Submitted:

16 May 2025

Posted:

20 May 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Core Formulations

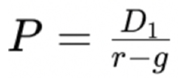

2.1. The Gordon Growth Model Is Expressed as

- P is the stock price,

- D1 is next year's dividend,

- r is the required rate of return,

- g is the expected growth rate of dividends.

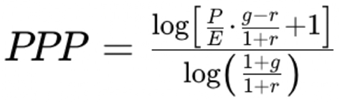

2.2. The Potential Payback Period (PPP) Is Defined as

- P is the stock price,

- E is current earnings per share,

- g is the earnings growth rate,

- r is the discount rate.

3. Limit Case: When g → r

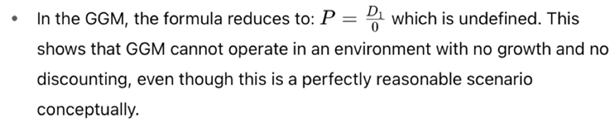

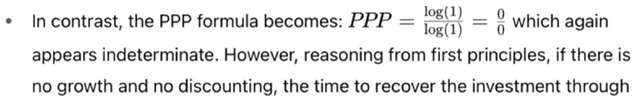

4. Extreme Case: When g = r = 0

5. Interpretation and Implications

- Both models are built on the same valuation logic: future cash flows adjusted for time and growth.

- However, PPP demonstrates greater mathematical resilience and interpretive clarity near and at critical boundaries.

- The fact that PPP collapses to the P/E ratio when g = r = 0 reinforces its role as a generalization of static valuation multiples.

- Practically, PPP offers usable, consistent outputs in conditions where GGM fails — such as early-stage companies, low-growth environments, or when applying valuation to earnings rather than dividends.

6. Conclusions

Remark

References

- Gordon, M. J., & Shapiro, E. (1956). Capital Equipment Analysis: The Required Rate of Profit. Harvard Business Review, 34(5), 102–110.— Provides the foundation for the Gordon Growth Model (GGM), which the PPP extends and surpasses under limiting conditions.

- Gordon, M. J. (1962). The Investment, Financing, and Valuation of the Corporation. Richard D. Irwin, Inc.— Develops the dividend discount model that influenced PPP’s time-discounting structure.

- Sam, R. (2025). Proving that the P/E Ratio is Just a Limiting Case of the Potential Payback Period (PPP) When Earnings Growth and Interest Rate are Ignored. Preprints. — Provides the mathematical proof that PPP generalizes and reduces to the P/E ratio under static conditions. [CrossRef]

- Sam, R. (2025). How to Adjust the P/E Ratio for Earnings Growth in Equity Valuation: PEG or PPP? Preprints. — Compares PPP with PEG to show how PPP better integrates growth into valuation. [CrossRef]

- Sam, R. (2025). Revisiting the Gordon-Shapiro Model: How the Potential Payback Period (PPP) Refines and Operationalizes a Foundational Framework in Stock Valuation. Preprints. — Demonstrates how PPP refines the structure of the Gordon-Shapiro model by making it applicable in modern contexts. [CrossRef]

- Sam, R. (2025). Extending the P/E and PEG Ratios: The Role of the Potential Payback Period (PPP) in Modern Equity Valuation. Preprints. — Positions PPP as a superior alternative to both P/E and PEG ratios in dynamic valuation environments. [CrossRef]

- Sam, R. (2025). SIRRIPA: The Stock-Tailored Yield to Maturity (YTM) and the Emergence of a Cross-Asset Valuation Metric. Preprints. — Introduces SIRRIPA as a complement to PPP, bridging equity and fixed-income valuation methodologies. [CrossRef]

- Sam, R. (2025). How the Potential Payback Period (PPP) Bridges the Gap Between Stocks and Bonds — and Revolutionizes Portfolio Management. Preprints. — Expands on PPP’s role in creating a unified valuation framework across asset classes. [CrossRef]

- Sam, R. (2025). Why SIRRIPA is Set to Replace the P/E Ratio in Modern Equity Valuation. Preprints. — Advocates for a cross-metric valuation system that builds upon PPP-derived logic. [CrossRef]

- Sam, R. (2025). Challenging Conventional Wisdom in Stock Valuation with the Potential Payback Period (PPP). SSRN. https://ssrn.com/abstract=5248808 or. — Critiques legacy valuation metrics and positions PPP as a more rational, time-sensitive alternative. [CrossRef]

- Sam, R. (2025). Breaking the Valuation Deadlock: Replacing the P/E Ratio with the Potential Payback Period (PPP) for Loss-Making Companies – A Case Study on Intel (2025). SSRN. https://ssrn.com/abstract=5247858 or. — Applies PPP in contexts where P/E is inapplicable due to negative earnings, showing its practical advantages. [CrossRef]

- Damodaran, A. (2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset (3rd ed.). Wiley.— Provides foundational DCF and risk-pricing frameworks that underpin PPP’s treatment of discounting.

- Penman, S. H. (2010). Financial Statement Analysis and Security Valuation (4th ed.). McGraw-Hill/Irwin.— Offers techniques for earnings-based valuation, aligned with PPP’s focus on EPS recovery.

- Brealey, R. A., Myers, S. C., & Allen, F. (2017). Principles of Corporate Finance (12th ed.). McGraw-Hill Education.— Covers key principles in financial theory including discounting, capital costs, and valuation logic integral to PPP.

- Bodie, Z., Kane, A., & Marcus, A. J. (2018). Investments (11th ed.). McGraw-Hill Education.— Discusses risk-return relationships and valuation methodologies that conceptually support PPP's discount-rate framework.

- Copeland, T. E., Koller, T., & Murrin, J. (2000). Valuation: Measuring and Managing the Value of Companies(3rd ed.). Wiley Finance.— Emphasizes practical DCF techniques and cost of capital, both central to PPP computation.

- Siegel, J. J. (2014). Stocks for the Long Run (5th ed.). McGraw-Hill Education.— Advocates for long-term valuation strategies, compatible with PPP’s time-recovery approach.

- Greenwald, B., Kahn, J., Sonkin, P. D., & van Biema, M. (2001). Value Investing: From Graham to Buffett and Beyond. Wiley.— Reinforces intrinsic value investing principles that PPP seeks to quantify more rigorously.

- Graham, B., & Dodd, D. L. (2008). Security Analysis (6th ed.). McGraw-Hill Education.— A foundational text on valuation that influenced PPP’s emphasis on earnings and intrinsic value.

- Miller, M. H., & Modigliani, F. (1961). Dividend Policy, Growth, and the Valuation of Shares. Journal of Business, 34(4), 411–433.— Established valuation equivalence principles that underlie PPP's sensitivity to growth and discounting.

- Fama, E. F., & French, K. R. (1992). The Cross-Section of Expected Stock Returns. Journal of Finance, 47(2), 427–465.— Provides empirical insights on return factors, supporting PPP’s incorporation of discount-rate-driven expectations.

- Arnott, R. D., & Bernstein, P. L. (2002). What Risk Premium Is “Normal”? Financial Analysts Journal, 58(2), 64–85.— Explores variability in equity risk premiums, essential for interpreting PPP's discounting logic.

- Koller, T., Goedhart, M., & Wessels, D. (2020). Valuation: Measuring and Managing the Value of Companies (7th ed.). McKinsey & Company / Wiley.— Offers contemporary valuation frameworks that PPP helps to extend under extreme or unconventional conditions.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).