1. Introduction

Sustainability has emerged as a critical concern for businesses in the last few years, driven by global markets and the need to address environmental concerns (Xiao et al. 2018). Firms are increasingly recognising the significance of integrating sustainability practices into their services, not only to mitigate negative environmental impacts but also to enhance their overall performance and competitiveness in the market. The concept of sustainability encompasses a broad range of environmental, social, and economic factors that contribute to long-term success and resilience (Magon et al. 2018). This paper aims to explore the relationship between sustainability and firm performance by conducting a scientometric study, which involves analysing the existing literature on this topic. By examining the scientific articles, publications, and research papers, this study aims to map the landscape of corporate sustainability and firm performance, identify key trends and knowledge gaps, and provide insights for further research and managerial decision-making (Xiao et al. 2018).

Firm performance refers to the measure and evaluation of a company’s success in achieving its goals and objectives (Nath et al. 2010). Firm performance is often assessed through various financial indicators such as profitability, revenue growth, ROI, and market share (Hartley et al. 1970). These indicators provide insights into the overall financial health and success of a company (Hermawan et al. 2023). Furthermore, firm performance is not solely determined by financial indicators, but also by non-financial factors such as employee productivity, innovation (Delen et al. 2013), customer satisfaction (Debnath et al. 2016), board size (Ammari et al. 2016), enterprise risk management (Yang et al. 2018), and ownership identity (Perwitasari et al. 2022). These factors enable driving the long-term sustainability and competitive advantage of a firm.

Scientometric and bibliometric research has been instrumental in understanding the landscape of corporate sustainability and firm performance. By analysing and synthesising various research studies, this type of research provides insights into the key themes, trends, and gaps in the literature (Schrettle et al. 2014). Furthermore, it helps identify the origins and motivators of sustainability, along with the correlation between sustainability and performance (Magon et al. 2018; Bui et al. 2020; Saleem et al. 2021; Bota-Avram 2022). By examining the methodologies employed and the data sets of diverse research studies, scientometric and bibliometric analysis offers a comprehensive overview of the current knowledge landscape in this field. Scientometric and bibliometric analysis also helps to uncover potential areas for future research and offers valuable insights for practitioners and policymakers (Jia et al. 2019; Bhatt el al. 2020; Prashar and M 2020; Ye et al. 2020).

Corporate communications plays a crucial role in shaping the image and perception of a company among its stakeholders (Groth 1988; Yamauchi 2001; Chaudhri 2016; Sinha and Bhatia 2016; Chopra and Singh 2023). It helps to build trust, establish relationships, and create a positive reputation for the company (Goodman 2006). Effective corporate communications is essential for firms because it can enhance firm value and overall performance. It enables firms to effectively communicate their sustainability initiatives and efforts, which are becoming increasingly important in today’s business landscape. Companies are recognising the value of incorporating sustainability practices into their corporate communications strategies, as it helps to align their values with those of their stakeholders and meet the growing demands for responsible and ethical business practices. Moreover, studies indicate a favorable correlation between corporate communications practices and effective global relationships, potentially laying the groundwork for a sustainable business strategy. Through effective communication, companies can effectively convey their sustainability initiatives and demonstrate their commitment to social, environmental, and economic responsibilities. This can lead to increased stakeholder engagement, improved reputation, and enhanced firm performance in terms of financial, environmental, and social metrics (Signitzer and Prexl 2007). In addition, corporate communications contributes in professional development and the success of future executives (Crane and Glozer 2016; Bashar 2020). By understanding the functions of corporate communications and being skilled in strategic implementation, professionals can contribute to the overall success and sustainability of their organizations.

A study by Achour and Boukattaya (2022) highlighted the link between effective corporate communications and increased firm value. They found that companies with strong corporate communications strategies and practices were able to build trust and credibility with stakeholders, leading to positive financial performance. Furthermore, a research article by Cornelissen (2023) emphasised the role of corporate communications in firm performance. The article suggested that successful corporates should closely look at the functions of corporate communications and the capability of strategy implementation. In addition, researchers have also examined the challenges and opportunities in the practice of corporate responsibility communication. These studies have identified the need for companies to align their corporate behaviour with stakeholder expectations and effectively communicate their responsible corporate actions. Moreover, the literature on corporate communication has also examined the role of communication in managing internal and external relationships. For example, the book “Essentials of Corporate Communications” provides students with a research-based toolbox for effective corporate communication and reputation management. Overall, the literature on corporate communications highlights its significance in organisational success and reputation management. Corporate communications is a critical aspect of organisational success and reputation management.

RQ1. What are the documents cited by authors and the top authors related to “Corporate Sustainability and“Firm Performance”?

RQ2. What are the trends of growth of publications of related to “Corporate Sustainability” and “Firm Performance”?

RQ3. What is the concept sketch out of research related to “Corporate Sustainability" and “Firm Performance”?

RQ4. What is the Annual Growth Rate, Annual Ratio of Growth, Relative Growth Rate and Doubling Time of publications related to “Corporate Sustainability” and “Firm Performance”?

RQ5. What is the scientific production index in field of “Corporate Sustainability" and “Firm Performance”?

RQ6. What are the future production levels of publications related to Corporate Sustainability and Firm Performance?

The existing frameworks have examined firm performance and sustainability, by prioritising the sustainability indicators (Ikram et al., 2020). The firm performance element concentrates on assessing the financial performance and operational efficiency of the organization. Sustainability focuses on evaluating the organization’s environmental, social, and governance practices and their long-term viability. However, studies haven’t examined scholarship, or mapped the intersection of corporate sustainability and firm performance. There is a lack of comprehensive framework that integrates bibliometric and scientometric analysis to provide a holistic understanding of the literature on firm performance and corporate sustainability (Morioka et al. 2016). This study fills in the gap, and provides insights for further research and managerial decision-making that have a bearing on the financial performance of firms. It also helps to identify the most cited documents by authors, production rates, growth rates, thereby facilitating knowledge sharing and collaboration. Overall, the framework provides a structured guide for researchers and practitioners interested in conducting bibliometric and scientometric analysis of firm performance and sustainability.

2. Literature

According to Cornelissen (2023), Corporate Communications allows for the integration of “internal and external communication with the overall purpose of establishing and maintaining favourable reputations” for the companies. A number of scholars have identified the need for investigation in domain of corporate communications positing requirement for critical assessment of practices and has generated academic interest (Radford and Goldstein 2002). “It is an integrative structure linking stakeholders to the organisation” (Kolahgar et al. 2021). Firms adopt sustainable strategies to create a favourable reputation amongst its stakeholders (Goodman 2009; Melewar et al. 2012; Zerfass and Volk 2020).

The review of literature on Corporate Sustainability reveals a growing interest and recognition of the importance of sustainability in business practices (Dyllick and Hockerts 2002). Researchers from various disciplines have explored different aspects of sustainability in the context of corporate operations and management (Jia et al. 2019). The studies have shown that sustainability is beyond the realm of environmental concerns, and encompasses both the economic and social dimensions (Magon et al. 2018). This research has emphasised the need for businesses to consider the triple bottom line - people, planet, and profit - in their decision-making processes. Additionally, the literature highlights the potential benefits of integrating sustainability into corporate strategies, including better financial performance, greater brand reputation, and higher levels of engagement with the stakeholder. Moreover, the literature has examined various approaches and frameworks for measuring and managing sustainability within organizations, such as the use of sustainability indicators, reporting standards, and sustainability management practices. The literature review also identifies gaps and challenges in the field of corporate sustainability. These include the lack of consensus on definitions and metrics, highlighting the requirement for empirical research on the the relationship, and the limited understanding of the mechanisms and drivers that lead to sustainable practices within organizations. Furthermore, the literature signals towards role of leadership and organisational culture in propelling sustainability efforts.

Understanding firm performance is crucial for both researchers and practitioners in the field of business and management. Over the years, numerous studies have been conducted to explore the various factors that impact firm performance. These factors encompass a wide range of internal and external variables, including organisational structure, leadership, human resource management, innovation, industry dynamics, and macroeconomic conditions. By examining the existing literature on firm performance, this review aims to offer a thorough comprehension of the key determinants and outcomes associated with performance of firms in different contexts (McGuire et al. 1990).

2.1. Firm Performance and Financial Performance

Firm performance and financial performance are key concepts in corporate management and research (Ontita and Muigai Kinyua, 2020). Firm performance refers to the overall success and achievement of a company in reaching its objectives, while financial performance specifically focuses on the financial health and profitability of the company (Magara et al., 2015). Firm performance can be assessed using various indicators such as profitability, return on investment, market share growth and liquidity. Furthermore, financial performance is often considered an essential element in evaluating the overall performance of a firm. It provides crucial information about the company’s ability to generate revenue, manage expenses, and generate profits. In majority of studies, financial performance serves as a proxy for firm performance (Goyal et al., 2013). Studies are also referring to firm performance and financial performance as Firm Financial Performance (FFP) (Alam and Tariq, 2023; Wasara and Ganda, 2019).

However, for the purpose of this study, we employ the use of the term firm performance for our investigation and accept that they cannot be used interchangeably. Firm performance is encompassing as compared to financial performance and gives a comprehensive picture. It encompasses various factors such as financial stability, organizational stability, managerial capacity, and technical capacity (Ilham, 2020). Additionally, non-financial performance indicators play a vital role in capturing long-term competitive advantage and assessing the achievement of strategic goals and objectives (Mitrea-Curpanaru, 2021).

The existing literature concerning corporate sustainability and financial performance is in its nascent stages, grappling with the challenge of elucidating the universality of the concept of corporate sustainability and its effects on firms’ financial performance (Ferlito and Faraci, 2022; Haffar and Searcy, 2015). While some studies have treated sustainability as a unidimensional construct, there is a dearth of research utilizing the triple bottom line approach or a multidimensional framework. However, significant literature posits that corporate social responsibility profoundly influences firm financial performance (Licandro et al., 2024). Over the past two decades, the corporate sustainability literature has seen a surge in studies exploring the relationship between sustainability and firm performance, encompassing both financial and non-financial aspects. This study broadens the scope of current research by introducing human resources as a third factor in lieu of economic sustainability within the triple bottom line framework.

The discourse should focus on whether integrating the economic, social, and environmental aspects of corporate sustainability yields a favorable impact on firm performance. As suggested by Vieira Nunhes et al. (2021) corporate sustainability should steer corporate decision-makers toward adopting more sustainable business practices. Scholars further advocate that corporate sustainability can exert both direct and indirect influences on corporate financial performance. For instance, involvement in sustainability endeavors enhances a firm’s transparency, thereby positively impacting its reputation, which in turn contributes to improved firm performance. Consequently, to sustain competitiveness, firms are compelled to integrate sustainability into their corporate strategy (Oertwig et al., 2017), necessitating reform, redesign, and restructuring efforts (Peters and Simaens, 2020).

The research landscape on the relationship between corporate sustainability and financial performance is complex and varied, with contradictory results and a lack of focus on developing countries (Hull and Rothenberg, 2008; Gupta and Gupta, 2020). However, it is important to note that overall, the literature leans more towards a positive relationship between corporate sustainability and financial performance. Overall, the literature suggests a positive relationship between corporate sustainability and financial performance.

While many reviews concentrate on either one or a combination of two sustainability dimensions, comprehensive examinations encompassing all three dimensions, like this paper, are uncommon. Reviews limited to a single dimension often emphasise the environmental aspect and do not provide a holistic overview (Yawar, 2015; Aguinis and Glavas, 2012). This research encompasses papers from all three dimensions, providing a more comprehensive understanding of sustainability.

2.2. Corporate Communications and Governance Mechanisms

The link between internal and external communication and the governance mechanisms of an organisation is a topic of great importance in the field of corporate governance (Welch and Jackson 2007). Numerous studies have explored this link, highlighting the critical role that effective communication plays in enhancing both internal and external governance (Collett and Hrasky 2005; Cremers and Nair 2005; Mazzei 2010; Zalewska 2014; Hurtado et al. 2015). These relationships are vital for maintaining the organisation’s reputation, building trust, and ensuring compliance with external regulations and standards (Nawawi et al. 2020).

The link between internal and external communication plays a vital role in the efficacy of both internal and external governance mechanisms (Twizeyimana and Andersson 2019). Both internal and external communication ensures that information flows seamlessly between myriad stakeholders, encompassing employees, managers, board members, shareholders, customers, and masses (Welch and Jackson 2007). This flow of information allows for better coordination, transparency, and decision-making within the organisation. It also helps in building trust and maintaining a positive reputation with external stakeholders. Furthermore, internal communication helps to align the goals and objectives of the organisation with employees’ actions and behaviours. Overall, the integration of internal and external communication with the internal and external governance mechanisms is essential for creating a cohesive and successful organisation. Internal communication within an organisation ensures that employees are aware of corporate governance policies, procedures, and expectations. It also allows for the dissemination of important information regarding strategic decisions, performance updates, and any changes that may impact employees. External communication, on the other hand, involves interactions with external stakeholders like the customers, shareholders, regulatory authorities, and general people. It is through external communication that the organisation conveys its values, mission, and performance to these stakeholders. By effectively integrating internal and external communication with the internal and external governance mechanisms, organizations can enhance accountability, transparency, and stakeholder engagement. This integration creates a more holistic approach to governance, where both internal and external stakeholders have clear lines of communication and are actively involved in decision-making processes (Frias-Aceituno et al. 2012).

Corporate Communications has a governance role that impacts sustainability and firm performance (Lizbetinova et al. 2019; Shahab et al. 2019). By incorporating both internal and external communication, organizations can cultivate a positive reputation with external stakeholders while aligning their goals and objectives internally. It also fosters trust and credibility, as stakeholders feel informed, involved, and valued. Overall, the integration of internal and external communication with governance mechanisms is vital for creating a cohesive and successful organisation. To address stakeholders’ need for openness, companies are consistently deliberating over what and when to reveal. Enhanced transparency mitigates the agency problem, consequently elevating a company’s value and reducing risk to a significant extent (Agarwal et al. 2015). The body of research on corporate disclosures and transparency operates under an assumption that regulatory authorities’ rules and regulations determine the extent and quality of obligatory disclosures, while the board of directors’ mandates determine the extent and quality of voluntary disclosures (El-Haj et al. 2019). However, this overlooks the influence of communication that reflects a company’s dedication towards engaging with its stakeholders. In their study, Kolahgar et al. (2021) found that corporate communication exhibits a ‘substitution-complementary relationship’ with various aspects of board composition, and imply that communication should be integrated into the governance framework, and its optimal level should align with the specific configuration of each firm.

2.3. Corporate Sustainability and Firm Performance Relationship

The link between “corporate sustainability” and “firm performance” has been a subject of extensive research and debate. Numerous studies have identified a positive correlation between corporate sustainability and the financial performance of firms (Galimulina et al. 2023), suggesting that companies that prioritise sustainability practices tend to outperform their competitors (Ioannou and Serafeim 2019; Ammer et al. 2020). This can be attributed to several factors, including cost savings through energy efficiency and waste reduction, enhanced brand reputation and customer loyalty, increased employee engagement and productivity, and improved risk management (Rodgers et al. 2019). However, there are also studies that have found a negative or no relationship between sustainability efforts and profitability. These varied findings underscore the intricacy of the relationship between sustainability and firm performance, indicating that the impact may vary depending on industry, company size, market conditions, and other contextual factors (Hirunyawipada and Pan 2020).

Further research is needed to better understand the specific mechanisms through which corporate sustainability practices influence firm performance and to identify strategies that can effectively integrate sustainability into business operations and drive positive financial outcomes (Grewal and Serafeim 2020; Zhang et al. 2020). Furthermore, it’s crucial to take into account the influence of external pressures and regulatory frameworks in molding a company’s dedication to sustainability and its effects on financial performance. Furthermore, there is a need for more research on the long-term effects of sustainability initiatives on firm performance, as well as the potential trade-offs or synergies between different dimensions of sustainability performance, such as environmental, social, ethical, and governance aspects. Thus the relationship between the two constituents are seen to be complex and context-dependent (Alshehhi et al. 2018).

2.4. Status of Investigation of Corporate Sustainability and Firm Performance

Despite the increase in studies related to “firm performance” and “corporate sustainability,” there hasn’t been any proper categorisation of research (Jacobsen et al. 2020). This lack of categorisation makes it difficult for researchers and practitioners to evaluate and compare findings across different studies. As a result, there is a need for a comprehensive review that organises existing research on corporate sustainability and firm performance into distinct categories (Morioka and Carvalho 2016). By systematically categorising the literature, we can gain a better understanding of the various dimensions of corporate sustainability and its impact on firm performance. This approach will facilitate the identification of significant trends, gaps, and potential avenues for future research. Moreover, it will offer valuable insights for businesses aiming to enhance their sustainability practices.

Existing review studies have noted conflicting results due to various measurement approaches, causality, and influencing factors in the relationship between corporate sustainability and firm performance (Hallinger 2020; Alam and Tariq 2023). Given the inconsistencies and enhanced calls from stakeholders and regulations, we conducted a scientometric and bibliometric analysis to map out the intellectual landscape and development trajectory of this field. Consequently, this paper delineates the historical progression of the field, identifies current research focal points, and suggests future directions for inquiry.

3. Materials and Methods

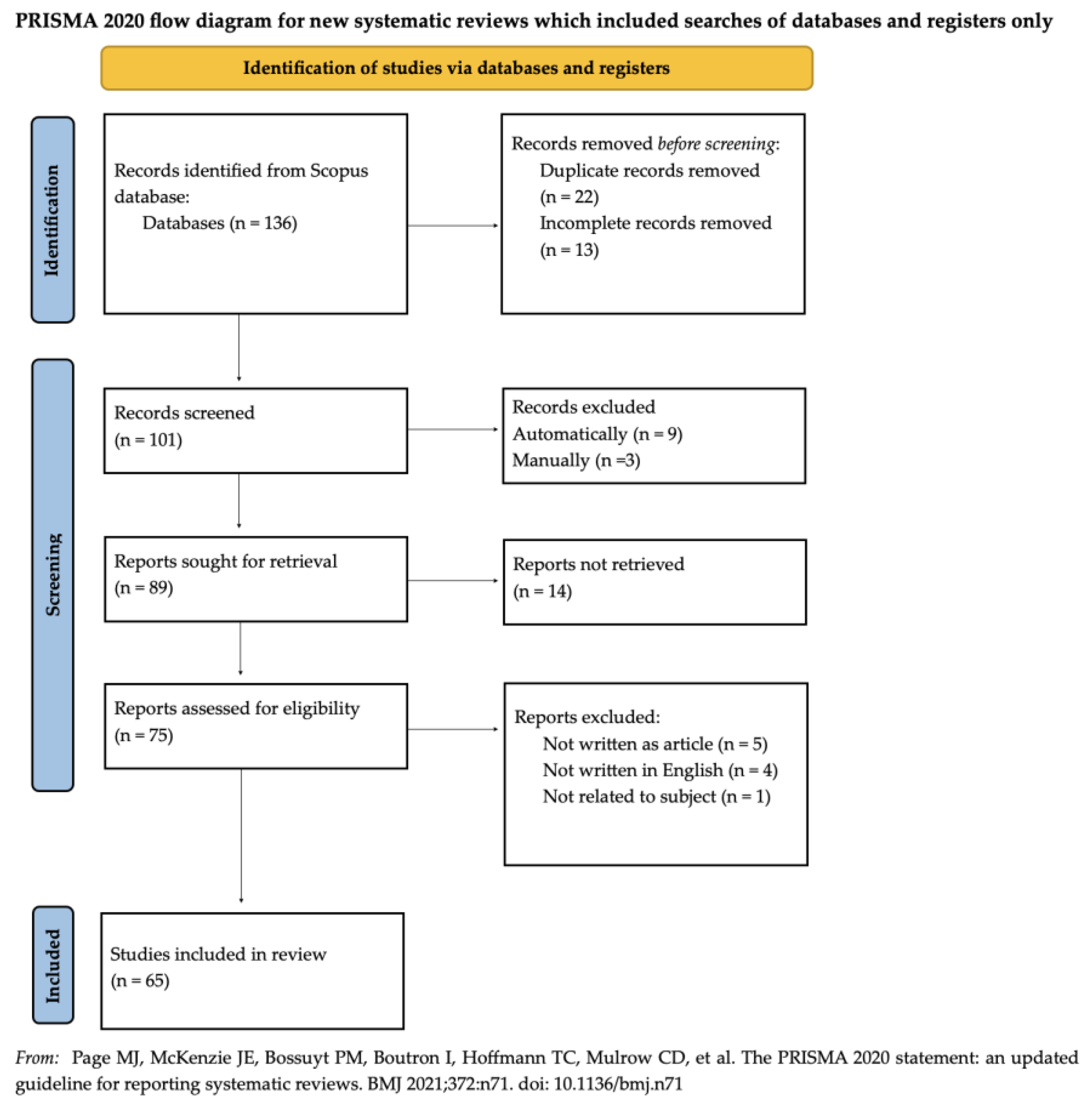

The present study adopted a systematic approach for investigating the research questions by following the ‘Preferred Reporting Items for Systematic reviews and Meta-Analyses’ (PRISMA) Protocol (

Figure 1). The PRISMA protocol is a standardised framework that outlines the systematic review process. It provides guidelines for the design, execution, and reporting of systematic reviews and meta-analyses (Moher et al. 2009; Page et al. 2021). The steps followed for this systematic and methodological study included defining the research objectives and figuring the outcome of the study on basis of defining the research question. Further, the research design was framed to answer if the analysis will use only citation data or will it be combination of approaches of bibliometric, visualisation and analysing content. The data collection keyword was finalised and database was selected. Results were filtered as per the exclusion criteria, applied to database of Scopus and visualised for clarity. The results were restricted to English language only. The process of collection of records and elimination for the purpose of the study have been condensed at

Figure 1.

Data was mined through Scopus database and the basis of the study were articles encompassing “corporate sustainability” and “firm performance” in the title, abstract and keywords. It resulted in 136 documents which was further refined to ascertain absence of other types of publications in our analysis. Further, we inserted different query strings which led to elimination of journal publications being potentially not relevant to the present study. The results were further refined to populate only English language articles, creating a corpus of 65 documents. This embarked the mechanism of analysing and testing origin, country, author, keywords and citations. The details were exported as csv file. This systematic investigation follows a thorough research protocol. The choice of sample size in such studies depends on several factors, including the research questions, objectives, available data, and the level of granularity. While larger sample sizes can provide statistical power, smaller sample sizes yield valuable findings, particularly when focusing on specific research niches and help draw meaningful conclusions. According to standardised procedures the minimum number of papers required for bibliometric or scientometric analysis is five, and the aim and type of analysis influences the size of the sample (Rogers et al. 2020). This paper goes beyond analytical minimum and analyses the sample of 65 documents for review.

Through the theoretical framework of ‘Theory of Citation’ (Leydesdorff 1998) we could fathom that research inquiry is reflexive and makes use of quantitative approaches for context setting and analysing research activity. This helps evaluate the productivity and visibility of researchers, journals, publication numbers and identify intellectual lineage of subjects (Mandard 2022; Tahamtan and Bornmann 2018; Katchanov 2015). It also leads to fostering collaborative networks towards advancing knowledge in the field (Bhardwaj 2016; Robledo et al. 2023; Vinkler 2010). The analysis of any body of work needs to be consistent and should encapsulate the scholarly publications to reduce the chance of missing publications and also maintain specificity and relevance (Chen and Song 2019). Through this study we also extend upon the framework proposed by Sau and Nayak (2022) to look at trends, organisations, keywords and Cite Scores, H-index. However, we also factor in doubling time and relative growth rates to ascertain the meanings within the trajectories of publication growth.

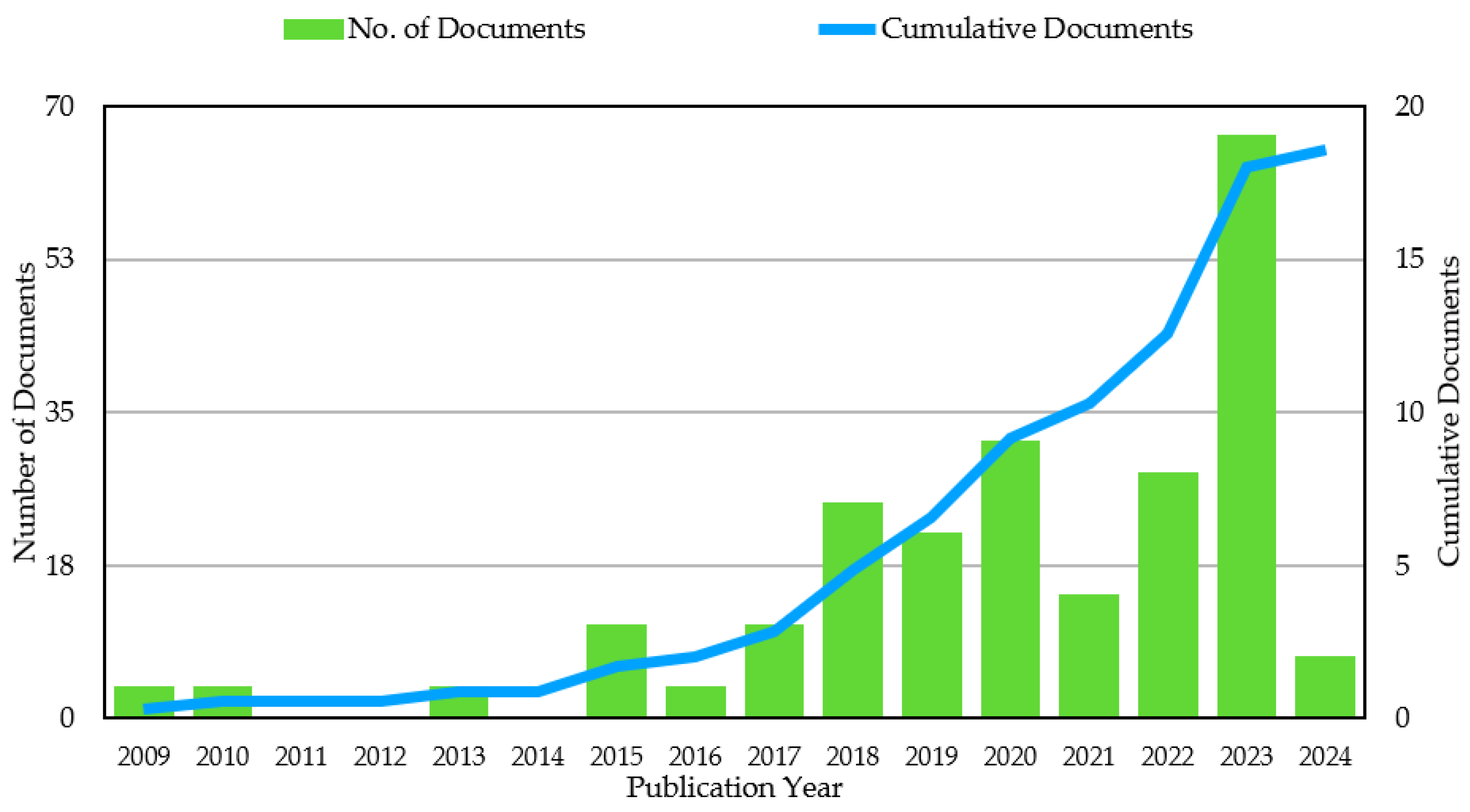

The scientific landscapes were visualised for 1148 publications which were exported to VOSViewer. The objects of interest have an element of relatedness which is measured through strength parameters that are directly proportional to their value (Van Eck and Waltman 2009). Output of publications and trends of research interest can be seen in

Figure 2, that showcases upward movement and growth of publications.

4. Results

4.1. Yearly Distribution and Growth Trends

It is evident from

Figure 2 that the publication frequency was less during the initial period from 2009 onwards and there was no publication activity during 2011-2012. However, it saw a rise the next year, with a dip in the corresponding year, following the gradual path of rise in amount of publications during the course. The frequency of publications had peaked in 2023 as can be observed. This showcases that there is an enhanced trend for research in “corporate sustainability” and “firm performance” area in the recent period from 2017 onwards. We mapped the number of publications and cumulate counts on an annual basis to analyse indagation of corporate sustainability and firm performance studies. The cumulative accruing plot showcases that there has been active research activity in this subject, and trends suggest that we are in the growth phase of research in this field.

4.2. Subject Areas

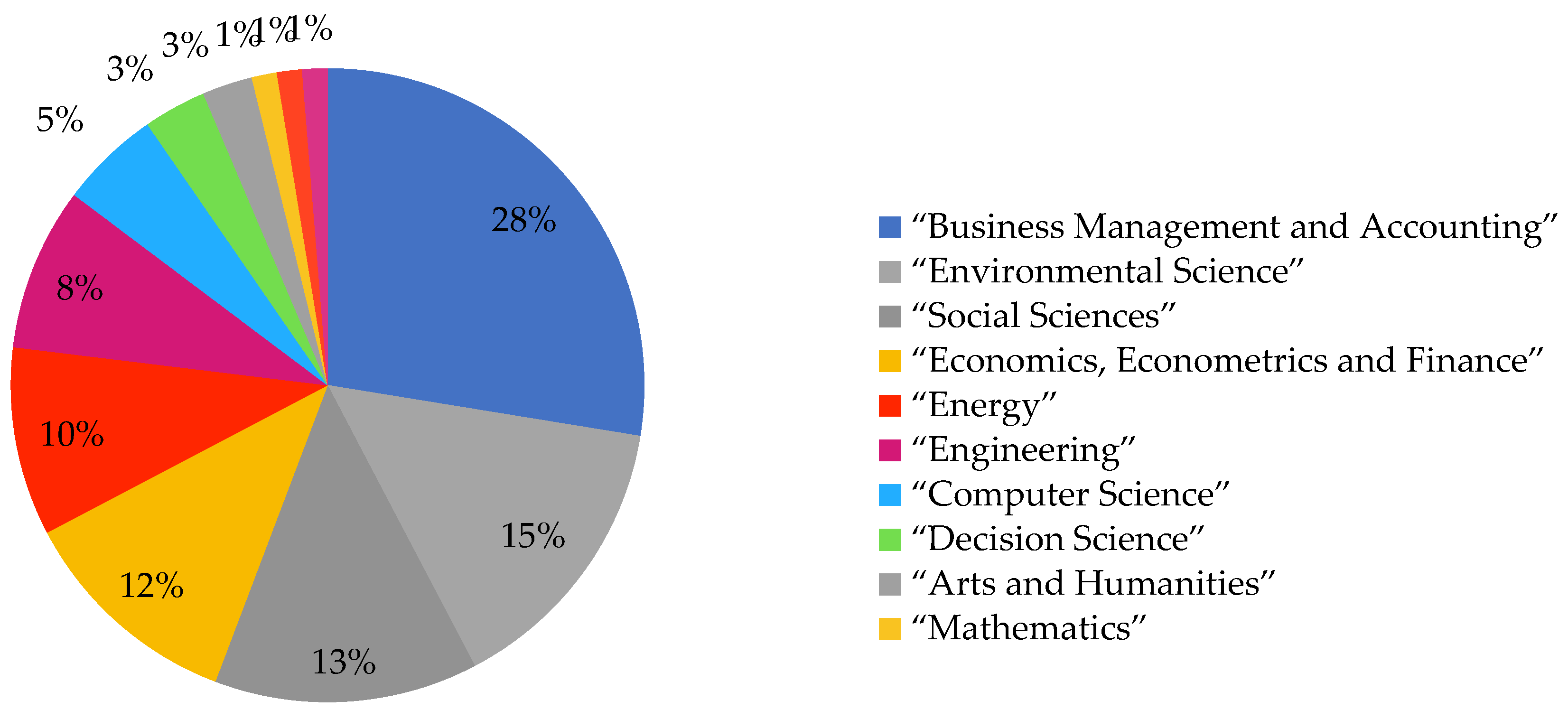

Documents by subject area were mapped to gauge the topics that these publications have been addressing as condensed in

Figure 3. It showcased that major subject catered was Business Management and Accounting followed by Environmental Science and Social Sciences. The least number of publications addressed the psychology domain.

4.3. Countries

The corpus of documents has been published from 37 countries and 11 countries have published three or more documents as can be seen in

Table 1. Much of the research activity in this field has been accelerated from China, India and United States which contributed to more than 45 percent of the global publications, that suggests their pivotal role in advancement of studies in “corporate sustainability” and “firm performance”. China is leading with 13 publications. There were 18 countries generating only one paper each. It is also evident that countries having nominal GDP rank 46 or fewer feature in the top countries publishing three or more documents. This points that economically developed nations have progressed in research on Corporate Sustainability and Firm Performance. USA recorded highest number of citations in the category. Interestingly, Italy with only three documents has a greater coverage citation per document (138.33) as compared to the China having the most number of publications and average citation per document of 27.92.

The scientific production index showcases enhanced research activity in China followed by India and United States coming a close third. As is visible in

Figure 4, countries contributing to the field of research in “corporate sustainability” and “firm performance” with three or more publications belong majorly to the Asian and European regions. There hasn’t been adequate research activity in this field from the African and South American regions.

4.4. Top Organisations

Further, top organisations publishing two or more documents in field of Corporate Sustainability and Firm Performance were identified at

Table 2. The analysis showcased that only three organisations had published at least two documents. It was found that the Department of Management Sciences, City University of Science and Information Technology, Peshawar, Pakistan had published 3 documents, gathering 34 citations, which resulted in average citations of 11.33. This showcases that despite the research activity in this field generating from different countries, the research is not accumulated from singular organisations and publications are authored from a myriad of organisations.

The authors and documents with 50 or more citations can be seen in

Table 3. As can be seen, Naciti V. has maximum number of citations.

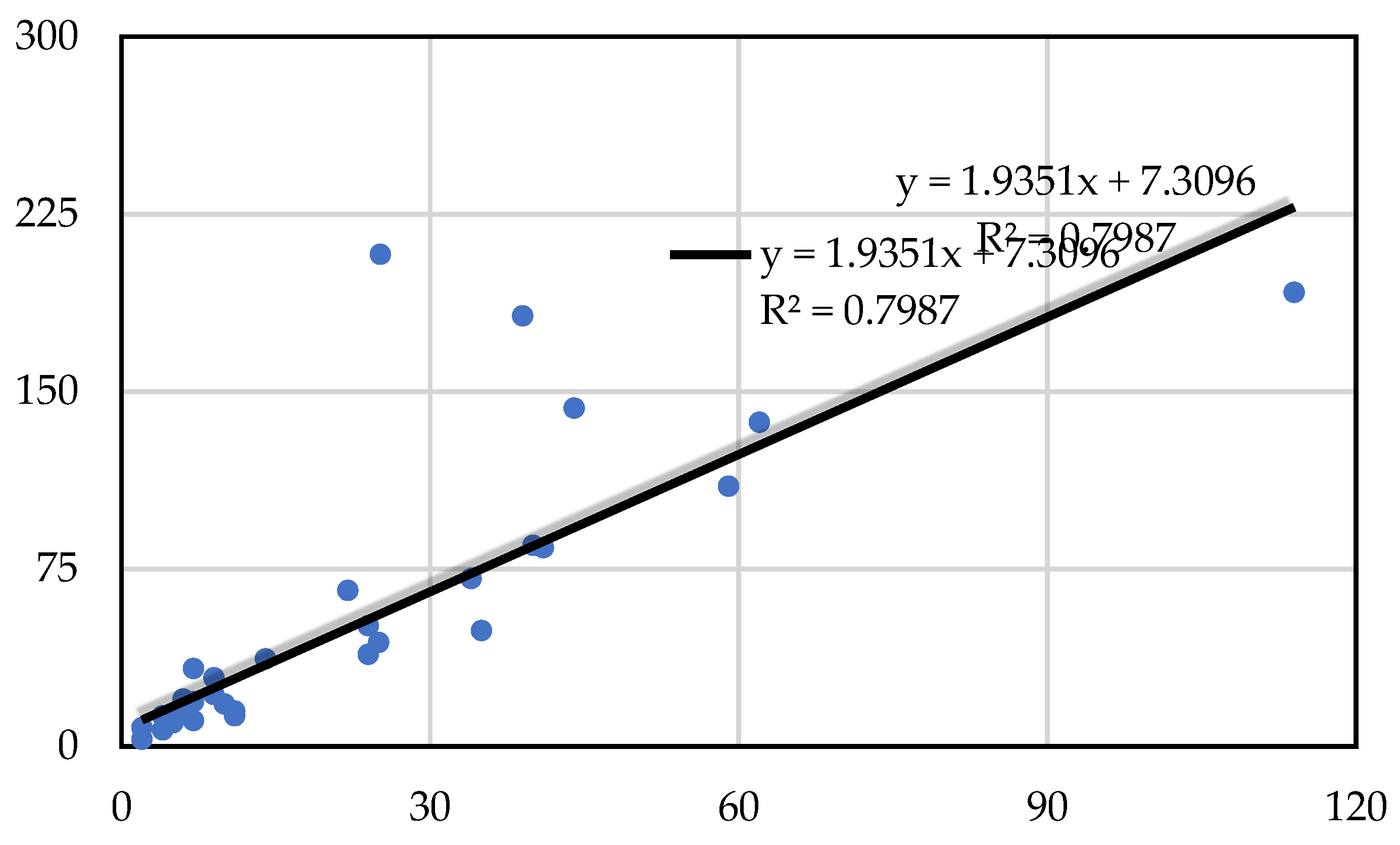

Wang J. stands out with an impressive overall g-index of 182, making him a prominent figure in the academic landscape. Following closely behind are Van Passel S. and Schaltegger S. However, it’s noteworthy that some authors, despite having high citation frequencies, exhibit comparatively lower impact according to both h and g indexes. For instance, Naciti V., despite having a substantial number of citations, only has an h-index of 6 and a g-index of 20. In

Figure 5, the scatter plot illustrates the distribution of authors’ h and g indexes. It is evident from the plot that there exists a linear relationship between these indexes, indicating a positive correlation. The coefficient of determination (r^2) is calculated to be 0.7987, suggesting a strong association between the two indexes. This relationship is encapsulated by the equation y = mx + c, where the variables are represented by the slope (m) and intercept (c). In this case, the equation is satisfied by the specific values: y = 1.9351x + 7.3096.

Bibliographic coupling is a method used to examine the relationships and connections between academic papers based on their shared references. This method allows researchers to identify and analyse the influence and impact of certain papers within a specific field of study. Bibliographic coupling serves as a vital method in academic research, enabling a comprehensive grasp of the relationships and connections among scholarly works (Liu 2016). Furthermore, bibliographic coupling provides valuable insights into the development and trends within a discipline, helping academics to identify the most influential studies and track the progress of research in that field. Bibliographic coupling remains unaffected by changes in the number of cited references over time, distinguishing it from other bibliometric tools. Thus, it is regarded as particularly beneficial for informing systematic literature reviews. Thematic clusters in bibliographic coupling are based on citing publications, allowing for the inclusion of latest and unique publications, unlike co-citation analysis. Qualitative analysis of articles was conducted, and an Excel data-sheet was used to capture content and tag it with keywords for meaningful conclusions.

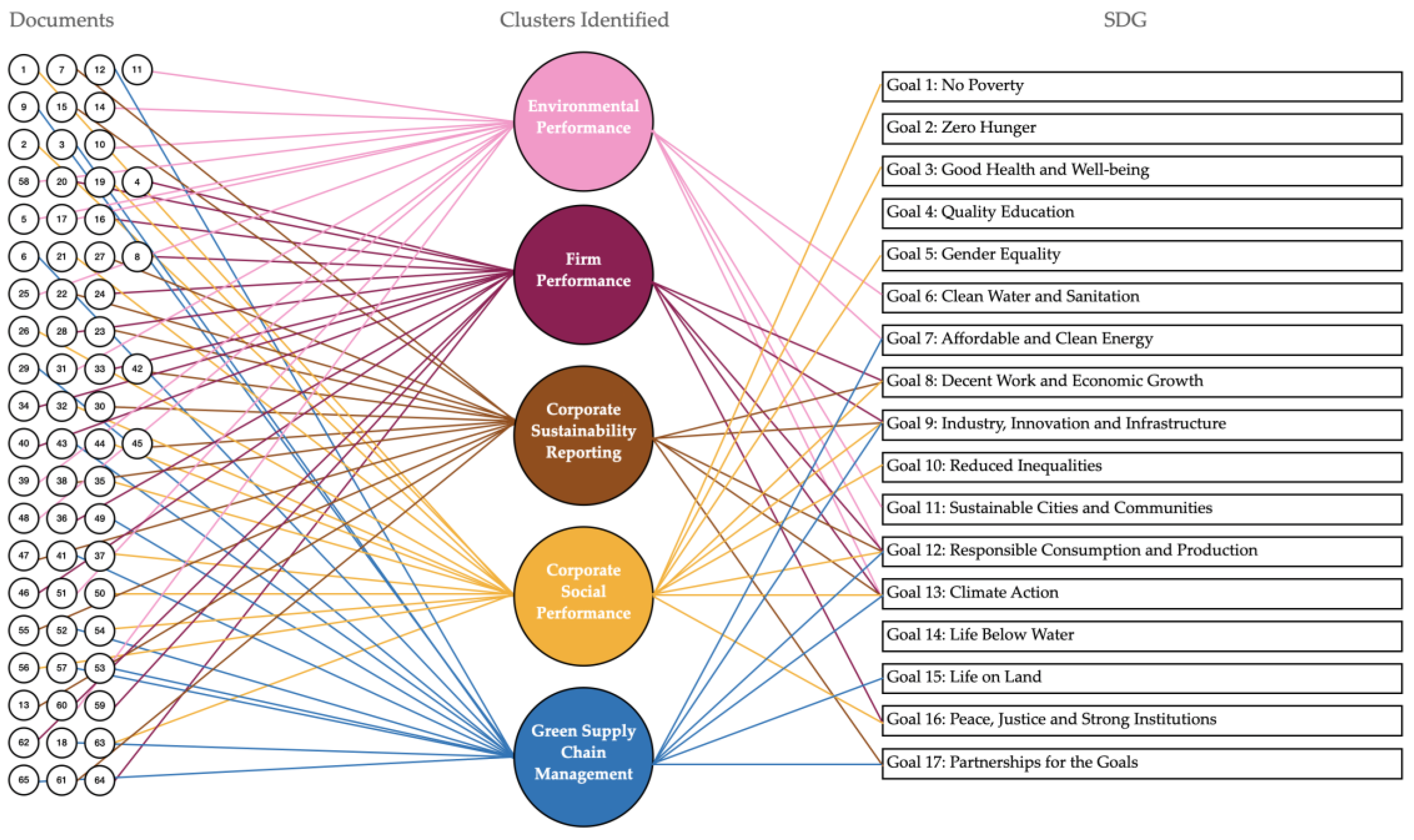

Five main clusters have been identified determine the research themes that indicate the present and future research trends, represented by different colours (Pink, Purple, Brown, Orange and Blue), were formed. Cluster 1 (Pink) focused on environmental performance and environmental reputation, CSR, sustainability, SDGs and financial performance; Cluster 2 (Purple) explored firm financial performance and sustainability association and role played sustainable chain management and corporate governance mechanisms; Cluster 3 (Brown) delved into relationship between “corporate sustainability reporting” and “firms profitability,” examining disclosure pattern of corporate sustainability and sustainability strategies; Cluster 4 (Orange) examined impact of corporate sustainability on financial performance as well as analysed connection amongst financialisation, accumulation of real capital, and corporate social performance; Cluster 5 (Blue) looked at long term value creation through adoption of green supply chain management. These were further mapped with the Sustainable Development Goals.

4.4.1. Cluster 1 (Pink) Environment Performance, CSR and Sustainability

The Cluster 1 comprising 7 articles highlights the nexus between environmental performance, CSR and sustainability. Dangelico (2015) investigates the role of employee green teams in shaping a firm’s environmental performance and reputation. Through an analysis of data from the largest publicly traded US companies, the study established a positive correlation between the establishment of green teams and both environmental performance and reputation. By examining information gathered from sustainability reports and rankings, the research highlighted the significant impact of employee-driven initiatives on enhancing a company’s environmental standing and public perception.

The findings underscore the importance of internal environmental management capabilities and employee involvement in fostering a culture of sustainability within organizations. Alda (2019) focuses on the role of socially responsible pension funds in shaping the sustainability practices of UK firms. Studying 197 such funds and 1,253 firms over 16 years, the research identified a significant impact on 41.93% of ESG indicators. Larger pension-fund shareholding was associated with positive ESG performance, encouraging environmentally friendly practices and increased transparency. The study by Jo et al. (2015) investigated the relationship between Corporate Environmental Responsibility (CER) and operating performance in the financial services sector. Analyzing data from 29 countries, the research demonstrates that investing in CER can lead to reduced environmental costs and improved return on assets, particularly in well-developed financial markets. Schaltegger and Burritt (2018) explored the link between ethical motivations and various corporate social responsibility (CSR) activities. Distinguishing between four ethical motivations, their study highlighted impact on operational activities and business cases related to sustainability. According to a study done by Gautam et al. (2023), CSR has a big impact on sustainable development. The study by Naciti (2019) received highest number of citations amongst the cluster 1 and analysed the relationship between board composition and sustainability performance.

It posited that greater diversity and separation of chair and CEO roles are associated with higher sustainability performance. However, an increase in independent directors correlates with lower sustainability performance. Zhang et al. (2020) explored the critical success factors of green innovation, focusing on technology, organisation, and environment readiness. Their study suggested that these dimensions, when adequately addressed, contribute to the success of green innovation, leading to competitive advantage and sustainability outcomes. Eide et al. (2020) investigated leaders’ impact on sustainability efforts in Norwegian manufacturing firms, and found that leaders’ personal motivation influences firm strategy (Roy et al. 2021) through intellectual leadership. It also highlighted that incorporating sustainability efforts into core business strategies is linked to perceived value creation and organisational impact. The highlights of Cluster 1 (purple) include the following -

Introducing employee green teams has a positive impact on both firm environmental performance and reputation, apart from financial performance through cost savings achieved via sustainable practices.

Socially responsible pension funds significantly influence ESG performance of investee firms, promoting sustainability practices and transparency and potentially bolstering financial performance.

Investing in Corporate Environmental Responsibility (CER) leads to reduced environmental costs and improved financial performance, particularly in developed financial markets.

Different ethical motivations drive distinct CSR activities, raising questions about their relationship with business success.

Board diversity and separation of chair and CEO’s role correlate with higher sustainability performance, emphasizing the importance of inclusive decision-making in shaping sustainable practices and positively influencing financial performance.

4.4.2. Cluster 2 (Purple) Firm Performance and Sustainability Chain Management

Shin et al. (2018) explored the relationship between renewable energy (RE) utilisation and firm financial performance. By comparing large US firms recognised for exceptional RE usage with industry medians over a 7-year period, it investigated annual ROI, Tobin’s Q, and operating margin. It highlighted the potential economic benefits of RE utilisation, complementing its societal and environmental advantages. Van Passel et al. (2009) presented a methodology for assessing firm sustainability by combining the sustainable value approach with frontier efficiency benchmarks.

By integrating efficiency analysis methods, it offered a comprehensive sustainability assessment tool. Focusing on Chinese firms, Wang and Dai (2018) investigated the impact of sustainable supply chain management (SSCM) practices on performance. Through a comprehensive model, it incorporated internal and external SSCM practices, and examines their influence on economic, environmental, and social performance. The study by Puni and Anlesinya (2020) examined the influence of corporate governance mechanisms on firm performance among listed Ghanaian companies. Using panel regression analysis, it assessed various SEC-recommended governance variables from 2006 to 2018. The findings contributed to understanding how corporate governance practices affect firm performance and hold implications for policymakers and practitioners in developing countries. The highlights of the studies part of this cluster were -

- 6.

Renewable energy (RE) utilising firms consistently outperform industry peers financially, indicating a positive association between Sustainable Chain Management and Financial Performance.

- 7.

Sustainable value assessment methodology integrates sustainable value approach with frontier efficiency benchmarks, offering a comprehensive tool for evaluating firm sustainability.

- 8.

Internal sustainable supply chain management (SSCM) practices positively influence environmental and social performance, subsequently enhancing economic performance of firms.

4.4.3. Cluster 3 (Brown) Corporate Sustainability Reporting and Firms’ Profitability

Laskar (2019) investigated how corporate sustainability reporting affects the profitability of companies in India and South Korea. Analyzing data from 28 Indian and 26 South Korean non-financial listed firms over six years, the research utilises content analysis to evaluate sustainability performance disclosure. Findings indicated a positive and significant association between sustainability reporting and profitability for South Korean firms, while Indian firms experience a negative impact. Examining corporate sustainability disclosure patterns and its influence on firm performance across Japan, South Korea, Indonesia, and India, Laskar and Gopal Maji (2018) employed data from 111 firms over six years.

Using content analysis based on the GRI framework, they evaluated the corporate sustainability disclosure quality. Laskar and Maji (2016) looked at the sustainability reporting practices among Indian firms, evaluating disclosure quality and its impact on firm performance. Analyzing data from 28 listed Indian non-financial firms over six years, they undertook content analysis to assess disclosure levels and quality and questioned the adequacy of existing reporting frameworks. Further, Gupta and Gupta (2020) investigated the impact of environmental sustainability on various dimensions of firm performance, focusing on Indian organizations. It filled the knowledge gap by establishing a comprehensive relationship between sustainability and firm performance across key functional dimensions. The following were the highlights of this cluster -

- 9.

Japanese companies not only lead in both the level and quality of sustainability disclosure among Asian countries. They also demonstrate a positive correlation between robust sustainability practices and financial performance. This suggests that their commitment to transparency and sustainability contributes to enhanced investor confidence and may lead to improved financial outcomes.

- 10.

High levels of sustainability reporting are observed among Indian firms, with a significant impact on firm performance. This has led to attracting socially responsible investors, access capital more easily, and potentially achieve better financial results due to improved operational efficiency and reduced risks associated with environmental and social issues.

- 11.

Environmental sustainability positively influences various dimensions of firm performance and contributes to stronger financial performance over long term.

4.4.4. Cluster 4 (Orange) Financialisation, Accumulation of Real Capital, and Corporate Social Performance

The study by Ghardallou (2022) examined how corporate sustainability impacts firm financial performance, particularly exploring the moderating role of CEO characteristics on the link between corporate social responsibility (CSR) and financial performance. Analyzing data from 34 publicly traded Saudi companies between 2015 and 2020, the research revealed that firms engaging in CSR practices tend to exhibit better financial performance. Cupertino et al. (2019) looked at the impact of financialisation on corporate real investment and its relationship with corporate social performance (CSP) in US manufacturing firms from 2002 to 2017. Amidst the increasing focus on shareholder value maximisation and short-term profit orientation, the research uncovered a negative correlation between financialisation and real investment. Jeffers (2010) explored the integration of sustainability principles and information technology (IT) investments in third-party logistics (3PL) firms, focusing on the strategic leveraging of operations. By adopting an “operations-as-marketing” strategy, firms can transform their operations into strategic marketing assets aimed at meeting customer needs while achieving lean productivity. The papers in this cluster underscore the growing importance of sustainability in business practices and its impact on firm performance. The analyses shed light on the multifaceted nature of sustainability and its implications for corporate decision-making and performance.

4.4.5. Cluster 5 (Blue) Value Creation and Green Supply Chain Management

The study by Sandberg et al. (2022) delved into the impact of environmental, social, and governance (ESG) ratings on financial performance. Using ordinary least squares regression, it examined the relationship between ESG ratings and profitability measures like Return on Assets (ROA) and Return on Equity (ROE) over a 4-year period. Investigating corporate sustainability’s influence on firm profitability in India, the study by Bodhanwala and Bodhanwala (2018) analysed data from 58 Indian firms to assess the relationship between sustainability and various performance measures. Empirical evidence suggests a significant positive association between sustainability efforts and profitability indicators, emphasising the potential benefits of sustainable development strategies for firms. The findings underscored the importance of integrating environmental, social, and governance efforts into business policies to achieve long-term value creation and competitive advantage, particularly for mid- and large-capitalized Indian firms.

Focusing on green supply chain management (GSCM) practices in Brazilian firms, the study by Jabbour et al. (2015) explored GSCM impact on environmental and operational performance. Through multiple-case analysis, it identified “internal environmental management” as crucial for enhancing environmental performance and “cooperation with customers” for improving operational performance. The findings provide practical insights for companies seeking to enhance their environmental and operational performance through tailored GSCM initiatives, emphasising the importance of aligning practices with strategic objectives for sustainable innovation and growth. Within this cluster, studies emphasised the significance of incorporating environmental, social, and governance initiatives into business policies to foster sustainable innovation and growth. They also underscore the growing importance of corporate sustainability in driving financial performance and long-term value creation across different industries and regions.

4.5. Mapping Clusters with SDGs

The clusters identified from the corpus of 65 documents were further mapped to SDGs (

Figure 6). The clusters so formed through the papers are relatable to the Sustainable Development Goals. It is important in identifying the changes and growth of literature that is linked to a specific SDG and whether any SDG has garnered varied research interest. It is noteworthy that all SDGs barring two have been considered in these papers mined in the corpus. The clusters identified were analysed to gauge alignment with the SDGs, which allowed elucidation of the SDGs that are considered in papers related to the topic under study.

4.6. Keyword Co-Occurence

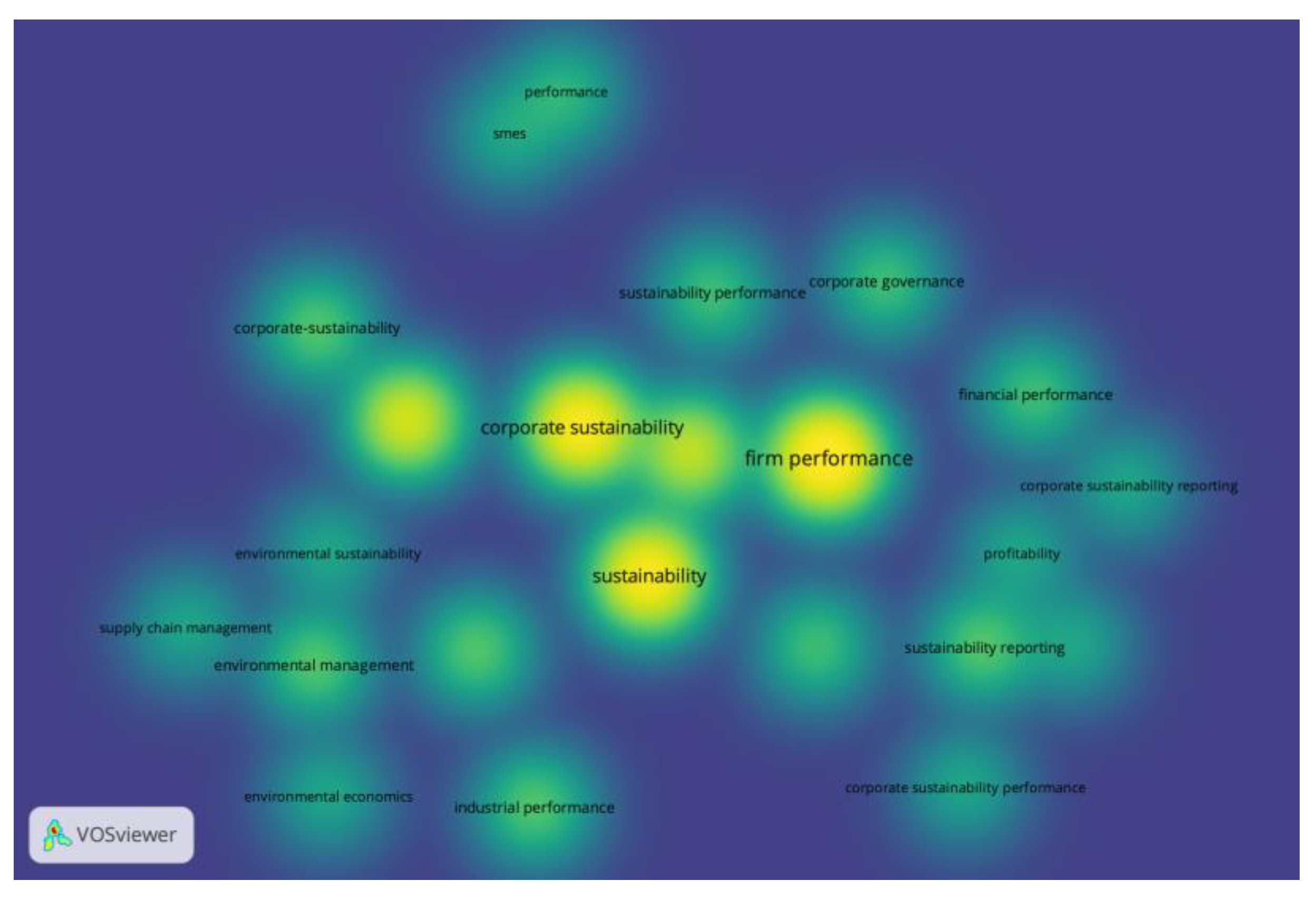

Through density visualisation we can see that corporate sustainability and firm performance have been most frequently used, followed by sustainability. Keywords were manually screened, so that relevant words to the study are selected for generating density visualisation map displayed at

Figure 7. There was a good correlation with sustainability reporting, sustainability performance, corporate governance, financial performance, profitability and their relationship is pertinent. Therefore, researchers have made use of these variables while researching about firm performance and corporate sustainability.

To assess the production relative indicator, we make use of formula given by Gracio et al. (2012) and calculate the AGR of publications. According to Santha kumar and Kaliyaperumal (2015), it is an effective method for calculation of growth on an annual basis. As can be seen, the production levels have dipped and risen intermittently and it saw a jump of 2023. It is an effective measure of growth for specific year utilising the primary and secondary values. The calculation of CAGR is another method to gauge geometric progressions ratio. It was calculated using formula available at “

https://www.investopedia.com/terms/c/cagr.asp”. Average number of papers per year has been a meagre 4.06 and the CAGR has been -2.88.

Further, growth rate was determined through metrics of RGR & Dt. provided by Mahapatra (1985). The relative growth rate (RGR) reflects surge in documents over time and has its origins in biology. It has been used as a measure of publications by a number of scholars (Dandoti et al. 2023; Hadagali and Anandhalli 2015; Ramakrishna et al. 2018). The doubling time (Dt.) refers to time undertaken in doubling of value and is in direction relation to RGR.

Table 4 depicts the RGR and Dt. of publications. It can be observed that RGR value has decreased from 0.69 in 2010 to 0.36 in 2023, which is also oscillating over the years. The Dt. has witnessed an increase from 1.00 in 2010 to 1.93 in 2023, followed by 22.35 in 2024.

4.7. Future Projections

Time Series Analysis was employed to forecast the future trends of Firm Performance and Corporate Sustainability publications as can be seen in

Table 5. With 2016 as the midpoint of our 16-year dataset, it is anticipated that publications will witness an increase in the forthcoming years. By following the established patterns and utilising the provided formula, “Year ‘a=ΣY/ N’ + (Year ‘b=ΣXY/ΣX2’ × (2028−2011)),” projections indicate an estimated 15 publications in 2025, 19 publications in 2030, 22 publications in 2040, and 33 publications in 2050.

5. Discussion

The academic discourse surrounding corporate sustainability and its correlation with firm performance has garnered considerable attention lately, evidenced by the existence of scholarly articles. Nonetheless, there remains ample room for further exploration in this area. This article outlines several avenues for future research on the relationship between corporate sustainability and firm performance. Documents mined through only Scopus corpus have been considered, which can be regarded as a limitation of this study.

The five clusters that have been identified in the study were mapped to 17 SDGs (

Figure 6). This means that an article has considered specific SDGs for their research. Cluster 1 i.e. for

Environmental Performance, clean water and sanitation (6), affordable and clean energy (7), sustainable cities and communities (11), responsible consumption and production (12), and climate action (13) are considered. Cluster 2 i.e. for

Firm Performance, decent work and economic growth (8), industry, innovation and infrastructure (9), responsible consumption and production (12), climate action (13), and peace, justice and strong institutions (16) are considered. Cluster 3 i.e. for

Sustainability Reporting, decent work and economic growth (8), industry, innovation and infrastructure (9), responsible consumption and production (12), climate action (13), and partnerships for the goals (17) are considered. Cluster 4 i.e. for

Corporate Social Performance, no poverty (1), good health and wellbeing (3), gender equality (5), decent work and economic growth (8), innovation and infrastructure (9), reduced inequalities (10), responsible consumption and production (12), climate action (13), and peace, justice and strong institutions (16) are considered. Cluster 5 i.e. for

Green Supply Chain Management, affordable and clean energy (7), industry, innovation and infrastructure (9), responsible consumption and production (12), climate action (13), life on land (15), and partnerships for the goals (17) are considered. Further, the researchers can explore the unexplored SDGs among the 17 SDGs, which are not being considered in the previous researches w.r.t. to the clusters identified in our research.

Cluster 1 identified through our evaluation showcases the intricate interplay between environmental performance, corporate social responsibility (CSR), and sustainability across various industries and regions. The articles in the cluster 1 shed light on how organizations navigate sustainability challenges, engage stakeholders, and strive for long-term success in an increasingly complex business landscape. One of the key findings highlighted in the cluster is the positive impact of employee green teams on firm environmental performance and reputation. This underscores the importance of internal environmental management capabilities and employee involvement in driving sustainability initiatives within organizations. The studies also indicate that larger pension-fund shareholding is associated with enhanced Environmental, Social, and Governance (ESG) performance, promoting sustainability practices and potentially bolstering financial performance. This suggests that investors’ increasing focus on sustainability considerations can incentivize companies to adopt more sustainable business practices, thereby positively impacting financial outcomes. Ethical motivations driving CSR activities and their impact on organizational performance have also been explored. These also signal towards aligning CSR initiatives with core business strategies and values, raising questions about the relationship between ethical practices and business success, including financial performance. Diversity and the separation of chair and CEO roles are not only driving sustainability outcomes but are also having positive implications for financial performance.

We could fathom in the Cluster 2 that their lies a relationship between financial performance and sustainability chain management, and that sustainable practices can impact firms’ economic, environmental, and social performance. Researchers have looked at the correlation between renewable energy (RE) utilization and firm financial performance and assessed firm sustainability by combining the sustainable value approach with frontier efficiency benchmarks. Researches have also investigated influence of corporate governance mechanisms on firm performance and highlighted the positive association between sustainable chain management practices and financial performance. These findings point towards the importance of integrating sustainability considerations into firms’ strategic decision-making processes, emphasizing the potential for sustainable practices to drive long-term value creation and success.

Cluster 3 shedded light on the association between corporate sustainability reporting, environmental sustainability, and firm performance across India, South Korea, and Japan. Through a series of empirical studies, researchers delved into the nuanced dynamics shaping corporate sustainability practices and their impact on financial outcomes. The papers have looked at the diverse responses to sustainability reporting practices across different regions and underscored the need for tailored strategies to enhance financial performance. Examining corporate sustainability disclosure patterns can reveal insights into the quality of sustainability reporting, and indicate the potential economic benefits of transparency and sustainability. These studies also suggest that sustainability reporting not only attracts socially responsible investors and facilitates access to capital but also contributes to improved financial results through enhanced operational efficiency and reduced risks. Integrating sustainability considerations into strategic decision-making processes can enable achievement of long-term value creation and success.

Collectively, the papers in Cluster 4 underline the growing importance of sustainability in contemporary business practices and its profound implications for firm performance. The analyses shed light on the multifaceted nature of sustainability and its role in shaping corporate decision-making processes. By recognizing the interconnectedness of financial, social, and environmental factors, organizations can better navigate the complexities of the modern business landscape and drive sustainable value creation for stakeholders and society at large.

However, the Cluster 5 presents an in-depth examination of the intersection between environmental, social, and governance (ESG) practices, corporate sustainability, and financial performance across various industries and regions. Through a series of empirical studies, researchers delve into the multifaceted dynamics shaping firms’ sustainable development strategies and their implications for profitability and competitiveness. For example they look at the impact of ESG ratings on financial performance, employing ordinary least squares regression to analyze the relationship between ESG ratings and profitability measures such as Return on Assets (ROA) and Return on Equity (ROE) over a 4-year period. Their findings reveal a significant positive association between ESG efforts and profitability indicators, underscoring the potential benefits of sustainable development strategies for firms. This highlights the importance of integrating environmental, social, and governance considerations into business policies to achieve long-term value creation and competitive advantage, particularly for mid- and large-capitalized Indian firms. Shifting the focus to green supply chain management (GSCM) practices researchers have explored the impact of GSCM on environmental and operational performance, thereby highlighting the importance of aligning practices with strategic objectives for sustainable innovation and growth. Overall, the studies within Cluster 5 have showcased that by embracing sustainable development strategies and aligning them with strategic objectives, companies can position themselves for success in an increasingly competitive and environmentally conscious marketplace.

Through the use of scatter plot of the h-index and g-index for top authors in Corporate Sustainability and Firm Performance we got an insight into the relationship between productivity and impact within this specific research domain. The scatter plot shows a strong positive linear correlation between the h-index and g-index, and suggests that authors with higher productivity (as indicated by a higher h-index) tend to also produce more highly cited works (as indicated by a higher g-index). In other words, authors who publish more papers also tend to have a greater number of highly influential papers within the field of Corporate Sustainability and Firm Performance.

Initially, it has been observed through thorough examination and bibliographic analysis that there is a dearth of research on the link of firm performance and corporate sustainability. While studies have delved into this aspect, there is a pressing need for more comprehensive investigations. Empirical studies utilising cross-national data are necessary to enhance the credibility and applicability of findings. There is a notable lack of theoretical diversity in examining the association as existing literature predominantly relies on selected theories. Although these theories provide valuable insights, they have the potential to limit the growth and adaptability of the field. Therefore, it is advisable to integrate theories from various management disciplines to enhance the discourse.

Another notable observation is the prevalent tendency among researchers to utilize financial performance as a surrogate for firm performance. Moreover, a significant proportion of research has primarily focused on developed countries. However, there is a growing but gradual shift in research focus towards developing countries, albeit at a slow pace.

Moreover, future studies should explore additional mediators and moderators influencing the corporate sustainability and firm performance relationship. Existing research predominantly focuses on the impact of corporate sustainability on financial performance, neglecting its effects on non-financial aspects of firm performance. Given that organisational performance encompasses financial, operational, and organisational effectiveness, it is crucial to embrace a holistic approach when evaluating the influence of Corporate Sustainability on Firm Performance. While studies in the developed nations are abundant, research on developing nations is scarce, highlighting the need for more comprehensive cross-country studies to elucidate variations in the Corporate Sustainability levels and their implications for firm performance. The link strength was a nullity amongst the countries, as there were no collaborations amongst countries publishing 3 or more documents.

6. Conclusion

The research gave us an insight into the field of “corporate sustainability” and “firm performance” through 65 documents mined through Scopus corpus. The number of documents published have grown since inception and with major upheaval in the number of documents since 2017, showcase that we are in the growth stage of research in this field. We could discover that China, India and United States have been faring well as compared to other countries and have undertaken visible research efforts in studies related to this field. The largest chunk of the papers belonged to Business Management and Accounting followed by Environmental Science and Social Sciences.

It could also be fathomed that economically developed nations have progressed in research, especially Asian and European countries. In terms of mean citations of a publication, the Ahlia University Bahrain scored higher than University of Science and Information Technology Pakistan. This shows that they have a sound research practices in comparison to other institutions publishing a large number of documents. Naciti V. has garnered highest number of citations. However, there is need for greater collaboration in research so that knowledge can move from tacit to known, as authors should look to write from multi-author perspectives to have overall views on the subject.

Through mapping keywords co-occurrence, we could get a sense of the closely related variables and terms that have been used in relation with corporate sustainability and firm performance studies. Five clusters were identified that were mapped to the Sustainable Development Goals. We could also see a CAGR of -2.88 throughout the study period and average quantity of papers per year has been a meagre 4.06.

There has been a decrease in the relative growth rate over the years to 0.03 in 2024 from 0.69 in 2010 and the doubling time has increased to 22.35 in 2024. The study concludes there is a trend towards increased collaboration. This also matches the perspective of researchers that there has been enhanced research activity related to corporate sustainability and firm performance.

The concentration of the journals also indicates that there is an effort towards adeptness in such studies, with enhanced research interest. Utilising this study for other databases such as Web of Science and combination studies with Scopus database can be undertaken for future research. This utilisation of multiple data sources will be a move towards comprehensive and comparative studies.

Author Contributions

Conceptualization, A.C. and A.S..; methodology, A.C. and A.S.; software, A.C. and A.S.; validation, A.S. and R.D.; formal analysis, A.C., A.S., R.D. and M.A.Q.; investigation, A.C., A.S. and R.D.; resources, A.C., A.S., and R.D.; data curation, A.C., A.S., R.D. and M.A.Q.; writing—original draft preparation, A.C.; writing—review and editing, A.C., A.S., R.D. and M.A.Q.; visualization, A.C. and R.D.; supervision, R.D. and M.A.Q.; project administration, A.S and R.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data can be made available on request.

Acknowledgments

The financial and infrastructural support provided by the FORE School of Management, New Delhi; and infrastructural support provided by Amity School of Communication, Amity University, Noida, Uttar Pradesh and College of Business Administration, Kuwait University in completing this paper is gratefully acknowledged.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Achour, Z.; Boukattaya, S. The moderating effect of firm visibility on the corporate social responsibility-firm financial performance relationship: Evidence from France. Corporate Social Responsibility 2022, 24, 437–454. [Google Scholar]

- Agarwal, V.; Taffler, R.J.; Bellotti, X.; Nash, E.A. Investor relations, information asymmetry and market value. Accounting and Business Research 2015, 46, 31–50. [Google Scholar] [CrossRef]

- Aguinis, H.; Glavas, A. What we know and don’t know about corporate social responsibility. Journal of Management 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Alam, Z.; Tariq, Y.B. Corporate Sustainability Performance Evaluation and firm Financial Performance: Evidence from Pakistan. SAGE Open 2023, 13. [Google Scholar] [CrossRef]

- Alda, M. Corporate Sustainability and institutional shareholders: The pressure of social responsible pension funds on environmental firm practices. Business Strategy and the Environment 2019, 28, 1060–1071. [Google Scholar] [CrossRef]

- Alshehhi, A.; Nobanee, H.; Khare, N. The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef]

- Ammari, A.; Amdouni, S.; Zemzem, A.; Ellouze, A. The effect of monitoring committees on the relationship between Board structure and firm performance. Journal of Risk and Financial Management 2016, 9, 14. [Google Scholar] [CrossRef]

- Ammer, M.A.; Aliedan, M.M.; Alyahya, M.A. Do corporate environmental sustainability practices influence firm value? the role of Independent Directors: Evidence from Saudi Arabia. Sustainability 2020, 12, 9768. [Google Scholar] [CrossRef]

- Bashar, M.A. Exploring new ways of communicating CSR to the relevant stakeholders: An empirical study. Business and Management Research 2020, 9, 25. [Google Scholar] [CrossRef]

- Bhardwaj, R.K. Ebola virus: A scientometric study of world research publications. Journal of Scientometric Research 2016, 5, 34–42. [Google Scholar] [CrossRef]

- Bhatt, Y.; Ghuman, K.; Dhir, A. Sustainable Manufacturing. Bibliometrics and content analysis. Journal of Cleaner Production 2020, 260, 120988. [Google Scholar] [CrossRef]

- Bodhanwala, S.; Bodhanwala, R. Does corporate sustainability impact firm profitability? evidence from India. Management Decision 2018, 56, 1734–1747. [Google Scholar] [CrossRef]

- Bota-Avram, C. Bibliometric analysis of Sustainable Business Performance: Where Are We Going? A science map of the field. Economic Research-Ekonomska Istraživanja 2022, 36, 2137–2176. [Google Scholar] [CrossRef]

- Bui, T.D.; Ali, M.H.; Tsai, F.M.; Iranmanesh, M.; Tseng, M.-L.; Lim, M.K. Challenges and trends in Sustainable Corporate Finance: A bibliometric systematic review. Journal of Risk and Financial Management 2020, 13, 264. [Google Scholar] [CrossRef]

- Chaudhri, V. Corporate Social Responsibility and the communication imperative. International Journal of Business Communication 2016, 53, 419–442. [Google Scholar] [CrossRef]

- Chen, C.; Song, M. Visualizing a field of research: A methodology of systematic scientometric reviews. PLoS ONE 2019, 14. [Google Scholar] [CrossRef] [PubMed]

- Chopra, A.; Singh, A. Analysis of Mission, Vision and Value Statements of Indian Public Sector Enterprises. Mekal Mimansa 2023, 15, 78–92. [Google Scholar]

- Collett, P.; Hrasky, S. Voluntary disclosure of corporate governance practices by listed Australian companies. Corporate Governance 2005, 13, 188–196. [Google Scholar] [CrossRef]

- Cornelissen, J.P. Corporate communication: A guide to theory and practice; Sage Publications: S.l, 2023. [Google Scholar]

- Crane, A.; Glozer, S. Researching Corporate Social Responsibility Communication: Themes, opportunities and challenges. Journal of Management Studies 2016, 53, 1223–1252. [Google Scholar] [CrossRef]

- Cremers, K.J.; Nair, V.B. Governance mechanisms and equity prices. The Journal of Finance 2005, 60, 2859–2894. [Google Scholar] [CrossRef]

- Cupertino, S.; Consolandi, C.; Vercelli, A. Corporate Social Performance, financialization, and real investment in US manufacturing firms. Sustainability 2019, 11, 1836. [Google Scholar] [CrossRef]

- Dalton, D.R.; Todor, W.D.; Spendolini, M.J.; Fielding, G.J.; Porter, L.W. Organization structure and performance: A critical review. Academy of Management Review 1980, 5, 49–64. [Google Scholar] [CrossRef]

- Dandoti, S.S.; Ansari, K.M. Global Research Assessment of CRISPR: A scientometric analysis of literature published in scopus. Journal of Scientometric Research 2023, 12, 02–16. [Google Scholar] [CrossRef]

- Dangelico, R.M. Improving firm environmental performance and reputation: The role of employee green teams. Business Strategy and the Environment 2015, 24, 735–749. [Google Scholar] [CrossRef]

- Debnath, R.; Datta, B.; Mukhopadhyay, S. Customer relationship management theory and research in the new millennium: Directions for Future Research. Journal of Relationship Marketing 2016, 15, 299–325. [Google Scholar] [CrossRef]

- Delen, D.; Kuzey, C.; Uyar, A. Measuring firm performance using financial ratios: A decision tree approach. Expert Systems with Applications 2013, 40, 3970–3983. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for Corporate Sustainability. Business Strategy and the Environment 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Eide, A.E.; Saether, E.A.; Aspelund, A. An investigation of leaders’ motivation, intellectual leadership, and sustainability strategy in relation to Norwegian manufacturers’ performance. Journal of Cleaner Production 2020, 254, 120053. [Google Scholar] [CrossRef]

- El-Haj, M.; Rayson, P.; Walker, M.; Young, S.; Simaki, V. In search of meaning: Lessons, resources and next steps for computational analysis of Financial Discourse. Journal of Business Finance & Accounting 2019, 46, 265–306. [Google Scholar]

- Ferlito, R.; Faraci, R. Business Model Innovation for Sustainability: A new framework. Innovation & Management Review 2022, 19, 222–236. [Google Scholar]

- Frias-Aceituno, J.V.; Rodriguez-Ariza, L.; Garcia-Sanchez, I.M. The role of the board in the dissemination of integrated corporate social reporting. Corporate Social Responsibility and Environmental Management 2012, 20, 219–233. [Google Scholar] [CrossRef]

- Galimulina, F.; Shinkevich, M.; Barsegyan, N. Development of the financial flow model for the Sustainable Development of an industrial enterprise. Journal of Risk and Financial Management 2023, 16, 128. [Google Scholar] [CrossRef]

- Gautam, R.S.; Bhimavarapu, V.M.; Rastogi, S.; Kappal, J.M.; Patole, H.; Pushp, A. Corporate Social Responsibility funding and its impact on India’s sustainable development: Using the poverty score as a moderator. Journal of Risk and Financial Management 2023, 16, 90. [Google Scholar] [CrossRef]

- Ghardallou, W. Corporate Sustainability and firm performance: The moderating role of ceo education and tenure. Sustainability 2022, 14, 3513. [Google Scholar] [CrossRef]

- Goodman, M.B. Corporate Communication Practice and pedagogy at the dawn of the New Millennium. Corporate Communications: An International Journal 2006, 11, 196–213. [Google Scholar] [CrossRef]

- Goodman, M.B. Introduction: Corporate communication and strategic adaptation. Corporate Communications: An International Journal 2009, 14, 225–233. [Google Scholar] [CrossRef]

- Goyal, P.; Rahman, Z.; Kazmi, A.A. Corporate Sustainability Performance and firm performance research. Management Decision 2013, 51, 361–379. [Google Scholar] [CrossRef]

- Gracio, M.C.; de Oliveira, E.F.; de Araujo Gurgel, J.; Escalona, M.I.; Guerrero, A.P. Dentistry Scientometric Analysis: A comparative study between Brazil and other most productive countries in the area. Scientometrics 2012, 95, 753–769. [Google Scholar] [CrossRef]

- Grewal, J.; Serafeim, G. Research on corporate sustainability: Review and directions for future research. Foundations and Trends in Accounting 2020, 14, 73–127. [Google Scholar] [CrossRef]

- Groth, J.C. Corporate Communications and firm value. Managerial Finance 1988, 14, 1–5. [Google Scholar] [CrossRef]

- Gupta, A.K.; Gupta, N. Effect of corporate environmental sustainability on dimensions of firm performance – towards sustainable development: Evidence from India. Journal of Cleaner Production 2020, 253, 119948. [Google Scholar] [CrossRef]

- Hadagali, G.S.; Anandhalli, G. Modeling the growth of neurology literature. Journal of Information Science Theory and Practice 2015, 3, 45–63. [Google Scholar] [CrossRef]

- Haffar, M.; Searcy, C. Classification of trade-offs encountered in the practice of corporate sustainability. Journal of Business Ethics 2015, 140, 495–522. [Google Scholar] [CrossRef]

- Hallinger, P. Analyzing the intellectual structure of the knowledge base on managing for sustainability, 1982–2019: A meta-analysis. Sustainable Development 2020, 28, 1493–1506. [Google Scholar] [CrossRef]

- Hartley, W.C.F.; F. C.Azx.; F.C.W.A.; Dip.M.A., J. Critical decision areas in Corporate Financial Policy. Long Range Planning 1970, 2, 54–61. [Google Scholar] [CrossRef]

- Hermawan, W.D.; Ishak, G.; Budiantoro, A. The impact of financial ratios on return on asset, moderated by total assets: A study on pharmaceutical companies in Indonesia. European Journal of Business and Management Research 2023, 8, 40–45. [Google Scholar] [CrossRef]

- Hirunyawipada, T.; Pan, Y. When will going green enhance firm performance? Journal of Marketing Theory and Practice 2020, 28, 226–241. [Google Scholar] [CrossRef]

- Hull, C.E.; Rothenberg, S. Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strategic Management Journal 2008, 29, 781–789. [Google Scholar] [CrossRef]

- Hurtado, J.C.; Ferras, X.; Arimany, N.; Meijide, D. Communications and corporate social responsibility: A canvas to build its strategy. 2015 10th Iberian Conference on Information Systems and Technologies (CISTI) 2015. [Google Scholar]

- Ikram, M.; Zhang, Q.; Sroufe, R.; Ferasso, M. The social dimensions of corporate sustainability: An integrative framework including covid-19 insights. Sustainability 2020, 12, 8747. [Google Scholar] [CrossRef]

- Ilham, I. Effect of return on assets, return on equity and earning per share on the price of shares at pt. Gajah Tunggal Tbk. Jurnal Ilmiah Ilmu Administrasi Publik 2020, 10, 173. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. Corporate sustainability: A strategy? SSRN Electronic Journal 2019. [Google Scholar] [CrossRef]

- Jabbour, A.B.; Frascareli, F.C.; Jabbour, C.J. Green Supply Chain Management and firms’ performance: Understanding potential relationships and the role of green sourcing and some other Green Practices. Resources, Conservation and Recycling 2015, 104, 366–374. [Google Scholar] [CrossRef]

- Jacobsen, S.S.; Korsgaard, S.; Günzel-Jensen, F. Towards a typology of sustainability practices: A study of the potentials and challenges of sustainable practices at the firm level. Sustainability 2020, 12, 5166. [Google Scholar] [CrossRef]

- Jeffers, P.I. Embracing sustainability. International Journal of Operations & Production Management 2010, 30, 260–287. [Google Scholar]

- Jia, Q.; Wei, L.; Li, X. Visualizing Sustainability Research in Business and Management (1990–2019) and emerging topics: A large-scale bibliometric analysis. Sustainability 2019, 11, 5596. [Google Scholar] [CrossRef]

- Jo, H.; Kim, H.; Park, K. Corporate Environmental Responsibility and firm performance in the Financial Services Sector. Journal of Business Ethics 2015, 131, 257–284. [Google Scholar] [CrossRef]

- Katchanov, Y.L. Towards a simple mathematical theory of citation distributions. SpringerPlus 2015, 4. [Google Scholar] [CrossRef]

- Kolahgar, S.; Babaghaderi, A.; Bhabra, H.S. Corporate communication as a governance mechanism: A content analysis of corporate public disclosures. Corporate Ownership and Control 2021, 18, 438–468. [Google Scholar] [CrossRef]

- Laskar, N. Does sustainability reporting enhance firms profitability? A study on select companies from India and South Korea. Indian Journal of Corporate Governance 2019, 12, 2–20. [Google Scholar] [CrossRef]

- Laskar, N.; Gopal Maji, S. Disclosure of corporate sustainability performance and firm performance in Asia. Asian Review of Accounting 2018, 26, 414–443. [Google Scholar] [CrossRef]

- Laskar, N.; Maji, S.G. Corporate Sustainability Reporting Practices in India: Myth or reality? Social Responsibility Journal 2016, 12, 625–641. [Google Scholar] [CrossRef]

- Leydesdorff, L. Theories of citation? Scientometrics 1998, 43, 5–25. [Google Scholar] [CrossRef]

- Liu, R.-L. A new bibliographic coupling measure with descriptive capability. Scientometrics 2016, 110, 915–935. [Google Scholar] [CrossRef]

- Licandro, O.; Burguete, J.L.; Ortigueira-Sanchez, L.C.; Correa, P. Corporate Social Responsibility and financial performance: A relationship mediated by stakeholder satisfaction. Administrative Sciences 2024, 14, 15. [Google Scholar] [CrossRef]