Submitted:

26 June 2025

Posted:

27 June 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Dynamics of Interacting Populations Under Competition

- Predator-prey: One population’s growth decreases while the other’s increases.

- Competition: Growth rates of both populations decrease.

- Mutualism (symbiosis): Growth rates of both populations increase.

3. Deep Neural Network Model for Crypto Dynamics

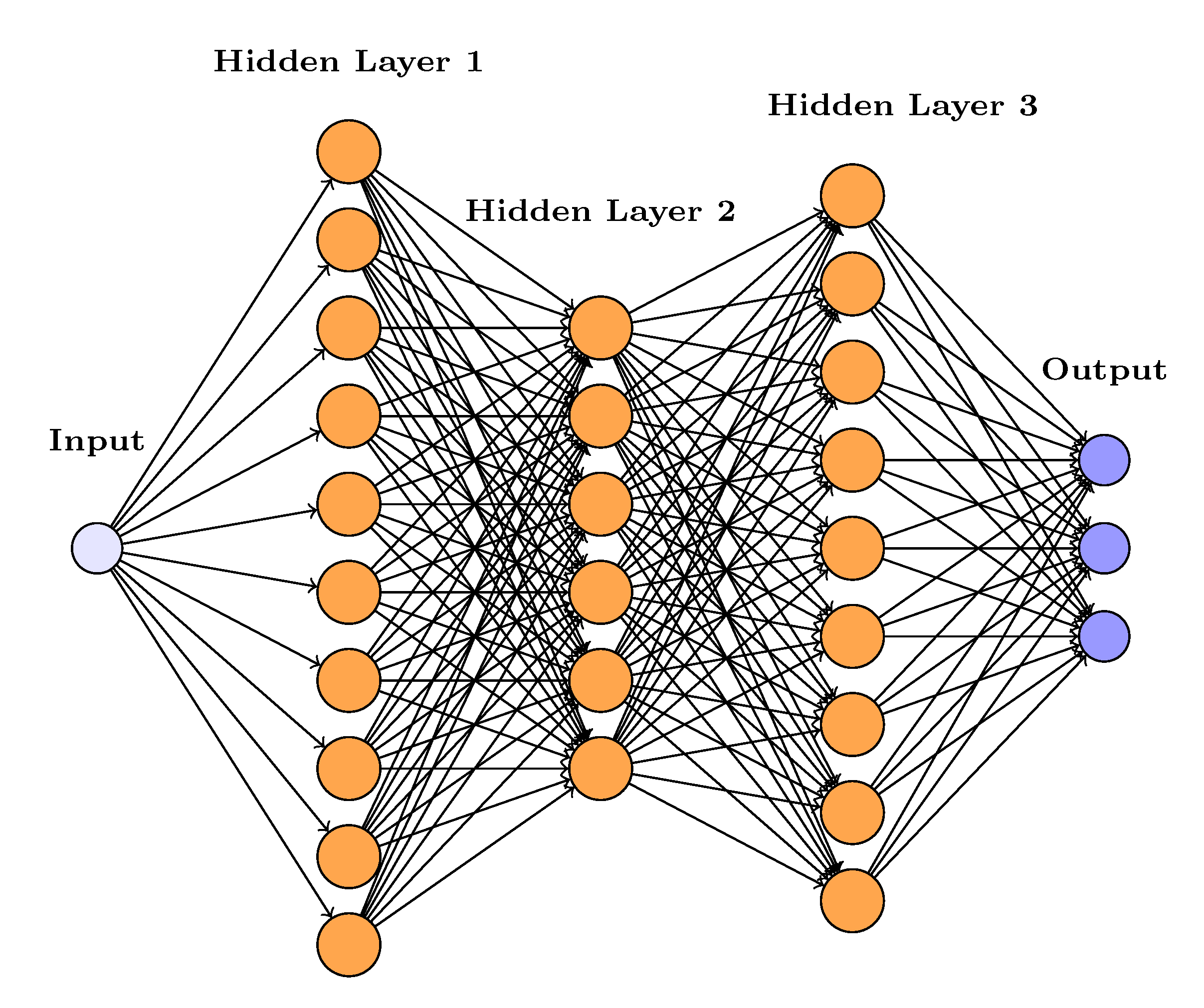

3.1. Feed Forward Neural Network Architecture

- Input Layer: Accepts a single input feature corresponding to time, denoted as t.

- Hidden Layers: Three fully connected hidden layers, whith 10,6 and 9 neurons each and using the hyperbolic tangent (tanh) activation function. To promote stable learning, weights were initialized to small values and biases were set to zero.

- Output Layer: A fully connected layer with three outputs, representing the estimated values of the variables , , and . Each output is connected to a regression layer, which calculates the loss based on the deviation between predicted and actual values.

- Time-Series Prediction: The neural network is trained on datasets to learn and predict their evolution over time. Once trained, it produces predictions for the three variables based solely on time input.

- Modeling Underlying Relationships: By learning from data, the NN approximates the hidden relationships between the variables and time, capturing complex and nonlinear behaviors that traditional models might overlook.

- Preparing for Optimization: After prediction, the outputs obtain continuous estimates of the state variables. These are then used to compute numerical derivatives , , and . These derivatives are essential for the next phase of analysis, where model parameters are estimated via optimization using lsqnonlin.

3.2. Feed-Forward Propagation

4. Hybrid Neural Network–ODE Framework for Parameter Estimation and Forecasting

| Algorithm 1 Proposed Method |

|

4.1. Mathematical Formulation

4.2. Numerical Integration via Runge–Kutta

4.3. Model Evaluation

| Algorithm 2 Selection of Best Neural Network Architecture |

|

5. Numerical Experiment

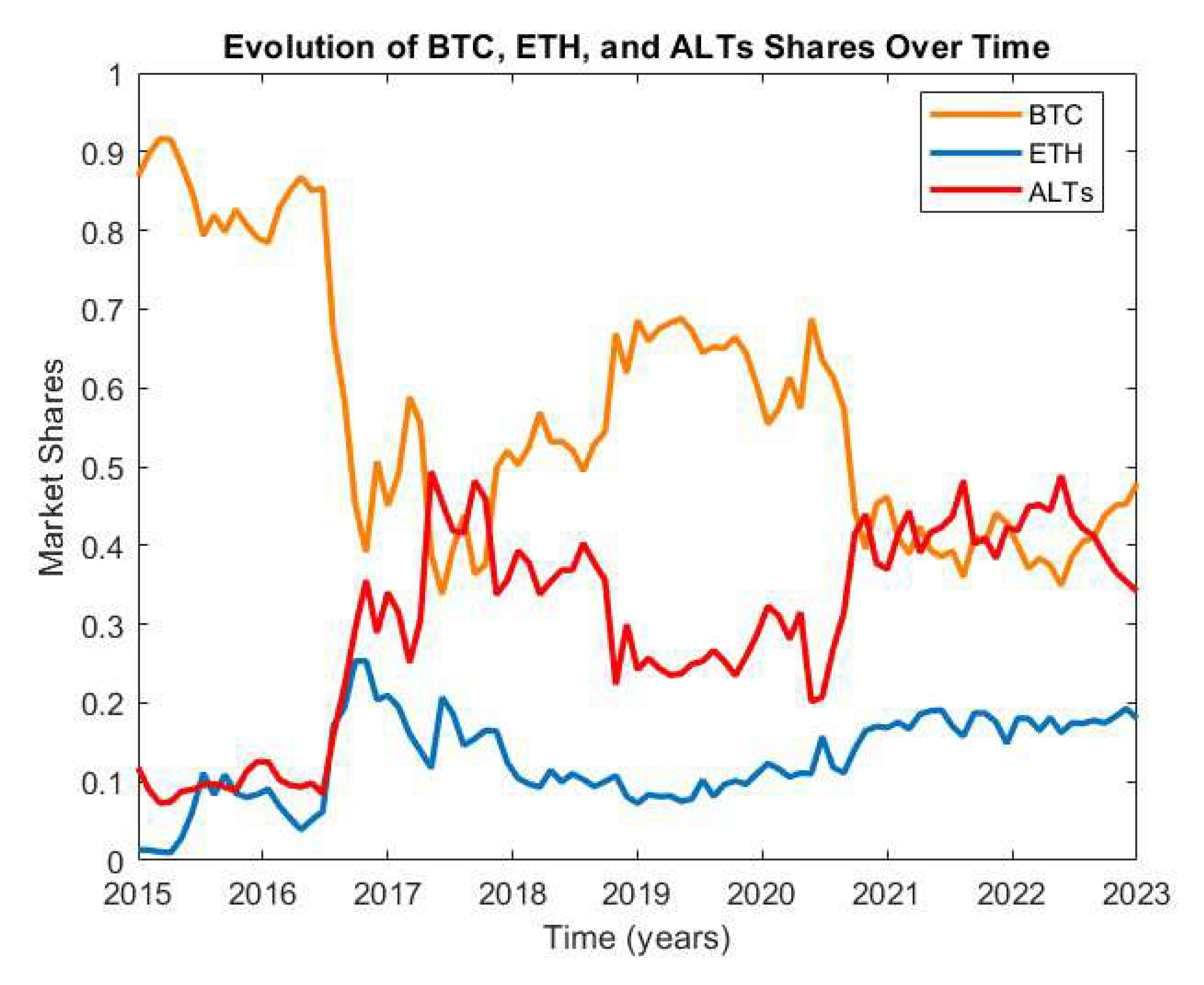

5.1. Case Study Description

- (BTC), (ALTs), and (ETH) are all positive, indicating that each asset class would grow in isolation absent any competition or inhibition.

- (BTC) and (ETH) are negative, reflecting strong self-limitation (diminishing returns) as market share increases.

- (ALTs) is also negative, indicating that, unlike before, the Altcoin sector exhibits some self-inhibitory effects at high share levels.

-

BTC Equation:

- –

- : A strong negative influence of ALTs on BTC, suggesting that as Altcoin share rises, BTC’s growth is sharply suppressed.

- –

- : A substantial positive effect from ETH on BTC, implying that Ethereum growth tends to bolster Bitcoin’s market share.

-

ETH Equation:

- –

- : A strong negative effect of BTC on ETH, reversing the previous supportive role—here Bitcoin dominance inhibits Ethereum.

- –

- : A very strong inhibitory influence of ALTs on ETH, indicating fierce competition from the broader Altcoin market.

-

ALT Equation:

- –

- : Bitcoin slightly inhibits Altcoins.

- –

- : Ethereum exerts a moderate negative effect on Altcoins.

- –

- : Confirms Altcoins also self-inhibit at high share.

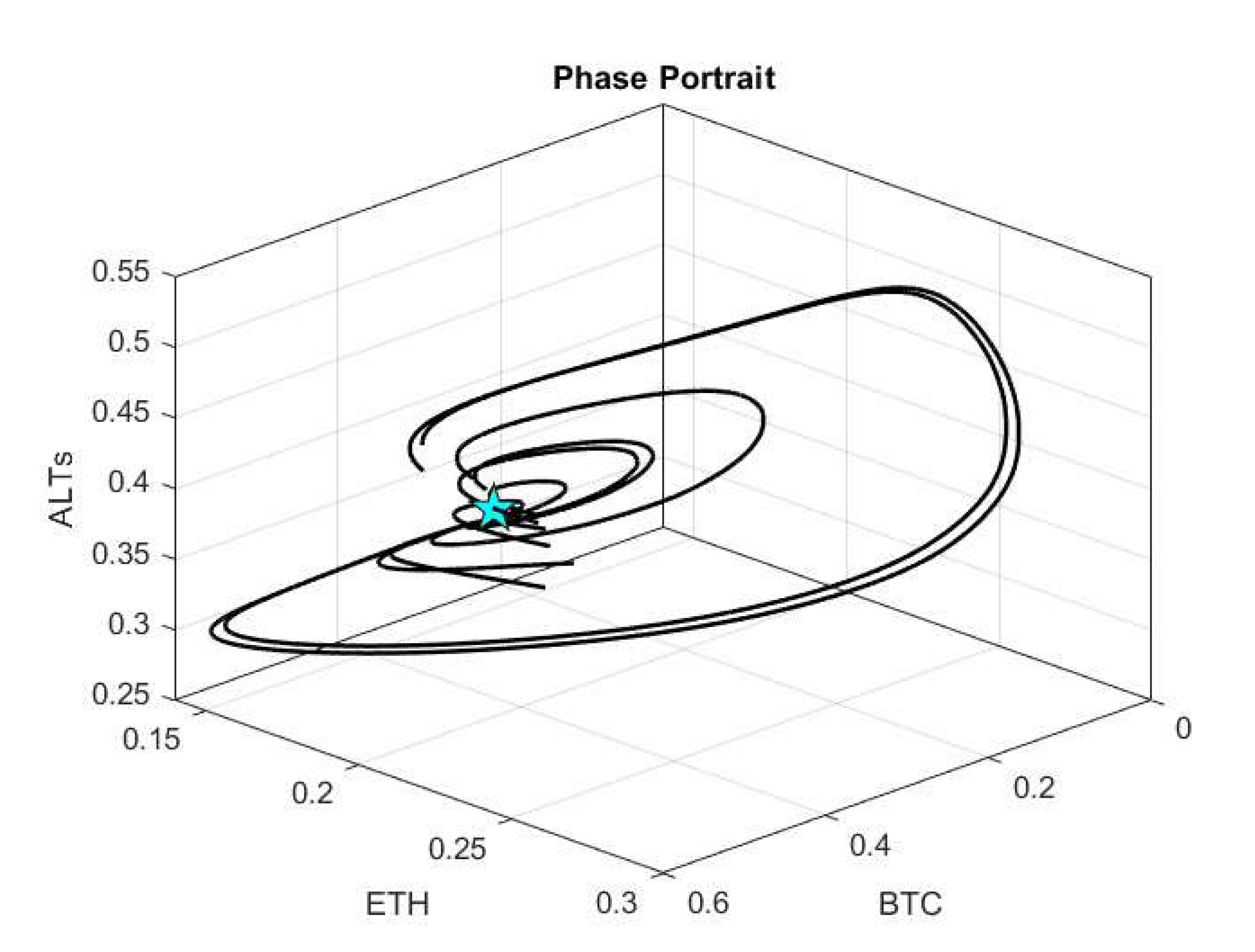

5.2. System Stability Testing

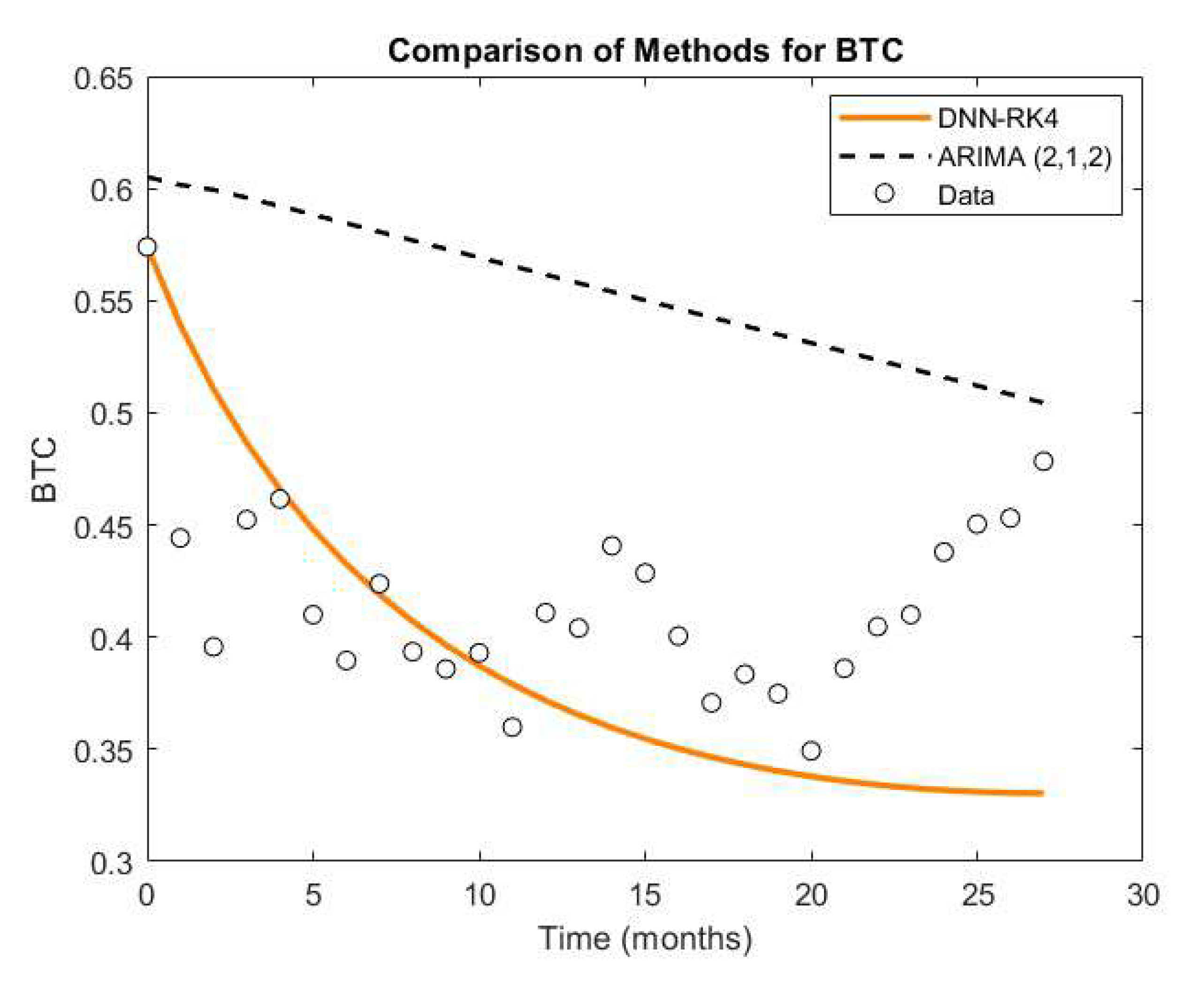

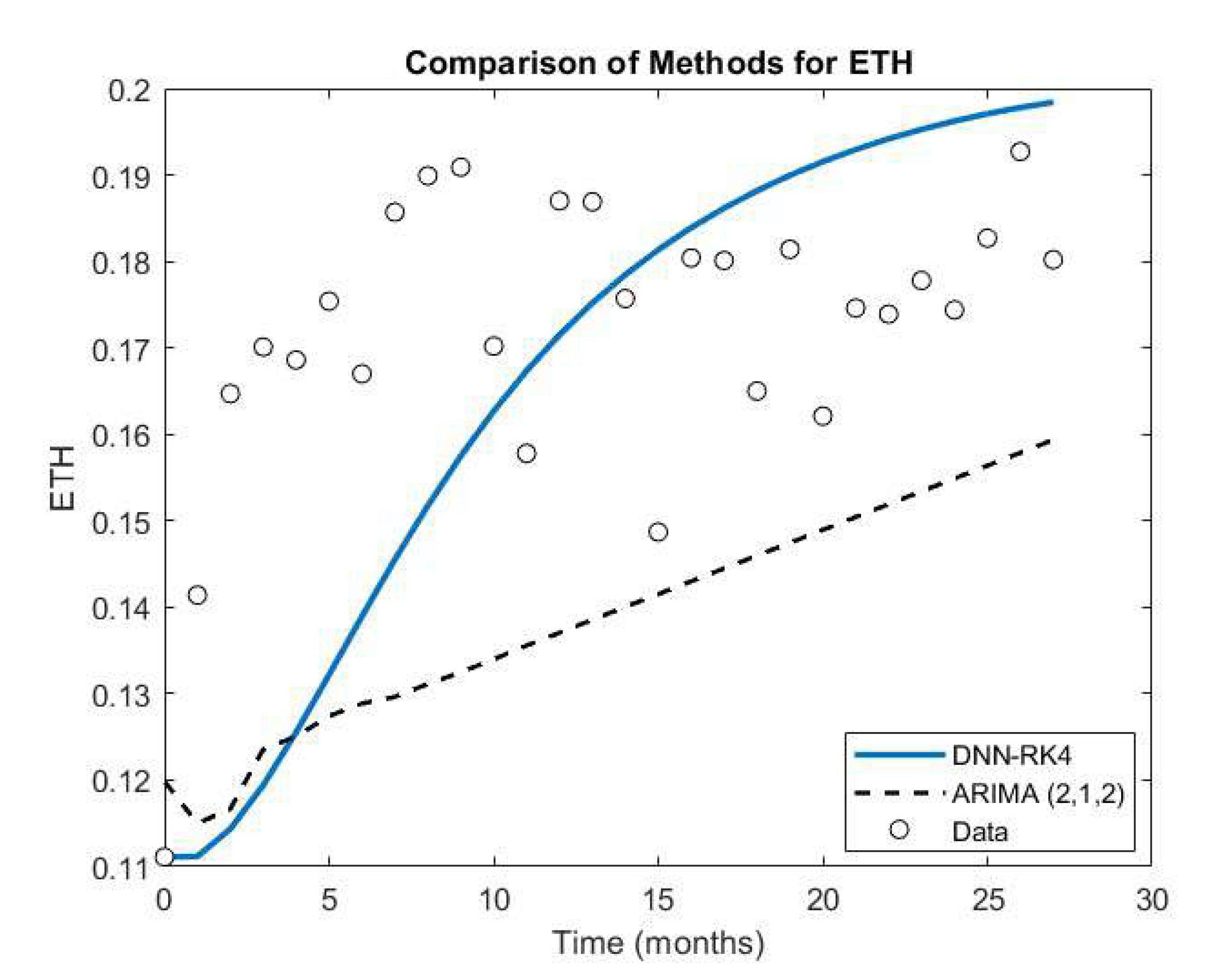

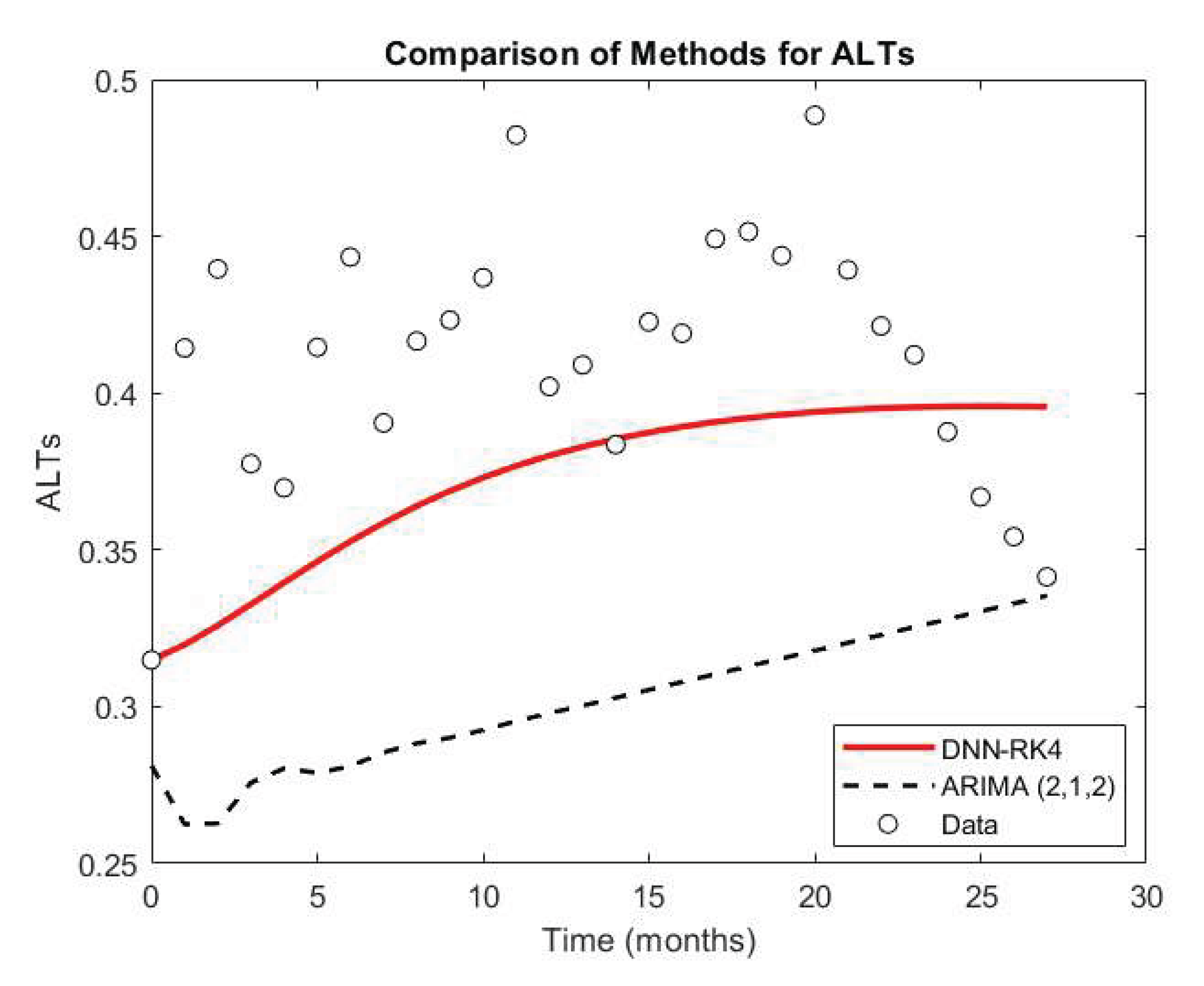

5.3. Case Study Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- White GRT. Future applications of blockchain in business and management: A Delphi study . Strategic Change ,2017, 26, 439–451. [CrossRef]

- Bitcoin.org. Available online: https://bitcoin.org/bitcoin.pdf.

- Tradingview.com. Available online: https://www.tradingview.com/symbols/BTC/.

- Taleb, N. et al.Prospective applications of blockchain and bitcoin cryptocurrency technology . TEM J ,2019, 8, 48–55. [CrossRef]

- Navamani, T. M. A Review on Cryptocurrencies Security . Journal of Applied Security Research ,2021, 18(1), 49–69. [CrossRef]

- T. Nandy, U. Verma, P. Srivastava, D. Rongara, A. Gupta and B. Sharma.The Evaluation of Cryptocurrency: Overview, Opportunities, and Future Directions . 2023 7th International Conference on Intelligent Computing and Control Systems (ICICCS) ,2023, 1421–1426. [CrossRef]

- Tradingview.com. Available online: https://www.tradingview.com/symbols/ETH/.

- Forbes.com. Available online: https://www.forbes.com/sites/lawrencewintermeyer/2021/08/12/institutional-money-is-pouring-into-the-crypto-market-and-its-only-going-to-grow/?sh=1a5424261459.

- Nicholas Taleb, N.Bitcoin, currencies, and fragility . Quantitative Finance ,2021, 21(8), 1249–1255. [CrossRef]

- VISUAL CAPITALIST. Available online: https://www.visualcapitalist.com/crypto-ownership-growth-by-region/.

- Javarone, M. A. and Wright, C. S.From bitcoin to bitcoin cash: A network analysis . In Proceedings of the 1st Workshop on Cryptocurrencies and Blockchains for Distributed Systems ,2018, 77–81. [CrossRef]

- Donet, J. A. D., Pérez-Sola, C. and Herrera-Joancomartí, J.The bitcoin p2p network . In International conference on financial cryptography and data security ,2014, 87–102. [CrossRef]

- Kjærland, F., Khazal, A., Krogstad, E. A., Nordstrøm, F. B. and Oust. An analysis of bitcoin’s price dynamics . J. Risk Financ. Manag ,2018,11, 63. [CrossRef]

- Velankar, S., Valecha, S. and Maji, S.Bitcoin price prediction using machine learning . In 2018 20th International Conference on Advanced Communication Technology (ICACT) ,2018, 144–147.

- ElBahrawy Abeer, Alessandretti Laura, Kandler Anne, Pastor-Satorras Romualdo and Baronchelli Andrea.2017Evolutionary dynamics of the cryptocurrency markeT . R. Soc. Open Sci ,2017, 4:170623. [CrossRef]

- Wu, K., Wheatley, S. and Sornette .Classification of cryptocurrency coins and tokens by the dynamics of their market capitalizations . Soc. Open Sci ,2018, 5, 180381. [CrossRef]

- J.D. Murray.Mathematical Biology. Springer-Verlag, ,1993, New York.

- A. W. Wijeratnea, F. Yi, and J. Wei. “Biffurcation analysis in the diffu- sive Lotka-Voltera system: An application to market economy. Chaos,Solitons Fractals, ,2009, vol. 40 , 902–911. [CrossRef]

- D. Neal.Introduction to Population Biology. New York: Cambridge University Press, ,2004.

- W. E. Boyce and R. C. DiPrima .Elementary Differential Equations and Boundary Value Problems, . Hoboken, NJ: Wiley, ,2004, 8th ed.

- J. C. Fisher and R. H. Pry .“A simple substitution model of technological change,” . Technol. Forecast. Soc. Change, ,1971, vol. 3, 75–88. [CrossRef]

- L. P. Rai.“Appropriate models for technology substitution” . J. Sci. Ind. Res. ,1999, vol. 58 , 14–18.

- M. Begon, C. Townsend, and J. Harper. Ecology: From Individuals to Ecosystems . Oxford, U.K.: Blackwell ,2006, 4th ed.

- T. H. Fay and J. C. Greeff. “A three species competition model as a decision support tool” . Ecol. Modell ,2008, vol. 211,, 142–152. [CrossRef]

- P. G. L. Leach and J. Miritzis.“Analytic behaviour of competition among three species” . J. Nonlinear Math. Phys ,2006, vol. 13, 535–548. [CrossRef]

- Olivença DV, Davis JD and Voit EO. Inference of dynamic interaction networks: A comparison between Lotka-Volterra and multivariate autoregressive models . Front. Bioinform ,2022, Volume 2. [CrossRef]

- Kastoris, D.; Giotopoulos, K.; Papadopoulos, D. Neural Network-Based Parameter Estimation in Dynamical Systems . Information ,2024, vol. 15, 809. [CrossRef]

- C. Michalakelis, T.S. Sphicopoulos, D. Varoutas.Modelling competition in the telecommunications market based on the concepts of population biology.Transactions on Systems, Man and Cybernetics. Part C: Applications and Reviews 4 2011, 200–210. [CrossRef]

- G. Bebis and M. Georgiopoulos. Feed-forward neural networks . In IEEE Potentials ,1994, Vol 13 (4), 27–31.

- L. Huang, J. Qin, Y. Zhou, F. Zhu, L. Liu and L. Shao. Normalization Techniques in Training DNNs: Methodology, Analysis and Application . in IEEE Transactions on Pattern Analysis and Machine Intelligence ,2023, vol. 45, no. 8, 10173-10196. [CrossRef]

- J. C. Butcher.Numerical Methods for Ordinary Differential Equations . 3 ,2016, 10, 143–331. [CrossRef]

- Tan Delin , Chen Zheng. "On A General Formula of Fourth Order Runge-Kutta Method" . Journal of Mathematical Science & Mathematics Education, ,2012, 7(2), 1–10.

- J. R. Dormand, M. E. A. El-Mikkawy, P. J. Prince.Families of Runge-Kutta-Nyström formulae . IMA J. Numer ,1987, 7, 235–250. [CrossRef]

- D. F. Papadopoulos, T. E. Simos.A new methodology for the construction of optimized Runge-Kutta- Nyström methods . International Journal of Modern Physics C ,2011, 22 (6), 623–634. [CrossRef]

- D. F. Papadopoulos, T. E. Simos. The use of phase lag and amplification error derivatives for the construction of a modified Runge-Kutta-Nyström method. Abstract and Applied Analysis ,2013, 910624. [CrossRef]

- Papadopoulos, D.F., Anastassi, Z.A., Simos, D.F. The use of phase-lag and amplification error derivatives in the numerical integration of ODEs with oscillating solutions. AIP Conference Proceedings , 2009. [CrossRef]

- Papadopoulos, D.F., Anastassi, Z.A., Simos, D.F. A zero dispersion RKN method for the numerical integration of initial value problems with oscillating solutions. AIP Conference Proceedings , 2009. [CrossRef]

- Papadopoulos, D.F. A Parametric Six-Step Method for Second-Order IVPs with Oscillating Solutions. Mathematics ,2024, vol. 12, 3824. [CrossRef]

- Steyerberg, Ewout W,Harrell, Frank E, Jr ,Borsboom, Gerard J.J.M,Eijkemans, M.J.C,Vergouwe, Yvonne,Habbema, J.Dik F.Internal validation of predictive models: Efficiency of some procedures for logistic regression analysis . Journal of Clinical Epidemiology ,2001, 54 (8), 774–781. [CrossRef]

- coinmarketcap.com. Available online: https://coinmarketcap.com/historical/.

- Schulz, A. W. Equilibrium modeling in economics: a design-based defense. Journal of Economic Methodology ,2024, 31(1), 36–53. [CrossRef]

- Kontopoulou, V.I.; Panagopoulos, A.D.; Kakkos, I.; Matsopoulos, G.K. A Review of ARIMA vs. Machine Learning Approaches for Time Series Forecasting in Data Driven Networks . Future Internet ,2023, 15, 255. [CrossRef]

- Ying Liu, Xiaohua Huang, Liwei Xiong, Ruyu Chang, Wenjing Wang, Long Chen. Stock price prediction with attentive temporal convolution-based generative adversarial network . Array ,2025, 25. [CrossRef]

- Zening Zhao, Jinsong Wang, Jiajia Wei. Graph-Neural-Network-Based Transaction Link Prediction Method for Public Blockchain in Heterogeneous Information Networks . Blockchain: Research and Applications ,2025. [CrossRef]

- Coelho, C.; da Costa, M.F.P.; Ferrás, L.L. XNODE: A XAI Suite to Understand Neural Ordinary Differential Equations . AI ,2025, 6, 105. [CrossRef]

- Vincent Gurgul, Stefan Lessmann, Wolfgang Karl Härdle. Deep learning and NLP in cryptocurrency forecasting: Integrating financial, blockchain, and social media data . International Journal of Forecasting ,2025. [CrossRef]

| BTC | ETH | ALTs | MRMSE | LR | Epochs | |||

| 10 | 6 | 9 | 0.056355 | 0.097497 | 0.096556 | 0.083469 | 0.0001 | 200 |

| 10 | 6 | 9 | 0.063268 | 0.092336 | 0.097758 | 0.084454 | 0.0001 | 100 |

| 8 | 10 | 10 | 0.068767 | 0.097675 | 0.101360 | 0.089267 | 0.0001 | 200 |

| 7 | 7 | 6 | 0.062612 | 0.100960 | 0.102480 | 0.088684 | 0.0001 | 200 |

| 7 | 10 | 10 | 0.071430 | 0.096462 | 0.102860 | 0.090251 | 0.0001 | 200 |

| 6 | 5 | 10 | 0.063437 | 0.101870 | 0.102940 | 0.089416 | 0.0001 | 200 |

| 9 | 10 | 5 | 0.071015 | 0.099051 | 0.103100 | 0.091055 | 0.00005 | 200 |

| 9 | 9 | 10 | 0.068600 | 0.099730 | 0.104540 | 0.090957 | 0.0001 | 200 |

| 10 | 8 | 10 | 0.058409 | 0.114040 | 0.105150 | 0.092533 | 0.0001 | 200 |

| 9 | 10 | 5 | 0.072399 | 0.100790 | 0.105270 | 0.092820 | 0.0001 | 100 |

| Method | RMSE for BTC | RMSE for ETH | RMSE for ALTs |

|---|---|---|---|

| DNN-RK4 | 0.06865 | 0.02682 | 0.05581 |

| ARIMA (2,1,2) | 0.14742 | 0.03665 | 0.11890 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).