Submitted:

07 September 2024

Posted:

10 September 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Regulatory Implications of ETS for the Indian Maritime Industry

2.1. Overview of ETS Regulations

- a.

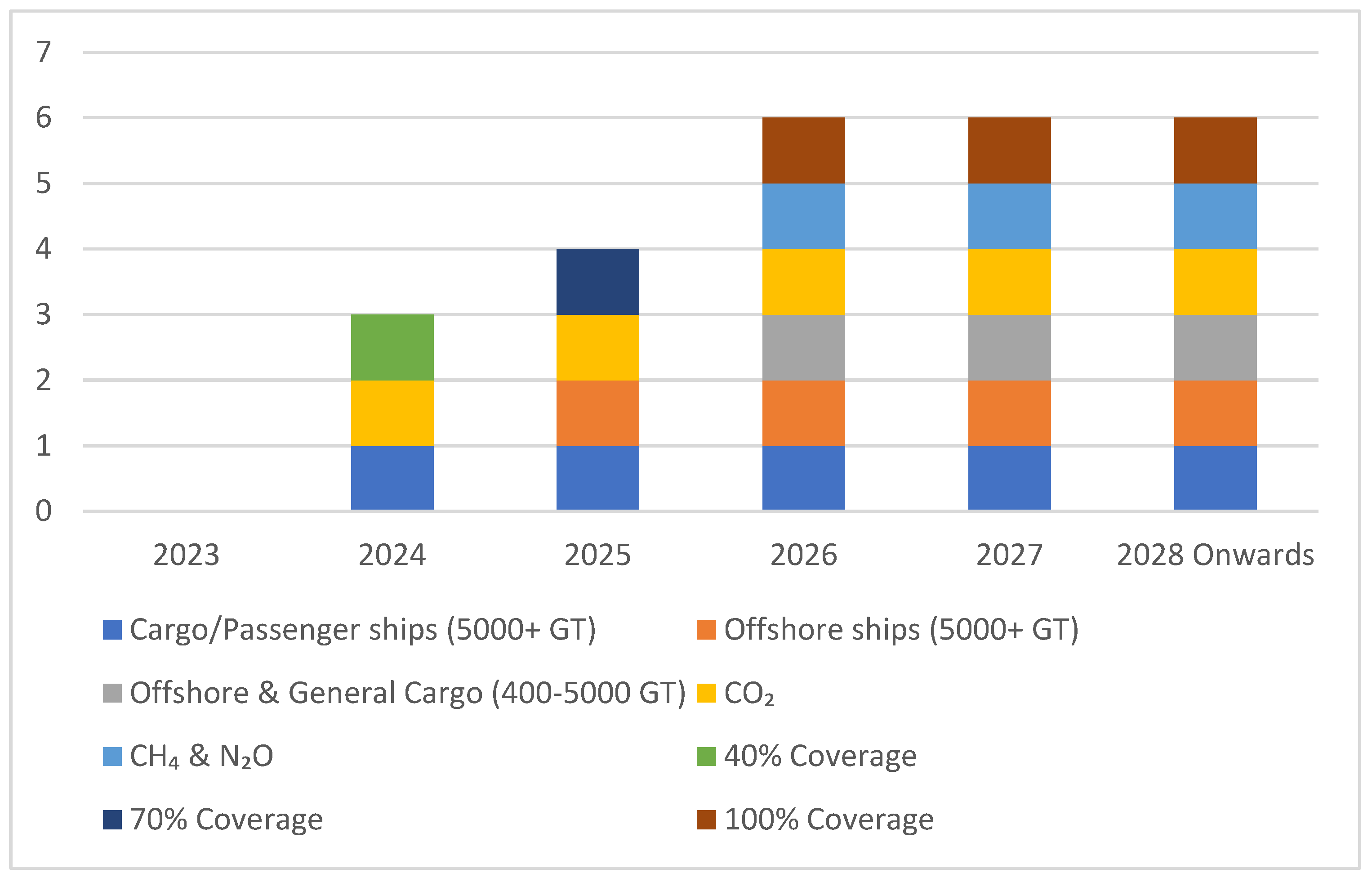

- Applying EU ETS to cargo and passenger ships (5000+ GT) from 2024 and offshore ships (5000+ GT) from 2027 reduces the emissions from 40% in 2024 to 70% in 2025 and 100% in 2026.

- b.

- The emissions caused by greenhouse gases such as carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O) will also be reduced from 2024 and 2026, respectively.

- c.

- Under Section 34 of 2015/757 on the monitoring, reporting, and verification (MRV) of CO2 emissions from maritime shipping, and the Directive 2009/16/EC, require all vessels to annually report emissions for ships greater than 5000 GT [5].

- d.

- Under IMO MEPC.278(70), IMO adopted Data Collection System (DCS) which will report the fuel consumption data for vessels greater than 5000 GT [6].

2.2. Impact on Compliance Requirements

- Increased Costs: In order to comply with ETS, shipping companies face additional costs. For instance, with carbon allowances priced €72.52 per tonne of CO2, a vessel emitting 1000 tonnes of CO2 annually would suffer costs of €72,520 per vessel per year.

- Operational Costs: Companies need to opt for greener technologies in order to achieve a target of 40% reduction in GHG emissions by 2030, which may cost high to the Indian maritime industry [8].

- Market Competitiveness: With an increase in fuel rates due to ETS, a 2017-built Supramax vessel is expected to see a rise of 13% compared to the fuel price in 2024, which may rise to 22% by 2026 [9]. This can affect global trade competitiveness, especially for older and less efficient vessels.

- Trade and Economic Impact: With higher shipping and freight rates, volume of trade also gets affected. For instance, a 10% increase in shipping costs may impact the competitiveness of exports from major shipping nations like India.

3. Chapter 2: Economic Impacts of ETS on Indian Shipping Companies

3.1. Cost Analysis and Revenue Impact

- Operational costs for all vessels significantly rise from 2024 to 2026 due to ETS, by €1.4m in 2026.

- Passenger ships and Ro-Pax ships showcase the highest increase in cost by €3 million by 2026.

- Increase in costs rise from €380,000 per tanker in 2024 to €1m per tanker in 2026, due to ETS.

3.2. Market Competitiveness

4. Adaptation Strategies for Indian Shipping under ETS Regulations

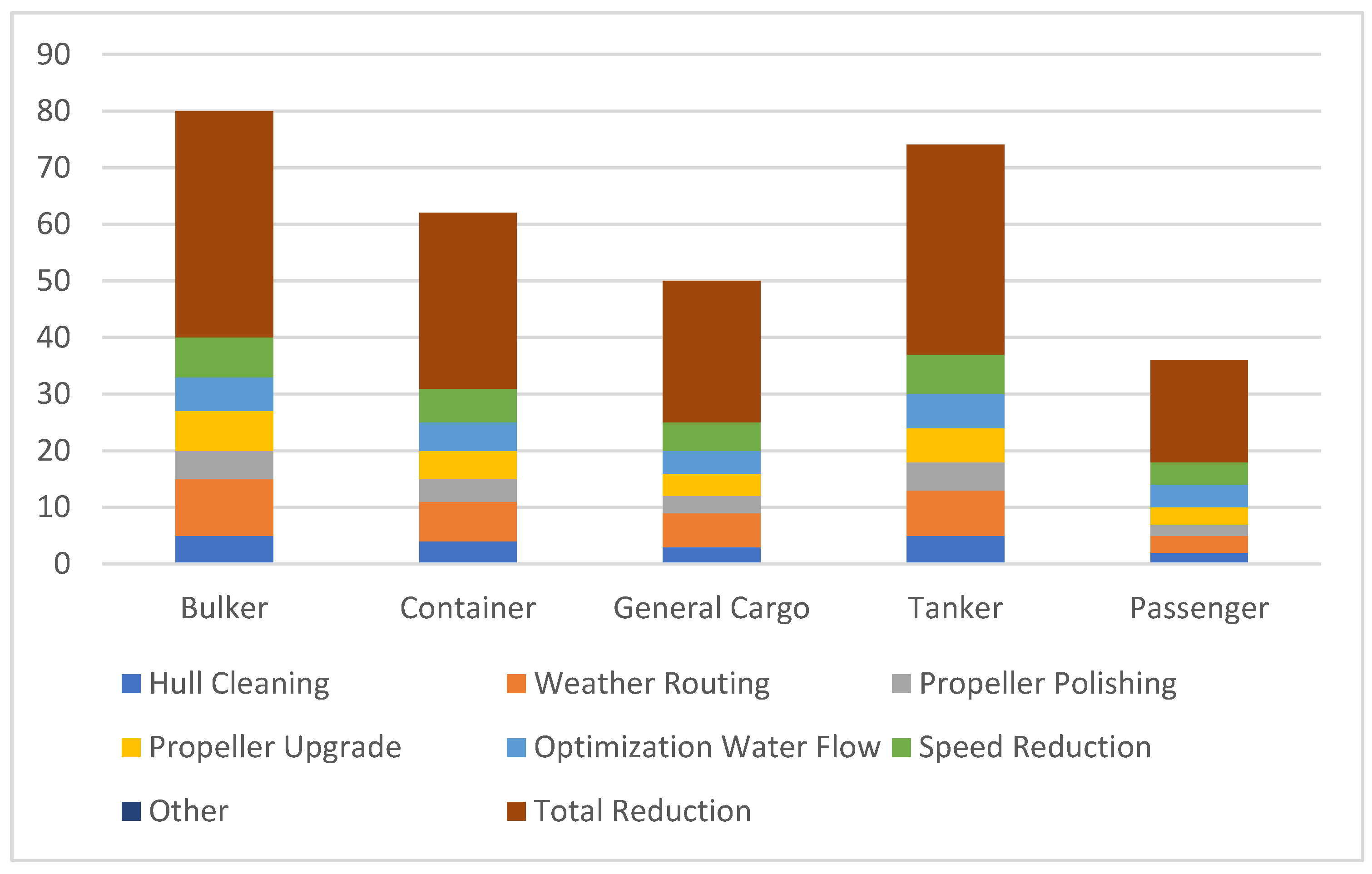

- Hull Optimization: Hull optimization reduces emissions by minimizing water resistance thus decreasing the energy required to propel the vessel. This in turn, lowers the fuel consumption rate and CO2 emissions. Modification in bulbous bow such as X-Bow, leads to a smoother and more efficient way to reduce emissions, especially in rough seas. As per a report of Lloyd’s Register, 1-2% of fuel can be saved via hull modifications due to less resistance offered by the hull, which in turn helps to reduce the emissions [15].

- Air Lubrication: Air lubrication is a way of reducing the friction between the hull and water by creating a layer of air bubbles along its surface. This method is capable of reducing the emissions by 10% over last year [16]. The technique enhances energy efficiency and effectively reducing the fuel consumption rate.

- Electrification: Replacing traditional vessels with fully electric vessels can reduce carbon emissions by 100% due to less or no consumption of fuel oil. This shift reduces reliance on fossil fuels which also gets saved for future and better use. Electrification also contributes to less noisy operations and decreased operational costs.

- Hydrogen Fuel Cells: The hydrogen fuel cells generate electricity via a chemical reaction between hydrogen and oxygen, producing water and some amount of heat. This method significantly reduces greenhouse gas emissions by 100% and eliminates harmful pollutants such as NOx and Sox. Hydrogen fuel cells, in conjunction with electric vessels, can reduce the CO2 emissions by 30-40% [17].

- Slow steaming: Slow steaming, sailing at lower speed, can effectively reduce fuel consumption and CO2 emission by 19% [18]. If the speed is reduced to half the calculated speed, the fuel consumption and emissions can decrease up to 70% [19]. This approach can increase the time of a round trip by 10-20%, while reducing the fuel consumption and emissions simultaneously. However, slow streaming may alter the engine operating conditions, thus increasing fouling and corrosion due to low operating temperatures.

- Route Optimization: Route planning can significantly reduce emissions by optimizing the routes. Less time investment, less fuel oil consumption can effectively reduce the CO2 emissions by 30% [20].

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- https://www.lse.ac.uk/granthaminstitute/explainers/how-do-emissions-trading-systems-work/.

- News Article, Record reduction of 2023 ETS emissions due largely to boost in renewable energy, Directorate-General for Climate Action, 3 April 2024, https://climate.ec.europa.eu/news-your-voice/news/record-reduction-2023-ets-emissions-due-largely-boost-renewable-energy-2024-04-03_en.

- World Bank’s annual “State and Trends of Carbon Pricing 2024” report, https://www.worldbank.org/en/news/press-release/2024/05/21/global-carbon-pricing-revenues-top-a-record-100-billion.

- Dimerco, “The EU Emissions Trading System & its Impact on the Shipping Industry”, Blog Post, 5 December 2023, https://dimerco.com/eu-ets-impact-on-shipping-industry/.

- “REGULATION (EU) 2015/757 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL OF 29 APRIL 2015 on the Monitoring, Reporting, and Verification of Carbon-dioxide Emissions from Maritime Transport, and Amending Directive 2009/16/EC”, Official Journal of the European Union, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32015R0757.

- Resolution MEPC.278(70), “AMENDMENTS TO THE ANNEX OF THE PROTOCOL OF 1997 TO AMEND THE INTERNATIONAL CONVENTION FOR THE PREVENTION OF POLLUTION FROM SHIPS, 1973, AS MODIFIED BY THE PROTOCOL OF 1978 RELATING THERETO”, https://wwwcdn.imo.org/localresources/en/KnowledgeCentre/IndexofIMOResolutions/MEPCDocuments/MEPC.278(70).pdf.

- Flodén, J., Zetterberg, L., Christodoulou, A., Parsmo, R., Fridell, E., Hansson, J., … Woxenius, J. (2024). Shipping in the EU emissions trading system: implications for mitigation, costs and modal split. Climate Policy, 24(7), 969–987. https://doi.org/10.1080/14693062.2024.2309167. [CrossRef]

- “Understanding EU ETS and its Impact on the Shipping Industry”, Blog, 6 August 2023, https://www.sertica.com/blog/understanding-eu-ets-and-its-impact-on-the-shipping-industry/#gref.

- Danish Ship Finance A/S (“DSF”), “Shipping Market Review”, May 2024, https://skibskredit.dk/wp-content/uploads/2024/03/shipping-market-review-may-2024.pdf.

- World Bank’s annual “State and Trends of Carbon Pricing 2024” report, https://www.worldbank.org/en/news/press-release/2024/05/21/global-carbon-pricing-revenues-top-a-record-100-billion.

- Ian Tiseo, “EU-ETS allowance prices in the European Union 2022-2024”, 19 August 2024, https://www.statista.com/statistics/1322214/carbon-prices-european-union-emission-trading-scheme/.

- “US, China and India: Top carbon emitters to face the biggest economic losses”, 28 September 2018, https://www.downtoearth.org.in/climate-change/us-china-and-india-top-carbon-emitters-to-face-the-biggest-economic-losses-61747.

- Friederike Hesse, “Up to €1.5m per year: understanding financial implications of the EU ETS”, News article, Seatrade Maritime News, 2 March 2023, https://www.seatrade-maritime.com/opinions-analysis/15m-year-understanding-financial-implications-eu-ets.

- “Global Maritime Digitization Market Size, Share & Industry Trends Analysis Report by Application, By End User (Ports & Terminals, Shipping Companies, and Maritime Freight Forwarders), By technology, By Regional Outlook and Forecast, 2022-2028”, KBV Research, Report ID: KBV-13961, https://www.kbvresearch.com/maritime-digitization-market/.

- Arastu Sajjad Husain, “Improving Hull Design for Better Efficiency and Environmental Protection”, https://isomase.org/OMAse/Vol.1-2014/Section-3/3-7.pdf.

- “Air lubrication can cut your fuel consumption and emissions”, https://www.wartsila.com/marine/products/propulsors-and-gears/energy-saving-technology/air-lubrication.

- Bruce Beaubouef, “More vessel owners looking to hydrogen fuel to reduce emissions”, 11 December 2023, https://www.offshore-mag.com/vessels/article/14301870/more-vessel-owners-looking-to-hydrogen-fuel-to-reduce-emissions.

- Balcombe, P.; Brierley, J.; Lewis, C.; Skatvedt, L.; Speirs, J.; Hawkes, A.; Staffell, I. How to decarbonise international shipping: Options for fuels, technologies and policies. Energy Convers. Manag. 2019, 182, 72–88. [CrossRef]

- Corbett, J.J.; Wang, H.; Winebrake, J.J. The effectiveness and costs of speed reductions on emissions from international shipping. Transp. Res. Part D 2009, 14, 593–598. [CrossRef]

- Jack Glenn, “Intelligent route optimization key to helping shippers achieve ESG goals”, https://www.freightwaves.com/news/intelligent-route-optimization-key-to-helping-shippers-achieve-esg-goals.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).