Submitted:

26 March 2025

Posted:

27 March 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

2.1. Theoretical Studies

2.2. Empirical Studies

2.2.1. Evolution of Corporate Social Responsibility and Sustainable Investments

2.2.2. Financial Instruments for Sustainability

2.2.3. The Role of Companies and Other Actors in the Sustainability of Emerging Markets

2.2.2. Other Factors Related to Sustainable Investing in Emerging Markets

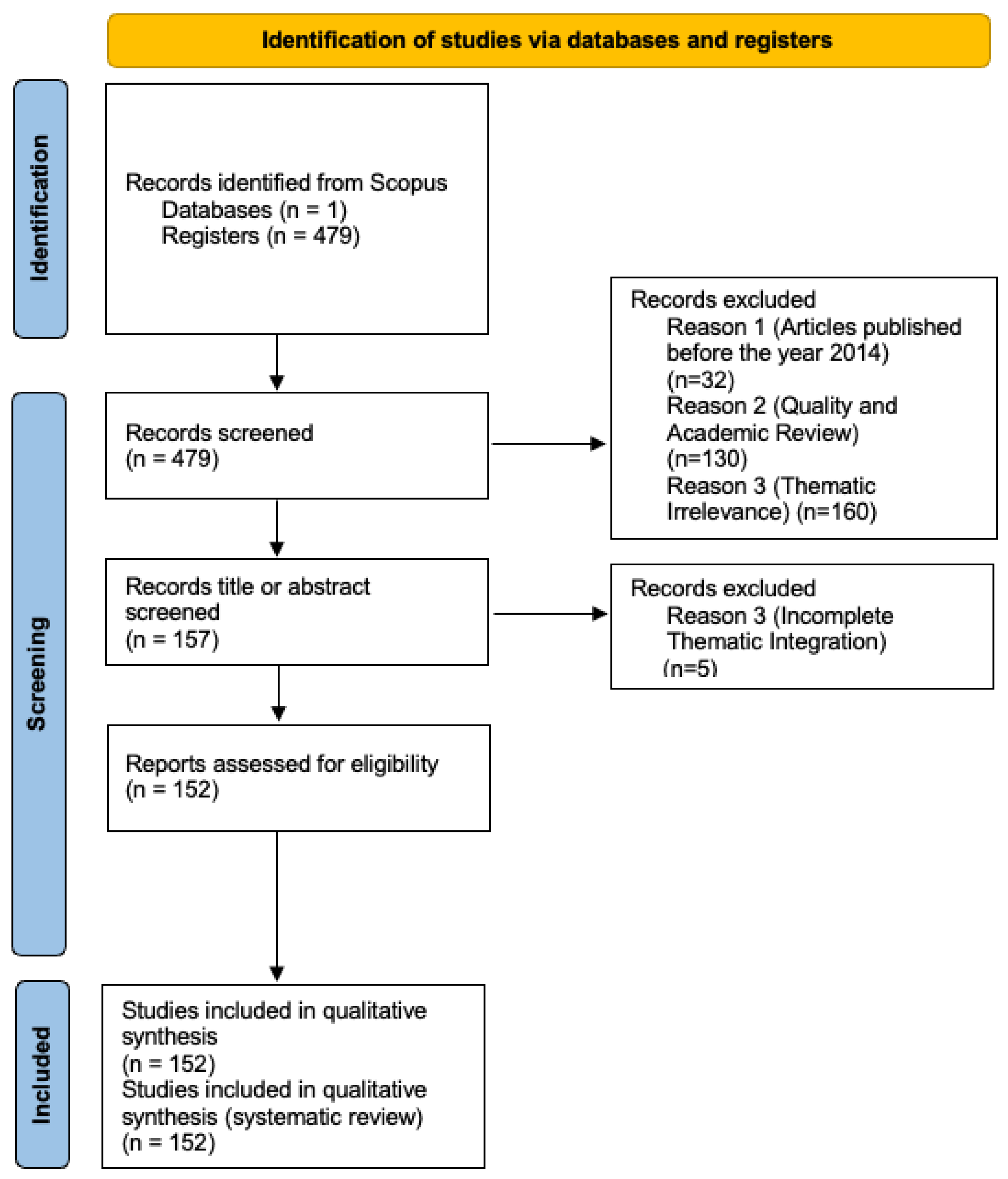

3. Materials and Methods

3.1. Identification of Sources of Information

3.2. Data Extraction and Search Strategy

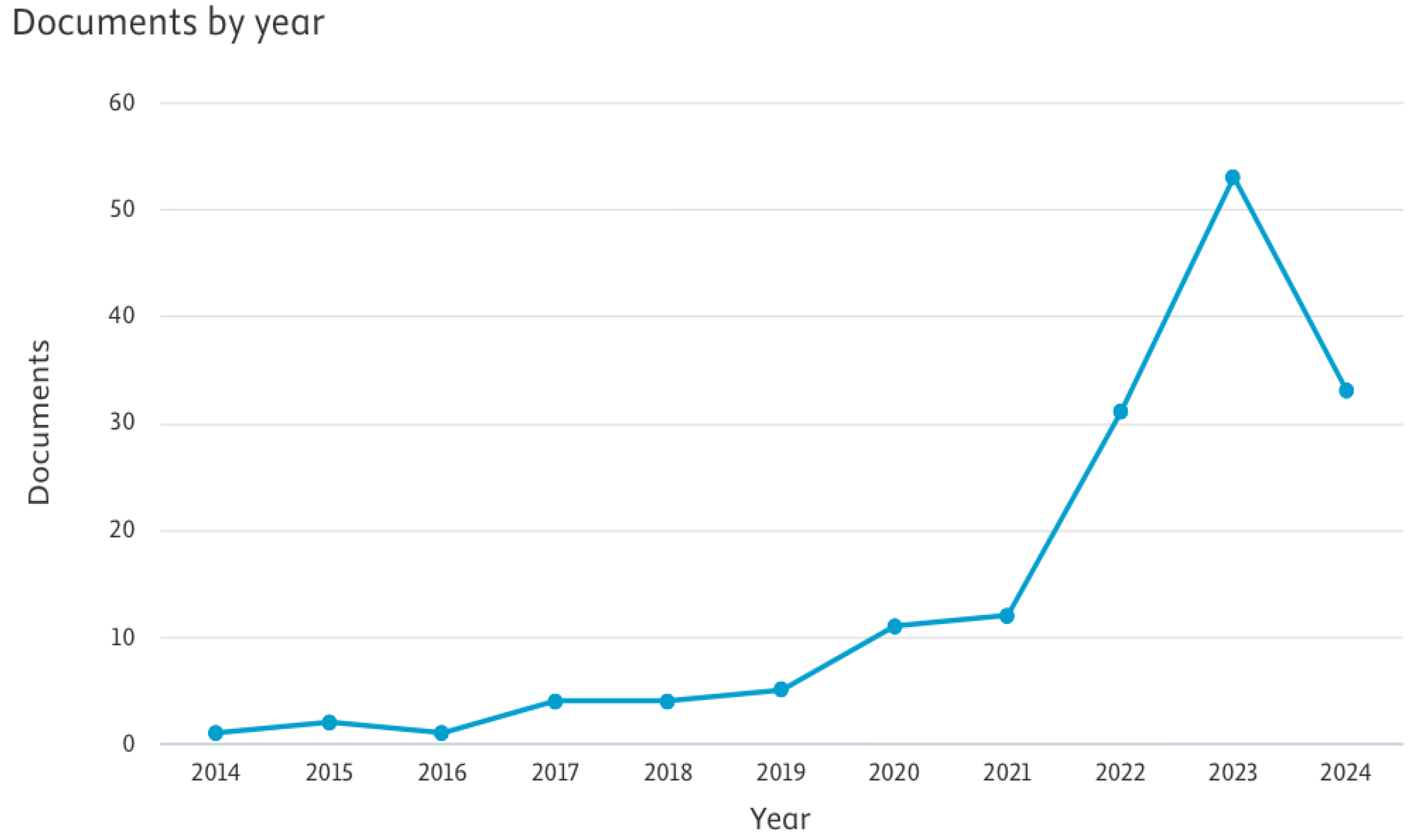

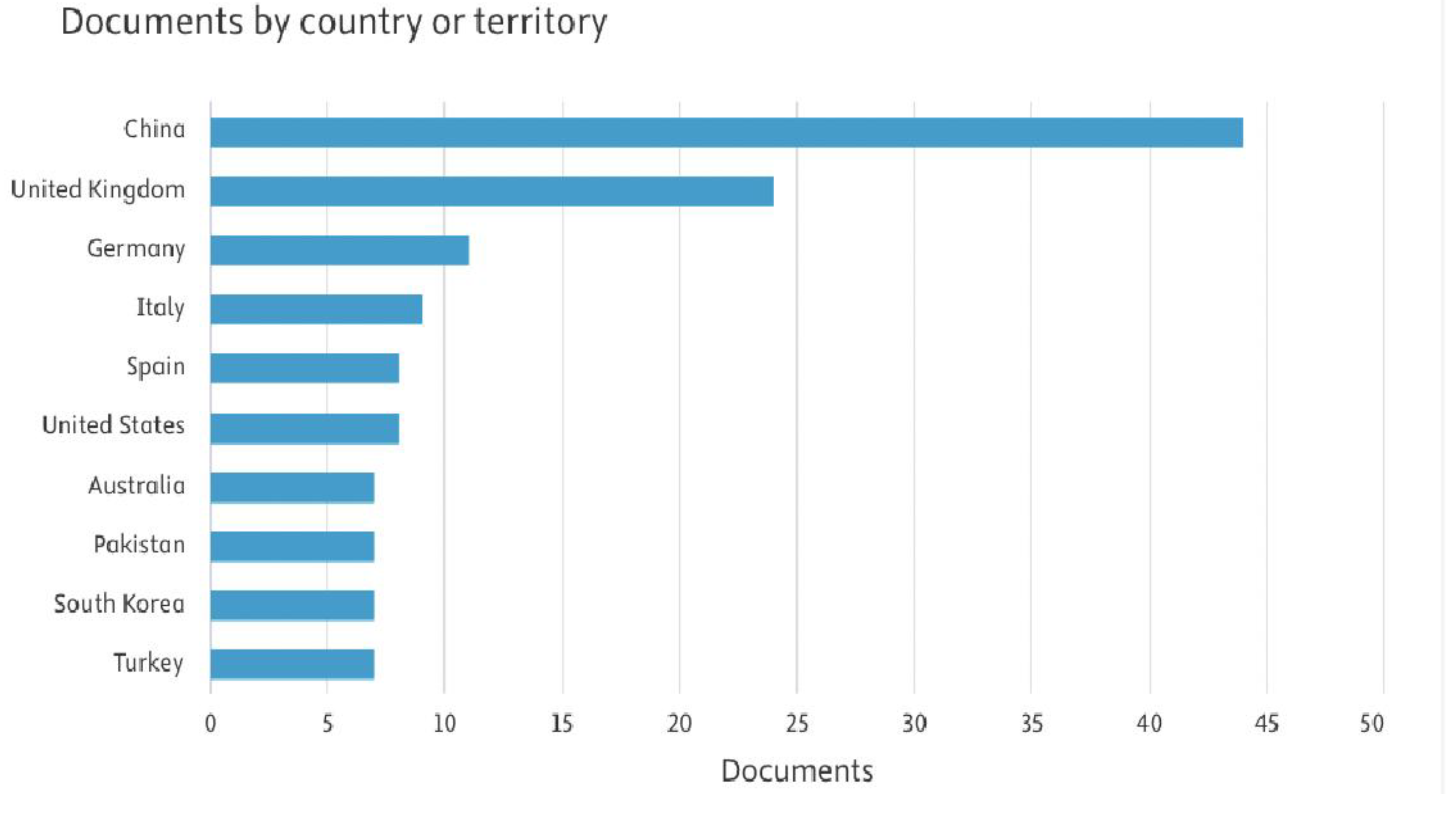

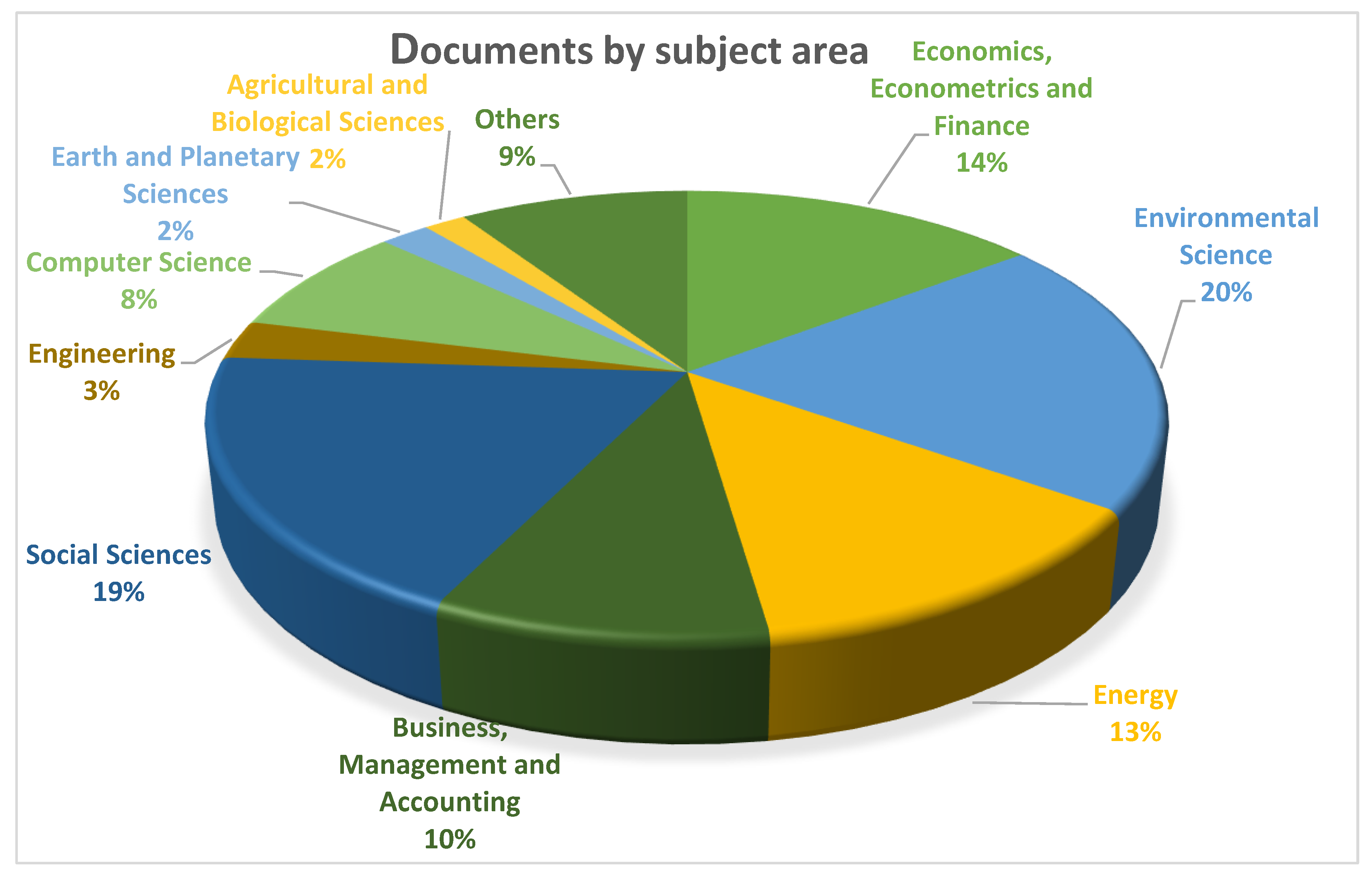

3.3. Analysis of Bibliographic Data

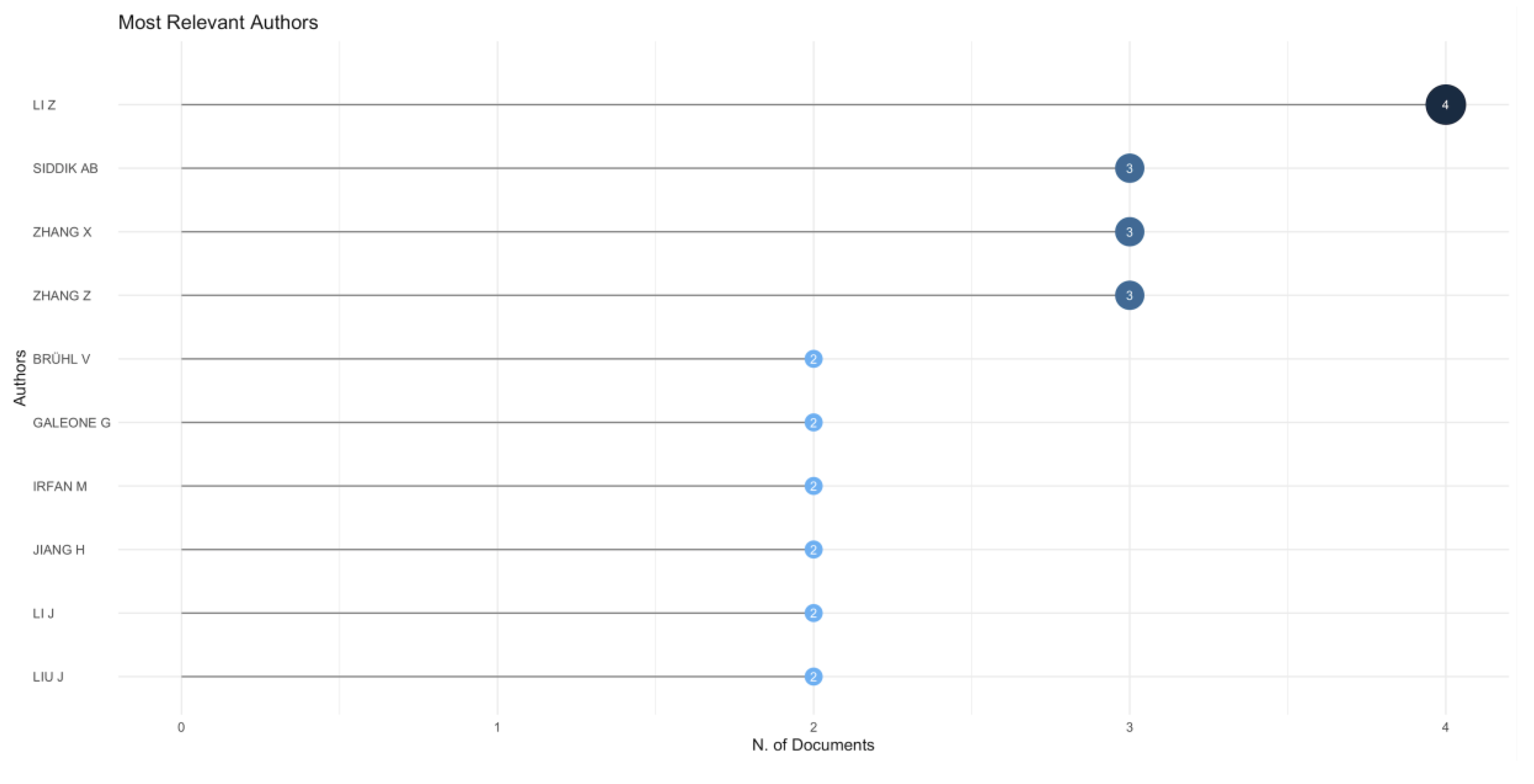

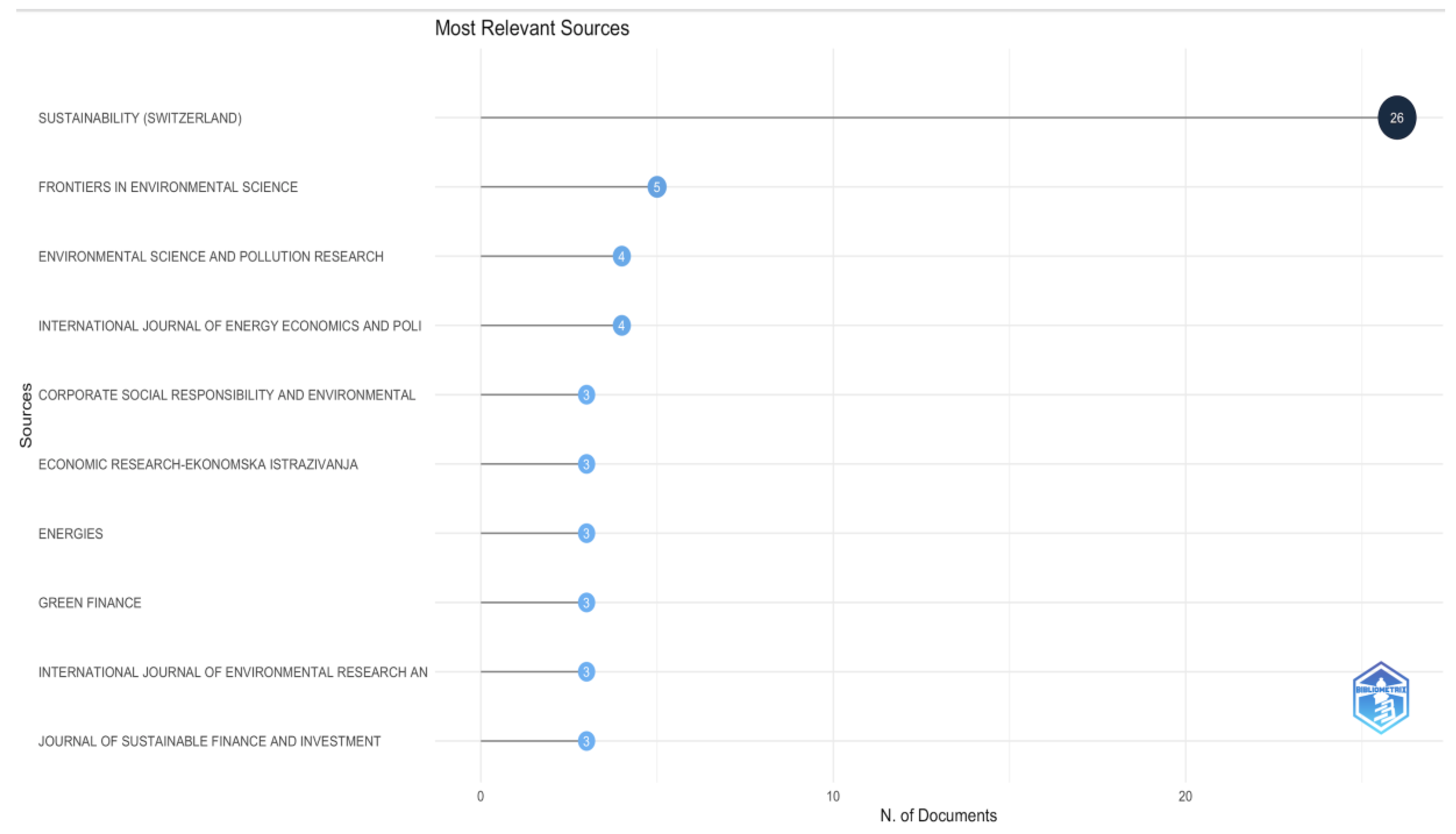

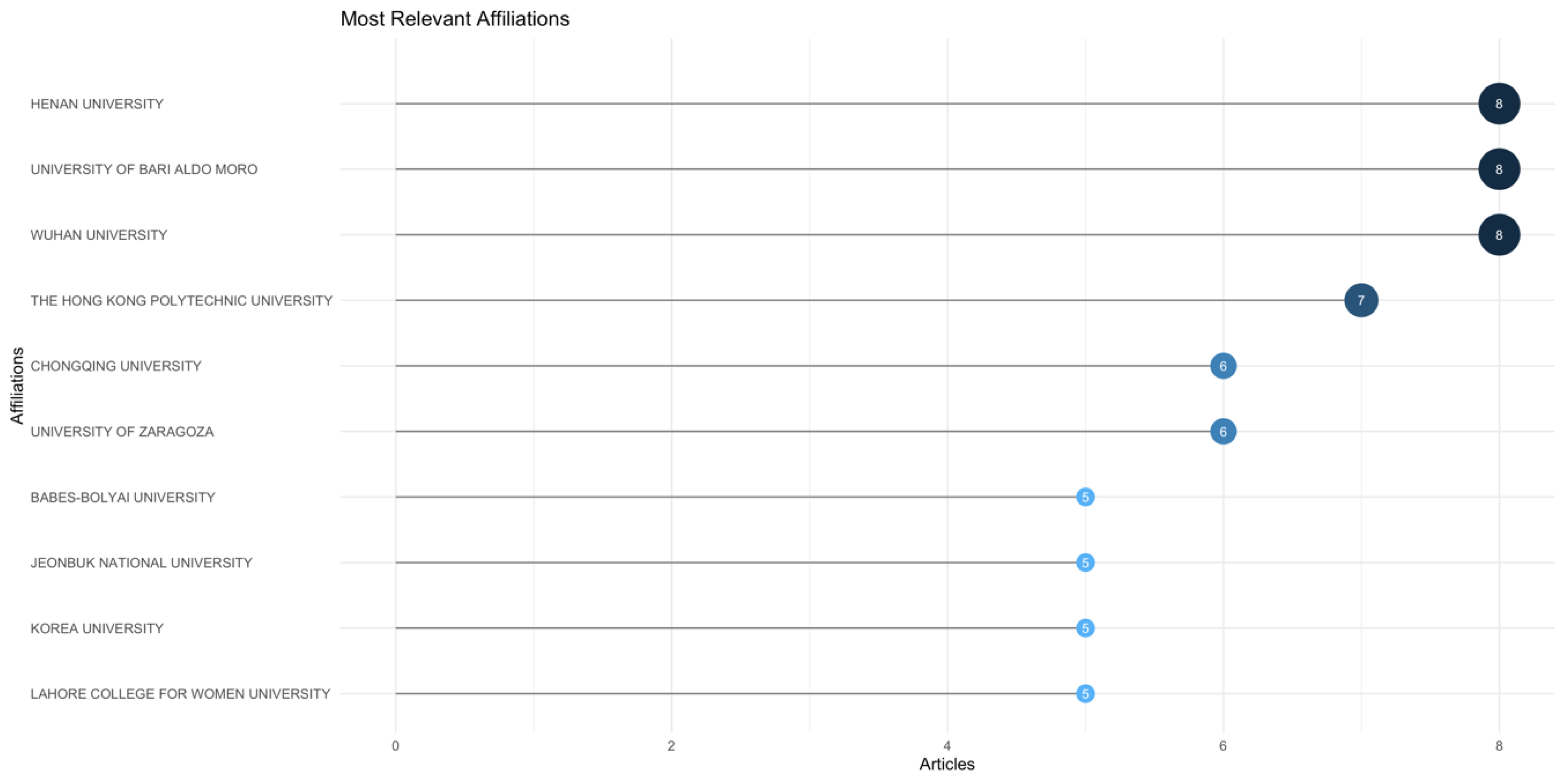

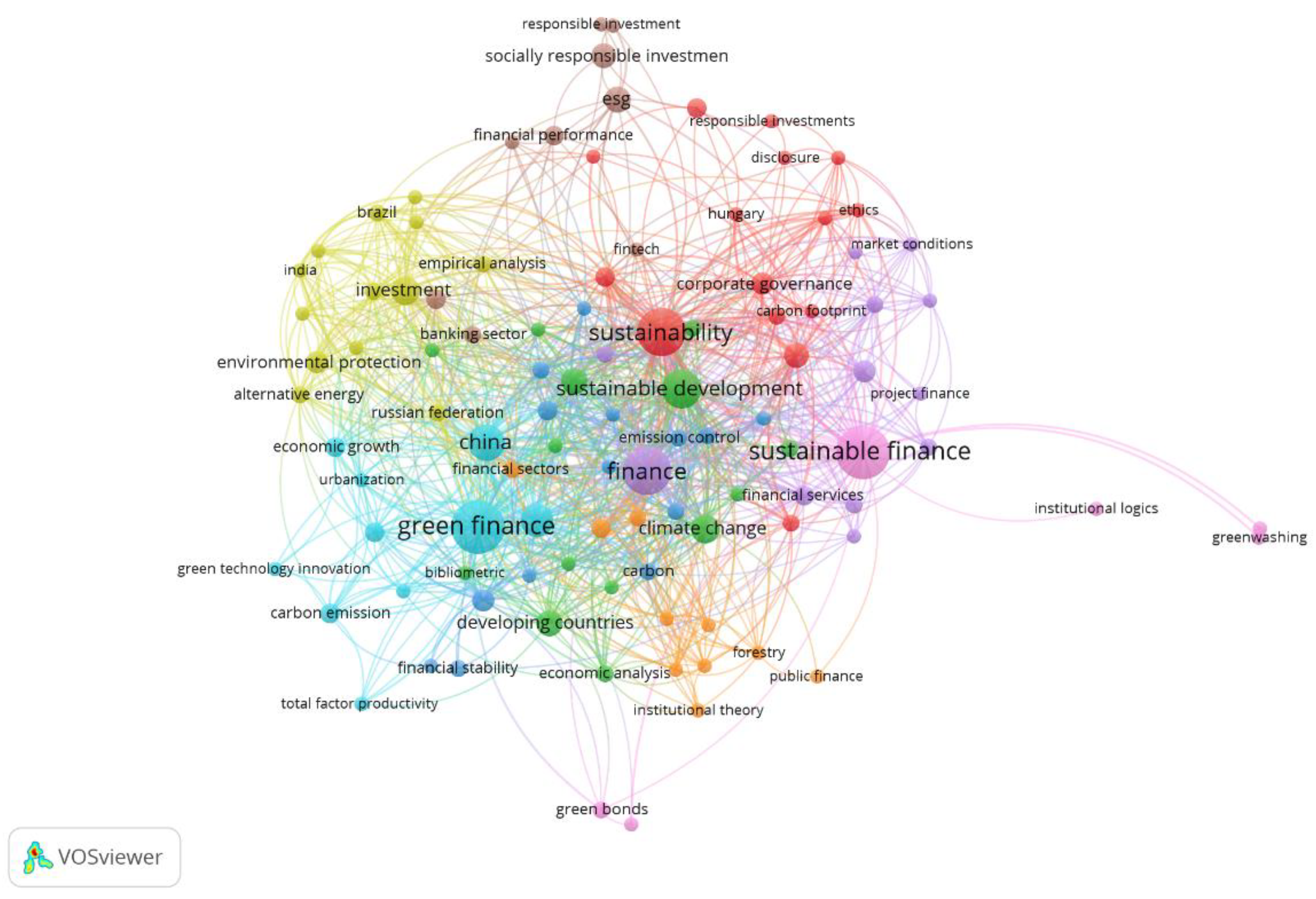

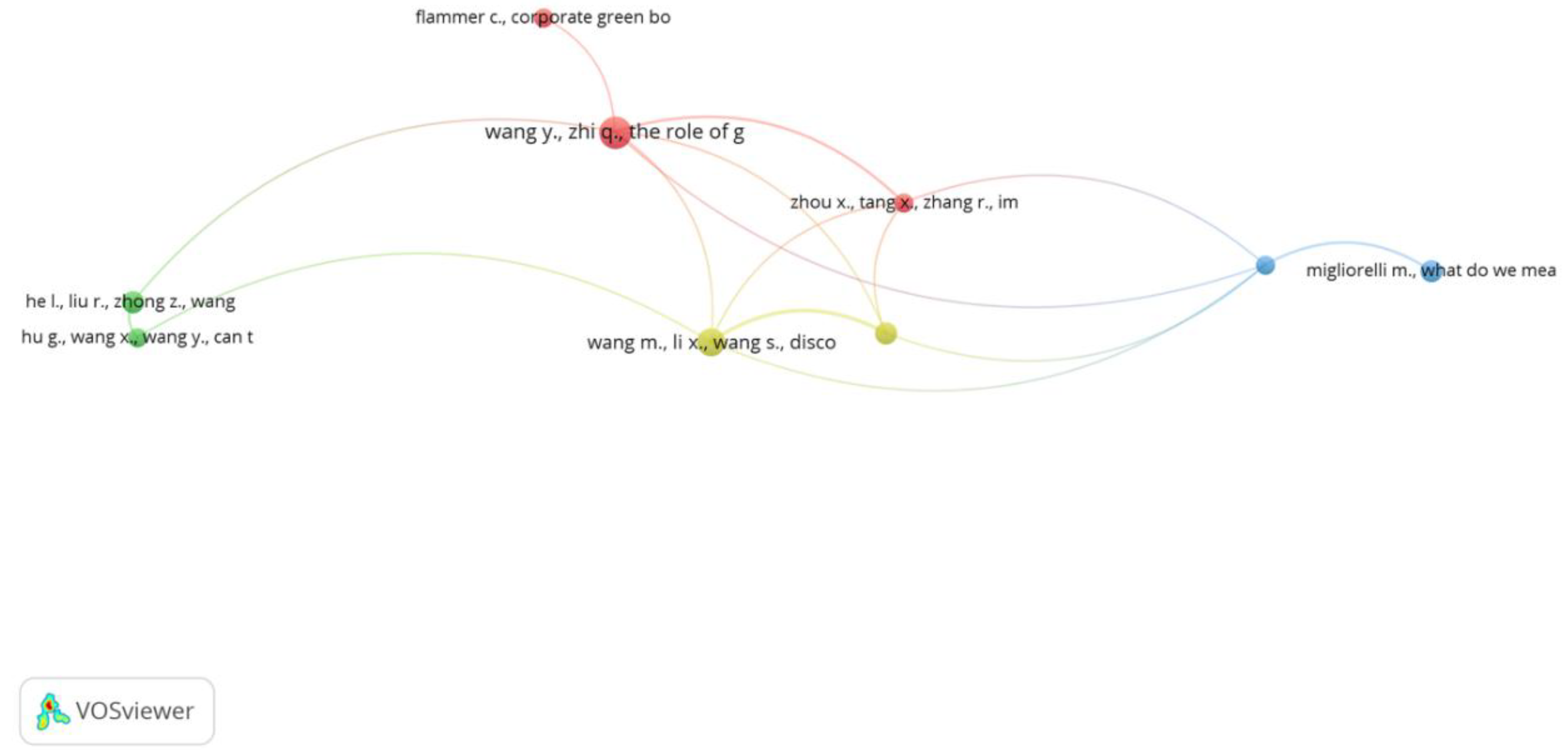

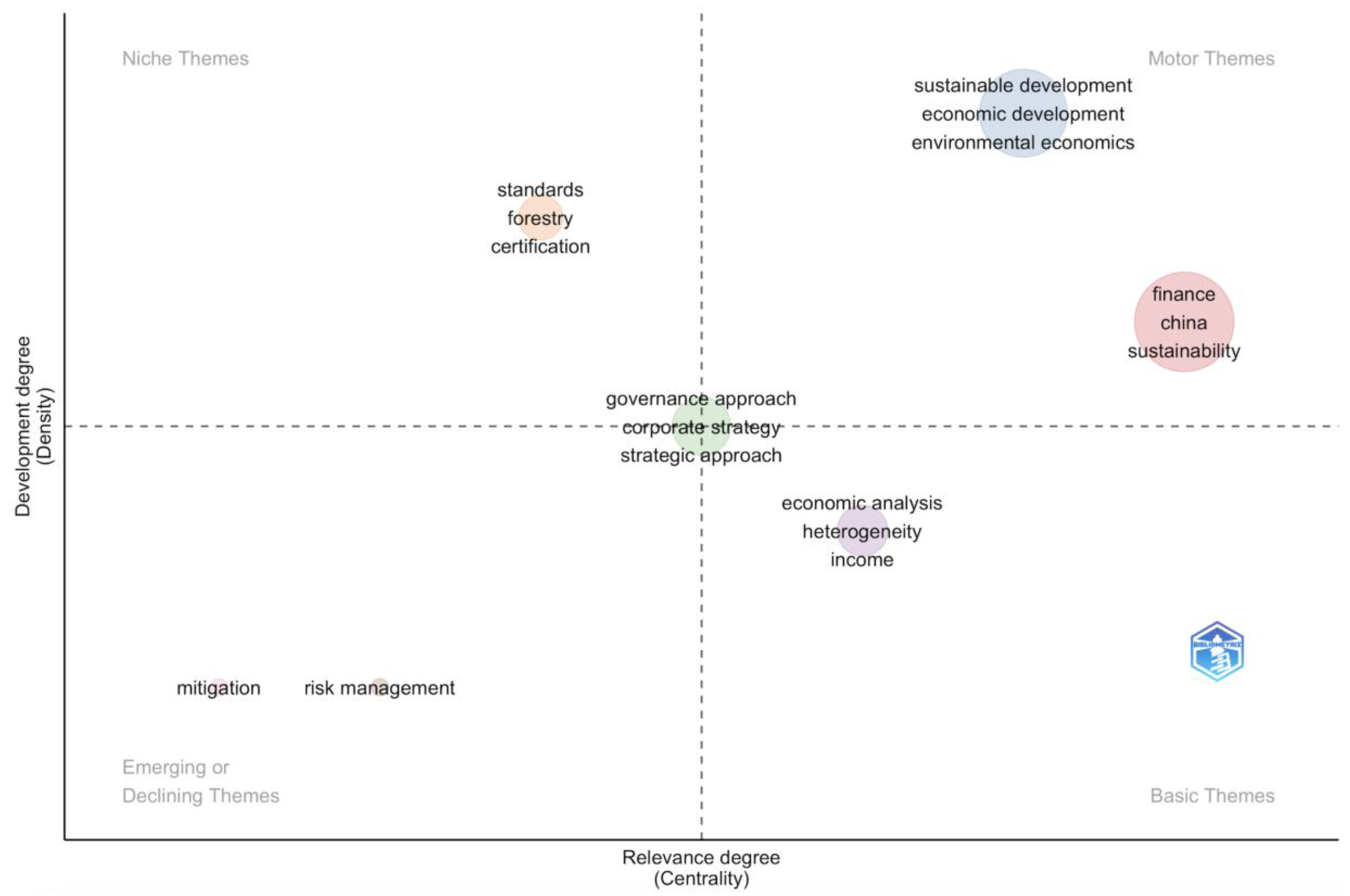

4. Results

5. Discussion and Future Research Agenda

5.1. Integration of ESG Criteria, Financial Performance and Competitive Advantage

5.2. Barriers and Opportunities for Sustainable Investment in Emerging Markets

5.3. Future Research Agenda in Sustainable Investments in Emerging Markets

5.3. Limitations of the Investigation

6. Conclusions

Conflicts of Interest

References

- Alam, A., Uddin, M., & Yazdifar, H. (2019). Institutional determinants of R&D investment: Evidence from emerging markets. Technological Forecasting and Social Change. [CrossRef]

- Aleknevičienė & Bendoraitytė. (2023). ROLE OF GREEN FINANCE IN GREENING THE ECONOMY: CONCEPTUAL APPROACH. Central European Business Review, 12(2), 105-130. Scopus. [CrossRef]

- Ararat, M., & Suel, E. (2011). The State of Sustainable Investment in Key Emerging Markets. Investment & Social Responsibility eJournal. [CrossRef]

- Arjaliès, D.-L. (2010). A Social Movement Perspective on Finance: How Socially Responsible Investment Mattered. Journal of Business Ethics, 92(1), 57-78. [CrossRef]

- Babon-Ayeng, P., Oduro-Ofori, E., Owusu-Manu, D.-G., Edwards, D. J., Kissi, E., & Kukah, A. S. K. (2022). Socio-political factors underlying the adoption of green bond financing of infrastructure projects: The case of Ghana. Journal of Capital Markets Studies, 6(3), 304-319. Scopus. [CrossRef]

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Banani, A., & Sunarko, B. (2022). Nexus between Green Finance, Creativity, Energy Accounting and Financial Performance: Banks Sustainability Analysis from Developing Country. International Journal of Energy Economics and Policy, 12(6), 447-455. Scopus. [CrossRef]

- Bhatnagar, M., Taneja, S., & Özen, E. (2022). A wave of green start-ups in India—The study of green finance as a support system for sustainable entrepreneurship. Green Finance, 4(2), 253-273. Scopus. [CrossRef]

- Bertalanffy, L. von. (1968). General systems theory as integrating factor in contemporary science. In Akten des XIV. Internationalen Kongresses für Philosophie (Vol. 2, pp. 335-340). [CrossRef]

- Bollen, N. P. B. (2007). Mutual Fund Attributes and Investor Behavior. Journal of Financial and Quantitative Analysis, 42(3), 683-708. [CrossRef]

- Brammer, S., & Millington, A. (2008). Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Management Journal, 29(12), 1325-1343. [CrossRef]

- Brühl, V. (2022). Green Financial Products in the EU — A Critical Review of the Status Quo. Intereconomics, 57(4), 252-259. Scopus. [CrossRef]

- Carroll, A. B. (1991). The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Business Horizons, 34(4), 39-48. [CrossRef]

- Cheng, P., Wang, X., Choi, B., & Huan, X. (2023). Green Finance, International Technology Spillover and Green Technology Innovation: A New Perspective of Regional Innovation Capability. Sustainability (Switzerland), 15(2). Scopus. [CrossRef]

- Chen, Z., Mirza, N., Huang, L., & Umar, M. (2022). Green Banking—Can Financial Institutions support green recovery?. Economic Analysis and Policy, 75, 389 - 395. [CrossRef]

- Chipalkatti, N., Le, Q., & Rishi, M. (2021). Sustainability and Society: Do Environmental, Social, and Governance Factors Matter for Foreign Direct Investment?. Energies. [CrossRef]

- Clark, G., & Hebb, T. (2004). Pension Fund Corporate Engagement: The Fifth Stage of Capitalism. Industrial Relations/Industrial Relations, 59(1), 142-171. [CrossRef]

- Crona, B., Folke, C., & Galaz, V. (2021). The Anthropocene reality of financial risk. One Earth, 4(5), 618–628. [CrossRef]

- Danila, N. (2022). Random Walk of Socially Responsible Investment in Emerging Market. Sustainability (Switzerland), 14(19). Scopus. [CrossRef]

- Dai, Y. (2024). Sustainable investing in emerging markets: Evidence from the Sustainable Stock Exchanges initiative. International Journal of Finance and Economics. [CrossRef]

- Dewi, V. I., Effendi, N., Anwar, M., Nidar, S. R., Fitrijanti, T., & Tjandrasa, B. (2023). Do Shadow Banking Depositors Discipline the Market? Australasian Accounting, Business and Finance Journal, 17(4), 3-25. Scopus. [CrossRef]

- Elkington, J. (1998). Cannibals with forks: The triple bottom line of 21st century business. Capstone Publishing. https://books.google.com.co/books/about/Cannibals_with_Forks.html?id=dIJAbIM7XNcC&redir_esc=y.

- Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 142(2), 499–516. [CrossRef]

- Freeman, R. E. (1984). Strategic management: A stakeholder approach. Pitman Publishing Inc. [CrossRef]

- Gavira-Durón, N., Martínez Peña, D. G., & Espitia Moreno, I. C. (2020). Financial determinants of corporate sustainability of companies listed on the BMV's sustainable CPI. Revista Mexicana de Economía y Finanzas Nueva Época, 15(2), 277-293. [CrossRef]

- Golgeci, I., Makhmadshoev, D., & Demirbag, M. (2021). Global value chains and the environmental sustainability of emerging market firms: A systematic review of literature and research agenda. International Business Review, 30(5), 101857. https://doi.org/10.1016/j.ibusrev.2021.101857.

- Gonzaga, B. R., Klotzle, M. C., Brugni, T. V., Rakos, I.-S., Cioca, I. C., Barbu, C.-M., & Cucerzan, T. (2024). The ESG patterns of emerging-market companies: Are there differences in their sustainable behavior after COVID-19? Sustainability, 16(2), 676. [CrossRef]

- Gorelick, J., & Walmsley, N. (2020). The greening of municipal infrastructure investments: Technical assistance, instruments, and city champions. Green Finance, 2(2), 114-134. Scopus. [CrossRef]

- Győri, Z., Khan, Y., & Szegedi, K. (2021). Business model and principles of a values-based bank—Case study of magnet hungarian community bank. Sustainability (Switzerland), 13(16). Scopus. [CrossRef]

- Haigh, M., & Hazelton, J. (2004). Financial Markets: A Tool for Social Responsibility? Journal of Business Ethics, 52(1), 59-71. [CrossRef]

- Hart, S. L. (1997). Beyond greening: Strategies for a sustainable world. Harvard Business Review, 75(1), 67-76. https://hbsp.harvard.edu/product/97105-PDF-ENG.

- He, L., Liu, R., Zhong, Z., Wang, D., & Xia, Y. (2019). Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renewable Energy, 143, 974–984. [CrossRef]

- Hu, G., Wang, X., & Wang, Y. (2021). Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Economics, 98, 105134. [CrossRef]

- Hunjra, A. I., Hassan, M. K., Zaied, Y. B., & Managi, S. (2023). Nexus between green finance, environmental degradation, and sustainable development: Evidence from developing countries. Resources Policy, 81, Article 103371. [CrossRef]

- Jensen, M. (2001). Value Maximisation, Stakeholder Theory, and the Corporate Objective Function. European Financial Management, 7(3), 297-317. [CrossRef]

- Jonsdottir, A. T., Johannsdottir, L., & Davidsdottir, B. (2024). Systematic literature review on system dynamic modeling of sustainable business model strategies. Cleaner Environmental Systems, 13, 100200. [CrossRef]

- Kapil, S., & Rawal, V. (2023). Sustainable investment and environmental, social, and governance investing: A bibliometric and systematic literature review. Business Ethics, the Environment & Responsibility. [CrossRef]

- Kouwenberg, R., & Zheng, C. (2023). A Review of the Global Climate Finance Literature. Sustainability (Switzerland), 15(2). Scopus. [CrossRef]

- LCR Capital Partners. (2023, November 27). The rise of sustainable investment. https://www.lcrcapital.com/es/blog/auge-inversion-sostenible/.

- Liou, J. J. H., Liu, P. Y. L., & Huang, S.-W. (2023). Exploring the key barriers to ESG adoption in enterprises. Systems and Soft Computing, 5, 200066. [CrossRef]

- Ma, D., Ullah, F., Khattak, M., & Anwar, M. (2018). Do International Capabilities and Resources Configure Firm's Sustainable Competitive Performance? Research within Pakistani SMEs. Sustainability. [CrossRef]

- Ma, M., Zhu, X., Liu, M., & Huang, X. (2023). Combining the role of green finance and environmental sustainability on green economic growth: Evidence from G-20 economies. Renewable Energy, 207, 128-136. [CrossRef]

- Makarenko, I., Vorontsova, A., Sergiienko, L., Hrabchuk, I., & Gorodysky, M. (2023). Sustainability-related disclosure rules and financial market indicators: Searching for interconnections in developed and developing countries. Investment Management and Financial Innovations, 20(3), 188-199. Scopus. [CrossRef]

- Margolis, J. D., & Walsh, J. P. (2003). Misery Loves Companies: Rethinking Social Initiatives by Business. Administrative Science Quarterly, 48(2), 268-305. [CrossRef]

- Meneses Cerón, L. Ángel ., Orozco Álvarez, J. E., Muñoz Zúñiga, D. F., & Pareja, A. . (2022). ESG practices and their effect on corporate financial performance: empirical analysis in the Brazilian stock market. Opinión Libre, (31: July–December), 93–117. [CrossRef]

- Meneses Cerón, L. Ángel., Orozco Álvarez, J. E. ., Cortés Avirama, C. S. ., & Suns Imbachi, J. F. (2023). Economic performance of Colombian companies and environmental responsibility. Free Opinion, (33: July-December). [CrossRef]

- Meneses Cerón, L. Á., van Klyton, A., Rojas, A., & Muñoz, J. (2024). Climate Risk and Its Impact on the Cost of Capital—A Systematic Literature Review. Sustainability, 16(23), 10727. [CrossRef]

- Migliorelli, M. (2021). What Do We Mean by Sustainable Finance? Assessing Existing Frameworks and Policy Risks. Sustainability, 13(2), 975. [CrossRef]

- Monzón Citalán, R. E., Díaz Tinoco, J., & Morales Castro, A. (2024). Literature Review on ESG Investment Performance: A Bibliometric Study. Revista Mexicana de Economía y Finanzas Nueva Época REMEF, 20(1). [CrossRef]

- Mugova, S. (2017). Trade credit and bank credit as alternative governance structures in South Africa: Evidence from banking sector development. Banks and Bank Systems, 12(3), 204-214. Scopus. [CrossRef]

- Nelling, E., & Webb, E. (2009). Corporate social responsibility and financial performance: The "virtuous circle" revisited. Review of Quantitative Finance and Accounting, 32(2), 197-209. [CrossRef]

- Ngwakwe, C. C., & Netswera, F. G. (2014). The corporate response to the socially responsible investment (SRI) index of the Johannesburg stock exchange (JSE). Corporate Ownership and Control, 12(1 Continued 4), 399-405. Scopus. [CrossRef]

- Nicholls, A. (2010). The Institutionalization of Social Investment: The Interplay of Investment Logics and Investor Rationalities. Journal of Social Entrepreneurship, 1(1), 70-100. [CrossRef]

- Onishchuk, M., & Kushnir, S. (2023). Investment opportunities in emerging markets: risks and prospects. Problems of systemic approach in the economy. [CrossRef]

- Pesce, G., Pedroni, F. V., Chavez, E. S., & Piñeiro, V. (2022). Analysis of the literature on climate risk hedging: a systematic review in international repositories. Revista Mexicana de Economía y Finanzas Nueva Época, 19(4). [CrossRef]

- Porter, M. E., & Kramer, M. R. (2011). Creating shared value. Harvard Business Review, 89(1/2), 62-77.

- Roshan, R., & Balodi, K. C. (2024). Sustainable business model innovation of an emerging country startup: An imprinting theory perspective. Journal of Cleaner Production, 475, 143687. [CrossRef]

- Schueth, S. (2003). Socially Responsible Investing in the United States. Journal of Business Ethics, 43(3), 189-194. [CrossRef]

- Schumacher, K., Chenet, H., & Volz, U. (2020). Sustainable finance in Japan. Journal of Sustainable Finance and Investment, 10(2), 213-246. Scopus. [CrossRef]

- Setiawan, S., Ismalina, P., Nurhidajat, R., Tjahjaprijadi, C., & Munandar, Y. (2021). Green finance in indonesia's low carbon sustainable development. International Journal of Energy Economics and Policy, 11(5), 191-203. Scopus. [CrossRef]

- Shvarts, E., Bunina, J., & Knizhnikov, A. (2015). Voluntary environmental standards in Key Russian industries: A comparative analysis. International Journal of Sustainable Development and Planning, 10(3), 331-346. Scopus. [CrossRef]

- Siri, M., & Zhu, S. (2019). Will the EU Commission successfully integrate sustainability risks and factors in the investor protection regime? A Research Agenda. Sustainability (Switzerland), 11(22). Scopus. [CrossRef]

- Tamasiga, P., Onyeaka, H., & Ouassou, E. H. (2022). Unlocking the Green Economy in African Countries: An Integrated Framework of FinTech as an Enabler of the Transition to Sustainability. Energies, 15(22). Scopus. [CrossRef]

- Tan, Y., & Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers' environmental awareness. Technology in Society, 68. Scopus. [CrossRef]

- Tang, X., & Zhou, X. (2023). Impact of green finance on renewable energy development: A spatiotemporal consistency perspective. Renewable Energy, 204, 320–337. [CrossRef]

- Thi Thanh Tu, T., & Thi Hoang Yen, T. (2015). Green bank: International experiences and Vietnam perspectives. Asian Social Science, 11(28), 188-199. Scopus. [CrossRef]

- Tosun, O. K. (2017). Is corporate social responsibility sufficient enough to explain the investment by socially responsible funds? Review of Quantitative Finance and Accounting, 49(3), 697-726. Scopus. [CrossRef]

- Tseng, Y.-C., Lee, Y.-M., & Liao, S.-J. (2017). An integrated assessment framework of offshore wind power projects applying equator principles and social life cycle assessment. Sustainability (Switzerland), 9(10). Scopus. [CrossRef]

- Vitols, S. (2011). European pension funds and socially responsible investment. Transfer: European Review of Labour and Research, 17(1), 29-41. [CrossRef]

- Vives, A., & Wadhwa, B. (2012). Sustainability indices in emerging markets: impact on responsible practices and financial market development. Journal of Sustainable Finance & Investment, 2, 318 - 337. [CrossRef]

- Volodina, A.O., & Trachenko, M.B. (2023). ESG Investment Profitability in Developed and Emerging Markets with Regard to the Time Horizon. Financial Journal. [CrossRef]

- Wang, M., Li, X., & Wang, S. (2021). Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis. Energy Policy, 153, 112295. [CrossRef]

- Wang, K., Xue, K.-K., Xu, J.-H., Chu, C.-C., Tsai, S.-B., Fan, H.-J., Wang, Z.-Y., & Wang, J. (2018). How does a staggered board provision affect corporate strategic change?-Evidence from China's listed companies. Sustainability (Switzerland), 10(5). Scopus. [CrossRef]

- Wan Mohammad, W & Wasiuzzaman, S. (2021). Environmental, social and governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Cleaner Environmental Systems, 2, 100015. [CrossRef]

- Wang, Y., & Zhi, Q. (2016). The role of green finance in environmental protection: Two aspects of market mechanism and policies. Energy Procedia, 104, 311–316. [CrossRef]

- Wang, S., Shen, H., Zhang, H., Asif, M., & Shahzad, M. F. (2025). From greenwashing to genuine sustainability: Insights from FinTech and banking executives in emerging market experience. Journal of Environmental Management, 373, 123690. [CrossRef]

- Wen, H., Ho, K. C., Gao, J., & Yu, L. (2022). The fundamental effects of ESG disclosure quality in boosting the growth of ESG investing. Journal of International Financial Markets, Institutions and Money, 81, 101655. [CrossRef]

- Xiao, R., Deng, J., Zhou, Y., & Chen, M. (2023). Analyzing Contemporary Trends in Sustainable Finance and ESG Investment. Law and Economy. [CrossRef]

- Yan, S., Ferraro, F., & Almandoz, J. (2019). The Rise of Socially Responsible Investment Funds: The Paradoxical Role of the Financial Logic. Administrative Science Quarterly, 64(2), 466-501. Scopus. [CrossRef]

- Zairis, G., Liargovas, P., & Apostolopoulos, N. (2024). Sustainable Finance and ESG Importance: A Systematic Literature Review and Research Agenda. Sustainability (Switzerland), 16(7). Scopus. [CrossRef]

- Zhang, C., Farooq, U., Jamali, D., & Alam, M. M. (2024). The role of ESG performance in the nexus between economic policy, uncertainty and corporate investment. Research in International Business and Finance, 70(Part B), 102358. [CrossRef]

- Zhang, J., & Qian, F. (2023). Digital economy enables common prosperity: Analysis of mediating and moderating effects based on green finance and environmental pollution. Frontiers in Energy Research, 10. Scopus. [CrossRef]

- Zhang, M., Lian, Y., Zhao, H., & Xia-Bauer, C. (2020). Unlocking green financing for building energy retrofit: A survey in the western China. Energy Strategy Reviews, 30. Scopus. [CrossRef]

- Zheng, G.-W., Siddik, A. B., Masukujjaman, M., & Fatema, N. (2021). Factors affecting the sustainability performance of financial institutions in Bangladesh: The role of green finance. Sustainability (Switzerland), 13(18). Scopus. [CrossRef]

- Zou, P., Wang, Q., Xie, J., & Zhou, C. (2020). Does doing good lead to doing better in emerging markets? Stock market responses to the SRI index announcements in Brazil, China, and South Africa. Journal of the Academy of Marketing Science, 48(5), 966-986. Scopus. [CrossRef]

| Criteria | Inclusion | Exclusion |

|---|---|---|

| Publication date | Studies published between 2014 and 2024 to ensure the timeliness and relevance of the information reviewed. | Articles that do not focus on emerging markets or developing economies, or that address developed markets exclusively. |

| Academic areas | Articles that directly address sustainable investing, green finance, or socially responsible investing (SRI) in the context of emerging markets or developing economies. | Studies that do not deal with sustainable investment, green finance or SRI, or that do not consider ESG criteria in their analysis. |

| Language | Documents written in English and Spanish, to ensure uniform accessibility and understanding in review. | Articles written in languages other than English and Spanish, to maintain linguistic consistency and accessibility. |

| Access | Articles available in open access to facilitate consultation and analysis by researchers. | Documents that are not available in open access, which limits their accessibility for comprehensive review. |

| Document Type | Research articles and reviews published in peer-reviewed academic journals, ensuring quality and scientific rigor. | Documents such as technical reports, theses, book chapters, conference proceedings, or others that are not peer-reviewed articles or reviews. |

| # | Authors | Document title | Source | Year | Citation |

|---|---|---|---|---|---|

| 1 | So Y.; Zhu Z. | The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers' environmental awareness | Technology in Society | 2022 | 263 |

| 2 | Yan S.; Ferraro, F.; Almandoz, J. | The Rise of Socially Responsible Investment Funds: The Paradoxical Role of the Financial Logic | Administrative Science Quarterly | 2019 | 116 |

| 3 | Zheng G.-W.; Siddik A.B.; Masukujjaman M.; Fatema, N. | Factors affecting the sustainability performance of financial institutions in Bangladesh: The role of green finance | Sustainability (Switzerland) | 2021 | 95 |

| 4 | Hunjra A.I.; Hassan M.K.; Zaied Y.B.; Managi S. | Nexus between green finance, environmental degradation, and sustainable development: Evidence from developing countries | Resources Policy | 2023 | 76 |

| 5 | Khan, K., Mata, M., Martins, J., Correia, A., Saghir, M. | Impediments of green finance adoption system:linking economy and environment | Emerging Science Journal | 2022 | 71 |

| Total | 621 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).