1. Background

The term FinTech consists of both financial and technologies, referring to the delivery of financial solutions using technology(Arner, 2016). FinTech was first mentioned by the Citigroup Chairman in the 1990s (Puschmann, 2017,Arner, 2016). FinTech has many descriptions from various scholars. For example, Murinde, Rizopoulos and Zachariadis (2022) concluded that FinTech generates significant benefits for consumers through breakthroughs in technology having the potential to revolutionize the delivery of financial services and foster the development of innovative business models, applications, processes, and products. Financial Services Board (FSB) defined FinTech as “technologically enabled financial innovation that could result in new business models, applications, processes, or products with an associated material effect on financial markets, financial institutions, and the provision of financial services” (CGFS&FSB, 2017). Schueffel (2016) explained that FinTech improves financial activities through application of technology.

Advancements and developments in information technologies (IT) have affected and continue to affect financial services. FinTech has had a significant impact on the financial industry, resulting in a wave of fintech innovations that have transformed how banks and other financial institutions operate(Walker, Nikbakht and Kooli, 2023). IT development usually increases process automation; however, ongoing progress is leading to the fundamental reorganization of the value chain of financial services by introducing new business models (Puschmann, 2017). The International Monetary Fund (IMF) policy paper proposed that the adoption of FinTech by users can be linked to FinTech solutions through technological innovations that successfully cover the gaps in speed, cost, transparency, access, and security, which are not covered by the traditional model of financial services (Khera et al., 2022). Corporates should not ignore Fintech innovations because their customers may move towards competitors, hence, it is of high importance that banks adopt FinTech as a customer retention strategy. It costs five times as much to attract a new customer versus retain a current customer (Tripathy and Jain, 2020).

Banks face different challenges in adopting and implementing FinTech, including customer management, investment management, regulatory environment, and other risks (Lee and Shin, 2018). Furthermore, shifted customer behavior has a critical impact on businesses, including the banking sector (Lestari and Rahmanto, 2023). While FinTech provides new opportunities for businesses, it also presents new challenges (Bhandari, 2021).

The Palestinian banking sector has recently emerged. It began in 1994 after the establishment of the Palestinian National Authority. The Palestinian Monetary Authority (PMA) is a regulator equivalent to the central bank. Thirteen banks operate in Palestine(PMA, 2021). Banks in Palestine are expected to invest in FinTech and face different challenges, both global and local, which is the same as the banking sector globally.

Little research is available on the challenges faced by banks in Palestine that prevent, delay, or slow Fintech investments. This study aims to fill this gap and investigate the challenges faced by banks in Palestine concerning FinTech implementation.

2. Literature Review

While FinTech is improving accessibility, efficiency, and security for both consumers and businesses, thereby reshaping the financial landscape (Gopal, Gupta and Minocha, 2023), it is worth noting that the integration between financial services and technology has developed over time. According to Puschmann (2017), FinTech evolution can be summarized as falling within three developmental areas starting in 1960:

The first era is internal digitization, in which information technology usage is directed into internal processes or automation. Customers were dependent on one and two later channels: branches and ATMs. Financial institutions have locally developed information technology systems.

The second era is provider-oriented digitization, in which financial institutions have shifted to the use of providers of information technology systems. As a result, the process and application functions were standardized. Outsourcing of business processes such as information systems and some back-office functions also occurred.

Customer-oriented digitization is a third era in which customers have FinTech applications centered around them. Moreover, new entrants provide financial services, in addition to incumbents expanding the ecosystems.

The collaboration of FinTech ecosystem categories benefits financial system consumers by fueling innovation, providing an economy with added value, and raising competition levels in the financial industry (Albarrak and Alokley, 2021). For example, Karim and Lucey (2024) concluded that while BigTech and FinTech disrupt various aspects of banking, they also offer opportunities to adapt to blockchain-based financing mechanisms. Understanding the ecosystem is important for identifying Fintech innovations and their interactions. Lee and Shin (2018) identified five main elements of the Fintech ecosystem:

Fintech start-ups are entrepreneurial ventures that provide financial services in innovative ways across areas like payments, wealth management, lending, crowdfunding, capital markets, and insurance.

Technology providers and developers work in emerging fields such as big data analytics, cloud computing, social media, and cryptocurrency. These tech advancements allow entrepreneurs to benefit from an environment with significant cost savings and minimal capital requirements.

Governmental bodies are responsible for legislation and regulations, creating a supportive environment for entrepreneurs through favorable licensing and capital requirements, while tightening regulations on established companies. This approach fosters innovation and helps new solutions spread.

Consumers, both individuals and organizations, play a major role. Millennials, those aged 18 to 34, are the primary consumers of Fintech in many countries, with future demographics also likely to favor Fintech.

Telecom service providers are considered the main FinTech enablers through the provision of domestic and global broadband setups of connectivity, which is considered the basic infrastructure needed for FinTech growth (Lestari and Rahmanto, 2023). Traditional banking products, such as payments and investment advisories, are being widely challenged by innovative fintech solutions. Moreover, new technologies such as blockchain are enhancing many traditional banking services, enabling more security and lower costs. Financial incumbents such as banks, insurance companies, stock brokerage firms, and venture capitalists who offer financial services in the traditional forms, and after realizing the disruptions introduced by entrepreneurs, were forced to reevaluate their business models and develop strategies to catch up with the FinTech era, shifting into collaboration strategies. Although More disruptions are expected in the future, challenges are present and will emerge for both FinTech and incumbents(Lee and Shin, 2018). Moreover, Lee and Shin (2018) the six proposed FinTech challenges are as follows:

- -

Investment management: The selection of the best FinTech portfolios by financial institutions has the potential to provide better results. Incumbents may choose internal Fintech investments or collaborative investments with external start-ups.

- -

Customer management: Considering the availability of unbundled financial services by FinTech companies focusing on niche markets and the tendency for customers to deal with different providers for different services, incumbents need to figure out ways to retain customers, and FinTech needs to be innovative in attracting and retaining customers.

- -

Regulatory challenges: incumbents already face the regulatory requirements of capital adequacy, data security, and other reserves and regulations, whereas FinTech companies need to be aware of and keep an eye on future regulatory directions and requirements that affect their business models. Venaik, Garg and Agarwal (2024) argue that the Fintech sector has demonstrated significant potential to revitalize the current financial system, prompting regulators worldwide to work towards achieving a balance between innovation and protection.

- -

Technology Integration: This focuses on financial institutions’ legacy IT systems and the challenges to integrate with FinTech new technologies.

- -

Security and privacy: Fintech companies must pay attention to customers’ privacy and security of their information, where breaches to such data may result in losses. AlBenJasim et al. (2023) suggested that developing a cybersecurity framework for FinTech could be beneficial, offering a fresh perspective by highlighting it as a natural extension of existing knowledge.

- -

Risk management: FinTech innovations and adopted technologies, such as Robo-advisory, may result in faulty investment advice where FinTech may be held liable.

In a comprehensive systematic literature review (SLR) of FinTech, Suryono, Budi and Purwandari (2020) summarized FinTech challenges into three main categories:

- -

Collaboration, where the development of a FinTech systematic framework is of clear importance, and adoption models are also being researched because of their high importance. Additionally, support from stakeholders, including regulators and banks, and the transition of FinTech’s consideration from disruption to collaboration is a challenge.

- -

Regulation is another challenge owing to global differences in practices. Some are reactive, whereas others are proactive. The adoption of sandboxes by regulators can help better regulate this new field.

- -

The protection and security of technology and data are of high importance for FinTech to secure the confidentiality of customers’ data and for the continuity and efficiency of service.

Sanyaolu et al., (2024) explains that FinTech implementation must overcome various challenges, including regulatory, ethical, and technological challenges. Furthermore, traditional financial institutions face challenges in adapting to changes introduced by FinTech, such as technological agility needs, adaptation to regulatory modern requirements, and the fostering of consumer confidence in digital platforms. Oberoi and Dharni (2023) concluded that the main challenges that must be addressed for Fintech include risk management and investment, customer management, technology integration, privacy and security, and regulatory compliance. Naz et al., (2024) identified the major challenges posed by fintech startups in the MENA region, including privacy concerns, cybercrimes, financial disruption and instability, exploitation of social norms and values, growing inequalities, and regulatory authorities’ lack of compliance. FinTech has a multifaceted impact on the banking sector, encompassing dimensions such as customers, companies, banks, regulatory authorities, and the society (Elia, Stefanelli and Ferilli, 2023). Moreover, FinTech has sparked concerns related to privacy, security, consumer protection, ethical issues, and regulatory compliance(Prastyanti, Rezi and Rahayu, 2023).

Research shows that FinTech implementation faces different challenges in Palestine. For example, Al-Daya, Nassar and Al-Massri (2022) concluded that prominent challenges include the legal environment, cybersecurity, and customers not trusting digital services. Additionally, Awwad (2023) underscored that differences in FinTech adoption were linked to the city where the bank was situated and the educational background of the study participants. Furthermore, according to Magdy Rezk and Halim (2022) the regulatory environment development and readiness is a challenge for FinTech implementation in Arab countries, including Palestine.

3. Methodology

3.1. Theoretical framework

Diffusion on innovation theory (DOI) (Rogers, 1995), and the technology, organization, environment model (TOE) (Tornatzky et al., 1983) are both considered the technology adoption theories at the firms’ level (Oliveira and Martins, 2011). TOE is the mostly used; for instance, Awa and Ojiabo (2016) emphasizes its robustness and dominance in studies concerned with organizational-level adoption, supported theoretically and empirically by recent studies. Gierdien and Jokonya (2023) study revealed that technology factors are the main influencers at FinTech adoption at universities, while Megahed, Al-Kayaly and Al-Hadad (2021) investigated the relevance of DOI and TOE on the banks Fintech adoption in Egypt and Bahrain. Urumsah et al. (2022) found that factors like pressure of customers, pressure of competition, readiness of organizations, support of top management, and information technology knowledge influence significantly FinTech adoption.

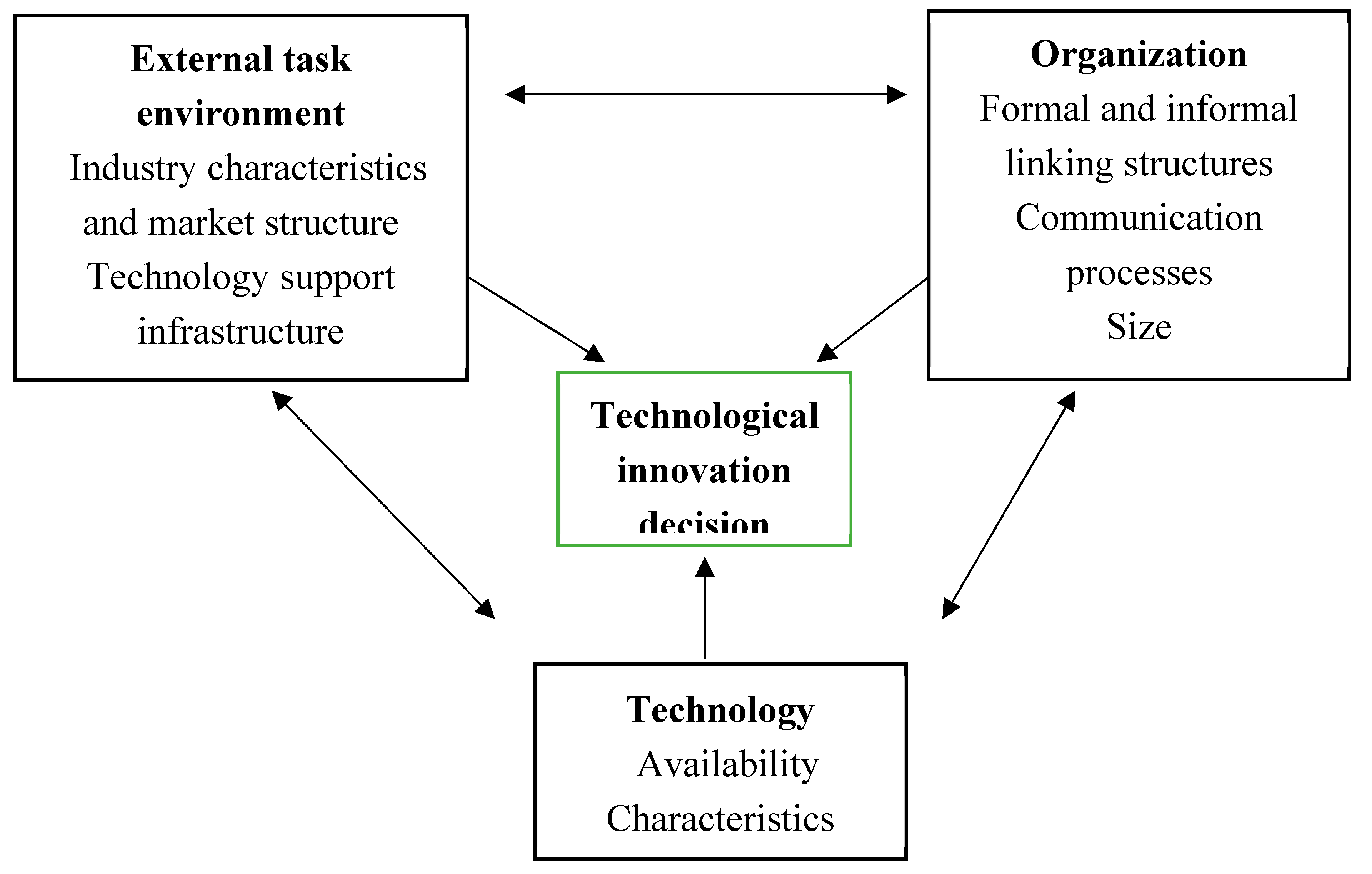

As

Figure 1 shows, Oliveira and Martins (2011) concluded that the TOE framework emphasizes the organizations’ internal and external factors and variables that interact with each other to facilitate technology adoption:

Technology factors consider technology characteristics including systems and technologies both internal and external. Complexity, compatibility, availability, trialability, observability and other factors are of main importance to facilitate or restrict technology innovation in an organization.

The organization factor considers the characteristics of the organization itself. Factors like culture, structure, size, available resources, and its capabilities affects the organizations’ position and abilities to adopt new innovative technologies.

The environment factor is the external field where the organization operates. Many issues can be crucial including industry standards, regulatory environment and competition have large influence on the organization’s position towards development and innovation.

The TOE framework will be used in this study to investigate the challenges faced by the banking sector in adopting FinTech solutions. This model is particularly useful as it is widely employed to analyse technology adoption from an institutional perspective.

3.2. Instrument Development

A qualitative approach was adopted, where the opinions of stakeholders, including the bank’s seniors in addition to the regulator and other FinTech companies, were explored through semi-structured interviews. The researchers prepared and proposed questions to be used while interviewing the proposed sample based on the TOE framework mentioned before. The proposed questions are listed in

Table 1.

3.3. Data Collection

Semi-structured interviews were conducted with sample bank Chief Executive Officers (CEOs), Business Development Heads (BDs), and information technology heads (ITH). Additionally, the interviewees included five FinTech companies (e-wallets) in addition to the PMA governor, PMA deputy governor, and PMA assistant governor.

Semi-Structured interviews are suitable for the purpose as it gives the researchers the ability to have a clearer picture of the responses with the ability to have the ‘why?’ answered in addition to the ‘what?’ and ‘how?’ (Mark, Philip and Adrian, 2007). Interviewees were contacted by phone first to secure their participation; an official email was sent to some interviewees according to their preference. Schedule was prepared according to interviewees preferences, and interviews took place at their offices. They were assured at the start of each interview that collected data would only be used for scientific research, additionally there would be no mention of any data that may disclose their privacy. After each interview, the recording was converted into script, and script was sent back to them for any modifications. The version received from interviewees was used for thematic analysis.

3.4. Analysis Tools and Methods

The increasingly popular thematic analysis (TA) method was used to analyze the interview scripts. Braun and Clarke (2012) and Vaismoradi et al. (2016) suggests four stages to develop themes in the thematic analysis process, as shown in

Table 3.

The use of computer-assisted qualitative data analysis software (CAQDAS) improves the quality of qualitative research outcomes. The CAQDAS software helps researchers collect, organize, analyze, and visualize the reporting data. It is important to highlight that CAQDAS software assists and does not replace human researchers. NVivo is an example of a popular CAQDAS software(Dhakal, 2022). NVivo development began in 1981 by Lyn and Tom Richards, and since then, developers have incorporated continuous capabilities and enhancements into their abilities and features to handle large amounts of different types of data (Jackson, Bazeley and Bazeley, 2019). Owing to its ability to improve and streamline qualitative research methods, researchers from a variety of fields have increasingly used qualitative data analysis software, such as NVivo. NVivo offers several noteworthy benefits, including the capacity to effectively handle and arrange massive amounts of qualitative data from textual texts and multimedia sources, thereby allowing researchers to dive deeper into intricate datasets. NVivo enhances the rigor and depth of research findings by making it easier to extract significant insights and patterns from various sources by offering an intuitive interface and an extensive suite of tools for coding, categorization, and data exploration(Limna, 2023). Thematic analysis was conducted using NVivo software V12.

Table 4 and

Table 5 show the participants’ institutes and their job titles. The institutes were carefully chosen to have a repressing sample consisting of the regulator (PMA), in addition to the supply side of FinTech, that is, banks and FinTech companies. The sample included five out of 13 banks operating in Palestine and five licensed e-wallet companies. Due to its critical and important role, PMA, which is the banking and FinTech companies’ regulator in Palestine, was chosen for inclusion in the sample. According to ABP (2023)), the sample banks’ assets constitute more than 71.1% of the total banking sector assets in Palestine. FinTech companies constitute all payment companies licensed operating in Palestine. The large and diverse sample size enhances the reliability and credibility of the research. Each participant was assigned a code between X1 and X17 for confidentiality.

Parallel to interview execution using the iPhone recorder with the permission of participants, researchers transcribed the audio recordings into script, and then translated them into English, as they were multilingual in Arabic and English according to participants’ preferences. The translation was checked, and a semifinal version was introduced. The transcripts were then sent back to participants who did some amendments, corrections, and modifications, and sent them back to the researchers. This procedure aims to enhance the reliability and validity of data collection and analysis, as well as the ethical stance of researchers.

The interview files were uploaded to the NVivo software. The coding process took place by parsing the files line-by-line, and the coding process was performed three times to ensure accuracy and comprehensiveness. After the last run, the researchers reviewed the resulting codes and grouped them into categories, which were then grouped into themes correlating with the paper goals.

4. Data Analysis

Table 6 shows the codebook extracted from NVivo highlighting the main themes and their relative appearance within the interview files.

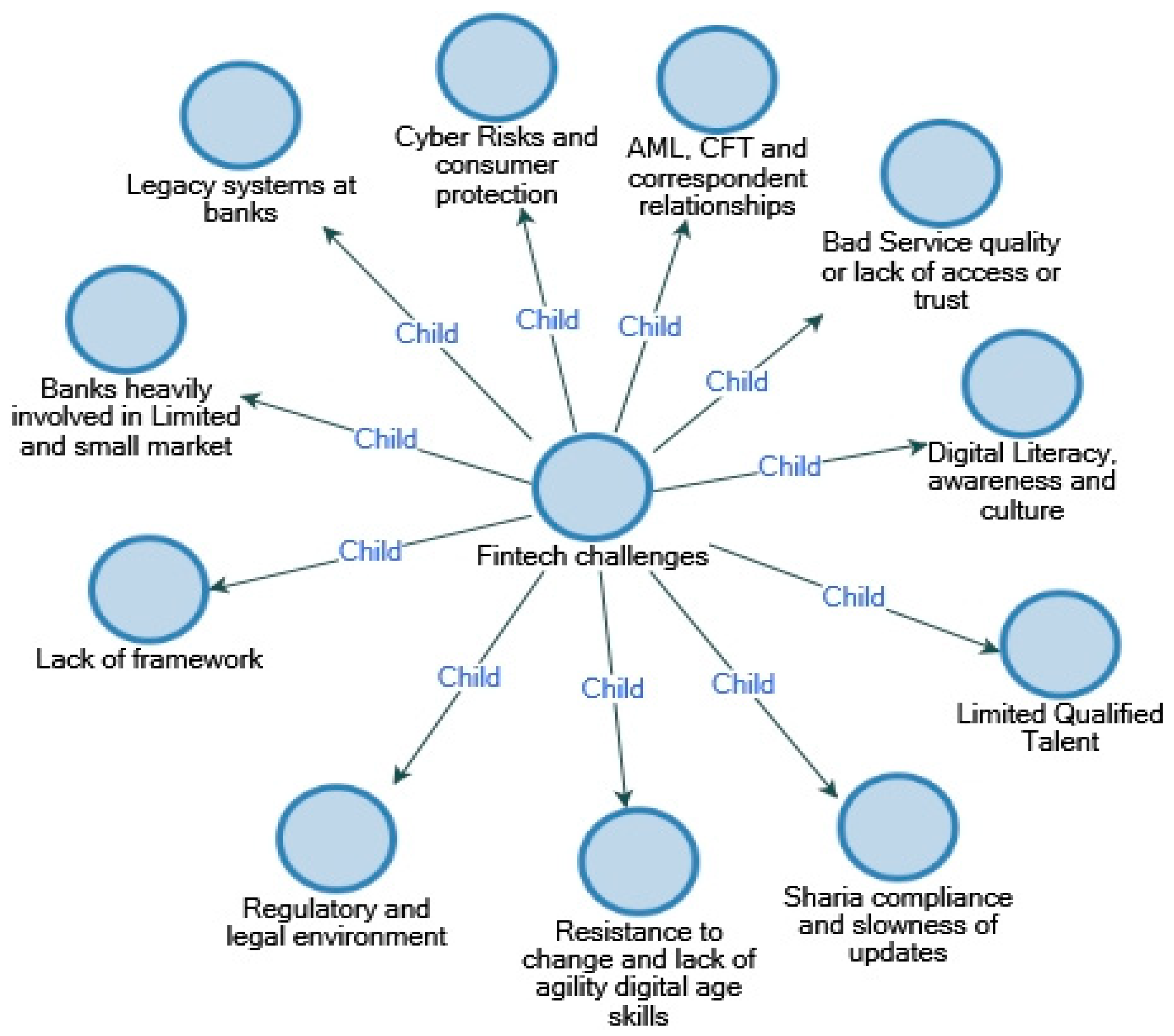

Figure 2 also shows the main challenges mentioned by the participants. Subsections will discuss each identified challenge in further detail.

4.1. Regulatory and Legal Environment

Restoy (2019) discussed the regulatory challenges of FinTech to regulators and classified the regulatory framework into three groups: FinTech activities regulations such as digital banking, new technologies regulations like artificial intelligence, and financial services promotion technologies such as digital identification technologies. Moreover, Lee and Shin (2018) explained that incumbents are already facing regulatory challenges, including capital, data security, and other requirements, while FinTech companies are not aware of, or used to, such a highly regulated environment. Venaik, Garg and Agarwal (2024) addressed the regulatory challenge of balancing between protection and innovation. Suryono, Budi and Purwandari (2020) identified regulatory environment as a major challenge for FinTech globally.

Interviewees agreed with literature review about regulatory challenges. The regulatory and legal environment came first with fifty-three references out of fifteen files. This shows how important and vital the readiness of the regulatory and legal environment is to the success of FinTech. While many banks praised the monetary authority’s steps towards FinTech, others saw that more is still needed; on the other hand, FinTech companies saw that the PMA’s actions were not supportive. Participant (X15) commented, “The legal environment in Palestine is still evolving when it comes to FinTech. The (PMA) has taken some steps to create a more supportive environment for FinTech, but there is still room for improvement”, he elaborated by saying that “The regulatory environment, which is not yet conducive to FinTech innovation.”, he also emphasized the need for framework clarity “One of the biggest challenges is that the regulatory framework is still not clear”. Participant (X12) saw that the regulator should spread support at its operational level, “I think the challenge for the regulator is that while I think at the top the directions are there, but it is always much difficult when it comes to the operational level where really the blockers come from those who are used to do the day-to-day work. There is a positive sign”. On the other hand, participants saw an adverse actions by the PMA, especially interfering with the fees and commissions, which represent the soul of the FinTech, for example participant (X17) commented “in many cases they are giving themselves the right to interfere in fees and commissions of the services.” Moreover, participants addressed the need to facilitate laws and regulations other than those of the PMA, participant (X13) commented, “The law and regulations and the legal legislation should be in place in order to facilitate working, it’s about time for the laws and regulations and the legal aspect to be solved out”. Participant (X2) went to say, “Many regulations should change to cope with FinTech revolution”.

4.2. Banks Resistance to Change and Lack of Agility

This challenge came second with twenty-four references from eleven of fifteen files. Participants said that some banks were slow to adopt and implement FinTech. Reasons for this slowness and resistance were diverse among the participants, considering that online services and mobile banking provided by banks are sufficient, finding difficulty in managing the change, and banks assessing that customers are still preferring branches; hence, banks do not need to rush to FinTech.

Participant (X14) said” Other banks are more resistant to change and are taking a wait-and-see approach”, while participant (X9) commented by saying “other banks find it difficult to manage the change”, additionally, participant (X16) concluded “Until now except bank of Palestine and Arab bank, the banks coping PMA and FinTech solutions as it is “. Participant (X5) referred this slowness to the situation of customer’s preferences of branches “The branches are still working, and customers come daily”. Participant (X3) noted that FinTech understanding by majority banks is not right “The issue depends on their view and understanding of FinTech. There are banks that believe that if they establish online services, they believe that it is sufficient”, he added “I would say that at least 10 banks look at FinTech as online services and are not concerned with developing the platform.” and concludes “I see that a bank that does not want to develop its electronic services will not have future sustainability.”.

4.3. Customers’ Culture, Digital Literacy, and FinTech Awareness

The third challenge came with twenty-one references from nine out of fifteen files. While these factors affect customers’ FinTech adoption and usage, they also affect the supply side, namely, banks. It does not encourage or challenge them to act rapidly towards FinTech investments. Participants concluded that culture has not developed enough towards digital services, where many customers still prefer traditional ways of banking (i.e., branches); they referred this to insufficient customers’ digital literacy. Participant (X14) said, “Similar to other markets in the region, digital literacy across the mass is not at the stage of easy adoption”, while participant (X8) argued that “Digital literacy and trust in tech is still low.” Participant (X1) referred to the culture in the country as “Cultural resistance, preferring the old ways of banking.”

4.4. Cyber Risks and Consumer Protection

Came as the fourth challenge, with seventeen references from eight out of fifteen files. This challenge was mentioned from two perspectives: one as a barrier for customer adoption, which results in low customer appetite for FinTech. The second as a challenge to FinTech providers, and the risks of fraud. Participant (X5) spoke about the potential risks saying” the issue of electronic security, electronic piracy, and fraud operations”, Participant (X8) elaborated on the risks of scaling up FinTech “Scaling while managing risk is challenging.” On the other hand, some participants showed confidence of tec talent to handle such cyber risks as well, participant (X10) commented saying” if you are having good developers, then you need to be having cyber security experts also”.

4.5. IT and Telecommunication Infrastructure Availability and Cost

Come as the fifth challenge, with sixteen references and eight out of fifteen files. This factor is of high importance considering that FinTech is fully dependent on technology and telecommunications. It is of utmost importance in the Palestinian context, as telecommunication is fully controlled by the Israeli occupation. First, Israel controls the mobile frequencies Palestinians are allowed to use; hence, Gaza uses 2G, and West Bank uses limited 3G frequencies. Second, Israel controls the communication equipment allowed in Palestine, limiting its ability to use suitable and sufficient equipment to guarantee service quality. Third, the full Israeli control of area C, which is more than 62% of the West Bank and Gaza, limits telecommunication companies’ abilities to lay communication equipment like fibers, with their need to acquire Israeli permissions before any action. Finally, these restrictions increase the cost of services offered by telecommunications to customers.

Participants highlighted this challenge in many ways: Participants (X1) commented on the challenges subject saying “Telecommunications Infrastructure: There are a lot of mobile phones, but it can be hard to get consistent high-speed internet access, especially in rural places”. Participant (X17) also said “Internet, in Palestine still under 3G.”, furthermore participant (X15) commented also “The cost of internet access in Palestine is still relatively high, which can make it difficult for some people to access FinTech products and services”. Participant (X9) pointed to Israeli restrictions saying, “We know that in Palestine there is certain challenges with the network due to Israeli restrictions”. Technology companies’ availability and suitability are also important; participant (X12) mentioned their limited availability by “availability of resources including the tech companies”.

4.6. Limited Availability of Qualified Talent

This was also mentioned as a main challenge, with sixteen references from ten out of fifteen files. FinTech is recent and the availability of talent expertise can be considered critical for the development of this sector. It is not concerned with technology only, but also with financial services knowledge and global FinTech developments. Participant (X14) mentioned “Qualified talent with global exposure” as a major challenge, which was also mentioned by participant (X15) “The lack of skilled talent in the FinTech sector”. Participant (X12) emphasized the importance of comprehensive knowledge “Maybe a wonderful young man will come up with an idea of how to automate something, but he lacks deep understanding of how financial sector works. It is very different from other industries”. Participant (X9) spoke about difficulties in hiring IT talent “companies find it difficult sometimes to hire IT people”. Participant (X5) also said,” it can help to certain limits, and then those who seek greater development will be insufficient”.

4.7. The lack of FinTech Framework

Identified as an important challenge. The availability of a comprehensive FinTech framework is critical; it provides straightforward data for everyone interested in the field, including legal, regulatory, ecosystem, government, incubating environment, and clear strategies. Participant (X15) highlighted “The lack of a comprehensive FinTech framework: The PMA is still working to develop a comprehensive FinTech framework, which can make it difficult for FinTech companies to know exactly what is required of them”. Participant (X12) also said,” we lack the framework in Palestine that shows that opportunities needed to be covered by FinTech to make the banking sector more efficient and advance”. Participant (X14) described that saying” There isn’t a complete framework for FinTech”. Participant (X11) described the deficiency in the running framework, before some fixtures by PMA, by” part of the framework regulating the work of banks and financial institutions in Palestine, was hindering the ability of start-ups and companies in the FinTech field, to innovate in the field of developing financial services, and creating more services”.

4.8. Limited Market Size

The small and limited Palestinian market was highlighted with twelve references from seven out of fifteen files. Market size provides opportunities for competitors and market players; additionally, market openness and exposure to neighboring and global markets provide opportunities for market players to innovate and progress. Unfortunately, Palestine is a small market with a population of about 5.5 million people, and the segregation between West Bank, Jerusalem, and Gaza causes current market players to compete fiercely and nearly cover all segments. Additionally, because of occupation, the Palestinian market is very limited and nearly closed from the outside because of border control by Israel. Participant (X9) addressed this factor, saying, “it is very difficult for those FinTech to find the untapped market because maybe it’s not there”. Participant (X5) mentioned, “As for competition in the market, I believe that the situation of banks in Palestine does not allow any intruder, and this will be prevented by providing the service”, while participant (X5) described the market as “Limited market size”. Furthermore, participant (X3) thinks that with such a market size, only creative ideas will have opportunities, this is the result of the fact, that Palestine is small, and the spread of banks is large. These companies may not be able to compete with banks, but this does not mean that if someone comes up with a creative idea in the future, you will not be able to take it on”.

4.9. Sharia Compliance and the Slowness of Its Updates

Islamic banking is attached to Sharia compliance, which was identified as a challenge, with ten references from three out of fifteen files. This challenge is important to Islamic banks, as they are the ones concerned. Islamic banks cannot adopt or introduce any product or service without passing the Sharia conditions from the Fatwa Agency. Some participants assessed that such slowness provides a competitive advantage to conventional banks. Participant (X5) says, “Commercial banks are faster than Islamic ones, this may be because Sharia standards are still not ready to deal with the issue of financial technology”, but he affirms that efforts are being extended to handle this challenge “Sharia and supervisory bodies are making great efforts to reach legitimate solutions regarding digital transformation and financial technology for Islamic banks”. Participant (X7) clarifies the subject further saying, “Sharia compliance certification process for any new products in this regard, may be a lengthy process, especially taking into consideration that Sharia compliance regulations, from accredited international institutions are being updated much slower than needed”. Participant (X3) sheds light on the complexity of Islamic lending services in comparison to conventional lending products by saying,” Regarding credit, how will you have integrated electronic services in credit issues and credit approvals? It differs from traditional banks in which credit is a loan regardless of the goal, whether personal, a car, or a house, for example”.

4.10. Non-bank Companies’ Challenges

FinTech non-bank companies’ specific challenges were assessed to be of high importance, with sixty-eight references from fifteen out of the fifteen files. FinTech companies are challengers who globally compete banks and challenge them, and for that, banks joined the race and started to invest in FinTech to preserve their revenues and market shares. Benefits are substantial for their existence and ability to work, and the challenges they face require special attention.

Regulatory Challenges

There were eighteen references from nine out of fifteen files. Fintech companies do not have experience dealing with the well-regulated banking sector. The same is true for PMA, which is not used to regulate small businesses. PMA restrictions concerning fees and commissions, for example, hinder Fintech companies from building their business models. Participant (X15) explains this matter saying, “There are several regulations that FinTech companies need to comply with, and these regulations can be complex and time-consuming”. Regulatory constraints are diverse and may affect the companies’ abilities to develop their profitable business model, participant (X9) explains “another challenge is how will those FinTech’s make money, the market is not free in terms of commissions and fees for FinTech to do their own operating business model”. Participant (X5) infers that the regulator purposely prevents FinTech companies from gaining market share “the regulator is afraid of providing the environment and tools for new companies to obtain a market share”. Participant (X8) says “But regulations still favor traditional formats”.

Access to Capital and Funding

With ten references from eight out of fifteen files. This matter is important to Fintech companies, hence, an important challenge. Entrepreneurs with weak financial abilities fear loss and become hesitant to invest their money without guaranteed compensation in case of loss. Participant (X10) described this challenge, “Fear that they are going to invest and then if we fail, no one compensates them”. Participant (X5) shared a similar view “the most important reasons for that is that failure to do so means exiting the market”.

Low Barriers for Banking Relationships

Ten references from three out of fifteen files considered low barriers for establishing a banking relationship as a challenge to non-bank FinTech companies. This is important because market availability and entry opportunities are critical for success. Participants argued about the low requirements for people to start a banking relationship. and the high coverage of banks’ branches in the geography of Palestine. Participant(X9) commented on this matter saying,” in Palestine I believe it’s very easy for anyone to open a bank account as banks are everywhere.” He even doubted the financial inclusion issue because of banks availability, “I don’t think there’s an issue of financial inclusion”. Participant (X3) saw that there was no need for electronic payment companies, considering size of country, and developed banking system, he said, “it became clear that in countries that have a fairly developed banking system, there is no need for electronic payment companies, especially in countries that are geographically small and where banks are well spread”.

Other Challenges for Non-Banks Companies

Other challenges included fierce competition by banks, the high cost of doing business in Palestine, the positive reputation of banks in Palestine, and the lack of creativity in the services offered by FinTech companies adds to their challenges. Participant (X3) addressed this matter saying, “do not redo something existing because you will not be able to compete with it”.

4.11. Other Challenges

Other challenges for banks were identified and mentioned, including:

The anti-money laundry and counter financing of terrorism (AML/CFT) subject needs special attention while engineering FinTech services. FinTech companies lack experience and proper knowledge of this critical matter: Participant (X3) said “The third difficulty, I believe, is the issue of combating money laundering and combating terrorism”.

The Absence of Ecosystem and its Interconnectivity Was identified as another challenge, where FinTech is dependent on connectivity with other stakeholders, such as billers and service providers, in addition to the banking system. Participant (X12) described that saying, “How to set up business architectures that connect with different networks”.

Political Instability Caused by Occupation was mainly mentioned as a challenge, also causing a less attractive investment environment for investors, especially global investors. Participant (X17) said “Availability of FinTech investors that mean less FinTech and less competitors, affected by occupation”.

Government Tec-Maturity and Technological Readiness Government in Palestine was described by participants as lacking digital services and development; hence, it is another challenge for FinTech in general and FinTech companies in particular. The government is a main biller from one side and has important resources required for FinTech, such as state registers. Participant (X9), for example, mentioned “Also the digital maturity of the government”.

legacy IT systems at banks, FinTech trust by customers, customers’ perceived quality of service, fear from global FinTech players such as ApplePay, GooglePay, and Amazon market penetration without any ability to supervise or even proper regulatory frameworks and licensing.

5. Discussion

As seen in the literature review section, Lee and Shin (2018) we discuss six FinTech challenges: investment management, customer management, regulatory, technology integration, security and privacy, and risk management. Suryono, Budi and Purwandari (2020)FinTech challenges are summarized into three categories: collaboration, legal framework, and IT infrastructure. It is worth mentioning that every researcher looks at the matter from a different angle, resulting in diverse FinTech challenge classifications. The participants in the semi-structured interviews had a compatible perspective regarding all the previously mentioned challenges. Moreover, additional challenges were identified because of the special situation in Palestine: IT and communication infrastructure, talent availability, digital literacy, lack of framework, and Sharia compliance.

5.1. Investment Management

Lee and Shin (2018) stated that investment management is a FinTech challenge related to incumbents choosing the right FinTech investments and choosing a suitable framework, being local or through collaboration with start-ups. Bank participants (representing incumbents) said that they preferred in-house development. While all banks’ participants reiterated their plans and strategies for FinTech development, three participants argued that two banks, namely Bank of Palestine and Arab Bank, were ahead of other banks in FinTech development and implementation, and that all banks’ participants showed willingness to collaborate with FinTech companies and entrepreneurs, conditions to provide innovative services and solutions. Evidence tends to suggest that while two banks are proceeding heavily, other banks follow a wait-and-see strategy with fair expenditures on digital projects, especially those forced by PMA, leaving other banks to lead. This situation can be explained by the two leading banks financial, technical, and capital abilities that enable them to be pioneers in FinTech investments, while other banks with fewer abilities and resources learn from their success and failure to decide their way forward.

5.2. Customer Management

Lee and Shin (2018) related customer management challenges to their tendency to deal with different providers for different services. All participants said that their institutes were investing heavily in Fintech. Banks and banks related to FinTech companies’ participants clarified their banks and companies’ plans to sufficiently cover their customers’ needs through in-house FinTech development and investments. FinTech non-bank companies, on the other hand, explained that they are gaining market share and attracting customers from both the unbanked and banking sectors. One PMA participant commented that most FinTech companies’ users were already bank customers. The results tend to suggest that customer management challenges will deepen in the future because they deal with banks and FinTech companies.

PMA participants explained PMA’s efforts and plans to enable FinTech development to banks and FinTech companies. Efforts included the licensing of five FinTech companies and the launch of the FinTech Sandbox. Furthermore, PMA’s bill presentation (E-Sadad) and instant payment projects are being developed. It is worth mentioning that the E-Sadad bill presentation system is currently alive; it connects all billers in one system that is integrated with all banks and e-wallets companies, and mobile and electronic applications.

All participants (17) agreed that challenges are the highest for FinTech non-bank companies. Two out of three PMA participants reiterated that challenges for FinTech companies are high, explaining their concerns about their ability to survive competition with banks, unless they introduce innovative solutions to the market. The FinTech companies’ participants argued that they need more support and protection from regulators to enable them to gain market share, especially for the provision of FinTech services that banks have neglected so far. Banks’ participants do not share this direction requested by FinTech companies and see those companies as not needed in the market, considering the banks’ abilities and appetite to invest and provide FinTech. Here, one can see the existential challenges facing FinTech companies, as on one hand they need to face formidable competition from banks because they have financial muscles, and they can develop the FinTech offering in-house; on the other hand, they are expected to compete with each other to gain customer base and trust.

5.3. Regulatory Challenges

Restoy (2019) discussed the regulatory challenges of FinTech to regulators and classified the regulatory framework into three groups: FinTech activities regulations such as digital banking, new technologies regulations like artificial intelligence, and financial services promotion technologies such as digital identification technologies. Moreover, Lee and Shin (2018) incumbents are already facing regulatory challenges, including capital, data security, and other requirements, while FinTech companies are not aware of, or used to, such a highly regulated environment.

All 17 participants agreed with the regulatory challenges and their importance. Each group of participants had a point of view in this regard.

PMA participants said that the current legal framework imposes restrictions on their ability to enable FinTech innovations. They explained their plans to introduce law amendments that fix current legal gaps, but they reiterated that it is not an easy mission as it requires other parties’ involvement, such as the Commercial Law, and another example is the lack of data protection law. It is worth mentioning that Fintech entrepreneurs who want to scale globally are expected to face complex regulations in different jurisdictions, which inhibits access to markets and delays customer adoption(AllahRakha, 2023).

Banks (and bank-related companies) participate in highlighted regulatory challenges from their own perspectives. They raised the subject of restrictions imposed by PMA on fees and commissions categories and amounts, as banks are unable to collect any type of commission or fee that was not approved by PMA beforehand. The bank participants also expressed their views that PMA does not introduce the required law amendments required for FinTech development. One participant mentioned that while senior management at PMA may be supportive of FinTech, lower-level management and staff may delay or block FinTech innovation. All bank participants expressed their views that PMA is extending some effort in the right direction, but they need to accelerate these efforts.

The Fintech companies’ participants also agreed that regulatory challenges are of the highest importance. They highlighted their views that PMA needs to be more flexible with FinTech companies, and give actors space to innovate and create, especially to build different business models. Participants criticized PMA for their intervention by imposing the fees and commissions structure for FinTech transactions, which are the blood life that will make FinTech services profitable. Moreover, companies’ participants reiterated the imminent need for regulations and law amendments that enable FinTech innovation by the companies; for example, one participant spoke about open banking, which refers to banks opening their core systems for third parties using application interfaces (APIs), condition to customers’ consent, and those third parties can introduce innovations of value to customers like account aggregators(Premchand and Choudhry, 2018).

5.4. Banks Legacy Systems

Banks and PMA participants agreed to Lee and Shin (2018) describe banks’ legacy systems as a challenge for FinTech because of IT integration between such systems and FinTech. Contrary to the inference, the two large banks in Palestine are leading FinTech development in the market, as participants highlighted. It is worth highlighting that witnessing the two large banks leading FinTech in the Palestinian banking sector does not mean that they are not having the legacy systems challenges; it may be evidence of their efforts to overcome such challenges and provide solutions.

5.5. Cyber Risks and Consumer Privacy Protection

Consistent with Suryono, Budi and Purwandari (2020) the conclusions, participants emphasized the importance of cyber risks and consumer privacy protection and considered them an important challenge facing the development of Fintech in Palestine, which has been confirmed by all participants. Cyber risk is defined as “an operational risk associated with the performance of activities in cyberspace, threatening information assets, ICT resources, and technological assets, which may cause material damage to an organization’s tangible and intangible assets, business interruption, or reputational harm. The term ’cyber risk’ also includes physical threats to ICT resources within an organization”(Strupczewski, 2021). Robust and effective controls are required for the prevention and mitigation of serious cyber risks, especially in areas such as cybersecurity, injection of malware, denial of service attacks, privacy, insecure APIs, insider threats, vulnerabilities, and data security(AlBenJasim et al., 2023). Participants highlighted such cyber risk challenges; hence, they emphasized that they should be considered and handled from origination. One PMA participant highlighted the need for banks to invest in this field and deepen their experience and knowledge in the cyber risk field considering the shortage of available local expertise.

5.6. Risk Management

Risk management is important Lee and Shin (2018), as faulty advice or decisions that may be taken by FinTech applications, such as robot-advisors or artificial intelligence, will make concerned companies or banks legally liable. The participants addressed this subject as part of the regulatory and legal challenges faced by FinTech in Palestine. While the examples are of global and local importance, additional legal issues were highlighted by participants related to the primitive digital legal environment in Palestine. They emphasized the importance of legislation, such as electronic transactions and digital signatures. This legislation is basic and enables innovation and creativity in FinTech. On the other hand, Global FinTech are heavily utilizing artificial intelligence (AI) and machine learning (ML) technologies to introduce innovative solutions and services, including advisory and support services, introducing new types of risks and challenges. While banks in Palestine did not reach the AI and ML levels of technologies, such technology usage will soon become the new normal; hence, Palestine should consider these risks and have appropriate legislation that is comparable to global directions.

5.7. Palestinian specific FinTech Challenges

The participants identified further challenges that are specific to Palestine and may be similar to other markets. are IT and communication infrastructure, talent availability, digital literacy, lack of framework, legal compliance, and Sharia compliance.

IT and communication infrastructure: Participants spoke about the weak communication infrastructure in Palestine, especially mobile frequencies. One participant explained that Palestine is split between West Bank, where 3G became available a few years ago, and Gaza Strip, which is still on the 2G. This is related to the restrictions of Israeli occupation, preventing and restricting the communication environment in Palestine. It was recently announced that 4G is expected to be approved by Israel soon. Knowing that FinTech is interrelated with Internet connectivity, and considering Palestinian telecommunication networks, participants considered this matter as an acritical challenge.

Talent availability: This was addressed by all the participants as a challenge. All expressed their views about insufficient talent availability, both technological talents, and even business talent who innovate new ideas. While all agreed to the challenge, the proposed solutions included the ability to cooperate with external experts, the development of FinTech training programs for young graduates, and collaboration with universities to enhance Tech graduates. It is worth mentioning that continuous instabilities in Palestine and the occupation’s entry restrictions for international experts contributed to this challenge by preventing expertise exchange.

Digital literacy: Participants considered weak digital literacy within some parts of the Palestinian population, limiting and creating challenges for FinTech development and adoption. They relate this challenge to seniors and older people, while young Palestinians, who are the majority, are tec-savvy high technology demands.

The lack of a FinTech framework that clarifies strategy, organizes efforts, and shows development priorities was identified by participants with high importance. While it was part of the investment management challenge mentioned before Lee and Shin (2018), participants paid special attention to it because its severity increases with the severity of every other challenge.

Sharia compliance for Islamic banking was mentioned by six out of seventeen participants, who are Islamic banks and PMA participants, as a challenge for Islamic banks. Participants highlighted a slow approval process by Sharia committee at each Islamic bank and by Islamic banking and finance agencies such as Accounting and Auditing Organizations for Islamic Financial Institutions (AAOIFI). Participants explained the inability to have comprehensive technological solutions for Islamic bank services, especially financing services. important to say, this challenge is not a Palestinian one; it concerns all Islamic banking providers globally. Participants elaborated that the FinTech Sharia compliance subject is attracting the attention of all stakeholders in the Islamic Banking industry, and intensive efforts are being made to address and accelerate the process.

FinTech companies’ special challenges: On the other hand, according to five out of seventeen participants representing FinTech companies, there are challenges with high importance specific to those FinTech companies, which, according to the participants, require attention and solving.

Regulatory challenges: Nine out of 17 participants mentioned the regulations as complex and difficult to comply with by FinTech companies, describing them as complex. rigid, sometimes restrictive to innovation, and time-consuming; for example, they mentioned capital requirements and restrictions on fees and commissions. One participant expressed his view that PMA is afraid that FinTech companies will gain market share.

Limited access to capital, financing, and venture capital: Eight out of 17 participants spoke about the limited availability of venture capital and investment instruments. Moreover, access to financing is limited because banks are hesitant to lend to start-ups. The weak financial position led to the fear of loss in the case of failure of Fintech start-ups.

Competition with banks was considered an important challenge for five out of 17 participants. They describe competition with banks as fierce and strong. It hardens considering the limited size of the Palestinian market and banks targeting and accepting all types of clients, from ultra-high net worth individuals (UHNI) to the smallest consumer clients. Consequently, this prevents Fintech companies from finding market gaps to penetrate the marketplace. On the other hand, banks and PMA participants argued that non-bank FinTech companies lacked creativity. One PMA participant criticized the FinTech companies for focusing only on payment services; such services he said, “are well served by banks”. This shows an irreconcilable position and paradox in the marketplace between banks, regulators, and FinTech companies.

6. Conclusions

In conclusion, FinTech in Palestine faces several challenges. They are diverse and complicated and are concerned with different parties. The regulatory environment was the top challenge, where actions were required for legal and regulatory environment transformations. The second challenge is the banking sector itself, where many banks are reluctant to change and resist change. On the other hand, the digital literacy of customers and their awareness of FinTech encourages banks to continue their slow steps towards FinTech provision. Cyber risks added to the insufficiency of talented technology expertise heightens fears and slows FinTech developments, while the IT and telecommunication infrastructure with the lack of mobile frequencies caused by Israeli occupation controls does not support FinTech progress. The non-bank companies’ challenges include regulatory frameworks that discourage them, while there is a lack of funding and limited access to financing and investors for such companies, which adds up to fierce competition by banks and limited market size, which requires them to be creative and innovative to survive and excel.

References

- ABP (2023) Comparative Performance 2022. Available at:(Accessed: 22/11/2023).

- Albarrak, M.S. and Alokley, S.A. (2021) ‘FinTech: Ecosystem, Opportunities and Challenges in Saudi Arabia’, Journal of Risk and Financial Management, 14(10), pp. 460.

- AlBenJasim, S. , Dargahi, T., Takruri, H. and Al-Zaidi, R. (2023) ‘FinTech Cybersecurity Challenges and Regulations: Bahrain Case Study’, Journal of Computer Information Systems,, pp. 1–17. [CrossRef]

- Al-Daya, W. , Nassar, S. and Al-Massri, M. (2022) Financial Technology (FinTech) Innovations and the Future of Financial Institutions (FIs) in Palestine “An Exploratory Study”.. Development. Cham: Springer International Publishing, pp. 15.

- AllahRakha, N. (2023) ‘Legal Challenges for International Fintech Startups’, International Journal of Law and Policy, 1(8).

- Arner, D.W. (2016) ‘The Evolution of Fintech’, SSRN Electronic Journal, 47(4). [CrossRef]

- Awa, H.O. and Ojiabo, O.U. (2016) ‘A model of adoption determinants of ERP within T-O-E framework’, Information Technology & People, 29(4), pp. 901–930 Available at. [CrossRef]

- Awwad, B.S. (2023) ‘Fintech Adoption in Palestine: Bank Customers’ Perspectives’Technological Sustainability and Business Competitive Advantage Springer, pp. 153–167.

- Bhandari, V. (2021) ‘FinTech: A Study of Enablers, Opportunities, and Challenges in the Banking and Financial Services Sector’, Research Anthology on Concepts, Applications, and Challenges of FinTech,, pp. 24–31.

- Braun, V. and Clarke, V. (2012) Thematic analysis. American Psychological Association.

- CGFS&FSB (2017) FinTech credit Market structure, business models and financial stability implications. Available at:(Accessed: 13/4/2022).

- Dhakal, K. (2022) ‘NVivo’, Journal of the Medical Library Association : JMLA, 110(2), pp. 270–272. [CrossRef]

- Elia, G. , Stefanelli, V. and Ferilli, G.B. (2023) ‘Investigating the role of Fintech in the banking industry: what do we know?’, European Journal of Innovation Management, 26(5), pp. 1365–1393.

- Gierdien, A. and Jokonya, O. (2023) ‘Factors Affecting the Adoption of Financial Technology at Universities’Smart Technologies for Organizations: Managing a Sustainable and Inclusive Digital Transformation Springer, pp. 3–15.

- Gopal, S. , Gupta, P. and Minocha, A. (2023) Advancements in Fin-Tech and Security Challenges of Banking Industry. IEEE, pp. 1.

- Jackson, K. , Bazeley, P. and Bazeley, P. (2019) Qualitative data analysis with NVivo Sage.

- Karim, S. and Lucey, B.M. (2024) ‘BigTech, FinTech, and banks: A tangle or unity?’, Finance Research Letters, 64, pp. 105490.

- Khera, P. , Ng, S., Ogawa, S. and Sahay, R. (2022) Measuring Digital Financial Inclusion in Emerging Market and Developing Economies: A New Index Wiley.

- Lee, I. and Shin, Y.J. (2018) ‘Fintech: Ecosystem, business models, investment decisions, and challenges’, Business horizons, 61(1), pp. 35–46. [CrossRef]

- Lestari, D. and Rahmanto, B.T. (2023) ‘Fintech and its challenge for banking sector’, Lestari, D., & Rahmanto, BT (2021).Fintech and Its Challenge for Banking Sector.The Management Journal of BINANIAGA, 6(01), pp. 55–70.

- Limna, P. (2023) ‘The impact of NVivo in qualitative research: Perspectives from graduate students’, Journal of Applied Learning and Teaching, 6(2).

- Magdy Rezk, W. and Halim, M.A.A. (2022) ‘Financial technology (Fintech) in the Arab countries challenges and opportunities’, L’Egypte Contemporaine, 113(547), pp. 33–62.

- Mark, S. , Philip, L. and Adrian, T. (2007) Research Methods for business studentsFourth Edition England: Pearson Education Limited.

- Megahed, N. , Al-Kayaly, D. and Al-Hadad, A. (2021) ‘Relevance of DOI and TOE for assessing FinTech adoption by banks: comparative analysis between Egypt and Bahrain’, Journal for Global Business Advancement, 14(6), pp. 768–803.

- Murinde, V., Rizopoulos, E. and Zachariadis, M. (2022) ‘The impact of the FinTech revolution on the future of banking: Opportunities and risks’, International Review of Financial Analysis, 81, pp. 102103. [CrossRef]

- Naz, F. , Karim, S., Houcine, A. and Naeem, M.A. (2024) ‘Fintech growth during COVID-19 in MENA region: current challenges and future prospects’, Electronic Commerce Research, 24(1), pp. 371–392.

- Oberoi, V. and Dharni, K. (2023) ‘Challenges faced by the FinTech Industry: A Review’, Financial Technology and Business in the Era of Industry, 4, pp. 37.

- Oliveira, T. and Martins, M.F. (2011) ‘Literature review of information technology adoption models at firm level’, Electronic journal of information systems evaluation, 14(1), pp. pp110-121.

- PMA (2021) PMA Fact Sheet. Available at: https://www.pma.ps/Portals/0/Users/002/02/2/About%20PMA/Fact%20Sheet/En-Q4-2020.pdf?ver=2021-02-08-095545-730 (Accessed: 12/3/2021).

- Prastyanti, R.A. , Rezi, R. and Rahayu, I. (2023) ‘Ethical Fintech is a New Way of Banking’, Kontigensi: Jurnal Ilmiah Manajemen, 11(1), pp. 255–260.

- Premchand, A. and Choudhry, A. (2018) Open banking & APIs for transformation in banking. IEEE, pp. 25.

- Puschmann, T., Dr (2017) ‘Fintech’, Business & Information Systems Engineering, 59(1), pp. 69–76. [CrossRef]

- Restoy, F. (2019) ‘Regulating fintech: what is going on, and where are the challenges’, Bank for International Settlements,, pp. 1–7.

- Rogers, E.M. (1995) ‘Diffusion of Innovations: Modifications of a Model for Telecommunications’, in Stoetzer, M. and Mahler, A. (eds.) Die Diffusion von Innovationen in der Telekommunikation Berlin, Heidelberg: Springer Berlin Heidelberg, pp. 25–38.

- Sanyaolu, T.O. , Adeleke, A.G., Efunniyi, C.P., Azubuko, C.F. and Osundare, O.S. (2024) ‘Exploring fintech innovations and their potential to transform the future of financial services and banking’, International Journal of Scholarly Research in Science and Technology, 5(01), pp. 54.

- Schueffel, P. (2016) ‘Taming the Beast: A Scientific Definition of Fintech’, SSRN Electronic Journal, 4(4). [CrossRef]

- Strupczewski, G. (2021) ‘Defining cyber risk’, Safety Science, 135, pp. 105143. [CrossRef]

- Suryono, R.R. , Budi, I. and Purwandari, B. (2020) ‘Challenges and trends of financial technology (Fintech): a systematic literature review’, Information, 11(12), pp. 590.

- Tornatzky, L.G. , Eveland, J.D., Boylan, M.G., Hetzner, W.A., Johnson, E.C., Roitman, D. and Schneider, J. (1983) ‘The process of technological innovation: Reviewing the literature’,.

- Tripathy, A.K. and Jain, A. (2020) ‘FinTech adoption: strategy for customer retention’, Strategic Direction, 36(12), pp. 47–49. [CrossRef]

- Urumsah, D. , Ispridevi, R.F., Nurherwening, A. and Hardinto, W. (2022) ‘Fintech adoption: Its determinants and organizational benefits in Indonesia’, Jurnal Akuntansi dan Auditing Indonesia,, pp. 88–101.

- Vaismoradi, M. , Jones, J., Turunen, H. and Snelgrove, S. (2016) ‘Theme development in qualitative content analysis and thematic analysis’,.

- Venaik, A. , Garg, N. and Agarwal, V. (2024) ‘Global revolutionary challenges and opportunities of FinTech globally’, Revolutionary Challenges and Opportunities of Fintech,, pp. 187–203.

- Walker, T. , Nikbakht, E. and Kooli, M. (2023) ‘Fintech and banking: an overview’, The fintech disruption: how financial innovation is transforming the banking industry,, pp. 1–8.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).