1. Introduction

The rapid growth of Artificial Intelligence (AI) technologies is driving innovation across the financial sector. By 2026, the domestic AI market is projected to reach 17.4 trillion KRW (

$11.864 billion), a significant rise from 1.5 trillion KRW (

$1.32 billion) in 2019, with the financial AI market alone doubling from 300 billion KRW (

$206.5 million) to 600 billion KRW (

$412.9 million) between 2019 and 2021 [

1]. This rapid growth highlights AI’s transformative role in enhancing customer experiences and institutional competitiveness.

A notable example is KB Kookmin Bank’s AI chatbot "Bibi," which has improved service quality and market competitiveness through personalized consultations. Such advancements demonstrate that chatbots are becoming indispensable for meeting customer needs and accelerating digital transformation in financial services.

As face-to-face interactions give way to non-face-to-face channels, the importance of AI-driven chatbot systems is increasingly clear [

2]. However, while studies on chatbot adoption and acceptance are abundant, research on factors sustaining their continuous usage remains limited. Without addressing this gap, financial institutions may fail to maximize the long-term benefits of chatbot services.

This study explores how financial chatbot characteristics influence users’ continuous usage intentions. Unlike prior research focusing on initial adoption, this study investigates sustained engagement, offering strategic insights for improving chatbot services. These findings contribute to understanding digital transformation in the financial industry, providing practical recommendations for enhancing service quality, customer satisfaction, and market competitiveness.

2. Theoretical Background

2.1. Chatbot Services: Concept and Necessity in Financial Institutions

A chatbot, a combination of "chatting" and "robot," is an interactive system designed to answer user inquiries through dialogue [

3]. The National Information Society Agency defines chatbots as AI-based software that provides information through text-based conversations. Initially limited to text, chatbots have now evolved to incorporate voice support, expanding their scope [

5].

Chatbots primarily automate consumer consultations. Unlike traditional phone or email support, they provide instant assistance through online chats on mobile devices or PCs, enhancing service efficiency [

6,

7]. Modern chatbots can understand user queries and offer optimal answers, engaging in two-way communication to deliver tailored solutions [

40]. Such interactions build "social presence," where users view chatbots as partners, leading to higher satisfaction and usage intention [

8]. For instance, Garrison et al. found users interacting with high-presence chatbots reported a 25% increase in satisfaction.

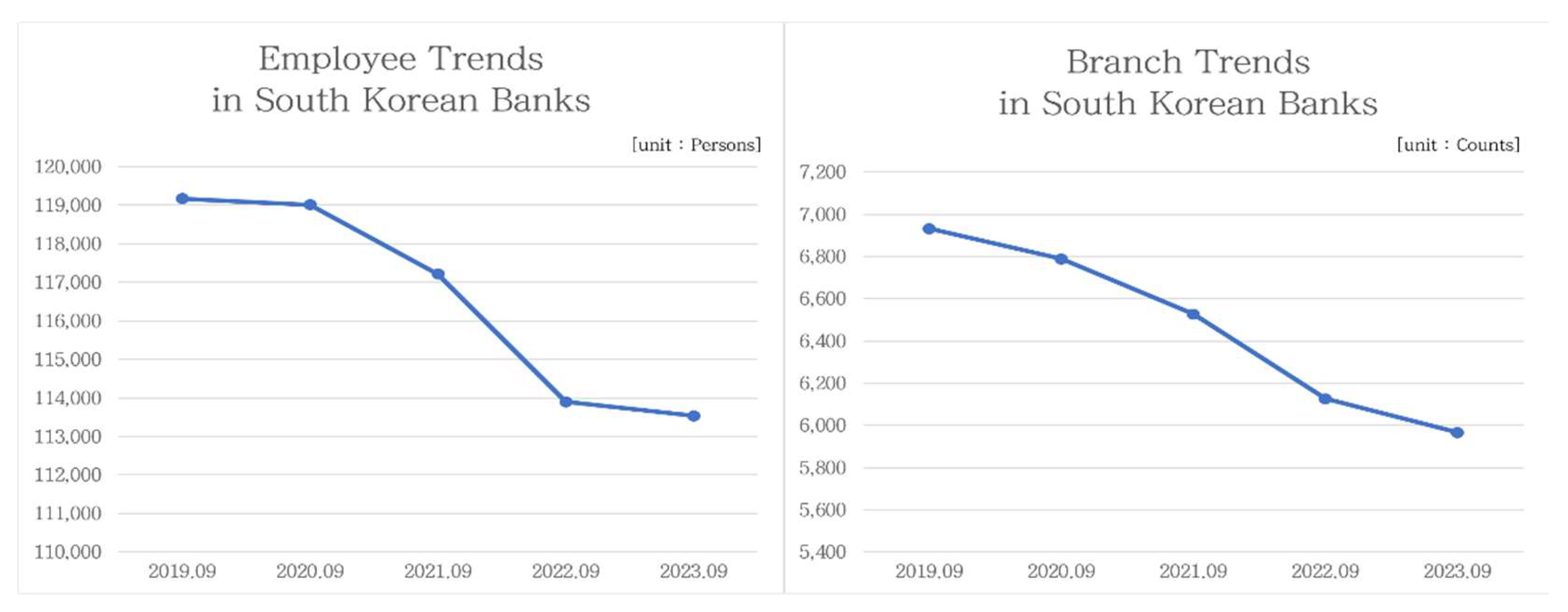

The financial industry has expanded chatbot use significantly amid digital transformation. The COVID-19 pandemic accelerated demand for non-face-to-face services, shifting the focus to digital channels. Between 2019 and 2023, South Korean banks closed 965 branches and cut 5,635 jobs, signaling a transition to digital services [

2]. For example, KB Kookmin Bank’s chatbot improved efficiency and customer satisfaction.

Chatbots are emerging as "online tellers" capable of handling tasks like authentication, transaction verification, and document preparation. Lee shows that chatbots reduce operational costs by 30% and provide 24/7 support, enhancing customer engagement and solidifying their role in the financial sector’s digital transformation.

Figure 1.

Employee and Branch Trends in South Korean Banks (2019-2023).

Figure 1.

Employee and Branch Trends in South Korean Banks (2019-2023).

2.2. Literature Review

2.2.1. Chatbot Services in Financial Institutions

The domestic financial industry has rapidly adopted chatbot services in response to the rising demand for non-face-to-face services [

10]. This trend has extended from first-tier institutions to second-tier institutions. Chatbots are employed by financial institutions to enhance customer experience and service quality [

11]. The COVID-19 pandemic has accelerated preference for non-face-to-face channels, resulting in increased bank branch closures [

12]. Consequently, chatbots have become crucial "online tellers," managing tasks such as authentication, transaction verification, and document processing [

9]. Chatbots enhance operational efficiency by providing 24/7 customer support, reducing labor costs, and improving the speed of problem resolution [

13].

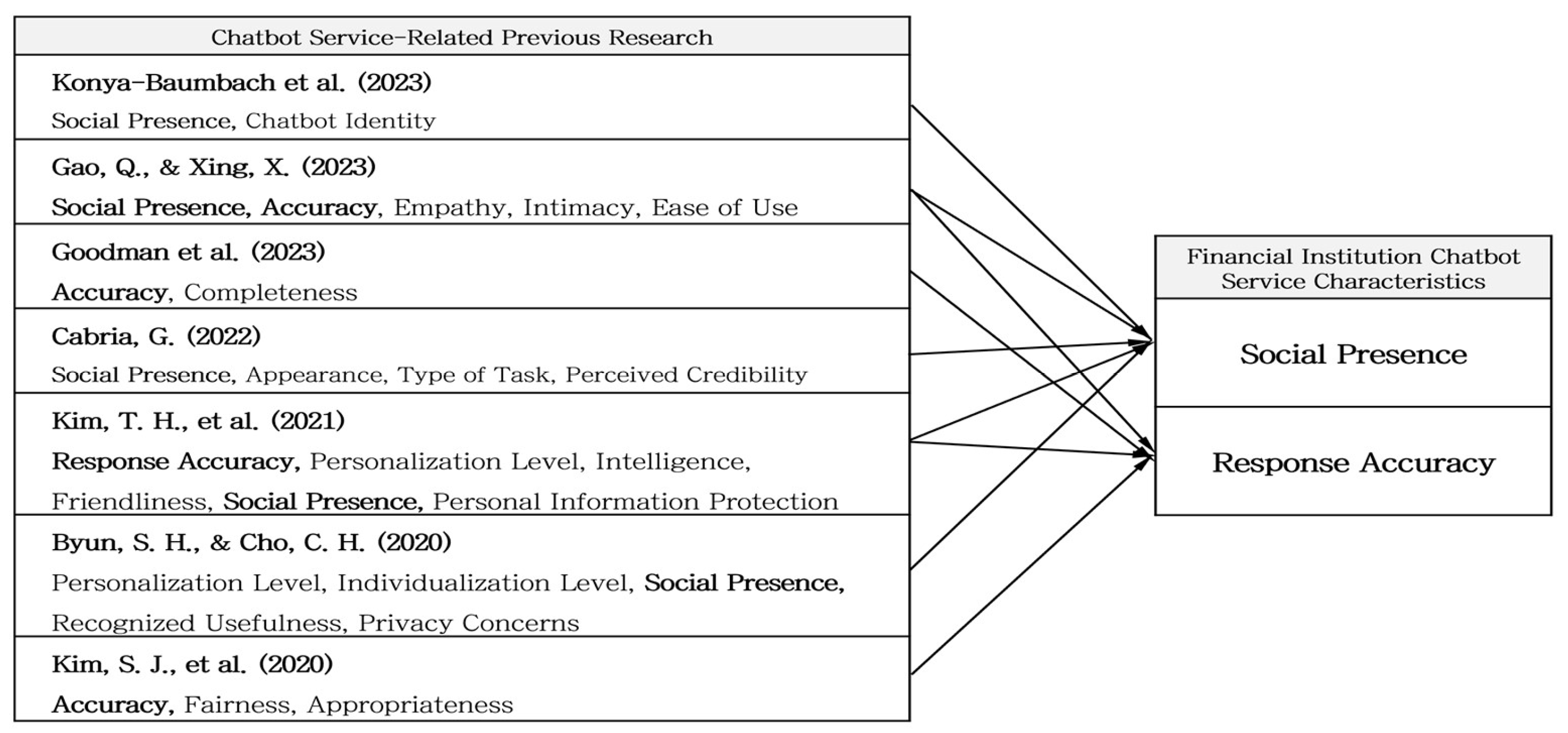

In this study, Social Presence and Response Accuracy are identified as key characteristics of effective chatbot services in financial institutions, based on an analysis of prior research, as shown in

Figure 2.

2.2.2. Service Quality Measurement Model (SERVQUAL Model)

The SERVQUAL model, developed by Parasuraman et al. [

14], is widely used for evaluating customer satisfaction. It builds on the Expectation Disconfirmation Theory and research by Grönroos [

16]. The model includes five dimensions: Tangibility, Reliability, Assurance, Responsiveness, and Empathy, using 22 items to measure gaps between service expectations and experiences.

Jeon & Yu examined the impact of chatbot service quality on usage intention in finance and e-commerce. Park studied the effects on customer loyalty and satisfaction in online shopping, while Nguyen et al. focused on banking chatbot quality and its influence on trust and satisfaction. Meyer et al. analyzed how airline chatbot quality affects usage intention.

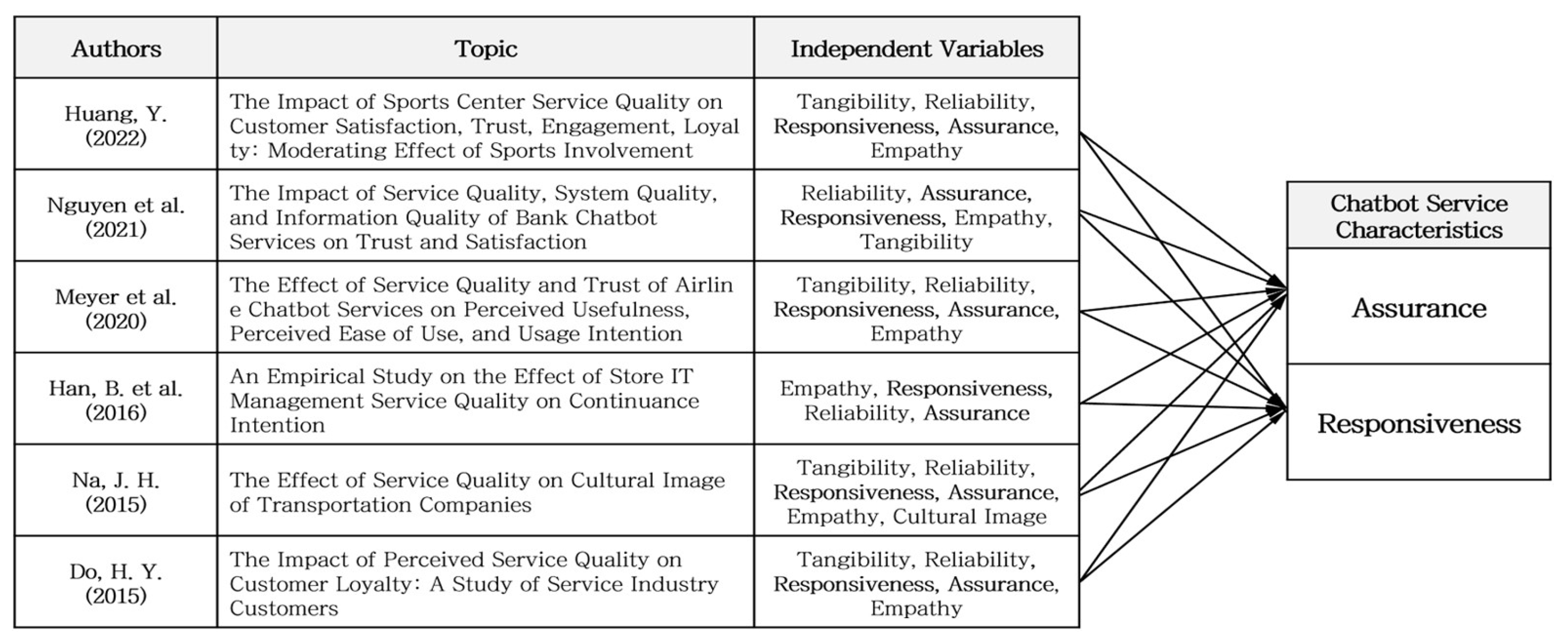

In this study, based on prior research, Assurance and Responsiveness are identified as key characteristics representing chatbot service quality in financial institutions, as shown in

Figure 3. These variables are crucial for understanding service quality dimensions in the financial chatbot context.

2.2.3. Information System Success Model (IS-SUCCESS Model)

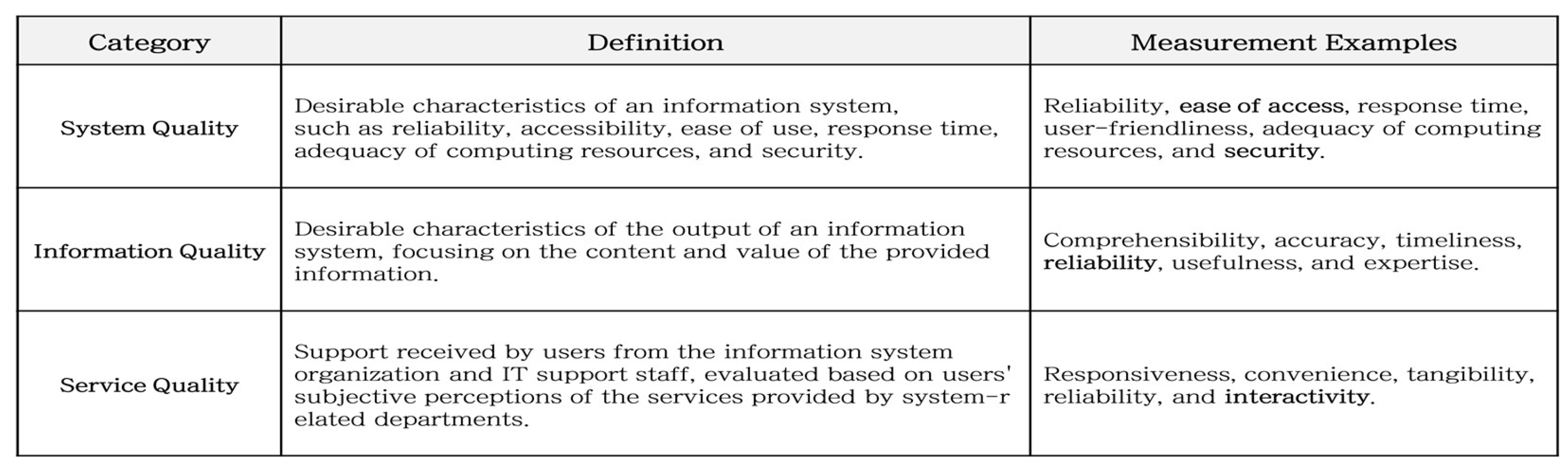

The Information Systems Success Model is used to comprehensively evaluate system quality, information quality, and service quality [

21]. This model was expanded by and [

23], and the revised model by DeLone & McLean allowed for a more comprehensive and systematic evaluation. Han et al. studied the impact of service quality and system quality of unmanned store kiosks on the intention of continued use, providing insights into successful operational strategies. Similarly, Alksasbeh et al. examined how information quality, system quality, and service quality influenced satisfaction and behavioral intentions in the context of mobile social network apps used in learning environments.

In this study, based on previous research, Trust, Ease of Use, Security, and Interactivity are identified as key characteristics representing the quality of financial chatbot services, as illustrated in

Figure 4. These variables are crucial for understanding service quality dimensions in the financial chatbot context.

2.2.4. Post-Acceptance Model (PAM)

In the field of information systems, research has increasingly focused on post-adoption behaviors and continued usage intentions beyond the initial adoption phase. Bhattacherjee proposed the Post-Acceptance Model by combining Oliver’s Expectation Confirmation Theory with the Technology Acceptance Model, identifying perceived usefulness, confirmation, and satisfaction as key factors affecting continued usage intention. This model has become a representative framework for explaining success factors in information systems.

In domestic studies, the post-adoption model has been applied to various areas such as the CM channel of insurance companies [

29], OTT services [

30], and YouTube home training [

31]. These studies found that service characteristics, information quality, content quality, and usage motivation significantly influence continued usage intention through the mediating effects of confirmation, perceived usefulness, and satisfaction. Similarly, international studies have reported that confirmation, satisfaction, and perceived usefulness significantly affect continued usage intention in contexts such as IPTV [

32], mobile services [

33], group-buying websites [

34], and mobile messaging services [

35].

In this study, based on the Post-Acceptance Model, we investigate the factors that influence users’ continued usage intention of financial chatbots. This research framework provides a theoretical foundation for understanding the long-term adoption behavior of financial chatbot services.

3. Research Design

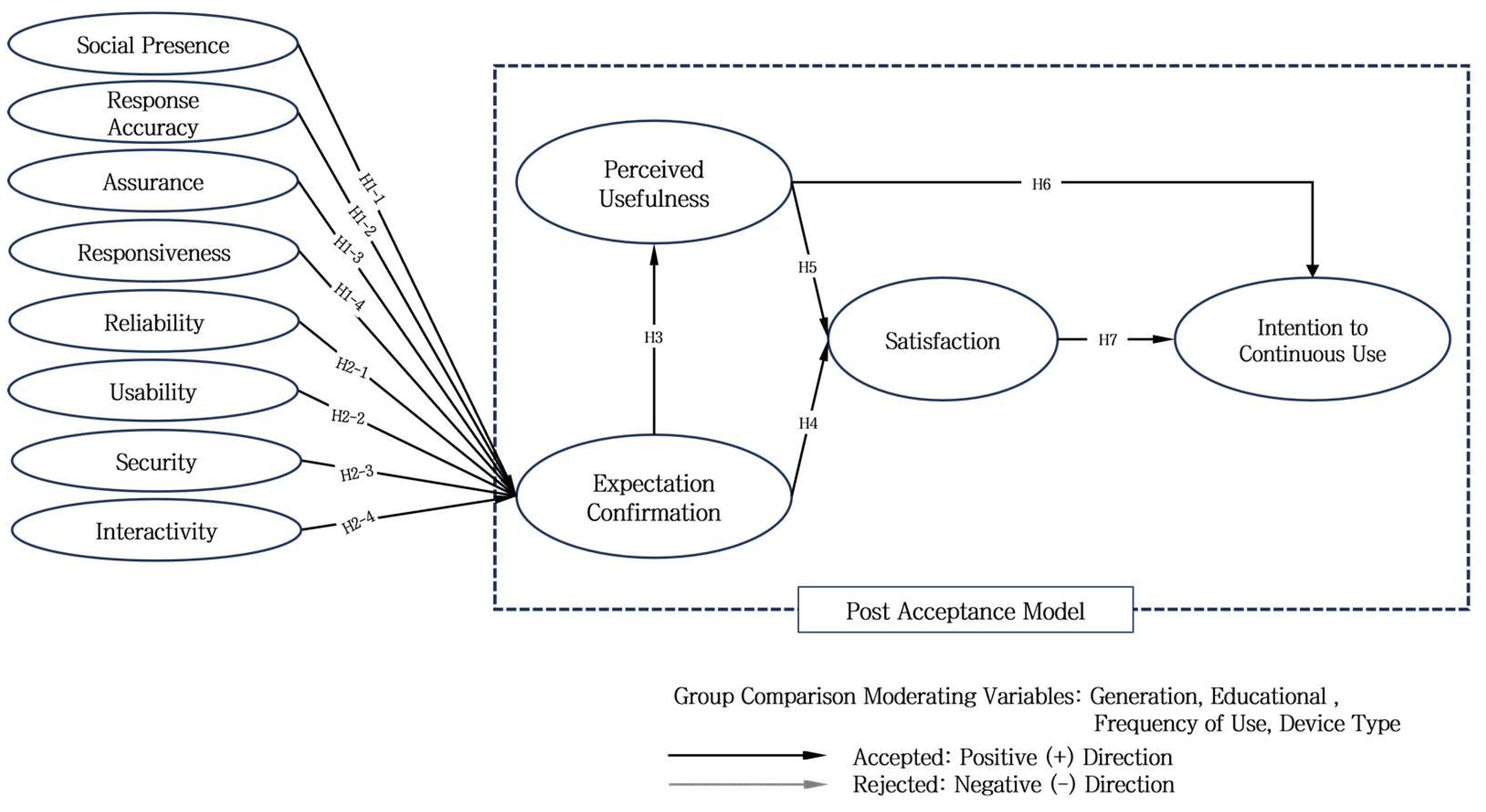

3.1. Research Model

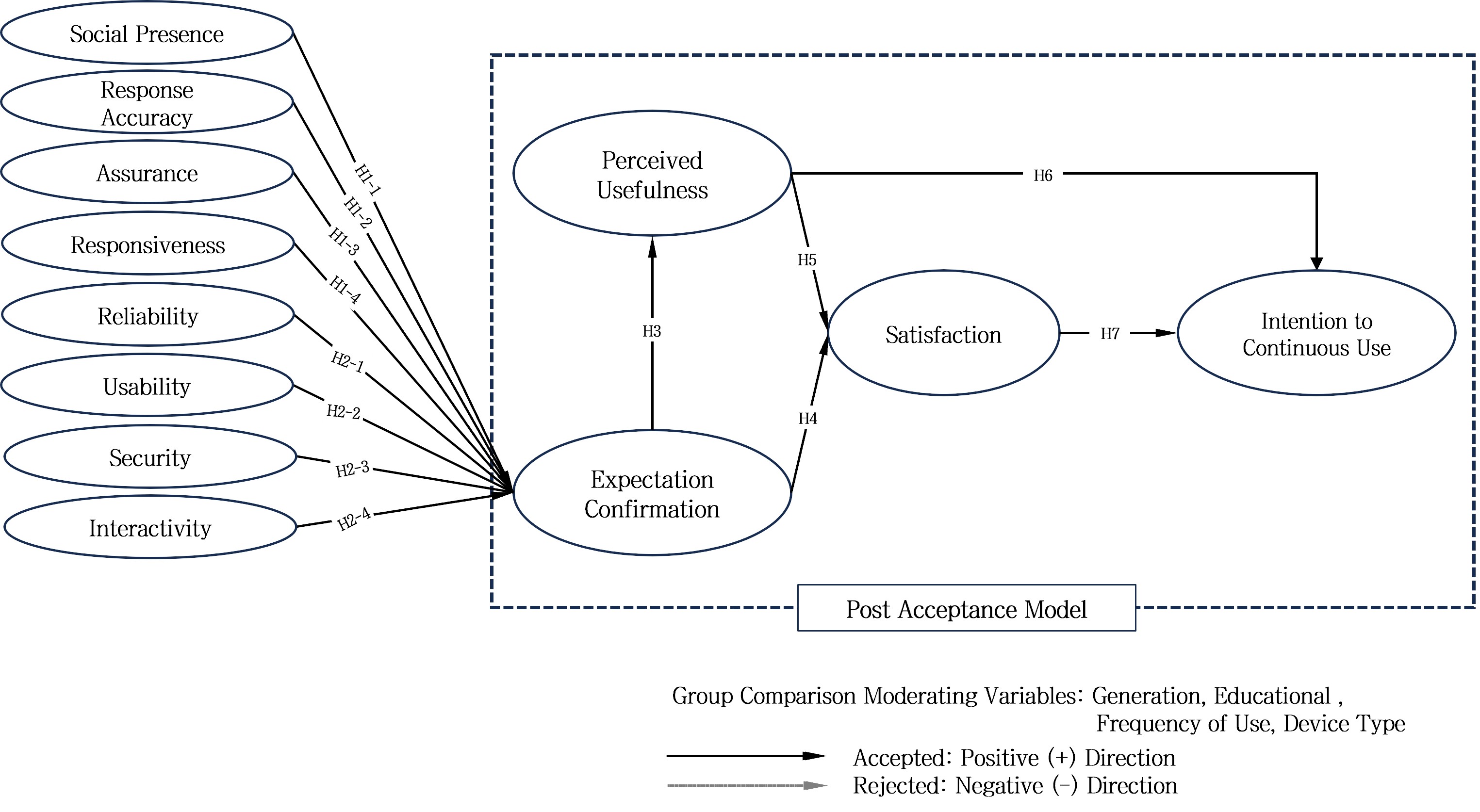

This study aims to examine the factors affecting continued usage intention of financial chatbot services, as shown in

Figure 5. Key characteristics such as Social Presence, Response Accuracy, Assurance, and Responsiveness were identified, along with system quality factors including Trust, Ease of Use, Security, and Interactivity. The Post-Acceptance Model is used to verify the impact of Perceived Usefulness, Confirmation, and Satisfaction on continued usage intention.

3.2. Hypothesis Development

3.2.1. Relationship Between Financial Chatbot Service Characteristics and Expectation Confirmation

In financial chatbot services, social presence makes users perceive the chatbot as realistic, while response accuracy refers to the chatbot’s ability to understand and process user requests correctly. Assurance provides trust in the chatbot’s knowledge, competence, and safety, whereas responsiveness is expected to positively influence expectation confirmation through prompt service. Expectation confirmation assesses how well the service meets prior expectations and is crucial for consumer satisfaction and repurchase decisions [

36]. Thus, this study formulates hypotheses on the relationship between financial chatbot characteristics and expectation confirmation.

H1. The characteristics of financial chatbot services will have a positive effect on expectation confirmation.

H1-1. Social Presence will have a positive effect on expectation confirmation.

H1-2. Response Accuracy will have a positive effect on expectation confirmation.

H1-3. Assurance will have a positive effect on expectation confirmation.

H1-4. Responsiveness will have a positive effect on expectation confirmation.

3.2.2. Relationship Between Information System Quality Characteristics and Expectation Confirmation

Reliability ensures consistent and accurate delivery of promised services, while usability helps users easily understand the information they need [

37]. Security guarantees system access and protects user information, and interactivity facilitates smooth communication between the service and the user, which is expected to positively influence expectation confirmation [

38]. Therefore, this study establishes hypotheses based on prior research regarding the relationship between information system quality and expectation confirmation.

H2. Information system quality characteristics will have a positive effect on expectation confirmation.

H2-1. Reliability will have a positive effect on expectation confirmation.

H2-2. Usability will have a positive effect on expectation confirmation.

H2-3. Security will have a positive effect on expectation confirmation.

H2-4. Interactivity will have a positive effect on expectation confirmation.

3.2.3. Relationship Between Expectation Confirmation and Perceived Usefulness

Expectation confirmation refers to the degree to which initial expectations align with the actual experience of using the service [

39]. It is anticipated that expectation confirmation will positively influence the perceived usefulness of financial chatbot services. Therefore, based on prior research on expectation confirmation and perceived usefulness, this study establishes relevant hypotheses.

H3. Expectation Confirmation will have a positive effect on Perceived Usefulness.

3.2.4. Relationship Between Expectation Confirmation and Satisfaction

Expectation confirmation represents the extent to which initial expectations are met during actual use of the service [

40]. It is expected that expectation confirmation will positively affect user satisfaction with financial chatbot services. Therefore, this study formulates hypotheses based on prior research regarding the relationship between expectation confirmation and satisfaction.

H4. Expectation Confirmation will have a positive effect on Satisfaction.

H4-1. Product Benefits will have a positive effect on Perceived Usefulness.

H4-2. Customer Orientation will have a positive effect on Perceived Usefulness.

H4-3. Brand Reputation will have a positive effect on Perceived Usefulness.

3.2.5. Relationship Between Perceived Usefulness and Satisfaction

Perceived usefulness refers to the extent to which users believe that using the service will enhance their performance or fulfill their needs [

41]. It is anticipated that perceived usefulness will positively influence user satisfaction with financial chatbot services. Therefore, based on prior research on perceived usefulness and satisfaction, this study establishes relevant hypotheses.

H5. Perceived Usefulness will have a positive effect on Satisfaction.

3.2.6. Relationship Between Perceived Usefulness and Continuous Usage Intention

Perceived usefulness reflects the degree to which users believe the service will improve their outcomes or fulfill their objectives [

42]. It is expected that perceived usefulness will positively influence users’ continuous usage intention. Therefore, based on prior research on perceived usefulness and continuous usage intention, this study formulates relevant hypotheses..

H6. Perceived Usefulness will have a positive effect on Continuous Usage Intention.

3.2.7. Relationship Between Satisfaction and Continuous Usage Intention

Satisfaction represents the overall level of contentment users experience from using the service [

43]. It is expected that satisfaction will positively affect the continuous usage intention of financial chatbot services. Therefore, this study formulates hypotheses based on prior research regarding the relationship between satisfaction and continuous usage intention.

H7. Satisfaction will have a positive effect on Continuous Usage Intention.

4. Research Results

4.1. Data Collection

Data collection for this study was conducted using Survey Monkey from February 3 to February 20, 2024, targeting users with experience using financial chatbot services. Of 300 responses, 250 valid responses were used for final analysis. The survey included 56 items, with 48 measurement items and 8 demographic questions, all measured on a 7-point Likert scale.

4.2. Demographic Analysis

Among the 250 respondents, 54.4% were male and 45.6% were female. The largest age group was 30-39 years old (25.2%), while the Millennial generation represented the highest proportion by generation (38.4%). The most frequently used financial institution was a bank (45.0%), with usage frequency of more than eight times (37.2%), and mobile devices were the most commonly used platform (71.6%). The results of the demographic characteristics analysis conducted through the survey are presented in

Table 1.

4.3. Reliability and Validity Analysis

The statistical analysis was conducted under the assumption that the sample follows a normal distribution, which provides advantages in terms of efficient parameter estimation and hypothesis testing [

44]. R was used for descriptive statistics and normality testing, with skewness and kurtosis as key metrics. Skewness measures the asymmetry of the distribution, while kurtosis assesses the flatness of the peak of the distribution. Absolute values exceeding ±1.96 for skewness and ±2 for kurtosis are considered indicative of an extreme distribution [

45]. As shown in

Table 2, the skewness and kurtosis of all variables are within these acceptable ranges, indicating no significant issues with normality.

Table 3 presents the results of the internal consistency reliability assessment. The Cronbach’s α coefficients for the latent variables exceeded the threshold of 0.7, and the Composite Reliability (CR, DG.ρ) values also surpassed 0.7 [

46]. Additionally, the eigenvalue for each latent variable met the criterion of being greater than or equal to 1.0 [

46]. Thus, the internal consistency reliability and composite reliability of all latent variables were well above the required thresholds, ensuring the internal reliability of the measurement indicators.

The validity evaluation of the PLS-SEM structural equation model was conducted by assessing discriminant validity and convergent validity. Discriminant validity was evaluated through the square root of the Average Variance Extracted (AVE) and the cross-loading criteria. If the square root of the AVE for each variable is greater than the correlation coefficients between that latent variable and other latent variables, the model is considered to have achieved discriminant validity [

47]. As shown in

Table 4, the diagonal values of the AVE square root were higher than the correlation coefficients with other latent variables, confirming the discriminant validity of the model.

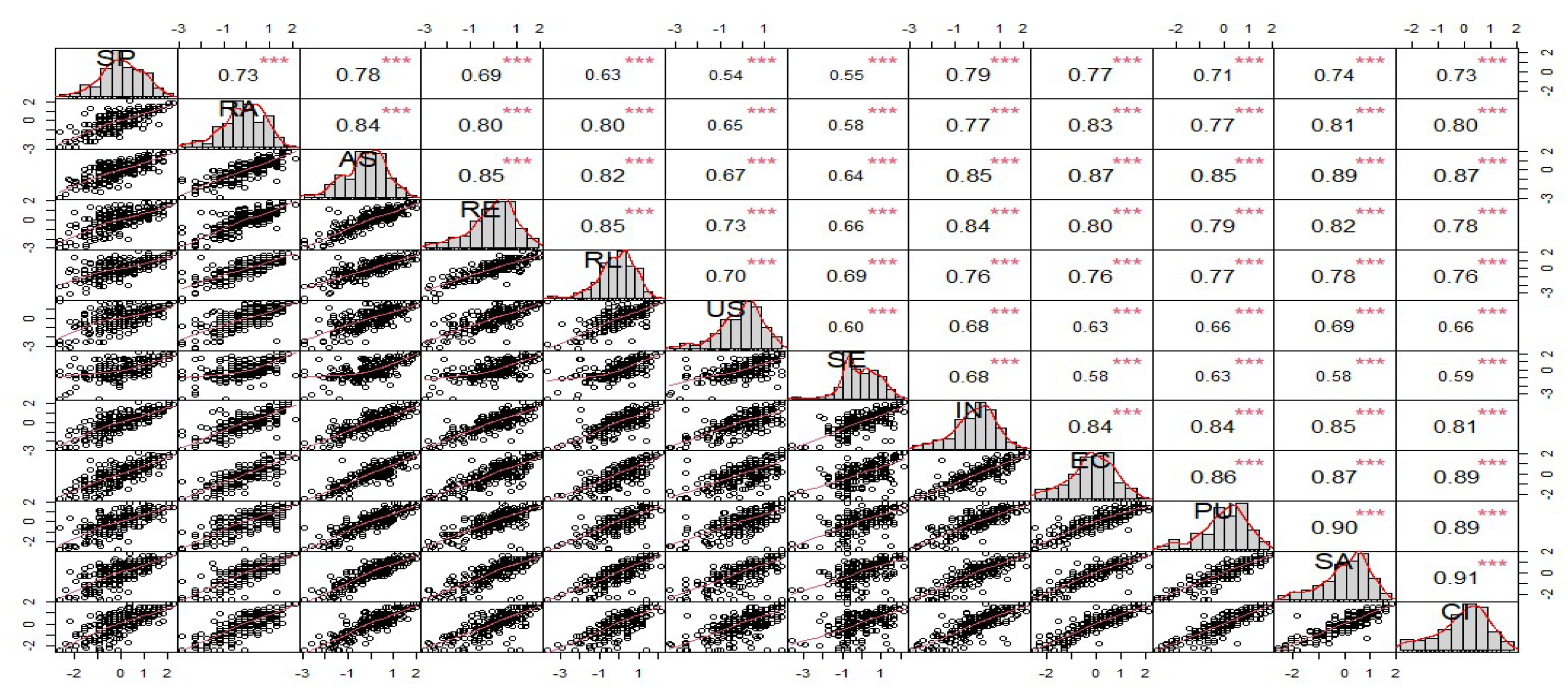

Correlation analysis results showed that most variables were significantly correlated. Social Presence exhibited a high correlation with Interactivity (p=0.79) and Assurance (p=0.78). Response Accuracy was strongly correlated with Assurance (p=0.84) and Expectation Confirmation (p=0.83). Responsiveness showed a high correlation with Reliability (p=0.85) and Interactivity (p=0.84). Perceived Usefulness was strongly correlated with Expectation Confirmation (p=0.86) and Assurance (p=0.85). Satisfaction exhibited high correlations with Perceived Usefulness (p=0.90), Assurance (p=0.89), and Expectation Confirmation (p=0.87). Expectation Confirmation showed a strong correlation with Continuous Usage Intention (p=0.89), while Continuous Usage Intention was highly correlated with Satisfaction (p=0.91), Expectation Confirmation (p=0.89), and Perceived Usefulness (p=0.89). The results of the correlation analysis are presented in

Figure 6.

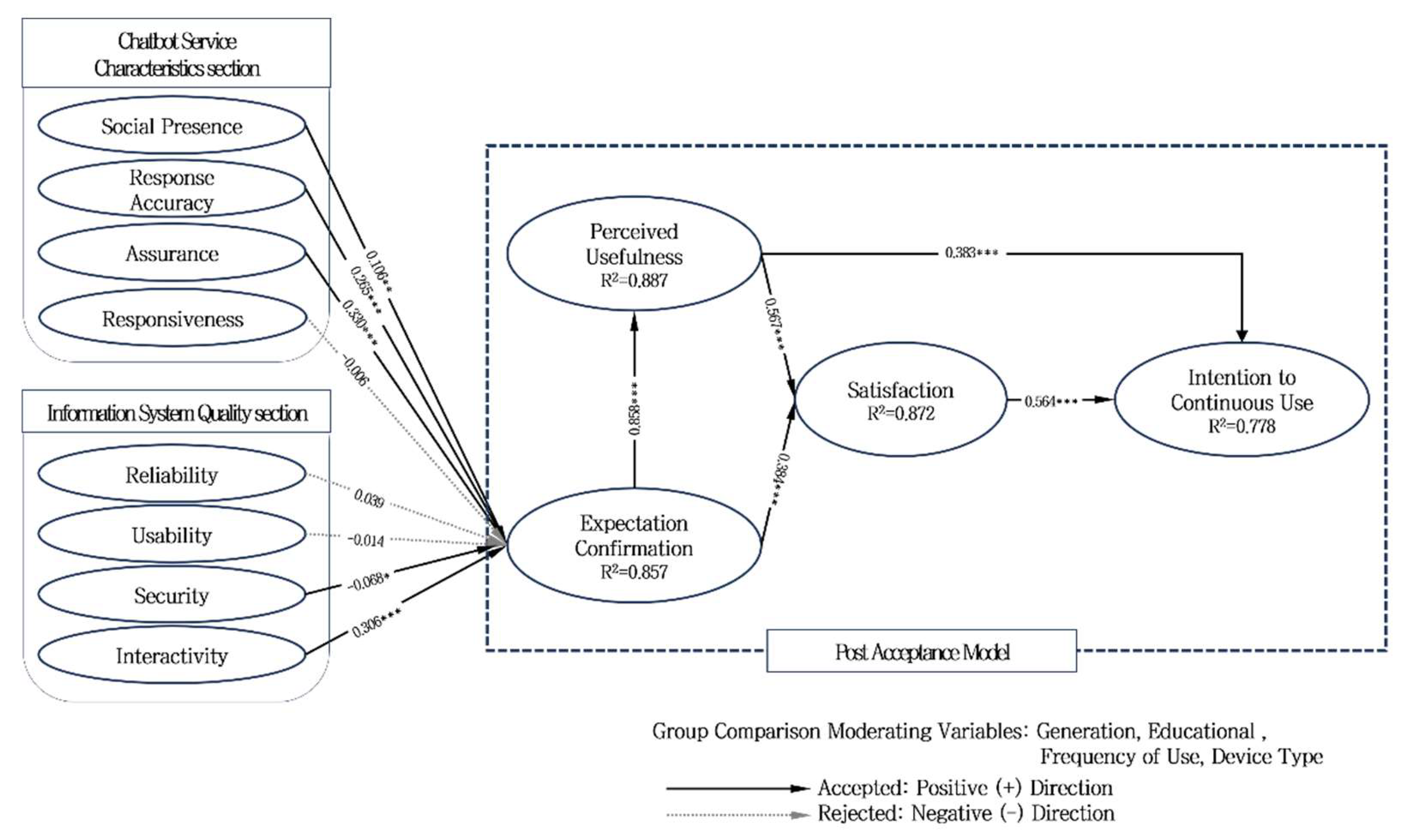

4.4. Path Analysis Results

In the path analysis, path coefficients were evaluated for statistical significance using a non-parametric bootstrapping method [

46]. The structural equation modeling (SEM) analysis in this study used the PLSPM Package in R, and 2,000 bootstrap resampling iterations were performed to verify the significance of the path coefficients. Path coefficients are calculated based on the relationship between the standardized values of two variables and their correlation. A path coefficient value close to +1 indicates a strong positive relationship between two variables, while a value close to -1 indicates a strong negative relationship. Conversely, a value close to 0 indicates a weak relationship between the two variables. When the calculated t-value exceeds the critical value, the path coefficient is deemed statistically significant at a given level of error probability (significance level) [

48]. The critical t-value for a two-tailed test is generally 1.96, which corresponds to a significance level of 5% [

46]. The results of the path analysis are presented in

Table 5.

The path analysis results, considering the critical value (t-value = 1.96) at the 5% significance level, are as follows. For the path analysis between financial chatbot service characteristics and expectation confirmation, Social Presence (t = 3.137, p = 0.002), Response Accuracy (t = 6.735, p = 0.000), and Assurance (t = 6.867, p = 0.000) were found to have a positive effect on expectation confirmation, while Responsiveness (t = -0.134, p = 0.894) was rejected, indicating no significant impact. In the path analysis between information system quality characteristics and expectation confirmation, Security (t = -2.396, p = 0.017) had a negative effect on expectation confirmation, whereas Interactivity (t = 6.903, p = 0.000) had a positive effect. Reliability (t = 0.921, p = 0.357) and Usability (t = -0.476, p = 0.634) were rejected, indicating no significant effect. For the path analysis between expectation confirmation and perceived usefulness, Expectation Confirmation (t = 37.264, p = 0.000) was found to have a positive effect on perceived usefulness. In the path analysis between expectation confirmation, perceived usefulness, and satisfaction, Expectation Confirmation (t = 11.076, p = 0.000) and Perceived Usefulness (t = 16.364, p = 0.000) both had positive effects on satisfaction, with Perceived Usefulness showing a stronger effect. In the path analysis between perceived usefulness, satisfaction, and continuous usage intention, Perceived Usefulness (t = 9.824, p = 0.000) and Satisfaction (t = 14.473, p = 0.000) both had positive effects on continuous usage intention, with Satisfaction showing a stronger effect. Overall, Interactivity was found to have the greatest impact on expectation confirmation, followed by Assurance, Response Accuracy, and Social Presence in that order. The research model with the path analysis results is shown in

Figure 7.

5. Conclusion

5.1. Significance and Implications of the Study

The necessity and importance of financial institution chatbot services have been highlighted due to the increase in non-face-to-face financial transactions and the reduction in branch offices after the COVID-19 pandemic. Particularly, chatbots integrated with AI technology have become a key tool for improving the efficiency of financial services and providing new value to customers. This study aimed to identify the continuous usage intention of financial institution chatbot services by establishing a research model that integrates financial institution chatbot service characteristics, SERVQUAL, the information system success model, and the post-acceptance model. Key variables such as Social Presence, Response Accuracy, Assurance, Responsiveness, Reliability, Usability, Security, and Interactivity were used to empirically analyze the impact of Expectation Confirmation and Perceived Usefulness on continuous usage intention. The findings of this study contribute to understanding customers’ continuous usage intention for chatbot services provided by financial institutions and provide significant implications for developing customized strategies and action plans to encourage ongoing use.

5.1.1. Theoretical Implications

This study holds academic significance as it addresses the limitations of previous studies and provides a more comprehensive understanding of financial institution chatbot services. Unlike previous research that focused primarily on individual analyses of chatbot service quality or acceptance intention, this study expands the research scope through the following differentiated approaches:

First, the service quality measurement model was used to derive four key characteristics of financial institution chatbot services (Social Presence, Response Accuracy, Assurance, and Responsiveness) and to build a comprehensive analytical framework by including four information system quality characteristics (Reliability, Usability, Security, and Interactivity).

Second, the post-acceptance model was applied to systematically analyze the complex interrelationships between factors affecting the continuous usage intention of financial institution chatbot services. This novel approach, which has not been attempted in previous studies, contributes to understanding the long-term success factors of chatbot services.

Through these academic contributions, this study enhances the understanding of consumer behavior in the use of financial institution chatbot services and contributes to the advancement of the related research field by applying the post-acceptance model to the financial industry.

5.1.2. Practical Implications

The practical implications of this study are as follows. First, among the quality characteristics of financial institution chatbot services, Assurance had the greatest impact on Expectation Confirmation. This trend was particularly prominent among users who used chatbots more than four times and those with at least a bachelor’s degree. Social Presence was also found to increase Expectation Confirmation as it increased. This suggests that financial institutions should adopt strategies that promote repeated use and enhance Social Presence to build customer trust through chatbot services.

Second, among information system quality characteristics, Interactivity was found to be the most important factor affecting Expectation Confirmation. Notably, frequent users expressed concerns about Security. On the other hand, Reliability and Usability did not have significant effects, suggesting that these are perceived as basic requirements. Therefore, financial institutions should focus on enhancing Interactivity and improving trust in Security while providing differentiated personalized services.

Third, Perceived Usefulness, Expectation Confirmation, Satisfaction, and Continuous Usage Intention were all found to have positive correlations. Particularly, the Expectation Confirmation level was higher among mobile users, and the satisfaction level of older generations was higher than that of the MZ generation. These results suggest the need for differentiated strategies that consider generational characteristics and usage environments. Financial institutions should improve user experience through mobile optimization and customized UI/UX design for each generation to promote continuous use.

5.2. Limitations and Future Study

Despite deriving academic and practical implications through empirical analysis, this study has several limitations. First, the characteristics of financial institution chatbots were defined as Social Presence, Response Accuracy, Assurance, and Responsiveness, while information system quality was categorized into Reliability, Usability, Security, and Interactivity. Although these classifications were based on previous studies, future research should incorporate qualitative studies reflecting deeper factors such as users’ emotional experiences and cultural factors.

Second, this study was conducted in a transitional period when generative AI technology was not yet widely adopted in financial institutions. Future research should analyze the actual changes in financial institution chatbot services and the relationships between variables after the adoption of generative AI.

Third, the sample used in this study lacked sufficient demographic diversity. Future studies should increase the generalizability of their findings by comparing different demographic groups in terms of gender, age, income, and education or by securing a more diverse sample.

Fourth, this study was conducted from a short-term perspective, which limited the ability to reflect changes in user behavior over time. Future research should conduct longitudinal studies and panel data analysis to provide an in-depth analysis of changes in user behavior and the factors influencing continuous usage from a long-term perspective.

References

- Hong, D.S. Prospects and current status of the financial AI market: Focusing on the banking sector. Korea Credit Inf. Serv. CIS Issue Rep. 2022, 22, 1–10. [Google Scholar]

- Expert Market Research.Global chatbot market size, trends, analysis, forecast: 2024–2032 2023. Available online: https://www.expertmarketresearch.com/reports/chatbot-market (accessed on 19 April 2024).

- Jung, J.H. Major issues and challenges of artificial intelligence (AI) policy. J. Korean Assoc. Reg. Inf. Soc. 2019, 19, 39–50. Available online: https://www.nia.or.kr/site/nia_kor/ex/bbs/View.do?cbIdx=39485&bcIdx=17512 (accessed on 10 May 2024).

- National Information Society Agency (NIA). The emergence and development trends of AI-based ‘Chatbot’ services. Issues Trends ICT Converg. 2016, 2016. [Google Scholar]

- Park, J.H.; Yoon, K.I.; Min, S.T. Trends in AI-based chatbot system technology. Korea Inf. Process. Soc. Rev. 2019, 26, 39–46. [Google Scholar]

- Seo, G.R. Analysis of domestic and international trends and development prospects of AI-based chatbot services. Natl. Inf. Soc. Agency 2018, 18, 1–34. [Google Scholar]

- Hill, J.; Ford, W.R.; Farreras, I.G. Real conversations with artificial intelligence: A comparison between human-human online conversations and human-chatbot conversations. Comput. Hum. Behav. 2015, 49, 245–250. [Google Scholar] [CrossRef]

- Garrison, D.R.; Anderson, T.; Archer, W. Critical Inquiry in a text-based environment: Computer conferencing in higher education. The Internet and Higher Education 2000, 2, 87–105. [Google Scholar] [CrossRef]

- Lee, S.E. Increased non-face-to-face transactions in the financial sector lead to proactive chatbot adoption: Utilized in counseling by distribution companies as well. Korea Economic Daily, 26 December 2022. [Google Scholar]

- Kim, J.W.; Jo, H.I.; Lee, B.G. A study on factors affecting the intention to use financial chatbot services: Focused on UTAUT model. J. Digit. Contents Soc. 2019, 20, 41–50. [Google Scholar] [CrossRef]

- Byun, S.H.; Cho, C.H. The Effect of the Anthropomorphism Level and Personalization Level on AI Financial Chatbot Recommendation Messages on Customer Response. Korean J. Advert. Public Relat. 2020, 22, 466–502. [Google Scholar] [CrossRef]

- Lee, H.Y. Bank tellers disappearing: Acceleration of digitalization in bank branches. Dailyian, 14 November 2023. [Google Scholar]

- Kim, H.R. The evolving banking industry in the era of artificial intelligence (AI). Deloitte Insights, 2023. [Google Scholar]

- Parasuraman, A.; Zeithaml, V.A.; Berry, L.L. SERVQUAL: A multiple-item scale for measuring consumer perceptions of service quality. J. Retail. 1988, 64, 12–40. [Google Scholar]

- Oliver, R.L. A cognitive model of the antecedents and consequences of satisfaction decisions. J. Mark. Res. 1980, 17, 460–469. [Google Scholar] [CrossRef]

- Grönroos, C. A service quality model and its marketing implications. Eur. J. Mark. 1984, 18, 36–44. [Google Scholar] [CrossRef]

- Jeon, S.Y.; Yu, H.J. A Study on the effect of Chatbot service quality on Intention to use and a comparative study between industries. J. Korea Serv. Manag. Soc. 2023, 19, 39–50. [Google Scholar]

- Park, S.H. A study on the effect of Chatbot service quality on customer loyalty and satisfaction in online shopping. E-Bus. Stud. 2023, 24, 19–28. [Google Scholar] [CrossRef]

- Nguyen, D.M.; Chiu, Y.-T.H.; Le, H.D. Determinants of continuance intention towards banks’ chatbot services in Vietnam: A necessity for sustainable development. Sustainability 2021, 13, 1–24. [Google Scholar] [CrossRef]

- Meyer-Waarden, L.; Pavone, G.; Poocharoentou, T.; Prayatsup, P. How service quality influences customer acceptance and usage of chatbots? J. Serv. Manag. Res. 2020, 4, 35–51. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. Information systems success. The quest for the dependent variable. Inf. Syst. Res. 1992, 3, 60–69. [Google Scholar] [CrossRef]

- Pitt, L.F.; Watson, R.T.; Kavan, C.B. Service quality: A measure of information systems effectiveness. MIS Q. 1995, 19, 173–187. [Google Scholar] [CrossRef]

- Seddon, P.B. A respecification and extension of the DeLone and McLean model of IS success. Information Systems Research 1997, 8, 240–253. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. The DeLone and McLean model of information systems success: A ten-year update. J. Manag. Inf. Syst. 2003, 19, 9–30. [Google Scholar]

- Han, S.U.; Han, K.S.; Kwon, T.H.; Koh, I.S.; An, Y.J. An empirical study on the effect of unmanned store kiosk management quality on sustainable use intention. J. Digit. Contents Soc. 2020, 21, 761–770. [Google Scholar] [CrossRef]

- Alksasbeh, M.; Abuhelaleh, M.; Almaiah, M.A.; AL-Jaafreh, M.; Abu Karaka, A. Towards a model of quality features for mobile social networks apps in learning environments: An extended information system success model. Int. J. Interact. Mob. Technol. 2019, 13, 75–93. [Google Scholar] [CrossRef]

- Bhattacherjee, A. Understanding information systems continuance: An expectation confirmation model. MIS Q. 2001, 25, 351–370. [Google Scholar] [CrossRef]

- Oliver, R.L. Cognitive, affective, and attribute bases of the satisfaction response. J. Consum. Res. 1993, 20, 418–430. [Google Scholar] [CrossRef]

- Lee, S.J. A study on factors affecting intention to continuous use of CM channel service of general insurance companies. Doctoral Thesis, Graduate School of Soongsil University, 2023. [Google Scholar]

- An, S.J.; Seo, J.I.; Choi, J.I. A study on the factors affecting the intention to continuous use of digital content OTT(Over-the-Top) service. J. Korean Soc. Qual. Manag. 2022, 50, 105–124. [Google Scholar]

- Oh, J.H.; Oh, J.W.; Cho, K.M. Research on consistent use intention of home-training program on personal media service YouTube based on post-adoption model. J. Korea Converg. Soc. 2019, 10, 183–193. [Google Scholar]

- Lin, C.S.; Wu, S.; Tsai, R.J. Integrating perceived playfulness into expectation-confirmation model for web portal context. Inf. Manag. 2005, 42, 683–693. [Google Scholar] [CrossRef]

- Chen, S.C.; Liu, M.L.; Lin, C.P. Integrating technology readiness into the expectation-confirmation model: An empirical study of mobile services. Cyberpsychology Behav. Soc. Netw. 2013, 16, 604–612. [Google Scholar] [CrossRef]

- Zhang, H.; Lu, Y.; Gupta, S.; Gao, P. Understanding group-buying websites continuance: An extension of expectation confirmation model. Internet Res. 2015, 25, 767–793. [Google Scholar] [CrossRef]

- Oghuma, A.P.; Libaque-Saenz, C.F.; Wong, S.F.; Chang, Y. An expectation-confirmation model of continuance intention to use mobile instant messaging. Telemat. Inform. 2016, 33, 34–47. [Google Scholar] [CrossRef]

- Kotler, P.; Armstrong, G. Principles of Marketing, 10th ed.; Pearson-Prentice Hall, 2004. [Google Scholar]

- Bailey, J.E.; Pearson, S.W. Development of a tool for measuring and analyzing computer user satisfaction. Manag. Sci. 1983, 29, 530–545. [Google Scholar] [CrossRef]

- Moon, J.H. The effect of interactivity on satisfaction and word of mouth in internet shopping malls by types. J. Korea Contents Assoc. 2010, 10, 239–246. [Google Scholar] [CrossRef]

- Kotler, P.; Armstrong, G. Principles of Marketing, 10th ed; Pearson-Prentice Hall, 2004. [Google Scholar]

- Kim, B. An empirical investigation of mobile data service continuance: Incorporating the theory of planned behavior into the expectation–confirmation model. Expert Syst. Appl. 2010, 37, 7033–7039. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of decisions. J. Mark. Res. 1989, 17, 460–469. [Google Scholar]

- Lee, J.H.; Ko, K.A.; Ha, D.K. A study on the viewing motivation and user response of personal live streaming broadcast: Focusing on post acceptance model (PAM). Korean J. Advert. Public Relat. 2018, 20, 178–215. [Google Scholar] [CrossRef]

- Yoon, J.H.; Kim, K.S. A study on the effect of logistics service quality factors on customer satisfaction and post-purchase behavior in internet shopping malls. J. Inf. Syst. 2006, 15, 21–48. [Google Scholar]

- Yeo, I.K. A test of the multivariate normality based on likelihood functions. Korean J. Appl. Stat. 2002, 15, 3–232. [Google Scholar] [CrossRef]

- Yoo, S.M. Easy learning of SPSS practical statistical analysis for thesis writing, Rev. ed.; Hwangso-gulum Academy, 2021. [Google Scholar]

- Hair, J.F.; Hult GT, M.; Ringle, C.M.; Sarstedt, M. A primer on partial least squares structural equation modeling (PLS-SEM); Sage Publications, 2014. [Google Scholar]

- Gefen, D.; Straub, D. A practical guide to factorial validity using PLS-Graph: Tutorial and annotated example. Commun. Assoc. Inf. Syst. 2005, 16, 91–109. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult GT, M.; Ringle, C.M.; Sarstedt, M. A primer on partial least squares structural equation modeling (PLS-SEM), 3rd ed.; Sage Publications, 2022. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).