weekes-Marshall, D. (2020). The role of internal audit in the risk management process: A developing economy perspective. Journal of Corporate Accounting and Finance, 2020,1-12.

- Zaidan, A. M., & Neamah, I. S. (2022). The effect of the quality of the Internal Audit Function on improving the operational efficiency of companies: An Empirical Study. Webology , 19(1), 6990-7019 (ISSN: 1735-188X).

- Zain, M., Subramaniam, N., & Stewart, J. (2021). Internal audit and corporate governance: A review of research and future directions. International Journal of Auditing, 25(3, 309-328.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).