1. Introduction

Electricity supply and demand management are becoming increasingly complex. This complexity arises from the increasing contribution of decentralized renewable energy source (RES), like solar and wind power, feeding into local distribution grids [

1]. Furthermore, the increase in electricity consumption types, such as electric vehicles, often resulting in high demand peaks, further adds to these challenges [

2]. As this trend advances, the integration of distributed RES through optimal energy management within smart buildings and neighborhoods is gaining heightened importance [

3,

4]. The feasibility of intermittent RES such as solar photovoltaic (PV) as standalone power sources is limited due to the inherent fluctuations in electricity generation [

5]. A straightforward solution to address RES intermittency is by using storage units. Co-generation units and (legacy) connections to electricity and heat grids may help balance generation peaks and ease the integration of RES. Dispatchable energy units such as storage units for heat and power, and Combined heat and power (CHP) are especially important in disconnected energy communities [

6]. The increased flexibility benefits all actors in the energy system at large; however, it comes at the expense of significant investment costs. Optimal use of storage capacity allows investing in smaller, cheaper units. Moreover, considering battery degradation allows trading off arbitrage opportunities with battery lifetime.

The increasing number of electric vehicles (EVs), most of which are idle over

of the time, may have role as a flexible source in terms of shiftable demand and storable supply. Managing charging schedules can be beneficial not only for the charging costs of the EVs but also the operational cost of the entire system. Within this landscape, two distinct paradigms come into focus:

passive, uncontrolled charging, and

active, flexible charging (e.g., [

7]. In uncontrolled strategies, vehicles are charged upon plugging in, charging at their maximum capacity until the battery is fully charged. Conversely, active strategies align with electricity price signals and broader system costs, potentially encompassing battery degradation considerations. Taking active charging a step further is the concept of Vehicle-to-Grid (V2G), which represents the most flexible utilization of EV batteries. V2G allows for discharges too, albeit at the cost of added stress and a reduction in battery lifetime [

7].

Battery lifetime consists of two distinct components: calendar life and cycle life, both of which contribute to capacity reduction through chemical and mechanical stresses [

8]. For batteries that are used frequently, cycle life is often the key factor affecting lifespan [

9]. In contrast, for EV batteries, which may only be charged a few times per week, calendar aging is usually the dominant factor. Avoiding battery degradation in techno-economic models of smart grids or energy systems is commonly achieved by imposing a cost per

throughput and establishing (often conservative) boundaries for state of charge (SOC) [

10,

11]. However, these models often overlook the non-linear increase in aging caused by cycle depth (CD) and other aging factors. This oversight typically results in relatively deep charge-discharge cycles and high resting SOC levels, leading to substantially higher battery degradation than the model predicts. Alternatively, excessively penalizing smaller cycles or setting overly tight SOC boundaries can hinder leveraging arbitrage opportunities due to inter-temporal price differences. Several studies focus specifically on modeling battery degradation. For instance, [

9,

12] analyzes the impact of degradation on electric vehicle batteries and its associated cost implications. Similarly, [

13] investigates the effects of battery degradation in electric vehicles and stationary batteries on the investment costs of distribution networks for renewable energy-based distributed generation, energy storage systems, and electric vehicle charging stations. This study only includes the impacts of depth of discharge on the degradation cost. However, many other studies examining the interplay between EVs and smart neighborhoods oversimplify degradation costs, often reducing them to a constant value [

14,

15,

16,

17].

Moreover, the challenge of (foreseeable) intermittency, as well as uncertainty arising from sources such as RES, market prices, and demand, impacts least-cost operation [

14,

15,

18,

19]. Uncertainty in electricity prices and demand impacts least-cost operation and is a key challenge in energy systems. For instance, virtual power plants have been proposed to aggregate small-scale battery energy storage systems for frequency regulation, demonstrating how managing uncertainties in market prices and storage degradation is crucial for their operational success [

20]. Despite the significant impact of uncertainty, most researchers deploy deterministic models (c.f., [

21,

22,

23]). An exception is [

24], who propose a two-stage stochastic model aimed at optimizing the operation of a RES-based micro grid (MG) equipped with an EV parking lot. However, in energy systems, uncertain events typically unfold across multiple temporal instances, making stochastic programs with multiple (more than two) stages more appropriate [

25,

26]. At present, the number of multi-stage models for operational scheduling in energy systems is relatively limited. Most smart grid literature focuses on deterministic or two-stage stochastic models to deal with optimal operational problems of smart energy neighborhoods [

16,

17,

27]. However, [

28] employ a multi-stage stochastic model to enhance energy-efficient scheduling of a CHP unit, PV, heat boiler, and energy storage systems within a building, addressing both electricity and thermal demands. [

29] apply stochastic dual dynamic programming and compare a two-stage and a multi-stage model to minimize the expected total cost of an IEEE 118-bus system with integrated RES. Additionally, many papers overlook or simplify the degradation costs associated with stationary storage and EV batteries. With this paper, we aim to contribute to the literature by developing a multi-stage stochastic model of a local energy system with a detailed battery degradation representation.

This paper investigates how electric vehicle charging strategies interact with behavioral and price uncertainties in a building complex equipped with various energy generation and storage options. We aim to minimize expected operational costs, including battery degradation costs. To achieve this, we adopt the improved battery degradation model as developed in [

30]. In [

30], a battery and a spot market for electricity are the two considered elements. The multi-stage operational model in the current paper considers a system with many more elements, and it provides a comprehensive framework for accommodating uncertainty in EV owners’ behavior (charging demand) and electricity prices.

This study is conducted to assess the impact of different charging strategies for EV on the operational energy costs while taking into account battery degradation. The method is applied to a neighborhood within an urban setting, representing a building complex in Pfreimd, Germany. It consists of four buildings with a total of 80 apartments and approximately 300 residents. The complex has its own energy resources and connections to the main energy grids for power, heat, and natural gas. The buildings are outfitted with PV modules. One of the buildings features a small-scale CHP, a TES, and a stationary battery. External electricity and district heating grids both supply energy to this community, and surplus electricity can be fed back into the grid, however, heat can not. In this analysis, we account for battery degradation in both the stationary battery and the EVs batteries with the representations developed in [

30]. We also consider uncertainty in electricity prices and demand. In this study, we consider Nickel Manganese Cobalt (NMC) batteries only due to their widespread usage in electric vehicles [

31]. Due to lacking data, other battery types, such as Lithium Iron Phosphate batteries, as promising as they may be in light of sustainability and ethical considerations [

32], are not in the scope of the current paper.

In summary, the key contributions of this paper are as follows:

The interaction between electric vehicle charging strategies, behavioral uncertainty, and price fluctuations in a building complex equipped with various energy generation and storage options is analyzed.

A comprehensive framework is provided for considering both electric vehicle and stationary battery degradation, based on calendar aging, cycle depth, and SOC levels, in the context of minimizing operational costs.

A multi-stage stochastic operational model is developed to minimize expected operational costs, including battery degradation costs, by accounting for uncertainty in EV charging demand and electricity prices.

Three charging strategies — passive charging, smart charging, and V2G charging — are considered to investigate the impact on degradation costs and evaluate the differences in operational energy costs for each strategy.

We show that smart charging achieves a significant reduction in energy cost and battery degradation, and that most benefits are obtainable just by optimized timing of charging itself; Vehicle-to-Grid delivery adds relatively little value.

The remainder of the paper is structured as follows. In

Section 2, we explain the scenario tree structure used to represent uncertainty and present the mathematical formulation of the proposed model, including the cost function, energy balances, and operational constraints of generation units as well as storage facilities.

Section 2.4 provides an electric battery degradation model used in the optimization, detailing three degradation mechanisms. Following this,

Section 3 discusses numerical results and findings of the conducted case study. Lastly,

Section 4 summarizes our findings and identifies future research directions.

4. Conclusions

We have developed a novel optimization model that can easily be parameterized to analyse and optimize smart-energy building complexes and neighborhoods. We have examined the impact of different charging strategies for EV batteries under demand and price uncertainties while considering a detailed model for battery degradation. This analysis focuses on how charging strategies affect the overall operational energy cost within a smart urban neighborhood. Our results show an about cost decrease from smart charging compared to passive charging. This reduction is mainly achieved by shifting the charging time frame from the expensive evening period to the early morning hours with lower prices. This delayed charging also reduces EV battery degradation, with reductions of up to . When considering V2G and allowing EV discharges, total system costs hardly reduce further compared to smart charging, as the modest direct energy cost decrease is partly undone by higher degradation costs. However, uncertainty in electricity prices and EV arrival SOCs allows a more significant cost improvement of V2G compared to smart charging. Its increased flexibility makes V2G cheaper than smart charging.

Battery degradation is up to of total costs in some scenarios, which is substantial, and highlights the importance of accurately trading off degradation costs and grid electricity price variations.

Smart management of a building complex reduces demand in high price periods and increases demand in lower price periods. This provides value to the energy system and society at large, increasing utilization of cheaper generation options, and allowing higher-value utilization of generated electricity by other sources.

The flexibility of V2G is likely to become increasingly beneficial in a future with much more renewable electricity supply and potentially more volatile prices. As suggested by [

41], benefiting from demand shifting should not rely on manual actions and be automated as much as possible. Artificial intelligence will play a key-role in customizing charging patterns for specific users and situations through real-time monitoring of battery degradation [

42,

43] Apps and bidirectional charging equipment should empower consumers to easily or automatically set, accept or override suggested charge-discharge patterns, resulting in lower energy bills, and contributing to higher system efficiency.

Future work may consider degradation of other distributed energy resources such as a CHP and TES. Moreover, employing decomposition methods could shorten solution times and enable the examination of extended scheduling periods.

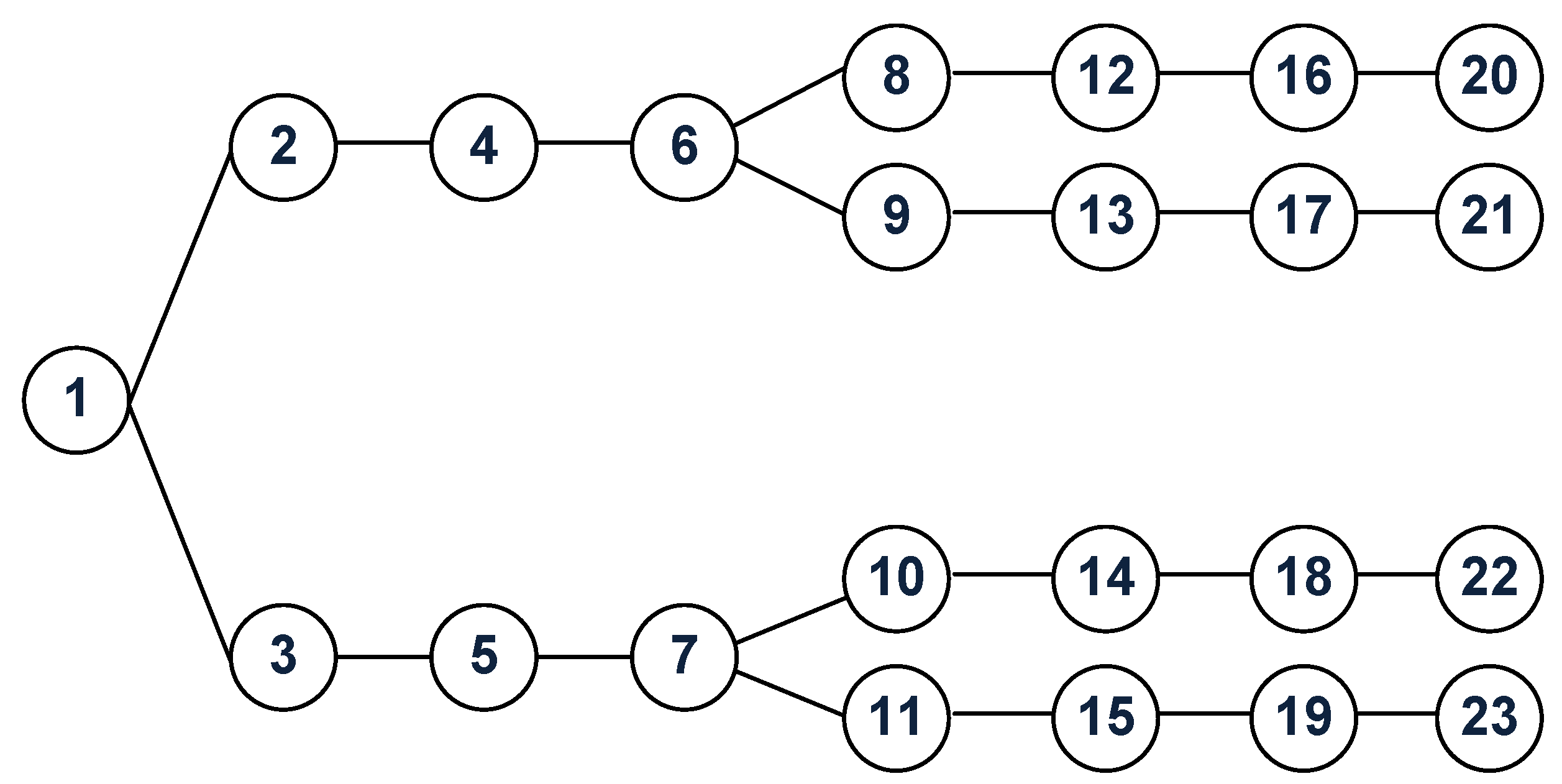

Figure 1.

Scenario tree example illustration.

Figure 1.

Scenario tree example illustration.

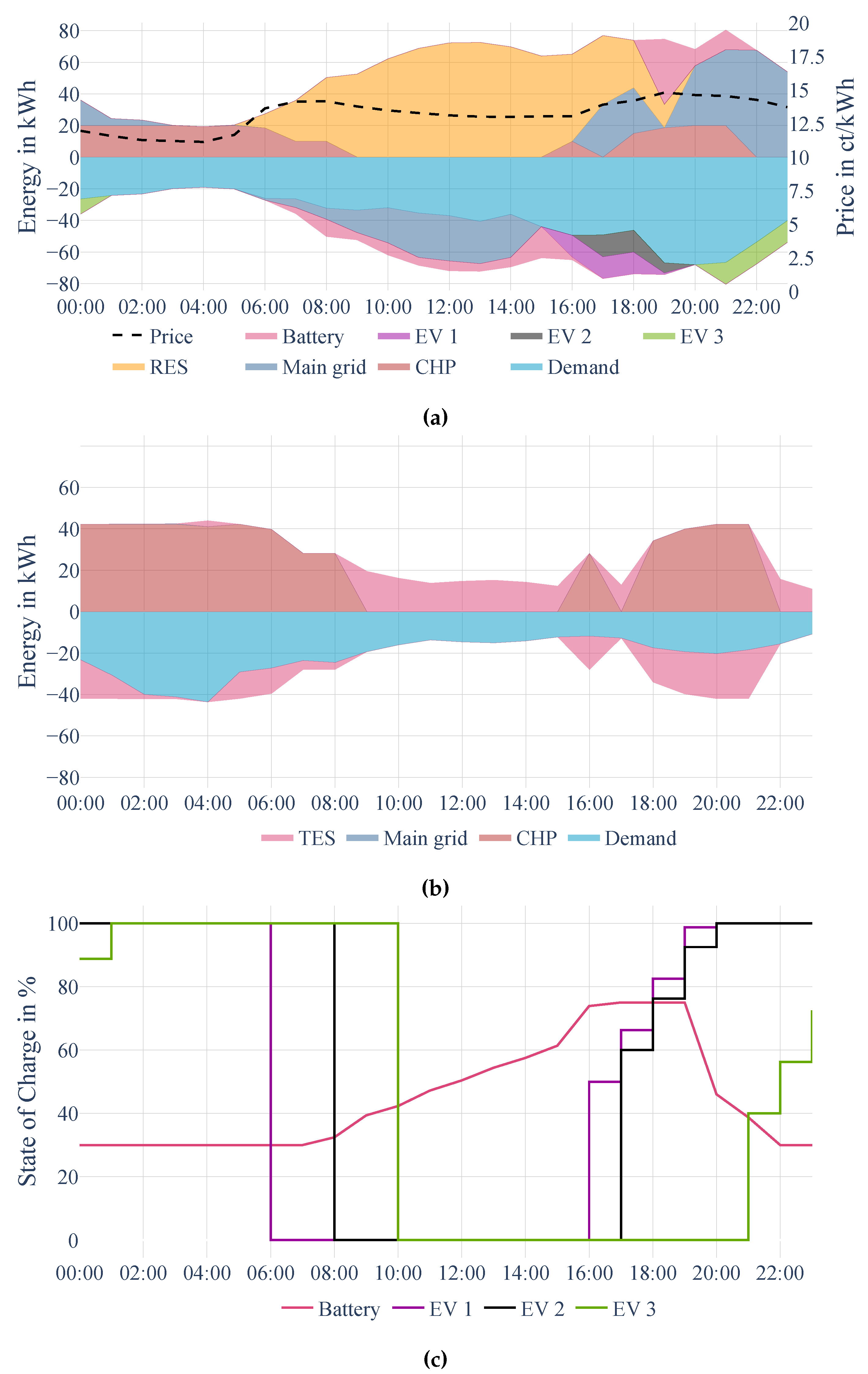

Figure 2.

Passive charging results– Deterministic. (a) Hourly mass balance electricity. (b) Hourly mass balance heat. (c) Battery and EV SOC profiles.

Figure 2.

Passive charging results– Deterministic. (a) Hourly mass balance electricity. (b) Hourly mass balance heat. (c) Battery and EV SOC profiles.

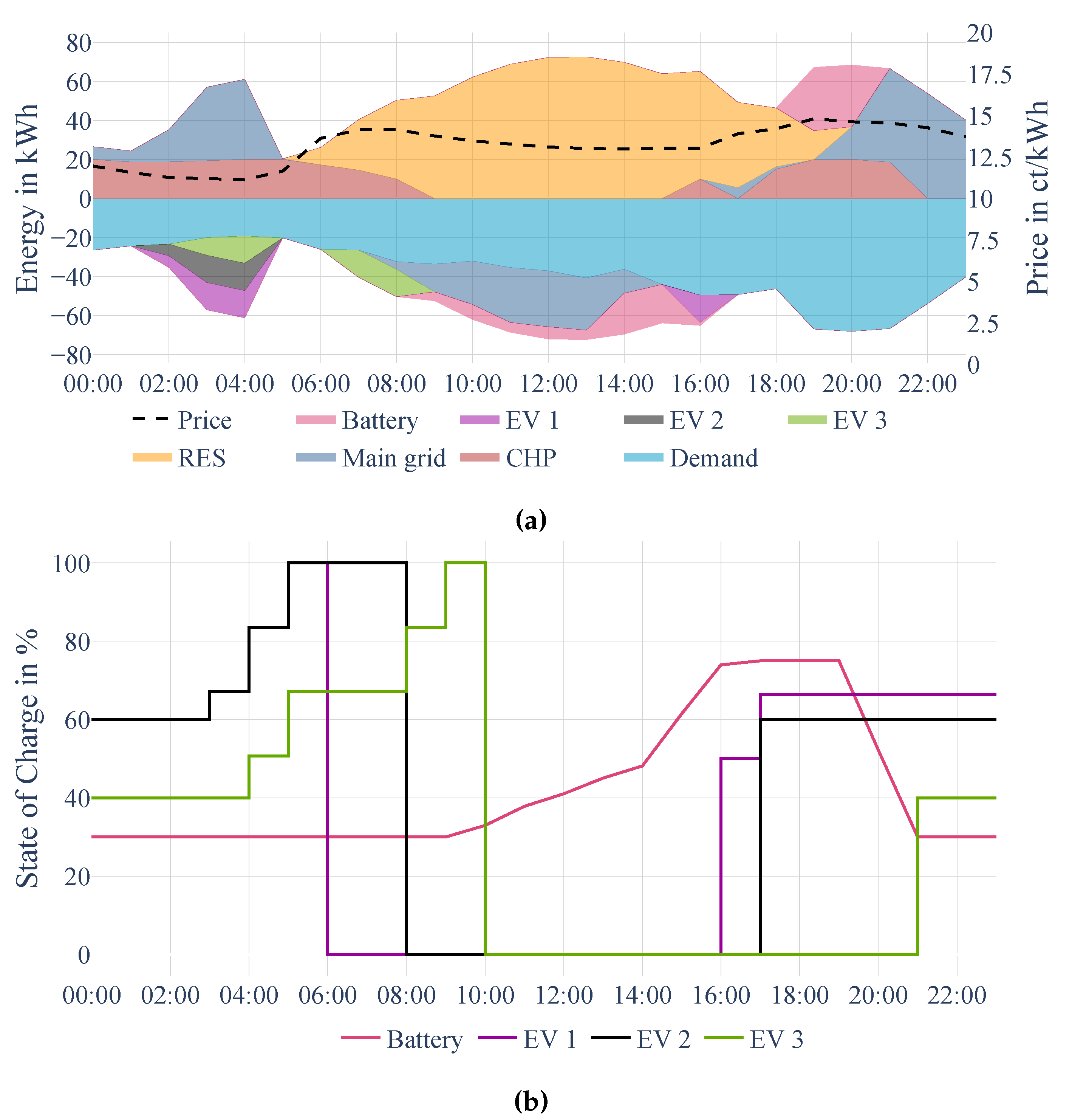

Figure 3.

Smart charging results – Deterministic. (a) Hourly mass balance electricity. (b) Battery and EV SOC profiles.

Figure 3.

Smart charging results – Deterministic. (a) Hourly mass balance electricity. (b) Battery and EV SOC profiles.

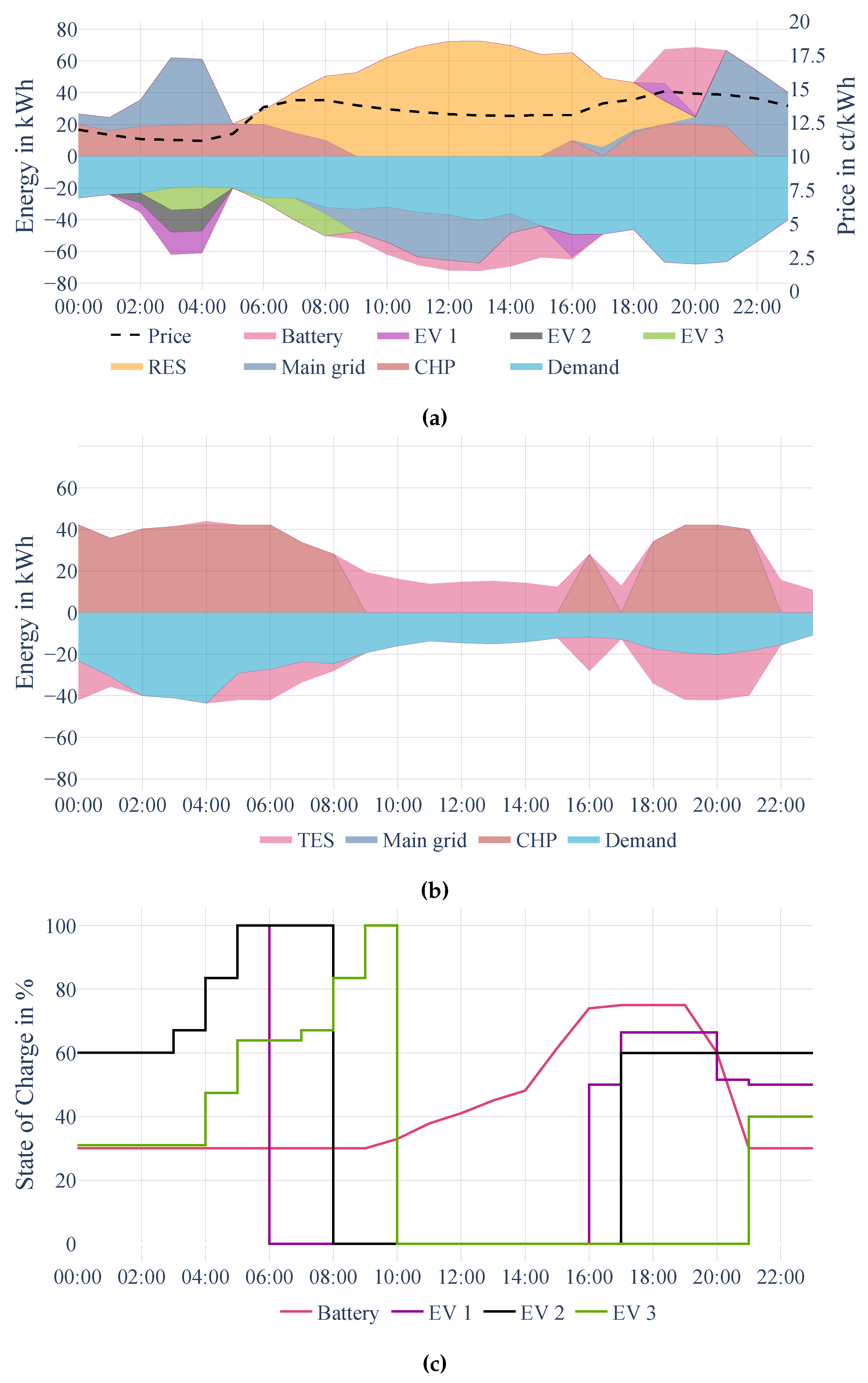

Figure 4.

V2G charging results – Deterministic. (a) Hourly mass balance electricity. (b) Hourly mass balance heat. (c) Battery and EV SOC profiles.

Figure 4.

V2G charging results – Deterministic. (a) Hourly mass balance electricity. (b) Hourly mass balance heat. (c) Battery and EV SOC profiles.

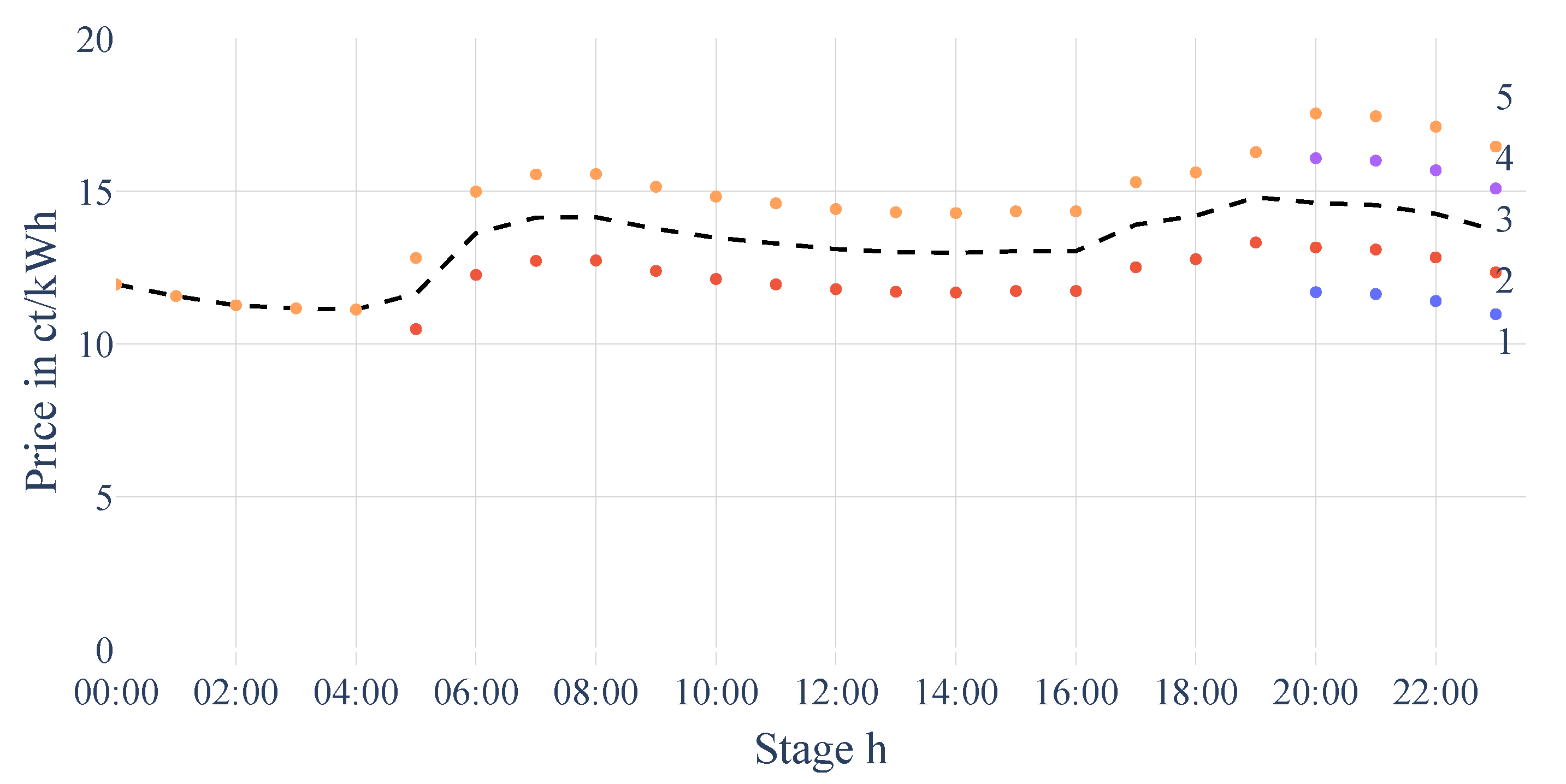

Figure 5.

Price scenarios in the stochastic analysis.

Figure 5.

Price scenarios in the stochastic analysis.

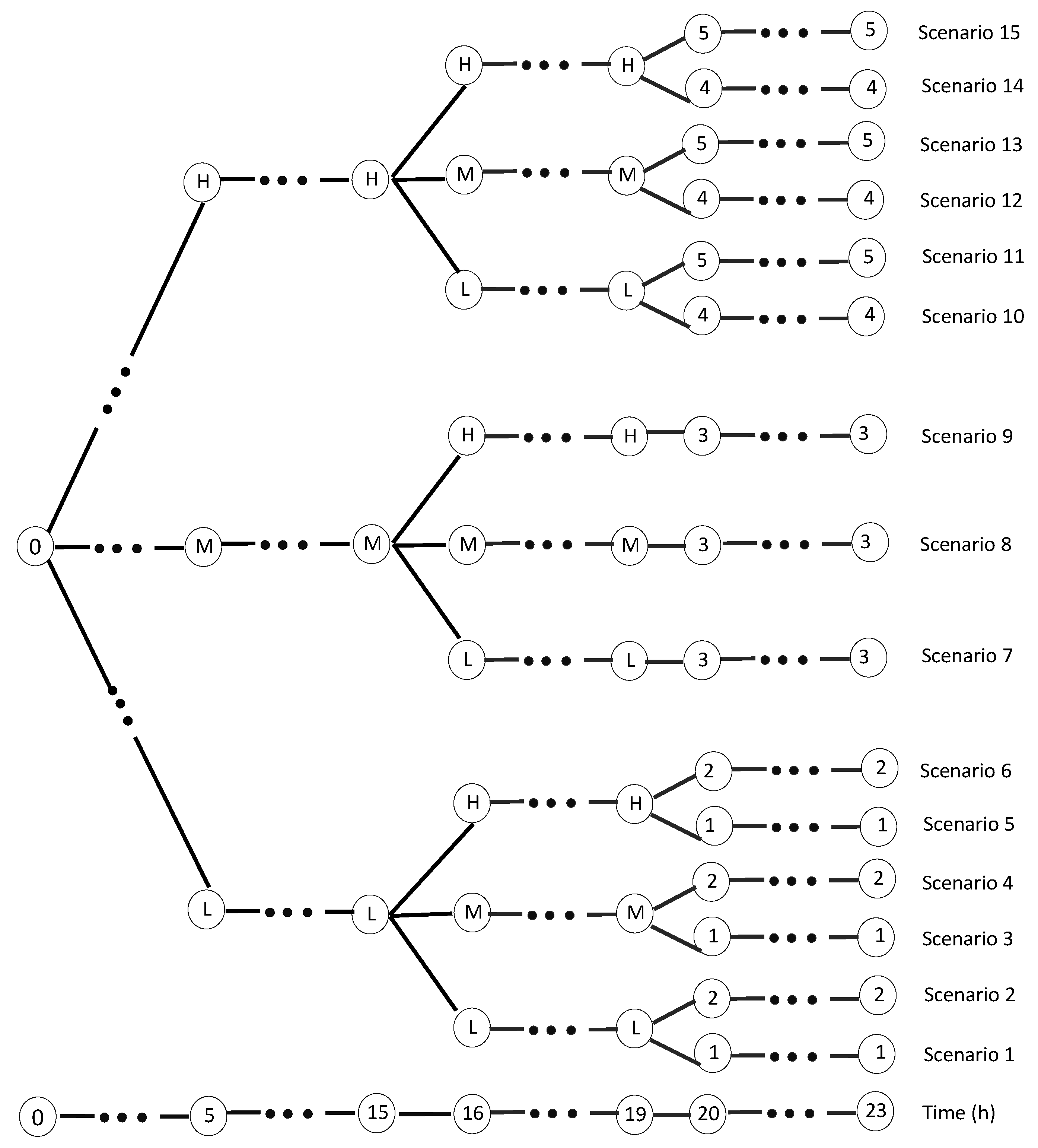

Figure 6.

Scenario tree showing 15 scenarios based on price and EVs’ SOC uncertainties over 24 hours.

Figure 6.

Scenario tree showing 15 scenarios based on price and EVs’ SOC uncertainties over 24 hours.

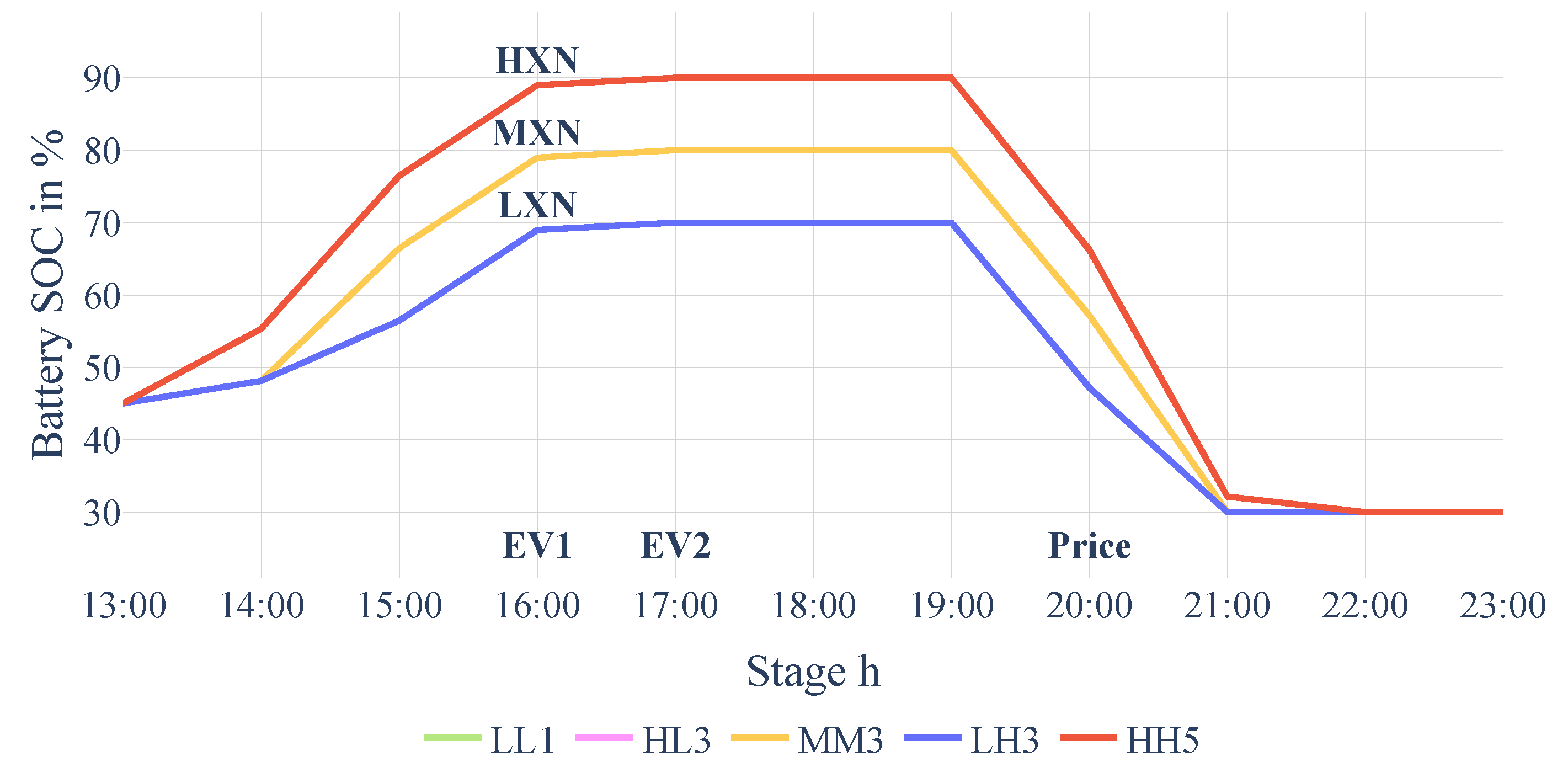

Figure 7.

SOC profiles, Stationary battery, Smart charging, Stochastic. Vertical axis truncated for readability.

Figure 7.

SOC profiles, Stationary battery, Smart charging, Stochastic. Vertical axis truncated for readability.

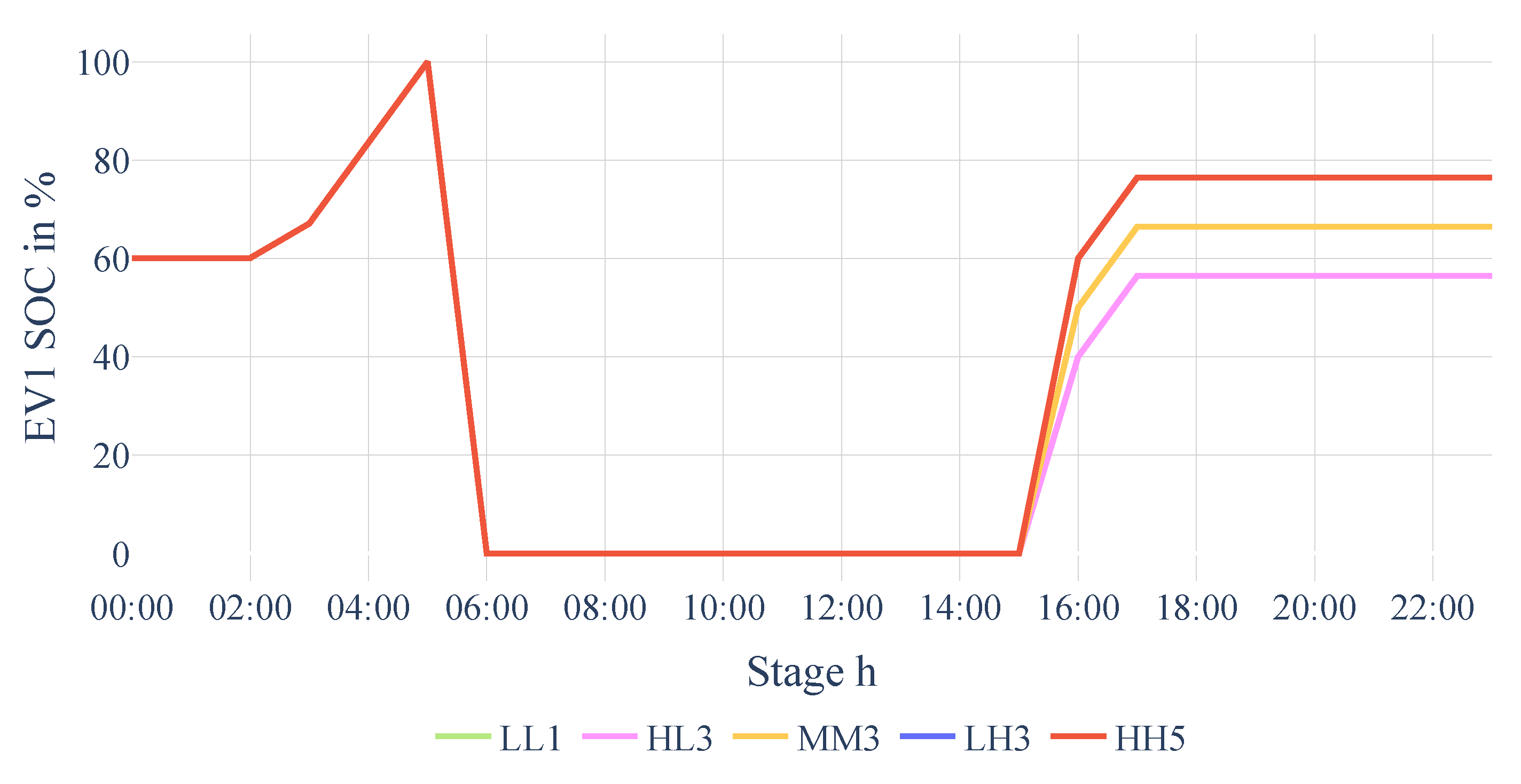

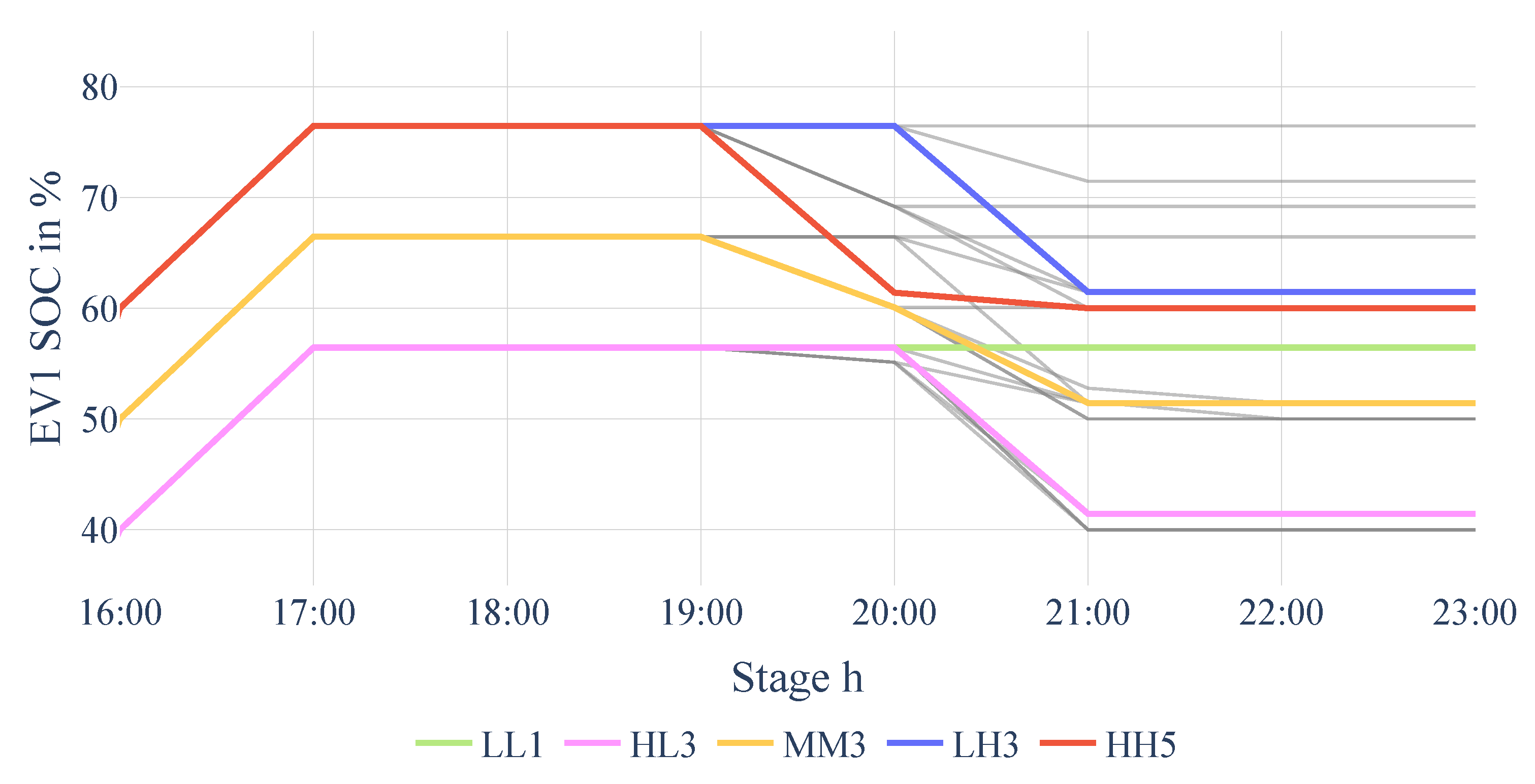

Figure 8.

SOC profiles, EV1, Smart charging, Stochastic.

Figure 8.

SOC profiles, EV1, Smart charging, Stochastic.

Figure 9.

SOC profiles, EV1, V2G charging—Stochastic. Both axes truncated for readability. Results are shown for all 15 scenarios. For brevity, the legend is only provided for scenarios discussed in the text.

Figure 9.

SOC profiles, EV1, V2G charging—Stochastic. Both axes truncated for readability. Results are shown for all 15 scenarios. For brevity, the legend is only provided for scenarios discussed in the text.

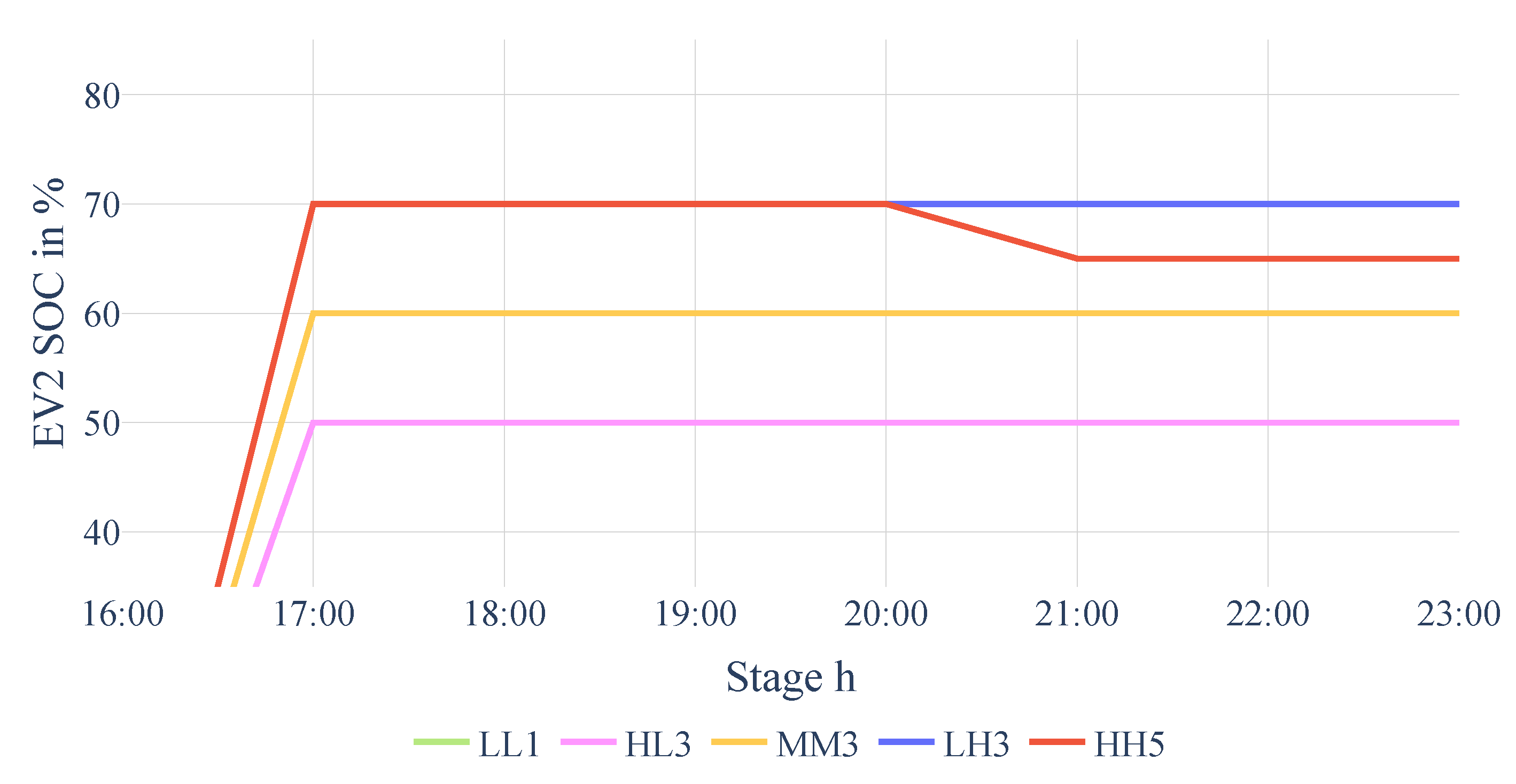

Figure 10.

EV2, V2G charging—Stochastic. Both axes truncated for readability.

Figure 10.

EV2, V2G charging—Stochastic. Both axes truncated for readability.

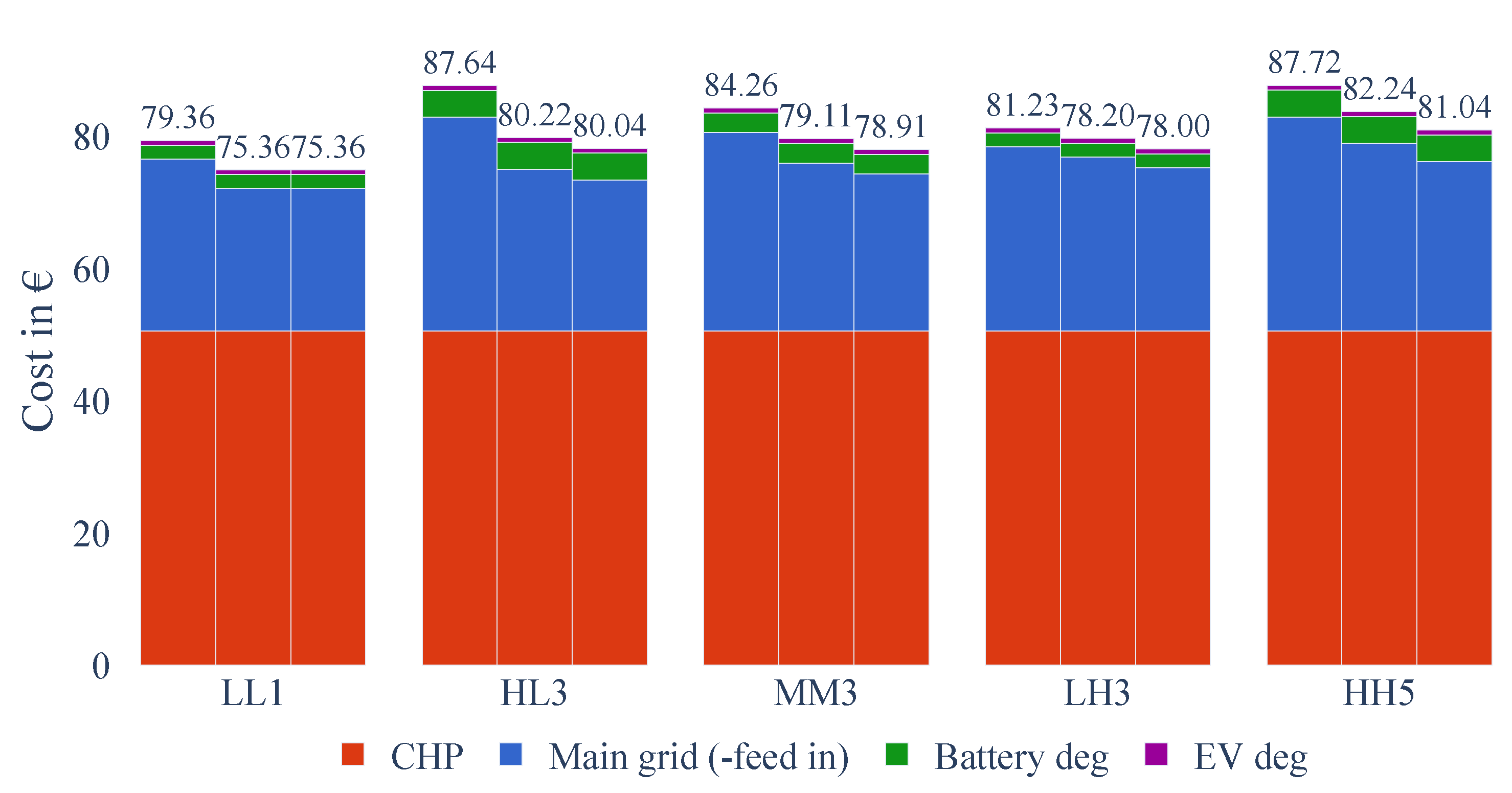

Figure 11.

System cost breakdown. Each column group: left: Passive, middle: Smart, right: V2G. Net grid import costs main grid (-feedin) is the difference between power purchase cost and remuneration for solar power feed-in. Vertical axis truncated for readability.

Figure 11.

System cost breakdown. Each column group: left: Passive, middle: Smart, right: V2G. Net grid import costs main grid (-feedin) is the difference between power purchase cost and remuneration for solar power feed-in. Vertical axis truncated for readability.

Table 1.

CHP segment breakpoint data.

Table 1.

CHP segment breakpoint data.

| Operating Level |

0% |

50% |

75% |

100% |

| Gas consumption [kW] |

0 |

37.1 |

48.1 |

61.1 |

| Electric output [kW] |

0 |

10.0 |

15.0 |

20.0 |

| Heat output [kW] |

0 |

28.1 |

34.2 |

42.2 |

Table 2.

Storage characteristics.

Table 2.

Storage characteristics.

| Storage type |

Battery |

TES |

EV (each) |

| Capacity [kWh] |

150 |

172 |

40 |

| Power [kW] |

90 |

42.2 |

7.0 |

| Round trip efficiency [%] |

90 |

90 |

88 |

| Assumed operating temperature [°C] |

25 |

– |

25 |

| Max. capacity loss [%/cycle] |

0.04519 |

– |

0.04519 |

| Fatigue strength exponent |

0.4926 |

– |

0.4926 |

| Fitting parameter SOC stress[%/cycle] |

0.0085 |

– |

0.0085 |

Table 3.

Battery degradation segment breakpoint data .

Table 3.

Battery degradation segment breakpoint data .

| Breakpoint

|

0% |

30% |

60% |

70% |

100% |

| Aging val OLD |

15.01 |

35.02 |

40.02 |

73.62 |

89.34 |

| Aging value y |

3.75 |

8.76 |

10.01 |

18.41 |

22.34 |

Table 4.

Deterministic case KPI.

Table 4.

Deterministic case KPI.

| KPI |

Passive |

Smart |

V2G |

| Objective value [€] |

86.45 |

80.16 |

80.13 |

| Battery throughput [kWh] |

64.12 |

64.12 |

64.12 |

| PV generation [kWh] |

681.13 |

681.13 |

681.13 |

| Electric CHP generation [kWh] |

241.31 |

242.50 |

242.50 |

| Peak demand [kW] |

80.46 |

68.08 |

68.08 |

| Peak grid import [kW] |

67.64 |

53.81 |

53.81 |

| Total grid import [kWh] |

294.01 |

273.42 |

268.82 |

| Total grid export [kWh] |

161.08 |

136.34 |

136.34 |

| Annualized stationary battery aging [%] |

4.12 |

4.11 |

4.11 |

| EV battery aging while connected [%]1

|

1.17 |

0.83 |

1.02 |