Submitted:

20 January 2025

Posted:

21 January 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

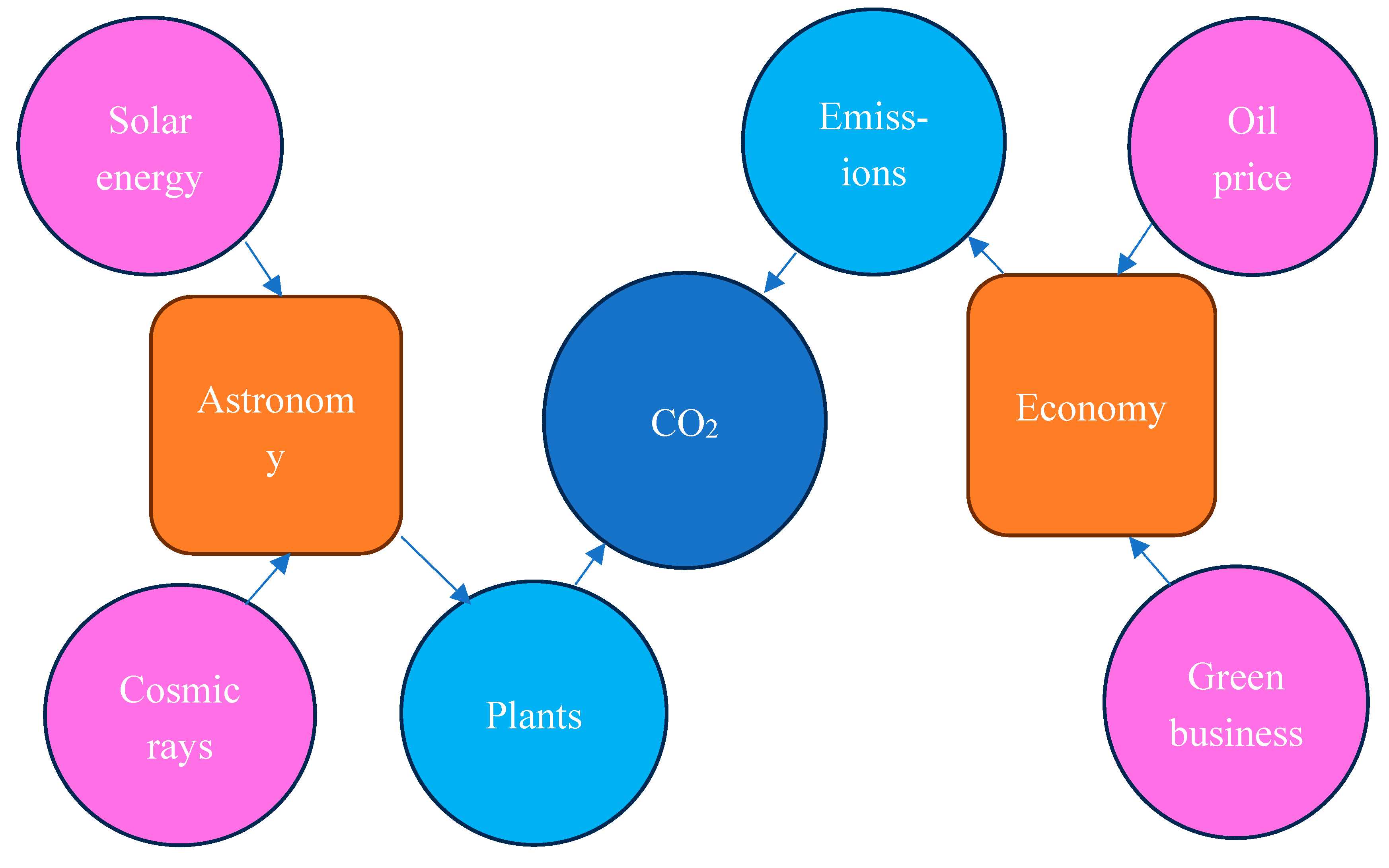

3. Analysis

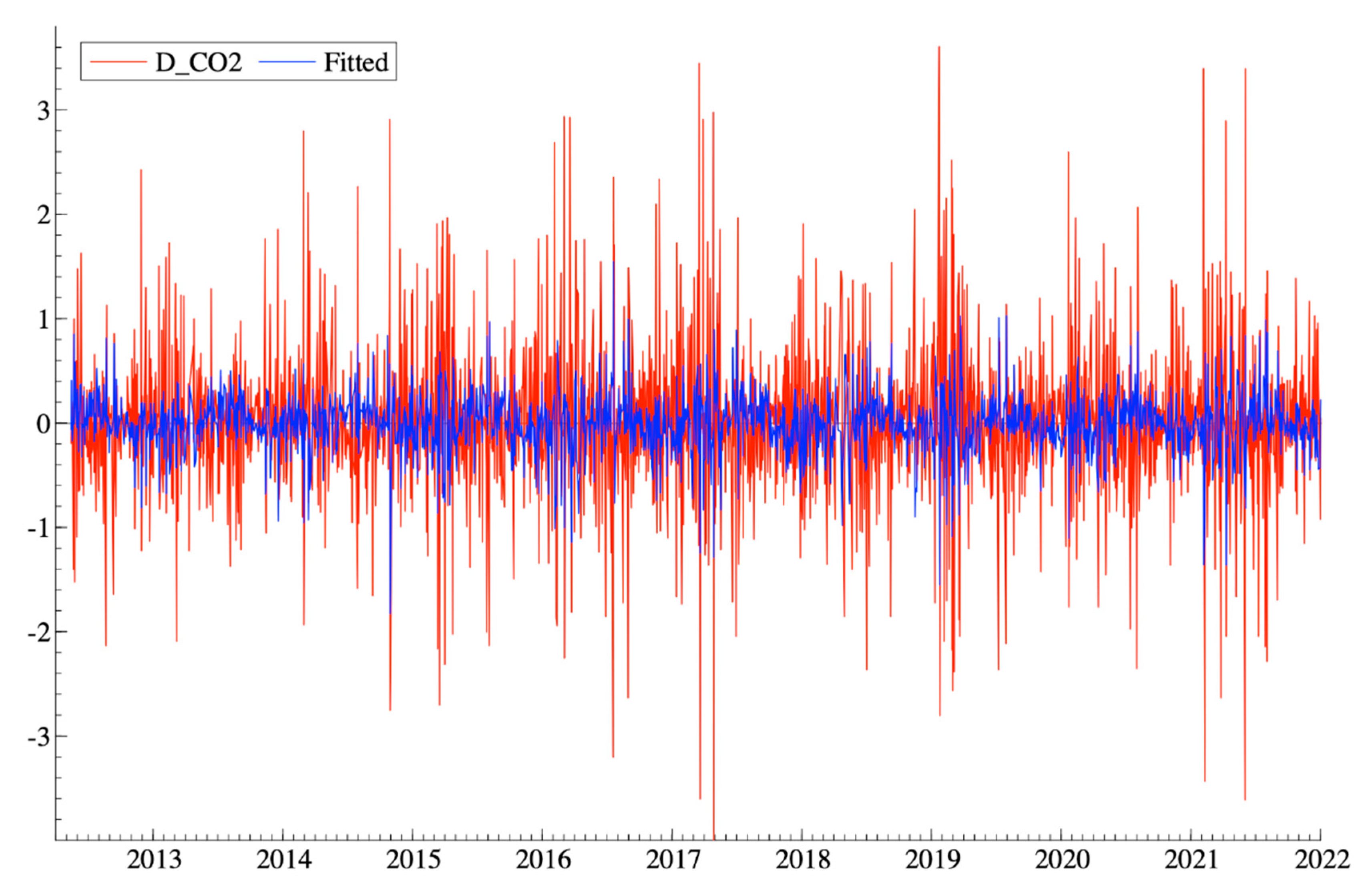

3.1. Dow Jones Sustainability Index.

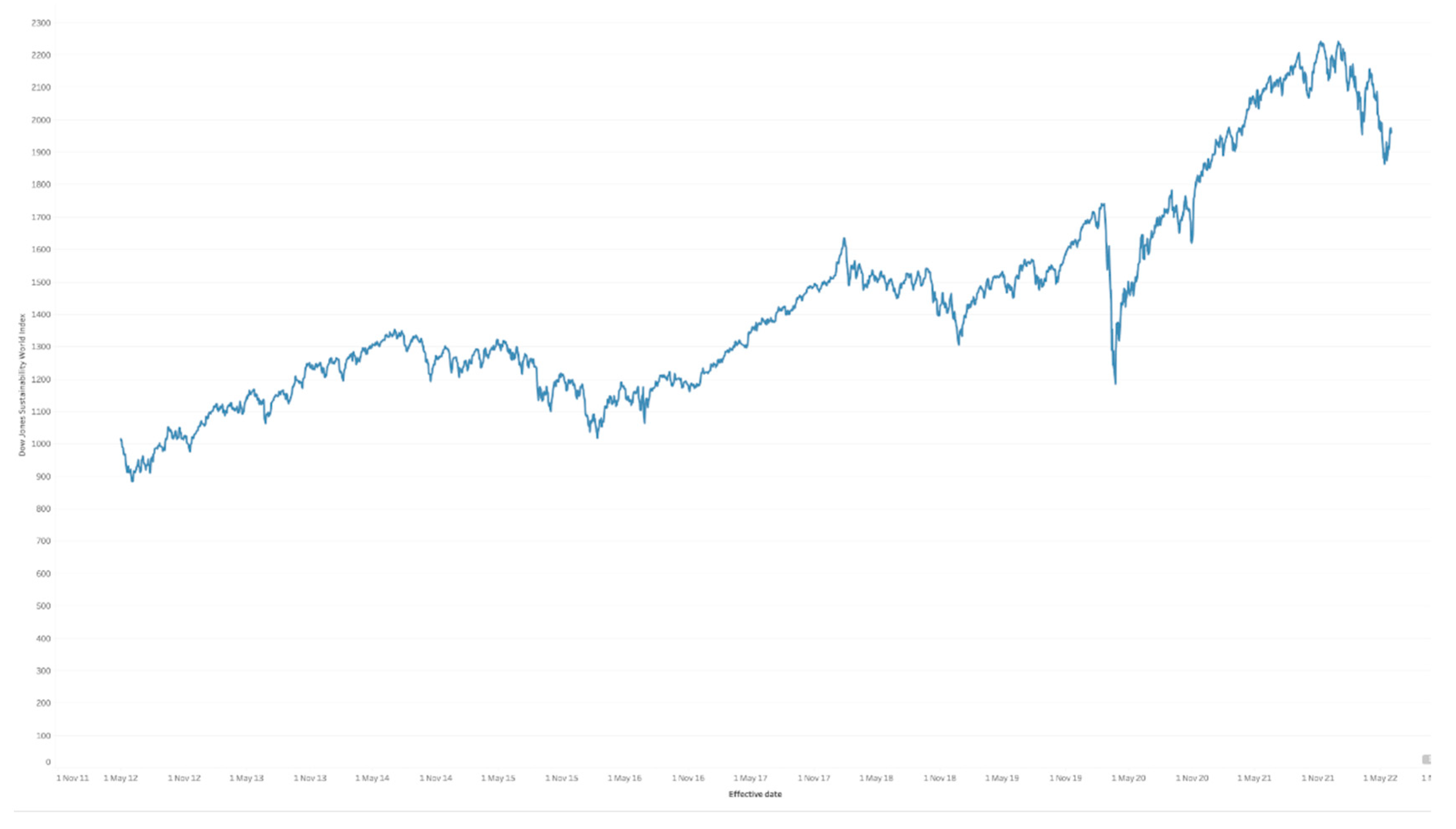

3.2. Brent Crude Oil Price.

3.3. Global CO2 concentrations

3.4. Total Solar Irradiance

3.5. Cosmic Rays

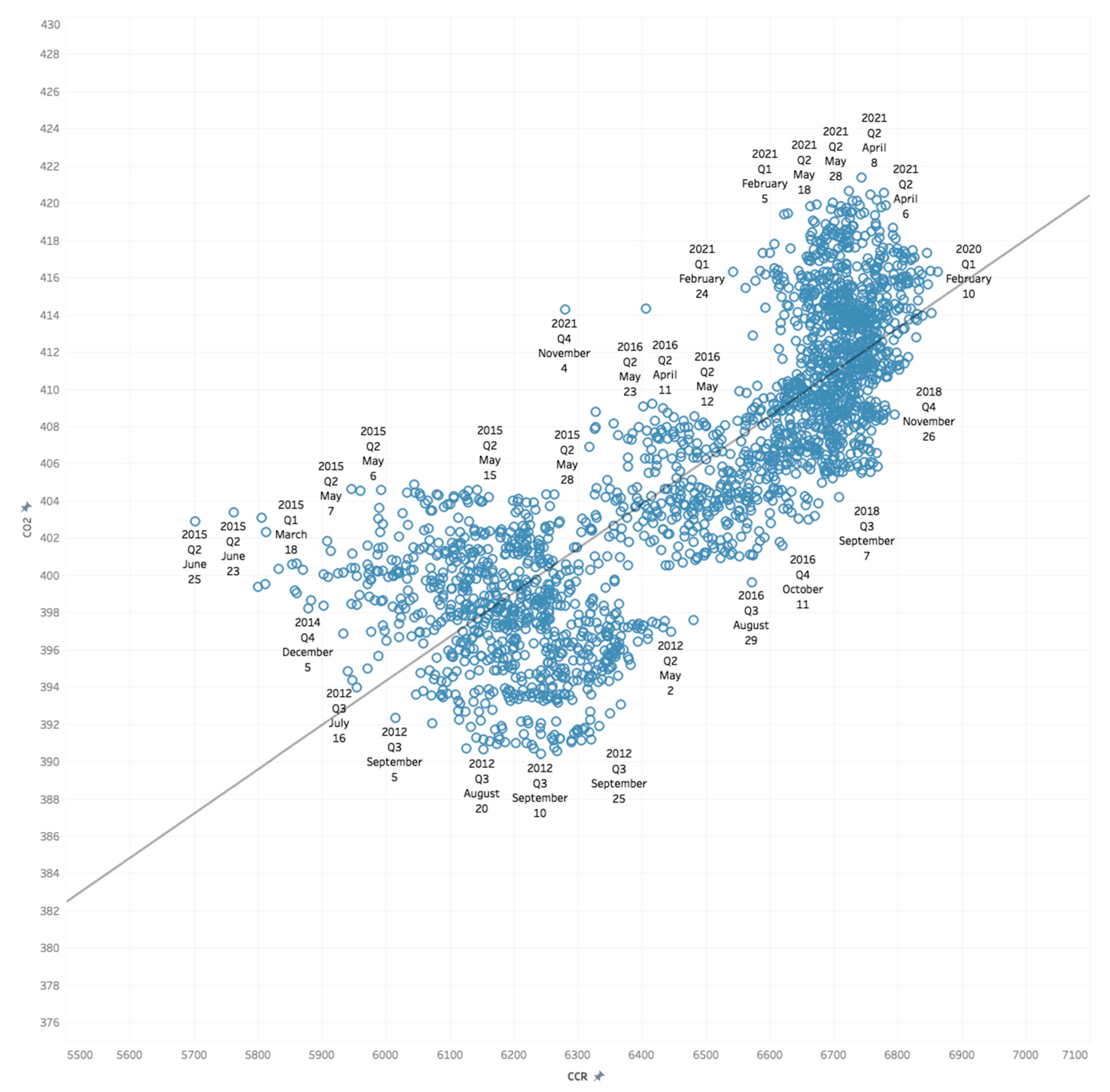

4. Model Building

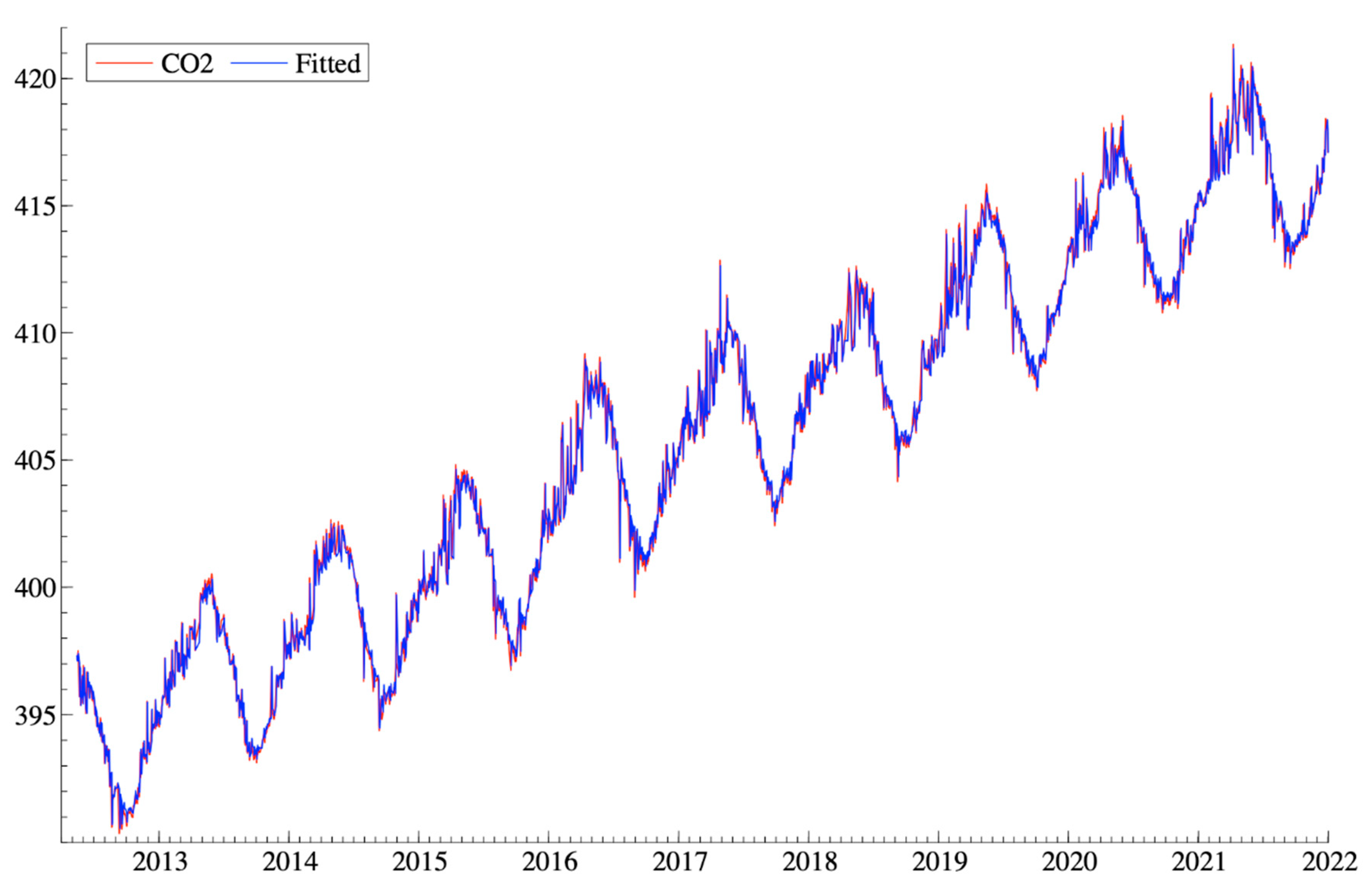

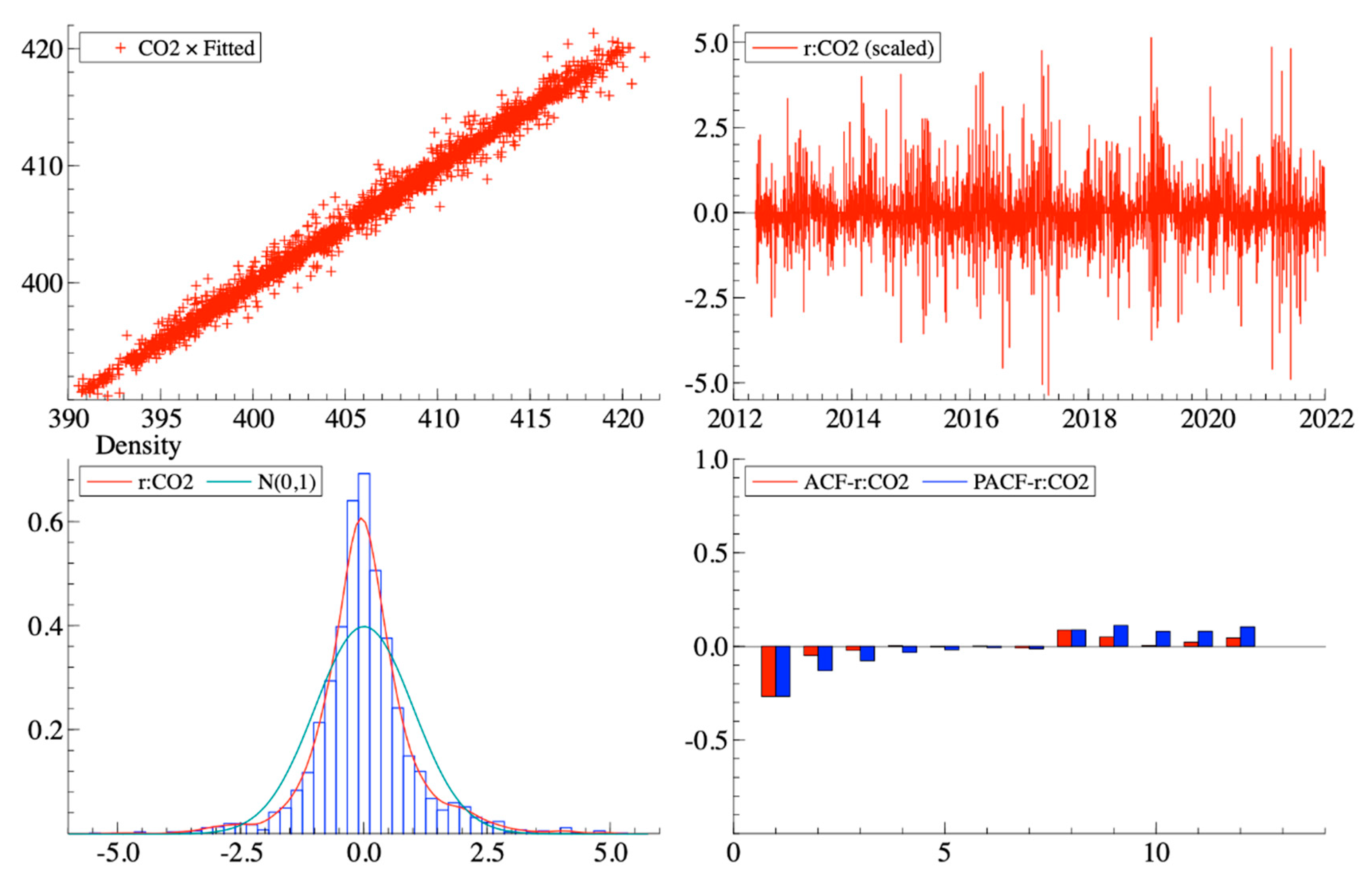

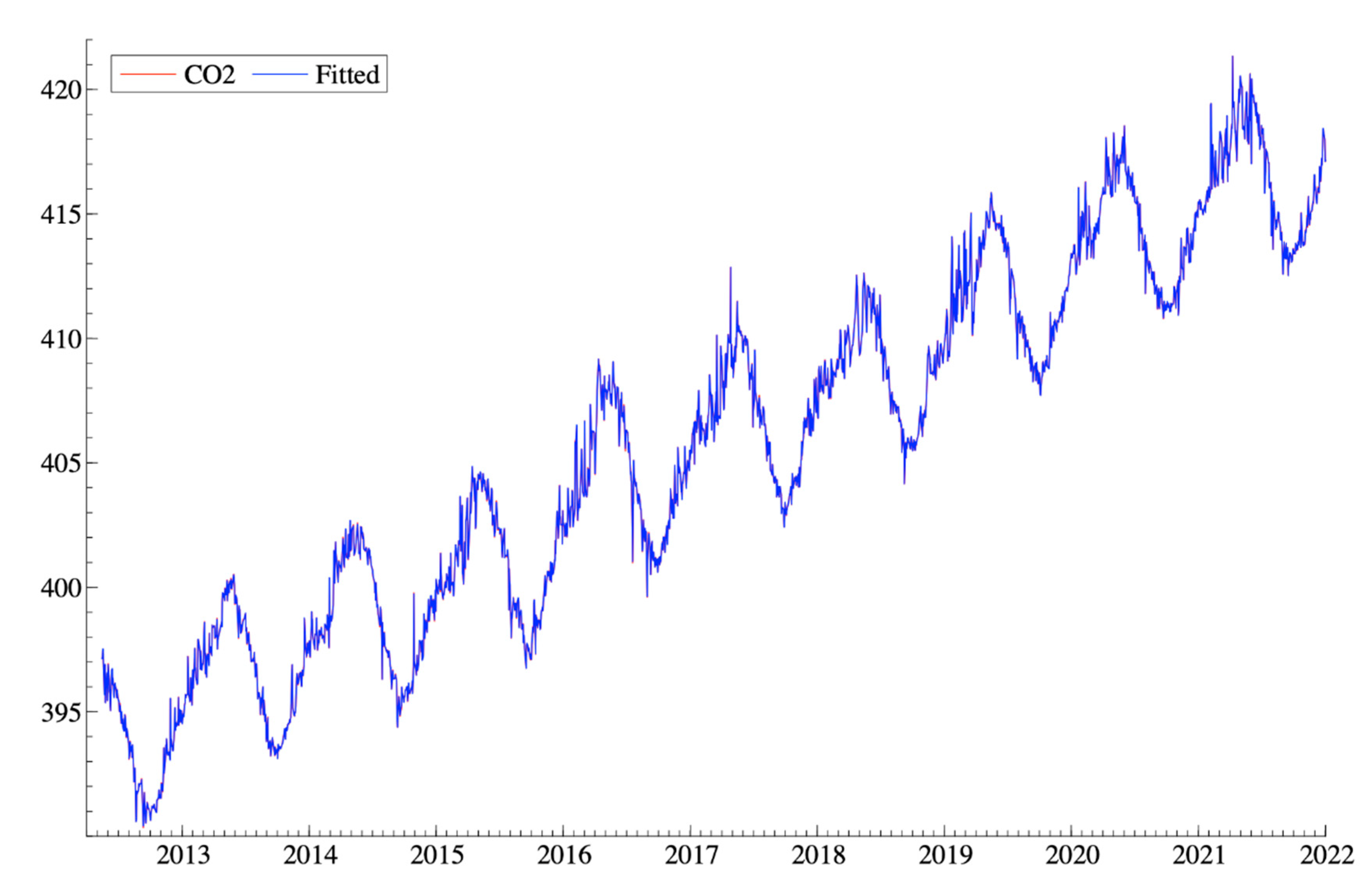

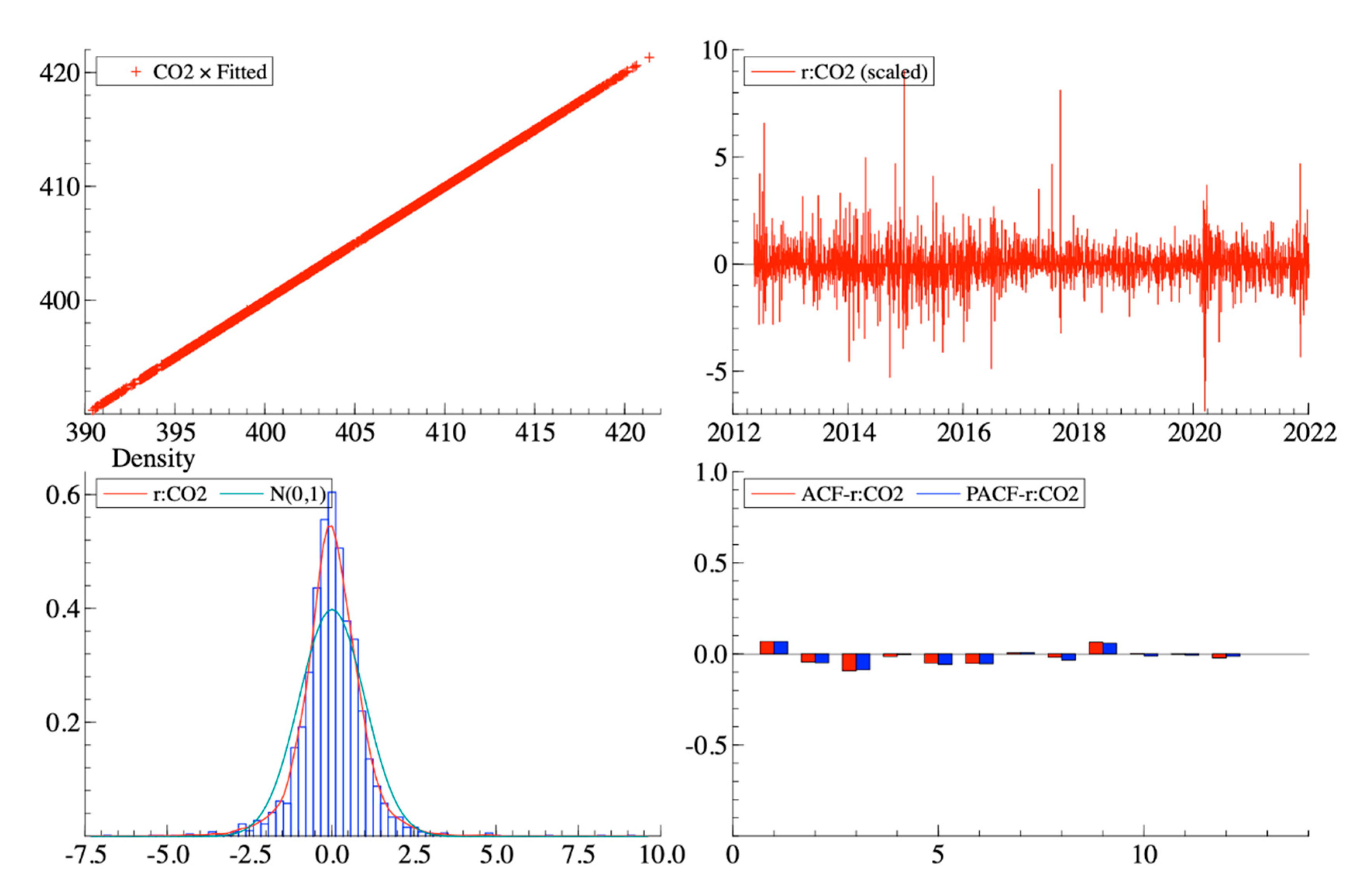

4.1. Modelling CO2 Concentrations in Levels

4.2. Modelling CO2 Concentrations in Differences

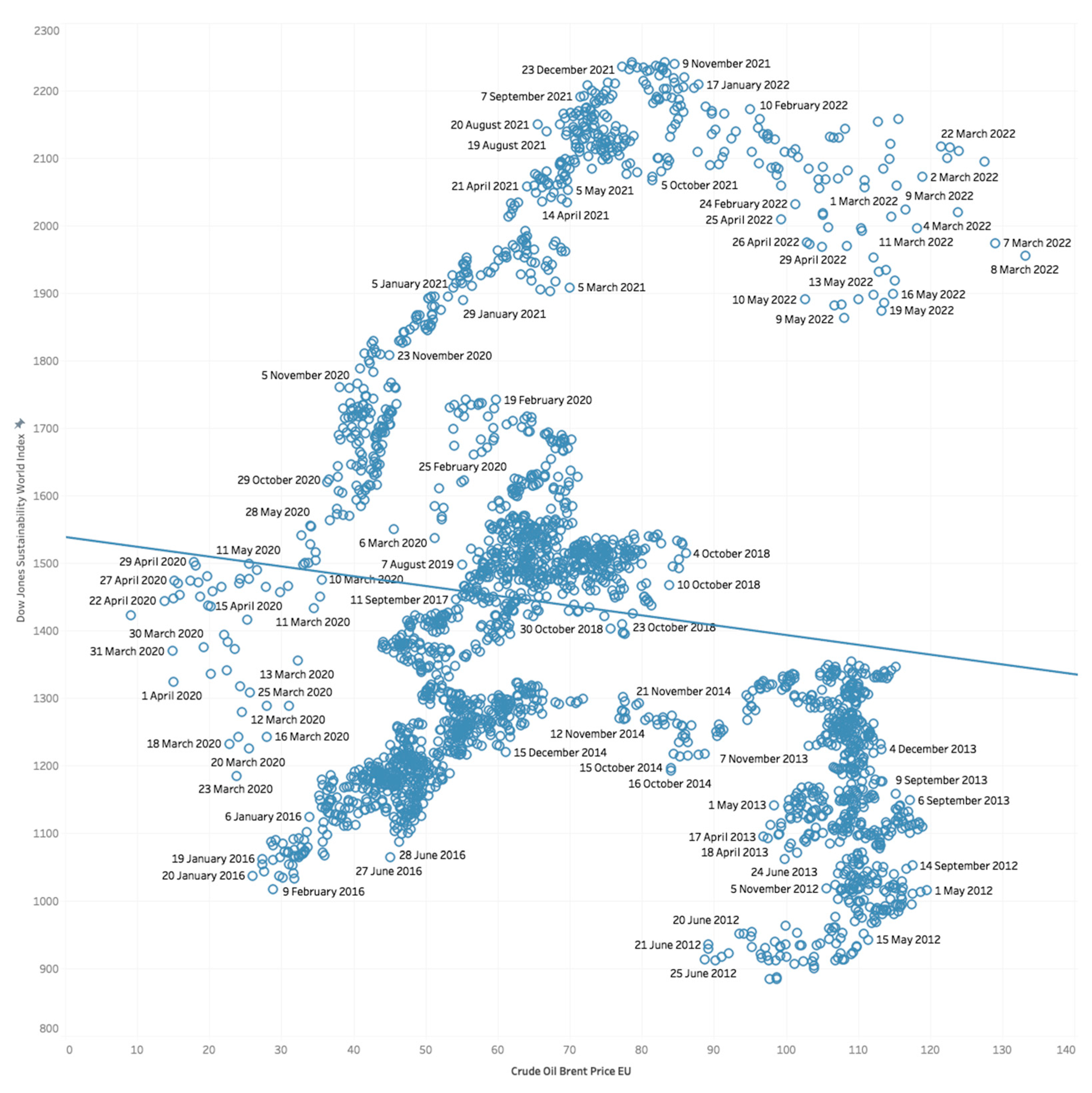

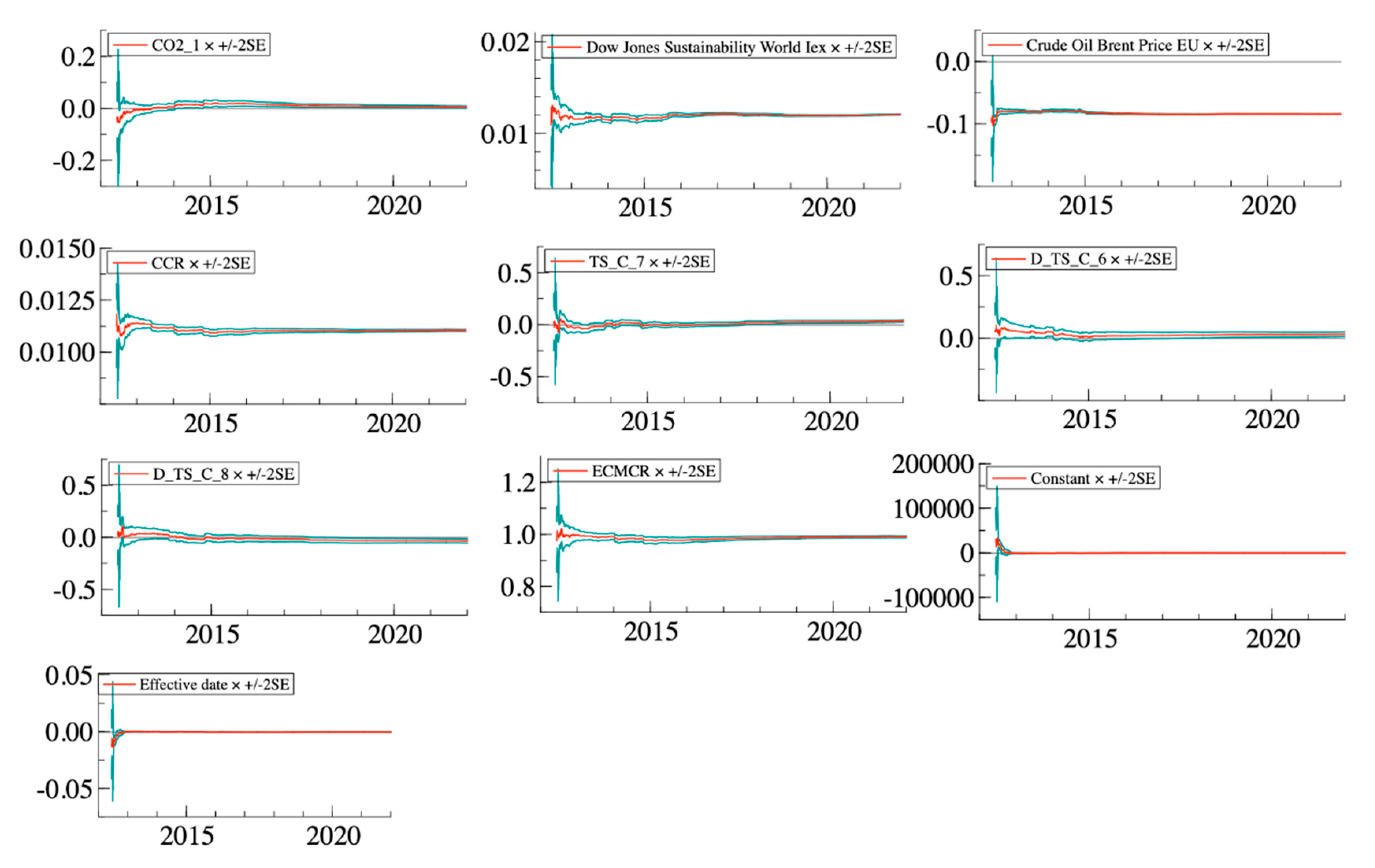

4.3. Final Combined Model

5. Discussion

5.1. The Negative Constant

5.2. DecimalDate

5.3. CO2(t-1) or Lagged CO2

5.4. Dow Jones Sustainability World Index (DJSI)

5.5. Crude Oil Brent Price

5.6. CCR_SQUARE (Squared Terms of Cosmic Rays)

5.7. TSI_SQUARE (Squared Terms of Total Solar Irradiance)

5.8. D_CCR_4 (Differenced CCR Terms)

5.9. ECM_DIFF (Error Correction Term)

Conclusions

6. Conclusions

References

- Arvidsson, s., & Dumay, J. (2022). Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? 31: 1091-1110. [CrossRef]

- Babynina, L., Kartashova, L., Busalov, D., Chernitsova, K., & Akhmedov, F. (2023). Effective ESG Transformation of Russian Companies in the New Environment: Current Challenges and Priorities. Academic Journal of Interdisciplinary Studies. [CrossRef]

- Broadstock, D. C., Chan, K., Cheng, L. T.W., & Wang, X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Research Letters 38, 101716 . [CrossRef]

- Carney, M. (2021) Value(s): The must-read book on how to fix our politics, economics and values, William Collins, 608 pp.

- Catalyst. (2020). The Bottom Line: Connecting Corporate Performance and Gender Diversity.

- Cheng, B., Ioannou, I. and Serafeim, G. (2104), ‘Corporate Social Responsibility and Access to Finance’, Strategic Management Journal, Vol. 35, Issue 1, pp. 1–23. [CrossRef]

- Clement, A., Robinot, E., & Trespeuch, L. (2023). The use of ESG scores in academic literature: a systematic literature review. Journal of Enterprising Communities: People and Places in the Global Econom. [CrossRef]

- Cohen, R. (2020). Impact: Reshaping Capitalism to Drive Real Change, Ebury Press, 256pp.

- Crace, L., & Gehman, J. (2023). What Really Explains ESG Performance? Disentangling the Asymmetrical Drivers of the Triple Bottom Line (Vol. 36). Organization & Environment 2023.

- Eccles, R. G., & Serafeim, G. (2013). The Performance Frontier: Innovating for a Sustainable Strategy, Harvard Business Review. https://hbr.org/2013/05/the-performance-frontier-innovating-for-a-sustainable-strategy.

- Eccles, R.G., Serafeim, G. and Krzus, M.P. (2011), Market Interest in Nonfinancial Information. Journal of Applied Corporate Finance, 23: 113-127. [CrossRef]

- Eccles, R. Ioannou, I. and Serafeim, G. (2011) The Impact of a Corporate Culture of Sustainability on Corporate Behaviour and Performance, National Bureau of Economic Research, Working Paper 17950 http://www.nber.org/papers/w17950.

- Eccles, R., Ioannou, I. and Serafeim, G. (2014), ‘The Impact of Corporate Sustainability on Organizational Processes and Performance’, Management Science, Vol. 60, Issue 11, pp. 2835–2857. Available at: . [CrossRef]

- El Ghoul, S., Guedhami, O., Kwok, C. and Mishra, D. (2011), ‘Does Corporate Social Responsibility Affect the Cost of Capital?’, Journal of Banking and Finance, Vol. 35, Issue 9, pp. 2388–2406. Available at: https://econpapers.repec.org/article/eeejbfina/v_3a35_3ay_3a2011_3ai_3a9_3ap_3a2388-2406.htm.

- Elkington, J. (2004). Enter the Triple Bottom line. In Henriques, A., Richardson, J., eds. (2004) The triple bottom line: does it all add up?, Routledge.

- Elkington (2021) Green Swans: The Coming Boom in Regenerative Capitalism, Fast Company Press.

- Ferri, G. and Pini, M. (2019) Environmental vs. Social Responsibility in the Firm. Evidence from Italy, Sustainability 2019, 11, 4277;. [CrossRef]

- Freiberg, D., Rogers, J., & Serafeim, G. (2020). How ESG Issues Become Financially Material to Corporations and Their Investors. Harvard Business School.

- Friede, G., Busch T. & Bassen, A. (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, 5:4, 210-233. [CrossRef]

- Fulton, M., Kahn, B., & Sharples, C. (2012). Sustainable investing: Establishing long-term value and performance. Available at SSRN 2222740.

- Gabriel, V. (2019) Environmentally sustainable investment: Dynamics between global thematic indices, Cuadernos de Gestión Vol. 19-Nº1, 2019, pp. 41-62. [CrossRef]

- 22. GUIDO GIESE, LINDA-ELING LEE, DIMITRIS MELAS, ZOLTÁN NAGY, and LAURA NISHIKAWA Performance and Risk Analysis of Index-Based ESG Portfolios.

- 23. Guido Giese, Linda-ElingLee, Dimitris Melas, Zoltán Nagy, and Laura Nishikawa(2019) Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance, The Journal of Portfolio Management, 45 (5), pp.1-15.

- Guido Giese, Zoltan Nagy, Linda-Eling Lee (2020) Deconstructing ESG Ratings Performance Risk and Return for E, S and G by Time Horizon, Sector and Weighting, MSCI, June 2020.

- Halbritter, G., & Dorfleitner, G. (2015). The wages of social responsibility — where are they? A critical review of ESG investing. Review of Financial Economics, Volume 26, September 2015, Pages 25-35. [CrossRef]

- Hartzmar, S. M., Sussman, A.B. (2019) Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows, The Journal of Finance, Vol. LXXIV, No. 6, December 2019.

- Huang, D. Z. X. (2021). Environmental, social and governance (ESG) activity and firm performance: a review and consolidation. Accounting & Finance, vol. 61(1), pages 335-360. [CrossRef]

- Kell, G. (2018) The Remarkable Rise Of ESG, Forbes, https://www.forbes.com/sites/georgkell/2018/07/11/the-remarkable-rise-of-esg/#549a69021695.

- Khan, M., Serafeim, G. and Yoon, A. (2016), ‘Corporate Sustainability: First Evidence on Materiality’, The Accounting Review, Vol. 91, Issue 6, pp. 1697–1724. http://www.aaajournals.org/doi/abs/10.2308/accr-51383. [CrossRef]

- Kotsantonis, S., Pinne, C., & Serafeim, G. (2016). ESG Integration in Investment Management: Myths and Realities. Journal of applied corporate finance, 28, no. 2 (Spring 2016): 10–16. [CrossRef]

- Kotsantonis, S., Pinne, C., & Serafeim, G. (2019). Four things no one will tell you about ESG data. Journal of applied corporate finance, 31 (2), Spring 2019, pages 50-58, . [CrossRef]

- Krosinsky C., and Purdom, S. (2016) Sustainable Investing: Revolutions in theory and practice, Routledge.

- Linnenluecke, M. K. (2021). Environmental, social and governance (ESG) performance in the context of multinational business research. Multinational Business Review. [CrossRef]

- Maiti, M. (2020): Is ESG the succeeding risk factor?, Journal of Sustainable Finance & Investment. [CrossRef]

- McKinsey & Company. (2020). Diversity Wins: How Inclusion Matters.

- Menicucci, E., & Paolucci, G. (2022). ESG dimensions and bank performance: an empirical investigation in Italy. Emerald Publishing Limited. [CrossRef]

- Miralles-Quirós, M. M., Miralles-Quirós, J. L., & Valente Gonçalves, L. M. (2018). The Value Relevance of Environmental, Social, and Governance Performance: The Brazilian Case. Sustainability, 2018, 10(3), 574; [CrossRef]

- MSCI. (2021). MSCI World ESG Leaders Index.

- Nguyen-Taylor, K. and Martindale, M. (2018), Financial Performance of ESG Integration in US Investing (Principles for Responsible Investment, London). Available at: https://www.unpri.org/download?ac=4218.

- Polman, P. (2022) Net Positive: How Courageous Companies Thrive by Giving More Than They Take, Harvard Business Review Press.

- Porter, M. E., Serafeim, G., & Kramer, M. (2019). Where ESG fails? Institutional Investor, October 16: https://www.institutionalinvestor.com/article/2bswdin8nvg922puxdzwg/opinion/where-esg-fails.

- Sadiqa, M., Ngob, T. Q., Pantameec, A. A., Khudoykulovd, K., Ngane, T. T., & Tan, L. P. (2022). The role of environmental social and governance in achieving sustainable development goals: evidence from ASEAN countries. Economic Research-Ekonomska Istraživanja.

- Schoenmaker, D. & Schramade, W. (2019) Investing for longterm value creation, Journal of Sustainable Finance & Investment, 9:4, 356-377. [CrossRef]

- Serafeim, G., & Yoon, A. (2011). The Consequences of Mandatory Corporate Sustainability Reporting, Harvard Business School Working Paper, 11-110. https://www.hbs.edu/research/pdf/11-100.pdf.

- Serafeim, G., & Yoon, A. (2023). Stock price reactions to ESG news: the role of ESG ratings and disagreement. Review of Accounting Studies (2023), Springer, vol. 28(3), pages 1500-1530. [CrossRef]

- Serafeim, G., & Yoon, A. (2022). Which Corporate ESG News Does the Market React To? Financial Analysts Journal, Vol 72, Issue 1, Pages 59-78. [CrossRef]

- Setyahuni, S. W., Handayani, R. S. (2020). On the value relevance of information on environmental, social, and governance (ESG): an evidence from Indonesia. Journal of critical reviews, 7 (12), 50-58, 2020.

- Shmelev, S. E. (2012) Ecological Economics: Sustainability in Practice, Springer, 248pp.

- Shmelev S. E., Shmeleva I. A. (2018). Global urban sustainability assessment: A multidimensional approach. Sustainable Development, 26: 904–920. [CrossRef]

- Shmelev, S. E., Speck, S. U. (2018). Green fiscal reform in Sweden: Econometric assessment of the carbon and energy taxation scheme. Renewable and Sustainable Energy Reviews, 90, 969-98. [CrossRef]

- Shmelev, S. (Ed.). (2019). Sustainable Cities Reimagined: Multidimensional Assessment and Smart Solutions. Routledge. Retrieved from https://www.routledge.com/Sustainable-Cities-Reimagined-Multidimensional-Assessment-and-Smart-Solutions/Shmelev/p/book/9780367254209.

- Shmelev, S.E.; Salnikov, V.; Turulina, G.; Polyakova, S.; Tazhibayeva, T.; Schnitzler, T.; Shmeleva, I.A. (2021) Climate Change and Food Security: The Impact of Some Key Variables on Wheat Yield in Kazakhstan. Sustainability 2021, 13, 8583. [CrossRef]

- Sondre R. Fiskerstrand , Susanne Fjeldavli , Thomas Leirvik , Yevheniia Antoniuk & Oleg Nenadić (2020) Sustainable investments in the Norwegian stock market, Journal of Sustainable Finance & Investment, 10:3, 294-310. [CrossRef]

- Sparkes, R. (2002), Socially Responsible Investment: A Global Revolution (Wiley).

- Strekalina, A., Zakirova, R., Shinkarenko, A., & Vatsaniuk, E. (2023). The Impact of ESG Ratings on Financial Performance of the Companies: Evidence from BRICS Countries. Journal of Corporate Finance Research.

- 20 September 2019; 9, 56. UK Government Actuary’s Department (2019) Investment Bulletin, Issue 9, September 2019.

- UN Global Compact (2005) Who Cares Wins: Connecting Financial Markets to a Changing World.

- UNDESA (2015) A Briefing Note on Addis Ababa Agenda on Financing sustainable development and developing sustainable finance.

- UNDESA (2017) SDG Investing: Advancing a New Normal in Capital Markets.

- UNDP (2019) The SDG Impact Practice Standards for Private Equity Funds.

- UNEP FI (2019) SDG Investment Case.

- UNEP FI (2020) Fiduciary Duty in the 21st Century.

- University of Oxford and Arabesque Partners (2015), From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance (March 2015). Available at: https://arabesque.com/research/From_the_stockholder_to_the_stakeholder_web.pdf.

- Wang, N., Pan, H., & Du, S. (2022). How do ESG practices create value for businesses? Research review and prospects. Sustainability Accounting, Management and Policy Journal. [CrossRef]

- Stubbs, W. (2017). Sustainable entrepreneurship and B corps. Business Strategy and the Environment. [CrossRef]

- Whelan, T. Atz, U., Van Holt, T., and Clark, C. (2021) ESG and Financial Performance: Uncovering the Relationship by Aggregating Evidence from 1,000 Plus Studies Published between 2015 – 2020, NYU Centre for Sustainable Business, 19pp.

- NOAA (2025) National Oceanic and Atmospheric Administration. Trends in Atmospheric Carbon Dioxide: Mauna Loa CO₂ Monthly Mean Data. NOAA, https://gml.noaa.gov/ccgg/trends/mlo.html. Accessed 18 Jan. 2025.

- Engle, R. F., & Granger, C. W. J. (1987) Cointegration and Error Correction: Representation, Estimation, and Testing, Econometrica, 55(2), 251-276. [CrossRef]

- Hendry, D. (1995) Dynamic Econometrics. Oxford University Press.

- Hendry, D. Nielsen B. (2007) Ecomometric Modelling. A Likelihood Approach. Princeton University Press.

- Hendry, D., Doornik, J. (2014) Empirical Model Discovery and Theory Evaluation, MIT Press.

- Dengel, S.; Aeby, D.; Grace, J. A relationship between galactic cosmic radiation and tree rings. New Phytol. 2009, 184, 545–551. [CrossRef]

- Ormes, J.F. Cosmic Rays and Climate. Adv. Space Res. 2018, 62, 2880–2891. [CrossRef]

- Svensmark, H. Cosmic Rays and Earth’s Climate. Space Sci. Rev. 2000, 93, 175–185. [CrossRef]

- UN Principles for Responsible Investment (2025) https://www.unpri.org/.

| TITLE | AUTHORS | YEAR | REF | COUNTRY | METHODOLOGY | FINDINGS AND DISCUSSION |

| What Really Explains ESG Performance? Disentangling the Asymmetrical Drivers of the Triple Bottom Line | Crace, L., Gehman, J. | 2023 | [9] | CANADA | The study employs MSCI ESG KLD STATS dataset for its extensive coverage and historical evaluation. Variance partitioning analysis, using two samples from 2003 to 2010 and 1993 to 2010, examines categorical variables' impact on ESG performance. Multilevel modeling with cross-classified structures and MCMC estimation in MLwiN software ensure robust analysis. | The article examines ESG performance in strategic management, debating whether it's influenced more by external factors or internal traits. It highlights challenges in quantifying social impacts and suggests negative ESG indicators are driven by external factors while positive ones reflect internal strategies. Firm and CEO effects significantly shape ESG performance across dimensions. The article advocates for nuanced measures over aggregated indicators to capture true sustainability practices, contributing to a better understanding of ESG performance variation among firms. |

| The use of ESG scores in academic literature: a systematic literature review | Clement, A., Robinot, E., & Trespeuch, L. | 2023 | [7] | CANADA | The study followed Xiao and Watson's (2019) methodology for systematic qualitative systematic reviews. It collected and described definitions of ESG scores in academic literature using systematic meta-analysis. Initial data comprised 6,685 articles, narrowed down to 342 after systematic procedures and analysis of definitions. Various classification themes emerged from the analysis. | The reviewed article offers a qualitative systematic examination of environmental, social, and governance (ESG) scores in academic literature, focusing on their diverse definitions and applications. ESG scores serve as key financial tools for constructing green portfolios and evaluating companies' responsible performances, with investments projected to exceed US$53 trillion by 2025. ESG scores encompass environmental, social, and governance aspects, providing quantitative assessments through tangible and intangible data published by commercial firms. Initially tailored for financial companies, ESG scores have expanded to aid reputation enhancement and risk reduction. However, challenges persist in measuring sustainable practices, especially regarding community and environmental impacts. While significant for aligning with UN Sustainable Development Goals, ESG scores primarily focus on financial risk rather than comprehensive corporate social responsibility (CSR) performance. Academic research diverges across sustainability, CSR, disclosure, finance, and transdisciplinary analyses of ESG scores, revealing inconsistencies in definitions and utilization. The review underscores the necessity for cautious use of ESG scores beyond financial risk assessment and calls for improved methodologies to evaluate environmental and social impacts. It advocates for standardization and increased representation of small and medium-sized businesses in ESG assessments while suggesting a roadmap for future research to refine ESG score definitions and applications. |

| How do ESG practices create value for businesses? Research review and prospects | Wang, N., Pan, H., & Du, S. | 2022 | [64] | CHINA | Bibliometric method is used to analyze literature co-citation, burst detection and keyword co-occurrence, and literature review method is used to condense important ideas from the existing literature |

The text examines the rising importance of ESG (Environmental, Social, and Governance) factors in business, reflecting changing investor and stakeholder priorities. ESG criteria now gauge a company's sustainability and viability, influencing investment decisions and demanding transparency. Investors increasingly prefer firms with strong ESG performance, recognizing its significance for financial success. ESG practices extend beyond financial metrics, impacting societal resilience and market value while reducing risks. The text highlights theoretical frameworks explaining how ESG practices signal positive information, manage risks, and offer strategic advantages. It stresses the critical link between ESG performance and disclosure for transparency and accountability, despite challenges like greenwashing. External factors such as regulations and market dynamics, alongside internal factors like governance structures, shape ESG practices and corporate value. Embracing ESG as a strategic imperative is crucial for long-term value creation and stakeholder trust in businesses. |

| Effective ESG Transformation of Russian Companies in the New Environment: Current Challenges and Priorities | Babynina, L., Kartashov L., Busalov, D., ChernitsovK., & Akhmedov, F. | 2023 | [2] | RUSSIA | The article employs a comprehensive methodology, blending theoretical insights with empirical data to develop ESG-rating methodologies for businesses. | The article examines ESG (Environmental, Social, and Governance) awareness and transformation in Russian businesses, tracing its evolution from state-regulated to corporate norms. Despite economic shifts, ESG remains relevant as companies target Asian markets and restructure supply chains. Tasks include analyzing domestic and foreign studies on sustainable development, comparing Russian ESG rating methodologies, and assessing ESG factor significance. Benefits like risk reduction are acknowledged, but conflicting views exist on efficiency and reporting costs. Challenges include corporate understanding, skill shortages, and financial limitations, influenced by geopolitics and regulations. ESG disclosure is vital for confidence, but inconsistencies in rating agency practices persist. Proposed initiatives aim to promote collaboration and transparency, such as the National ESG Alliance and an ESG Infrastructure Atlas. The article calls for clearer regulations and increased stakeholder engagement to advance sustainable development in Russia. |

| Environmental, social and governance (ESG) performance in the context of multinational business research | Linnenluecke, M. K | 2021 | [33] | AUSTRALIA | The paper outlines emerging literature on global ESG ratings. It covers research on ESG-financial links in emerging markets, multinational ESG performance, and country-level ESG risks. | The article explores the complex landscape of monitoring firms' ESG performance, crucial in socially responsible investment strategies. It notes investors' shift towards aligning investments with societal values, necessitating robust ESG frameworks. Challenges arise when applying Western-centric ESG models to emerging markets due to weaker institutions and limited data. Research on ESG performance's financial impact yields varied results, especially in emerging markets, indicating nuanced patterns across jurisdictions. The text identifies diverse metrics and challenges in studying the ESG–financial performance relationship, including incomplete disclosures and cultural factors. Concerns also arise about the accuracy of ESG ratings, biases, and failures to capture material issues in emerging markets. The article suggests exploring supply chain analysis and incorporating local community concerns into ESG ratings for comprehensive sustainability assessments. In conclusion, it calls for enhanced research to address unresolved issues in ESG assessment, especially in emerging markets and multinational operations. It advocates for improved methodologies and stakeholder integration, emphasizing the importance of indigenous community perspectives in corporate sustainability evaluation. |

| ESG and financial performance: aggregated evidence from more than 2000 empirical studies | Friede, G., Busch T. & Bassen, A. | 2015 | [19] | GERMANY | Two methods aggregate primary and secondary study results, each with distinct calculation approaches. Analysis includes distributions, correlation effect sizes, and subgroup analyses. | The article analysis the evolving role of Environmental, Social, and Governance (ESG) criteria in investment decisions, noting slow mainstream adoption despite significant assets managed under Principles for Responsible Investment (PRI) signatories. It highlights limited integration of ESG information by investment professionals and minimal formal training in ESG analysis. Debates persist over the compatibility of ESG criteria with Corporate Financial Performance (CFP), with studies presenting ambiguous or contradictory results. A review of over 2,000 empirical studies since the 1970s reveals a positive correlation between ESG criteria and CFP across various assets and regions, except for portfolio-related studies. Using a two-step method, the authors analyze findings from 60 review studies, concluding empirical support for the business case for ESG investing. Despite limitations such as publication delays and diverse methodologies, ESG outperformance opportunities exist, particularly in non-equity assets and regions like North America and Emerging Markets. The article advocates deeper ESG integration into investment processes to align with broader societal goals, calling for further research into ESG criteria interaction and long-term performance impacts in portfolios. |

| ESG dimensions and bank performance: an empirical investigation in Italy | Menicucci, E., & Paolucci, G. | 2022 | [36] | ITALY | This study examines a sample of 105 Italian banks and develops three econometric models to verify the effect of ESG initiatives on BP indicators. The independent variables are the ESG dimensions collected from the Refinitiv database, whereas the explanatory variables are performance indicators measured through accounting and market variables | The article examines ESG integration in Italy's banking sector driven by client, investor, and regulatory pressures post-global financial crisis. It assesses the feasibility of enhanced corporate governance, reduced environmental impact, and social responsibility programs. Environmental commitments positively impact efficiency and trust, while social initiatives may challenge profitability. Corporate governance, especially board diversity and risk governance, correlates positively with performance. Empirical findings suggest varying impacts of ESG dimensions on bank performance, highlighting the complex relationship between ESG factors and profitability. The study contributes insights for practitioners and policymakers in sustainable finance and responsible banking. |

| The role of environmental social and governance in achieving sustainable development goals: evidence from ASEAN countries | Sadiqa, M., Ngob, T. Q., Pantameec, A. A., Khudoykulovd, K., Ngane, T. T., & Tan, L. P. | 2022 | [43] | ASEAN COUNTRIES (Brunei, Cambodia, Laos, Indonesia, Malaysia, Myanmar, Philippines, Thailand, Singapore, and Vietnam) | The study employs Panel Autoregressive Distributed Lag (ARDL) modeling to analyze the relationships between ESG scores, economic growth (GDP), and Sustainable Development Goals (SDGs) in ASEAN countries. Secondary data from SDG reports and World Development Indicators are used, with descriptive statistics, correlation analysis, and Augmented Dickey-Fuller tests applied for data assessment and model selection. | The article explores global challenges arising from industrial expansion and the limited engagement in environmental and social initiatives despite increasing awareness. It discusses the 2030 Agenda for Sustainable Development, comprising 17 SDGs targeting environmental, social, and economic sustainability. ESG criteria are pivotal in evaluating firms' commitment to these goals, emphasizing environmental protection, social welfare, and corporate governance. Collaborative efforts from businesses are crucial to achieve SDGs, with effective environmental policies and social governance practices facilitating progress. Corporate governance ensures accountability and transparency, enhancing financial and social performance. In ASEAN countries, progress varies across social, environmental, and economic indicators. While strides have been made in poverty reduction and gender equality, environmental challenges persist. The article stresses the need for enhanced environmental, social, and corporate governance to accelerate SDG attainment. The discussion section further examines the intersection of ESG dimensions and SDG achievement. It highlights the positive impact of environmental practices on ecosystem preservation and social criteria on poverty alleviation. Corporate governance and economic growth also play vital roles in driving sustainable development initiatives. In conclusion, the study advocates for integrated approaches to address environmental, social, economic, and governance challenges, emphasizing the importance of ongoing research and evidence-based policy decisions to advance sustainable development agendas globally. |

| How ESG Issues Become Financially Material to Corporations and Their Investors | Freiberg, D., Rogers, J., & Serafeim, G. | 2020 | [18] | USA | Qualitative analysis | The article explores the journey of ESG issues from being financially immaterial to becoming material, using the Purdue Pharma opioid crisis as a case study. It presents a framework comprising five stages: Status Quo, Catalyst Events, Stakeholder Reaction, Company Reaction, and Regulatory Reaction/Innovation. Catalyst events and stakeholder actions trigger a reassessment of ESG issue materiality, leading to regulatory changes and industry-wide responses. The text illustrates this framework through case studies like JUUL and Facebook. Stakeholders engage with companies, potentially influencing regulators and public perception. The document also discusses a theory of change and action, emphasizing the role of impact-first investors and NGOs in driving corporate responsibility. It advocates for forward-looking frameworks to identify emerging material issues and flexible ESG disclosure regulations. Understanding materiality dynamics is vital for corporate management, investment decisions, and regulatory effectiveness. |

| The Value Relevance of Environmental, Social, and Governance Performance: The Brazilian Case | Miralles-Quirós, M. M., Miralles-Quirós, J. L., & Valente Gonçalves, L. M. | 2018 | [37] | BRAZIL | It employs a modified Ohlson's asset valuation model, panel data methodology, and regression analysis. Four CSR measures are examined, including environmental, social, and corporate governance factors, alongside a composite ESG score. An interaction term accounts for the impact of environmentally sensitive industries. The methodology aims to understand how CSR influences stock prices, informing investors, managers, and policymakers about CSR's strategic implications. |

The study explores the value relevance of Corporate Social Responsibility (CSR) practices in Brazilian listed companies during 2010–2015. Despite sustainable development's global priority, research on CSR in emerging economies like Brazil is limited. The research introduces a novel measure of CSR activities and uses ESG performance scores from Thomson Reuters Eikon to analyze shareholder value creation. Findings suggest that investors positively value firms with higher ESG performance, particularly in environmentally sensitive industries. While environmental practices are significantly valued, social and corporate governance practices, although positively valued, lack statistical significance. The study fills a crucial gap in CSR literature by examining the long-term relationship between ESG performance and stock prices in the São Paulo securities markets. It highlights the importance of analyzing the Brazilian market due to its unique resources and proposes a methodology to overcome biases associated with self-reported information. The results support the value enhancing theory and have implications for investors, managers, and policymakers. Investors can consider CSR practices in investment decisions, while managers can view CSR as a differentiation strategy contributing to shareholder value. The study underscores the strategic mandate for Brazilian listed firms to conduct business in alignment with ESG principles and calls for policymakers to develop supportive public policies for sustainable development in Brazil. Future research directions include expanding the analysis to other stock markets to deepen the understanding of shareholder commitment to CSR globally. |

| The Impact of ESG Ratings on Financial Performance of the Companies: Evidence from BRICS Countries | Strekalina, A., Zakirova, R., Shinkarenko, A., & Vatsaniuk, E. | 2023 | [55] | BRIC COUNTRIES | The study investigates ESG (Environmental, Social, and Governance) scores' impact on financial performance in BRICS countries. It employs ESG scores as the independent variable and financial performance metrics (ROA, TSR, EVA) as dependent variables, considering control variables. The research spans 2017-2021, aiming to address gaps in understanding ESG-FP relations in emerging markets, particularly in BRICS nations. | The paper explores the complex relationship between ESG performance and financial outcomes, highlighting the evolving landscape where sustainability increasingly influences business practices. It emphasizes the multidimensional nature of ESG, driven by global concerns like climate change and social inequality, and the emergence of frameworks like the SDGs. While some studies suggest a positive correlation between ESG and financial performance, others indicate a neutral or negative relationship, underscoring the complexity of assessing sustainability's financial implications. Geographical variations in ESG-FP dynamics are discussed, considering differences between developed and emerging economies. Methodological considerations in studying the ESG-FP nexus are explored, including metrics and research approaches. The conclusion emphasizes the need for nuanced approaches and further research to inform business practices and investment decisions. Recommendations for BRICS countries include strengthening regulatory frameworks, enhancing transparency in data disclosure, and addressing social aspects of sustainable development. Despite limitations such as data quality and methodology variations, the study contributes to understanding sustainability's impact on financial performance, offering insights for investors, regulators, and company managers. Future research directions include broader sample coverage, longer time horizons, and comparative analyses of statistical methods and ESG databases, enriching the literature on sustainable development and financial performance, particularly in emerging markets like the BRICS countries. |

| The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China | Broadstock, D. C., Chan, K., Cheng, L. T.W., & Wang, X. | 2020 | [3] | CHINA | The study analyzes ESG performance's systematic pricing during the COVID-19 pandemic using stock price data and firm characteristics from the WIND database. It consists of three main parts: assessing ESG investment strategies' materiality, conducting an event study on ESG factors during COVID-19, and testing ESG factors' importance during the crisis. The methodology integrates regression analyses, event studies, and portfolio backtesting to evaluate the relationship between ESG performance and stock market dynamics, particularly during times of crisis. | The text explores the surge in ESG (Environmental, Social, and Governance) investing, surpassing US$30 trillion globally by 2019, driven by ethical considerations and potential portfolio performance enhancements. While early evidence on financial benefits was mixed, recent studies suggest investors increasingly consider sustainability factors, with high-ESG firms showing resilience during crises. Limited research on ESG's role in crises led to investigating the COVID-19 pandemic's impact on high-ESG stocks in China, where ESG investing is nascent. Governance dominates ESG concerns, and Syntao Green Finance provides ESG data. Empirical evidence from the study supports the systematic pricing of ESG during the pandemic, with high-ESG firms showing lower trading activity, higher returns, smaller stock declines, and lower volatility. Industry-neutral portfolios based on ESG scores performed better for high-ESG firms. The analysis indicates heightened investor importance of ESG during crises, suggesting the resilience of high-ESG firms. Overall, the study underscores ESG's growing significance in investment decisions, particularly during crises, shedding light on its role in financial markets and emphasizing sustainability's importance in portfolio management. |

| The wages of social responsibility — where are they? A critical review of ESG investing | Halbritter, G., & Dorfleitner, G. | 2015 | [25] | GERMANY | The methodology entails constructing ESG portfolios and employing cross-sectional regressions. ESG portfolios are formed based on ratings from three providers spanning 1991-2012, categorized into high and low portfolios. Performance is evaluated using the Carhart model, with adjustments for sectors and sub-periods. Cross-sectional regressions analyze ESG variables' direct impact, controlling for factors like market capitalization. Robustness checks include pooled OLS regressions with SIC-clustered standard errors. | The paper delves into Socially Responsible Investments (SRIs) and the relevance of Environmental, Social, and Governance (ESG) ratings in investment decisions. It explores the nuanced relationship between ESG ratings and financial performance, analyzing data from three providers. Contrary to previous findings, it suggests a nuanced relationship influenced by rating methodology and time period. The study highlights the importance of cautious interpretation of ESG ratings for investors and researchers in socially responsible investing. |

| Environmental, social and governance (ESG) activityand firm performance: a review and consolidation | Huang, D. Z. X. | 2019 | [27] | AUSTRALIA | The study employed a systematic approach to explore the link between Environmental, Social, and Governance Performance (ESGP) and Corporate Financial Performance (CFP). Researchers conducted a thorough literature search, screening 69 studies for eligibility based on specific criteria, including the use of ESGP and CFP metrics. They excluded studies with event analyses or probit models and focused only on those providing clear statistical information. After screening, 21 studies were chosen for analysis, ensuring a rigorous and comprehensive examination of the ESGP-CFP relationship. | The article provides a comprehensive review of the relationship between Environmental, Social, and Governance Performance (ESGP) and Corporate Financial Performance (CFP) through a meta-analytical approach spanning 1980 to 2019. It explores theoretical perspectives, historical contexts, and contemporary debates surrounding ESG issues in business. While studies confirm a positive relationship between ESGP and CFP, the strength and nature of this relationship vary across different measures and moderating factors. Operational CFP measures exhibit the strongest correlation with ESGP, followed by accounting and market-based measures. However, the economic significance of the relationship appears modest, capturing only about 2.0 percent of the explained variance in CFP. Environmental measures tend to show a stronger relationship with operational CFP compared to social or governance measures. Additionally, ESGP measures exhibit a higher correlation with accounting-based CFP compared to market-based CFP. Moderators and mediators such as firm size, location, and stakeholder engagement influence the relationship but remain inconclusive. The review underscores the complexity of the ESGP-CFP relationship and calls for further research to elucidate these intricacies and inform both theory and practice in the realm of ESG performance and financial outcomes. |

| Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? | Arvidsson, S., & Dumay, J. | 2021 | [1] | SWEDEN, AUSTRALIA, DENMARK | The methodology analyzed ESG reporting trends among 27 Swedish companies listed on NasdaqOMXS30 from 2008 to 2018. Sustainability reports from 2008, 2013, 2015, and 2018 were examined for quantity, quality, and impact of ESG reporting. Data from corporateregister.com tracked report numbers, while content analysis assessed quality. Triangulation and longitudinal analysis ensured robustness, capturing changes and effects over time. | The excerpt highlights the growing importance of ESG (Environmental, Social, and Governance) issues in corporate reporting and performance, driven by factors like climate change and regulatory changes. It discusses the changing marketplace tone, with investors demanding improved ESG performance and regulatory requirements compelling more ESG disclosures. Despite increased reporting, empirical research on the ESG reporting and performance relationship yields conflicting results, challenging companies to demonstrate tangible ESG progress. The analysis focuses on the Swedish context, noting historical leadership in sustainability reporting and the influence of regulatory changes and investor demands. The study investigates trends in ESG reporting quantity, quality, and corporate performance, leveraging data from sustainability reports and methodologies like the Analytical ESG Information Quality Framework. Findings indicate a surge in ESG reporting but plateauing performance trends after 2015, suggesting a need for sustained efforts to drive ESG improvements. The study underscores the importance of aligning ESG reporting with global standards and addressing sustainability challenges through proactive policies and enhanced reporting practices. It suggests avenues for future research, including exploring consumer and investor influences on corporate ESG behavior and considering alternative policy solutions. |

| ESG Integration in Investment Management: Myths and Realities | Kotsantonis, S., Pinne, C., & Serafeim, G. | 2016 | [30] | USA | Qualitative analysis | The text discusses the evolution and significance of integrating Environmental, Social, and Governance (ESG) considerations into business practices and investment decision-making. It notes the increasing interest among investors and companies in assessing the financial viability of sustainable approaches, supported by the emergence of ESG data. Recent studies suggest that companies with high ESG scores tend to outperform competitors, although the relationship varies across industries and does not imply causation. Challenges remain in integrating material ESG issues into investment management, but efforts by organizations like the Sustainability Accounting Standards Board (SASB) aim to address this. Sustainable practices, such as waste reduction and effective risk management, can enhance corporate value by attracting investors and improving brand reputation. While negative screening remains common, there's growing interest in ESG integration and corporate engagement. Despite challenges, progress in ESG reporting standards and data availability is notable, with regulators also promoting better ESG disclosure. Efforts to address misconceptions about ESG integration are underway, emphasizing its relevance to economic value. Overall, the text highlights advancements in ESG reporting, data availability, and regulatory frameworks, underscoring the importance of integrating ESG factors into investment decisions for long-term value creation. |

| On the value relevance of information on environmental, social, and governance (ESG): an evidence from Indonesia | Setyahuni, S. W., & Handayani, R. S. | 2020 | [47] | INDONESIA | The study population includes 467 public-listed companies in Indonesia, forming 3.789 firm-year observations. Purposive sampling selects 70 companies with ESG disclosure out of 467. Sectors focused are mining, agriculture, and manufacture due to environmental sensitivity, resulting in a final sample of 34 companies and 281 firm-year observations. | The text highlights the critical role of Environmental, Social, and Governance (ESG) factors in financial reporting and investment decisions, with a focus on Indonesia's regulatory environment. Investors now consider ESG metrics alongside financial indicators, recognizing their insights into sustainability, risk management, and societal impact. Indonesian regulations mandate ESG disclosures, aligning with global trends. Studies suggest a positive correlation between ESG disclosures and share prices, indicating investors' perception of ESG's relevance in financial performance. Transparent ESG reporting enhances trust and credibility, attracting capital and mitigating risks. ESG factors also gauge a company's adaptability to market dynamics and societal needs, fostering innovation and resilience. Meaningful engagement with stakeholders through ESG disclosures aligns corporate strategies with societal goals. Globally, companies recognize the importance of integrating ESG principles to stay competitive and resilient. In conclusion, ESG factors are pivotal in financial markets, regulation, and corporate strategies. Embracing ESG principles enhances transparency and resilience, fostering sustainable growth and societal well-being in a changing world. |

| Four things no one will tell you about ESG data | Kotsantonis, S., Pinne, C., & Serafeim, G. | 2019 | [31] | USA | The study examines ESG metrics and corporate reporting by analyzing sustainability reports from 50 Fortune 500 companies. It identifies over 20 reporting methods for Employee Health and Safety, revealing significant inconsistencies. Four key limitations of ESG data are highlighted: data inconsistency, benchmarking challenges, ESG data imputation, and disagreement among providers. Visual aids illustrate these challenges. | The text explores the purpose, challenges, and implications of Environmental, Social, and Governance (ESG) metrics in corporate performance evaluation. ESG metrics aim to quantify a company's performance beyond financial indicators, providing stakeholders with holistic insights. Challenges include data accuracy, benchmarking complexities, peer group selection, data imputation, and the need for disclosure standardization. Transparent benchmarking and peer group selection are crucial, while data imputation methods impact ESG ratings. Standardization and collaboration among stock exchanges and data providers are vital for improving ESG reporting reliability and comparability. The text underscores the importance of addressing these complexities to enhance understanding and application of ESG metrics in corporate decision-making. |

| Stock price reactions to ESG news: the role of ESG ratings and disagreement | Serafeim, G., & Yoon, A. | 2022 | [45] | USA | The study employs TruValue Labs Pulse data to track ESG-related news across companies, sourced from various reputable sources. It also utilizes ESG ratings from MSCI, Sustainalytics, and Thomson Reuters Asset 4. Regression analysis tests hypotheses on the predictive power of ESG ratings on future news and market reactions. Factors like consensus ratings, disagreement among raters, and financial materiality of events are considered. The study explores whether different ESG ratings have varying predictive abilities and if future stock returns can be forecasted based on the most accurate ESG rating, especially in high disagreement scenarios. In conclusion, the study provides insights into the relationship between ESG ratings, market reactions, and investor decision-making processes, offering implications for investment strategies and understanding ESG rating quality. | This study examines how environmental, social, and governance (ESG) ratings predict future ESG-related news and stock returns. Despite challenges in assessing ESG rating quality due to disagreement among raters and the multidimensional nature of ESG issues, consensus ratings can forecast future news. Positive ESG news prompts a market response, although firms with high ESG ratings show smaller reactions, suggesting such news is already priced in. Firms with low rating disagreement experience stronger stock price reactions, indicating higher expectations for future news. ESG ratings from different providers vary in predictive ability, with the most predictive rating influencing future stock returns, particularly in cases of high disagreement. Overall, ESG ratings serve as proxies for market expectations and can forecast future news and stock returns, despite rating disagreement. While acknowledging that predictive ability is just one aspect of rating quality, the findings highlight the importance of ratings in reflecting organizational commitments to ESG outcomes and suggest avenues for further research. |

| Where ESG fails? | Porter, M. E., Serafeim, G., & Kramer, M. | 2019 | [41} | USA | The article utilizes Michael Porter's Five Forces model to assess industry dynamics and profitability, emphasizing the impact of social and environmental factors. It showcases case studies like Enel and Generation Investment Management to demonstrate how integrating social considerations into investment strategies can drive competitive advantage and superior returns. Critiquing traditional ESG analysis, it advocates for merging societal impact with competitive strategy for long-term value creation. Additionally, it underscores investors' social responsibility to allocate capital to companies that contribute to societal progress profitably. The methodology involves combining theoretical frameworks, empirical evidence, and practical insights to promote holistic investment analysis. By considering social and environmental factors alongside financial metrics, investors can make informed decisions that align with financial goals and societal well-being, fostering a more sustainable investment landscape. | The article challenges the dominance of Environmental, Social, and Governance (ESG) metrics in driving shareholder returns, advocating for a shift towards shared-value investing. It critiques the limitations of traditional ESG rankings and Socially Responsible Investing (SRI) funds, highlighting the superior performance of companies creating tangible societal value, often overlooked by conventional metrics. The article questions the efficacy of the existing ESG framework and emphasizes the need for a more holistic approach that integrates social impact with economic performance. Central to the argument is the concept of shared-value investing, asserting that social impact can directly contribute to competitive advantage and shareholder returns. Through case studies of companies like Discovery, MasterCard, and Nike, the article illustrates how integrating social innovation into business models can lead to shared value and strategic differentiation. It calls for a fundamental shift in investor mindset, urging recognition and reward for companies that contribute meaningfully to social progress while delivering sustained economic value. Additionally, the article discusses the transformative impact of social and environmental factors on industry competition and shareholder returns, using Michael Porter's Five Forces framework. It underscores the need for investors to consider social factors alongside financial metrics, promoting effective communication between companies and investors regarding the economic value of social impact. Ultimately, the article advocates for a return to fundamental investing with a social purpose, unlocking growth, fostering innovation, and contributing to a more equitable and prosperous future. |

| Which Corporate ESG News Does the Market React To? | Serafeim, G., & Yoon, A. | 2022 | [46] | USA | The article employs a comprehensive methodology to study market reactions to Environmental, Social, and Governance (ESG) news. It utilizes data from TVL, which monitors ESG-related information across companies and classifies news as positive or negative based on its financial impact. The study also incorporates ESG performance data from MSCI ESG Ratings, assessing key issues relevant to investors. By categorizing news based on SASB standards and analyzing sentiment scores, the study captures market perceptions of ESG-related events. It examines market-adjusted and industry-adjusted returns around news events from January 2010 to June 2018, totaling 109,014 observations. In essence, the methodology combines data collection, classification, and analysis techniques to understand how markets respond to ESG news, considering its financial materiality and sentiment. |

The article investigates how Environmental, Social, and Governance (ESG) news shapes investor behavior and market dynamics, utilizing a rich dataset spanning from January 2010 to June 2018. It scrutinizes market reactions to diverse ESG news items and assesses the predictive power of ESG performance scores. Key findings reveal substantial market reactions to financially material ESG news, particularly positive news related to social capital issues like product impact. The study challenges traditional assumptions about investor responses to ESG news and underscores the evolving role of ESG considerations in investment strategies. Positive ESG news, especially regarding product quality and safety, drives significant market reactions, while negative news impacts market performance, particularly concerning customer welfare and GHG emissions. The research highlights the importance of unexpected news in influencing market dynamics and emphasizes the selective nature of market reactions to ESG news. In conclusion, the study sheds light on the intricate relationship between ESG news and investor behavior, offering valuable insights for sustainable investing. It calls for further exploration of global variations in market reactions to ESG news and the relationship between firm disclosures and ESG news to inform informed investment strategies and policy decisions. |

| Market Interest in Nonfinancial Information | Eccles, R.G., Serafeim, G. and Krzus, M.P. | 2011 | [11] | USA | The methodology used in the article involves analyzing market interest in nonfinancial information by examining data from Bloomberg across various asset classes and firm types. The analysis involves comparing the preferences and priorities of different investor groups, including equity investors, fixed income investors, broker-dealers, money managers, insurance companies, pension funds, and hedge funds. The researchers study the frequency and distribution of hits for different nonfinancial metrics to understand the relative importance placed on various environmental, social, and governance (ESG) factors by different types of investors. This methodology allows for a detailed exploration of market trends and investor preferences regarding nonfinancial information. | The article explores market interest in nonfinancial information across asset classes and firm types, highlighting the growing importance of environmental, social, and governance (ESG) factors in investment decisions. Equity investors prioritize environmental metrics like carbon emissions, anticipating regulatory impacts, while fixed income investors focus on metrics affecting cash flows, such as waste and energy consumption. Broker-dealers prioritize greenhouse gas emissions, while money managers adopt a broader approach, considering environmental and governance metrics. Asset owners like insurance companies prioritize transparency, while pension funds focus on governance to mitigate management risks. Hedge funds prioritize ESG disclosure and energy consumption metrics. Executives are advised to enhance transparency and tailor communication strategies to meet investor expectations. The article predicts increased market interest in nonfinancial data, driven by corporate disclosures and sophisticated valuation methodologies, presenting opportunities for companies to align with sustainable practices. |

| The Performance Frontier: Innovation for a sustainable strategy | Eccles, R. G., & Serafeim, G. | 2013 | [10] | USA | Qualitative analysis | Investments in sustainability programs often require trade-offs in companies' financial performance, but this doesn't have to be. By strategically focusing on the environmental, social and governance issues that are the most relevant to shareholder value, firms can simultaneously boost both financial and ESG performance. Firms must do four things to achieve this: (1) identify which ESG issues are most critical in their particular business. Materiality maps that the SASB is creating for 88 industries can aid this process. (2) Quantify the financial impact that improvements on those issues would have. (3) Undertake major innovation in products, processes, and business models to achieve the improvements. (4) Communicate with stakeholders about those innovations, integrated reporting, which combines financial and ESG performance information in one document, is an effective way to do this. To facilitate the process, companies must break down barriers to change- namely, incentive systems and investor pressure that emphasize short-term performance, a shortage of required expertise; and capital-budgeting limitations that fail to account for projects environmental and social value. |

| The impact of corporate sustainability on Organizational Processes and performance | Eccles, R., Ioannou, I. and Serafeim, G. | 2014 | [13] | USA | Identification: High Sustainability and Low Sustainability firms were identified based on their environmental and social policies since the mid-1990s. Data Collection and Analysis: Data on governance, stakeholder engagement, measurement systems, and performance implications were collected and analyzed. Statistical methods were used to compare the performance of High Sustainability firms with Low Sustainability firms over 18 years. Sector Analysis: The study analyzed how the performance of High Sustainability firms varied across different sectors. Addressing Alternative Explanations: Potential alternative explanations for performance differences were considered and addressed through robustness checks. |

The discussion explores the evolving perspective on corporations, moving beyond traditional profit-maximization models to consider long-term goals, stakeholder interests, and sustainability practices. Over the past two decades, companies increasingly integrate social and environmental concerns into their operations, raising questions about governance, performance implications, and stakeholder engagement. A study compares 90 "High Sustainability" firms with extensive sustainability policies to similar "Low Sustainability" firms. High Sustainability companies exhibit robust governance, stakeholder engagement, and disclosure practices. Statistical analyses reveal that High Sustainability firms consistently outperform Low Sustainability firms in both stock market and accounting performance over 18 years, attracting long-term investors and communicating a strategic, long-term approach effectively. The findings suggest that integrating sustainability practices can yield long-term financial benefits and enhance stakeholder relationships. Short-termism in decision-making may hinder value creation and stakeholder engagement. High Sustainability firms, committed to stakeholder engagement, tend to adopt longer-term perspectives, attracting investors aligned with such values. Measurement and disclosure play crucial roles in assessing corporate performance. High Sustainability firms emphasize transparency, integrate environmental and social information, and balance financial and nonfinancial disclosures. High Sustainability firms tend to outperform Low Sustainability firms over the long term, attributed to factors such as attracting better human capital, establishing reliable supply chains, and engaging in sustainability-aligned innovations. The study underscores the importance of understanding the conditions and mechanisms influencing sustainability integration, with implications for corporate decision-making and stakeholder relationships. Areas for future research include exploring variations across countries and assessing the optimal degree of sustainability policy adoption. |

| The Impact of a Corporate Culture of Sustainability on Corporate Behavior and Performance | Eccles, R. Ioannou, I. and Serafeim, G | 2011 | [12] | USA | Firstly, the researchers gathered data from a sample of 180 companies, dividing them into two groups: High Sustainability firms and Low Sustainability firms, based on their sustainability initiatives and policies. Secondly, they utilized propensity score matching techniques to pair High Sustainability firms with comparable Low Sustainability firms. This matching process aimed to balance out potential confounding variables and ensure a fair comparison between the two groups. Next, extensive statistical analyses were conducted to scrutinize various aspects of corporate behavior, governance structures, stakeholder engagement practices, and performance metrics across the 18-year study period spanning from 1993 to 2010. The empirical examination delved into both stock market and accounting performance metrics to assess the financial implications of integrating sustainability into corporate strategies. Furthermore, multivariate analysis techniques were employed to explore the underlying factors driving the superior performance of High Sustainability firms. This analysis considered factors such as industry sectors and the extent of stakeholder engagement practices. |

The article explores the rise of sustainability-focused policies in corporations and their impact on governance, stakeholder engagement, and performance. Key findings include: 1. Governance and Stakeholder Engagement: - High Sustainability firms have distinct governance structures, with boards overseeing environmental and social objectives. - They prioritize stakeholder engagement, fostering transparency and accountability throughout various phases. 2. Measurement and Disclosure Practices: - High Sustainability firms emphasize nonfinancial performance measures and exhibit greater transparency in external reporting. - They integrate environmental and social information into financial reporting and issue global sustainability reports. 3. Performance Implications: - Empirical analysis from 1993 to 2010 shows that High Sustainability firms significantly outperform Low Sustainability firms in both stock market and accounting performance. - Sustainable firms exhibit higher annual abnormal performance and lower volatility in performance metrics. Overall, the study suggests that sustainability integration may confer a competitive advantage, leading to higher profits and stock returns over the long term. However, further research is needed to understand causality and optimal sustainability levels across different contexts. |

| The Consequences of Mandatory Corporate Sustainability Reporting | Serafeim, G., & Yoon, A. | 2011 | [44] | USA | The methodology applied in the study includes a differences-in-differences approach, propensity score matching, and instrumental variable specifications. These methods are used to assess the impact of sustainability disclosure regulations on firms' reporting practices and valuations. | The introduction underscores the global trend of companies adopting governance processes to measure, analyze, and communicate sustainability efforts. It notes a significant increase in the number of S&P 500 companies with sustainability committees and those releasing sustainability reports, indicating a growing emphasis on environmental, social, and governance (ESG) performance. The article explores the implications of mandatory sustainability disclosure regulations on firms' disclosure strategies and subsequent valuations. It examines how such regulations may influence companies positively by enhancing transparency and motivating improvements in socio-environmental performance, while also potentially leading to costly efforts to differentiate themselves and erode shareholder value. To address these questions, the study analyzes data from four countries—China, Denmark, Malaysia, and South Africa—before and after the enforcement of disclosure regulations. Using differences-in-differences methodology, it assesses the regulation's impact on treated firms compared to control groups. The results indicate that treated firms significantly increase ESG disclosure following the regulation, accompanied by improvements in the credibility and comparability of disclosures. Instrumental variable models suggest a positive correlation between ESG disclosure and firms' valuations, challenging the notion that disclosure regulations destroy shareholder value. The historical background provides insights into the evolution of sustainability reporting, emphasizing the shift from voluntary to mandatory disclosure driven by societal pressures, investor demands, and regulatory changes. It outlines the regulatory frameworks adopted by the four focus countries, highlighting diverse approaches to sustainability reporting and disclosure requirements. In conclusion, the study reveals that sustainability disclosure regulations have led to substantial changes in firms' disclosure practices, with a positive economic impact on firm value. The findings underscore the importance of qualitative attributes of information and offer valuable insights for policymakers, investors, and corporate stakeholders. Despite certain limitations, the research suggests avenues for further exploration, emphasizing the profound impact of sustainability disclosure regulations on corporate behavior and firm value. |

| Sustainable entrepreneurship and B corps | Stubbs, W. | 2017 | [65] | AUSTRALIA | Qualitative analysis |

The paper aimed to contribute to the understanding of business models for sustainable entrepreneurship by exploring the practices of B Corps in Australia. The findings revealed insights into how B Corps combine market and social logics to pursue social, environmental, and economic outcomes. Unlike traditional market logic, where profitability is the primary focus, B Corps incorporate practices from the social logic to achieve "profit with a purpose," prioritizing positive social and environmental impacts alongside financial gains. The study identified that B Corps strive for an aligned organizational form, integrating goals, values, and practices associated with both market and social logics. While conflicts and tensions between these logics were minimal in the examined cases, further research is needed to understand the extent of integration across various aspects of hybrid organizing, such as inter-organizational relationships, organizational culture, and workforce composition. Combining market and social logics in B Corps can lead to innovation, generating novel organizational forms aimed at creating public benefit. However, mainstream adoption of the B Corp model is hindered by limited interest from large publicly-listed companies. The study suggests that while early adopters align well with B Corp values, companies primarily focused on financial returns may experience conflicts between market and social logics. The research raises questions for future investigation, including understanding the dynamics of combining market and social logics in sustainable entrepreneurship, exploring the founders of B Lab and the creation of the B Corp model, and examining the visibility and legitimacy of B Corps within mainstream business and the general public. Overall, further research is needed to evaluate the potential for B Corps to become a mainstream form of business and expand their influence globally. |

| The triple bottom line: does it all add up? Chapter 1: Enter the Triple Bottom line. |

Elkington, J. | 2004 | [15] | UK | Qualitative analysis | It introduced a framework for evaluating business performance that incorporates three dimensions: economic, social, and environmental. Elkington argued that traditional measures of business success, which focused solely on financial performance, were insufficient for assessing the overall impact of businesses on society and the environment. The TBL framework encourages businesses to consider not only their economic profitability but also their social and environmental impacts. By doing so, businesses can better understand their overall contributions to society and the planet. |

| Impact: Reshaping Capitalism to Drive Real Change | Cohen, R. | 2020 | [8] | UK | Qualitative analysis | It is a comprehensive exploration of impact investing and its potential to revolutionize capitalism. Cohen examines the evolution of impact investing, tracing its roots from traditional philanthropy to a more dynamic approach that integrates financial returns with social and environmental impact. He emphasizes the importance of measuring impact rigorously and advocates for the mobilization of capital on a global scale to address pressing societal challenges such as poverty, inequality, and climate change. Throughout the book, Cohen highlights real-world examples and offers practical guidance for investors, entrepreneurs, and policymakers interested in leveraging capital for positive change. "Impact" serves as a roadmap for reshaping capitalism to create a more sustainable and equitable world. |

| Variable | Coefficient | Std.Error | t-value | t-prob | Part.R^2 |

| CO2_1 | 0.959060 | 0.005851 | 164. | 0.0000 | 0.9246 |

| Dow Jones Sustainability World | 0.000492610 | 9.896e-05 | 4.98 | 0.0000 | 0.0112 |

| Crude Oil Brent Price EU | -0.00341374 | 0.0008441 | -4.04 | 0.0000 | 0.0074 |

| CCR | 0.000463131 | 0.0001055 | 4.39 | 0.0000 | 0.0087 |

| TSI_C | 0.00966428 | 0.001458 | 6.63 | 0.0000 | 0.0197 |

| Variable | Coefficient | Std.Error | t-value | t-prob | Part.R2 |

| D_CO2_1 | -0.392604 | 0.02124 | -18.5 | 0.0000 | 0.1353 |

| D_CO2_2 | -0.255569 | 0.02268 | -11.3 | 0.0000 | 0.0549 |

| D_CO2_3 | -0.193659 | 0.02312 | -8.37 | 0.0000 | 0.0311 |

| D_CO2_4 | -0.142319 | 0.02315 | -6.15 | 0.0000 | 0.0170 |

| D_CO2_5 | -0.118610 | 0.02271 | -5.22 | 0.0000 | 0.0123 |

| D_CO2_6 | -0.0792410 | 0.02123 | -3.73 | 0.0002 | 0.0063 |

| D_DJS_3 | 0.00198668 | 0.001073 | 1.85 | 0.0642 | 0.0016 |

| D_TS_C_6 | 0.277973 | 0.08987 | 3.09 | 0.0020 | 0.0044 |

| D_TSI_SQUARE_1 | 0.302699 | 0.1036 | 2.92 | 0.0035 | 0.0039 |

| D_CCR_4 | -0.000736258 | 0.0003235 | -2.28 | 0.0230 | 0.0024 |

| Variable | Coefficient | Std.Error | t-value | t-prob | Part.R^2 |

| Constant | -6.17092 | 2.419 | -2.55 | 0.0108 | 0.0030 |

| DecimalDate | 0.00387243 | 0.001021 | 3.79 | 0.0002 | 0.0065 |

| CO2 (t-1) | 1.00034 | 0.0001803 | 5548 | 0.0000 | 0.9999 |

| Dow Jones Sustainability World | -1.60759e-05 | 5.682e-06 | -2.83 | 0.0047 | 0.0036 |

| Crude Oil Brent Price | 0.000110840 | 3.571e-05 | 3.10 | 0.0019 | 0.0044 |

| CCR_SQUARE | -2.62072e-09 | 3.510e-10 | -7.47 | 0.0000 | 0.0249 |

| TSI_SQUARE | -8.90689e-07 | 5.858e-07 | -1.52 | 0.1286 | 0.0011 |

| D_CCR_4 | 3.16413e-05 | 9.779e-06 | 3.24 | 0.0012 | 0.0024 |

| ECM_DIFF | 0.999205 | 0.0006052 | 1651. | 0.0000 | 0.9992 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).