Submitted:

11 June 2024

Posted:

12 June 2024

Read the latest preprint version here

Abstract

Keywords:

1. Introduction

1.1. Brief Industry Overview

1.1.1. Big versus Small: Size Dynamics in the EU Plant-Based Industry

1.1.2. Research State of the Art

1.1.3. Study Objectives

2. Methodology

2.1. Data Collection Methods

2.1.1. Criteria for Selection

2.1.2. Ethical Considerations

3. Results and Discussion

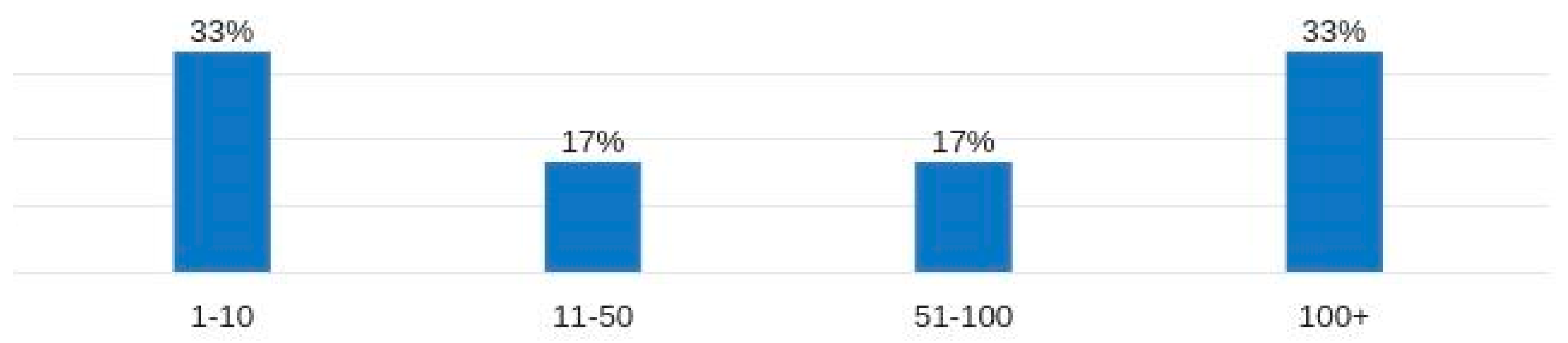

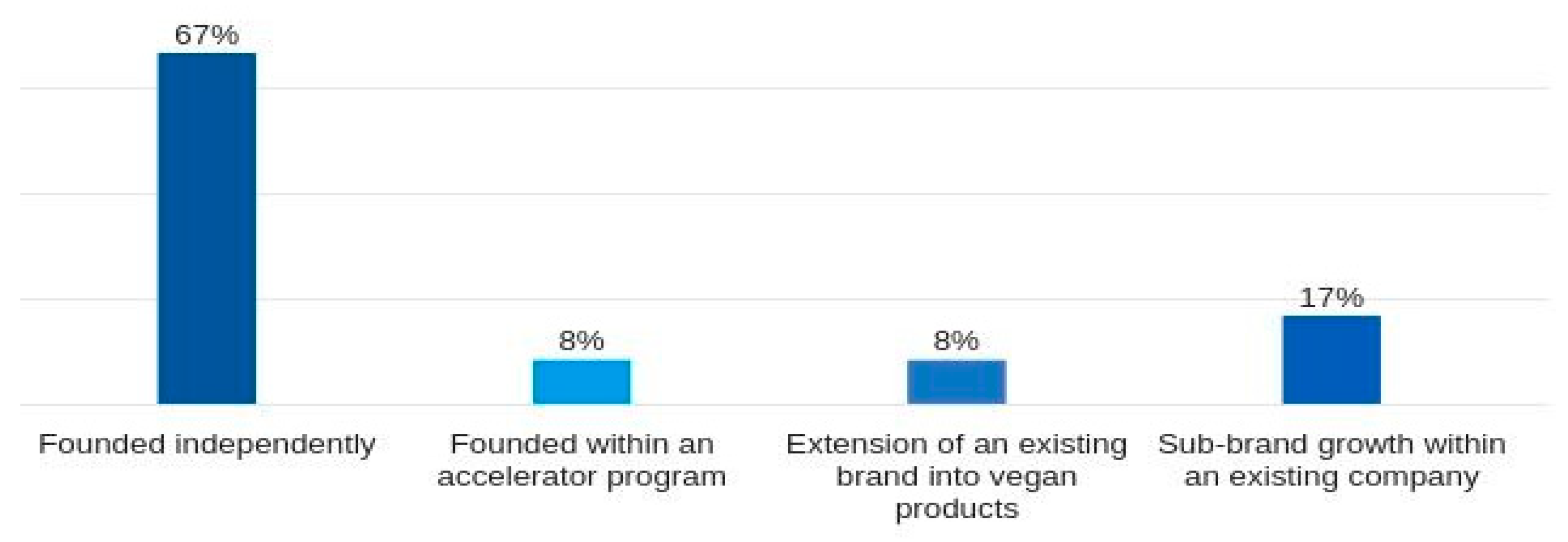

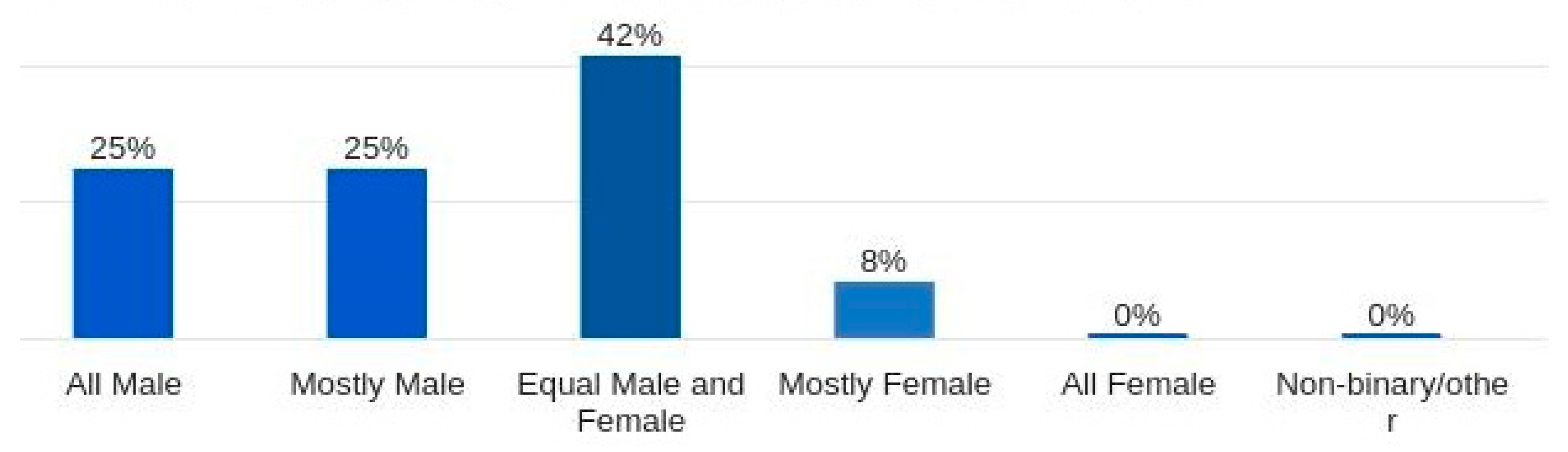

3.1. Sample Characteristics

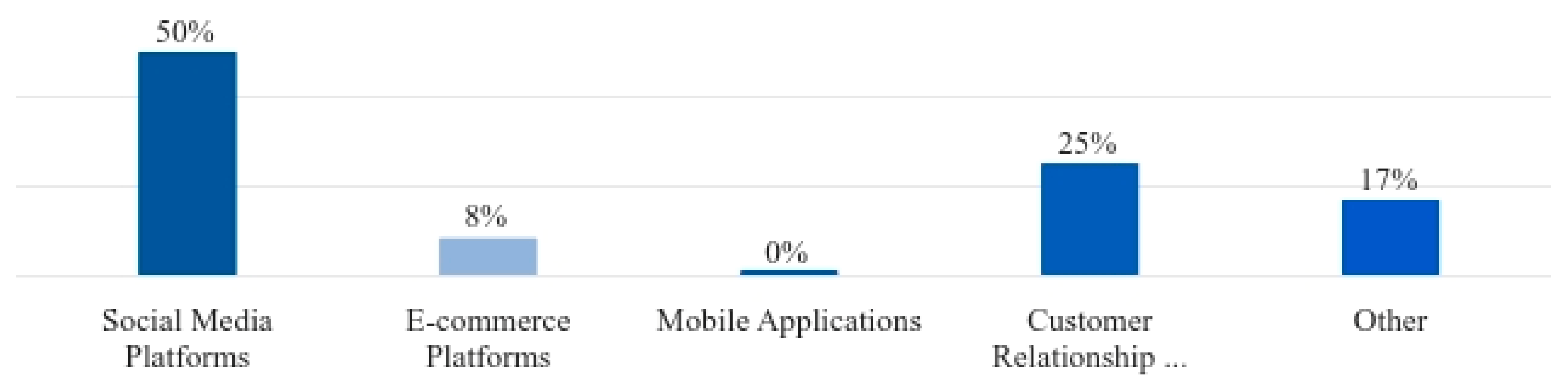

3.1.1. Brand “Platformization” Patterns

3.1.2. Focus on Online Review

| Topic | Business A | Business B |

| 1 | Healthy and sustainable food | Organic and sustainable food |

| 2 | Plant-based nutrition | Plant-based diet |

| 3 | Sustainable practices | Convenient delivery |

- ❖

- Average Rating: 4.6 Stars

- ❖

- Total Reviews: 1894

- ❖

-

Rating Distribution:

- ➢

- 5 Stars: 78%

- ➢

- 4 Stars: 15%

- ➢

- 3 Stars: 4%

- ➢

- 2 Stars: 1%

- ➢

- 1 Star: 2%

- ❖

- Average Rating: 4.5 Stars

- ❖

- Total Reviews: 2879

- ❖

-

Rating Distribution:

- ➢

- 5 Stars: 75%

- ➢

- 4 Stars: 12%

- ➢

- 3 Stars: 7%

- ➢

- 2 Stars: 3%

- ➢

- 1 Star: 3%

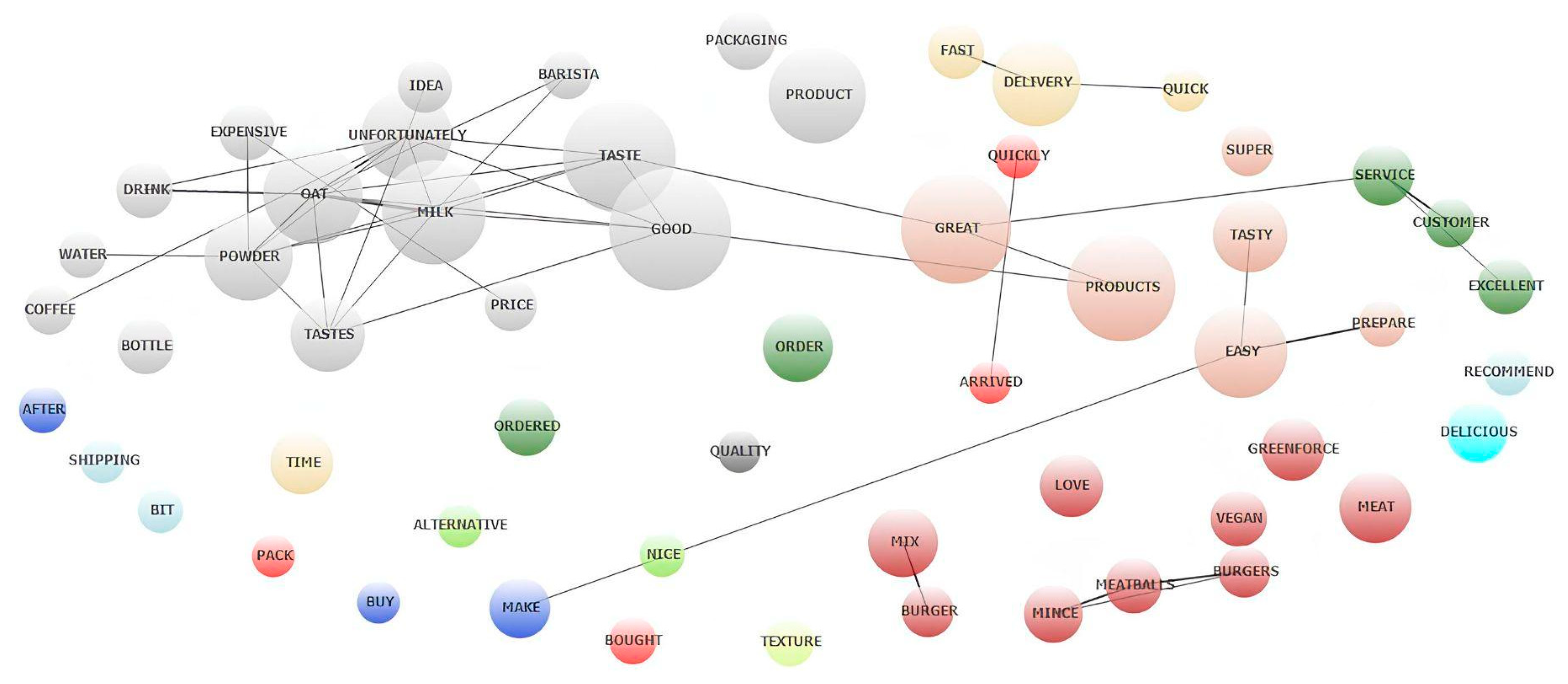

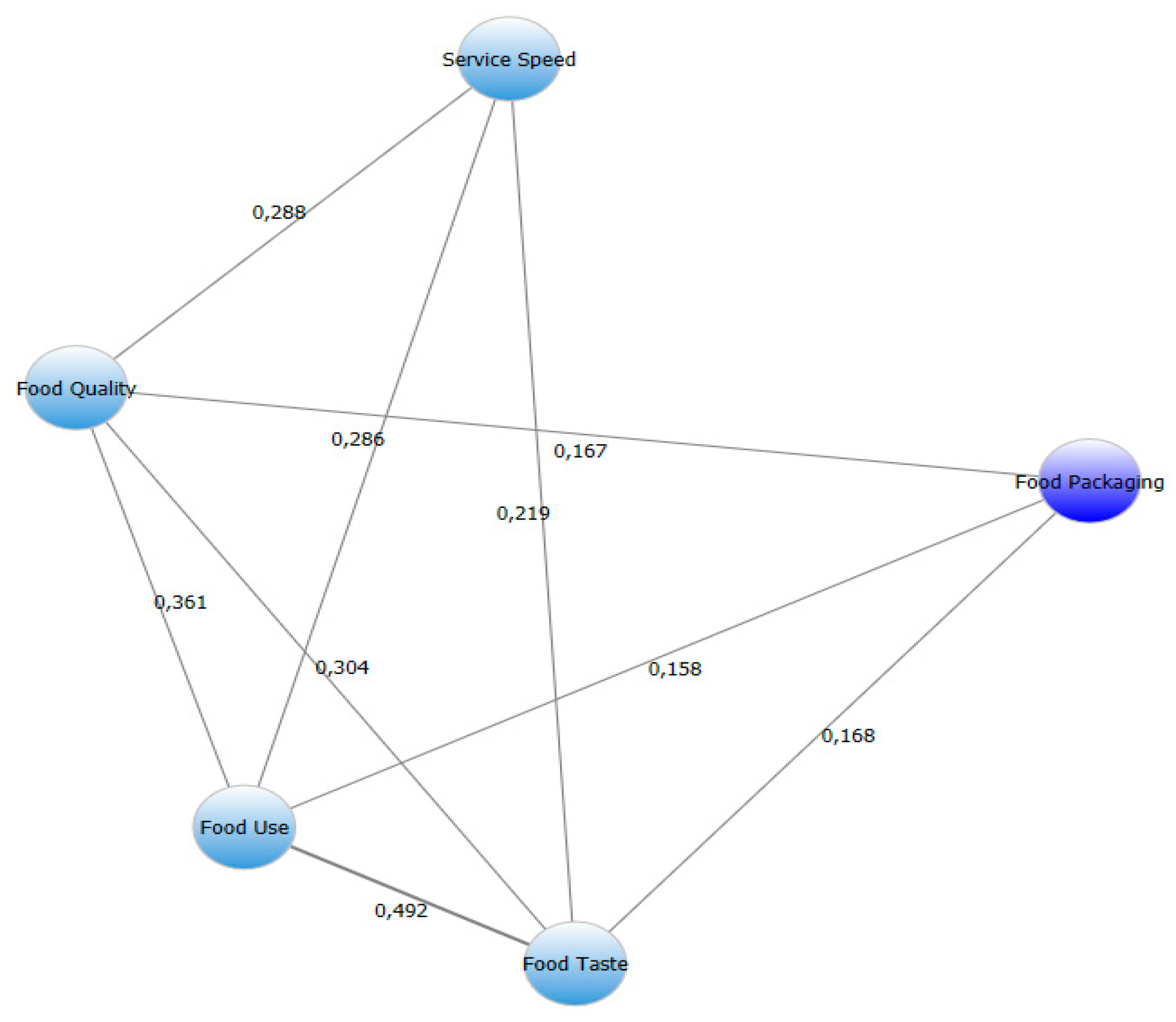

| Code | % Cases |

| Food Use | 62,9% |

| Food Taste | 41,3% |

| Food Quality | 34% |

| Food Packaging | 13,8% |

| Service Speed | 34,9% |

Food Use and Food Taste:

- The strong link between Food Use and Food Taste suggests that discussions about how to use a product often coincide with comments on its taste. This relationship indicates that, within the context of online reviews, the practical use of the plant-based food product is intrinsically tied to its sensory evaluation. Consumers not only want to know how to use the product but also what sensory experience to expect when following these suggestions.

Food Use and Food Quality:

- Food Use and Food Quality are also closely linked, potentially because when consumers discuss the use of a plant-based product, they are also considering the inherent quality of the product in that usage. High-quality ingredients often yield a better culinary experience, so users discussing one are likely to mention the other.

Food Quality, Food Use, Food Taste:

- The fact that Food Quality and Food Use have a stronger relationship to each other than to Food Taste may be indicative of a trend where the perceived quality of the food is not just about taste but about the entire experience of using the product, including preparation and consumption.

Service Speed and Food Packaging:

- Service speed and food packaging being outliers suggests they aren’t commonly discussed alongside other factors. This denotates a separation from the food’s quality itself. Speed of service likely relates to the purchasing experience, while packaging is often about logistics and the environment. These outliers hint at how consumers compartmentalize their considerations. While product quality dominates, logistical and service aspects form a separate evaluation.

- Response: In our analysis, we found that 89.4% of the time, businesses engaged with customer reviews, and notably, over 9% of these responses were directed towards negative feedback. This pattern predominantly comprised acknowledgments and expressions of gratitude towards consumers, thereby fostering a sense of connection and demonstrating sincere appreciation for their input. Such interactions significantly enhance the likelihood of repeat patronage. According to a survey involving more than 1,000 participants, 89% expressed a high or moderate inclination to support businesses that consistently address online reviews. Conversely, 57% indicated a low or nonexistent propensity to frequent establishments that neglect to respond to customer feedback (Paget, 2024). This behavior underscores the commitment of our sample businesses to maintaining a strong consumer relationship, signifying an exceptional level of consumer care. This trend is particularly pronounced within plant-based business sectors, suggesting these enterprises are more attuned to customer concerns compared to traditional brands. This might stem from the core values of care and universalism that are prevalent among vegans and those adhering to vegan diets (Nunes et al., 2021). Given this context, plant-based businesses may benefit from aligning their consumer engagement strategies with these fundamental values, thereby deepening their connection with customers.

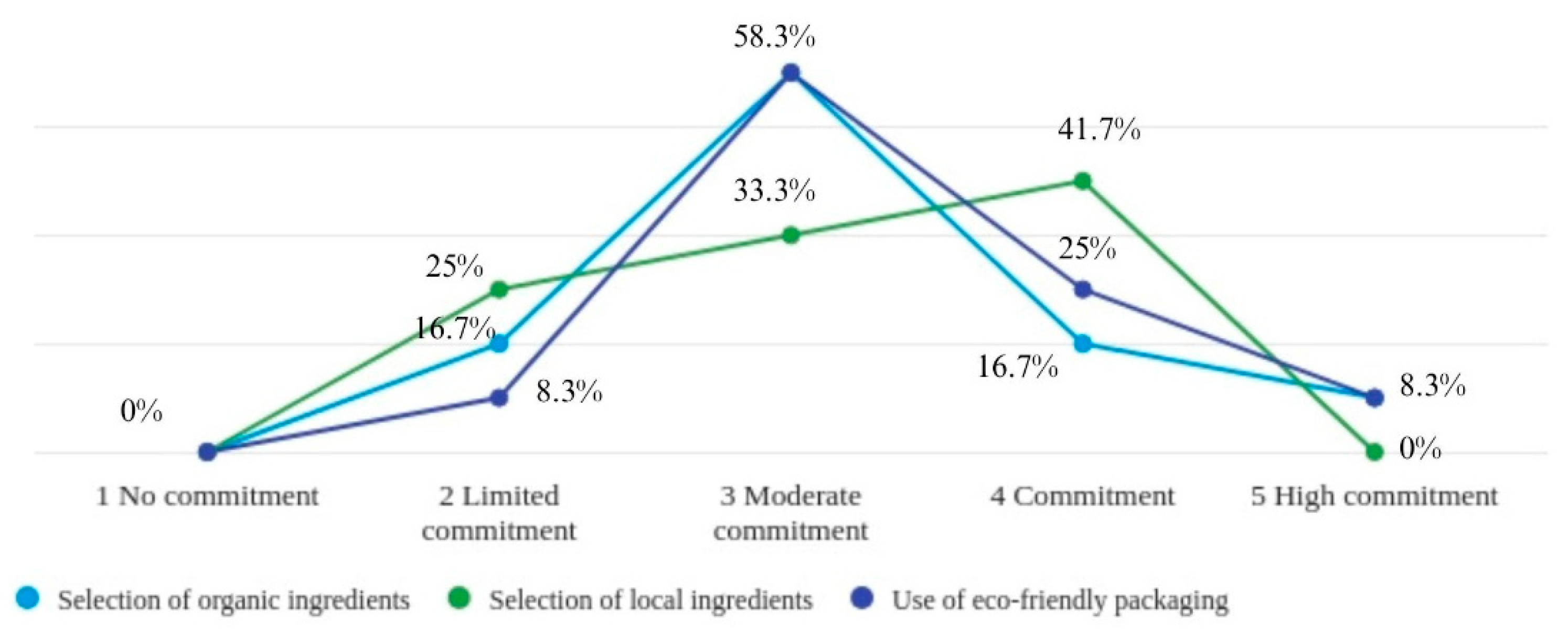

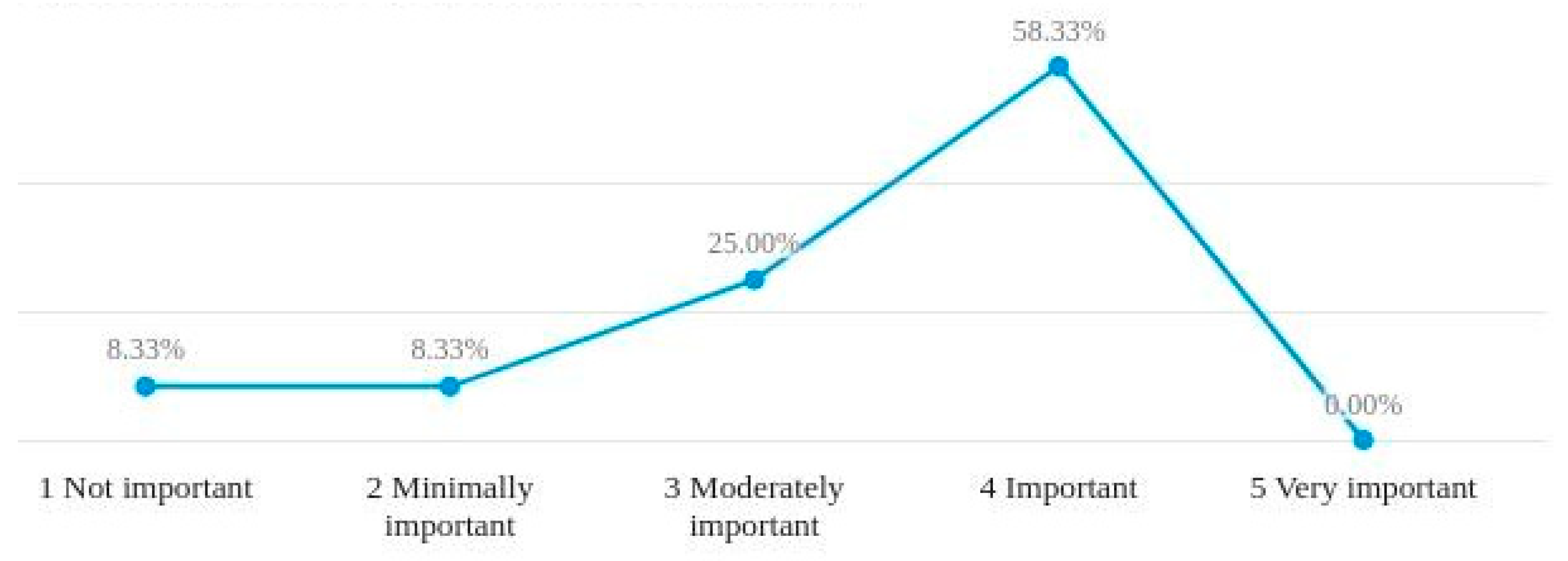

- Selection of Organic Ingredients

- Selection of Local and Sustainable Ingredients

- Use of Eco-Friendly Packaging

Selection of Organic Ingredients

Selection of Local Ingredients

Use of Eco-Friendly Packaging

4. Conclusions

4.1. Summary of Findings

4.1.1. Study Limitations

References

- Alcorta, A.; Porta, A.; Tárrega, A.; Alvarez, M.D.; Vaquero, M.P. Foods for Plant-Based Diets: Challenges and Innovations. Foods 2021, 10, 293. [Google Scholar] [CrossRef]

- Anthony, A. (2021, October 12). From fringe to mainstream: how millions got a taste for going vegan. The Guardian. https://www.theguardian.com/lifeandstyle/2021/oct/10/from-fringe-to-mainstream-how-millions-got-a-taste-for-going-vegan.

- Casidy, R.; Leckie, C.; Nyadzayo, M.W.; Johnson, L.W. Customer brand engagement and co-production: an examination of key boundary conditions in the sharing economy. Eur. J. Mark. 2022, 56, 2594–2621. [Google Scholar] [CrossRef]

- Chan, D. , Voortman, F., Rogers, S., & Deloitte. (2019, January). The rise of the platform economy. Deloitte. https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/humancapital/deloitte-nl-hc-the-rise-of-the-platform-economy-report.pdf.

- Cochoy, F.; Licoppe, C.; McIntyre, M.P.; Sörum, N. Digitalizing consumer society: equipment and devices of digital consumption. J. Cult. Econ. 2020, 13, 1–11. [Google Scholar] [CrossRef]

- EIT Food Fast track to market 2024 - EIT Food. (n.d.). EIT Food. https://www.eitfood.eu/open-calls/fast-track-to-market-2024.

- Al Essa, M.; Ben Yahia, I. Success and failure factors of social media integration - insights from business experience. Int. J. Electron. Mark. Retail. 2019, 10, 118. [Google Scholar] [CrossRef]

- Fehér, A.; Gazdecki, M.; Véha, M.; Szakály, M.; Szakály, Z. A Comprehensive Review of the Benefits of and the Barriers to the Switch to a Plant-Based Diet. Sustainability 2020, 12, 4136. [Google Scholar] [CrossRef]

- Fiorentini, M.; Kinchla, A.J.; Nolden, A.A. Role of Sensory Evaluation in Consumer Acceptance of Plant-Based Meat Analogs and Meat Extenders: A Scoping Review. Foods 2020, 9, 1334. [Google Scholar] [CrossRef] [PubMed]

- Gelsky, J. (2019, October 1). Sustainable product market could hit $150 billion in U.S. by 2021. Food Business News. Retrieved May 13, 2021, from https://www.foodbusinessnews.net/articles/13133-sustainable-product-market-could-hit-150-billion-in-us-by-2021.

- Gender Equality Index | 2022 | European Institute for Gender Equality. (2024, February 9). European Institute for Gender Equality. https://eige.europa.eu/gender-equality-index/2022/domain/power/DE.

- Giacalone, D.; Clausen, M.P.; Jaeger, S.R. Understanding barriers to consumption of plant-based foods and beverages: insights from sensory and consumer science. Curr. Opin. Food Sci. 2022, 48. [Google Scholar] [CrossRef]

- Gielens, K.; Steenkamp, J.-B.E. Branding in the era of digital (dis)intermediation. Int. J. Res. Mark. 2019, 36, 367–384. [Google Scholar] [CrossRef]

- Glaser, B. G. , & Strauss, A. L. (1967). The discovery of grounded theory: strategies for qualitative research. London: Wiedenfeld and Nicholson. (n.d.). https://www.sciepub.com/reference/58253.

- Glaser, B.G.; Strauss, A.L.; Strutzel, E. The discovery of grounded theory; strategies for qualitative research. Nurs. Res. 1968, 17, 364. [Google Scholar] [CrossRef]

- Gretzel, U.; Yoo, K.H. Use and Impact of Online Travel Reviews. Inf. Commun. Technol. Tour. 2008, 35–46. [Google Scholar]

- Gretzel, U.; Yoo, K.H. Use and Impact of Online Travel Reviews. Inf. Commun. Technol. Tour. 2008, 35–46. [Google Scholar]

- GTAI - Invest in Germany. (2023). Germany: Europe’s food & beverage market leader. Retrieved February 28, 2024, from https://www.gtai.de/resource/blob/64004/e80f4dd7ccd691158b0ee2bc10f8cd6c/industry-overview-food-beverage-industry-en-data.pdf.

- Guiné, R.P.F.; Florença, S.G.; Barroca, M.J.; Anjos, O. The Link between the Consumer and the Innovations in Food Product Development. Foods 2020, 9, 1317. [Google Scholar] [CrossRef]

- Hansen, T. Rethinking Consumer Perception of Food Quality. J. Food Prod. Mark. 2005, 11, 75–93. [Google Scholar] [CrossRef]

- Hashemi-Pour, C. , & Chai, W. (2023, October 19). CRM (customer relationship management). Customer Experience. https://www.techtarget.com/searchcustomerexperience/definition/CRM-customer-relationship-management.

- Hedin, B.; Katzeff, C.; Eriksson, E.; Pargman, D. A Systematic Review of Digital Behaviour Change Interventions for More Sustainable Food Consumption. Sustainability 2019, 11, 2638. [Google Scholar] [CrossRef]

- Hein, A.; Schreieck, M.; Riasanow, T.; Setzke, D.S.; Wiesche, M.; Böhm, M.; Krcmar, H. Digital platform ecosystems. Electron. Mark. 2019, 30, 87–98. [Google Scholar] [CrossRef]

- Isbrecht, S. (2023, December 15). Die EU stellt 50 Millionen Euro für Startups und kleine Unternehmen im Bereich der Präzisionsfermentation. Vegconomist. https://vegconomist.de/investments-finance/investitionen-akquisitionen/eu-50-millionen-euro-fuer-praezisionsfermentation/.

- Johnson, R.B.; Onwuegbuzie, A.J.; Turner, L.A. Toward a Definition of Mixed Methods Research. J. Mix. Methods Res. 2007, 1, 112–133. [Google Scholar] [CrossRef]

- Juteau, S. TheFork by TripAdvisor: A French success story. J. Inf. Technol. Teach. Cases 2023. [Google Scholar] [CrossRef]

- Kavi, A. (2023, December 10). Berlin’s Vegan Food Scene Is Flourishing. The New York Times. https://www.nytimes.com/2023/12/10/world/europe/vegan-food-berlin.html.

- Kenton, W. (2024, February 6). Fast-Moving Consumer Goods (FMCG) Industry: Definition, Types, and Profitability. Investopedia. https://www.investopedia.com/terms/f/fastmoving-consumer-goods-fmcg.asp.

- Kilian, D.; Hamm, U. Perceptions of Vegan Food among Organic Food Consumers Following Different Diets. Sustainability 2021, 13, 9794. [Google Scholar] [CrossRef]

- Krishen, A.S.; Dwivedi, Y.K.; Bindu, N.; Kumar, K.S. A broad overview of interactive digital marketing: A bibliometric network analysis. J. Bus. Res. 2021, 131, 183–195. [Google Scholar] [CrossRef]

- Maehle, N.; Iversen, N.; Hem, L.; Otnes, C. Exploring consumer preferences for hedonic and utilitarian food attributes. Br. Food J. 2015, 117, 3039–3063. [Google Scholar] [CrossRef]

- Martin, K.; Todorov, I. How Will Digital Platforms be Harnessed in 2010, and How Will They Change the Way People Interact with Brands? J. Interact. Advert. 2010, 10, 61–66. [Google Scholar] [CrossRef]

- Martinho, V.J.P.D. Food Marketing as a Special Ingredient in Consumer Choices: The Main Insights from Existing Literature. Foods 2020, 9, 1651. [Google Scholar] [CrossRef] [PubMed]

- Moreira, M.N.B.; da Veiga, C.R.P.; Su, Z.; Reis, G.G.; Pascuci, L.M.; da Veiga, C.P. Social Media Analysis to Understand the Expected Benefits by Plant-Based Meat Alternatives Consumers. Foods 2021, 10, 3144. [Google Scholar] [CrossRef] [PubMed]

- Nambisan, S.; Siegel, D.S.; Kenney, M. On Open Innovation, Platforms, and Entrepreneurship. Strateg. Entrep. J. 2018, 12, 354–368. [Google Scholar] [CrossRef]

- Nasution, M.D.T.P.; Rini, E.S.; Absah, Y.; Sembiring, B.K.F. Social network ties, proactive entrepreneurial behavior and successful retail business: a study on Indonesia small enterprises. J. Res. Mark. Entrep. 2022, 24, 141–160. [Google Scholar] [CrossRef]

- Nunes, J.C.; Ordanini, A.; Giambastiani, G. The Concept of Authenticity: What It Means to Consumers. J. Mark. 2021, 85, 1–20. [Google Scholar] [CrossRef]

- Onorati, M.G.; Giardullo, P. Social media as taste re-mediators: emerging patterns of food taste on TripAdvisor. Food, Cult. Soc. 2020, 23, 347–365. [Google Scholar] [CrossRef]

- Osborne, L. (2016, October 20). Vegan haven Berlin. dw.com. https://www.dw.com/en/berlin-vegan-capital-of-the-world/a-35951064.

- Paget, S. (2024, March 6). Local Consumer Review Survey 2024: Trends, Behaviors, and Platforms Explored. BrightLocal. https://www.brightlocal.com/research/local-consumer-review-survey/#.

- Pashchenko, Y.; Rahman, M.F.; Hossain, S.; Uddin, K.; Islam, T. Emotional and the normative aspects of customers? reviews. J. Retail. Consum. Serv. 2022, 68. [Google Scholar] [CrossRef]

- Petrescu, D.C.; Vermeir, I.; Petrescu-Mag, R.M. Consumer Understanding of Food Quality, Healthiness, and Environmental Impact: A Cross-National Perspective. Int. J. Environ. Res. Public Heal. 2019, 17, 169. [Google Scholar] [CrossRef]

- Powers, T.; Advincula, D.; Austin, M.S.; Graiko, S.; Snyder, J. Digital and Social Media In the Purchase Decision Process. J. Advert. Res. 2012, 52. [Google Scholar] [CrossRef]

- Ravula, P.; Bhatnagar, A.; Gauri, D.K. Role of gender in the creation and persuasiveness of online reviews. J. Bus. Res. 2023, 154. [Google Scholar] [CrossRef]

- Rehder, L. (2023). Plant-Based food goes mainstream in Germany (K. Luxbacher, Ed.; No. GM2023-0002). United State Department of Agricolture. Foreign Agricultural Service. Retrieved February 28, 2024, from https://fas.usda.gov/.

- Ricardo. (2023, January 17). The Growth of Vegan Restaurants in Europe, 2022. HappyCow. https://www.happycow.net/blog/the-growth-of-vegan-restaurants-in-europe-2022/.

- Rohn, D.; Bican, P.M.; Brem, A.; Kraus, S.; Clauss, T. Digital platform-based business models – An exploration of critical success factors. J. Eng. Technol. Manag. 2021, 60, 101625. [Google Scholar] [CrossRef]

- Rousseau, S. (2012). Food and social media: You are what You Tweet. Rowman & Littlefield Studies in Food and Gastronomy.

- Rutsaert, P.; Regan. ; Pieniak, Z.; McConnon,.; Moss, A.; Wall, P.; Verbeke, W. The use of social media in food risk and benefit communication. Trends Food Sci. Technol. 2013, 30, 84–91. [Google Scholar] [CrossRef]

- Satwani, U. , Singh, J., & Pandya, N. (2020). Using Sentiment Analysis to Obtain Plant-Based Ingredient Combinations that Mimic Dairy Cheese. springerprofessional.de. https://www.springerprofessional.de/en/using-sentiment-analysis-to-obtain-plant-based-ingredient-combin/18227058.

- Sheikh, S. (2018). Why should the business community and organizations leverage social media to demonstrate their corporate social responsibility (CSR) commitment? In Advances in marketing, customer relationship management, and e-services book series (pp. 86–116). [CrossRef]

- Statista. (2024, February 26). Revenue from vegan products Germany 2023, by category. https://www.statista.com/statistics/1451893/vegan-products-revenue-by-category-germany/.

- Survarachakan, S.; Prasad, P.J.R.; Naseem, R.; de Frutos, J.P.; Kumar, R.P.; Langø, T.; Cheikh, F.A.; Elle, O.J.; Lindseth, F. Deep learning for image-based liver analysis — A comprehensive review focusing on malignant lesions. Artif. Intell. Med. 2022, 130, 102331. [Google Scholar] [CrossRef]

- The Aggie. (2021, May 18). Fast fashion’s increasingly rapid trend cycles are driving major overconsumption. https://theaggie.org/2021/05/18/fast-fashions-increasingly-rapid-trend-cycles-are-driving-major-overconsumption/.

- Ukpere, C.L.; Slabbert, A.D.; Ukpere, W.I. Rising Trend in Social Media Usage by Women Entrepreneurs across the Globe to Unlock Their Potentials for Business Success. Mediterr. J. Soc. Sci. 2014, 5, 551. [Google Scholar] [CrossRef]

- Cuesta-Valiño, P.; Rodríguez, P.G. Perception of Advertisements for Healthy Food on Social Media: Effect of Attitude on Consumers’ Response. Int. J. Environ. Res. Public Heal. 2020, 17, 6463. [Google Scholar] [CrossRef]

- Cuesta-Valiño, P.; Rodríguez, P.G. Perception of Advertisements for Healthy Food on Social Media: Effect of Attitude on Consumers’ Response. Int. J. Environ. Res. Public Heal. 2020, 17, 6463. [Google Scholar] [CrossRef] [PubMed]

- Venkatesh, V. (2013, March 1). Bridging the Qualitative-Quantitative Divide: Guidelines for Conducting Mixed Methods Research in Information Systems. https://misq.umn.edu/bridging-the-qualitative-quantitative-divide-guidelines-for-conducting-mixed-methods-research-in-information-systems.html.

- Waehrens, S.S.; Faber, I.; Gunn, L.; Buldo, P.; Frøst, M.B.; Perez-Cueto, F.J. Consumers' sensory-based cognitions of currently available and ideal plant-based food alternatives: A survey in Western, Central and Northern Europe. Food Qual. Preference 2023, 108. [Google Scholar] [CrossRef]

- Wagner, H.R.; Glaser, B.G.; Strauss, A.L. The Discovery of Grounded Theory: Strategies for Qualitative Research. Soc. Forces 1968, 46, 555. [Google Scholar] [CrossRef]

- Wichmann, J.R.K.; Wiegand, N.; Reinartz, W.J. The Platformization of Brands. J. Mark. 2021, 86, 109–131. [Google Scholar] [CrossRef]

- Williams, A. (2023, September 26). Market insights on European plant-based sales 2020-2022 - GFI Europe. GFI Europe. https://gfieurope.org/market-insights-on-european-plant-based-sales-2020-2022/.

- Wong, B. (2023, May 18). Top Social Media Statistics And Trends Of 2024. Forbes Advisor. https://www.forbes.com/advisor/business/social-media-statistics/#source.

- Zohoori, F. (2019). Chapter 1: Nutrition and Diet. In Monographs in oral science (pp. 1–13). [CrossRef]

- Волик, М.В.; Kovaleva, M.A.; Khachaturova, E. The concept of implementing a customer interaction system based on CRM Bitrix24. SHS Web Conf. 2021, 94, 01022. [Google Scholar] [CrossRef]

1 HappyCow is a user-driven platform aimed at helping individuals discover, review, and share information about vegan, vegetarian, and vegan-friendly restaurants and health food stores globally. https://www.happycow.net/ |

5 “Jaccard's coefficient is a statistical measure used in this context to quantify the similarity and diversity of sample sets. It is calculated by dividing the number of observations where both codes occur by the union of the number of times each code occurs separately and together. The coefficient ranges from 0 to 1, where 0 indicates no co-occurrence and 1 indicates that the codes always occur together” (Survarachakan et al., 2022). |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).