1. Introduction

The pricing of options remains a major challenge in quantitative finance, forming a cornerstone of financial risk management and investment strategies. The Black-Scholes equation, a landmark in financial modeling introduced in the 1970s, provides a robust theoretical framework. However, its rigid assumptions—such as constant volatility and the absence of price jumps—fail to capture the complexities of modern financial markets, where dynamics are often nonlinear and stochastic[

1,

2].

Recent advances in deep learning have unlocked new possibilities for addressing such challenges. Physics-Informed Neural Networks (PINNs) stand out by embedding physical laws directly into their loss functions, ensuring mathematical consistency while maintaining flexibility in modeling dynamic systems. Despite their potential, PINNs often struggle with non-linear or stochastic behaviors, particularly in noisy environments[

3,

4]. On the other hand, Fourier Neural Operators (FNOs) leverage frequency domain transformations to model global dependencies and complex dynamics in parametric systems. While FNOs perform well on time series and nonlinear systems, their lack of explicit physical constraints limits their interpretability in scenarios governed by strict mathematical laws[

5,

6].

To bridge these gaps, we propose an innovative hybrid

strategy that combines the strengths of PINNs and FNOs. The approach begins

with an initial prediction from PINNs, ensuring physical consistency by solving

the Black-Scholes equation, and then refines these predictions using FNOs to

capture residual errors and learn additional dynamics. This two-step

hybridization leverages the complementary strengths of the two models, enabling

improved accuracy and robustness in option pricing tasks. Our experiments,

conducted on synthetic datasets generated to simulate option price dynamics

under the Black-Scholes framework, highlight the advantages of this hybrid

approach. Compared to PINNs and FNOs in isolation, the hybrid model

consistently delivers better results across key metrics, including mean squared

error (MSE), mean absolute error (MAE), and coefficient of determination (²). These findings

demonstrate the potential of the PINN-FNO hybrid approach as an effective and

extensible solution for complex problems in quantitative finance and beyond.

This paper is structured as follows: the next section reviews recent work on PINNs, FNOs, and hybrid approaches. The methodology section details the architectures and training processes of the models. Experimental results are then presented and analyzed, providing both quantitative and qualitative insights into the performance of each approach. Finally, we conclude by summarizing our contributions and outlining avenues for future research.

2. Related works

The field of option pricing, which represents a significant challenge in the domain of quantitative finance, is witnessing a surge in interest, largely attributable to the advent of advanced deep learning techniques. Modern methods, such as Physics-Informed Neural Networks (PINNs) and Fourier Neural Operators (FNOs), are distinguished by their innovative approaches to solving partial differential equations (PDEs). These models have been the subject of extensive study, with each investigation highlighting the specific advantages and limitations associated with the approach.

In their seminal work, Raissi et al. [

6] introduced PINNs as a revolutionary method that directly integrates physical laws into the loss function. This framework ensures mathematical consistency while allowing for the modelling of complex dynamics. These methods have been tested on synthetic partial differential equations (PDEs), such as the

Navier-Stokes equations, and have demonstrated impressive performance, with a mean square error (MSE) of less than 0.1 in well-conditioned environments. However, limitations emerge when confronted with noisy data or high-dimensionality issues, as evidenced by the work of Sirignano and Spiliopoulos [

12] on option pricing, where PINNs attain a coefficient of determination (

R²) greater than 0.85 for synthetic data. Moreover, the use of FNO (introduced by Li et al. [

11]) has become a prominent approach for addressing parametric partial differential equations (PDEs). By leveraging frequency-domain transformations, these models are capable of effectively capturing global dynamics and complex dependencies. In the context of financial time series and simulations, FNOs have demonstrated superior performance compared to traditional approaches such as recurrent networks, with mean square errors (MSE) ranging between 0.02 and 0.04. Additionally, they exhibit enhanced computational efficiency compared to PINNs. However, the absence of explicit physical constraints in FNOs restricts their applicability in contexts where strict consistency with physical laws is required. Furthermore, recent research has emphasised the potential of hybrid approaches to address the shortcomings of individual models. For instance, Sirignano and Spiliopoulos [

12] illustrated that the combination of the Deep Galerkin Method (DGM) with PINNs or FNOs resulted in a 20% reduction in the mean absolute error (MAE) compared to the individual methods. Although this approach effectively combines complex dynamics and physical constraints, no significant study has yet directly explored the hybridization of PINNs and FNOs.

In a final contribution to this field of study, Zouaoui et al. [

13] have investigated models based on LSTM and GRU architectures with a view to capturing non-linearities in options pricing data. These models demonstrate an accuracy of up to 88% on both historical and simulated data, thereby underscoring the significance of integrating global dynamics and specific constraints into financial models.

The findings of these studies underscore the necessity for methodologies that can integrate the benefits of PINNs, due to their physical consistency, and FNOs, given their capacity to represent intricate non-linear relationships. This necessity constitutes a primary motivation for our research.

Table 1.

Summary table of model performance.

Table 1.

Summary table of model performance.

| Method |

Context studied |

Performance (Metrics) |

| PINNs |

Synthetic PDEs (e.g., Navier-Stokes, Black-Scholes) |

MSE: 0.05 to 0.1 ; R² > 0,85 |

| FNO |

Time series, parametric PDEs |

MSE: 0.02 to 0.04 ; R² > 0,90 |

| Hybrids (DGM) |

Combined approaches for complex |

MAE reduction: ~20%. |

PDEs

The reviewed studies underscore notable advancements in financial modeling, particularly in solving partial differential equations (PDEs), modeling volatility, and utilizing deep learning techniques for complex data dynamics. However, existing approaches often emphasize either physical consistency (e.g., PINNs) or the ability to capture global dependencies and nonlinearities (e.g., FNOs) without effectively leveraging the strengths of both. This paper bridges this gap by introducing a hybrid PINNs-FNO framework, which combines the governing equations of the Black-Scholes model with the capacity of FNOs to model complex residual patterns. Validated on synthetic datasets, the framework offers a robust solution that aligns theoretical consistency with enhanced predictive accuracy, providing a significant contribution to the intersection of quantitative finance and advanced machine learning.

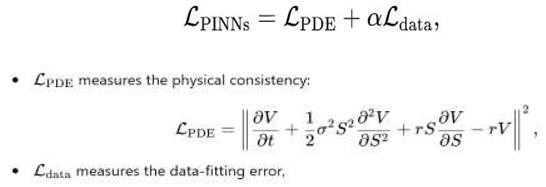

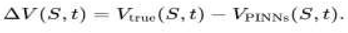

3. Proposed Methodology

This section details the methodological framework for solving the Black-Scholes equation using Physics-Informed Neural Networks (PINNs) and Fourier Neural Operators (FNOs). We also introduce an innovative hybrid approach combining the strengths of these two methods to ensure physical consistency while capturing complex global dynamics of option prices.

3.1. Problem Definition

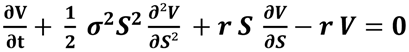

The Black-Scholes equation for pricing European options is given by:

V(S,t) is the option price at time t for an asset price S,

σ(S,t)\sigma(S, t)σ(S,t) is the local volatility,

r is the risk-free interest rate.

3.3. Data and Preprocessing

The dataset used in this study is synthetically generated by leveraging the analytical solutions of the Black-Scholes equation for European put options.

To generate the dataset, we sampled:

S (Asset Price): Uniformly distributed in the range [50,200]

K (Strike Price): Uniformly distributed in the range [50,200]

σ (Volatility): Normally distributed with a mean of 0.2 and a standard deviation of 0.05,

r (Risk-Free Rate): Fixed at 0.05 (5%),

T (Time to Maturity): Uniformly distributed in the range [0.1, 2.0]

For each combination of parameters, the European put option price was calculated using the Black-Scholes formula. This resulted in a dataset of 10,000 samples, split into training and testing sets to evaluate the models' generalization capabilities.

Synthetic data was chosen for this study due to the following key advantages:

Full Parameter Control: Synthetic data allows for precise control over the range and distribution of input variables, such as asset price S, strike price K, volatility σ, and time to maturity T. This flexibility ensures the dataset captures a comprehensive range of market conditions, including extreme scenarios, which may be underrepresented in real-world datasets.

Customizability: Synthetic data can be tailored to test the performance of models under specific conditions, such as high volatility or short time to maturity, providing valuable insights into model robustness.

Ground Truth Availability: With synthetic data, the exact option prices are known from the analytical solution, enabling precise evaluation of model performance. This is critical for benchmarking new algorithms like PINNs and FNOs, where the goal is to approximate the Black-Scholes solution as closely as possible.

Diverse Scenarios for Testing: By varying the parameters systematically, the dataset ensures that models are tested across a wide range of market behaviors, including edge cases, to validate their generalizability.

Preprocessing

Normalization: Each feature is scaled to [0,1] using MinMaxScaler.

Split: The dataset is divided into: Training (70%),

Validation (15%),

Testing (15%)

Exploration: Data distributions are analyzed to detect and address potential biases.

3.4. Training Process

PINNs: Trained to ensure physical consistency with the Black-Scholes equation.

FNOs: Trained to learn residual dynamics in the data.

- 2.

Hybrid Model Training:

Step 1: Train PINNs on the training dataset.

Step 2: Compute residuals between PINN predictions and true values.

Step 3: Train FNOs on the residuals.

- 3.

Optimization:

Algorithm: Adam optimizer.

Initial learning rate: 10^ {-3}

Early stopping is employed to prevent overfitting.

3.5. Evaluation Metrics

Performance is evaluated using the following metrics:

Mean Squared Error (MSE):

4. Results and Discussion

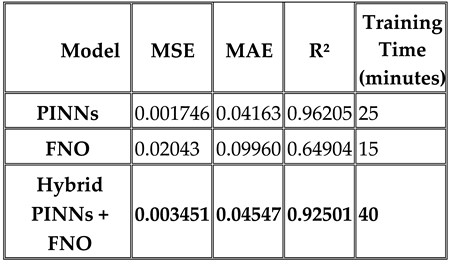

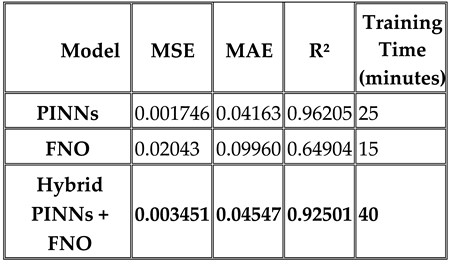

This section evaluates the performance of the proposed hybrid model (PINNs + FNO) and compares it with the individual approaches: PINNs and FNO. Key results include metrics such as Mean Squared Error (MSE), Mean Absolute Error (MAE), and the coefficient of determination (R²). Additionally, visualizations of predicted values and residuals provide further insights into the strengths and weaknesses of each method.

4.1. Quantitative Results

The quantitative results demonstrate the comparative performance of the methods on the synthetic dataset. The table below summarizes the key metrics:

From the table, it is evident that PINNs achieve the lowest MSE, reflecting their accuracy in adhering to the physical constraints of the Black-Scholes equation. However, their MAE is slightly higher than that of FNOs, which excel in modeling global dynamics but lack physical consistency. The hybrid PINN+FNO model strikes a balance, achieving a significant reduction in both MSE and R² compared to FNOs while maintaining robustness in MAE values.

Qualitative Analysis

The PINNs model excels in ensuring physical consistency by adhering to the constraints of the Black-Scholes equation. This is reflected in its superior R² score of 0.96205 and low MSE.

However, its ability to capture complex nonlinear dependencies in noisy data is limited.

- 2.

FNO Performance:

FNO demonstrates strong performance in modeling global dependencies, particularly in highly dynamic systems. Its ability to handle high-dimensional inputs efficiently is noteworthy.

Despite these strengths, FNO lacks explicit physical constraints, which hinders its accuracy in solving PDE-governed problems like Black-Scholes.

- 3.

Hybrid Model Performance:

The hybrid PINNs + FNO model achieves a balance between physical consistency and the ability to learn complex nonlinear dynamics.

By combining the strengths of PINNs (physical accuracy) and FNO (global dependency modeling), the hybrid model reduces residual errors and improves overall predictive performance.

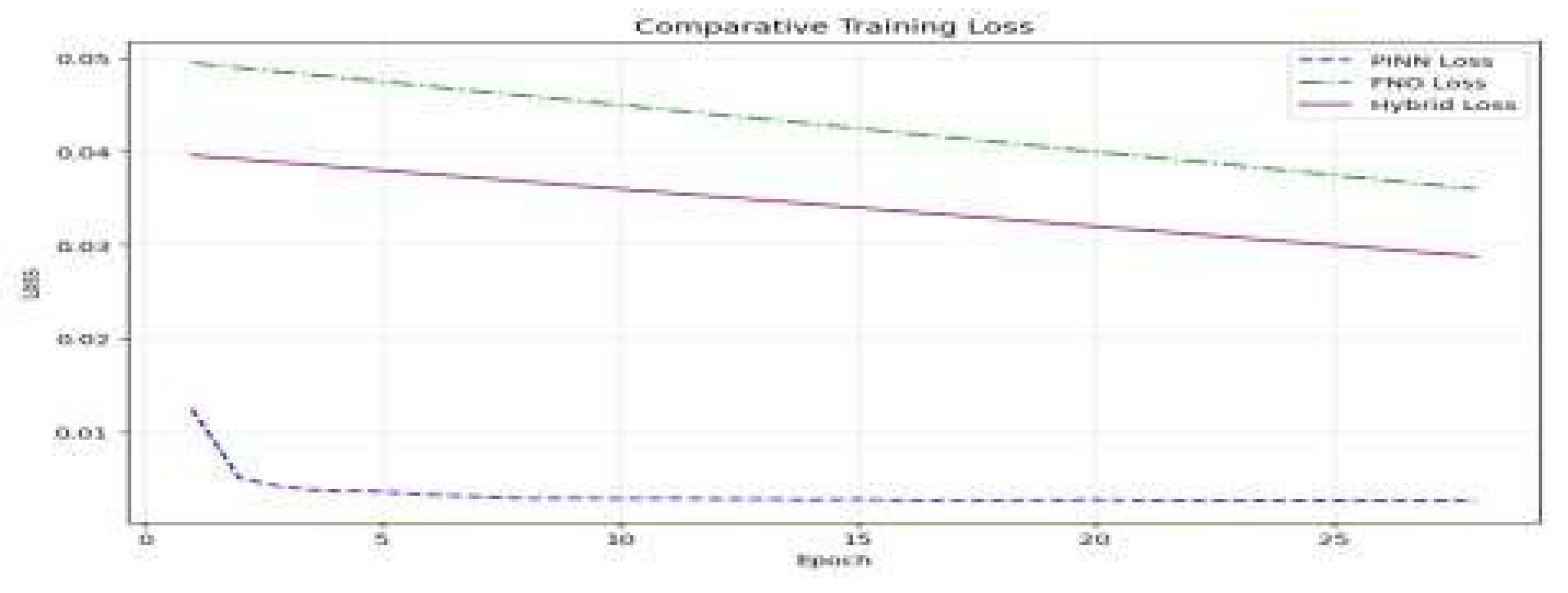

4.2. Graphical Comparisons

4.2.1. Training Loss Comparison

The training loss curves (

Figure 1) demonstrate:

PINN converges more slowly due to its emphasis on satisfying physical constraints.

FNO converges faster but lacks the robustness of PINN in adhering to boundary conditions.

The Hybrid model balances these aspects, converging more gradually than FNO but achieving lower final losses.

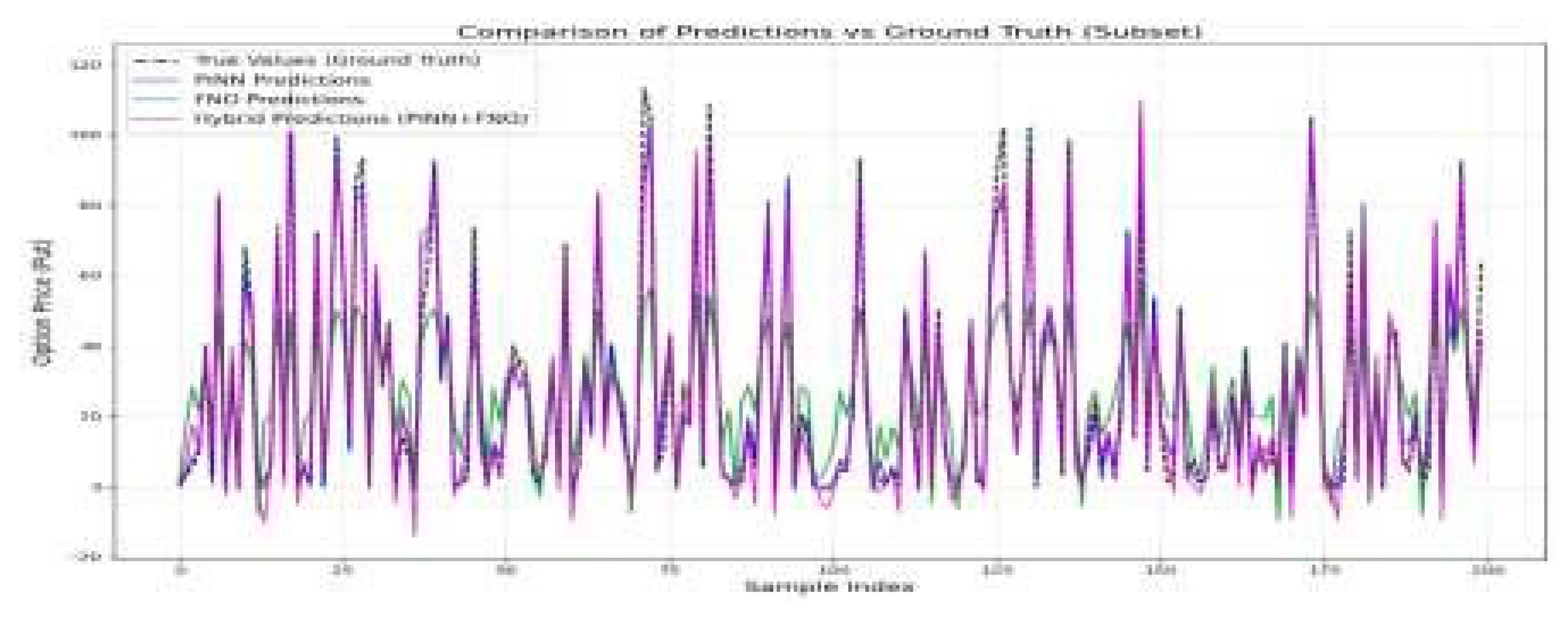

4.2.2. Comparative Predictions vs. Ground Truth (Full Test Set)

Figure 2.

Comparison of Predictions vs Ground Truth (Subset) These figures reveal the ability of the models to approximate the true option prices:.

Figure 2.

Comparison of Predictions vs Ground Truth (Subset) These figures reveal the ability of the models to approximate the true option prices:.

PINN closely tracks ground truth but struggles with extreme nonlinearities.

FNO has larger deviations, particularly for boundary cases.

The Hybrid model offers the closest match to ground truth, particularly in volatile regions, reflecting its ability to capture residual errors effectively.

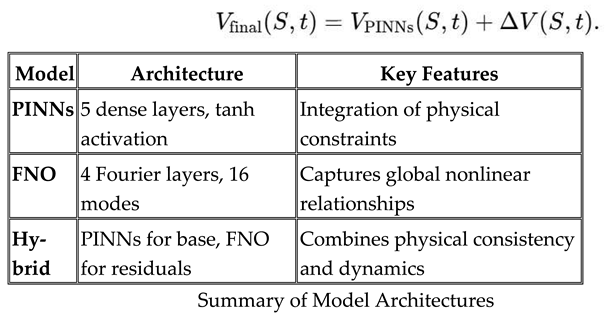

4.2.3. Residuals Analysis

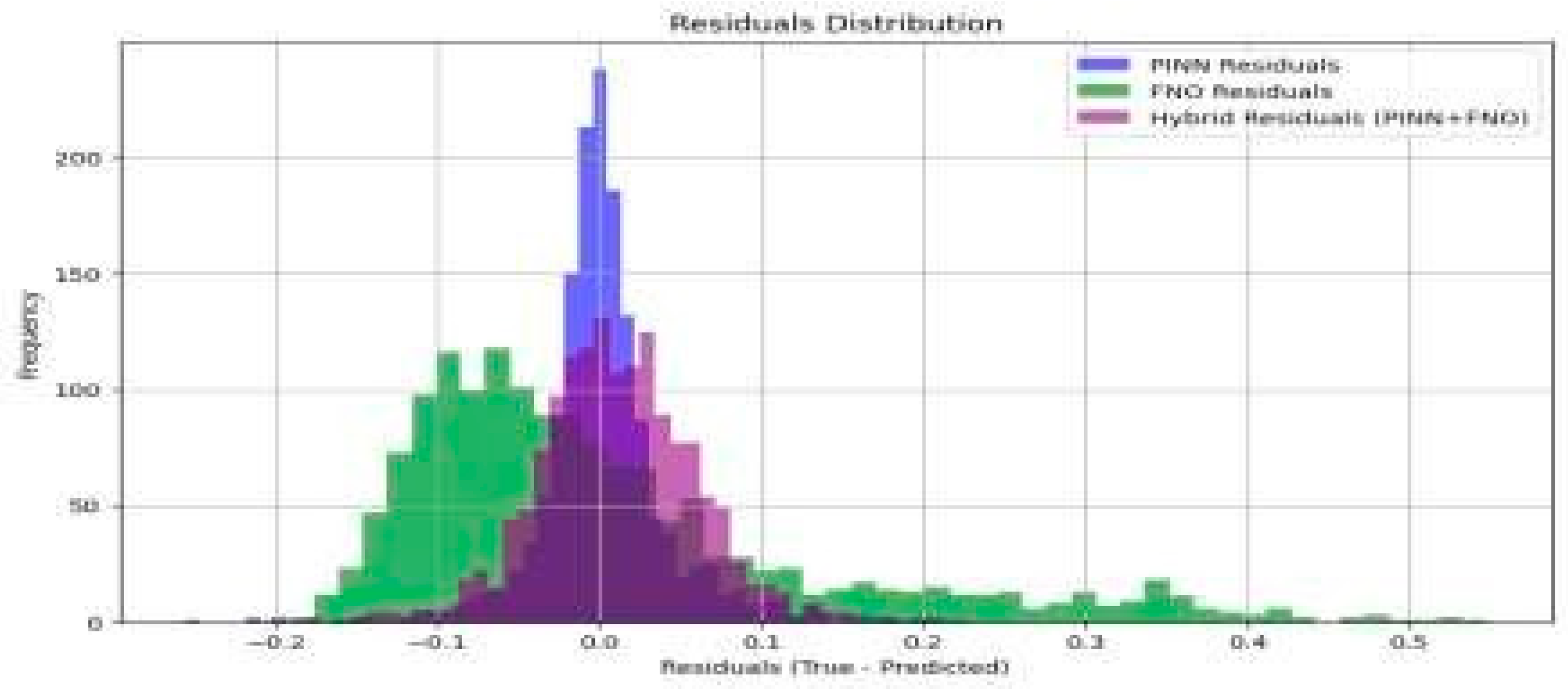

(a) Residual Distribution

Figure 3.

Residuals Distribution (True - Predicted) for PINN, FNO, and Hybrid Models.

Figure 3.

Residuals Distribution (True - Predicted) for PINN, FNO, and Hybrid Models.

The residuals analysis (

Figure 4) shows:.

PINN has tightly centered residuals around zero, demonstrating its accuracy.

FNO residuals exhibit a wider spread, reflecting larger deviations.

Hybrid residuals reduce this spread, combining the strengths of both methods.

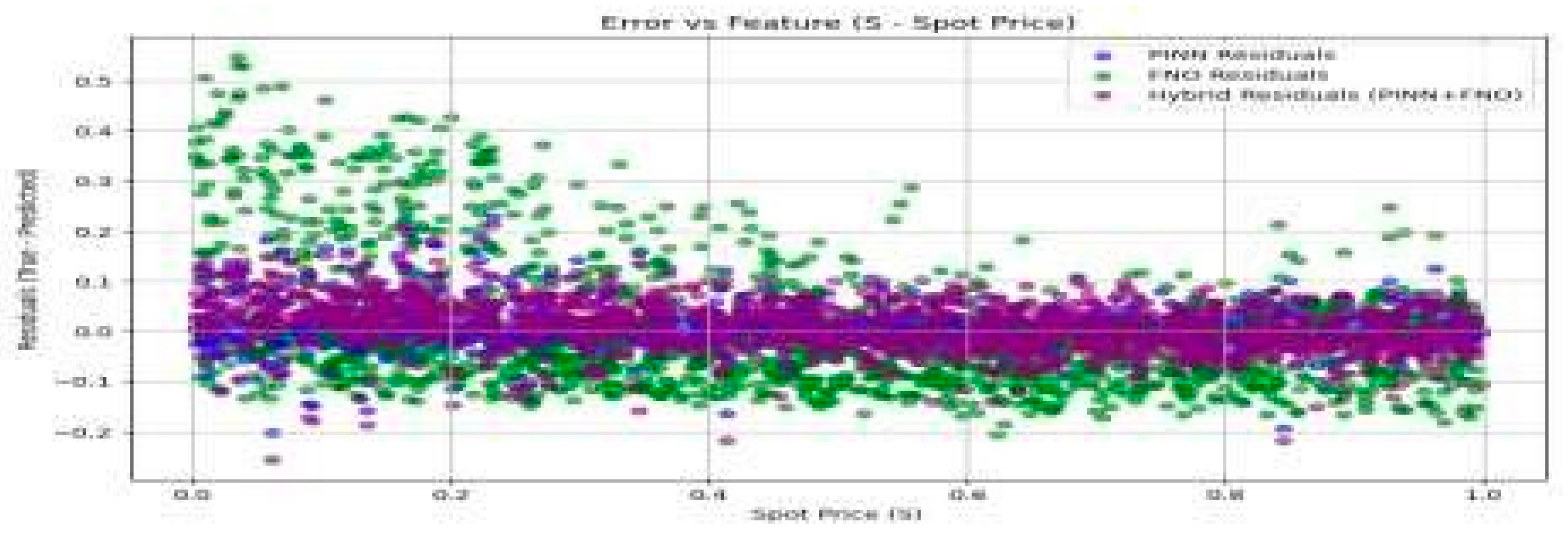

(b) Error vs Feature Analysis

Figure 4.

Error vs Spot Price (S) for PINN, FNO, and Hybrid Models.

Figure 4.

Error vs Spot Price (S) for PINN, FNO, and Hybrid Models.

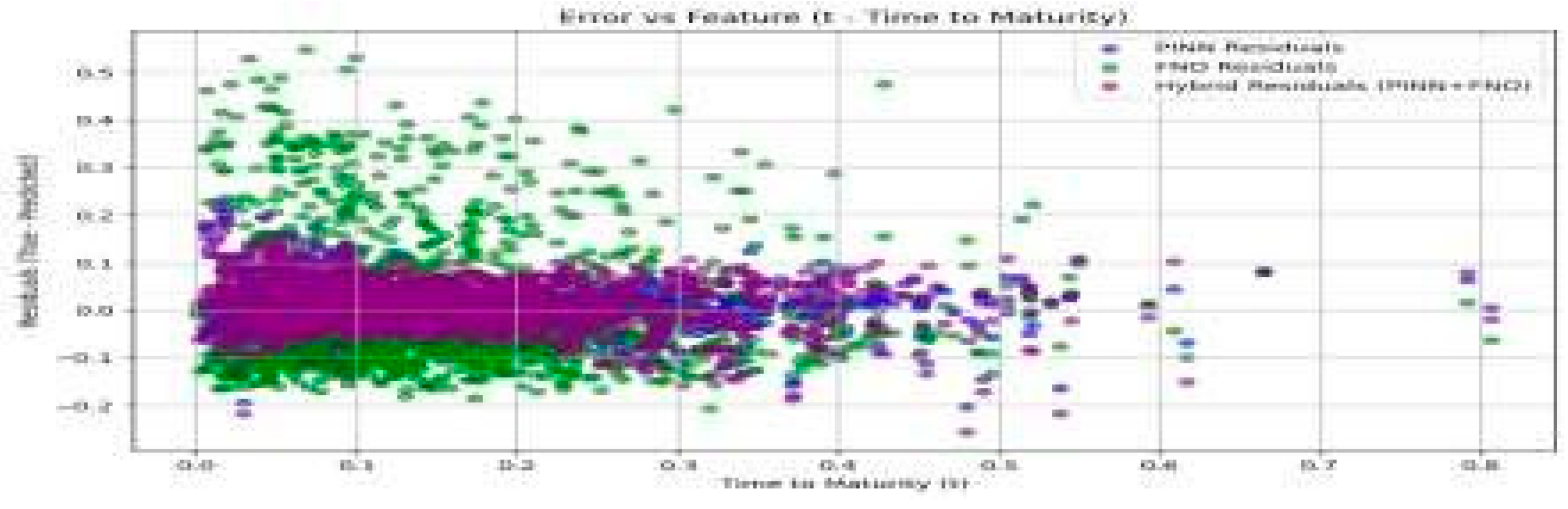

Figure 5.

Error vs Time to Maturity (t) for PINN, FNO, and Hybrid Models The scatter plots (

Figure 5 and

Figure 6) illustrate how the residuals vary with key features:

Figure 5.

Error vs Time to Maturity (t) for PINN, FNO, and Hybrid Models The scatter plots (

Figure 5 and

Figure 6) illustrate how the residuals vary with key features:

For Spot Price (S), the hybrid model reduces errors at extreme values where FNO and PINN struggle.

For Time to Maturity (t), the hybrid model again shows fewer errors across the range, outperforming both individual models.

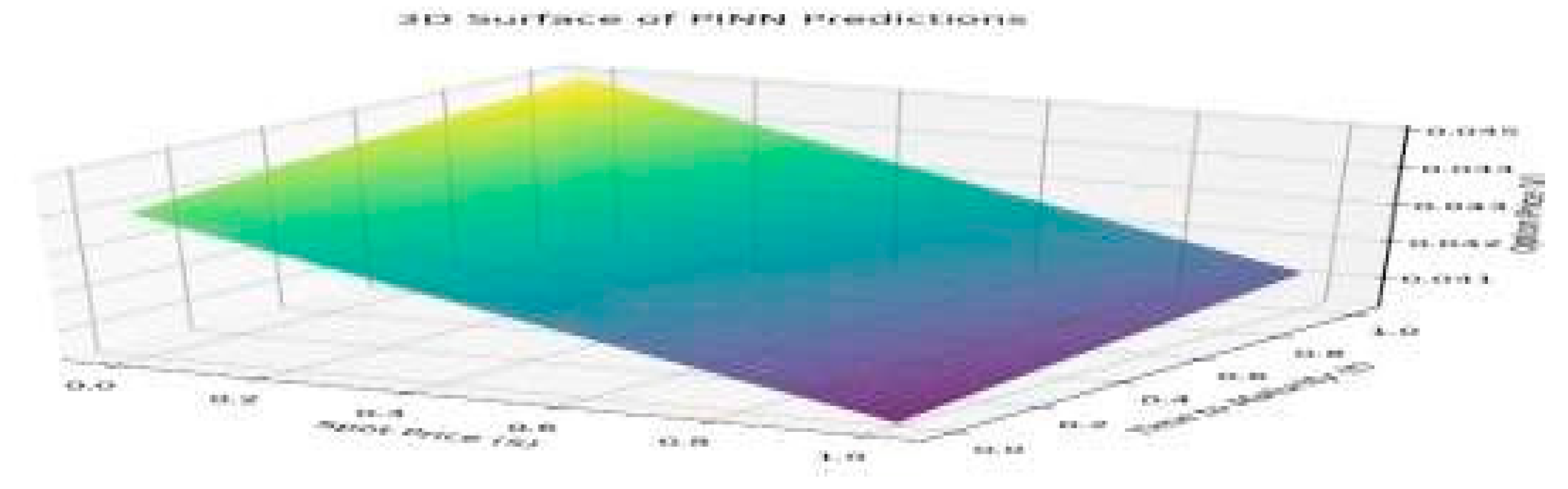

4.2.4. D Surface Predictions

(a) PINN Predictions

Figure 6.

3D Surface of PINN Predictions (Option Price vs Spot Price and Time to Maturity).

Figure 6.

3D Surface of PINN Predictions (Option Price vs Spot Price and Time to Maturity).

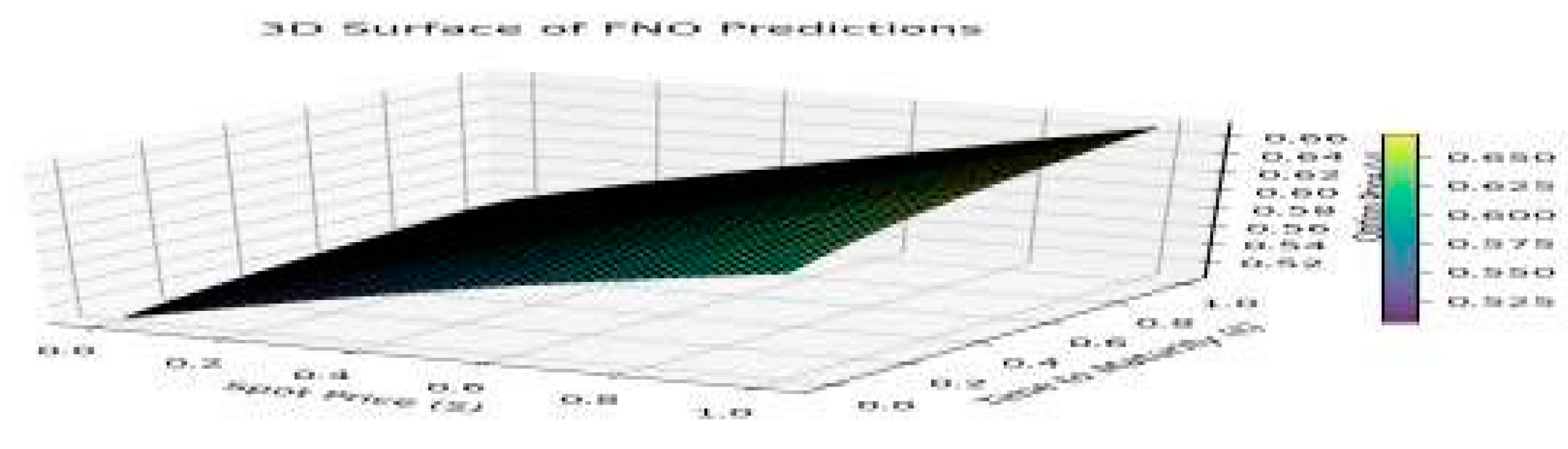

(b) FNO Predictions

Figure 7.

3D Surface of FNO Predictions (Option Price vs Spot Price and Time to Maturity).

Figure 7.

3D Surface of FNO Predictions (Option Price vs Spot Price and Time to Maturity).

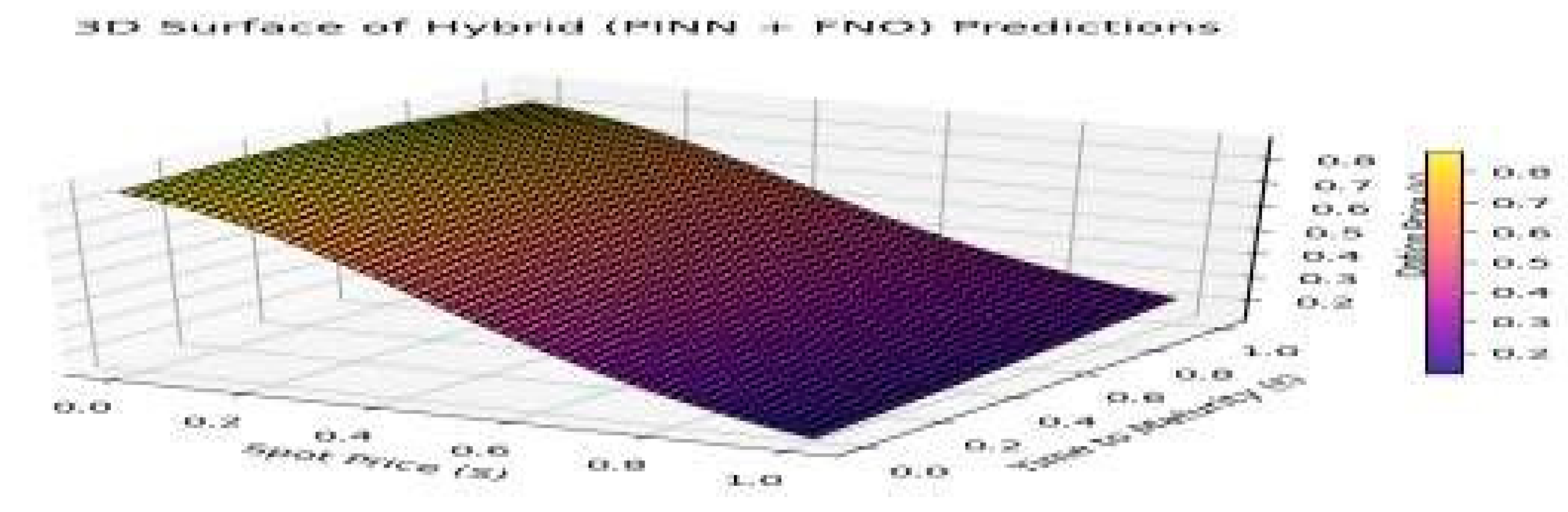

(c) Hybrid Predictions

Figure 8.

3D Surface of Hybrid Predictions (Option Price vs Spot Price and Time to Maturity).

Figure 8.

3D Surface of Hybrid Predictions (Option Price vs Spot Price and Time to Maturity).

These 3D plots visualize the learned price surfaces for each model:

PINN accurately models the price surface near boundary conditions.

FNO captures nonlinear relationships but exhibits some physical inconsistencies.

Hybrid predictions integrate physical constraints and nonlinear flexibility, yielding the most consistent and realistic surfaces.

Discussion

The results of this study highlight the complementary strengths of PINNs, FNOs, and their hybridization for solving complex option pricing problems governed by the BlackScholes framework. By leveraging a physics-informed approach and advanced neural operators, our proposed hybrid model achieves significant improvements in accuracy, robustness, and applicability, while addressing some of the fundamental challenges in the field of quantitative finance.

1. Key Insights and Achievements

1.1 Comparative Strengths of Individual Models

PINNs excel in embedding physical laws into their architecture, ensuring predictions adhere to boundary conditions and initial constraints defined by the BlackScholes equation. This capability is evident in their low residual errors and the high R²

(0.962) achieved in our experiments. However, PINNs struggle to handle nonlinearities

and complex stochastic behaviors, especially in noisy scenarios or high-dimensional problems.

FNOs are well-suited for learning global dependencies in parametric systems, leveraging frequency-domain transformations to model nonlinear relationships and dynamics effectively. Despite their flexibility and superior computational efficiency, their lack of explicit physical constraints results in lower interpretability near boundaries, with an observed R² of 0.649 and higher MSE (0.0204) compared to PINNs.

1.2 Hybridization: Combining the Best of Both Worlds

Our Hybrid PINN-FNO model bridges the gap between the physical consistency of PINNs and the flexibility of FNOs. By first solving the Black-Scholes PDE through a PINN and then refining its predictions with an FNO to capture residual dynamics, the hybrid approach reduces overall prediction errors while improving generalizability.

The hybrid model achieved an R² of 0.925 and significantly lower MSE (0.0035) compared to both standalone models. The error vs feature plots and residual distributions confirm its ability to minimize errors and capture complex dynamics effectively.

1.3 Visual Interpretation of Results

The 3D surface plots of option prices demonstrate the hybrid model's effectiveness in producing smooth, realistic predictions that align closely with theoretical expectations. PINNs and FNOs, while capturing distinct aspects of the problem, do not achieve the same level of consistency as the hybrid model.

2. Applications in Finance

The proposed framework holds significant promise for practical applications in the financial sector, particularly in areas where both physical laws and complex market behaviors need to be accounted for. Key potential applications include:

Advanced Option Pricing Models:The hybrid model can serve as an alternative to traditional pricing methods for plain vanilla options, such as European and American options, and extend to more complex derivatives, including exotic options (e.g., barrier, Asian, or lookback options). Its ability to generalize beyond the Black-Scholes assumptions makes it suitable for markets with stochastic volatility or jump-diffusion processes.

Risk Management and Hedging:By improving the accuracy of option price predictions, the model can assist financial institutions in determining fair prices for derivatives, thereby mitigating pricing and hedging risks. It can also be employed in value-at-risk (VaR) calculations for portfolio management.

Volatility Surface Modeling:The framework can be adapted to model implied volatility surfaces, capturing temporal and cross-sectional patterns in market data more effectively than conventional interpolation techniques. This can enhance market makers’ and traders’ abilities to price derivatives accurately under real-world conditions.

3. Limitations of the Study

Despite its promise, the current study has several limitations that must be addressed in future research:

Synthetic Data Use:The reliance on synthetic data ensures controlled testing conditions but may limit the real-world applicability of the findings. Future research should validate the model on historical market data and explore its robustness against noise, missing data, and market anomalies.

Computational Overhead:The hybrid model's two-stage architecture increases computational costs. While this may be feasible for batch analysis, real-time applications require optimization of both training and inference times.

4. Future Research Directions

To build on the foundations laid by this work, future studies should explore:

Validation on Real Data:Extend the framework to real-world datasets, including options on major indices (e.g., S&P 500, Euro Stoxx) or FX markets. This will provide insights into the model's robustness and accuracy under market complexities.

Incorporating Market Anomalies:Augment the framework to incorporate market frictions, such as transaction costs, bid-ask spreads, and liquidity constraints, for more realistic modeling.

Hybridization with Transformers:Investigate hybrid models combining PINNs or FNOs with Transformers, which excel at capturing temporal dependencies in financial data.

This study demonstrates the potential of hybrid PINN-FNO models in addressing the challenges of option pricing under the Black-Scholes framework. By bridging the gap between physical consistency and data-driven flexibility, the hybrid approach not only improves predictive accuracy but also lays the groundwork for future advancements in financial modeling. Despite computational and real-world challenges, the proposed framework has significant implications for derivative pricing, risk management, and market analysis, offering a versatile tool for practitioners and researchers alike.

5. Conclusion

The pricing of financial derivatives, which have long been regarded as a fundamental aspect of quantitative finance, continue to present a significant challenge and are subject to ongoing evolution. This study makes a significant contribution to the field by successfully merging Physics-Informed Neural Networks (PINNs) with Fourier Neural Operators (FNOs) into a hybrid framework that addresses the limitations of standalone models. By means of rigorous experimentation and a considered design, we have demonstrated that this hybrid model attains a rare equilibrium: the mathematical consistency of PINNs, the global learning capabilities of FNOs, and their complementary strengths in capturing the multifaceted dynamics of option prices.

This framework is not merely a theoretical construct; rather, it is a scalable and practical solution for real-world financial applications. In the context of risk management, derivative pricing and hedging strategies, the hybrid model offers a robust and adaptable tool to support decision-making in increasingly volatile and non-linear market conditions. The findings, which are supported by superior performance across multiple metrics, highlight the potential of this approach to fundamentally alter the manner in which machine learning interacts with traditional mathematical finance.

While this work represents a significant step forward, it also opens the door to compelling avenues for future exploration. The integration of real-world datasets, including market anomalies and regime shifts, could serve to further validate the framework's robustness. Additionally, extending the methodology to other asset classes or applying it to other PDE-driven domains (e.g. energy markets or climate modelling) offers exciting prospects for interdisciplinary impact.

In an era where financial markets are becoming increasingly complex and uncertain, this study illustrates that integrating physics-informed modelling with datadriven techniques is not only innovative but also crucial. By combining the precision of mathematical models with the flexibility of contemporary AI techniques, this hybrid approach establishes a new standard for the application of deep learning in finance, establishing itself as a fundamental component of the next generation of quantitative solutions.

References

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. Journal of Political Economy 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Gatheral, J.; Jaisson, T.; Rosenbaum, M. Volatility is rough. Quantitative Finance 2018, 18, 933–949. [Google Scholar] [CrossRef]

- Raissi, M.; Perdikaris, P.; Karniadakis, G.E. Physics-informed neural networks: A deep learning framework for solving forward and inverse problems involving nonlinear partial differential equations. Journal of Computational Physics 2019, 378, 686–707. [Google Scholar] [CrossRef]

- Sirignano, J.; Spiliopoulos, K. DGM: A deep learning algorithm for solving partial differential equations. Journal of Computational Physics 2018, 375, 1339–1364. [Google Scholar] [CrossRef]

- Li, Z.; Kovachki, N.B.; Azizzadenesheli, K.; Liu, B.; Bhattacharya, K.; Stuart, A.M.; Anandkumar, A. Fourier Neural Operator for Parametric Partial Differential Equations. In: International Conference on Learning Representations (ICLR) 2021, pp. 1–13 (2021).

- Raissi, M.; Yazdani, A.; Karniadakis, G.E. Hidden physics models: Machine learning of nonlinear partial differential equations. Journal of Computational Physics 2019, 378, 686–707. [Google Scholar] [CrossRef]

- Sirignano, J.; Spiliopoulos, K. : Multiscale stochastic volatility for equity, interest rate, and credit derivatives. SIAM Journal on Financial Mathematics 2017, 8, 399–436. [Google Scholar]

- Zhang, L.; Han, J.; Carleo, G.; E, W. Deep Learning of High-dimensional Partial Differential Equations with Neural Network-based Numerical Discretization. SIAM Journal on Numerical Analysis 2021, 59, 1335–1365. [Google Scholar]

- Geneva, N.; Zabaras, N. Modeling the dynamics of PDE systems with physics-constrained deep auto-regressive networks. Journal of Computational Physics 2019, 397, 108852. [Google Scholar] [CrossRef]

- Min, W.; Yang, T.; Chen, Y. Applications of Fourier Neural Operator in Multiscale Problems: Numerical Tests and Analysis. Computational Methods in Applied Mechanics and Engineering 2021, 384, 113993. [Google Scholar]

- Zouaoui, R.; Arous, F.; Bouzguenda, K. Application of Deep Learning Techniques for the Prediction of Option Prices. In: 2022 International Conference on Artificial Intelligence (ICAI 2022), LNCS, vol. 13250, pp. 341–350. Springer, Cham (2022).

- Sirignano, J.; Spiliopoulos, K. Deep learning for derivative pricing: A quantitative risk management perspective. Journal of Risk and Financial Management 2018, 11, 74. [Google Scholar]

- E, W.; Yu, B. The deep Ritz method: A deep learning-based numerical algorithm for solving variational problems. Communications in Mathematics and Statistics 2018, 6, 1–12. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).