Submitted:

26 April 2025

Posted:

21 May 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

2.1. Factors Affecting Mobile Banking Usage

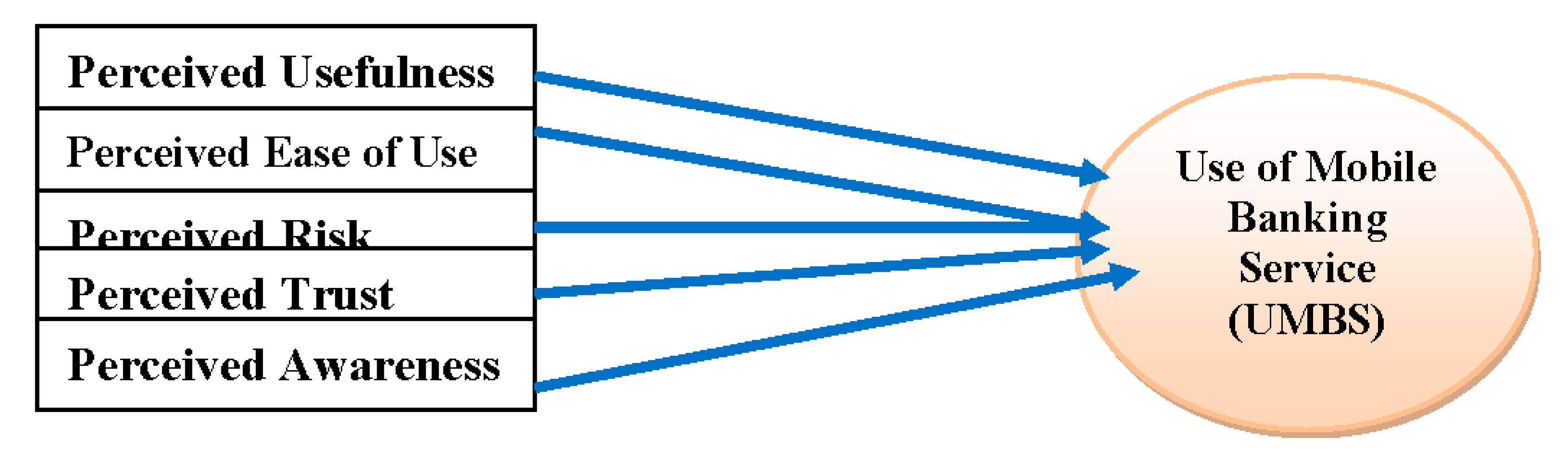

Technology Acceptance Model (TAM)

- Perceived Usefulness

- 2.

- Perceived Ease of Use

- 3.

- Perceived Risk

- 4.

- Perceived Trust

- 5.

- Perceived Awareness

2.2. Benefits of Mobile Banking

2.3. Research Gap

2.4. Conceptual Framework

3. Research Methodology

3.1. Description of the Study Area

3.2. Research Approaches and Design

3.3. Data Collection Methods

3.4. Target Population

3.5. Sample Size and Sampling Method

- n = sample size

- N = population size

- e = sample error at 5%

| No | Name of Branch | Active mobile banking user(N) | Sample size form each strata by using proportional method(n) |

|---|---|---|---|

| 1 | Harar branch | 75,000 | 105 |

| 2 | Jegol branch | 61,000 | 86 |

| 3 | Shenkor branch | 50,000 | 70 |

| 4 | Jenela branch | 44,000 | 62 |

| 5 | Aboker branch | 55,000 | 77 |

| Total | 285,000 | 400 | |

3.6. Model Specification

| Variable | Expected Sign (+/-) | Notation | Description |

| Dependent Variable | |||

| Y | UMBST | Usage of Mobile Banking Service Technology | |

| Independent Variable | |||

| X1 | +ve | PU | Perceived Usefulness |

| X2 | +ve | PEOU | Perceived Ease of Use |

| X3 | -ve | PR | Perceived Risk |

| X4 | -ve | PT | Perceived Trust |

| X5 | +ve | PA | Perceived Awareness |

3.7. Validity and Reliability

| Constructs | Cronbach's Alpha | N of Items |

|---|---|---|

| PU | .892 | 5 |

| PEOU | .740 | 5 |

| PR | .981 | 5 |

| PT | .825 | 5 |

| PA | .740 | 5 |

8.8. Data Analysis Method

3.9. Ethical Consideration

4. Results and Discussion

4.1. Correlations Analysis

| Correlations | |||||||

| PU | PEOU | PR | PT | PA | UMBST | ||

| PU | Pearson Correlation | 1 | |||||

| Sig. (2-tailed) | |||||||

| PEOU | Pearson Correlation | .314** | 1 | ||||

| Sig. (2-tailed) | .000 | ||||||

| PR | Pearson Correlation | -.515** | -.605** | 1 | |||

| Sig. (2-tailed) | .000 | .000 | |||||

| PT | Pearson Correlation | .411** | .276** | -.466** | 1 | ||

| Sig. (2-tailed) | .000 | .000 | .000 | ||||

| PA | Pearson Correlation | .390** | .379** | -.519** | .351** | 1 | |

| Sig. (2-tailed) | .000 | .000 | .000 | .000 | |||

| UMBST | Pearson Correlation | .591** | .596** | -.858** | .389** | .536** | 1 |

| Sig. (2-tailed) | .000 | .000 | .000 | .000 | .000 | ||

| **. Correlation is significant at the 0.01 level (2-tailed). | |||||||

| b. Listwise N=385 | |||||||

4.1.1. Regression Analysis

Regression Model Summary

| Model Summary | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

| 1 | .885a | .784 | .781 | .568 | 1.600 |

| a. Predictors: (Constant), PA, PT, PEOU, PU, PR | |||||

| b. Dependent Variable: UMBST | |||||

| ANOVAa | ||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 443.229 | 5 | 88.646 | 274.533 | .000b |

| Residual | 122.378 | 379 | .323 | |||

| Total | 565.606 | 384 | ||||

| a. Dependent Variable: UMBST | ||||||

| b. Predictors: (Constant), PA, PT, PEOU, PU, PR | ||||||

| Coefficients | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | |||||

| 1 | (Constant) | 4.908 | .369 | 13.305 | .000 | .684 | 1.463 | |

| PU | .207 | .029 | .204 | 7.050 | .000 | .628 | 1.592 | |

| PEOU | .170 | .046 | .111 | 3.667 | .000 | .442 | 2.263 | |

| PR | -.876 | .047 | -.672 | -18.701 | .000 | .734 | 1.363 | |

| PT | -.087 | .035 | -.070 | -2.515 | .012 | .694 | 1.440 | |

| PA | .144 | .046 | .090 | 3.130 | .002 | .684 | 1.463 | |

| a. Dependent Variable: UMBST | ||||||||

UMBST = 4.908 + .204PU + .111PEOU + (-.672PR) + (-.070PT) + .090PA +

| Hypothesis | Effects | Decision | Significant level |

|---|---|---|---|

| H1: the perceived usefulness has a positive effect on usage of mobile banking service | Significant Positive Effect | Do not reject H1 | Βeta1=0.204 P-Value=0.000 Sig<0.01 |

| H2: the perceived ease of use has a positive effect on usage of mobile banking service. | Significant Positive Effect | Do not reject H1 | Βeta2=0.111 P-Value=0.000 Sig<0.01 |

| H3: the perceived risk has a negative effect on usage of mobile banking service. | Significant Negative Effect | Do not reject H1 | Βeta3=-0.672 P-Value=0.000 Sig<0.01 |

| H4: the perceived trust has a positive effect on usage of mobile banking service. | Significant Negative Effect | Reject H1 | Βeta4=-0.070 P-Value=0.012 Sig<0.01 |

| H5: the perceived awareness has a positive on usage of mobile banking service. | Significant Positive Effect | Do not reject H1 | Βeta5=0.266 P-Value= 0.002 Sig<0.01 |

5. Conclusions

5.1. Future Research Directions

References

- Aboelmaged, M., & Gebba, T. R. (2013). Mobile banking adoption: An examination of technology acceptance model and theory of planned behavior. International Journal of Business Research and Development, 2(1). [CrossRef]

- Algozzine, B., & Hancock, D. (2017). Doing case study research: A practical guide for beginning researchers. Teachers College Press.

- Amirkhanpour, M., Vrontis, D., & Thrassou, A. (2014). Mobile marketing: A contemporary strategic perspective. International Journal of Technology Marketing 5, 9(3), 252–269. [CrossRef]

- Ba, S., & Pavlou, P. A. (2002). Evidence of the effect of trust building technology in electronic markets: Price premiums and buyer behavior. MIS Quarterly, 243–268. [CrossRef]

- Bhatt, A., & Bhatt, S. (2016). Factors affecting customers adoption of mobile banking services. The Journal of internet Banking and Commerce, 21(1).

- Bhattacherjee, A. (2002). Individual trust in online firms: Scale development and initial test. Journal of Management Information Systems, 19(1), 211–241. [CrossRef]

- Bhatti, T. (2007). Exploring Factors Influencing the Adoption of Mobile Commerce. Journal of internet Banking and Commerce, 12(3).

- Bihari, S. C. (2014). MOBILE BANKING IN INDIA-YOUR MONEY IN YOUR POCKET. Journal on Management, 9(3). [CrossRef]

- Brown, I., Cajee, Z., Davies, D., & Stroebel, S. (2003). Cell phone banking: Predictors of adoption in South Africa—An exploratory study. International Journal of Information Management, 23(5), 381–394. [CrossRef]

- Bučevska, V., & Bučevska, J. (2011). A LOGIT MODEL OF ELECTRONIC BANKING ADOPTION: THE CASE OF KOMERCIJALNA BANKA AD SKOPJE. Interdisciplinary Management Research, 7.

- Bultum, A. (2012a). Adoption of Electronic Banking System in Ethiopian Banking Industry: Barriers and Driver.

- Bultum, A. (2012b). Adoption of Electronic Banking System in Ethiopian Banking Industry: Barriers and Driver.

- Chen, Y., & Barnes, S. (2007). Initial trust and online buyer behaviour. Industrial Management & Data Systems.

- Creswell, J. W. (2014). A concise introduction to mixed methods research. SAGE publications.

- Cruz, P., Neto, L. B. F., Muñoz-Gallego, P., & Laukkanen, T. (2010). Mobile banking rollout in emerging markets: Evidence from Brazil. International Journal of Bank Marketing. [CrossRef]

- Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8), 982–1003. [CrossRef]

- Deshwal, P. (2015). A study of mobile banking in India. International Journal of Advanced Research in IT and Engineering, 4(12), 1–12.

- Donner, J., & Tellez, C. A. (2008). Mobile banking and economic development: Linking adoption, impact, and use. Asian Journal of Communication, 18(4), 318–332. [CrossRef]

- Egger, F. N., & Abrazhevich, D. (2001). Security and trust: Taking care of the human factor. Electronic Payment Systems Observatory Newsletter, 9, 17–19.

- Field, A. P. (2005). Is the meta-analysis of correlation coefficients accurate when population correlations vary? Psychological Methods, 10(4), 444. [CrossRef]

- Garbarino, E., & Johnson, M. S. (1999). The different roles of satisfaction, trust, and commitment in customer relationships. Journal of Marketing, 63(2), 70–87. [CrossRef]

- Garedachew, W. (2010). Electronic Banking in Ethiopia-Practice, Opportunities and Challenges. Addis Ababa, Ethiopia. Retrieved from http. 1492006.

- Garson, G. D. (2012). Testing statistical assumptions.

- Gefen, D., Karahanna, E., & Straub, D. W. (2003). Trust and TAM in online shopping: An integrated model. MIS Quarterly, 51–90. [CrossRef]

- Gefen, D., & Straub, D. W. (2004). Consumer trust in B2C e-Commerce and the importance of social presence: Experiments in e-Products and e-Services. Omega, 32(6), 407–424. [CrossRef]

- Geoffrey, M., & David, D. (2005). Essentials of research design and methodology.

- Gerrard, P. Gerrard, P., & Cunningham, J. B. (2003). The diffusion of internet banking among Singapore consumers. International Journal of Bank Marketing. [CrossRef]

- Gezahegn, K. (2016). Factors Influencing Usage of Mobile Banking in Addis Ababa, Ethiopia.

- Ghosh, I. (2013). The agent in a transformational m-banking ecosystem: Interface or intermediary? 33–36.

- Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220–265. [CrossRef]

- Gu, J.-C., Lee, S.-C., & Suh, Y.-H. (2009). Determinants of behavioral intention to mobile banking. Expert Systems with Applications, 36(9), 11605–11616. [CrossRef]

- Harris, L., & Goode, M. (2004). The Four Levels of Loyalty and the Pivotal Role of Trust: A Study of Online Service Dynamics. Journal of Retailing, 80, 139–158. [CrossRef]

- Im, I., Kim, Y., & Han, H.-J. (2008). The effects of perceived risk and technology type on users’ acceptance of technologies. Information & Management, 45(1), 1–9. [CrossRef]

- Jeong, B. K., & Yoon, T. E. (2013). An empirical investigation on consumer acceptance of mobile banking services. Business and Management Research, 2(1), 31–40. [CrossRef]

- Kabir, M. R. (2013). Factors influencing the usage of mobile banking: Incident from a developing country. World Review of Business Research, 3(3), 96–114.

- Khalifa, M., & Shen, K. N. (2008). Explaining the adoption of transactional B2C mobile commerce. Journal of Enterprise Information Management. [CrossRef]

- Kim, G., Shin, B., & Lee, H. G. (2009a). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283–311. [CrossRef]

- Kim, G., Shin, B., & Lee, H. G. (2009b). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283–311. [CrossRef]

- Kothari, C. R. (2004). Research methodology: Methods and techniques. New Age International.

- Kumar, R. (2018). Research methodology: A step-by-step guide for beginners. Sage.

- Laforet, S., & Li, X. (2005a). Consumers’ attitudes towards online and mobile banking in China. International Journal of Bank Marketing, 23(5), 362–380. [CrossRef]

- Laforet, S., & Li, X. (2005b). Consumers’ attitudes towards online and mobile banking in China. International Journal of Bank Marketing, 23(5), 362–380. [CrossRef]

- LEE, K., LEE, H., & KIM, S. (2007). FACTORS INFLUENCING THE ADOPTION BEHAVIOR OF MOBILE BANKING: A SOUTH KOREAN PERSPECTIVE.

- Lee, M.-C. (2009a). Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications, 8(3), 130–141. [CrossRef]

- Lee, M.-C. (2009b). Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications, 8(3), 130–141. [CrossRef]

- Liao, Z., & Cheung, M. T. (2002). Internet-based e-banking and consumer attitudes: An empirical study. Information & Management, 39(4), Article 4. [CrossRef]

- Lin, H.-H., & Wang, Y.-S. (2006a). An examination of the determinants of customer loyalty in mobile commerce contexts. Information & Management, 43(3), 271–282. [CrossRef]

- Lin, H.-H., & Wang, Y.-S. (2006b). An examination of the determinants of customer loyalty in mobile commerce contexts. Information & Management, 43(3), 271–282. [CrossRef]

- Liu, B. (2010). Sentiment analysis and subjectivity. Handbook of Natural Language Processing, 2(2010), 627–666.

- Luarn, P., & Lin, H.-H. (2005a). Toward an understanding of the behavioral intention to use mobile banking. Computers in Human Behavior, 21, 873–891. [CrossRef]

- Luarn, P., & Lin, H.-H. (2005b). Toward an understanding of the behavioral intention to use mobile banking. Computers in Human Behavior, 21, 873–891. [CrossRef]

- Malhotra, R. (2012). Factors affecting the adoption of mobile banking in New Zealand: A thesis presented in partial fulfilment of the requirements for the degree of Masters in Information Technology in Information Systems at Massey University, Albany campus, New Zealand.

- Masinge, K. (2010). Factors influencing the adoption of mobile banking services at the Bottom of the Pyramid in South Africa.

- Mattila, M. (2003). Factors affecting the adoption of mobile banking services. Journal of internet Banking and Commerce, 8, 8–12.

- Maurer, B. (2008). Retail electronic payments systems for value transfers in the developing world. Department of Anthropology, University of California.

- Medberg, G., & Heinonen, K. (2014). Invisible value formation: A netnography in retail banking. International Journal of Bank Marketing. [CrossRef]

- Mishra, S. K., & Sahoo, D. P. (2013). Mobile banking adoption and benefits towards customers service. International Journal on Advanced Computer Theory and Engineering, 2(1), 78–83.

- Misra, S. K., & Wickamasinghe, N. (2004). Security of a mobile transaction: A trust model. Electronic Commerce Research, 4(4), 359–372. [CrossRef]

- Morawczynski, O., & Miscione, G. (2008). Examining trust in mobile banking transactions in Kenya: The case of m-PESA in Kenya. IFIP WG.

- Nasri, W. (2011). Factors influencing the adoption of internet banking in Tunisia. International Journal of Business and Management, 6(8), 143–160. [CrossRef]

- Nesibu, H. (2017). Mobile Banking adoption in Ethiopia: A Case of Commercial Bank of Ethiopia.

- Olasina, G. (2015). Factors influencing the use of m-banking by academics: Case study sms-based m-banking. The African Journal of Information Systems, 7(4), 4.

- Oni, A. A., Adewoye, O. J., & Eweoya, I. O. (2016). E-banking users’ behaviour: E-service quality, attitude, and customer satisfaction. International Journal of Bank Marketing. [CrossRef]

- Pallant, J. (2020). SPSS survival manual: A step by step guide to data analysis using IBM SPSS. McGraw-hill education (UK).

- Palvia, P. (2009). Palvia, P.: The role of trust in E-Commerce relational exchange: A unified model. Information and Management 46, 213-220. Information & Management, 46, 213–220. [CrossRef]

- Porteous, D. (2011). The enabling environment for mobile banking in Africa, Bankablefrontier.

- Ramdhony, D., & Munien, S. (2013). An investigation on mobile banking adoption and usage: A case study of Mauritius. World J. Soc. Sci., 3, 197–217.

- Ravichandran, D., & Madana, M. H. B. A. H. (2016). Factors influencing mobile banking adoption in Kurunegala district. Journal of Information Systems & Information Technology, 1(1), 24–32.

- Riquelme, H. E., & Rios, R. E. (2010a). The moderating effect of gender in the adoption of mobile banking. International Journal of Bank Marketing, 28(5), 328–341. [CrossRef]

- Riquelme, H. E., & Rios, R. E. (2010b). The moderating effect of gender in the adoption of mobile banking. International Journal of Bank Marketing, 28(5), 328–341. [CrossRef]

- Sathye, M. (1999). Adoption of internet banking by Australian consumers: An empirical investigation. International Journal of Bank Marketing. [CrossRef]

- Siau, K., Sheng, H., & Nah, F. (2003). Development of a framework for trust in mobile commerce.

- Singh, S. (2014). The impact and adoption of mobile banking in Delhi. International Research Journal of Business and Management, 1(7), Article 7.

- Sripalawat, J., Thongmak, M., & Ngramyarn, A. (2011). M-Banking in Metropolitan Bangkok and a Comparison with other Countries. Journal of Computer Information Systems, 51(3), 67–76. [CrossRef]

- Venkatesh, V. (2000). Determinants of perceived ease of use: Integrating control, intrinsic motivation, and emotion into the technology acceptance model. Information Systems Research, 11(4), 342–365. [CrossRef]

- Wang, S., & Barnes, S. (2007). Exploring the acceptance of mobile auctions in China. 27–27.

- Wu, J.-H., & Wang, S.-C. (2005). What drives mobile commerce?: An empirical evaluation of the revised technology acceptance model. Information & Management, 42(5), 719–729. [CrossRef]

- Yeh, Y. S., & Li, Y. (2009). Building trust in m-commerce: Contributions from quality and satisfaction. Online Information Review. [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).