Submitted:

18 April 2025

Posted:

21 April 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Preliminaries

2.1. Related Work

2.2. Primary Parameters

3. Methodologies

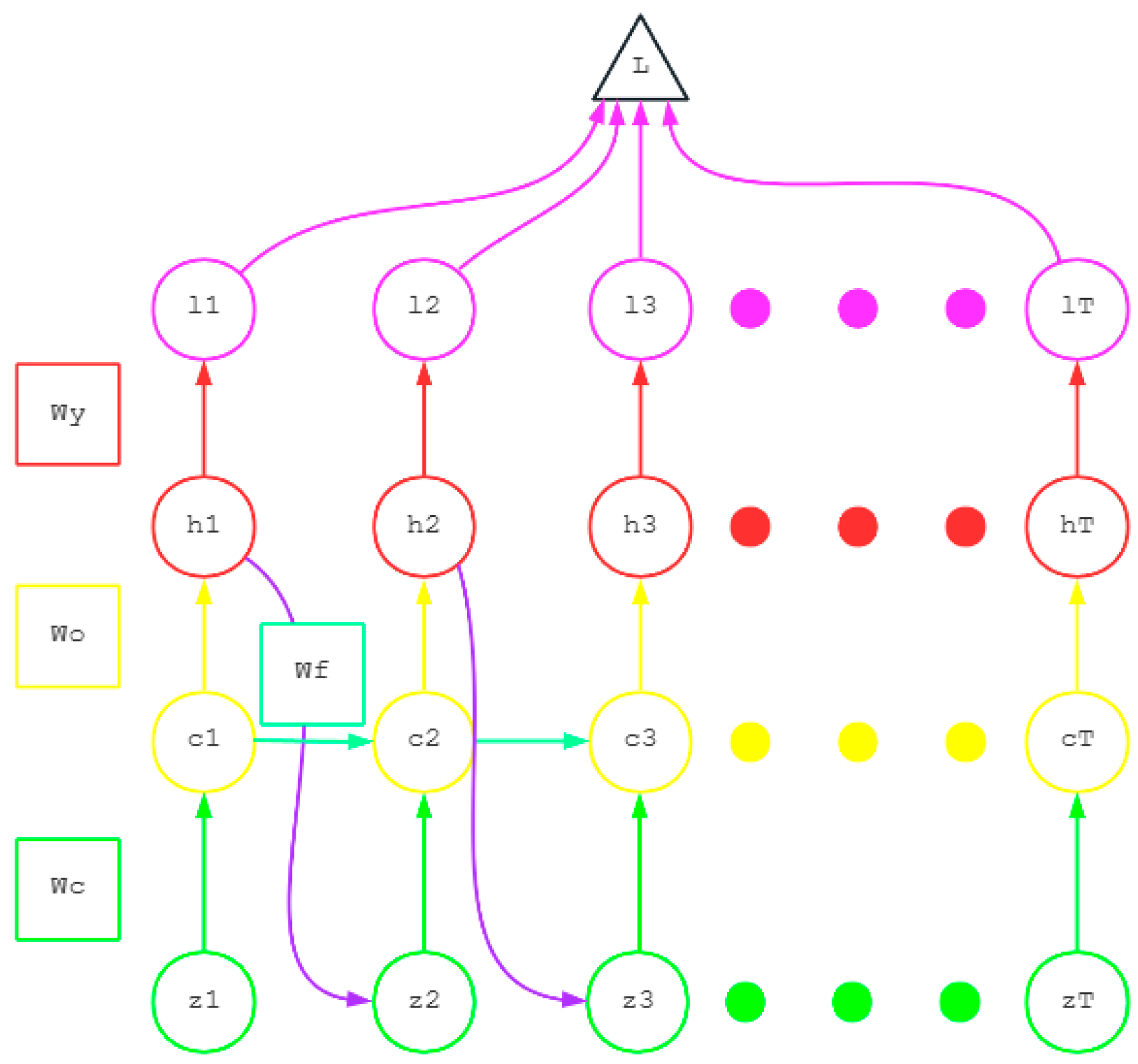

3.1. iLSTM Architecture

3.2. Multi-Objective Optimization Mechanism

3.3. Real-Time Policy Adjustments

4. Experiments

4.1. Experimental Setup

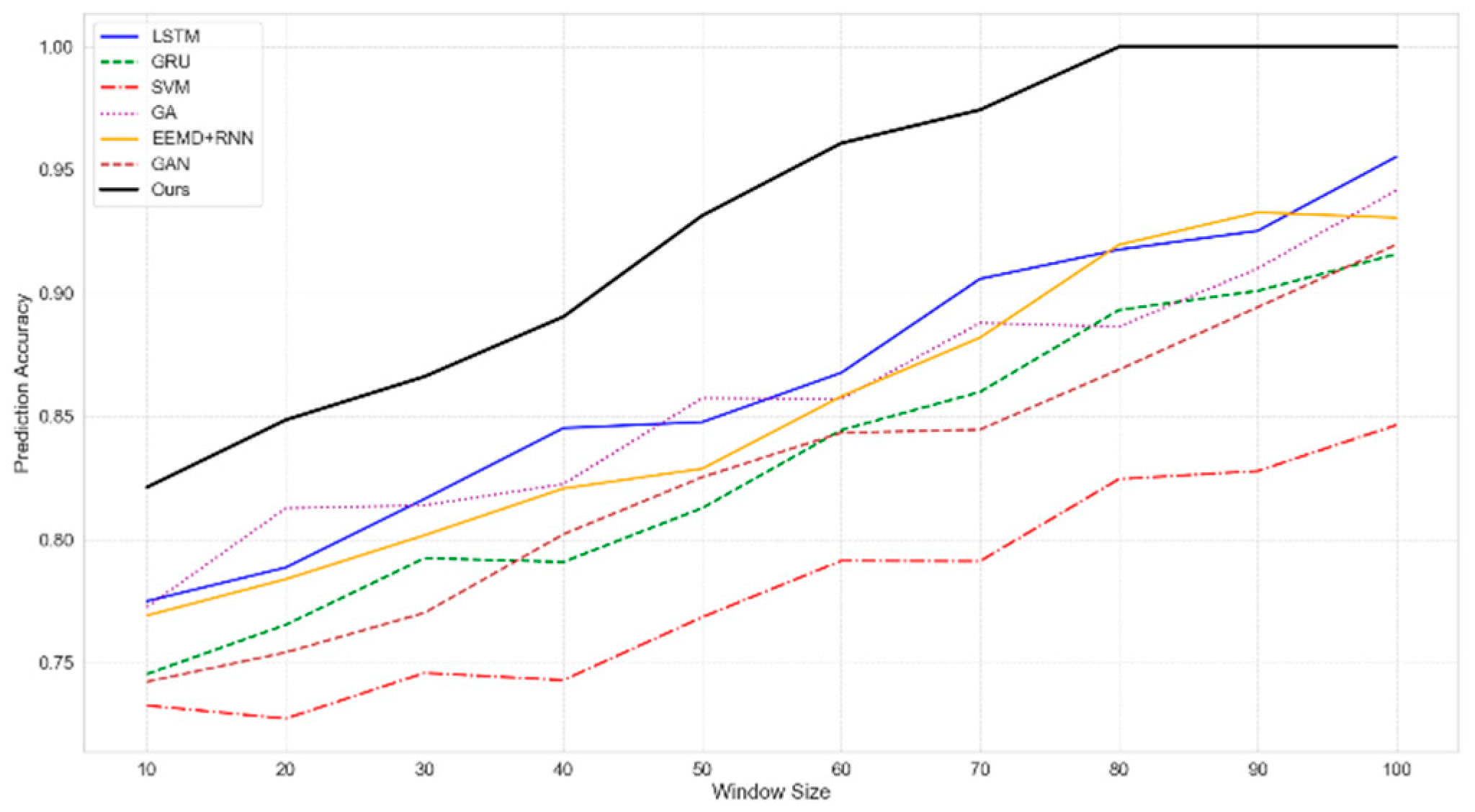

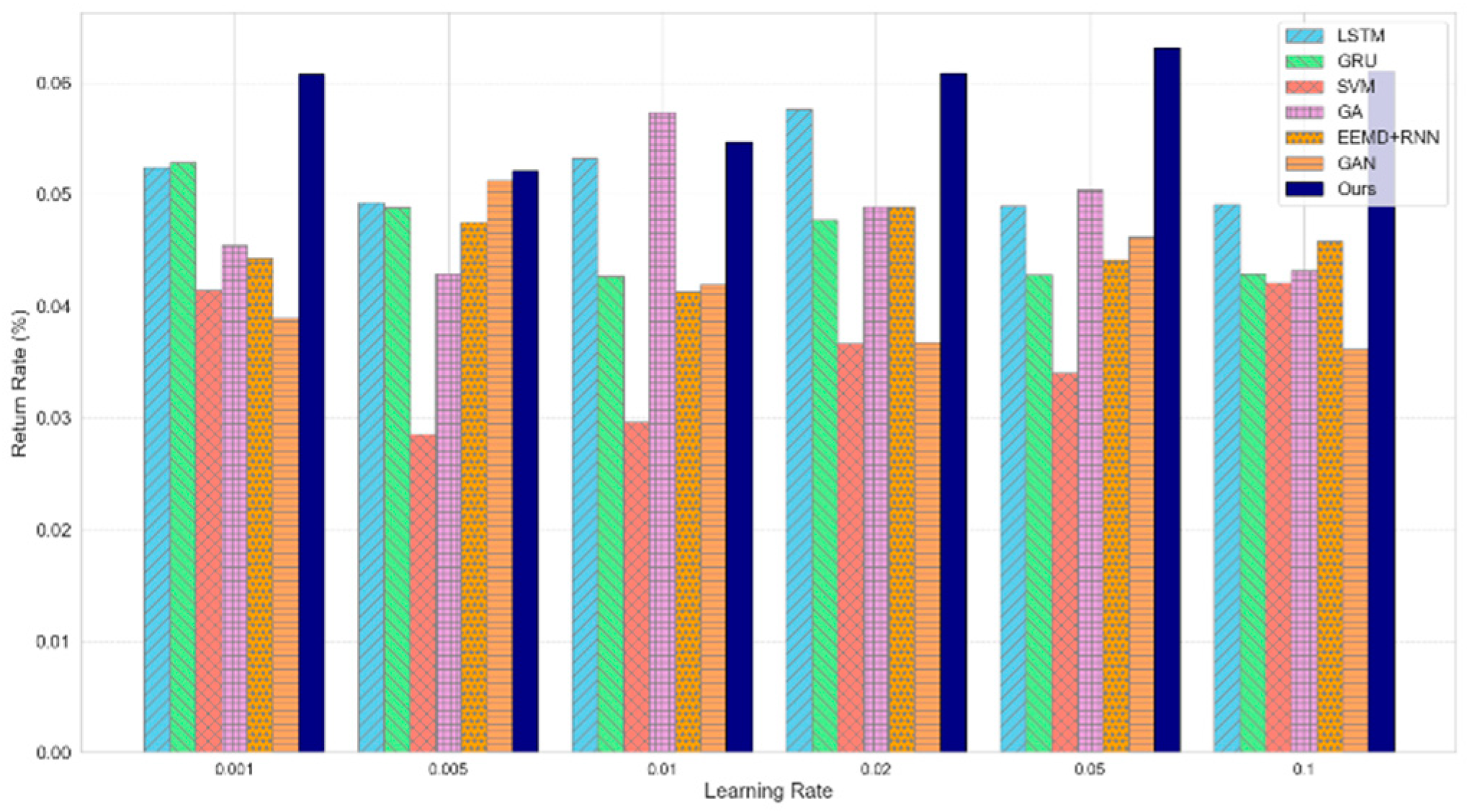

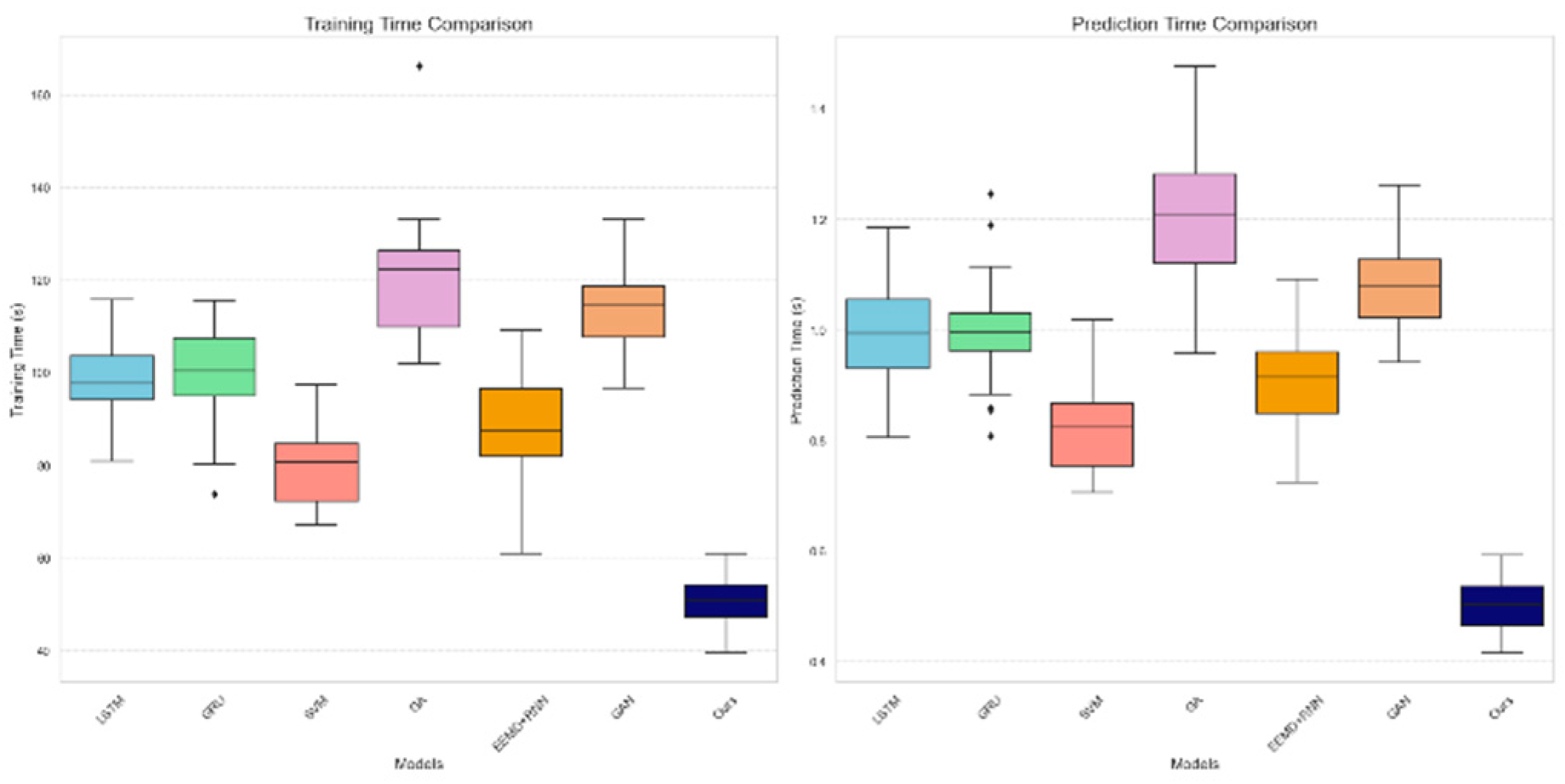

4.2. Experimental Analysis

5. Conclusions

References

- Qian, Hao, et al. "MDGNN: Multi-Relational Dynamic Graph Neural Network for Comprehensive and Dynamic Stock Investment Prediction." Proceedings of the AAAI Conference on Artificial Intelligence. Vol. 38. No. 13. 2024. [CrossRef]

- Lee, Woon Ming. Stock market equity advisory tool using analytic hierarchy process and single-layer perceptron neural network. Diss. UTAR, 2023.

- Nguyen, Minh. "AI-Powered Financial Advisory Services." Journal of AI-Assisted Scientific Discovery 4.2 (2024): 115-125.

- Asemi, Asefeh. A Novel Combined Investment Recommender System Using Adaptive Neuro-Fuzzy Inference System. Diss. Budapesti Corvinus Egyetem, 2023.

- Trivedi, Jeegar A., and Priti Srinivas Sajja. "Online Guidance for Effective Investment Using Type 2 Fuzzy-Neuro Advisory System." International Journal of Computer Science and Information Technologies (IJCSIT) 2.2 (2011): 799-803.

- Talwar, Shalini, et al. "Why retail investors traded equity during the pandemic? An application of artificial neural networks to examine behavioral biases." Psychology & Marketing 38.11 (2021): 2142-2163. [CrossRef]

- Shao, Qixiang, et al. "Toward intelligent financial advisors for identifying potential clients: a multitask perspective." Big Data Mining and Analytics 5.1 (2021): 64-78. [CrossRef]

- Needhi, Jeyadev, and S. Manokar. "Enhancing Financial Intelligence: AI Robo-Advisors for Strategic Investment Decisions." (2024).

- Day, Min-Yuh, Jian-Ting Lin, and Yuan-Chih Chen. "Artificial intelligence for conversational robo-advisor." 2018 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining (ASONAM). IEEE, 2018.

- Ng, Shun Yi. Stock market equity advisory tool by using of neural network method. Diss. UTAR, 2024.

- Shahani, M. N. A., et al. "INVESTOPAL-Smart Financial Investment Advisory System." 2023 7th International Conference On Computing, Communication, Control And Automation (ICCUBEA). IEEE, 2023.

- Wang, Pei-Ying, et al. "A robo-advisor design using multiobjective RankNets with gated neural network structure." 2019 IEEE international conference on agents (ICA). IEEE, 2019.

- Roy, Sunil K., et al. "Empowering Robo-Advisors: Data-Driven Mutual Fund and Stock Market Price Prediction with Deep Learning Techniques." 2024 Third International Conference on Electrical, Electronics, Information and Communication Technologies (ICEEICT). IEEE, 2024.

- Day, Min-Yuh, Tun-Kung Cheng, and Jheng-Gang Li. "AI robo-advisor with big data analytics for financial services." 2018 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining (ASONAM). IEEE, 2018.

- Méndez-Suárez, Mariano, Francisco García-Fernández, and Fernando Gallardo. "Artificial intelligence modelling framework for financial automated advising in the copper market." Journal of Open Innovation: Technology, Market, and Complexity 5.4 (2019): 81. [CrossRef]

- Lynch, Dustin Shane. Asset Allocation Technique for a Diversified Investment Portfolio Using Artificial Neural Networks. MS thesis. Ohio University, 2015.

| Notion symbols | Utilization |

|---|---|

| Sigmoid activation function | |

| Weight matrix of the forgetting gate | |

| Regularization parameters | |

| The fully invested Lagrange multiplier | |

| Weight coefficients | |

| Upper limit of the value | |

| Upper bound of the two norms of the weight vector | |

| The total number of training samples | |

| Small constant |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).