2. Theoretical Framework and Methodology

Political ecology is an interdisciplinary field of study that investigates the dynamic and complex interactions between political, social, economic, and environmental factors in relation to environmental issues, natural resources governance, and the human-environment relationship (Robbins, 2012; Bryant & Bailey, 1997). It focuses on understanding the distribution of power, social dynamics, economic and political processes that shape human-environment relationships and their consequences.

At its core, political ecology analyzes how political and economic structures influence access to and control over natural resources, the allocation of environmental risks and benefits, and the ways in which communities and individuals respond to and negotiate environmental change (Zimmerer & Bassett, 2003). It recognizes that environmental issues are not solely the result of neutral ecological processes but are intricately intertwined with economic, social, and political dynamics. As such, the field has been influential in challenging mainstream environmental narratives and highlighting the power dynamics, social inequalities, and diverse interests that shape environmental decision-making and resource governance (Peet & Watts, 1996). It has also provided insights into grassroots movements, social dynamics, and environmental justice struggles.

Political ecology draws on theoretical perspectives from various disciplines, including geography, anthropology, sociology, political science, political economy, and environmental studies (Robbins, 2012). It can employ a broad range of qualitative and quantitative research methods, including case studies, surveys, ethnography, and ecosystems modeling, to investigate complex socio-environmental issues such as deforestation, oil spills management, land grabbing, water management policies, climate change, and energy transitions, inter alia.

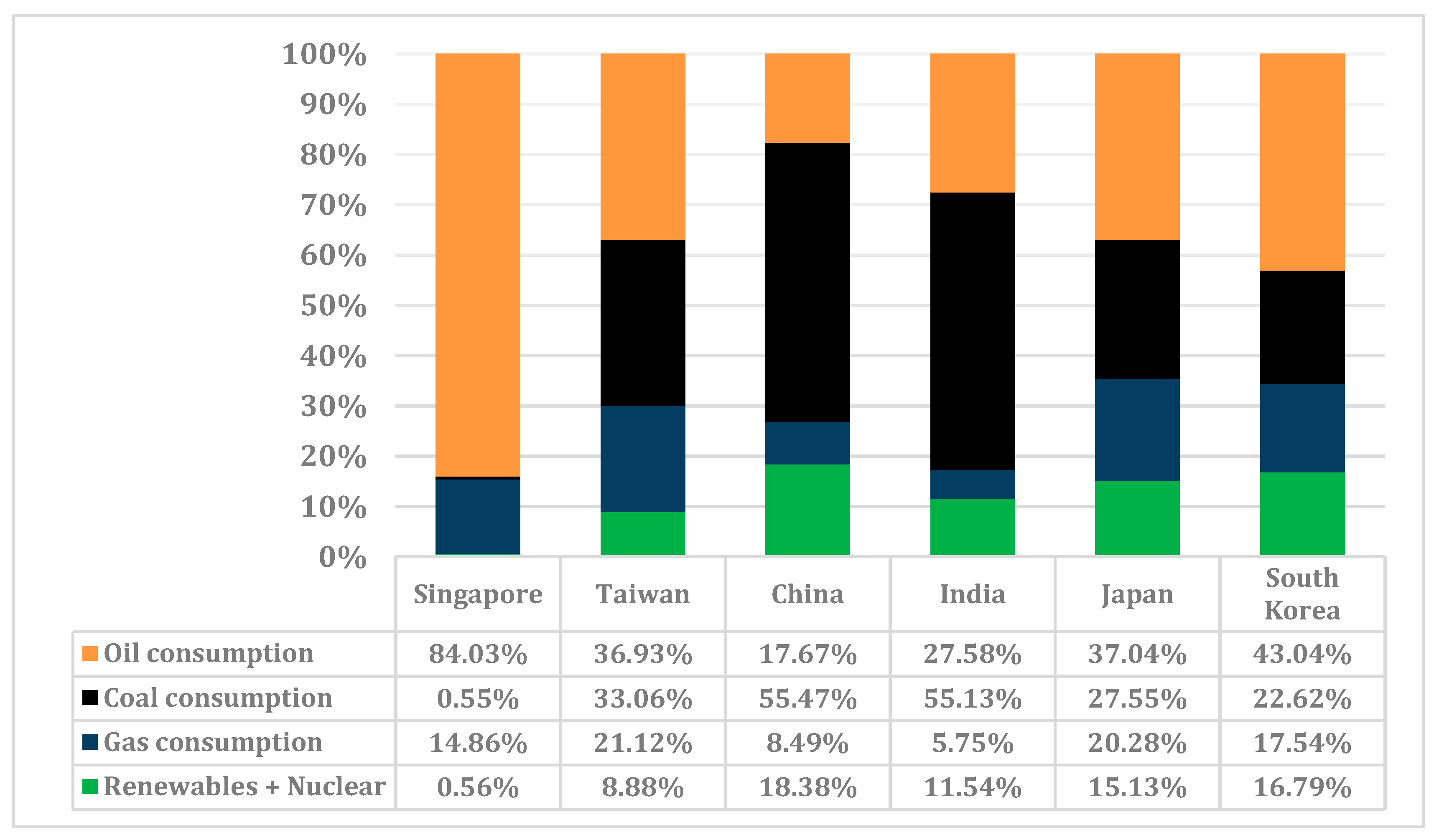

For this investigation of the new dynamics of energy transition in West Asian oil and gas exporting countries and, most importantly, their (counter-intuitive) economic rationale to do so, we have analyzed data from a selected sample of six (6) key energy importing countries (i.e., China, India, Japan, Singapore, South Korea, and Taiwan) which are large energy importers and which are widely expected to remain net energy importers now and for the foreseeable future despite potential competition from the rapidly growing economies of Indonesia and the Philippines. According to the United Nations Comtrade database, these six selected countries accounted for about 90% of energy imports made by all energy net importing Asian countries in 2021, as can be seen on

Figure 1. This preponderant position in the continent’s oil and gas energy demand is largely explained by their strong demographic weights in the region or by the industrialized nature of their economies. However, this situation is unlikely to remain still. These six countries’ strong hydrocarbons-based energy demand seems now to be entering a phase of structural change and accelerated decarbonization efforts.

To investigate this situation, we conducted a scoping review of academic, media and grey literature to understand and analyze, through the political ecology framework, the changes happening in the energy landscape of these six countries and future trade dynamics between Qatar and the case countries. Quantitative data is aggregated from various resources, be they local, such as the respective authorities and ministries, or international such as the International Energy Agency (IEA), the United Nations ComTrade database, and the International Panel on Climate Change (IPCC).

3. Global Energy Transition and Asia: A Review of the Literature and Recent Decarbonization Policies

3.1. Energy Transitions around the World

The long-term and massive accumulation of carbon dioxide (CO2) and other greenhouse gas emissions in the atmosphere has led to transformative changes in our climate system (Crutzen, 2002). It is first and foremost characterized by an increase in global surface temperature, especially over the past half century, a period with no equivalent increase during at least the past 2000 years (IPCC, 2023, p.4). This warming of the planetary system is forcing an increase in the frequency and destructive consequences of extreme meteorological events, such as heat waves, droughts, changing rainfall patterns, tropical cyclones, flash floods, inter alia (IPCC, 2022; 2023), leaving no country unaffected. The recent massive flooding of Pakistan’s majority of national territory in 2022, which was the hottest year ever recorded worldwide, Iran and Iraq’s multiyear drought and increasingly frequent dust storms, or the continuous melting of Himalayan glaciers that disrupts the hydrology of Bangladesh, China, India, and Nepal, are but examples of the climate crisis affecting the whole world and particularly Asia.

In 2015, all industrialized countries and emerging economies in the world have agreed to contribute to and signed the Paris Agreement on Climate Change with the goal to collectively work to limit global warming to +1.5 and “well below” 2 degrees Celsius by the end of this century compared to pre-industrial times (UNFCCC, 2015). As most greenhouse gas emissions and especially Carbon Dioxide (CO2) come from the combustion of fossil fuels, which still represent most of the global energy consumption (IEA, 2022), the international community must rapidly transition to a largely decarbonized energy mix to reduce their impact on the climatic system (IEA, 2022; IPCC, 2022; IRENA, 2022). However, different countries have different levels of commitment, different circumstances, different ambitions, and use different methods and timelines to transition to cleaner energy systems (IRENA, 2022).

The 2018 Intergovernmental Panel on Climate Change (IPCC) special report on global warming of 1.5 degrees Celsius has emphasized the need of reaching global net-zero emissions (i.e., an exact balance between greenhouse gasses emitted and those absorbed by the natural environment and technologies) by mid-century, to prevent the worst effects of a destabilizing climate change crisis (IPCC, 2018). In that report, several scenarios were presented, and the increasing use of carbon capture and storage (CCS) was part of the solutions needed. Yet in the fourth scenario, which did not include CCS, the most wide-ranging and the most expensive changes in human behaviors were necessary, including an unprecedented reduction in the consumption of carbon-intensive fuels: coal, oil, and natural gas.

The International Energy Agency (IEA) estimates that 2.3 Gt of CO2 will need to be stored each year by 2060 to meet the goals fixed by the IPCC and agreed upon by the international community as part of the 2015 Paris Agreement on Climate Change. The Global CCS Institute (2019) estimates with a high level of confidence that substantial CO2 storage sites exist around the world to meet these scenarios. The IPCC, however, is more cautious as to the safe utilization of that emerging technique to be rolled out in the decades to come. Worth mentioning, many environmental NGOs reject the potential of CCS, arguing that it is not a mature technology and that it may only extend the duration of massive production and consumption of hydrocarbons under the pretext of unproved possibilities to sequestrate the related Carbon emissions.

3.2. A Review of Decarbonization Policies across Major Asian Energy Importing Countries

In recent years, Asian economies have dominated the ranking of the world’s top largest importers of crude oil, with China becoming the world’s largest importer in 2023, followed by India, then by Japan in fourth position and South Korea as fifth largest importer. Only the United States of America ranked third largest crude oil importer among Asian nations.

To be able to import the vast amounts of oil their economies need, a particularly well-developed system of commercial cooperation has developed between Asian importing nations and the world’s leading producers from the Western side of the Asian landmass (i.e., the Middle East region), such as Kuwait, Qatar, Saudi Arabia, the United Arab Emirates, Iraq, among others.

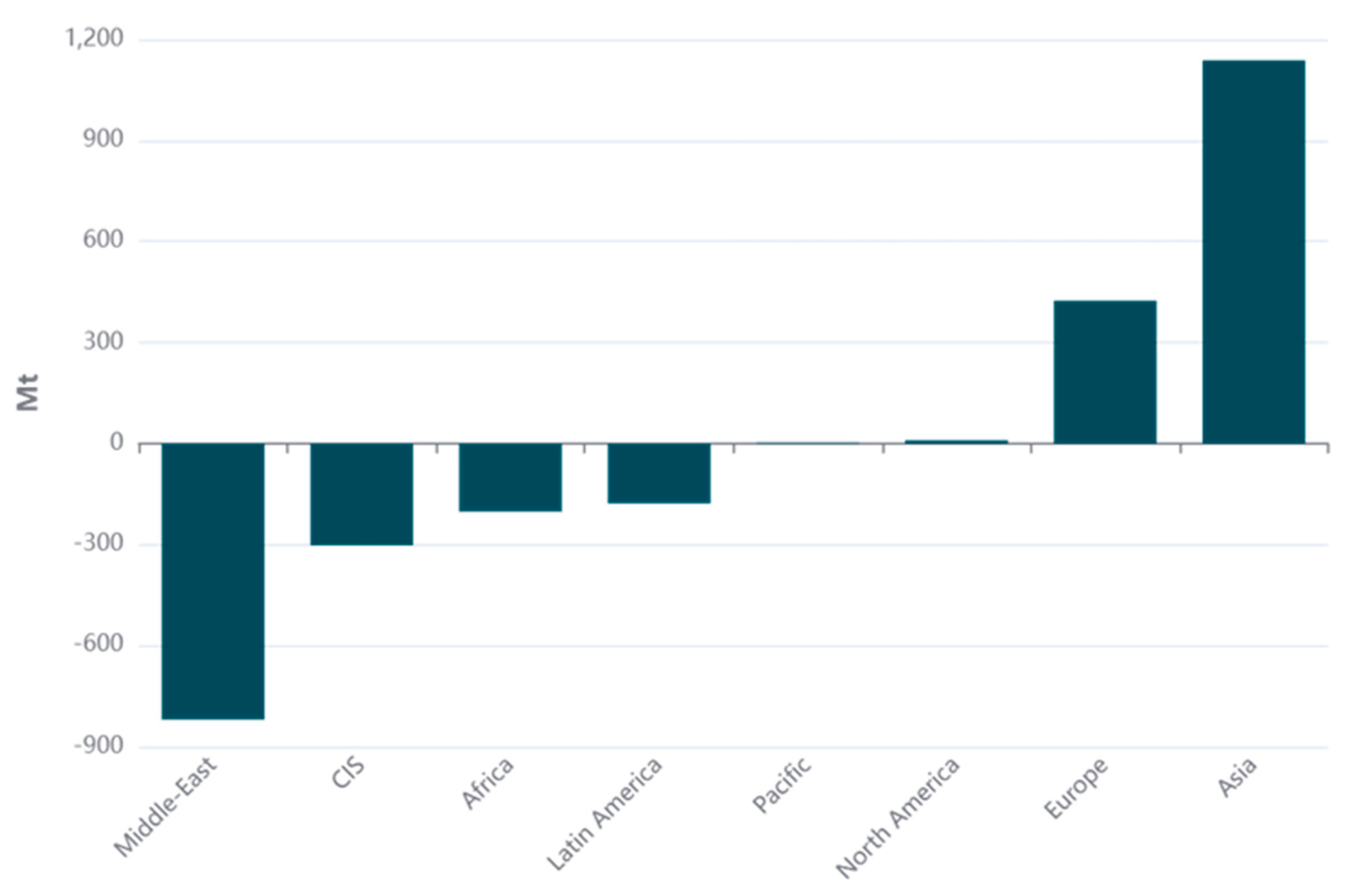

Figure 2.

2021 Oil trade balance broken down by region – in Million tons. Source: Enerdata World Energy & Climate Statistics - Yearbook 2022.

Figure 2.

2021 Oil trade balance broken down by region – in Million tons. Source: Enerdata World Energy & Climate Statistics - Yearbook 2022.

But this structural energy dependence on crude oil, the combustion of which releases CO2, is incompatible with the East and South Asian emerging economies’ commitment to the Paris Agreement and Sustainable Development Goals of the United Nations. To mitigate climate change and the growing risks and costs stemming from it, Asian energy importing countries have recently adopted net zero targets, which means that in the future, they will not emit more greenhouse gasses than they absorb, either through their ecosystem processes, like afforestation & reforestation, or via technological processes, like Carbon Capture & Storage (CCS) or Carbon Capture & Utilization (CCU). In the latter, the captured Carbon serves as raw material, as in the food and beverage industry, or in the chemical industry for instance.

Among the six major energy-importing Asian economies, two groups of countries can be distinguished. The first group can be considered as climate mitigation leaders, as they have arrested a target for net zero emissions by 2050. It gathers Japan, Singapore, South Korea, and Chinese Taipei (also known as ‘Taiwan’). The second group has also announced ambitions of reaching net-zero emissions, but with significantly later target years. The People’s Republic of China (here, ‘China’) announced a strategy for net zero emissions by 2060 (Government of China, 2021), while India ambitions to reach net zero emissions by 2070 (Government of India, 2022).

The first group of countries analyzed in this study has more meticulously developed their nationally determined contributions documentation as part of their obligations within the framework of the Paris Agreement on Climate Change than the second, as can be seen in

Table 1. To achieve these long-term goals of net zero, each of these six major energy-importing Asian countries has prepared short-term as well as long-term policies. This includes reducing CO

2 emissions or decreasing the emissions intensity of their GDP, with different targets for 2030. The strategies and targets in question are outlined in

Table 1.

However, these countries are still facing several challenges that have been slowing their energy transition down towards green and sustainable energy, mainly due to their dependence on conventional sources of power generation. Coal and oil still account for most of the energy consumption in the case countries (IEA, 2022), as can be seen in

Figure 3. For the short to medium term, the priority for these nations has been the phasing down and ultimately the phasing out of coal primarily through coal-to-gas switching, especially as their economies are largely built on the hard to abate industrial sector (Valentine & Sovacool, 2010; Hoon, 2021), with the only exception of Singapore. This partly explains the recent increase in long-term agreements over deliveries of Liquified Natural Gas (LNG).

Because massive investments have already been made in conventional manufacturing processes and other fossil fuel-based technologies, an immediate and radical transition is economically complicated due to the risk of stranded assets for many economic agents. On the longer term however, the integration of renewable energy technologies that enable carbon mitigation is likely to come at the cost of natural gas. In the context of trans-national energy trade, several internationally energy organizations have projected that the global energy mix should mostly include hydrogen and its derivatives for heating, transportation, and heavy industry. Hence the growing importance for the hydrocarbons and petrochemical-based economies of the Middle East to adapt and develop hydrogen-centric energy solutions.

Accordingly, the six Asian countries have set ambitious targets to decarbonize and plan on integrating renewable (like wind, solar, and tidal energy) and low carbon sources of energy (like nuclear and hydrogen sources) in their energy and economic development policies. Many countries have recognized the benefits of investing in renewable energies as an efficient way to decrease their carbon emissions and air pollution, and pay tribute to their international commitments, like to the Paris Agreement on Climate Change, the United Nations Sustainable Development Goals (which include ‘Climate Action’), and the UN so-called ‘sister conventions’ of 1992 on climate change, biodiversity, and desertification, while positively transforming their economies. China, for instance, has become the world’s largest producer and exporter of solar panels and holds a commanding position in pivotal segments of the energy transition value chain, demonstrating notable dominance in the processing of essential minerals and new energy vehicles (NEV). This is not only enabling decarbonization locally but also globally.

India now has a goal of achieving 450 gigawatts of renewable energy capacity and becoming a key exporter of renewable equipment (Government of India, 2022). Similarly, Taiwan's government plans to increase its renewable energy development target to 17,250 megawatts by the year 2030 (Government of Taiwan, 2022). China aims to increase its wind and solar power capacity to 1.2 billion kilowatts with almost exclusively, local production (Government of China, 2021).

An analysis of national strategies reveals that three countries (Japan, South Korea, and Singapore) have developed strategies to achieve carbon neutrality by 2050 and have set GHG reduction targets for 2030 (Singapore's Ministry of the Environment and Water Resources, 2020; METI, 2021; Ministry of Environment, Republic of Korea, 2019). Specifically, they aim for a 46% reduction from the 2013 level in the case of Japan, a 45% reduction compared to 2010 for South Korea, and a 36% reduction compared to 2005 for Singapore by the year 2030.

To gradually substitute the use of fossil fuels while ensuring a stable and cost-efficient energy supply, these countries have developed other sources of energy. For instance, Japan plans to adopt renewables as the main power source by 2030, in addition to promoting the use of electric vehicles which are critical to dethroning oil’s hegemony over the transport sector (METI,2021). South Korea plans to develop renewables for it to account for 20% of its electricity production by 2030 (The republic of Korea, 2021) and Singapore aims to have at least 2 gigawatt-peak of solar energy by 2030 (MSE, 2021).

The case of Singapore is exceptional regarding nuclear power compared to South Korea and Japan. The latter two plan to develop nuclear energy as an important part of their energy mix by 2030 and 2050. In contrast, Singapore is yet to declare the buildout of a nuclear power plant despite the Energy Market Authority (EMA) stating that nuclear energy will account for 10 percent of Singapore's energy mix by 2050 (EMA, 2022).

The following table provides a summary of the energy transition strategies for the selected Asian countries:

Table 1.

Energy strategies of India, China, Taiwan, South Korea, Japan, and Singapore. Source: Authors, based on each country’s national energy strategies and the nationally determined contributions (NDCs).

Table 1.

Energy strategies of India, China, Taiwan, South Korea, Japan, and Singapore. Source: Authors, based on each country’s national energy strategies and the nationally determined contributions (NDCs).

| Country |

Net Zero Target |

Emission reduction target for 2030 |

Renewables targets (2030) |

Nuclear Energy targets (2030) |

| China [1] |

2060 |

Peak CO2 emissions before 2030 |

Increase its installed capacity of wind and solar power to 1.2 billion kilowatts by 2030 |

120-150 GW by 2030 |

| Chinese Taipei/Taiwan [2] |

2050 |

GHG reduction by 50% from the business-as-usual level |

Target of 17,250MW in 2030 |

The non-nuclear homeland policy |

| India [3] |

2070 |

GHG reduction by 45 percent from

2005 level |

450 GW of renewable energy capacity by 2030 |

Total nuclear capacity is likely to be around 22.5 GWe by 2031. |

| Japan [4] |

2050 |

GHG reduction by 46% compared to the 2013 level |

Renewable energy set to account for 36%-38% of the energy mix by 2030 |

20%-22% of the energy mix |

South Korea [5]

|

2050 |

GHG reduction by 40% compared to the 2018 level |

Producing 20% of electricity from renewables by 2030 |

23.4% by 2029 share of nuclear energy in the energy mix |

| Singapore [6] |

2050 |

GHG reduction by 36% compared to the 2005 level (reaching 60 MtCO2) |

The renewable in this case is mainly the solar energy: reaching.

2 gigawatt-peak by 2030 |

No information is available about the possible energy mix scenarios including nuclear power by 2030. However, by 2050 the Energy Market Authority of Singapore announced nuclear energy will make up about 10% of its energy mix. |

3.3. Towards an Energy Transition in the GCC Countries: The Case of Qatar

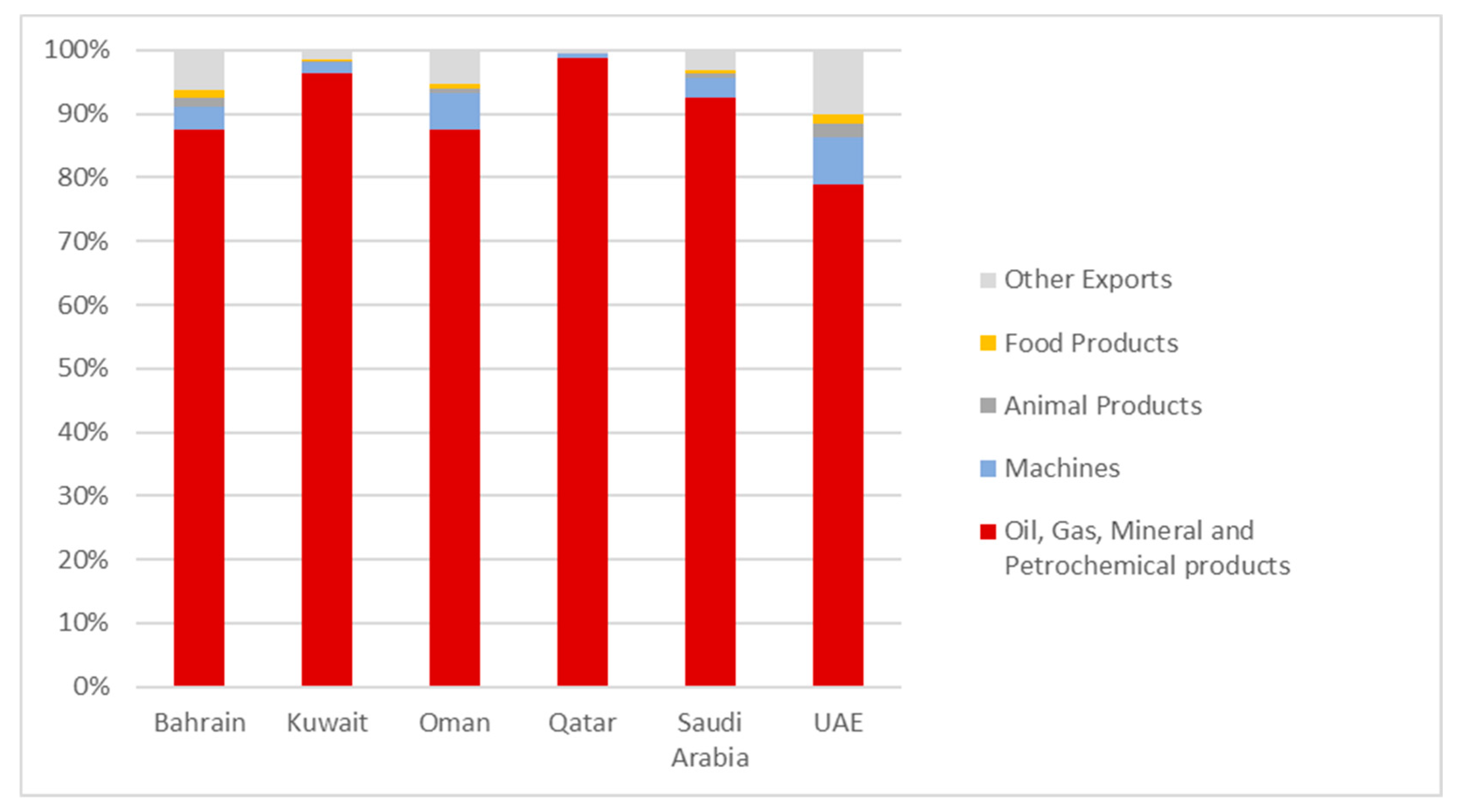

The Gulf Cooperation Council (GCC) countries have been economically relying on their oil and gas industry for decades as they hold some of the world's largest reserves and as they have not managed to sufficiently diversify their economy, despite important programs, reforms, and investments to do so (Gray, 2011; Hertog, 2016; Gengler & Lambert, 2016). The oil, gas and petrochemical industries have generated significant economic output to its respective nations as well as important diplomatic leverage and soft power gains. Accordingly, during the last few decades, the oil and gas exports have accounted for more than 75% of each country's total exports, as represented in the

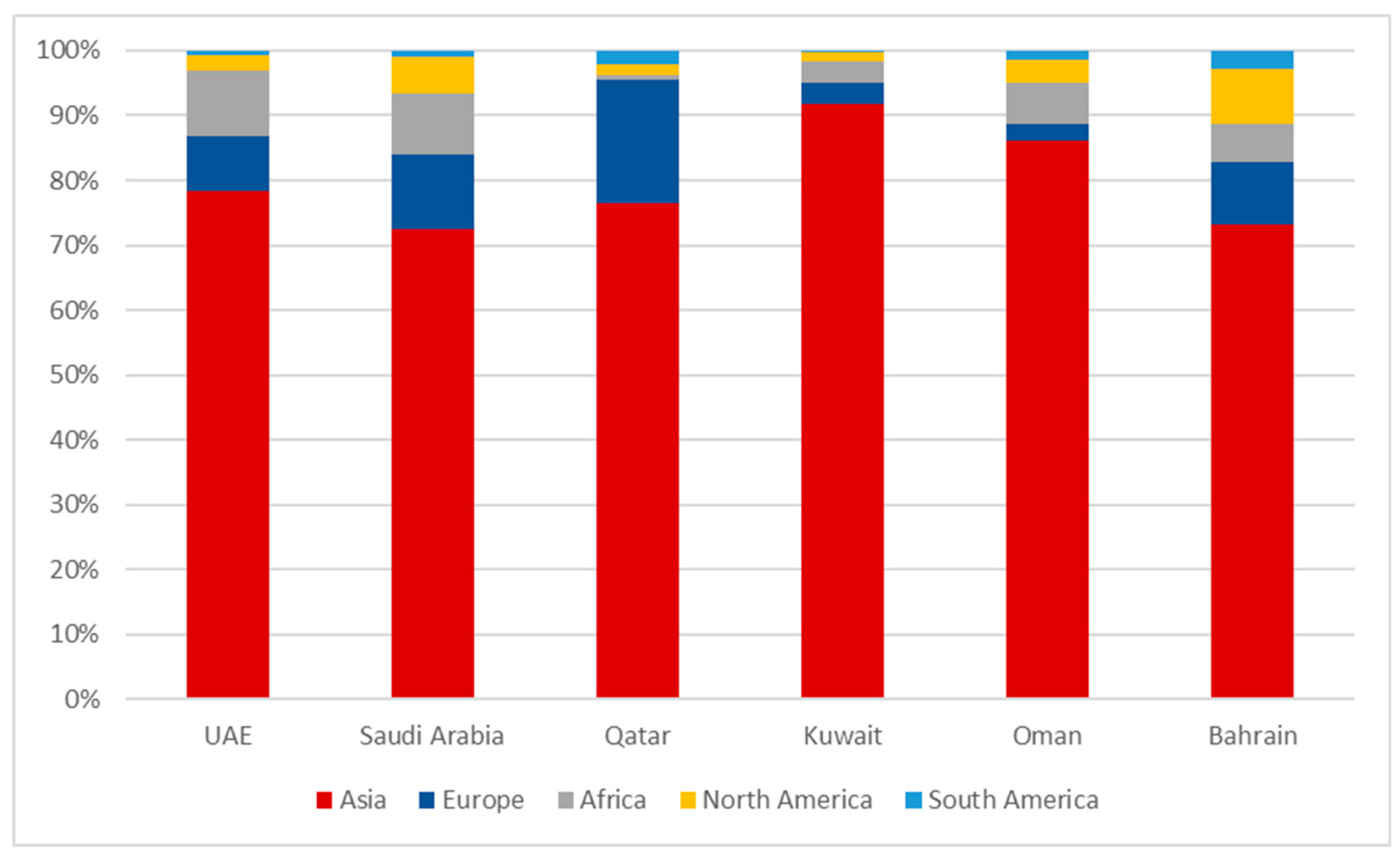

Figure 4 (Tagliapietra, 2019). In recent years, East and South Asian countries represented 70% of these total exports, as displayed in

Figure 5.

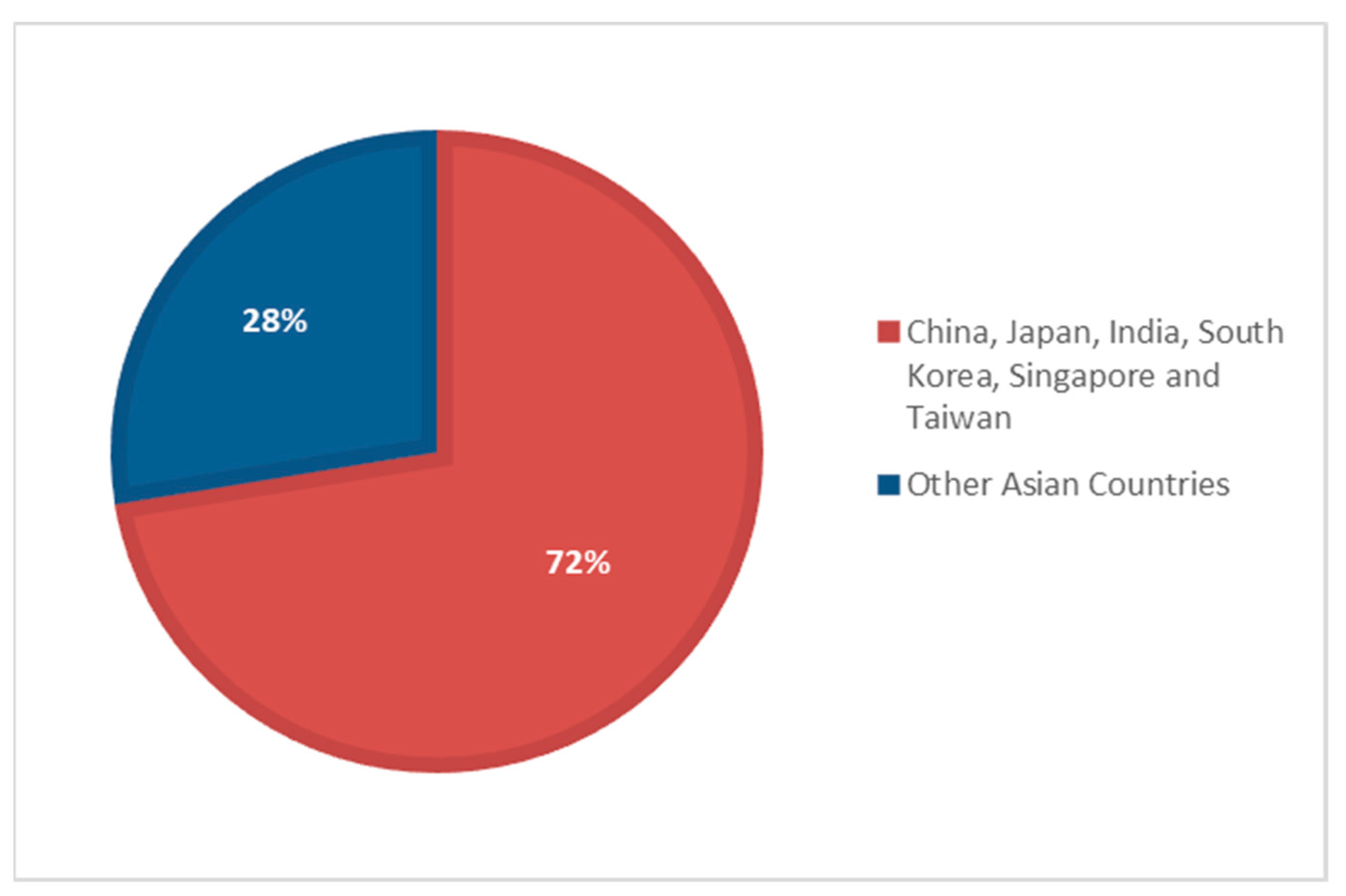

There is a strong concentration of the GCC’s exports towards Asia in general, which means a strong inter-dependence. Said differently, there is a form of reliance of the GCC countries on Asia for most of their exports. And there is a strong concentration towards just a few countries, more specifically. When it comes to the case of Qatar, 72% of the country’s total exports to Asia are directed towards the six following countries: China, India, Japan, South Korea, Singapore, and Taiwan, as illustrated in

Figure 6.

However, as highlighted in the previous section, these East and South Asian countries are implementing several strategies to ensure a smooth and sustainable energy transition as part of their international commitments. In this context, it is imperative for the GCC countries, including Qatar, to review and revise their energy strategies and adapt to this rapidly evolving and changing global energy landscape. In the following sections, we will explore Qatar’s future energy policies and strategies for decarbonizing exports.

4. Gulf States and Qatar’s Policies for Decarbonized Exports

This section situates Qatar’s ongoing decarbonization effort by highlighting the development of renewable sources of power generation, the increasingly likely possibility of energy export diversification with ammonia and hydrogen, and finally, the role of carbon capture technologies such as carbon capture, storage, and utilization (CCUS).

4.1. Decarbonization via Energy Exports Sophistication: Qatar’s Decarbonization Policies and Changes

In 1992, all the oil and gas-rich monarchies of the Gulf region have followed the international community in signing and subsequently ratifying the United Nations Framework Convention on Climate Change (UNFCCC). Although over the years a country like Saudi Arabia has several times played a disruptive role in the international climate negotiations aimed to reduce the emissions of greenhouse gases (chiefly coming from the burning of fossil fuels) to protect a strong global demand for oil, the situation has changed significantly in recent years. Saudi Arabia, similarly to the United Arab Emirates (which hosts the 2023 UN climate negotiations), the Sultanate of Oman and Qatar have understood that climatic changes represent major issues for them (Al-Samri, 2011; Lambert and D’Alessandro, 2019; 2022) and that the energy market has already been slowly but massively shifting towards a more decarbonized global energy mix in what is seen as a long-term trend (IEA, 2022; GECF, 2022; IPCC, 2023).

Already in 2012, the Qatari government had hosted the first climate negotiations (technically called ‘conference of the Parties’, or COPs) under the UNFCCC in Doha, its capital city. A first ministry of the environment and climate change was launched then, and the government commissioned several studies on climate risks for the country and on how its energy industry could suffer or benefit from a decarbonizing global energy market. The first

In 2021, it re-established a Ministry of Environment and Climate Change (MoECC)[7] to be devoted to this endeavor.

Already in 2008, the Qatari government had devoted a significant share of its newly launched Qatar National Vision 2030 (QNV 2030) to environmental matters. with one of the four pillars being fully focusing on ‘Environmental development’. Under this broad terminology, the QNV 2030 contains broad commitments to biodiversity conservation and natural heritage, but also to the medium to long-term energy transition via a multitude of projects of which some are being executed, in the planning phase or still unknown (Bianco, 2021).

One such project is the Msheireb free economic zone which has become one of the largest sustainable cities in the world as stated by Qatari leaders (Kanso, 2019). Moreover, Qatar is actively advancing the decarbonization of its power generation with a set target of reaching 20 percent of total power generation from renewables by 2030 (Ministry of Municipality and Environment, 2021). In 2022, following a Joint Venture between QatarEnergy, QEWC, and TotalEnergies— the Al Kharsaah solar power plant commenced operations generating 800 megawatts (MW) per year or 10% of the country’s total electricity demand (TotalEnergies, 2023). In addition to the Al Kharsaah solar power plant, another two are currently being commissioned in Mesaieed and Ras Laffan, the plants should be operational by the end of 2024 and bring the total solar output to 1.67 GW (QNA, 2022). The Qatar Investment Authority (QIA) the entity managing the nation’s sovereign wealth funds is actively investing in clean energy generation and decarbonization solutions globally with for instance clean energy generation in sub-Saharan Africa to align its portfolio with ESG standards and offset the country’s upstream emissions.

This strategic direction is believed to be crucial in securing Qatar’s position in the LNG industry as more ‘environmentally sensitive’ to attune to European and market ‘green economy’ standards and enable LNG to remain a viable energy source in a future carbon neutral world. Hence, despite economic diversification efforts, LNG will remain a key pillar of Qatar’s economy as the country aims to be the biggest producer of LNG in the world for the next two decades. The nation is leveraging expanding gas demand and exceptionally high prices with substantial opportunities in Europe because of Russia's decoupling from the continent's gas market and a keen appetite in East and South Asia driven by coal-to-gas switching and the rapidly growing economies in the region. Banking on the surge in demand and acknowledging the escalating competition from Australia, Russia, and the USA, Doha is presently in the process of expanding LNG production by around 60% before 2027 through the North Field Expansion project. Long term offtake agreements for the additional capacity have already been signed with China, France, Germany, Italy, Japan, and the Netherlands.

However, gas prices are bound to correct with expansions coming online in North America in 2024, global LNG trade is forecast to expand by nearly 25% by 2026 driven mainly by the USA and Qatar (IEA, 2023). Therefore, commodity volatility coupled with uncertainty regarding the long-term future of the energy market have meant that Qatar has already begun investing in new economic activities that harness its established completive advantage to diversify its fiscal revenues, such as the hydrogen industry. Green hydrogen as well as blue hydrogen (fueled by natural gas with the use of Carbon Capture & Storage) are increasingly seen as a promising policy option to sustain the GCC countries’ leadership in the global energy market.

In this regard, in August 2022, QatarEnergy signed agreements with Industries Qatar and Qatar Chemical Fertilizer Company to construct a blue ammonia plant capable of producing up to 1.2 million tons of blue ammonia per year (Reuters, 2022). Ammonia currently stands as a more cost-effective means to transport hydrogen, as it demands less energy for cooling during transportation and storage compared to hydrogen. This makes ammonia a viable and sustainable interim solution especially for energy storage and chemical applications until the technological and economic viability of green hydrogen production advances further (Lambert et al., 2022). While not directly convertible to hydrogen, the magnitude of the investment in ammonia production is a strong indicator towards future for high scale hydrogen production.

Qatar’s interest in hydrogen dates to as early as 2010 with a collaboration between Qatar's Science and Technology Park and Germany's Fraunhofer Institute. The focus of their investigation was on the solar thermal production of hydrogen from methane (Bianco, 2021). In 2023, hydrogen holds an important role in the country’s research community's mandate as government, industry, and academia engage in active collaboration to advance technology and policy.

Qatar is advancing the promotion of the green LNG branding through investments in mitigation technologies such as Carbon Capture & Storage and Carbon Capture, Utilization & Storage (CCUS). This strategic initiative aims to significantly reduce CO2 emissions, transforming Qatar's LNG into an environmentally friendly and sustainable source known as carbon neutral or “Green LNG”. Doha promotes natural gas as a clean fuel that is lower in carbon dioxide emissions than coal and oil and contrary to most renewables, can utilize the existing infrastructure and technology (Bianco, 2021). In October 2021, the Energy Minister Saad Al-Kaabi announced that the name of the company changed from Qatar Petroleum to Qatar Energy and claimed that Qatar’s aim is to deploy technologies for capturing 9m tons of carbon dioxide per annum by the end of this decade (John, 2021). In its 2022 sustainability report, QatarEnergy states “Nearly 5 million tons of CO 2 equivalent (CO 2 -eq) captured through carbon capture and storage (CCS) since inception of the facility in 2019. “(QatarEnergy, 2023).

Qatar already has one of the world's least carbon-intensive natural gas production systems. This distinction is primarily attributed to two main reasons. The first is the unique composition of its natural gas reserves, particularly the prevalence of methane-rich deposits within the North Field. The second is, the strategic implementation of advanced mechanisms and cutting-edge technologies throughout the production chain to reduce flaring. Moreover, Qatar has one of the lowest unitary costs in global natural gas production, this enables the emirate to incorporate technologies such carbon capture and still maintain competitiveness (Meza & Koç, 2020).

4.2. Green Hydrogen Investment in the GCC and the Potential for Partnerships

Green hydrogen could be essential to the efforts of the EU for achieving net zero emissions and for reducing the reliance of GCC countries on oil and gas exports. Taking into consideration that clean water is the only byproduct of green hydrogen (as shown in

Figure 8) is highly significant to Middle Eastern countries that have water insecurity and to the EU for reaching net zero by 2050 (Calabrese, 2021). Following Russia’s invasion of Ukraine, the EU has intensified its efforts to reduce energy reliance and has sought out partnerships with the GCC countries, notably Qatar, this opens avenues for cooperation to advance economic diversification and sustainability (Bianco, 2022).

The EU revised its energy policy through the REPowerEU initiative in March 2022 to decrease its reliance on Russian fossil fuels. The objectives of this initiative are to cut the reliance on Russian gas by two-thirds before 2030 and to attain carbon neutrality by 2050 (European Commission, 2022). The accelerated development of renewable energy sources emerged as a pivotal strategy to simultaneously reduce reliance on Russian energy and accelerate decarbonization efforts.

Consequently, hydrogen was regarded as a key technology in this endeavor. The plan aims to circumvent some of the finance gap for hydrogen development and mobilizes close to €300 billion, with approximately €225 billion in loans and €72 billion in grants with a target of producing 10 million tonnes of domestic renewable hydrogen and importing another 10 million tonnes by 2030. A massive increase from the previous commitment of €9 billion (European Commission, 2022). In 2023 the EU has committed an additional €9.3 billion to hydrogen projects through its Green Deal Industrial Plan (European Commission, 2023). This capital will feed in to bolster hydrogen production, logistics, and storage infrastructure, and foster the growth of new hydrogen-centric technologies globally.

The EU’s bullish position on hydrogen provides an important opportunity for the GCC countries to expedite their stated ambitions, leverage their potential in hydrogen production and trade through joint ventures, technology transfer and collaborative research and development (R&D). The GCC countries’ favorable position for hydrogen production stems from fiscal resilience, substantial hydrocarbon reserves and well hedged diplomatic positions. These factors have positioned the region to potentially achieve the lowest blue hydrogen production costs globally (IEA, 2018). Overall, collaboration with the EU in the field of hydrogen is poised to catalyze the broadening of the GCC’s economic landscape and advance the region towards a net-zero future.

Blue hydrogen production is more commercially viable than green hydrogen in the context of the GCC especially for countries like Qatar and Saudi Arabia which possess large natural gas reserves. Conversely, green hydrogen comes at a higher cost due to the need a greater infrastructure overhaul with for instance large parks of renewable energy fitted with electrolyzers. Nonetheless, the UAE and Oman have been prioritizing green hydrogen within their respective strategies with Saudi Arabia adopting a more pragmatic approach. Yet both pathways necessitate important and complex transformations such as big-scale investment, large upgrade of energy infrastructure, construction of new hydrogen-ready pipeline, network ports and import terminals (such as between Germany and Qatar).

Also, the EU may build on the memorandum of understanding of Germany with different GCC countries such as Qatar, Saudi Arabia, the UAE, and Oman. The cooperation has also included the GCC countries in all value chain stages such as storage, transport, transfer, and certification schemes (Bianco, 2020). Lambert et al (2022), document that the EU is structuring its long-term LNG contracts, with the likes of Qatar for example, on two phases, the first being exclusively LNG based while the second will incorporate a hydrogen component. This complements the ongoing initiatives within the Eurozone to devise retrofitting solutions for adapting natural gas infrastructure and support hydrogen integration. For instance, Germany’s new floating storage regasification units (FSRUs) will be retrofittable to accommodate hydrogen in the future.

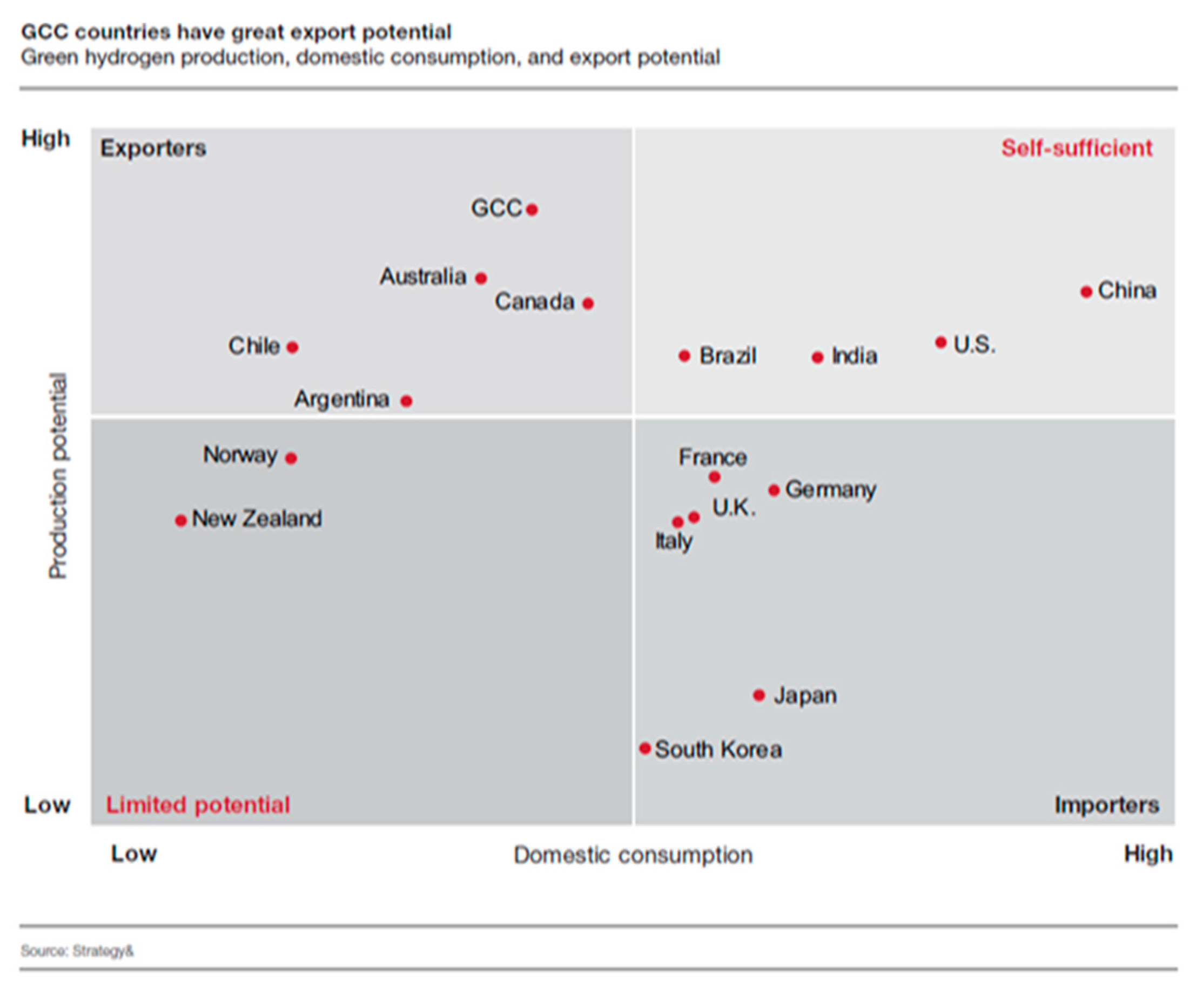

The success of clean energy trade between the EU and GCC countries, especially Qatar, would make the EU an important destination for Qatar’s green hydrogen exports due to its strong export potential in addition to other GCC countries as shown in

Figure 8 (Strategy &, 2020). A potential EU - GCC partnership to develop interconnected infrastructure would upscale hydrogen production, promote energy sustainability and security and hedge from the spillover of political and economic shocks (Meltzer et al., 2014). Advances in hydrogen development in the GCC are already in motion. Oman, the UAE, and Saudi Arabia have been the more proactive actors thus far. Long haul Hydrogen related trade for the short to medium term is likely to mostly involve derivatives and green products such as ammonia, synthetic fuels, and green steel.

4.3. Ongoing Hydrogen Developments in the GCC

The United Arab Emirates (UAE) already has a strong presence in the global hydrogen arena. With ambitious plans to increase its hydrogen production capacity to 300,000 tons annually with production capacity in 2025 expected to exceed 1 million tons annually (ADNOC, 2021). On November 22, 2023, the UAE released its official hydrogen strategy, the country aims to have a production capacity of 1.4 mtpa and 0.6 mtpa of export potential by 2031. Although so far, almost all partnerships in the field of hydrogen had been with Japan and South Korea, the strategy highlights the potential for EU involvement and partnerships (MoEI, 2023).

Oman is another GCC country that has been active on the hydrogen front, especially green hydrogen. The government is in the process of finalizing its green hydrogen strategy and in 2022, established Hydrogen Oman (HYDROM), an autonomous subsidiary of Energy Development Oman, to oversee large-scale "green" hydrogen projects. HYDROM manages land allocation through auctions, supports common infrastructure development, and supervises project execution. In April 2023, HYDROM conducted its first auction, allocating land to six renewable hydrogen projects totaling USD 20 billion and significant government funding from Germany and the Netherlands (MEM, 2023).

While Oman and the UAE have announced large-scale and export-oriented projects, their contribution to global trade volume is projected to be a limited by 2030, with the entire Middle East region representing only 6% of global exports by 2040 (IEA, 2023).

Similarly to Oman, Saudi Arabia is in the process of finalizing its hydrogen strategy. The country has already reached final investment decision (FID) on the world largest carbon free hydrogen plant, the NEOM “green” hydrogen and ammonia project. The project valued at $8.4 billion, should be fully operational by 2026 and produce around 1.2 mtpa of green ammonia (NEOM, 2023). Saudi Arabia has ambitions to become the world’s top hydrogen supplier with clean hydrogen production targets of 2.9 mtpa by 2030 and 4 mtpa by 2035 (Nakano, 2022). There is also potential for collaboration, especially with Europe and Asia, especially as the NEOM hydrogen project financing was sourced from around 23 local, regional, and international banks, and financial institutions (NEOM, 2023).

Although Qatar is rumored to be currently developing a renewable energy strategy which is bound to include a hydrogen roadmap, the emirate has adopted a comparatively conservative approach in materializing its hydrogen ambitions. The biggest hydrogen related development in Qatar thus far has been the commissioning of the 1$ billion and world’s biggest blue ammonia plant which should come online in the first quarter of 2026 with production at 1.2 mtpa (Reuters, 2022).

GCC countries could in theory collaborate to establish a regional hydrogen market, allowing them to pool resources and expertise, and ultimately bring down the cost of hydrogen production.

EU policies and investments have the potential to facilitate the inflow of foreign investments and accelerate the industry’s regional development. Established partnerships with the East Asian economies could also play an important role in the development of hydrogen in the GCC. With Singapore, Taiwan and especially South Korea and Japan planning to become key demand hubs for hydrogen. In the case of China and India, the two countries plan on meeting their needs via domestic production but could be key for technology transfer, especially for electrolyzes. Hydrogen partnerships between the Gulf Cooperation Council (GCC) countries and Asian nations, are gaining momentum.

As a concrete example, India recently approved its national Green Hydrogen Mission, targeting a production capacity of 5 million metric tonnes per year by 2030. Given India's dependence on the GCC countries for a substantial portion of its energy needs, with almost 35% of oil imports and 70% of gas imports coming from the region, collaborative efforts are crucial. Notably, Abu Dhabi National Oil Company (ADNOC) and GAIL India have signed an MoU for cooperation in the Green Hydrogen sector (Gas World, 2022). Additionally, ACME India has chosen Oman as the location for its first large-scale green ammonia commercial project (Financial Express, 2023). These initiatives underscore a strategic and sustainable approach to energy collaboration between these regions.

Japan is actively forging a new energy interdependence model with its longstanding partners, the Gulf Cooperation Countries (GCC), viewed as promising hubs for the production and export of green hydrogen and ammonia. Leaders in the GCC see clean hydrogen as an appealing avenue for economic diversification. The Saudi energy ministry has inked agreements with Japan's industry and trade ministry, encompassing the development of clean hydrogen, ammonia production, derivatives, and recycled carbon fuels. Notably, 26 cooperation agreements between Saudi Arabia and Japan focus on hydrogen production and trade. Among the notable agreements signed, there is a collaborative exploration between JERA and ADNOC to assess potential cooperation in the realm of clean hydrogen and ammonia. Additionally, a partnership has been established between Sumitomo Corp (8053.T) and Sharjah National Oil to delve into the feasibility of a carbon capture and storage project in the UAE (Reuters, 2023). Additionally, various memoranda of understanding have been signed between Japanese companies and Middle Eastern counterparts, spanning areas such as clean hydrogen, ammonia, carbon capture and storage projects, and studies on low-carbon metal production (Middle East Institute, 2023; Reuters, 2023; Solar Quarter, 2023).

China is becoming a crucial partner for Gulf states in their energy transition, particularly in emerging technologies like electric vehicles, energy storage, hydrogen, and carbon capture (Center for Strategic and International Studies, 2023). China's collaboration with Gulf countries extends to promoting a clean-energy transition, encompassing solar, wind, nuclear, and hydrogen options (South China Morning Post, 2023).

In a significant development for South Korea, a joint statement was adopted by Korea and Saudi Arabia on October 23, 2023, during President Yoon Suk Yeol's state visit to the Arab nation. The agreement reflects a shared commitment to actively pursue the expansion of mutual investments in key areas of interest, encompassing the hydrogen economy, smart cities, future mobility solutions, and startups. Notably, the Hydrogen Oasis Initiative (H2Oasis) was formalized during this diplomatic exchange, marking a strategic move to fortify collaboration and bolster project developments in the realm of clean hydrogen (Korea.net, 2023).

4.4. The Role and Potential of CCS/CCUS in Decarbonization of the Energy Industry

Carbon Capture and Storage (CCS) and Carbon Capture, Utilization, and Storage (CCUS) technologies have the potential to assist and support countries in their energy transition and promote economic development (McLaughlin et al., 2023). The International Energy Agency (IEA) considers carbon capture technologies as one of the seven key pillars in achieving net-zero emissions by 2050. These technologies can play an important role in heavy hard to abate industries (once the technology becomes commercially viable), hydrogen production, and reducing atmospheric CO2 levels. By capturing and utilizing Carbon dioxide, CCUS projects can be more financially attractive than other carbon removal technologies as they provide an additional revenue stream which helps to offset the costs associated with carbon capture and storage through carbon credits the production of fertilizer, enhanced oil recovery, and chemical products from the captured CO2 (Cabrera et al., 2022).

It is worth mentioning that, since 2015, the worldwide capacity of commercial CCS facilities has increased five times in the various stages of their development. Current CCS projects are expected to reach a capture capacity of 243 Mtpa across 196 facilities in the various stages of their development, as shown in

Table 2. However, only 17.5% (42.5 Mtpa) of CO

2 is currently captured in operational projects (Global CCS Institute, 2022).

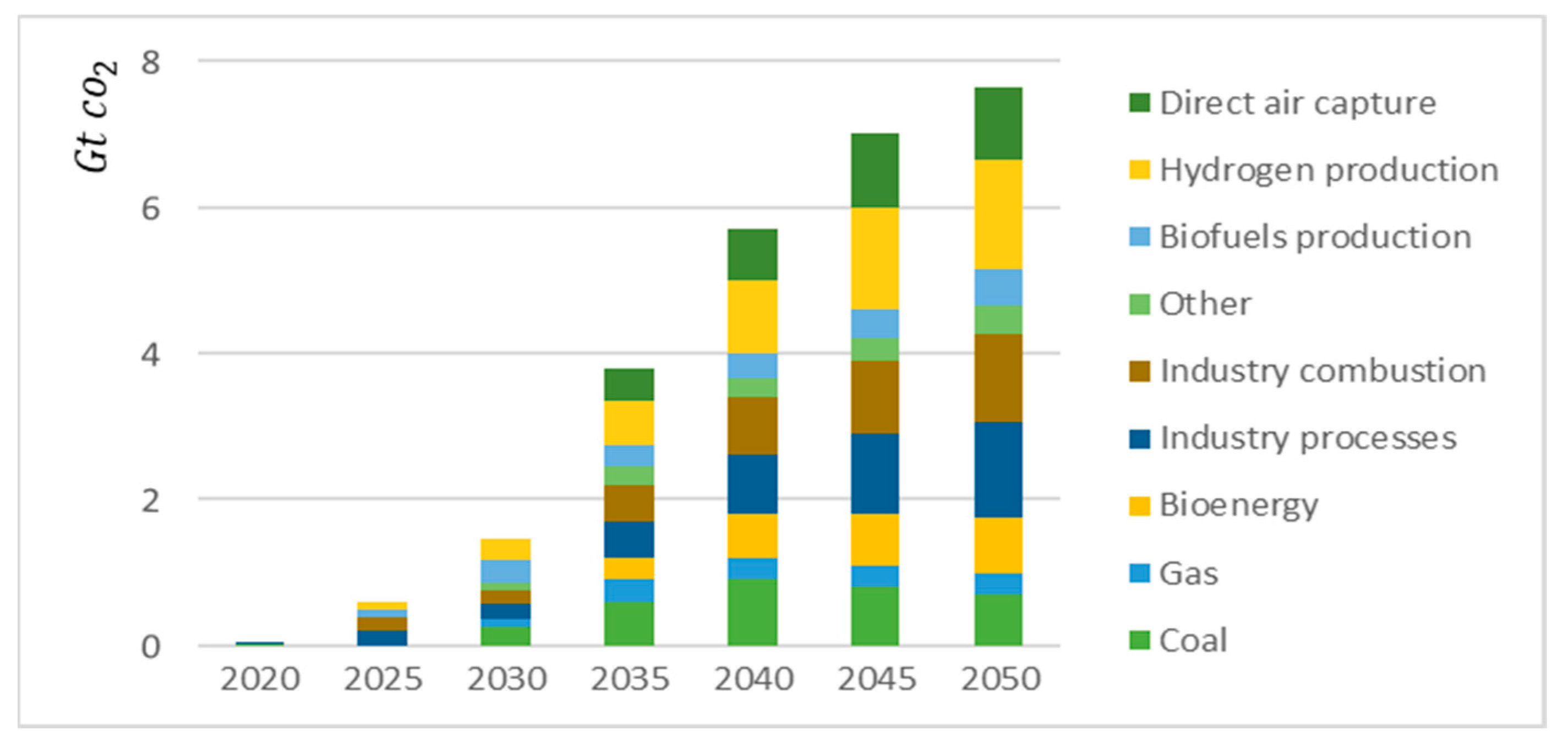

The IEA, in its Net Zero Emissions (NZE) scenario, predicts that 7.6 Gt of CO

2 would be captured by 2050 from various sources, as shown in

Figure 7. On the other side, some experts are concerned that increasing carbon removal projects can create disincentives for decarbonization while also incentivizing actions that delay progress toward it (Sovacool, 2023).

Figure 7.

Green hydrogen production, domestic consumption, and export potential. Source: Strategy & (2020).

Figure 7.

Green hydrogen production, domestic consumption, and export potential. Source: Strategy & (2020).

Figure 8.

Projected Global CO2 captured in the IEA’s NZE. Source (IEA, 2021).

Figure 8.

Projected Global CO2 captured in the IEA’s NZE. Source (IEA, 2021).

On the international level, the relative contributions of technologies such as CCUS differ among countries and regions across the world, depending on their specificities, including their economic, geographic, social, and industrial contexts (IEA 2021).

4.5. CCS/CCUS in the GCC Region

The Gulf Cooperation Council countries have opted for carbon capture technology as a strategy to reduce their annual CO2 emission, which amounted to about 700 Mt in 2022 (IEA,2023). The CCUS technology is considered comparatively more cost-effective in the GCC region for two main reasons: firstly, the concentration and availability of CO2 capture industries. Secondly, the proximity of these CO2 capture industries to geological storage facilities, such as depleted reservoirs (AFRY & GaffneyCline, 2022). These factors reduce transportation costs and save significant investments in oil recovery processes since captured CO2 can be used in enhanced oil recovery (EOR).

The following table shows the different CCS/CCUS projects across the GCC countries while displaying each country’s CO2 capture capacity. Saudi Arabia, UAE, and Qatar already capture up to 10% of global CO2 each year (Global Carbon, 2022). Additionally, Kuwait has a small CCU project (Co2 Recovery Plant, Kuwait, n.d.), and Bahrain plans to implement the world's first CCUS at an aluminum plant (IEA, 2022).

Table 3.

CCS/CCUS projects across the GCC. Source: a(Global Status of CCS, 2022), b(Abu Zahra,2022), c(Qatar Builds World’s Largest Blue Ammonia Facility, 2022).

Table 3.

CCS/CCUS projects across the GCC. Source: a(Global Status of CCS, 2022), b(Abu Zahra,2022), c(Qatar Builds World’s Largest Blue Ammonia Facility, 2022).

CCS & CCUS Project Name

Capture capacity (Mtpa CO2) |

Country |

Facility status |

Operational date |

Capture capacity (Mtpa CO2) |

| Uthmaniyah Co2-Eor Demonstration (a) |

Saudi Arabia |

Operational |

2015 |

0.8 |

| Abu Dhabi CCS (Phase 1 Being Emirates Steel Industries) (a) |

UAE |

Operational |

2016 |

0.8 |

| Qatar LNG CCS(a) |

Qatar |

Operational |

2019 |

2.2 |

| Qatar Gas(b) |

Qatar |

Operational |

2021 |

1.18 |

| North Field East Project (NFE) CCS(a) |

Qatar |

In construction |

2025 |

1 |

| Abu Dhabi CCS Phase 2: Natural Gas Processing Plant(a) |

UAE |

Advanced development |

2025 |

2.3 |

| Ghasha Concession Fields(a) |

UAE |

Advanced development |

2025 |

Under evaluation |

| Ammonia-7 Project (c) |

Qatar |

- |

2026 |

1.5 |

4.6. CCS/CCUS in the Case of Qatar

To get insight into the future of CCUS in Qatar, we will provide an overview of the current operational projects, future, and ongoing research projects.

In 2019, Qatar succeeded in inaugurating the largest CCUS facility in the Middle East and North Africa region, with a total capacity of approximately 2.2 million tons per annum (Mtpa) (IEA, 2022). The captured CO2 is transported, afterwards, to the Dukhan oil field (Abu Zahra, 2022). To further its efforts in CCUS technology, Qatar is constructing additional facilities as part of the North Field Expansion Project, which aims to expand the CCUS capacity to 5 Mt CO2 by 2050 (IEA, 2022).

However, several studies have highlighted several key obstacles to the adoption and investment in CCUS technology. These potential challenges include the fact that there is no one-size-fits-all solution to the CO2 problem and that the cost of retrofitting already existing infrastructure for capturing CO2 is relatively high (McLaughlin et al., 2023). To address these issues and further advance the development of CCUS technology and projects, Qatar has partnered with multiple organizations and invested in different research projects.

For instance, Qatar has invested $70 million in research at the Qatar Carbonates and Carbon Storage Research Centre (QCCSRC) since 2012 (About QCCSRC, n.d.-b). The QCCSRC aims to help build Qatar’s capacity in CCS through collaboration between four different energy companies and universities (Qatar Carbonate and Carbon Storage…, n.d.). Additionally, the Qatar Environment and Energy Research Institute (QEERI) is conducting CCUS research projects aimed at reducing the carbon footprint of industrial operations by utilizing innovative technologies (Research and Development Efforts by Qatar Environment and Energy Research Institute Focus on Innovation in Carbon Capture, Utilization, and Storage Technologies, 2021b). In 2019, energy multinational Total and the national university of Qatar’s Center for Sustainable Development jointly started two research projects for the investigation of micro-algae from Qatar to produce biofuels as well as Carbon Capture, Utilization and Storage (CCUS). The Senior Vice President and Group Chief Technology Officer at Total Marie-Noelle Semeria explained that “Total is investing and supporting the development of Algae with CO2 in partnership with Qatar University as we believe that Carbon Capture Utilization and Storage will leverage innovative technologies which contribute to achieve carbon neutrality in the second half of the century”. And neither energy multinationals nor hydrocarbons-rich countries want to be left outside of this future market (https://thepeninsulaqatar.com/article/19/11/2019/Total,-Qatar-University-launch-algae-based-research-collaboration). In the same context, Qatar Energy signed a Memorandum of Understanding, in September 2022, with General Electric Company to develop a roadmap for CCUS in the energy sector of Qatar (QatarEnergy and GE…., 2022). This roadmap will include the development of carbon capture and storage technologies, the use of hydrogen, and the possibility of using ammonia in GE gas turbines to reduce their CO2 emissions (QatarEnergy and GE…., 2022).

4.7. Qatar Blue Hydrogen

Carbon capture technologies alone cannot be deployed fast enough and at scale to ensure the required carbon mitigation necessary to reach the ambitious targets of climate stabilization from the Paris Agreement on Climate Change by the end of the Century. There is thus a consensus that current and future energy and climate policies should increasingly couple CCS technologies with cleaner energy sources that can be traded inter-continentally, such as hydrogen.

More precisely, the development of Carbon capture and storage technologies may set the stage to produce blue hydrogen, which, while not as emissions-free as green hydrogen, offers a viable and practical pathway towards a carbon-neutral energy future.

In addition to scaling CCS technology deployment, Qatar can capitalize on its expertise and abundant natural gas reserves to produce blue hydrogen, a low-carbon fuel with applications in various sectors. Blue hydrogen is manufactured through a process called steam methane reforming (SMR), in which natural gas (primarily methane) is reacted with high-temperature steam to generate hydrogen and carbon monoxide. This process involves the removal of CO2 from the source and therefore directly mitigates Qatar’s CO2 stock. The captured CO2 can be stored in the same manner as the CO2 that is captured from power generation.

Qatar is currently the largest hydrogen consumer in the region, using grey hydrogen (through steam reforming of natural gas) for refining petroleum products and producing ammonia (QatarEnergy, 2020). Blue hydrogen could potentially advance Qatar’s hydrogen production, secure local demand and displace the more polluting grey hydrogen. Producing blue hydrogen through SMR with integrated CCS would reduce the emissions of natural gas by up to 90% (Global CCS Institute, 2021).

For Qatar, a heightened emphasis on hydrogen over natural gas entails risks, particularly considering the prevailing long-term global policy emphasis on green hydrogen rather than blue. In this context, Qatar might face comparatively diminished competitiveness in green hydrogen production due to constraints related to water and land availability (renewables require a lot of land).

While hydrogen is anticipated to play an important role in future energy markets accounting for 10-12 % of the total energy mix by 2050 (IEA NZE, 2022), it is important to note that the opportunities for differentiation are comparatively limited when compared to the fossil fuel market. This is attributed to the fact that contrary to natural gas, hydrogen's production is less dictated by scarce resource allocation and more influenced by factors such as financial investment, technological expertise, and the development of suitable infrastructure and skilled human resources. Notably, countries endowed with extensive land resources may gain a competitive advantage in the hydrogen market due to their ability to accommodate larger-scale infrastructure, such as solar power plants and wind farms. Blue hydrogen in this case could be a bridge technology for green hydrogen as it is relatively cleaner than all conventional hydrocarbons and is simultaneously less expensive than green hydrogen as highlighted in

Table 4.

Figure 7 shows the potential of GCC countries to export green hydrogen which comes from renewables, as ambitioned by Saudi Arabia, for instance. However, it also shows the competitive potential of other countries in the future hydrogen market with new players such as Chile and Argentina. Moreover, rent opportunities in hydrogen markets may be less pronounced due to the market’s trade dynamics as countries are likely to opt to satiate domestic demand via local production. Importantly, some of the self-sufficient economies highlighted are China and India, key trade partners of Saudi Arabia, Qatar, and the rest of the GCC countries.

The above table from the global status report of CCS represents the average cost of producing hydrogen. Currently the blue hydrogen is less expensive than green hydrogen and it would make more economical sense for Qatar to invest in it. Meanwhile, this would require Qatar to look more aggressively for all methods to sequestrate Carbon. Including ecosystem services which are now being seen as particularly cost-efficient to massively mitigate carbon emissions.5. Decarbonization potential of natural carbon sinks in hydrocarbons exporting countries: the case of mangrove forestry in Qatar

The role of mangroves to fight global warming has been highlighted in recent years due to their viability as carbon sinks, capable of absorbing and storing significant amounts of carbon dioxide and monoxide from the atmosphere in areas of the intertropical zone, including in hydrocarbons producing countries, including the countries of the Arabian Gulf, the delta of Niger, or the shores of Venezuela, Indonesia, and Malaysia, for instance.

Similarly to Carbon capture technologies, mangrove afforestation projects constitute a tool for policymakers as part of their decarbonization pathways. By sequestering carbon, these mangroves help mitigate the impacts of climate change and reduce greenhouse gas emissions. Article 6.4 of the Paris Agreement defines carbon removal activities that Parties can undertake domestically to achieve emission reductions and to enhance international cooperation for mitigation and adaptation. Accordingly, some of those activities are carbon capture technologies and biological solutions, in the case of Qatar, mangroves (UNFCCC, 2023). This rational is further consolidated by Qatar’s commitment to the preservation and protection of its coastal wetlands, and their inclusion in the country’s NDC as a means of mitigating carbon emissions.

Avicennia marina, commonly known as white mangroves, constitutes the only mangrove species found in Qatar's coastal ecosystems (Al-Khayat & Alatalo, 2021). These mangroves hold significant importance for the environment and offer several benefits to both the ecosystem and local communities. One important benefit of the Avicennia marina mangrove is its role in carbon sequestration from the atmosphere (this is climate change mitigation) via its dense root system (Kandasamy et al., 2021).

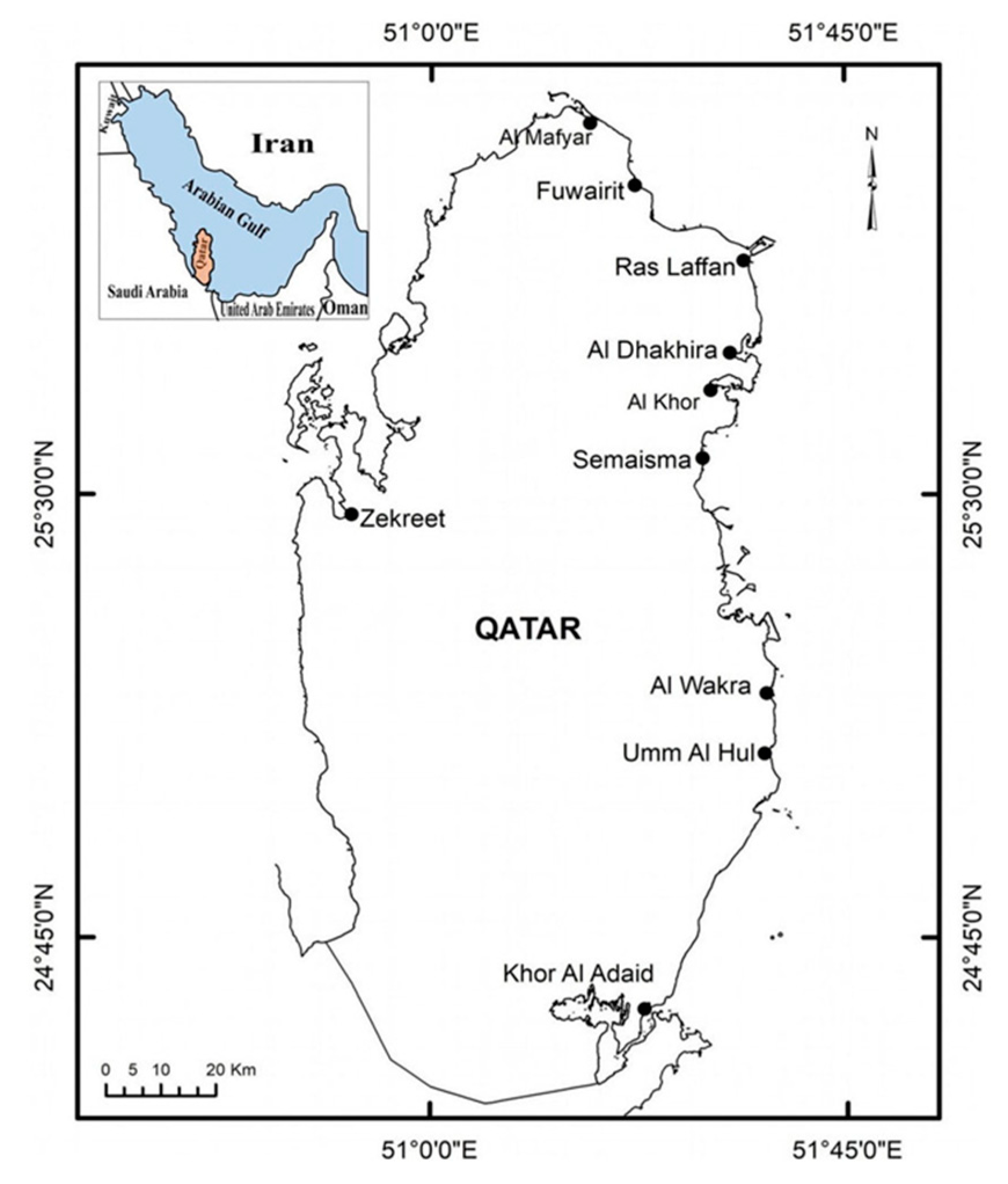

Figure 9.

Mangrove stands in Qatar. Source: Al-Khayat & Alatalo, 2021.

Figure 9.

Mangrove stands in Qatar. Source: Al-Khayat & Alatalo, 2021.

In a small country like Qatar, there are nevertheless ten distinct mangrove stands along the country's coastline. Among these, Al Khor and Al Dhakhira mangrove stands are the only two natural mangrove ecosystems, covering a combined area of around 800 hectares (ha). The rest of the mangrove stands, including Al Mafyar, Ras Laffan, Semaisma, Al Wakrah, Umm Al Hul, Khor Al Adaid, and Zekreet, are planted and cover approximately 183 ha. This distribution reflects the concentration of mangrove ecosystems mainly on the eastern and northeastern coasts, with only the Zekreet mangrove stand located on the western coast, covering a smaller area of 1 ha (Al-Khayat, J., & Balakrishnan, P, 2015) These could have easily been destroyed and cleared up to leave room for real estate and tourism projects, but they are increasingly considered for their benefits in the protection of the shores from sea-related erosion, extreme weather events, and sea level rise which threaten the region (Lambert and D’Alessandro, 2019; 2022). Additionally, to their benefits in terms of adapt to climatic changes, the mangroves of Qatar help the country mitigate the CO2 emissions of the country.

Mangrove stands in Qatar are effective at sequestering carbon from the atmosphere: on average, these mangrove ecosystems have been found to store approximately 50 Megagrams of carbon per hectare (Mg C ha-1) in the soil to a depth of 1 meter. Additionally, the tree biomass of these mangroves stores an average of 10 Mg C ha-1.

Additionally, Qatar has been participating in collaborative initiatives. These efforts involve key stakeholders from academia, private foundations, the national government, and municipalities, inter alia. Together, they have committed to implementing a scalable national program focused on preserving and restoring three interconnected coastal ecosystems: mangrove forests, seagrass beds, and coral reefs. This comprehensive approach acknowledges the interdependencies among these ecosystems and highlights the essential importance of mangroves as integral components in Qatar's overall ecosystem and as part of its strategy for environmental conservation and carbon mitigation (MSC foundation, 2022).