3. Results And Discussion

3.1. Growth of Factories in RMG Industry

Factories and exports grew at the same rate. Which was consistent with exports. The number of RMG factories has increased comparatively in the last 3 Times Period. They are following-

o 1st period (1990-2001)

o 2nd period (2001-2012)

o 3rd period (2012-2023)

Table 1.

Number of garment factories (1st period).

Table 1.

Number of garment factories (1st period).

| Year |

Number of garment factories |

| 1990-1991 |

834 |

| 1991-1992 |

1163 |

| 1992-1993 |

1537 |

| 1993-1994 |

1839 |

| 1994-1995 |

2182 |

| 1995-1996 |

2353 |

| 1996-1997 |

2503 |

| 1998-1999 |

2726 |

| 1999-2000 |

2963 |

| 2000-2001 |

3200 |

Table 2.

Number of garment factories (2nd period).

Table 2.

Number of garment factories (2nd period).

| 2001-2002 |

3480 |

| 2002-2003 |

3618 |

| 2003-2004 |

3760 |

| 2004-2005 |

3957 |

| 2005-2006 |

4107 |

| 2006-2007 |

4220 |

| 2007-2008 |

4490 |

| 2008-2009 |

4743 |

| 2009-2010 |

4925 |

| 2010-2011 |

5150 |

| 2011-2012 |

5400 |

Table 3.

Number of garment factories (3rd period).

Table 3.

Number of garment factories (3rd period).

| Year |

Number of garment factories |

| 2012-2013 |

5876 |

| 2013-2014 |

4222 |

| 2014-2015 |

4296 |

| 2015-2016 |

4328 |

| 2016-2017 |

4482 |

| 2017-2018 |

4560 |

| 2018-2019 |

4621 |

| 2019-2020 |

4620 |

| 2020-2021 |

4576 |

| 2021-2022 |

4580 |

| 2022-2023 |

4790 |

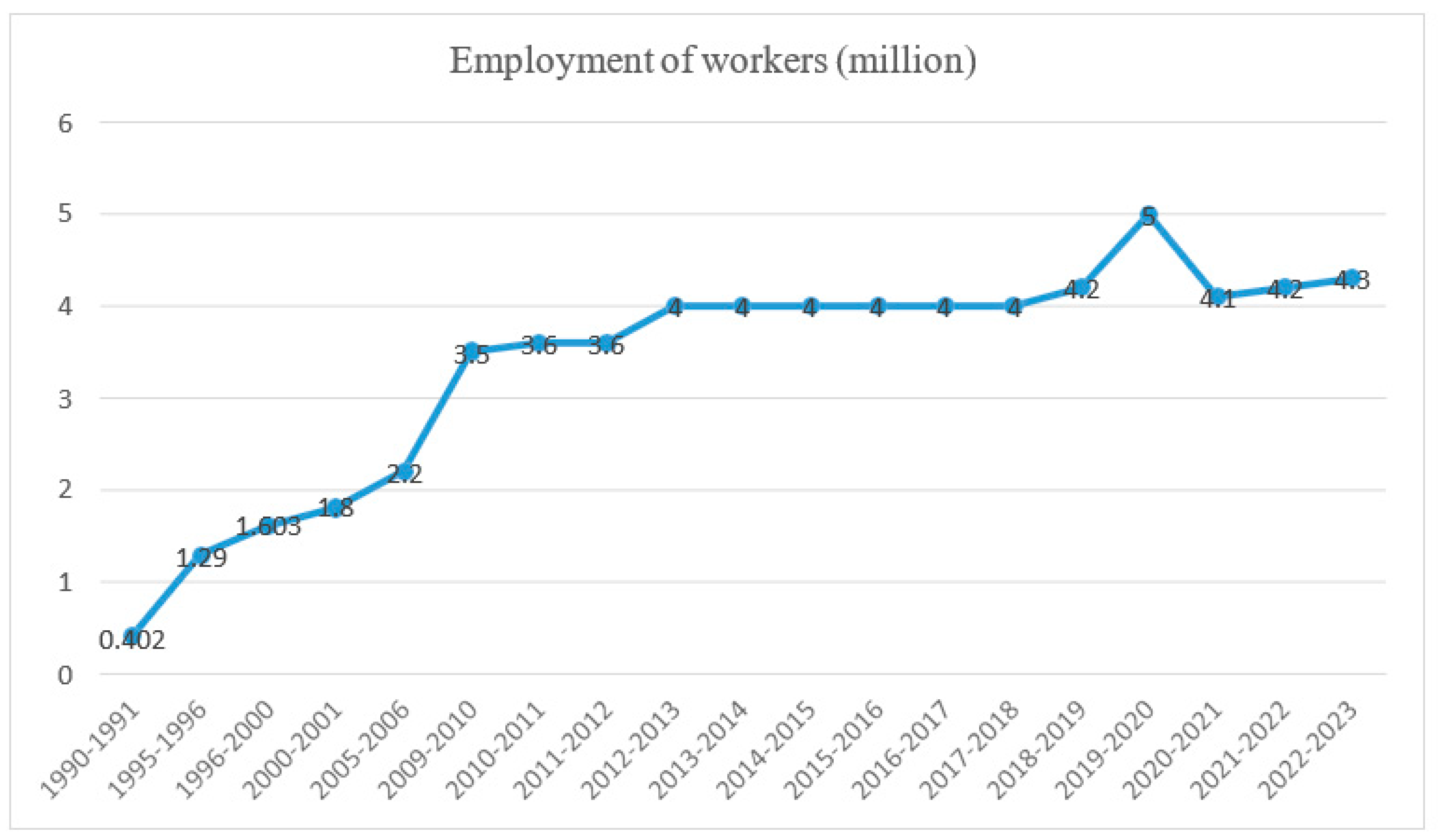

3.2. The Number of Workers in Garment Factories:

The rise of the RMG industry is regarded as one of the best developments in Bangladeshi economy since it gave the labor force, particularly women, many job opportunities. It gave women a space to participate and feel empowered. The RMG sector directly employs over 4 million people.

Table 4.

Employment of workers (1st period).

Table 4.

Employment of workers (1st period).

| Year |

Employment of workers (in million) |

| 1990-1991 |

0.402 |

| 1995-1996 |

1.290 |

| 1996-2000 |

1.603 |

| 2000-2001 |

1.800 |

Table 5.

Employment of workers (2nd period).

Table 5.

Employment of workers (2nd period).

| Year |

Employment of workers (in million) |

| 2005-2006 |

2.200 |

| 2009-2010 |

3.500 |

| 2010-2011 |

3.600 |

| 2011-2012 |

3.600 |

Table 6.

Employment of workers (3rd period).

Table 6.

Employment of workers (3rd period).

| Year |

Employment of workers (in million) |

| 2012-2013 |

4.000 |

| 2013-2014 |

4.000 |

| 2014-2015 |

4.000 |

| 2015-2016 |

4.000 |

| 2016-2017 |

4.000 |

| 2017-2018 |

4.000 |

| 2018-2019 |

4.200 |

| 2019-2020 |

5.000 |

| 2020-2021 |

4.100 |

| 2021-2022 |

4.200 |

| 2022-2023 |

4.300 |

Figure 1.

Employment of workers (million).

Figure 1.

Employment of workers (million).

3.3. Export Analysis:

The RMG sector's share in the nation's exports has grown tremendously over time. It has developed into Bangladesh's primary export-generating industry. The RMG industry has become the engine of economic growth and development during the past 20 years, emerging as the thrust sector. Bangladesh's Gross Domestic Product (GDP) increased from US$ 6.29 billion in 1972, as estimated by the World Bank, to US$

173.82 billion in 2014. Of that amount, $31.2 billion came from exports, of which 82% were ready-made clothing. Bangladesh was the second-largest producer of clothing in the world as of 2016, right behind China.

Bangladesh is the world’s second largest apparel exporter of western fast fashion brands. Sixty percent of the export contracts of western brands are with European buyers and about thirty percent with American buyers’ ten percent to others. Only 5% of the textile factories are owned by foreign investors, with most of the production being controlled by local investors. In the financial year 2016-2017 the RMG industry generated US$ 28.14 billion, which was 80.7% of the total export earning in exports and 12.36% of the GDP.

In 2022, the country received $9.72 billion of Bangladeshi-made garments, which is 50 percent more than the previous year, 2021. But it was precisely post-Covid-19 that exports were lower in 2021. But in 2022, the export was 9.72 billion dollars, but in 2023, it decreased instead of increasing. Exports in 2023 are 7.29 billion dollars. Thus, in one year, exports decreased by about two and a half billion dollars or 25 percent.

As US consumers reduce their purchase of clothing, exports to the country have decreased in many countries including Bangladesh, but despite the decrease in exports to major markets like America, it has not negatively affected Bangladesh's total exports of ready-made garments, rather it has been positive.

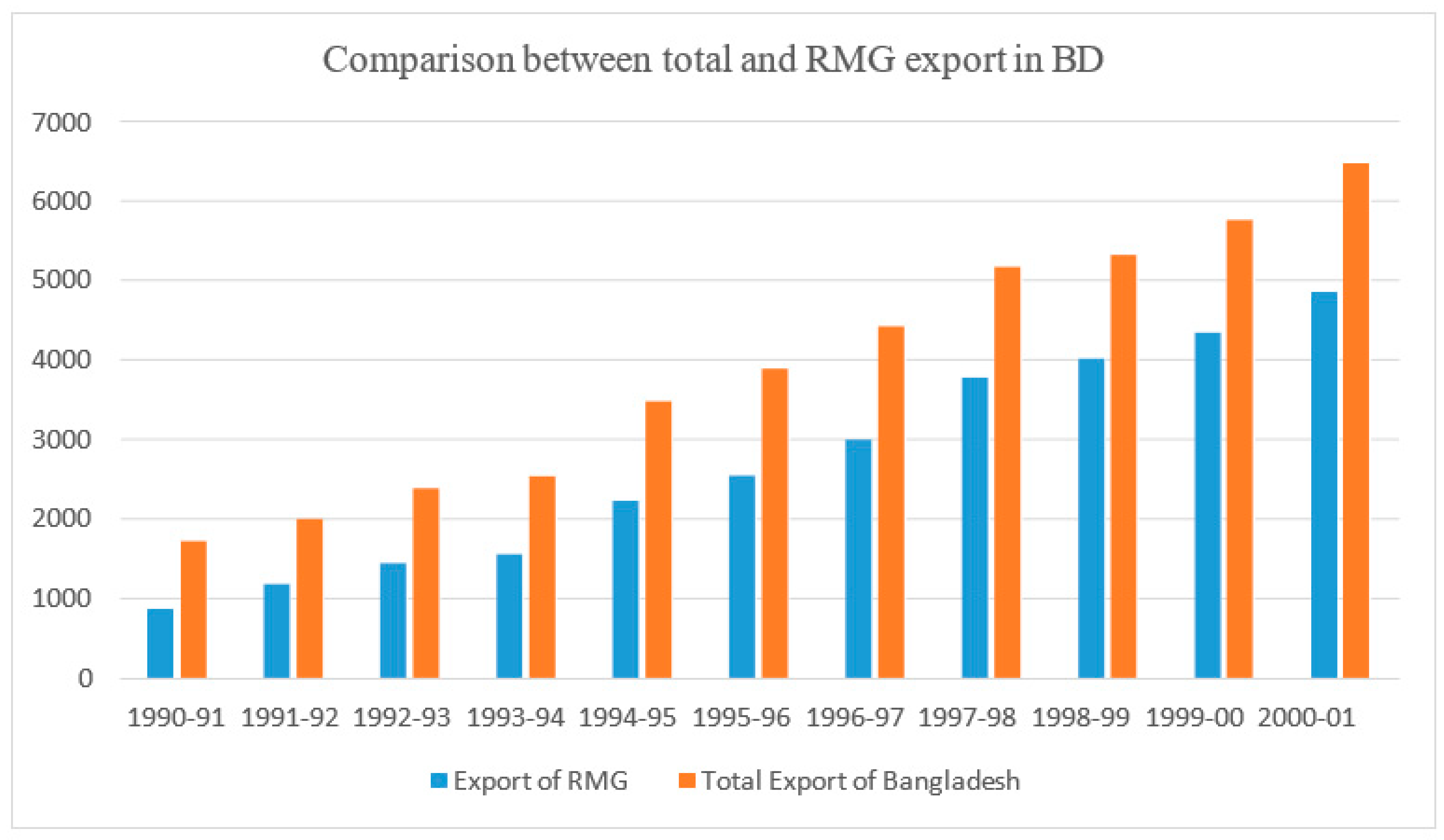

3.3.1. 1st Period (1990-2001):

Since the early days, different sources of impetus have contributed to the development and maturity of the industry at various stages.

Export of RMG

Table 7.

Export of RMG.

| Year |

Export of RMG |

Total Export of Bangladesh |

% of RMG’s to Total Export |

| 1990-91 |

866.82 |

1717.55 |

50.47 |

| 1991-92 |

1182.57 |

1993.90 |

59.31 |

| 1992-93 |

1445.02 |

2382.89 |

60.64 |

| 1993-94 |

1555.79 |

2533.90 |

61.40 |

| 1994-95 |

2228.35 |

3472.56 |

64.17 |

| 1995-96 |

2547.13 |

3882.42 |

65.61 |

| 1996-97 |

3001.25 |

4418.28 |

67.93 |

| 1997-98 |

3781.94 |

5161.20 |

73.28 |

| 1998-99 |

4019.98 |

5312.86 |

75.67 |

| 1999-00 |

4349.41 |

5752.20 |

75.61 |

| 2000-01 |

4859.83 |

6467.30 |

75.14 |

Figure 2.

Comparison Between Total and RMG Export in BD.

Figure 2.

Comparison Between Total and RMG Export in BD.

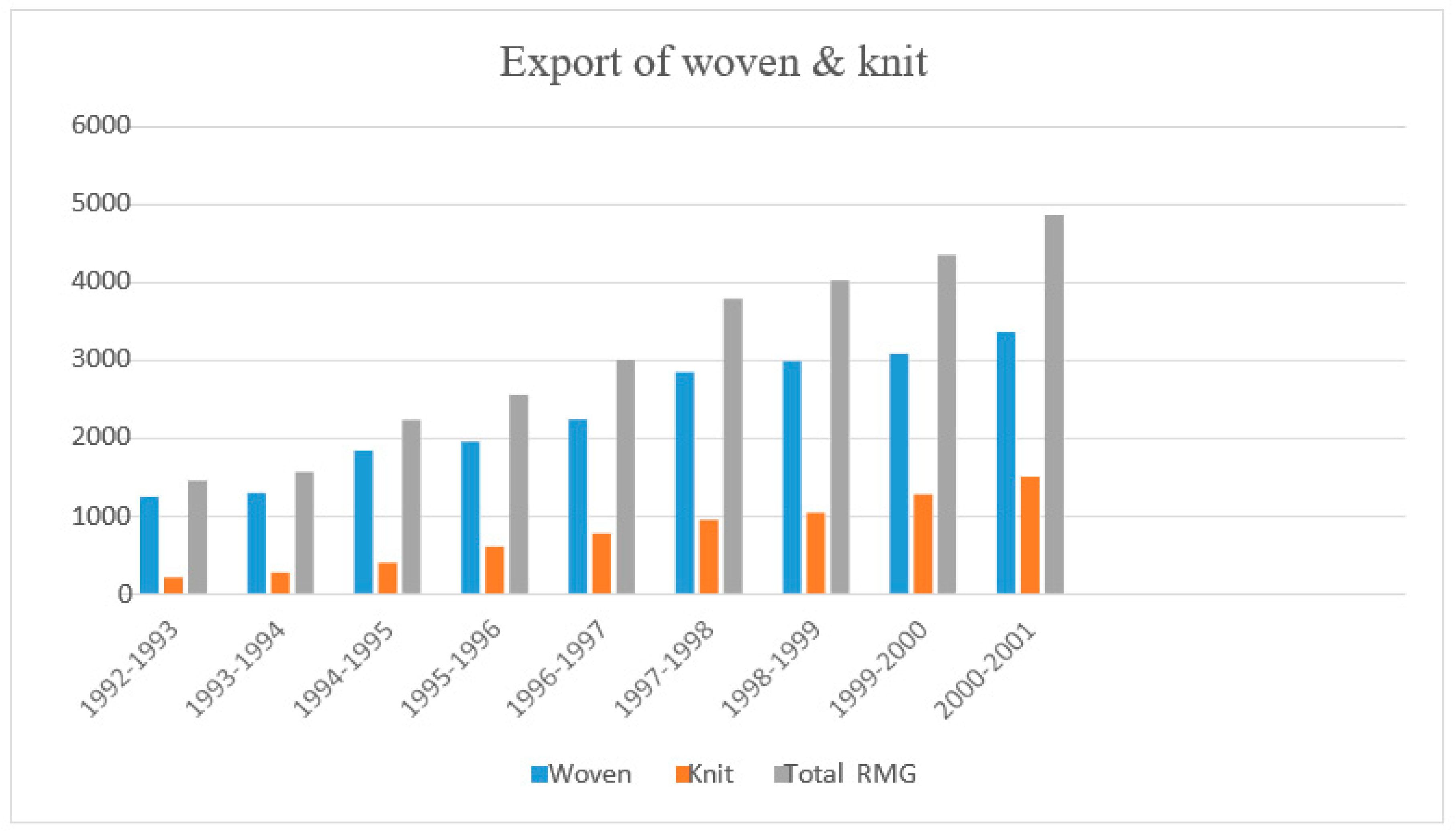

Products:

Table 8.

Export of woven & knit Products value in million USD.

Table 8.

Export of woven & knit Products value in million USD.

| Year |

Woven |

Knit |

Total RMG |

| 1992-1993 |

1240.48 |

204.54 |

1445.02 |

| 1993-1994 |

1291.65 |

264.14 |

1555.79 |

| 1994-1995 |

1835.09 |

393.26 |

2228.35 |

| 1995-1996 |

1948.81 |

598.32 |

2547.13 |

| 1996-1997 |

2237.95 |

763.30 |

3001.25 |

| 1997-1998 |

2844.43 |

937.51 |

3781.94 |

| 1998-1999 |

2984.96 |

1035.02 |

4019.98 |

| 1999-2000 |

3081.19 |

1268.22 |

4349.41 |

| 2000-2001 |

3364.32 |

1495.51 |

4859.83 |

Figure 3.

Export of Woven & Knit.

Figure 3.

Export of Woven & Knit.

Specific Garments Export:

Table 9.

Export of specific garments (Export Value in Million USD).

Table 9.

Export of specific garments (Export Value in Million USD).

| YEAR |

SHIRTS |

TROUSERS |

JACKETS |

T-SHIRT |

SWEATER |

1993-

1994 |

805.34 |

80.56 |

126.85 |

225.9 |

|

1994-

1995 |

791.20 |

101.23 |

146.83 |

232.24 |

|

1995-

1996 |

807.66 |

112.02 |

171.73 |

366.36 |

70.41 |

1996-

1997 |

759.57 |

230.98 |

309.21 |

391.21 |

196.6 |

1997-

1998 |

961.13 |

333.28 |

467.19 |

388.5 |

296.29 |

1998-

1999 |

1043.11 |

394.85 |

393.44 |

471.88 |

271.7 |

1999-

2000 |

1021.17 |

484.06 |

439.77 |

563.58 |

325.07 |

2000-

2001 |

1073.59 |

656.33 |

573.74 |

597.42 |

476.87 |

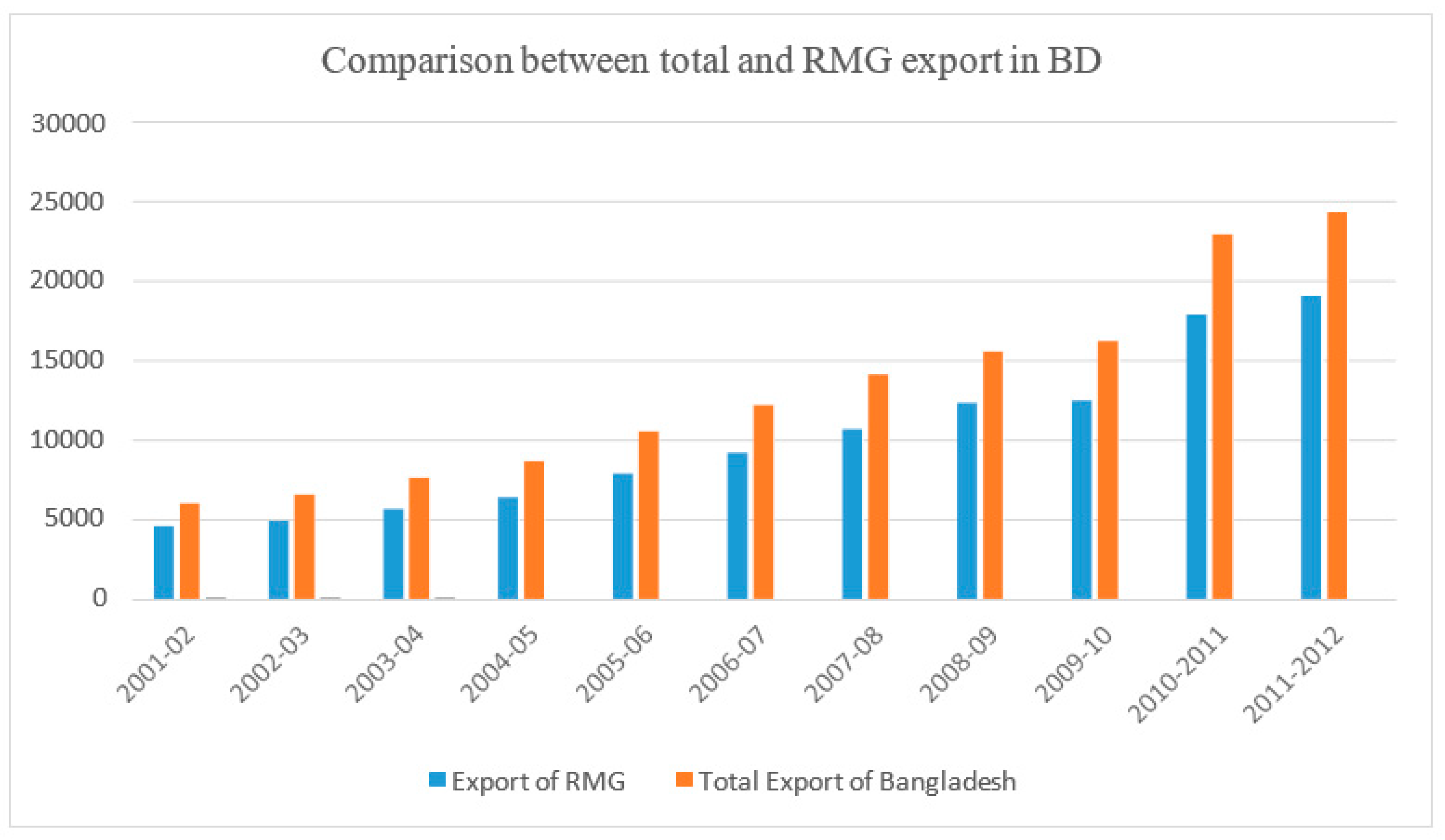

3.3.2. 2nd Period (2000-2012)

Export of RMG:

Table 10.

Export of RMG.

| Year |

Export of RMG |

Total Export of Bangladesh |

% of RMG’s to Total Export |

| 2001-02 |

4583.75 |

5986.09 |

76.57 |

| 2002-03 |

4912.09 |

6548.44 |

75.01 |

| 2003-04 |

5686.09 |

7602.99 |

74.79 |

| 2004-05 |

6417.67 |

8654.52 |

74.15 |

| 2005-06 |

7900.80 |

10526.16 |

75.06 |

| 2006-07 |

9211.23 |

12177.86 |

75.64 |

| 2007-08 |

10699.80 |

14110.80 |

75.83 |

| 2008-09 |

12347.77 |

15565.19 |

79.33 |

| 2009-10 |

12496.72 |

16204.65 |

77.12 |

| 2010-11 |

17914.46 |

22924.38 |

78.15 |

| 2011-12 |

19089.73 |

24301.90 |

78.55 |

Figure 4.

Comparison Between Total and RMG Export in BD.

Figure 4.

Comparison Between Total and RMG Export in BD.

Products:

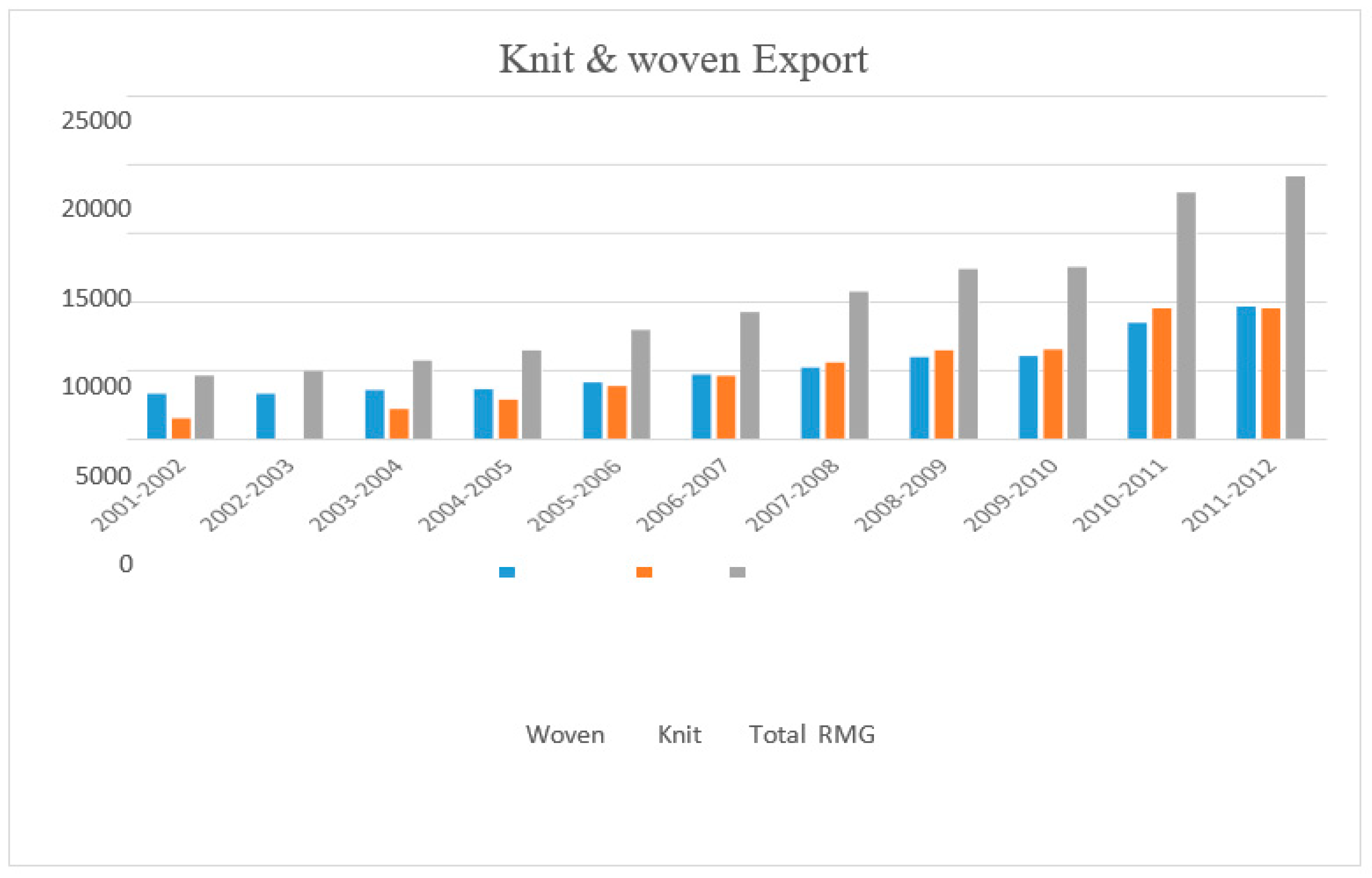

Table 11.

Export of woven & knit products Value in Million USD (Fiscal Year Basis).

Table 11.

Export of woven & knit products Value in Million USD (Fiscal Year Basis).

| Year |

Woven |

Knit |

Total RMG |

| 2001-2002 |

3258.27 |

1458.93 |

4583.75 |

| 2002-2003 |

3258.27 |

1653. 82 |

4912.09 |

| 2003-2004 |

3538.07 |

2148.02 |

5686.09 |

| 2004-2005 |

3598.20 |

2819.47 |

6417.67 |

| 2005-2006 |

4083.82 |

3816.98 |

7900.80 |

| 2006-2007 |

4657.63 |

4553.60 |

9211.23 |

| 2007-2008 |

5167.28 |

5532.52 |

10699.80 |

| 2008-2009 |

5918.51 |

6429.26 |

12347.77 |

| 2009-2010 |

6013.43 |

6483.29 |

12496.72 |

| 2010-2011 |

8432.40 |

9482.06 |

17914.46 |

| 2011-2012 |

9603.34 |

9486.39 |

19089.73 |

Figure 5.

Knit & woven Export.

Figure 5.

Knit & woven Export.

Specific Garments Export:

Table 12.

Export of specific garments (Export Value in Million).

Table 12.

Export of specific garments (Export Value in Million).

| YEAR |

SHIRTS |

TROUSERS |

JACKETS |

T-SHIRT |

SWEATER |

2001-

2002 |

871.21 |

636.61 |

412.34 |

546.28 |

517.83 |

2002-

2003 |

1019.87 |

643.66 |

464.51 |

642.62 |

578.37 |

2003-

2004 |

1116.57 |

1334.85 |

364.77 |

1062.1 |

616.31 |

2004-

2005 |

1053.34 |

1667.72 |

430.28 |

1349.71 |

893.12 |

2005-

2006 |

1056.69 |

2165.25 |

389.52 |

1781.51 |

1044.01 |

2006-

2007 |

943.44 |

2201.32 |

1005.06 |

2208.9 |

1248.09 |

2007-

2008 |

915.6 |

2512.74 |

1181.52 |

2765.56 |

1474.09 |

2008-

2009 |

1000.16 |

3007.29 |

1299.74 |

3065.86 |

1858.62 |

2009-

2010 |

993.41 |

3035.35 |

1350.43 |

3145.52 |

1795.39 |

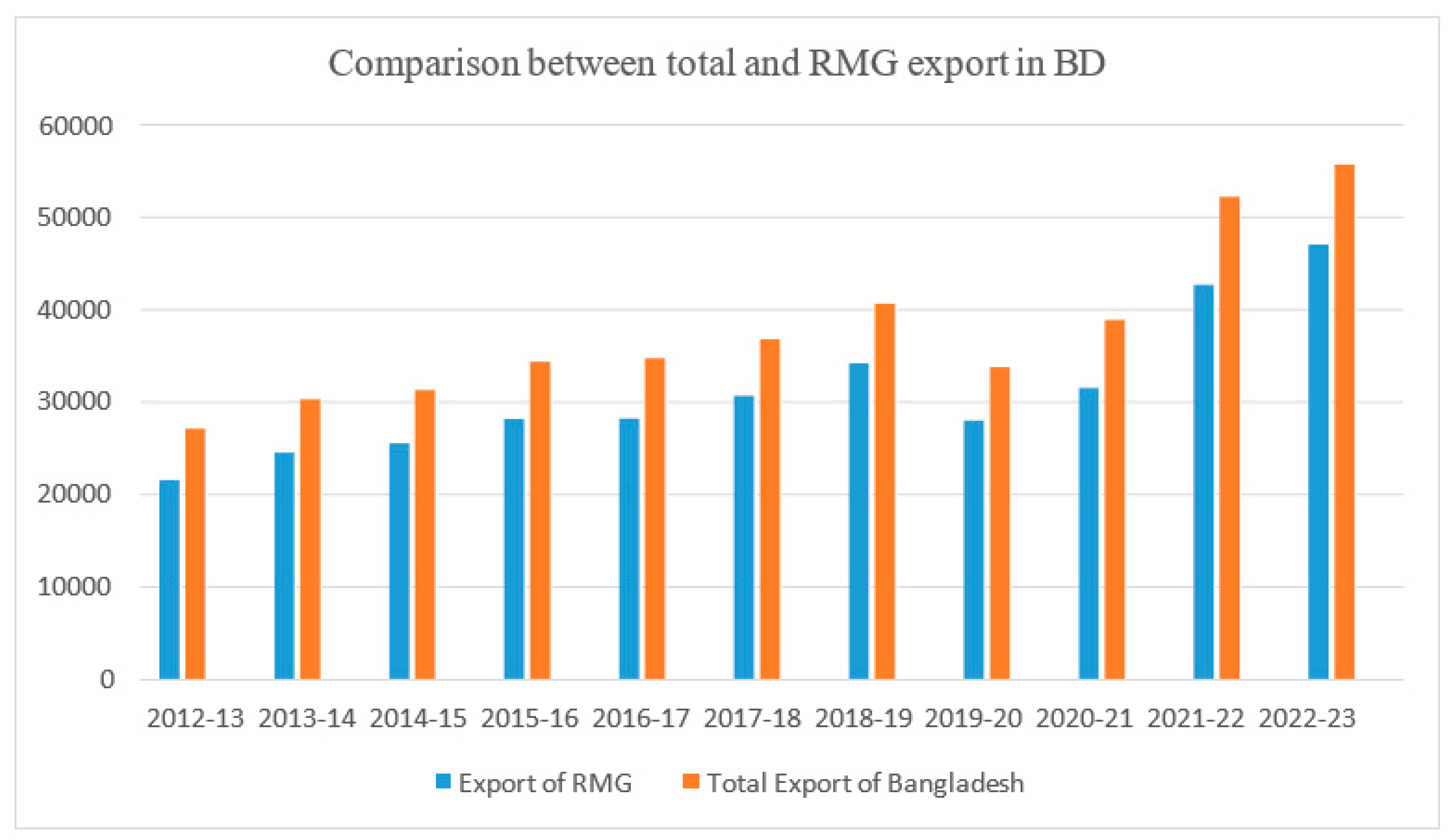

3.3.2. 3rd Period (2010-2020).

Export of RMG

Table 13.

Export of RMG.

| Year |

Export of RMG |

Total Export of Bangladesh |

% of RMG’s to Total Export |

| 2012-13 |

21515.73 |

27027.36 |

79.61 |

| 2013-14 |

24491.88 |

30186.62 |

81.13 |

| 2014-15 |

25491.40 |

31208.94 |

81.68 |

| 2015-16 |

28094.16 |

34257.18 |

82.01 |

| 2016-17 |

28149.84 |

34655.90 |

81.23 |

| 2017-18 |

30614.76 |

36668.17 |

83.49 |

| 2018-19 |

34133.27 |

40535.04 |

84.21 |

| 2019-20 |

27949.19 |

33674.09 |

83.00 |

| 2020-21 |

31456.73 |

38758.31 |

81.16 |

| 2021-22 |

42613.15 |

52082.66 |

81.82 |

| 2022-23 |

46991.61 |

55558.77 |

84.58 |

Figure 6.

Comparison Between Total and RMG Export in BD.

Figure 6.

Comparison Between Total and RMG Export in BD.

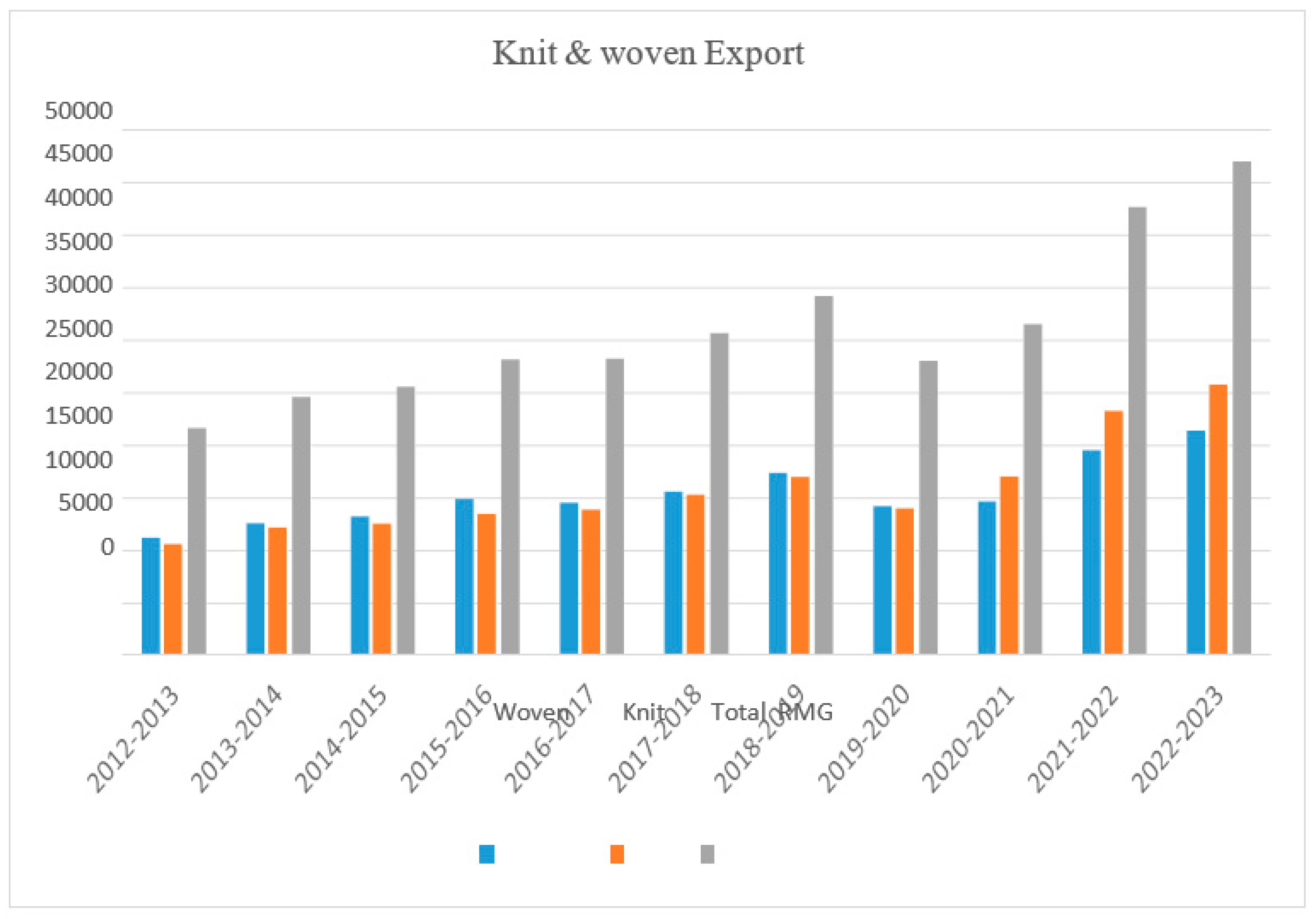

Products:

Table 14.

Export of woven & knit products Value in Million.

Table 14.

Export of woven & knit products Value in Million.

| Year |

Woven |

Knit |

Total RMG |

| 2012-2013 |

11039.85 |

10475.88 |

21515.73 |

| 2013-2014 |

12442.07 |

12049.81 |

24491.88 |

| 2014-2015 |

13064.61 |

12426.79 |

25491.40 |

| 2015-2016 |

14738.74 |

13355.42 |

28094.16 |

| 2016-2017 |

14392.59 |

13757.25 |

28149.84 |

| 2017-2018 |

15426.25 |

15188.51 |

30614.76 |

| 2018-2019 |

17244.73 |

16888.54 |

34133.27 |

| 2019-2020 |

14041.19 |

13908.00 |

27949.19 |

| 2020-2021 |

14496.70 |

16960.03 |

31456.73 |

|

| 2021-2022 |

19398.84 |

23214.32 |

42613.16 |

|

| 2022-2023 |

21253.41 |

25738.20 |

46991.61 |

Figure 7.

Knit & woven Export.

Figure 7.

Knit & woven Export.

Specific Garments Export:

Table 15.

Export of specific garments.

Table 15.

Export of specific garments.

| YEAR |

SHIRTS |

TROUSERS |

JACKETS |

T-SHIRT |

SWEATER |

2009-

2010 |

1073.59 |

656.33 |

573.74 |

597.42 |

476.87 |

2010-

2011 |

871.21 |

636.61 |

412.34 |

546.28 |

517.83 |

2011-

2012 |

1019.87 |

643.66 |

464.51 |

642.62 |

578.37 |

2012-

2013 |

1116.57 |

1334.85 |

364.77 |

1062.1 |

616.31 |

2013-

2014 |

1053.34 |

1667.72 |

430.28 |

1349.71 |

893.12 |

2014-

2015 |

1056.69 |

2165.25 |

389.52 |

1781.51 |

1044.01 |

2015-

2016 |

943.44 |

2201.32 |

1005.06 |

2208.9 |

1248.09 |

2016-

2017 |

915.6 |

2512.74 |

1181.52 |

2765.56 |

1474.09 |

2017-

2018 |

1000.16 |

3007.29 |

1299.74 |

3065.86 |

1858.62 |

2018-

2019 |

993.41 |

3035.35 |

1350.43 |

3145.52 |

1795.39 |

2019-

2020 |

1783.14 |

5447.13 |

3514.21 |

5614.00 |

3597.68 |

2020-

2021 |

2048.4 |

10681.52 |

4083.65 |

7239.74 |

4051.83 |

2021-

2022 |

2765.91 |

14507.50 |

5571.138 |

9857.54 |

5640.45 |

2022-

2023 |

3650.12 |

14953.30 |

6019.429 |

10862.52 |

5942.47 |

3.4. Impacts of Garment Industry Focus in Bangladesh:

The yearly economic expansion from 1970 to 1980 averaged a rate of 2%. The economy experienced a prolonged period of slow growth. The economy experienced moderate growth as it shifted from an agricultural-based economy to an industrialized one, surpassing a 5% growth rate in 2004. Therefore, Bangladesh's economy demonstrated robust growth in 2006, outpacing that of Pakistan and exceeding most other countries in South Asia. From 2011 until the onset of the COVID-19 pandemic, the nation maintained a steady economic growth rate of over 6%.

As a result, Bangladesh's growth rate in 2006 exceeded that of South Asia. From 2011 onwards, there was a regular increase of 6% until the 19 covid pandemic in 2020.

The share of the agricultural sector has declined sharply from over 60% in the early 1970s to 30% in the 1990s to 12% in recent years. Increasing shares in the industrial and service sectors offset this decline. Currently, these industries make up about 33% of the domestic sector, while 55% of GDP comes from the service sector.

Bangladesh's service sector expanded rapidly in the 1980s The economy began to flourish in the 1990s through trade liberalization. Wholesale and retail trade, transportation, storage, and communication account for the major intermediation subsectors of Bangladesh's service sector

A 10-year economic survey here reveals that the services sector grew at a rate of 6.17% in 2000-2010, beating agriculture at a rate of 3.21, while industries (7.49) grew in comparison to services. GDP declined by 2.2% between 2010-2021. Has increased over the past 20 years. which was concentrated in production in the 1990s.which increased the share of the industry. According to the World Bank, the RMG sector is primarily responsible for productivity growth, with the textile and apparel sector accounting for about 57% of total value addition. In contrast, the value-added share of medium- and high-tech manufacturing has steadily decreased, going from 24% in the 1990s to 7% in 2019.

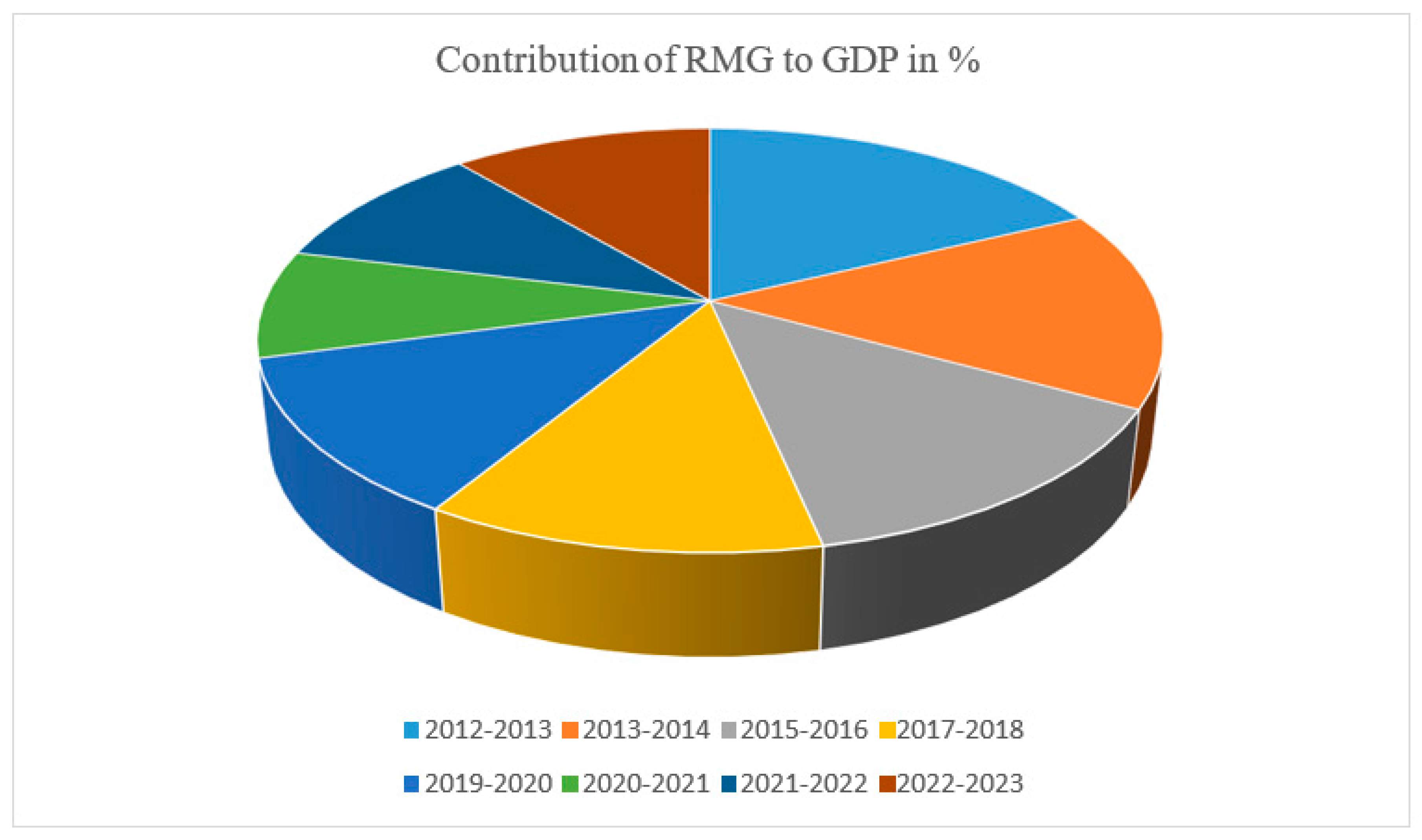

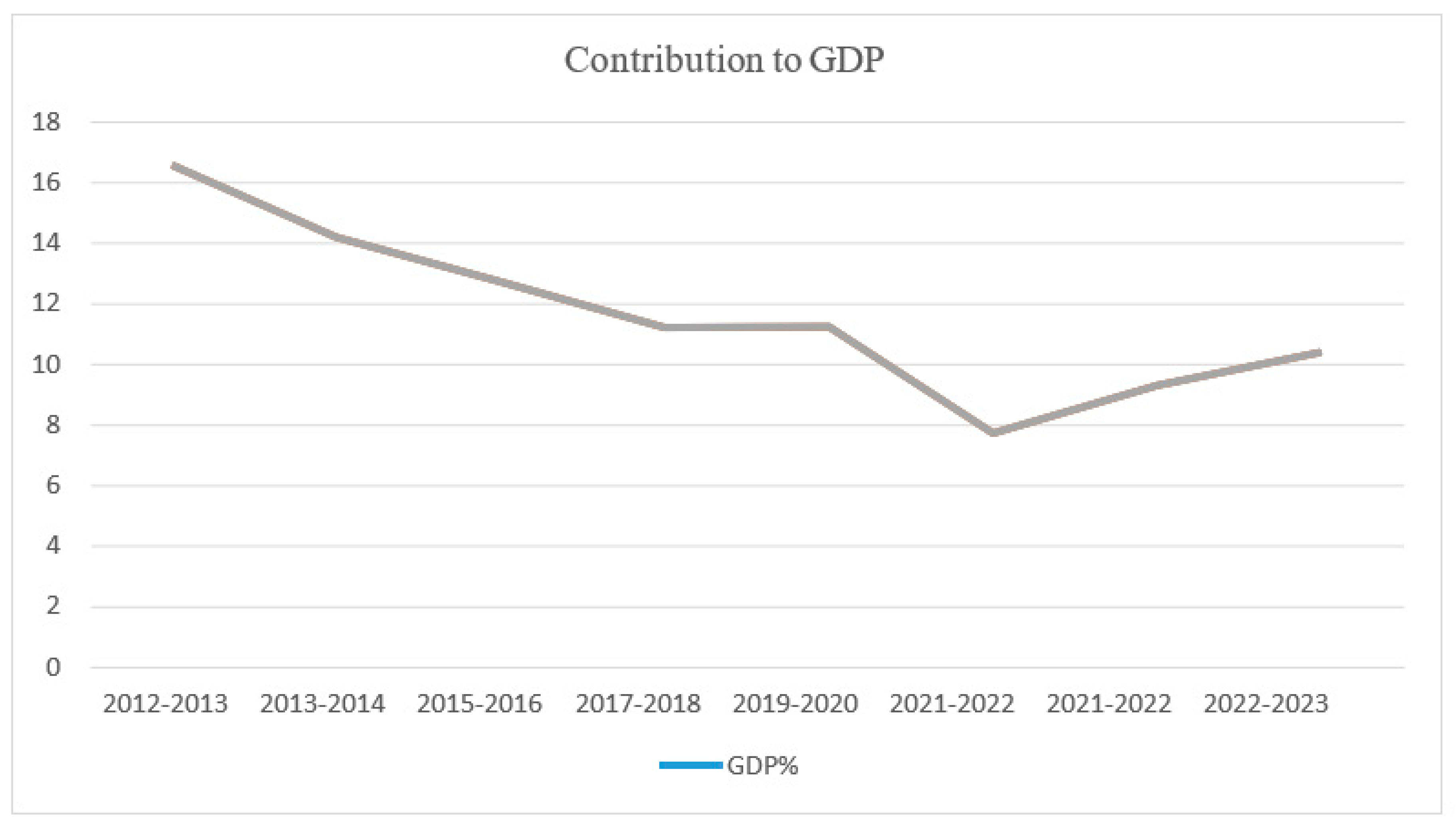

3.4.1. Macro Contribution to GDP:

The RMG sector's contribution to GDP in Bangladesh is extremely impressive; in FY15, it reached 13.10 percent of GDP, compared to just over 3 percent in 1991. Nevertheless, it was 14.2% of GDP in FY14.In FY21, the RMG sector contributed 7.66 percent to GDP. In FY22, the RMG sector contributed 9.25. In FY23, the RMG sector made a significant contribution of 10.35 percent to Bangladesh's GDP. The woven sector contributes 6.72% of GDP, whereas the knitwear sector contributes 6.39%. Thus, RMG is essential to the growth of other important economic sectors, such as banking, insurance, the shipping and logistics industries, etc.

Table 16.

Contribution to GDP.

Table 16.

Contribution to GDP.

| Year |

2012-

2013 |

2013-

2014 |

2015-

2016 |

2017-

2018 |

2019-

2020 |

2020-

2021 |

2021-

2022 |

2022-

2023 |

Contribution to GDP in

% |

16.56 |

14.17 |

12.69 |

11.17 |

11.2 |

7.66 |

9.25 |

10.35 |

Figure 8.

Contribution of RMG to GDP in %.

Figure 8.

Contribution of RMG to GDP in %.

3.4.2. Current Scenario of the Garment Industry (Fiscal Year 2022- 2023) Bangladesh:

Overall Exports in FY 2022-23 (July 2022 - June 2023): Bangladesh's total export earnings reached a record high of $55.56 billion in FY 2022-23.

RMG Exports in FY 2022-23: The Ready-Made Garment (RMG) sector, which is the main driver of Bangladesh's exports, contributed $47.38 billion to the total export earnings in FY 2022-23, also a record high. This translates to 84.58% of the country's total exports.

Table 17.

Export Data in Bangladesh.

Table 17.

Export Data in Bangladesh.

| Month |

Total export |

RMG export |

| January 2023 |

5.72 billion |

4.97 billion |

|

March 2023 |

4.64 billion |

3.89 billion |

|

May 2023 |

4.85 billion |

4.05 billion |

| July 2023 |

3.95 billion |

3.95 billion |

| September 2023 |

4.31 billion |

1.24 billion |

| November 2023 |

4.78 billion |

4.05 billion |

| January 2024 |

5.72 billion |

4.97 billion |

3.4.3. Major Competitors:

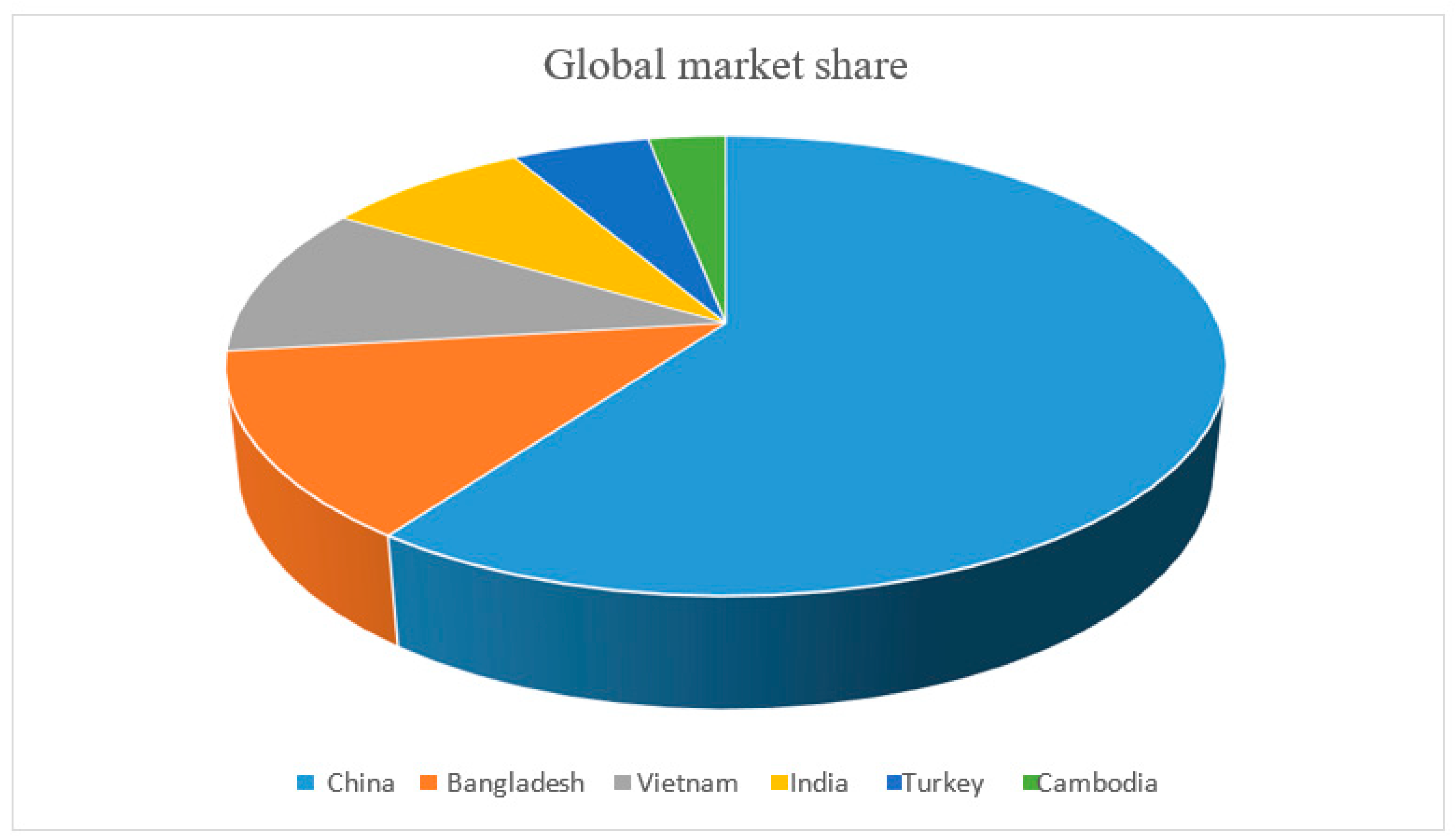

According to data of 2022-2023 from the World Trade Organization AFTA(WTO), Bangladesh still retains its position as the second biggest apparel producer by exporting $55.55 billion in the world by contributing 6.67% share of the market.

In 2022, China exported a total of 182 billion of ready-made garments. However, the full data for 2023 has not been released yet.

In 2022, Total export earnings: $40.9 billion USD Growth Rate: 10.5% In 2023 (first 10 months): Total export earnings: $31.3 billion Growth Rate: 4.4%. India is in 4th position.

Table 18.

Global market Share (Country wise).

Table 18.

Global market Share (Country wise).

| Country |

Global market share |

| China |

36 |

| Bangladesh |

7.9 |

| Vietnam |

6.4 |

| India |

4.8 |

| Turkey |

3.2 |

| Cambodia |

1.8 |

Figure 9.

Global Market Share.

Figure 9.

Global Market Share.

3.4.4. Reasons Behind Closure of RMG Factory:

Covid-19 Pandemic: This pandemic started in 2020 due to global lockdowns and economic recession which reduced the demand for clothing. This led to the closure of many RMG factories and the unemployment of millions of workers.

Russia-Ukraine War: This war, which began in 2023, has increased fuel and transportation costs. This has resulted in increased cost of production and decreased profitability of RMG products.

Competition in International Market: Countries like Vietnam, Cambodia etc. are becoming increasingly competitive in RMG production. Cost of production in these countries is relatively low due to low wages and government benefits.

Low Wages: Wages of RMG workers in Bangladesh are very low compared to other countries. However, workers are demanding higher wages due to rising living standards.

Factory Safety: Incidents like fire and building collapse occur in RMG factories. This is creating a negative perception among global buyers.

Environmental Pollution: RMG industry adversely affects the environment.

Lack of Skilled Workers: There is a shortage of skilled workers in the RMG industry.

Inadequate Infrastructure: Bangladesh's infrastructure, especially port and road systems, is not adequate for the expansion of the RMG industry.

Factors such as slow payment of wages in the new structure, labor protests and use of shared buildings are also behind the factory closures. Talking to related sources and factory owners, it is known that the closure of garment factories in the country is not new. Every month there are cases of factory closures. Before the Rana Plaza accident in 2013, the garment factory owners' association BGMEA had about 5,000 companies. After that accident, 1200 to 1300 factories were closed.

Diversifying into international markets: Finding new markets for RMG products. Productivity Enhancement: Using Technology to Enhance Productivity.

Upskilling of workers: Upskilling of workers by imparting training. Improving factory safety: Improving factory safety standards.

Environmental Pollution Control: Taking steps to control environmental pollution. Infrastructure Development: Improving port and road systems.

Note that the RMG sector is the backbone of Bangladesh's economy. The closure of this industry will have a huge impact on the country's economy. So, the government and all concerned should take steps for sustainable development of this industry

There are many growing risks for the garment industry in Bangladesh which should be eliminated as soon as possible.

o Following the points below will reduce the threat to some extent

o Political instability of the country.

o Increase in cost of raw materials.

o Environmental pollution is a threat to survival.

o Labor discontent in RMG factories.

o Ability to hold the market for long term future.

o Financial assistance.

The opportunity of RMG Sector in Bangladesh:

RMG sector of Bangladesh has some key factors which inspired the steady growth of this sector. Though it’s a matter of great surprise for so many that how the RMG sector of Bangladesh continues to show its robust performance in the world.

The main key factors which have a great influence on the RMG sector of Bangladesh are the following:

o Vast labor force,

o Skilled human resources,

o Technological upgrades,

o Government supports for textile and clothing,

o Special economic/export processing zones,

o Creation of textile and clothing villages,

o The incentive for use of local inputs,

o Duty reduction for the import of inputs/machines,

o Income tax reduction,

By using the above key points, we can easily take place the world’s readymade garments market very strongly.

3.5. Discussion:

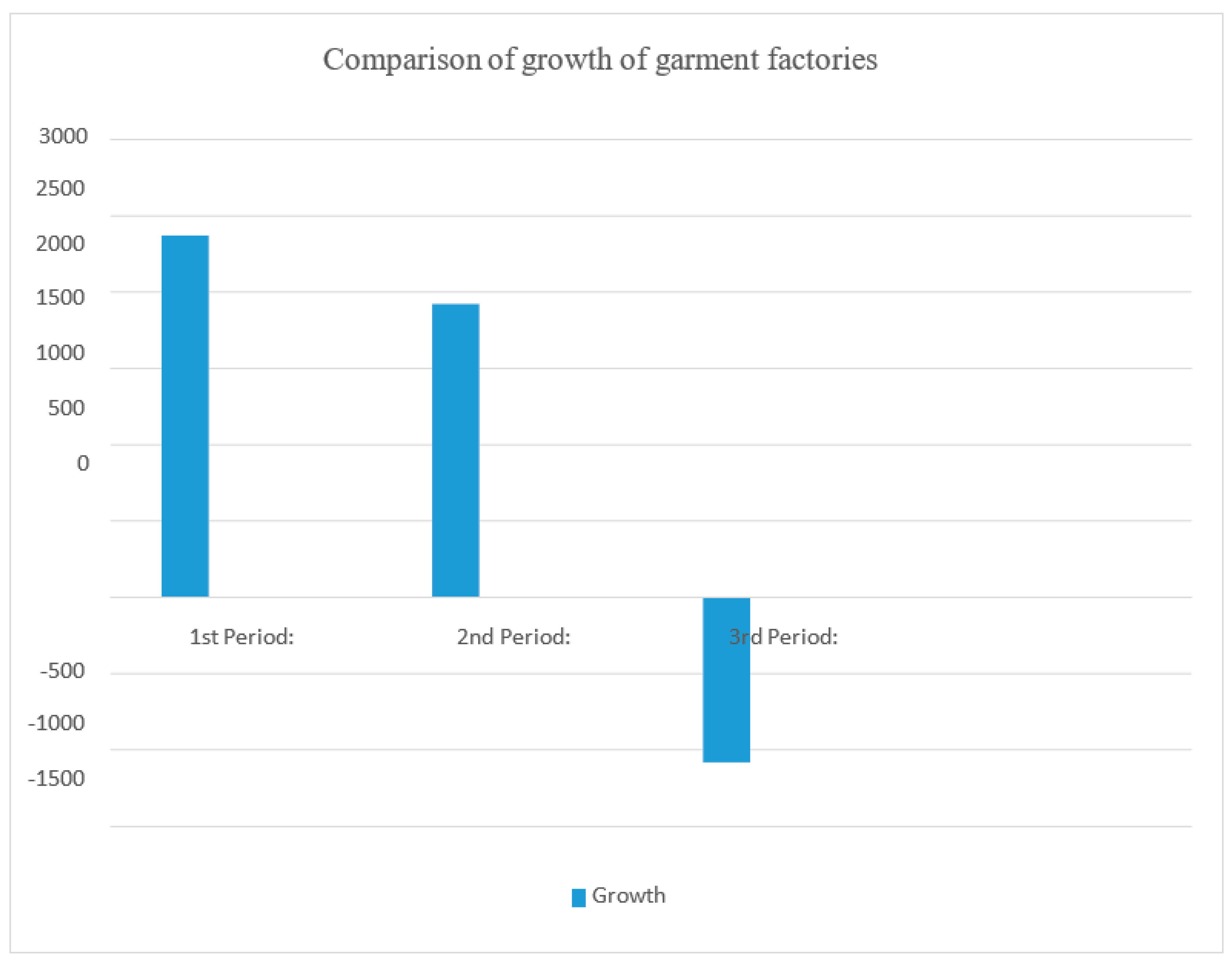

3.5.1. Comparison of Growth of Garment Factories Within 3 Period:

Growth: 3200-834 = 2366

Growth: 5400- 3480= 1920

Growth: 4790-5876 = -1086

Figure 10.

Comparison of Growth of Garment Factories.

Figure 10.

Comparison of Growth of Garment Factories.

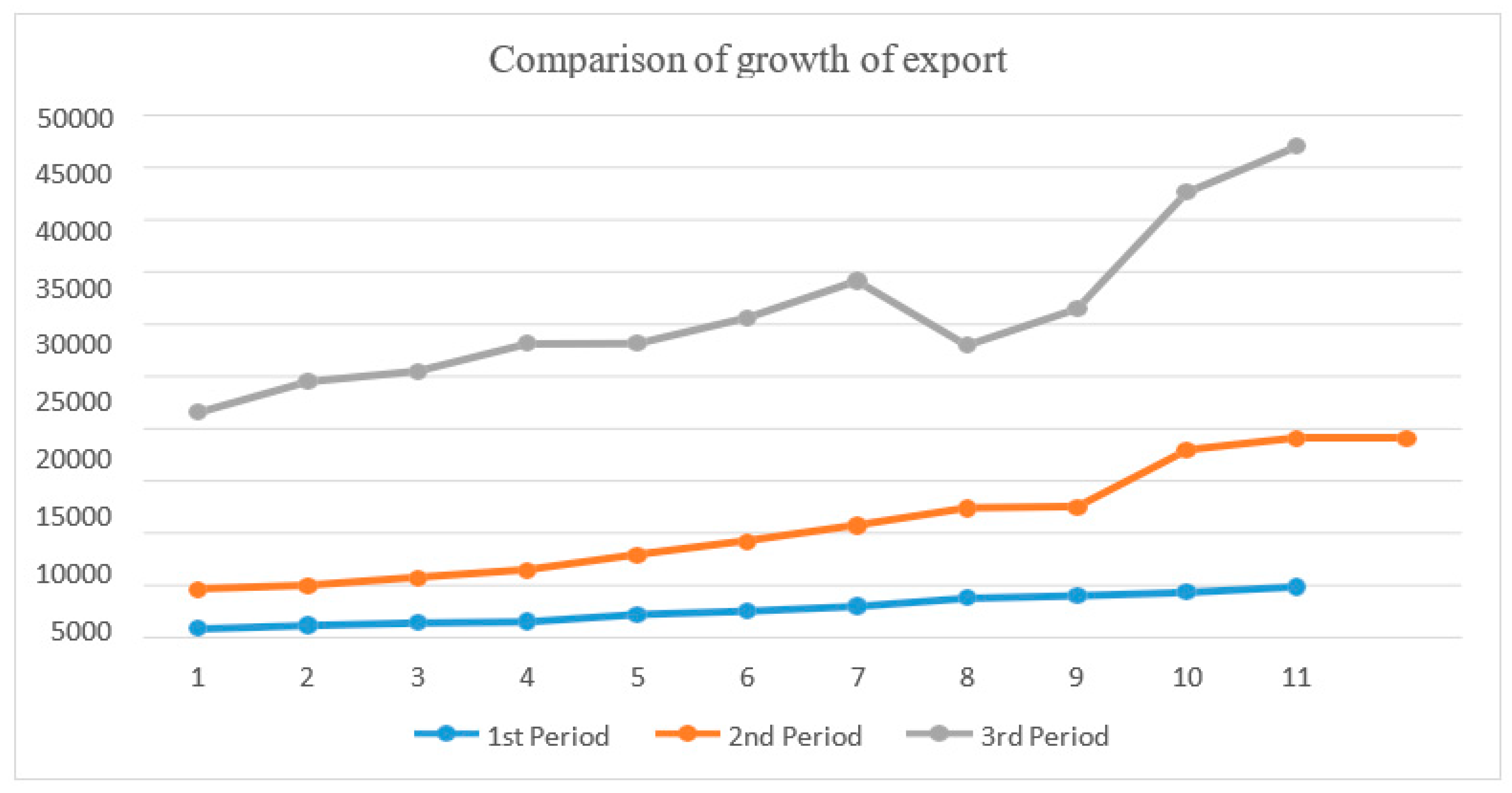

3.5.2. Comparison of Growth of Export Within 3 Period:

Figure 11.

Comparison of Growth of Export.

Figure 11.

Comparison of Growth of Export.

3.5.3. Analysis of Contribution to GDP:

Figure 12.

Contribution to GDP.

Figure 12.

Contribution to GDP.

3.6. The RMG Sector's GDP Has Been Decreasing Recently. The Reasons Behind This Are Briefly Discussed Below.

Infrastructure is the main barrier preventing Bangladesh's RMG business from growing. Transportation issues, such as traffic jams, petrol shortages, and inefficient seaports, all provide a challenge.

- ○

The high cost of raw materials and their quick price fluctuations.

- ○

The reliance on imports is regarded as a big risk

- ○

This strategy may be hampered by a lack of efficiency and risk-takers

The biggest challenge in Bangladesh is corruption.

Investing in the RMG sector is hampered by high interest rates.

Sourcing from Bangladesh carries the greatest risk of political turmoil and strikes.

By taking advantage of the workers' ignorance and poverty, the owners made them labor in hazardous and unhealthy environments with inadequate ventilation and a worker population that exceeded the capacity of the factory floor.

The majority of our nation's clothing factories lack the bare necessities, despite the fact that our garment workers toil day and night to earn the majority of our nation's foreign cash.

Insufficient marketing strategies, a dearth of readily available middle management, a limited number of manufacturing techniques, and inadequate training for employees, managers, and supervisors

Slow backward or forward blending process, inept ports, difficult access and exit, lengthy loading and unloading times, etc.

The industry is frequently hampered by things like late or inadequate loans, unstable electricity, delays in receiving supplies, poor communication, tax issues, etc.

Machine layout is often staggered

No provision for emergency lighting

Doors, opening along escape routes are not fire resistance

Lack of proper exit route

Parked vehicles, goods and rubbish on the outside of the building obstruct exits to the open air.

3.7. Problems Surrounding Readymade Garments Sector:

A thorough interview with 20 high level managers, 6 middle level managers, and 200 workers over 20 garments was conducted to learn more about the issues facing the ready-made clothing industry. industry, located in the Gazipur and Dhaka districts. Two sets of the questionnaires have been developed. There are two: one for workers and one for management. The following barriers were discovered through in-person interviews and questionnaires.

1) 80% of managing directors in the apparel industry stated that the main barrier to the growth of ready-made clothing is the diesel and power crises. Just 5% of the generators used in clothing factories are powered by petrol; 90% of them are powered by diesel. Hence, in an effort to meet deadlines, clothing factory owners are being compelled to ship their products by air to make up for lost time due to diesel and power outages.

2) According to 72% of managing directors in the apparel industry, they must import raw materials like cotton and thread color for their clothing. The growth of the apparel business is hampered by this reliance on raw materials. Furthermore, low-quality products are frequently produced using low-quality components from overseas suppliers.

3) Of the mid-level managers, 52% admitted that they occasionally have to borrow money in order to ship an order. However, they did not receive it at a low interest rate from the government or a commercial bank. They were having issues at the time since they weren't getting loans in a timely manner, which frequently caused industry obstruction.

4) 99% of CEOs expressed that the ready-to-wear industry has been negatively impacted by recent political upheaval and widespread strikes, which has increased production costs.

5) According to 56% of CEOs, lead time is another issue impeding the growth of the apparel sector. The average lead time in the apparel sector in the 1980s was 120–150 days for the major global garment supplier nations; in the present decade, that lead time has dropped to 30–40 days. The Bangladeshi RMG industry hasn't done much better in this area, either; for instance, the typical lead time for woven garment companies is 90–120 days, while the average lead time for knit garment companies is 60–80 days. For woven and knit products, the average lead time in China is 40–60 days and 50–60 days, respectively; in India, the same products have lead times of 50–70 days and 60–70 days, respectively. Bangladesh ought to raise its mean lead time for global market competition.

6) 87 percent of mid-level managers stated that the majority of illiterate men and women. Because garment workers lack expertise, the quality of their products frequently declines. Thirty percent of workers are illiterate in their native tongue. 35 percent finish their elementary schooling. Ten percent of workers finish their higher secondary level, compared to twenty-five percent who finish their secondary level. They explained that they had to drop out of school in order to support their families and pay their living bills. Furthermore, 10% of the clothing industry gives its employees insufficient training. This facility is not present in the remaining 70% of the apparel sector. Not even 80% of employees with over five years of experience receive any kind of training. Thus, it must be a typical occurrence for garment workers to be inefficient.

7) 67% of the supervisors said that tasks are primarily assigned based on gender in Bangladesh's clothing sector. Nearly all of the workers in the cutting, ironing, and finishing sectors are men, whereas all of the women work in the sewing department. Women are employed in a wide range of jobs, including cutting, sewing, buttonhole creation, checking, thread cleaning, ironing, folding, packing, training, and managing. Women are employed mostly as machinists and assistants; they are less common as line supervisors and quality controllers. No female cutting masters exist. Jobs in management and administration are dominated by men. When it comes to getting into management and higher- paying white collar jobs, women face discrimination.

8) 95% of employees stated that employers exploited their ignorance and poverty to force them to labor in hazardous and unhealthy environments that were overcrowded with more employees than they could handle. Inadequate airflow and the production floor's capacity. It results in a devastation that kills the employees. In the owners' eyes, they also break the safety rule in order to make a significant profit.

9) For the several worker groups shown in the table, the Bangladeshi government sets minimum salaries. According to 99% of the workforce, this pay grade is likewise extremely low when compared to living standards. Compared to 15% of their male counterparts, 73% of female aides did not receive even the minimum pay, according to a 1998 poll. There is labour discontent as a result.

10) Workers at factories had unhealthy working conditions. They frequently have to deal with extreme heat, loud noise, gas, fire, dust, and flames. hazardous instruments, Work at heights and beneath the surface. Of the workers, 67% are exposed to fire, gas, and fumes, and 30% are exposed to dust and fumes. 80% of employees are subjected to loud noises. 42% are subjected to severe cold and heat. Of the workers, 84% are exposed to dangerous tools, and 2% are exposed to working at heights and underground. Therefore, getting a high-quality product is a pipe dream without the right working atmosphere. When conducting in-person interviews, surveyors discover that. Routes are blocked by storage materials.

➢ Machine layout is often staggered.

➢ Lack of signage for escape route.

➢ No provision for emergency lighting.

➢ Doors, opening along escape routes, are not fire resistant.

➢ Fire exit or emergency staircase lacks proper maintenance.

➢ Lack of proper exit route to reach the place of safety proper. Parked vehicles, goods and rubbish on the outside of the building obstruct exits to the open air.

11) Although the 1965 Factory Act permits women to labor past delivery dates, working after 8 o'clock is practically required of them. There are instances when they work till three in the morning and return to work five hours later at eight. The Factory Act, which states that no employee shall work more than ten days in a row without a break, requires them to labor entire months at a time.

3.8. Challenges of RMG Sector in Bangladesh

Since 2005, Bangladesh's RMG has emerged as the country's largest export earner and taken the lead in the global clothing market. Several issues have jeopardized the garment industry in Bangladesh, including the 2008 financial crisis, the Tazreen fire catastrophe, the collapse of Rana Plaza, the Trans-Pacific Partnership Agreement (TPP), and the United States' removal of the generalized system of preference (GSP). However, fresh hurdles accompany every achievement. The following are a few of the challenges:

Unskilled workers: Industry growth and development depend on having the right kind of knowledge and experience. However, despite the industry's growth, a shortage of skilled workers is impeding its development. Ninety percent of its 4 million workers are women, the most of them are from rural areas of the nation, lack formal education, and are unskilled.

Insufficient infrastructure: Infrastructure related to transport and utilities: The main problem impeding Bangladesh's RMG sector is infrastructure. Nearly 85% of the nation's commercial goods are handled at the Chittagong port, which is plagued by labor issues, subpar management, and a lack of apparatus (World Bank, 1999). There are relatively little carrying and handling facilities offered by other modes of transportation, such as Bangladesh Railways and Dhaka-Chittagong Airports.

Safety issue: When the RMG industry first started, manufacturing structures were in an unplanned a process that led to common structures being converted for industrial use. As a result, other catastrophic collapses occurred, including the Tazrin and Rana Plaza events, which left thousands of people injured and thousands of people dead. These have made the problem of safety a top priority.

Raw materials: Bangladesh imports cotton, thread color, and other raw materials needed to make clothing. The growth of the apparel business is hampered by this reliance on raw materials. Furthermore, low-quality products are frequently produced using low-quality components from overseas suppliers. In addition, the cost of cotton and other raw materials used in Bangladesh's textile industry varies greatly.

Energy crises: Gas, oil, and electrical shortages thwarted the profitable investment strategy intended to expand the RMG sector. Water, electricity, gas, and oil are the essential building blocks of industrial development. Electricity load-shedding resulted in a sharp decline in output, which lowered the amount of goods available for export. shortage of gas and electricity, making it impossible to take in export orders from all over the world.

Political Crisis: In the nation, political instability is a regular problem. The economy and political stability are the fifth in Bangladesh, according to the European and US CPO study (Berg et al., 2011), which also states that they will cut back on sourcing from Bangladesh if political stability were to decline. The primary hindrances to economic progress are political instability, labor strikes, and corruption.

Coverage of Accord and Alliance: The Alliance and Accord are currently posing a significant threat to Bangladesh's garment sector. The garment brands, merchants, and importers from both Europe and the USA have empowered two distinct autonomous organizations, the Accord and the Alliance. Working towards a secure and thriving RMG sector in Bangladesh is the aim of accord and alliance. Complying with the fire and building safety rules and instructions is a significant difficulty for accord and alliance.

3.9. Contribution of RMG Sector in Bangladesh:

The Bangladeshi economy benefits greatly from the ready-made garment (RMG) sector. Millions of people, particularly the impoverished, rely heavily on this business for work and income. The following lists some of the ready-made garment (RMG) sectors' contributions to Bangladesh's national economy:

Over time, the RMG sector's share of the nation's exports has grown astronomically. It has developed into Bangladesh's primary export-generating industry. Between 1983 and 1984, Bangladesh's overall exports and RMG exports amount to just 31.57 million, or 3.89% of the country's total exports. The RMG exports are rising steadily, reaching

$30,614.76, and account for 83.49% of total exports. Additionally, the RMG sector employs the majority of people in Bangladesh. Bangladesh's RMG in US dollars for the years 2016–2017 and 2017–2018. RMG exports accounted for 81.23% and 83.49% of total national exports in the fiscal years 2016–17 and 2017–18. The majority of Bangladesh's national exports are RMG exports. RMG Exports in FY 2022-23: The Ready-Made Garment (RMG) sector, which is the main driver of Bangladesh's exports, contributed $47.38 billion to the total export earnings in FY 2022-23, also a record high. This translates to 84.58% of the country's total exports.

Contribution to GDP: In FY 2021-22, the RMG sector contributed 11% to Bangladesh's GDP. Export Earnings: In FY 2021-22, the RMG sector generated export earnings of US$ 47.38 billion, which is 84.58% of the total export earnings.

Employment: About 4.3 million workers work in the RMG sector, of which 80% are women.

Foreign Investment: The RMG sector received $19.57 billion in foreign investment.

Social Contribution: Social activity and things are depending on the economy of a country. RMG sector are contributing in social works in many ways.

Women Empowerment: Employment of women in the RMG sector increases their financial independence and empowers their families and society

Poverty Alleviation: Employment in the RMG sector plays an important role in poverty reduction.

Improving quality of life: Employment in the RMG sector has increased the income of workers, which has improved their standard of living.

Infrastructure development: As a result of the expansion of the RMG sector, infrastructure such as roads, electricity, water supply etc. has been improved.

Human Resource Development: The demand for trained manpower for the RMG sector has increased, leading to an emphasis on human resource development.

3.10. The Issue of Bangladesh's RMG Sector's Compliance and Sustainability:

Sustainability refers to the capacity to continue, be upheld, supported, or verified. Bangladesh faces difficulties in creating a viable RMG industry. These difficulties include insufficient worker welfare programs, a small number of product offerings, unexplored markets, and unstable political environments. These are the four obstacles that Bangladesh's RMG industry must overcome to remain sustainable. Bangladesh must therefore guarantee worker welfare in addition to a safe working environment, diversify its product line, focusing especially on high-end items, explore new markets, both conventional and unconventional, and maintain a reasonable level of sociopolitical stability if it hopes to have a sustainable RMG sector.

Adhering to a regulation, be it a statute, policy, specification, or standard, is known as compliance. Bangladesh is a developing nation, thus stakeholders in corporate social responsibility (CSR) and nongovernmental organizations (NGOs) closely monitor compliance. Buyers and CSR both note higher labor and social compliance criteria, but there are still numerous unanswered questions and a wide spectrum of compliance problems. In the Bangladeshi apparel business, resolving these problems and establishing moral labor standards and sourcing procedures are essential requirements.

3.10.1. Factors That Need to Be Considered to Achieve Sustainability in Global Market:

Political aspects

➢ To what extent is the political climate stable?

➢ Will laws governing or taxing the business be impacted by government policy?

➢ What is the government's stance on the ethics of marketing?

➢ What economic policies does the government implement?

➢ What is the government's position on religion and culture?

Economic factors:

➢ Interest rates

➢ Inflation rate

➢ And per-capita employment

➢ Long-term economic outlooks, including GDP per capita and other metrics.

Socio-cultural factors:

Include consumers' lifestyles, buying habits, education, religion, beliefs, values, demographics, social classes. These factors determine the suitability of an organization’s products and services for its customers' needs.

Technological factors

➢ Does technology allow for products and services to be made more cheaply and to a better standard of quality?

➢ Do the technologies offer consumers and business more innovative products and services such as internet banking, new generation mobile, telephones etc.

➢ How is distribution changed by new technologies e.g., books via internet, flight tickets, auctions etc.

➢ Does technology offer companies a new way to communicate with consumers e.g., banners, Customer Relationship Management (CRM) etc.

3.11. SWOT Analysis of Bangladesh Apparel Industries:

SWOT analysis is not just helpful for businesses looking to make money. SWOT analysis can be applied in any circumstance where a desirable end-state, or objective, needs to be determined.

3.11.1. Strength:

The RMG sector of Bangladesh in the breadwinning source fet about 4 million workers associated with more than 4000 garments factories who are taking parts to obtain more than 83 percent of the country's export and approximately 16 percent. to the GDP.

The strengths are:

➢ Less labor cost

➢ Energy at relatively lesser price

➢ Freely accessible infrastructure like railway, plan, river and route.

➢ Has great number of pre-export financing organizations for guidance

➢ Reasonably open economy, particularly in the Export Processing Zone

➢ Several associations like BGMEA BKMEA and BEPZA etc. to build the tight collaboration with various Connected organization.

➢ Duty Lee access to some of the Ingest market of the world like ELI, USA

➢ Thinness of currency opposed to dollar euro helping exporters to earn subtle profit.

➢ Convince of duty free custom bonded warehouses.

3.11.2. Weakness:

The leading obstacles of ready-made garments are low net exporting low value addition, low quality and standard, low productivity, elimination of quota and GSP, intense competition, scarcity of backward linkage industries etc. to comply with the set standards by the supporting countries.

Weaknesses of Bangladesh Industry are as follows.

➢ Longer lead time.

➢ Lack of marketing tactics

➢ Weak infrastructure

➢ Lack of sea port capacity

➢ Political instability

➢ Small number of manufacturing methods.

➢ Petty number of products viamety

➢ Lack of among organizations for industrial workers. Supervisors and managers

➢ Autocratic approach of nearly all the investors

➢ Absence of easily on hand addle management

➢ Fewer process unit of textile and garments

➢ Speed money cutline

➢ Time consumming custom clearance

➢ Subject to natural climate

➢ Incomplete port entry exit complicated and leading unloading takes much time

➢ Communication gap created by the lack of English knowledge.

3.12. Opportunities of Bangladeshi Garments Industry:

Bangladesh has always been a land of opportunities Bangladesh's textile industry has been part of the trade versus and debare the encouragement of the garments industry of Bangladesh as an open trade regiour angued to be a much more effective form of assistance than foreign aid Opportunities are below:

➢ The EU is willing to establish industries in a big way as an option for Cluna particularly for knits, including sweaters

➢ Bangladesh is included in the least developed countries with whach the US is conmatted to enluatuor export trade

➢ Chittagong port is going to be handed over foreign operators, which will make the port service faster.

➢ Bangladesh is gaining in political stability.

3.12.1. Threats of Bangladesh Garments Industry:

Bangladesh has a great number of rising threats emerging which needs to be eliminated as fast as possible. They are:

➢ Political unrest situation of the country.

➢ Rise of price of raw materials.

➢ Environmental pollution is a threat for survival.

➢ Labor unrest in RMG factories.

➢ Capability to hold the market for the long-term future.

➢ Financial supports.

3.12.2. Five Forces to the Ready-Made Garment (RMG) Sector in Bangladesh:

Analyzing the Ready-Made Garment (RMG) sector in Bangladesh through Porter's Five Forces framework can provide valuable insights for your thesis. Here's a breakdown of how each force applies to the RMG sector in Bangladesh:

-

1)

New Entrants into an established Market:

Government Regulations: Bangladesh has relatively low barriers to entry in the RMG sector, which has led to a plethora of new entrants. However, the government has started imposing stricter regulations regarding safety standards, labor rights, and environmental sustainability, increasing the cost of compliance and thus deterring some potential new entrants.

Access to Distribution Channels: Established brands and companies often have strong relationships with international buyers and access to global distribution channels, making it difficult for new entrants to compete on a similar scale.

Economies of Scale: Large-scale production facilities and established supply chains provide existing players with significant economies of scale, making it challenging for new entrants to compete on cost.

-

2)

Dealing Power of Suppliers:

Raw Material Suppliers: Bangladesh heavily relies on imported raw materials like cotton and fabrics. The bargaining power of suppliers can fluctuate based on global market conditions and geopolitical factors. Any disruptions in the supply chain can impact the profitability of RMG companies.

Labor Force: The large pool of available labor in Bangladesh gives suppliers (i.e., workers) less bargaining power, keeping labor costs relatively low. However, increasing awareness and activism around labor rights could potentially strengthen their bargaining power in the future.

-

3)

Dealing Power of Buyers:

Global Trader and Brands: International retailers and brands exert significant Dealing power over Bangladeshi garment manufacturers due to the large amount of orders they place. This often leads to pressure on prices and delivery timelines.

Diversification of Buyers: Dependency on a few major buyers can increase vulnerability for RMG companies. Diversifying the customer base can help mitigate this risk and reduce the bargaining power of any single buyer.

-

4)

Threat of Alternative:

Shifts in Consumer Preferences: Changes in fashion trends and consumer preferences can lead to the substitution of RMG products with alternatives such as athleisure wear or sustainable fashion. RMG companies need to stay agile and adapt to evolving market demands to mitigate this threat.

Technological Advancements: Innovations in textile technology could lead to the development of alternative materials or manufacturing processes that could potentially substitute traditional garment production methods.

-

5)

Competitive Conflict:

Industry Competition: The RMG sector in Bangladesh is highly competitive, with numerous local and international players vying for market share. Intense competition often leads to price wars and pressure on profit margins.

-

6)

Brand Differentiation:

Building strong brands and focusing on product differentiation can help RMG companies stand out in a crowded market and reduce the intensity of competitive rivalry.

By analyzing these forces, you can gain a comprehensive understanding of the opportunities and challenges facing the RMG sector in Bangladesh, which can form the basis of your thesis. Additionally, consider incorporating current industry data and case studies to strengthen your analysis.

4. Conclusion:

The inception of the Ready-Made Garments (RMG) sector in Bangladesh can be traced back to 1978. The economy of Bangladesh heavily relies on this sector for growth, with employment opportunities and export revenues playing a crucial role. The research illuminates the significance of the industry, commercial data, and obstacles encountered. Through meticulous analysis of market trends, trade policies, and economic dynamics, this research has identified avenues for Bangladesh to bolster its competitiveness and expand its market share in the global garment market.

However, the path toward sustained growth is fraught with challenges. Issues such as labor rights violations, environmental sustainability concerns, and supply chain vulnerabilities pose significant hurdles to the sector's progress. Moreover, structural constraints such as the scarcity of skilled labor, inadequate infrastructure, energy shortages, financial constraints, regulatory complexities, and geopolitical pressures further exacerbate the challenges faced by Bangladesh's RMG industry.

Despite these obstacles, this study offers actionable insights for policymakers, industry stakeholders, and academia to navigate the intricate interplay of opportunities and challenges. By leveraging empirical evidence, case studies, and theoretical frameworks, this research aims to inform strategic decision-making and foster sustainable development in Bangladesh's RMG sector.

Moving forward, addressing the identified challenges will require concerted efforts from all stakeholders. Policymakers need to enact reforms that prioritize labor rights, environmental sustainability, and infrastructure development. Industry practitioners must invest in skill development, innovation, and technology adoption to enhance productivity and competitiveness. Collaboration between the government, private sector, civil society, and international partners is imperative to overcome the multifaceted challenges facing the RMG sector.

In essence, by confronting these Demanding head-on and capitalizing on emerging Scope, Bangladesh's RMG industry can continue to thrive and contribute to the resilience and prosperity of the nation's economy in the global arena.