Submitted:

12 June 2025

Posted:

12 June 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

2.1. Comprehensive Evaluation Index System for Resilience of OGI

2.2. Evaluation Method

2.2.1. Resilience Comprehensive Evaluation Model

2.2.2. Obstacle Model

2.2.3. Coupling Coordination Dgree Model (CCD Model)

2.3. Data Sources and Processing

3. Results Analysis

3.1. Analysis of The Results of The Resilience Evaluation of China’s OGI Chain

3.1.1. Comprehensive Index Analysis

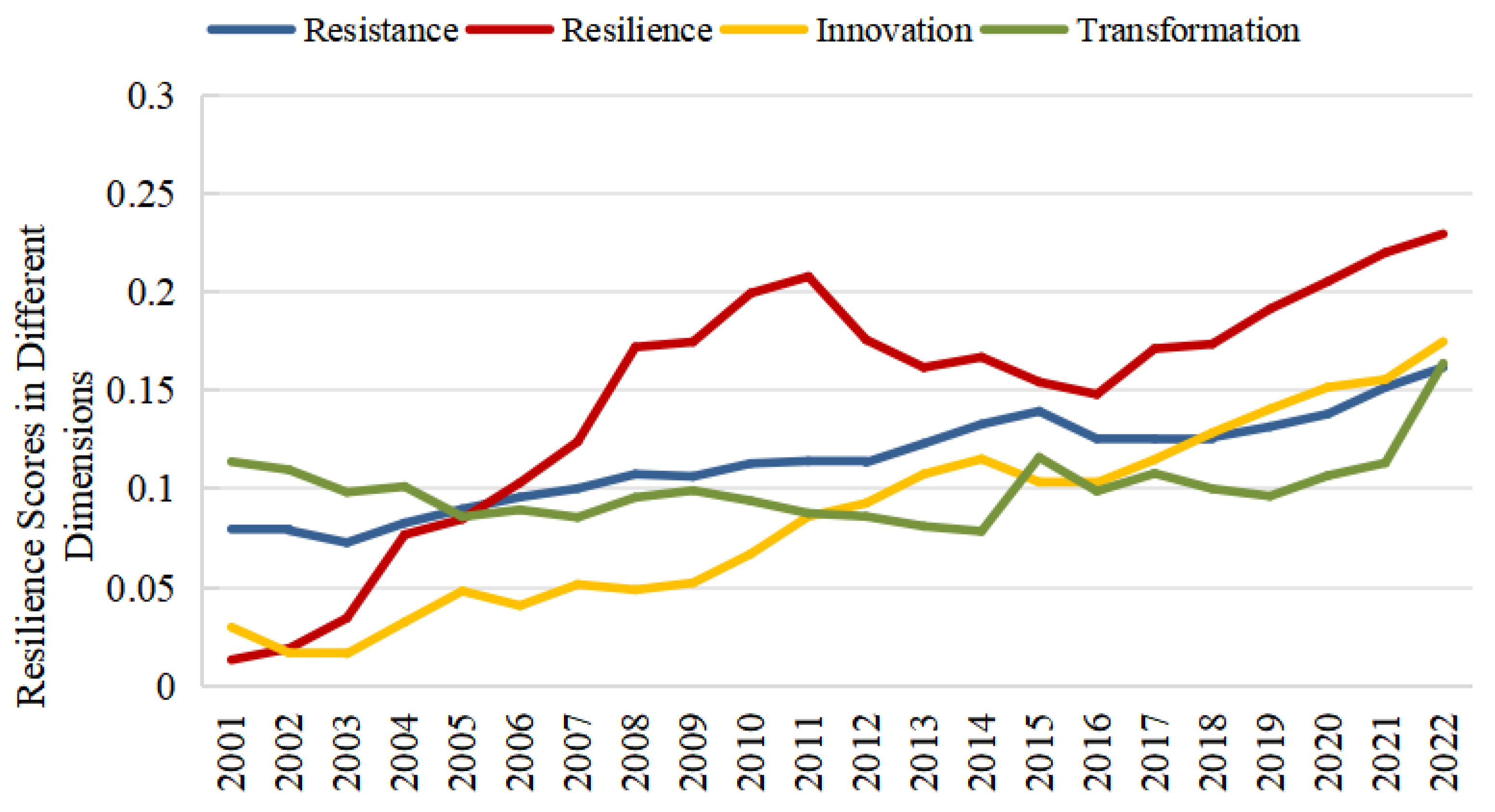

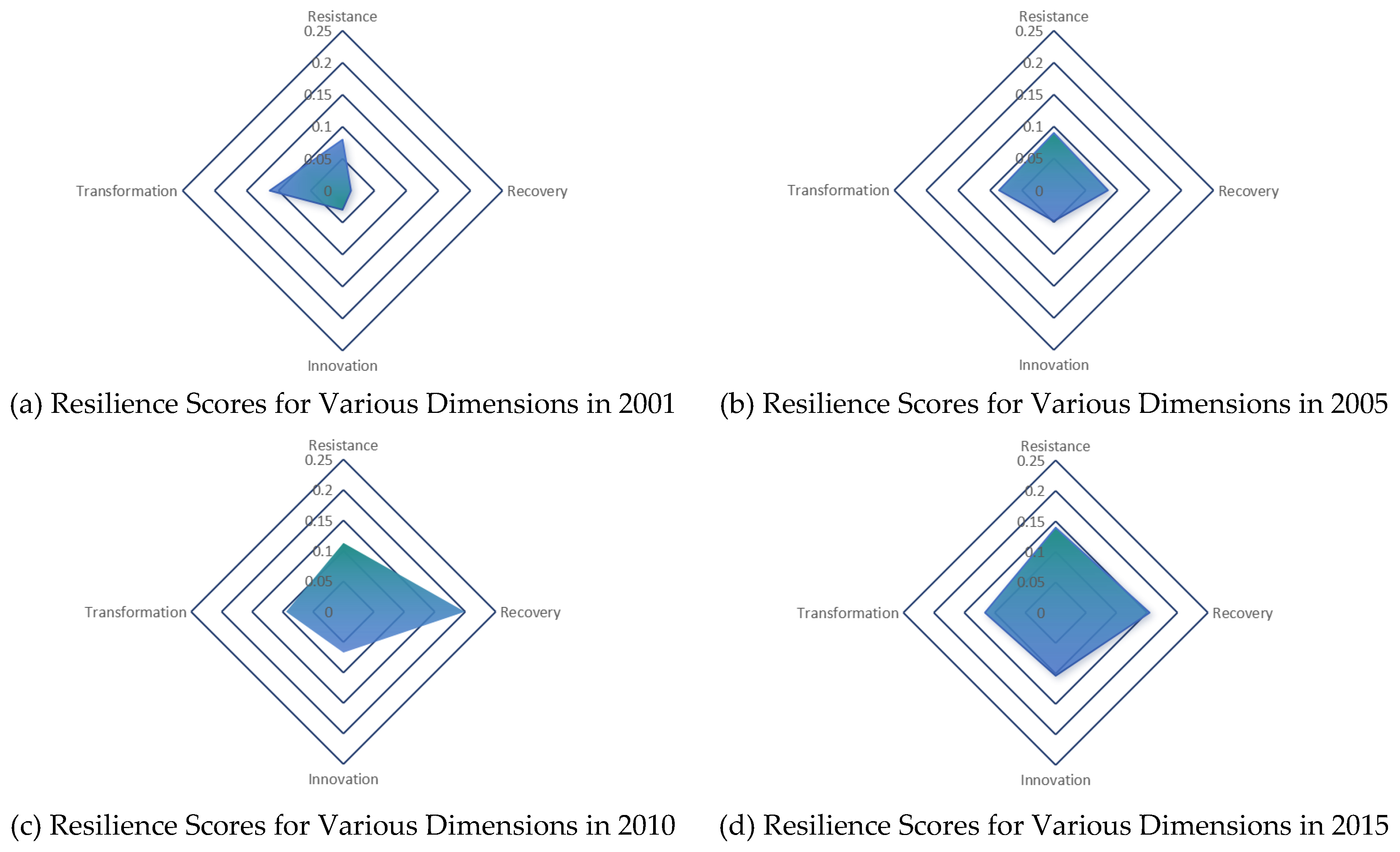

3.1.2. Multidimensional Index Analysis

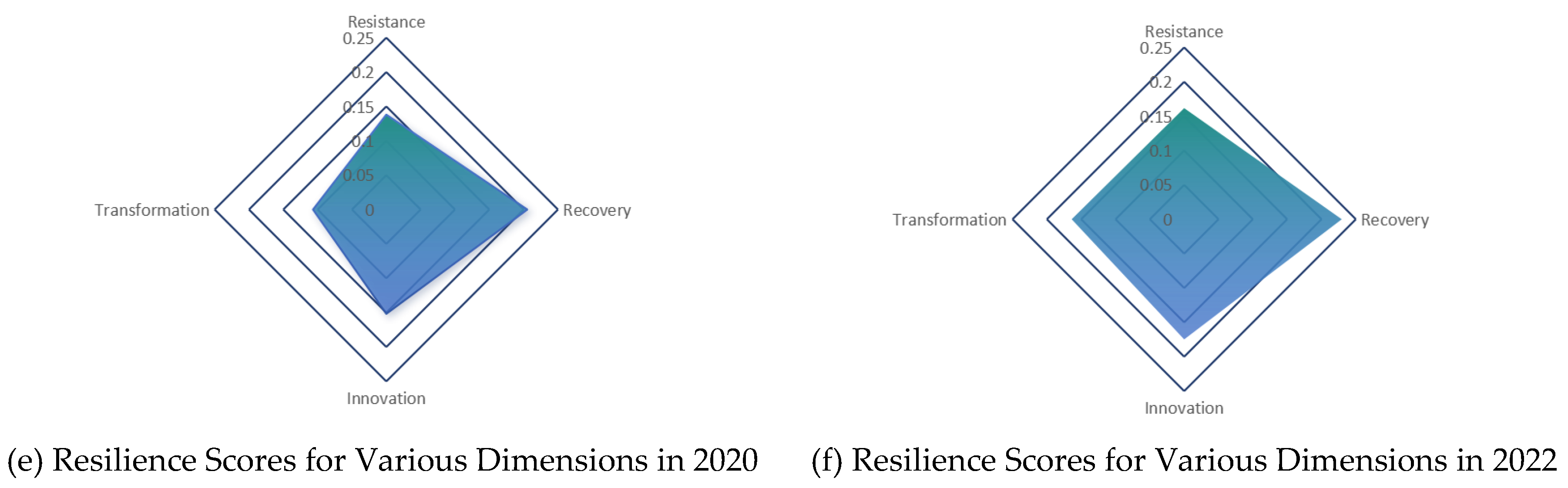

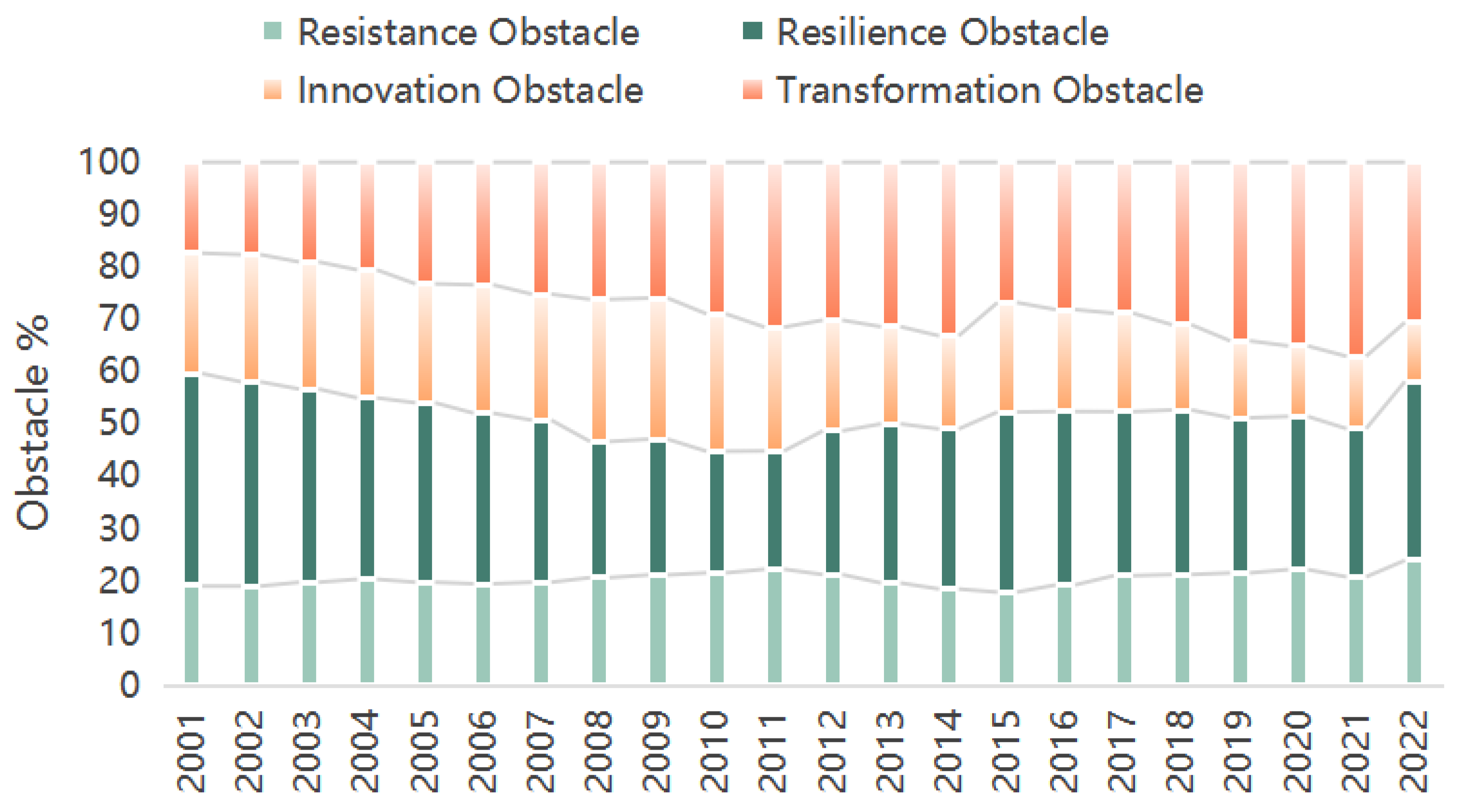

3.2. Analysis of Key Barriers

3.3. Coupling Coordination Analysis

4. Discussion

5. Conclusion and Implications

5.1. Research Conclusions

- (1)

- The resilience of China’s OGI chain is generally on the rise, with obvious phased characteristics. From 2001 to 2022, the resilience of China’s OGI chain increased from 0.23652 to 0.72977, with an average annual growth rate of 5.51%. Although China’s OGI has experienced multiple external shocks and internal adjustments during this period, its overall resilience has significantly improved, indicating that China’s OGI’s ability to cope with shocks is constantly improving.

- (2)

- According to the phased considerations of China’s five-year economic development plan cycle, the resilience of the OGI chain shows different characteristics at different stages. For example, during the 10th Five-Year Plan period, resilience showed a “V” shape, while resilience increased steadily during the 11th and 12th Five-Year Plan periods. This reflects the adaptability of the OGI in responding to fluctuations in international oil prices and changes in domestic economic growth rates. Although there were setbacks in the beginning of the 13th Five-Year Plan and the first two years of the 14th Five-Year Plan, it almost maintained long-term rapid growth. Despite frequent fluctuations in the international oil and gas market, the slowdown in China’s economic growth, and the global spread of COVID-19, the resilience of China’s OGI chain has still significantly increased. This shows that China’s OGI’s ability to resist risk shocks is constantly improving.

- (3)

- There are significant differences in resilience performance in different dimensions. The improvement in the resilience dimension was the most significant, the innovation dimension grew steadily, the resistance dimension was relatively stable, and the transformation dimension increased significantly after 2019. This shows that China’s OGI has made positive progress in technological innovation and low-carbon transformation, but its ability to resist external shocks still needs to be further strengthened.

- (4)

- Key obstacle factors are significant at different stages: Through obstacle analysis, it is found that resilience is the key factor inhibiting the improvement of the resilience of the OGI chain. In particular, CCUS technology and innovative achievements in the downstream of the industrial chain are the main obstacles. In addition, the dependence on natural gas imports and the economic benefits of the industrial chain also have a significant impact on improving resilience.

- (5)

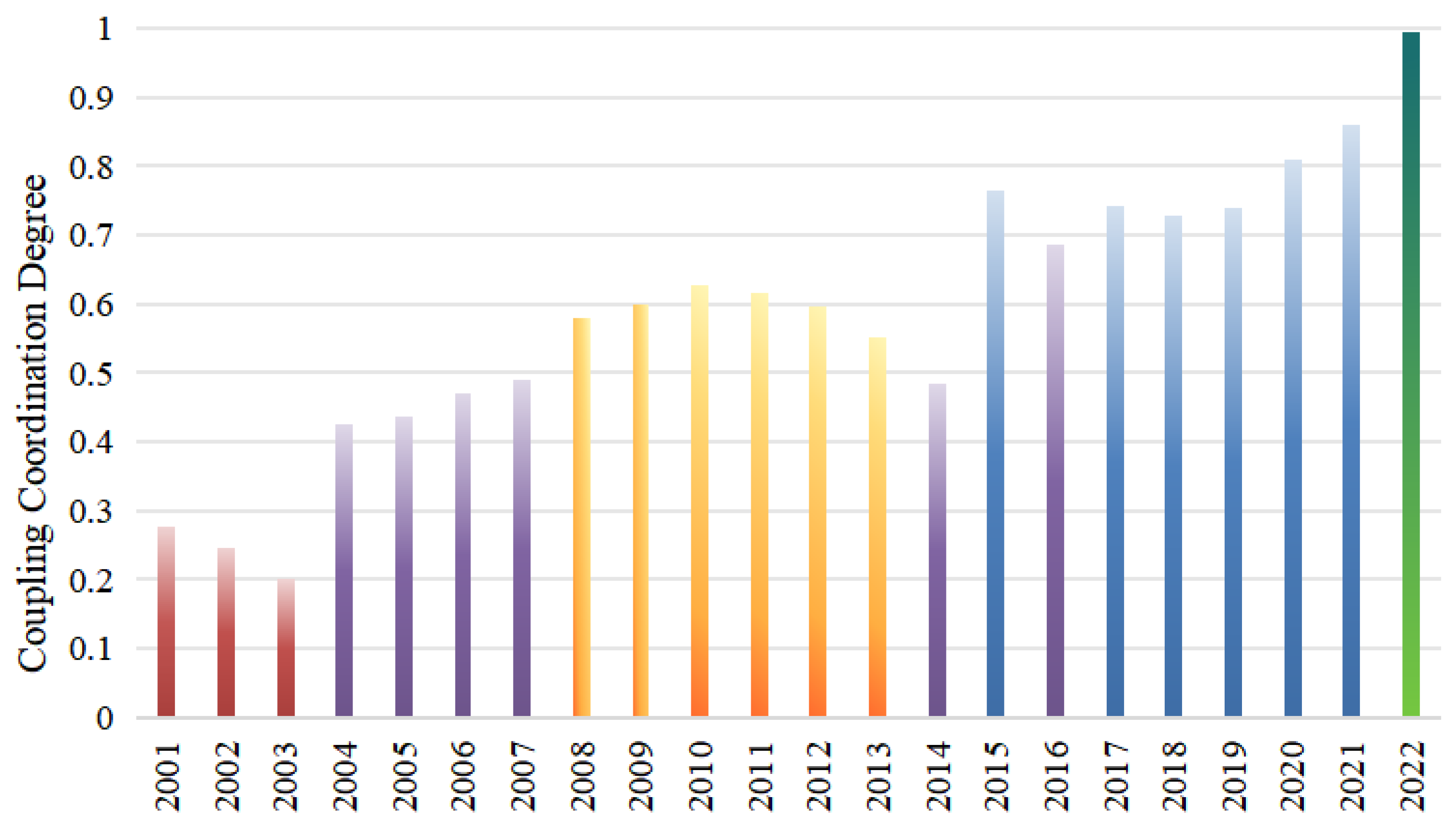

- The CCD of the subsystems of China’s OGI chain has gradually improved. From 2001 to 2022, the CCD between the four subsystems of resistance, resilience, innovation and transformation of China’s OGI chain gradually increased from mild imbalance to moderate coordination, indicating that the synergy between the subsystems continued to increase and the overall ability of the industry chain to cope with risks significantly improved.

5.2. Research Implications

- (1)

- The path to improving the resilience of China’s OGI chain mainly relies on technological innovation and low-carbon transformation. In the future, we should continue to increase the research and development and application of CCUS technology, reduce carbon emission intensity, and promote the transformation of the OGI towards a green and low-carbon direction. The oil and gas import structure should be further optimized to reduce dependence on a single country or region and enhance the risk resistance of the industrial chain.

- (2)

- Government policy support has an important impact on improving the resilience of the OGI chain. 1) Strengthen support for technological innovation. The government should increase financial and policy support for technological innovation in the OGI, especially in the fields of CCUS technology and unconventional oil and gas development, to promote the development of the industrial chain towards high-end and intelligent directions. 2) Optimize energy structure: Under the “dual carbon” goal, we should accelerate the use of clean energy such as natural gas, reduce the proportion of oil consumption, and enhance the diversity and sustainability of the energy structure [Error! Reference source not found.]. 3) Improve the national oil reserve system. Further expand the scale of national oil reserves, enhance the ability to cope with international oil price fluctuations and supply disruptions, and ensure energy security [Error! Reference source not found.,43].

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| OGI | Oil and Gas Industry |

| CCD | Coupling Coordination Degree |

References

- Holling, C.S. (1973). Resilience and Stability of Ecological Systems. Annual Review of Ecology, Evolution, and Systematics, 4, 1-23. [CrossRef]

- Stadtfeld, G. M., & Gruchmann, T. (2023). Dynamic capabilities for supply chain resilience: A meta-review. The International Journal of Logistics Management. [CrossRef]

- Walker, B. W., Holling, C. S., Carpenter, S. R., & Kinzig, A. (2004). Resilience, adaptability and transformability in social-ecological systems. Ecology and Society, 9(2), 5. [CrossRef]

- Pu, G., Zhang, J., Wang, Y., & Li, S. (2022). Effect of supply chain resilience on firm’s sustainable competitive advantage: A dynamic capability perspective. Environmental Science and Pollution Research, 30, 4881–4898. [CrossRef]

- Martin, J., et al. (2012). Environmental indicator report 2012: Ecosystem resilience and resource efficiency in a green economy in Europe. European Environment Agency.

- Pisano, U. (2012). Resilience and sustainable development: Theory of resilience, systems thinking and adaptive governance. European Sustainable Development Network.

- Shishodia, A., et al. (2021). Supply chain resilience: A review, conceptual framework and future research. The International Journal of Logistics Management. [CrossRef]

- Guo Yaohui, Xie Lei & Du Xingduan. (2025). Evaluation of food security resilience: system construction, development differences and barrier analysis. Rural Economy, (01), 29-37.

- Ma, L., et al. (2023). Global industrial chain resilience research: Theory and measurement. Systems, 11(5), 466. [CrossRef]

- Wang Yifan, Yang Hanfang & Wang Xiaosong. (2024). Construction of a new development pattern of dual circulation from the perspective of industrial chain and supply chain security: A study based on an open macro model. International Financial Research, (12), 22-35. [CrossRef]

- Gu Cheng & Zhang Shushan. (2023). Research on the measurement, regional differences and convergence of industrial chain resilience. Economic Problem Exploration, (06), 123-139.

- Zhang Min. (2025). Research on the measurement and influencing factors of resilience of China’s high-tech industrial chain. Statistics and Decision, 41 (03), 118-123. [CrossRef]

- Wu, A. B., et al. (2023). Research on resilience evaluation of coal industrial chain and supply chain based on interval type-2F-PT-TOPSIS. Processes, 11(7), 2080.

- Wang Shouwen, Guo Rui & Wang Shubin. (2025). Research on the coordinated evolution and influencing factors of China’s energy resilience and scientific and technological innovation. Chinese Soft Science, (01), 208-224.

- Ouyang, M., Dueñas-Osorio, L., & Min, X. (2012). A three-stage resilience analysis framework for urban infrastructure systems. Structural Safety, 36–37, 23–31. [CrossRef]

- Wang, Z.Y., Tang, Y.Q., Han, Z.L. & Wang, Y.X. (2022). Measurement of resilience of marine shipping industry chain in coastal provinces of China and its influencing factors. Economic Geography, 42 (07), 117-125. [CrossRef]

- Zuo Zhili, Cheng Jinhua, Guo Haixiang & Zhan Cheng. (2024). Evolution and evaluation of the structural resilience of lithium industry chain trade network. Chinese Journal of Population, Resources and Environment, 34 (02), 155-166.

- Sun Yang, Zhang Luocheng & Yao Shimou. (2017). Evaluation of resilience of cities at prefecture level in the Yangtze River Delta based on the perspective of social ecological system. Chinese Population, Resources and Environment, 27 (08), 151-158.

- Guan W., Xu H., Wu W., Wu X., Zhang H. & Wu L. (2024). Comprehensive and dynamic prediction of urban resilience in Nanjing based on the new development concept. Geographical Science, 44 (04), 681-692. [CrossRef]

- Chang Xin & Han Ping. (2024). Research on the measurement, spatiotemporal evolution and regional differences of resilience of China’s digital industry chain. Statistics and Decision, 40 (16), 28-32. [CrossRef]

- Zhu, Y.G., Zhang, W.F., Wang, D., Dou, S.Q. & Xu, D.Y. (2023). Evaluation of supply chain resilience of China’s copper resource industry chain. Resources Science, 45 (09), 1761-1777.

- Zhao Yu, Ye Shiqi, Yang Cuihong & Hong Yongmiao. (2025). Measurement, correlation and attribution of industrial chain resilience from the perspective of big data. Chinese Journal of Industrial Economics, (02), 61-79. [CrossRef]

- Andrews-Speed, P. (2015). China’s oil and gas industry: Stranded between the plan and the market. The Oxford Institute for Energy Studies.

- Vermeer, E. B. (2015). The global expansion of Chinese oil companies: Political demands, profitability and risks. China Information, 29(1), 3–32. [CrossRef]

- Wang Yukun, Wang Zhaohua & Ding Yueting. Evolution of natural gas development path and resilience measurement of supply and demand system based on system dynamic response. Systems Engineering - Theory and Practice, 1-18.

- Kong, Z. Y., Dong, X. C., & Jiang, Q. Z. (2018). Analysis of energy return on investment of China’s oil and gas production. IOP Conference Series: Earth and Environmental Science, 146, 012052.

- Liu, C. Z., et al. (2023). Energy eco-efficiency in China’s oil and gas resource-based enterprises and its influencing factors: A data envelopment analysis from static and dynamic perspectives. Polish Journal of Environmental Studies, 32(3), 2825–2837. [CrossRef]

- Lyu, C., Lv, Y. L., & Zhang, J. (2024). A model for determining CO2 emission reduction targets in China’s oil and gas industry. SPE International Conference and Exhibition on Health, Safety, Environment, and Sustainability.

- Zhang Chuanping & Liu Le. (2015). System dynamics analysis of oil supply and demand security in my country. Science and Technology Management Research, 35 (20), 143-149.

- Chen, S. (2022). Research on the resilience of my country’s petroleum energy system under the import shortage scenario (PhD dissertation, China University of Mining and Technology). PhD https://link-cnki-net-s.webvpn.nepu.edu.cn/doi/10.27623/d.cnki.gzkyu.2022.000079. [CrossRef]

- Wu Wenjie & Feng Wangyi. (2024). Evaluation of the resilience of China’s oil industry chain and supply chain. Journal of Xi’an Shiyou University (Social Science Edition), 33 (06), 23-30+70.

- Xiao Xingzhi & Li Shaolin. (2022). Industrial chain resilience under major changes: generation logic, practical concerns and policy orientation. Reform, (11), 1-14.

- Cai Wugan & Xu Fengru. (2022). Research on the measurement and spatiotemporal evolution characteristics of China’s industrial resilience. Economic System Reform, (06), 90-97.

- Li Yan. (2023). Improving the resilience and security of my country’s industrial chain and supply chain in accelerating the construction of a new development pattern. Economic Perspectives, (11), 51-58. [CrossRef]

- Xi, X., et al. (2020). Impact of the global mineral trade structure on national economies based on complex network and panel quantile regression analyses. Resources, Conservation and Recycling, 161, 104989. [CrossRef]

- Li Xiaohua. (2022). The supporting foundation of industrial chain resilience: From the perspective of industry rootedness. Gansu Social Sciences, (06), 180-189. [CrossRef]

- Farley, J., & Voinov, A. (2016). Economics, socio-ecological resilience and ecosystem services. Journal of Environmental Management, 183, 389–398. [CrossRef]

- Xiang, K. L., et al. (2022). Evaluation and obstacle degree analysis of low-carbon development level in Fujian province–based on entropy weight TOPSIS method. Frontiers in Energy Research, 10, 966708. [CrossRef]

- Wang Bin & Tang Sheng. (2023). Evaluation of intensive utilization of cultivated land resources in China and diagnosis of barrier factors. Macroeconomic Research, (05), 117-127. [CrossRef]

- Xiao, Cuixian. (2021). Research on comprehensive evaluation of urban resilience in China (PhD dissertation, Jiangxi University of Finance and Economics). PhD https://link-cnki-net-s.webvpn.nepu.edu.cn/doi/10.27175/d.cnki.gjxcu.2021.001855. [CrossRef]

- Li Xiangjun & Li Mengmeng. (2023). Resilience reconstruction plan for key industry supply chains in the United States and its implications. Macroeconomic Management, (03), 83-90. [CrossRef]

- Han, S. Y., et al. (2023). The coupling and coordination degree of urban resilience system: A case study of the Chengdu–Chongqing urban agglomeration. Environmental Impact Assessment Review, 101, 107131. [CrossRef]

- Ni Hongfu, Zhong Daocheng & Fan Zijie. (2024). Measurement, structure and international comparison of China’s industrial chain risk exposure: from the perspective of production chain length. Management World, 40 (04), 1-26+46+27-45. [CrossRef]

| First-level Indicators | Second-level Indicators | Third-level Indicators | Type | Weight | |

|---|---|---|---|---|---|

| Resistance | Resource Guarantee Capability | Ultimate Recoverable Reserves of Oil | A1 | Maximum | 0.0297 |

| Ultimate Recoverable Reserves of Natural Gas | A2 | Maximum | 0.0292 | ||

| Oil Import Dependence | A3 | Minimum | 0.0269 | ||

| Natural Gas Import Dependence | A4 | Minimum | 0.0394 | ||

| Product Supply Capability | Crude Oil Production | A5 | Maximum | 0.0181 | |

| Natural Gas Production | A6 | Maximum | 0.0341 | ||

| Pipeline Cargo Turnover | A7 | Maximum | 0.0365 | ||

| Price Buffer Capability | Price Buffer Capability of Upstream Industry Chain | A8 | Median | 0.0067 | |

| Price Buffer Capability of Downstream Industry Chain | A9 | Median | 0.0058 | ||

| Resilience | Industrial Base | Pipe Length | B1 | Maximum | 0.0295 |

| Number of Upstream Enterprises in The Industry Chain | B2 | Maximum | 0.0352 | ||

| Number of Downstream Enterprises in The Industry Chain | B3 | Maximum | 0.0474 | ||

| Element Base | Upstream Capital Stock of The OGI | B4 | Maximum | 0.0284 | |

| Downstream Capital Stock of The OGI | B5 | Maximum | 0.0342 | ||

| Upstream Labor Stock of The OGI | B6 | Maximum | 0.0289 | ||

| Downstream Labor Stock of The OGI | B7 | Maximum | 0.0296 | ||

| Investment Capacity | Upstream Investment in The OGI | B8 | Maximum | 0.0278 | |

| Downstream Investment inThe OGI | B9 | Maximum | 0.0272 | ||

| Economic Foundation | Main Operating Revenue Per 100 Yuan of Assets of Large-scale Enterprises |

B10 | Maximum | 0.0177 | |

| Return on Total Assets of Industrial Enterprises Above Designated Size | B11 | Maximum | 0.0159 | ||

| Innovation | Innovation Investment | Funding for R&D Investment in the Upstream OGI to Develop New Products | C1 | Maximum | 0.0212 |

| Funding for R&D Investment in the Downstream OGI to Develop New Products | C2 | Maximum | 0.0380 | ||

| Innovation Output | Number of Invention Applications from Upstream Oil and Gas Companies | C3 | Maximum | 0.0370 | |

| Number of Invention Applications from Downstream Oil and Gas Companies | C4 | Maximum | 0.0663 | ||

| Technology Improvement | Refining Rate | C5 | Maximum | 0.0270 | |

| Efficiency of Energy Conversion | C6 | Maximum | 0.0158 | ||

| Transformation | Structural Transformation | The Proportion of Crude Oil Consumption in Chemical Raw Materials and Chemical Products Manufacturing Industry | D1 | Maximum | 0.0183 |

| Low-carbon Transformation | CO2 Emissions - Oil | D2 | Minimum | 0.0239 | |

| CO2 Emissions - Natural Gas | D3 | Minimum | 0.0176 | ||

| Carbon Emission Intensity of Oil | D4 | Minimum | 0.0174 | ||

| Carbon Emission Intensity of Natural Gas | D5 | Minimum | 0.0305 | ||

| Sulfur Dioxide Emissions from Upstream of The Industrial Chain | D6 | Minimum | 0.0059 | ||

| Sulfur Dioxide Emissions from Downstream of The Industrial Chain | D7 | Minimum | 0.0448 | ||

| Annual storage of CO2 by CCUS | D8 | Maximum | 0.0719 | ||

| Extension and Integration of The Industrial Chain | Number of Downstream Enterprises in The Industrial Chain | D9 | Maximum | 0.0162 | |

| Title 1 | NO.1 | NO.2 | NO.3 | NO.4 | NO.5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Index | Obstacle | Index | Obstacle | Index | Obstacle | Index | Obstacle | Index | Obstacle | |

| 2001 | D8 | 9.41 | C4 | 8.63 | B3 | 6.20 | C2 | 4.95 | C3 | 4.85 |

| 2002 | D8 | 9.27 | C4 | 8.48 | B3 | 6.09 | C2 | 4.89 | C3 | 4.72 |

| 2003 | D8 | 9.24 | C4 | 8.42 | B3 | 6.02 | C2 | 4.88 | C3 | 4.65 |

| 2004 | D8 | 10.17 | C4 | 9.03 | B11 | 6.32 | D7 | 5.33 | C3 | 5.05 |

| 2005 | D8 | 10.39 | C4 | 9.19 | B11 | 6.49 | D7 | 5.68 | C3 | 4.85 |

| 2006 | D8 | 10.44 | C4 | 9.81 | B11 | 6.59 | D7 | 5.46 | C2 | 4.85 |

| 2007 | D8 | 10.97 | C4 | 10.38 | B11 | 6.77 | D7 | 5.68 | C3 | 4.78 |

| 2008 | D8 | 12.16 | C4 | 11.39 | B11 | 6.81 | D7 | 6.06 | C3 | 5.25 |

| 2009 | D8 | 12.34 | C4 | 11.23 | B11 | 6.77 | C2 | 5.86 | C7 | 5.22 |

| 2010 | D8 | 13.30 | C4 | 11.68 | B11 | 7.11 | D7 | 6.69 | C2 | 6.06 |

| 2011 | D8 | 11.46 | C4 | 10.87 | D7 | 8.89 | B11 | 7.72 | C2 | 5.49 |

| 2012 | D8 | 10.86 | C4 | 9.32 | D7 | 8.36 | B11 | 6.99 | B10 | 5.23 |

| 2013 | D8 | 10.39 | C4 | 9.00 | D7 | 8.35 | B11 | 6.65 | B5 | 5.40 |

| 2014 | D8 | 10.80 | D7 | 8.62 | C4 | 8.08 | B11 | 6.38 | A4 | 5.56 |

| 2015 | D8 | 10.93 | C4 | 8.87 | B11 | 6.30 | B5 | 5.82 | A4 | 5.80 |

| 2016 | D8 | 10.14 | C4 | 8.51 | A4 | 6.07 | B5 | 5.65 | B11 | 5.60 |

| 2017 | D8 | 11.06 | A4 | 7.31 | C4 | 6.82 | B10 | 6.10 | D5 | 5.87 |

| 2018 | D8 | 11.18 | A4 | 8.34 | B10 | 6.56 | D5 | 6.47 | C4 | 6.37 |

| 2019 | D8 | 11.98 | A4 | 8.79 | B10 | 6.83 | D5 | 6.45 | C5 | 6.13 |

| 2020 | D8 | 13.24 | A4 | 9.33 | B10 | 7.21 | C5 | 6.78 | A3 | 6.75 |

| 2021 | D8 | 12.53 | A4 | 10.96 | B4 | 7.78 | B10 | 7.33 | C5 | 7.19 |

| 2022 | A4 | 13.22 | B4 | 10.70 | B10 | 9.43 | C2 | 9.15 | A3 | 8.87 |

| Grade | Extremely Incoordination | Mild Incoordination |

Primary Coordination |

Mildly Coordination |

High-quality Coordination |

|---|---|---|---|---|---|

| CCD | [0.0,0.3) | [0.3,0.5) | [0.5,0.7) | [0.7,0.9) | [0.9,1.0) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).