3.1. Investment Risk Management

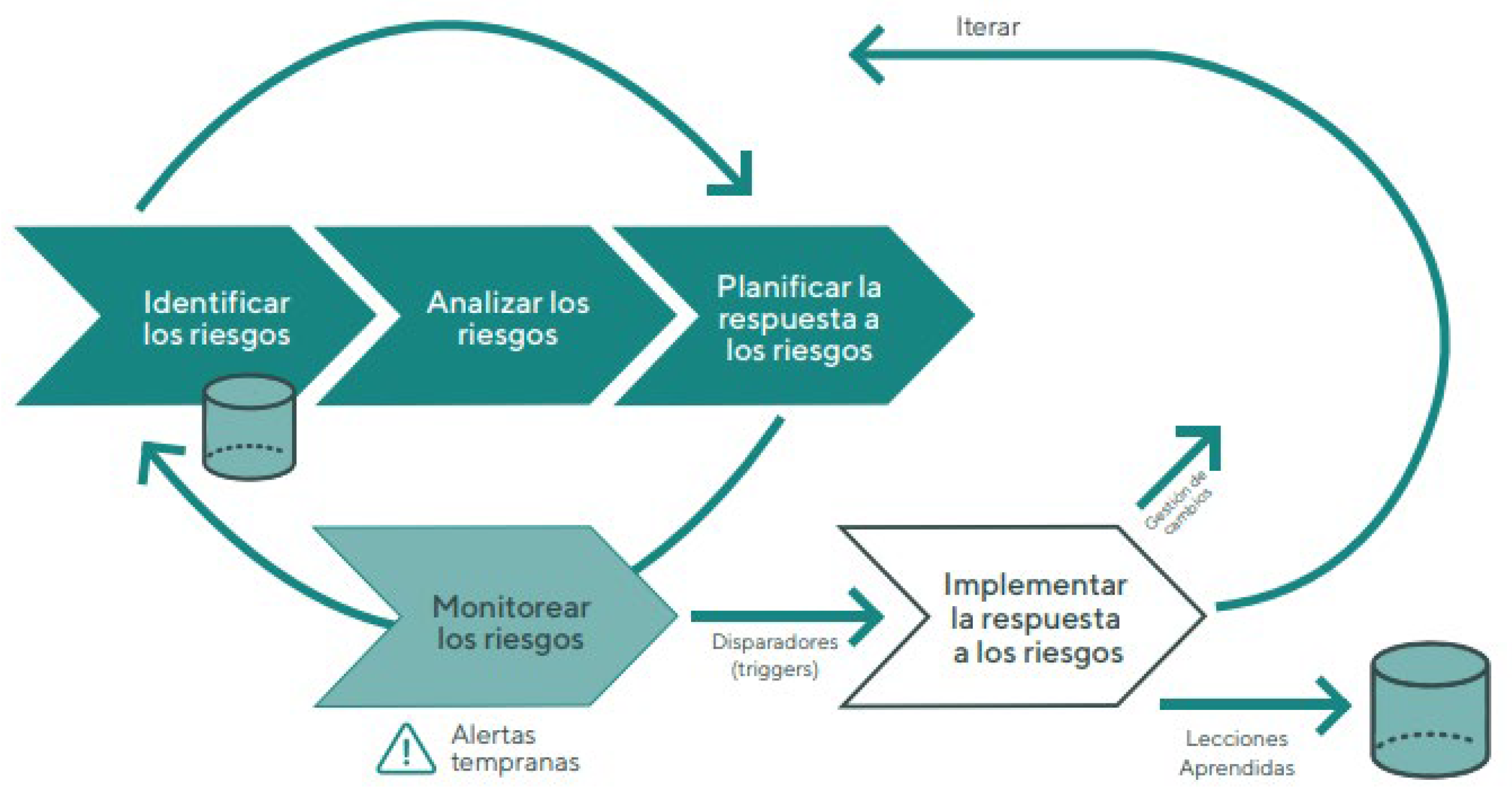

Risk management is an iterative process. One by one, it is planned, executed, and controlled. Therefore, in an ideal world, risk management would have to be using an agile approach (AGILE) that mimics the complexity and uncertainty inherent in investment management and that allows the delivery of temporal value through iterations and increments (Moreno, 2024). The processes involved in risk management are the following:

Figure 1.

Global trend in financial fraud crimes.

Figure 1.

Global trend in financial fraud crimes.

On the other hand, risk management is considered a process aimed at facilitating decision-making and carrying them out knowing that they can result in significant losses as a component of a learning experience or process (Oke, 2016). From there, its main purpose is to reduce risks to a manageable and acceptable level, based on an approach designed to manage uncertainty regarding events that are considered threats through different human tasks (Dotres & Sánchez, 2020).

Likewise, financial risk management corresponds to the process that is how institutions identify, measure, control and monitor losses inherent in the business while evaluating their performance in terms of the level of exposure they are willing to take in the development of the company and the existing hedging mechanisms to safeguard their own resources and those of those under their management and control.

Organizations should use risk management as a tool capable of helping with process orientation, resource allocation, optimization of production costs, and establishment of internal control (Guerrero, Medina y Nogueira, 2020). There are now transnational changes related to the functioning of the global economy, such as the global recession that includes Latin American countries, which is causing structural changes in business activity.

As for fraud in Latin America, as a result of the health crisis that occurred in 2020, the economy was paralyzed, several control bodies were duplicated and rules were issued that favored the economic reaction, replacing ways of evading taxes and paying attention to the national treasury, favoring dissident individuals in the misuse of the operations of the companies over which they have authority.The effectiveness of companies has also been significantly affected by preventive measures that provide employees with the security of working remotely because they have lost the ability to monitor employee behavior and control access to their information, leaving them vulnerable to cyberattacks and requiring significant efforts to increase their operational capacity.

To address financial risks and their effects in times of crisis, efforts should be directed towards the reorganization of financial strategies and the proper use of the information disclosed in the financial statements (Centro de Comercio Internacional, Therefore, in this globalized and changing world, an essential requirement for the viability and competitiveness of industries is effective financial management that facilitates decision-making on policy issues, components of production costs, profits, solvency, cash cycles, financing, and in general those decisions related to the management and strategic direction of the organization.

The two reference standards for risk management are ISO 31000 and COSO 2013, which means that the second edition of ISO 31000:2018, published in February 2018, aims to assist organisations in risk management by implementing a focus on risk management, taking into account the variety of risks and the challenges in identifying them. Although adherence to this standard does not allow certification to be requested, its implementation within an organization can allow its risk management policies to be compared with an international benchmark that improves their effectiveness.

Adopting a risk management model requires identifying the types of events that could occur and result in losses; These risks are as varied as companies and their operations and are caused by several factors, such as the following: strategic, operational, controlling, financial, compliance and technological risks; additionally, it is analyzed according to its internal and external origin, according to the classification of the company into operational, financial, commercial and legal; and according to the company’s sources in terms of risks of: credit, market, liquidity, operation, legal, fraud, competition and control of criminal activities.

In relation to the types of financial risks, market risks are the probabilities of a loss occurring if the factors affect prices and the results of financial activities fluctuate so much that they give rise to negative differences in market prices; credit risks are defined as the economic damage caused by the failure to comply with a payment commitment; operational risk is the possibility of suffering losses as a result of errors made in the operation and negotiation of financial instruments; and legal risk arises when losses are caused by legal variations. liquidity risk, which arises from the economic crisis caused by carrying out a transaction at a price other than the market price; It is important to understand the different financial risks faced by each entity since, by maintaining a balance between these risks and profitability, the solvency of the company is guaranteed and, therefore, its ability to attract future investors.

This study highlights the impact of risk factors on investment and construction costs in developed and emerging countries, including China, Australia, Ireland, Canada and Chile. Risk factors include improper intervention in the property during construction, reversal of decisions, legal uncertainty due to contractual or regulatory changes, and more (Dotres, Mirón y Sanchéz, 2021). Other examples in emerging African countries, such as Nigeria, Uganda, and Kuwait, demonstrate common risks that have a negative impact on total investment costs, but do not specifically correlate with negative consequences such as project definition issues and property tax changes during the process.

The Cuban experience demonstrates five practices used in the rehabilitation of the Ordoño Hotel in Holguín and the presence of Coca Yagrumaje Norte in Moa. Risks were managed from planning to execution. Subsequently, an impact assessment was conducted to determine how risk management was used both in construction investments and how it influenced project objectives in terms of cost, schedule and quality. According to (Dotres, Sanchéz, & Zuñiga, 2020), Financial evaluations of contracts are crucial for the closing of a construction investment. Conducting financial evaluations of contracts through external auditors helps to build and establish policies.

Another case of risk management in investment is presented by the company Pescanova, S.A. was a leading multinational corporation in the maritime products marketing industry. More than 70 types of fish and marine animals were caught and sold worldwide as their main activities. Manuel Fernández de Sousa-Faro had a significant stake at the time of 24% of the company’s share capital, both directly and indirectly, which meant that the Board of Directors had decision-making authority. Alfonso Paz-Andrade, son of another founder, Valentín Paz-Andrade, also joined the company’s management team but left due to major disagreements with Manuel Fernández de Sousa-Faro over the company’s trajectory.

Between 2007 and 2012, Mr. Fernández de Sousa-Faro carried out a number of important investments, mainly focused on aquaculture. These included the construction of marine farms for the production of salmon, shrimp and turbot, as well as the acquisition of new businesses in South America and Africa. The company lost almost €830 million as a result of these investments.In addition, in 2012 there was a capital increase by Pescanova, S.A., which facilitated the incorporation of new institutional investors to the Board of Directors. These new investors would include Silicon Metal Holding LLC with 5% of the votes, Luxempart, S.A. with 5.873% and Sociedad Anónima Damm, S.A. with 6.183% of the votes.

However, investments in aquaculture did not turn out as planned and the company struggled to produce positive effects. During the ordinary meeting to formalize the annual accounting reports for the 2012 financial year, these new investors were the ones who found discrepancies between the annual accounting reports and the bank figures; as a result, they were not allowed to sign them. Once the board has passed, in the long run, Manuel Fernandez De Sousa-Faro admitted that he had sold the majority of his stake to the board (Galán, 2014).

The new investors were committed because, during their meetings with Pecana, S.A. prior to its incorporation, they were assured that the auditors, BDO Auditor, 41 S.L., delivered a detailed and discredited report of the parties that made up the financial debt and that they were responsible for it. In the period of capital increase, Pescanova’s financial debt, audited by BDO Auditores, S.L., amounts to a total of 1,522 million euros.

However, it did not happen until 2013, when they expressed their concern that the company did not submit the financial statements of the previous year to the National Securities Market Commission8. In addition, Chairman Manuel Fernández de Sousa-Faro informed them of his potential withdrawal from the company and suggested to the CNMV that the company’s listing be suspended to avoid this. It all started at that moment when they began to highlight operations that did not coincide with the real operations of the company. Due to this, the National Securities Market Commission decided to paralyze the trading of the shares of Pescanova, S.A., which meant a 60% drop in the company’s share price.

When the “Nueva Pescanova Group” was constituted in 2015 after a process of social devolution by Pecsanova S.A., the company devised a new business model focused on the creation of 45 honoring the history and achievements of its predecessor, constant innovation, dedication to sustainability and the local communities where the Group operates.In this case, it is evident how the prospective forensic audit was the investment risk management tool that brought to light all the economic irregularities caused by Pecsanova in relation to the topic dealt with in this work. As can be seen, the company lacked internal control and effective supervision, which made it easy to hide important irregularities. In addition, the work of the auditors is questioned since they did not previously identify these financial irregularities, which is why the forensic audit was carried out to demonstrate the fraudulent acts.

Both financial and non-financial organizations are exposed to risks such as risks related to interest, liquidity, credit, financing, and exchanges, among others, under the umbrella of financial risk. The basic hypothesis is that if SMEs do not properly manage financial risk, it can result in poor performance of SMEs. Therefore, the goal of SME financial risk management is to minimize utility fluctuations caused by their exposure to financial risk. Financial risk management helps the company make profitable predictions and investments and ultimately steers the company away from excessive operating costs and financial crises.On the other hand Blázquez, Dorta y Verona (2020) They established a negative risk-reward relationship based on the fact that companies can increase profits while reducing risks. Inferentially, the level of performance will decrease if SMEs fail to control their exposure to risk, and vice versa. Along the same lines, a significant negative correlation was found between financial constraints, risk, and benefits.

3.2. Using Forensic Auditing in Investment Risk Management

3.2.1. Fraude en Empresas de Inversión

According to López y Salazar (2021), Forensic auditing

It is a valuable tool for avoiding risks in annual audit plans. This methodology helps reduce criminal activity, corruption, fraud, and financial risk. In addition, internal audit expertise improves performance, benefiting organizations. (p. 72).

According to Mueller (2020), The open lawsuits include that citizens can participate in the improvement of public services and the performance of accounts, which entails improving safety, health, education and generating job opportunities. According to Macías et al. (2020), Transparency includes a series of management tools aimed at improving the availability of public data and open government procedures. For open government, transparency is essential because it eliminates information costs and provides people with valuable public knowledge that influences government actions and decisions.

Problems with management have arisen in both public and private companies due to the lack of robust controls, which facilitates the involvement of third parties or employees in corrupt activities. During financial audits, several watchdogs in Latin American countries have integrated auditing as a mechanism to identify fraud activities and protect public sector resources, to prevent corruption that has eroded trust in institutions.

According to Bermeo et al. (2021), When conducting fraud investigations, public authorities must take ethics into account to understand the deeper reasons of fraudsters. Currently, organizations and entities of the State that are susceptible to various risks that affect the financial and economic aspects of the achievement and development of social goals.

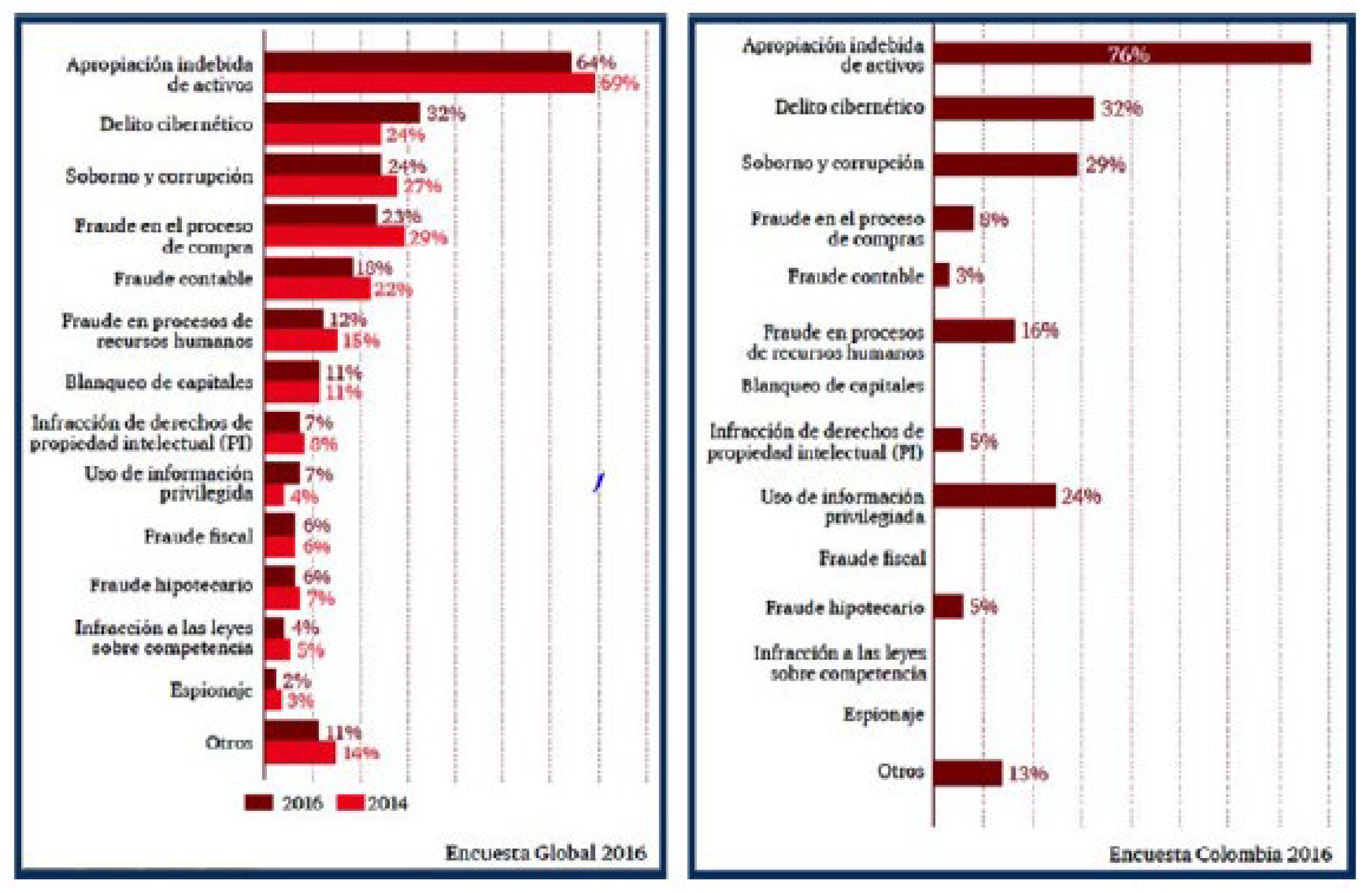

Some of these risks include, but are not limited to, the following: the gradual increase in business and financial fraud; money laundering; alteration of financial statements; and enormous executive remuneration. It’s vital to pay close attention to your fraud research, as you’re always evolving to evade all forms of regulation, which is your biggest concern. Because it is always evolving to evade all the legal framework and it is imperative to apply in-depth research in this context.

Therefore, the purpose of forensic auditing is to uncover incidents related to corruption and financial fraud arising from illegal and unethical behaviors. Similarly, you should try to determine precisely what type of fraudster you are. Companies have chosen to take legal action on fraud, which involves identifying any illicit behavior in financial data (Malamed, 2020). Corruption and fraud in companies can be detected by conducting public audits. Despite this, the first stage is the documentary review whose purpose is to identify the conceptual and methodological progress in this area for the prevention of accounting fraud.

Among the most important cases that were registered worldwide and nationally during the past year we can point out: “AL CAPONE” (Alcohol vapor), ENRON (Técnicas de contabilidad fraudulenta), WORLDCOM “Financial Statement Maneuvers” DUAL accounting, PARMALAT Investment Firm Bernad L. Madoff Investment Securities, LLC REBAJA DROGAS (Error Wash) Overestimation Lack of reserve, Important active payments.

Con respecto a los casos más destacados a nivel mundial se resalta el de lavado de dinero dirigido a DMG, equipos de fútbol colombiano en particular el Independiente Santa Fe, Atlético Nacional, Deportivo Independiente Medellín, y Club Deportivo los Millonarios (Activos), y al grupo Nule “Carrusel de la Contratación” (licitaciones y contratos fraudulentos), otro como el de INTERBOLSA (Manipulación y Datos Financieros Inconsistentes), el fraude de Jérome Kerviel, las pérdidas financieras de JP Morgan Chase (riesgos a nivel especulativo financiero, mercado y legal), Fraude por Barings (operaciones realizadas por Nick Leeson, empleado del banco), en Société Générale (como resultado de transacciones no aprobadas por empleado del Banco), Crédit la crisis bancaria de Lyonnais (mala gestión bancaria) y el colapso del Riggs Bank (mala gestión del riesgo) (Maldonado et al.2022).

Likewise, we can add the case of DMG between 2006 and 2008, David Murcia Guzmán supervised the operation of a pyramid scam. It used aggressive marketing strategies and offered benefits in essence that investors deposited money into the company with the promise of high returns with bankruptcies that cannot be sustained. The plan became unsustainable as more people invested and collapsed, leaving thousands of investors without the money invested. The hardest hit were people with low incomes who relied on DMG’s promises to improve their financial situation. The case had a significant social and economic effect in Colombia, prompting the government to intervene and leading to the subsequent capture and conviction of David Murcia Guzmán.

Likewise, the case of the company Margisol SRL, in Chiclayo, can be highlighted, it has been found that the corresponding vault inspections are not carried out, as well as the daily vault inspections; Of course, the registrations are made, but the records on the destination of the funds are made without the due authorization of the person in charge.

It was evident that in terms of the accounts that must be paid, many of them are not paid in a timely manner so that short-term obligations are responsibly assumed. Similarly, there is no adequate credit risk assessment, which makes it possible for customers to fall behind in their payments. In short, financial records are not kept up to date or include all the income and expenses that the company records. As a result, daily operation records are not kept up to date, so reports that are required on a monthly basis are usually provided after the fact.

Stock control is also not available on a daily basis, so it is only updated when the inventory is taken at the end of the day or on a monthly basis, but is supported through input and output formats. One of the most well-known cases in which fraudulent acts were discovered is the case of the 2003 Interbolsa holding company in Colombia. This year, the commission’s initial findings were announced, which led to the conclusion that the Superintendence of the Securities Market would support them for reasons related to the destruction of operations, personnel, massive and regular capture of public deposits for illegal investments, conquest of crime and manipulation of species.

In this regard, after conducting an exhaustive investigation, forensic auditors were able to identify cases of deception involving around 12 million narcotics-related activities, operations and certificates falsely issued to obtain funds in an Intervalores bank account (Damaso et al., 2020).

On the other hand, in recent years, Peru has shown great economic growth supported by Latin America, which is also reflected at the commercial level with the boom in new investments; However, this growth is occurring through a recession. One of its main stigmas is institutional corruption, and there is also a high level of informality, which increases its risks for many economic crimes that can occur in companies. In the face of increased business transactions, the lack of control leads to all forms of internal fraud. These data show that, based on the results obtained, which are derived from the general alternative hypothesis presented in the surveys, this research shows that forensic accounting reduces the risk of occupational fraud, which will benefit the company’s management by reducing losses due to internal fraud. This is applicable to industrial companies listed on the Lima Stock Exchange.

According to the report of the Association of Certified Auditors (2020) Regarding employment fraud and abuse, the inappropriate use of employee resources is one of the most common and most prevalent frauds in organizations, resulting in 86% of fraud situations resulting in losses of at least $100,000 USD. On the other hand, financial statement frauds are less common, accounting for 10% of all frauds. However, they are the most costly, because the perpetrator intentionally makes a false statement or materially omits information from the financial state of the economy. Finally, 43% of corruption cases result in losses of at least $200,000 USD.

In the world in the different countries, laws, regulations and other documents have been issued aimed at the prevention and control of fraud, especially financial crimes, through the establishment of evidence through the intervention of the Public Prosecutor’s Office. These groups include the Basel Committee on Banking Supervision, the Organization of the United States of America, the Northern Measures, the Southern Measures, the United Nations, the Caribbean Measures, and the Basel I, II, and III Treaties.

As a means of proof, forensic accounting allows us to make a financial analysis that will be accepted by the courts, in addition to the collection and presentation of information at a financial, legal, administrative, and immaterial level. The documents should have the merits of the case, an explanation of the processes filled out, a timeline that includes the range of responsibilities, the restrictions that have been shown, and an analysis. Forensic auditing is used as a risk management tool to detect anomalies in accounting processes and records.

Forensic auditing is an essential investigative technique for preventing fraud and managing financial resources. It is used as an instrument to comply with financial crimes that impact both private and public organizations, through specific and general procedures. Even though there is a high rate of corruption in the regions and the conditions that facilitate its expansion, Latin American government entities rarely use forensic auditors to uncover fraud, money laundering and other forms of corruption, considering that it is a technique that requires specific technical skills on the part of auditors.

Culture, politics, and economics are negatively affected by corrupt societies. Cases of fraud and illegal activities have increased in Latin American public administration, causing constant damage. Faced with this situation, certain nations implement control policies that do not cause economic or legal damage to public institutions. In accordance with national legislation and international standards, these measures are aimed at improving opportunities for the prevention of debt-related acts (Arévalo, 2022).

Governments and international organizations can identify and combat illegal and corrupt activities with the help of forensic auditing, which gives them a detailed view of the flow of funds. To uncover dubious financial transactions, uncover any illegal connections, and provide strong evidence in court proceedings, it is vital that government entities and forensic auditors work together. This work increases measures to gain public trust and ensure transparency in the management of resources. The objectives of this comprehensive approach are to reduce corruption and financial crime, ensure financial reserves, and promote integrity in both the public and private sectors (Arévalo, 2022).

Auditing practices are essential to identifying and preventing financial fraud. Latin American public auditors must comply with current legislation and maintain a foundation based on solid legal and accounting knowledge. In addition, it is important to have effective audit integration that emphasizes the relevance of evidence, which leads to truth and plays an important role in court cases. According to Díaz (2020), Forensic assessments are based on techniques such as document review, risk analysis, transaction monitoring, and forensic testing.

Forensic auditing is emerging as a new discipline in Latin America. The main goal of organizations is to identify any type of illegal activity, fraud, or corruption within their entities. The forensic auditor uses a variety of approaches, technological tools, document evaluation, interviews, forensic testing, risk assessments, and techniques to achieve these goals. The objective is to collect all the necessary information to determine if a company is fake or not, therefore, the Forensic Auditor has a role with proactivity and in turn behaving reactively.

However, the forensic auditor needs a certain regulatory framework to be able to execute these methodologies. Currently, the Forensic Audit lacks specific regulation and relies on alternatives such as the NIA to provide guidelines and procedures. In several countries, existing laws, such as commercial, criminal and civil codes, serve as the basis for regulation in this area (Pinilla & Bricello, 2022).

3.2.2. Manipulation of Financial Statements

The Association of Certified Fraud Examiners (ACFE) lists three types of fraud in its Annual Report to the Nation: financial statement fraud, improper disposition of assets, and corruption. The countries that are most represented in this study are Mexico, Argentina, Brazil and Colombia. The 2022 National Report examines 95 cases from 23 countries in Latin America and the Caribbean. According to the ACFE, 59% of the cases investigated included corruption, while 17% were involved in financial fraud. Companies use financial manipulation, which is becoming increasingly difficult to identify due to the sophisticated techniques used by perpetrators. To prevent fraud that threatens the stability and functioning of the organization, companies must use incentive and control strategies (Roque, Escobar y Gutiérrez, 202).

The Forensic Audit was created in response to recent financial scandals and frauds, such as those involving Enron, Worldcom and Tyco in Mexico. Auditing institutions are critical in assessing quality control, accounting regulations, corporate responsibilities, reporting, and guidelines to combat corporate fraud.

In this regard, the case of the air conditioning companies of the Machala Canton is presented, whose evaluation of financial statements gives credibility shows that seven out of nine companies comply with the requirements for the presentation of financial instruments. This implies that a point of origin has been established from the legal framework under IFRS 1, which will have the responsibility of guaranteeing reliable financial management. That is why accounting systems, especially Visual Fac, are used by these companies to record information in order to facilitate the preparation of reports since it maintains the traceability of the data, however, incorrect accounting entries are evidenced, which shows that two companies are not fully complying with the IFRS 1 standard (Heredia et al., 2022).

Within these companies, there is a lack of order in the storage of physical files, as well as the lack of supporting documentation such as invoices, (physical) withholdings, there are also withholdings with their declarations, the information presented in the Financial Statements is verified, for the purposes of evaluating the actions related to the distortion of numbers, the observation allowed to conclude that in all the companies investigated, the information shown in the financial instruments of the microenterprise is consistent with its monthly and annual reports. It can also be pointed out that one of the nine companies has physical purchase receipts with anomalies in dates and amounts that do not coincide, as well as the erroneous calculation of VAT, which allows us to assume that there is a probability of alterations to the accounting documents and therefore the declarations were not carried out correctly.

Likewise, as a result of the lack of documentation that supports the inspection processes in the climate microenterprises investigated, there are not enough elements to analyze the existence of past tax crimes. However, according to the findings, the companies did not incur in major crimes that could generate severe penalties for them. According to Centeno et al. (2021), the Ecuadorian Comprehensive Penal Code establishes severe penalties for tax crimes in this context, including economic fines. and loss of freedom.

The goal of a financial audit is not to prevent fraud, but to obtain a judgment on an entity’s financial statements. This is because certain entities engage in fraudulent activities, misuse information about their operations, and manipulate financial statements, which can result in legal ramifications for the company. In addition, accounting serves as a tool for the justice system by allowing the verification of significant data. Companies must build an internal control system with their employees to strengthen their financial and tax situations in a competitive market. Gaining competitive advantages will help them succeed.

Forensic auditing is a system that improves a company’s performance by increasing efficiency and effectiveness in practical exercises that maximize results. However, there are limitations, and no control can guarantee the complete elimination of irregular events; Still, it is possible to maximize profits.

In this regard, forensic auditors impose indicators of criminal responsibility with the help of evidence obtained by the court competent for the verdict; In addition, they provide the economic community with essential tools for the implementation of preventive and corrective controls to avoid future fraud scenarios (Briozzo & Albanese, 2020). The auditor plays a critical role in capturing the perspectives of the audited organization and turning them into a useful management tool that generates added value and reduces the fees demanded by companies in the modern era.

It has been observed that many of these companies do not correctly apply the evaluations of their internal control systems, even though they have experienced fraud in the past and are aware that they are still vulnerable to this type of fraud and other incidents that, if they were to occur again, would cause serious problems in their performance.

In addition, in the case of Ecuadorian manufacturing companies in Zone 3, it is vital to determine whether internal audit is an effective method to prevent and identify fraud risks, as it affects financial and operational processes.Analysis of the results revealed that many manufacturers believe that forensic auditing is useful in preventing fraud, but do not use it to regulate their financial resources. While this is true, other techniques are also used to monitor and evaluate internal control systems. However, these techniques are not as effective at reducing this type of risk.

On the other hand, it has been observed that some shareholders of manufacturers are unaware of the types of actions that are considered fraudulent. This contradicts the fact that some of these organizations do not carry out any external oversight or auditing techniques. A number of companies have put in place a supervisory control system to monitor the activities of their employees to ensure that they comply with regulatory requirements. While this can reduce the risk of fraud or crime, businesses still face the risk of not being able to identify problems in time due to inadequate oversight, such as that of forensic auditors. As a consequence, many have already fallen victim to this.

In the case of Efecty in 2017, tax authorities discovered documents of social investors in the Mossack Fonseca company. It was revealed that Luz Mary Guerrero, legal representative of Efecty (which is owned by Servientrega), would have illegally transferred around 4.5 million dollars. The money was exchanged through fake transactions. It is believed that Servientrega signed contracts for courier services that were never fulfilled, but that were billed as if they were real throughout its operations. Dinero (2017).

After the investigation of the Attorney General’s Office of the country, which is supported by a forensic audit, a very special role had the aforementioned procedures, which allowed the triangulation of the perpetrated fraud and demonstrated the payment of fictitious invoices, the payment of fictitious services, and payment of money in accounts in the Bahamas after deducting the commission of Mossack Fonseca. which ranged between 2.5 and 4 percent, although it is legal to manage offshore entities in Colombia, there is evidence of false rental declarations, which does not excuse tax evasion or fraud in private documents.

These facts showed that the fictitious invoice reduces socioeconomic factors such as the value and utility of the shares, as well as the base, which translates into a reduction in the need to pay DIAN fees. With this, it is demonstrated that despite having a qualified, objective and black auditor, the auditor violated the principle of mental independence of ISA 700, the rules inherent to his profession and article 207 of the CCo, which refers to the functions of the auditor.

In this case, the tax auditor is responsible for making known and/or reporting the risks of fraud since he is part of the management of the organization and must do so in addition to exercising his functions and signing documents (Ayala, Celis y Sanchéz, 2020). This leads to highlight that forensic auditing is crucial to detect and prevent fraud as it provides the necessary tools for an accurate assessment of business-critical areas. The findings of Ochoa & Sepúlveda (2022) financial fraud can be based on falsified statements, such as the intentional omission of a financial record with the intent to embezzle funds and mislead company directors.

According to Valdivia (2022), Fraud risk assessment is the basis for developing prevention programs that companies can use to manage potential misconduct. In addition, because the nature of this type of risk is related to intent, fraud risk assessment differs from traditional risk assessment procedures in audit, finance, and other areas.

On the other hand, in ISA 240, auditors should be concerned about two types of fraud: financial fraud and activity fraud. The first occurs when any of the three components of the fraud triangle materialize: power, opportunity and racialization. First, financial fraud involves faults or omissions in the content or disclosures of data, which are created with the purpose of deceiving those who use such information.

Second, the goal of activity manipulation is the reactivation of an entity. Most cases of fraud on relatively small or minor imports are the responsibility of the organization’s employees. However, in other cases, management is shown to be involved in business activity fraud. Company management and government employees are acting quickly due to their concern about this loss of activity.

According to Vásquez (2021), the National ACFE 2020 (Vásquez, 2021) It states that financial audits can be used to discover, prevent, and correct fraudulent activities that are expected to persist over time. These investigations begin with the identification of the crime and can range in length from 13 to 24 months, depending on the classification of the crime. As the duration of the event increases, so will the assessment of economic losses.

According to the report of the aforementioned institution, during 2020 2,500 cases of fraud were reported, classified as embezzlement of assets (85%), corruption (43%) and fraud in the financial sector (10%). According to Vásquez (2021), Companies in the manufacturing and distribution sectors are the most likely to commit this type of crime. Despite the lack of studies on the subject, there are publications that address the risks faced by service-oriented companies. For example, in commercial enterprises, accounting fraud is common, especially in situations where equitable personnel contracts are entered into in exchange for actual payments.

La descapitalización de la Corporación Financiera Nacional (CFN) es otro ejemplo de los tipos de engaños que pueden existir. Esto, en especial, significó que se emitieron billetes como forma de pago de deudas pendientes y para satisfacer a sus acreedores, así como certificados emitidos por instituciones en quiebra y gobiernos corruptos durante la crisis del año 2000. La única manera en que se pudo detectar estos eventos fue a través de la implementación de auditoría interna. Como resultado de este suceso, se creó en el país la Agencia de Garantía de Depósitos con la responsabilidad de proteger los fondos del público en caso de una potencial catástrofe financiera (Arévalo, 2022).

3.2.3. Strategies for Implementing Forensic Auditing in Investment Risk Management

One of the strategies of implementing audit is to improve internal controls within organizations, which is a fundamental function of internal auditing, where forensic auditors are critical to effectively prevent and detect fraud. It will also contribute to improving the internal control infrastructure by identifying deficiencies and proposing improvements. It should be noted that one of the main contributions of forensic auditing is the implementation of improvements in internal control practices. Public auditors examine subordinate fraud cases and provide specific recommendations to improve internal policies and procedures. The risk of fraud can be significantly reduced by establishing stronger and more transparent processes and implementing more effective internal control practices.

It’s also critical to remember that functional separation is one of the best ways to establish who is responsible for applying controls to financial and accounting processes. This means that critical responsibilities are shared among multiple employees so that a single person does not have ultimate control over all stages of a transaction. There is also a widespread belief that constant monitoring and review of transactions and records helps detect anomalies and prevent fraud.

In addition, it is crucial to maintain the right policies and procedures to respond to changes in the regulatory and technological environment. An example of new risks and opportunities that internal control policies should review and adjust is the use of emerging technologies such as artificial intelligence and blockchain.

In order for employees to feel safe and for all actions to be carried out uniformly and in accordance with established policies, it would be recommended, according to Almeida (2024), the creation of detailed procedure manuals that include all critical organizational processes.

The process of continuous assessment and monitoring of internal controls encompasses the “forensic audit”. To ensure that controls remain effective over time, forensic auditors not only find weaknesses in existing controls but also develop continuous monitoring systems. That’s why continuous monitoring involves using advanced technologies to identify anomalies in real-time and monitor transactions. Organizations’ ability to prevent fraud is greatly enhanced through continuous data analysis, also known as continuous auditing, which allows them to detect suspicious actions and respond to them quickly.

Training and sensitizing employees to conduct internal audits are essential to improving internal controls. The reason is that forensic auditors need a specific training program to inform their employees about fraud risks, marketing signals, and best practices for maintaining the integrity of internal controls, with a focus on integrating all employees into control and prevention methods.

Improved corporate governance and reduced risk are some of the immediate outcomes that an audit-enhanced corporate culture can achieve. In addition to protecting the business against fraud, proactively identifying risks and implementing preventive controls improve operational efficiency and governance. Organizations with leadership from stronger structures, clearly established roles and responsibilities, along with more effective and transparent decision-making processes, are combined companies that incorporate internal auditing practices into their corporate culture.

By using forensic auditing, a culture of informed presentation can be promoted throughout the organization. By establishing clear and confidential channels, companies can identify and resolve issues before they escalate, allowing employees to report suspicious activity without fear of retaliation. The delineation of the roles and responsibilities of staff in financial and accounting processes, as well as a safe and ethical work environment, depends on this culture of reporting.

That’s why having both financial and legal knowledge is critical to forensic auditing. Forensic auditors must be well-versed in the rules and regulations governing accounting and financial transactions; With this knowledge and understanding, they can identify and record legal violations related to financial fraud. Herrera et al. (2021) It states that in order to conduct thorough investigations in accordance with the law, forensic auditors must possess essential training in accounting and legal standards.

From that point, you can see the connection between information technology (IT), cybersecurity, and modern financial auditing. These aspects are essential for financial auditors, in collaboration with cybersecurity specialists, to better identify and reduce the risk linked to information security and cybercrime. To find anomalies in large data sets, forensic auditors must have a strong understanding of damage tools and specialized software. To combat digital fraud, it is essential to have the ability to analyze digital records and observe online activities (Heredia et al., 2022).

Attached to sociological and psychological methods, which help to better understand the reasons and behaviors that underpin fraud. Forensic psychology helps auditors conduct investigations and interviews more effectively, detect signs of deception, and obtain important information. According to the social and psychological dynamics of an organization, fraudulent behaviors can be detected, according to Casanova et al. (2021).

The practice of forensic auditing was significantly different in different regions due to variations in legal, cultural, and regulatory frameworks. over nations such as the United States and the United Kingdom, where financial auditing is recognized and recognized, focuses on professional certification and continuing education. Professionals in these regions highly value and widely use the certifications offered by the Chartered Institute of Management Accountants (CIMA) y la Association of (CIMA, 2021).

This is why, in many developing countries, financial auditing is still in its early stages. The effectiveness of forensic audits could be limited by a lack of resources, training and institutional support. There is undoubtedly a growing movement towards the adoption of international standards to improve corporate governance and transparency, as well as a growing recognition of their importance.

The globalization of financial markets has increased the importance of the need to harmonize the rules and regulations of professional auditing. Financial auditing can be more consistent and comparable around the world if it adheres to the common standards set by the International Federation of Auditors (IFAC) and International Financial Reporting Standards (IFRS). The confidence of investors and other stakeholders can be maintained by organizations that follow these global standards. The use of international standards has the power to improve the effectiveness of internal audits in international contexts, which can reduce compliance gaps.

To combat these problems, international cooperation and knowledge sharing are required. Global organizations such as the International Federation of Senior Auditors (INTOSAI) and the American College of Financial Examiners (ACFE) participate in training programs, publish articles, and organize conferences to promote cooperation and the cultivation of best practices. According to IN-TOSAI (2020), These initiatives help professional auditors stay up-to-date with the latest trends and techniques, thereby improving the overall ability to fight fraud.

The use of technological tools to perform forensic audits is an essential aspect to consider. For example, by offering sophisticated tools for data analysis, the use of Artificial Intelligence (AI) has revolutionized prospective auditing. With the use of AI, which shows auditors patterns and irregularities that may indicate fraud, auditors can detect fraudulent activity early on and stop them. Machine learning algorithms have the ability to process large amounts of data in real-time and detect suspicious transactions that might go undetected using traditional methods.

In addition, AI can perform predictive analytics, predicting potential fraud before it occurs. The risks and impact of fraud on organizations can be reduced through this proactive approach. According to Casanova et al. (2021), auditors have more time to focus on more critical elements of the investigation when AI-powered systems are implemented, allowing them to automate repetitive tasks.

On top of that, blockchain technology offers an innovative new method to improve transparency and confidentiality in criminal audits. Blockchain, a distributed ledger technology, provides an immutable record of all transactions, significantly reducing the risk of data tampering and fraud. Because each transaction is encrypted and linked to the previous one, it is difficult to change a key on the blockchain without being detected.

All this allows us to believe that forensic auditors can efficiently verify the authenticity of transactions thanks to the integrity of data and the facilitation of transparent financial transactions made possible by blockchain technology. In transnational and international contexts, where trust and transparency are fundamental elements, this technology is particularly useful (Herrera et al., 2021).

In addition, it is taken into account that forensic auditing has been impacted by the new technological innovation that is Big Data analysis. This is because Big Data tools allow them to manage and analyze large volumes of structured and unstructured data from various sources, such as financial transactions, electronic correspondence, and communications records. Data visualization helps to quickly identify areas of interest and provides a clear and concise representation of audit findings. According to Herrera et al. (2021), This is critical to making informed decisions and implementing corrective and preventive measures effectively.