1. Introduction

In today's complex and uncertain global business environment, enterprises are faced with unprecedented challenges and opportunities. On the one hand, rapid technological advancements, swift changes in market demand, and fierce competition compel enterprises to constantly innovate in order to maintain their competitiveness. On the other hand, various emergencies, such as global public health crises, economic fluctuations, and natural disasters, have posed a severe test to the survival and sustainable development of enterprises. Consequently, the traditional mode of enterprise development can hardly adapt to the requirements of the new situation. High-quality enterprise development is no longer confined to the pursuit of scale expansion and short-term profit growth; instead, it lays greater emphasis on sustainable competitiveness, innovation, the balance between economic and social benefits, and long-term value creation [

1]. To achieve high-quality development, enterprises are required to be able to provide high-quality products and services to meet consumers' increasingly diversified and individualized needs. Meanwhile, they should possess efficient operation and management capabilities to allocate resources rationally, cut costs, and enhance productivity. Additionally, they need to actively fulfill their social responsibilities and attach importance to environmental protection, thus realizing the coordinated development of the economy, society, and the environment [

2]. However, realizing the high-quality development of enterprises is by no means an easy feat, and many enterprises encounter multiple obstacles during the development process. For instance, the lack of innovative capabilities results in severe product homogenization, making it difficult for them to stand out in the market. In the face of sudden changes in the external environment, the absence of sufficient coping abilities causes the business to suffer a serious impact or even plunge into difficulties. With this background, how to realize the high-quality development of enterprises has become a focus of attention in both academic and practical circles.

Innovation serves as the core driving force for enterprise development. However, a single innovation model can no longer meet all the needs of enterprises' high-quality development. The real competitive advantage lies in the sustainable development and growth of enterprises, which can be achieved by those that carry out both exploitative innovation and exploratory innovation [

3]. Exploitative innovation specifically emphasizes continuously extending existing technology and knowledge, expanding existing products and services, and enhancing the exploitability of existing products as well as the efficiency of marketing strategies through continuous quality improvement. In this way, it aims to satisfy current customer needs and market demands [

4] [

5]. Exploratory innovation is associated with complex search, basic research, innovation, variation, and risk tolerance. It involves the continuous pursuit of new knowledge and the development of new products and services that are designed to meet potential or emerging customer needs and market demands [

6] [

7]. Enterprises need to balance the synergistic development of these two types of innovation and avoid over-relying on one mode of innovation. Over-relying on exploratory innovation may result in excessive risks and waste of resources, while focusing solely on exploitative innovation might cause enterprises to fall into an innovation bottleneck and miss opportunities for long-term development [

8].

In the current complex and dynamic environment, the process and results of innovation will expose enterprises to more uncertainty. In order to maintain competitiveness within this changing and uncontrollable environment, organizations must possess the abilities to foresee, prepare for, cope with, and adapt to both general changes and major sudden changes, namely organizational resilience [

9]. Organizational resilience, as an implicit ability of organizations to effectively respond to the impact of unexpected events in uncertain environments, can assist firms in transforming the uncertainty in the innovation process into opportunities and conditions for innovation [

10]. Enterprises with high organizational resilience are capable of giving early warnings, reserving resources, flexibly adjusting strategies to minimize losses, and optimizing changes after a crisis. By doing so, they can enhance the innovation efficiency and success rate of the enterprise, which helps the enterprise turn the crisis into an opportunity and achieve counter-trend growth as well as sustainable growth [

11].

However, the development of an enterprise is a dynamic process, and it will undergo different life cycle stages during its development [

12]. Enterprises at each stage possess different characteristics and face distinct problems and challenges. Correspondingly, their requirements for ambidextrous innovation and organizational resilience, as well as the impact of these two factors on the high-quality development of the enterprise, will also differ. Nevertheless, few scholars have explored the impact of innovation on enterprise high-quality development and the dynamic relationship between ambidextrous innovation and enterprise high-quality development in different life cycle stages from the perspectives of exploratory innovation and exploitative innovation. herefore, by adopting the dynamic perspective of the enterprise life cycle and conducting in-depth research on the relationship among ambidextrous innovation, organizational resilience, and enterprise high-quality development, we can reveal its intrinsic mechanism of action more comprehensively and accurately. This, in turn, can provide powerful theoretical support for enterprises to formulate reasonable strategic decisions at different stages of their development.

The contributions of this paper are as follows: Firstly, it comprehensively takes into account the innovation heterogeneity and enterprise life cycle heterogeneity, conducts an in-depth analysis of the differences in the impact of ambidextrous innovation on enterprise high-quality development at different stages, and provides incremental evidence for the empirical research on the relationship between innovation and enterprise high-quality development. Secondly, organizational resilience is incorporated into the research path where innovation affects enterprise high-quality development, clarifying the mechanism through which ambidextrous innovation influences enterprise high-quality development by enhancing organizational resilience. Thirdly, exploring the relationship between ambidextrous innovation and the high-quality development of enterprises at different life cycle stages can assist enterprises in carrying out exploratory and exploitative innovation activities in a more scientific and targeted manner in the VUCA (Volatile, Uncertain, Complex, and Ambiguous) environment.

5. Discussion

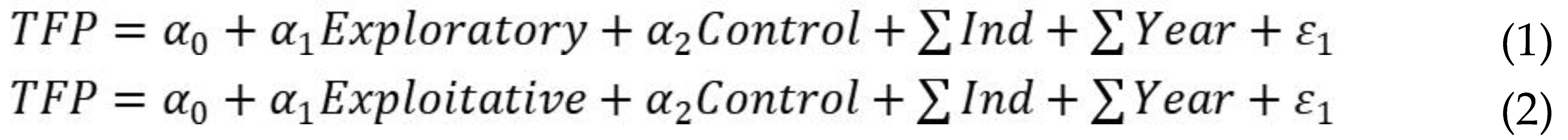

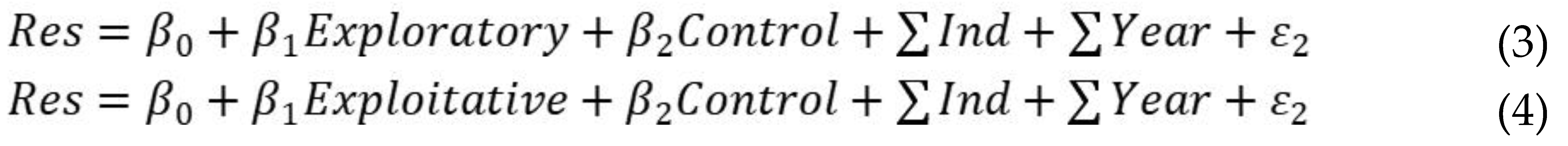

Taking organizational resilience as the mediating variable, this paper incorporates ambidextrous innovation, organizational resilience, and enterprise high-quality development into the same research framework. It explores the impact of ambidextrous innovation on enterprise high-quality development at different life cycle stages and reveals the mechanism through which ambidextrous innovation influences enterprise high-quality development capability under the VUCA environment.

Using Shanghai and Shenzhen A-share listed companies as research samples, in line with the research content of this paper and based on the organizational ambidextrous theory, dynamic capability theory, and enterprise life cycle theory, we propose hypotheses and conduct empirical tests. Eventually, the following research conclusions are drawn:

Firstly, both exploratory innovation and exploitative innovation can effectively promote the high-quality development of enterprises. Exploitative innovation can significantly enhance short-term financial performance, stabilize current earnings, and maintain an enterprise's market position and core competitiveness by improving existing products and technologies and providing better products and services for customers in the current market. Exploratory innovation, on the other hand, aims to tap new profit growth points, capture new market opportunities, and gain sustainable competitive advantages in the future by creating new knowledge, products, and technologies. Hence, both exploratory innovation and exploitative innovation can effectively contribute to the high-quality development of an enterprise to a certain extent.

Secondly, there are differences in the effects of the two dimensions of ambidextrous innovation, namely exploratory innovation and exploitative innovation, on the high-quality development of enterprises in different life cycle stages. During the three stages of growth, maturity, and decline, the positive effects of both exploratory innovation and exploitative innovation on the high-quality development of enterprises are significant. Exploratory innovation has the most significant promoting effect on enterprises in the growth stage, while exploitative innovation plays the most prominent role in promoting the high-quality development of enterprises in the maturity stage.

Thirdly, both exploratory innovation and exploitative innovation can facilitate the improvement of organizational resilience within enterprises. By observing crisis events, constantly predicting industry developments, and learning from the coping behaviors of other industry enterprises, those enterprises that have been carrying out exploratory innovation and exploitative innovation activities over a long period can effectively enhance their organizational anticipation, coping, and adaptive abilities. This enables enterprises that are constantly exploring new opportunities to more actively engage in creative knowledge integration, helps them better identify and handle risks, and strengthens their crisis coping capabilities. Moreover, an enterprise's ability to cope with crises can be utilized to drive its own development.

Fourthly, organizational resilience has a partial mediating effect between exploratory innovation, exploitative innovation, and the high-quality development of enterprises. Enterprises can enhance their resilience through the implementation of exploratory innovation and exploitative innovation activities, which, in turn, has a positive impact on the quality of their development. Organizational resilience is essential for enterprises to achieve high-quality development. The continuous implementation of innovation activities not only promotes the upgrading of enterprise products and services but also enhances the resilience of enterprises, helping them flexibly respond to risks and challenges in the market, consolidate their core competitive advantages, and thus drive the high-quality development of enterprises.

5.1. Implications of the Study

Firstly, exploratory innovation and exploitative innovation are equally vital to enterprise development. Therefore, ambidextrous innovation activities should be carried out in a scientific manner to continuously inject impetus into enterprise development. During the process of enterprise growth, attention should not only be paid to stability and efficiency but also placed on long-term competitive advantages. To this end, enterprises ought to establish an ambidextrous innovation synergy mechanism in light of the internal and external environments as well as the requirements of their development characteristics. Meanwhile, they should combine their own resource advantages and organizational traits to make appropriate selections regarding ambidextrous innovation activities and allocate resources reasonably between exploratory innovation and exploitative innovation, thus achieving coordination and balance between the two. In daily operations, on one hand, enterprises should conduct exploratory innovation activities to explore new markets and seize new opportunities to guarantee their future development. On the other hand, they should also focus on exploitative innovation to continuously improve existing products, technologies, and capabilities, thereby enhancing operational efficiency and maintaining their current survival and development. Moreover, the relationship between exploratory innovation and exploitative innovation should be managed well simultaneously to realize the balance and complementarity of the two, which can provide a more enduring and powerful driving force for enterprise development.

Secondly, enterprises should integrate their own development stage with the internal and external environments to formulate dynamic and differentiated innovation strategies. In a VUCA (Volatile, Uncertain, Complex, and Ambiguous) environment, the market landscape is changing rapidly, and the progress of science and technology is evolving on a daily basis. As a result, enterprises need to constantly adjust their innovation models and development strategies by devising a framework for selecting and adjusting enterprise strategy orientation based on the diverse internal and external environments they encounter at each development stage. When determining whether to adopt a radical or conservative innovation strategy, they should also take into account the life cycle stage and development characteristics of the enterprise itself. It is crucial to comprehensively evaluate the adaptability of exploratory and exploitative innovations at different stages and allocate enterprise resources rationally. Scarce high-quality resources should be distributed appropriately between exploratory and exploitative innovations to maximize innovation efficiency. This targeted innovation approach will enable enterprises to continuously enhance their innovation levels and foster core competitive advantages, thereby better achieving high-quality development.

Thirdly, while carrying out innovation activities, enterprises should also attach importance to the cultivation of organizational resilience and strike a balance between innovation risks and resilience capabilities. In the current VUCA environment, numerous low-probability crisis events occur frequently. The objective of an enterprise is not only to develop and expand but also to possess the ability to respond promptly to emergencies and progress steadily. During the process of conducting innovative activities, it is necessary to establish a comprehensive risk control mechanism, strengthen internal prevention, foster risk awareness, and improve its perception and decision-making abilities when confronted with risks, so as to promote the enterprise's "dualistic" activities. When formulating strategies and making decisions regarding innovation activities, enterprises should combine them with the actual situation, fully analyze the market environment, competitive landscape, and internal and external resources to reasonably formulate plans for exploratory innovation and exploitative innovation, thereby achieving effective risk distribution and risk management. At the same time, enterprises should focus on cultivating resilience during the innovation process. The enhancement of organizational resilience is beneficial for enterprises to seize development opportunities while dealing with crises and achieve counter-trend growth. When facing emergencies, highly resilient enterprises can quickly detect and respond to various risks, effectively integrate and coordinate internal and external resources, and make steady progress by virtue of organizational resilience. Organizations should build resilience capabilities and adopt a proactive prediction attitude instead of a reactive response approach to face innovation risks, enabling them to respond swiftly to environmental changes and seize market opportunities.

5.2. Limitations and Future Research

Constrained by factors such as research methodology, research capability, data processing, and variable measurement, this study still has certain limitations.

Firstly, in this paper, ambidextrous innovation is divided into two dimensions, namely exploratory innovation and exploitative innovation, to explore its impact on the high-quality development of enterprises. However, in practice, enterprises usually conduct these two types of innovation activities simultaneously. This paper discusses the dimensions of exploratory innovation and exploitative innovation separately and fails to consider the impact of the balance and complementarity of ambidextrous innovation at a deeper level. Hence, future research could be enriched from more dimensions and perspectives related to ambidextrous innovation, so as to gain a more comprehensive and in-depth understanding of the impact of ambidextrous innovation on enterprises.

Secondly, the variable measurement of Organizational resilience in this paper has some limitations. Organizational resilience is a complex concept encompassing multiple levels and dimensions. In future research, more scientific and rigorous data and indicators can be employed to measure Organizational resilience.

Finally, the control variables selected in this paper may have limitations. The development of an enterprise is affected by numerous factors. This paper only chose some of the main factors with a relatively greater impact as control variables, which might lead to the omission of other factors. Moreover, factors such as the external environment and the macroeconomic situation were not taken into account. In future research, it should be considered to incorporate more factors into the model for the study of the high-quality development of the enterprise.

Table 1.

Variable definitions and deescriptions.

Table 1.

Variable definitions and deescriptions.

| Type |

Variable Name |

Variable Symbol |

Variable Definition |

| Explained Variable |

High-Quality Enterprise Development |

TFP |

Total Factor Productivity Of Enterprises By Lp Method |

| Explanatory Variable |

Exploratory Innovation |

Exploratory |

Ln (Number Of Patents For Inventions + 1) |

| Exploitative Innovation |

Exploitative |

Ln (Number Of Design And Utility Model Patents + 1) |

| Mediating Variable |

Organizational Resilience |

Resilience |

Composite Indicator Of Growth In Performance And Financial Volatility |

| Control Variable |

Number of Years Listed |

Age |

Age Of Listing |

| Enterprise Size |

Size |

Natural Logarithm Of Total Assets |

| Profitability |

Roa |

Return On Assets = Net Profit/Total Assets |

| Solvency |

Lev |

Gearing Ratio = Liabilities/Total Assets |

| Corporate Growth |

Growth |

Revenue Growth Rate |

| Business Risk |

Risk |

Consolidated Leverage = Financial Leverage * Operating Leverage |

| Board Size |

Board |

The Number Of Board Members Is Taken As a Natural Logarithm |

| Year |

Year |

Year Dummy Variable |

| Industry |

Ind |

Industry Dummy Variables |

Table 2.

Classification of enterprise life cycle stages.

Table 2.

Classification of enterprise life cycle stages.

| |

Growth Stage |

Maturation Stage |

Recession Stage |

| |

Inception |

Growth Stage |

Maturation Stage |

Turbulent Stage |

Turbulent Stage |

Turbulent Stage |

Recession

Stage |

Recession

Stage |

Cash Flow From

Operating Activities Symbol |

- |

+ |

+ |

- |

+ |

+ |

- |

- |

Cash Flow From

Investing Activities Symbol |

- |

- |

- |

- |

+ |

+ |

+ |

+ |

Cash Flow From

Financing Activities Symbol |

+ |

+ |

- |

- |

+ |

- |

+ |

- |

Table 3.

Descriptive Statistics for Key Variables.

Table 3.

Descriptive Statistics for Key Variables.

| Variable Name |

Sample Size |

Average Value |

Standard Deviation |

Minimum Value |

Median |

Maximum Value |

| TFP |

22418 |

8.373 |

1.036 |

5.204 |

8.256 |

13.096 |

| Exploratory |

22418 |

1.361 |

1.446 |

0 |

1.098 |

9.028 |

| Exploitative |

22418 |

1.424 |

1.589 |

0 |

1.098 |

9.221 |

| Res |

22418 |

0.891 |

0.054 |

0.742 |

0.899 |

0.974 |

| Size |

22418 |

22.290 |

1.295 |

20.045 |

22.085 |

26.302 |

| Age |

22418 |

9.660 |

7.262 |

0 |

8 |

30 |

| Roa |

22418 |

0.052 |

0.040 |

0.010 |

0.043 |

0.198 |

| Risk |

22418 |

2.128 |

2.139 |

0.873 |

1.447 |

15.48 |

| Growth |

22418 |

0.189 |

0.336 |

-0.412 |

0.128 |

1.970 |

| Lev |

22418 |

0.396 |

0.195 |

0.0482 |

0.387 |

0.833 |

| Board |

22418 |

2.127 |

0.198 |

1.099 |

2.197 |

2.890 |

Table 4.

Correlation analysis.

Table 4.

Correlation analysis.

| |

TFP |

Exploratory |

Exploitative |

Res |

Size |

Age |

Roa |

Risk |

Growth |

Lev |

Board |

| TFP |

1 |

|

|

|

|

|

|

|

|

|

|

| Exploratory |

0.141*** |

1 |

|

|

|

|

|

|

|

|

|

| Exploitative |

0.113*** |

0.714*** |

1 |

|

|

|

|

|

|

|

|

| Res |

0.092*** |

0.020*** |

0.011* |

1 |

|

|

|

|

|

|

|

| Size |

0.795*** |

0.149*** |

0.117*** |

0.137*** |

1 |

|

|

|

|

|

|

| Age |

0.370*** |

-0.117*** |

-0.141*** |

0.107*** |

0.450*** |

1 |

|

|

|

|

|

| Roa |

0.024*** |

0.089*** |

0.075*** |

-0.021*** |

-0.097*** |

-0.176*** |

1 |

|

|

|

|

| Risk |

-0.013* |

0.007 |

0.0110 |

-0.002 |

0.095*** |

0.117*** |

-0.436*** |

1 |

|

|

|

| Growth |

0.090*** |

0.003 |

-0.015** |

0.030*** |

0.019*** |

-0.105*** |

0.172*** |

-0.118*** |

1 |

|

|

| Lev |

0.555*** |

0.007 |

0.030*** |

0.024*** |

0.567*** |

0.347*** |

-0.398*** |

0.280*** |

0.056*** |

1 |

|

| Board |

0.173*** |

0.024*** |

0.011* |

0.011* |

0.262*** |

0.162*** |

-0.037*** |

0.062*** |

-0.032*** |

0.144*** |

1 |

Table 5.

Benchmark regression results.

Table 5.

Benchmark regression results.

| Variables |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| TFP |

TFP |

Res |

Res |

TFP |

TFP |

| Exploratory |

0.023*** |

|

0.072*** |

|

0.023*** |

|

| |

(8.07) |

|

(6.12) |

|

(7.93) |

|

| Exploitative |

|

0.019*** |

|

0.088*** |

|

0.019*** |

| |

|

(7.33) |

|

(8.01) |

|

(7.15) |

| Res |

|

|

|

|

0.532*** |

0.522*** |

| |

|

|

|

|

(3.30) |

(3.24) |

| Size |

0.558*** |

0.561*** |

0.372*** |

0.372*** |

0.556*** |

0.559*** |

| |

(140.67) |

(143.34) |

(22.58) |

(22.96) |

(138.63) |

(141.22) |

| Age |

0.003*** |

0.003*** |

0.025*** |

0.026*** |

0.003*** |

0.003*** |

| |

(5.27) |

(5.40) |

(10.07) |

(10.48) |

(5.04) |

(5.16) |

| Roa |

3.772*** |

3.763*** |

-2.987*** |

-3.112*** |

3.788*** |

3.779*** |

| |

(34.60) |

(34.46) |

(-6.61) |

(-6.88) |

(34.72) |

(34.58) |

| Risk |

-0.028*** |

-0.029*** |

-0.034*** |

-0.034*** |

-0.028*** |

-0.028*** |

| |

(-15.28) |

(-15.30) |

(-4.38) |

(-4.42) |

(-15.18) |

(-15.20) |

| Growth |

0.108*** |

0.109*** |

-0.678*** |

-0.667*** |

0.112*** |

0.113*** |

| |

(9.77) |

(9.86) |

(-14.73) |

(-14.50) |

(10.05) |

(10.13) |

| Lev |

1.234*** |

1.229*** |

-1.273*** |

-1.299*** |

1.241*** |

1.236*** |

| |

(46.53) |

(46.30) |

(-11.58) |

(-11.81) |

(46.66) |

(46.42) |

| Board |

-0.064*** |

-0.064*** |

0.173** |

0.169** |

-0.065*** |

-0.065*** |

| |

(-3.39) |

(-3.37) |

(2.19) |

(2.14) |

(-3.44) |

(-3.42) |

| Constant |

-4.824*** |

-4.879*** |

84.684*** |

84.676*** |

-5.274*** |

-5.321*** |

| |

(-53.74) |

(-55.03) |

(227.49) |

(230.51) |

(-32.29) |

(-32.68) |

| Ind |

YES |

YES |

YES |

YES |

YES |

YES |

| Year |

YES |

YES |

YES |

YES |

YES |

YES |

| N |

22418 |

22418 |

22418 |

22418 |

22418 |

22418 |

| R-squared |

0.739 |

0.740 |

0.837 |

0.837 |

0.729 |

0.731 |

Table 6.

Enterprise life cycle grouping regression results.

Table 6.

Enterprise life cycle grouping regression results.

| Variables |

Growth Stage |

Maturation Stage |

Recession Stage |

| TFP |

TFP |

TFP |

TFP |

TFP |

TFP |

| Exploratory |

0.026*** |

|

0.020*** |

|

0.018** |

|

| |

(6.02) |

|

(5.60) |

|

(2.21) |

|

| Exploitative |

|

0.017*** |

|

0.022*** |

|

0.011** |

| |

|

(4.22) |

|

(5.95) |

|

(2.57) |

| Size |

0.547*** |

0.551*** |

0.564*** |

0.565*** |

0.582*** |

0.584*** |

| |

(88.82) |

(90.64) |

(97.77) |

(99.76) |

(53.39) |

(54.16) |

| Age |

0.006*** |

0.006*** |

0.003*** |

0.003*** |

-0.006*** |

-0.006*** |

| |

(5.78) |

(5.80) |

(3.75) |

(3.90) |

(-3.92) |

(-3.90) |

| Roa |

3.729*** |

3.769*** |

3.702*** |

3.671*** |

3.424*** |

3.427*** |

| |

(18.09) |

(18.28) |

(25.13) |

(24.86) |

(12.78) |

(12.78) |

| Risk |

-0.034*** |

-0.034*** |

-0.026*** |

-0.026*** |

-0.024*** |

-0.024*** |

| |

(-12.23) |

(-12.17) |

(-9.01) |

(-9.06) |

(-4.99) |

(-5.00) |

| Growth |

0.135*** |

0.134*** |

0.064*** |

0.068*** |

0.186*** |

0.186*** |

| |

(8.67) |

(8.53) |

(3.20) |

(3.39) |

(6.69) |

(6.68) |

| Lev |

1.172*** |

1.169*** |

1.257*** |

1.249*** |

1.514*** |

1.511*** |

| |

(27.22) |

(27.10) |

(31.66) |

(31.43) |

(22.97) |

(22.92) |

| Board |

-0.076** |

-0.074** |

-0.070** |

-0.071** |

-0.059 |

-0.057 |

| |

(-2.57) |

(-2.50) |

(-2.51) |

(-2.58) |

(-1.17) |

(-1.14) |

| Constant |

-4.542*** |

-4.641*** |

-4.969*** |

-4.996*** |

-5.177*** |

-5.231*** |

| |

(-32.44) |

(-33.56) |

(-38.03) |

(-38.71) |

(-21.29) |

(-21.72) |

| Ind |

YES |

YES |

YES |

YES |

YES |

YES |

| Year |

YES |

YES |

YES |

YES |

YES |

YES |

| N |

9,363 |

9,363 |

8,897 |

8,897 |

4,158 |

4,158 |

| R-squared |

0.731 |

0.730 |

0.784 |

0.784 |

0.692 |

0.692 |

Table 7.

Regression results with replacement of explanatory variables.

Table 7.

Regression results with replacement of explanatory variables.

| Variables |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| TFP |

TFP |

Res |

Res |

TFP |

TFP |

| Exploratory |

0.005** |

|

0.072*** |

|

0.005*** |

|

| |

(1.99) |

|

(6.12) |

|

(2.55) |

|

| Exploitative |

|

0.007*** |

|

0.088*** |

|

0.007*** |

| |

|

(2.82) |

|

(8.01) |

|

(2.93) |

| Res |

|

|

|

|

0.293*** |

0.330*** |

| |

|

|

|

|

(3.30) |

(3.24) |

| Size |

0.397*** |

0.401*** |

0.372*** |

0.372*** |

0.396*** |

0.400*** |

| |

(100.85) |

(103.36) |

(22.58) |

(22.96) |

(99.45) |

(101.86) |

| Age |

0.004*** |

0.003*** |

0.025*** |

0.026*** |

0.004*** |

0.003*** |

| |

(6.14) |

(5.54) |

(10.07) |

(10.48) |

(6.00) |

(5.38) |

| Roa |

2.914*** |

2.955*** |

-2.987*** |

-3.112*** |

2.923*** |

2.965*** |

| |

(26.93) |

(27.28) |

(-6.61) |

(-6.88) |

(26.99) |

(27.35) |

| Risk |

-0.025*** |

-0.025*** |

-0.034*** |

-0.034*** |

-0.025*** |

-0.025*** |

| |

(-13.36) |

(-13.34) |

(-4.38) |

(-4.42) |

(-13.30) |

(-13.28) |

| Growth |

0.148*** |

0.146*** |

-0.678*** |

-0.667*** |

0.150*** |

0.148*** |

| |

(13.49) |

(13.22) |

(-14.73) |

(-14.50) |

(13.60) |

(13.36) |

| Lev |

0.990*** |

0.993*** |

-1.273*** |

-1.299*** |

0.994*** |

0.998*** |

| |

(37.61) |

(37.72) |

(-11.58) |

(-11.81) |

(37.64) |

(37.77) |

| Board |

-0.108*** |

-0.105*** |

0.173** |

0.169** |

-0.108*** |

-0.106*** |

| |

(-5.71) |

(-5.59) |

(2.19) |

(2.14) |

(-5.73) |

(-5.62) |

| Constant |

-2.735*** |

-2.822*** |

84.684*** |

84.676*** |

-2.983*** |

-3.102*** |

| |

(-30.71) |

(-32.09) |

(227.49) |

(230.51) |

(-18.40) |

(-19.20) |

| Ind |

YES |

YES |

YES |

YES |

YES |

YES |

| Year |

YES |

YES |

YES |

YES |

YES |

YES |

| N |

22418 |

22418 |

22418 |

22418 |

22418 |

22418 |

| R-squared |

0.637 |

0.637 |

0.312 |

0.311 |

0.641 |

0.641 |

Table 8.

Lagged explanatory variables regression results.

Table 8.

Lagged explanatory variables regression results.

| Variables |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| TFP |

TFP |

Res |

Res |

TFP |

TFP |

| Exploratory |

0.022*** |

|

0.057*** |

|

0.021*** |

|

| |

(7.13) |

|

(4.48) |

|

(7.01) |

|

| Exploitative |

|

0.018*** |

|

0.064*** |

|

0.017*** |

| |

|

(6.23) |

|

(5.37) |

|

(6.10) |

| |

|

|

|

|

|

|

| Res |

|

|

|

|

0.595*** |

0.594*** |

| |

|

|

|

|

(3.22) |

(3.24) |

| Size |

0.557*** |

0.560*** |

0.348*** |

0.351*** |

0.555*** |

0.558*** |

| |

(126.36) |

(128.91) |

(19.38) |

(19.83) |

(124.60) |

(127.06) |

| Age |

0.004*** |

0.005*** |

0.017*** |

0.017*** |

0.004*** |

0.004*** |

| |

(6.77) |

(6.87) |

(6.12) |

(6.38) |

(6.61) |

(6.71) |

| Roa |

3.769*** |

3.761*** |

-3.036*** |

-3.112*** |

3.787*** |

3.780*** |

| |

(30.78) |

(30.66) |

(-6.08) |

(-6.22) |

(30.90) |

(30.79) |

| Risk |

-0.028*** |

-0.029*** |

-0.040*** |

-0.040*** |

-0.028*** |

-0.028*** |

| |

(-12.64) |

(-12.67) |

(-4.33) |

(-4.36) |

(-12.53) |

(-12.56) |

| Growth |

0.139*** |

0.140*** |

-0.762*** |

-0.754*** |

0.144*** |

0.145*** |

| |

(10.72) |

(10.78) |

(-14.40) |

(-14.25) |

(11.00) |

(11.06) |

| Lev |

1.237*** |

1.231*** |

-1.168*** |

-1.191*** |

1.244*** |

1.239*** |

| |

(41.16) |

(40.92) |

(-9.53) |

(-9.71) |

(41.30) |

(41.05) |

| Board |

-0.064*** |

-0.064*** |

0.204** |

0.201** |

-0.066*** |

-0.066*** |

| |

(-3.04) |

(-3.05) |

(2.37) |

(2.33) |

(-3.10) |

(-3.11) |

| Constant |

-4.854*** |

-4.913*** |

68.029*** |

67.981*** |

-5.259*** |

-5.316*** |

| |

(-48.63) |

(-49.84) |

(167.10) |

(169.16) |

(-32.78) |

(-33.30) |

| Ind |

YES |

YES |

YES |

YES |

YES |

YES |

| Year |

YES |

YES |

YES |

YES |

YES |

YES |

| N |

17656 |

17656 |

17656 |

17656 |

17656 |

17656 |

| R-squared |

0.748 |

0.747 |

0.844 |

0.844 |

0.748 |

0.748 |

Table 9.

Bootstrap method mediation effect test.

Table 9.

Bootstrap method mediation effect test.

| |

|

Coef |

Std. Err. |

[95% Conf. Interval] |

| Exploratory |

indirect effect |

0.0018 |

0.0008 |

0.0002 |

0.0034 |

| direct effect |

0.0657 |

0.0261 |

0.0132 |

0.1174 |

| Exploitative |

indirect effect |

0.0014 |

0.0003 |

0.0009 |

0 .0020 |

| direct effect |

0.0235 |

0.0033 |

0.0170 |

0.0300 |

Table 10.

Instrumental variable method regression results.

Table 10.

Instrumental variable method regression results.

| Variables |

Phase I |

Phase II |

Phase I |

Phase II |

| Exploratory |

TFP |

Exploitative |

TFP |

| l. Exploratory |

0.824*** |

|

|

|

| |

(188.53) |

|

|

|

| Exploratory |

|

0.027*** |

|

|

| |

|

(7.13) |

|

|

| l. Exploitative |

|

|

0.795*** |

|

| |

|

|

(170.15) |

|

| Exploitative |

|

|

|

0.023*** |

| |

|

|

|

(6.24) |

| Size |

0.065*** |

0.555*** |

0.068*** |

0.558*** |

| |

(10.58) |

(124.18) |

(9.81) |

(127.12) |

| Age |

-0.003*** |

0.005*** |

-0.006*** |

0.005*** |

| |

(-3.36) |

(6.89) |

(-5.40) |

(7.04) |

| Roa |

0.943*** |

3.744*** |

1.246*** |

3.732*** |

| |

(5.52) |

(30.54) |

(6.36) |

(30.35) |

| Risk |

-0.001 |

-0.028*** |

0.000 |

-0.029*** |

| |

(-0.19) |

(-12.65) |

(0.08) |

(-12.69) |

| Growth |

-0.037** |

0.140*** |

-0.057*** |

0.141*** |

| |

(-2.04) |

(10.80) |

(-2.74) |

(10.88) |

| Lev |

0.067 |

1.235*** |

0.066 |

1.230*** |

| |

(1.59) |

(41.15) |

(1.38) |

(40.89) |

| Board |

0.046 |

-0.066*** |

0.054 |

-0.066*** |

| |

(1.56) |

(-3.11) |

(1.60) |

(-3.11) |

| Constant |

-1.731*** |

-4.783*** |

-2.091*** |

-4.845*** |

| |

(-12.37) |

(-46.94) |

(-13.22) |

(-48.25) |

| Ind |

YES |

YES |

YES |

YES |

| Year |

YES |

YES |

YES |

YES |

| N |

17656 |

17656 |

17656 |

17656 |

| R-squared |

0.759 |

0.748 |

0.736 |

0.747 |

Table 11.

Test for heterogeneity in the nature of property rights.

Table 11.

Test for heterogeneity in the nature of property rights.

| Variables |

State-owned enterprise group |

Non-State Enterprise Group |

| TFP |

TFP |

TFP |

TFP |

| Exploratory |

0.0004 |

|

0.043*** |

|

| |

(0.07) |

|

(10.12) |

|

| Exploitative |

|

-0.00003 |

|

0.004*** |

| |

|

(-0.03) |

|

(4.50) |

| Size |

0.558*** |

0.563*** |

0.567*** |

0.566*** |

| |

(88.95) |

(90.87) |

(106.46) |

(107.41) |

| Age |

0.008*** |

0.008*** |

-0.004*** |

-0.004*** |

| |

(7.60) |

(7.46) |

(-5.13) |

(-4.84) |

| Roa |

3.532*** |

3.529*** |

3.871*** |

3.845*** |

| |

(15.96) |

(15.91) |

(31.74) |

(31.49) |

| Risk |

-0.028*** |

-0.027*** |

-0.029*** |

-0.029*** |

| |

(-9.56) |

(-9.48) |

(-11.93) |

(-11.92) |

| Growth |

0.188*** |

0.189*** |

0.078*** |

0.080*** |

| |

(8.91) |

(8.95) |

(6.13) |

(6.31) |

| Lev |

1.153*** |

1.145*** |

1.213*** |

1.206*** |

| |

(23.95) |

(23.77) |

(38.43) |

(38.20) |

| Board |

-0.223*** |

-0.226*** |

0.015 |

0.015 |

| |

(-6.55) |

(-6.63) |

(0.66) |

(0.65) |

| Constant |

-13.446*** |

-13.471*** |

-19.997*** |

-19.694*** |

| |

(-10.68) |

(-10.35) |

(-18.08) |

(-17.10) |

| Ind |

YES |

YES |

YES |

YES |

| Year |

YES |

YES |

YES |

YES |

| N |

7813 |

7813 |

14605 |

14605 |

| R-squared |

0.297 |

0.297 |

0.302 |

0.298 |

Table 12.

Tests for heterogeneity of industry properties.

Table 12.

Tests for heterogeneity of industry properties.

| Variables |

High-tech industry group |

Non-high-tech industry group |

| TFP |

TFP |

TFP |

TFP |

| Exploratory |

0.042*** |

|

0.023*** |

|

| |

(8.25) |

|

(4.56) |

|

| Exploitative |

|

0.005*** |

|

0.002* |

| |

|

(6.18) |

|

(1.80) |

| Size |

0.518*** |

0.522*** |

0.580*** |

0.583*** |

| |

(88.67) |

(90.84) |

(107.81) |

(109.88) |

| Age |

0.011*** |

0.011*** |

-0.001 |

-0.001 |

| |

(12.62) |

(12.60) |

(-1.28) |

(-1.30) |

| Roa |

3.911*** |

3.906*** |

3.771*** |

3.763*** |

| |

(27.49) |

(27.42) |

(23.49) |

(23.38) |

| Risk |

-0.035*** |

-0.035*** |

-0.024*** |

-0.024*** |

| |

(-12.70) |

(-12.74) |

(-9.51) |

(-9.47) |

| Growth |

0.050*** |

0.051*** |

0.156*** |

0.155*** |

| |

(3.16) |

(3.23) |

(10.21) |

(10.16) |

| Lev |

1.297*** |

1.285*** |

1.166*** |

1.165*** |

| |

(36.26) |

(35.82) |

(30.62) |

(30.56) |

| Board |

-0.015 |

-0.017 |

-0.075*** |

-0.074*** |

| |

(-0.60) |

(-0.66) |

(-2.80) |

(-2.73) |

| Constant |

-3.289*** |

-3.362*** |

-5.264*** |

-5.335*** |

| |

(-6.69) |

(-6.84) |

(-44.02) |

(-45.17) |

| Ind |

YES |

YES |

YES |

YES |

| Year |

YES |

YES |

YES |

YES |

| N |

9,657 |

9,657 |

12,761 |

12,761 |

| R-squared |

0.725 |

0.725 |

0.744 |

0.744 |