1. Introduction

Drought, a serious hazard with an annual cost of over $6 billion, ranks third among environmental phenomena associated with billion-dollar weather disasters (NIDIS 2025). Drought consequences on socioeconomic systems across multiple sectors, including agriculture, energy, water resource management, and financial markets. Unlike hurricanes, floods, or tornadoes, drought is a slow-onset disaster often described as a “creeping phenomenon.” Its impacts gradually unfold over time, making them harder to predict, measure, and manage. Drought not only threatens ecosystems and food security but also poses significant economic challenges. Recent severe droughts in the United States (U.S.), such as the California drought (2012–2016) and the Texas drought (2022), have caused billions of dollars in economic losses, highlighting the widespread ramifications of this natural hazard (Cheng et al. 2022; Huynh et al. 2020).

Among the many sectors affected by drought, agriculture is one of the most directly impacted. Prolonged periods of low precipitation reduce crop yields, increase irrigation costs, and lead to higher food prices, all of which negatively affect agricultural companies’ profitability (Chavas et al. 2016; Schnepf 2014, National Drought Mitigation Center 2023). These disruptions can ripple through financial markets, resulting in reduced earnings and declining stock prices for companies in the agriculture sector. For example, agricultural equipment manufacturers, seed companies, and food processing businesses are particularly vulnerable to drought-related risks. On the other hand, companies offering drought-resilient technologies, such as irrigation systems or drought-tolerant seeds, may experience a positive impact on their stock performance.

The energy sector is another area significantly affected by drought. Reduced water availability for hydropower generation can lead to energy shortages and increased electricity prices, affecting energy companies’ profitability (National Renewable Energy Laboratory, 2018). Additionally, drought conditions often heighten the risk of wildfires, which can cause extensive damage to energy infrastructure, disrupt energy supplies, and further increase operational costs (Hoover et al. 2016). The combined effects of reduced water availability and wildfire risks make the energy sector particularly susceptible to prolonged drought conditions.

Beyond agriculture and energy, drought can have broader economic impacts by influencing consumer spending and overall economic growth. For example, during the California drought, households redirected spending from discretionary items to basic necessities like water, which contributed to slower regional economic growth (Koomey et al. 2016). Similarly, drought-related price increases for essential goods like food and energy can strain household budgets, reducing demand for non-essential products and services. These dynamics have far-reaching consequences for consumer goods companies and other industries dependent on discretionary spending (Hong et al. 2019).

Despite these well-documented impacts, the relationship between drought and stock market performance remains underexplored. While some studies have linked extreme weather events, including drought, to stock market fluctuations, findings on this subject have been mixed. For instance, while some researchers have identified significant negative impacts of drought on stock prices, others have found little to no effect (Chen et al. 2021). These inconsistencies may arise from differences in study methodologies, regional variations in drought impacts, and the mediating effects of factors such as government policies, market conditions, and company-specific resilience strategies.

At the policy level, droughts have driven efforts to develop adaptive strategies for mitigating their impacts on key sectors. European Union member states, for instance, have conducted extensive evaluations of their drought policies to strengthen resilience in water resource management, agriculture, and energy production (European Environment Agency 2023). These strategies aim to balance short-term economic stability with long-term sustainability in the face of recurring drought events.

Drought Severity and Coverage Index (DSCI), developed by the U.S. Drought Monitor (Akyuz, 2017), is a widely used tool for quantifying drought severity. By assigning a numerical value (ranging from 0 to 500) based on drought intensity levels, DSCI provides a standardized measure for evaluating drought impacts across regions. While DSCI is widely used in environmental studies, its application in financial research remains limited, particularly in examining how drought severity influences stock market performance across key sectors.

The interplay between drought and the stock market is complex, as drought impacts vary based on severity, duration, and the specific industries and companies involved. For example, agricultural companies heavily reliant on water resources are more sensitive to drought than multinational corporations operating in diverse geographic regions. Similarly, water-dependent industries like hydropower, manufacturing, and food services face unique challenges during drought conditions, ranging from supply chain disruptions to increased raw material costs.

This study seeks to address the gap in understanding by analyzing the relationship between drought severity, measured using DSCI, and stock market performance in critical sectors, including agriculture, water management, industrial manufacturing, and food services. By incorporating lag effects of 2–5 years, this research aims to capture the delayed economic impacts of drought, which are often overlooked in short-term analyses. Understanding these lagged effects is crucial for investors, policymakers, and businesses seeking to forecast financial trends and develop strategies to mitigate drought-related risks. The overarching objective of this study is to evaluate the relationship between drought severity and stock market performance in the U.S., with a focus on key economic sectors. To achieve the objectives the following approaches were taken: (1) Sectoral Analysis: Assessing the impact of drought on stock performance in agriculture, water management, industrial manufacturing, and food services. (2) Lagged Impacts: Investigating how drought severity affects stock indices over varying timeframes, incorporating lag effects of 2–5 years to account for delayed economic consequences. (3) Temporal Analysis: Examining correlations between drought severity and stock prices across monthly, quarterly, and yearly periods to identify patterns and trends. (4) Practical Insights: Providing actionable insights for investors, policymakers, and stakeholders to improve financial risk management and resilience to drought. By bridging the gap between environmental and financial research, this study contributes to a growing body of literature that seeks to quantify the economic impacts of climate-related natural disasters. The findings are expected to enhance understanding of how drought influences financial markets, ultimately supporting more informed decision-making in the face of increasing climate variability.

2. Methodology

2.1. Study Area

This study focuses on the United States (U.S.), with specific attention to drought-prone regions such as California and Texas. These states were selected due to their historical exposure to severe droughts, which have caused significant economic and environmental impacts. California and Texas are home to key economic sectors, including agriculture, water management, and industrial manufacturing, making them ideal for analyzing the relationship between drought severity and stock market performance. Their distinct climatic conditions and reliance on water-intensive industries further highlight their vulnerability to prolonged droughts, aligning with the study’s objectives.

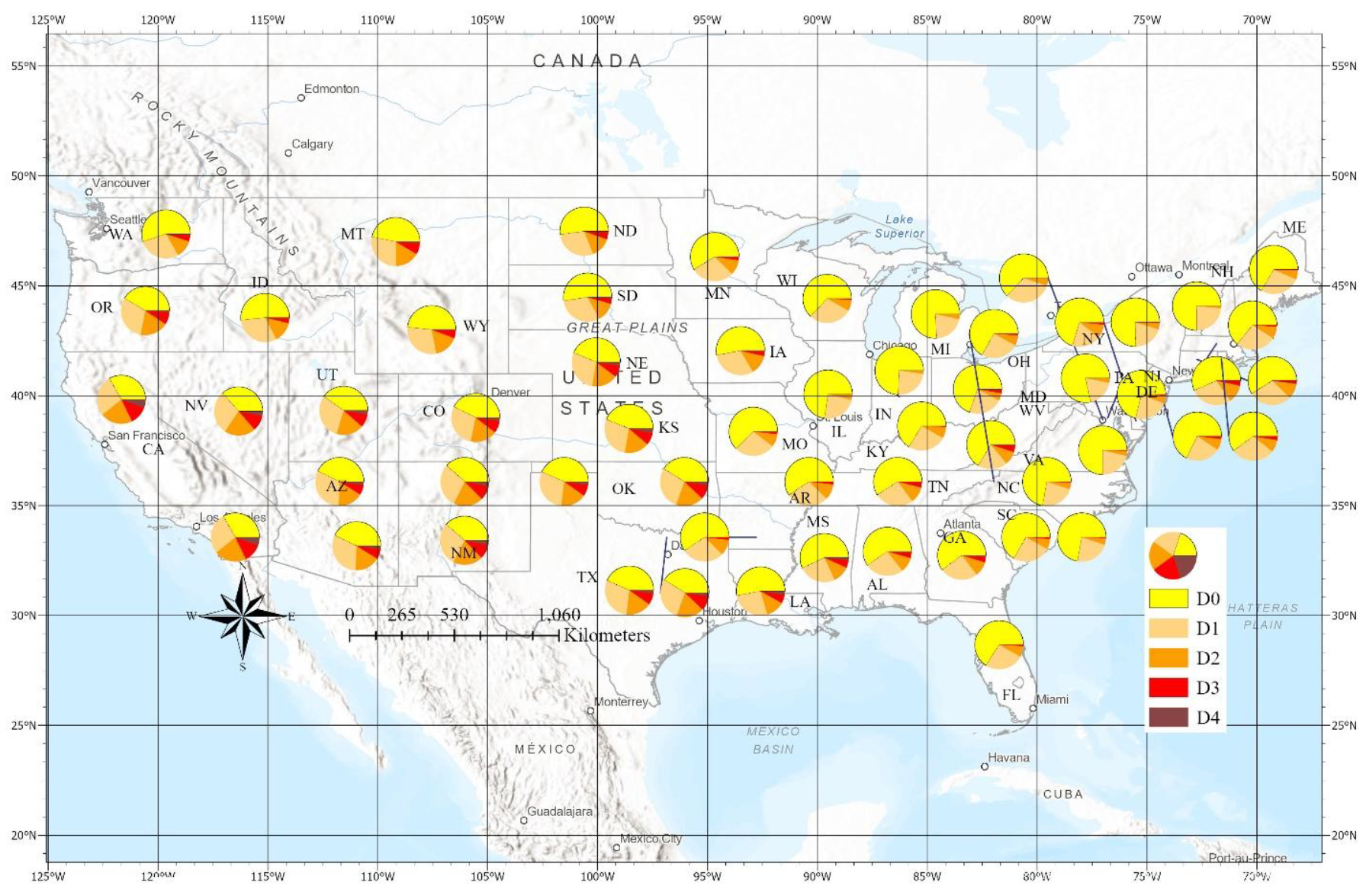

Figure 1 illustrates the distribution of drought across the U.S. based on average USDM data from 2013 to 2023. Drought conditions are classified as follows: D0 represents abnormal conditions (yellow), and D4 denotes exceptional drought (brown). On average, 39%, 21%, 11%, 4%, and 1% of the U.S. experienced abnormal, mild, severe, extreme, and exceptional droughts, respectively. For California, these percentages are significantly higher, with 71%, 58%, 46%, 26%, and 12% of the state affected by abnormal, mild, severe, extreme, and exceptional droughts, respectively. In Texas, the corresponding values are 56%, 39%, 22%, 10%, and 3%. As shown in

Figure 1, California experienced a notably higher proportion of exceptional drought (12%) compared to Texas (3%) and the U.S. average (1%). The overall percentages for the U.S. are lower than those for Texas and California, primarily due to the influence of wetter states.

2.2. Data Collection

2.2.1. DSCI

The DSCI (Akyuz, 2017) is an experimental method for converting drought levels from the U.S. Drought Monitor map to a single value for an area. DSCI values are part of the U.S. Drought Monitor data tables. Possible values of the DSCI are from 0 to 500. Zero means that none of the area is abnormally dry or in drought, and 500 means that all the area is in D4, exceptional drought. To quantify the impact of drought on the stock market, the DSCI data from 2013 to 2023 were obtained from USDM.

2.2.2. Selected Stocks in Water, Agricultural, and Industrial Sectors

To analyze the impacts of drought on stock performance, stock price data from 2013 to 2023 were obtained from the Nasdaq website. The analysis focused on selected companies in key sectors affected by drought. In the water management sector, American Water Works (AWK), a leader in water services and infrastructure, was included for its significant role in addressing water-related challenges. In the food services sector, Chipotle Mexican Grill (CMG) and Starbucks (SBUX) were chosen due to their reliance on agricultural inputs that are directly influenced by drought conditions. Lastly, Tesla (TSLA) was selected from the industrial sector, representing companies with global operations and supply chains. These companies were chosen for their direct or indirect exposure to drought risks, offering diverse perspectives on sector-specific impacts.

2.3. Correlation Analysis

To evaluate the relationship between drought severity and stock performance, Pearson correlation coefficients were calculated. This method was chosen for its ability to quantify the strength and direction of linear relationships between two variables. Various lag times, extending up to five years, were applied to account for the delayed economic impacts of drought on stock market indices, as these effects often take time to appear in financial markets. Correlations were analyzed across monthly, quarterly, and yearly timeframes to identify temporal patterns and trends.

3. Results

3.1. Trends in Drought Severity and Stock Prices

The DSCI data revealed that large portions of the U.S. experienced severe droughts in 2013 and from 2020 to 2023. These drought periods coincided with significant declines in stock prices for companies in agriculture and water management sectors, such as American Water Works (AWK). In contrast, industrial and food service stocks, including Tesla (TSLA) and Starbucks (SBUX), were less affected due to their diversified supply chains and global operations.

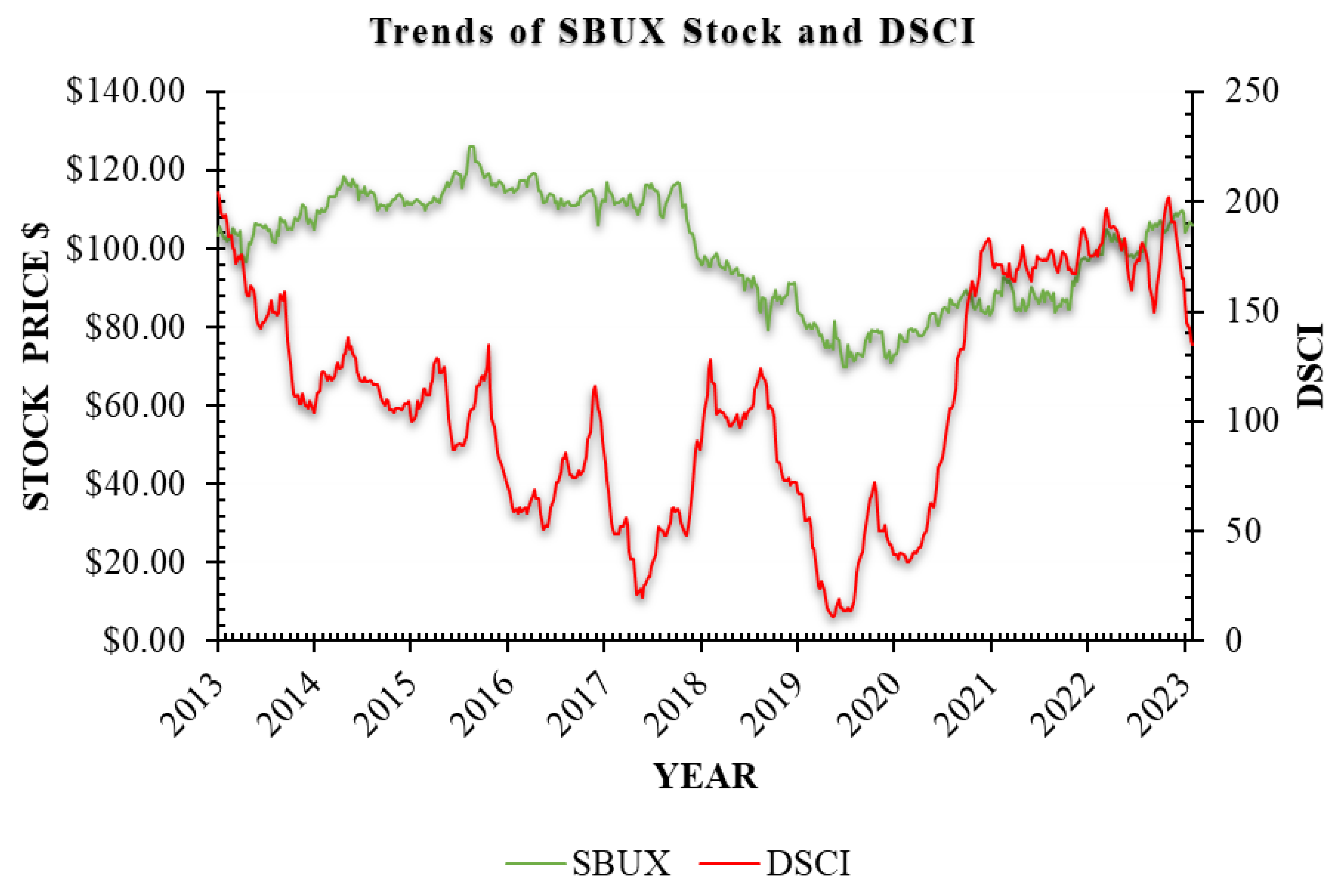

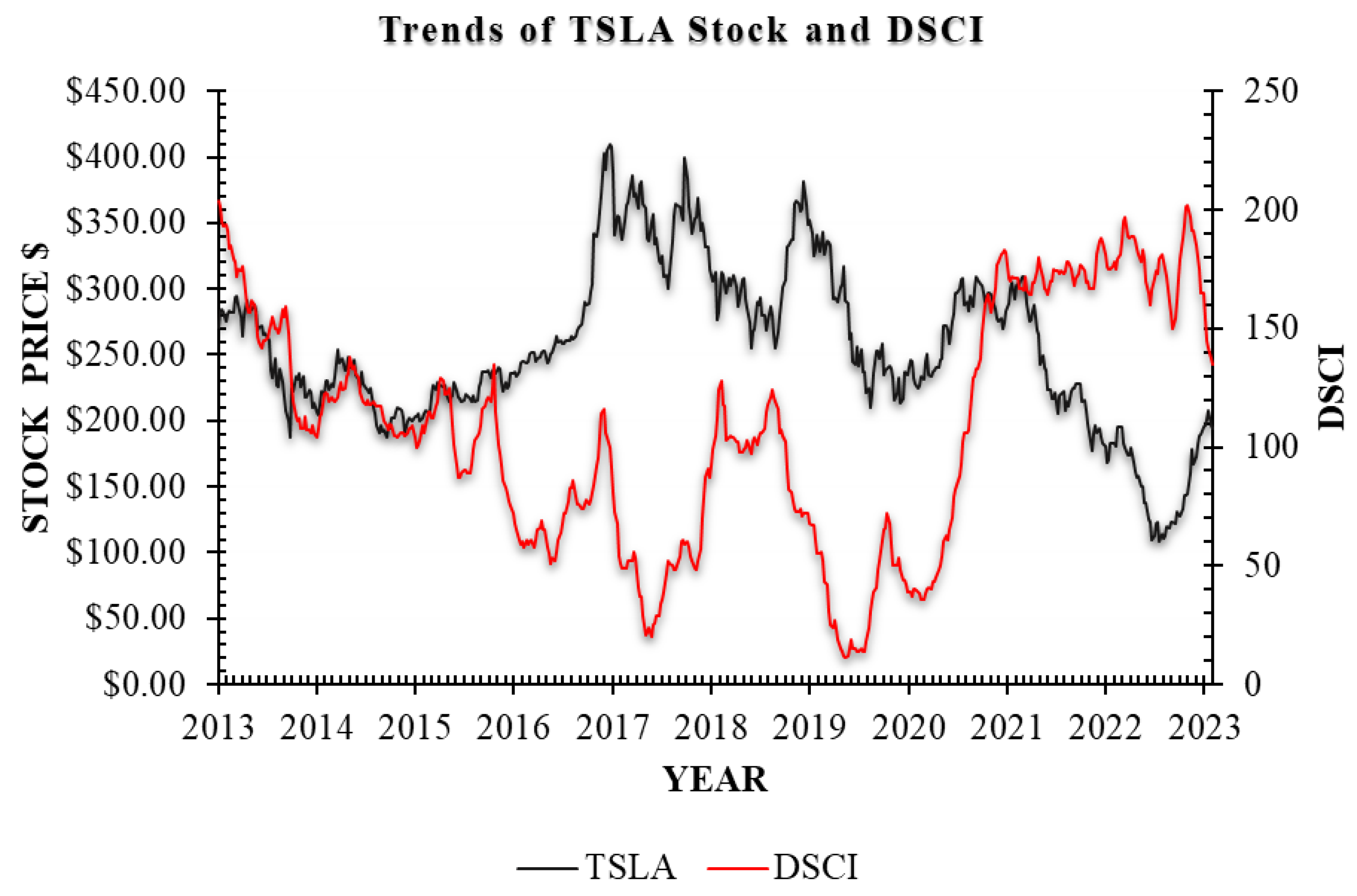

Figure 2 illustrates the trends in stock indices for AWK, SBUX, TSLA, and Chipotle Mexican Grill (CMG) in relation to DSCI values during these periods. The trend in

Figure 2 demonstrates a strong correlation between drought conditions and stock market prices. Notably, as drought peaked in 2018, a corresponding decline in AWK stock prices was observed. However, due to the COVID-19 pandemic, stock market fluctuations became largely independent of drought and its impacts. Similar patterns are evident for SBUX (

Figure 3), TSLA (

Figure 4), and CMG (

Figure 5). The COVID-19 pandemic triggered one of the most significant stock market crashes in history, occurring in March 2020. Sharp declines in NASDAQ insurance stock indices were particularly evident following the onset of the pandemic and in March 2020 (Li and Su, 2023).

3.2. Correlation Analysis

3.2.1. Yearly Analysis

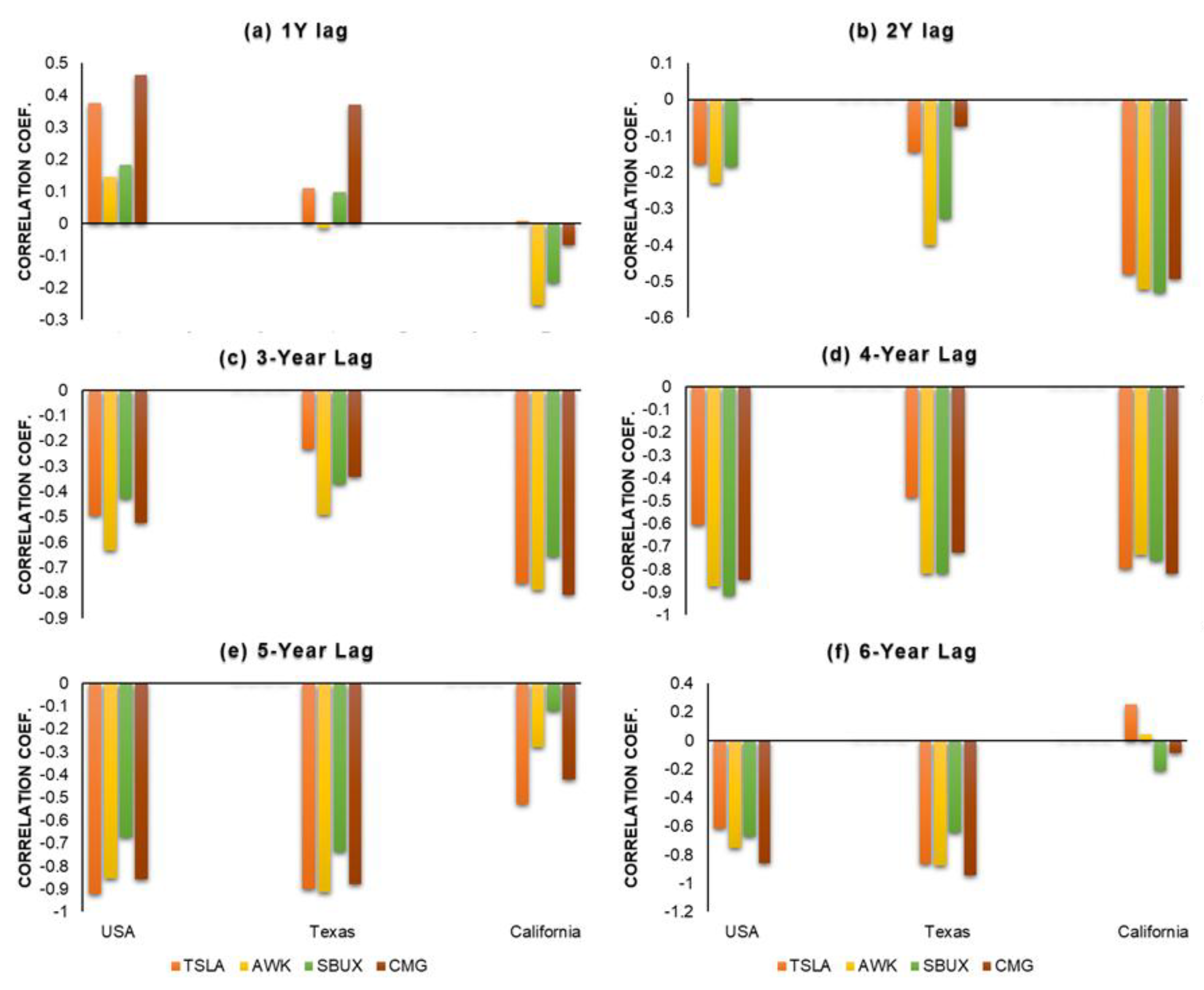

Initial analysis without lagging the data showed no significant correlations between drought severity and stock performance. However, when applying a 4-year lag, strong negative correlations (-0.6 to -0.85) were observed for agriculture-related stocks such as AWK. These results suggest that drought impacts on agricultural companies may take several years to fully manifest due to delayed effects on crop production and water resource management.

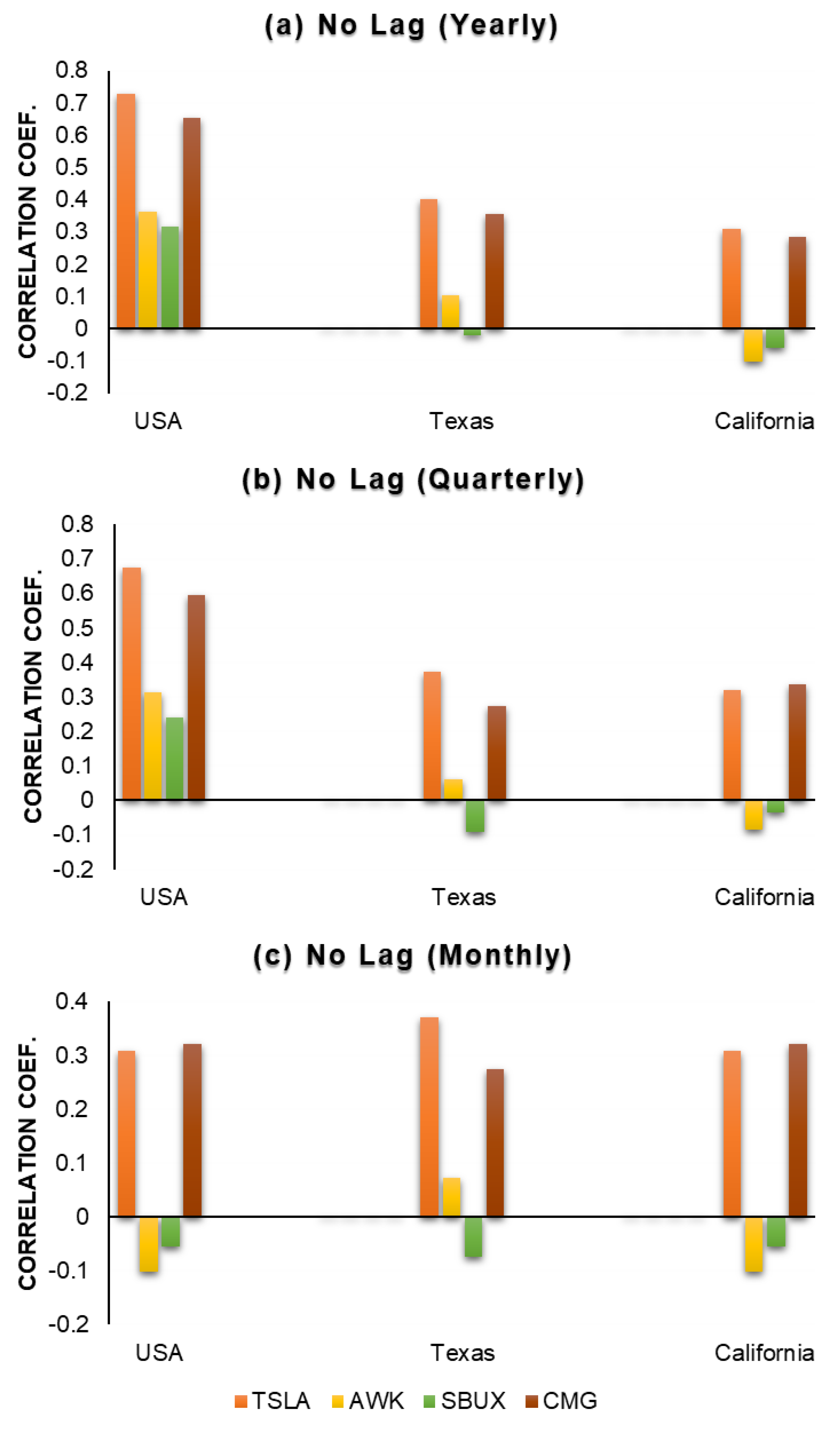

Figure 6 displays correlation coefficients with no lag, while

Figure 7 shows correlations with varying yearly lags, highlighting the 4-year lag as the most significant.

3.2.2. Quarterly Analysis

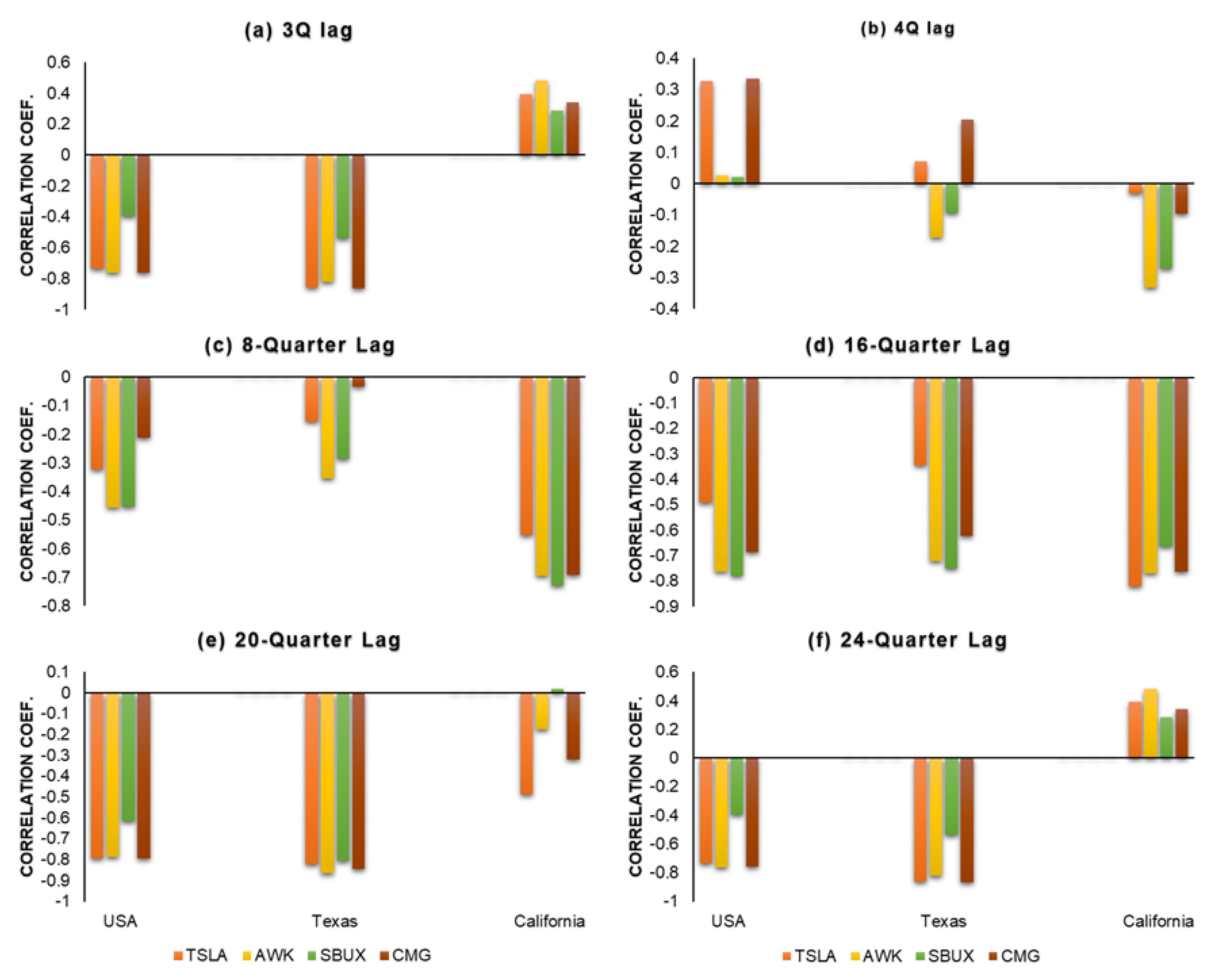

To capture shorter-term trends, quarterly correlations were also examined. Quarterly correlations revealed the highest sensitivity to drought at 16- and 20-quarter lags, particularly for water management stocks like AWK. These findings underscore the importance of considering intermediate timeframes, as they may capture more nuanced relationships between drought and stock performance. The geographic concentration of AWK’s operations in drought-prone regions like California may explain its heightened sensitivity.

Figure 8 illustrates the correlation coefficients across quarterly lags, with notable peaks at 16 and 20 quarters.

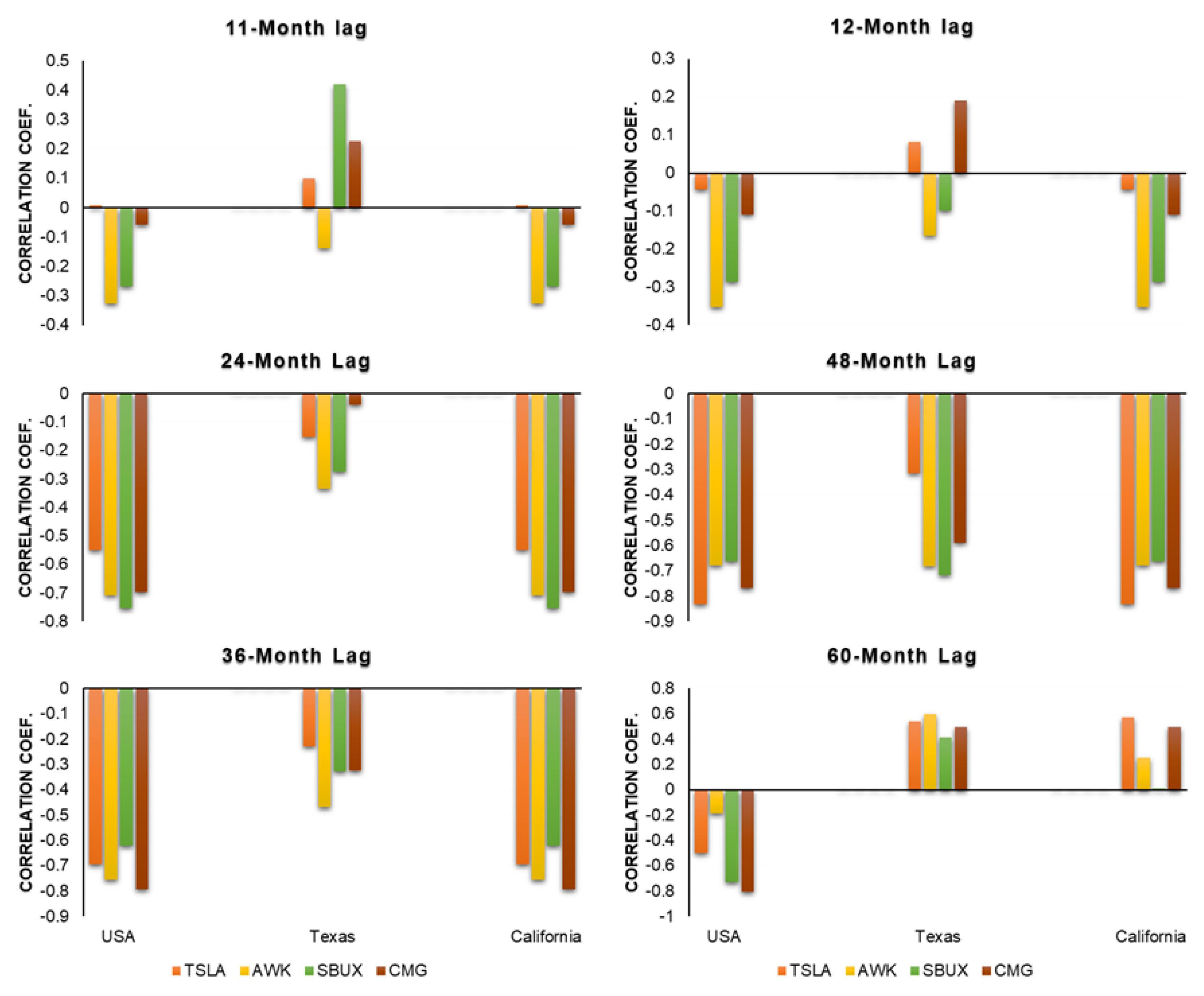

3.2.3. Monthly Analysis

Monthly analysis identified peak correlations at 36- and 48-month lags, with CMG demonstrating the strongest response. This is likely due to its reliance on locally sourced ingredients, which are directly affected by prolonged drought conditions. By contrast, stocks like SBUX, which source ingredients globally, showed weaker monthly correlations.

Figure 9 highlights the monthly correlations with various lag periods, emphasizing the impact of longer drought durations on locally dependent businesses.

4. Discussion

The findings of this study highlight the delayed economic impacts of drought on stock markets, particularly in agriculture and water management sectors. Agriculture stocks demonstrated the strongest negative correlations, reflecting the direct impact of drought on crop yields and the associated economic repercussions. Similarly, water management stocks were significantly affected, as reduced water availability during droughts poses challenges for both industrial and municipal uses.

In contrast, industrial manufacturing and food services exhibited weaker correlations with drought severity. For example, Tesla’s global operations mitigate its exposure to regional drought conditions, while Starbucks’ reliance on international supply chains reduces its sensitivity to U.S. droughts. These sectoral differences underscore the importance of understanding how geographic and operational factors influence a company’s vulnerability to climate risks.

The results emphasize the necessity of considering lag effects when evaluating the financial risks associated with drought. The observed 2- to 5-year delays in economic impacts highlight the importance of long-term planning for investors and businesses. Incorporating climate resilience into financial and operational strategies is critical. This includes diversifying supply chains, investing in drought-resistant technologies, and improving water management practices to mitigate potential risks.

These findings align with previous studies that highlight the economic impacts of climate-related natural disasters, though the magnitude and timing of effects vary across sectors. However, this study is limited by its focus on U.S. data, which may not fully capture global dynamics, and by its exclusion of mediating factors such as government policies and market conditions. Future research should expand the scope to include international data and explore the interplay of additional factors influencing the relationship between drought and financial performance.

By shedding light on the delayed and sector-specific impacts of drought, this study contributes to a growing body of literature on climate change and financial risk. The findings provide actionable insights for investors, policymakers, and businesses to proactively address climate-related challenges and enhance market resilience in the face of increasing climate variability.

5. Conclusion

This study demonstrates that drought significantly affects the stock market, with impacts manifesting over a lag period of 2 to 5 years. The results reveal varying levels of vulnerability among companies, depending on their supply chain structures and geographic operations. For instance, Chipotle, which relies heavily on locally sourced ingredients, shows greater sensitivity to U.S. drought conditions. Conversely, Tesla, with a substantial portion of its factories located outside the U.S., is less affected by domestic droughts. Similarly, Starbucks sources its ingredients predominantly from regions outside the U.S., such as South America, where similar drought propagation patterns may contribute to observed correlations.

There is a noticeable alignment between drought trends and stock market performance. However, the unprecedented recession and recovery during the COVID-19 pandemic in 2019 and 2020 disrupted this relationship, causing stock market fluctuations to become detached from drought impacts.

Beyond these findings, the study highlights the importance of considering additional mediating factors that influence the relationship between drought and stock market performance, such as government policies, global market dynamics, and corporate resilience strategies. While this study focuses solely on drought impacts, future research could examine these factors in greater depth to provide a more comprehensive understanding of the complex interplay between climate events and financial markets.

By exploring these dimensions, future studies can support businesses, investors, and policymakers in developing adaptive strategies to mitigate climate-related financial risks and enhance market resilience in the face of increasing climate variability.

References

- (n.d.). Historical Data. NASDAQ. Retrieved February 1, 2023, from https://www.nasdaq.com/market-activity/stocks.

- Akyuz, F. A. 2017. Drought Severity and Coverage Index. United States Drought Monitor. https://droughtmonitor.unl.edu/About/AbouttheData/DSCI.aspx.

- Bazrkar, M. H., J. Zhang, and X. Chu. 2020. Hydroclimatic aggregate drought index (HADI): A new approach for identification and categorization of drought in cold climate regions. Stochastic Environmental Research and Risk Assessment, 34(11), 1847-1870. [CrossRef]

- Chavas, J. P., Knapp, K. C., & Iqbal, M. (2016). The economic impact of drought: a US case study. Agricultural Economics, 47(3), 271-281.

- Chen, S., Miao, H., & Wang, Y. (2021). The Impact of Climate Change on Stock Market Returns: Evidence from the United States. Journal of Business Ethics, 168(4), 733-753.

- Cheng, X., Wang, Y., & Wu, X. (2022). The effects of drought on stock prices: An industry-specific perspective. Frontiers in Environmental Science, 10, 978404. [CrossRef]

- European Environment Agency. (2023). Stock-taking analysis and outlook of drought policies, planning, and management in EU member states. Retrieved from https://climate-adapt.eea.europa.eu/en/metadata/publications/stock-taking-analysis-and-outlook-of-drought-policies-planning-and-management-in-eu-member-states.

- Hong, H., Li, F. W., & Xu, J. (2019). Climate risks and market efficiency. Journal of Econometrics, 208(1), 265-281. [CrossRef]

- Hoover, J., Johnson, T., & Knudson, C. (2016). Wildfires and drought: perceived impacts on the electric utility industry in the western United States. Natural Hazards, 82(3), 1945-1961.

- Huynh, T. D., Nguyen, T. H., & Truong, C. (2020). Climate risk: The price of drought. Journal of Corporate Finance, 65, 101750. [CrossRef]

- Koomey, J. G., Deyette, J., & Wong, H. (2016). Economic and environmental impacts of the California drought. Environmental Research Letters, 11(7), 075009.

- Li, L., Guan, D., Tao, S., & Su, X. (2018). Effects of drought on US crop yields: a spatial econometric analysis. Environmental Research Letters, 13(5), 054021.

- Li, X., & Su, F. (2023). The Dynamic Effects of COVID-19 and the March 2020 Crash on the Multifractality of NASDAQ Insurance Stock Markets. Fractal and Fractional, 7(1), 91. [CrossRef]

- National Drought Mitigation Center. (2023). Agriculture and drought. Retrieved from https://www.drought.gov/sectors/agriculture.

- National Integrated Drought Information System (NIDIS). (n.d.). Agriculture. U.S. Drought Portal. Retrieved [Jan17, 2025], from https://www.drought.gov/sectors/agriculture.

- National Renewable Energy Laboratory. (2018). The water-energy nexus: impact of drought on electricity supply. Technical Report NREL/TP-6A20-71521.

- Schnepf, R. (2014). Drought in the United States: causes and issues for Congress. Congressional Research Service.

- Seager, R., et al. (2022). California’s exceptional drought conditions in 2021. Environmental Research Letters, 17(5), 0456. [CrossRef]

- U.S. Department of Agriculture. (2023). Potential drought impacts on prices and crop production. Retrieved from https://www.ndsu.edu/agriculture/ag-hub/ag-topics/farm-management/disasters/drought/crops/potential-drought-can-impact-prices-and.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).