1. Introduction

Over the past decades, international trade has become a cornerstone of economic growth and national development, enabling countries to access new opportunities, enhance their competitiveness, and strengthen global trade relations [

1]. The strategic role of exports in fostering economic growth, both at the national and firm level, has facilitated the emergence of new markets for innovative and differentiated products. As a result, consumers today benefit from a broader array of goods and services, many of which operate within frameworks of monopolistic competition [

2]. The wine industry serves as a distinct yet representative example of globalization, experiencing a notable increase in export volumes relative to global wine production levels [

3]. Intensified competition, the rise of new producers and exporters, and the expansion of wine consumption into new markets have contributed to an increasingly globalized and competitive wine industry [

4].

Indeed, among southern European countries, wine ranks among the most exported agri-food products, playing a crucial role in strengthening foreign trade [

5]. On a global scale, wine experienced a considerable growth in the late 1990s and early 2000s, as highlighted by Mariani et al. [

6]. However, more recent data indicates that global wine sales have declined by approximately 9% between 2017 and 2023. Despite this overall contraction, a segmentation of the market reveals that sales of sparkling wine increased by 9% over the same period [

7].

Within the sparkling wine category, Prosecco (considering its three denominations: Prosecco DOC, Conegliano Valdobbiadene Prosecco DOCG, and Asolo Prosecco DOCG, hereafter denominated Prosecco) dominates both domestic and international markets. It accounts for 53.5% of the total market value of sparkling wines in Italy, well ahead of other Charmat wines (excluding Prosecco) at 30.3%, and the Italian classic method (Metodo Classico Italiano) at 16.3% [

8]. Similarly, on the global stage, Prosecco is the most exported sparkling wine [

5], with Prosecco DOC and Prosecco Conegliano Valdobbiadene DOCG making up over 95% of total production. Made primarily from Glera grapes and produced in Veneto and Friuli-Venezia Giulia, Prosecco’s use of the Charmat/Martinotti method enables lower production costs compared to traditional-method sparkling wines such as Franciacorta, Cava, Trento DOC, and even Champagne in the case of high-demand market segments. This combination of competitive pricing and a strong international appeal has contributed to Prosecco’s dominant presence in global sparkling wine exports [

9].

However, despite the recent success of Prosecco in international markets, signs of a slowdown in its growth trajectory have emerged in some recent years [

5]. Several exogenous factors may be contributing to this trend, most notably the COVID-19 pandemic and the renewed threat of tariffs under the Trump administration. The COVID-19 crisis severely disrupted both international trade and domestic wine sales. While on-store consumption declined rapidly, this negative impact was partially offset by increased off-store and e-commerce sales [

10].

Tariffs, however, are now an additional and growing source of concern, especially following Trump’s recent announcement threatening to sharply increase the existing 10% import tariffs, already introduced in April 2025 under the so-called “Liberation Day”, raising them to 30% on EU goods starting August 1st [

11]. This threat was communicated through an unusually direct letter addressed to the President of the European Commission, in which Trump not only announced the forthcoming tariff increase, but also emphasized that any retaliatory measures by the EU would trigger a proportional escalation in trade restrictions. Specifically, he declared that “the amount of the EU’s tariff will be added to the 30%”, implying that if the EU were to respond with a retaliatory tariff of equal magnitude (i.e., 30%), the U.S. would impose an additional 30% on top of that, resulting in a punitive 60% tariff on targeted goods [

12].

The potential consequences of such tariffs are not purely speculative. In 2019, the Trump administration imposed 25% duties on several EU wines (excluding Prosecco), resulting in estimated losses of approximately

$10 million for French white wine exports and around

$19 million for French red wines [

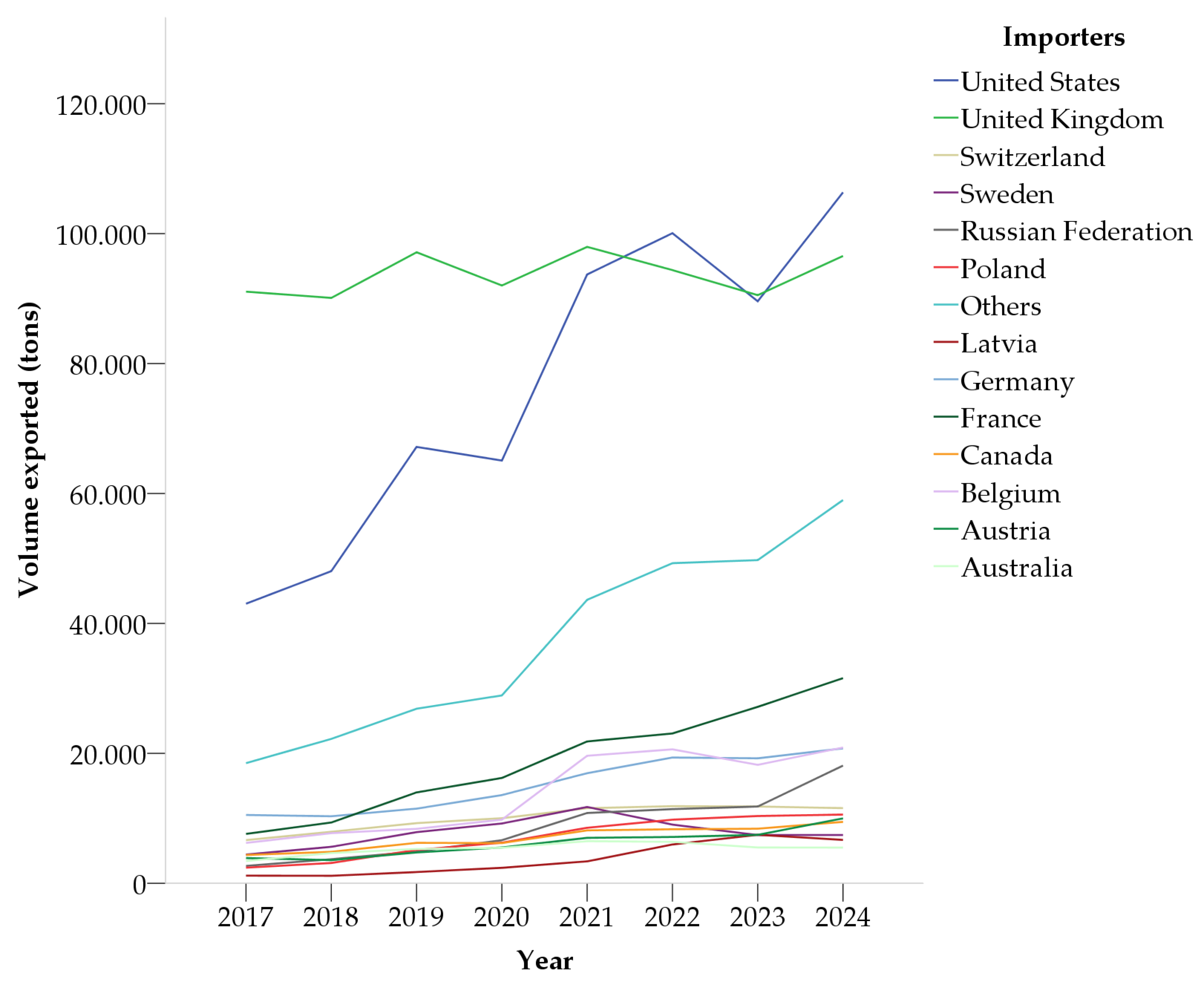

13]. These developments are especially concerning considering the strategic importance of the U.S. market for Prosecco. In recent years, the United States has consistently ranked as the second-largest importer and even reached first place in 2022 and in 2024, with a staggering 101% growth in imports between 2017 and 2024 [

5].

In this context, and given the limited body of research addressing these dynamics, it is necessary not only to analyse the international export performance of Prosecco, but also to assess the potential impact of current and hypothetical U.S. tariff scenarios, specifically at 10%, 30%, and 60%. Among the most established approaches in trade analysis, the gravity model offers a robust and widely accepted methodological framework for identifying the determinants of export flows, particularly effective in evaluating the effects of trade barriers such as tariffs [

14]. However, despite its proven applicability across various sectors, including agri-food, the use of the gravity model in the wine market remains relatively underexplored. In particular, there is a clear lack of studies focusing on specific wine categories and, to the best of our knowledge, no existing research has yet applied this model to the case of Prosecco. Yet this typology of wine warrants dedicated investigation, as the influence of key explanatory variables may differ significantly depending on the type of wine and its market positioning. This study aims to address this gap by focusing specifically on Prosecco exports. In addition, by incorporating years beyond the peak of the COVID-19 pandemic, this study helps to evaluate whether Prosecco exports were affected in the long term and assess its resilience in the market over time. Finally, simulating the short-term effects of Trump’s tariff (at 10%, 30% and 60%) on Prosecco exports could provide predictive insights into how such measures, if implemented by the U.S. administration, could reshape trade flows.

2. Background: The Gravity Model

International trade is a core subject in economic research, due to its impact on global economic development. Among the several different tools used to examine trade flows, the gravity model is one of the most widely applied. Inspired by Newton’s law of gravitation, this model posits that trade flows between two countries (

) are directly proportional to their economic sizes, typically measured by GDP (

) and inversely proportional to the distance between them (

), as in 1.

It should be stressed that the concept of “distance” extends beyond merely geographical factors, including economic, cultural, and institutional barriers which may influence trade. Within this framework, the GDP of each trading partner serves as a proxy for their “mass”, and the model assumes that larger and closer economies are more likely to trade with each other.

The foundation of the gravity model was first introduced empirically by Leibenstein and Tinbergen in 1966 [

15] and was later refined by various economists, such as Anderson [

16], who provided a more theoretical foundation. Anderson’s formulation [

16] introduced the concept of product differentiation by country of origin, thereby offering a rationale for the existence of trade even in the absence of comparative advantage.

Recent advancements in the gravity model framework extend beyond geographical distance and GDP, including economic, institutional, and cultural factors in the model. Among these, trade barriers are frequently employed as proxies for economic distance, as they can significantly constrain international trade flows. Recent studies, such as Muradovna [

17] and Gnutzmann-Mkrtchyan and Hugot [

18], apply gravity models to empirically assess the impact of such barriers, finding robust evidence that both tariff and non-tariff measures exert a statistically significant and negative effect on exports. Focusing specifically on wine trade, Zhang et al. [

13] found that tariff barriers could drastically and negatively affect exports, although their analysis does not apply a gravity model. Yet, Dal Bianco et al. [

14], employing a gravity model to examine the impact of barriers on global wine trade, demonstrated that tariff and non-tariff barriers negatively impact on trade flows.

Besides, a growing body of literature has investigated the extent to which the COVID-19 pandemic has influenced trade patterns. To illustrate, Davidescu et al. [

19] and Barbero et al. [

20] employed the gravity model analysis to evaluate the pandemic’s effect on the exports of Romania and Malaysia, respectively, emphasizing the importance of currently including such variables when measuring international trades. More specifically, Davidescu et al. [

19] included quantitative indicators such as the number of COVID-19 cases and deaths as explanatory variables in the gravity equation. Similarly, Barbero et al. [

20] introduced government policy indices as proxies for COVID-related disruption, even if finding a low impact on the trade, likely due to the short observation period during the initial phase of the crisis, when trade disruptions were still unfolding. More recently, Macedo et al. [

21] conducted one of the few studies extending the analysis beyond 2020 to assess the pandemic’s longer-term implications. Notably, their research also stands out as one of the few that specifically investigates the wine sector. Their results indicate that COVID-19 did not have a statistically significant negative effect on wine exports from major producing countries such as France, Spain, and Italy. This outcome may be attributed to the distinctive nature of these wines, which benefit from strong geographical indications and limited substitutability in international markets.

3. Materials and Methods

The study analyses the determinants of Prosecco exports through an augmented gravity model, contributing to a deeper understanding of the factors shaping its international trade dynamics. Following Macedo et al. [

21], the model includes, in addition to Italy’s GDP, the GDP of importer countries, and bilateral distance (described in equation 1), three additional explanatory variables: COVID-19-related disruptions (Covid), tariff barriers (Tariffs) and the time trend (Time), as specified in equation 2 (

section 3.3.1.). A detailed analysis of these variables, along with their respective data sources, is presented below.

3.1. Dependent Variable: Prosecco Export Performance

The dependent variable in this study reflects the export performance of Prosecco. Specifically, it measures the total volume (in kilograms) of Prosecco exported from Italy to a set of importing countries. The data were obtained from the TradeMap [

5] database using HS code 22041015, which captures trade flows encompassing Prosecco DOC, Conegliano Valdobbiadene Prosecco DOCG, and Asolo Prosecco DOCG. To stabilize variance and improve the linearity of the regression model, the export variable was transformed using natural logarithms.

The analysis covers the period 2017–2023, providing sufficient temporal variability to capture both structural trends and external shocks, such as the COVID-19 pandemic. The sample includes the top 40 importing countries, which together account for approximately 97% of total Prosecco exports. This selection ensures a high degree of representativeness while minimizing potential bias arising from unobserved heterogeneity across trade partners. With seven years of observations and 40 destination countries, the final dataset consists of 280 panel observations.

3.2. Independent Variables

In order to capture the key determinants of Prosecco exports, the augmented gravity model includes a comprehensive set of independent variables, as presented in

Table 1. The economic size of trading partners is represented by the GDP of Italy and of each importing country, both sourced from the World Bank [

22] and measured in billions of U.S. dollars. Geographical distance is captured by the straight-line distance between Rome and the capital of each trade partner. To account for economic distance, two variables related to tariff barriers are introduced: a continuous measure of tariffs (standardized to USD per kilogram) and a binary variable indicating whether a fixed tariff is applied. The model also includes a time trend variable to control for temporal effects and a COVID-19 dummy variable to estimate the short-term impact of the pandemic on Prosecco exports.

3.3. Model Specification and Simulation of Tariffs Effects

3.3.1. Model Specification

The gravity model equation used in this study is defined as follow:

where:

represents the log of the trade flows between countries; and represent the log of the economic sizes of the exporter (Italy) and importer countries; represents the log of the distance between countries; represents the log of tariff barriers (including both fixed and ad valorem duties expressed per kg of imported wine), is a dummy variable indicating the existence of fix tariffs among applied trade barriers, is a dummy variable for the COVID-19 pandemic, equal to 1 for the years 2020–2021 and 0 otherwise; and is a time trend component.

Following Gouveia et al. [

24] and Dal Bianco et al. [

14], the model was specified in a log-log form. This functional specification is indeed widely used in gravity model literature, as it allows for the interpretation of coefficients as elasticities, while also improving the linearity of relationships and reducing issues of heteroscedasticity. To address the issue of zero values in the tariff data, a constant (0,001) was added to all observations prior to the logarithmic transformation, in line with the procedure proposed by Dal Bianco et al. [

14]. Multicollinearity among independent variables (detailed in

Table 1) was tested and found to be negligible, allowing for consistent estimation of each variable’s individual effect on export performance. All estimations were performed using SPSS (version 29).

3.3.2. Simulation of Tariff Effects

To assess the potential impact of the proposed U.S. tariff increases on Prosecco wine exports, volumes exported to the United States were forecast for time span 2025-2027 using the PREDICT function in SPSS, based on the coefficients of the gravity model estimated on trade flows with all partner countries. This forecasting exercise enabled the simulation of three distinct scenarios, corresponding to different ad valorem additional tariff levels: 10%, 30%, and 60%. In each scenario, the fixed tariff rate of

$0.198/kg, applied up to 2024, was maintained, and then augmented by the per-kilogram equivalent of the respective ad valorem rates. These equivalents were calculated using the average unit export price to the U.S. in 2024. Nominal GDP data for Italy and the United States were updated using World Bank [

22] figures available up to 2024 and then extended using the projected growth rates provided by the International Monetary Fund [

25].

4. Results and Discussions

The model estimates (reported in Tabel 2) are largely consistent with the theoretical foundations of the gravity model. Key variables such as the GDP of the importing country and geographical distance display the expected signs and are statistically significant, confirming that economic size fosters trade, while distance reduce it. Overall, the model demonstrates a good explanatory power, with an adjusted R2 of 0.522.

Table 2.

Gravity Model estimates.

Table 2.

Gravity Model estimates.

| |

Coeff (β) |

Std. Error |

p-value |

| (Constant) |

13.120 |

12.339 |

0.289 |

| lnGDPItaly |

-0.084 |

1.623 |

0.959 |

| lnGDPImporter |

0.644 |

0.047 |

0.000 |

| lnDistance |

-0.424 |

0.085 |

0.000 |

| lnTariffs |

-0.130 |

0.032 |

0.000 |

| FixTariffs |

1.394 |

0.266 |

0.000 |

| Time |

0.147 |

0.047 |

0.002 |

| Covid |

0.051 |

0.158 |

0.748 |

| Fitting of the Model |

|

|

| Adj- R2 |

0.522 |

|

|

More specifically, the estimated elasticity associated with the GDP of importing countries (

= 0.644) provides a clearer indication of the influence of economic size on export volumes. The results suggest that a 1% increase in a destination country’s GDP is associated, on average, with a 0.644% increase in Prosecco exports. This positive and highly significant relationship is consistent with the fundamental predictions of the gravity model and reinforces findings from previous studies in the wine trade literature [

14,

26,

27]. In line with Gouveia et al. [

24], who observed a similar effect for aged Port wine, this result confirms the importance of economic size in driving demand also for premium wine products in wealthier markets.

In line with theoretical expectations, also geographical distance (

= -0.424) shows a significant and negative effect on exports. Therefore, a 1% increase in the distance between Rome and the importer’s capital results in a 0.424% decrease in exports,

ceteris paribus. While such a result aligns with many general gravity model applications [

28,

29], it stands in contrast to the findings of Dal Bianco et al. [

14] and Castillo et al. [

4], who argued that the trade of differentiated wine products, like DOC or DOCG wines, may be less sensitive to transport costs due to the non-substitutability of quality wines. Nevertheless, our result suggests that in the case of Prosecco, transportation and logistical costs remain relevant constraints.

When it comes to the trade barriers, the negative and statistically significant coefficient for ad valorem tariffs (

= -0,130) supports the hypothesis that higher tariff protection tends to reduce market access. This finding is in line with the broader literature [

13,

17,

18], while recent studies (see for instance Gouveia et al. [

24]) indicate that custom duties appear to have no influence on Port wine exports. Interestingly, the dummy variable for fixed tariffs shows a positive and statistically significant coefficient. Given that the continuous ad valorem tariff variable negatively affects exports, this result suggests a differential impact of tariff structure: fixed tariffs may be perceived as more predictable or less distortive. This finding underscores that both the intensity and the design of trade protection measures play a crucial role in influencing export dynamics. Yet, temporal dynamics emerge as a relevant factor in the analysis. The time trend variable displays a positive and statistically significant coefficient (

= 0.147), indicating a structural increase in Prosecco exports over the observed period. This pattern is clearly illustrated in

Figure 1, which presents Prosecco import volumes by years for the main importer countries, where a consistent upward trend is evident. This is probably driven by rising global demand, enhanced branding strategies, and the growing international prestige of Italian sparkling wines. These findings are consistent with Agostino and Trivieri [

30], who observed a steady expansion in the market share and trade value of origin-designated wines among major European producers.

Interestingly, the COVID-19 variable does not exhibit statistical significance in the model, suggesting that the pandemic did not produce a significant effect on Prosecco exports. This result is particularly noteworthy given the widespread impact of COVID-19 on global trade flows. It supports the conclusions of Macedo et al. [

21], who found that exports of highly specialized wines, such as those from Italy, France, and Spain, were relatively resilient during the pandemic. This resilience is likely attributable to the inelastic nature of demand for premium wines, the loyalty of niche consumer segments, and the existence of robust, diversified supply chains. In the case of Prosecco, the findings imply that the product’s market position and international recognition may have shielded it from short-term exogenous shocks, reinforcing the idea that certain wine categories benefit from structural demand stability even in periods of global uncertainty.

Turning to the most critical current issue,

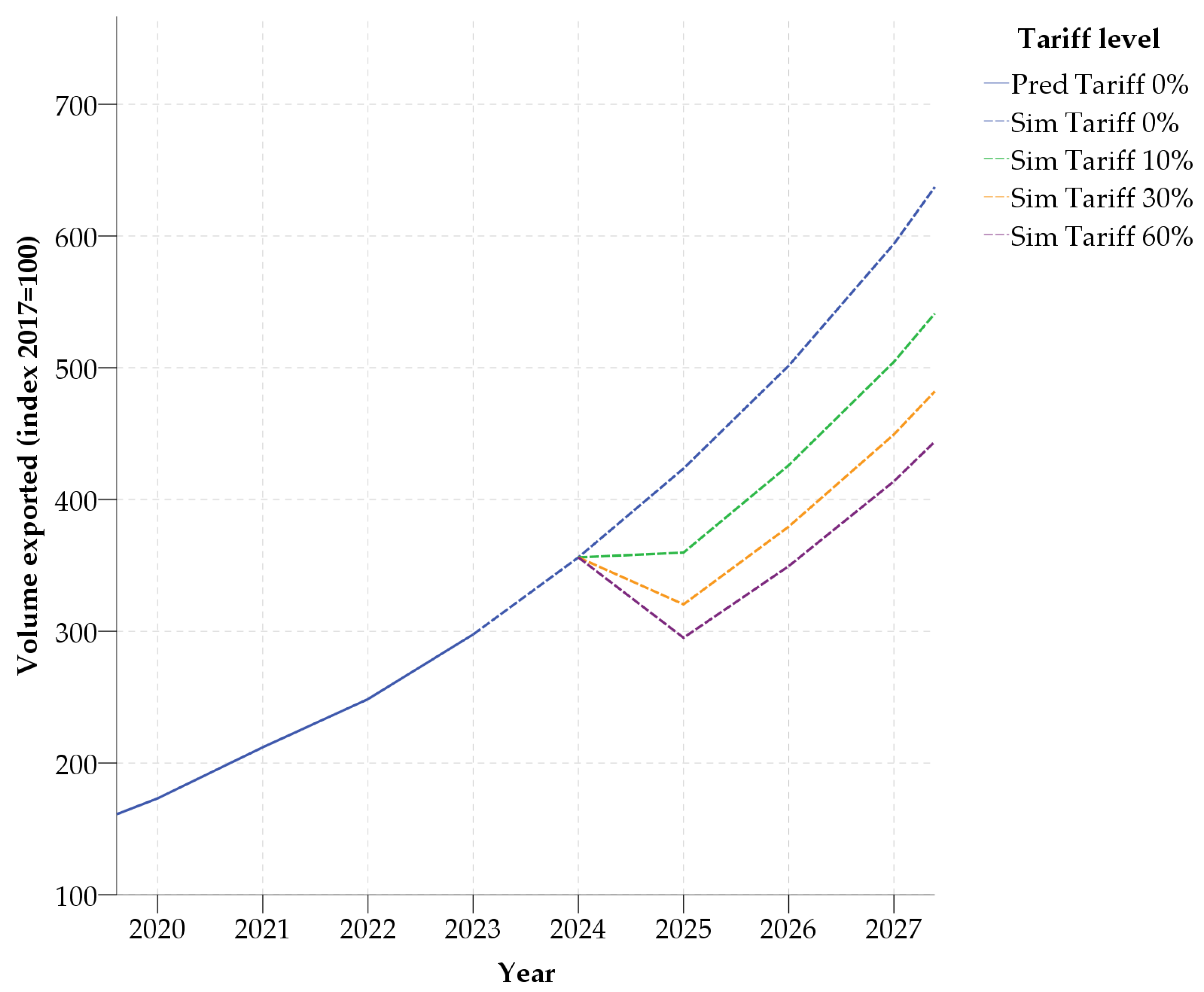

Table 3 presents the estimated and forecasted percentage variations in Prosecco exports from Italy to the United States in the short run (i.e., for 2025, 2026, and 2027) under three different ad valorem tariff scenarios: i) 10%, corresponding to the current tariff level already imposed; ii) 30%, referring to the new tariffs threatened by Trump in July 2025 and expected to take effect starting in August the 1st, 2025; iii) 60%, representing a potential escalation scenario in which the U.S. would impose a retaliatory extra tariff if the EU were to respond with an equivalent counter-tariff on American products.

Although the results confirm that tariffs have a significant negative impact on Prosecco exports when compared to the counterfactual scenario for 2025 without additional trade barriers, their magnitude appears less severe when benchmarked against actual export levels in 2024. This suggests that, while the projected losses are notable, they may not be as dramatic as initially anticipated. Indeed, in a no-tariff scenario, exports to the United States are projected to grow by 19% in 2025 compared to 2024, continuing the positive trajectory observed in recent years (with the exception of 2023). Even though tariffs do flatten this flourishing trend, the findings (when compared to actual 2024 export levels) indicate some capacity for short-term recovery, underscoring a degree of resilience in the sector. Specifically, under a 10% tariff, export growth slows markedly to just +1.0%, while 30% and 60% tariffs are projected to result in outright declines of -10.0% and -17.1%, respectively. When compared to the no-tariff baseline for 2025, these figures correspond to estimated export losses of -15.1%, -24.3%, and -30.3% under the 10%, 30%, and 60% scenarios, respectively. Nevertheless, supported by a robust underlying growth trend (as illustrated in

Figure 1), model projections suggest that the export volume recorded in 2024 would be fully recovered by the end of 2026 under the 30% tariff scenario, and by the end of 2027 under the 60% scenario (as clearly reported in

Figure 2).

While these projections indicate a significant short-term loss in the U.S. market, it is important to contextualize the magnitude of this impact. As of 2024, the United States represents approximately 25% of total Prosecco exports. Consequently, a 10% reduction in exports (30% tariff) to this market would correspond to a 2.5% decrease in overall exports, while a 17.1% drop, such as that projected under the 60% tariff scenario, would translate into a 4.3% decline in total Prosecco exports. This figure, although non-negligible, is not necessarily dramatic, particularly if producers are equipped with adequate tools and strategies to preserve product value. Among such strategies, supply-side management plays a crucial role: for instance, temporarily halting the expansion of Prosecco DOC and DOCG production could help maintain market balance and support price stability in the face of external demand shocks. As a Protected Designation of Origin, Prosecco is subject to a regulated production system that includes the possibility of controlling supply. In particular, the Prosecco DOC is defined by a permanent production area and a secondary “reserve” area that can be activated annually as needed, the so-called “attingimenti”. In recent years, producers have regularly drawn on this reserve, utilizing an average of 5,000 hectares annually (Zannol, 2025). For 2025, a formal request has been submitted to access approximately 6,900 hectares from the reserve (Regione del Veneto, 2025). This mechanism increases the area eligible for Prosecco DOC production by approximately 25%, providing a valuable margin of flexibility to manage potential market disruptions triggered by the tariffs proposed by the Trump administration.

Moreover, part of the tariff negative effect could be offset by expanding exports to other international markets, in line with the global upward trend. From 2017 to 2024, indeed, average world market growth for Prosecco stood at 11.0%, with a particularly strong year-on-year increase of 13.6% observed between 2023 and 2024, highlighting the potential for geographical diversification as a mitigating factor.

5. Conclusions

This study analysed the determinants of Prosecco export performance over the past seven years, using a gravity model framework that incorporates key variables such as geographical and economic distance, trade barriers (including tariffs), and external shocks like the COVID-19 pandemic. The results confirm that core explanatory variables (i.e., GDP of the partners country and geographical distance) exhibit the expected signs and are statistically significant, reinforcing the idea that larger economies tend to attract more trade flows, while greater distances act as a deterrent. Moreover, the analysis reveals a significant and positive time trend in Prosecco exports, reflecting the sustained growth of this segment in recent years. This pattern aligns with the broader expansion of the sparkling wine market, which has outperformed the overall wine sector, currently facing a period of stagnation and decline. In line with theoretical expectations, the model also shows that higher tariff protection significantly reduces market access, highlighting the concrete effects of trade barriers on export performance. By contrast, external shocks such as the COVID-19 pandemic do not appear to have had a significant impact on Prosecco exports, suggesting that Prosecco, like other premium wines, benefits from relatively inelastic demand.

The paper also pursued a second and more policy-oriented objective, namely to quantify the potential impact of the U.S. tariffs recently threatened by the Trump administration, scheduled to take effect on August 1, 2025, on EU exports. These new tariffs, set at 30%, are substantially higher than the 10% duties already imposed in April 2025 by the same administration. The analysis further considered the implications of a hypothetical EU counter-tariff of equivalent magnitude, considering that the United States has warned it would respond by layering the new measure on top of the existing 30% tariff. This would effectively result in a combined tariff burden of 60% on Prosecco exports if the EU were to adopt a 30% retaliatory duty as a defensive measure. Although our results confirm a significant negative impact of tariffs on Prosecco exports compared to the baseline no-tariff scenario, with projected losses of (-) 24.3% and (-)30.3% under the 30% and 60% tariff scenarios respectively, the severity of these effects appears less dramatic when assessed against the export performance of 2024. Given Prosecco’s sustained growth trajectory, model projections indicate that the 2024 export volume would be fully recovered by the end of 2026 under the 30% tariff scenario, and by the end of 2027 under the 60% scenario. While such losses are certainly relevant, they may not compromise overall market equilibrium, particularly if producers implement effective strategies to preserve product value. Among these, supply-side management plays a critical role. For instance, temporarily halting the expansion of the eligible production under the Prosecco GI could help maintain market balance and stabilize prices in the face of external shocks. By closely monitoring export dynamics and strategically managing the activation of the reserve area, stakeholders within the Prosecco supply chain can more effectively balance supply and demand, thereby reducing the risk of oversupply and supporting price stability, even in the face of potential declining exports to the United States. These projections provide an additional analytical dimension to ongoing debates regarding the price sensitivity of U.S. demand for Prosecco, which find the Prosecco’s success in the U.S. market in its positioning in the lower to mid-price segment, with an average retail price of around €4-€5 per litre. From this perspective, a sharp price increase triggered by new tariffs could lead American consumers to shift toward cheaper alternatives, potentially resulting in a substantial drop in sales volumes.

Despite offering a valuable overview of the short-term effects that potential U.S. tariffs could have on Prosecco exports, this study has certain limitations. Notably, it does not consider potential adaptive responses by producers, such as shifting export destinations or adjusting price strategies. Additionally, it does not account for substitution effects with other products, even within the EU context, nor does it consider possible domestic and world market adjustments due to the potential U.S. demand decline. These aspects represent opportunities for further research and refinement of the analysis.

Supplementary Materials

The following supporting information can be downloaded at the website of this paper posted on Preprints.org.

Author Contributions

Conceptualization, S.T.; methodology, J.E.G., S.T. and A.S.; software, J.E.G; validation, S.T.; formal analysis, J.E.G., S.T. and A.S.; investigation, J.E.G.; resources, S.T.; data curation, J.E.G., S.T.; writing—original draft preparation, A.S., J.E.G.; writing—review and editing, A.S., S.T.; visualization, A.S.; supervision, S.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding

Data Availability Statement

DATASET.

Conflicts of Interest

The authors declare no conflicts of interest

Abbreviations

The following abbreviations are used in this manuscript:

| DOC |

Denominazione di Origine Controllata: an Italian certification that guarantees the geographic origin and quality standards of a wine |

| DOCG |

Denominazione di Origine Controllata e Garantita: a higher-tier certification than DOC, with stricter quality and production requirements. |

| GI |

Geographical Indication |

| GDP |

Gross Domestic Product |

| EU |

European Union |

| U.S. |

United States of America |

| COVID-19 |

Coronavirus Disease 2019 (global pandemic) |

| LN_GDP_IMPORTER |

Natural logarithm of the GDP of the importing country |

| LN_DISTANCE |

Natural logarithm of the geographical distance (in kilometers) between Rome (Italy) and the capital of the importing country |

| LN_TARIFFS |

Natural logarithm of tariff levels (standardized to USD per kilogram) |

| FIX_TARIFFS |

Binary (dummy) variable indicating whether a fixed tariff (a set monetary amount per kg) is applied (1 = yes; 0 = no) |

| TIME |

A continuous time variable (coded as 0 for 2017, 1 for 2018, etc.) to capture general temporal trends in export dynamics |

| COVID |

Dummy variable equal to 1 for pandemic years (2020 and 2021) and 0 otherwise. Used to measure short-term disruptions due to COVID-19 |

References

- International Entrepreneurship in Latin America: Lessons from Theory and Practice. In In-ternational Business in Latin America; Palgrave Macmillan UK: London, 2015; pp. 57–82. ISBN 978-1-349-68138-9.

- Heterogeneous Firms and Trade. In Handbook of International Economics; Elsevier, 2014; pp. 1–54.

- Anderson, K.; Nelgen, S. Wine’s Globalization: New Opportunities, New Challenges. Wine Economics Research Centre Working Papers 2011, University of Adelaide, Wine Economics Research Cen-tre.

- Castillo, J.S.; Villanueva, E.C.; García-Cortijo, M.C. The International Wine Trade and Its New Export Dynamics (1988–2012): A Gravity Model Approach. Agribusiness 2016, 32, 466–481. [Google Scholar] [CrossRef]

- Trade Map- Trade Statistics for International Business Development 2024, Accessed in June, 2024; available at:. https://www.trademap.org/Index.aspx.

- Mariani, A.; Pomarici, E.; Boatto, V. The International Wine Trade: Recent Trends and Criti-cal Issues. Wine Economics and Policy 2012, 1, 24–40. [Google Scholar] [CrossRef]

- Euromonitor International Passport 2024 - Accessed in June, 2024; available at:. https://www.euromonitor.com/solutions/passport.

- Consorzio di Tutela del Conegliano Valdobbianede DOCG Rapporto Economico 2023. Scenari Economici in Evoluzione—Un Percorso per Il Futuro Della Denominazione; 2023.

- Onofri, L.; Boatto, V.; Bianco, A.D. Who Likes It “Sparkling”? An Empirical Analysis of Pro-secco Consumers’ Profile. Agricultural and Food Economics 2015, 3. [Google Scholar] [CrossRef]

- Wittwer, G.; Anderson, K. COVID-19 and Global Beverage Markets: Implications for Wine. J Wine Econ 2021, 16, 117–130. [Google Scholar] [CrossRef]

- Viner, K. Trump’s 30% Tariffs Would Eliminate EU-US Trade, Says Chief Negotiator Šefčovič. The Guardian 2025.

- Il Sole 24 Ore Dazi, Il Testo Della Lettera Di Trump Alla Ue 2025.

- Zhang, L.; Onel, G.; Seale, J.L. Aircraft Dispute, Wine, and the US–EU Trade War: Implica-tions for US Consumers and Wine Suppliers. J. Agric. Appl. Econ. 2021, 53, 301–321. [Google Scholar] [CrossRef]

- Dal Bianco, A.; Boatto, V.L.; Caracciolo, F.; Santeramo, F.G. Tariffs and Non-Tariff Frictions in the World Wine Trade. Eur Rev Agric Econ 2016, 43, 31–57. [Google Scholar] [CrossRef]

- Leibenstein, H.; Tinbergen, J. Shaping the World Economy: Suggestions for an International Economic Policy. The Economic Journal 1966, 76, 92. [Google Scholar] [CrossRef]

- Anderson, J.E. 16. Anderson, J.E. A Theoretical Foundation for the Gravity Equation. The American Economic Review 1979, 69, 106–116, doi:http://www.jstor.org/stable/1802501.

- Muradovna, I.N. Impact of Tariffs and Nontariff Barriers on the International Trade. IJSMS 2020, 72–80. [Google Scholar] [CrossRef]

- Gnutzmann-Mkrtchyan, A.; Hugot, J. Gravity-Based Tools for Assessing the Impact of Tariff Changes; Asian Development Bank: Manila, Philippines, 2022. [Google Scholar]

- Davidescu, A.A.; Popovici, O.C.; Strat, V.A. An Empirical Analysis Using Panel Data Gravity Models and Scenario Forecast Simulations for the Romanian Exports in the Context of COVID-19. Economic Research-Ekonomska Istraživanja 2022, 35, 480–510. [Google Scholar] [CrossRef]

- Barbero, J.; De Lucio, J.J.; Rodríguez-Crespo, E. Effects of COVID-19 on Trade Flows: Mea-suring Their Impact through Government Policy Responses. PLoS ONE 2021, 16, e0258356. [Google Scholar] [CrossRef] [PubMed]

- Macedo, A.; Rebelo, J.; Gouveia, S. The Impact of COVID-19 Government Policy on the In-ternational Wine Trade. Agric Econ 2023, 11. [Google Scholar] [CrossRef]

- World Bank Group World Bank Open Data 2025.

- World Trade Organization WTO Data - Information on Trade and Trade Policy Measures 2024.

- Gouveia, S.; Rebelo, J.; Lourenço-Gomes, L. Port Wine Exports: A Gravity Model Approach. IJWBR 2018, 30, 218–242. [Google Scholar] [CrossRef]

- International Monetary Fund IMF DataMapper 2025.

- Yusiana, E.; Hakim, D.B.; Syaukat, Y.; Novianti, T. Analysis of Factors Influencing Thai Rice Trade Based on Gravity Model. IOP Conf. Ser.: Earth Environ. Sci. 2022, 951, 012039. [Google Scholar] [CrossRef]

- Zainuddin, M.R.K.V.; Shukor, M.S.; Zulkifli, M.S.; Abdullah, A.H. Dynamics of Malaysia’s Bilateral Export Post Covid-19: A Gravity Model Analysis. JEM 2021, 55. [Google Scholar] [CrossRef]

- Lombardi, P.; Dal Bianco, A.; Freda, R.; Caracciolo, F.; Cembalo, L. Development and Trade Competitiveness of the European Wine Sector: A Gravity Analysis of Intra-EU Flows. Wine Econo-mics and Policy 2016, 5, 50–59. [Google Scholar] [CrossRef]

- Macedo, A.; Rebelo, J.; Gouveia, S. Export Propensity and Intensity in the Wine Industry: A Fractional Econometric Approach. Bio-based and Applied Economics 2020, 261-277 Pages. 2020. [CrossRef]

- Agostino, M.; Trivieri, F. Geographical Indication and Wine Exports. An Empirical Investi-gation Considering the Major European Producers. Food Policy 2014, 46, 22–36. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).