Submitted:

26 November 2024

Posted:

27 November 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

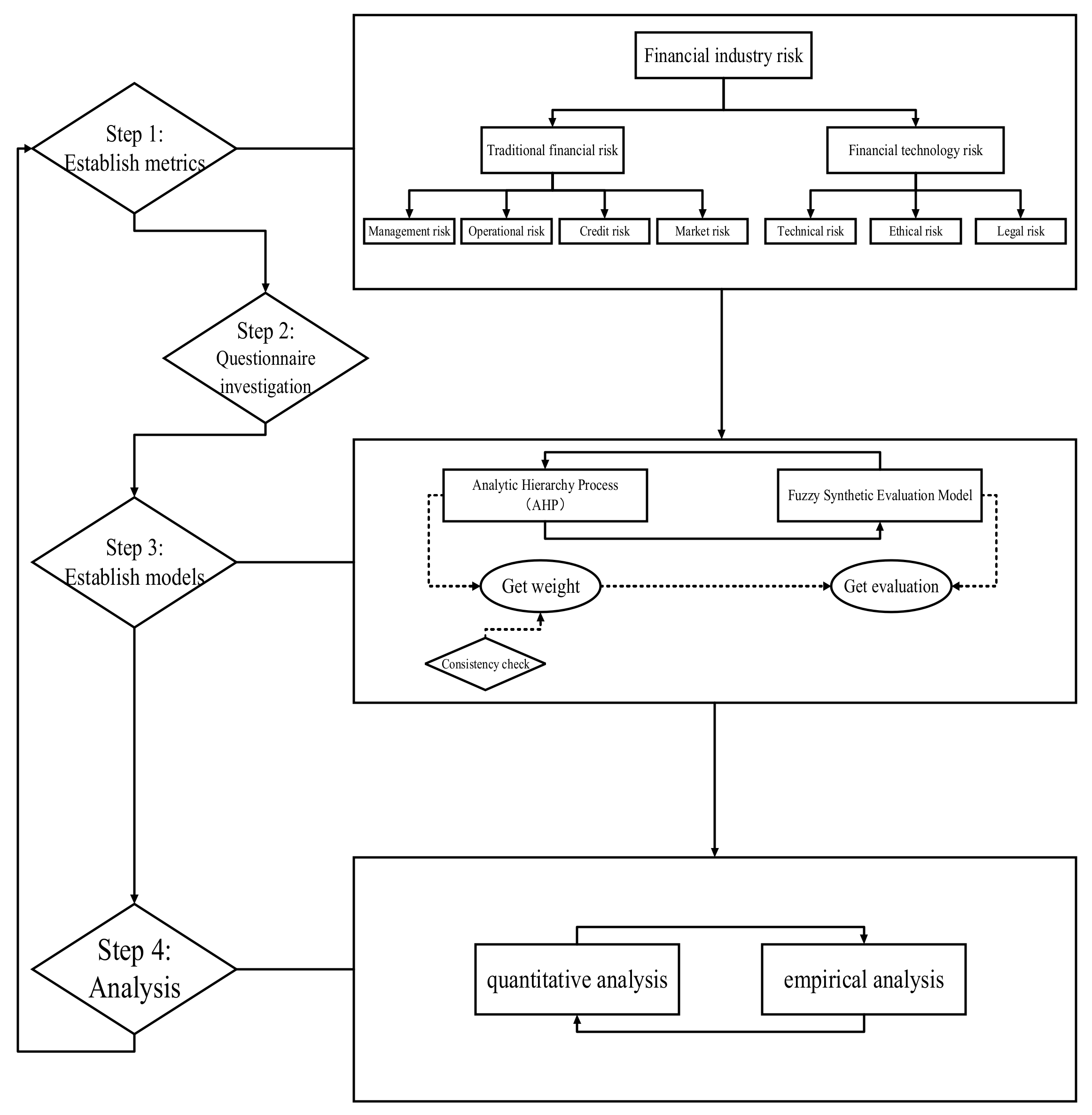

2. Model Settings

2.1. Establishment of Financial Industry Risk Assessment System Based on Delphi Method

2.2. Determining the Weight of Financial Industry Risk Indicators According to Analytic Hierarchy Process

2.2.1. Establishing Multi-Level Hierarchical Structural Model

- The highest level: also known as the target level or target level, it is the goal or result that the system wants to achieve, and it is the primary criterion of systematic evaluation. The main purpose of this paper is to quantify the risks of China's financial industry, so the highest level established in this paper is the main financial industry risk indicators (such as Technical risk: U1) and the secondary financial industry risk indicators (such as Network system security risk: u11).

- Criteria layer: It is the criteria, sub-criteria, etc. set up to achieve the target layer. See Table 4 Financial Industry Risk Judgment Matrix in 3.1.1 for the establishment of the criterion layer in this paper.

- The lowest layer: also called the scheme layer. It is a variety of programs, measures, etc. taken to achieve the goal.

2.2.2. Constructing a Judgment Matrix

2.2.3. Calculate Indicator Weights

2.2.4. Check the Consistency of Fuzzy Judgment Matrix

2.3. Quantifying the Risk of Financial Industry by Fuzzy Comprehensive Evaluation Method

2.3.1. Determine the Evaluation Factor Set

2.3.2. Determine the Evaluation Set

2.3.3. Establishment of Single-Factor Fuzzy Evaluation Matrix

2.3.4. Fuzzy Comprehensive Evaluation

3. Empirical Analysis of Financial Industry Risk Based on Fuzzy Analytic Hierarchy Process

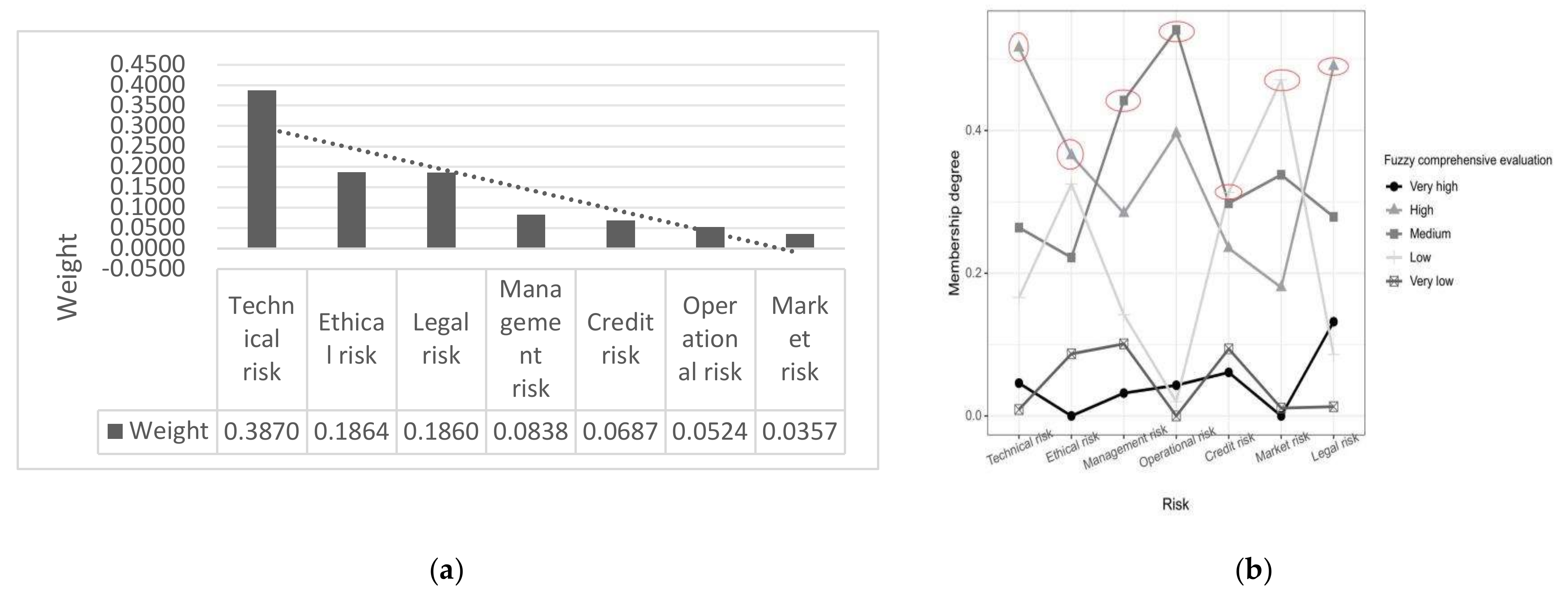

3.1. Determine Indicator Weights

3.1.1. Weights of Key Indicators

3.1.2. Secondary Indicator Weight

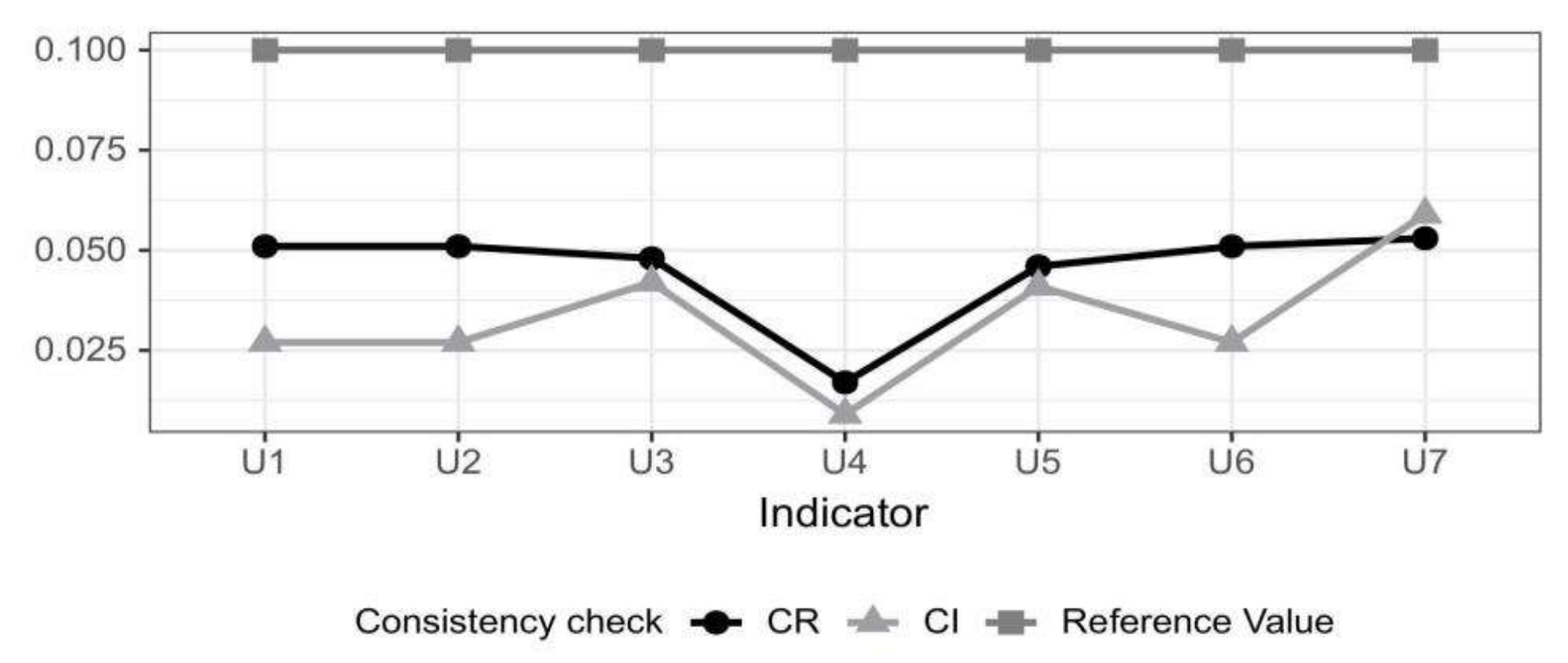

3.2. Consistency Test

3.2.1. Consistency Test Of Main Indicators

3.2.2. Secondary Index Consistency Test

3.3. Fuzzy Comprehensive Evaluation

3.4. Analysis of Fuzzy Evaluation Results

3.4.1. Quantitative Conclusion Analysis: Analysis of Main Indicators

3.4.2. Empirical Conclusion Analysis: Secondary Index Analysis

4. Discussion

References

- Ma, Y.; Liu, D. Introduction to the Special Issue on Crowdfunding and FinTech. Financ. Innov. 2017, 3, 8. [Google Scholar] [CrossRef]

- Khudiakova, L.S.; Sidorova, E.A. Eu Single Financial Market: Illusion or Reality? MIROVAYA Ekon. MEZHDUNARODNYE Otnos. 2020, 64, 63–72. [Google Scholar] [CrossRef]

- Pi, T.; Hu, H.; Lu, J.; Chen, X. The Analysis of Fintech Risks in China: Based on Fuzzy Models. Mathematics 2022, 10, 1395. [Google Scholar] [CrossRef]

- Scholtens, B.; van Wensveen, D. A Critique on the Theory of Financial Intermediation. J. Bank. FINANCE 2000, 24, 1243–1251. [Google Scholar] [CrossRef]

- Boyd, J.; Smith, B. Intermediation and the Equilibrium Allocation of Investment Capital - Implications for Economic-Development. J. Monet. Econ. 1992, 30, 409–432. [Google Scholar] [CrossRef]

- Grohmann, A.; Kluehs, T.; Menkhoff, L. Does Financial Literacy Improve Financial Inclusion? Cross Country Evidence. WORLD Dev. 2018, 111, 84–96. [Google Scholar] [CrossRef]

- Li Zhan. Research on Measurement and Supervision of Fintech Risk in China. Ph.D., Beijing Jiaotong University, 2023. [CrossRef]

- Murinde, V.; Rizopoulos, E.; Zachariadis, M. The Impact of the FinTech Revolution on the Future of Banking: Opportunities and Risks. Int. Rev. Financ. Anal. 2022, 81, 102103. [Google Scholar] [CrossRef]

- Wilson, J.P.; Campbell, L. Financial Functional Analysis: A Conceptual Framework for Understanding the Changing Financial System. J. Econ. Methodol. 2016, 23, 413–431. [Google Scholar] [CrossRef]

- (Mansour, N. The Impact of Fintech Development on Commercial Banks’ Profitability. J. Organ. END USER Comput. 2024, 36, 349933. [Google Scholar] [CrossRef]

- Brunner-Kirchmair, T.M.; Wiener, M. Knowledge Is Power - Conceptualizing Collaborative Financial Risk Assessment. J. RISK FINANCE 2019, 20, 226–248. [Google Scholar] [CrossRef]

- Li, J.; Li, J.; Zhu, X.; Yao, Y.; Casu, B. Risk Spillovers between FinTech and Traditional Financial Institutions: Evidence from the U.S. Int. Rev. Financ. Anal. 2020, 71, 101544. [Google Scholar] [CrossRef]

- Zhou, H.; Li, S. Effect of COVID-19 on Risk Spillover between Fintech and Traditional Financial Industries. Front. Public Health 2022, 10. [Google Scholar] [CrossRef] [PubMed]

- Virglerova, Z.; Dvorsky, J.; Kozubikova, L.; Cepel, M. Perception of Non-Financial Risk Determinants in SMEs in Visegrad Countries. OECONOMIA Copernic. 2020, 11, 509–529. [Google Scholar] [CrossRef]

- Lee, I.; Shin, Y.J. Fintech: Ecosystem, Business Models, Investment Decisions, and Challenges. Bus. Horiz. 2018, 61, 35–46. [Google Scholar] [CrossRef]

- Vives, X. Endogenous Public Information and Welfare in Market Games. Rev. Econ. Stud. 2017, 84, 935–963. [Google Scholar] [CrossRef]

- Xu, C.; Shiina, T. Financial Investment, Financial Risk and Risk Management. In RISK MANAGEMENT IN FINANCE AND LOGISTICS.; Translational Systems Sciences; Springer-Verlag Singapore Pte Ltd: Singapore, 2018; pp. 3–11. [Google Scholar] [CrossRef]

- Zhu, H.; Liu, X. The Financial Risk Index System and Early-Warning Research. In PROCEEDINGS OF THE 3RD INTERNATIONAL CONFERENCE ON MECHATRONICS, ROBOTICS AND AUTOMATION (ICMRA 2015); Yarlagadda, P., Ed.; ACSR-Advances in Comptuer Science Research; Atlantis Press: Paris, 2015; Vol. 15, pp 443–447.

- Breidbach, C.F.; Keating, B.W.; Lim, C. Fintech: Research Directions to Explore the Digital Transformation of Financial Service Systems. J. Serv. THEORY Pract. 2019, 30, 79–102. [Google Scholar] [CrossRef]

- Kou, G.; Akdeniz, O.O.; Dincer, H.; Yuksel, S. Fintech Investments in European Banks: A Hybrid IT2 Fuzzy Multidimensional Decision-Making Approach. Financ. Innov. 2021, 7, 39. [Google Scholar] [CrossRef]

- Kong, M.-Q.; Tang, J.-X.; Yu, S.-M. Financial Risk Assessment of an Ocean Shipping Company Based on the AHP. J. Coast. Res. 2020, 481–485. [Google Scholar] [CrossRef]

- Ferreira, F.A.F.; Santos, S.P.; Dias, V.M.C. An Ahp-Based Approach to Credit Risk Evaluation of Mortgage Loans. Int. J. Strateg. Prop. Manag. 2014, 18, 38–55. [Google Scholar] [CrossRef]

- Hou, X.; Gao, Z.; Wang, Q. Internet Finance Development and Banking Market Discipline: Evidence from China. J. Financ. Stab. 2016, 22, 88–100. [Google Scholar] [CrossRef]

- Brady, S.R. Utilizing and Adapting the Delphi Method for Use in Qualitative Research. Int. J. Qual. METHODS 2015, 14. [Google Scholar] [CrossRef]

- Barrios, M.; Guilera, G.; Nuno, L.; Gomez-Benito, J. Consensus in the Delphi Method: What Makes a Decision Change? Technol. Forecast. Soc. CHANGE 2021, 163, 120484. [Google Scholar] [CrossRef]

- Bodin, L.; Gass, S.I. On Teaching the Analytic Hierarchy Process. Comput. Oper. Res. 2003, 30, 1487–1497. [Google Scholar] [CrossRef]

- Zhu, L. Research and Application of AHP-Fuzzy Comprehensive Evaluation Model. Evol. Intell. 2022, 15, 2403–2409. [Google Scholar] [CrossRef]

- Chan, H.K.; Sun, X.; Chung, S.-H. When Should Fuzzy Analytic Hierarchy Process Be Used Instead of Analytic Hierarchy Process? Decis. SUPPORT Syst. 2019, 125, 113114. [Google Scholar] [CrossRef]

- Cato, S. Pareto Principles, Positive Responsiveness, and Majority Decisions. THEORY Decis. 2011, 71, 503–518. [Google Scholar] [CrossRef]

| Evaluation object | Primary indicator | Secondary indicator |

|---|---|---|

| Fintech risk: U | Technical risk: U1 | Network system security risk: u11 |

| Date transmission security risk: u13 | ||

| Date transmission security risk: u13 | ||

| Ethical risk: U2 | Social ethical risk: u21 | |

| Liability ethical risk: u22 | ||

| Technical ethical risk: u23 | ||

| Management risk: U3 | Consumer operational risk: u31 | |

| Supplier operational risk: u32 | ||

| Mediator operational risk: u33 | ||

| Payment method innovation risk: u34 | ||

| Operational risk: U4 | Internal management risk: u41 | |

| Liquidity risk: u42 | ||

| Associated risk: u43 | ||

| Credit risk: U5 | Internal fraud risk: u51 | |

| External fraud risk: u52 | ||

| Credit risk: u53 | ||

| Credit information abuse risk: u54 | ||

| Market risk: U6 | Interest rate risk: u61 | |

| Exchange rate risk: u62 | ||

| Price movement risk: u63 | ||

| Legal risk: U7 | Laws and regulations absence risk: u71 | |

| Regulatory vacancy risk: u72 | ||

| Subject qualification risk: u73 | ||

| Virtual currency risk: u74 | ||

| Online money laundering risk: u75 |

| Scale aij | Meaning |

|---|---|

| 1 | i factor is as important as j factor |

| 3 | i factor is slightly more important than j factor |

| 5 | Compare with factor j, factor i is obviously more important than factor j |

| 7 | i factor is more important than j factor |

| 9 | i factor is absolutely more important than j factor |

| 2,4,6,8 | Intermediate value of the above adjacent judgment |

| Reciprocal | Indicates that the former is less important than the latter |

| n | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RI | 0 | 0 | 0.58 | 0.90 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.49 | 1.51 |

| U | U1 | U2 | U3 | U4 | U5 | U6 | U7 |

|---|---|---|---|---|---|---|---|

| U1 | 1 | 4 | 5 | 5 | 5 | 6 | 3 |

| U2 | 1/4 | 1 | 3 | 4 | 3 | 3 | 2 |

| U3 | 1/5 | 1/3 | 1 | 2 | 2 | 3 | 1/4 |

| U4 | 1/5 | 1/4 | 1/2 | 1 | 1/2 | 3 | 1/5 |

| U5 | 1/5 | 1/3 | 1/2 | 2 | 1 | 3 | 1/4 |

| U6 | 1/6 | 1/3 | 1/3 | 1/3 | 1/3 | 1 | 1/4 |

| U7 | 1/3 | 1/2 | 4 | 5 | 4 | 4 | 1 |

| Primary indicator | Secondary indicator | Membership degree | ||||

|---|---|---|---|---|---|---|

| Technical risk: U1 (38.703%) |

Network system security risk: u11(8.522%) | 0.00 | 0.15 | 0.25 | 0.50 | 0.10 |

| Technical support risk: u12(27.056%) | 0.05 | 0.55 | 0.30 | 0.10 | 0.00 | |

| Date transmission security risk: u13(64.422%) | 0.05 | 0.55 | 0.25 | 0.15 | 0.00 | |

| Ethical risk: U2 (18.636%) |

Social ethical risk: u21(21.764%) | 0.00 | 0.40 | 0.30 | 0.30 | 0.00 |

| Liability ethical risk: u22(9.14%) | 0.00 | 0.40 | 0.20 | 0.20 | 0.20 | |

| Technical ethical risk: u23(69.096%) | 0.00 | 0.35 | 0.20 | 0.35 | 0.10 | |

| Management risk: U3 (8.375%) |

Consumer operational risk: u31(5.761%) | 0.05 | 0.15 | 0.50 | 0.30 | 0.00 |

| Supplier operational risk: u32(24.664%) | 0.00 | 0.10 | 0.50 | 0.20 | 0.20 | |

| Mediator operational risk: u33(11.143%) | 0.00 | 0.15 | 0.50 | 0.15 | 0.20 | |

| Payment method innovation risk: u34(58.431%) | 0.05 | 0.40 | 0.40 | 0.10 | 0.05 | |

| Operational risk: U4 (5.24%) |

Internal management risk: u41(13.65%) | 0.05 | 0.35 | 0.45 | 0.15 | 0.00 |

| Liquidity risk: u42(62.501%) | 0.00 | 0.50 | 0.50 | 0.00 | 0.00 | |

| Associated risk: u43(23.849%) | 0.15 | 0.15 | 0.70 | 0.00 | 0.00 | |

| Credit risk: U5 (6.871%) |

Internal fraud risk: u51(7.195%) | 0.00 | 0.30 | 0.30 | 0.30 | 0.10 |

| External fraud risk: u52(10.175%) | 0.00 | 0.30 | 0.40 | 0.30 | 0.00 | |

| Credit risk: u53(21.584%) | 0.00 | 0.00 | 0.10 | 0.50 | 0.40 | |

| Credit information abuse risk: u54(61.047%) | 0.10 | 0.30 | 0.35 | 0.25 | 0.00 | |

| Market risk: U6 (3.573%) |

Interest rate risk: u61(21.764%) | 0.00 | 0.30 | 0.20 | 0.45 | 0.05 |

| Exchange rate risk: u62(9.14%) | 0.00 | 0.50 | 0.20 | 0.30 | 0.00 | |

| Price movement risk: u63(69.096%) | 0.00 | 0.10 | 0.40 | 0.50 | 0.00 | |

| Legal risk: U7 (18.602%) |

Laws and regulations absence risk: u71(6.415%) | 0.05 | 0.35 | 0.45 | 0.15 | 0.00 |

| Regulatory vacancy risk: u72(4.45%) | 0.10 | 0.20 | 0.70 | 0.00 | 0.00 | |

| Subject qualification risk: u73(13.135%) | 0.00 | 0.30 | 0.70 | 0.00 | 0.00 | |

| Virtual currency risk: u74(26.146%) | 0.00 | 0.65 | 0.20 | 0.10 | 0.05 | |

| Online money laundering risk: u75(49.853%) | 0.25 | 0.50 | 0.15 | 0.10 | 0.00 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).