Introduction

Alarming Point

In the contemporary discourse on global challenges, environmental sustainability has emerged as a paramount concern, increasingly capturing the public and academic attention with every passing day. The intricate task of nurturing a sustainable environment alongside ensuring the uninterrupted progression of human well-being represents a profound and ubiquitous challenge. This challenge is accentuated by the complexity of factors contributing to environmental degradation, among which human activities have been identified as significant, yet frequently underestimated, contributors. The empirical evidence from several studies underscores the pivotal role of human factors in driving ecological imbalances, highlighting a critical area that demands greater scrutiny and action (Murshed, Alam, et al., 2021; Murshed, Ali, et al., 2021; S. Nathaniel, Anyanwu, et al., 2020; S. Nathaniel, Nwodo, et al., 2020).

Ecology and Human Well-Being

The relationship between ecological health and human well-being is a testament to the interconnectedness of our planet’s biological systems and societal health. Acknowledging this interdependence is crucial for developing strategies that foster a symbiotic relationship between the environment and humanity. MEa (2005) posits that judicious environmental management can yield substantial benefits, catalyzing a virtuous cycle of improved human welfare and enhanced ecological conditions. This potential for positive synergy illuminates the path toward a future where human progress and environmental stewardship are not mutually exclusive but are instead complementary forces. However, aspiring to such a harmonious coexistence necessitates a nuanced understanding that the relationship between human well-being and environmental quality is not inherently self-reinforcing. The assumption that these objectives naturally support one another without trade-offs is overly simplistic and overlooks the complexities inherent in balancing ecological and economic considerations. Klugman (2011), cautions against this oversimplification, arguing for a critical examination of the inevitable compromises that arise, especially when environmental conservation efforts and economic growth policies are misaligned or inadequately formulated.

The phenomena of urbanization, globalization, increased energy consumption, and the relentless exploration and exploitation of natural resources serve as catalysts for ecological disturbances. These disturbances, in turn, amplify the demands on systems that are fundamental to human development, such as healthcare, food supply, education, and economic stability. The escalation of these demands in the face of environmental stressors underscores the urgent need for policies that are not only responsive to the challenges of human development but are also cognizant of their environmental impacts.

Islamic Finance, Sustainability, and Equity

Islamic finance significantly contributes to addressing global challenges, such as environmental sustainability and human well-being, by adhering to principles of responsible finance and fostering socially conscious development. The Islamic finance industry is recognized for its alignment with the Sustainable Development Goals (SDGs), promoting socially responsible development and linking economic growth with social welfare. This industry offers substantial and non-traditional sources of financing for sustainable development, highlighting its potential to mobilize financial resources towards underfunded humanitarian and development needs.

Research emphasizes that Islamic social finance instruments, including Zakat, Waqf, Sadaqat, and Qard-hasan, are pivotal in realizing SDGs through fairness, justice, and equity. A systematic literature review spanning over two decades has shown that Islamic social financing mechanisms can address many social issues and improve welfare conditions by ensuring economic, social, and environmental sustainability. This approach aligns with 11 out of the 17 SDGs, while Islamic commercial finance can address the remaining goals, showcasing the sector’s significant potential to fill the SDG funding gap (Dirie et al., 2023).

Moreover, Islamic financial instruments, particularly green sukuk, play a crucial role in combating climate change and promoting environmental protection. The Sovereign Green Sukuk issued by Indonesia, which raised US$2 billion for green and sustainable projects, exemplifies how these instruments can finance initiatives that mitigate and adapt to climate change, preserve biodiversity, and support the country’s Nationally Determined Contributions under the Paris Agreement. This initiative underscores the importance of transparency in Islamic finance and its ability to attract both sharia and conventional investors (UNDP, 2019).

The global framework for Islamic Finance and Sustainable Development explores various experiences and practices from around the world, including the Gulf, African countries, and the SAARC region, emphasizing the role of zakat, waqf, and other Islamic financial instruments in promoting sustainability. This comprehensive approach highlights the challenges and opportunities within Islamic finance to contribute to sustainable economic growth, environmental protection, and social equity (Hassan et al., 2021).

To effectively align Human Development Indexes (HDIs) with Ecological Footprints (EFs), a strategy encompassing sustainable development, ecological restoration, and innovative economic and educational paradigms is paramount. This comprehensive approach aims not only at reducing our ecological footprint through waste elimination, emissions reduction, and a transition to renewable energy sources but also at restoring ecosystems through reforestation and biodiversity conservation measures. Such efforts are crucial for the sustainability of our planet and the well-being of its inhabitants. Role of Islamic Finance GET requires significant reforms in many areas. Some of the reforms needed are:

Economic Paradigm Shift

The necessity for a new economic model is evident, one that prioritizes sustainability and is built upon the principles of zero waste, zero emissions, and minimal financialization of natural resources. This paradigm shift is critical to address the current unsustainable practices that contribute to environmental degradation and climate change. According to the Ellen MacArthur Foundation, the circular economy model is a systemic approach to economic development designed to benefit businesses, society, and the environment. It contrasts with the traditional linear economy, advocating for the reduction, reuse, and recycling of materials to minimize waste and emissions (MacArthur & others, 2013).

Islamic Finance and Sustainability

Islamic finance offers unique opportunities to support sustainable development and ecological conservation. Its principles of risk-sharing, prohibition of interest, and ethical investments make it a viable framework for promoting environmental sustainability. The Islamic Development Bank has highlighted the potential of Islamic finance in supporting green projects through instruments like Green Sukuk, which fund renewable energy projects and other environmental initiatives (IsDB, 2020).

Regulatory and Technological Support

Regulatory bodies have a crucial role in facilitating this transition by implementing Shariah-based standards that promote green initiatives and sustainability. The International Islamic Financial Market (IIFM) and the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) have been pivotal in developing standards that align Islamic finance with global sustainability goals.

Moreover, technological advancements play a significant role in supporting the Green Economic Transition (GET). Green technologies, or “Greentech,” offer innovative solutions for reducing environmental impacts and promoting sustainable growth. The International Energy Agency (IEA) reports on the significance of green technologies in achieving energy efficiency and reducing greenhouse gas emissions, underscoring their role in the transition to a sustainable economy (IEA, 2020).

Achieving a sustainable balance between HDIs and EFs requires an integrated approach that includes rethinking our economic models, reforming education to include sustainable development principles, leveraging the unique position of Islamic finance, enforcing supportive regulatory frameworks, and embracing technological innovations. These strategies are essential for fostering a sustainable, equitable, and prosperous future for all.

Climate Change

The conventional model of economic development, heavily reliant on the exploitation of finite natural resources, has propelled unprecedented improvements in living standards globally. Yet, this progress comes at a significant environmental cost, including resource depletion and detrimental climate impacts. The concept of decoupling economic growth from physical growth emerges as a vital strategy in navigating towards sustainable development.

The Finite Limits of Earth’s Resources

The Earth’s natural resources are finite, and the current trajectory of resource use and environmental degradation is unsustainable. Despite advancements in resource efficiency, the fundamental challenge remains: how to sustain economic growth without exacerbating physical growth and resource exploitation. Evidence suggests that beyond a certain wealth threshold, nations can achieve higher levels of resource efficiency, waste reduction, and environmental stewardship (Almond et al., 2021). However, this improvement is often offset by the tendency of wealthier countries to relocate resource-intensive and environmentally harmful activities to less affluent nations, perpetuating global environmental disparities.

Economic Growth and Environmental Impact

The relationship between economic growth and environmental impact is complex. While economic prosperity has traditionally been associated with increased resource consumption and environmental degradation, there is growing evidence to suggest that it is possible to achieve economic growth while reducing the environmental footprint. The concept of “green growth” as outlined by the Organisation for Economic Co-operation and Development (OECD) emphasizes strategies for achieving economic growth and development while preventing environmental degradation, biodiversity loss, and unsustainable natural resource use (Chang et al., 2022).

Historical Context and Future Directions

The historical increase in living standards, facilitated by economic growth, has come at the expense of environmental health. Concepts such as “peak oil” and the broader implications of climate change illustrate the limits of traditional growth models. The Intergovernmental Panel on Climate Change (IPCC) provides comprehensive assessments that underscore the urgent need to address climate change and its relationship with economic activities (IPCC, 2021).

Decoupling Economic Growth from Resource Consumption

The notion of decoupling economic growth from resource consumption and environmental degradation is gaining traction. The United Nations Environment Programme (UNEP) discusses decoupling in its “Global Resources Outlook,” highlighting the necessity and potential for economies to grow without proportional increases in environmental pressure (Oberle et al., 2019). This approach is fundamental to sustainable development, aiming to ensure that economic growth can continue without compromising the planet’s ecological balance.

Achieving sustainable development in the face of climate change requires a paradigm shift towards decoupling economic growth from environmental degradation. By leveraging innovative strategies, technologies, and policies that promote efficiency, renewable energy, and sustainable practices, it is possible to chart a path towards a resilient and prosperous future for all. The references cited herein, including reports from the WWF, OECD, IPCC, and UNEP, provide a solid foundation for understanding and addressing the challenges at the intersection of economic growth and environmental sustainability.

The emerging framework of Islamic finance is increasingly recognized for its potential to contribute significantly to sustainable development, boasting robust capabilities to positively influence the Human Development Index (HDI) and Ecological Footprints (EFs). By promoting innovative products closely aligned with ecological sustainability and human development effectiveness, Islamic finance stands as a potent force in the global financial landscape. However, this promising domain is not without its challenges. Key among these are the regulatory hurdles and variations in legal frameworks across different jurisdictions, necessitating concerted efforts to standardize legal frameworks and guidelines to fully harness its potential. Moreover, the advent of technology as a catalyst for global transformation offers immense opportunities, particularly in advancing the Sustainable Development Goals (SDGs) (Harahap et al., 2023). Technological innovations in Islamic finance could further enhance productivity and sustainability, especially in relation to the Ecological Framework and the Human Development Index. Nonetheless, the path towards integrating these advancements is fraught with complexities, including the economic and political ramifications of transitioning away from fossil fuels—a dominant economic force in Gulf countries. This shift towards green energy sources poses significant economic and political challenges, especially for nations heavily reliant on oil exports, highlighting the intricate balance between ecological sustainability and economic and political interests in the global pursuit of sustainable development and human welfare.

Table 1.

SDG’s vs Islamic Finance.

Table 1.

SDG’s vs Islamic Finance.

| SDG |

Description |

Islamic Finance Contribution |

| 1. No Poverty |

End poverty in all its forms everywhere. |

Zakat (compulsory charity), Sadaqah (voluntary charity), and Qard Hasan (benevolent loans) provide direct financial support to the needy, aiming to reduce poverty. |

| 2. Zero Hunger |

End hunger, achieve food security and improved nutrition, and promote sustainable agriculture. |

Islamic microfinance can support small-scale farmers, while investments in Halal industries promote sustainable agriculture practices. |

| 3. Good Health and Well-being |

Ensure healthy lives and promote well-being for all at all ages. |

Islamic social finance instruments can fund healthcare services and infrastructure, particularly in underserved regions. |

| 4. Quality Education |

Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all. |

Waqf (endowments) can be used to establish and maintain educational institutions, scholarships for students, and funding for educational materials. |

| 5. Gender Equality |

Achieve gender equality and empower all women and girls. |

Islamic finance emphasizes equitable treatment and provides opportunities for women to participate in economic activities, including business ownership and financial decisions. |

| 6. Clean Water and Sanitation |

Ensure availability and sustainable management of water and sanitation for all. |

Investments in water and sanitation projects through Islamic bonds (Sukuk) can finance infrastructure developments in line with Shariah principles. |

| 7. Affordable and Clean Energy |

Ensure access to affordable, reliable, sustainable, and modern energy for all. |

Islamic finance can fund renewable energy projects through green Sukuk, promoting environmental stewardship and clean energy. |

| 8. Decent Work and Economic Growth |

Promote sustained, inclusive, and sustainable economic growth, full and productive employment. |

Islamic finance supports SMEs and entrepreneurship through Mudarabah (profit-sharing contracts) and Musharakah (joint venture), fostering economic growth and job creation. |

| 10. Reduced Inequalities |

Reduce inequality within and among countries. |

Islamic finance principles promote wealth distribution and discourage excessive leveraging, aiming to reduce financial inequalities. |

| 11. Sustainable Cities and Communities |

Make cities and human settlements inclusive, safe, resilient, and sustainable. |

Financing urban development projects through Islamic finance can support infrastructure that is sustainable and benefits communities equitably. |

| 13. Climate Action |

Take urgent action to combat climate change and its impacts. |

Green Sukuk and Islamic investments in sustainable projects support environmental preservation and combat climate change. |

| 16. Peace, Justice, and Strong Institutions |

Promote peaceful and inclusive societies for sustainable development. |

Shariah principles advocate for justice, ethical conduct, and transparency, which align with building strong and accountable institutions. |

| 17. Partnerships for the Goals |

Strengthen the means of implementation and revitalize the global partnership for sustainable development. |

Islamic finance encourages partnerships and collaborative investments to achieve broader social, economic, and environmental goals. |

As nations look to recover and rebuild from recent challenges, there is a significant emphasis on leveraging green transformation to create a balance between Human Development Index (HDI) and Ecological Footprints (EFs). The call for a green transmission and distribution architecture encompasses financial, political, and social paradigms, highlighting the importance of sustainable development. Academics, governing bodies, and reporting entities advocate for green transformation as pivotal in addressing contemporary challenges, suggesting various reforms to achieve this balance. This approach is particularly relevant for countries aiming to improve their infrastructure in health, education, and employment sectors, with some regions, like Europe, exploring social bond issuances as a mechanism to support these efforts.

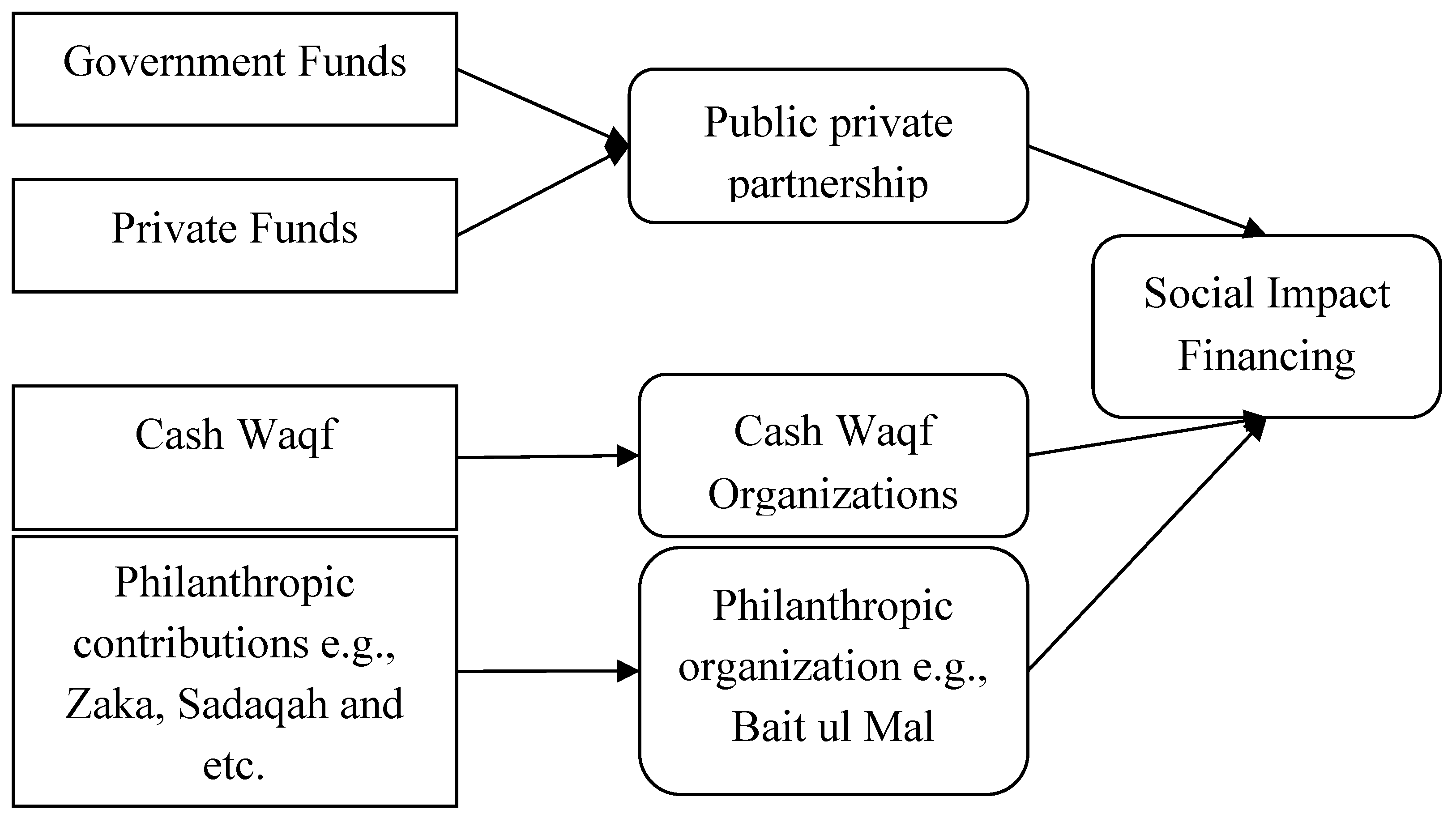

Figure 2.

Islamic Blended Finance Model.

Figure 2.

Islamic Blended Finance Model.

Sukuk

Sukuk, plural of Sakk, historically served as an innovative financial instrument within the Islamic mercantile era, acting as a precursor to the modern cheque. This instrument embodies a proportional beneficial ownership in an underlying asset pool, offering a Shariah-compliant means of generating returns based on asset performance. Unlike conventional bonds, Sukuk structures necessitate asset backing, aligning investment returns with real economic activities and adhering to Islamic finance principles.

Market Evolution

The Sukuk market has witnessed significant evolution from its traditional roots, expanding its reach to address contemporary challenges such as climate change and environmental degradation. The advent of Green Sukuk is particularly noteworthy in this context, serving as a bridge between the rich heritage of Islamic finance and the urgent need for sustainable development practices. It offers a novel approach for investors to engage in ethical financing that not only yields financial returns but also contributes to the greater good of the environment.

Green Sukuk’s Role in Sustainable Development

The role of Green Sukuk in promoting sustainable development is multifaceted. By providing necessary funding for green projects, Green Sukuk plays a crucial role in advancing renewable energy projects, enhancing energy efficiency, and supporting the transition to low-carbon economies. This alignment with sustainable development goals (SDGs) positions Green Sukuk as a key player in the global effort to mitigate the adverse effects of climate change and promote environmental sustainability. The World Bank’s 2020 report on Green Sukuk marks a significant milestone, underscoring the instrument’s effectiveness in mobilizing Islamic finance capital for environmentally sustainable initiatives. This report highlights the innovative nature of Green Sukuk and its capacity to address financing gaps in green projects, thereby accelerating progress towards achieving SDGs (World Bank, 2020).

At its core, Green Sukuk is tailored to finance a range of environmental projects. This includes the development and expansion of renewable energy sources such as solar parks, wind farms, and hydroelectric facilities, which are essential for reducing the global carbon footprint and combating climate change. Additionally, it extends to funding green infrastructure projects that incorporate sustainable design and construction practices to minimize environmental impact, and eco-friendly transportation solutions like electric vehicles and mass transit systems that aim to reduce pollution and enhance urban mobility (Simonyan & Solntsev, 2010).

The framework provided by Green Sukuk for ethical investment does not only ensures financial returns but also guarantees that the investments contribute positively to society and the environment. The ethical dimension of Green Sukuk aligns perfectly with global sustainability objectives, making it an attractive option for investors seeking to make a difference. Green Sukuk is instrumental in mobilizing resources to combat climate change. By channelling funds into renewable energy projects, it supports the transition away from fossil fuels towards more sustainable energy sources, thereby reducing greenhouse gas emissions and mitigating global warming. The promotion of renewable energy adoption through Green Sukuk not only addresses environmental concerns but also enhances energy security and reduces dependency on volatile oil markets (Fitrah & Soemitra, 2022).

Moreover, it also plays a vital role in facilitating sustainable urban development. Investments in green infrastructure and eco-friendly transportation contribute to creating sustainable cities that offer high-quality life for their inhabitants while minimizing their ecological footprint. Through these investments, Green Sukuk supports the development of urban areas that are resilient, environmentally friendly, and economically vibrant.

Challenges and Opportunities

Green Sukuk represents a pivotal innovation in Islamic finance, offering a shariah-compliant mechanism to fund environmentally sustainable projects. Despite its potential to contribute significantly to global sustainability goals, the widespread adoption of Green Sukuk faces numerous challenges. These challenges stem from both within the Islamic finance industry and the broader context of global finance, sustainability standards, and regulatory environments. Conversely, the successful integration of Green Sukuk presents substantial opportunities for economic, environmental, and social development, aligning with the principles of Islamic finance and the broader objectives of sustainable investment (Alam et al., 2023).

Conclusion

This study has illuminated the transformative potential of Islamic finance as a catalyst for sustainable development, integrating ethical and moral foundations with the pressing needs of environmental sustainability, social equity, and economic development. Through the lens of Value-Based Intermediation, it has demonstrated how Islamic finance not only aligns with but actively promotes the Sustainable Development Goals (SDGs), leveraging innovative instruments like Zakat, Waqf, and green Sukuk. These instruments embody the principles of risk-sharing, social justice, and environmental stewardship, offering a paradigm shift towards a more sustainable and equitable global financial system.

The analysis underscores the necessity of harmonizing Human Development Indexes (HDIs) with Ecological Footprints (EFs), proposing a strategic framework that encompasses sustainable development, ecological conservation, and educational reforms. It calls for a holistic approach that integrates Islamic finance into the broader agenda of global sustainability efforts, highlighting the sector’s unique position to bridge the funding gap for the SDGs.

As the world grapples with the dual challenges of economic development and environmental sustainability, Islamic finance offers a viable path forward. It emphasizes the importance of transitioning towards sustainable economic models, innovative educational paradigms, and regulatory frameworks that support green initiatives. The study’s findings advocate for a concerted effort among policymakers, financial institutions, and educators to leverage Islamic finance in achieving a balanced, sustainable, and inclusive global economy.

This study contributes to the growing body of literature on Islamic finance and sustainability, providing a comprehensive roadmap for leveraging ethical finance towards achieving the SDGs. It highlights the critical role of Islamic finance in fostering a sustainable future, calling for continued research, policy development, and practical implementation to fully realize its potential.