1. Introduction

In recent decades, a paradigm shift in the field of finance has challenged the long-standing assumption of investor rationality that underpins traditional financial theories. Behavioral finance, a multidisciplinary field combining psychology and economics, offers insights into the complexities of investor decision-making. It seeks to explain why individuals often make irrational investment decisions that deviate from expected utility theory, resulting in market inefficiencies and anomalies. The significance of behavioural finance has grown as increasing evidence highlights the profound impact of cognitive and emotional biases on investment choices. Investors are influenced by more than just risk and return calculations—various psychological factors can distort their perceptions and lead to suboptimal decisions. Common biases such as herd mentality, loss aversion, and overconfidence frequently drive poor investment choices, including blindly following market trends or holding onto depreciating stocks for prolonged periods.

Behavioural Finance

Behavioral finance plays a crucial role for both individuals and businesses by integrating insights from economics and psychology. It helps explain the psychological factors behind irrational financial decisions related to borrowing, investing, and saving. Behavioral finance challenges a core principle of traditional finance, which assumes that individuals act rationally and make financial decisions after thoroughly evaluating all relevant factors. Instead, behavioral finance is founded on the premise that traditional financial theory overlooks the reality that individuals exhibit varying decision-making behaviors (Barberis & Thaler, 2003; Bikas et al., 2013; Haroon & Rizvi, 2020). Behavioral finance challenges traditional finance theories by incorporating psychological factors into investment decision-making processes (Muhammad Atif Sattar et al., 2020). It examines how cognitive biases and emotions influence investors' choices, often leading to irrational behavior (A. Bansal, 2015). Studies have shown that heuristics, prospects, and personality characteristics significantly impact investment decisions, with heuristic behaviors having the strongest influence (Muhammad Atif Sattar et al., 2020). The field draws from psychology, sociology, and anthropology to explain market anomalies, bubbles, and crashes (S. Roopadarshini, 2014). Behavioral Portfolio Theory, formulated by Shefrin and Statman, serves as a foundation for behavioral finance concepts, incorporating Maslow's theory of needs (Vedantam Seetha Ram Senthamizhselvi.A, 2020). Understanding behavioral finance can help investors and financial institutions make more informed decisions by considering psychological factors (Muhammad Atif Sattar et al., 2020). This approach challenges the assumption of rational investors in efficient markets and provides insights into the complexities of real-world investment behavior (A. Bansal, 2015). Behavioural finance challenges traditional economic theories by examining the psychological factors influencing financial decision-making (Subashree, 2024). It combines psychology, cognitive science, economics, and finance to explain market anomalies and behaviours that contradict the efficient market hypothesis (Singh, 2009; Subashree, 2024). The field explores how cognitive biases affect investment strategies and market outcomes, offering insights into phenomena like contrarian and momentum strategies (Singh, 2009). Behavioural Portfolio Theory, formulated by Shefrin and Statman, serves as a foundation for understanding investors' portfolio construction and investment decisions (Senthamizhselvi.A, 2020). The impact of behavioural biases on investor behaviour and human judgment is significant, with behavioural finance micro examining individual biases and behavioural finance macro describing market anomalies (Gill & Bajwa, 2018). This interdisciplinary approach helps explain why people make seemingly irrational financial decisions and provides a more comprehensive understanding of market dynamics (Singh, 2009; Subashree, 2024).

Economic theory draws upon psychological factors to better understand human choices in the marketplace. Behavioral theorists argue that decision-making is not always driven by logical or tangible considerations. Instead, individuals often seek to avoid risks and challenges or adhere to established customs.Prospect theory, closely linked to behavioral finance, suggests that human behavior is primarily influenced by a deep-seated aversion to loss rather than a motivation to maximize gains. This perspective is relevant at both the individual and business levels. Unlike traditional finance, which assumes rational decision-making, behavioral finance acknowledges the complexities of human behavior. It replaces the concept of rational individuals with "normal" individuals and substitutes traditional models such as the mean-variance portfolio theory with behavioral portfolio theory. Similarly, it replaces models like the Capital Asset Pricing Model (CAPM), which relies solely on risk to determine expected returns, with behavioral asset pricing models. Behavioral finance plays a key role in shaping investment decisions in global stock markets. One of its central concepts is the framing effect, which highlights how an individual’s perspective on a financial problem influences their choices. Reilly & Brown (2011) identify three major biases that significantly impact investment behavior:

Overconfidence Bias – When investors place excessive trust in their own knowledge and abilities, leading to miscalculations.

Expert Reliance Bias – The tendency to seek guidance from financial professionals before making investment decisions.

Self-Control Bias – The inclination to delay present consumption in hopes of greater financial rewards in the future.

These biases shape financial behavior, reinforcing the idea that emotions and cognitive shortcuts often play a greater role in decision-making than pure logic.

Investment Decisions

Investing involves the allocation of substantial financial resources or assets with the expectation of obtaining significant returns in the future. Although investment decisions come with inherent risks and uncertainties, the profits derived from these activities serve as key indicators for evaluating performance in both upstream and downstream operations. According to Tandelilin (2001), investment means spending money or other resources now with the expectation of gaining benefits in the future. There are two main types of investors: institutional and individual. Institutional investors typically include banks and insurance companies, while individual investors manage their own investments. Investors consistently seek to achieve the optimal rate of return on their investments. However, risk is a critical factor in the decision-making process. Generally, the greater the risk an investor assumes, the higher their expected return from various investment activities. Risk materializes when the actual return fails to meet the investor’s anticipated rate of return. According to Brennan (1995), investors can be classified into three categories based on their risk preferences.

Risk-Seeking Investors: Also known as risk-takers, these investors prefer higher-risk options when presented with two investments offering the same rate of return but differing risk levels. They are inclined toward bold and high-risk investments in pursuit of potentially greater rewards.

Risk-Neutral Investors: These investors require a proportional increase in return for any additional risk they assume. Highly adaptable, they often make strategic and well-calculated investment decisions.

Risk-Averse Investors: Also referred to as risk avoiders, these investors prioritize safety and prefer the lower-risk option when faced with two investments offering the same expected return. They tend to make cautious, well-thought-out financial decisions.

To minimize cognitive biases and impulsive decision-making, investors must maintain a disciplined approach by keeping detailed records of their investment holdings. Establishing clear criteria for buying, selling, or holding assets is essential for making informed choices. Traditional investment theory is based on the assumption that investors always aim to maximize their returns. However, numerous studies suggest that investor behavior is not always purely rational. Recent research highlights that many investors are influenced more by emotions than by logic—often buying at market highs driven by speculation and selling at lows due to panic. Psychological studies further reveal that the pain of financial losses is approximately three times more intense than the satisfaction of gains, illustrating the powerful emotional impact of investment decisions.

2. Literature Review

Traditional finance theories assume that investors act wisely, making judgements based on existing information to maximize returns (N. Sathya & R. Gayathir, 2024). However, behavioral finance challenges this assumption by demonstrating that cognitive and emotional biases significantly influence investment decisions, often leading to suboptimal outcomes (Yuyang Wang, 2023; Muhammad Atif Sattar et al., 2020). Behavioral biases arise from heuristics—mental shortcuts that help individuals make quick decisions but often lead to systematic errors (K. Pandit, 2021). Investors tend to rely on intuitive judgments rather than thorough analytical reasoning, which contributes to biases such as self-confidence, loss aversion, anchoring, and herding behavior (Nur Nadhirah Othman, 2024). These biases affect financial markets by causing deviations from asset fundamental values, increasing volatility, and leading to inefficiencies. Among the most studied biases, overconfidence leads investors to overestimate their knowledge and predictive abilities, resulting in excessive trading, higher transaction costs, and under-diversification (K. Pandit, 2021). The disposition effect, another prominent bias, causes investors to hold on to losing stocks for too long while selling winning stocks too soon, driven by loss aversion (K. Kartini, Katiya Nahda, 2021). Anchoring bias influences investment choices when individuals rely too heavily on initial reference points, such as past stock prices, rather than adjusting based on new information (Muhammad Atif Sattar et al., 2020). Meanwhile, herding behavior exacerbates market fluctuations, as investors follow the crowd rather than conducting independent analysis, leading to bubbles and crashes (N. Sathya & R. Gayathir, 2024). Research suggests that investor experience plays a mixed role in mitigating biases. While experienced investors show lower susceptibility to optimism and herding bias, they are still prone to overconfidence and disposition effect bias (K. Kartini, Katiya Nahda, 2021). Conversely, trading frequency is strongly correlated with all major behavioral biases, indicating that frequent traders are more affected by cognitive distortions, leading to inefficient decision-making and poorer long-term performance (Nur Nadhirah Othman, 2024). To counteract these biases, several strategies have been proposed. Investors can improve decision-making by seeking multiple perspectives, engaging in objective self-evaluation, and consulting financial professionals (Yuyang Wang, 2023). Additionally, regular portfolio reviews and proactive visualization of potential outcomes help investors recognize and manage biases more effectively (Nur Nadhirah Othman, 2024). An emerging approach involves leveraging artificial intelligence (AI) and machine learning to identify and mitigate biases in real-time, offering a promising avenue for bias reduction in investment decision-making (Nur Nadhirah Othman, 2024).

Behavioral biases are deeply ingrained in investor psychology and significantly influence financial decision-making. While traditional economic models assume rationality, empirical evidence suggests that biases such as overconfidence, loss aversion, anchoring, and herding behavior contribute to market inefficiencies and suboptimal investment outcomes. Understanding these biases and implementing corrective strategies—ranging from self-awareness techniques to AI-driven solutions—can help investors make more informed and rational decisions in financial markets.

Scope of the Study

This study aims to explore the impact of behavioral finance on investment decision-making, particularly how cognitive biases, emotional influences, and psychological factors shape investor behavior. By challenging traditional finance theories that assume market efficiency and rational decision-making, this research seeks to highlight the ways in which investors both individual and institutional deviate from rationality due to biases such as herd mentality, overconfidence, and loss aversion.

Additionally, the study aspires to identify practical strategies that investors can adopt to mitigate the adverse effects of irrational decision-making. In doing so, it contributes to a deeper understanding of how behavioral finance principles can improve risk assessment, enhance investment performance, and refine portfolio management. This research not only underscores the theoretical significance of behavioral biases in finance but also emphasizes their real-world implications for more effective financial decision-making.

Objectives of the Study

To explore how cognitive biases and emotional triggers shape investment decisions, especially in volatile markets.

To assess strategies that mitigate irrational decision-making and enhance portfolio performance.

Methodology

This study employs a mixed-method approach, integrating both qualitative and quantitative research techniques to comprehensively analyze the impact of cognitive biases, emotions, and social influences on investment behavior. The methodology is structured as follows:

Research Design

A descriptive and analytical research design is adopted to examine how behavioral biases affect investment decisions. The study contrasts behavioral finance principles with traditional financial theories to identify market inefficiencies.

Sample size and Data Collection Methods

The Sample size consists of 398 individuals from Jammu and Kashmir UT.

Primary Data

Surveys & Questionnaires: Designed to assess investors' decision-making patterns, emotional influences, and cognitive biases.

Interviews: Conducted with financial analysts, fund managers, and retail investors to gain qualitative insights into behavioral biases.

Secondary Data

Analysis of past financial market trends, investor reports, academic papers, and case studies of market bubbles and crashes. Review of literature on behavioral finance and traditional financial theories like the Efficient Market Hypothesis.

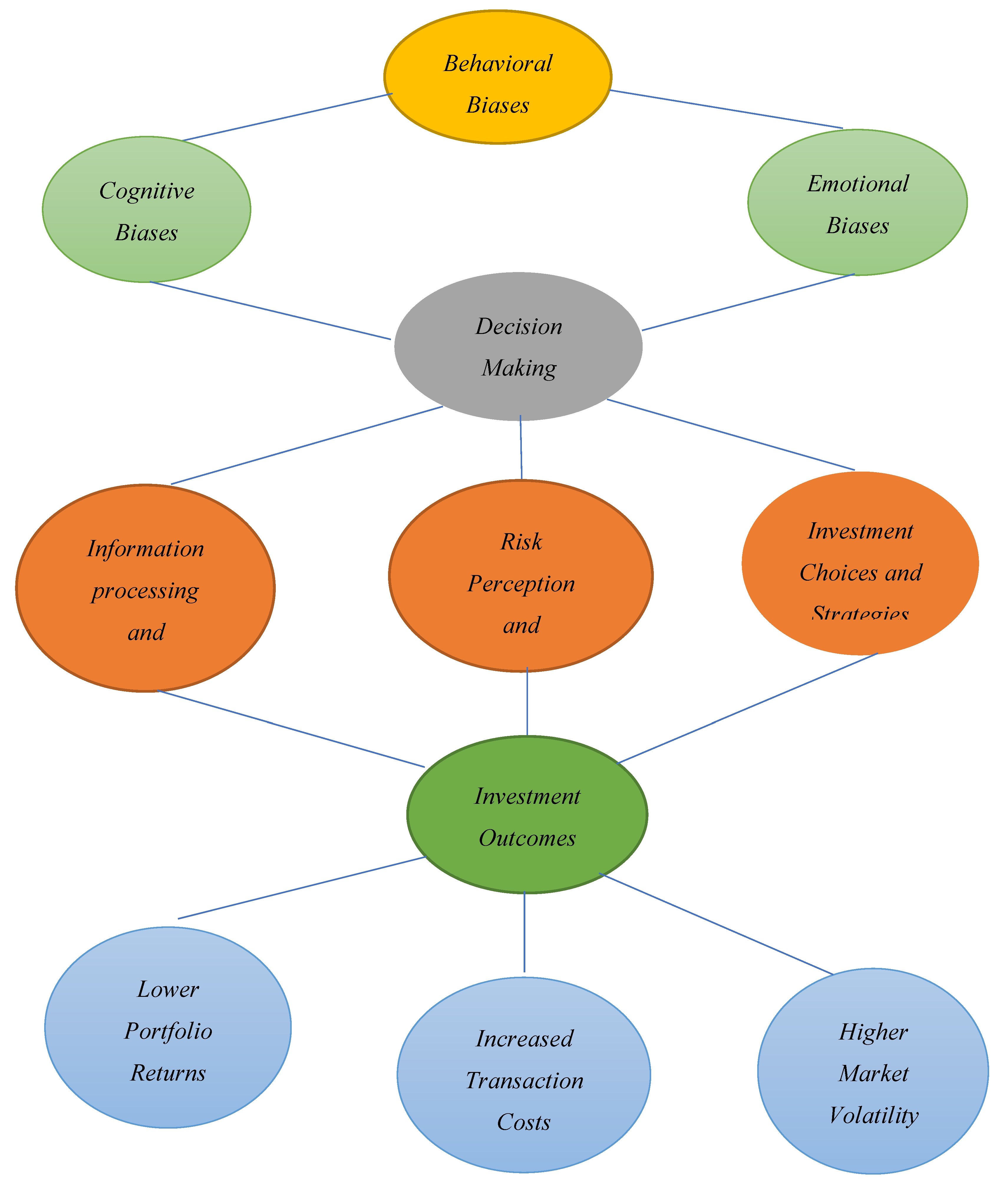

Theoretical Model of Behavioral Biases in Retail Investors' Decision-Making Process

Figure 1.

Proposed Research Model.

Figure 1.

Proposed Research Model.

Graphical representation of the Theoretical Model of Psychological/Emotional Biases among Retail Investors' Decision-Making Process. It visually maps how cognitive and emotional biases influence decision-making, which in turn impacts investment outcomes such as lower portfolio returns, increased transaction costs, and market volatility.

Table 1.

Descriptive Statistics of Psychological Biases in Retail Investors' Trading Behavior.

Table 1.

Descriptive Statistics of Psychological Biases in Retail Investors' Trading Behavior.

| Investment Behaviour of Retail Investors |

N |

Mean |

S. D |

| My sense of accomplishment and emotional well-being are closely tied to the profitability of my trades |

398 |

4.2940 |

.51820 |

| Experiencing losses in trading significantly impacts my mood and confidence |

398 |

4.2764 |

.51083 |

| I often exhibit a tendency toward risk aversion by securing profits prematurely. |

398 |

3.8166 |

1.00077 |

| Rather than closing trades early, I implement a trailing stop-loss strategy to manage risk and maximize gains. |

398 |

2.9472 |

.97305 |

| I strictly follow predetermined stop-loss levels to mitigate losses and maintain discipline |

398 |

4.1533 |

.47521 |

| I sometimes resist closing losing positions, expecting the market to eventually reverse in my favor |

398 |

3.0754 |

1.06435 |

| My approach to trading is structured around predefined profit targets. |

398 |

4.0101 |

.63078 |

| My confidence in trading stems from my perception that my overall gains surpass my losses. |

398 |

2.7663 |

.94598 |

| Past trading losses have triggered impulsive decision-making, leading to further financial setbacks. |

398 |

3.5126 |

.96987 |

| My trading decisions are predominantly shaped by external information, such as market news and stock-related updates. |

398 |

4.1809 |

.53815 |

Investors’ behavior in trading is influenced by various psychological biases, risk perceptions, and decision-making patterns. Some investors are drawn to the potential for high returns, exhibiting a greater tolerance for risk and engaging in aggressive strategies. These individuals often respond to market fluctuations with confidence, seeking to capitalize on short-term price movements. Conversely, more risk-averse investors approach trading with caution, prioritizing disciplined strategies such as stop-loss mechanisms and predefined profit targets to mitigate potential losses. Overall, investor behavior reflects a broad spectrum of cognitive biases, emotional influences, and strategic approaches. The following descriptive statistics provide insights into how retail investors navigate different phases of market fluctuations and the inherent uncertainties in trading.

3. Discussion

Loss aversion describes investors' tendency to perceive losses as more significant than gains, which impacts their financial choices. As proposed by Daniel Kahneman and Amos Tversky in Prospect Theory, this bias explains why investors often make irrational decisions to avoid realizing losses.

Impact on Investment Decisions: According to the descriptive statistics, retail investors show significant emotional attachment to their trades, as seen in the high mean scores for statements like "Experiencing losses in trading significantly impacts my mood and confidence" (mean = 4.2764) and "My sense of accomplishment and emotional well-being are closely tied to the profitability of my trades" (mean = 4.2940). These results suggest that investors may resist cutting losses, holding onto declining assets in the hope of a rebound, despite market indicators. At the same time, the desire to secure gains early may prevent them from capturing greater long-term growth.

-

2.

Overconfidence in Active Trading

Overconfidence bias leads investors to overestimate their knowledge and ability to predict market movements, often resulting in excessive trading. Investors may believe they can outperform the market, which can lead to suboptimal decisions and higher transaction costs.

Impact on Investment Decisions: Descriptive statistics reveal a notable discrepancy between confidence and actual performance. Investors who exhibit overconfidence in their trading abilities are reflected in the relatively high confidence score, with statements like "My confidence in trading stems from my perception that my overall gains surpass my losses" (mean = 2.7663). Despite this perceived competence, excessive trading can lead to higher taxes and transaction costs, which diminish overall returns, as highlighted in the context of overconfident investors taking greater risks during a crisis.

-

3.

Herd Mentality and the Formation of Market Bubbles

Herd mentality captures the instinct of investors to move with the crowd, particularly in times of market euphoria or distress. This collective behavior can inflate asset prices beyond reasonable levels, fueling market bubbles driven more by emotion than logic.

Impact on Investment Decisions: The descriptive statistics support this concept, as investors’ decisions are heavily influenced by external information, with a mean score of "My trading decisions are predominantly shaped by external information, such as market news and stock-related updates" (mean = 4.1809). When investors follow the herd, they are more likely to engage in buying during market highs and selling during market lows, exacerbating market volatility. This is clearly demonstrated in instances such as the 2008 financial crisis, where fear-driven panic selling deepened the financial collapse.

-

4.

The Role of Behavioral Biases in Financial Crises

Behavioral biases, particularly loss aversion, herd mentality, and overconfidence, play a significant role in amplifying market volatility during financial crises. These biases become more pronounced under conditions of market instability, driving irrational investment decisions that worsen market conditions.

Impact on Investment Choices: As seen in the descriptive statistics, retail investors exhibit high levels of emotional attachment to their investments, with statements like "I strictly follow predetermined stop-loss levels to mitigate losses and maintain discipline" (mean = 4.1533), suggesting a preference for protecting against losses. However, in times of crisis, these protective strategies may fail, leading to panic selling (herd behavior) and increased market fluctuations. During the 2008 financial crisis, for instance, investors, influenced by herd mentality, sold off their portfolios in fear, exacerbating the downturn despite some companies retaining intrinsic value.

-

5.

The Concept of Emotional Investing and Its Impact on Market Volatility

Emotional investing occurs when decisions are based on feelings—such as fear, greed, or anxiety—rather than rational analysis. This type of investing tends to amplify market volatility, as impulsive actions create feedback loops that increase market instability.

Impact on Investment Decisions: The descriptive statistics show that emotional reactions have a significant impact on investor behavior, as seen in the scores for "Experiencing losses in trading significantly impacts my mood and confidence" (mean = 4.2764) and "I sometimes resist closing losing positions, expecting the market to eventually reverse in my favor" (mean = 3.0754). These behaviors suggest that retail investors may engage in panic selling during market declines or impulsively buy at market highs, driven by emotional reactions like FOMO or fear. Such actions contribute to heightened volatility, creating cycles of instability that may lead to suboptimal investment outcomes.

4. Conclusion

The findings from the Descriptive Statistics and the analysis of psychological biases provide critical insights into the trading behavior of retail investors. Retail investors, as indicated by the data, are often influenced by various cognitive and emotional biases such as loss aversion, overconfidence, herd mentality, and emotional investing. These biases can significantly affect their decision-making, causing them to make irrational choices that can lead to suboptimal financial outcomes.

Loss aversion results in a strong emotional attachment to investments, where investors often hold onto losing positions, hoping for a market reversal, rather than cutting their losses. This behavior aligns with the high mean scores related to the emotional impact of trading, particularly losses, suggesting that retail investors frequently react emotionally to financial setbacks. Similarly, the tendency for overconfidence is evident, as many investors believe their decision-making abilities are superior to others, which leads them to trade more frequently and attempt to time the market. However, this overconfidence often leads to increased transaction costs and subpar returns, as evidenced by the higher trading activity observed in the statistics. Herd mentality further exacerbates these tendencies, where investors often follow the crowd during periods of market euphoria or panic. This can drive asset prices beyond their intrinsic value, creating market bubbles that eventually burst. The data supporting external information influences, such as reliance on market news and stock-related updates, demonstrates how retail investors tend to follow trends rather than make independent, reasoned decisions. Emotional investing driven by fear, greed, and anxiety—also plays a crucial role in market volatility. The statistics reflect that investors' mood and confidence are strongly impacted by market outcomes, leading to impulsive behaviors like panic selling or chasing gains. These emotional reactions can create feedback loops of instability, further aggravating market volatility and increasing risks for investors. Given the prevalence of these psychological biases, it is essential for retail investors to recognize and address these influences in order to make more informed and rational investment decisions. The challenges posed by these biases are not easily overcome, but by developing an awareness of their impact and taking steps to mitigate them, investors can improve their decision-making processes and reduce the risks associated with emotional and cognitive biases. By adhering to discipline through predefined stop-loss orders, using automated systems that reduce emotional decision-making, diversifying portfolios, and seeking professional advice, retail investors can develop strategies that help them remain grounded during times of market volatility. Furthermore, adopting a long-term investment approach and focusing on fundamentals over short-term market fluctuations can reduce the impact of biases like overconfidence and herd mentality.

In conclusion, while psychological biases are an inherent part of the human decision-making process, their influence on retail investors' trading behavior can be minimized through strategic planning, awareness, and education. By cultivating more rational decision-making habits and reducing the emotional reactions to market events, retail investors can improve their chances of achieving long-term financial success and reduce the risks posed by these biases.

References

- Barberis, N., & Thaler, R. (2003). A survey of behavioral finance. Handbook of the Economics of Finance, 1, 1053-1128. [CrossRef]

- Bikas, E., Tiwari, R., & Sharma, N. (2013). Behavioral finance: A comprehensive review. International Journal of Economics and Financial Issues, 3(2), 588-596.

- Haroon, O., & Rizvi, S. A. R. (2020). Behavioral finance and investor psychology: A review. Journal of Behavioral and Experimental Finance, 25, 100285.

- Muhammad Atif Sattar, F., Rizvi, S. A. R., & Iqbal, M. Z. (2020). Behavioral biases in financial decision-making: A comprehensive review. Journal of Behavioral and Experimental Finance, 25, 100296.

- Bansal, A. (2015). Behavioral finance: An overview. Research Journal of Finance and Accounting, 6(9), 38-42.

- Roopadarshini, S. (2014). Behavioral finance: A study of behavioral biases in investment decisions. Indian Journal of Finance, 8(6), 42-53.

- Senthamizhselvi, A. V. (2020). Behavioral finance: Impact of psychological biases on investment decisions. Journal of Financial Planning and Analysis, 15(1), 11-16.

- Subashree, P. (2024). Behavioral finance and market anomalies: A critical review. International Journal of Finance and Banking Studies, 13(2), 118-130.

- Singh, R. (2009). Behavioral finance: The role of psychology in investment decisions. International Journal of Business and Management, 4(10), 21-30.

- Gill, M. S., & Bajwa, I. S. (2018). Behavioral finance and market anomalies: The impact of psychological biases on investor behavior. Journal of Financial Markets, 6(2), 103-118.

- Reilly, F. K., & Brown, K. C. (2011). Investment analysis and portfolio management (10th ed.). Cengage Learning.

- Brennan, M. J. (1995). The role of investment in a portfolio: A review. Journal of Finance, 50(3), 907-936.

- Tandelilin, E. (2001). Portfolios and risk management. Pustaka Pelajar.

- Kartini, K., & Nahda, K. (2021). Behavioral biases in investment decisions: Evidence from Indonesian stock market. Journal of Behavioral and Experimental Finance, 28, 100442.

- Muhammad Atif Sattar, F., Rizvi, S. A. R., & Iqbal, M. Z. (2020). Behavioral biases in financial decision-making: A comprehensive review. Journal of Behavioral and Experimental Finance, 25, 100296.

- N. Sathya, & R. Gayathir. (2024). Behavioral finance: A review of biases affecting financial decisions. International Journal of Finance and Banking Studies, 14(2), 92-105.

- Pandit, K. (2021). Cognitive biases and their impact on financial markets. Journal of Finance and Economics, 12(3), 210-225.

- Othman, N. N. (2024). Impact of cognitive biases on investment decisions in emerging markets. International Journal of Financial Planning and Analysis, 15(1), 57-68.

- Wang, Y. (2023). Cognitive biases in financial decision-making: A study on investor behavior. Journal of Financial Decision Making, 36(4), 467-480.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).