1. Introduction

The global market dynamics have led to construction companies to become more and more concerned with new strategic directions and forms of management to improve their competitiveness and sustainability. The Portuguese construction companies follow this trend and assume a great relevance in the national economy, both in terms of employability and in terms of recognition of their diverse activities and business areas, such as civil construction, civil engineering and specialized activities.

When compared the Portuguese construction sector with its European counterparts, there is a lack of competitiveness due to the recognition of signs such as failure to meet deadlines, performance, insufficient quality of the final product and a manifest lack of safety at work (Couto, 2007). Despite the poor performance of these management indicators is acknowledged by the large majority of stakeholders, there are still few studies focused on an objective quantification of these factors, and on the reasoned identification of the specific reasons for this.

However, it can be seen that companies the Portuguese construction sector need to identify the factors that affect the performance of their construction projects so that they can compete on equal terms in an increasingly global and competitive market.

The literature identifies a number of factors that affect the performance of construction companies' projects, such as: delays, shortage of materials, shortage of technical professionals, changes in projects, environment where the company operates, low productivity, excess of costs and time, method of financing, shortcomings of contracts and oscillation of prices of materials (Enshassi, Mohamed, & Abushaban, 2009; Kaming, Olomolaiye, Holt, & Harris, 1997; Okpala & Aniekwu, 1988).

Factors that affect the performance of construction companies' projects can be measured and evaluated through numerous performance indicators, considering various dimensions such as organizational environment, time / delay, cost, health and safety, project complexity and project financing (Cheung, Suen, & Cheung, 2004; Mendes, Couto, Ferreira, & Mendes, 2021; Odeck, 2004).

The importance and relevance of this topic, associated with the scarcity of studies on this issue, in Portugal, motivated this research work. Thus, it was undertaken to analyse the factors that have impact on the performance of Portuguese construction companies' projects.

This research work report is structured in five parts, namely: in the second section (ii), the explanatory variables of performance are illustrated conceptually in the light of related literature, and the hypotheses of the research model are developed. In section three (iii), the sample, data collection and research method are discussed. In the fourth section (iv), the results of the analyses are presented, and in the last section (v), we tried to discuss the conclusions as well as the contributions, the aspects that limit the study and the suggestions for future investigations.

2. Literature Review

The purpose of this section is to explore the specialized literature on main dimensions or factors that affect the performance of construction company projects (organizational environment, time / delay, project financing).

2.1. The Impact of the Organizational Environment Factor in the Performance of Construction Companies' Projects

Over time the organizational environment has become interesting in the field of scientific research due to its changes that are the main factors that affect the performance of organizations' projects (Drucker, 2009).

However, it is perceived that the organizational environment is considered as the totality of the physical and social factors that are recognized directly in the organization's decision making (Duncan, 1972).

The organizational environment is the sum of several points within the organization that can be internal and external capable of having a certain influence on the performance of construction company projects (Mao, Zhu, & Wang, 2013). It should be pointed out that the organizational environment referred in this paper deals only with the external environment of construction companies.

According to Mao et al. (2013), the external environment of the construction company can be divided into two levels: Uncertainty of the operating environment and general environmental uncertainty. The uncertainty of the operating environment is directly related to the performance of the company's projects, through the entry of new companies in the market, the negotiation capacity of the owners, the negotiation capacity of suppliers and competitors. The uncertainty of the general environment indirectly influences the daily functioning of each organization, in particular as regards political uncertainty, uncertainty of the economy, legal uncertainty and technological uncertainty.

The external environment factors that affect the impact on the performance of construction companies' projects are measured through measures that are outside the organization boundaries and that affect economic, demographic, social, political, legal, technological, etc. issues, influencing the performance of the activities of the construction companies' projects, namely in the process of transformation itself, in the climatic conditions, in the oscillation of service demand, in the alteration of the structure of the market, in the process of acquisition of resources and in the creation of consumption of the products (Duncan, 1972; Hartmann, 2006; Mao et al., 2013; Worthington & Britton, 2009).

It is generally perceived that the external environment is beyond the control of organizations, being considered as the source of the uncertainty that most organizations have to face.

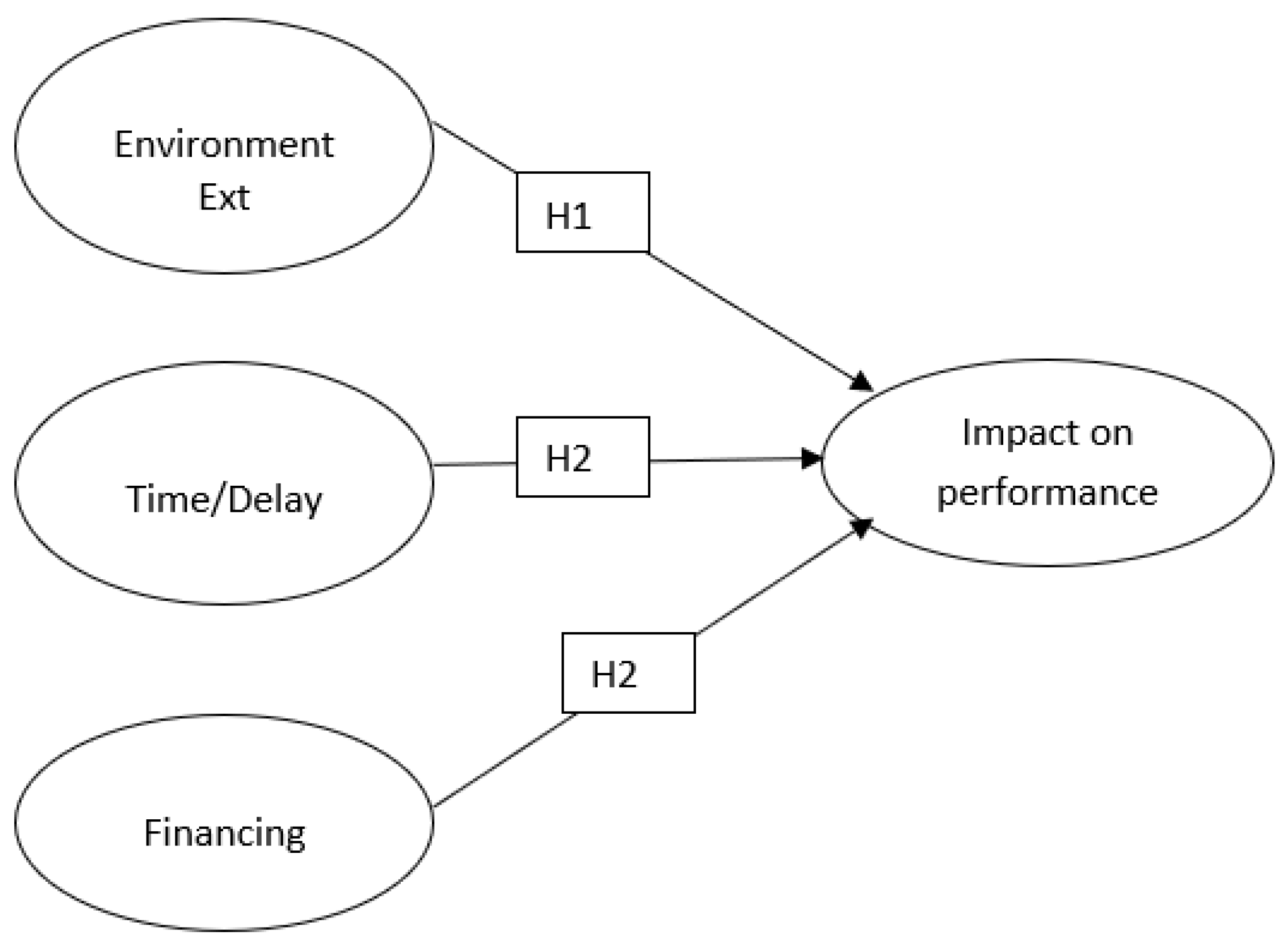

However, this study analyses the relationship between the impacts of the organizational environment on the performance of construction companies' projects. In this regard, the perception of the organizational environment of this study leads to the formulation of the following hypothesis:

H1.

The impact of the external environment factor negatively affects the performance of construction company projects.

2.2. The Impact of the Time / Delay Factor in the Performance of Construction Companies' Projects

There are many factors that contribute to delays in construction projects (Zidane & Andersen, 2018). The time factor of accomplishment of the activities of a construction project is without doubt one of the factors that affects the performance of the companies. The variable "time to complete a construction project" still does not have a precise solution due to its enormous complexity and interdependence with other variables that cause impacts that affect performance (Couto, 2007).

The delays occur in most construction projects and the magnitude of these delays varies considerably from project to project (Zidane & Andersen, 2018). Therefore, important to define the real time / delay factors that explain the variable time, to minimize, mitigate and avoid delays in any construction project.

The factors that determine the delays are crucial within a construction project and it is relevant that all organizations have knowledge on this subject so that the project is completed within the established deadlines (Wong & Vimonsatit, 2012). These authors also point out that, delays cause the impact on the factors that affect the performance, and may jeopardize the economic feasibility of the project.

The excess of time is the delay in the execution of an activity, that is, when the activities are completed after the expected time (Zhu.K. & Lin.L., 2004), or when they lead to the postponement of the completion date (Al-Gahtani & Mohan, 2007).

Several scholars have shown that the excess of time / delay in achieving the proposed objectives are important factors in explaining the impact of factors that affect the performance of construction projects (Ahsan & Gunawan, 2010; Cantarelli, van Wee, Molin, & Flyvbjerg, 2012; Kaming et al., 1997).

The factors related to the time / delay will be measured and explained in this study as one of the factors that affect the performance of the projects of the construction companies, through alterations of the projects, planning, non-compliance with contract details, shortage of materials etc. (Arditi, Akan, & Gurdamar, 1985; Cantarelli et al., 2012; Couto, 2007; Flyvbjerg, Skamris Holm, & Buhl, 2004; Kaming et al., 1997).

In this context, it is sought to analyse to what extent factors related to the time / delay, contribute to a better understanding of the impact of the factors that affect the performance of construction companies' projects. The authors referenced above indicate that delays or excesses of time are common and costly, hence it is necessary to analyse their impact on the performance of projects of construction companies in Portugal. Concomitantly, the hypothesis to be formulated is the following:

H2. The impact of the time / delay factor negatively affects the performance of construction companies' projects.

In addition to the organizational environment and the time delay, it is also important to examine another factor that affects the performance of the project of construction companies namely the method of financing construction projects.

2.3. The Impact of the Financing Factor in the Performance of Construction Companies' Projects

The organizations often seek to find the best financing instruments for their construction projects. As it is known, there are currently several banking products that allow to finance construction projects, even in its project preparation and approval phase (Chirkunova, Kireeva, Kornilova, & Pschenichnikova, 2016).

The banking sector and the securities market have sufficient mechanisms that can be used to finance construction projects through various instruments such as (i) bank loans, (ii) bond loans, (iii) issuance of new shares, among others. In the process of implementing any project, the main component of success is the correct choice of financing instrument (Chirkunova et al., 2016).

Brealey, Myers & Allen (2018) the financing can be done with own or other capital, being more usual a combination of these two modalities. Nowadays, with the opening of the capital market, obtaining financing for a given project enables organizations to exploit a wide range of sources of foreign financing (Westhead, Wright, & Ucbasaran, 2001).

However, it is understood that during project investment decisions, managers should be able to analyse and evaluate potential investment opportunities in order to enable the return on investment of the organization's assets (Urionabarrenetxea & Rodríguez Castellanos, 2009).

It is important to measure the impact of the various types of financing on the evaluation of construction projects, considering the impact both in terms of profitability and in terms of risk, namely the intensity of use, equity, loans to suppliers, loan factoring etc. (Brealey et al., 2018; Brigham & Ehrhardt, 2013; Chirkunova et al., 2016; Gitman, Juchau, & Flanagan, 2010; Hackethal & Schmidt, 2004). According to the pecking order theory, internal financing is the primary source of financing for a project, followed by recourse to foreign capital, since the former has a great advantage over the latter with respect to the cost of capital.

Obtaining knowledge about the decisions of construction companies regarding equity or external financing for the project is a relevant subject in the analysis of company financing. It is essential to seek to know the optimal capital structure and to take into account that, even if companies have acceptable debt ratios, they can change their capital structure, jeopardizing the viability of company and the project (Rauh & Sufi, 2010).

The importance of various financial factors for a project, it is important to test the following hypothesis:

H3. The impact of the financing factor negatively affects the performance of the projects of the construction companies.

It is sought to analyse the measures of performance evaluation of construction projects.

2.4. Measures of Performance Evaluation in the Projects of Construction Companies

As organizational performance plays a major role in organizations, new challenges related to management will naturally arise. Organizational performance is generally understood as the company's results that are achieved based on the indicators previously defined to reflect the company's goals (Venkatraman & Ramanujam, 1986).

Odeck (2004) the projects of construction companies still waste thousands of euro due to factors that affect performance. The factors that negatively influence the impact on the performance of construction projects are: external environment of the organization, time delay, project financing and project dynamism (Love, Mandal, & Li, 1999).

Organizational performance can be measured according to the use of three indicators: the financial condition of the company, its position in the market and its internal performance (Hansen & Van der Stedeb, 2004; Van der Stede, 2000). Regarding to the financial condition of the company, the following indicators are usually used to measure performance: the internal rate of return on investment, the net present value of the investment; the payback period, the profitability indicator of the company's business, the profitability of the total assets; the growth of the company's market share; the productivity of the company's employees and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

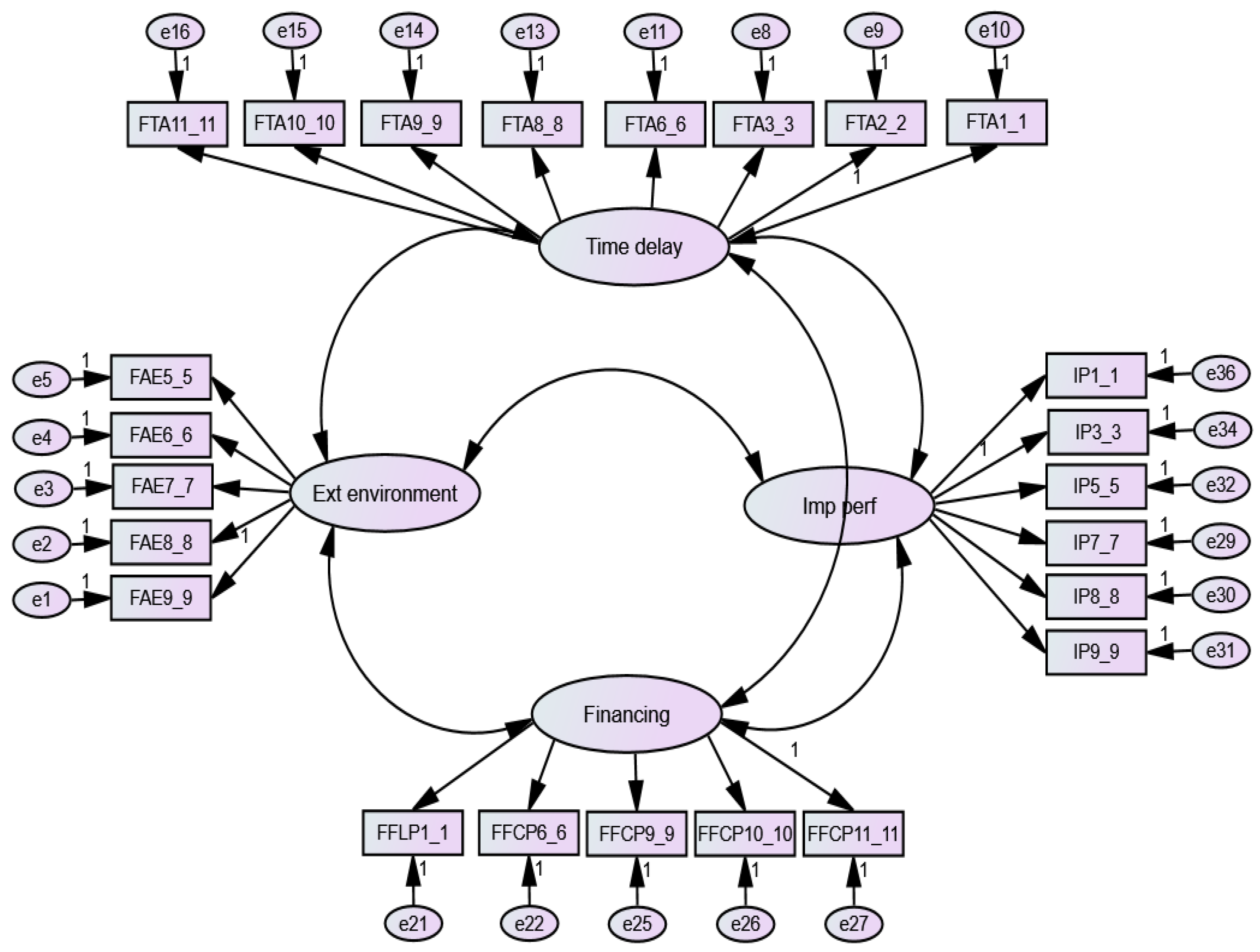

It should be noted that impact analysis can be viewed as a valuable tool in assessing the performance of construction companies' projects, providing the necessary information to identify ways to improve future decisions and results. This aspect has been comprehensively presented in the immense literature review throughout empirical analysis. . The present work is based on the study model below (

Figure 1).

3. Research Methodology

From the methodological point of view, the exploratory and confirmatory factorial analysis technique was used, in order to allow the investigator to explore the main dimensions to generate a theory or model, from a relatively large set of latent variables that are often represented by a set of items (Williams, Onsman, & Brown, 2010), taking into account the analysis of the impact of the factors that affect the performance of the projects of Portuguese construction companies and then confirm the feasibility of the model proposed in

Figure 1.

However, the use of this method allows the application of specific variables, the formulation of hypothesis, use of measurement, evaluation of statistical data (Creswell, Hanson, Clark Plano, & Morales, 2007).

With the use of exploratory factor analysis, data reduction and agreement of measures will be achieved, with extraction of the main components and factors with eigenvalues. According to the Kaiser criterion, the factors are extracted using the varimax rotation method to facilitate the explanation of the components through the total variability of the variables (Williams et al., 2010). However, the exploratory and confirmatory factor analyses were performed in SPSS software (Statistical Package for Social Sciences), version 29 and AMOS Graphics 29.

3.1. Sample and Data Collection

According to Zikmund, Babin, Carr & Griffin (2002), sample is a process that the researcher uses to select a certain number of population or target that provides draw the conclusions of the investigation.

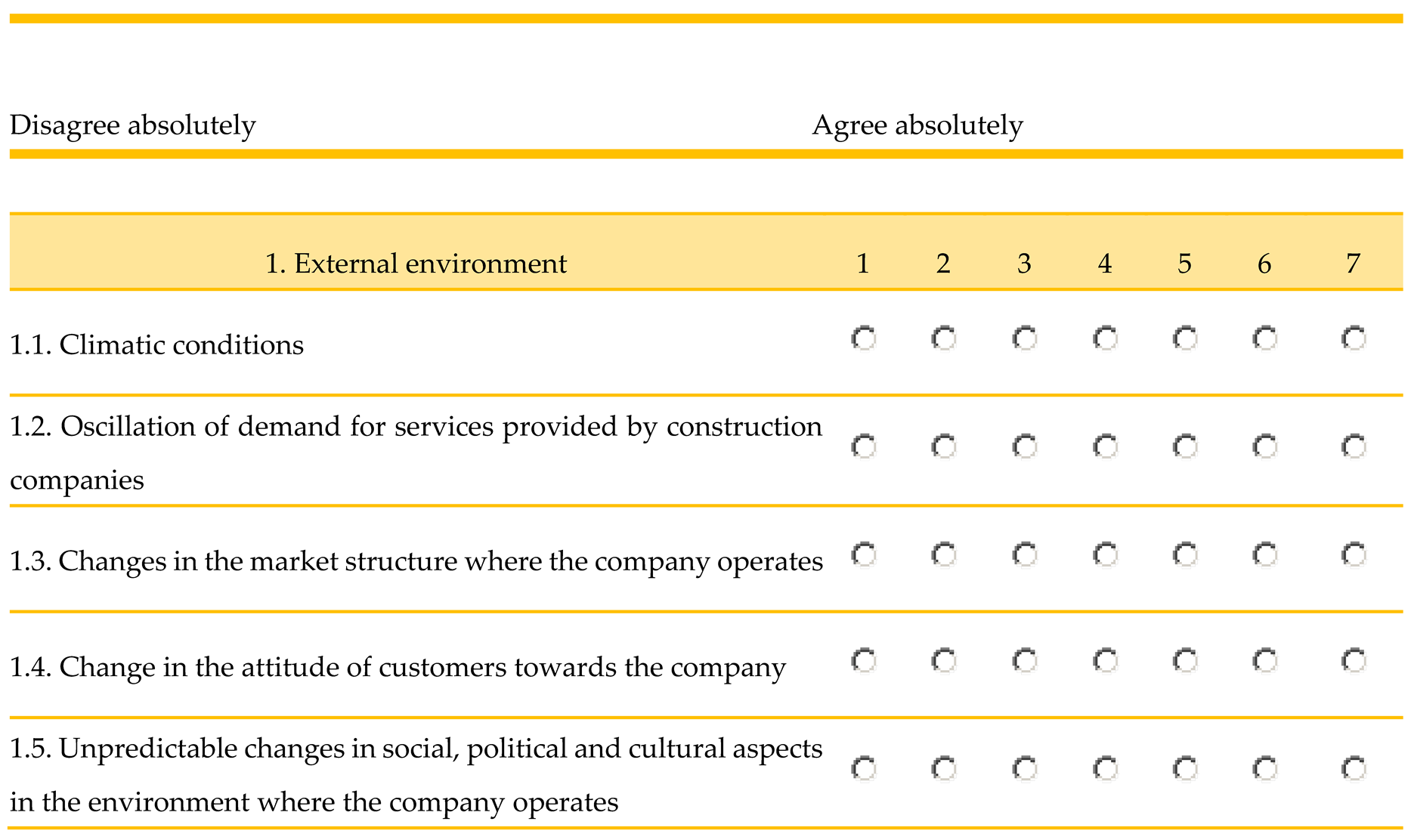

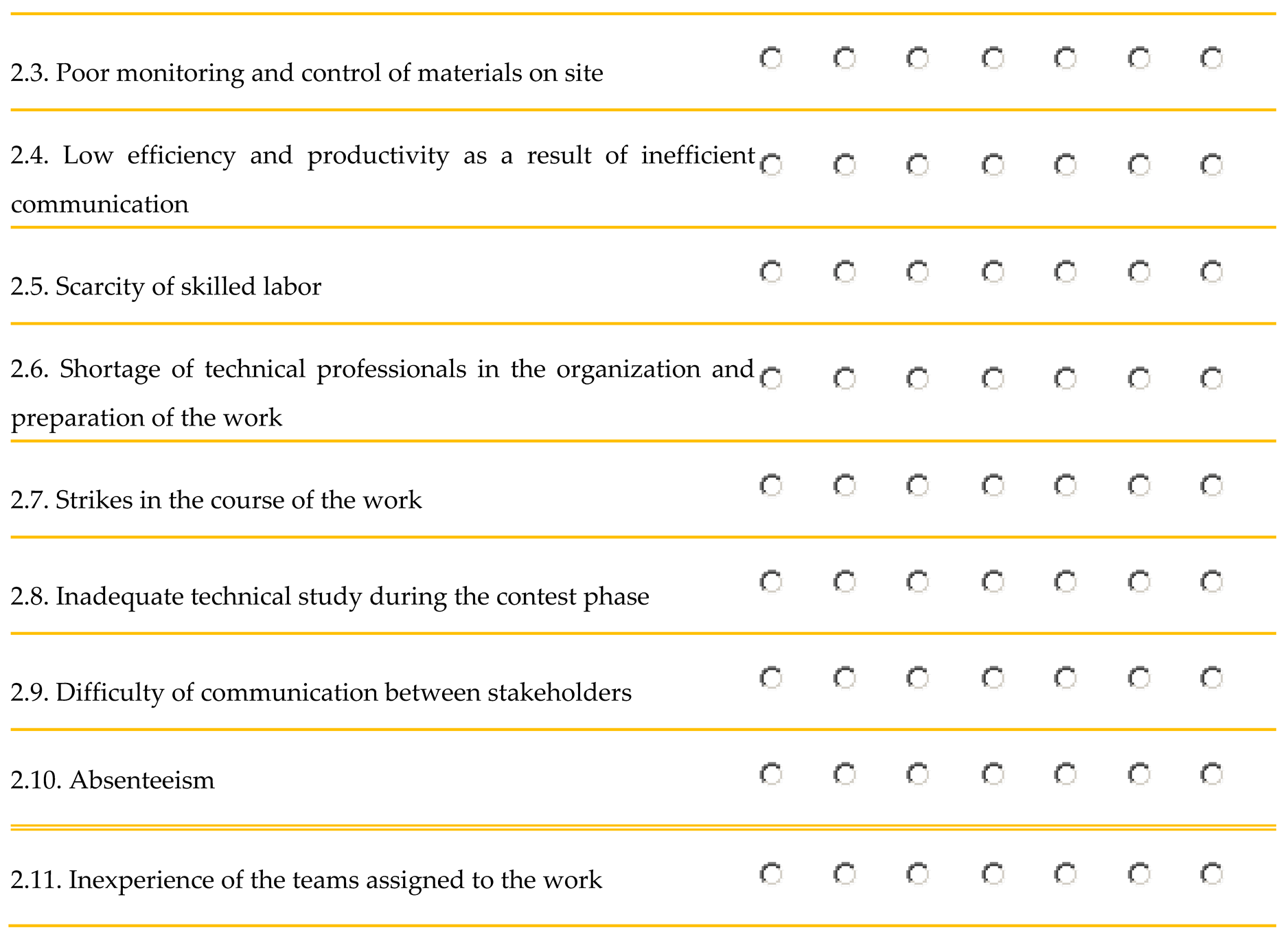

The 218 answers obtained in the data collection were through the answers from questionnaire addressed to companies production directors, managers, financial directors and CEO / Chief executive officer of Portuguese construction companies. The scale used in the questionnaire is a Likert type from 1 to 7 (I disagree at all and agree at all). The questionnaires were mostly collected through the web platform "LimeSurvey", but some were collected fisically.

3.2. Measures of Factors Affecting Performance

The measurement instruments adopted in this study were used in previous studies.. In order to measure the external organizational environment as a factor that affects performance, this study it adopted the measures used by (Worthington & Britton, 2009). The measure of the organization's external environment was also adopted by several authors, among which we highlight,(Inkson & Minnaert, 2018; Sakiru, D'Silva, Othman, Silong, & Busayo, 2013; Tassiopoulos, 2011). The following table shows the scales of instruments for the evaluation of the external environment of the projects of construction companies in Portugal.

Table 1.

Evaluation scale of the external environment.

Table 1.

Evaluation scale of the external environment.

To measure time / delay as a factor affecting performance, we adopted an instrument used by Okpala & Aniekwu (1988); (Abdul Rahman, Memon, Karim, & Tarmizi, 2013; Elhag & Boussabaine, 1999; Kaming et al., 1997). H In

Table 2 we show the scale of the instruments for assessing the time / delay of construction projects in Portugal..

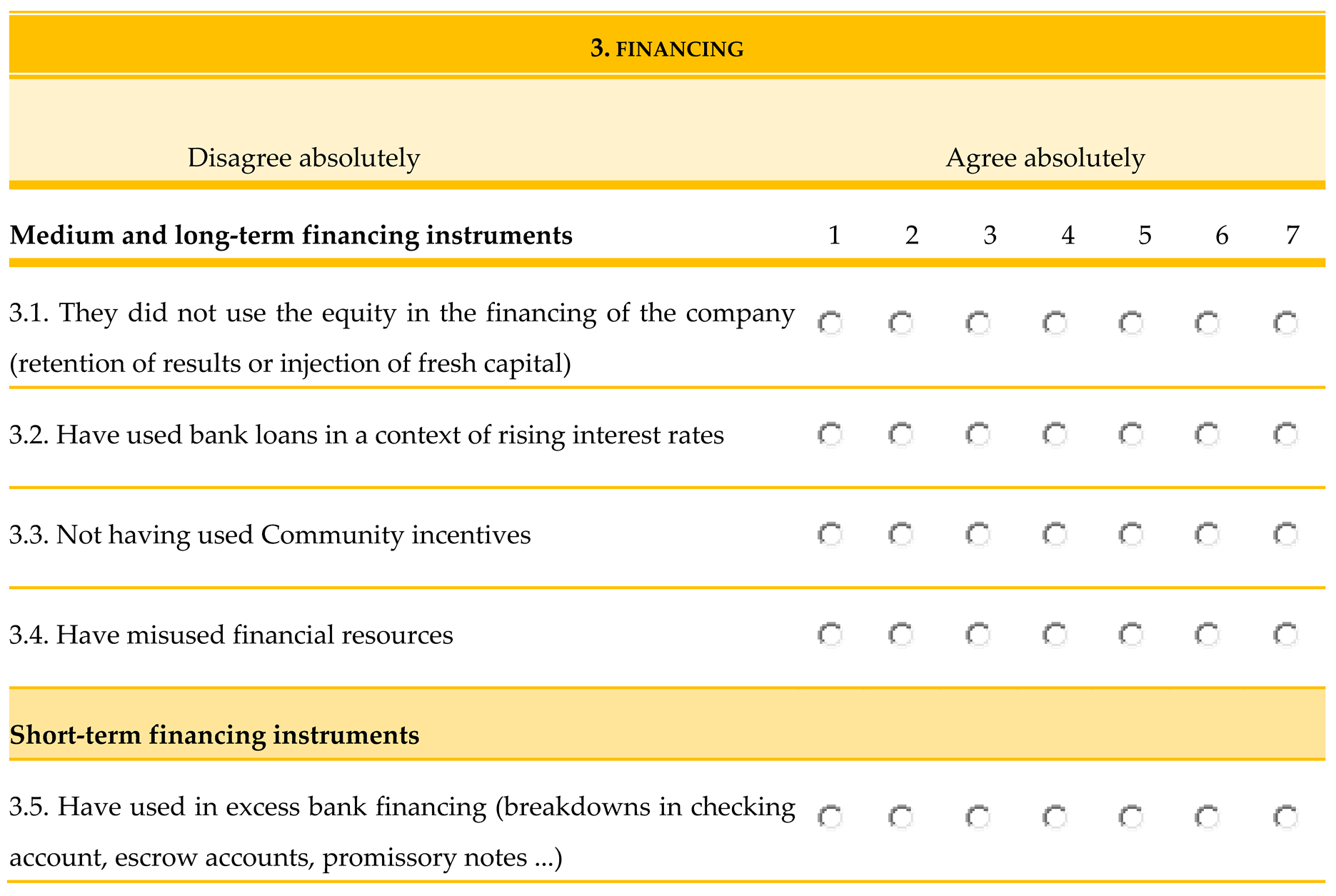

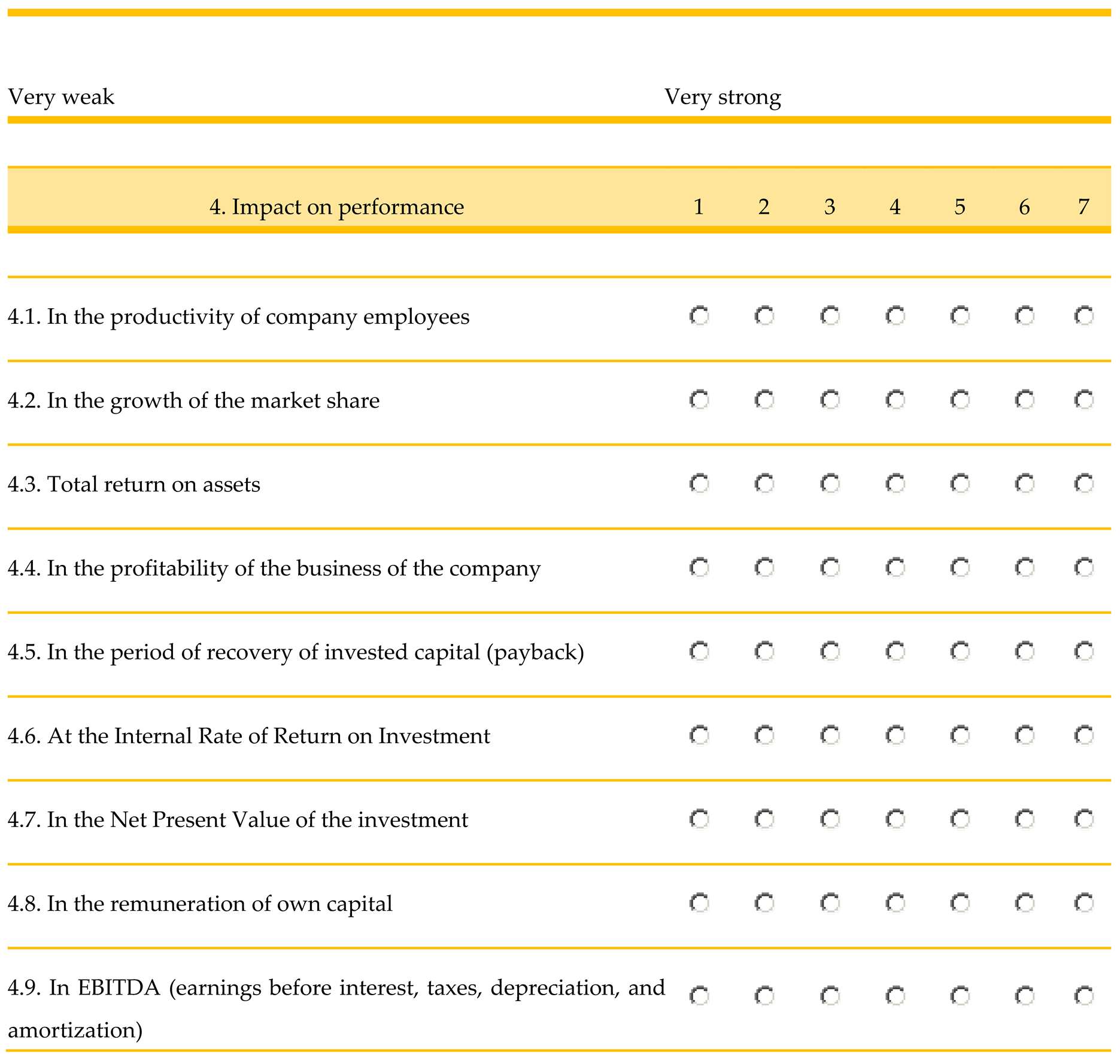

The metrics used to measure findings was adopted from (Hackethal & Schmidt, 2004) as well as other author like (O'Sullivan, 2007; Schmidt & Hryckiewicz, 2006). In this context, the scales of the instruments for evaluating the financing of projects of construction companies in Portugal are shown in

Table 3.

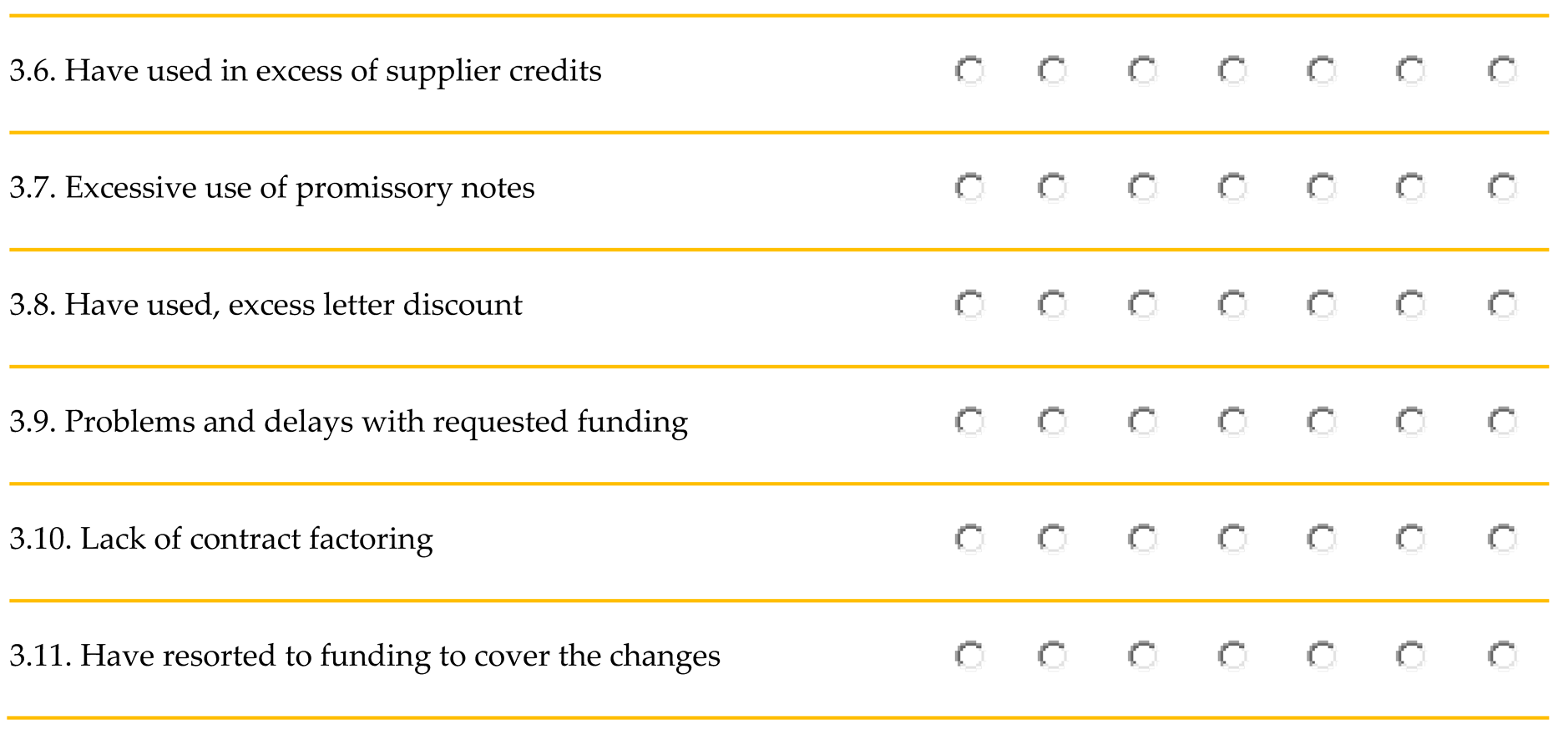

In order to measure the performance of the organization we applied an instrument whose authorship belong, among other authors, to (Venkatraman & Ramanujam, 1986); (Rauch, Wiklund, Lumpkin, & Frese, 2009; Zahra & Pearce, 1989). Thereby, we used as the scale of the instruments for assessing the performance of construction companies in Portugal (

Table 4).

4. Data Analysis

As we have stated before, we applied exploratory factorial analysis with varimax rotation to determine the items of the scale that explain the total variability of the variables, putting into account, in this particular case, the impact of the factors that affect the performance of the projects of Portuguese construction companies. In this sense, to determine the adequacy of the exploratory factorial analysis, we evaluated the quality of the correlations between the variables according to KaiserMeyer-Olkin (KMO)[1] and the Bartlett sphericity test (APPENDIX 1). Thus, the exploratory factorial analysis allowed us to evaluate the factorial structure of the variable points to four factors: "external environment, time / delay, financing and impact of factors on performance", showing a good correlation between the same variables. The four factors explain 71.39% of the total variance above the acceptable lower limit of 0.60 as predicted (Nakip, 2003).

The KaiserMeyer-Olkin test and Bartlett's sphericity were considered significant with significance levels of 0.924 and 0.000 for the four constructs, also both show the existence of a correlation between the variables. We realized that results from both KaiserMeyer-Olkin and Bartlett sphericity tests show the adequacy of the data and allow the continuity of exploratory factorial analysis as described (Hair, Black, Babin, & Anderson, 2014). The four constructs were performed using exploratory factorial analysis using the principal component method with varimax rotation (APPENDIX 1). , When we applied the Cronbach's alpha, it has been realized that the values are higher than 0.72, revealing that the constructs have a good internal consistency.

Furthermore, , it can be verified that the exploratory factorial analysis by construct made it possible to evaluate the unidimensionality of the observable variables of the model under study (Tabachnick & Fidell, 2007). The results presented (APPENDIX 1) corroborate with the literature on exploratory factorial analysis (Williams et al., 2010). The factorial loads and the Cronbach alpha coefficients of the variables are also presented in the same

Table 1 (APPENDIX 1). It is important to say that the main results of the confirmatory factor analysis are presented and discussed in the following section, and have been using the maximum likelihood estimation method.

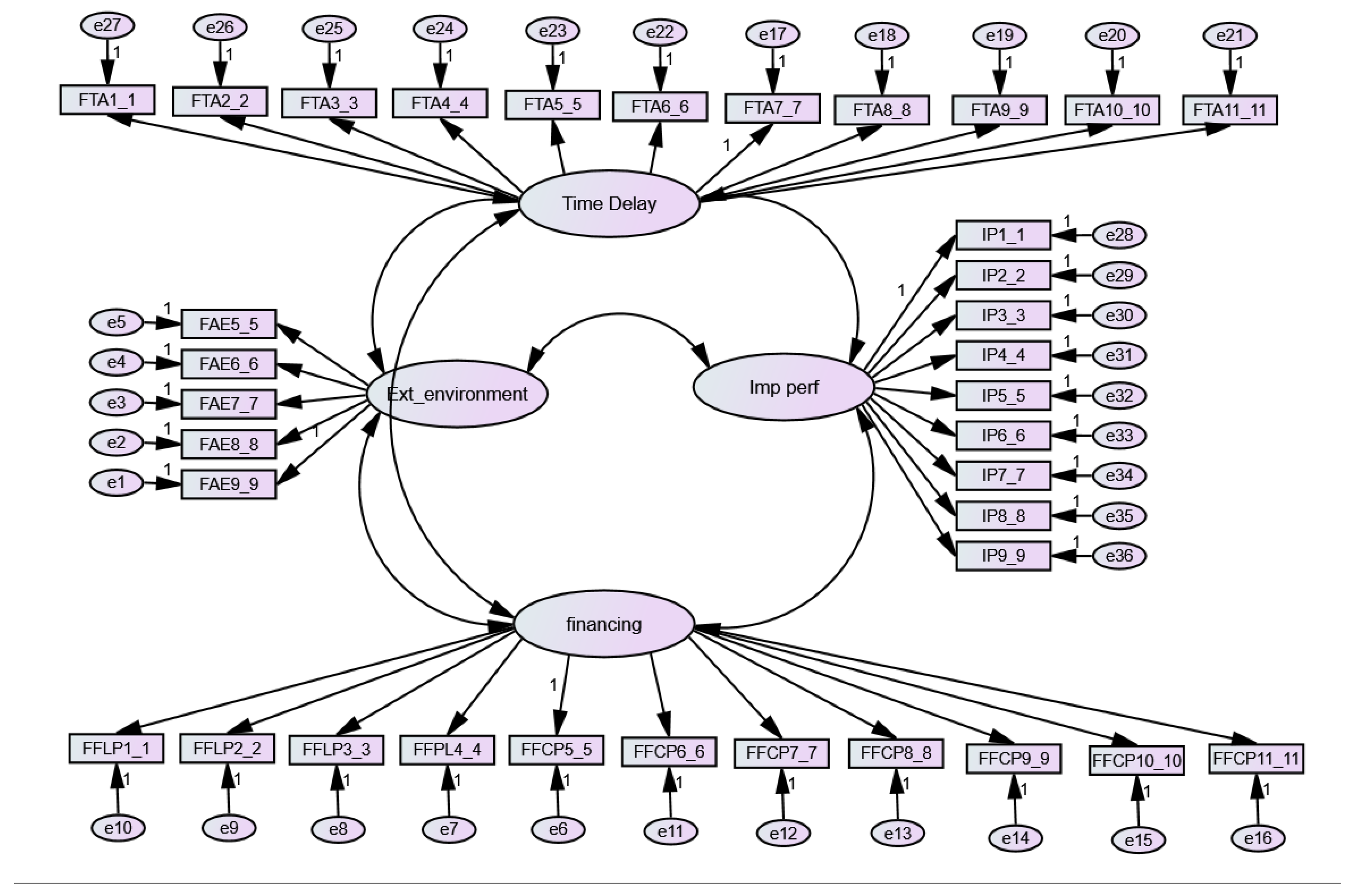

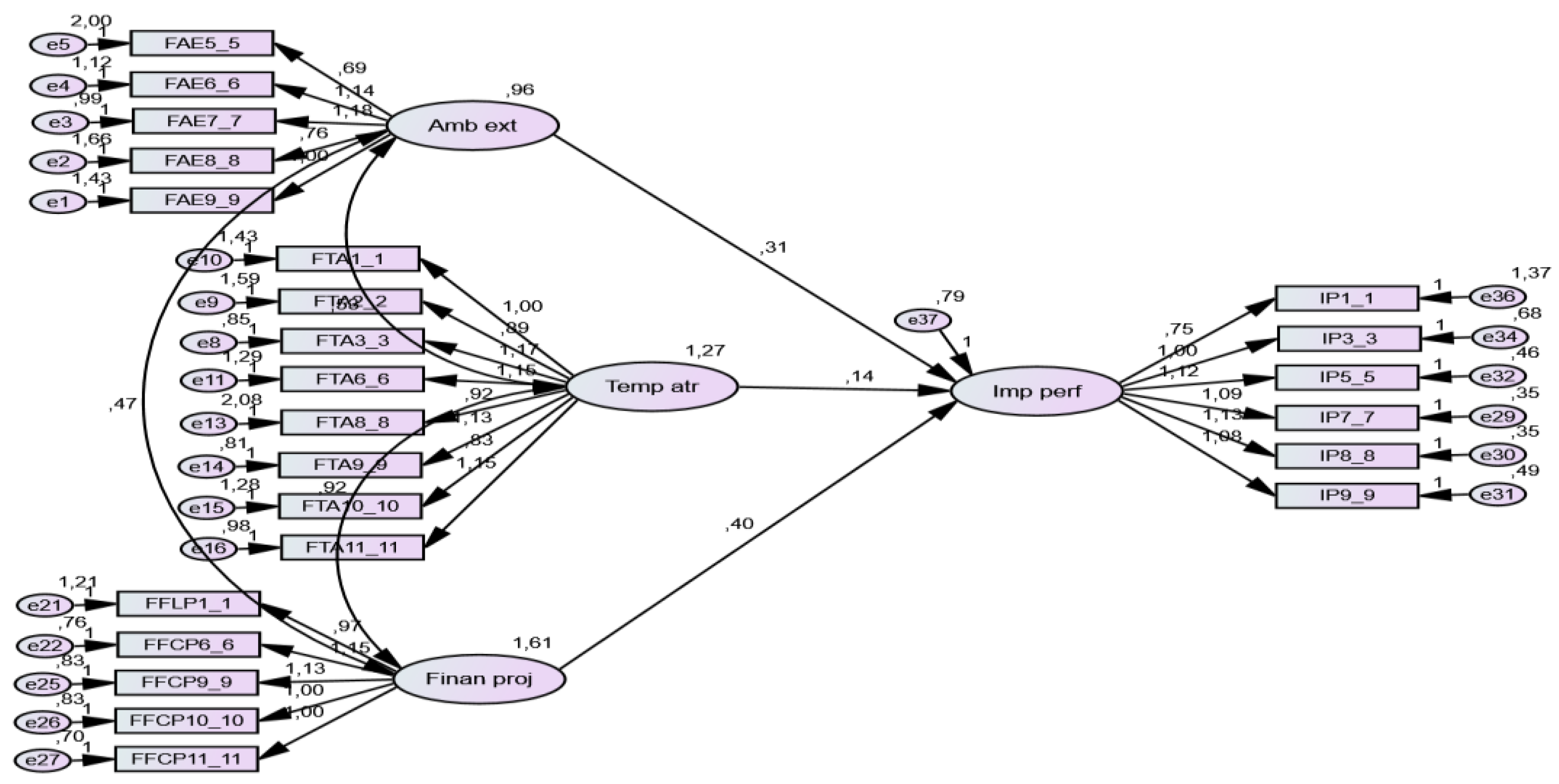

In this context, we try to evaluate in

Figure 2 the quality of the relationship between observed variables and their respective constructs. Referring to

Table 5, it can be seen that the results of the first figure of the measurement model show a poor fit of the model[2] to the applied sample data, as shown in the results of the adjustment quality indices: = 1966,153; gl = 588; p-

value = 0,000; /gl = 3,395; RMSA = 0,104; PCLOSE = 0,000; TLI = 0,794; CFI = 0,808; PCFI = 0,754; NFI = 0,748.

For a deeper understanding of the figure presented above to occur, it is important to look at table 5 which shows descriptions and reference values of the indices of adjustment measures of the model.

With the help of

Table 5 and with the results of

Figure 2, it can be seen that the results of the analysis show the poor quality of adjustment of the model, so that it is essential to use the modification indices analysis and the standardized residues to enable improvement in data adjustment (Hair et al., 2014; Lomax & Schumacker, 2010).

In this sense, the indicators IP4, IP2 and IP6 (on the profitability of the company's business, growth of the market share and the internal rate of return on investment) were selected because they presented the index of change between their error term of 95,597; 49,242 and 57,441 and the error term of the IP3, IP1 and IP7 indicators (in the yield of the total assets, in the productivity of the company's workers and in the net present value of the investment).

It is clear that the FFCP7, FFLP2, FFCP8, FFLP3, FFCP5 and FFLP4 indicators (having used excessive promissory notes, used bank loans in a context of rising interest rates, used excessive letter discounts, did not use incentives have used excess bank funding and have misused financial resources) were removed because of the high rates of change between their 97,706 error term; 89,440; 25.049; 42,283; 27,380 and 18,519 with the error term of indicators FFLP1, FFCP11 and FFCP6 (retention of results or injection of fresh capital, have resorted to financing to cover changes in material prices and have used in excess of credits from suppliers).

In the same line of analysis, the FTA4, FTA7 and FTA5 indicators (Low efficiency and productivity as a result of inefficient communication, strikes during the construction and shortage of skilled labor) were excluded due to the high indexes of change between the its error term of 33,427; 28,080 and 27,516 with the error term of the FTA3, FTA10 and FTA6 indictors (poor monitoring and control of materials on site, Absenteeism and shortage of technical professionals in the organization and preparation of the work).

It shows clearly that modifications of the terms of correlated errors were avoided by excluding one of the indicators in each pair presented in the previous paragraph (Hair et al., 2014). However, in some cases it was not possible to present the pairs due to the repetition of some indicators such as FFLP1 and FFCP8.

Regarding the re-specification of the initial model[3]and despite the statistical tests showing the removal of the indicators with high error terms, it shows that in the 36 items presented in

Table 1 (APPENDIX 1) there are only 24 items remaining after the adjustment of the model measured according to

Table 3 (APPENDIX 2), also showing that it was more than half that initially considered in

Table 1 (APPENDIX 1). But, it was verified that none of the factors remained unclassified, which means that each one of them occurs, although it may not be serious and therefore correctable, thus being validated the set of factors considered in the study (Couto, 2007).

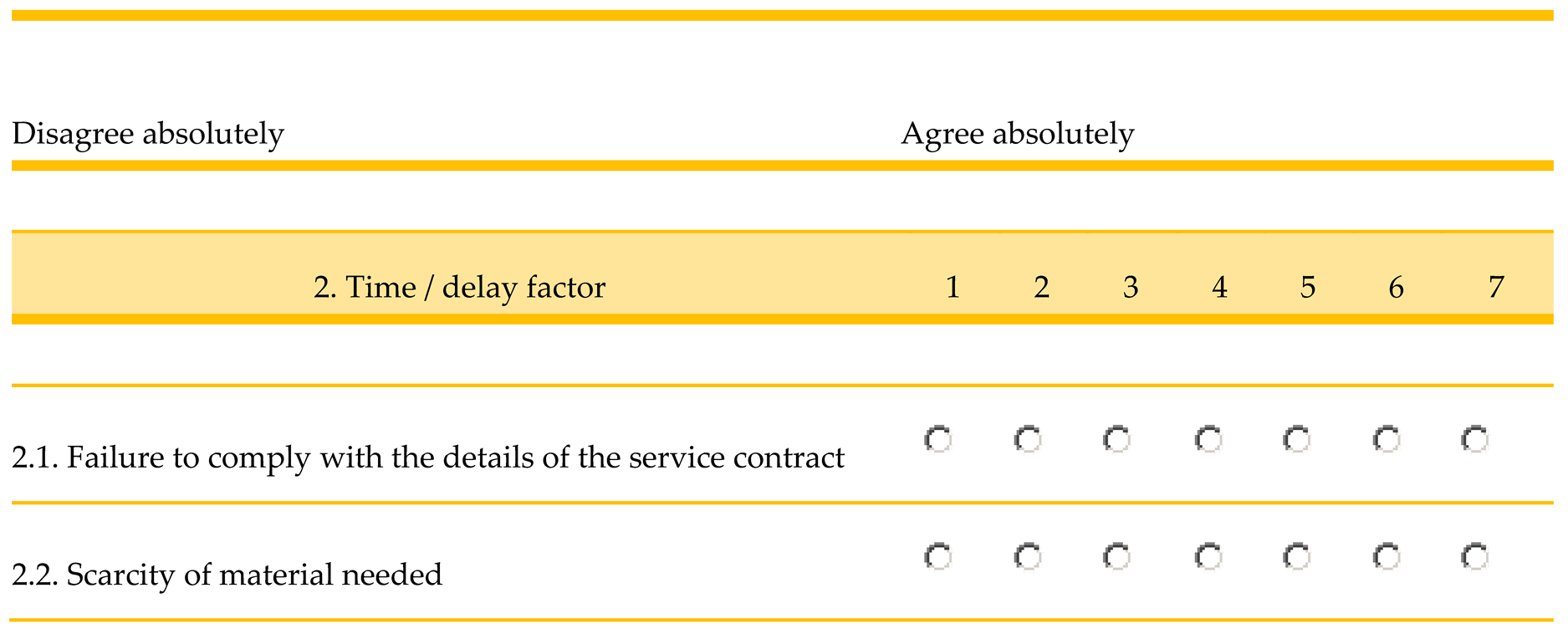

The adjustment of the current model has been progressed compared to the initial model, and it can be proved through the results of the following indices: = 530,309; gl = 246; p-

value = 0,000; /gl = 2,156; RMSA = 0,073; PCLOSE = 0,000; IFI = 0,916; TLI = 0,905; CFI = 0,915; PCFI = 0,816; NFI = 0,854. With the presented results, the internal consistency of the model is verified, taking into account the loading factors that are present in the majority the statistical significance (

p-value <0,001). However, it follows the model adjusted in

Figure 3.

The convergent validity of the model and the reliability of the constructs were analyzed by composite reliability (CR), mean extracted variance (AVE) and alpha Cronbach (Fornell & Larcker, 1981).

Thereby, the results are shown in

Table 3 (APPENDIX 2), where Cronbach's alpha (α) indicates the reliability of the construct with values greater than 0.720. The composite reliability (CR) was represented with values higher than 0.888 confirming the internal consistency. Finally, the mean extracted variance (AVE) appears with values above 0.500 recommending the appropriate convergent validity (Hair et al., 2014). When analyzing

Table 4 it is noticed that, the model does not present problems of discriminant validity, showing that the constructs presented in the study are different from each other and the AVE is larger than the square of the correlation between the same constructs (Fornell & Larcker, 1981).

However, the validation of the measurement model was applied to the structural model in order to confirm the hypothesis through the tests performed, taking in consideration the relation of the constructs.

The structural equation model presents the relationships between the constructs. The reason of comparing different constructs is to evaluate to what extent these relations are valid, and it is fundamental that the measurement of each construct is psychometrically solid (Byrne, 2010).

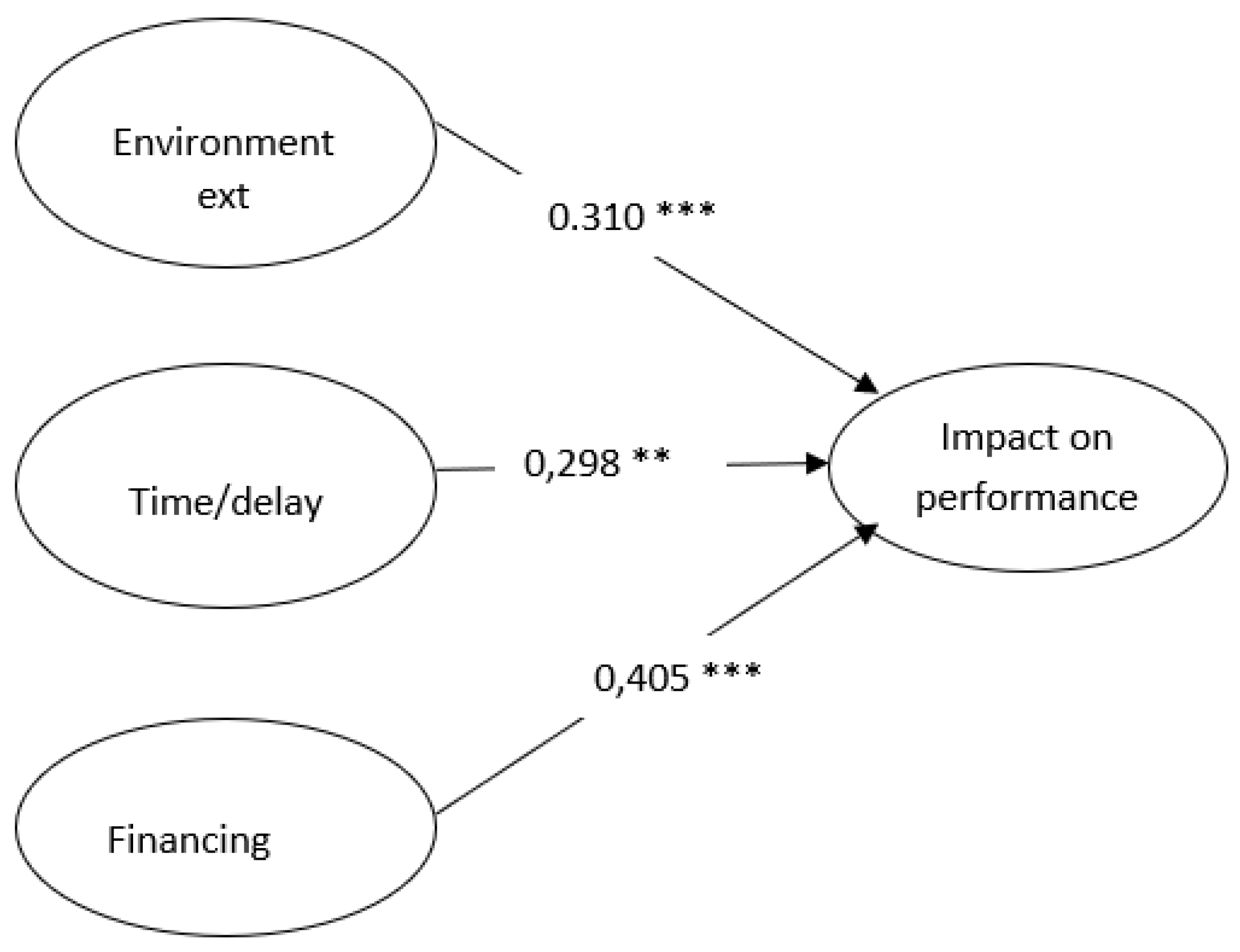

According to the result presented in

Figure 4, it appears that, of the 3 hypotheses tested, all are statistically confirmed by this article. However, the information found in the studies shows that the 3 constructs “external environment, time/delay and financing” are the main factors that negatively affect the performance of construction company projects in Portugal.

5. Conclusions

The main objective of the study is to analyze the impact of factors that affect the performance of construction company projects in Portugal.

During the study, we sought to focus the analysis on literature related to the impact of factors that affect the performance of construction company projects, namely, delay time, organizational environment, financing method, excess costs and time (Enshassi et al., 2009; Hackethal & Schmidt, 2004; Kaming et al., 1997; Love et al., 1999; Mao et al., 2013; Okpala & Aniekwu, 1988).

The data were collected through the managers and production directors in the Portuguese construction companies. The analysis was performed in SPSS software (Statistical Package for Social Sciences), version 29 and AMOS Graphics 29.

The results of the analysis corroborate the study of (Love et al., 1999), financing is one of the factors that negatively influence the impact on the performance of Brazilian construction projects, thus statistically confirming in this study the hypothesis H3. On the other hand, hypothesis H1 was confirmed, which states that the external environment is related to the impact on the performance of projects by companies in the Brazilian construction sector. In the same line of thought, it was confirmed in studies (Worthington & Britton, 2009) that the external environment influences the organization's performance, namely in the transformation process itself, in the process of acquiring resources and creating consumption of products.

Finally, it appears that hypothesis H2 corroborated the study. The time/delay factor negatively affects the performance of Brazilian construction companies’ projects (Enshassi et al., 2009; Mendes, 2019) who state that the causes that negatively influence the impact on the performance of construction projects are: shortage of technical professionals in the organization and preparation of the work, inadequate technical study during the tender phase, low efficiency and productivity as a result of inefficient communication, unavailability of resources, etc. It is worth mentioning that the impact of factors that affect the performance of construction projects may vary according to the environment in which the construction projects are located.

This study contributes to understanding how constructs relate to performance, presenting in some way the indicators necessary to understand the factors that affect the performance of construction company projects in Portugal. The limitations of the study arise from the limits established for analysis of the proposed theoretical model, taking into account the comparisons of results with other studies. However, the factors presented in this study are not the only ones that affect the performance of construction companies' projects, which is why it is necessary to carry out future investigations to better clarify this issue. A comparative study is suggested between Portuguese construction companies and companies from other European countries.

Appendix A

Table A1.

Result of exploratory factorial analysis - Impact of factors affecting performance in construction companies in Portugal.

Table A1.

Result of exploratory factorial analysis - Impact of factors affecting performance in construction companies in Portugal.

| Factor and scales |

Factor 1 |

Factor 2 |

Factor 3 |

Factor 4 |

|

Time / delay factor - (KaiserMeyer-Olkin KMO: 0,899 ; Cronbachα: 0,917)

|

| FTA1_1 |

0,712 |

|

|

|

| FTA2_2 |

0,660 |

|

|

|

| FTA3_3 |

0,839 |

|

|

|

| FTA4_4 |

0,854 |

|

|

|

| FTA5_5 |

0,758 |

|

|

|

| FTA6_6 |

0,817 |

|

|

|

| FTA7_7 |

0,528 |

|

|

|

| FTA8_8 |

0,623 |

|

|

|

| FTA9_9 |

0,824 |

|

|

|

| FTA10_10 |

0,664 |

|

|

|

| FTA11_11 |

0,809 |

|

|

|

|

Financing factor - (KaiserMeyer-Olkin KMO: 0,924 ; Cronbachα: 0,956)

|

| FFLP1_1 |

|

0,825 |

|

|

| FFLP2_2 |

|

0,830 |

|

|

| FFLP3_3 |

|

0,680 |

|

|

| FFPL4_4 |

|

0,812 |

|

|

| FFCP5_5 |

|

0,881 |

|

|

| FFCP6_6 |

|

0,887 |

|

|

| FFCP7_7 |

|

0,916 |

|

|

| FFCP8_8 |

|

0,890 |

|

|

| FFCP9_9 |

|

0,823 |

|

|

| FFCP10_10 |

|

0,803 |

|

|

| FFCP11_11 |

|

0,840 |

|

|

|

Impact on performance - (KaiserMeyer-Olkin KMO: 0,906 ; Cronbachα: 0,957)

|

| IP1_1 |

|

|

0,679 |

|

| IP2_2 |

|

|

0,794 |

|

| IP3_3 |

|

|

0,889 |

|

| IP4_4 |

|

|

0,896 |

|

| IP5_5 |

|

|

0,904 |

|

| IP6_6 |

|

|

0,919 |

|

| IP7_7 |

|

|

0,914 |

|

| IP8_8 |

|

|

0,900 |

|

| IP9_9 |

|

|

0,877 |

|

|

External environment factor - (KaiserMeyer-Olkin KMO: 0,753 ; Cronbachα: 0,733)

|

| FAE5_5 |

|

|

|

0,549 |

| FAE6_6 |

|

|

|

0,795 |

| FAE7_7 |

|

|

|

0,825 |

| FAE8_8 |

|

|

|

0,571 |

| FAE9_9 |

|

|

|

0,728 |

Appendix B

Table A2.

Results of the confirmatory factorial analysis of the adjusted measurement model.

Table A2.

Results of the confirmatory factorial analysis of the adjusted measurement model.

| Variables |

Factor Loading |

α |

FC |

AVE |

| External environment factor |

|

0,733 |

0,896 |

0,508 |

| FAE5 |

0,629 |

|

|

|

| FAE6 |

0,725 |

|

|

|

| FAE7 |

0,758 |

|

|

|

| FAE8 |

0,800 |

|

|

|

| FAE9 |

0,634 |

|

|

|

| Time / delay factor |

|

0,890 |

0,934 |

0,517 |

| FTA1 |

0,686 |

|

|

|

| FTA2 |

0,623 |

|

|

|

| FTA3 |

0,818 |

|

|

|

| FTA6 |

0,753 |

|

|

|

| FTA8 |

0,582 |

|

|

|

| FTA9 |

0,817 |

|

|

|

| FTA10 |

0,637 |

|

|

|

| FTA11 |

0,795 |

|

|

|

| Financing factor |

|

0,909 |

0,949 |

0,671 |

| FFLP1 |

0,744 |

|

|

|

| FFCP6 |

0,858 |

|

|

|

| FFCP9 |

0,843 |

|

|

|

| FFCP10 |

0,812 |

|

|

|

| FFCP11 |

0,835 |

|

|

|

| Impact on performance |

|

0,933 |

0,963 |

0,715 |

| IP1 |

0,609 |

|

|

|

| IP3 |

0,823 |

|

|

|

| IP5 |

0,893 |

|

|

|

| IP9 |

0,879 |

|

|

|

| IP8 |

0,916 |

|

|

|

| IP7 |

0,911 |

|

|

|

Appendix C

Figure A1.

Results of the structural model.

Figure A1.

Results of the structural model.

References

- Abdul Rahman, I. Abdul Rahman, I., Memon, A. H., Karim, A., & Tarmizi, A. (2013). Significant factors causing cost overruns in large construction projects in Malaysia. Journal of Applied Science, 13.

- Ahsan, K. Ahsan, K., & Gunawan, I. (2010). Analysis of cost and schedule performance of international development projects. International Journal of Project Management, 28.

- Al-Gahtani, K. S. Al-Gahtani, K. S., & Mohan, S. B. (2007). Total float management for delay analysis. Cost engineering, 49.

- Arditi, D. Arditi, D., Akan, G. T., & Gurdamar, S. (1985). Cost overruns in public projects. International Journal of Project Management, 3.

-

Blunch, N, Sage: (2008). Introduction to structural equation modelling using SPSS and AMOS.

-

Brealey, R, AMGH: A., Myers, S. C., & Allen, F. (2018). Princípios de Finanças Corporativas-12.

-

Brigham, E, Cengage Learning: , & Ehrhardt, M. (2013). Financial management: theory & practice.

-

Byrne, B, Routledge: M. (2010). Structural equation modeling with AMOS: Basic concepts, applications, and programming.

-

Cantarelli, C, The case of cost overruns in Dutch transport infrastructure projects: C., van Wee, B., Molin, E. J., & Flyvbjerg, B. (2012). Different cost performance: different determinants?

-

Cheung, S, a web-based construction project performance monitoring system: O., Suen, H. C., & Cheung, K. K. (2004). PPMS.

- Chirkunova, E. K. Chirkunova, E. K., Kireeva, E. E., Kornilova, A. D., & Pschenichnikova, J. S. (2016). Research of instruments for financing of innovation and investment construction projects. Procedia Engineering, 153.

- Couto, J. P. Couto, J. P. (2007). Incumprimento dos prazos na construção. [Dissertação de Doutoramento].

-

Creswell, J, Selection and implementation: W., Hanson, W. E., Clark Plano, V. L., & Morales, A. (2007). Qualitative research designs.

-

Drucker, P, Harper Collins: F. (2009). Management cases.

- Duncan, R. B. Duncan, R. B. (1972). Characteristics of organizational environments and perceived environmental uncertainty. Administrative science quarterly.

- Elhag, T. In , & Boussabaine, A. (1999). Evaluation of construction costs and time attributes. Paper presented at the Proceedings of the 15th ARCOM Conference.

- Enshassi, A. Enshassi, A., Mohamed, S., & Abushaban, S. (2009). Factors affecting the performance of construction projects in the Gaza strip. Journal of Civil engineering and Management, 15.

- Flyvbjerg, B. Flyvbjerg, B., Skamris Holm, M. K., & Buhl, S. L. (2004). What causes cost overrun in transport infrastructure projects? Transport reviews, 24.

-

Fornell, C, Algebra and statistics: , & Larcker, D. F. (1981). Structural equation models with unobservable variables and measurement error.

-

Gitman, L; Pearson Higher Education AU: J., Juchau, R., & Flanagan, J. (2010). Principles of managerial finance.

-

Hackethal, A, Finance & Accounting: , & Schmidt, R. H. (2004). Financing patterns: measurement concepts and empirical results: Working paper series.

-

Hair, J; Pearson Education Limited: J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2014). Multivariate data analysis (Seventh, Pearson new international ed.). Harlow.

-

Hansen, S, an exploratory analysis: C., & Van der Stedeb, W. A. (2004). Multiple facets of budgeting.

- Hartmann, A. Hartmann, A. (2006). The context of innovation management in construction firms. Construction Management and Economics, 24.

-

Hooper, D, Guidelines for determining model fit: , Coughlan, J., & Mullen, M. (2008). Structural equation modelling.

-

Inkson, C, Sage: , & Minnaert, L. (2018). Tourism management: An introduction.

- Kaming, P. F. Kaming, P. F., Olomolaiye, P. O., Holt, G. D., & Harris, F. C. (1997). Factors influencing construction time and cost overruns on high-rise projects in Indonesia. Construction Management & Economics, 15.

-

A beginner's guide to structural equation modeling, Routledge Academic New York: (3ª rd ed.).

- Love, P. E. Love, P. E., Mandal, P., & Li, H. (1999). Determining the causal structure of rework influences in construction. Construction Management & Economics, 17.

-

Mao, H, A field study on CREC 2nd Bureau Co: , Zhu, B., & Wang, T. a. (2013). The effect of organizational environment on engineering project cost management.

-

Marôco, J, ReportNumber: (2010). Análise de equações estruturais: Fundamentos teóricos, software & aplicações.

- Mendes, C. C. Mendes, C. C. (2019). Determinantes dos Desvios Orçamentais e o Seu Impacto Na Performance das Empresas de Construção Portuguesas.

-

Mendes, C, o caso dos projetos das empresas de construção portuguesas: C., Couto, J. P., Ferreira, J. V., & Mendes, E. (2021). Causas dos desvios orçamentais desfavoráveis e os seus constructos.

-

Nakip, M, Techniques and Applications (with SPSS): (2003). Marketing Researches.

-

O'Sullivan, M, understanding the recent transformation of the French financial system: (2007). Acting out institutional change.

- Odeck, J. Odeck, J. (2004). Cost overruns in road construction—what are their sizes and determinants? Transport Policy, 11.

- Okpala, D. C. Okpala, D. C., & Aniekwu, A. N. (1988). Causes of high costs of construction in Nigeria. Journal of construction engineering and management, 114.

-

Rauch, A, An assessment of past research and suggestions for the future: , Wiklund, J., Lumpkin, G. T., & Frese, M. (2009). Entrepreneurial orientation and business performance.

- Rauh, J. D. Rauh, J. D., & Sufi, A. (2010). Capital structure and debt structure. The Review of Financial Studies, 23, 4280. [Google Scholar]

- Sakiru, O. K. Sakiru, O. K., D'Silva, J. L., Othman, J., Silong, A. D., & Busayo, A. T. (2013). Leadership styles and job satisfaction among employees in small and medium enterprises. International Journal of Business and Management, 8.

-

Schmidt, R, IMFS Working Paper Series: H., & Hryckiewicz, A. (2006). Financial systems-importance, differences and convergence.

-

Tabachnick, B, Allyn & Bacon/Pearson Education: G., & Fidell, L. S. (2007). Using multivariate statistics.

-

Tassiopoulos, D, Juta and Company Ltd: (2011). New Tourism Ventures: An Entrepreneurial and Mangerial Approach.

-

Urionabarrenetxea, S, an empirical study: , & Rodríguez Castellanos, A. (2009). Decisive factors in company financial internationalization.

-

Van der Stede, W, budgetary slack creation and managerial short-term orientation: A. (2000). The relationship between two consequences of budgetary controls.

-

Venkatraman, N, A comparison of approaches: , & Ramanujam, V. (1986). Measurement of business performance in strategy research.

-

Westhead, P, A resource-based view: , Wright, M., & Ucbasaran, D. (2001). The internationalization of new and small firms.

-

Williams, B, A five-step guide for novices: , Onsman, A., & Brown, T. (2010). Exploratory factor analysis.

- Wong, K. Wong, K., & Vimonsatit, V. (2012). A study of the factors affecting construction time in Western Australia. Scientific Research and Essays, 7, 3398. [Google Scholar]

-

Worthington, I, Pearson Education: , & Britton, C. (2009). The business environment.

-

Zahra, S, A review and integrative model: A., & Pearce, J. A. (1989). Boards of directors and corporate financial performance.

-

A stage – by – stage factor control frame work for cost estimation of construction projects, Owners Driving Innovation International, http:/ flybjerg. Plan.aau.dk / Japaaspublish, ed. Pelf.

- Zidane, Y. J.-T. Zidane, Y. J.-T., & Andersen, B. (2018). The top 10 universal delay factors in construction projects. International Journal of Managing Projects in Business, 11.

-

Zikmund, W, Western College Publishers: , Babin, B., Carr, J., & Griffin, M. (2002). Business Research Methods. South.

|

1 It should be noted that the higher the KMO value the better the result of the exploratory factorial analysis. |

|

2 The adjustment of the model presupposes evaluating the potential of the theoretical model according to the established correlations between observed variables (Marôco, 2010). |

|

3 When the models do not present a good adjustment to the data, it is imperative to use the Modification Index index in order to re-specify the model to improve the results, seeking consistency with the theory (Byrne, 2010; Marôco, 2010). |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).