1. Introduction

The Royal Institute of Chartered Surveyors (RICS) defines two broad types of discounted cash flow (DCF) model for real estate valuations: implicit and explicit. The RICS red book [

1] promotes the use of an implicit DCF model within an explicit DCF model to determine the terminal value. This inclusion causes the line between implicit and explicit DCF models to be confused. The combination of methods, implicit within explicit, may be a cause of valuers not switching to explicit models despite the recent encouragement of valuers by the RICS to consider doing so, following the Pereira-Gray report

Independent Review of Real Estate Investment Valuations [

2], for market valuations. In addition, the inclusion of implicit valuations within explicit valuations might be a cause of systematic investment value over-pricing of income producing property.

This paper reconciles implicit and fully explicit valuation methods. Reconciliation will give valuers a solid basis to defend explicit DCF valuations and further encourage the use of explicit methods. This paper also updates the partially explicit Shortcut DCF with a fully explicit Shortcut DCF. Shortcut DCFs are an accurate proxy for chronologically explicit cash flows, enabling the techniques to be translated into market and investment valuations used in practice. The techniques demonstrated in the fully explicit Shortcut DCF will promote consistent terminal valuations which are also less prone to error. It will also enable further research into valuation output and index construction.

2. Background: Recent Valuation Standards

2.1. Explicit DCF and Valuation Standards

The RICS has updated their

Valuation Global Standards [

1], also known as the Red Book, effective January 31, 2025. Part of their update includes an encouragement for professional valuers to consider explicit methods of valuation.

There has been a trend in some markets towards greater interest and use of growth explicit valuation methods, including growth explicit discounted cash flow (DCF) methods. Use of such methods is not mandated but encouraged in appropriate circumstances. [

1]

The predominant methodology in the UK for real estate valuation is the implicit method. An implicit valuation uses a capitalisation rate

k to value rental income. An explicit valuation, on the other hand, uses rental growth

g and rate of return

r. Gordon growth theory [

3] states that, where income grows annually,

k can be defined by

g and

r in the relationship:

.

The single figure k, in the implicit method, allows for a simple comparison between property assets. The alternative use of g and r require a more detailed model, but is attractive due to the increased level of insight.

..the more explicit model enables the valuer to be more analytical concerning the different locational, physical, leasing and current and future occupational demand characteristics of the assets. [

4]

The

RICS practice information paper on DCF valuations [

4],

the Red Book [

1] and the

IVSC International Valuation Standards [

5] do not identify fully explicit methods. Instead, an implicit method is identified to calculate the terminal value within an explicit model, necessitating the use of a capitalisation rate

k in the valuation as well as

g and

r. In the words of the practice information paper this seems incongruous.

The method for assessing the market value of the asset at the end of the discounting period can be based on an implicit income capitalisation method, although this would seem incongruous for an explicit DCF model that is replacing the implicit model. Where an implicit capitalisation of the exit rental value is undertaken, both rental value and exit yield can be adjusted as appropriate. [

4]

The use of an implicit valuation within the DCF of an income producing property is embedded in the Standards in (a), from item A20.22 in the Red Book and for context, fully reproduced here.

The valuer may apply any reasonable method for calculating a terminal value. While there are many different approaches to calculating a terminal value, the three most commonly used are:

(a) Gordon growth model/constant growth model,

(b) market approach/exit value (appropriate for both deteriorating/finitelived assets and indefinite-lived assets), and

(c) salvage value/disposal cost (appropriate only for deteriorating/finitelived assets). [

1]

In the author’s experience `..most commonly used..’ is a fair observation. However, where explicit methods are promoted as an update to valuation standards an explicit terminal value merits listing among terminal value approaches. The method also merits further explanation, since an explicit terminal value uniquely enables a fully explicit DCF.

Furthermore, on investigation into the use of implicit terminal valuations, it can be shown that the convention of terminal value capitalisation rates set equal to equivialent yields may systematically overprice income producing property.

2.2. The RICS Example

The RICS Red Book was preceded by draft [

6] and final [

4] practice information papers on DCF valuations. The draft paper included an example in its appendix of an implicit and an explicit valuation model of an under rented property (this example is referred to hereafter as the RICS example).

The explicit model in the draft is illustrated in the form of a Shortcut DCF (Crosby, 1985). The Shortcut DCF is shortcut because it mimics the sequence summation feature of the implicit method. However, the method is only partially explicit in that it incorporates the use of g and r, but retains the use of k. Crosby’s Shortcut DCF also faithfully mimics more chronologically explicit cash flows (where rent is shown period by period) and is therefore an appropriate stand-in for more detailed formats of the explicit method.

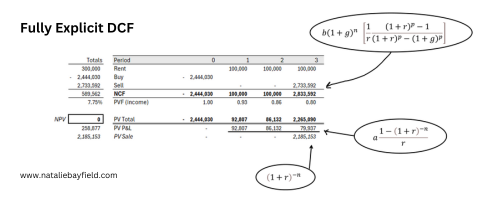

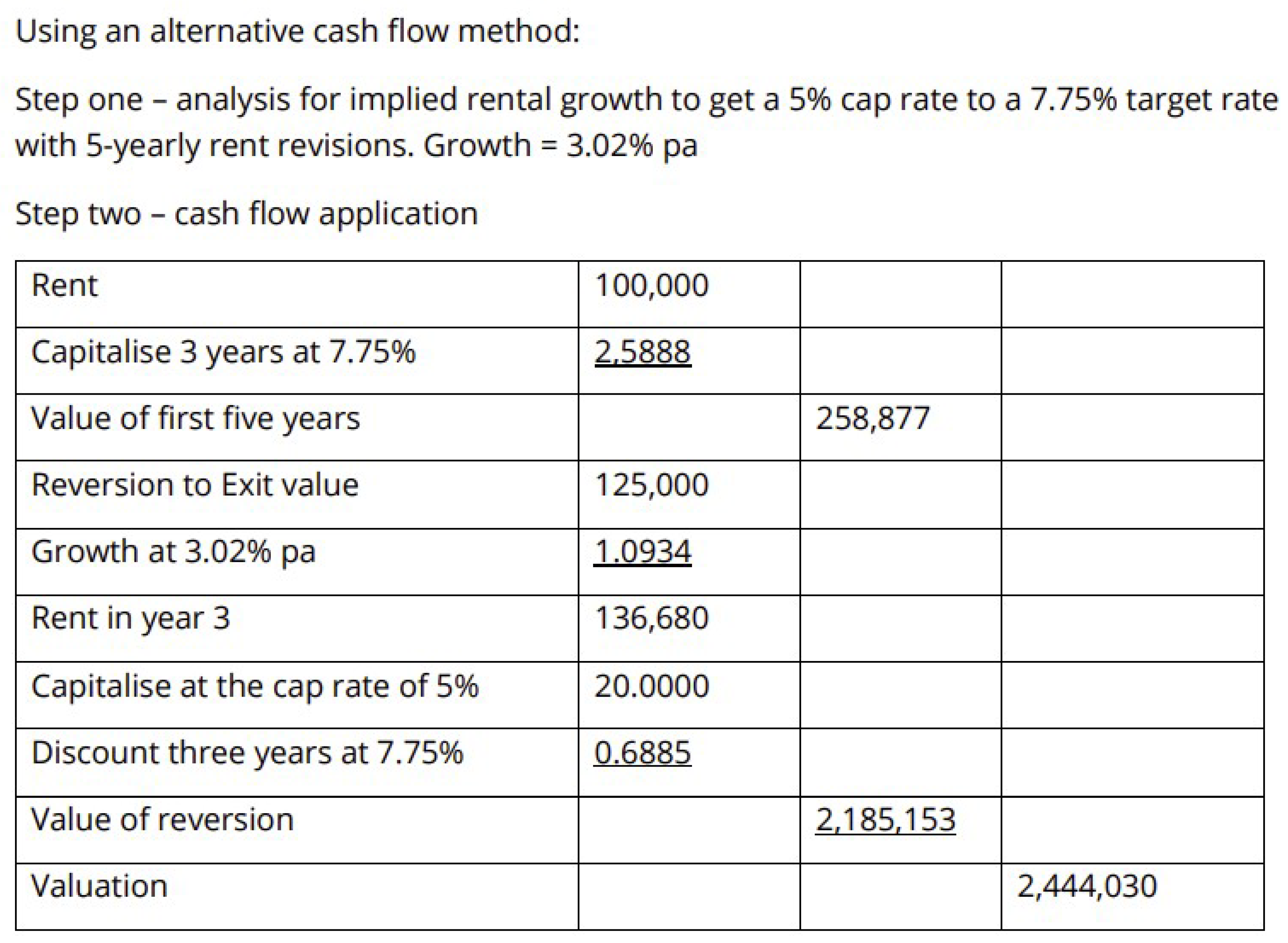

In the RICS example, the Shortcut DCF in

Figure 1 returns a value of 2,444,030 whereas the implicit model returns a value of 2,434,319. The two models do not reconcile. This is unlikely to be an acceptable result to valuers wishing to switch methods. It should be noted that the RICS example was removed from the draft practice information paper. However, no alternative was provided in the final version to deal with an under rented property.

2.2.1. Why the RICS Example Does Not Reconcile

The RICS example does not reconcile because the capitalisation rate from the fully rented comparable property is not adjusted for use in the implicit model of the under rented subject property. However, the capitalisation rate is used appropriately in the fully rented portion of the under rented subject in the Shortcut DCF model.

The comparable is a fully rented property recently transacted at

and where rent

. From this we can determine the capitalisation rate

.

If we know the rate of return

and that rent is reviewed every 5 years

we can also derive the annual rental growth rate from the comparable [

7]

.

The subject property has an unsystematic initial term

(3 years until the next rent review), a current rent of

and a reversionary rent of

. The subject’s value

can be found using the implicit term and reversion model [

8] where

is conventionally referred to as the equivalent yield.

The RICS example applies the capitalisation rate from the fully rented property giving (a typographical error in the practice paper shows ).

However, the RICS example also applies the capitalisation rate

in the alternative partially explicit model, the Shortcut DCF [

9]

, where

is the capitalisation rate used to calculate the terminal value at the end of the holding period, giving

.

The capitalisation rate is appropriately applied in the Shortcut DCF since it is used in the valuation of the fully rented portion of the income only.

If we assume the Shortcut DCF valuation, Equation (

4), is correct then

will generate a different equivalent yield in Equation (

3) of

.

The models in the RICS example do not reconcile because the capitalisation rate is not adjusted for a change in the extant lease pattern in the subject property. In practice, valuers are used to making adjustments to take account of differences between different properties. However, what also appears to be overlooked in the RICS guidance is the adjustment needed between entry and exit in Shortcut DCF models or the chronologically explicit DCF models used ubiquitously in investment valuations.

3. Cap Rate Adjustment and Mispricing

The extant lease pattern of a given property is usually different on purchase (entry) and on sale (exit). Furthermore, different exit capitalisation rates (exit yields) are required as the holding period changes. In most cases the capitalisation rate on entry and exit must be different for implicit and explicit models to reconcile. If they are not different, it can be shown there is the potential for mispricing.

3.1. Terminal Equality

The author observes, from practice, a convention in investment valuations whereby

is adjusted for changes in market and general property (fabric) conditions on exit using

as the unadjusted starting point. In other words, prior to adjustment for market and fabric conditions on exit, it is assumed that

. This is because

is seen as a summary of the valuation at period 0. However, given

depends on

a valuation following this convention, as shown in

2.2.1, is circular. It is therefore impossible to reconcile in all but fully rented examples.

The final version of the RICS practice information paper appears to support the use of an equivalent yield applied on sale, albeit using a fully rented example, in Example 3 of Appendix A:

The outlay is the capital value (Rent1/k) .. The rental value on review is capitalised at the same capitalisation rate as represented by the current purchase, and the capital value obtained is then entered as an inflow at the first review. [

4]

Note that the formula given and rewritten in math notation in Equation (

5) is the same as Equation (

4) but the notation used is slightly different in the RICS paper.

t is used in place of

n and

is used in place of

g. Also note there is no distinction between

a and

b. The property appears to be fully rented.

Although the proxy for a chronologically explicit cash flow on the right hand side is valid, the Shortcut DCF, the equality with the formula for a fully rented property , as a generalised model, is misleading. The only occasion where the equality is valid is where the following three conditions are met.

Nonetheless, Equation (

5) is a fair model of the terminal equality convention and is worth studying for its potential for mispricing.

3.2. Explaining the Terminal Equality Convention

It is proposed that the terminal equality convention is difficult to avoid if the terminal value is an implicit model and as such requires a capitalisation rate in its calculation, since:

The most similar, and readily available, comparable is the same property valued at period zero.

Commercial instinct encourages a holding period to coincide with an optimal rental income, meaning the property is often fully rented on sale, making a single capitalisation rate adjustment easy to use.

The term and reversion method uses the same value of k throughout the valuation giving false credence to the terminal equality convention.

The Shortcut DCF uses a capitalisation rate on exit, lending credibility to implied methods used for terminal valuations.

The circularity is difficult to spot because heuristic adjustments are made for several different factors on exit.

3.3. Mispricing

The attempt to reconcile models is given by equating the implicit DCF from Equation (

3) with the Shortcut DCF from Equation (

4).

Using the RICS example, by the Shortcut DCF method, we can say that

. As shown in

2.2.1 this results in an equivalent yield of

. If the Shortcut DCF is then updated so that

the Shortcut DCF returns

. This results in an equivalent yield of

and so on. As stated the equation is circlar,

unless the conditions in

Section 2.2.1 are met.

in most cases because does not always imply the holding period trend growth and return projected on exit. The capitalisation rate that does imply the growth and return projected on exit, and reconciles the two methods, we call the true exit yield .

In the RICS example if the terminal equality convention is used i.e. then over values the property by or . This error would be added to any error from heuristic adjustment for other factors. It is also an unnecessary error that can be corrected by making the Shortcut DCF fully explicit.

3.4. The True Exit Yield

As the holding period changes so does the true exit yield

. This is because the extant lease pattern on exit changes as the holding period changes. In the RICS example

for holding periods 1 through to 13 are found in

Table 1.

The true exit yields all reflect a perpetual rate of and given the rent and lease conditions extant at the respective terminal period. Holding periods 3, 8 and 13 are holding periods where the terminal valuation is a fully rented scenario, .

In all cases since the holding period does not change the lease pattern extant at period 0. For all holding periods in the RICS example . This means, in the RICS example, a higher terminal valuation will result, generating a positive NPV and an over-valuation of some percentage.

3.5. Summary of Investigation

Where an implicit terminal valuation is used in a DCF, necessitating an exit capitalisation rate

and where

is the valuation using

and

is the valuation using

, the following parameters will hold true.

The capitalisation rate on exit equals the equivalent yield if and only if the passing rent and market rent are the same; the intital term is the same as the review period; and the holding period occurs on an integer multiple of the review period.

If the capitalisation rate used on exit is the same as the equivalent yield then, where the equivalent yield is less than the true exit yield, an over-valuation will result.

4. Fully Explicit Valuations

The formula for the fully explicit Shortcut DCF and the explicit terminal value used in the investigation are shown here rather than in an appendix since the explicit terminal value is considered of central importance to the process of transitioning to explicit valuations.

4.1. Explicit Terminal Value

The implicit terminal value can be replaced with an explicit terminal value.

The fully rented explicit model can be found in Brown and Matysiak [

7] and in the form of a finite geometric progression in Baum [

10] but it is not used in either, in the discussion of terminal valuations.

4.2. Fully Explicit Shortcut DCF

This substitution updates the partially implicit Shortcut DCF in Equation (

4) to a fully explicit Shortcut DCF where no capitalisation rate is required.

If a Shortcut DCF is constructed from

g and

r in Equation (

10) a true exit yield

can be derived, using Equation (

9), if required.

4.3. Extending the Holding Period

When extending the holding period the implicit terminal value should be substituted with the fully explicit Shortcut DCF taking into account the unexpired term until review, current rent and market rent on the date at the end of the holding period. This is essential for mathematically correct answers, given an assumption of g and r under conditions of changing holding periods, in sensitivity and risk analysis.

5. Conclusions

This paper has shown how a formulated ‘explicit terminal value’ assists in reconciliation between implicit and explicit valuation methods. Furthermore, the paper encourages the use of an explicit terminal value for all explicit market and investment valuations going forward to aid clarity in reporting and to avoid any potential for mispricing.

The extent to which the circa 1 trillion commercial property stock in the UK [

11] is mispriced will depend on:

Actual valuation conventions employed by valuers and investment professionals,

To what extent heuristic adjustments compensate for the technical difference between valuations of property with different lease patterns, and

The number and extent of actual differences between properties valued each year.

The terminal valuation in explicit valuation methods and reconciliation between implicit and explicit methods merits further study, specifically in the three areas enumerated above but also the reconciliation of methods where other factors are included in the valuation, for example transaction costs, CAPEX and OPEX. The explicit terminal value and its use in context presented in this paper should provide a clear technical framework for further study.

References

- RICS. Global Valuation Standards. Published by Royal Institute of Chartered Surveryors, London, UK, 2024. Available at: https://www.rics.org (accessed 1 March 2025).

- Peter Pereira Gray. Independent review of real estate investment valuations, December 2021. URL https://www.rics.org/content/dam/ricsglobal/documents/standards/independent_review_of_real_estate_investment_valuations.pdf.

- Myron J. Gordon and Eli Shapiro. Capital equipment analysis: The required rate of profit. Management Science, 3(1):102–110, 1956. [CrossRef]

- RICS. Final practice information paper on DCF valuations. Published by Royal Institute of Chartered Surveryors RICS, London, UK, 2023. Final approved version.

- IVSC. International Valuation Standards. Published by International Valuation Standards Ccouncil, London, UK, 2024. Available at: https://www.ivsc.org (accessed 1 March 2025).

- RICS. Draft practice information paper on DCF valuations. Published by Royal Institute of Chartered Surveryors, London, UK, 2023. Draft version.

- Gordon Brown and George Matysiak. Real Estate Investment: A Capital Market Approach. Financial Times Prentice Hall, 2000.

- Andrew Baum and Neil Crosby. Property Investment Appraisal. Routledge, London, 1988.

- Neil Crosby. Short-cut dcf methods in property valuation. Unpublished RICS seminar notes, 1985. Circulated internally by the Royal Institution of Chartered Surveyors.

- Andrew E. Baum, Neil Crosby, and Steven Devaney. Property Investment Appraisal. Wiley-Blackwell, Hoboken, NJ, 4 edition, 2021. ISBN 978-1-118-39955-2.

- Nick Mansley. Size and structure of the uk property market – an update. IPF Webinar, January 2025. URL https://www.ipf.org.uk/event/ipf-webinar-size-and-structure-of-the-uk-property-market-an-update.html.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).