Submitted:

18 November 2024

Posted:

18 November 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

2.1. Environmental Footprints and the Impact of Renewable Energy

2.2. Influence of Urbanization on Environmental Footprints

2.3. Industrialization and Environmental Footprints

2.4. Energy Consumption and Environmental Footprints

2.5. Economic Growth and Environmental Footprints

3. Data, Methodology, and Estimation Strategies

3.1. Data

3.2. Model Specification

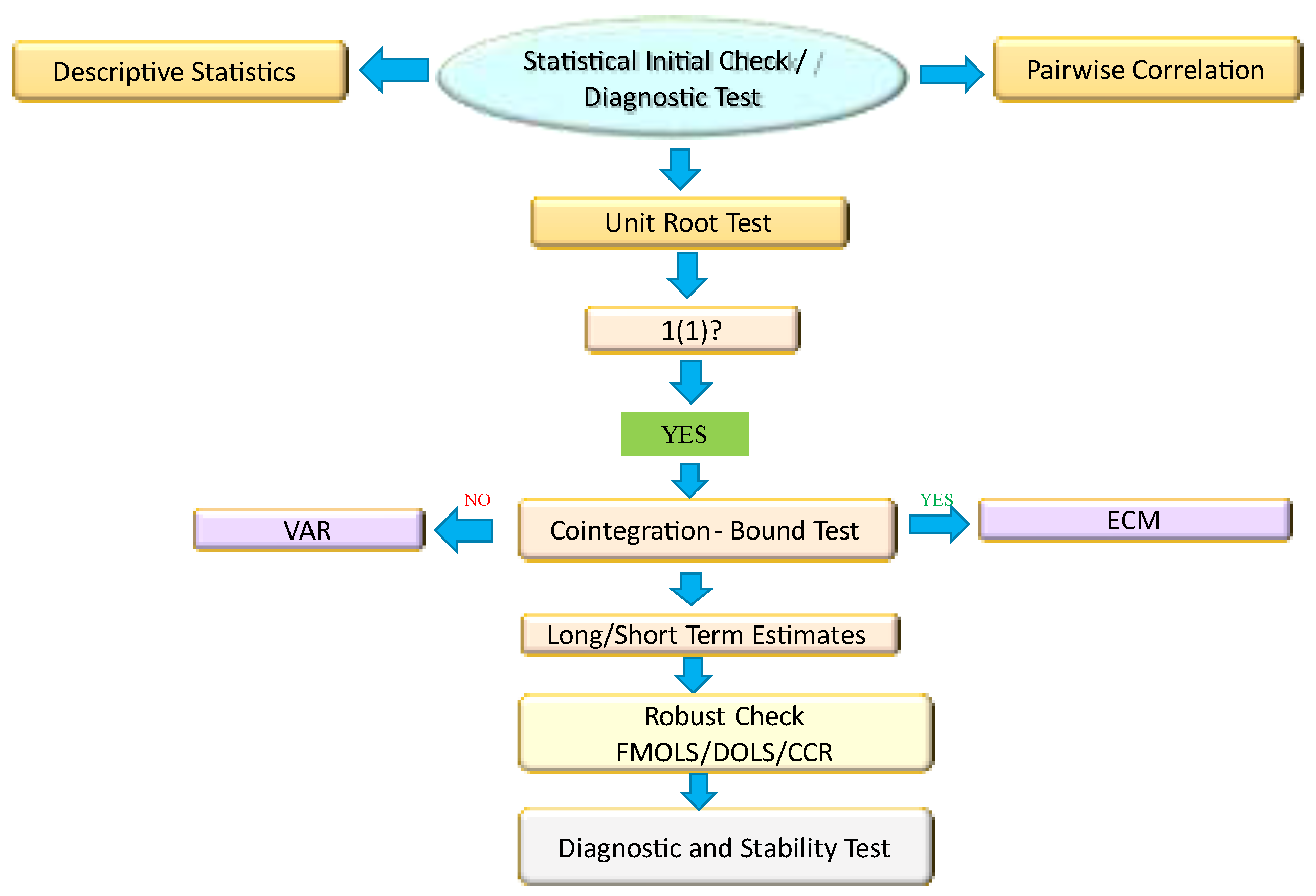

3.3. Estimation Strategies

3.3.1. ARDL Model

- o

- Null (H₀): No long-run relationship among variables.

- o

- Alternative (H₁): Long-run relationship exists.

- Greater than Upper Bound: Reject H₀ (long-run relationship exists).

- Less than Lower Bound: Fail to reject H₀ (no long-run relationship).

- Between Bounds: Inconclusive; further testing needed.

3.3.2. Unit Root Tests

3.3.3. Robustness Check

4. Results and Discussion

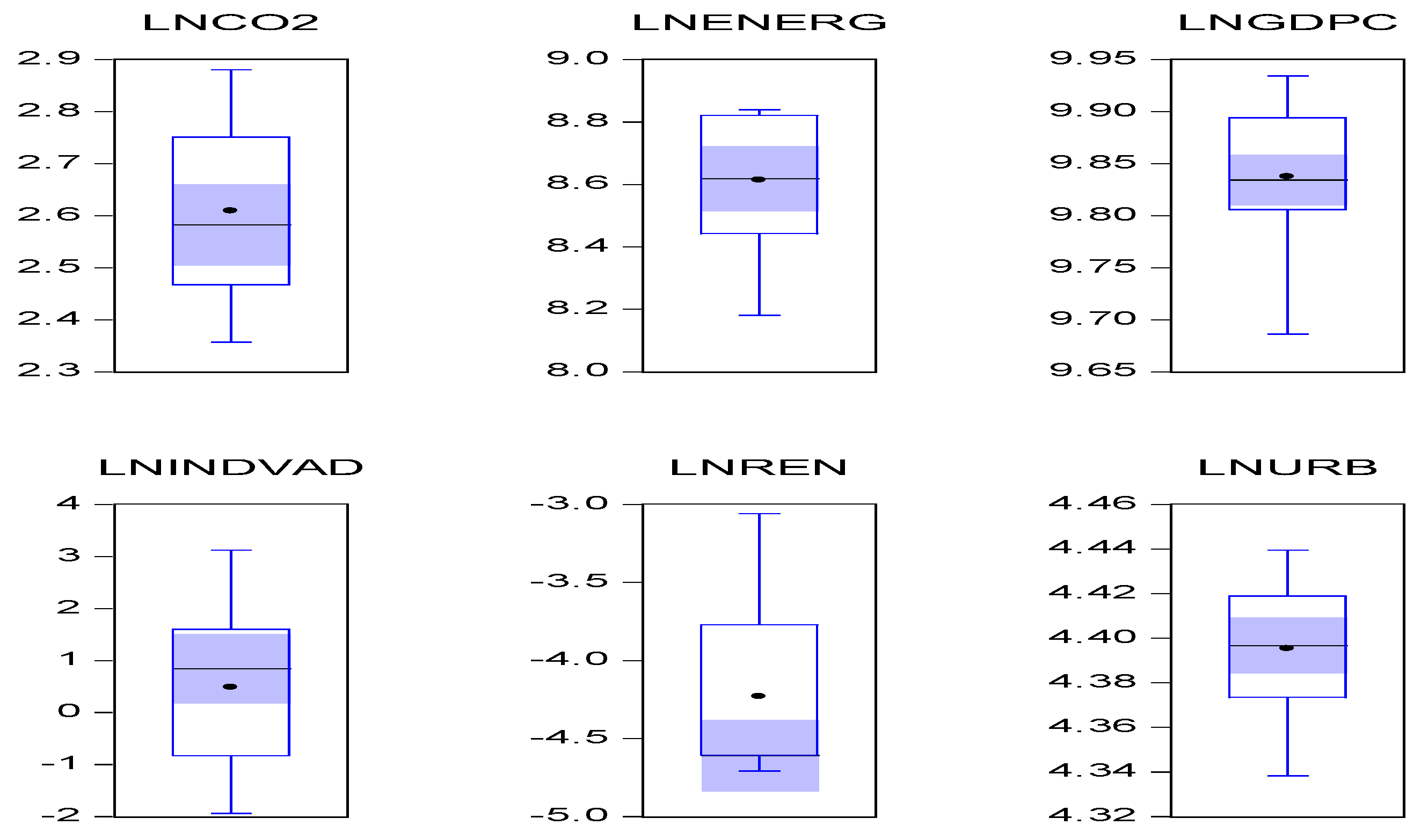

4.1. Descriptive Analysis

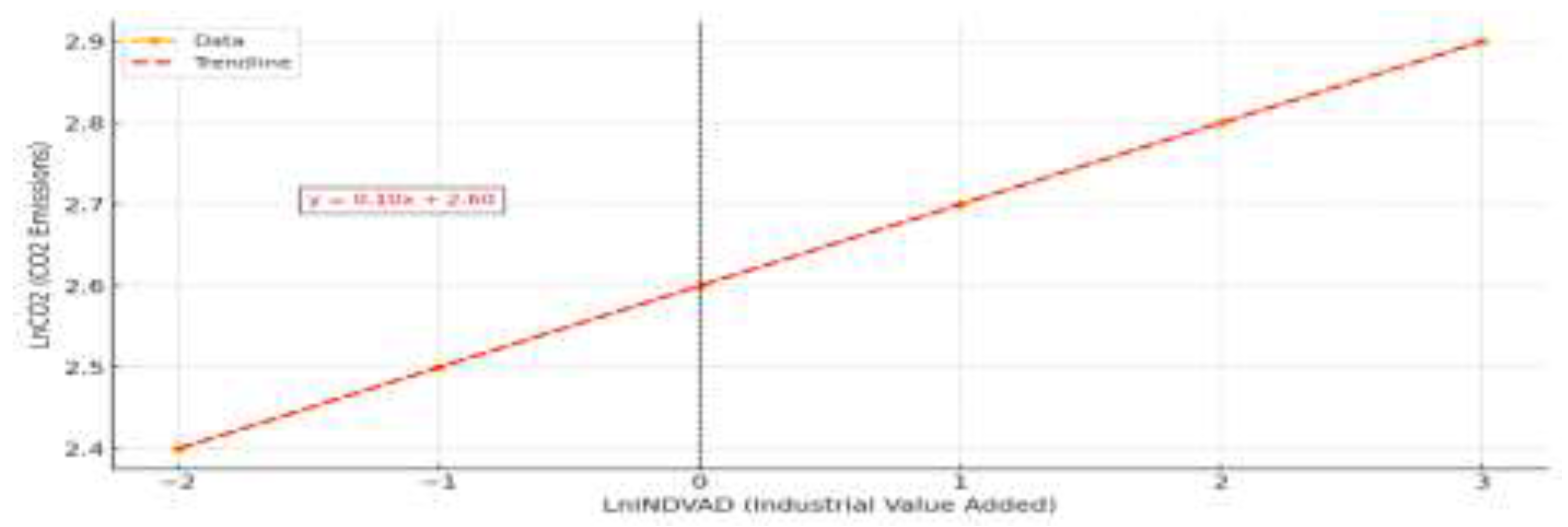

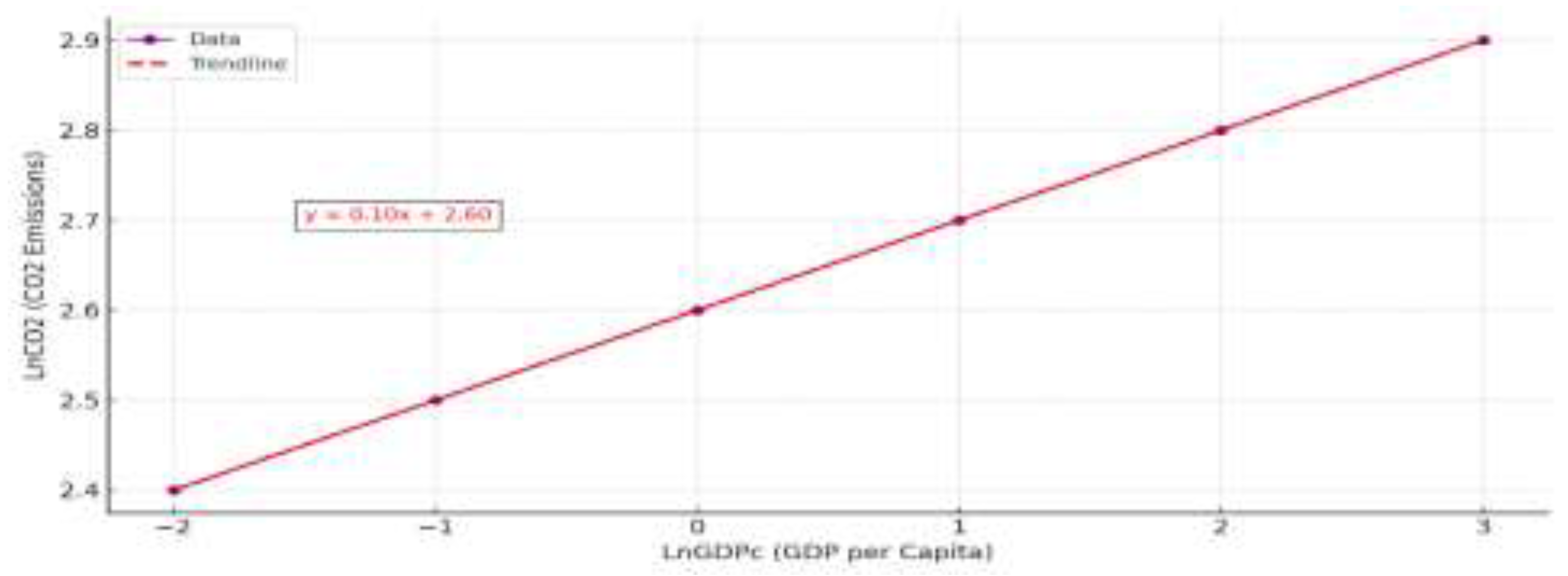

4.2. Detecting Outliers and Assessing Multicollinearity

4.2.1. Outliers

4.2.2. Multicollinearity

4.2. Unit Root Results

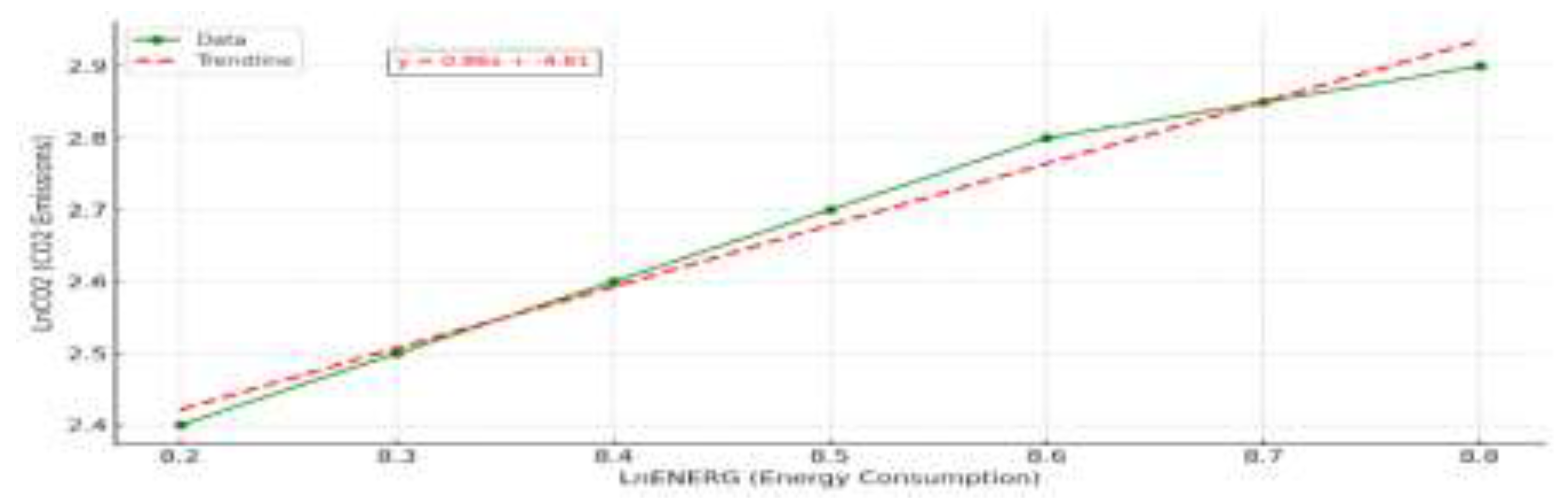

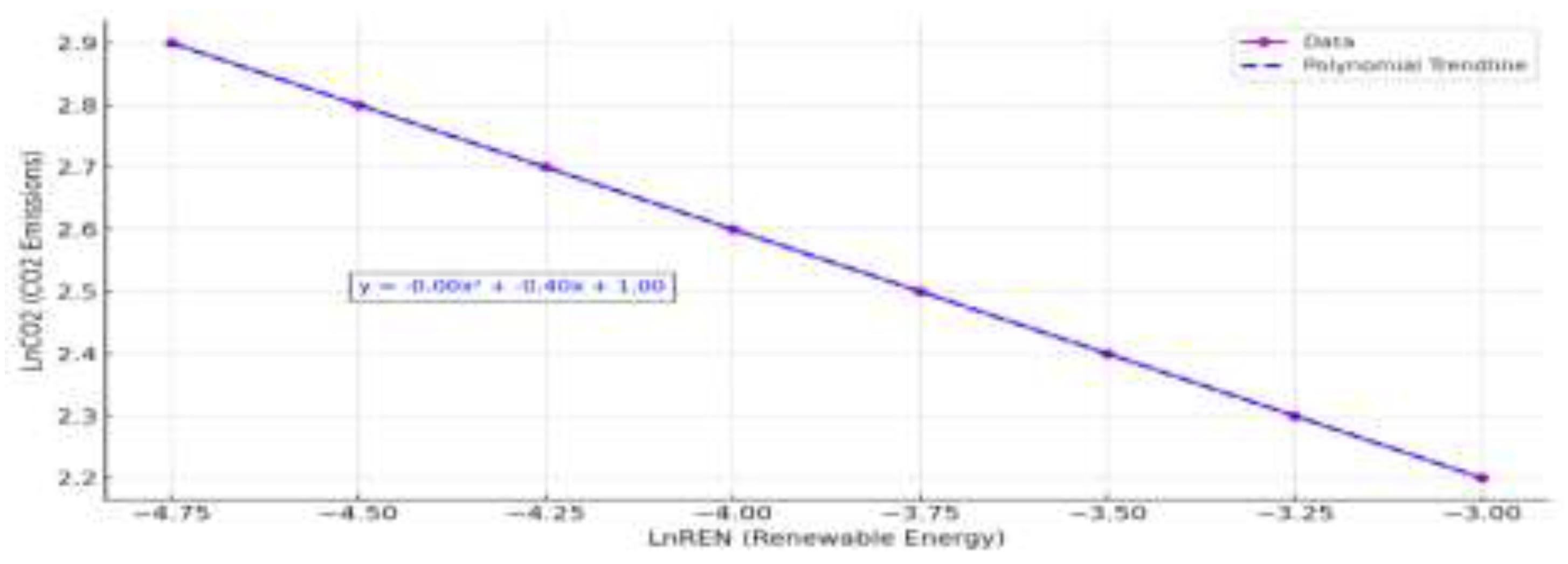

4.3. ARDL Result

4.4. Robustness Test Results

| FMOLS | DOLS | ROLS | CCR | |||||

| Coeff | t-Stats | Coeff | t-Stats | Coeff | z-Stats | Coeff | t-Stats | |

| LNENERG | 0.82483 | 7.487409 | 0.7289 | 7.9331 | 0.846709 | 5.876167 | 0.86977 | 6.19835 |

| LNPGDP | 4.45792 | 4.186441 | 5.6018 | 6.8802 | 3.362555 | 2.470193 | 4.967898 | 4.52174 |

| LNINDVAD | 0.005393 | 1.567901 | 0.0134 | 2.2417 | 0.001822 | 0.426336 | -96.9674 | -4.4889 |

| LNREN | -0.08078 | -8.68756 | -0.024 | -0.8292 | -0.08694 | -7.68205 | 0.00377 | 0.67328 |

| LNURB | -1.47342 | -2.13669 | -5.549 | -4.6332 | -1.37821 | -1.52492 | -0.07922 | -8.4917 |

| C | 425.2653 | 4.131107 | 552.74 | 6.6977 | 318.9391 | 2.424705 | -1.90459 | 0.0257 |

| R-squared | 0.963997 | 0.999433 | 0.792008 | 0.9611 | ||||

| Adjusted R2 | 0.955357 | 0.99671 | 0.744009 | 0.9518 | ||||

| S.E. of Regre | 0.033137 | 0.009017 | 0.045505 | 0.0344 | ||||

| DW stat | 2.796668 | 2.747657 | 1.7228 | |||||

| Mean dep.V | 2.617559 | 2.626124 | 2.609662 | 2.6175 | ||||

| S.D. dep.var | 0.156832 | 0.157204 | 0.045505 | 0.1568 | ||||

| SS resid | 0.027452 | 0.000407 | 0.053839 | 0.0296 | ||||

4.4. Diagnostic Tests

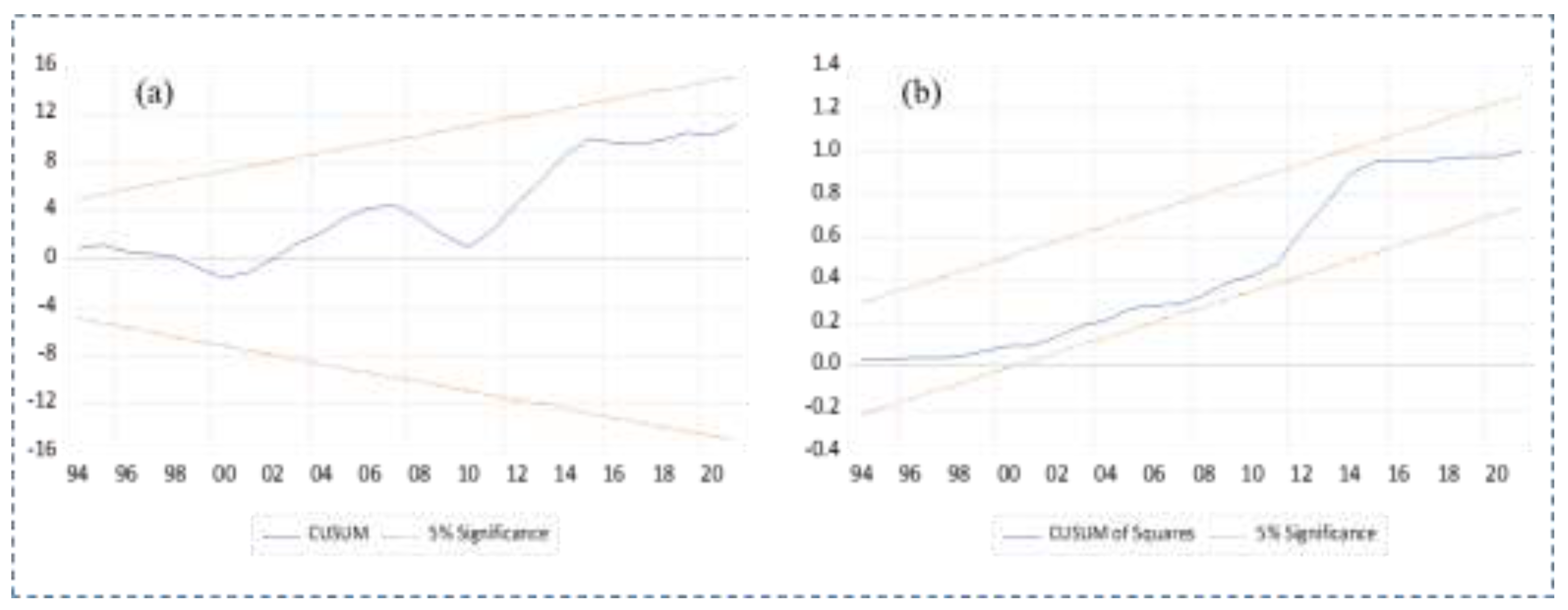

4.4. Stability Test: The CUSUM and CUSUMSQ

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Recommendations

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- https://moenergy.gov.sa/en/OurPrograms/RenewableEnergy/Pages/default.aspx, Accessed 1/September 20242030 ( Ministry of Energy).

- Alajmi, R.G. Carbon emissions and electricity generation modeling in Saudi Arabia. Environ Sci Pollut Res 29, 23169–23179 (2022). [CrossRef]

- Abdel-Gadir, S.E.M.; Mohammed, M.G.A (2024). Oman’s Green Horizon: Steering Towards Sustainability Through Decarbonization and Energy Transition. Sustainability 2024, 16, 9375. [CrossRef]

- Mehdi, Abid. (2023). How Does Renewable Energy Consumption Affect Environmental Quality in Saudi Arabia? Evidence from Quantile Regressions. International Journal of Energy Economics and Policy. [CrossRef]

- Md., Shafiul, Alam. (2023). 5. Impacts of Renewable Energy Generation on Greenhouse Gas Emissions in Saudi Arabia: A Comprehensive Review. Sustainability. [CrossRef]

- Abdulaziz, Aldegheishem. (2024). 2. The Relationship between Urbanization, Energy Consumption, Economic Growth, and Carbon Dioxide Emissions in Middle Eastern Countries: Jordan, Saudi Arabia and Egypt. Environmental research communications. [CrossRef]

- Amjad, Ali., Sumaira., Hafiz, Muhammad., Abubakar, Siddique., Saima, Ashiq. (2023). 3. Impact of Econ Md., Shafiul, Alam. (2023). omic Growth, Energy Consumption and Urbanization on Carbon Dioxide Emissions in the Kingdom of Saudi Arabia. Journal of policy research. [CrossRef]

- Yousif Osman. "The Correlation among Industrial Economic Growth, Renewable Energy Provision and CO₂ Emissions in Saudi Arabia." WSEAS Transactions on Environment and Development, 2024.

- Furqan, Asghar., Fahad, Abdullah, Alshahrani., Muhammad, Imran, Akhtar., Waseem, Amjad., Muhammad, Shahzad., Syed, Nabeel, Husnain., Gwi, Hyun, Lee. (2024). (3) Technoeconomic analysis of standalone hybrid renewable energy systems for telecommunication sector under different climatic conditions in Saudi Arabia. Energy Reports. [CrossRef]

- Ghazala, Aziz., Rida, Waheed., Majid, Ibrahim, Alsaggaf. (2023). Investigating the Impact of Green Natural Resources and Green Activities on Ecological Footprint: A Perspective of Saudi Vision 2030. Sustainability. [CrossRef]

- Saad, F., Al-Gahtani. (2024). 3. Saudi Arabia’s Journey toward a Renewable Future. Energies. [CrossRef]

- Faris Alruweili (2023). Impact of GDP growth on the ecological footprint: Theoretical and empirical evidence from Saudi Arabia. International Journal of Advanced and Applied Sciences. [CrossRef]

- James, Temitope, Dada., Mamdouh, Abdulaziz, Saleh, Al-Faryan. (2024). 4. Linking per capita income, renewable energy, natural resources, trade, and Urbanisation to material footprint: insights from Saudi Arabia. Energy nexus. [CrossRef]

- Ellaythy, I., Osman, Y., & Elmotkassi, T. (2024). Assessment of Economic and Environmental Impacts of using Green Hydrogen Gas for Generating Electricity in the KSA. WSEAS Transactions on Environment and Development. Available at: WSEAS.

- Emre Caglar, A., 2020. The importance of renewable energy consumption and FDI inflows in reducing environmental degradation: bootstrap ARDL bound test in selected 9 countries. J. Clean. Prod. 264 . [CrossRef]

- Abid, N., Ceci, F., Ahmad, F., Aftab, J., 2022. Financial development and green innovation, the ultimate solutions to an environmentally sustainable society: evidence from leading economies. J. Clean. Prod. 369 . [CrossRef]

- Sahoo, B., Behera, D.K., Rahut, D., 2022. Decarbonization: examining the role of environmental innovation versus renewable energy use. Environ. Sci. Pollut. Control Ser. 29 (32), 48704–48719. [CrossRef]

- International Energy Agency (2020). World Energy Outlook 2020. Paris: IEA.

- Dincer, I. (2011). "Renewable energy and sustainable development: A crucial review." Renewable and Sustainable Energy Reviews, 15(2), 1513-1524.

- REN21 (2022). Renewables 2022 Global Status Report. Paris: REN21 Secretariat.

- Panwar, N. L., Kaushik, S. C., & Kothari, S. (2011). "Role of renewable energy sources in environmental protection: A review." Renewable and Sustainable Energy Reviews, 15(3), 1513-1524.

- World Bank (2023). Toward Green Growth: World Bank Strategies for Sustainability. Washington, DC: World Bank Group.

- United Nations Environment Programme (UNEP) (2019). Emissions Gap Report 2019. Nairobi: UNEP.

- Jyotsana, Pandit., Anil, Kumar, Sharma. (2022). 1. Urbanization’s environmental imprint: A review. Environment Conservation Journal. [CrossRef]

- Edmund, Ntom, Udemba., Nazakat, Ullah, Khan., Syed, Ale, Raza, Shah. (2024). 2. Demographic change effect on ecological footprint: A tripartite study of urbanization, aging population, and environmental mitigation technology. Journal of Cleaner Production. [CrossRef]

- Behera, S. R., & Dash, D. P. (2017). The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renewable and Sustainable Energy Reviews, 70, 96-106..

- Salahuddin, M., Ali, M. I., Vink, N., & Gow, J. (2019). The effects of urbanization and globalization on CO 2 emissions: evidence from the Sub-Saharan Africa (SSA) countries. Environmental Science and Pollution Research, 26, 2699-2709..

- Salahuddin, M., Gow, J., Ali, M. I., Hossain, M. R., Al-Azami, K. S., Akbar, D., & Gedikli, A. (2019). Urbanization-globalization-CO2 emissions nexus revisited: empirical evidence from South Africa. Heliyon, 5(6)..

- Yasmeen, H., Tan, Q., Zameer, H., Vo, X. V., & Shahbaz, M. (2021). Discovering the relationship between natural resources, energy consumption, gross capital formation with economic growth: can lower financial openness change the curse into blessing. Resources Policy, 71, 102013..

- Chen, F., Liu, A., Lu, X., Zhe, R., Tong, J., & Akram, R. (2022). Evaluation of the effects of urbanization on carbon emissions: the transformative role of government effectiveness. Frontiers in Energy Research, 10, 848800..

- Adebayo, T. S., Ullah, S., Kartal, M. T., Ali, K., Pata, U. K., & Ağa, M. (2023). Endorsing sustainable development in BRICS: The role of technological innovation, renewable energy consumption, and natural resources in limiting carbon emission. Science of the Total Environment, 859, 160181.

- Nathaniel, S. P., Adeleye, N., & Adedoyin, F. F. (2021). Natural resource abundance, renewable energy, and ecological footprint linkage in MENA countries. Estudios de economía aplicada, 39(2)..

- Ebrahim, Amer., E., Meyad., Yigong, Gao., Xiaxia, Niu., Nanxu, Chen., Huiyong, Xu., Da-Wei, Zhang. (2022). 1. Exploring the link between natural resources, urbanization, human capital, and ecological footprint: A case of GCC countries. Ecological Indicators. [CrossRef]

- Haider, Ali, Mahmood., Alam, Asadov., Muhammad, Tanveer., Maham, Furqan., Zhang, Yu. (2022). 2. Impact of Oil Price, Economic Growth and Urbanization on CO2 Emissions in GCC Countries: Asymmetry Analysis. Sustainability. [CrossRef]

- Mehmood, U., Tariq, S., Haq, Z. U., Nawaz, H., Ali, S., Murshed, M., & Iqbal, M. (2023). Evaluating the role of renewable energy and technology innovations in lowering CO2 emission: a wavelet coherence approach. Environmental Science and Pollution Research, 30(15), 44914-44927..

- Christine, Schliesser. (2023). Industrialization Impact on Climate Change. Advances in business strategy and competitive advantage book series. [CrossRef]

- Ghazala, Aziz., Suleman, Sarwar., Kishwar, Nawaz., Rida, Waheed., Mohd, Saeed, Khan. (2023). 2. Influence of tech-industry, natural resources, renewable energy and urbanization towards environment footprints: A fresh evidence of Saudi Arabia. Resources Policy. [CrossRef]

- Byron, Quito., María, del, Río-Rama., José, Álvarez-García., Amador, Durán-Sánchez. (2022). 4. Impacts of industrialization, renewable energy and urbanization on the global ecological footprint: A quantile regression approach. Business Strategy and The Environment. [CrossRef]

- Wided, Mohamed, Ragmoun. (2023). 1. Ecological footprint, natural resource rent, and industrial production in MENA region: Empirical evidence using the SDM model. Heliyon. [CrossRef]

- M., D., A., Hossain., M., D., Eleais., Afrida, Jinnurain, Urbee., M., D., A., Hasan., Farian, Tahrim. (2024). 5. Assessing the Intensity of Economic Progress, Industrialization,Energy Use on Environmental Degradation. South Asian Journal of Social Sciences and Humanities. [CrossRef]

- Kamel, Touati., Ousama, Ben-Salha. (2024). 1. Reconsidering the Long-Term Impacts of Digitalization, Industrialization, and Financial Development on Environmental Sustainability in GCC Countries. Sustainability. [CrossRef]

- Hilmi, S., Salem., Musa, Yahaya, Pudza., Yohannes, Yihdego. (2023). 2. Harnessing the energy transition from total dependence on fossil to renewable energy in the Arabian Gulf region, considering population, climate change impacts, ecological and carbon footprints, and United Nations’ Sustainable Development Goals. [CrossRef]

- Gheorghe, H., Popescu., Elvira, Nica., Tomáš, Klieštik., Katarína, Zvaríková., Eleodor-Alin, Mihai., Kriselda, Gura. (2023). 1. Exploring the Environmental Impact of Energy Consumption, Globalization, and Research & Development in Europe: Insights from the STIRPAT-EKC Framework. [CrossRef]

- Atif, Jahanger., A, Awan., Ahsani, Amalia, Anwar., Tomiwa, Sunday, Adebayo. (2023). 2. Greening the Brazil, Russia, India, China and South Africa (BRICS) economies: Assessing the impact of electricity consumption, natural resources, and renewable energy on environmental footprint. Natural Resources Forum. [CrossRef]

- Saeid, Satari, Yuzbashkandi., Amir, Mehrjo., Mohammad, Hadi, Eskandari, Nasab. (2023). 2. Exploring the dynamic nexus between urbanization, energy efficiency, renewable energies, economic growth, with ecological footprint: A panel cross-sectional autoregressive distributed lag evidence along Middle East and North Africa countries. Energy & environment. [CrossRef]

- Bassem, Kahouli., Nahla, Chaaben. (2022). Investigate the Link among Energy Consumption, Environmental Pollution, Foreign Trade, Foreign Direct Investment, and Economic Growth: Empirical Evidence from GCC countries. Energy and Buildings. [CrossRef]

- Jammazi, R., & Aloui, C. (2015). Environment degradation, economic growth and energy consumption nexus: A wavelet-windowed cross correlation approach. Physica A: Statistical Mechanics and Its Applications, 436, 110-125..

- Eyüp, Çakmak., Samet, Acar. (2022). 5. The nexus between economic growth, renewable energy and ecological footprint: An empirical evidence from most oil-producing countries. Journal of Cleaner Production. [CrossRef]

- Ramzi, Boussaidi., Abdelaziz, Hakimi. (2024). 1. Financial inclusion, economic growth, and environmental quality in the MENA region: What role does institution quality play?. [CrossRef]

- Lamy, Mamdoh, Mohamed, Hamed., Latifa, Dhaouadi., Fatma, Zehri., Sofien, Tiba., Houda, Besser., Nissaf, Karbout., Eman, I., R., Emara. (2024). 2. Examining the relationship between the economic growth, energy use, CO2 emissions, and water resources: Evidence from selected MENA countries. Journal of the Saudi Society of Agricultural Sciences. [CrossRef]

- Al Hattali, Noor Ulhuda Mohammed and Saboori, Dr. Behnaz and Zekri, Prof. Slim and Gulsevin, Dr. Osman, Towards Ecological Sustainability in GCC Countries, the Role of Trade Market Diversification, Economic Growth, Energy Consumption, and Foreign Direct Investment. Available at SSRN: https://ssrn.com/abstract=4711944. [CrossRef]

- Hussain, A., Khan, F., & Albalawi, O. (2024). Modeling and Monitoring CO2 Emissions in G20 Countries: A Comparative Analysis of Multiple Statistical Models. Sustainability. Available at: ResearchGate.

- Osman, Y. (2024). The Correlation among Industrial Economic Growth, Renewable Energy Provision and CO2 Emissions in Saudi Arabia. WSEAS Transactions on Environment and Development. Available at: WSEAS.

- Rehman, S., Kotb, K. M., Zayed, M. E., & Menesy, A. S. (2024). Techno-economic evaluation and improved sizing optimization of green hydrogen production and storage under higher wind penetration in Aqaba Gulf. Journal of Energy Storage. Available at: ScienceDirect.

- Alotaibi, A. M., Makhdoom, T. K., & Al-Khayyat, S. H. (2024). Pathways Toward Improving the Energy Efficiency of Residential Air-Conditioning Systems in Saudi Arabia. Journal of Solar Energy Engineering. Available at: ASME Digital Collection.

- Hazrat, Yousaf., Azka, Amin., Waqar, Ameer., Muhammad, Rais, Akbar. (2022). Investigating the determinants of ecological and carbon footprints. Evidence from high-income countries. AIMS energy. [CrossRef]

- Qian, Chen., Ghulam, Rasool, Madni., Adnan, Ali, Shahzad. (2023). The usage of spatial econometric approach to explore the determinants of ecological footprint in BRI countries. PLOS ONE. [CrossRef]

- Syed, Asif, Ali, Naqvi., Syed, Ale, Raza, Shah., Syed, Ale, Raza, Shah., Sofia, Anwar., Hassan, Raza. (2021). Renewable energy, economic development, and ecological footprint nexus: fresh evidence of renewable energy environment Kuznets curve (RKC) from income groups. Environmental Science and Pollution Research. [CrossRef]

- Umar, M., Ji, X., Mirza, N., & Naqvi, B. (2021). Carbon neutrality, bank lending, and credit risk: Evidence from the Eurozone. Journal of Environmental Management, 296, 113156.).

- Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics, 16(3), 289-326. [CrossRef]

- Abumunshar, M., Aga, M., & Samour, A. (2020). Oil price, energy consumption, and CO2 emissions in Turkey. New evidence analysis of level relationships. Journal of applied econometrics, 16(3), 289-326.

- Sereyvath, Ky., Siphat, Lim. (2024). 2. Examination of Banks' Performance and Intellectual Capital in Cambodia: Utilizing FMOLS and DOLS Methods. Journal of ecohumanism. [CrossRef]

- Anindya, Banerjee., Josep, Lluís, Carrión, i, Silvestre. (2024). 3. Panel data cointegration testing with structural instabilities. [CrossRef]

- Gujarati, D. N., & Porter, D. C. (2009). Basic Econometrics (5th ed.). New York, NY: McGraw-Hill Education.

- Jordaan, A. C., & Eita, J. H. (2007). Testing for stability and structural change in an import demand function: The case of Namibia. South African Journal of Economics, 75(2), 258-2.

| Series | Ln ENF | Ln ENERG | Ln PGDP | LN INDVAD | LN REN | LN URB |

| Mean | 2.610 | 8.615 | 9.838 | 0.489 | -4.229 | 4.396 |

| Median | 2.583 | 8.620 | 9.835 | 0.853 | -4.605 | 4.397 |

| Maximum | 2.880 | 8.840 | 9.934 | 3.123 | -3.058 | 4.439 |

| Minimum | 2.357 | 8.181 | 9.686 | -1.940 | -4.707 | 4.338 |

| Std. Dev. | 0.161 | 0.194 | 0.060 | 1.498 | 0.557 | 0.028 |

| Skewness | 0.200 | -0.266 | -0.293 | -0.065 | 0.908 | -0.207 |

| Kurtosis | 1.660 | 1.836 | 2.648 | 1.983 | 2.147 | 2.033 |

| Jarque-Bera | 2.688 | 2.252 | 0.642 | 1.446 | 5.529 | 1.522 |

| Probability | 0.261 | 0.324 | 0.725 | 0.485 | 0.063 | 0.467 |

| Sum | 86.12 | 284.30 | 324.65 | 16.15 | -139.56 | 145.05 |

| Sum Sq. Dev. | 0.828 | 1.209 | 0.116 | 71.773 | 9.932 | 0.025 |

| CV | 6.17% | 2.25% | 0.61% | 306.34% | 13.17% | 0.64% |

| Observations | 33 | 33 | 33 | 33 | 33 | 33 |

| LNENF | LNENERG | LNGDPC | LNINDVAD | LNREN | LNURB | |

| LNENF | 1.000 | |||||

| LNENERG | 0.900 | 1.000 | ||||

| LNGDPC | 0.701 | 0.596 | 1.000 | |||

| LNINDVAD | -0.052 | -0.211 | 0.180 | 1.000 | ||

| LNREN | -0.279 | -0.043 | 0.091 | 0.017 | 1.000 | |

| LNURB | 0.815 | 0.965 | 0.489 | -0.238 | 0.019 | 1.000 |

| Variable | VIF | 1/VIF |

| Ln ENF | 1.66 | 0.602 |

| Ln | 1.57 | 0.637 |

| Ln ENERG | 2.34 | 0.427 |

| Ln PGDP | 1.89 | 0.529 |

| Ln INDVAD | 3.02 | 0.331 |

| Ln URB | 1.45 | 0.690 |

| Variable | Level T-Statistic | Level Prob | First Difference T-Statistic | First Difference Prob | Order of Cointegration |

| Ln PGDP | -2.052 | 0.264 | -6.179 | 0.000 | I(1) |

| Ln EnF | -1.225 | 0.651 | -3.385 | 0.576 | I(1) |

| Ln INDAVD | -5.418 | 0.000 | -6.291 | 0.000 | I(0) |

| Ln REN | -1.266 | 0.633 | -4.872 | 0.001 | I(1) |

| Ln ENERG | -0.583 | 0.800 | -4.710 | 0.001 | I(1) |

| Ln URB | -0.323 | 0.910 | -5.663 | 0.000 | I(1) |

| Test Statistic* | Value | Signif | I (0) | I (1) |

| F-statistic | 26.36 | 10% | 2.75 | 3.79 |

| K | 5 | 5% | 3.12 | 4.25 |

| 2.50% | 3.49 | 4.67 | ||

| 1.% | 3.39 | 5.23 | ||

| *Null Hypothesis: No levels relationship *Note: K is the number of explanatory variables |

||||

| F-statistic | χ2 | |

| Breusch-Godfrey Serial correlation Lm Test | 0.1408 (0.8699) | 0.611 (0.7367) |

| AECHHeteroscedasticity | 1.390 (1.2800) | 1.419 (0.2342) |

| Ramsey RESET | 5.9421 (0.0277) | - |

| Jarque-Bera for Normality | - | 0.265 (0.8761) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).