3. DigStratCon: A Digital or Technology Strategy Framework

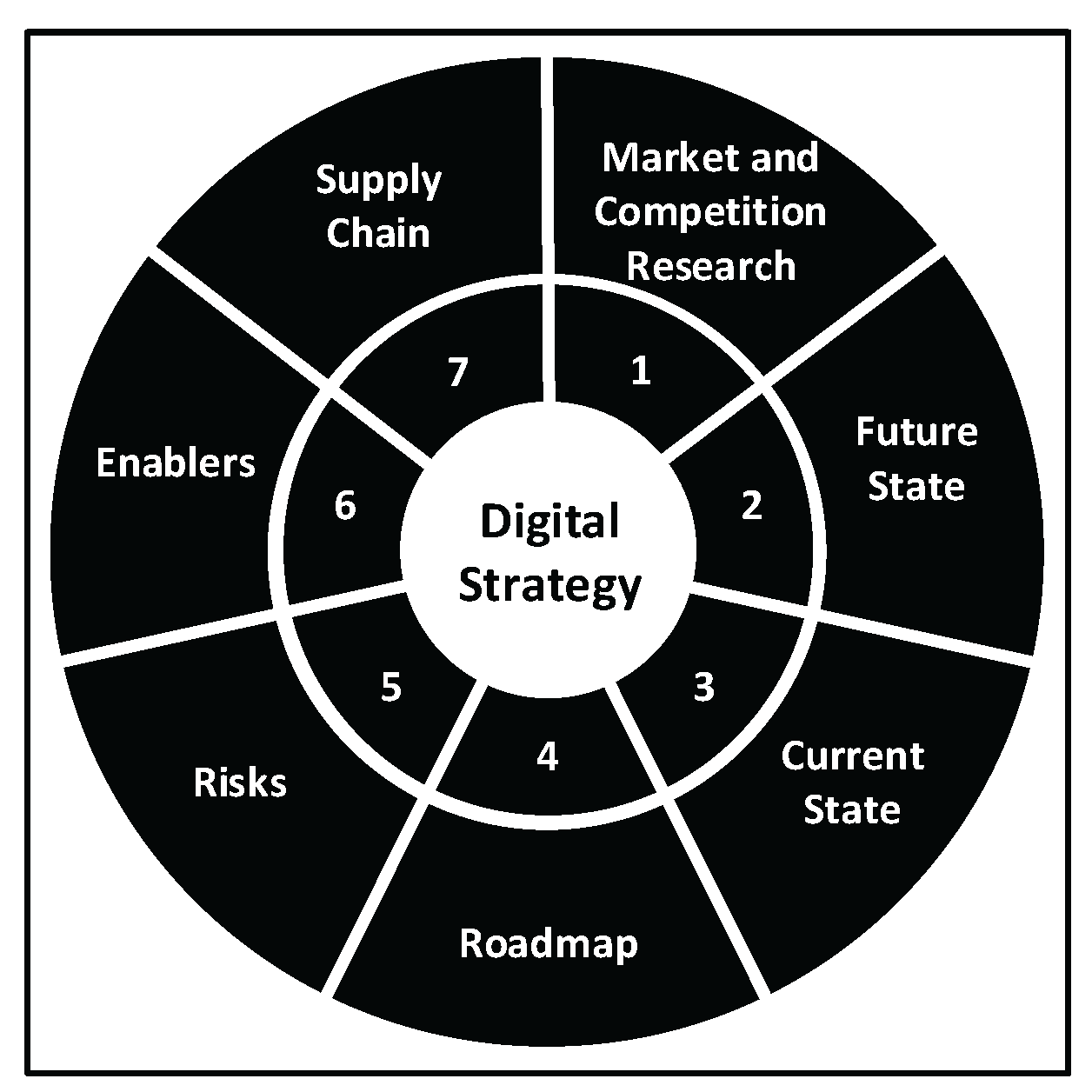

This article proposes DigStratCon as A Digital or Technology Strategy Framework that includes 1) Market and competition research of current applications of digital and technology, equivalent initiatives, standards and regulations, 2) Digital vision or future state, 3) Current state of the digital landscape, 4) Roadmap based on prioritisation based on benefits versus cost and dependencies, 5) Risks 6) Enablers including project management, target operational model, change management and finally 7) Supply chain.

Based on the gap identified within the research background, the innovation provided by DigStratCon consists of its generalisation of the Digital Transformation in seven stages, detaching it from specific functional applications, such as real estate, assets, marketing, products, IT or OT. Therefore, DigStratCon applies to any area within a government, organisation or infrastructure, including Data and AI. By following a standardised structure in the digital strategy, stakeholders are guaranteed that risks are mitigated, areas are holistically considered, and relevant information is easily identified by the next stage of the Digital Transformation, thus promoting digital and knowledge independence. In addition, this approach supports the Minimum Viable Product (MVP) approach in an agile methodology.

Figure 1.

DigStratCon Framework.

Figure 1.

DigStratCon Framework.

3.1. Market and Competition Research

Market and competition research is a vital component of a digital strategy as it provides insights into the current digital trends, user needs, business opportunities, competitor strategies and market landscape. This enhanced commercial understanding supports the development of informed decisions based on benchmark analysis. A useful approach is the assessment of previous and current issues affecting business and competition, and how technology has supported in addressing them, rather than directly recommending technology to be deployed in the market. Every organisation or asset is different; therefore, equivalent issues are normally solved via different solutions. In addition, technology evolves quite rapidly, therefore generating product obsolescence at the hardware and software levels.

Several methods provide research intelligence via the gathering of qualitative and quantitative data. These include direct online surveys to target audiences, interviews, focus groups and workshops, desktop analysis of information retrieved from the Internet, such as case studies or blogs, paid research reports by research and advisory organisations specialised in conducting them, or even hiring employees from the competition.

The data gathered from these methods is subsequently analysed and tailored to the organisation or asset requirements for trend identification, customer preferences, market opportunities, and regulatory updates. This research outcome identifies not only the strengths and weaknesses of the market and the competition based on comparable metrics, but also the organisation conducting the assessment, where weaknesses are then translated into opportunities. The impact of new technology on the customers, suppliers, partners, and competitors is also assessed. These gained insights inform the digital strategy supporting the business objectives and requirements.

3.2. Future State

The definition of the future state in a digital strategy for an asset or organisation involves envisioning where the asset or organisation wants to be in terms of digital capabilities and functionality. This clear and precise vision includes long term goals that align with the overall business strategy, such as environmental or sustainability, supported by Key Performance Indicators (KPIs) based on outcomes, rather than deployment progress, and measurable metrics like time or energy reduction, revenue generation or customer satisfaction. The alignment between business values, goals and technology delivers proactiveness in market opportunities and responsiveness against rapid market changes while staying ahead of the competition.

User centric digital strategies include simple user interfaces where users, including employees, are included in the process of developing the vision of the digital strategy vision. Another benefit of a user centric approach is users understand the benefits of the change.

The future state objectives are divided into smaller initiatives or use cases, according to an expandable Minimum Viable Product (MVP) and Specific, Measurable, Achievable, Relevant, and Time bound (SMART) definitions to provide clear direction. Furthermore, stakeholders covering leadership, team members, and external partners are consulted in the process to ensure their alignment and buy-in while avoiding scope gaps and overlaps.

Use cases relevant to the organisation or asset are enabled by digital systems, which in turn are dependent on the digital architecture or framework that hosts the software and information. These dependencies, therefore, generate a subset of foundational initiatives and use cases that require prioritisation for a successful orchestration of the digital strategy. Direct access to data, applications and systems enhances digital applications while enabling cross functional teams to innovate and improve continually. Modular technology architecture and Commercial Off the Shelf (COTS) applications with specific customisations, both at the cloud or premise level, reduce complexity and improve efficiency.

3.3. Current State

The assessment of the current state of a digital strategy involves a thorough analysis of the organisation or asset's existing digital infrastructure, with its associated management and utilisation processes. For a digital strategy, this includes the revision of the current systems, assets, platforms, applications, and capabilities, in terms of functionality, efficiency, scalability, and integration.

For enhanced user experience, current touch points such as websites, mobile apps or Graphical User Interfaces (GUIs), control panels, and data connectors are evaluated in terms of their performance and applicability. Feedback from customers, user engagement and direct stakeholder evaluations identify the strengths and weaknesses of the current digital use cases, applications and architecture. These current performance metrics are collected, analysed, and recorded to benchmark the effectiveness of the new digital applications and justify Return on Investment (ROI) challenges.

In addition to the current technology stack, its related asset management and processes are assessed and documented. This evaluation includes user team structures, workflows, resource allocation, asset manager and maintainer. Process inefficiencies and resource constraints are identified and their potential impact recorded in a risk register.

3.4. Roadmap

The digital roadmap is an essential tool to guide and align stakeholders throughout the Digital Transformation, ensuring collaboration while reducing conflicts. The different use cases are prioritised based on the quantitative and qualitative assessment of benefits and value to the organisation, including their alignment to the business strategy versus their cost of procurement, installation and maintenance. The technical dependencies between use cases are also accounted for to inject flexibility, agility and dynamism into the roadmap that enables possible future inclusions of changes from the evolution of the new technological advances and lessons learnt during the implementation of the digital strategy.

Gap analyses are conducted based on the target and the current state, and these gaps are accounted for via the use cases in the roadmap. Gaps include technical and organisational capabilities and skills to achieve the full benefits of the Digital Transformation. There are several tools to support the gap analysis elicitation, such as the Strengths, Weaknesses, Opportunities and Threats (SWOT) methodology. Strengths refer to the resources of an organisation that provide an advantage against the market, whereas weaknesses refer to the elements that induce disadvantages from the current state. Opportunities are features that can be exploited to the organisational advantage, while threats are characteristics that can cause issues from the market and competition research, respectively.

The roadmap is detailed with specific timelines, milestones, dependencies, key performance metrics, cash flows, resource allocation and Responsibility, Accountability, Consultation and Information (RACI) matrix for each digital initiative. These RACI roles in the project, system and asset levels are not limited to individuals but also include service providers, organisations or departments. This additional information, rather than a single list of use cases, ensures the successful orchestration of the Digital Transformation in alignment with the different functional units of the organisation and assets. Digital Transformation balances upfront Capital Expenditure (CAPEX) cost with ongoing Operational Expenditure (OPEX) cost based on service fees, cloud subscriptions and maintenance to keep the digital infrastructure up to date and secure, with the associated training and support. Capital investments follow scheduled cash flows for funding allocation and budget agreement for the programme, with contingencies for unexpected costs.

3.5. Risks

Digital Transformation is vulnerable to several risks that are identified, assessed and mitigated. These risks include every threat from the people, processes and technology dimension that has the potential to impact the successful implementation of a digital strategy. Once the risks have been identified via workshops or other research tools, the probability and impact are evaluated to generate a risk profile based on the likelihood and severity of the consequences. Solutions that minimise the probability of the risks while mitigating their impact are included in the roadmap. The residual risks are continuously monitored, and the effectiveness of the mitigation techniques is reviewed.

Risks normally include technology obsolescence, integration compatibility, gaps and overlaps in projects and use cases, organisational siloes, conflicting interests, funding for unplanned expenses, and availability of human and skilled resources.

Compliance with regulations, sustainability, directives and standards between different countries and regions is also incorporated into the risk register. This includes data privacy and protection at data collection, transmission and storage to ensure compliance with data governance policies. Potential changes in regulation, intellectual property infringements, the use of patented products, and antitrust monopolistic practices are also considered based on consultation with legal experts. Additional technology also brings cybersecurity risks that are efficiently mitigated via assessments and treatment plans to protect against data breaches and cyber attacks. Elicited cybersecurity requirements are fed into the overall strategy at the early stages.

3.6. Enablers

Enablers of digital strategies involve several essential methodologies that facilitate the successful Digital Transformation. These methods primarily include project management, change management and Target Operation Models (TOMs). Without these enablers, the application of technology will not directly integrate with the different functions and processes of the organisational or asset.

Project management regularly monitors the progress of the implementation of the digital strategy via its roadmap, releasing the budget when required, tracking risks and making adjustments to the schedule as required. Project management also addresses its governance of the strategy to establish the rules, policies, and controls to ensure compliance and effective implementation. Stakeholders are engaged and informed of the vision, reasons and benefits of the Digital Transformation. Delivery progress is continuously monitored and ready to adapt to deviations, where individuals are held accountable.

Change management supports the organisational transition to the future state, focusing on the skills, competencies, and culture that will successfully implement the digital strategy and drive its adoption among the different teams and users. Other elements to be considered include training, communication, and the address of any possible resistance to change. Change management covering users and processes is communicated and instructed to avoid misunderstandings and promote adoption.

The TOM includes the definition of the new teams, processes, asset capabilities and functions in alignment with the target operational state of the organisation to fully achieve the benefits of the Digital Transformation. The TOM defines and aligns the hierarchy, roles, responsibilities, reporting structure, workflows, and procedures covering the management and operation of the new digital assets delivered by the digital strategy while achieving operational efficiency.

3.7. Supply Chain

The supply chain has a fundamental role in successfully implementing digital strategies and delivering Digital Transformation. The supply chain can provide outsourced downstream services such as project, cost or design management as well as upstream digital assets comprising the manufacturing of hardware and software devices. Therefore, the mapping of the supply chain of different services and assets aligns with the digital strategy. Once the procurement, installation, commissioning and handover stages are accomplished, the supply chain can also provide services covering the maintenance and management of the digital assets that are accounted for.

4. Qualitative Research in Current Digital Strategies

Based on the previous research background and proposed sections for a Digital or Technology Strategy, DigStratCon, this section provides a qualitative assessment of alignment between several UK governments' digital strategies against the DigStratCon structure. These strategies have been chosen based on their public availability, retrieved from their websites and referenced accordingly. The information within this section has been extracted from these strategies. When the DigStratCon concept has been considered, the respective section is marked as “Provided” in the table; otherwise, the mark corresponds to “Lacking”.

Table 1.

Qualitative Analysis of DigStratCon sections in UK Government digital strategies.

Table 1.

Qualitative Analysis of DigStratCon sections in UK Government digital strategies.

| Strategy |

Research |

Digital vision |

Current state |

Roadmap |

Risks |

Enablers |

Supply Chain |

Score |

| DfT 2012 |

Lacking |

Provided |

Provided |

Provided |

Lacking |

Provided |

Provided |

5/7 |

| DWP 2012 |

Lacking |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

6/7 |

| DCMS 2017 |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

7/7 |

| DfE 2019 |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

7/7 |

| MoD 2021 |

Lacking |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

6/7 |

| HMG 2021 |

Lacking |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

6/7 |

| DBEIS 2021 |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

7/7 |

| DDCMS 2022 |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

7/7 |

| HO 2024 |

Lacking |

Provided |

Provided |

Provided |

Lacking |

Provided |

Lacking |

5/7 |

| MoJ 2025 |

Lacking |

Provided |

Provided |

Provided |

Provided |

Lacking |

Lacking |

4/7 |

| Average |

Lacking |

Provided |

Provided |

Provided |

Provided |

Provided |

Provided |

6/7 |

4.1. Department for Transport

The 2012 Department for Transport (DfT) digital strategy covers the scope, the digital aim, what has been delivered, how the DfT will become a more digital department, and the final monitoring of the delivery of the strategy [

71].

Market and competition research: There are justifications for the reasons for going digital, with some research information that confirms the use of the Internet by businesses and online interaction with public sector bodies. However, there is no comparative study or benchmark against other national or international departments or trend analysis.

Digital vision or future state: There is a digital aim covering the provision of online self service, the collection of customer feedback, the use of digital tools to engage with customers, the support via digital help, the digital collaboration within the department and the improvement of DfT ICT systems and platforms. In addition, there are some high level KPIs without figures based on the reduction of the cost of delivery while improving the quality of services. There are no specific KPIs defined or an agile structure of the vision.

Current state of the digital landscape: The DfT has already delivered a list of thirty digital transactions and enquiry services, such as renewing car tax or booking driving tests, with services including Transport Direct, Web tools, computerised Ministry of Transport tests, and online blue badges. Opportunities are highlighted, such as some services not being online, the need to update technical platforms and the lack of systems integrations. In addition, some successful case studies include the DVLA Electronic Vehicle Licensing, The use of social media by the Driving Standards Agency to promote the Highway Code, The use of a web chat to engage with customers, the help of customers to get online via the Driver and Vehicle Licensing Agency silver surfer event, cost savings via YouTube, and engaging with younger drivers via social media. There are no details of the current ICT, technology infrastructure, service providers, or suppliers for these.

Roadmap: Initiatives are defined including the delivery of a common digital service standard across the department via Application Programming Interfaces (APIs), the creation of a common and simple user experience, the redesign of DfT contact centres, the provision of assisted digital services, the use of web chat, the migration of customer contacts to digital channels, the automation of the collection of digital performance data, the make of all new transactions digital by default, the definition of entry requirements for digital services to the minimum level required for cybersecurity, the development of a new identity assurance for DfT customers. There are no priorities on these activities, dependencies between them, nor an assessment of value versus cost.

Risks: There is no risk assessment or proposed mitigations to deliver this strategy.

Enablers: The removal of barriers that make it difficult for people to access, operate and pay digitally, the collaboration with the Government Digital Service to identify changes in legislation, the identification of individuals who have high end digital skills that could be deployed, the setup of digital skills training in place, the revision of the organisational boundaries. There are no estimated costs or cash flows. There is no TOM or changes to the organisational structure to embed the changes delivered by the strategy.

Supply chain: Third parties and intermediaries have a role to support DfT to deliver services digitally through their websites by providing them access via APIs and open data standards for all new procurements. The Cabinet Office will provide lean and lightweight procurement processes to incorporate more SMEs. There are no specific details about the services or assets that will be provided by the supply chain or delivered in-house.

4.2. Department for Work and Pensions

The 2012 Department for Work and Pensions (DWP) digital strategy includes its purpose, users, existing digital services, new services, the delivery of digital services, changing how policy is made and transforming the methods of work [

72].

Market and competition research: There is no market analysis or competition assessment based on national or international case studies.

Digital vision or future state: High quality digital services built around the needs of users, the avoidance of duplication, the enablement of improved conversations between users and the department, the seamless integration with other digital and non-digital channels, the continuous improvement based on user feedback and analytics, working across different benefits, the engineered compatibility with a broad range of devices, the protection of personal data from cyber theft and taxpayers’ money from fraud, the simpler and faster access and use of services.

Current state of the digital landscape: The current welfare system is very complex and fragmented based on outdated legacy systems, leading to growing costs and established deprivation areas. Some current systems are already online, such as Jobseeker’s Allowance, State Pension, Carer’s Allowance, Benefits Adviser, My Benefits Online and Universal Jobmatch. On several occasions, even where a service has a digital front end interface, the underpinning back office processes are still manual.

Roadmap: The approach of agility, continuous improvement and user feedback to design services, the delivery of three exemplar services namely universal credit, personal independence payment and carer’s allowance; the redesign of services handling over 100,000 transactions a year, collaboration with Government Digital Service to create a digital standard for all services, the production of a standard for management information, alignment with policymakers and delivery experts. There are no dependencies or prioritisation on the activities arranged in a schedule.

Risks: The main threat identified is the time and cost to implement technology solutions in a complex organisation; however, new ways of working established in the government ICT and digital strategies enable faster development of new systems at a lower cost. In addition, other risks include the security of millions of citizens’ details, the protection of taxpayers’ money from fraud and theft based on identity and security and the dependence on obsolete legacy systems.

Enablers: Support staff and users with the required digital skills, partnerships with other government departments and organisations to enhance digital skills between disadvantaged users, the appointment of a digital champion at the board level to coordinate and direct the digital strategy, the assignation of accountability to skilled and experienced managers, the identification of digital gaps in the technical capabilities within the different departments and resolve these via external recruitment and internal development, the change of legislation and internal processes that stop the transformation of manual services into online. There are no details about costs or cash flows.

Supply chain: collaboration with a broad variety of suppliers including more SMEs, the reassessment of contracts to enable flexible services with a faster implementation, scalability and upgrade, the steer on providers to deliver better value, higher quality services, the use of common technology platforms and working with other departments for the development of combined services. There are two opportunities for DWP to potentially improve the user experience, subject to legal considerations: enabling the supply to access DWP data or enabling the supply chain to add to DWP databases.

4.3. Department for Digital, Culture, Media and Sport

The 2017 Department for Culture, Media and Sport (DCMS) Next Generation Mobile Technologies: A 5G Strategy for the UK covers the ambition, the development of the economic case, effective regulation, governance and local policy frameworks, coverage and capacity, safe and secure deployment of 5G, spectrum, technology and standards [

73].

Market and competition research: Other countries are already providing 5G with an intrinsic lead in the development of some components of 5G, such as hardware. Tests and trials on 5G networks are already set in Japan, South Korea, the United States, China, Australia, and Sweden. The strategy leverages the UK’s existing strengths, focusing on systems integration, interoperability, and cybersecurity.

Digital vision or future state: The acceleration of the deployment of 5G networks, the maximisation of its associated productivity and efficiency and the creation of new national and international opportunities for UK businesses while promoting inward investment. The expected 5G capabilities are themed as massive machine type communications, ultra reliable and low latency communications, and enhanced mobile broadband. There are no specific KPIs for 5G coverage or fibre rollout.

Current state of the digital landscape: There are several 5G related projects currently in the UK at different stages, from technical test bed trials for network capabilities to the development of new use cases focused on smart cities and IoT. These projects are also developing expertise and commitment to the digital economy in regions, local areas and industry. In addition, two reports have already been commissioned for informed support in the strategy: the National Infrastructure Commission (NIC) and the Future Communications Challenge Group (FCCG).

Roadmap: The creation of a national 5G innovation network for trialing and demonstration of 5G use cases in collaboration with industry and public sector bodies, the establishment of a centre of 5G expertise in the DCMS, the efficient enablement and support of 5G networks from regulatory and planning frameworks, the funding of local projects to increase the delivery of fibre broadband networks. The collaboration with Ofcom includes several activities to ensure that network operators get access to fibre ducts and poles while identifying unnecessary barriers to infrastructure sharing, reporting coverage based on services experienced by customers including roads and rail, to assess the feasibility of sharing 5G frequencies within the spectrum, to consider methods for the cost reduction of deployment and operation of the network and digital infrastructure. The engagement with appropriate Standards Developing Organisations (SDOs) to develop 5G Standards, the commission of a 5G mapping tool in network planning for small cells, the assessment of how the government buildings and land, and local authorities are enabled by the right planning for mobile infrastructure development, the collaboration with the National Cyber Security Centre (NCSC) to ensure cybersecurity. However, there is no prioritisation of activities, dependencies or time scales.

Risks: Challenges and risks are provided, such as the interference in the spectrum, private sector funding, access to land to deploy base stations, antennas and fibre cables, and the share of infrastructure and assets between operators. However, there is no exhaustive list of risks and mitigations in the strategy.

Enablers: the consideration for strategic policy statements in the telecommunications sector, the establishment of a working group with local areas, government departments, landowners and industry to capture requirements for the deployment of 5G networks, the establishment of a new Digital Infrastructure Officials Group to coordinate public projects and include the long term capacity requirements of the telecommunications networks and 5G, the investigation of the skills requirements by monitoring labour market trends to assess availability, the establishment of a digital training and support framework to procure the digital support for citizens. However, the governance and management of the strategy, including the TOM, are not provided, nor are cash flows or the overall budget.

Supply chain: Key collaborator in global 5G developments to develop international links, collaboration with industry, Ofcom, academia, local area partnerships, and the assessment of commercial delivery models.

4.4. Department for Education

The 2019 Department for Education (DfE) strategy covers the vision for education technology, the security of the digital infrastructure, the improvement of digital capabilities and skills, the support of effective procurement, the promotion of digital safety, the expansion of a dynamic EdTech business, the support of innovation through EdTech challenges, and the improvement of the DfE digital services [

74].

Market and competition research: There are references to the UK as a world leader in education, while acknowledging more work is needed to compete against the US, Australia, and Scandinavian countries. However, there are no international benchmarks against equivalent departments or trend analysis.

Digital vision or future state: The support of the education sector via technology, the reduction of workload, the promotion of efficiencies, the removal of obstacles to education and the drive for enhancements in educational outcomes. Five opportunities where technology provides benefits cover administration processes, assessment, teaching practices, progressing professional development, and learning throughout life. There are no specific KPIs to measure progress against this vision.

Current state of the digital landscape: Recognition of present barriers such as slow Internet and outdated internal network equipment and devices, the requirement for greater digital capability and skills, the lack of awareness of available tools and expertise, digital procurement capabilities, concerns about privacy, safety, and data security. In addition, specific challenges which could be solved by technology include administration, assessment, teaching practice, continued professional development, and learning throughout life. In addition, several case studies are presented through the strategy. There is no exhaustive information about current technology, infrastructure or service providers, except for a few examples.

Roadmap: Provision of broadband infrastructure to schools, the continuation of the support for Jisc to deliver fibre connections via their Janet network, the migration to the cloud from current legacy IT systems and storage, and the provision of digital safety and security. These activities are independent, with no dependencies, priorities or benefits versus cost analysis.

Risks: The strategy acknowledges that several technology initiatives have unsuccessfully delivered value for money or have not provided a positive impact due to their lack of use or integration. There is no exhaustive list of specific risks and mitigations to forecast issues in delivering the strategy.

Enablers: Guidance documents to steer purchasers through main considerations when implementing their technology infrastructure to get the best value, collaboration with the Chartered College of Teaching to launch online courses for teachers and headteachers, the launch of a demonstrator network to leverage existing expertise in the sector while providing peer to peer support and training, the partnership with the British Educational Suppliers Association (BESA) to deliver the LearnEd programme, showcasing teachers, education leaders and industry most valuable practice and products, the encouragement to education leaders to expand their technology vision, the continuation of professional development to staff. There are no details about project or programme management, governance, target operational models, accountability, budgets or cash flows.

Supply chain: the development of pre negotiated and recommended buying deals from different suppliers, the trial of the LendEd service for education technology software via trying before purchasing, the facilitation of better online marketplace to buy with confidence based on an efficient and effective route to market, the collaboration with industry, research and education groups to establish small testbeds, development, piloting and evaluation of technology, the collaboration with EdTech investors to ensure access to government procurement facilities, the British Business Bank’s (BBB) angel, venture and patient capital programmes, the collaboration with the EdTech Leadership Group and main partners to engage with incubators and accelerators while ensuring the awareness of opportunities.

4.5. Ministry of Defence

The 2021 Ministry of Defence (MoD) digital strategy is divided into a strategy and operating model section [

75]. The strategy section presents the vision and strategic outcomes, digital backbone, people process, data and technology, followed by an implementation of the strategy, delivery, investment and benefits. On the other side, the operating model section defines the accountabilities and authorities, the construction and processes of the operating model, senior leadership accountabilities and final governance.

Market and competition research: The strategy acknowledges that the world is changing, and this change is accelerated by technology such as Automation, AI, Autonomous Vehicles, Virtual Reality, and Synthetic Environments. However, there is no provision for market competition and research in terms of how other countries are focusing on defence and research about trends.

Digital vision or future state: The vision is based on five outcomes; data exploitation at scale and speed as a strategic asset, the right talent in a single unified function with UK industry and academia, defence systems and assets are secured by design with dynamic risk management based on intelligence, technology platform to support integration, interoperability and operational speed, digital delivery capability applicable to the requirements, easy to use, reliable, cost effective and delivered on time. There are no KPIs to measure progress and success, or a gradual vision based on milestones.

Current state of the digital landscape: Fixed data in siloes, critical skill gaps, technology fragmentation, obsolescence and industrial age processes and culture. There is no clear distinction between current and new structures and processes.

Roadmap: There is a north star diagram with a set of activities that the five outcomes and the people, process, data and technology areas across five years. Specific activities include the delivery of the Ministry of Defence data strategy, the development of the data fundamentals, the embedded data controls and governance, the drive of advanced data exploitation, the development of the hyperscale Cloud, the deployment of the next generation networks and the creation of advanced user services. However, there are no dependencies between these activities or a benefit versus cost assessment.

Risks: Some constraints include the security of the required investment across several years, the legacy of existing commercial agreements, the interoperability of current platforms and the capability to influence solutions from partners or industry. There is no risk specific assessment and mitigations that cover the delivery of the strategy.

Enablers: The transformation of the digital workforce to deliver the digital backbone, the creation of an interoperable workforce, the enabling of a digital mindset across defence, the strengthening of our management processes and controls, the collaboration between UKStratCom and the Digital CIOs across Defence, a digital operational model based on a Chief Information Officer and senior leadership accountabilities and authorities including defence CIOs, Digital Function Directorates, Demand capture from commissioning customers and Service Delivery. There are no cost details or cash flow information.

Supply chain: Partnerships with front line commands, functions and their digital leaders to support their Digital Transformation via digital capability and policy guidance. The establishment of a digital foundry in partnership with Her Majesty's Government, Defence, Equipment & Support, Defence Science and Technology, industry and academia. The foundry incorporates the AI delivery centre while combining additional centres of expertise in data, automation and AI with new teams and skills. There are no clear demarcations of responsibility between the solutions and products delivered by the MoD and the supply chain.

4.6. Her Majesty's Government

The 2021 Her Majesty’s Government (HMG) AI Strategy presents a ten year vision with opportunities and challenges based on three pillars: The investment in the long term requirements of the AI sector, the assurance that AI brings benefits to every sector and region, and the effective governance of AI [

76].

Market and competition research: No international market and competition research context assesses how other countries are implementing AI.

Digital vision or future state: The digital vision is based on three foundations. Investment in the AI sector is expected to raise the number of people that work with AI, the availability of data and computing resources and the provision of finance and clients to expand sectors. The distribution of AI across the economy to benefit every region, business, and sector. The development of a regulatory and governance framework supporting innovation while protecting the public. There are no KPIs to measure progress against the vision.

Current state of the digital landscape: There are already several initiatives including the Tech Nation Applied AI programme, the Office for National Statistics Data Science Campus; the Crown Commercial Service’s public sector AI procurement portal, the Department for International Trade AI task force, the AI Council, the Office for Artificial Intelligence, the Centre for Data Ethics and Innovation. In addition, there are various AI standardisation initiatives covering the International Standardisation Organisation (ISO) and the International Electrotechnical Commission (IEC) and engagement in the Industry Specification Group on Securing AI at the European Telecommunications Standards Institute (ETSI).

Roadmap: There is a roadmap with a set of activities based on the three pillars, short term for three months, medium term for six months and long term for the next twelve months and beyond. The publication of a framework to enable improved data availability within the wider economy, the consultation on the role for a National Cyber Physical Infrastructure Framework, the implementation of the US-UK cooperation in AI Research & Development, the assessment of the compute capacity supporting AI, the publication of open and machine readable datasets for AI models, the launch of a new National AI Research and Innovation Programme, the use of National Security and Investment Act for national security protection, the development of the National Strategy for AI driven technology in Health and Social Care via the National Health Service AI Lab, the publication of the Defence AI Strategy via the Ministry of Defense, the consultation on copyright and patents for AI via the Intellectual Property Office, the analysis on algorithmic transparency, the piloting of an AI Standards hub to engage globally in AI standardisation, the update guidance on AI ethics and safety in the public sector with the Alan Turing Institute to update. There are no dependencies or prioritisation on the roadmap.

Risks: AI systems’ autonomy brings unique risks for liability and fairness, as well as safety, including the ownership of creative content, transparency and bias from decisions made by AI algorithms. Larger infrastructure requirements for AI applications incur expensive high performance computing resources and large data sets. Several specialised skills are required to develop, validate and deploy AI algorithms. Wide and expensive commercialisation and product development journey due to R&D. Inconsistent or even contradictory methods for AI implementation across sectors, the overlap among regulatory mandates, the potential limitation of AI from existing regulation, the increasing multi-stakeholder forums internationally and global standardisation.

Enablers: The development of AI, data science and digital skills via the Department for Education’s Skills Bootcamps, the research into the skills to use AI, the support of the National Centre for Computing Education to ensure AI programmes for schools are accessible, the support of people to perform AI jobs via career pathways, new visa regimes to attract the best AI talent, the backing of diversity in AI, the development of a diverse and skilled workforce, the publication of the Centre for Data Ethics and Innovation AI assurance roadmap, the determination of the role for data protection in wider AI governance, the creation of a white paper on a pro innovation national position for the governance regulation of AI. There is clear governance on how AI is governed; however, the governance of the AI strategy, including budgets and cash flows, is missing.

Supply chain: The inclusion of trade deal provisions in AI technology, the evaluation of private funding requirements and challenges of AI startups, the review of the semiconductor supply chains, the increment of the workforce from a diverse labour supply, the generation of an AI ecosystem, the collaboration with industry leaders to develop a shared understanding and vision, the collaboration with global partners on shared Research & Development challenges, the leverage of public and pre commercial procurement following the development of AI, the evaluation of the funding for organisations developing AI technology.

4.7. Department for Business, Energy and Industrial Strategy

The 2021 Department for Business, Energy and Industrial Strategy digital strategy covers the reasons and benefits for the digitalisation of the energy system, the current journey, the barriers, the activities and the final delivery of the strategy and action plan [

77].

Market and competition research: The strategy is the first in the UK and one of the first in the world. There is no international benchmark or lessons learnt from other countries in their energy sector digitalisation effort.

Digital vision or future state: The decarbonisation of the energy system at the minimum cost to taxpayers and consumers, the creation of a fair deal for consumers, and the stimulation of economic growth across all sectors. There are no established KPIs to measure progress.

Current state of the digital landscape: The government and Ofgem published a combined smart systems and flexibility plan, where energy data is an essential pillar for the decarbonisation of the energy system. In addition, an independent energy data task force provided four recommendations covering the share and distribution of digital datasets, the development of a single searchable platform to make datasets more visible to stakeholders, the enhancement of the alignment for asset registration, and the creation of a system infrastructure map. To implement them, Ofgem and Innovate UK created “Modernising Energy: Digitalisation”, a partnership for collaboration between policymakers, regulators and innovation funders in the sector. Ofgem demanded energy network companies publish digitalisation strategies and action plans and comply with energy data best practices. The Energy Networks Association developed the energy data request application and the data triage playbook standard based on open data principles. The UK Geospatial Strategy and the National Infrastructure Strategy created the National Underground Asset Register to access data across the water, electricity, gas, telecommunications and transport sectors. The creation of the Centre for Digital Built Britain to develop an Information Management Framework for common tools, frameworks and languages by which digital twins connect, share and integrate data. The Local Energy Data Innovation initiative identifies challenges experienced by stakeholders in their energy systems that energy data can resolve.

Roadmap: The development of standards and regulatory frameworks for open and accessible energy data collection and applications, the development of new data governance, the assurance of data privacy and cybersecurity in market frameworks and institutional designs while increasing market access and services, and the assurance of access from system operators to all energy assets. In addition, the development of the data and digitalisation strategic change programme by Ofgem to simplify the Digital Transformation of the regulator in addition to the implementation of an agile regulatory framework, the integration of data and digitalisation responsibilities into licenses, increment the monitoring of the network via price controls, the transformation of asset visibility, and the identification of a resolution to small scale asset registration. There are no dependencies, costs or cash flows.

Risks: The present energy system hardly considers data as a public asset; therefore, it is frequently underutilised or not collected, resulting in datasets of insufficient quality. The change to digitalise the energy system includes the integration of new energy assets with possible differences of ownership, the collaboration between multiple large and likely competing organisations, and new infrastructure to manage and predict secure data flows. In addition, a rapidly changing landscape and perceived potential first mover disadvantages can default businesses to data gathering rather than data sharing without the right incentives. The lack of investment in critical elements of practical digital infrastructure is due to a respective lack of standardisation. The improved connectivity between energy production, transmission and distribution creates new cybersecurity vulnerabilities to must be avoided with robust cybersecurity and data privacy practices. Social inequality and unfairness in how people are treated, digital inclusion, and ethical practices via data ethics.

Enablers: The government and Ofgem will lead and steer through the adoption and promotion of a partnership to deliver a digitalised energy system, develop a shared vision and agree on a delivery approach. Data literacy and skills to monitor and run a complex distributed network via modern data collection, data analysis and digital control systems. The launch of the Green Jobs Taskforce to partner with businesses, skills providers, and trade unions. The government and Ofgem will confirm whether intended outcomes have been achieved or develop corrective actions, as an essential part of the policy cycle, via their respective governance. The new Smart Systems and Flexibility Plan is the first step of a systematic monitoring framework to identify the expected outcomes and establish monitoring indicators to measure progress.

Supply chain: The provision of a digital platform for entrepreneurs and innovators to interact with the energy system and integrate with wider national infrastructure and services. The government and Ofgem will coordinate change via industry forums for market participants and stakeholders to take advantage of digitalisation opportunities, the development of a catalogue of projects on energy data prototypes, the funding of an Energy Digitalisation Taskforce, and the completion of the Open Networks Project. This project will simplify and align data collection, build foundational capabilities that enable sector wide visibility of and access to data, stimulate the market and deliver real world solutions.

4.8. UK Digital Strategy Department for Digital, Culture, Media & Sport

The 2022 UK digital strategy from the Department for Digital, Culture, Media & Sport is divided into digital pillars, ideas and intellectual property, digital skills and talent, the finance of the digital growth, spreading prosperity and levelling up across the whole UK and improving the UK’s place in the world [

78].

Market and competition research: References and benchmarks against other countries, such as the total impact of the data economy, cumulative unicorns, and venture capital investment. There are no new use cases or lessons learnt from other countries that could develop into a competitive advantage.

Digital vision or future state: The strengthening of the science and technological position based on four foundations of the digital economy. The provision of a robust and secure digital infrastructure, the liberation of power from data, the gentle innovation advocates a regulatory framework, and the secure digital environment. There are specific KPIs to measure progress.

Current state of the digital landscape: Improvement on digital infrastructure with increasing superfast gigabit capable broadband coverage where a large proportion of the UK area is already covered by a strong 4G signal, the data driven economy is also expanding based on a dedicated national data strategy, a competent pool of UK and global talent, large jobs in the digital sector, a thriving startup scene with several unicorns, the establishment of an international venture capital investment community, investment on digital Research & Development (R&D), the lowest corporation tax rate in the G7 and several regulatory streams. Several case studies support the current state, such as the product security and telecommunications infrastructure bill, and the local digital skills partnership.

Roadmap: The support of universities to develop new ideas and technology, the innovation in the National Health Service, the initial and increasing investment, the support of the UK’s businesses and public services through digital adoption, the improvement of public services, the levelling up of the regional economies, the support of net zero. There are no dependencies between activities, time scales and cash flow analysis.

Risks: The development of a robust risk management framework within the national data strategy for the data storage and processing infrastructure, promoting security and resilience. The National Security and Investment Act ensures the continuous, predictable and transparent flow of investment while protecting national security. There are no risks and mitigations that cover the successful application of the strategy.

Enablers: the reinforcement of digital education activities, the increment of awareness for options into digital professions, the development of advanced digital skills, the collaboration with the private and third party sectors, and the attraction of the finest skilled pool. There is no governance or TOM to supervise the implementation of the digital strategy.

Supply chain: the incentivisation of business to innovate, the fostering of the UK as the global tech Initial Public Offering (IPO) capital, the seed investment for initial and increasing investment, the easier access to public procurement opportunities, the promotion of global leadership governance and values, the sponsoring of digital exports and inward investment, the establishment of international partnerships to achieve the vision of the Strategy.

4.9. Digital, Data & Technology Home Office

The 2024 Home Office Digital, Data & Technology Strategy presents the Home Office Digital, Data & Technology organisation, principles for change, the benefits of these principles and how these will be implemented [

79].

Market and competition research: There is no market or competition research or trends to contextualise this strategy.

Digital vision or future state: Six principles for change include the application of converged technology, the development of shared technology products, the use of product centric over programme centric, the embracement of innovation, the delivery of efficiency at scale, and the use of data to improve decisions. Each principle is supported by a benefit and how the principle will be implemented based on accessible, scalable and maintainable technology, including open source and cloud solutions. There are no specific KPIs to measure improvement in service delivery.

Current state of the digital landscape: There are several instances for search, container and cloud hosting applications, alongside an abundance of equivalent software solutions. In addition, each home office business area already has systems, teams and products at different scales and maturity levels. However, there are no specific details about those services, systems and duplications across the departments.

Roadmap: The development of convergence plans and roadmap for every system, the development of Open Standards based on interoperability, the creation of compulsory registers for products, solutions and technology, the technology convergence in operational activities, the creation of a development approach based on reuse, the investment in documentation and knowledge management, the identification of the best initiatives for shared technology products, the share of guidance, standards and best practice, the development of federated data architecture, the creation of compulsory data storage, the enhancement of data search processes via metadata, the increased use of APIs, the development of new reference data architecture models, the creation of a central DDaT innovation team. Although there are detailed activities, there is no prioritisation, time scales, dependencies or value versus cost analysis.

Risks: There is no specific risk assessment or proposed mitigations with an impact on delivering this strategy.

Enablers: The setup of autonomous, multi-skilled, long lived product teams, the development of a user centric ‘test and learn’ approach, the description of product centric data driven roles and methods of working, the closer collaboration with other government organisations, bold leadership, the Empowerment of individuals via clear roles and responsibilities and continuing professional development plans, the creation of a Technical Design Authority for governance, continuous improvement, and informed decision making to enhance quality while reducing risk aligned with Home Office Business Design Authority and Home Office Business Design Principles, the alignment with Government Internal Audit Agency, Government Digital Service and Equality and Human Rights Commission. However, there are no specific target operational models, costs, schedules or cash flows associated with the strategy.

Supply chain: External platforms procured either directly from the government or third party suppliers, the aggregation of supplier contracts to increase buying power. However, there is no specific information about the systems or services that could be delivered by the Home Office or third party suppliers.

4.10. Ministry of Justice

The 2025 Ministry of Justice (MoJ) digital strategy covers strategic themes, the outcomes the MoJ will be delivering, measuring success, and changing the user experience [

80].

Market and competition research: There is no assessment of similar organisations facing equivalent issues to the MoJ, or research about novel use cases that use technology to support justice.

Digital vision or future state: Three strategic themes for the MoJ becoming a more flexible organisation, reducing reliance on legacy systems, driven by data for decision making from paper to digital, and led by users on a simpler, faster and better service for everyone, including criminals. There are no specific KPIs except for the security, de-risk and health visibility of the top 45 business critical systems.

Current state of the digital landscape: The are currently large, complex legacy systems that inhibit change, frustrate users and disable data extraction. No specific details describe the existing systems and processes.

Roadmap: The delivery of simple, clear, fast services for probation staff, the replacement of legacy systems with digital prison services that support rehabilitation, the simplification and reliable access to legal aid services, the creation of a modern lasting power of attorney, the provision of direct and secure access to compensation, the delivery and maintenance of sustainable core technology services and workplace digital experiences, the development of proportionate functional API standards, the modernisation and upgrade courts and tribunals services. There are no priorities, dependencies or benefits versus costs associated with the several activities.

Risks: Technical debt, including poorly understood monolithic legacy systems, limited funding, people and capacity to change, and delivery within complex legal policies and frameworks. There are no specific risks or mitigations.

Enablers: The development of a strong digital & technology capability based on multidisciplinary product and service teams, training and upskilling staff. The management of the change, project, cost and funding allocation and TOM are not defined.

Supply chain: There are no details about the supply chain, and which services or applications will be outsourced to third party providers.