Submitted:

16 February 2025

Posted:

17 February 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

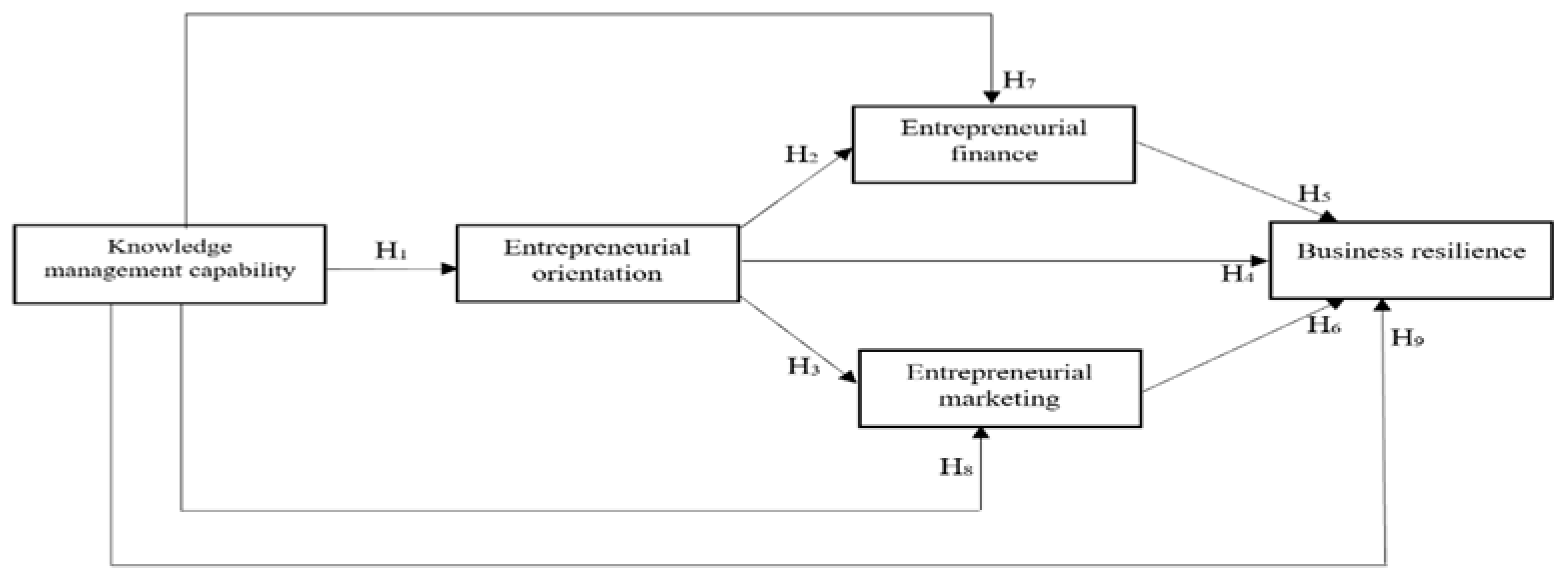

2. Theoretical Background and Hypotheses Formulation

2.1. Knowledge Management Capability (KMC) as an Independent Variable

2.2. Entrepreneurial Orientation (EO) and Entrepreneurial Finance (EF)

2.3. Entrepreneurial Orientation (EO) and Entrepreneurial Marketing (EM)

2.4. Business Resilience (BR) as a Dependent Variable

3. Research Methodology

3.1. Sampling and Data Collection

3.2. Variables and Indicators

4. Result

4.1. Respondent Characteristics

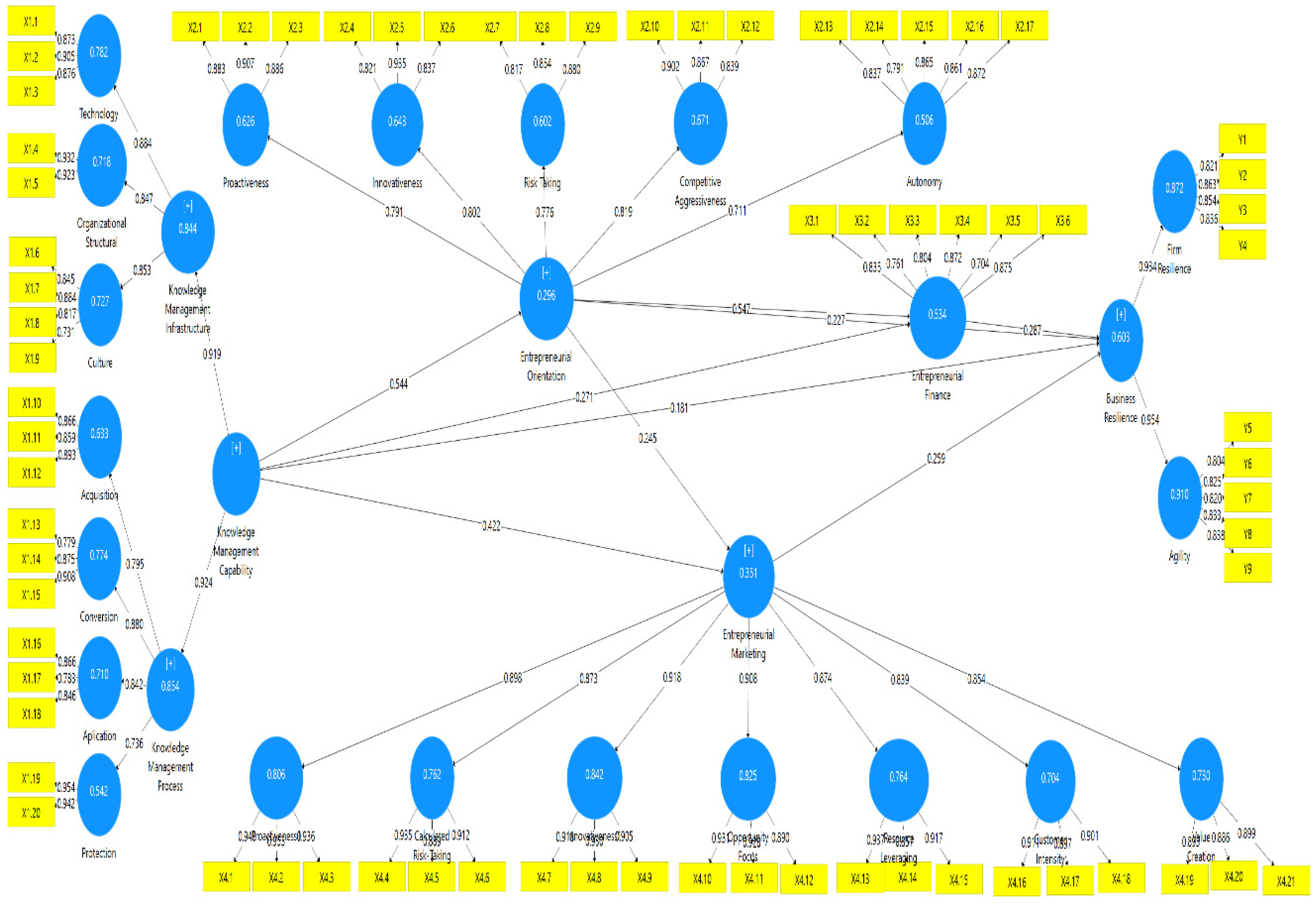

4.2. Outer Model Results

4.3. Inner Model Results

5. Discussion

6. Conclusions

6.1. Theoritical and Policy Implications

6.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- M. Breier, A. Kallmuenzer, T. Clauss, J. Gast, S. Kraus, and V. Tiberius, “The role of business model innovation in the hospitality industry during the COVID-19 Crisis.,” Int. J. Hosp. Manag., vol. 92, p. 102723, 2021. [CrossRef]

- S. Brammer, L. Branicki, and M. K. Linnenluecke, “Covid-19, societalization, and the future of business in society,” Acad. Manag. Perspect., vol. 34, no. 4, pp. 493–507, 2020. [CrossRef]

- N. Donthu and A. Gustafsson, “Effects of COVID-19 on Business and Research,” J. Bus. Res., vol. 117, pp. 284–289, 2020. [CrossRef]

- S. Kraus, M. Breier, and S. Dasí-Rodríguez, “The art of crafting a systematic literature review in entrepreneurship research,” Int. Entrep. Manag. J., vol. 16, no. 3, pp. 1023–1042, 2020. [CrossRef]

- O. Damilola, I. Deborah, O. Oyedele, and A.-A. Kehinde, “Global pandemic and business performance,” Int. J. Res. Bus. Soc. Sci., vol. 9, no. 6, pp. 01–11, 2020. [CrossRef]

- W. McKibbin and R. Fernando, “The Global Macroeconomic Impacts of COVID-19: Seven Scenario,” Asian Econ. Pap., vol. 20, pp. 1–30, 2020. [CrossRef]

- E. W. Liguori, J. Muldoon, O. M. Ogundana, Y. Lee, and G. A. Wilson, “Charting the future of entrepreneurship: a roadmap for interdisciplinary research and societal impact,” Cogent Bus. Manag., vol. 11, no. 1, 2024. [CrossRef]

- C. Bratianu and R. Bejinaru, “COVID-19 induced emergent knowledge strategies,” Knowl. Process Manag., vol. 28, no. 1, pp. 11–17, 2021. [CrossRef]

- R. V. Mahto, O. Llanos-Contreras, and M. Hebles, “Post-disaster recovery for family firms: The role of owner motivations, firm resources, and dynamic capabilities.,” J. Bus. Res., vol. 145, pp. 117–129, 2022. [CrossRef]

- R. Chaudhuri, S. Chatterjee, S. Kraus, and D. Vrontis, “Assessing the AI-CRM technology capability for sustaining family businesses in times of crisis: The moderating role of strategic intent,” J. Fam. Bus. Manag., vol. 13, no. 1, pp. 46–67, 2023. [CrossRef]

- R. M. Pelikanova, E. D. Cvik, and R. K. MacGregor, “Addressing the COVID-19 challenges by SMEs in the hotel industry – A czech sustainability message for emerging economies,” J. Entrep. Emerg. Econ., vol. 13, no. 4, pp. 525–546, 2021. [CrossRef]

- R. Swaminathan, “How Can Resilience Create and Build Market Value?,” J. Creat. Value, vol. 8, no. 2, pp. 204–218, 2022. [CrossRef]

- C. A. Lengnick-Hall, T. E. Beck, and M. L. Lengnick-Hall, “Developing a capacity for organizational resilience through strategic human resource management,” Hum. Resour. Manag. Rev., vol. 21, no. 3, pp. 243–255, 2011. [CrossRef]

- R. J. Floetgen et al., “Introducing platform ecosystem resilience: leveraging mobility platforms and their ecosystems for the new normal during COVID-19,” Eur. J. Inf. Syst., vol. 30, no. 304–321, 2021. [CrossRef]

- C. Perrings, “Resilience and sustainable development,” Environ. Dev. Econ., vol. 11, no. 4, pp. 417–427, 2006. [CrossRef]

- M. Sabatino, “Economic crisis and resilience: resilient capacity and competitiveness of the enterprises,” J. Bus. Res., vol. 69, no. 5, pp. 1924–1927, 2016. [CrossRef]

- M. A. Hitt, R. D. Ireland, D. G. Sirmon, and C. A. Trahms, “Strategic Entrepreneurship: Creating Value for Individuals, Organizations, and Society,” Acad. Manag. Perspect., vol. 25, no. 2, pp. 57–75, 2011. [CrossRef]

- R. D. Ireland, J. G. Covin, and D. F. Kuratko, “Conceptualizing Corporate Entrepreneurship Strategy,” Entrep. Theory Pract., vol. 33, no. 1, pp. 19–46, 2009. [CrossRef]

- M. H. Morris, D. F. Kuratko, and M. Schindehutte, “Towards integration: Understanding entrepreneurship through frameworks,” Int. J. Entrep. Innov., vol. 2, no. 1, pp. 35–49, 2001. [CrossRef]

- S. A. Zahra, R. D. Ireland, and M. A. Hitt, “International expansion by new venture firms: International diversity, mode of market entry, technological learning, and performance,” Acad. Manag. J., vol. 43, no. 5, pp. 925–950, 2000. [CrossRef]

- V. Ratten, “Coronavirus (covid-19) and entrepreneurship: changing life and work landscape,” J. Small Bus. Entrep., vol. 32, no. 5, pp. 503–516, 2020. [CrossRef]

- N. Baporikar, Handbook of Research on Sustaining SMEs and Entrepreneurial Innovation in the Post-COVID-19 Era. United States of America: IGI Global, 2021. [Online]. Available: https://www.researchgate.net/profile/Sheikh_Mohammed_Huque/publication/348815326_Contemporary_Perspectives_on_Entrepreneurial_Challenges_and_Innovation_in_Education_A_Study_on_Pandemic_Situation_in_Bangladesh/links/601192f3a6fdcc071b97de39/Contemporary-Pe.

- D. A. Shepherd, “Multilevel entrepreneurship research: Opportunities for studying entrepreneurial decision making,” J. Manage., vol. 37, no. 2, pp. 412–420, 2011. [CrossRef]

- J. T. Mahoney and Y. Y. Kor, “The Entrepreneurial Mindset: Strategies for Continuously Creating Opportunity in an Age of Uncertainty, 26, 457-459.,” Acad. Manag. Rev., vol. 26, pp. 457–459, 2001. [CrossRef]

- G. D. Meyer and K. A. Heppard, Entrepreneurship as strategy: Competing on the entrepreneurial edge. Thousand Oaks, CA: Sage Publications, 2000. [CrossRef]

- M. A. Hitt, R. D. Ireland, S. M. Camp, and D. L. Sexton, “Strategic Entrepreneurship: Integrating Entrepreneurial and Strategic Management Perspectives,” Strateg. Entrep. Creat. a New Mindset, pp. 1–16, 2017. [CrossRef]

- B. Djordjevic, “Strategic entrepreneurship,” Mediterr. J. Soc. Sci., vol. 4, no. 15 SPEC.ISSUE, pp. 127–135, 2013. [CrossRef]

- Q. T. N. Nguyen, P. A. Neck, and T. H. Nguyen, “The Critical Role of Knowledge Management in Achieving and Sustaining Organisational Competitive Advantage,” Int. Bus. Res., vol. 2, no. 3, pp. 3–16, 2009. [CrossRef]

- A. H. Gold, A. Malhotra, and A. H. Segars, “Knowledge management: An organizational capabilities perspective,” J. Manag. Inf. Syst., vol. 18, no. 1, pp. 185–214, 2001. [CrossRef]

- M. Alvesson and D. Karreman, “Odd couple: Making sense of the curious concept of knowledge management,” J. Manag. Stud., vol. 38, no. 7, pp. 995–1016, 2001. [CrossRef]

- J. D. McKeen, M. H. Zack, and S. Singh, “Knowledge management and organizational performance: An exploratory survey,” Proc. Annu. Hawaii Int. Conf. Syst. Sci., vol. 7, no. C, pp. 1–9, 2006. [CrossRef]

- R. Hull, “Knowledge management and the conduct of expert labour. Managing knowledge: Critical investigations of work and learning,” Macmillan, 2000, pp. 49–68.

- P. Akhavan, M. Jafari, and M. Fathian, “Critical success factors of knowledge management systems: a multi-case analysis,” Eur. Bus. Rev., vol. 18, no. 2, pp. 97–113, 2006. [CrossRef]

- V. Grover and T. H. Davenport, “General perspectives on knowledge management: Fostering a research agenda,” J. Manag. Inf. Syst., vol. 18, no. 1, pp. 5–21, 2001. [CrossRef]

- R. D. Ireland, M. A. Hitt, and D. G. Sirmon, “A model of strategic entrepreneurship: The construct and its dimensions,” J. Manage., vol. 29, no. 6, pp. 963–989, 2003. [CrossRef]

- J. Hill and L. T. Wright, “Defining the Scope of Entrepreneurial Marketing: a Qualitative Approach,” J. Enterprising Cult., vol. 08, no. 01, pp. 23–46, 2000. [CrossRef]

- A. Rauch, J. Wiklund, G. T. Lumpkin, and M. Frese, “Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future,” Entrep. Theory Pract., vol. 33, no. 3, pp. 761–787, 2009. [CrossRef]

- J. Wiklund and D. Shepherd, “Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses,” Strateg. Manag. J., vol. 24, no. 13, pp. 1307–1314, 2003. [CrossRef]

- S. Lim and B. R. Envick, “Gender and entrepreneurial orientation: A multi-country study,” Int. Entrep. Manag. J., vol. 9, no. 3, pp. 465–482, 2013. [CrossRef]

- G. T. Lumpkin and G. G. Dess, “Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle,” J. Bus. Ventur., vol. 16, no. 5, pp. 429–451, 2001. [CrossRef]

- D. Miller, “The correlates of entrepreneurship in three types of firms,” Manage. Sci., vol. 29, no. 7, pp. 770–791, 1983. [CrossRef]

- C. A. Nwankwo and M. Kanyangale, “Entrepreneurial orientation and survival of small and medium enterprises in Nigeria: An examination of the integrative entrepreneurial marketing model,” Int. J. Entrep., vol. 24, no. 2, pp. 1–14, 2020.

- N. M. N. Ibrahim and R. Mahmood, “Mediating role of competitive advantage on the relationship between entrepreneurial orientation and the performance of small and medium enterprises,” Int. Bus. Manag., vol. 10, no. 12, pp. 2444–2452, 2016. [CrossRef]

- F. Gergely, “The effects of strategic orientations and perceived environment on firm performance,” J. Compet., vol. 8, no. 1, pp. 55–65, 2016. [CrossRef]

- J. Abor, “Debt policy and performance of SMEs: Evidence from Ghanaian and South African firms,” J. risk Financ., vol. 8, no. 4, pp. 364–379, 2007. [CrossRef]

- C. Bellavitis, I. Filatotchev, D. S. Kamuriwo, and T. Vanacker, “Entrepreneurial finance: new frontiers of research and practice: Editorial for the special issue Embracing entrepreneurial funding innovations,” Ventur. Cap., vol. 19, no. 1–2, pp. 1–16, 2017. [CrossRef]

- M. H. Morris, M. Schindehutte, and R. W. LaForge, “Entrepreneurial Marketing: A Construct for Integrating Emerging Entrepreneurship and Marketing Perspectives,” J. Mark. Theory Pract., vol. 10, no. 4, pp. 1–19, 2002. [CrossRef]

- G. E. Hills, C. M. Hultman, and M. P. Miles, “The Evolution and Development of EM,” J. Small Bus. Manag., vol. 46, no. 1, pp. 99–112, 2008. [CrossRef]

- S. Kraus, R. Harms, and M. Fink, “Entrepreneurial marketing: Moving beyond marketing in new ventures,” Int. J. Entrep. Innov. Manag., vol. 11, no. 1, pp. 19–34, 2010. [CrossRef]

- R. Jones and J. Rowley, “Presentation of a generic ‘EMICO’ framework for research exploration of entrepreneurial marketing in SMEs,” J. Res. Mark. Entrep., vol. 11, no. 1, pp. 5–21, 2009. [CrossRef]

- M. Hock-Doepgen, T. Clauss, S. Kraus, and C. F. Cheng, “Knowledge management capabilities and organizational risk-taking for business model innovation in SMEs.,” J. Bus. Res., vol. 130, pp. 683–697, 2021. [CrossRef]

- N. Fang, Z. Yuli, and X. Hongzhi, “Acquisition of resources, formal organization and entrepreneurial orientation of new ventures,” J. Chinese Entrep., vol. 1, no. 1, pp. 40–52, 2008. [CrossRef]

- R. L. Osborne, “The essence of entrepreneurial success,” Manag. Decis., vol. 33, no. 7, pp. 4–9, 1995. [CrossRef]

- V. Bouchard and O. Basso, “Exploring the links between entrepreneurial orientation and intrapreneurship in SMEs,” J. Small Bus. Enterp. Dev., vol. 18, no. 2, pp. 219–231, 2011. [CrossRef]

- D. J. Teece, “Dynamic capabilities: Routines versus entrepreneurial action,” J. Manag. Stud., vol. 49, no. 8, pp. 1395–1401, 2012. [CrossRef]

- M. Hughes and R. E. Morgan, “Deconstructing the relationship between entrepreneurial orientation and business performance at the embryonic stage of firm growth,” Ind. Mark. Manag., vol. 36, no. 5, pp. 651–661, 2007. [CrossRef]

- G. P. Huber, “Organizational learning: the contributing processes and the literatures.,” Organ. Sci., vol. 2, no. 1, pp. 88–115, 1991. [CrossRef]

- D. C. Galunic and S. Rodan, “Resource recombinations in the firm: knowledge structures and the potential for schumpeterian innovation,” Strateg. Manag. J., vol. 19, no. 12, pp. 1193–1201, 1998. [CrossRef]

- Salina Daud, “Knowledge management processes in SMES and large firms: A comparative evaluation,” African J. Bus. Manag., vol. 6, no. 11, 2012. [CrossRef]

- G. R. Oliver, “A tenth anniversary assessment of Davenport and Prusak (1998/2000) Working Knowledge: Practitioner approaches to knowledge in organisations.,” Knowl. Manag. Res. Pract., vol. 11, no. 1, pp. 10–22, 2013. [CrossRef]

- K. C. Lee, S. Lee, and I. W. Kang, “KMPI: measuring knowledge management performance,” Inf. Manag., vol. 42, no. 3, pp. 469–482, 2005. [CrossRef]

- S. T. Ha, M. C. Lo, M. K. Suaidi, A. A. Mohamad, and Z. Bin Razak, “Knowledge management process, entrepreneurial orientation and performance in smes: Evidence from an emerging economy,” Sustainability, vol. 13, no. 17, 2021. [CrossRef]

- M. H. Morris, M. Schindehutte, and R. W. LaForge, “The emergence of entrepreneurial marketing: Nature and meaning,” Entrep. W. Ahead, pp. 91–104, 2001. [CrossRef]

- Y. Sun, J. Liu, and Y. Ding, “Analysis of the relationship between open innovation, knowledge management capability and dual innovation.,” Technol. Anal. Strateg. Manag., vol. 32, no. 1, pp. 15–28, 2020. [CrossRef]

- L. Chi, T. Ravichandran, and G. Andrevski, “Information technology, network structure, and competitive action,” Inf. Syst. Res., vol. 21, no. 3, pp. 543–570, 2010. [CrossRef]

- R. Amit and P. J. H. Schoemaker, “Strategic assets and organizational rent,” Strateg. Manag. J., vol. 14, no. 1, pp. 33–46, 1993. [CrossRef]

- G. T. Lumpkin and G. G. Dess, “Clarifying the entrepreneurial orientation construct and linking it to performance,” Acad. Manag. Rev., 1996. [CrossRef]

- S. Kraus, J. P. C. Rigtering, M. Hughes, and V. Hosman, “Entrepreneurial orientation and the business performance of SMEs: A quantitative study from the Netherlands,” Rev. Manag. Sci., vol. 6, no. 2, pp. 161–182, 2012. [CrossRef]

- M. R. Rita, S. Wahyudi, H. Muharam, A. T. Thren, and R. Robiyanto, “The role of entrepreneurship oriented finance in improving MSME performance: The demand side of the entrepreneurial finance perspective,” Contaduria y Adm., vol. 67, no. 3, pp. 24–53, 2022. [CrossRef]

- D. Klonowski, “Venture capital and entrepreneurial growth by acquisitions: A case study from emerging markets,” J. Priv. Equity, vol. 19, no. 3, pp. 21–29, 2016. [CrossRef]

- D. Miller and P. H. Friesen, “Innovation in conservative and entrepreneurial firms: Two models of strategic momentum.,” Strateg. Manag. J., 1982. [CrossRef]

- H. Liu, J. Hou, P. Yang, and X. Ding, “Entrepreneurial orientation, organizational capability, and competitive advantage in emerging economies: Evidence from China,” African J. Bus. Manag., vol. 5, no. 10, pp. 3891–3901, 2011. [CrossRef]

- B. S. Anderson, J. G. Covin, and D. P. Slevin, “Understanding the relationship between entrepreneurial orientation and strategic learning capability: an empirical investigation,” Strateg. Entrep. J., vol. 3, no. 3, pp. 218–240, 2009. [CrossRef]

- M. Belitski, C. Guenther, A. S. Kritikos, and R. Thurik, “Economic effects of the COVID-19 pandemic on entrepreneurship and small businesses,” Small Bus. Econ., pp. 1–17, 2022. [CrossRef]

- O. Khlystova, Y. Kalyuzhnova, and M. Belitski, “The impact of the COVID-19 pandemic on the creative industries: A literature review and future research agenda.,” J. Bus. Res., no. 139, pp. 1192–1210, 2022. [CrossRef]

- O. Torrès, A. Benzari, C. Fisch, J. Mukerjee, A. Swalhi, and R. Thurik, “Risk of burnout in French entrepreneurs during the COVID-19 crisis,” Small Bus. Econ., pp. 1–23, 2021. [CrossRef]

- S. A. Zahra, “Being entrepreneurial and market driven: implications for company performance,” J. Strateg. Manag., vol. 1, no. 2, pp. 125–142, 2008. [CrossRef]

- M. K. Linnenluecke, “Resilience in business and management research: A review of influential publications and a research agenda,” Int. J. Manag. Rev., vol. 19, no. 1, pp. 4–30, 2017. [CrossRef]

- D. L. Coutu, “How resilience works,” Harv. Bus. Rev., vol. 80, no. 5, pp. 46–56, 2002.

- K. Burnard and R. Bhamra, “Organisational resilience: development of a conceptual framework for organisational responses,” Int. J. Prod. Res., vol. 49, no. 18, pp. 5581–5599, 2011. [CrossRef]

- P. P. Tallon and A. Pinsonneault, “Competing perspectives on the link between strategic information technology alignment and organizational agility: Insights from a mediation model,” MIS Q. Manag. Inf. Syst., vol. 35, no. 2, pp. 463–486, 2011. [CrossRef]

- Y. Xia, Z. Qiao, and G. Xie, “Corporate resilience to the COVID-19 pandemic: The role of digital finance,” Pacific Basin Financ. J., vol. 74, no. July 2021, p. 101791, 2022. [CrossRef]

- S. Ambulkar, J. Blackhurst, and S. Grawe, “Firm’s resilience to supply chain disruptions: Scale development and empirical examination,” J. Oper. Manag., vol. 33–34, pp. 111–122, 2015. [CrossRef]

- D. J. Teece, “The Palgrave Encyclopedia of Strategic Management,” Palgrave Encycl. Strateg. Manag., pp. 1–9, 2017. [CrossRef]

- T. A. Williams, D. A. Gruber, K. M. Sutcliffe, D. A. Shepherd, and E. Y. Zhao, “Organizational response to adversity: Fusing crisis management and resilience research streams,” Acad. Manag. Ann., vol. 11, no. 2, pp. 733–769, 2017. [CrossRef]

- A. V. Lee, J. Vargo, and E. Seville, “Developing a Tool to Measure and Compare Organizations’ Resilience,” Nat. Hazards Rev., vol. 14, no. 1, pp. 29–41, 2013. [CrossRef]

- A. Schwienbacher and B. Larralde, “Crowdfunding of small entrepreneurial ventures,” in Handbook of entrepreneurial finance, Forthcomin.Oxford University Press, 2010. [CrossRef]

- M. Cowling, W. Liu, A. Ledger, and N. Zhang, “What really happens to small and medium-sized enterprises in a global economic recession? UK evidence on sales and job dynamics,” Int. Small Bus. J. Res. Entrep., vol. 33, no. 5, pp. 488–513, 2015. [CrossRef]

- A. Tognazzo, P. Gubitta, and S. D. Favaron, “Does slack always affect resilience? A study of quasi-medium-sized Italian firms,” Entrep. Reg. Dev., vol. 28, no. 9–10, pp. 768–790, 2016. [CrossRef]

- G. McGuinness and T. Hogan, “Bank credit and trade credit: Evidence from SMEs over the financial crisis,” Int. Small Bus. J., vol. 34, no. 4, pp. 412–445, 2014. [CrossRef]

- E. Collinson and E. Shaw, “Entrepreneurial marketing – a historical perspective on development and practice,” Manag. Decis., vol. 39, no. 9, pp. 761–766, 2001. [CrossRef]

- G. E. Hills, “Marketing and entrepreneurship research issues: Scholarly justification.,” Res. Mark. interface, vol. 1, pp. 3–15, 1987.

- R. C. Becherer and J. G. Maurer, “The Moderating Effect of Environmental Variables on the Entrepreneurial and Marketing Orientation of Entrepreneur-Led Firms,” Entrep. Theory Pract., vol. 22, no. 1, pp. 47–58, 1997. [CrossRef]

- M. Franco, M. de F. Santos, I. Ramalho, and C. Nunes, “An exploratory study of entrepreneurial marketing in SMEs: The role of the founder-entrepreneur,” J. Small Bus. Enterp. Dev., vol. 21, no. 2, pp. 265–283, 2014. [CrossRef]

- I. Chaston, “Small Firm Performance: Assessing the Interaction between Entrepreneurial Style and Organizational Structure,” Eur. J. Mark., vol. 31, no. 11/12, pp. 814–831, 1997. [CrossRef]

- R. C. Becherer, M. M. Helms, and J. P. McDonald, “The Effect of Entrepreneural Marketing on Outcome Goals in SMEs,” New Engl. J. Entrep., vol. 15, no. 1, pp. 7–18, 2012. [CrossRef]

- H. Taherdoost, “Validity and reliability of the research instrument; how to test the validation of a questionnaire/survey in a research,” Int. J. Acad. Res. Manag., vol. 5, 2016. [CrossRef]

- T. P. Ryan, Sample size determination and power. John Wiley & Sons, 2013. [CrossRef]

- J. F. Hair, J. J. Risher, M. Sarstedt, and C. M. Ringle, “When to use and how to report the results of PLS-SEM,” Eur. Bus. Rev., vol. 31, no. 1, pp. 2–24, 2019. [CrossRef]

- D. Klonowski, Strategic Entrepreneurial Finance. 2014. [CrossRef]

- Q. Xia, Y. Xie, S. Hu, and J. Song, “Exploring how entrepreneurial orientation improve firm resilience in digital era: findings from sequential mediation and FsQCA,” Eur. J. Innov. Manag., 2022. [CrossRef]

- M. R. Ab Hamid, W. Sami, and M. H. Mohmad Sidek, “Discriminant Validity Assessment: Use of Fornell & Larcker criterion versus HTMT Criterion,” J. Phys. Conf. Ser., vol. 890, no. 1, pp. 0–5, 2017. [CrossRef]

- S. Marlow and D. Patton, “Minding the gap between employers and employees: The challenge for owner-managers of smaller manufacturing firms,” Empl. relations, vol. 24, no. 5, pp. 523–539, 2002. [CrossRef]

- M. Sarstedt, J. F. Hair, J. H. Cheah, J. M. Becker, and C. M. Ringle, “How to specify, estimate, and validate higher-order constructs in PLS-SEM,” Australas. Mark. J., vol. 27, no. 3, pp. 197–211, 2019. [CrossRef]

- W. W. Chin, “The partial least squares approach to structural equation modelling. In Marcoulides G. A. (Ed.),” Mod. Methods Bus. Res., vol. 295, no. 2, pp. 295–336, 1998. [CrossRef]

- D. F. Andrews and F. R. Hampel, Robust estimates of location: Survey and advances. Princenton University Press, 2015. [CrossRef]

- M. Tenenhaus, S. Amato, and V. Esposito Vinzi, “A global goodness-of-fit index for PLS structural equation modelling,” in Proceedings of the XLII SIS scientific meeting, 2004, pp. 739–742.

- C. Clark, “The impact of entrepreneurs’ oral ‘pitch’ presentation skills on business angels’ initial screening investment decisions,” Ventur. Cap., vol. 10, no. 3, pp. 257–279, 2008. [CrossRef]

- J. Dewald and F. Bowen, “Storm clouds and silver linings: Responding to disruptive innovations through cognitive resilience,” Entrep. Theory Pract., vol. 34, no. 1, pp. 197–218, 2010. [CrossRef]

- J. P. Walsh and G. R. Ungson, “Organizational Memory,” Acad. Manag. Rev., vol. 16, no. 1, pp. 57–91, 1991. [CrossRef]

- Y. J. Yeh, S. Q. Lai, and C. T. Ho, “Knowledge management enablers: A case study,” Ind. Manag. Data Syst., vol. 106, no. 6, pp. 793–810, 2006. [CrossRef]

- C. Bratianu, R. Mocanu, D. F. Stanescu, and R. Bejinaru, “The Impact of Knowledge Hiding on Entrepreneurial Orientation: The Mediating Role of Factual Autonomy,” Sustainability, vol. 15, no. 17. p. 13057, 2023. [CrossRef]

- J. P. Liebeskind, “Knowledge, strategy, and the theory of the firm,” in Knowledge and strategy, Routledge, 1999, pp. 197–219. [CrossRef]

- J. Alegre and R. Chiva, “Linking Entrepreneurial Orientation and Firm Performance: The Role of Organizational Learning Capability and Innovation Performance,” J. Small Bus. Manag., vol. 51, no. 4, pp. 491–507, 2013. [CrossRef]

- E. O. Jones, “Indigenous knowledge management practices in subsistence farming: A comprehensive evaluation,” Sustain. Technol. Entrep., vol. 3, no. 2, p. 100058, 2024. [CrossRef]

- S. S. Ghazwani and S. Alzahrani, “The Use of Social Media Platforms for Competitive Information and Knowledge Sharing and Its Effect on SMEs’ Profitability and Growth through Innovation,” Sustainability, vol. 16, no. 1. p. 106, 2024. [CrossRef]

- J. Mitra, Y. A. Abubakar, and M. Sagagi, “Knowledge creation and human capital for development: The role of graduate entrepreneurship,” Educ. Train., vol. 53, no. 5, pp. 462–479, 2011. [CrossRef]

- L. C. Ortigueira-Sánchez, D. H. B. Welsh, and W. C. Stein, “Innovation drivers for export performance,” Sustain. Technol. Entrep., vol. 1, no. 2, 2022. [CrossRef]

- G. D. Sharma, S. Kraus, E. Liguori, U. K. Bamel, and R. Chopra, “Entrepreneurial challenges of COVID-19: Re-thinking entrepreneurship after the crisis,” J. Small Bus. Manag., vol. 62, no. 2, pp. 824–846, 2022. [CrossRef]

- J. G. Covin, K. M. Green, and D. P. Slevin, “Strategic Process Effects on The Entrepreneurial Orientation-Sales Growth Rate Relationship,” Entrep. Theory Pract., vol. 30, no. 1, pp. 57–82, 2006. [CrossRef]

- S. Khodor, A. Y. Aránega, and V. Ramadani, “Impact of digitalization and innovation in women’s entrepreneurial orientation on sustainable start-up intention,” Sustain. Technol. Entrep., vol. 3, no. 3, 2024. [CrossRef]

- S. A. Zahra and J. G. Covin, “Contextual influences on the corporate entrepreneurship performance relationship: A longitudinal analysis,” J. Bus. Ventur., vol. 10, no. 1, pp. 43–58, 1995. [CrossRef]

- K. Amoa-Gyarteng, S. Dhliwayo, and V. Adekomaya, “Innovative marketing and sales promotion: catalysts or inhibitors of SME performance in Ghana,” Cogent Bus. Manag., vol. 11, no. 1, p. 2353851, 2024. [CrossRef]

- S. Demyen, “The Online Shopping Experience During the Pandemic and After—A Turning Point for Sustainable Fashion Business Management?,” J. Theor. Appl. Electron. Commer. Res. , vol. 19, no. 4, pp. 3632–3658, 2024. [CrossRef]

- S. B. Steidle, C. Glass, M. Rice, and D. A. Henderson, “Addressing Wicked Problems (SDGs) Through Community Colleges: Leveraging Entrepreneurial Leadership for Economic Development Post-COVID,” J. Knowl. Econ., pp. 1–26, 2024. [CrossRef]

- A. Arshad Ali and A. Mahmood, “How Do Supply Chain Integration and Product Innovation Capability Drive Sustainable Operational Performance?,” Sustainability, vol. 16, no. 1. p. 277, 2024. [CrossRef]

- N. Ortiz-de-Mandojana and P. Bansal, “The long term benefits of organizational resilience through sustainable business practices,” Strateg. Manag. J., vol. 37, no. 8, pp. 1615–1631, 2016. [CrossRef]

- E. Hadjielias, M. Christofi, and S. Tarba, “Contextualizing small business resilience during the COVID-19 pandemic: evidence from small business owner-managers,” Small Bus. Econ., vol. 59, no. 4, pp. 1351–1380, 2022. [CrossRef]

- M. Kamalahmadi and M. M. Parast, “A review of the literature on the principles of enterprise and supply chain resilience: Major findings and directions for future research,” Int. J. Prod. Econ., vol. 171, pp. 116–133, 2016. [CrossRef]

- D. Smallbone, D. Deakins, and M. Battisti, “Small business responses to a major economic downturn: empirical perspectives from New Zealand and the UK,” Int. Small Bus. J., vol. 3, no. 5, pp. 754–777, 2012. [CrossRef]

- E. de Oliveira Teixeira and W. B. Werther Jr, “Resilience: Continuous renewal of competitive advantages,” Bus. Horiz., vol. 56, no. 3, pp. 333–342, 2013. [CrossRef]

| Variable | Dimension | Indicator |

| Knowledge Management Capability (KMC) [29] |

Knowledge management infrastructure which consists of sub-dimensions: | |

| Technology | Easy to learn, technology as a source of learning information, utilizing technology to compete | |

| Organizational structure | Knowledge interaction and sharing, new knowledge facility, knowledge sharing reward system | |

| Culture | Believes in mistakes as a source of learning, mutual trust, company encourages asking questions, believing in imitation as a source of learning | |

| Knowledge management process which consists of sub-dimensions: | ||

| Acquisition | Extracting knowledge from customers, extracting knowledge from partners, extracting knowledge from employees | |

| Conversion | Turning knowledge into products/services, transferring knowledge, absorbing knowledge | |

| Aplication | Easy to practice, saves activity, improve competitive ability | |

|

Entrepreneurial orientation (EO) [67] |

Protection | Protection policy, protection procedures |

| Proactiveness | Initiative, excels at opportunity identification, quick to take action | |

| Innovativeness | Actively innovating, creative business operations, looking for new ways | |

| Risk taking | Risk perception, risk taking, exploration and experimentation for opportunities | |

| Competitive aggressiveness | Competitive business, aggressive competition, outperforming the competition | |

| Autonomy | Employees work independently, employee initiative, employees are given authority and responsibility, employees have access to important information, employees are free to communicate | |

| Entrepreneurial finance (EF) [100] |

- | Effective financial resource management entails the mobilization of capital, strategic allocation of resources, risk mitigation, optimization of financial agreements, and the creation and enhancement of value within the context of entrepreneurship |

|

Entrepreneurial marketing (EM) ([47]) |

Proactiveness | New ways to improve business, different ways of making products, anticipate problems and create opportunities |

| Calculated Risk-Taking | Willing to take risks, can predict risk, analyze environmental conditions | |

| Innovativeness | New innovation, prioritize creativity, changes in design | |

| Opportunity focus | Quick to seize new opportunities, search for new opportunities, knowing market demand information | |

| Resource leveraging | Utilize your closest contacts, work harder, positioning employees with many positions | |

| Customer intensity | Proximity to customers, customer satisfaction, providing new information to customers | |

| Value creation | Creating more value through service, providing something different, use of social media for advertising messages | |

| Business Resilience (BR) [101] |

Company resilience | The ability to manage and adapt effectively to disruptions in the supply chain, respond swiftly to unexpected challenges, and maintain a high level of situational awareness demonstrates organizational resilience and flexibility in dynamic environments |

| Agility | The capacity to address customer demands effectively, adjust production systems efficiently, make prompt and informed decisions, actively seek information to support organizational restructuring, and interpret market changes as opportunities reflects a dynamic and adaptive organizational approach | |

| Characteristics | Frequency | % | Characteristics | Frequency | % | ||

| Gender | Type of Business | ||||||

| 1. | Male | 92 | 73.6 | 1. | Restaurant | 5 | 0.04 |

| 2. | Female | 33 | 26.4 | 2. | Food stalls | 8 | 6.4 |

| Age | 3. | Culinary carts | 93 | 74.4 | |||

| 1. | <25 years old | 0 | 0 | 4. | Various cakes and snacks | 10 | 12 |

| 2. | 26 - 35 years old | 35 | 28 | 5. | Beverage/ coffee shop | 1 | 3.2 |

| 3. | 36 - 45 years old | 43 | 34.4 | Number of Workers | |||

| 4. | 46 - 55 years old | 31 | 24.8 | 1. | 1 - 3 people | 70 | 56 |

| 5. | >55 years old | 16 | 12.8 | 2. | 4 - 6 people | 50 | 40 |

| Education background | 3. | 7 - 9 people | 5 | 4 | |||

| 1. | Elementary school | 3 | 2.4 | 4. | >9 individuals | 0 | 0 |

| 2. | Junior high school | 12 | 9.6 | Work Experience | |||

| 3. | Senior high school | 62 | 49.6 | 1. | 6 years | 33 | 26,4 |

| 4. | Diploma | 20 | 16 | 2. | 7 - 13 years | 61 | 48,8 |

| 5. | Bachelor | 28 | 22.4 | 3. | 14 - 20 years | 20 | 16 |

| 6. | Magister | 0 | 0 | 4. | 21 - 27 years | 10 | 8 |

| 7. | Doctor | 0 | 0 | 5. | >27 years | 1 | 0,8 |

| Variable | KMC | EF | EO | EM | BR |

| KMC | 0.855 | ||||

| EF | 0.568 | 0.811 | |||

| EO | 0.544 | 0.694 | 0.881 | ||

| EM | 0.556 | 0.457 | 0.475 | 0.781 | |

| BR | 0.611 | 0.665 | 0.647 | 0.598 | 0.944 |

| Variable | AVE | CR | CA |

| KMC | 0.731 | 0.961 | 0.936 |

| EO | 0.609 | 0.886 | 0.921 |

| EF | 0.657 | 0.920 | 0.894 |

| EM | 0.776 | 0.960 | 0.972 |

| BR | 0.891 | 0.942 | 0.923 |

| Variable | R2 | Q2 | GoF |

| EO | 0.296 | 0.128 | 0.565 |

| EF | 0.534 | 0.341 | |

| EM | 0.351 | 0.220 | |

| BR | 0.603 | 0.354 |

| Hypothesis | Path coeff | T-Statistic | P-value | f-square | |

| H1 | KMC → OE | 0.544 | 7.710 | 0.000 | 0.421 |

| H2 | OE → EF | 0.547 | 7.675 | 0.000 | 0.452 |

| H3 | OE → EM | 0.245 | 3.097 | 0.001 | 0.065 |

| H4 | OE → BR | 0.227 | 2.573 | 0.005 | 0.061 |

| H5 | EF → BR | 0.287 | 3.082 | 0.001 | 0.096 |

| H6 | EM → BR | 0.259 | 3.438 | 0.000 | 0.109 |

| H7 | KMC → EF | 0.271 | 3.610 | 0.000 | 0.111 |

| H8 | KMC → EM | 0.422 | 5.749 | 0.000 | 0.193 |

| H9 | KMC → BR | 0.181 | 2.369 | 0.009 | 0.045 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).